SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

Form 6-K

REPORT OF FOREIGN PRIVATE ISSUER

PURSUANT TO RULE 13a-16 OR 15d-16 UNDER

THE SECURITIES EXCHANGE ACT OF 1934

For the month of October 2006

Commission File Number 1-12356

DaimlerChrysler AG

(Translation of registrant’s name into English)

MERCEDESSTRASSE 137, 70327 STUTTGART, GERMANY

(Address of principal executive office)

[Indicate by check mark whether the registrant files or will file annual reports under cover of Form 20-F or Form 40-F.]

Form 20-F x Form 40-F o

[Indicate by check mark whether the registrant by furnishing the information contained in this Form is also thereby furnishing the information to the Commission pursuant to Rule 12g3-2(b) under the Securities Exchange Act of 1934.]

Yes o No x

[If “Yes” is marked, indicate below the file number assigned to the registrant in connection with Rule 12g3-2(b): 82- ]

This report on Form 6-K is hereby incorporated by reference in the registration statement on Form F-3 of DaimlerChrysler North America Holding Corporation (Registration Statements Nos. 333-123535 and 333-13160) and the registration statements on Form S-8 (Nos. 333-5074, 333-7082, 333-8998, 333-86934 and 333-86936) of DaimlerChrysler AG

DAIMLERCHRYSLER AG

FORM 6-K: TABLE OF CONTENTS

1. Press Release: Mercedes Car Group and Truck Group above market expectations in Q3 2006.

2. Interim Report to Stockholders for the three- and nine-month periods ended September 30, 2006

CAUTIONARY STATEMENT REGARDING FORWARD-LOOKING STATEMENTS

This document contains forward-looking statements that reflect management’s current views with respect to future events. The words „anticipate,” „assume,” „believe,” „estimate,” „expect,” „intend,” „may,” „plan,” „project” and „should” and similar expressions identify forward-looking statements. Such statements are subject to risks and uncertainties, including, but not limited to: an economic downturn in Europe or North America; changes in currency exchange rates, interest rates and in raw material prices; introduction of competing products; increased sales incentives; the effective implementation of our New Management Model, and the CORE program, including the new business model for smart, at the Mercedes Car Group; renewed pressure to reduce costs in light of restructuring plans announced by our major competitors in NAFTA; the ability of the Chrysler Group to reduce dealer inventories with current incentive programs and respond to a shift in market demand for smaller, more fuel efficient vehicles; lower profit contributions by EADS due to delays in the deliveries of the Airbus A380; disruption of production or vehicle deliveries, resulting from shortages, labor strikes or supplier insolvencies; the resolution of pending governmental investigations; and decline in resale prices of used vehicles. If any of these or other risks and uncertainties occur (some of which are described under the heading “Risk Report” in DaimlerChrysler’s most recent Annual Report and under the heading “Risk Factors” in DaimlerChrysler’s most recent Annual Report on Form 20-F filed with the Securities and Exchange Commission), or if the assumptions underlying any of these statements prove incorrect, then actual results may be materially different from those expressed or implied by such statements. We do not intend or assume any obligation to update any forward-looking statement, which speaks only as of the date on which it is made.

1

|

| |

Contact | | Press Information |

Thomas Fröhlich | +49 (0)7 11/17-9 33 11 | |

| | | Date |

| | | October 25, 2006 |

Mercedes Car Group and Truck Group above

market expectations in Q3 2006

· Mercedes Car Group: Operating profit of €911 million (+127%)

· Chrysler Group: Operating loss of €1,164 million

· Truck Group: Operating profit of €556 million (+57%)

· Financial Services: Operating profit of €445 million (+9%)

· Group operating profit of €892 million (Q3 2005: €1,838 million)

· Net income of €541 million (Q3 2005: €855 million)

· Group operating profit in the magnitude of €5 billion anticipated for full-year 2006

Stuttgart - DaimlerChrysler (stock abbreviation DCX) achieved a third-quarter operating profit of €892 million (Q3 2005: €1,838 million).

The continuation of the very positive earnings trend at the Mercedes Car Group, the distinct increase in operating profit at the Truck Group as well as the Financial Services’ operating profit, which is above the high level of earnings in the prior-year quarter, only partially compensated for the loss contributed by the Chrysler Group.

Page 2

Net income amounted to €541 million in the third quarter (Q3 2005: €855 million). Earnings per share amounted to €0.53, compared with €0.84 in the third quarter of 2005.

The Mercedes Car Group increased its operating profit by 127% to €991 million. This significant increase in earnings is primarily due to the efficiency improvements achieved in the context of the CORE program. An additional factor was that earnings were favourably impacted by the improved model mix since the launch of the new S-Class and M-/ R-/GL-Class. Exchange-rate effects had a negative impact on operating profit.

The Chrysler Group posted an operating loss of €1,164 million in the third quarter of 2006, compared with an operating profit of €310 million in the same quarter of last year. The operating loss was primarily the result of a decrease in worldwide factory unit sales, an unfavorable shift in product and market mix, and negative net pricing. These factors reflect a continuing difficult market environment in the United States as the Chrysler Group faced increased dealer inventory levels from the prior quarter, a shift in consumer demand toward smaller vehicles due to higher fuel prices, and increased interest rates.

The Truck Group posted an operating profit of €556 million (Q3 2005: €354 million). This significant increase in earnings was due to higher unit sales, a high utilization of capacity combined with strong productivity, and an improved model mix. In addition, further efficiency

Page 3

improvements were realized in the context of the Global Excellence program, which more than compensated for the higher expenses incurred for new vehicle projects and the fulfillment of future emission regulations.

The Financial Services division continued its positive business trend in the third quarter, and improved its operating profit to €445 million, compared with €408 million in the third quarter of last year. This increase in earnings was assisted by the higher volume of new business and improved efficiency. There were opposing effects from increased risk costs, which had been extremely low in the prior-year quarter.

The Van, Bus, Other segment posted a third-quarter operating profit of €315 million (Q3 2005: €379 million), including expenses of €72 million for the implementation of the new management model, mainly for the voluntary headcount reduction program in administrative areas. The sale of real estate properties not required for operating purposes led to a gain of €86 million in the third quarter.

The contribution to earnings from the European Aeronautic Defence and Space Company (EADS) amounted to €247 million, which was slightly below the result of €256 million in the prior-year quarter. This was primarily caused by less favorable currency-hedging rates. The delays with the delivery of the Airbus A380 did not affect the profit contribution from EADS to DaimlerChrysler in the third

Page 4

quarter, as the results of EADS are consolidated by the DaimlerChrysler Group with a three-month time lag.

Outlook

The Mercedes Car Group anticipates full-year unit sales at least as high as in 2005. The division assumes that unit sales by Mercedes-Benz will exceed last year’s figure as a result of the market success of the brand’s new products. The Mercedes Car Group will continue to effectively implement the CORE efficiency-improving program. The division’s positive earnings trend is expected to continue in the fourth quarter.

Due to intense competition and the shift in demand towards smaller vehicles, the Chrysler Group assumes that unit sales (factory shipments) in 2006 will be lower than in the prior year. Eight new models, many of which are in the growing segments of passenger cars and small SUVs, are now being launched or will be launched this year. The Chrysler Group will implement further cuts in production volumes during the fourth quarter in order to reduce dealer inventories and clear the way for the current product offensive. DaimlerChrysler expects the division to post a loss of approximately €1 billion for full-year 2006.

The Truck Group expects full-year unit sales at least to reach 2005 sales figures. Due to positive market developments in the

Page 5

core markets of Europe, the United States and Japan in connection with upcoming new emission regulations, the ongoing strong demand for its products and further improvements in productivity and efficiency, the Truck Group expects to significantly exceed the prior year’s earnings.

The Financial Services division anticipates a continuation of its stable business development in the remaining months of the year 2006, despite the higher level of interest rates and falling growth in consumption in the United States. Enhanced process quality and efficiency will help to further improve the division’s competitive position. Operating profit in full-year 2006 should be higher than in the prior year.

The Vans unit expects lower unit sales than in 2005 due to the Sprinter model change. Unit sales of buses are likely to exceed the high level of the prior year. In connection with the revised delivery planning for the Airbus A380, EADS revoked its original earnings forecast at the beginning of October. EADS has not issued any new earnings guidance since then.

On September 15, DaimlerChrysler reduced the Group’s operating-profit target for 2006 to an amount in the magnitude of €5 billion.

Page 6

Although the company now has to assume that the profit contribution from EADS will be €0.2 billion lower than originally anticipated because of the delayed delivery of the Airbus A380, DaimlerChrysler is maintaining this earnings target due to very positive business developments in the divisions Mercedes Car Group, Truck Group and Financial Services.

This forecast also includes charges for the implementation of the new management model (€0.5 billion), the focus on the smart fortwo (€1 billion) and the staff reductions at the Mercedes Car Group (€0.4 billion). There are positive effects from gains on the disposal of the off-highway business (€0.2 billion), the sale of real estate no longer required for operating purposes (€0.1 billion) and the release of provisions for retirement-pension obligations (€0.2 billion).

