SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

Form 6-K

REPORT OF FOREIGN PRIVATE ISSUER

PURSUANT TO RULE 13a-16 OR 15d-16 UNDER

THE SECURITIES EXCHANGE ACT OF 1934

For the month of April 2005

DAIMLERCHRYSLER AG

(Translation of registrant’s name into English)

EPPLESTRASSE 225, 70567 STUTTGART, GERMANY

(Address of principal executive office)

[Indicate by check mark whether the registrant files or will file annual reports under cover of Form 20-F or Form 40-F.]

[Indicate by check mark whether the registrant by furnishing the information contained in this Form is also thereby furnishing the information to the Commission pursuant to Rule 12g3-2(b) under the Securities Exchange Act of 1934.]

[If “Yes” is marked, indicate below the file number assigned to the registrant in connection with Rule 12g3-2(b): 82-]

This report on Form 6-K is hereby incorporated by reference in the registration statement on Form F-3 of DaimlerChrysler North America Holding Corporation (Registration Statements Nos. 333-123535 and 333-13160) and the registration statements on Form S-8 (Nos. 333-5074, 333-7082, 333-8998, 333-86934 and 333-86936) of DaimlerChrysler AG

DAIMLERCHRYSLER AG

FORM 6-K: TABLE OF CONTENTS

1. Interim Report to Stockholders for the three-month period ended March 31, 2005

CAUTIONARY STATEMENT REGARDING FORWARD-LOOKING STATEMENTS

This document contains forward-looking statements that reflect management’s current views with respect to future events. The words „anticipate,” „assume,” „believe,” „estimate,” „expect,” „intend,” „may,” „plan,” „project” and „should” and similar expressions identify forward-looking statements. Such statements are subject to risks and uncertainties, including, but not limited to: an economic downturn in Europe or North America; changes in currency exchange rates, interest rates and in raw material prices; introduction of competing products; increased sales incentives; the successful implementation of the new business model for smart; and decline in resale prices of used vehicles. If any of these or other risks and uncertainties occur (some of which are described under the heading “Risk Report” in DaimlerChrysler’s most recent Annual Report and under the heading “Risk Factors” in DaimlerChrysler’s most recent Annual Report on Form 20-F filed with the Securities and Exchange Commission), or if the assumptions underlying any of these statements prove incorrect, then actual results may be materially different from those expressed or implied by such statements. We do not intend or assume any obligation to update any forward-looking statement, which speaks only as of the date on which it is made.

Contents

3 Management Report | | 8 Mercedes Car Group | | 11 Financial Services | | 17 Notes to Consolidated |

| | 9 Chrysler Group | | 12 Other Activities | | Financial Statements |

| | 10 Commercial Vehicles | | 13 Consolidated Financial | | 27 Financial Calendar |

| | | | Statements | | |

Q1

DaimlerChrysler

| | Q1 05 | | Q1 05 | | Q1 04 | | Change | |

Amounts in millions | | US $ (1) | | € | | € | | in% | |

Revenues | | 41,169 | | 31,744 | | 32,351 | | -2 | |

Western Europe | | 12,091 | | 9,323 | | 11,608 | | -20 | |

Germany | | 5,579 | | 4,302 | | 5,271 | | -18 | |

USA | | 18,921 | | 14,589 | | 15,799 | | -8 | |

Other markets | | 10,157 | | 7,832 | | 4,944 | | +58 | |

Employees (March 31) | | | | 386,789 | | 362,907 | | +7 | |

Research and development costs | | 1,747 | | 1,347 | | 1,259 | | +7 | |

Investment in property, plant and equipment | | 1,913 | | 1,475 | | 1,368 | | +8 | |

Cash provided by operating activities | | 4,461 | | 3,440 | | 3,969 | | -13 | |

Operating profit | | 814 | | 628 | | 1,546 | | -59 | |

Net income | | 374 | | 288 | | 412 | | -30 | |

per share (in US $/€) | | 0.36 | | 0.28 | | 0.41 | | -32 | |

(1) Rate of exchange: €1 = US $1.2969 (based on the noon buying rate on March 31, 2005).

2

Management Report

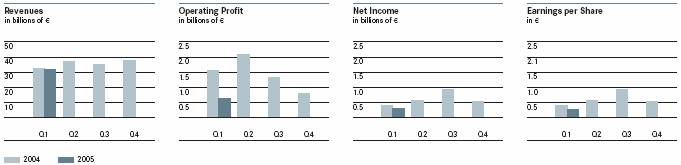

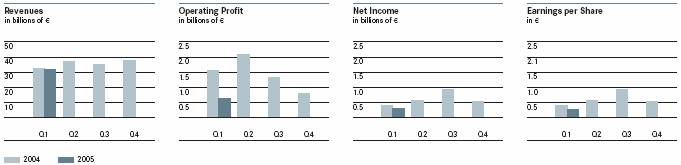

• First-quarter Group operating profit of €628 million (Q1 2004: €1,546 million); €1,428 million excluding exceptional charges from smart

• Net income of €288 million (Q1 2004: €412 million)

• Earnings per share of €0.28 (Q1 2004: €0.41)

• Revenues of €31.7 billion slightly lower than in prior-year period due to exchange-rate effects

• Excluding exceptional charges from smart, slight increase in Group operating profit still expected for full year compared with 2004 (€5.8 billion)

Business developments

Slightly weaker global demand for automobiles

• The world economy continued to expand in the first quarter of 2005, despite ongoing high raw-material prices. The rate of expansion decreased markedly, however. One positive aspect was that economic growth in the United States and China slowed less than had been expected. On the other hand, however, growth prospects for Germany and Japan have become less encouraging since the beginning of the year.

• The global demand for automobiles weakened slightly in the first quarter of this year, although developments still differed from region to region. Whereas new registrations of passenger cars decreased slightly in the United States, Western Europe and Japan, significant growth rates were recorded for most of the emerging markets. For commercial vehicles, last year’s worldwide upward trend continued in a slightly weaker form.

Revenues of €31.7 billion in the first quarter

• In the first quarter of this year, DaimlerChrysler sold 1.1 million vehicles worldwide (+1%).

• Unit sales by the Mercedes Car Group of 247,000 vehicles were 7% below the level of the prior-year period. Shipments at Chrysler Group decreased by 3% to 666,700 passenger cars and light trucks. Retail sales, however, increased by 5% to 664,500 vehicles. The Commercial Vehicles Division achieved a strong increase in unit sales to 179,400 trucks, vans and buses (+43%).

• Primarily due to the appreciation of the euro against the US dollar, DaimlerChrysler’s total first-quarter revenues decreased by 2% to €31.7 billion.

Profitability

Group first-quarter operating profit impacted by expenses

for realignment of smart

• DaimlerChrysler recorded an operating profit of €628 million in the first quarter of 2005, compared with €1,546 million in Q1 2004.

3

• The decrease in operating profit was primarily caused by expenses of €800 million related to the realignment of the business model of smart. Without this exceptional impact, Group operating profit in the first quarter would have been €1,428 million. Compared with the first quarter of 2004, operating profit was additionally impacted by the weaker US dollar and higher material prices. The Mercedes Car Group was particularly affected by exchange-rates effects arising from the operative business. For the Chrysler Group, Commercial Vehicles and Financial Services divisions, the main effect of exchange-rate movements arose from the translation of operating results into euros. Furthermore, the operating result of the Mercedes Car Group was significantly burdened by lower unit sales. The Chrysler Group did not quite equal its result of the prior-year quarter.

• The Commercial Vehicles Division posted a significantly higher operating profit, due in particular to positive developments in the truck business. In addition, the settlement reached with Mitsubishi Motors Corporation (MMC) in the first quarter of 2005 on compensation for expenses incurred in connection with quality actions and recall campaigns at Mitsubishi Fuso Truck and Bus Corporation (MFTBC) resulted in income of €276 million. The Financial Services division made a higher contribution to Group operating profit because of lower charges from Toll Collect. The improved operating profit contributed by Other Activities was primarily a result of the improved earnings of the DaimlerChrysler Off-Highway business unit and an increased contribution to earnings from EADS.

• The Mercedes Car Group reported a first-quarter operating loss of €954 million, compared with an operating profit of €639 million in the prior-year period. The result for the first quarter of 2005 was affected by expenses relating to the realignment of the smart business unit of €800 million.

• At Mercedes-Benz Passenger Cars, operating profit decreased due to lower unit sales, mainly caused by lifecycle reasons, a less favorable model mix, and the ongoing strength of the euro. Expenses for the continuation of the quality offensive also contributed to the decrease. Operating profit in the first quarter was additionally impacted by increased prices for raw materials.

• From ongoing business activities smart reported an operating loss. In addition to this loss, there were expenses for the realignment of the business model. These expenses mainly comprised impairments on property, plant and equipment, additions to accruals relating to risks arising from contractual obligations, and the valuation of vehicle inventories. In the course of the year 2005, further estimated expenses of up to €0.4 billion may be incurred.

