SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

Form 6-K

REPORT OF FOREIGN PRIVATE ISSUER

PURSUANT TO RULE 13a-16 OR 15d-16 UNDER

THE SECURITIES EXCHANGE ACT OF 1934

For the month of April 2007

Commission File Number 1-12356

DAIMLERCHRYSLER AG

(Translation of registrant’s name into English)

MERCEDESSTRASSE 137, 70327 STUTTGART, GERMANY

(Address of principal executive office)

Indicate by check mark whether the registrant files or will file annual reports under cover of Form 20-F or Form 40-F.

Form 20-F x Form 40-F o

Indicate by check mark whether the registrant by furnishing the information contained in this Form is also thereby furnishing the information to the Commission pursuant to Rule 12g3-2(b) under the Securities Exchange Act of 1934.

Yes o No x

If “Yes” is marked, indicate below the file number assigned to the registrant in connection with Rule 12g3-2(b): 82-

DAIMLERCHRYSLER AG

FORM 6-K: TABLE OF CONTENTS

1. | | Press release: DaimlerChrysler presents 2006 consolidated financial statements according to IFRS | |

| | | |

2. | | Transition to IFRS: Impact on Financial Statements | |

2

CAUTIONARY STATEMENT REGARDING FORWARD-LOOKING STATEMENTS

Forward-looking statements in this IFRS-Consolidated Financial Statements for the 2006 financial year:

This document contains forward-looking statements that reflect our current views about future events. The words “anticipate,” “assume,” “believe,” “estimate,” “expect,” “intend,” “may,” “plan,” “project,” “should” and similar expressions are used to identify forward looking statements. These statements are subject to many risks and uncertainties, including an economic downturn or slow economic growth, especially in Europe or North America; changes in currency exchange rates and interest rates; introduction of competing products and possible lack of acceptance of our products or services; competitive pressures which may limit our ability to reduce sales incentives and raise prices; price increases in fuel, raw materials, and precious metals; disruption of production or delivery of new vehicles due to shortages of materials, labor strikes, or supplier insolvencies; a decline in resale prices of used vehicles; the ability of the Chrysler Group to implement successfully its Recovery and Transformation Plan; the business outlook for our Truck Group, which may experience a significant decline in demand as a result of accelerated purchases in 2006 made in advance of the effectiveness of new emission regulations; effective implementation of cost reduction and efficiency optimization programs, including our new management model; the business outlook of our equity investee EADS, including the financial effects of delays in and potentially lower volume of future aircraft deliveries; changes in laws, regulations and government policies, particularly those relating to vehicle emissions, fuel economy and safety, the resolution of pending governmental investigations and the outcome of pending or threatened future legal proceedings; and other risks and uncertainties, some of which we describe under the heading “Risk Report” in DaimlerChrysler’s most recent Annual Report and under the headings “Risk Factors” and “Legal Proceedings” in DaimlerChrysler’s most recent Annual Report on Form 20-F filed with the Securities and Exchange Commission. If any of these risks and uncertainties materialize, or if the assumptions underlying any of our forward looking statements prove incorrect, then our actual results may be materially different from those we express or imply by such statements. We do not intend or assume any obligation to update these forward looking statements. Any forward looking statement speaks only as of the date on which it is made.

3

Contact: | | | Press information |

Thomas Fröhlich | | Phone: +49 (0)711 17 41361 |

| Date: |

DaimlerChrysler presents 2006 consolidated financial statements according to IFRS | April 26, 2007 |

• New performance measure EBIT is of the same magnitude as operating profit (US GAAP)

• IFRS net profit in 2006 of €3.8 billion (US GAAP: €3.2 billion)

• Unchanged Group targets and performance measurement

• Interim Report Q1 2007 according to IFRS to be published on May 15, 2007

Stuttgart - DaimlerChrysler (stock-exchange abbreviation DCX) today presented its 2006 consolidated financial statements according to International Financial Reporting Standards (IFRS).

Bodo Uebber, Board of Management member at DaimlerChrysler AG responsible for Finance & Controlling and Financial Services: “We have used the transition to IFRS to make our financial reporting even more transparent. At the same time, we have improved our internal information system.” The transition to IFRS does not change the divisions’ return targets or the Group’s performance measurement.

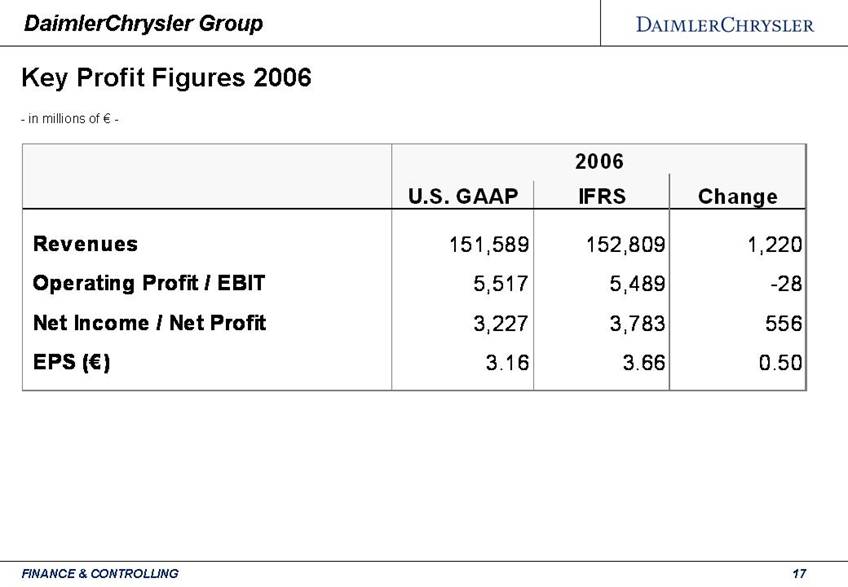

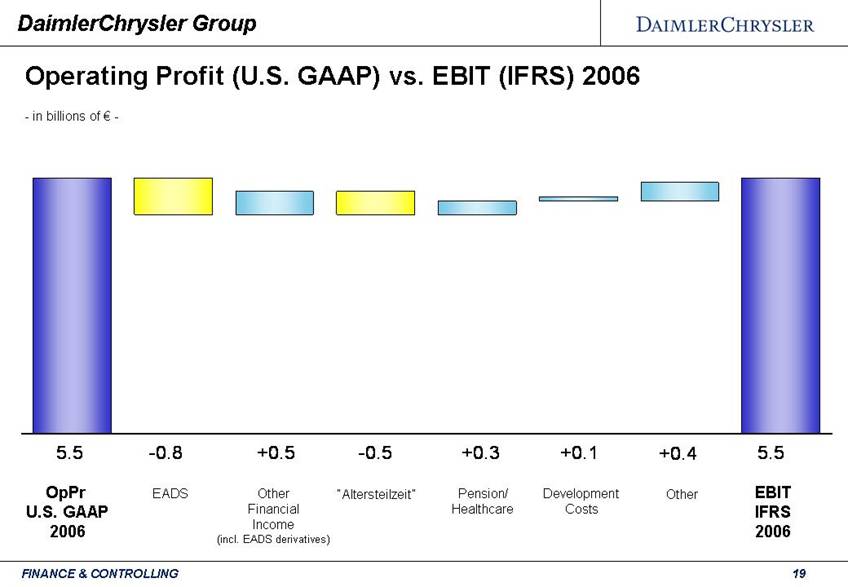

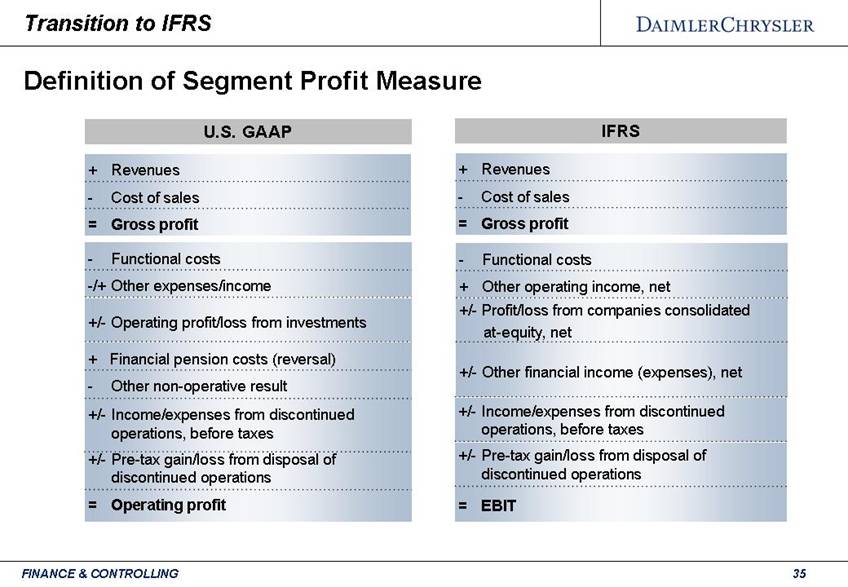

The performance measure operating profit, which was previously used to report the profitability of the Group and its divisions, has been replaced with EBIT (earnings before interest and taxes). As a measure of after-tax earnings, net profit is now used instead of net income. Unlike operating profit, EBIT can be directly derived from the income statement.

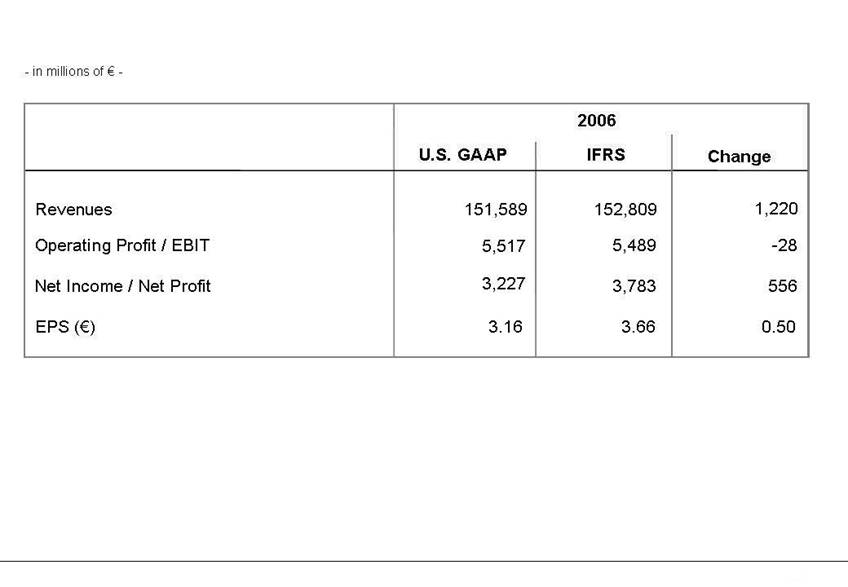

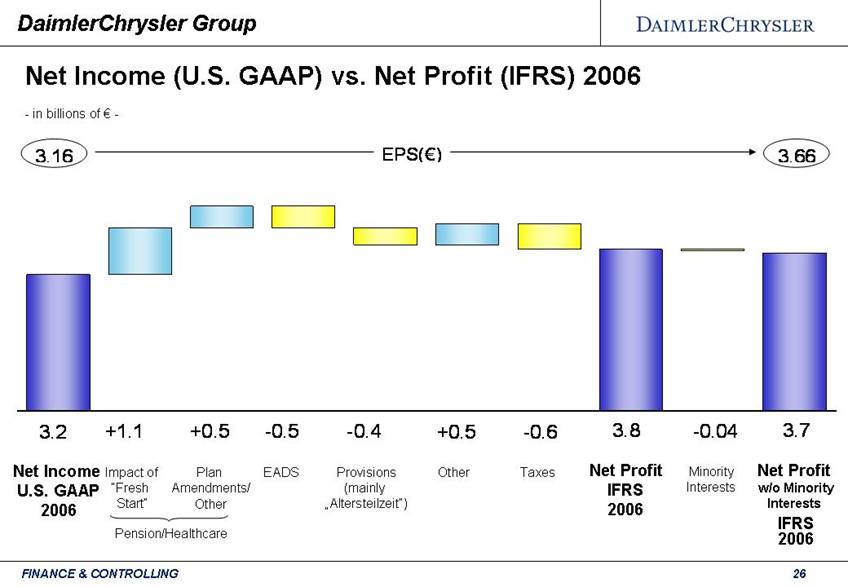

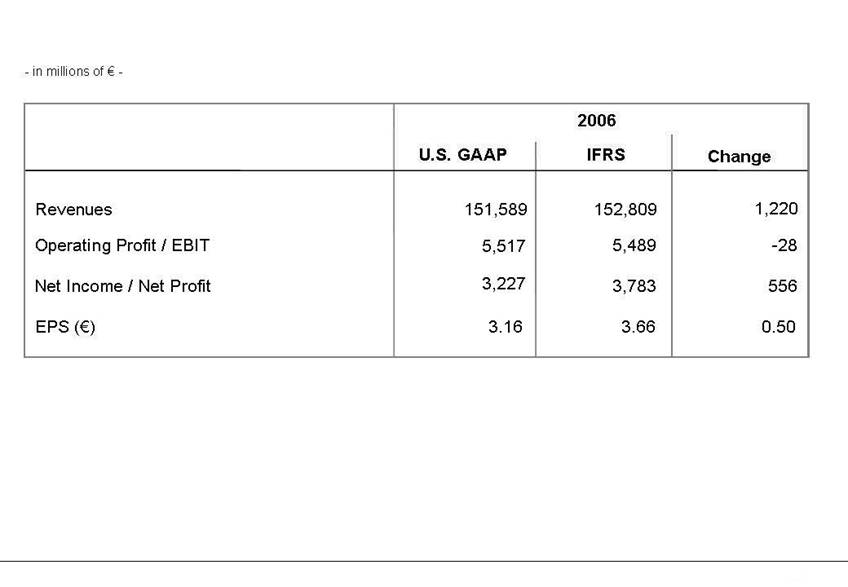

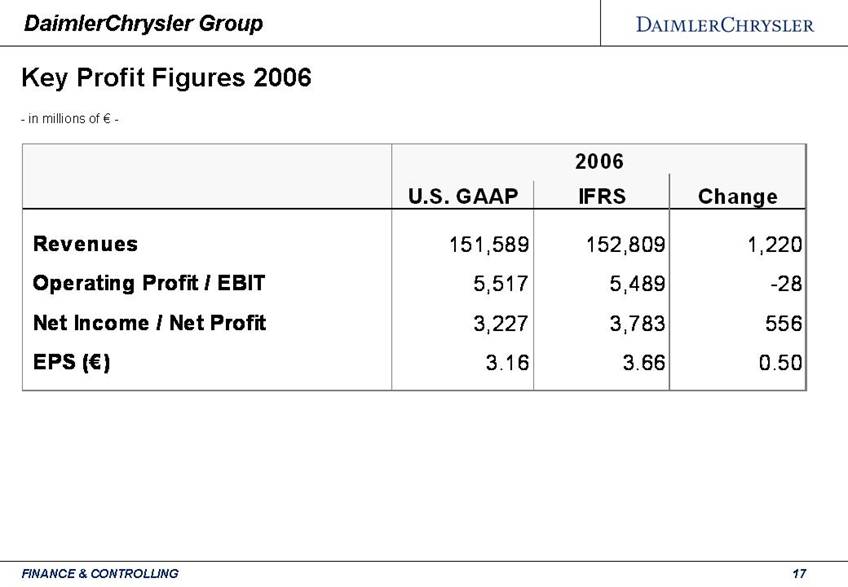

EBIT of €5.5 billion for the year 2006 is almost unchanged compared to the previous figure for operating profit. In terms of after-tax earnings, compared to US GAAP the change to IFRS leads to an increase of €0.6 billion to €3.8 billion, while earnings per share increase by €0.50. DaimlerChrysler presented its consolidated financial statements according to US GAAP in February.