This press release contains forward-looking statements that reflect management’s current views with respect to future events. The words “anticipate,” “assume,” “believe,” “estimate,” “expect,” “intend,” “may,” “plan,” “project” and “should” and similar expressions identify forward-looking statements. Such statements are subject to risks and uncertainties, including, but not limited to: an economic downturn in Europe or North America; changes in currency exchange rates, interest rates and raw material prices; the introduction of competing products; increased sales incentives; the effective implementation of our new management model, and the CORE program, including the new business model for smart at the Mercedes Car Group; renewed pressure to reduce costs in light of restructuring plans announced by our major competitors in NAFTA; the ability of the Chrysler Group to reduce dealer inventories with current incentive programs and to respond to a shift in market demand for smaller, more fuel efficient vehicles; lower profit contributions by EADS due to delays in deliveries of the Airbus A380; disruption of production or vehicle deliveries, resulting from shortages, labor strikes or supplier insolvencies; the resolution of pending governmental investigations; and a decline in resale prices of used vehicles. If any of these or other risks and uncertainties occur (some of which are described under the heading “Risk Report” in DaimlerChrysler’s most recent Annual Report and under the heading “Risk Factors” in DaimlerChrysler’s most recent Annual Report on Form 20-F filed with the Securities and Exchange Commission), or if the assumptions underlying any of these statements prove incorrect, then actual results may be materially different from those expressed or implied by such statements. We do not intend or assume any obligation to update any forward-looking statement, which speaks only as of the date on which it is made.

Page 7

Further information from DaimlerChrysler is available on the internet at: www.media.daimlerchrysler.com

2

DAIMLERCHRYSLER

Q3 2006

Interim Report

Contents

Q3

DaimlerChrysler Group

Amounts in millions of € | | Q3 2006 | | Q3 2005 | | Change in % | |

Revenues | | 35,176 | | 38,155 | | -8 | (1) |

Western Europe | | 11,910 | | 11,678 | | +2 | |

Germany | | 5,190 | | 5,065 | | +2 | |

United States | | 13,950 | | 17,435 | | -20 | |

Other markets | | 9,316 | | 9,042 | | +3 | |

Employees (September 30) | | 365,451 | | 388,014 | | -6 | |

Research and development costs | | 1,301 | | 1,408 | | -8 | |

Investment in property, plant and equipment | | 1,247 | | 1,690 | | -26 | |

Cash provided by operating activities | | 2,694 | | 4,037 | | -33 | |

Operating profit | | 892 | | 1,838 | | -51 | |

Net income | | 541 | | 855 | | -37 | |

per share (in €) | | 0.53 | | 0.84 | | -37 | |

(1) A 5% decrease after adjusting for the effects of currency translation.

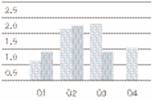

Revenues | Operating Profit | Net Income | Earnings per Share |

(in billions of €) | (in billions of €) | (in billions of €) | (in €) |

| | | |

|

|

|

|

| 2005 |

| 2006 |

Cover photo:

The Dodge Nitro is a new mid-sized SUV with five seats, featuring attractive styling, high performance and great versatility. The Dodge Nitro is now being launched in the United States and will be available in Europe starting in spring 2007.

2

Q1–3

DaimlerChrysler Group

Amounts in millions of € | | Q1–3 2006 | | Q1–3 2005 | | Change in % | |

Revenues | | 110,923 | | 108,322 | | +2 | |

Western Europe | | 36,144 | | 34,193 | | +6 | |

Germany | | 15,526 | | 14,861 | | +4 | |

United States | | 47,317 | | 48,966 | | -3 | |

Other markets | | 27,462 | | 25,163 | | +9 | |

Employees (September 30) | | 365,451 | | 388,014 | | -6 | |

Research and development costs | | 3,970 | | 4,080 | | -3 | |

Investment in property, plant and equipment | | 4,427 | | 4,771 | | -7 | |

Cash provided by operating activities | | 8,482 | | 11,006 | | -23 | |

Operating profit | | 3,640 | | 4,137 | | -12 | |

Net income | | 2,650 | | 1,880 | | +41 | |

per share (in €) | | 2.60 | | 1.85 | | +41 | |

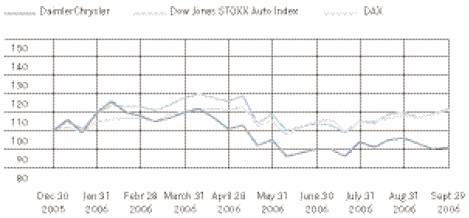

Share Price Index

Share price movements:

At the beginning of 2006, DaimlerChrysler’s share price continued the upward trend of the second half of 2005. In the summer months, however, our share price — like the entire market — came under significant pressure due to high oil prices, rising interest rates and concern about a weakening of economic growth. Global stock markets recovered a large part of their share-price losses during the third quarter. DaimlerChrysler’s share price also increased significantly at first. The recovery ended in the middle of September with the announcement of the new earnings forecasts for the Chrysler Group and the DaimlerChrysler Group. After that, our share price displayed a sideways tendency until the end of the quarter. The closing price for DaimlerChrysler shares at the end of September was €39.41 in XETRA trading in Frankfurt and $49.96 on the New York Stock Exchange.

3

Management Report

· Group operating profit of €0.9 billion compared with €1.8 billion in Q3 2005

· Net income of €541 million (Q3 2005: €855 million)

· Earnings per share of €0.53 (Q3 2005: €0.84)

· Revenues below prior-year level at €35.2 billion

· Operating profit in the magnitude of €5 billion anticipated for full-year 2006

Business developments

· The global economy expanded at a rate of 3.6% in the third quarter, once again higher than the long-term average. However, economic growth was not as strong as the 4.1% recorded in the first half of the year. The growth slowdown was primarily caused by rising inflation, higher interest rates and the burden of continuing high prices for raw materials. In particular in North America and China, where high growth rates of 3.6% and 10.7% respectively were recorded in the first half of the year, the economic dynamism has now subsided somewhat. Japan, Western Europe and the emerging markets developed positively.

· Parallel to the development of the world economy and due mainly to high prices for oil and fuel, growth in global demand for automobiles slowed down in the third quarter compared with the first half of the year. Compared with the third quarter of last year, market volume decreased in the United States, Western Europe and Japan. In the United States, there was a continuation of the shift in demand away from minivans, SUVs and light trucks and towards more fuel-efficient passenger cars. The emerging markets of Asia once again proved to be the engine of worldwide demand for automobiles, led by China and India. Worldwide demand for commercial vehicles remained at a high level, especially in the medium and heavy segments.

· DaimlerChrysler sold 1.0 million vehicles worldwide in the third quarter, not equaling the high level recorded in Q3 2005

(-14%).

· Unit sales of 307,500 vehicles by the Mercedes Car Group were close to the prior-year level. Unit sales by the Chrysler Group (factory shipments) decreased to 504,400 passenger cars and light trucks (Q3 2005: 663,400). The Truck Group increased its sales by 2% to 141,900 units. Mercedes-Benz Vans and DaimlerChrysler Buses sold 58,800 vans and 8,600 buses and chassis respectively (Q3 2005: 64,200 and 9,200). The Financial Services division increased its new business by 6%; contract volume at the end of the third quarter was similar to the level a year earlier.

· As a result of the lower unit sales, the Group’s revenues decreased from €38.2 billion to €35.2 billion. Adjusted for currency-translation effects, the decrease was 5%.

· For product-lifecycle reasons, investments in property, plant and equipment of €1.2 billion were lower than in Q3 2005, with decreases in all divisions. Research and development expenditure of €1.3 billion was lower than in the prior-year period.

Profitability

· The DaimlerChrysler Group’s operating profit amounted to €892 million, below the result of €1,838 million in the third quarter of last year.

· The continuation of the very positive earnings trend at the Mercedes Car Group and the distinct increase in operating profit at the Truck Group only partially compensated for the loss contributed by the Chrysler Group. Financial Services’ operating profit also exceeded its strong result in the prior-year period.

· Third-quarter operating profit was reduced by exchange-rate effects reflecting less favorable currency-hedging rates than in Q3 2005.

· Price developments for certain raw materials, such as specific precious metals, also burdened earnings in the third quarter of this year. However, the resulting higher costs of raw materials were offset by active material-cost management.

· The development of the Group’s earnings was affected by the special items shown in the following table:

4

Amounts in millions of € | | Q3 2006 | | Q3 2005 | |

| | | | | |

Mercedes Car Group | | | | | |

Restructuring at smart | | 40 | | | |

| | | | | |

Expenses relating to staff reductions in the context of CORE | | (47 | ) | | |

| | | | | |

Release of a provision after favorable verdict in a case concerning the infringement of EU competition law | | | | 60 | |

| | | | | |

Chrysler Group | | | | | |

Financial support for supplier Collins & Aikman | | (10 | ) | (57 | ) |

| | | | | |

Truck Group | | | | | |

Impairment American LaFrance | | | | (63 | ) |

| | | | | |

Van, Bus, Other | | | | | |

Expenses relating to the new management model | | (72 | ) | | |

| | | | | |

Sale of real estate not required for operating purposes | | 86 | | | |

· The Mercedes Car Group increased its operating profit by 127% to €991 million.

· This significant increase in earnings is primarily due to the efficiency improvements achieved in the context of the CORE program. An additional factor was that although total unit sales decreased slightly (-3,400 vehicles), earnings were favorably impacted by the improved model mix since the launch of the new S-Class and M/R/GL-Class. Whereas unit sales by the Mercedes-Benz brand increased slightly, unit sales at smart decreased, as expected. Exchange-rate effects had a negative impact on operating profit.