Operating Profit (Loss) by Segments

In millions | | Q1 05

US $ | | Q1 05

€ | | Q1 04

€ | |

Mercedes Car Group | | (1,237 | ) | (954 | ) | 639 | |

Chrysler Group | | 327 | | 252 | | 303 | |

Commercial Vehicles | | 926 | | 714 | | 268 | |

Financial Services | | 425 | | 328 | | 221 | |

Other Activities | | 284 | | 219 | | 134 | |

Eliminations | | 89 | | 69 | | (19 | ) |

DaimlerChrysler Group | | 814 | | 628 | | 1,546 | |

• Chrysler Group posted an operating profit of €252 million in the first quarter of 2005 compared with an operating profit of €303 million in the first quarter of 2004.

• The decrease in operating profit was primarily the result of lower factory unit sales and the appreciation of the euro against the US dollar. Worldwide factory unit sales of 666,700 vehicles in the first quarter of 2005 were 18,100 units lower than the prior-year period.

• Operating profit in the first quarter of 2004 was negatively impacted by turnaround plan charges and charges for an incentivized retirement program for skilled trade employees totaling €75 million.

• The Commercial Vehicles Division increased its first-quarter operating profit from €268 million to €714 million.

• This increase in earnings was primarily a result of the worldwide market success of the products of the truck business and the settlement reached with MMC on the compensation relating to the quality measures and recall campaigns at MFTBC. The compensation from MMC led to income of €276 million.

• The ongoing positive sales trend in nearly all business units and the successful continuation of the current programs to enhance efficiency more than offset negative effects which resulted from higher raw material prices and the ongoing strength of the euro.

4

• The Services division was renamed Financial Services in the first quarter of 2005 to reflect its focus on the provision of automotive financial services.

• In the first quarter of 2005, the Financial Services division improved its operating profit significantly compared with the prior-year quarter to €328 million (Q1 2004: €221 million).

• The increase in earnings resulted from lower charges from Toll Collect (Q1 2004: €279 million). The expenses incurred by Toll Collect during 2005 are related to the measures taken to ensure the successful start of the system and the planned expansion of the system functionality of on-board units.

• Compared with the very high prior-year level, margins decreased in the leasing and sales financing business due to rising interest rates, especially in the United States. These effects were partially compensated for by an increased contract volume and lower risk costs.

• The operating profit contributed by Other Activities amounted to €219 million in the first quarter of 2005, which was €85 million higher than in Q1 2004.

• This increase was mainly caused by a substantial improvement in earnings by the DaimlerChrysler Off-Highway business unit. In addition, the proportionate contribution from EADS increased due to a strong operating result from higher Airbus deliveries.

Reconciliation of Group Operating Profit to Income before Financial Income

In millions | | Q1 05

US $ | | Q1 05

€ | | Q1 04

€ | |

Operating profit | | 814 | | 628 | | 1,546 | |

Pension and postretirement benefit expenses, other than current and prior service costs and settlement/curtailment losses | | (375 | ) | (289 | ) | (208 | ) |

Operating (profit) loss from affiliated and associated companies and financial (income) loss from related operating companies | | (234 | ) | (181 | ) | 14 | |

Miscellaneous items | | (1 | ) | (1 | ) | (38 | ) |

Income before financial income | | 204 | | 157 | | 1,314 | |

• Financial income for the first quarter improved to €80 million (Q1 2004: loss of €389 million). The improvement was the result of better income from investments, which rose by €343 million to €27 million, primarily due to the significantly reduced charge from Toll Collect. Income from investments in the prior-year quarter was also impacted by the negative contribution from the Group’s equity-method investment in MMC. Net interest expense was €42 million compared to an expense of €107 million in the prior-year quarter. Net other financial income increased by €61 million to €95 million, primarily due to higher income from the sale of securities.

• Net income of €288 million was reported for the first quarter of 2005, compared with €412 million for the same period of last year. The reduction in operating profit was alleviated by the positive development of the tax situation resulting from tax-free income especially relating to the compensation for MFTBC. In addition, net income for the prior-year period was impacted by non tax-deductible expenses, mainly in connection with investments accounted for using the equity method, including MMC. The exceptional impact from smart reduced net income by €512 million.

• Earnings per share amounted to €0.28, compared with €0.41 in Q1 2004.

Cash Flow

• Cash provided by operating activities decreased to €3.4 billion compared with the first quarter of last year (€4.0 billion) due to the earnings trend, although the special impact from the realignment of the smart business model has not yet had an effect on cash flow. There was a positive effect compared with the prior year from the decrease in net cash outflows for tax payments, resulting from a tax refund in the NAFTA region in the first quarter of 2005.

• Cash used for investing activities decreased to €1.4 billion from €3.3 billion in the same period of last year. In addition to the net cash inflows from securities purchases and sales (Q1 2004: cash outflows), the reduction was also caused by increased revenues from the sale of receivables from financial services towards end customers. Opposing effects resulted from higher additions to equipment on operating leases, net, and property, plant and equipment.

• Cash used for financing activities of €0.6 billion mainly reflects the (net) repayment of financial liabilities (Q1 2004: €2.5 billion).

• Cash and cash equivalents with an original maturity of three months or less increased by €1.7 billion compared with December 31, 2004. Total liquidity, which also includes marketable securities with an original maturity of more than three months, rose from €11.7 billion to €13.0 billion, related to the dividend distribution due in April.

5

Financial Position

• Compared with December 31, 2004, total assets increased by €5.9 billion to €188.6 billion. €4.3 billion of the increase was attributable to currency translation effects.

• Equipment on operating leases and receivables from financial services totaled €86.1 billion, equivalent to 46% of total assets. The increase in inventories was a result of the fluctuating production volumes during the year in the vehicles business in connection with model changeovers. The intensely competitive situation in the Group’s sales markets also had the effect of increasing vehicle inventories. Other assets decreased, mainly due to the valuation of derivatives.

• On the liabilities side, minority interests decreased due to the Group’s increased equity interest in MFTBC. As of March 31, 2005, 15% of MFTBC’s stock was held by shareholders outside the Group (December 31, 2004: 35%). The increase in trade liabilities resulted primarily from the increase in production volumes compared with the fourth quarter of 2004.

• Stockholders’ equity increased from €33.5 billion to €34.4 billion at March 31, 2005, due primarily to the positive net income, currency translation effects, and to a lesser extent the valuation of derivative financial instruments. Adjusted for the proposed dividend distribution for the 2004 financial year (€1.5 billion), the equity ratio as of March 31, 2005, remained unchanged from December 31, 2004, at 17.5%. The equity ratio for the Industrial Business was 24.7% (December 31, 2004: 25.3%).

Workforce

• At the end of the first quarter of 2005, DaimlerChrysler employed a total workforce of 386,789 people worldwide, which was 23,882 more than a year earlier (+7%).

• There were increases and decreases due to changes in the consolidated Group following the inclusion of MFTBC, the acquisition of dealerships and the sale of component plants by the Chrysler Group. The workforce also expanded for operational reasons due to new recruitment by the Commercial Vehicles Division in North America and Europe. Employment levels also increased in the Mercedes Car Group, particularly in the United States due to the expansion of our plant in Tuscaloosa. Adjusted for changes in the consolidated Group, the number of employees increased by 3%.

Outlook

• DaimlerChrysler assumes that the global economy will continue its present development in the coming months, thus expanding in line with its long-term growth trend. However, if raw-material prices, particularly for oil, remain at the current high levels for a longer period or rise even further, global economic development is expected to be negatively affected. Rising interest rates could also have a negative effect on consumer spending.

• For the further course of the year, the growth of worldwide demand for automobiles is likely to be slower than in 2004. Whereas further expansion of truck markets is expected in the NAFTA region, there are indications of decreasing market expansion in Europe. In general, we expect the highly competitive situation across the entire automotive industry to continue, due to further reductions in product lifecycles and ongoing over-capacity.

• DaimlerChrysler anticipates a slight increase in unit sales in full-year 2005 compared with 2004.

• At the Mercedes Car Group, the launch of the M-, B-, R- and S-Class and the model update of the CLK are expected to result in a significant boost to unit sales, especially from mid 2005 onwards. We also expect positive effects from the new V6 and V8 gasoline and diesel engines, which are gradually being introduced in our model range. In total, we anticipate a slight increase in unit sales for the Mercedes Car Group.

• The Chrysler Group anticipates a very intensive competitive situation for the rest of this year. Total industry sales of 17.2 million vehicles are expected for the US market. With the launch of additional new products, we intend to continue the positive development of the year 2004. Overall, the Chrysler Group expects to achieve higher unit sales in 2005.

• For full-year 2005, the Commercial Vehicles Division expects its unit sales to continue the pleasing developments of 2004. There will be positive impetus in particular from the strong demand (evident since last year) for Freightliner’s heavy-duty trucks in the NAFTA region as well as for Mercedes-Benz trucks.

• The Financial Services division looks forward to stable business developments and continued portfolio growth in the financial services business. At Toll Collect, preparations are progressing for the changeover from On-Board Unit 1 (OBU 1) to OBU 2.

• EADS anticipates a continued upswing of the civil aircraft market in 2005. For the full year, EADS plans to deliver 350 to 360 Airbus aircraft (2004: 320 aircraft).