Key figures

The tables in the appendix show the effects of the transition to IFRS on key figures for the year 2006.

In detail, differences occur between IFRS and US GAAP in the consolidated financial statements primarily in the following areas:

• �� Development costs

• Equity interest in EADS

• Pensions and similar obligations

• ABS transactions

• Provisions

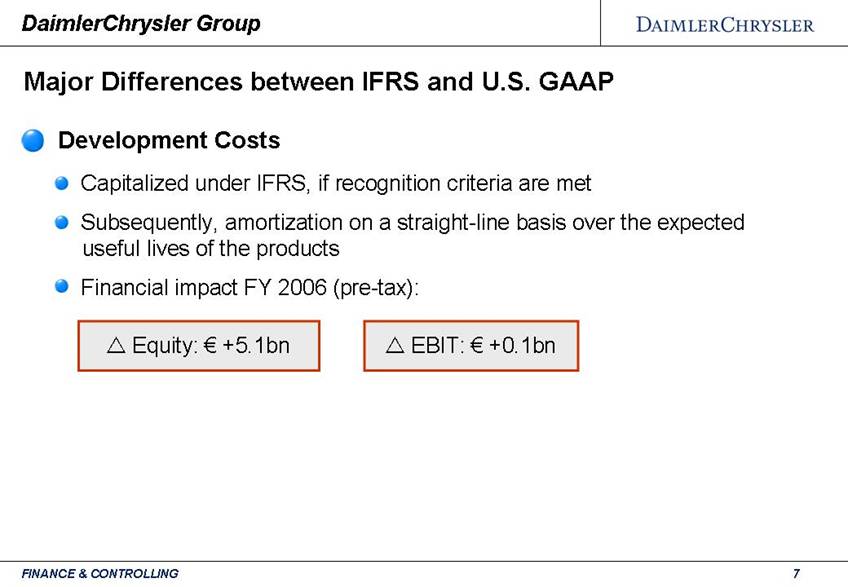

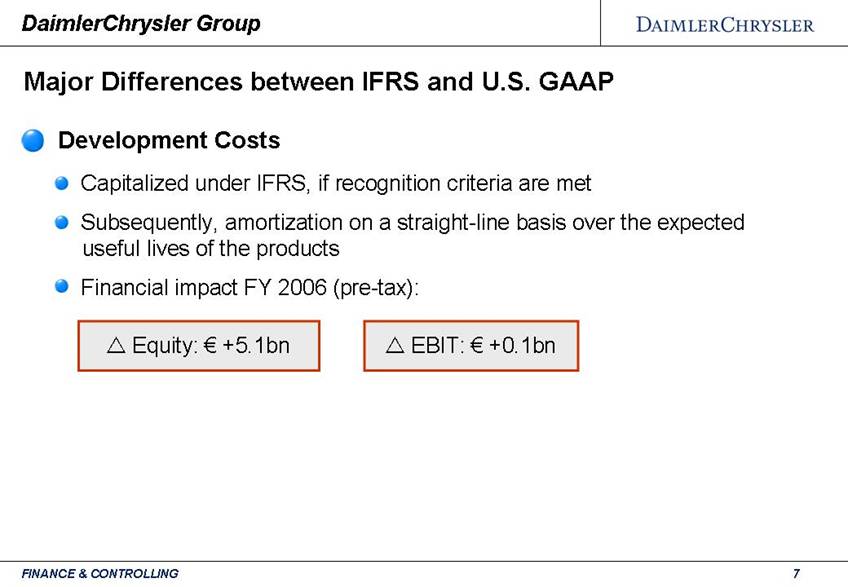

Development costs

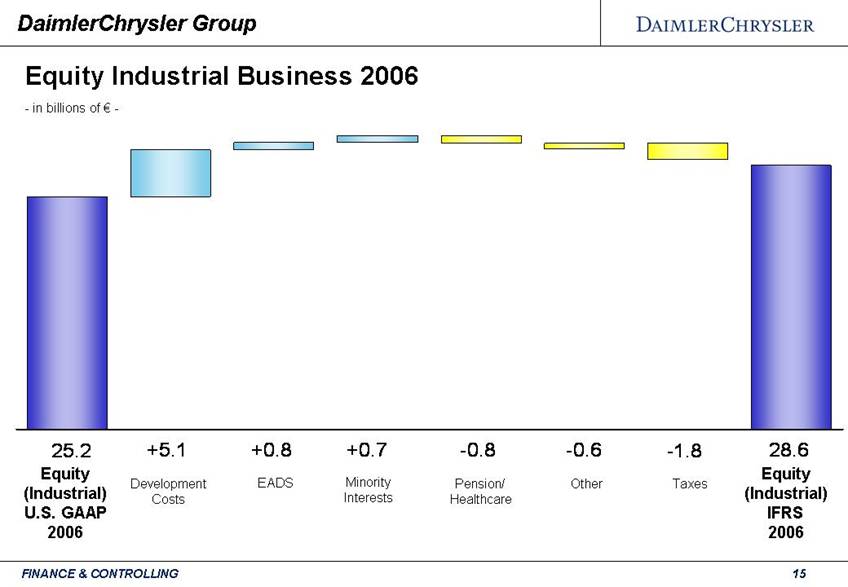

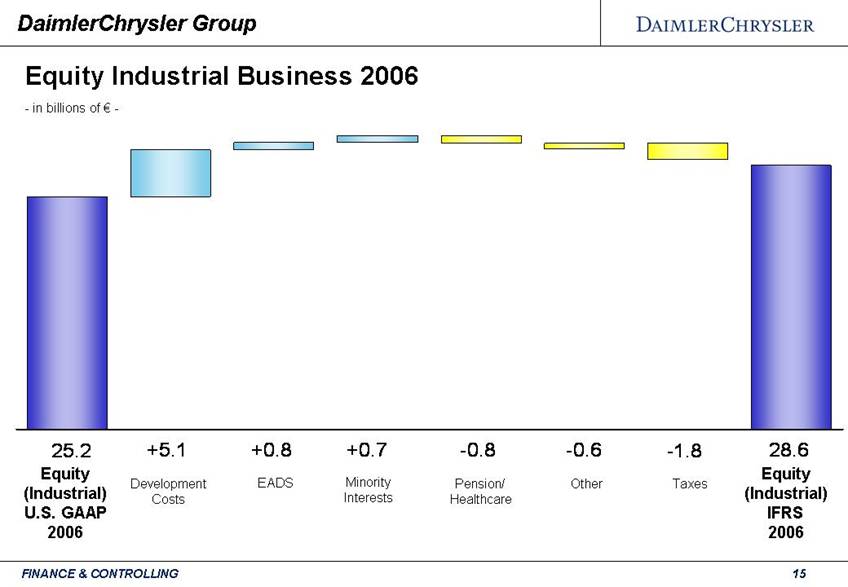

According to US GAAP, development costs are generally expensed in the same period that they are incurred. According to IFRS, however, some development costs are capitalized as intangible assets and amortized on a straight-line basis. In the 2006 consolidated financial statements, this change led to an increase in shareholders’ equity of €5.1 billion compared to the US GAAP accounts. The impact on EBIT was immaterial.

2

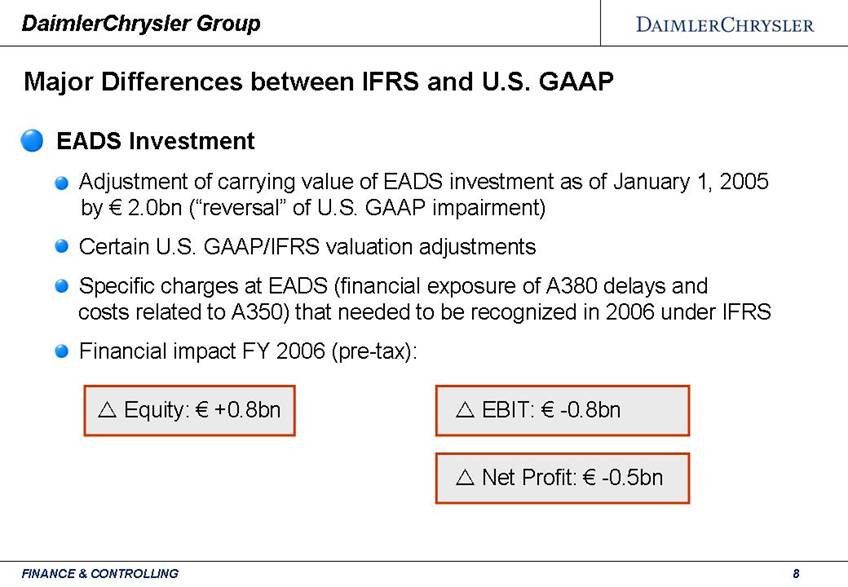

EADS

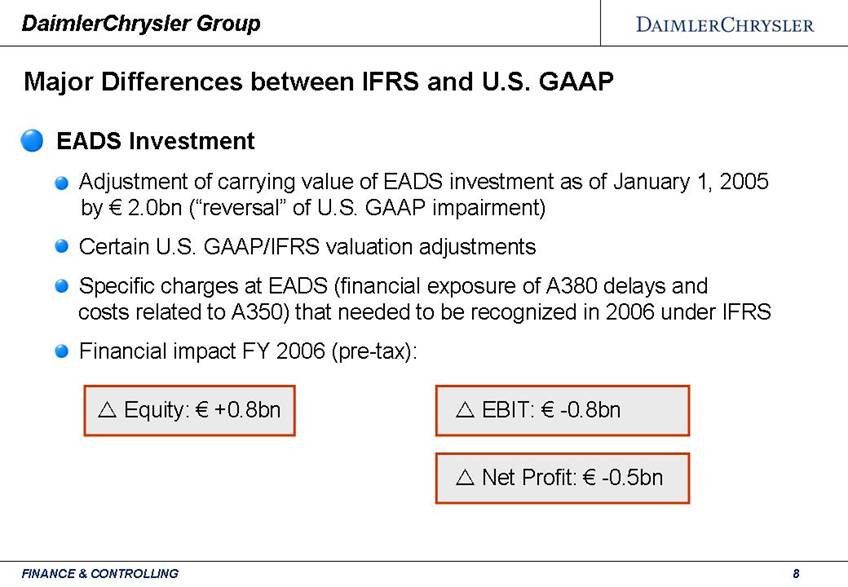

The impairment of nearly €2 billion recognized on the book value of the Group’s equity interest in EADS in 2003 according to US GAAP was not required under IFRS. Therefore, our EADS shareholding has a considerably higher valuation in the IFRS balance sheet at year-end 2006.

Under both IFRS and US GAAP, EADS is shown in DaimlerChrysler’s consolidated financial statements using the equity method after a three-month time lag. According to IFRS, important events such as the decisions by the EADS management in the fourth quarter of 2006 concerning the Airbus A380 and the Airbus A350 have to be reflected by DaimlerChrysler, with a resulting charge on earnings of €0.4 billion. Under US GAAP, there was no such effect in the fourth quarter of 2006 because the time-lag was to be observed. On balance, these two factors led to an increase in shareholders’ equity of €0.8 billion in the IFRS consolidated financial statements for 2006 compared with the US GAAP accounts. EBIT is reduced by €0.8 billion primarily due to the aforementioned additional charge to earnings of €0.4 billion compared with US GAAP and because unlike operating profit, EBIT includes the after-tax equity-method result of EADS. Net profit is reduced by €0.5 billion.