· Staff reductions at Mercedes-Benz Passenger Cars in the context of the CORE program led to charges of €47 million. Within the framework of the headcount reduction program announced in September 2005, approximately 9,300 employees had signed severance agreements or had already left the company. In connection with the restructuring of smart, original estimates had to be adjusted to current developments, which resulted in a gain of €40 million.

· The Chrysler Group posted an operating loss of €1,164 million in the third quarter of 2006, compared with an operating profit of €310 million in the same quarter of last year.

· The operating loss was primarily the result of a decrease in worldwide factory unit sales, an unfavorable shift in product and market mix, and negative net pricing. These factors reflect a continuing difficult market environment in the United States as the Chrysler Group faced increased dealer inventory levels from the prior quarter, a shift in consumer demand toward smaller vehicles as a result of higher fuel prices, and increased interest rates.

· In order to reduce the high levels of dealer inventories, we reduced shipments to dealers, which necessitated corresponding production adjustments. Total factory shipments of 504,400 vehicles in the third quarter were 158,900 units lower than in the third quarter of last year. During the third quarter, dealer inventories fell from 648,600 to 534,000 vehicles at September 30, 2006. At the end of third quarter of 2005, dealer inventories had totaled 580,200 vehicles.

· The Truck Group posted an operating profit of €556 million (Q3 2005: €354 million).

· This significant increase in earnings was due to higher unit sales (+3,000 vehicles), a high utilization of capacity combined with strong productivity, and an improved model mix. In addition, further efficiency improvements were realized in the context of the Global Excellence program, which more than compensated for the higher expenses incurred for new vehicle projects and for the fulfillment of future emission regulations.

Operating Profit (Loss) by Segment

Amounts in millions of € | | Q3 2006 | | Q3 2005 | | Change in % | | Q1–3 2006 | | Q1–3 2005 | | Change in % | |

| | | | | | | | | | | | | |

Mercedes Car Group | | 991 | | 436 | | +127 | | 1,120 | | (506 | ) | — | |

Chrysler Group | | (1,164 | ) | 310 | | — | | (994 | ) | 1,106 | | — | |

Truck Group | | 556 | | 354 | | +57 | | 1,533 | | 1,462 | | +5 | |

Financial Services | | 445 | | 408 | | +9 | | 1,315 | | 1,121 | | +17 | |

Van, Bus, Other | | 315 | | 379 | | -17 | | 897 | | 890 | | +1 | |

Eliminations | | (251 | ) | (49 | ) | -412 | | (231 | ) | 64 | | — | |

DaimlerChrysler Group | | 892 | | 1,838 | | -51 | | 3,640 | | 4,137 | | -12 | |

5

Reconciliation of Group Operating Profit to Income before Financial Income

Amounts in millions of € | | Q3 2006 | | Q3 2005 | | Change in % | | Q1–3 2006 | | Q1–3 2005 | | Change in % | |

| | | | | | | | | | | | | |

Operating profit | | 892 | | 1,838 | | -51 | | 3,640 | | 4,137 | | -12 | |

Pension and postretirement benefit expenses, other than current and prior service costs and settlement/curtailment losses | | (320 | ) | (317 | ) | -1 | | (932 | ) | (889 | ) | -5 | |

Operating (profit) loss from affiliated and associated companies and financial (income) loss from related operating companies | | (317 | ) | (248 | ) | -28 | | (853 | ) | (537 | ) | -59 | |

Miscellaneous items | | 6 | | (1 | ) | — | | 4 | | (8 | ) | — | |

Income before financial income | | 261 | | 1,272 | | -79 | | 1,859 | | 2,703 | | -31 | |

· Financial Services improved its operating profit to €445 million, compared with €408 million in the third quarter of last year.

· This increase in earnings was assisted by the higher volume of new business and improved efficiency. There were opposing effects from increased risk costs, which had been extremely low in the prior-year quarter.

· The Van, Bus, Other segment posted a third-quarter operating profit of €315 million (Q3 2005: €379 million), including expenses of €72 million for the implementation of the new management model, mainly for personnel reductions in administrative areas. The sale of real estate properties not required for operating purposes led to a gain of €86 million in the third quarter. The operating profit of the prior-year quarter included a profit contribution from the off-highway business, which was sold in the first quarter of 2006.

· Vans and Buses once again achieved positive contributions to earnings in the third quarter. The operating profit of Mercedes- Benz Vans decreased due to capacity restrictions related to the changeover of production for the new Sprinter model. DaimlerChrysler Buses increased its operating profit as a result of a more favorable model mix and the achieved efficiency improvements.

· The contribution to earnings from EADS amounted to €247 million, which was slightly below the result of €256 million in the prior-year quarter despite higher Airbus deliveries. This was primarily caused by less favorable currency-hedging rates. The delays with the delivery of the Airbus A380 did not affect the profit contribution from EADS in the third quarter, as the results of EADS are consolidated by the Daimler-Chrysler Group with a three-month time lag.

· The increase in eliminations with an effect on earnings resulted primarily from the leasing business in Germany and the increase in floor plan financing for European dealerships. The resulting profits and losses on the deliveries of vehicles between the divisions were not realized from the Group perspective and were thus eliminated.

· Financial income improved to €172 million in the third quarter (Q3 2005: financial loss of €9 million) as a result of higher income from investments and an improved net interest result. The increase in income from investments from €144 million to €199 million was mainly a result of higher contributions to earnings from investments accounted for using the equity method, including a gain of €48 million on the sale of real estate properties not required for operating purposes. The net interest expense amounted to €8 million compared to net interest expense of €120 million in the third quarter of last year; the other financial loss improved from €33 million to €19 million.

· Net income amounted to €541 million in the third quarter (Q3 2005: €855 million). The decrease in operating profit was partially offset by increased financial income and a lower tax expense. The recognition by the US tax authorities of tax credits for research and development expenditure and adjustments of deferred tax liabilities led to a tax benefit of €219 million.

· Earnings per share amounted to €0.53, compared with €0.84 in the third quarter of 2005.

6

Cash Flow

· Cash provided by operating activities of €8.5 billion was significantly lower than in the first nine months of 2005 (€11.0 billion). The decrease was primarily due to the negative business development at the Chrysler Group, which was only partially offset by the business development at the Mercedes Car Group. Cash provided by operating activities was also reduced by severance payments connected with the headcount reduction at the Mercedes Car Group, payments related to the realignment of smart, and higher tax payments. On the other hand, the slight reduction in contributions to the pension funds had a positive effect on cash provided by operating activities (€0.6 billion; Jan.-Sept. 2005: €0.9 billion). There was also an improvement as a result of the higher proportion of operate-lease contracts in the financial-services business. There were opposing effects on the development of working capital. The significantly lower increase in inventories and trade receivables was nearly offset by negative effects from trade liabilities and inventory-related receivables from financial services.

· Cash used for investing activities increased by €2.5 billion to €11.5 billion in the first nine months of this year, due not only to the significant increase in equipment on operating leases, but also to the development of receivables from financial services. The reduction in these receivables as a result of the shift from finance-lease contracts to operate-lease contracts was lower than in the first nine months of 2005. On the other hand, capital expenditure for property, plant and equipment was slightly lower than in the prior-year period, thus reducing cash used for investing activities. In addition to that, proceeds from the sale of businesses were higher than in the first nine months of 2005. The latter was mainly due to the sale of the off-highway business, which gave rise to a net cash inflow of €0.8 billion. The decrease in (net) payments for the purchase of securities also had the effect of reducing cash used for investing activities.

· Cash provided by financing activities amounted to €1.0 billion in the period under review. This was primarily the result of the (net) increase in financial liabilities, partially offset by a cash outflow for the distribution of the dividend for the year 2005. The main factors in the first nine months of last year were the dividend distribution and the (net) repayment of financial liabilities.

· Cash and cash equivalents with an original maturity of three months or less decreased by €2.2 billion to €5.4 billion compared with December 31, 2005, taking currency-translation effects into consideration. Total liquidity, which also includes long-term investments and securities, decreased from €12.6 billion to €10.2 billion as a result of optimized processes in the Group’s liquidity management.

7

Financial Position

· Compared with December 31, 2005, total assets decreased by €5.2 billion to €196.4 billion. After adjusting for currency-translation effects of €8.8 billion, there was an increase of €3.6 billion, primarily due to the expansion of the leasing and sales-financing business.

· Equipment on operating leases and receivables from financial services totaled €94.3 billion (December 31, 2005: €95.3 billion), equivalent to 48% of total assets. Without the effects of currency translation, there would have been a significant increase in the size of the portfolio. Within the portfolio, there was a shift from sales-financing contracts to operate-lease contracts. Inventories increased, after adjusting for currency translation. This was a result of the development of production volumes over the year, as was the increase in trade liabilities. The change in other assets was primarily due to an increase in the positive market values of derivative financial instruments. These financial transactions were undertaken to hedge against foreign-exchange risks and the price risks of EADS shares.