6

• DaimlerChrysler Group continues to expect higher revenues in 2005 compared with 2004. The development of revenues depends to a great extent on changes in the exchange rate between the euro and the US dollar.

• We also expect a slight increase in the size of the total workforce in 2005. In particular in the Commercial Vehicles Division and the Chrysler Group, employment levels should rise compared with the end of 2004.

• The development of earnings during the further course of this year will be impacted by increases in raw-material prices, higher interest rates and the weakness of the US dollar against the euro.

• After first-quarter operating profit was substantially impacted by exceptional charges from smart, we expect additional exceptional charges from smart also in the course of this year of up to €0.4 billion.

Following a weaker first half, excluding the exceptional charges from smart, DaimlerChrysler expects a slight increase in operating profit for full-year 2005 compared with the prior year.

Forward-looking statements in this Interim Report:

This interim report contains forward-looking statements that reflect management’s current views with respect to future events. The words “anticipate,” “assume,” “believe,” “estimate,” “expect,” “intend,” “may,” “plan,” “project” and “should” and similar expressions identify forward-looking statements. Such statements are subject to risks and uncertainties, including, but not limited to: an economic downturn in Europe or North America; changes in currency exchange rates, interest rates and in raw-material prices; introduction of competing products; increased sales incentives; the successful implementation of the new business model for smart; and decline in resale prices of used vehicles. If any of these or other risks and uncertainties occur (some of which are described under the heading “Risk Report” in DaimlerChrysler’s most recent Annual Report and under the heading “Risk Factors” in DaimlerChrysler’s most recent Annual Report on Form 20-F filed with the Securities and Exchange Commission), or if the assumptions underlying any of these statements prove incorrect, then actual results may be materially different from those expressed or implied by such statements. We do not intend or assume any obligation to update any forward-looking statement, which speaks only as of the date on which it is made.

7

Mercedes Car Group

• First-quarter unit sales below prior-year level at 247,000 vehicles

• Successful world debut of new M-Class and the B-Class and R-Class sports tourers

• New business model for smart

• Operating loss of €954 million including exceptional charges from smart of €800 million

Amounts in millions | | Q1 05

US $ | | Q1 05

€ | | Q1 04

€ | | Change

in% | |

Operating profit (loss) | | (1,237 | ) | (954 | ) | 639 | | . | |

Revenues | | 13,466 | | 10,383 | | 11,674 | | -11 | |

Unit sales | | | | 246,968 | | 265,988 | | -7 | |

Production | | | | 278,035 | | 307,112 | | -9 | |

Employees (March 31) | | | | 107,077 | | 104,801 | | +2 | |

Unit sales and revenues below prior-year level

• The Mercedes Car Group’s first-quarter unit sales decreased by 7% to 247,000 vehicles, while revenues were also 11% lower at €10.4 billion. The division posted an operating loss for the period of €954 million. This includes the exceptional charges from smart of €800 million.

Lifecycle-related lower unit sales by Mercedes-Benz

• Unit sales by the Mercedes-Benz brand in the first quarter fell from last year’s 246,000 to 220,600 vehicles. Demand for the M-Class and S-Class decreased for lifecycle reasons in advance of the upcoming model changeover. Unit sales of the C-Class were similar to the prior-year quarter, while unit sales of the E-Class were lower than in Q1 2004. Delays in vehicle deliveries caused by defective diesel injection pumps were not fully compensated for by the end of March. Due to continuing weak demand in several major markets, unit sales in Western Europe declined by 15% to 131,100 vehicles. In the United States, unit sales decreased by 3% to 49,800 vehicles.

• There was strong demand for the new models launched in 2004: in the first quarter of this year, 16,000 SLK roadsters (+157%) and 10,300 CLS coupes were sold. The new A-Class was also very successful with sales of 47,000 units (+20%).

Growth impetus from new models and new engines

• Three new models were revealed in the first quarter: the new M-Class and the B-Class and R-Class sports tourers. The new M-Class was launched in the United States in April and will be on the market in Europe this summer. The B-Class will be launched in Western Europe in June, while the R-Class will first go on sale in North America this autumn and will be available in Europe at the beginning of next year. The new S-Class will be presented to the public this fall. We also anticipate positive impetus from the new V6 and V8 engines, which will soon be available in numerous models.

A consistent focus on quality and efficiency

• We have continuously improved the quality of our vehicles during the past two years: the cars leaving our factories today have the highest level of quality. At the end of March, within the framework of our quality offensive, we began a comprehensive package of measures so that vehicles in customer’s hands can be brought up to this high level of quality.

• As a part of the CORE program initiated in February 2005, the Mercedes Car Group’s business system will be optimized. The key areas for action are cost reductions, revenue increases, and the effective implementation of all the required measures. By the year 2007, the Mercedes Car Group intends to improve its earnings by €3 billion and to achieve a return on sales of 7%.

New business model for smart

• Worldwide unit sales of smart increased by 32% to 26,400 vehicles. This growth was primarily due to first-quarter sales of 8,200 units of the smart forfour, which was launched in 2004. Sales of the smart fortwo, which is now in its seventh year of production, were slightly above the prior-year level.

• As a result of the new smart business model, the key elements of which were announced on April 1, 2005, fixed costs are to be reduced by 30% within the next two years and productivity will be boosted. The successor to the smart fortwo planned for the year 2007 will also be specified to meet the requirements of the US market. Production of the smart roadster will be discontinued by the end of 2005. The smart SUV project will not be pursued any further. smart’s goal is to achieve breakeven by 2007.

Unit sales

| | Q1 05 | | Q1 04 | | Change

in% | |

Total | | 246,968 | | 265,988 | | -7 | |

Western Europe | | 154,998 | | 172,996 | | -10 | |

Germany | | 70,455 | | 80,927 | | -13 | |

United States | | 49,800 | | 51,503 | | -3 | |

Japan | | 10,234 | | 11,086 | | -8 | |

Other markets | | 31,936 | | 30,403 | | +5 | |

8

Chrysler Group

• Retail sales increase by 5% due to market success of new products

• Worldwide shipments slightly below prior-year level

• Numerous new models and concept vehicles presented

• Operating profit of €252 million

Amounts in millions | | Q1 05

US $ | | Q1 05

€ | | Q1 04

€ | | Change

in% | |

Operating profit | | 327 | | 252 | | 303 | | -17 | |

Revenues | | 13,922 | | 10,735 | | 12,060 | | -11 | |

Unit sales | | | | 666,675 | | 684,751 | | -3 | |

Production | | | | 681,938 | | 680,713 | | +0 | |

Employees (March 31) | | | | 85,164 | | 91,056 | | -6 | |

Increased retail sales, shipments to dealers slightly below prior-year level

• The Chrysler Group increased its first-quarter retail sales by 5% to 664,500 units. The increase was primarily due to higher sales of minivans (+9%) and the Dodge Durango (+17%). Additionally, new products that were launched very successfully in 2004, such as the Chrysler 300 (42,000 units) and the Dodge Magnum (17,600 units), are in high demand and made a strong contribution to the quarter’s sales.

• Unit sales (factory shipments) decreased by 3% to 666,700 vehicles. US dealers’ inventories increased to 616,800 vehicles (end of Q1 2004: 585,100 vehicles), equivalent to 78 days’ supply, the same level as a year earlier.

• Due primarily to a slight decrease in unit sales and the appreciation of the euro against the US dollar first-quarter revenues of €10.7 billion were 11% lower than in Q1 2004. Measured in US dollars, revenues decreased by 7%. Operating profit did not quite equal the level of the prior-year quarter.

Presentation of new models and concept vehicles

• Production of the new Dodge Charger sedan started at the end of the first quarter of 2005. This vehicle is a sporty four-door with rear-wheel drive and is being built alongside the Chrysler 300 and the Dodge Magnum at the assembly plant in Brampton, Ontario. It will be launched in the second quarter of this year.

• The Chrysler Group revealed another three models that are set for market launch later in the year: the new Viper Coupe sports car, the Dodge Mega-Cab with the most interior space in a pickup truck, and the new Jeep® Commander with three rows of seats. In addition, four new high-performance versions were presented: the Chrysler 300 SRT-8, Dodge Magnum SRT-8, Dodge Charger SRT-8 and Jeep® Grand Cherokee SRT-8, which will all feature the new 6.1 liter V8 HEMI engine.

• Many concept vehicles made their US debuts at the auto shows in Los Angeles, Detroit, Chicago and New York. These vehicles included the Jeep® Hurricane with two HEMI engines, the Dodge Nitro mid-size SUV and the Jeep® Gladiator super utility truck. One additional study, the Chrysler Firepower sports-car was voted best concept vehicle at the Detroit Auto Show by the readers and journalists of the trade magazine Auto Week, while the 2005 MY production cars have captured a total of 125 “best of” awards so far.

Worldwide expansion of the Dodge brand

• Within the framework of its worldwide expansion, the Dodge brand had its European debut at the Geneva Motor Show in March. The Dodge Caliber concept vehicle was shown, demonstrating the brand’s high performance and sporty character. In the medium term, the Chrysler Group plans to significantly expand its presence with the launch of the Dodge brand in Europe and Asia as well as in additional markets in the Middle East, Latin America and Africa. The number of models offered by Chrysler Group outside the United States is to be more than doubled by the year 2007.