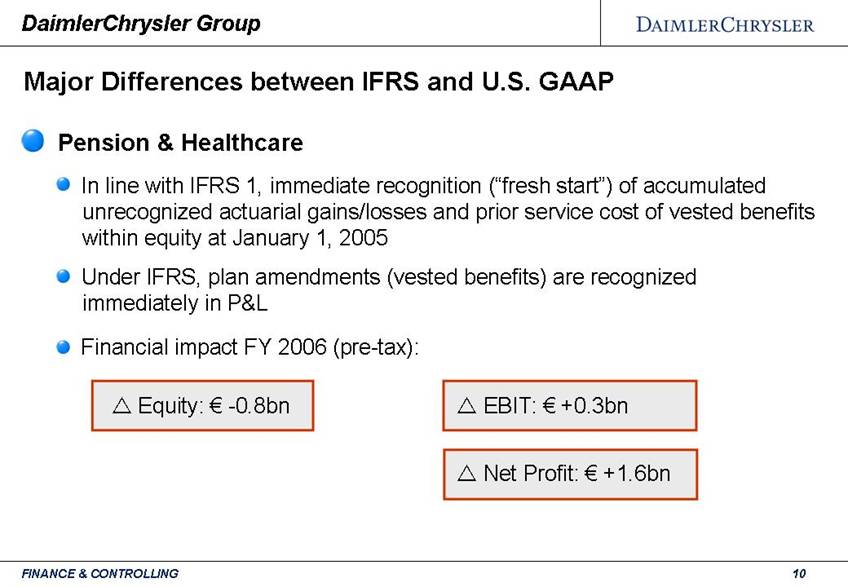

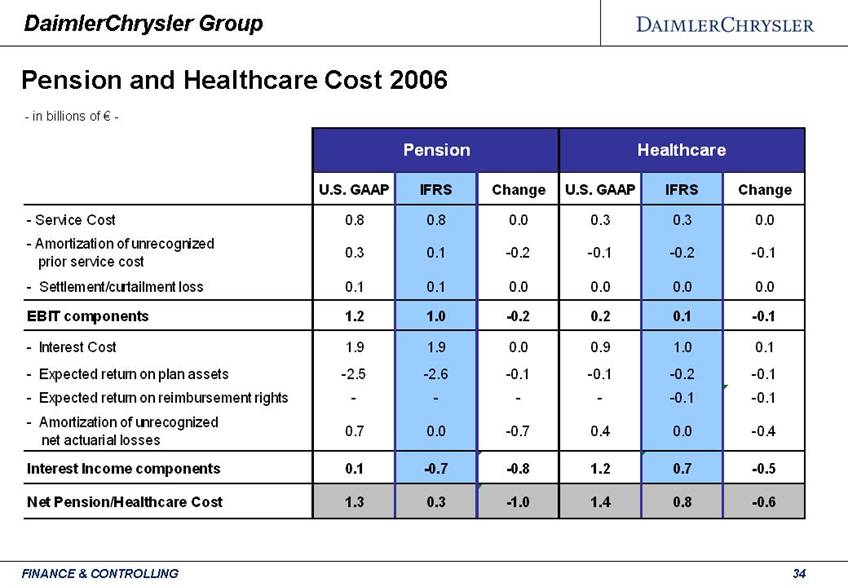

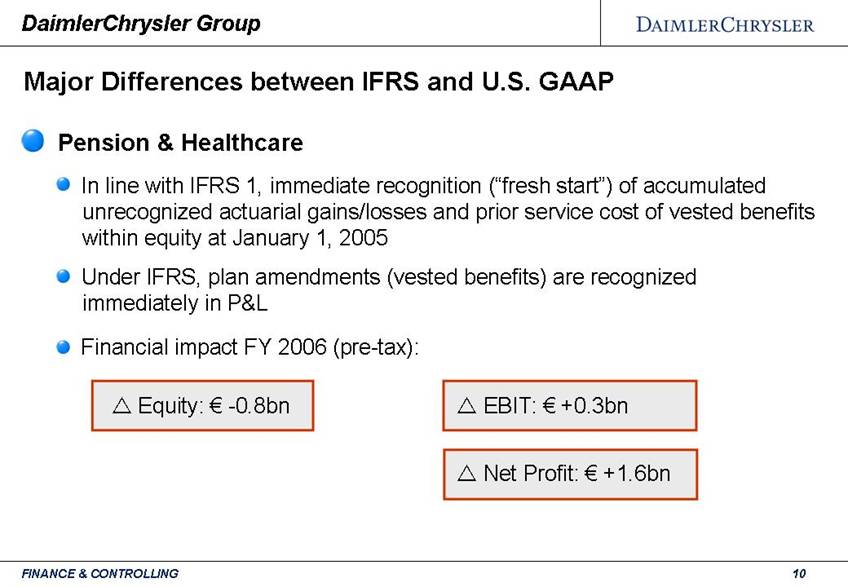

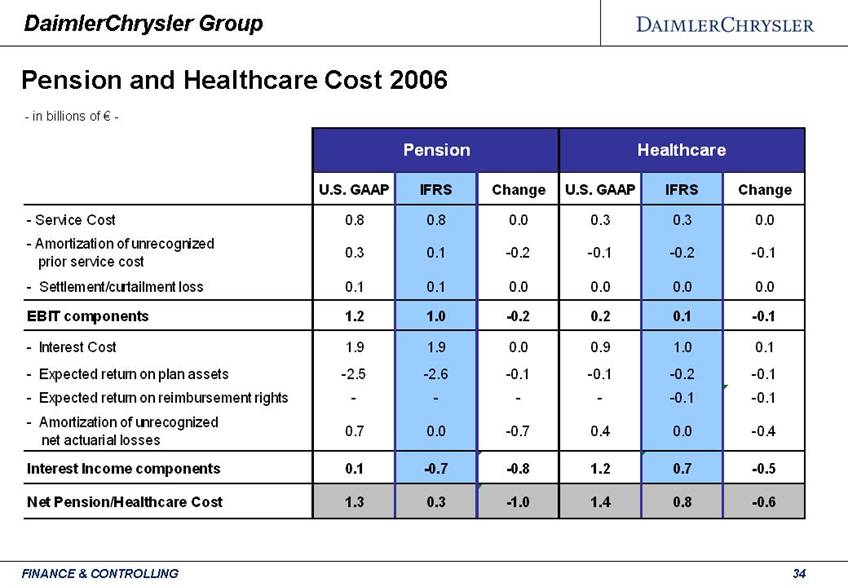

Pensions and similar obligations

With regard to pension and healthcare plans, DaimlerChrysler decided in favor of the “fresh-start” option as of the date of transition to IFRS, January 1, 2005. This means that at that date, all of the actuarial gains and losses previously accumulated have been charged to equity. But this led to a only slight reduction in shareholders’ equity of €0.8 billion in 2006, as due to a change in US GAAP, actuarial gains and losses are

3

fully included in equity as of December 31, 2006 also according to US GAAP. However, in the 2006 IFRS income statement, this results in a positive impact on EBIT of €0.3 billion, because retroactive plan adjustments are always immediately entered in the income statement under IFRS, whereas under US GAAP they are distributed over the remaining service period. Earnings before taxes according to IFRS increased by €1.6 billion compared to US GAAP.

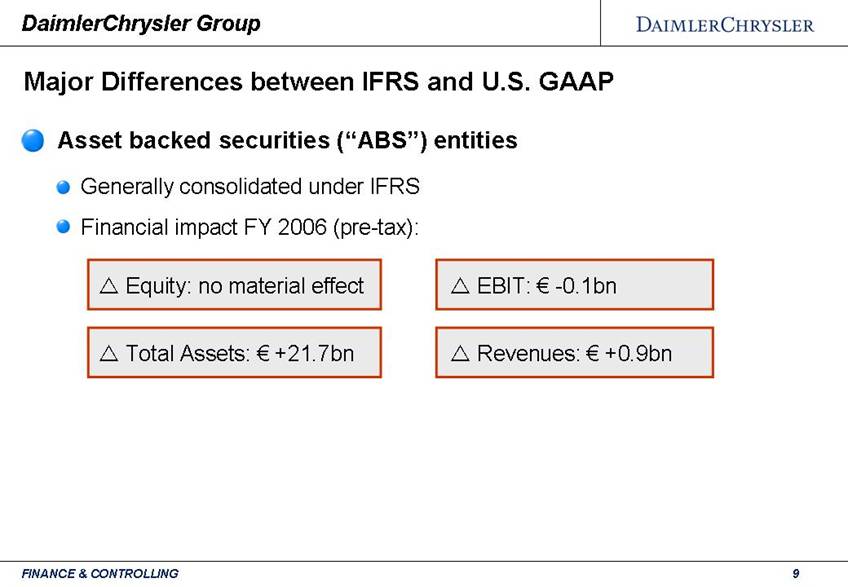

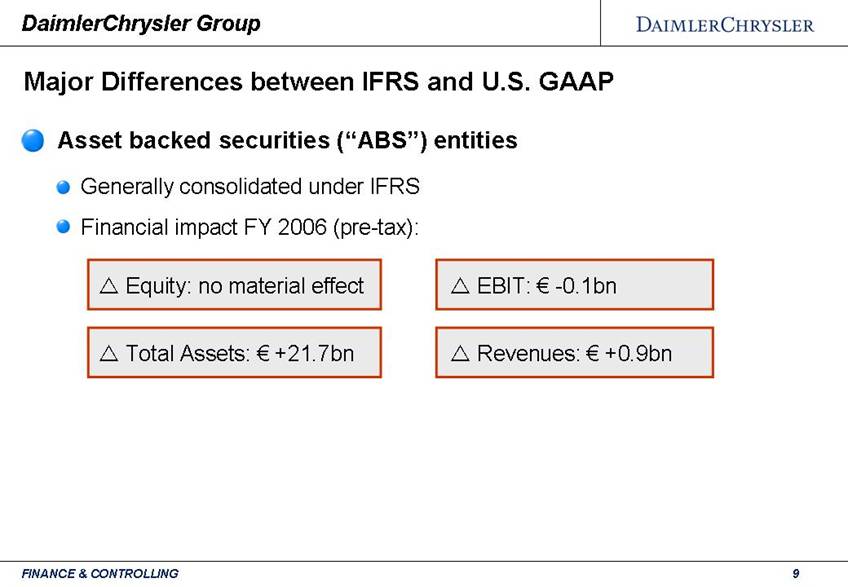

ABS transactions

Asset backed securities (ABS), which result mainly from the sale to institutional investors of receivables in the financial services business, are classified as “sold” under US GAAP and are not consolidated. But according to IFRS, they remain in the balance sheet. In the 2006 consolidated financial statements, this means that the balance sheet total is €21.7 billion higher than under US GAAP. In addition, the ABS items results in an increase in revenues of €0.9 billion.

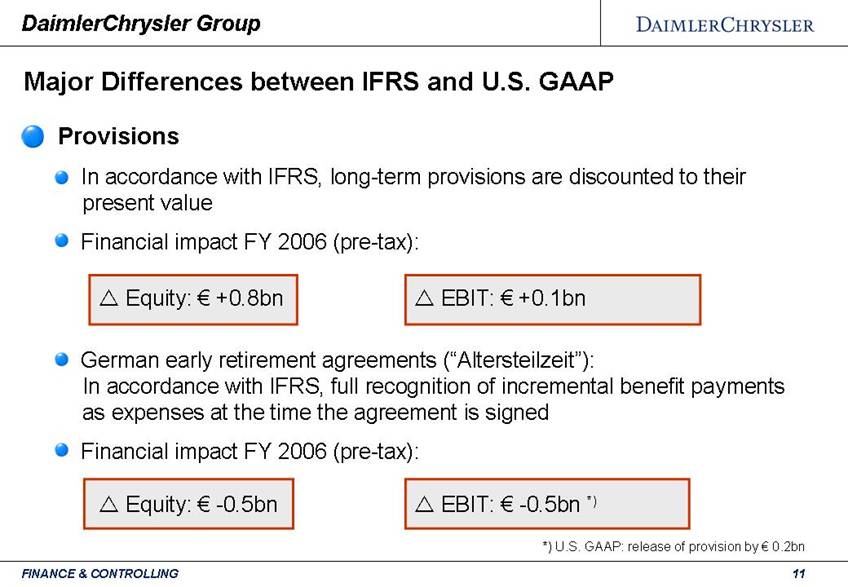

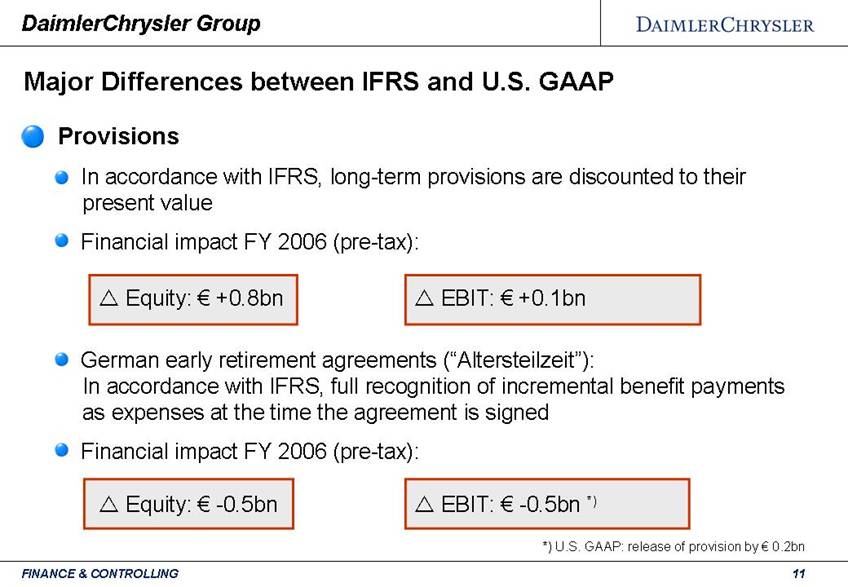

Provisions

According to IFRS, long-term provisions are generally to be discounted and recognized at their present value if the effects of discounting are material. According to US GAAP, discounting is only allowed for certain types of provisions if the dates of the amounts and cash flows can be reliably determined. This changed treatment results in a reduction of €0.8 billion in provisions in the IFRS consolidated financial statements for 2006.

The change to IFRS also led to valuation differences concerning the early-retirement model commonly used in Germany, the so-called “Altersteilzeit”. Under US GAAP, the total payments due during the non-working phase are “saved” by gradually setting up provisions

4

during the employment phase. Under IFRS however, provisions for the payments due during the non-working phase are set up in the full amount when the “Altersteilzeit” agreements are signed. In the IFRS consolidated financial statements, this resulted in a reduction of €0.5 billion in both shareholders’ equity while EBIT decreased by €0.5 billion.