· Accrued liabilities decreased, mainly due to the effects of currency translation, which also resulted in lower accrued liabilities for derivative financial instruments used to hedge against foreign-exchange risks. There was also an impact from the utilization of accrued liabilities for product warranties and for taxes. There was a slight rise in other accrued liabilities, however, related to the discontinuation of the smart forfour. After adjusting for currency translation, financial liabilities increased due to the higher refinancing requirement caused by the expansion of the leasing and sales-financing business. The decrease in other liabilities was mainly a result of lower liabilities in connection with the headcount reductions at the Mercedes Car Group.

· Stockholders’ equity at September 30, 2006 was slightly higher than at December 31, 2005. The positive effects on stockholders’ equity from net income and the valuation of derivative financial instruments (with no effect on earnings) were partially offset by the negative effects of currency translation and the distribution of the dividend for the year 2005.

· The Group’s equity ratio at September 30, 2006 was 18.8% (December 31, 2005: 17.3%). The equity ratio for the industrial business was 27.5% (December 31, 2005: 24.8%). The increases in the equity ratios were primarily caused by the decrease in total assets and the net income.

Workforce

· At the end of the third quarter of 2006, DaimlerChrysler employed a workforce of 365,451 people worldwide (end of Q3 2005: 388,014). Of this total, 168,965 were employed in Germany and 95,647 were employed in the United States (end of Q3 2005: 185,288 and 98,945 respectively).

· The size of the workforce decreased compared to employment figures on September 30, 2005, mainly as a result of the sale of the off-highway business with approximately 7,000 employees and the staff reductions at the Mercedes Car Group (-6%). At the Mercedes Car Group, 9,300 employees signed severance agreements or already left the company within one year. In the context of the new management model, the 2,200 employees of the former Corporate Research department, which was previously allocated to the Group level, were transferred into the Mercedes Car Group’s Product Development department. The Chrysler Group, Truck Group and Financial Services divisions also employed fewer people at the end of the third quarter than a year earlier.

Events after the end of the third quarter of 2006

· At the beginning of October, EADS announced that delays with the delivery of the Airbus A380 would lead to a shortfall of its operating result compared with previous planning. In line with our equity interest in EADS, DaimlerChrysler’s earnings will thus also be affected. In order to counteract the financial impact of these delays, EADS plans to implement a comprehensive program of cost reductions and efficiency improvements.

8

Outlook

· Due to the positive development of the world economy in the first nine months of 2006, DaimlerChrysler anticipates global economic growth of 3.8% in the full year, compared with 3.5% in 2005. Despite rising interest rates and ongoing high raw-material prices, we expect generally positive economic developments in the fourth quarter.

· We expect a slight decrease in worldwide demand for automobiles in the fourth quarter and thus slower market growth than in Q4 2005. For full-year 2006, we anticipate market growth of around 3% (2005: 4%). In the United States, the world’s largest market, demand is likely to decrease slightly (2005: 16.9 million cars and light trucks). The Japanese market is also expected to be smaller than in 2005 (4.7 million passenger cars), while there should be a moderate increase in demand in Western Europe (2005: 14.5 million passenger cars). Car sales are expected to increase significantly in full-year 2006 in nearly all of the major emerging markets of Asia, South America and Eastern Europe. The strong demand for commercial vehicles, especially in the heavy categories, should continue for the rest of this year, although with lower growth rates. In view of the ongoing overcapacity in the automotive industry, we assume that the situation of intense competitive pressure will continue.

· DaimlerChrysler expects unit sales in 2006 to be lower than in the previous year (4.8 million units).

· The Mercedes Car Group anticipates full-year unit sales at least as high as in 2005. We assume that unit sales by Mercedes- Benz will exceed last year’s figure as a result of the market success of the brand’s new products. We will continue to effectively implement the CORE efficiency-improving program. The positive earnings trend is expected to continue in the fourth quarter.

· Due to intense competition and the shift in demand towards smaller vehicles, the Chrysler Group assumes that unit sales (factory shipments) in 2006 will be lower than in the prior year. Eight new models, many of which are in the growing segments of passenger cars and small SUVs, are now being launched or will be launched this year. The Chrysler Group will implement further cuts in production volumes during the fourth quarter in order to reduce dealer inventories and clear the way for the current product offensive. DaimlerChrysler expects the Chrysler Group to post a loss of approximately €1 billion for the full-year 2006.

· The Truck Group expects full-year unit sales at least to reach 2005 sales figures. Due to positive market developments in our core markets of Europe, the United States and Japan in connection with upcoming new emission regulations, the ongoing strong demand for our products and further improvements in productivity and efficiency, the Truck Group expects to significantly exceed the prior-year's earnings.

· The Financial Services division anticipates a continuation of its stable business development in the remaining months of the year 2006, despite the higher level of interest rates and falling growth in consumption in the United States. Enhanced process quality and efficiency will help to further improve the division’s competitive position. Operating profit in full-year 2006 should be higher than in the prior year.

· The Vans unit expects lower unit sales than in 2005 due to the Sprinter model change. Unit sales of buses are likely to exceed the high level of the prior year.

· In connection with the revised delivery planning for the Airbus A380, EADS revoked its original earnings forecast at the beginning of October. EADS has not issued any new earnings guidance since then.

9

· The DaimlerChrysler Group’s revenues in full-year 2006 should be slightly higher than in 2005 (€149.8 billion).

· Due to the implementation of the staff-reduction program and the sale of the off-highway activities, the number of persons employed by the DaimlerChrysler Group at the end of 2006 will be significantly lower than the number of 382,700 at the end of last year.

· On September 15, DaimlerChrysler announced that due to the Chrysler Group’s unsatisfactory sales situation, the DaimlerChrysler Group’s original earnings target for 2006 could not be maintained. For this reason, we reduced the Group’s operating-profit target to an amount in the magnitude of €5 billion. Although we now have to assume that the profit contribution from EADS will be €0.2 billion lower than originally anticipated because of the delayed delivery of the Airbus A380, we are maintaining this earnings target due to very positive business developments in the divisions Mercedes Car Group, Truck Group and Financial Services.

· This forecast also includes charges for the implementation of the new management model (€0.5 billion), the focus on the smart fortwo (€1 billion) and the staff reductions at the Mercedes Car Group (€0.4 billion). There are positive effects from gains on the disposal of the off-highway business (€0.2 billion), the sale of real estate no longer required for operating purposes (€0.1 billion) and the release of provisions for retirement- pension obligations (€0.2 billion).

Forward-looking statements in this Interim Report:

This interim report contains forward-looking statements that reflect management’s current views with respect to future events. The words “anticipate,” “assume,” “believe,” “estimate,” “expect,” “intend,” “may,” “plan,” “project” and “should” and similar expressions identify forward-looking statements. Such statements are subject to risks and uncertainties, including, but not limited to: an economic downturn in Europe or North America; changes in currency exchange rates, interest rates and in raw material prices; introduction of competing products; increased sales incentives; the effective implementation of our new management model, and the CORE program, including the new business model for smart, at the Mercedes Car Group; renewed pressure to reduce costs in light of restructuring plans announced by our major competitors in NAFTA; the ability of the Chrysler Group to reduce dealer inventories with current incentive programs and respond to a shift in market demand for smaller, more fuel efficient vehicles; lower profit contributions by EADS due to delays in deliveries of the Airbus A380; disruption of production or vehicle deliveries, resulting from shortages, labor strikes or supplier insolvencies; the resolution of pending governmental investigations; and decline in resale prices of used vehicles. If any of these or other risks and uncertainties occur (some of which are described under the heading “Risk Report” in DaimlerChrysler’s most recent Annual Report and under the heading “Risk Factors” in DaimlerChrysler's most recent Annual Report on Form 20-F filed with the Securities and Exchange Commission), or if the assumptions underlying any of these statements prove incorrect, then actual results may be materially different from those expressed or implied by such statements. We do not intend or assume any obligation to update any forward-looking statement, which speaks only as of the date on which it is made.

10

Mercedes Car Group

· Unit sales at high level of 307,500 vehicles

· Very successful new models

· CORE efficiency-improving program progressing as planned

· Operating profit improves by 127% to €991 million

Amounts in millions of € | | Q3 2006 | | Q3 2005 | | Change in % | |

| | | | | | | |

Operating profit | | 991 | | 436 | | +127 | |

Revenues | | 13,477 | | 12,519 | | +8 | |

Unit sales | | 307,483 | | 310,885 | | -1 | |

Production | | 299,853 | | 301,023 | | -0 | |

Employees (September 30) | | 100,637 | | 106,532 | | -6 | |

Unit sales | | Q3 2006 | | Q3 2005 | | Change in % | |

| | | | | | | |

Total | | 307,483 | | 310,885 | | -1 | |

Western Europe | | 190,878 | | 201,731 | | -5 | |

Germany | | 86,155 | | 93,345 | | -8 | |

United States | | 61,588 | | 56,746 | | +9 | |

Japan | | 11,291 | | 11,325 | | -0 | |

Other markets | | 43,726 | | 41,083 | | +6 | |

Improved earnings in third quarter

· The Mercedes Car Group sold 307,500 vehicles worldwide in the third quarter of this year (Q3 2005: 310,900). Revenues increased by 8% to €13.5 billion, while operating profit improved from €436 million to €991 million (see page 5).

Strong demand for new models

· Third-quarter unit sales by Mercedes-Benz increased slightly to 282,800 vehicles, primarily due to the success of the new models launched in 2005 and 2006. At smart, unit sales decreased, as expected, to 24,700 vehicles (Q3 2005: 28,800). Customer orders have been received for nearly all smart fortwo cars that will be produced prior to the model changeover next year.

