SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

Form 6-K

REPORT OF FOREIGN PRIVATE ISSUER

PURSUANT TO RULE 13a-16 OR 15d-16 UNDER

THE SECURITIES EXCHANGE ACT OF 1934

April 29, 2008

Commission File Number 1-12356

DAIMLER AG

(Translation of registrant’s name into English)

MERCEDESSTRASSE 137, 70327 STUTTGART, GERMANY

(Address of principal executive office)

Indicate by check mark whether the registrant files or will file annual reports under cover of Form 20-F or Form 40-F.

Indicate by check mark whether the registrant by furnishing the information contained in this Form is also thereby furnishing the information to the Commission pursuant to Rule 12g3-2(b) under the Securities Exchange Act of 1934.

If “Yes” is marked, indicate below the file number assigned to the registrant in connection with Rule 12g3-2(b): 82-

This report on Form 6-K is hereby incorporated by reference in the registration statements on Form S-8 (Nos. 333-5074, 333-7082, 333-8998, 333-86934, 333-86936 and 333-134198) of Daimler AG

DAIMLER AG

FORM 6-K: TABLE OF CONTENTS

1. Press Release: Daimler achieves EBIT of €1,976 million in first quarter of 2008

2. Interim Report for the three-month period ended March 31, 2008

CAUTIONARY STATEMENT REGARDING FORWARD-LOOKING STATEMENTS

Forward-looking statements in this document:

This document contains forward-looking statements that reflect our current views about future events. The words “anticipate,” “assume,” “believe,” “estimate,” “expect,” “intend,” “may,” “plan,” “project,” “should” and similar expressions are used to identify forward-looking statements. These statements are subject to many risks and uncertainties, including an economic downturn or slow economic growth in important economic regions, especially in Europe or North America; the effects of the subprime crisis which could result in a weaker demand for our products particularly in the U.S. but as well in the European market; changes in currency exchange rates and interest rates; the introduction of competing products and the possible lack of acceptance of our products or services; price increases in fuel, raw materials, and precious metals; disruption of production due to shortages of materials, labor strikes or supplier insolvencies; a decline in resale prices of used vehicles; the business outlook for Daimler Trucks, which may be affected if the U.S. and Japanese commercial vehicle markets experience a sustained weakness in demand for a longer period than expected; the effective implementation of cost reduction and efficiency optimization programs; the business outlook of Chrysler, in which we hold an equity interest, including its ability to successfully implement its restructuring plans; the business outlook of EADS, in which we hold an equity interest, including the financial effects of delays in and potentially lower volumes of future aircraft deliveries; changes in laws, regulations and government policies, particularly those relating to vehicle emissions, fuel economy and safety, the resolution of pending governmental investigations and the outcome of pending or threatened future legal proceedings; and other risks and uncertainties, some of which we describe under the heading “Risk Report” in Daimler’s most recent Annual Report and under the headings “Risk Factors” and “Legal Proceedings” in Daimler’s most recent Annual Report on Form 20-F filed with the Securities and Exchange Commission. If any of these risks and uncertainties materialize, or if the assumptions underlying any of our forward-looking statements prove incorrect, then our actual results may be materially different from those we express or imply by such statements. We do not intend or assume any obligation to update these forward-looking statements. Any forward-looking statement speaks only as of the date on which it is made.

Contact:

Thomas Fröhlich | Telephone: +49 (0)711 17 41361 |

Date:

April 29, 2008

Daimler achieves EBIT of € 1,976 million in first quarter of 2008

Stuttgart – Daimler AG (stock-exchange abbreviation DAI) today presents its interim report on the first quarter of 2008. Daimler achieved EBIT of €1,976 million in the first quarter (Q1 2007: €3,292 million).

The Mercedes-Benz Cars division improved its EBIT and thus compensated for the lower earnings recorded by Daimler Trucks and Daimler Financial Services.

Earnings decreased primarily because EBIT in the first quarter of 2007 included a special gain of €1,563 million related to the transfer of EADS shares. In the first quarter of 2008, special gains were realized in connection with the sale of the real-estate properties at Potsdamer Platz (€449 million) and in connection with the transfer of EADS shares (€102 million). There were opposing effects from expenses of €491 million related to Chrysler.