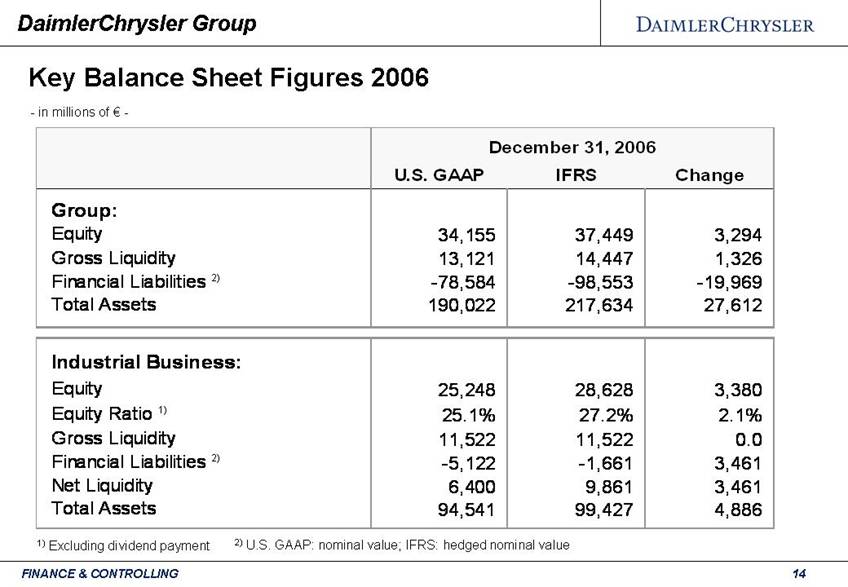

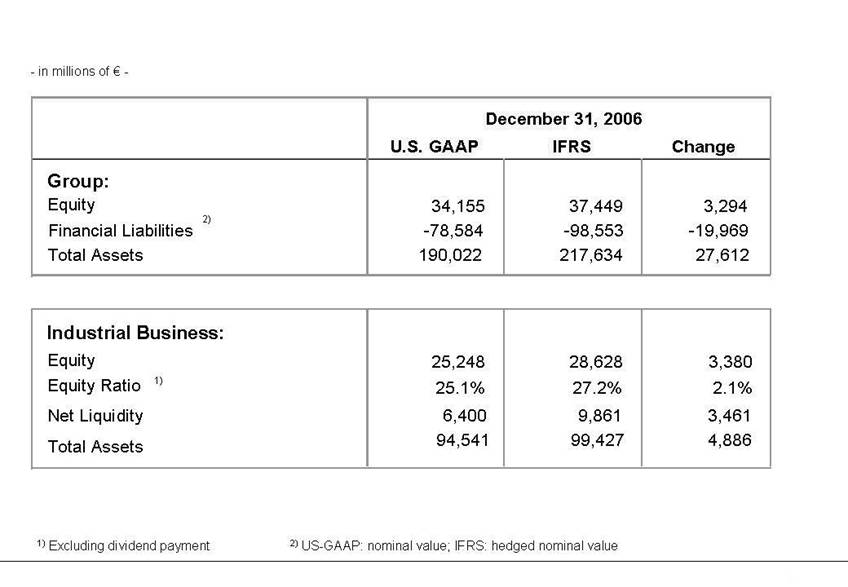

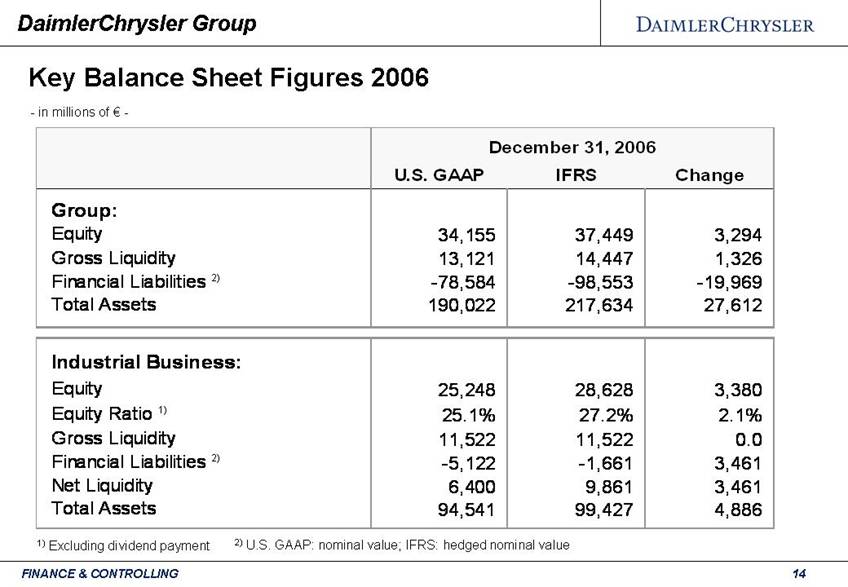

These differences resulted in the following effects on key figures in 2006 under IFRS:

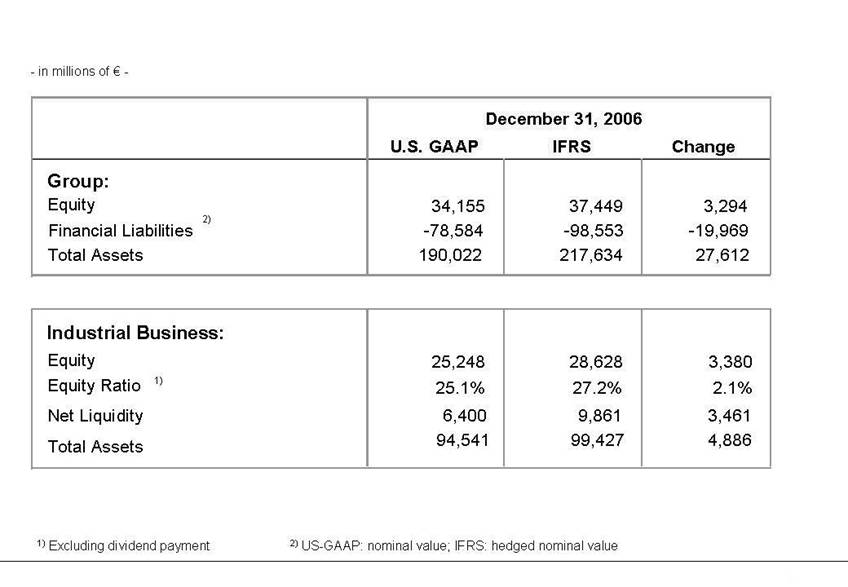

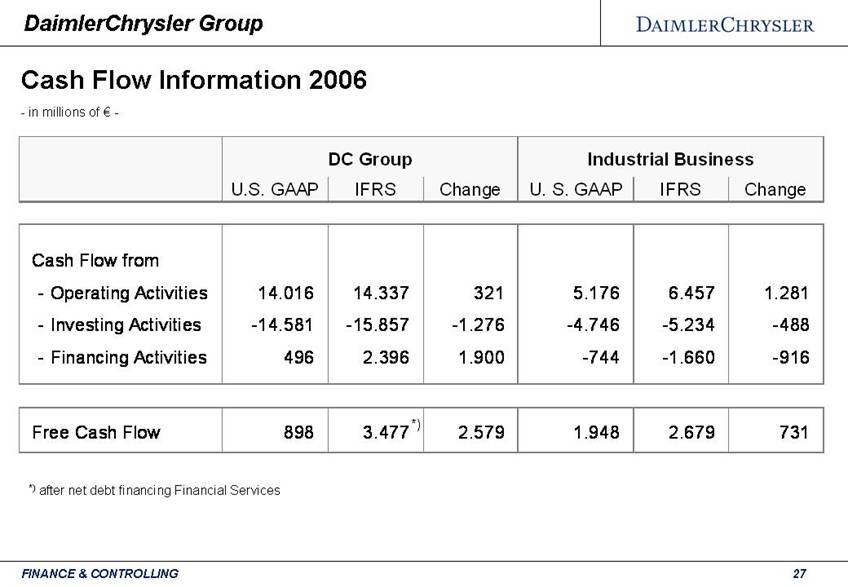

The substantial increase in the balance-sheet total to €218 billion was primarily due to consolidating the ABS transactions.

The equity of the industrial business increases to €28.6 billion, with a corresponding increase in the equity ratio to 27.2%. This was mainly caused by capitalizing development costs.

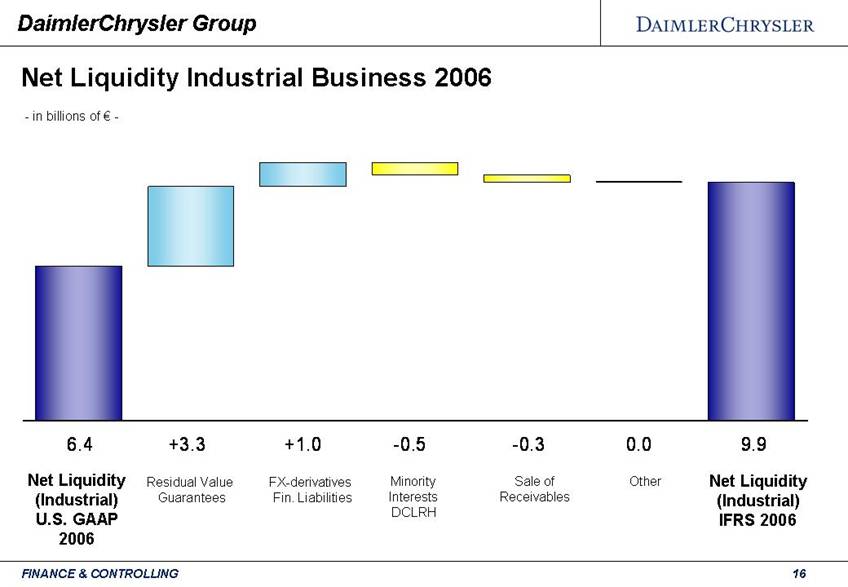

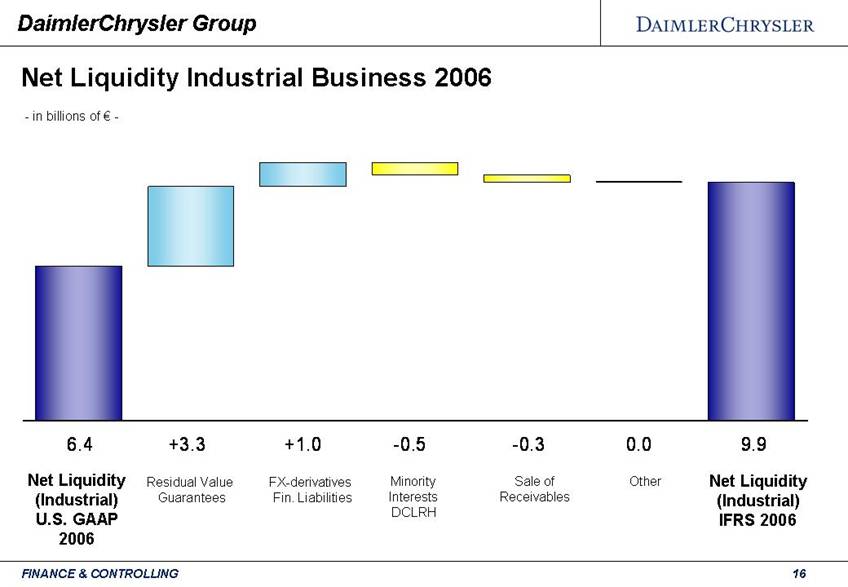

The net liquidity of the industrial business increases from €6.4 billion to €9.9 billion. One of the main reasons for this is that the residual-value guarantees for leased vehicles are no longer shown as financing liabilities, but under other financial liabilities due to their operating nature.

The consolidated cash flow from operating activities is slightly higher under IFRS than under US GAAP. There is a positive effect from the capitalization of development costs. On the other hand, there is a reduction in cash provided by operating activities because under IFRS the Group enters proceeds from the sale of vehicles with significant residual-value guarantees under cash provided by operating activities.

The increase in net profit to €3.8 billion compared with net income of

5

€3.2 billion under US GAAP is primarily a result of the lower cost of pensions and similar obligations. On the other hand, there are higher expenses mainly due to the treatment of EADS, taxes and provisions for early retirement.