· The S-Class sedan continued to extend its worldwide market leadership in the luxury segment; the figure of 20,500 units sold in the third quarter was double the number sold in Q3 2005. The new generation of the E-Class started very well and has regained worldwide market leadership in its category; unit sales of 68,700 vehicles were of the same magnitude as in the prior-year quarter. Sales of the C-Class decreased for lifecycle reasons by 16% to 79,700 units. Unit sales of 68,200 A-Class and B-Class cars were satisfactory (Q3 2005: 76,900). Worldwide unit sales of the M-, R-, GL- and G-Class increased by 67% to 41,400 vehicles.

· Outside Germany, the Mercedes Car Group sold 221,300 vehicles, which was 2% more than in the third quarter of last year. Unit sales in Germany of 86,200 vehicles were below the prior-year figure, however.

World premiere of CL Class

· The CL luxury coupe, based on the new S-Class, was presented to the public for the first time at the Paris Motor Show, and deliveries to customers began in September. Media reporting has been very positive about this car, which sets new standards for preventive occupant protection, styling and driving pleasure.

Improved efficiency as a result of CORE

· Within the context of the CORE program, we made further decisions during the third quarter that will strengthen the competitiveness of the Mercedes Car Group on a sustained basis. For example, a modular system has been developed with more than 100 defined modules, which will be available for all vehicle series in the future and will help us to achieve further quality enhancements, to reduce costs, and to shorten product-development times. In order to improve productivity, production has been restructured and processes and routines have been consistently standardized. Together with our suppliers, we have taken numerous measures to enable us to reduce material costs in the year 2006, despite the difficult situation on the raw-material markets.

Good progress with integration of smart

· The integration of smart into the Mercedes-Benz organization is progressing according to plan and should be completed by the end of this year. The resulting efficiency improvements will provide a foundation for smart’s profitability as of the year 2007.

Q1–3

Amounts in millions of € | | Q1–3 2006 | | Q1–3 2005 | | Change in % | |

| | | | | | | |

Operating profit (loss) | | 1,120 | | (506 | ) | . | |

Revenues | | 39,195 | | 35,374 | | +11 | |

Unit sales | | 914,442 | | 865,934 | | +6 | |

Production | | 929,736 | | 904,625 | | +3 | |

Employees (September 30) | | 100,637 | | 106,532 | | -6 | |

Unit sales | | Q1–3 2006 | | Q1–3 2005 | | Change in % | |

| | | | | | | |

Total | | 914,442 | | 865,934 | | +6 | |

Western Europe | | 580,735 | | 561,105 | | +3 | |

Germany | | 252,722 | | 258,039 | | -2 | |

United States | | 174,961 | | 160,618 | | +9 | |

Japan | | 36,046 | | 33,646 | | +7 | |

Other markets | | 122,700 | | 110,565 | | +11 | |

11

Chrysler Group

· Lower shipments and retail sales

· Dealer inventories significantly reduced

· Continuing product offensive

· Operating loss of €1,164 million

Amounts in millions of € | | Q3 2006 | | Q3 2005 | | Change in % | |

| | | | | | | |

Operating profit (loss) | | (1,164 | ) | 310 | | . | |

Revenues | | 9,511 | | 12,889 | | -26 | |

Unit sales | | 504,426 | | 663,363 | | -24 | |

Production | | 499,803 | | 664,737 | | -25 | |

Employees (September 30) | | 82,330 | | 84,106 | | -2 | |

Unit sales | | Q3 2006 | | Q3 2005 | | Change in % | |

| | | | | | | |

Total | | 504,426 | | 663,363 | | -24 | |

NAFTA | | 451,884 | | 622,840 | | -27 | |

United States | | 382,077 | | 550,307 | | -31 | |

Other markets | | 52,542 | | 40,523 | | +30 | |

Lower unit sales and production lead to operating loss

· In a difficult market environment, the Chrysler Group’s third-quarter retail and fleet sales totaled 635,300 vehicles (-14%). Newly launched models only partially offset lower sales of SUVs and light trucks, which were primarily impacted by increased fuel prices. Sales of the Dodge Caliber (40,400 units), Dodge Charger (32,000 units) and Jeep® Compass (7,400 units) were strong in the third quarter. However, decreases for minivans (-10%), Dodge Ram pickups (-20%), the Dodge Durango (-45%) and the Jeep® Grand Cherokee (-30%) contributed to a fall in US market share to 11.2% from 12.8% in the prior-year quarter.

· Due to high dealer inventories at the end of the second quarter, the Chrysler Group reduced shipments to dealers in the third quarter, which necessitated corresponding production adjustments. Total unit sales amounted to 504,400 vehicles (Q3 2005: 663,400). Whereas unit sales in the NAFTA region decreased by 27%, shipments to other markets rose by 30%. Dealer inventories in the United States totaled 534,000 vehicles (end of Q3 2005: 580,200), equivalent to 82 days’ supply, like a year earlier.

· Third-quarter revenues amounted to €9.5 billion (Q3 2005: €12.9 billion); measured in US dollars, revenues decreased by 23% as a result of lower unit sales, unfavorable mix and negative net pricing. This development contributed to an operating loss of €1,164 million (Q3 2005: operating profit of €310 million) (see page 5).

New models available

· During the third quarter, the Chrysler Group launched the compact SUV Jeep® Compass and the Jeep® Wrangler Unlimited (4-door). The Jeep® Compass features the new economical 4-cylinder World Engine, making it attractive to customers moving to more fuel-efficient vehicles due to higher fuel prices. The Chrysler Aspen, the first SUV from the Chrysler brand, was also launched in the third quarter. By the end of the year, the Chrysler Group will launch three more all-new vehicles featuring fuel-efficient engines: the Chrysler Sebring, the Dodge Nitro and the Jeep® Patriot.

· In July, the Chrysler Group opened its new flexible assembly plant and supplier park in Toledo (Ohio, USA), where the all-new Jeep® Wrangler models are produced. This supplier co-location project represents the latest example of Chrysler Group’s overall manufacturing strategy, enabling various models to be built on the same assembly line.

· In August, J.D. Power and Associates published their 2006 Dependability Study, which measures problems experienced by owners of three-year-old models. Improvements were reported for the Chrysler, Dodge and Jeep® brands compared with the previous study, in some cases significantly higher than the industry’s average rate of improvement.

Q1–3

Amounts in millions of € | | Q1–3 2006 | | Q1–3 2005 | | Change in % | |

| | | | | | | |

Operating profit (loss) | | (994 | ) | 1,106 | | . | |

Revenues | | 34,544 | | 36,654 | | -6 | |

Unit sales | | 1,961,529 | | 2,142,272 | | -8 | |

Production | | 1,914,886 | | 2,129,403 | | -10 | |

Employees (September 30) | | 82,330 | | 84,106 | | -2 | |

Unit sales | | Q1–3 2006 | | Q1–3 2005 | | Change in % | |

| | | | | | | |

Total | | 1,961,529 | | 2,142,272 | | -8 | |

NAFTA | | 1,808,616 | | 2,017,662 | | -10 | |

United States | | 1,565,026 | | 1,770,631 | | -12 | |

Other markets | | 152,913 | | 124,610 | | +23 | |

12

Truck Group

· Unit sales above prior-year level at 141,900 vehicles

· New products and innovations presented at IAA Commercial Vehicles

· Start of »Truck Dedication« initiative

· Operating profit up by 57% to €556 million

Amounts in millions of € | | Q3 2006 | | Q3 2005 | | Change in % | |

| | | | | | | |

Operating profit | | 556 | | 354 | | +57 | |

Revenues | | 8,030 | | 7,814 | | +3 | |

Unit sales | | 141,905 | | 138,949 | | +2 | |

Production | | 145,007 | | 138,571 | | +5 | |

Employees (September 30) | | 84,922 | | 85,948 | | -1 | |

Unit sales | | Q3 2006 | | Q3 2005 | | Change in % | |

| | | | | | | |

Total | | 141,905 | | 138,949 | | +2 | |

Western Europe | | 28,183 | | 25,108 | | +12 | |

Germany | | 16,571 | | 14,053 | | +18 | |

United States | | 42,613 | | 41,583 | | +2 | |

South America | | 9,770 | | 10,490 | | -7 | |

Asia | | 39,733 | | 42,065 | | -6 | |

Other markets | | 21,606 | | 19,703 | | +10 | |

Unit sales, revenues and operating profit surpass prior year levels

· Unit sales by the Truck Group of 141,900 vehicles were 2% above the level of Q3 2005. Due to the higher unit sales and a better model mix, revenues increased by 3% to €8.0 billion. Operating profit improved by 57% to €556 million (see page 5).

Continuation of positive unit-sales trend

· Sales by Trucks Europe/Latin America of 37,700 units were slightly higher than in Q3 2005. Unit sales developed positively in Western Europe (20,500 units, +17%), especially in Germany (10,500 units, +23%). The strong demand for vehicles with the new BlueTec technology continued in the third quarter. Due to the ongoing weakness of the Brazilian market, sales of 7,400 units in South America were 9% below the prior-year level.

· Unit sales of 55,400 vehicles by Trucks NAFTA under the Freightliner, Western Star and Sterling brands were 3% higher than in Q3 2005. This was primarily due to the positive development in the heavy-duty trucks segment (Class 8), as well as additional units sold in Classes 5 to 7.