Net profit amounted to € 1,332 million (Q1 2007: €1,972 million), equivalent to earnings per share of €1.29 (Q1 2007: €1.89).

Daimler Communications, 70546 Stuttgart, Germany

Unit sales up by 9% in Q1 2008

In the first quarter of 2008, Daimler sold 503,800 cars and commercial vehicles worldwide, thus surpassing the figure for the prior-year period by 9%.

Daimler’s revenue increased slightly from €23.4 billion to €23.5 billion in the first quarter of 2008. Adjusted for exchange-rate effects and changes in the consolidated group, revenue growth amounted to 4%.

Mercedes-Benz Cars increased its unit sales by 17% to 318,300 vehicles in the first three months of this year, thus setting a new record for the first quarter. The Mercedes-Benz brand sold 284,000 vehicles, an increase of 10%, also achieving a new record for the first quarter. The smart brand almost tripled its unit sales from 10,800 to 31,200 cars. The division’s revenue grew by 4% to €12.5 billion.

Mercedes-Benz Cars’ EBIT improved by 45% to €1,152 million.

The significant increase in earnings was mainly a result of the good development of unit sales for both the Mercedes-Benz and smart brands. Unit sales of the C-Class and the smart fortwo were particularly positive. Further efficiency advances also contributed to the EBIT improvement. Exchange-rate effects and increased raw-material prices had a negative impact on EBIT in the first quarter of 2008.

Daimler Trucks sold 107,700 vehicles worldwide in the first quarter of 2008 (Q1 2007: 119,200). The decrease is primarily due to the significantly lower sales volume in the USA and supplier bottlenecks in Germany. Revenue decreased from €7.3 billion to €6.3 billion.

Daimler Communications, 70546 Stuttgart, Germany

2

The Daimler Trucks division posted EBIT of €403 million (Q1 2007: €528 million). The decrease in earnings is primarily due to the tense economic situation in the United States and the weaker demand caused by the introduction of the EPA 07 exhaust-emission standards in the US in 2007. Earnings were also reduced in Europe as a result of production losses caused by a supply bottleneck of one supplier. But Daimler Trucks assumes it will be able to compensate for this production loss during the rest of the year. Earnings were positively affected, however, by the ongoing favorable sales trend in Latin America and in some important Asian markets. There were additional positive effects from efficiency improvements and improved product positioning.

Daimler Financial Services increased its contract volume by 2% to €58.3 billion in the first quarter of 2008. In the first quarter of 2008, 15 subsidiaries were fully consolidated for the first time (mainly in Eastern Europe and Asia). Adjusted for these consolidation effects and for exchange-rate effects, the increase was 7%. New business of €6.7 billion was 2% below the prior-year level. After adjusting for the two aforementioned factors, there was also a decrease of 2%.

EBIT of €168 million reported by Daimler Financial Services for the first quarter of 2008 was lower than the result for the prior-year period (Q1 2007: €214 million). The decrease in earnings was mainly due to the expenses incurred to set up a new financial services organization in the NAFTA region following the transfer of a majority interest in Chrysler. Increased risk costs also had a negative impact, but remained below the long-term average. There was a positive impact on earnings, however, from the increased contract volume.

Daimler Communications, 70546 Stuttgart, Germany

3

EBIT of the Vans, Buses, Other segment amounted to €371 million (Q1 2007: €1,872 million). The decrease in earnings was primarily caused by the lower special gain of €102 million related to the transfer of EADS shares (Q1 2007: €1,563 million). The sale of the real-estate properties at Potsdamer Platz resulted in a special gain of €449 million in the first quarter of 2008.

The Mercedes-Benz Vans and Daimler Buses units profited from the continued positive development of unit sales and both achieved higher earnings, which are now reported individually for the quarters due to the growing importance of the business. Mercedes-Benz Vans reported EBIT of €186 million and Daimler Buses reported EBIT of €75 million.

Daimler’s share of the earnings of EADS amounted to €22 million (Q1 2007: €165 million). The company’s 19.9% interest in Chrysler, which is accounted for using the equity method, reduced EBIT by €340 million in the first quarter of 2008; this result includes expenses of €94 million resulting from the restructuring actions at Chrysler. As the Group generally applies the equity method of accounting for its interests in EADS and Chrysler with a three-month time lag, these figures mainly reflect the developments in the fourth quarter of 2007.