Unit sales

| | Q1 05 | | Q1 04 | | Change

in% | |

Total | | 666,675 | | 684,751 | | -3 | |

NAFTA | | 630,629 | | 639,315 | | -1 | |

United States | | 560,939 | | 582,583 | | -4 | |

Other markets | | 36,046 | | 45,436 | | -21 | |

9

Commercial Vehicles

• Unit sales increase by 43%

• Ongoing positive market trend, especially in Western Europe and North America

• Successful conclusion of negotiations with Mitsubishi Motors

• Significant increase in operating profit

Amounts in millions | | Q1 05

US $ | | Q1 05

€ | | Q1 04

€ | | Change

in% | |

Operating profit | | 926 | | 714 | | 268 | | +166 | |

Revenues | | 11,042 | | 8,514 | | 6,612 | | +29 | |

Unit sales | | | | 179,385 | | 125,790 | | +43 | |

Production | | | | 196,621 | | 138,036 | | +42 | |

Employees (March 31) | | | | 116,268 | | 89,875 | | +29 | |

Strong increases in unit sales and revenues

• The Commercial Vehicles Division increased its first-quarter unit sales by 43% to 179,400 vehicles, while revenues rose by 29% to €8.5 billion. Excluding Mitsubishi Fuso Truck and Bus Corporation (MFTBC), which has been consolidated since March 31, 2004 with a one-month time lag, unit sales and revenues would have both increased by 11%. Operating profit rose from €268 million to €714 million. This includes €276 million from the settlement with Mitsubishi Motors Corporation (MMC).

Positive developments in the trucks and bus business

• In the trucks business, the positive development of unit sales continued in the first quarter of 2005.

Thanks to strong demand in the North American market, unit sales by the Trucks NAFTA business unit (Freightliner, Sterling, Thomas Built Buses, Western Star) increased by 29% to 44,000 vehicles. The sales trend for heavy trucks was particularly positive.

Unit sales by the Trucks Europe/Latin America business unit (Mercedes-Benz) increased by 20% to 32,200 vehicles. Demand for the new Actros remained very high. Sales volumes also rose significantly in Argentina and Brazil due to the improved economic conditions in those countries.

At MFTBC, unit sales decreased by 12% to 41,100 vehicles. An increase of 21% to 29,600 vehicles outside Japan was more than offset by a decline of 48% to 11,500 trucks and buses in the difficult domestic market.

• Unit sales by the Vans business unit decreased by 6% compared with the prior-year period to 51,600 vehicles. This was solely due to delivery difficulties caused by the lack of availability of diesel injection pumps from suppliers. The models affected were the Viano/Vito and the Sprinter for the US market.

• The DaimlerChrysler Buses business unit sold 7,500 vehicles, 11% more than in the first quarter of last year. Growth was especially strong in South America and Germany. With a market share of 25.7%, DaimlerChrysler Buses is still the undisputed market leader in Western Europe with its brands Mercedes-Benz and Setra.

Settlement reached with Mitsubishi Motors

• Based on the contractual regulation of warranties related to the acquisition of shares in MFTBC, DaimlerChrysler has successfully made claims against Mitsubishi Motors Corporation (MMC). Among other things, the settlement reached provides for MMC to transfer the remaining 20% of its shares in MFTBC to DaimlerChrysler without any payment. MMC will also pay compensation to DaimlerChrysler under the terms of this settlement.

Unit sales

| | Q1 05 | | Q1 04 | | Change

in% | |

Total | | 179,385 | | 125,790 | | +43 | |

Western Europe | | 55,759 | | 56,246 | | -1 | |

Germany | | 19,603 | | 19,729 | | -1 | |

United States | | 43,630 | | 33,576 | | +30 | |

South America | | 14,303 | | 11,689 | | +22 | |

Japan | | 11,843 | | 1,120 | | . | |

Other Markets | | 53,850 | | 23,159 | | +133 | |

10

Financial Services

• Positive business developments in the first quarter

• Significant growth in new business and contract volume

• Successful start of toll system

• Operating profit above prior-year level

Amounts in millions | | Q1 05

US $ | | Q1 05

€ | | Q1 04

€ | | Change

in% | |

Operating profit | | 425 | | 328 | | 221 | | +48 | |

Revenues | | 4,626 | | 3,567 | | 3,372 | | +6 | |

Contract volume | | 138,661 | | 106,917 | | 101,260 | | +6 | |

New business | | 15,532 | | 11,976 | | 10,638 | | +13 | |

Employees (March 31) | | | | 11,379 | | 11,200 | | +2 | |

Financial Services posts growth in new business and contract

volume

• The Financial Services division continued its positive business development. New business increased by 13% to €12.0 billion; adjusted for exchange-rate effects, the increase amounted to 16%. Contract volume of €106.9 billion was 6% above the prior-year level. Adjusted for exchange-rate effects, the portfolio expanded by 10%. Operating profit improved from €221 million to €328 million.

Continued focus on automotive financial services

• Due to its clear focus on financial services along the automotive value chain, we have changed the division’s name to Financial Services. The new name strengthens our identity and emphasizes the fact that Financial Services stands for global, first-class financial services and effective sales support for the automotive brands of the Group.

Intensified cooperation with dealers and the DaimlerChrysler

sales organization in North America

• In North America, we have further improved the services we provide to dealers with the introduction of innovative programs designed to accelerate credit approvals. In addition, we are focusing on optimizing our internal processes, especially in connection with customer care, credit processing and the sale of vehicles at the end of their leasing contracts. Attractive special financing programs caused new business in the NAFTA region to increase by 22% to €8.4 billion. Measured in US dollars, this increase amounted to 27%. Contract volume increased to €76.3 billion (Q1 2004: €72.8 billion).

Further growth in Europe

• Contract volume in Europe rose by 7% to €25.1 billion. Of this total, 57% was accounted for by Germany and 28% by the core markets of the United Kingdom, France and Italy. The division’s portfolio expanded dynamically (+14%) in the new EU member states in Central and Eastern Europe. In Germany, DaimlerChrysler Bank had a contract volume of €14.3 billion at the end of the quarter (end of Q1 2004: €13.3 billion). The deposit account business of €3.2 billion was close to the prior-year level, while the number of securities accounts rose from 11,500 to 15,500. At the end of the first quarter, DaimlerChrysler Bank had a total of around 940,000 customers, 8% more than a year earlier.

Successful start of toll system

• The successful start of the Toll Collect system on January 1, 2005, was an important milestone for Financial Services. Toll charging for trucks above 12 tons on German autobahns ran smoothly in the first quarter. By the end of March, some 4.5 billion toll kilometers had been recorded correctly. Financial Services holds a 45% interest in the Toll Collect consortium.

11

Other Activities

• EADS confirms its leading position for civil aircraft

• Positive developments at DaimlerChrysler Off-Highway

Amounts in millions | | Q1 05

US $ | | Q1 05

€ | | Q1 04

€ | | Change

in% | |

Operating profit | | 284 | | 219 | | 134 | | +63 | |

The Other Activities segment includes our shareholding in the European Aeronautic Defence and Space Company (EADS) and the DaimlerChrysler Off-Highway business unit. It also includes Corporate Research, the Group’s real-estate activities, and our holding and finance companies. The segment’s operating profit for the prior-year period also included the contribution to earnings from Mitsubishi Motors Corporation (MMC), which has been included in the Group’s consolidated financial statements as an investment measured at fair value since June 30, 2004.

The contribution to operating profit generated by our shareholding in EADS is included in DaimlerChrysler’s operating profit with a time lag of one quarter.

The operating profit contributed by the Other Activities segment rose from €134 million to €219 million in Q1 2005.

EADS

• The European Aeronautic Defence and Space Company (EADS), a global leader for aerospace and defense technology, will publish its figures on the first quarter on May 9, 2005.

• In the year 2004, Airbus delivered 320 civil aircraft to its customers (2003: 305), making it the biggest manufacturer in the world. In addition, Airbus defended its worldwide leading position in terms of incoming orders. In the first three months of the year 2005, 87 aircraft were handed over to customers (Q1 2004: 67).

• The A380 program is running according to schedule. In January 2005, the world’s biggest passenger aircraft was presented to the public. The A380 successfully performed its first flight in April 2005. Airbus intends to deliver the first aircraft of this type to customers in 2006. 154 orders and firm commitments have been placed for the A380 so far.

• Only 18 months after the start of the program, the A400M military transport aircraft went into production in January 2005. Delivery of the 180 aircraft ordered by customers in Europe will commence in the year 2009.

• In February 2005, the new, more powerful Ariane 5 ECA launcher rocket went into orbit successfully from the European spaceport in Kourou.

DaimlerChrysler Off-Highway

• At the end of the first quarter, a positive trend was apparent in the worldwide market for diesel engines for off-highway applications.

• The DaimlerChrysler Off-Highway business unit increased its first-quarter revenues by 23% to €378 million. The main areas of growth were ship engines and power generation (engines used for generating electricity).

• Incoming orders of €474 million were below the high level of the prior-year period, which had been influenced by booming demand in China.