· Trucks Asia sold 49,300 units under the Mitsubishi Fuso brand, a 2% increase compared to the prior-year quarter. The 26% increase in Japan to 19,200 units reflects positive market developments and the return of customer confidence following the quality offensive. In the markets outside Japan, unit sales decreased by 9% to 30,100 vehicles due to a slump in demand in Indonesia.

Innovations presented at IAA Commercial Vehicles

· At IAA (International Motor Show) Commercial Vehicles in Hanover, the Truck Group presented the new Unimog model U20 and the Canter Eco Hybrid from Mitsubishi Fuso, the cleanest light truck in the world. The Actros Space-Max study also debuted, with a cab usable as living space, bedroom and office. The Truck Group underscored its innovation and technology expertise with Mercedes Power-Shift, the new generation of automatic transmission for the Actros, and the BlueTec diesel technology.

· We are demonstrating our commitment to traffic safety with the Safety Truck, which has now been shown in 12 major European cities. The Safety Truck combines all of the currently available driver-assistance and safety systems such as the new Active Brake Assist, the Lane Assistant, Adaptive Cruise Control and the Stability Program.

Start of new »Truck Dedication« initiative

· The »Truck Dedication« initiative, which was launched during the third quarter of this year, aims to focus sales and service activities even more closely on customers’ needs. The key elements of the program include more intensive customer interaction such as additional service stations near logistics centers and autobahns, as well as service teams with 24-hour availability.

Q1—3

Amounts in millions € | | Q1—3 2006 | | Q1—3 2005 | | Change in % | |

| | | | | | | |

Operating profit | | 1,533 | | 1,462 | | +5 | |

Revenues | | 23,955 | | 22,674 | | +6 | |

Unit sales | | 399,808 | | 402,528 | | -1 | |

Production | | 401,496 | | 413,283 | | -3 | |

Employees (September 30) | | 84,922 | | 85,948 | | -1 | |

Unit sales | | Q1—3 2006 | | Q1—3 2005 | | Change in % | |

Total | | 399,808 | | 402,528 | | -1 | |

Western Europe | | 81,633 | | 72,613 | | +12 | |

Germany | | 46,727 | | 39,908 | | +17 | |

United States | | 123,164 | | 123,004 | | +0 | |

South America | | 29,299 | | 29,071 | | +1 | |

Asia | | 105,336 | | 124,330 | | -15 | |

Other markets | | 60,376 | | 53,510 | | +13 | |

13

Financial Services

· Positive business developments in the third quarter

· Contract volume at prior-year level

· Introduction of new financial-services products

· Continuation of high operating profit

Amounts in millions of € | | Q3 2006 | | Q3 2005 | | Change in % | |

Operating profit | | 445 | | 408 | | +9 | |

Revenues | | 4,303 | | 3,913 | | +10 | |

Contract volume | | 114,011 | | 113,415 | | +1 | |

New business | | 12,574 | | 11,814 | | +6 | |

Employees (September 30) | | 10,819 | | 11,356 | | -5 | |

Ongoing positive developments at Financial Services

· The Financial Services division continued its positive business trend in the third quarter. New business of €12.6 billion was 6% higher than in Q3 2005, while contract volume of €114.0 billion was at the prior-year level. Adjusted for the effects of currency translation, the portfolio grew by 4%. Q3 operating profit increased from €408 million to €445 million (see page 6).

Expansion of activities in North and South America

· Contract volume of €82.1 billion in the Americas region (North and South America) was at the same level as a year earlier; adjusted for exchange-rate effects, there was an increase of 4%. The positive developments continued in all of the region’s markets in the third quarter.

· Financial Services further expanded its »Business Vehicle Finance« program, which provides financing for commercial vehicles and passenger-car fleets. Furthermore, Truck Financial and Chrysler Financial in the United States started a pilot program for a new full-service leasing product for Dodge and Sterling commercial vehicles under the name “Complete Lease”.

· With the start of »eContracting«, the first completely paperless electronic system for processing leasing and financing contracts in North America, Chrysler Financial further accelerated its processes for credit approval and contract processing. The system makes a valuable contribution towards enhancing customer and dealer satisfaction in the region.

· Mercedes-Benz Financial and Chrysler Financial significantly improved their ratings in J.D. Power’s annual assessment of dealer satisfaction in the United States.

Continued growth in Europe, Africa and Asia/Pacific

· Contract volume in the region Europe, Africa and Asia/Pacific increased by 4% to €31.9 billion. In Japan, Fuso Financial Services expanded its presence and now supports all Mitsubishi Fuso dealerships. In China, DaimlerChrysler Automotive Finance expanded its activities to four more major conurbations.

· In Europe, Financial Services is working on further intensifying cooperation with dealerships by expanding its product range in the field of dealer financing. In the United Kingdom, Financial Services once again improved its result in Sewells’ annual Dealer Attitude Survey, which measures dealers’ satisfaction with their providers of financial services, achieving a leading position.

· In Germany, DaimlerChrysler Bank increased its contract volume by 5% to €15.5 billion. The portfolio of financial services for commercial vehicles also developed positively. At IAA (International Motor Show) Commercial Vehicles, the bank offered attractive financing and leasing packages for Mercedes-Benz vans for the first time featuring integrated insurance cover.

Q1—3

Amounts in millions of € | | Q1—3 2006 | | Q1—3 2005 | | Change in % | |

Operating profit | | 1,315 | | 1,121 | | +17 | |

Revenues | | 12,688 | | 11,292 | | +12 | |

Contract volume | | 114,011 | | 113,415 | | +1 | |

New business | | 40,390 | | 36,711 | | +10 | |

Employees (September 30) | | 10,819 | | 11,356 | | -5 | |

14

Van, Bus, Other

· New Sprinter available throughout Europe

· New models presented by Buses

· Delay in deliveries of Airbus A380 announced by EADS

· Operating profit of €315 million

Amounts in millions of € | | Q3 2006 | | Q3 2005 | | Change in % | |

Operating profit | | 315 | | 379 | | -17 | |

Revenues segment | | 3,200 | | 3,630 | | -12 | |

Revenues Vans | | 2,095 | | 2,020 | | +4 | |

Revenues Buses | | 949 | | 904 | | +5 | |

Unit sales Vans | | 58,812 | | 64,236 | | -8 | |

Unit sales Buses | | 8,620 | | 9,200 | | -6 | |

Third-quarter operating profit for the Van, Bus, Other segment decreased from €379 million to €315 million (see page 6).

Vans

· Mercedes-Benz Vans posted unit sales of 58,800 vehicles in the third quarter, which was lower than the very high prior-year number. The decrease was a result of the launch of the new Sprinter and the associated production changeover in the Düsseldorf and Ludwigsfelde plants. More than 19,500 units of the new Sprinter had already been sold by the end of September. This vehicle is now available in all European markets.

· The positive sales trend continued for the Vito/Viano, with 20,100 units being sold in the third quarter (+2%). In the core market of Western Europe, unit sales increased by 7% to 16,200 vehicles.

Buses

· DaimlerChrysler Buses sold 8,600 buses and chassis of the Mercedes-Benz, Setra and Orion brands (Q3 2005: 9,200).

· In Europe, sales increased by 16% to 2,100 units. In Latin America, unit sales decreased by 5% to 4,000 units.

· At IAA (International Motor Show) Commercial Vehicles in Hanover in September, we presented the new Mercedes-Benz Tourismo coach, the compact Mercedes-Benz Citaro K city bus, the new Mercedes-Benz minibus variants, based on the Mercedes-Benz Sprinter, and the Setra MultiClass 400NF and Setra S412 UL intercity buses. The Mercedes-Benz Citaro LE Ü was voted »Bus of the Year 2007« in the urban-bus category.

EADS

· EADS will publish its third-quarter figures on November 8, 2006.

· At the beginning of October, EADS and Airbus once again adjusted the schedule for deliveries of the Airbus A380 in the years 2007 through 2010. These repeated delays will cause substantial financial burdens for EADS until the year 2010. The first A380 is now to be delivered in the second half of 2007. The review of the A380 program has shown that certification can be expected by the end of this year. Test flights are taking place as planned; the A380 is fulfilling its performance targets and in some cases surpassing them. With the »Power8« efficiency-improving program, which EADS is now preparing, annual cost savings of at least €2 billion are to be achieved starting in the year 2010.

· In the first nine months of this year, Airbus delivered 320 aircraft to its customers (Jan.-Sept. 2005: 271).