These results are by no means indicative for the results to be reported by Chrysler Holding LLC due to substantial valuation differences between US-GAAP used by Chrysler and IFRS accounting used by Daimler.

In connection with the transfer of a majority interest in Chrysler, the Group retained certain rights contingent upon the development of economic circumstances, in particular the development of residual values of Chrysler vehicles. At the time of the Chrysler transaction,

Daimler Communications, 70546 Stuttgart, Germany

4

these rights were measured and recognized as an asset in an amount of €185 million. In light of falling residual values of Chrysler vehicles, Daimler had to impair these assets by €151 million in the first quarter of 2008. Neither the equity result of Chrysler nor the impairment of the assets is cash effective.

Outlook

Although economic growth has slowed down as a result of the international financial crisis – particularly in the United States – making life harder for the automotive industry including Daimler, the Group continues to assume that the unit-sales targets it has set for its divisions will be met in 2008.

Based on the divisions’ planning, Daimler expects its total unit sales to increase in the year 2008 (2007: 2.1 million vehicles).

Mercedes-Benz Cars expects to further increase its worldwide unit sales in 2008, thus surpassing the record level of the prior year. The full availability of the sedan and station-wagon versions of the new C-Class and of the new smart fortwo will make a decisive contribution to this development. Mercedes-Benz Cars expects to achieve a renewed increase in EBIT in 2008.

The Daimler Trucks division anticipates rising unit sales for full-year 2008. This will result on the one hand from the positive development of some Asian markets and on the other hand from higher unit sales in Europe – primarily due to the growth of markets in Eastern Europe. Based on these unit-sales expectations and the ongoing implementation of our Global Excellence program, Daimler Trucks assumes that the division’s earnings in full-year 2008 will be higher than in the prior year.

Daimler Communications, 70546 Stuttgart, Germany

5

Daimler Financial Services anticipates a moderate increase in its business volume as the year progresses. Despite the expenses connected with developing its own financial services organization in North America, Daimler Financial Services continues to assume that it will achieve a return on equity of at least 14% in full-year 2008.

Due to the strong demand for the new Sprinter and the positive sales trend of the Vito/Viano, Mercedes-Benz Vans expects a significant increase in unit sales and a new unit-sales record in the year 2008.

Daimler Buses also anticipates a continuation of strong demand and is therefore confident that it will match the high level of unit sales achieved in the prior year.

The Daimler Group assumes that total revenue will increase moderately in full-year 2008 (2007: €99.4 billion).

On the basis of the divisions’ confirmed projections, in 2008 the Daimler Group continues to expect to post EBIT from ongoing operations of well above the prior-year level. Effects related to Chrysler are not included therein. In the year 2007, earnings included positive contributions in particular from the transfer of shares in EADS and negative contributions from Chrysler and related to the new management model.

Further information on Daimler is available on the Internet at www.media.daimler.com.

Daimler Communications, 70546 Stuttgart, Germany

6

About Daimler

Daimler AG, Stuttgart, with its businesses Mercedes-Benz Cars, Daimler Trucks, Daimler Financial Services, Mercedes-Benz Vans and Daimler Buses, is a globally leading producer of premium passenger cars and the largest manufacturer of commercial vehicles in the world. The Daimler Financial Services division has a broad offering of financial services, including vehicle financing, leasing, insurance and fleet management.

Daimler sells its products in nearly all the countries of the world and has production facilities on five continents. The company’s founders, Gottlieb Daimler and Carl Benz, continued to make automotive history following their invention of the automobile in 1886. As an automotive pioneer, Daimler and its employees willingly accept an obligation to act responsibly towards society and the environment and to shape the future of safe and sustainable mobility with groundbreaking technologies and high-quality products. The current brand portfolio includes the world’s most valuable automobile brand, Mercedes-Benz, as well as smart, AMG, Maybach, Freightliner, Sterling, Western Star, Mitsubishi Fuso, Setra, Orion and Thomas Built Buses. The company is listed on the stock exchanges in Frankfurt, New York and Stuttgart (stock exchange abbreviation DAI). In 2007, the Group sold 2.1 million vehicles and employed a workforce of over 270,000 people; revenue totaled €99.4 billion and EBIT amounted to €8.7 billion. Daimler is an automotive Group with a commitment to excellence, and aims to achieve sustainable growth and industry-leading profitability.