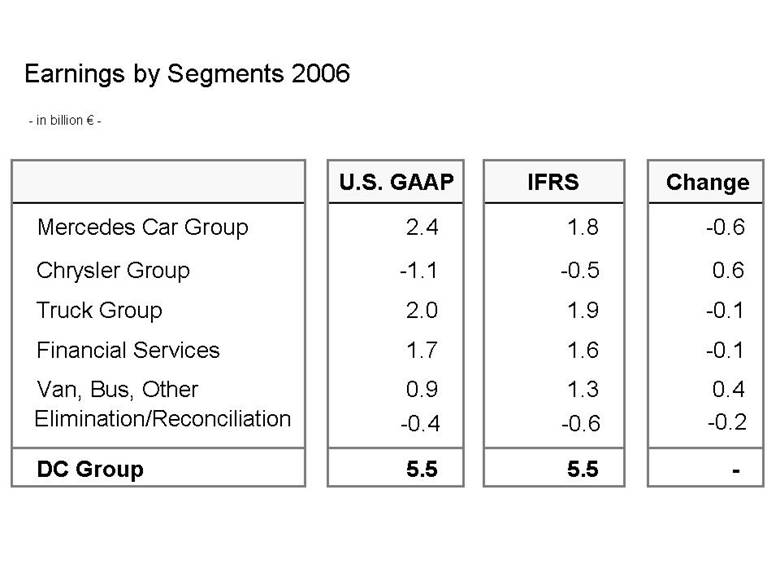

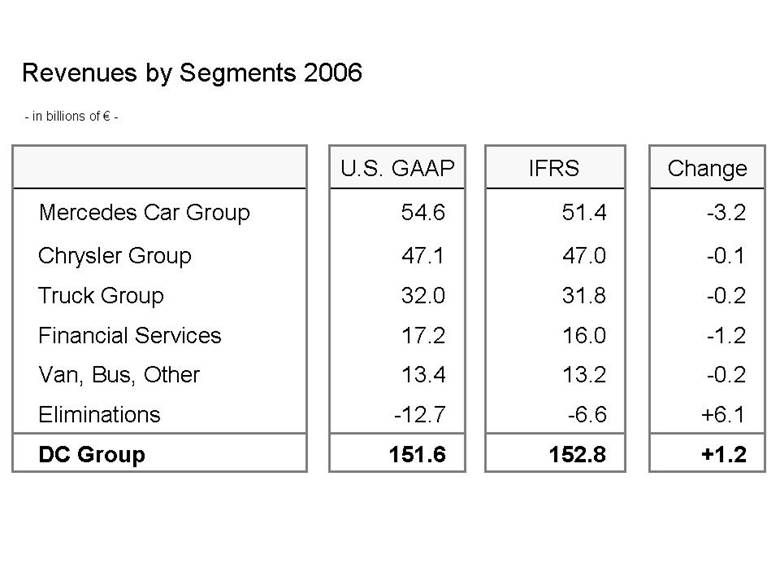

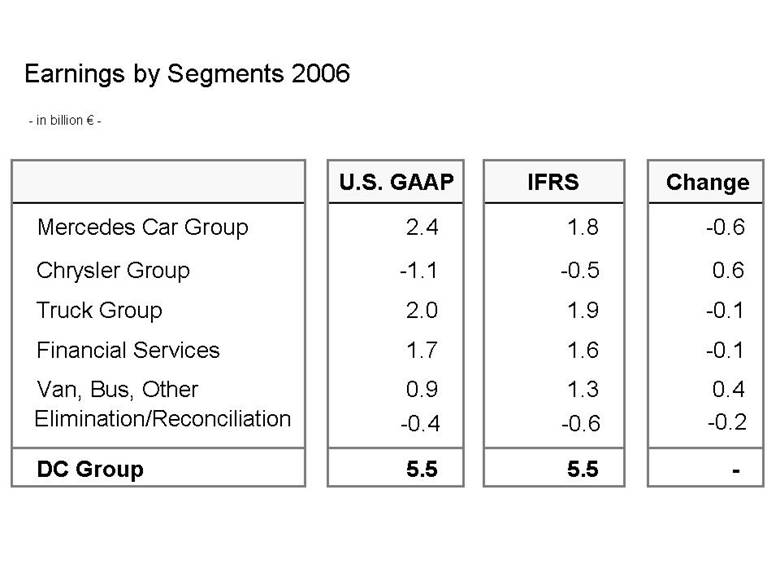

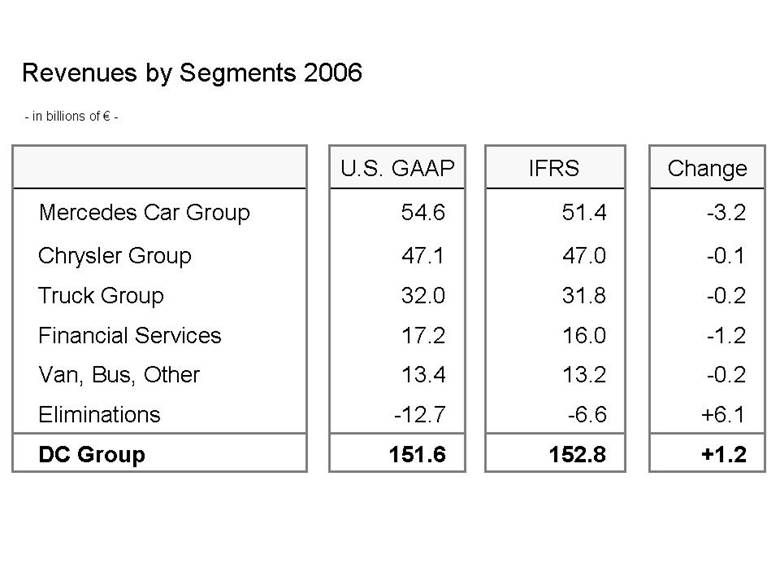

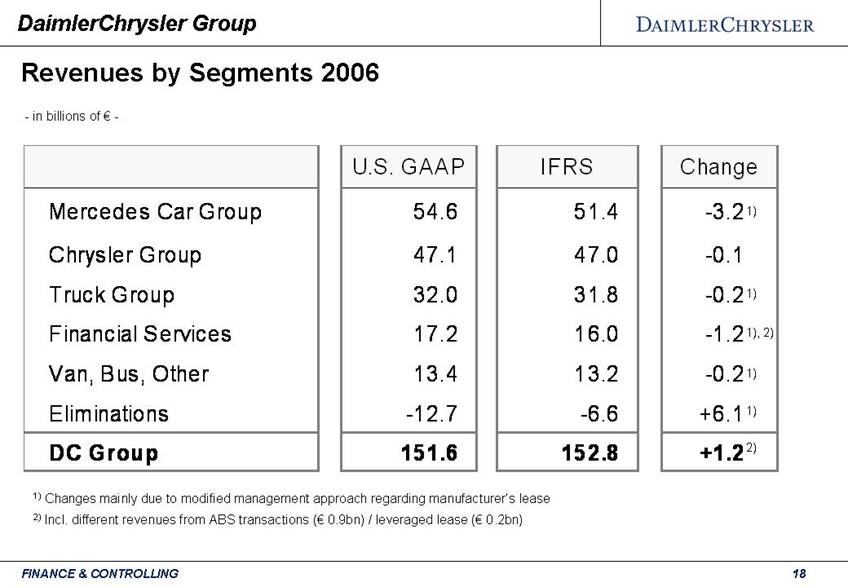

At the divisional level, the change to IFRS primarily affects the Mercedes Car Group and the Truck Group, whose revenues fall in 2006 compared to US GAAP. This is due to the altered allocation of effects from manufacturer leasing, that is, leasing vehicles to customers through the Financial Services division in Germany. With the use of IFRS, these vehicles are no longer regarded as being sold by the respective division. Instead, revenues are recognized on a pro-rata basis in line with the leasing payments over the period of the lease. This means that revenues and earnings are recognized within the divisions over the period of the leasing contracts. So this is only a timing difference and does not reflect any reduction in revenues from the operating business. There is no change in revenues at the Group level.

Additional information according to US GAAP

With its listing on the New York Stock Exchange, DaimlerChrysler continues to be subject to the rules of the US Securities and Exchange Commission (SEC). To the extent that is necessary, in the future the Group will therefore provide a reconciliation to US GAAP for net profit and shareholders’ equity in accordance with SEC disclosure rules.

The new accounting principles according to IFRS are to be applied on the basis of an EU directive for all capital-market oriented companies domiciled in member states of the European Union for financial years

6

beginning on or after January 1, 2005. DaimlerChrysler and other companies that are listed on a stock exchange in the United States were allowed to postpone the compulsory use of IFRS until the year 2007.

DaimlerChrysler’s full consolidated financial statements for 2006 according to IFRS are available on the Internet at http://www.daimlerchrysler.com/ifrs.

DaimlerChrysler will publish its interim report on the first quarter of 2007 according to IFRS on May 15, 2007.

Further information on DaimlerChrysler on the Internet: www.media.daimlerchrysler.com

This document contains forward-looking statements that reflect our current views about future events. The words “anticipate,” “assume,” “believe,” “estimate,” “expect,”“ intend,” “may,” “plan,” “project,” “should” and similar expressions are used to identify forward looking statements. These statements are subject to many risks and uncertainties, including an economic downturn or slow economic growth, especially in Europe or North America; changes in currency exchange rates and interest rates; introduction of competing products and possible lack of acceptance of our products or services; competitive pressures which may limit our ability to reduce sales incentives and raise prices; price increases in fuel, raw materials, and precious metals; disruption of production or delivery of new vehicles due to shortages of materials, labor strikes, or supplier insolvencies; a decline in resale prices of used vehicles; the ability of the Chrysler Group to implement successfully its Recovery and Transformation Plan; the business outlook for our Truck Group, which may experience a significant decline in demand as a result of accelerated purchases in 2006 made in advance of the effectiveness of new emission regulations; effective implementation of cost reduction and efficiency optimization programs, including our new management model; the business outlook of our equity investee EADS, including the financial effects of delays in and potentially lower volume of future aircraft deliveries; changes in laws, regulations and government policies, particularly those relating to vehicle emissions, fuel economy and safety, the resolution of pending governmental investigations and the outcome of pending or threatened future legal proceedings; and other risks and uncertainties, some of which we describe under the heading “Risk Report” in DaimlerChrysler’s most recent Annual Report and under the headings “Risk Factors” and “Legal Proceedings” in DaimlerChrysler’s most recent Annual Report on Form 20-F filed with the Securities and Exchange Commission. If any of these risks and uncertainties materialize, or if the assumptions underlying any of our forward looking statements prove incorrect, then our actual results may be materially different from those we express or imply by such statements. We do not intend or assume any obligation to update these forward looking statements. Any forward looking statement speaks only as of the date on which it is made.

7

| Earnings by Segments 2006 U.S. GAAP IFRS Change Mercedes Car Group 2.4 1.8 -0.6 Chrysler Group -1.1 -0.5 0.6 Truck Group 2.0 1.9 -0.1 Financial Services 1.7 1.6 -0.1 Van, Bus, Other 0.9 1.3 0.4 DC Group Elimination/Reconciliation -0.4 -0.6 -0.2 - in billion € - - 5.5 5.5 |

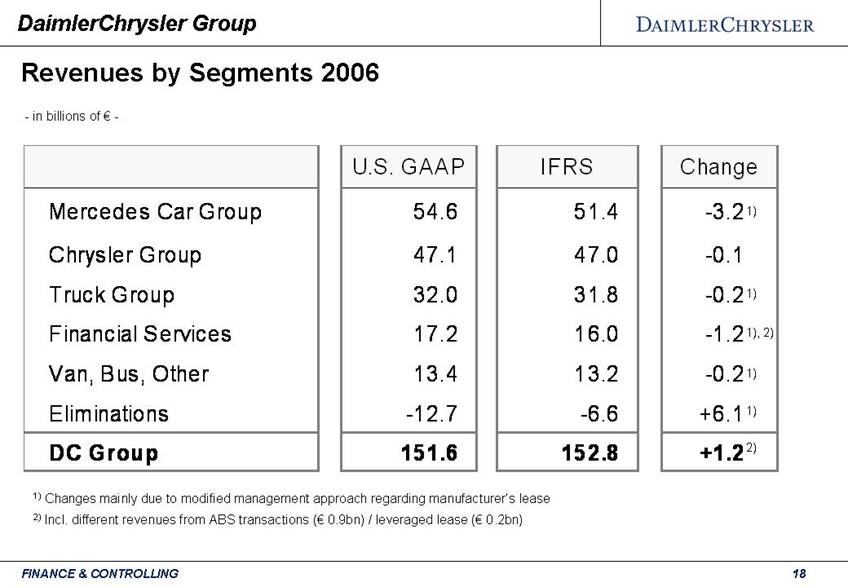

| - in billions of € - Revenues by Segments 2006 U.S. GAAP IFRS Change Mercedes Car Group 54.6 51.4 -3.2 Chrysler Group 47.1 47.0 -0.1 Truck Group 32.0 31.8 -0.2 Financial Services 17.2 16.0 -1.2 Van, Bus, Other 13.4 13.2 -0.2 Eliminations -12.7 -6.6 +6.1 DC Group 151.6 152.8 +1.2 |

| - in millions of € - U.S. GAAP IFRS Change Group: Equity 34,155 37,449 3,294 Financial Liabilities -78,584 -98,553 -19,969 Total Assets 190,022 217,634 27,612 Industrial Business: Equity 25,248 28,628 3,380 Equity Ratio 1) 25.1% 27.2% 2.1% Net Liquidity 6,400 9,861 3,461 Total Assets 94,541 99,427 4,886 December 31, 2006 1) Excluding dividend payment 2) US-GAAP: nominal value; IFRS: hedged nominal value 2) |

| - in millions of € - U.S. GAAP IFRS Change Revenues 152,809 1,220 Operating Profit / EBIT 151,589 5,489 -28 5,517 Net Income / Net Profit 3,783 556 3,227 EPS (€) 3.66 0.50 3.16 2006 |

| Transition to IFRS Impact on Financial Statements Bodo Uebber Stuttgart, April 26, 2007 |

| Introduction Major Differences between IFRS and U.S. GAAP Impact on Financial Statements 2006 Key Figures 2005/2006 Conclusion Appendix Transition to IFRS Agenda |

| Beginning with Q1 2007, DaimlerChrysler will change its financial reporting to International Financial Reporting Standards (“IFRS”) The IFRS consolidated financial statements FY 2006 are the basis for DaimlerChrysler’s future IFRS reporting IFRS transition date was January 1, 2005 As an SEC registered company, DaimlerChrysler will provide reconciliations to U.S. GAAP as and when required by the SEC Transition to IFRS Basic Approach |

| Transition to IFRS used to further increase transparency of financial reporting improve internal performance management Strengthening of internal = external philosophy Change from Operating Profit to EBIT EBIT can be derived from P&L Profit effect of at-equity investments as in P&L Transition to IFRS Guiding Principles |

| Minimizing reconciling items to Group Manufacturer’s lease Allocation of corporate research costs Enhanced footnote disclosure Shift of charges related to the new management model (“NMM”) and other corporate items from segment “Van, Bus, Other” to “Reconciliation” Transition to IFRS Segment Reporting |

| Introduction Major Differences between IFRS and U.S. GAAP Impact on Financial Statements 2006 Key Figures 2005/2006 Conclusion Appendix Transition to IFRS Agenda |

| Development Costs Capitalized under IFRS, if recognition criteria are met Subsequently, amortization on a straight-line basis over the expected useful lives of the products Financial impact FY 2006 (pre-tax): Equity: € +5.1bn EBIT: € +0.1bn Major Differences between IFRS and U.S. GAAP DaimlerChrysler Group |

| EADS Investment Adjustment of carrying value of EADS investment as of January 1, 2005 by € 2.0bn (“reversal” of U.S. GAAP impairment) Certain U.S. GAAP/IFRS valuation adjustments Specific charges at EADS (financial exposure of A380 delays and costs related to A350) that needed to be recognized in 2006 under IFRS Financial impact FY 2006 (pre-tax): Equity: € +0.8bn EBIT: € -0.8bn Net Profit: € -0.5bn Major Differences between IFRS and U.S. GAAP DaimlerChrysler Group |

| Asset backed securities (“ABS”) entities Generally consolidated under IFRS Financial impact FY 2006 (pre-tax): Equity: no material effect EBIT: € -0.1bn Total Assets: € +21.7bn Revenues: € +0.9bn Major Differences between IFRS and U.S. GAAP DaimlerChrysler Group DAIMLERCHRYSLER |

| Pension & Healthcare In line with IFRS 1, immediate recognition (“fresh start”) of accumulated unrecognized actuarial gains/losses and prior service cost of vested benefits within equity at January 1, 2005 Under IFRS, plan amendments (vested benefits) are recognized immediately in P&L Financial impact FY 2006 (pre-tax): Equity: € -0.8bn EBIT: € +0.3bn Net Profit: € +1.6bn Major Differences between IFRS and U.S. GAAP DaimlerChrysler Group |

| DaimlerChrysler Group Major Differences between IFRS and U.S. GAAP Provisions In accordance with IFRS, long-term provisions are discounted to their present value Financial impact FY 2006 (pre-tax): Equity: € +0.8bn EBIT: € +0.1bn German early retirement agreements (“Altersteilzeit”): In accordance with IFRS, full recognition of incremental benefit payments as expenses at the time the agreement is signed Financial impact FY 2006 (pre-tax): Equity: € -0.5bn EBIT: € -0.5bn *) *) U.S. GAAP: release of provision by € 0.2bn |