Q1—3

Amounts in millions of € | | Q1-3 2006 | | Q1-3 2005 | | Change in % | |

Operating profit | | 897 | | 890 | | +1 | |

Revenues segment | | 9,762 | | 10,236 | | -5 | |

Revenues Vans | | 6,187 | | 5,822 | | +6 | |

Revenues Buses | | 2,829 | | 2,555 | | +11 | |

Unit sales Vans | | 184,110 | | 188,125 | | -2 | |

Unit sales Buses | | 26,755 | | 26,118 | | +2 | |

DaimlerChrysler AG and Subsidiaries

Unaudited Condensed Consolidated Statements of Income Q3

| | Consolidated | | Industrial Business | | Financial Services (1) | |

Amounts in millions of €, except per share amounts | | Q3 2006 | | Q3 2005 | | Q3 2006 | | Q3 2005 | | Q3 2006 | | Q3 2005 | |

Revenues | | 35,176 | | 38,155 | | 30,873 | | 34,242 | | 4,303 | | 3,913 | |

Cost of sales | | (29,311 | ) | (31,201 | ) | (25,746 | ) | (28,043 | ) | (3,565 | ) | (3,158 | ) |

Gross margin | | 5,865 | | 6,954 | | 5,127 | | 6,199 | | 738 | | 755 | |

Selling, administrative and other expenses | | (4,472 | ) | (4,386 | ) | (4,182 | ) | (4,064 | ) | (290 | ) | (322 | ) |

Research and development | | (1,301 | ) | (1,408 | ) | (1,301 | ) | (1,408 | ) | — | | — | |

Other income | | 169 | | 142 | | 165 | | 129 | | 4 | | 13 | |

Goodwill impairment | | — | | (30 | ) | — | | (30 | ) | — | | — | |

Income (loss) before financial income | | 261 | | 1,272 | | (191 | ) | 826 | | 452 | | 446 | |

Financial income (expense), net | | 172 | | (9 | ) | 167 | | (33 | ) | 5 | | 24 | |

Income (loss) before income taxes | | 433 | | 1,263 | | (24 | ) | 793 | | 457 | | 470 | |

Income tax (expense) benefit | | 136 | | (374 | ) | 336 | | (193 | ) | (200 | ) | (181 | ) |

Minority interests | | (28 | ) | (34 | ) | (26 | ) | (31 | ) | (2 | ) | (3 | ) |

Income before cumulative effects of changes in accounting principles | | 541 | | 855 | | 286 | | 569 | | 255 | | 286 | |

Cumulative effects of changes in accounting principles: transition adjustments resulting from adoption of SFAS 123R | | — | | — | | — | | — | | — | | — | |

Net income | | 541 | | 855 | | 286 | | 569 | | 255 | | 286 | |

| | | | | | | | | | | | | |

Earnings per share | | | | | | | | | | | | | |

Basic earnings per share | | | | | | | | | | | | | |

Income before cumulative effects of changes in accounting principles | | 0.53 | | 0.84 | | | | | | | | | |

Cumulative effects of changes in accounting principles | | — | | — | | | | | | | | | |

Net Income | | 0.53 | | 0.84 | | | | | | | | | |

Diluted earnings per share | | | | | | | | | | | | | |

Income before cumulative effects of changes in accounting principles | | 0.53 | | 0.84 | | | | | | | | | |

Cumulative effects of changes in accounting principles | | — | | — | | | | | | | | | |

Net Income | | 0.53 | | 0.84 | | | | | | | | | |

(1) Contains the financing and leasing business of the Financial Services segment excluding Mobility Management and activities of DaimlerChrysler Financial Services AG.

16

DaimlerChrysler AG and Subsidiaries

Unaudited Condensed Consolidated Statements of Income Q1—3

| | Consolidated | | Industrial Business | | Financial Services (1) | |

Amounts in millions of €, except per share amounts | | Q1-3 2006 | | Q1-3 2005 | | Q1-3 2006 | | Q1-3 2005 | | Q1-3 2006 | | Q1-3 2005 | |

Revenues | | 110,923 | | 108,322 | | 98,233 | | 97,035 | | 12,690 | | 11,287 | |

Cost of sales | | (92,221 | ) | (88,514 | ) | (81,713 | ) | (79,377 | ) | (10,508 | ) | (9,137 | ) |

Gross margin | | 18,702 | | 19,808 | | 16,520 | | 17,658 | | 2,182 | | 2,150 | |

Selling, administrative and other expenses | | (13,635 | ) | (13,452 | ) | (12,736 | ) | (12,535 | ) | (899 | ) | (917 | ) |

Research and development | | (3,970 | ) | (4,080 | ) | (3,970 | ) | (4,080 | ) | — | | — | |

Other income | | 762 | | 457 | | 746 | | 424 | | 16 | | 33 | |

Goodwill impairment | | — | | (30 | ) | — | | (30 | ) | — | | — | |

Income before financial income | | 1,859 | | 2,703 | | 560 | | 1,437 | | 1,299 | | 1,266 | |

Financial income (expense), net | | 957 | | (67 | ) | 943 | | (100 | ) | 14 | | 33 | |

Income before income taxes | | 2,816 | | 2,636 | | 1,503 | | 1,337 | | 1,313 | | 1,299 | |

Income tax (expense) benefit | | (96 | ) | (695 | ) | 440 | | (196 | ) | (536 | ) | (499 | ) |

Minority interests | | (66 | ) | (61 | ) | (58 | ) | (54 | ) | (8 | ) | (7 | ) |

Income before cumulative effects of changes in accounting principles | | 2,654 | | 1,880 | | 1,885 | | 1,087 | | 769 | | 793 | |

Cumulative effects of changes in accounting principles: transition adjustments resulting from adoption of SFAS 123R | | (4 | ) | — | | (4 | ) | — | | — | | — | |

Net income | | 2,650 | | 1,880 | | 1,881 | | 1,087 | | 769 | | 793 | |

| | | | | | | | | | | | | |

Earnings per share | | | | | | | | | | | | | |

Basic earnings per share | | | | | | | | | | | | | |

Income before cumulative effects of changes in accounting principles | | 2.60 | | 1.85 | | | | | | | | | |

Cumulative effects of changes in accounting principles | | — | | — | | | | | | | | | |

Net Income | | 2.60 | | 1.85 | | | | | | | | | |

Diluted earnings per share | | | | | | | | | | | | | |

Income before cumulative effects of changes in accounting principles | | 2.58 | | 1.85 | | | | | | | | | |

Cumulative effects of changes in accounting principles | | — | | — | | | | | | | | | |

Net Income | | 2.58 | | 1.85 | | | | | | | | | |

(1) Contains the financing and leasing business of the Financial Services segment excluding Mobility Management and activities of DaimlerChrysler Financial Services AG.

The accompanying notes are an integral part of these Unaudited Interim Condensed Consolidated Financial Statements.

17

DaimlerChrysler AG and Subsidiaries

Condensed Consolidated Balance Sheets

| | Consolidated | | Industrial Business | | Financial Services (1) | |

| | Sept. 30, | | Dec. 31, | | Sept. 30, | | Dec. 31, | | Sept. 30, | | Dec. 31, | |

| | 2006 | | 2005 | | 2006 | | 2005 | | 2006 | | 2005 | |

Amounts in millions of € | | (unaudited) | | | | (unaudited) | | (unaudited) | | (unaudited) | | (unaudited) | |

Assets | | | | | | | | | | | | | |

Goodwill | | 1,798 | | 1,881 | | 1,732 | | 1,822 | | 66 | | 59 | |

Other intangible assets | | 2,980 | | 3,191 | | 2,927 | | 3,133 | | 53 | | 58 | |

Property, plant and equipment, net | | 34,962 | | 36,739 | | 34,814 | | 36,565 | | 148 | | 174 | |

Investments and long-term financial assets | | 6,271 | | 6,356 | | 6,006 | | 6,084 | | 265 | | 272 | |

Equipment on operating leases, net | | 37,399 | | 34,238 | | 3,648 | | 3,629 | | 33,751 | | 30,609 | |

Fixed assets | | 83,410 | | 82,405 | | 49,127 | | 51,233 | | 34,283 | | 31,172 | |

Inventories | | 19,913 | | 19,139 | | 18,462 | | 17,674 | | 1,451 | | 1,465 | |

Trade receivables | | 7,536 | | 7,595 | | 7,227 | | 7,348 | | 309 | | 247 | |

Receivables from financial services | | 56,891 | | 61,101 | | — | | — | | 56,891 | | 61,101 | |

Other assets | | 9,822 | | 8,731 | | 6,249 | | 4,654 | | 3,573 | | 4,077 | |

Securities | | 4,826 | | 4,936 | | 4,428 | | 4,502 | | 398 | | 434 | |

Cash and cash equivalents | | 5,396 | | 7,711 | | 4,528 | | 6,894 | | 868 | | 817 | |

Non-fixed assets | | 104,384 | | 109,213 | | 40,894 | | 41,072 | | 63,490 | | 68,141 | |

Deferred taxes | | 7,218 | | 7,249 | | 7,032 | | 7,060 | | 186 | | 189 | |

Prepaid expenses | | 1,386 | | 1,391 | | 1,281 | | 1,299 | | 105 | | 92 | |

Disposal group Off-Highway, assets held for sale | | — | | 1,374 | | — | | 1,374 | | — | | — | |

Total assets | | 196,398 | | 201,632 | | 98,334 | | 102,038 | | 98,064 | | 99,594 | |

| | | | | | | | | | | | | |

| | | | | | | | | | | | | |

Liabilities and stockholders’ equity | | | | | | | | | | | | | |

Capital stock | | 2,660 | | 2,647 | | | | | | | | | |

Additional paid-in capital | | 8,430 | | 8,221 | | | | | | | | | |

Retained earnings | | 32,811 | | 31,688 | | | | | | | | | |

Accumulated other comprehensive loss | | (7,042 | ) | (6,107 | ) | | | | | | | | |

Treasury stock | | — | | — | | | | | | | | | |

Stockholders’ equity | | 36,859 | | 36,449 | | 27,033 | | 26,859 | | 9,826 | | 9,590 | |