12

DaimlerChrysler AG and Subsidiaries

Unaudited Condensed Consolidated Statements of Income

| | Consolidated | | Industrial Business | | Financial Services (1) | |

(in millions, except per share amounts) | | Q1 2005

(Note 1) $ | | Q1 2005

€ | | Q1 2004

€ | | Q1 2005

€ | | Q1 2004

€ | | Q1 2005

€ | | Q1 2004

€ | |

Revenues | | 41,169 | | 31,744 | | 32,351 | | 28,180 | | 28,981 | | 3,564 | | 3,370 | |

Cost of sales | | (33,747 | ) | (26,021 | ) | (25,864 | ) | (23,118 | ) | (23,299 | ) | (2,903 | ) | (2,565 | ) |

Gross margin | | 7,422 | | 5,723 | | 6,487 | | 5,062 | | 5,682 | | 661 | | 805 | |

Selling, administrative and other expenses | | (5,641 | ) | (4,350 | ) | (4,075 | ) | (4,050 | ) | (3,794 | ) | (300 | ) | (281 | ) |

Research and development | | (1,747 | ) | (1,347 | ) | (1,259 | ) | (1,347 | ) | (1,259 | ) | — | | — | |

Other income | | 170 | | 131 | | 178 | | 116 | | 169 | | 15 | | 9 | |

Turnaround plan expenses – Chrysler Group | | — | | — | | (17 | ) | — | | (17 | ) | — | | — | |

Income (loss) before financial income | | 204 | | 157 | | 1,314 | | (219 | ) | 781 | | 376 | | 533 | |

Financial income (expense), net | | 104 | | 80 | | (389 | ) | 79 | | (393 | ) | 1 | | 4 | |

Income (loss) before income taxes | | 308 | | 237 | | 925 | | (140 | ) | 388 | | 377 | | 537 | |

Income tax benefit (expense) | | 78 | | 60 | | (505 | ) | 203 | | (310 | ) | (143 | ) | (195 | ) |

Minority interests | | (12 | ) | (9 | ) | (8 | ) | (7 | ) | (7 | ) | (2 | ) | (1 | ) |

Net income | | 374 | | 288 | | 412 | | 56 | | 71 | | 232 | | 341 | |

| | | | | | | | | | | | | | | |

Earnings per share | | | | | | | | | | | | | | | |

Basic earnings per share | | 0.36 | | 0.28 | | 0.41 | | | | | | | | | |

Diluted earnings per share | | 0.36 | | 0.28 | | 0.41 | | | | | | | | | |

(1) Contains the financing and leasing business of the Financial Services segment without Mobility Management and activities of DaimlerChrysler Services AG.

The accompanying notes are an integral part of these Unaudited Interim Condensed Consolidated Financial Statements.

13

DaimlerChrysler AG and Subsidiaries

Condensed Consolidated Balance Sheets

| | Consolidated | | Industrial Business | | Financial Services (1) | |

(in millions) | | March 31,

2005

(unaudited)

(Note 1) $ | | March 31,

2005

(unaudited)

€ | | Dec. 31,

2004

€ | | March 31,

2005

(unaudited)

€ | | Dec. 31,

2004

(unaudited)

€ | | March 31,

2005

(unaudited)

€ | | Dec. 31,

2004

(unaudited)

€ | |

Assets | | | | | | | | | | | | | | | |

Goodwill | | 2,452 | | 1,891 | | 2,003 | | 1,832 | | 1,945 | | 59 | | 58 | |

Other intangible assets | | 3,675 | | 2,834 | | 2,671 | | 2,764 | | 2,602 | | 70 | | 69 | |

Property, plant and equipment, net | | 44,602 | | 34,391 | | 34,001 | | 34,221 | | 33,835 | | 170 | | 166 | |

Investments and long-term financial assets | | 9,679 | | 7,463 | | 7,043 | | 7,208 | | 6,767 | | 255 | | 276 | |

Equipment on operating leases, net | | 37,160 | | 28,653 | | 26,711 | | 3,555 | | 3,099 | | 25,098 | | 23,612 | |

Fixed assets | | 97,568 | | 75,232 | | 72,429 | | 49,580 | | 48,248 | | 25,652 | | 24,181 | |

Inventories | | 24,960 | | 19,246 | | 16,792 | | 17,778 | | 15,317 | | 1,468 | | 1,475 | |

Trade receivables | | 8,731 | | 6,732 | | 6,951 | | 6,495 | | 6,755 | | 237 | | 196 | |

Receivables from financial services | | 74,509 | | 57,452 | | 56,785 | | — | | — | | 57,452 | | 56,785 | |

Other assets | | 14,304 | | 11,029 | | 12,924 | | 7,293 | | 9,209 | | 3,736 | | 3,715 | |

Securities | | 4,882 | | 3,764 | | 3,884 | | 3,351 | | 3,474 | | 413 | | 410 | |

Cash and cash equivalents | | 11,974 | | 9,233 | | 7,771 | | 8,089 | | 6,771 | | 1,144 | | 1,000 | |

Non-fixed assets | | 139,360 | | 107,456 | | 105,107 | | 43,006 | | 41,526 | | 64,450 | | 63,581 | |

Deferred taxes | | 6,155 | | 4,746 | | 4,130 | | 4,596 | | 3,988 | | 150 | | 142 | |

Prepaid expenses | | 1,475 | | 1,137 | | 1,030 | | 1,037 | | 953 | | 100 | | 77 | |

Total assets | | 244,558 | | 188,571 | | 182,696 | | 98,219 | | 94,715 | | 90,352 | | 87,981 | |

| | | | | | | | | | | | | | | |

| | | | | | | | | | | | | | | |

Liabilities and stockholders’ equity | | | | | | | | | | | | | | | |

Capital stock | | 3,415 | | 2,633 | | 2,633 | | | | | | | | | |

Additional paid-in capital | | 10,465 | | 8,069 | | 8,042 | | | | | | | | | |

Retained earnings | | 39,321 | | 30,320 | | 30,032 | | | | | | | | | |

Accumulated other comprehensive loss | | (8,525 | ) | (6,573 | ) | (7,166 | ) | | | | | | | | |

Treasury stock | | (19 | ) | (15 | ) | — | | | | | | | | | |

Stockholders’ equity | | 44,657 | | 34,434 | | 33,541 | | 25,739 | | 25,439 | | 8,695 | | 8,102 | |

Minority interests | | 875 | | 675 | | 909 | | 641 | | 885 | | 34 | | 24 | |

Accrued liabilities | | 55,957 | | 43,147 | | 41,566 | | 41,994 | | 40,506 | | 1,153 | | 1,060 | |

Financial liabilities | | 100,345 | | 77,373 | | 76,620 | | 8,185 | | 8,680 | | 69,188 | | 67,940 | |

Trade liabilities | | 19,610 | | 15,121 | | 12,914 | | 14,906 | | 12,704 | | 215 | | 210 | |

Other liabilities | | 11,352 | | 8,753 | | 8,707 | | 6,089 | | 6,095 | | 2,664 | | 2,612 | |

Liabilities | | 131,307 | | 101,247 | | 98,241 | | 29,180 | | 27,479 | | 72,067 | | 70,762 | |

Deferred taxes | | 2,830 | | 2,182 | | 2,189 | | (4,170 | ) | (3,989 | ) | 6,352 | | 6,178 | |

Deferred income | | 8,932 | | 6,886 | | 6,250 | | 4,835 | | 4,395 | | 2,051 | | 1,855 | |

Total liabilities | | 199,901 | | 154,137 | | 149,155 | | 72,480 | | 69,276 | | 81,657 | | 79,879 | |

| | | | | | | | | | | | | | | |

Total liabilities and stockholders’ equity | | 244,558 | | 188,571 | | 182,696 | | 98,219 | | 94,715 | | 90,352 | | 87,981 | |

(1) Contains the financing and leasing business of the Financial Services segment without Mobility Management and activities of DaimlerChrysler Services AG.

The accompanying notes are an integral part of these Unaudited Interim Condensed Consolidated Financial Statements.