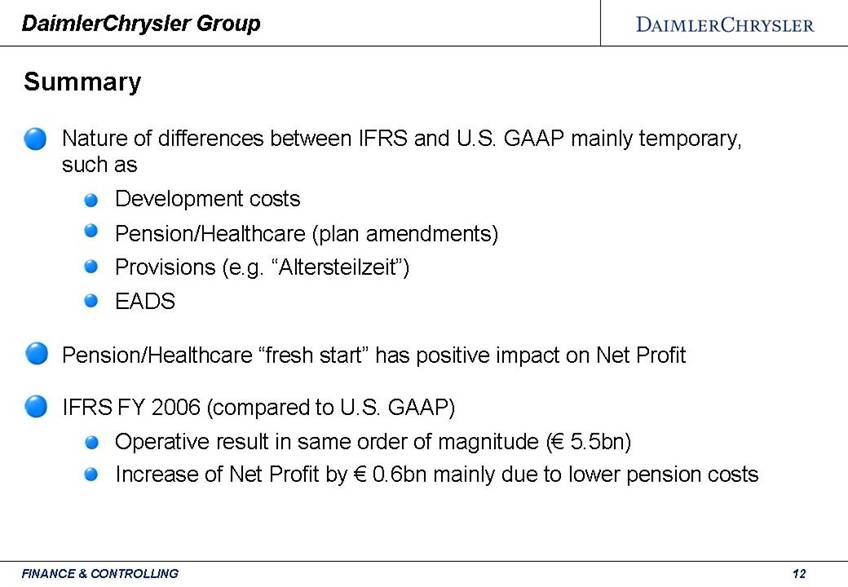

| Nature of differences between IFRS and U.S. GAAP mainly temporary, such as Development costs Pension/Healthcare (plan amendments) Provisions (e.g. “Altersteilzeit”) EADS Pension/Healthcare “fresh start” has positive impact on Net Profit IFRS FY 2006 (compared to U.S. GAAP) Operative result in same order of magnitude (€ 5.5bn) Increase of Net Profit by € 0.6bn mainly due to lower pension costs DaimlerChrysler Group Summary |

| Introduction Major Differences between IFRS and U.S. GAAP Impact on Financial Statements 2006 Key Figures 2005/2006 Conclusion Appendix Transition to IFRS Agenda |

| Key Balance Sheet Figures 2006 - in millions of € - DaimlerChrysler Group 1) Excluding dividend payment 2) U.S. GAAP: nominal value; IFRS: hedged nominal value December 31, 2006 U.S. GAAPIFRSChange Group: Equity34,15537,4493,294 Gross Liquidity13,12114,4471,326 Financial Liabilities 2)-78,584-98,553-19,969 Total Assets190,022217,63427,612 Industrial Business: Equity25,24828,6283,380 Equity Ratio 1)25.1%27.2%2.1% Gross Liquidity11,52211,5220.0 Financial Liabilities 2)-5,122-1,6613,461 Net Liquidity6,4009,8613,461 Total Assets94,54199,4274,886 |

| Equity Industrial Business 2006 Equity (Industrial) U.S. GAAP 2006 Equity (Industrial) IFRS 2006 Development Costs - in billions of € - DaimlerChrysler Group Taxes Pension/Healthcare EADS Minority Interests Other |

| DaimlerChrysler Group FX-derivatives Fin. Liabilities Other Residual Value Guarantees Minority Interests DCLRH Net Liquidity (Industrial) U.S. GAAP 2006 Net Liquidity (Industrial) IFRS 2006 - in billions of € - Net Liquidity Industrial Business 2006 Sale of Receivables 6.4 +3.3 +1.0 -0.5 -0.3 0.0 9.9 |

| Key Profit Figures 2006 - in millions of € - DaimlerChrysler Group 2006 U.S. GAAPIFRSChange Revenues151,589152,8091,220 Operating Profit / EBIT5,5175,489-28 Net Income / Net Profit3,2273,783556 EPS (€)3.163.660.50 |

| Revenues by Segments 2006 DaimlerChrysler Group 1) 1) 1), 2) 1) 1) 2) 1) Changes mainly due to modified management approach regarding manufacturer‘s lease 2) Incl. different revenues from ABS transactions (€ 0.9bn) / leveraged lease (€ 0.2bn) - in billions of € - U.S. GAAPIFRSChange Mercedes Car Group54.651.4-3.21) Chrysler Group47.147.0-0.1 Truck Group32.031.8-0.21) Financial Services17.216.0-1.21), 2) Van, Bus, Other13.413.2-0.21) Eliminations-12.7-6.6+6.11) DC Group151.6152.8+1.22) |

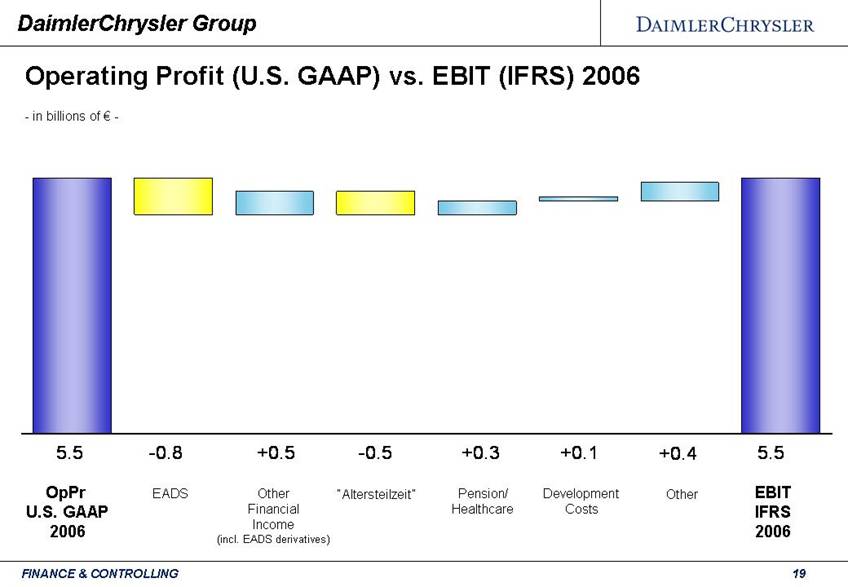

| Operating Profit (U.S. GAAP) vs. EBIT (IFRS) 2006 OpPr U.S. GAAP 2006 EBIT IFRS 2006 Development Costs Pension/ Healthcare Other Financial Income (incl. EADS derivatives) DaimlerChrysler Group Other EADS - in billions of € - “Altersteilzeit” 5.5 -0.8 +0.5 -0.5 +0.3 +0.1 +0.4 5.5 |

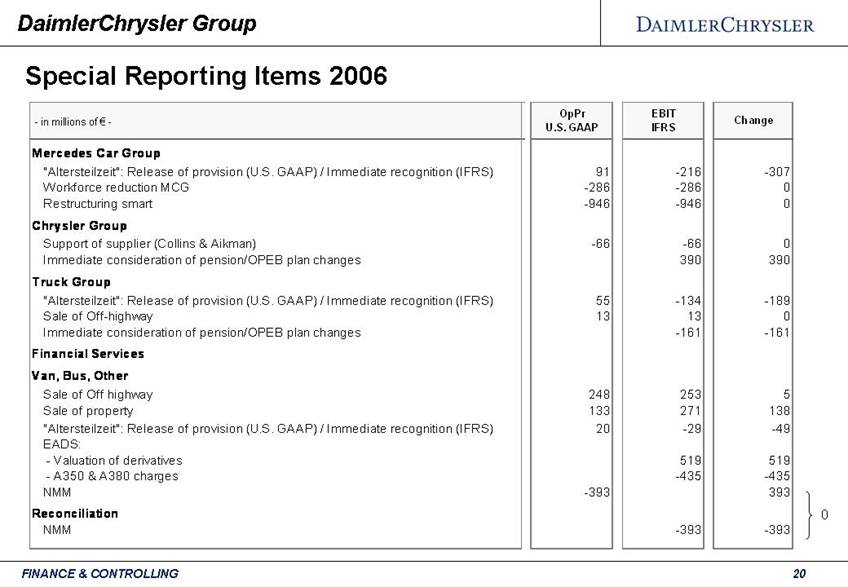

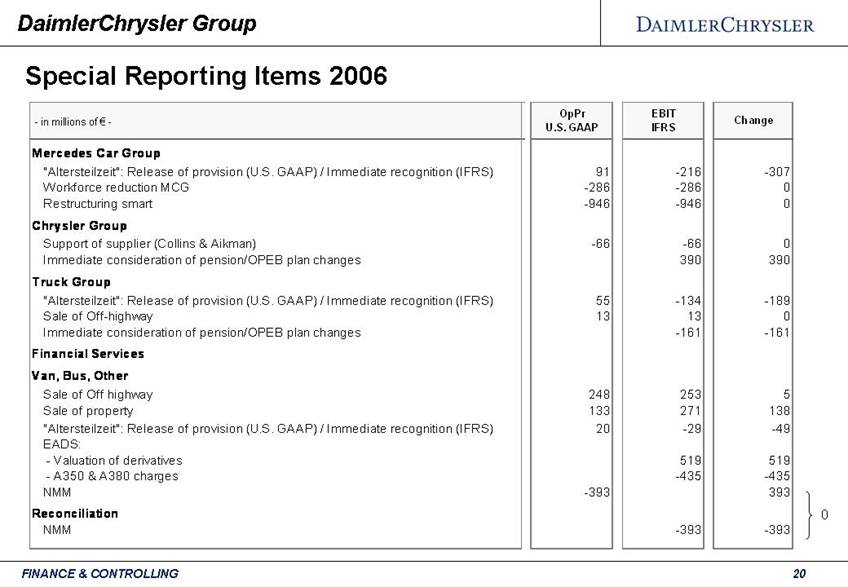

| Special Reporting Items 2006 DaimlerChrysler Group 0 OpPrEBIT - in millions of € -Change U.S. GAAPIFRS Mercedes Car Group "Altersteilzeit": Release of provision (U.S. GAAP) / Immediate recognition (IFRS)91-216-307 Workforce reduction MCG-286-2860 Restructuring smart-946-9460 Chrysler Group Support of supplier (Collins & Aikman)-66-660 Immediate consideration of pension/OPEB plan changes390390 Truck Group "Altersteilzeit": Release of provision (U.S. GAAP) / Immediate recognition (IFRS)55-134-189 Sale of Off-highway13130 Immediate consideration of pension/OPEB plan changes-161-161 Financial Services Van, Bus, Other Sale of Off highway2482535 Sale of property133271138 "Altersteilzeit": Release of provision (U.S. GAAP) / Immediate recognition (IFRS)20-29-49 EADS: - Valuation of derivatives519519 - A350 & A380 charges-435-435 NMM-393393 Reconciliation NMM-393-393 |

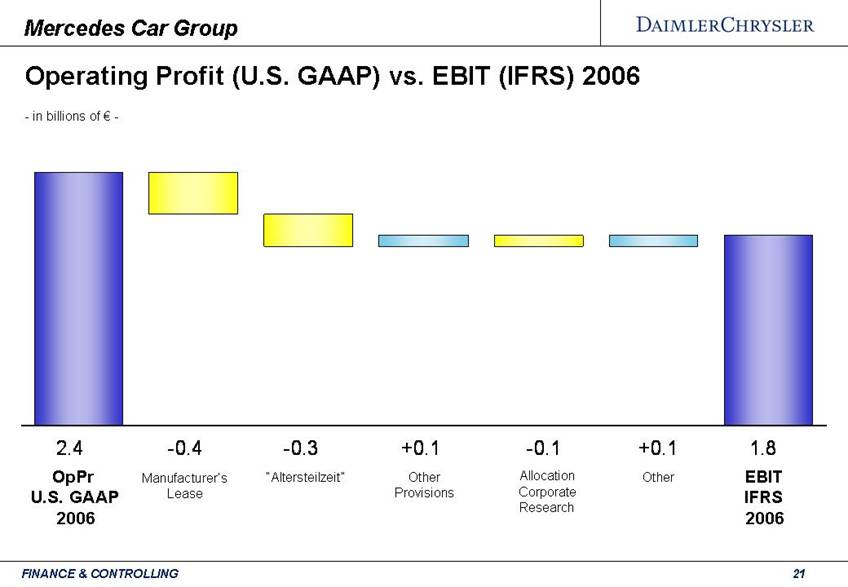

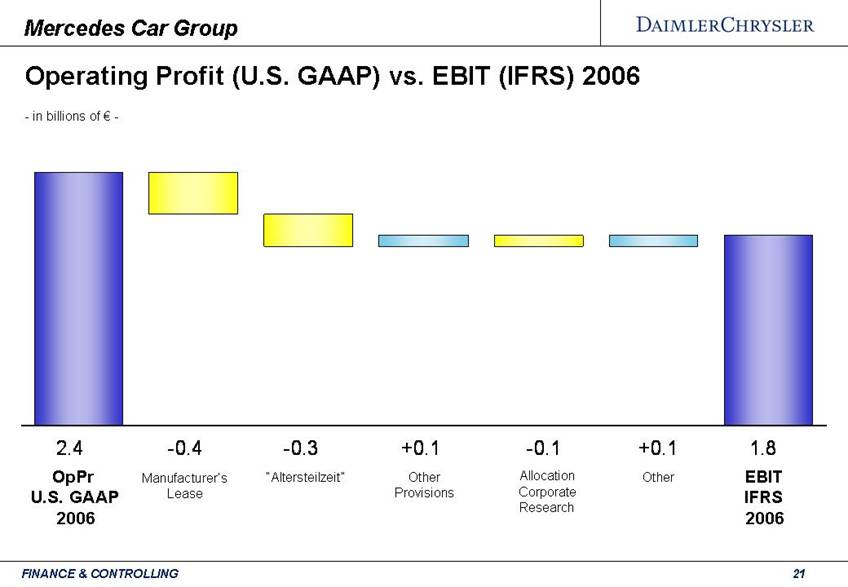

| Operating Profit (U.S. GAAP) vs. EBIT (IFRS) 2006 OpPr U.S. GAAP 2006 EBIT IFRS 2006 Manufacturer’s Lease “Altersteilzeit” Other Mercedes Car Group Other Provisions - in billions of € - Allocation Corporate Research 2.4 -0.4 -0.3 +0.1 -0.1 +0.1 1.8 |

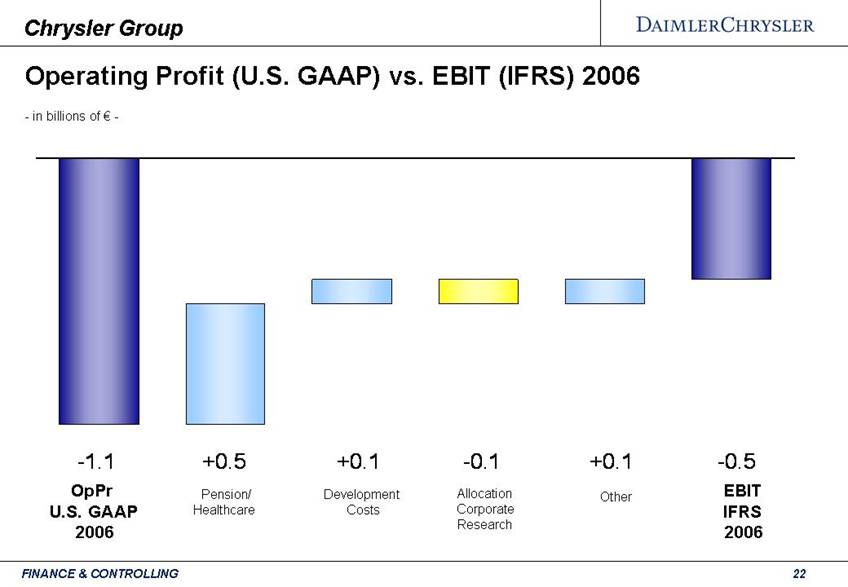

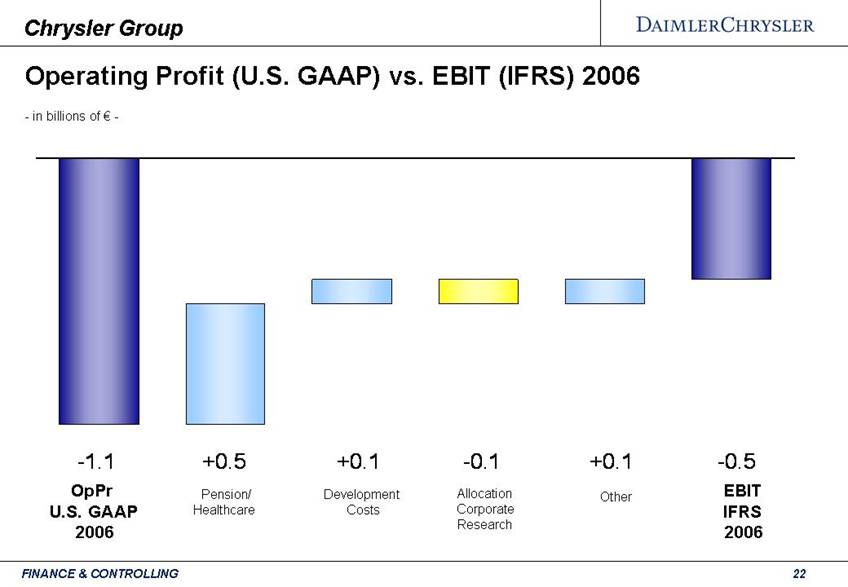

| Operating Profit (U.S. GAAP) vs. EBIT (IFRS) 2006 OpPr U.S. GAAP 2006 EBIT IFRS 2006 Development Costs Other Pension/ Healthcare Chrysler Group - in billions of € - Allocation Corporate Research -1.1 +0.5 +0.1 -0.1 +0.1 -0.5 |