Minority interests | | 674 | | 653 | | 634 | | 614 | | 40 | | 39 | |

Accrued liabilities | | 42,544 | | 46,682 | | 41,132 | | 45,389 | | 1,412 | | 1,293 | |

Financial liabilities | | 80,710 | | 80,932 | | 5,637 | | 4,146 | | 75,073 | | 76,786 | |

Trade liabilities | | 14,782 | | 14,591 | | 14,560 | | 14,381 | | 222 | | 210 | |

Other liabilities | | 7,953 | | 9,053 | | 5,701 | | 6,561 | | 2,252 | | 2,492 | |

Liabilities | | 103,445 | | 104,576 | | 25,898 | | 25,088 | | 77,547 | | 79,488 | |

Deferred taxes | | 4,286 | | 4,203 | | (1,800 | ) | (2,309 | ) | 6,086 | | 6,512 | |

Deferred income | | 8,590 | | 8,298 | | 5,437 | | 5,626 | | 3,153 | | 2,672 | |

Disposal group Off-Highway, liabilities held for sale | | — | | 771 | | — | | 771 | | — | | — | |

Total liabilities | | 159,539 | | 165,183 | | 71,301 | | 75,179 | | 88,238 | | 90,004 | |

| | | | | | | | | | | | | |

Total liabilities and stockholders’ equity | | 196,398 | | 201,632 | | 98,334 | | 102,038 | | 98,064 | | 99,594 | |

(1) Contains the financing and leasing business of the Financial Services segment excluding Mobility Management and activities of DaimlerChrysler Financial Services AG.

The accompanying notes are an integral part of these Unaudited Interim Condensed Consolidated Financial Statements.

18

DaimlerChrysler AG and Subsidiaries

Unaudited Condensed Consolidated Statements of Changes in Stockholders’ Equity

| | | | | | | | Accumulated other comprehensive loss | | | | | |

Amounts in millions of € | | Capital

stock | | Additional

paid-in

capital | | Retained

earnings | | Cumulative

translation

adjustment | | Available-

for-sale

securities | | Derivative

financial

instruments | | Minimum

pension

liability | | Treasury

stock | | Total | |

Balance at January 1, 2005 | | 2,633 | | 8,042 | | 30,361 | | (1,878 | ) | 127 | | 1,858 | | (7,621 | ) | — | | 33,522 | |

Net income | | — | | — | | 1,880 | | — | | — | | — | | — | | — | | 1,880 | |

Other comprehensive income (loss) | | — | | — | | — | | 2,171 | | 379 | | (957 | ) | (83 | ) | | | 1,510 | |

Total comprehensive income | | | | | | | | | | | | | | | | | | 3,390 | |

Stock based compensation | | — | | 73 | | — | | — | | — | | — | | — | | — | | 73 | |

Issuance of new shares | | 13 | | 134 | | — | | — | | — | | — | | — | | — | | 147 | |

Purchase of capital stock | | — | | — | | — | | — | | — | | — | | — | | (21 | ) | (21 | ) |

Re-issuance of treasury stock | | — | | — | | — | | — | | — | | — | | — | | 21 | | 21 | |

Dividends | | — | | — | | (1,519 | ) | — | | — | | — | | — | | — | | (1,519 | ) |

Other | | — | | (69 | ) | — | | — | | — | | — | | — | | — | | (69 | ) |

Balance at September 30, 2005 | | 2,646 | | 8,180 | | 30,722 | | 293 | | 506 | | 901 | | (7,704 | ) | — | | 35,544 | |

| | | | | | | | | | | | | | | | | | | |

Balance at January 1, 2006 | | 2,647 | | 8,221 | | 31,688 | | 849 | | 109 | | 635 | | (7,700 | ) | — | | 36,449 | |

Net income | | — | | — | | 2,650 | | — | | — | | — | | — | | — | | 2,650 | |

Other comprehensive income (loss) | | — | | — | | — | | (1,308 | ) | 30 | | 358 | | (15 | ) | — | | (935 | ) |

Total comprehensive income | | | | | | | | | | | | | | | | | | 1,715 | |

Stock based compensation | | — | | 26 | | — | | — | | — | | — | | — | | — | | 26 | |

Issuance of new shares | | 13 | | 147 | | — | | — | | — | | — | | — | | — | | 160 | |

Purchase of capital stock | | — | | — | | — | | — | | — | | — | | — | | (23 | ) | (23 | ) |

Re-issuance of treasury stock | | — | | — | | — | | — | | — | | — | | — | | 23 | | 23 | |

Dividends | | — | | — | | (1,527 | ) | — | | — | | — | | — | | — | | (1,527 | ) |

Other | | — | | 36 | | — | | — | | — | | — | | — | | — | | 36 | |

Balance at September 30, 2006 | | 2,660 | | 8,430 | | 32,811 | | (459 | ) | 139 | | 993 | | (7,715 | ) | — | | 36,859 | |

The accompanying notes are an integral part of these Unaudited Interim Condensed Consolidated Financial Statements.

19

DaimlerChrysler AG and Subsidiaries

Unaudited Condensed Consolidated Statements of Cash Flows

| | Consolidated | | Industrial Business | | Financial Services (1) | |

Amounts in millions of € | | Q1-3 2006 | | Q1-3 2005 | | Q1-3 2006 | | Q1-3 2005 | | Q1-3 2006 | | Q1-3 2005 | |

Net income | | 2,650 | | 1,880 | | 1,881 | | 1,087 | | 769 | | 793 | |

Income applicable to minority interests | | 66 | | 61 | | 58 | | 54 | | 8 | | 7 | |

Cumulative effects of changes in accounting principles | | 4 | | — | | 4 | | — | | — | | — | |

(Gains) losses on shares in companies | | (249 | ) | (12 | ) | (251 | ) | (12 | ) | 2 | | — | |

Depreciation and amortization of equipment on operating leases | | 5,586 | | 4,606 | | 486 | | 526 | | 5,100 | | 4,080 | |

Depreciation and amortization of fixed assets | | 4,600 | | 4,888 | | 4,567 | | 4,843 | | 33 | | 45 | |

Change in deferred taxes | | (33 | ) | (315 | ) | (84 | ) | (92 | ) | 51 | | (223 | ) |

Equity income from equity method investments | | (390 | ) | (190 | ) | (375 | ) | (172 | ) | (15 | ) | (18 | ) |

Change in financial instruments | | (733 | ) | (61 | ) | (725 | ) | (72 | ) | (8 | ) | 11 | |

Gains (losses) on disposals of fixed assets/securities | | (631 | ) | (732 | ) | (633 | ) | (688 | ) | 2 | | (44 | ) |

Change in trading securities | | (13 | ) | (8 | ) | (20 | ) | (6 | ) | 7 | | (2 | ) |

Change in accrued liabilities | | (714 | ) | 916 | | (964 | ) | 794 | | 250 | | 122 | |

Net changes in inventory-related receivables from financial services | | 540 | | 1,249 | | 540 | | 1,249 | | — | | — | |

Changes in other operating assets and liabilities: | | | | | | | | | | | | | |

— Inventories, net | | (1,622 | ) | (3,741 | ) | (1,430 | ) | (3,507 | ) | (192 | ) | (234 | ) |

— Trade receivables | | (286 | ) | (770 | ) | (214 | ) | (756 | ) | (72 | ) | (14 | ) |

— Trade liabilities | | 978 | | 2,688 | | 956 | | 2,676 | | 22 | | 12 | |

— Other assets and liabilities | | (1,271 | ) | 547 | | (1,286 | ) | 815 | | 15 | | (268 | ) |

Cash provided by operating activities | | 8,482 | | 11,006 | | 2,510 | | 6,739 | | 5,972 | | 4,267 | |

Purchases of fixed assets: | | | | | | | | | | | | | |

— Increase in equipment on operating leases | | (18,975 | ) | (14,942 | ) | (3,318 | ) | (3,306 | ) | (15,657 | ) | (11,636 | ) |

— Purchase of property, plant and equipment | | (4,427 | ) | (4,771 | ) | (4,406 | ) | (4,744 | ) | (21 | ) | (27 | ) |

— Purchase of other fixed assets | | (230 | ) | (153 | ) | (201 | ) | (140 | ) | (29 | ) | (13 | ) |

Proceeds from disposals of equipment on operating leases | | 10,065 | | 8,831 | | 4,153 | | 3,711 | | 5,912 | | 5,120 | |

Proceeds from disposals of fixed assets | | 472 | | 460 | | 435 | | 444 | | 37 | | 16 | |

Payments for investments in businesses | | (458 | ) | (493 | ) | (459 | ) | (500 | ) | 1 | | 7 | |

Proceeds from disposals of businesses | | 992 | | 452 | | 1,010 | | 444 | | (18 | ) | 8 | |

Investments in/collections from wholesale receivables | | (4,460 | ) | (3,734 | ) | 18,818 | | 18,988 | | (23,278 | ) | (22,722 | ) |

Proceeds from sale of wholesale receivables | | 4,248 | | 4,171 | | (19,513 | ) | (20,795 | ) | 23,761 | | 24,966 | |

Investments in retail receivables | | (21,241 | ) | (20,667 | ) | 2,681 | | 3,085 | | (23,922 | ) | (23,752 | ) |