14

DaimlerChrysler AG and Subsidiaries

Unaudited Condensed Consolidated Statements of

Changes in Stockholders’ Equity

| | | | | | | | Accumulated other comprehensive loss | | | | | |

(in millions of €) | | Capital

stock | | Additional

paid-in

capital | | Retained

earnings | | Cumulative

translation

adjustment | | Available-

for-sale

securities | | Derivative

financial

instruments | | Minimum

pension

liability | | Treasury

stock | | Total | |

Balance at January 1, 2004 | | 2,633 | | 7,915 | | 29,085 | | (949 | ) | 333 | | 2,227 | | (6,763 | ) | — | | 34,481 | |

Net income | | — | | — | | 412 | | — | | — | | — | | — | | — | | 412 | |

Other comprehensive income (loss) | | — | | — | | — | | 551 | | 92 | | (282 | ) | — | | — | | 361 | |

Total comprehensive income | | | | | | | | | | | | | | | | | | 773 | |

Stock based compensation | | — | | 27 | | — | | — | | — | | — | | — | | — | | 27 | |

Purchase of capital stock | | — | | — | | — | | — | | — | | — | | — | | (18 | ) | (18 | ) |

Balance at March 31, 2004 | | 2,633 | | 7,942 | | 29,497 | | (398 | ) | 425 | | 1,945 | | (6,763 | ) | (18 | ) | 35,263 | |

| | | | | | | | | | | | | | | | | | | |

| | | | | | | | | | | | | | | | | | | |

Balance at January 1, 2005 | | 2,633 | | 8,042 | | 30,032 | | (1,640 | ) | 127 | | 1,858 | | (7,511 | ) | — | | 33,541 | |

Net income | | — | | — | | 288 | | — | | — | | — | | — | | — | | 288 | |

Other comprehensive income (loss) | | — | | — | | — | | 583 | | (16 | ) | 109 | | (83 | ) | — | | 593 | |

Total comprehensive income | | | | | | | | | | | | | | | | | | 881 | |

Stock based compensation | | — | | 27 | | — | | — | | — | | — | | — | | — | | 27 | |

Purchase of capital stock | | — | | — | | — | | — | | — | | — | | — | | (15 | ) | (15 | ) |

Balance at March 31, 2005 | | 2,633 | | 8,069 | | 30,320 | | (1,057 | ) | 111 | | 1,967 | | (7,594 | ) | (15 | ) | 34,434 | |

The accompanying notes are an integral part of these Unaudited Interim Condensed Consolidated Financial Statements.

15

DaimlerChrysler AG and Subsidiaries

Unaudited Condensed Consolidated Statements of Cash Flows

| | Consolidated | | Industrial Business | | Financial Services (1) | |

(in millions) | | Q1 2005

(Note 1) $ | | Q1 2005

€ | | Q1 2004

€ | | Q1 2005

€ | | Q1 2004

€ | | Q1 2005

€ | | Q1 2004

€ | |

Net income | | 374 | | 288 | | 412 | | 56 | | 71 | | 232 | | 341 | |

Income applicable to minority interests | | 12 | | 9 | | 8 | | 7 | | 7 | | 2 | | 1 | |

Gains on disposals of businesses | | (1 | ) | (1 | ) | (3 | ) | (1 | ) | (3 | ) | — | | — | |

Depreciation and amortization of equipment on operating leases | | 1,823 | | 1,406 | | 1,280 | | 115 | | 101 | | 1,291 | | 1,179 | |

Depreciation and amortization of fixed assets | | 2,398 | | 1,849 | | 1,383 | | 1,833 | | 1,365 | | 16 | | 18 | |

Change in deferred taxes | | (770 | ) | (594 | ) | 105 | | (513 | ) | (109 | ) | (81 | ) | 214 | |

Equity (income) loss from associated companies | | (52 | ) | (40 | ) | 317 | | (37 | ) | 322 | | (3 | ) | (5 | ) |

Change in financial instruments | | (145 | ) | (112 | ) | (283 | ) | (70 | ) | (294 | ) | (42 | ) | 11 | |

Gains on disposals of fixed assets/securities | | (398 | ) | (307 | ) | (91 | ) | (306 | ) | (91 | ) | (1 | ) | — | |

Change in trading securities | | 4 | | 3 | | 12 | | 1 | | 17 | | 2 | | (5 | ) |

Change in accrued liabilities | | 464 | | 358 | | 428 | | 309 | | 405 | | 49 | | 23 | |

Turnaround plan expenses – Chrysler Group | | — | | — | | 17 | | — | | 17 | | — | | — | |

Turnaround plan payments – Chrysler Group | | (36 | ) | (28 | ) | (79 | ) | (28 | ) | (79 | ) | — | | — | |

Net changes in inventory–related receivables from financial services | | 489 | | 377 | | 80 | | 377 | | 80 | | — | | — | |

Changes in other operating assets and liabilities: | | | | | | | | | | | | | | | |

– Inventories, net | | (2,914 | ) | (2,246 | ) | (1,873 | ) | (2,204 | ) | (1,949 | ) | (42 | ) | 76 | |

– Trade receivables | | 412 | | 318 | | (187 | ) | 334 | | (205 | ) | (16 | ) | 18 | |

– Trade liabilities | | 2,381 | | 1,836 | | 2,262 | | 1,842 | | 2,232 | | (6 | ) | 30 | |

– Other assets and liabilities | | 420 | | 324 | | 181 | | 223 | | 241 | | 101 | | (60 | ) |

Cash provided by operating activities | | 4,461 | | 3,440 | | 3,969 | | 1,938 | | 2,128 | | 1,502 | | 1,841 | |

Purchases of fixed assets: | | | | | | | | | | | | | | | |

– Increase in equipment on operating leases | | (5,914 | ) | (4,560 | ) | (3,824 | ) | (1,188 | ) | (1,114 | ) | (3,372 | ) | (2,710 | ) |

– Purchase of property, plant and equipment | | (1,913 | ) | (1,475 | ) | (1,368 | ) | (1,466 | ) | (1,360 | ) | (9 | ) | (8 | ) |

– Purchase of other fixed assets | | (78 | ) | (60 | ) | (100 | ) | (57 | ) | (97 | ) | (3 | ) | (3 | ) |

Proceeds from disposals of equipment on operating leases | | 3,713 | | 2,863 | | 2,698 | | 1,223 | | 1,195 | | 1,640 | | 1,503 | |

Proceeds from disposals of fixed assets | | 125 | | 96 | | 119 | | 91 | | 115 | | 5 | | 4 | |

Payments for investments in businesses | | (97 | ) | (75 | ) | (192 | ) | (79 | ) | (192 | ) | 4 | | — | |

Proceeds from disposals of businesses | | 4 | | 3 | | 18 | | (2 | ) | 4 | | 5 | | 14 | |

Investments in/collections from wholesale receivables | | (1,686 | ) | (1,300 | ) | (1,749 | ) | 4,936 | | 6,862 | | (6,236 | ) | (8,611 | ) |

Proceeds from sale of wholesale receivables | | 1,681 | | 1,296 | | 1,655 | | (5,319 | ) | (7,067 | ) | 6,615 | | 8,722 | |

Investments in retail receivables | | (11,513 | ) | (8,877 | ) | (6,086 | ) | 1,069 | | 989 | | (9,946 | ) | (7,075 | ) |

Collections on retail receivables | | 8,343 | | 6,433 | | 4,422 | | (1,064 | ) | (864 | ) | 7,497 | | 5,286 | |

Proceeds from sale of retail receivables | | 5,114 | | 3,943 | | 1,709 | | — | | — | | 3,943 | | 1,709 | |

(Acquisition) disposition of securities (other than trading), net | | 432 | | 333 | | (498 | ) | 357 | | (513 | ) | (24 | ) | 15 | |

Change in other cash | | (33 | ) | (25 | ) | (75 | ) | (12 | ) | (79 | ) | (13 | ) | 4 | |

Cash provided by (used for) investing activities | | (1,822 | ) | (1,405 | ) | (3,271 | ) | (1,511 | ) | (2,121 | ) | 106 | | (1,150 | ) |

Change in financial liabilities (including amounts for commercial paper borrowings, net of €1,299 ($1,685) and €(893) in 2005 and 2004, respectively) | | (724 | ) | (558 | ) | (2,514 | ) | 935 | | (1,597 | ) | (1,493 | ) | (917 | ) |

Dividends paid (incl. profit transferred from subsidiaries) | | (4 | ) | (3 | ) | — | | — | | 3 | | (3 | ) | (3 | ) |

Proceeds from issuance of capital stock (incl. minority interests) | | — | | — | | — | | (14 | ) | 1 | | 14 | | (1 | ) |

Purchase of treasury stock | | (19 | ) | (15 | ) | (18 | ) | (15 | ) | (18 | ) | — | | — | |

Cash provided by (used for) financing activities | | (747 | ) | (576 | ) | (2,532 | ) | 906 | | (1,611 | ) | (1,482 | ) | (921 | ) |

Effect of foreign exchange rate changes on cash and cash equivalents (originally maturing within 3 months) | | 272 | | 209 | | 180 | | 192 | | 161 | | 17 | | 19 | |

Net increase (decrease) in cash and cash equivalents (originally maturing within 3 months) | | 2,164 | | 1,668 | | (1,654 | ) | 1,526 | | (1,443 | ) | 142 | | (211 | ) |

Cash and cash equivalents (originally maturing within 3 months) | | | | | | | | | | | | | | | |

At beginning of period | | 9,572 | | 7,381 | | 10,767 | | 6,381 | | 9,469 | | 1,000 | | 1,298 | |

At end of period | | 11,736 | | 9,049 | | 9,113 | | 7,906 | | 8,026 | | 1,143 | | 1,087 | |

(1) Contains the financing and leasing business of the Financial Services segment without Mobility Management and activities of DaimlerChrysler Services AG.

The accompanying notes are an integral part of these Unaudited Interim Condensed Consolidated Financial Statements.