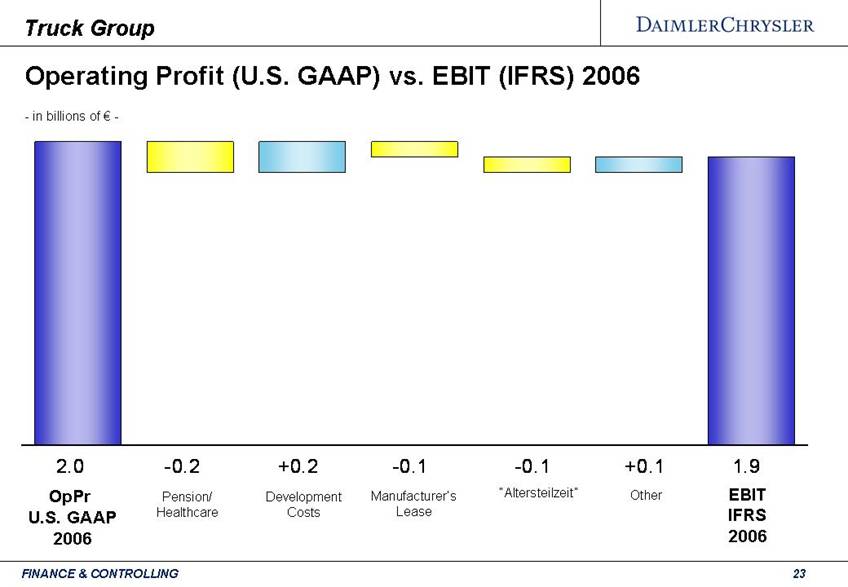

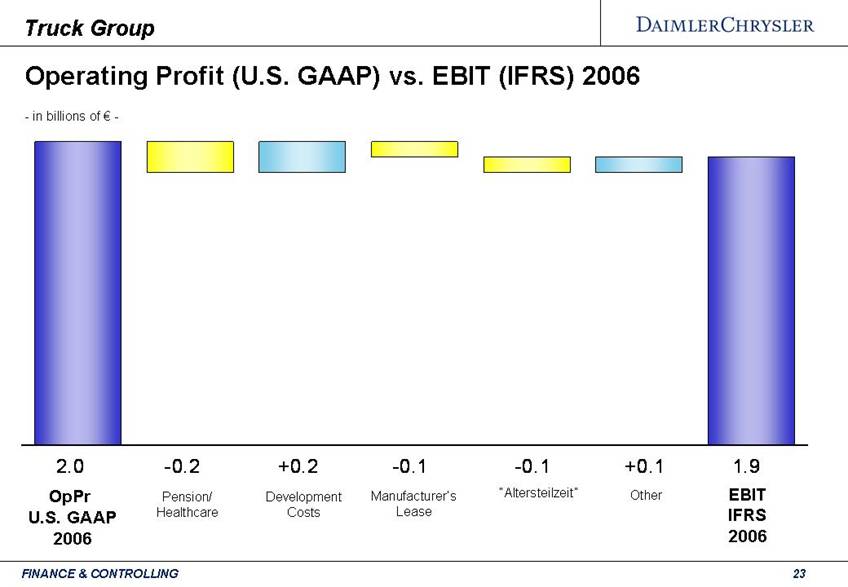

| Operating Profit (U.S. GAAP) vs. EBIT (IFRS) 2006 OpPr U.S. GAAP 2006 EBIT IFRS 2006 Truck Group - in billions of € - Manufacturer’s Lease “Altersteilzeit” Development Costs Other Pension/ Healthcare 2.0 -0.2 +0.2 -0.1 -0.1 +0.1 1.9 |

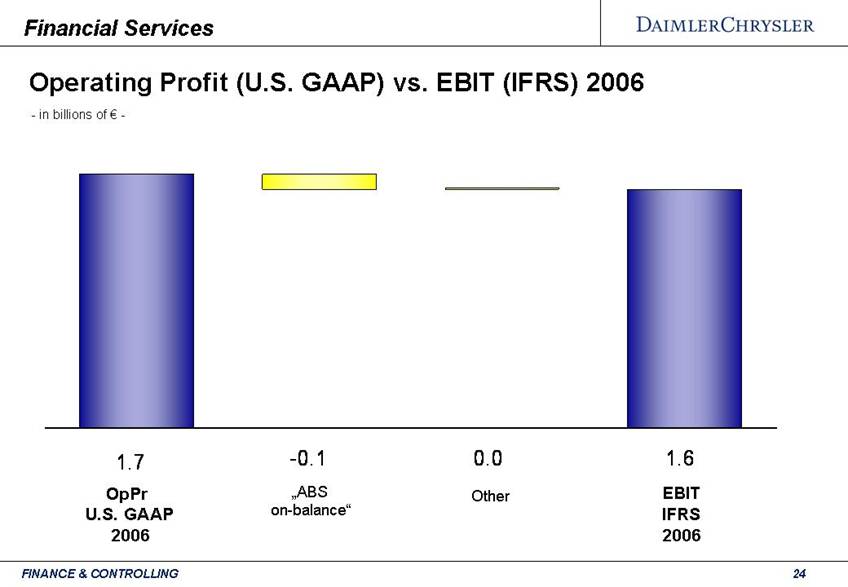

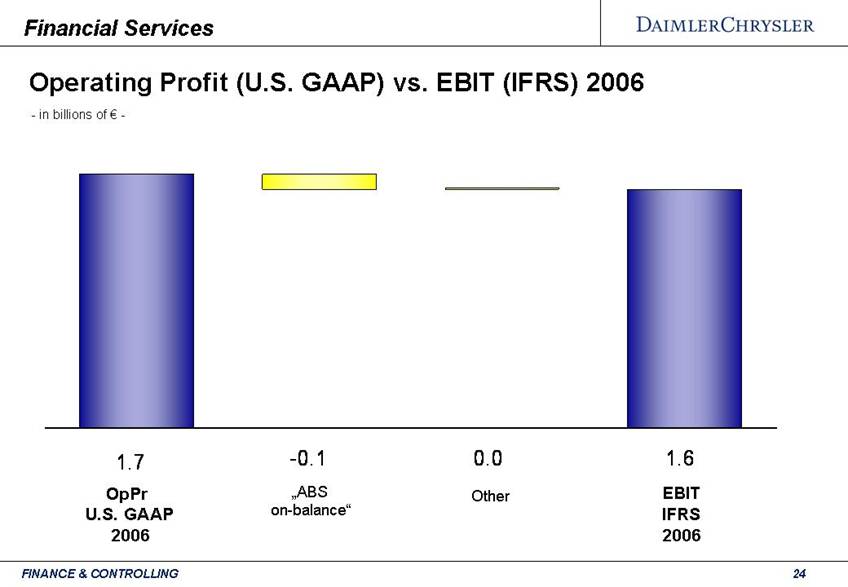

| Operating Profit (U.S. GAAP) vs. EBIT (IFRS) 2006 OpPr U.S. GAAP 2006 EBIT IFRS 2006 Other - in billions of € - Financial Services „ABS on-balance“ 1.7 -0.1 0.0 1.6 |

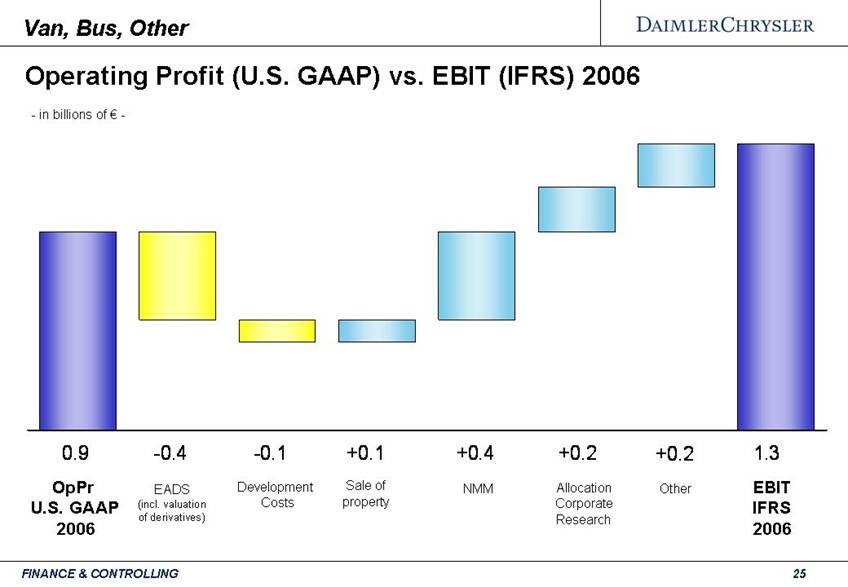

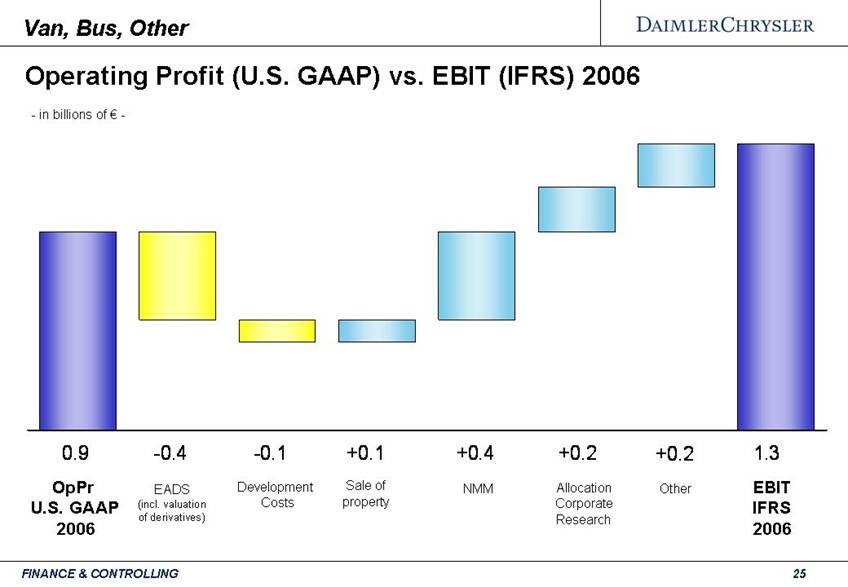

| Operating Profit (U.S. GAAP) vs. EBIT (IFRS) 2006 OpPr U.S. GAAP 2006 EBIT IFRS 2006 EADS (incl. valuation of derivatives) NMM Other Sale of property Van, Bus, Other Development Costs Allocation Corporate Research - in billions of € - 0.9 -0.4 -0.1 +0.1 +0.4 +0.2 +0.2 1.3 |

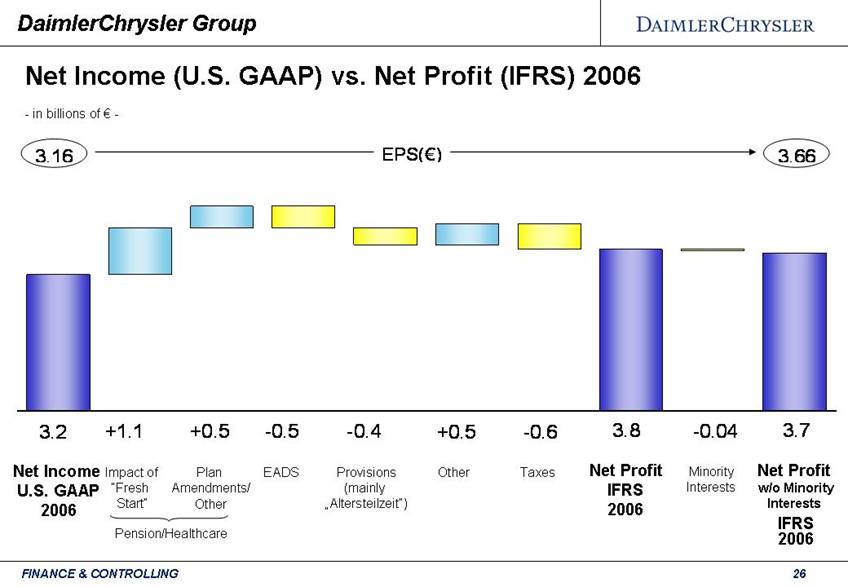

| Net Income (U.S. GAAP) vs. Net Profit (IFRS) 2006 Net Income U.S. GAAP 2006 Net Profit w/o Minority Interests IFRS 2006 EADS Provisions (mainly „Altersteilzeit“) DaimlerChrysler Group Pension/Healthcare Plan Amendments/ Other Other Net Profit IFRS 2006 Minority Interests Taxes - in billions of € - Impact of “Fresh Start” 3.16 EPS(€) 3.66 3.2 +1.1 +0.5 -0.5 -0.4 +0.5 -0.6 3.8 -0.04 3.7 |

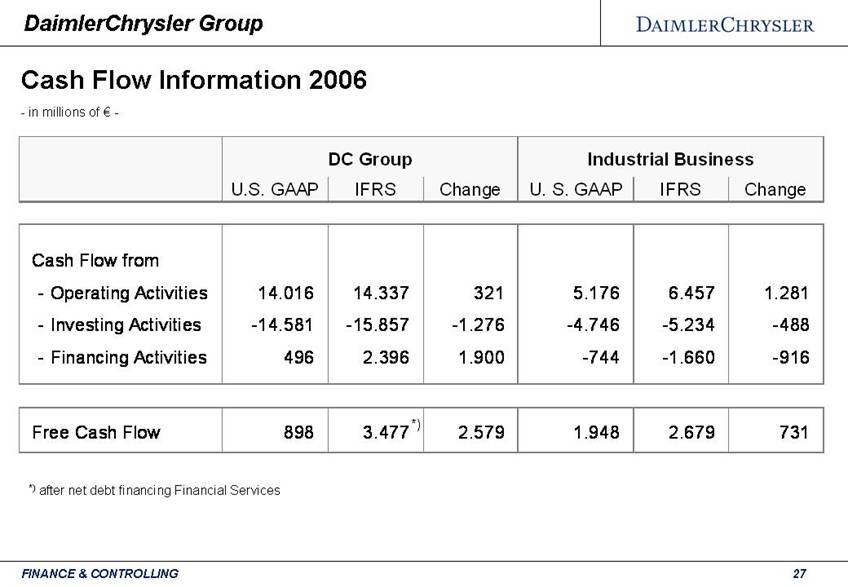

| Cash Flow Information 2006 DaimlerChrysler Group - in millions of € - *) *) after net debt financing Financial Services DC GroupIndustrial Business U.S. GAAPIFRSChangeU. S. GAAPIFRSChange Cash Flow from - Operating Activities14.01614.3373215.1766.4571.281 - Investing Activities-14.581-15.857-1.276-4.746-5.234-488 - Financing Activities4962.3961.900-744-1.660-916 Free Cash Flow8983.477*)2.5791.9482.679731 |

| Introduction Major Differences between IFRS and U.S. GAAP Impact on Financial Statements 2006 Key Figures 2005/2006 Conclusion Appendix Transition to IFRS Agenda |

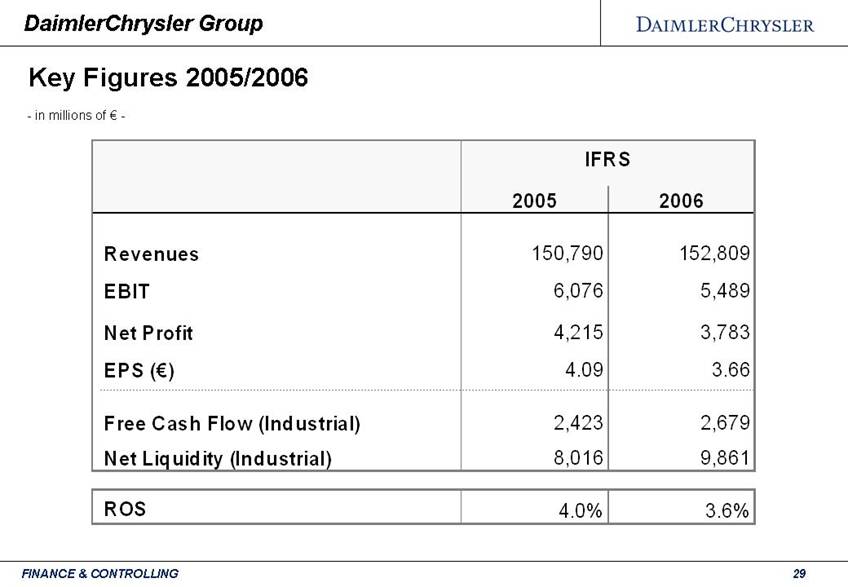

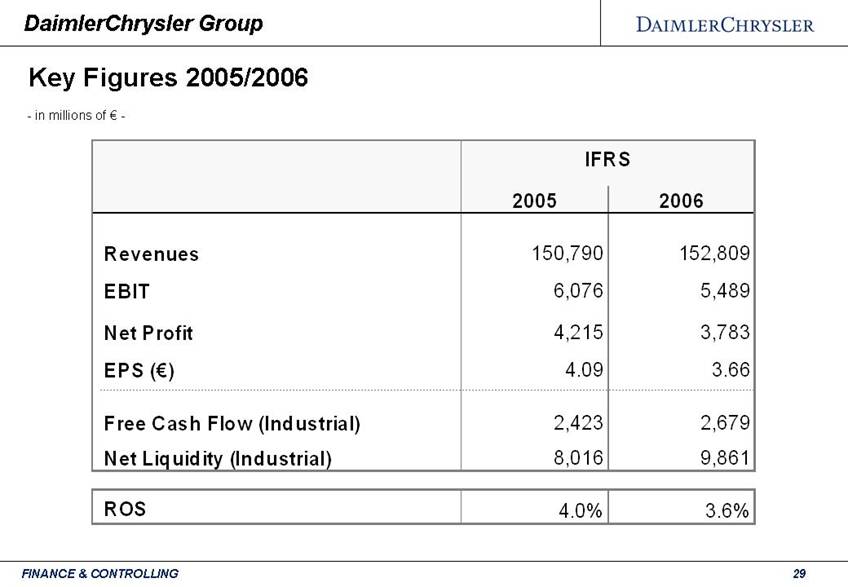

| Key Figures 2005/2006 DaimlerChrysler Group - in millions of € - IFRS 20052006 Revenues150,790152,809 EBIT6,0765,489 Net Profit4,2153,783 EPS (€)4.093.66 Free Cash Flow (Industrial)2,4232,679 Net Liquidity (Industrial)8,0169,861 ROS4.0%3.6% |

| Introduction Major Differences between IFRS and U.S. GAAP Impact on Financial Statements 2006 Key Figures 2005/2006 Conclusion Appendix Transition to IFRS Agenda |

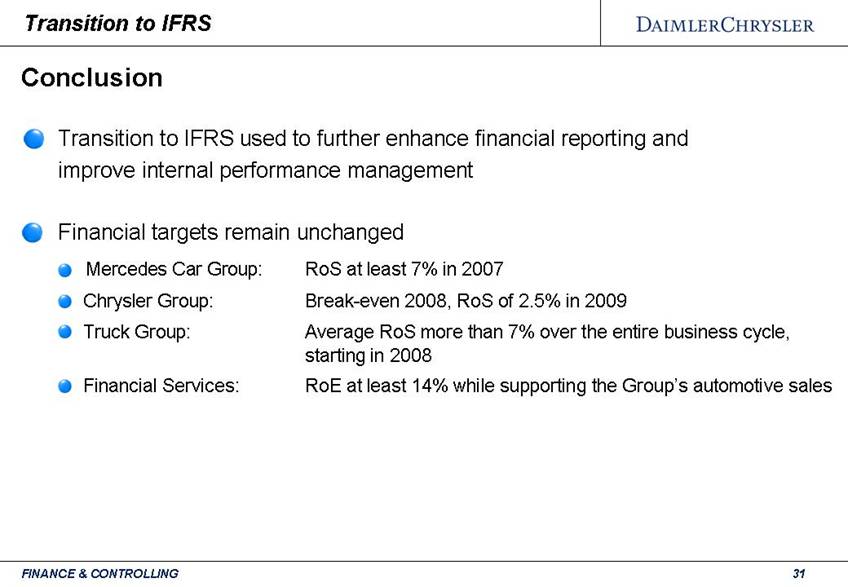

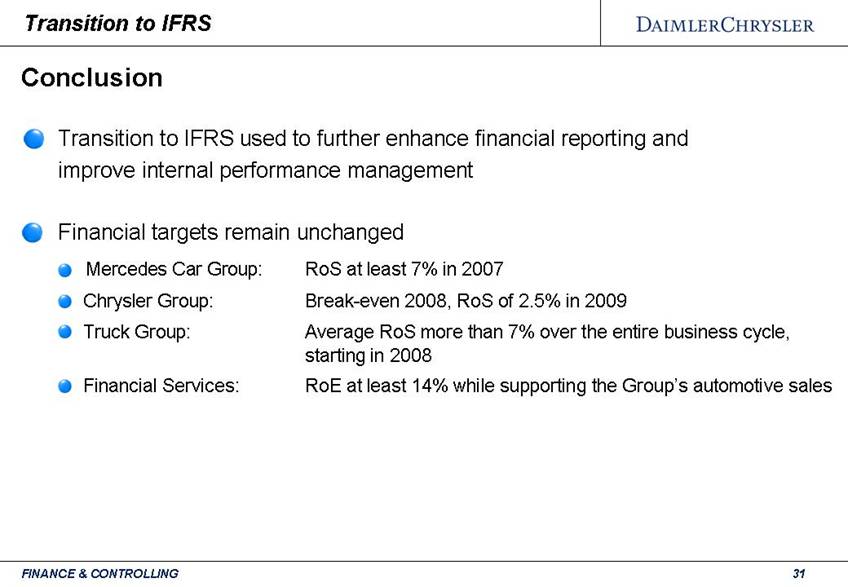

| Conclusion - Transition to IFRS used to further enhance financial reporting and improve internal performance management - Financial targets remain unchanged Mercedes Car Group: RoS at least 7% in 2007 Chrysler Group: Break-even 2008, RoS of 2.5% in 2009 Truck Group: Average RoS more than 7% over the entire business cycle, starting in 2008 Financial Services: RoE at least 14% while supporting the Group’s automotive sales Transition to IFRS |

| Introduction Major Differences between IFRS and U.S. GAAP Impact on Financial Statements 2006 Key Figures 2005/2006 Conclusion Appendix Transition to IFRS Agenda |

| Pension and Healthcare Status 2006 DaimlerChrysler Group - in billions of € - PensionHealthcare U.S. GAAPIFRSChangeU.S. GAAPIFRSChange Benefit Obligation37.537.50.016.017.31.3 Plan Assets-35.2-35.20.0-1.9-1.90.0 Sub-Total2.32.30.014.115.41.3 Reimbursement Medicare Act-----1.3-1.3 Funded Status2.32.30.014.114.10.0 |

| Pension and Healthcare Cost 2006 DaimlerChrysler Group - in billions of € - - in billions of € - PensionHealthcare U.S. GAAPIFRSChangeU.S. GAAPIFRSChange - Service Cost0.80.80.00.30.30.0 - Amortization of unrecognized 0.30.1-0.2-0.1-0.2-0.1 prior service cost - Settlement/curtailment loss0.10.10.00.00.00.0 EBIT components1.21.0-0.20.20.1-0.1 - Interest Cost1.91.90.00.91.00.1 - Expected return on plan assets-2.5-2.6-0.1-0.1-0.2-0.1 - Expected return on reimbursement rights-----0.1-0.1 - Amortization of unrecognized 0.70.0-0.70.40.0-0.4 net actuarial losses Interest Income components0.1-0.7-0.81.20.7-0.5 Net Pension/Healthcare Cost1.30.3-1.01.40.8-0.6 |

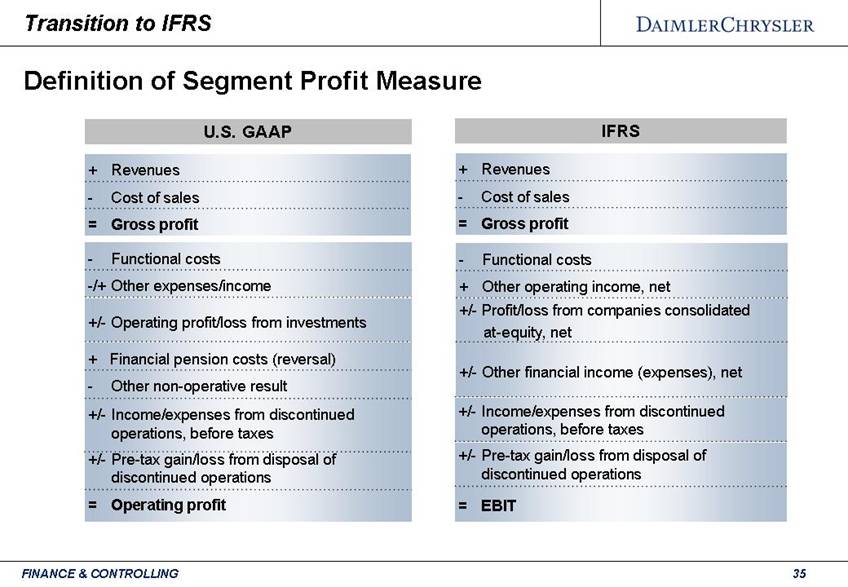

| Definition of Segment Profit Measure U.S. GAAP = Gross profit - Cost of sales + Revenues IFRS = Gross profit - Cost of sales + Revenues = Operating profit +/- Pre-tax gain/loss from disposal of discontinued operations - Other non-operative result +/- Income/expenses from discontinued operations, before taxes + Financial pension costs (reversal) +/- Operating profit/loss from investments -/+ Other expenses/income - Functional costs + Other operating income, net - Functional costs +/- Profit/loss from companies consolidated at-equity, net +/- Other financial income (expenses), net = EBIT +/- Income/expenses from discontinued operations, before taxes +/- Pre-tax gain/loss from disposal of discontinued operations Transition to IFRS |

| This document contains forward-looking statements that reflect our current views about future events. The words “anticipate,” “assume,” “believe,” “estimate,” “expect,” “intend,” “may,” “plan,” “project,” “should” and similar expressions are used to identify forward-looking statements. These statements are subject to many risks and uncertainties, including an economic downturn or slow economic growth, especially in Europe or North America; changes in currency exchange rates and interest rates; introduction of competing products and possible lack of acceptance of our products or services; competitive pressures which may limit our ability to reduce sales incentives and raise prices; price increases in fuel, raw materials, and precious metals; disruption of production or delivery of new vehicles due to shortages of materials, labor strikes, or supplier insolvencies; a decline in resale prices of used vehicles; the ability of the Chrysler Group to implement successfully its Recovery and Transformation Plan; the business outlook for our Truck Group, which may experience a significant decline in demand as a result of accelerated purchases in 2006 made in advance of the effectiveness of new emission regulations; effective implementation of cost reduction and efficiency optimization programs, including our new management model; the business outlook of our equity investee EADS, including the financial effects of delays in and potentially lower volume of future aircraft deliveries; changes in laws, regulations and government policies, particularly those relating to vehicle emissions, fuel economy and safety, the resolution of pending governmental investigations and the outcome of pending or threatened future legal proceedings; and other risks and uncertainties, some of which we describe under the heading “Risk Report” in DaimlerChrysler’s most recent Annual Report and under the headings “Risk Factors” and “Legal Proceedings” in DaimlerChrysler’s most recent Annual Report on Form 20-F filed with the Securities and Exchange Commission. If any of these risks and uncertainties materialize, or if the assumptions underlying any of our forward-looking statements prove incorrect, then our actual results may be materially different from those we express or imply by such statements. We do not intend or assume any obligation to update these forward-looking statements. Any forward-looking statement speaks only as of the date on which it is made. Disclaimer Transition to IFRS |

SIGNATURES

Pursuant to the requirements of the Securities Exchange Act of 1934, the registrant has duly caused this report to be signed on its behalf by the undersigned, thereunto duly authorized.

| DaimlerChrysler AG | |

| | | |

| | | | |

| By: | /s/ ppa. | Robert Köthner | |

| | Name: | Robert Köthner | |

| | Title: | Vice President | |

| | | Chief Accounting Officer | |

| | | | |

| | | | |

| By: | /s/ i.V. | Silvia Nierbauer | |

| | Name: | Silvia Nierbauer | |

| | Title: | Director | |

| | | | |

| | | | |

Date: April 26, 2007 | | | | |