16

DaimlerChrysler AG and Subsidiaries

Notes to Unaudited Interim Condensed Consolidated Financial Statements

1. Presentation of Condensed Consolidated Financial Statements

General. The unaudited interim condensed consolidated financial statements (“interim financial statements”) of DaimlerChrysler AG and subsidiaries (“DaimlerChrysler” or “the Group”) have been prepared in accordance with generally accepted accounting principles in the United States of America (“U.S. GAAP”). All amounts are presented in millions of euros (“€”). For the convenience of the reader, amounts as of and for the three months ended March 31, 2005, are also presented in millions of U.S. dollars (“$”), converted at the rate of €1= $1.2969, the Noon Buying Rate of the Federal Reserve Bank of New York on March 31, 2005.

Certain amounts reported in prior periods have been reclassified to conform to the current period presentation. In 2004, the presentation of the consolidated statements of cash flows was modified with regard to certain receivables from financial services resulting in reclassifications in the unaudited interim condensed consolidated statements of cash flows for the three months ended March 31, 2004. Further information, including effects on the amounts previously reported, is provided in Note 2.

The interim financial statements for the three months ended March 31, 2004 have been restated to reflect the reduction of net periodic postretirement benefit cost associated with the subsidies provided by the Medicare Prescription Drug, Improvement and Modernization Act of 2003 (“Medicare Act”). The restatement is mandatory due to DaimlerChrysler’s election in the third quarter of 2004 to recognize the effects of the Medicare Act retroactively as of January 1, 2004. Net income and earnings per share originally reported for the three months ended March 31, 2004, were €393 million and €0.39, respectively. The effect of the Medicare Act on net income and earnings per share for the three months ended March 31, 2004, was €19 million and €0.02, respectively.

Financial income (expense), net, and net income for the first quarter of 2005 were favorably impacted by an adjustment of €40 million and €26 million, respectively, related to derivative instruments that failed to meet the criteria for hedge accounting treatment in 2004.

All significant intercompany accounts and transactions have been eliminated. In the opinion of management, the interim financial statements reflect all adjustments (consisting only of normal recurring adjustments) necessary for a fair presentation of the results of operations and financial position of the Group. Operating results for the interim periods presented are not necessarily indicative of the results that may be expected for any future period or the full fiscal year. The interim financial statements should be read in conjunction with the December 31, 2004 audited consolidated financial statements and notes thereto included in DaimlerChrysler’s 2004 Annual Report on Form 20-F which was filed with the United States Securities and Exchange Commission (“SEC”) on February 28, 2005.

Commercial practices with respect to certain products manufactured by DaimlerChrysler necessitate that sales financing, including leasing alternatives, be made available to the Group’s customers. Accordingly, the Group’s consolidated financial statements are also significantly influenced by the activities of its financial services business. To enhance the readers’ understanding of the Group’s interim financial statements, the accompanying financial statements present, in addition to the unaudited interim financial statements, unaudited information with respect to the results of operations and financial position of the Group’s industrial and financial services business activities. Such information, however, is not required by U.S. GAAP and is not intended to, and does not represent the separate U.S. GAAP results of operations and financial position of the Group’s industrial or financial services business activities. This information concerning the financial services business activities of the Group contains the financing and leasing business of the Financial Services segment without Mobility Management and activities of DaimlerChrysler Services AG. Transactions between the Group’s industrial and financial services business activities principally represent intercompany sales of products, intercompany borrowings and related interest, and other support under special vehicle financing programs. The effects of intercompany transactions between the industrial and financial services businesses have been eliminated within the industrial business columns.

Preparation of the financial statements in conformity with U.S. GAAP requires management to make estimates and assumptions related to the reported amounts of assets and liabilities and the disclosure of contingent assets and liabilities at the reporting date and the reported amounts of revenues and expenses for the period. Actual amounts could differ from those estimates.

17

DaimlerChrysler AG and Subsidiaries

Notes to Unaudited Interim Condensed Consolidated Financial Statements

New Accounting Standards Not Yet Adopted. In December 2004, the Financial Accounting Standards Board (“FASB”) issued Statement of Financial Accounting Standards (“SFAS”) 123 (revised 2004), “Share-Based Payment” (“SFAS 123R”). SFAS 123R establishes accounting guidance for transactions in which an entity exchanges its equity instruments for goods or services. SFAS 123R also addresses transactions in which an entity incurs liabilities in exchange for goods or services that are based on the fair value of the entity’s equity instruments or that may be settled by the issuance of those equity instruments. Equity-classified awards are measured at grant date fair value and are not subsequently remeasured. Liability-classified awards are remeasured to fair value at each balance-sheet date until the award is settled. SFAS 123R originally applied to all awards granted after July 1, 2005, and to awards modified, repurchased or cancelled after that date using a modified version of prospective application. The effective date of SFAS 123R was deferred by an SEC Rule until the beginning of the first annual period beginning after June 15, 2005, with early adoption permitted. DaimlerChrysler is currently determining the effect of SFAS 123R on the Group’s consolidated financial statements.

In March 2005, the FASB issued Interpretation (“FIN”) 47 “Accounting for Conditional Asset Retirement Obligations — an interpretation of FASB Statement No. 143.” FIN 47 clarifies that a conditional asset retirement obligation is a legal obligation to perform an asset retirement activity whose timing or method of settlement is conditional on a future event. FIN 47 also clarifies that a conditional asset retirement obligation should be recognized if its fair value is reasonably estimable and provides guidance on when there is sufficient information to reasonably estimate the fair value of an asset retirement obligation. FIN 47 should be applied no later than the end of the fiscal year 2005. DaimlerChrysler is currently determining the effect of FIN 47 on the Group’s consolidated financial statements.

2. Presentation of Receivables from Financial Services in Consolidated Statements of Cash Flows

In prior periods, DaimlerChrysler reported the effects of all receivables from financial services as investing activities for purposes of presentation in the consolidated statements of cash flows as well as the accompanying information about cash flows of the financial services business. This policy, when applied to receivables from financial services related to sales of the Group’s products to its customers, had the effect of presenting an investing cash outflow and an operating cash inflow even though there was no cash flow on a consolidated basis. During 2004, based on concerns raised by the staff of the SEC, management has decided to report the cash flow related effects of those receivables from financial services which relate to sales of the products to customers within operating cash flows in the consolidated statements of cash flows. This presentation resulted in the elimination of the intercompany activity between the industrial business and financial services business. Management also determined to revise the presentation in the consolidated statements of cash flows for the three months ended March 31, 2004 to achieve a comparable presentation for all periods presented herein.

The cash flow related effects of receivables from financial services that are unrelated to the Group’s inventory or involve investments in loans or finance leases to retail customers of a dealer-customer continue to be reported within cash used for investing activities.

The balance of cash and cash equivalents at March 31, 2004 and the total net decrease in cash and cash equivalents and cash used for financing activities for the three months ended March 31, 2004 remained unchanged. The impact of the reclassification on the captions within the consolidated statements of cash flows with respect to the three months ended March 31, 2004 is:

| | Three months ended March 31,

2004 | |

(in millions of €) | | | |

Cash provided by operating activities, as previously reported | | 3,889 | |

Amount reclassified from investing activities | | 80 | |

Cash provided by operating activities, after reclassification | | 3,969 | |

| | | |

Cash used for investing activities, as previously reported | | (3,191 | ) |

Amount reclassified to operating activities | | (80 | ) |

Cash used for investing activities, after reclassification | | (3,271 | ) |

18

DaimlerChrysler AG and Subsidiaries

Notes to Unaudited Interim Condensed Consolidated Financial Statements

3. Acquisitions and Dispositions

On March 14, 2003, as part of the Group’s global commercial vehicle strategy, DaimlerChrysler acquired from Mitsubishi Motors Corporation (“MMC”) a 43% non-controlling interest in Mitsubishi Fuso Truck and Bus Corporation (“MFTBC”) for €764 million in cash plus certain direct acquisition costs. MFTBC is involved in the development, design, manufacture, assembly and sale of small, mid-size and heavy-duty trucks and buses, primarily in Japan and other Asian countries. Also, on March 14, 2003, ten Mitsubishi Group companies entered into a separate share sale and purchase agreement with MMC pursuant to which they purchased from MMC 15% of MFTBC’s shares for approximately €266 million in cash. On March 18, 2004, DaimlerChrysler acquired from MMC an additional 22% interest in MFTBC for €394 million in cash, thereby reducing MMC’s interest in MFTBC to a non-controlling 20%. The aggregate amount paid by DaimlerChrysler for its 65% controlling interest in MFTBC was €1,251 million, consisting of consideration paid plus direct acquisition costs in 2003 and 2004 (€770 million and €394 million, respectively), plus a re-allocation of €87 million of the initial purchase price of MMC pertaining to MFTBC and previously included in the Group’s investment in MMC, which was an equity method investee of DaimlerChrysler when the business combination with MFTBC was consummated. DaimlerChrysler has included the consolidated results of MFTBC beginning at the consummation date in the Group’s Commercial Vehicles segment. Prior to then, the Group’s proportionate share of MFTBC’s results are included in the Commercial Vehicles segment using the equity method of accounting.

Subsequent to DaimlerChrysler’s acquisition of a controlling interest in MFTBC, a number of quality problems concerning MFTBC vehicles spanning production years since July 1974 were identified. During the second and third quarters of 2004, DaimlerChrysler was able to comprehensively assess those quality issues and define necessary technical solutions and a course of action to implement them. The estimates of cost in the interim periods of 2004 were based on the status of the investigation and DaimlerChrysler’s best estimate of the probable costs to be incurred to address and remedy the identified quality issues.

Of the €1.1 billion quality costs recorded in 2004 by MFTBC, (i) €0.1 billion was recognized in “Financial income (expense), net” in the statement of income representing DaimlerChrysler’s proportionate share of the results of MFTBC, which is included on a one month lag relating to amounts attributed to refinements to estimates that were made before MFTBC was fully consolidated, (ii) €0.7 billion to cost of sales representing the sum of the 43% attributed to the March 2003 investment (for which the purchase price allocation period is closed) and the 35% of the costs attributed to minority shareholders of MFTBC; (iii) €0.2 billion to goodwill attributed to the 22% interest acquired in 2004; and (iv) €0.1 billion to deferred tax assets.

During the first quarter of 2005, MFTBC finished investigating the product quality reports and finalized its conclusions about the issues that require action. The level of information reached during this process enabled DaimlerChrysler to refine its estimate of the probable cost and an additional amount of €5 million was recorded in the first quarter of 2005. MFTBC expects to be able to complete the majority of the field campaigns within one year.

Under the two share purchase agreements under which DaimlerChrysler acquired 43% and 22%, respectively, of MFTBC shares, DaimlerChrysler had the right to a price adjustment if the warranty reserve recorded on the books of MFTBC proved to be inadequate. Negotiations with MMC resulted in a settlement agreement on March 4, 2005, in which the parties agreed on such a price adjustment. Under the terms of the settlement agreement, DaimlerChrysler received (i) MMC’s remaining 20% stake in MFTBC, (ii) a cash payment of €72 million, (iii) promissory notes having an aggregate face value of €143 million, payable in four equal installments over the next four years and (iv) certain other assets and rights pertaining to the distribution of MFTBC products in one Asian market. In exchange for the consideration received, DaimlerChrysler waived its claims for a purchase price reduction and the parties also clarified the terms of their cooperation under other, ongoing agreements. The estimated fair value of the consideration received from MMC was €0.5 billion and has been allocated to income and goodwill consistent with DaimlerChrysler’s accounting for the quality issues subsequent to the business combination. Accordingly, €0.3 billion was recognized as a reduction of cost of sales in the current interim period based on DaimlerChrysler’s proportionate after-tax loss recorded in the second and third quarter of 2004 relating to quality measures and €0.2 billion was recognized as reduction of goodwill.

As a result of the settlement with MMC, DaimlerChrysler’s controlling interest in MFTBC increased from 65% to 85% and the aggregate purchase price after giving effect to the price reduction was €1,014 million. DaimlerChrysler expects to finalize the purchase price allocation for the 20% interest received in connection with the settlement in the second quarter of 2005. As of March 31, 2005, goodwill of €57 million related to MFTBC which is not expected to be deductible for tax purposes was allocated to the Commercial Vehicles segment.

19

DaimlerChrysler AG and Subsidiaries

Notes to Unaudited Interim Condensed Consolidated Financial Statements

4. Functional Costs and Other Expenses

Based on the unit sales development of the smart roadster and the smart forfour, two products of the business unit smart, and the downward revisions to forecasted sales targets, DaimlerChrysler reduced its production and notified suppliers about declining shipments. These developments resulted in increasing operating and cash flow losses and an expectation that losses would continue in future periods. Therefore, during the first quarter of 2005, DaimlerChrysler evaluated the recoverability of the carrying amount of the long-lived assets that generate cash flows largely independent of other assets and liabilities of the Group. The smart roadster is assembled in a plant in France, whereas the asset group related to the smart forfour consists of owned real estate and equipment of a German plant as well as leased equipment located with suppliers, but carried on DaimlerChrysler’s balance sheet. As a result of the impairment test, DaimlerChrysler recognized charges of €440 million in “Cost of Sales” of the Mercedes Car Group segment representing the excess of the carrying amount of these long-lived assets over their fair value. After the impairment charge, the remaining carrying amount of the long-lived assets represents the estimated fair value of land and buildings.

As a result of the deterioration of operations in the first quarter of 2005, DaimlerChrysler decided to cease production of the smart roadster by the end of 2005, reduce prices of certain products and provide incentives to dealers related to those vehicles. Thus, also included as a reduction of revenue or in “Cost of Sales” in the first quarter are €97 million to recognize the effects of inventory write-downs, higher incentives and lower residual values of vehicles. Further costs related to the realignment of smart amounting to €48 million arise primarily from supplier claims. In connection with the activities related to the smart business unit, DaimlerChrysler also decided not to proceed with the launch of the smart SUV that was scheduled to be introduced in 2006. As a result of the decision to abandon the smart SUV, tooling and equipment located in our designated assembly plant in Brazil and equipment still under construction with suppliers for which firm purchase orders were in place, €61 million was written off by a charge to “Other Operating Expenses” to the extent those assets could not be redeployed for other purposes. In addition, charges of €154 million related to the liabilities arising from the cancellation of supply contracts were recognized as “Other Operating Expenses.”

In addition to the charges recorded in the current interim period, DaimlerChrysler expects to incur additional charges related to employee termination benefits, contract termination and other exit costs in the course of 2005.

5. Turnaround Plan for the Chrysler Group

In 2001, the DaimlerChrysler Supervisory Board approved a multi-year turnaround plan for the Chrysler Group. Key initiatives for the multi-year turnaround plan included a workforce reduction and an elimination of excess capacity.

There were no charges or adjustments recorded for the plan in the three months ended March 31, 2005. The net charges recorded for the plan in the three months ended March 31, 2004 were €17 million (€10 million net of taxes) and are presented as a separate line item in the accompanying consolidated statements of income (loss) (€16 million and €1 million would have otherwise been reflected in cost of sales and selling, administrative and other expenses, respectively). These adjustments were recorded for costs associated with the closing or disposition of certain manufacturing facilities in 2004 and 2005.

Workforce reduction charges were adjusted by €(19) million during the first quarter of 2004. The charges for the voluntary early retirement programs, accepted by 460 employees for the first quarter of 2004, were formula driven based on salary levels, age and past service. Additionally, 1,808 employees were involuntarily affected by the plan in the first quarter of 2004. The amount of involuntary severance benefits paid and charged against the liability during the three months ended March 31, 2005 and 2004 was €6 million and €1 million, respectively.

During the first quarter of 2004, the Chrysler Group recorded adjustments of €39 million to impairment charges previously recognized. In addition, other costs related to supplier contract cancellation costs and accruals related to divestiture and closure actions were adjusted by €(3) million during the first quarter of 2004.

In the three months ended March 31, 2005 and 2004, the Chrysler Group made cash payments of €28 million and €79 million, respectively for charges previously recorded. The Chrysler Group expects to make cash payments of approximately $150 million in 2005 for the previously recorded charges. The Chrysler Group may recognize additional adjustments to the turnaround plan charges in 2005 primarily relating to the sale or closure of selected operations.

As of March 31, 2005 and December 31, 2004, the Chrysler Group had workforce reduction reserves of €154 million and €160 million, respectively. In addition, reserves for other costs were €49 million and €60 million, as of March 31, 2005 and December 31, 2004, respectively.

20

DaimlerChrysler AG and Subsidiaries

Notes to Unaudited Interim Condensed Consolidated Financial Statements

6. Goodwill

During the three months ended March 31, 2005, the carrying amount of goodwill was reduced by a total of €112 million. In this period, the goodwill of MFTBC was reduced by €196 million (see Note 3). The remaining changes in the carrying amount of goodwill primarily relate to currency translation adjustments.

7. Other Intangible Assets

Other intangible assets comprise:

(in millions of €) | | At March 31,

2005 | | At Dec. 31,

2004 | |

Other intangible assets subject to amortization | | | | | |

Gross carrying amount | | 1,365 | | 1,309 | |

Accumulated amortization | | (841 | ) | (806 | ) |

Net carrying amount | | 524 | | 503 | |

Other intangible assets not subject to amortization | | 2,310 | | 2,168 | |

| | 2,834 | | 2,671 | |

DaimlerChrysler’s other intangible assets subject to amortization represent concessions, industrial property rights and similar rights as well as software developed or obtained for internal use. During the three months ended March 31, 2005, additions of €107 million were recognized. The aggregate amortization expense for the three months ended March 31, 2005 and 2004, was €47 million and €38 million, respectively.

Other intangible assets not subject to amortization represent primarily intangible pension assets.

8. Inventories

Inventories are comprised of the following:

(in millions of €) | | At March 31,

2005 | | At Dec. 31,

2004 | |

Raw materials and manufacturing supplies | | 1,930 | | 1,746 | |

Work-in-process | | 3,007 | | 2,545 | |

Finished goods, parts and products held for resale | | 14,665 | | 12,792 | |

Advance payments to suppliers | | 41 | | 75 | |

| | 19,643 | | 17,158 | |

Less: Advance payments received | | (397 | ) | (366 | ) |

| | 19,246 | | 16,792 | |

9. Cash and Cash Equivalents