This document contains forward-looking statements that reflect our current views about future events. The words “anticipate,” “assume,” “believe,” “estimate,” “expect,” “intend,” “may,” “plan,” “project,” “should” and similar expressions are used to identify forward-looking statements. These statements are subject to many risks and uncertainties, including an economic downturn or slow economic growth in important economic regions, especially in Europe or North America; the effects of the subprime crisis which could result in a weaker demand for our products particularly in the U.S. but as well in the European market; changes in currency exchange rates and interest rates; the introduction of competing products and the possible lack of acceptance of our products or services; price increases in fuel, raw materials, and precious metals; disruption of production due to shortages of materials, labor strikes or supplier insolvencies; a decline in resale prices of used vehicles; the business outlook for Daimler Trucks, which may be affected if the U.S. and Japanese commercial vehicle markets experience a sustained weakness in demand for a longer period than expected; the effective implementation of cost reduction and efficiency optimization programs; the business outlook of Chrysler, in which we hold an equity interest, including its ability to successfully implement its restructuring plans; the business outlook of EADS, in which we hold an equity interest, including the financial effects of delays in and potentially lower volumes of future aircraft deliveries; changes in laws, regulations and government policies, particularly those relating to vehicle emissions, fuel economy and safety, the resolution of pending governmental investigations and the outcome of pending or threatened future legal proceedings; and other risks and uncertainties, some of which we describe under the heading “Risk Report” in Daimler’s most recent Annual Report and under the headings “Risk Factors” and “Legal Proceedings” in Daimler’s most recent Annual Report on Form 20-F filed with the Securities and Exchange Commission. If any of these risks and uncertainties materialize, or if the assumptions underlying any of our forward-looking statements prove incorrect, then our actual results may be materially different from those we express or imply by such statements. We do not intend or assume any obligation to update these forward-looking statements. Any forward-looking statement speaks only as of the date on which it is made.

Daimler Communications, 70546 Stuttgart, Germany

7

Q1 2008 Interim Report

Contents

4 | | Management Report |

10 | | Mercedes-Benz Cars |

11 | | Daimler Trucks |

12 | | Daimler Financial Services |

13 | | Vans, Buses, Other |

14 | | Consolidated Financial Statements |

18 | | Notes to the Consolidated Financial Statements |

25 | | Financial Calendar |

Cover photo:

Deliveries to customers of the new Setra TopClass 400 travel coach started at the beginning of 2008, and the new model is even more attractive than its predecessor. A comprehensive upgrade of the travel coach led to a large number of technical innovations and visual improvements so that the latest model offers additional advantages in terms of comfort, quality and above all safety. For example, the integrated absorber structure and the movable driver’s workplace are elements of the new, improved crash protection entitled Front Collision Guard. The vehicle’s many exterior and interior technical enhancements include an improved driver’s workplace, the application of Power-Shift – the new automated manual transmission, and additional optimizations in the rear and front of the coach.

2

Q1

Key figures

Amounts in millions of € | | Q1 2008 | | Q1 2007 | | Change in % | |

| | | | | | | |

Revenue | | 23,455 | | 23,370 | | +0( | 1) |

Western Europe | | 11,449 | | 11,212 | | +2 | |

thereof Germany | | 5,249 | | 5,081 | | +3 | |

United States | | 4,615 | | 5,502 | | -16 | |

Other markets | | 7,391 | | 6,656 | | +11 | |

Employees (March 31) | | 273,902 | | 270,986 | | +1 | |

Research and development expenditure | | 1,065 | | 869 | | +23 | |

thereof capitalized development costs | | 283 | | 130 | | +118 | |

Investment in property, plant and equipment | | 823 | | 843 | | -2 | |

Cash provided by operating activities | | 1,961 | | 3,881( | 2) | -49 | |

EBIT | | 1,976 | | 3,292 | | -40 | |

Net profit | | 1,332 | | 1,972 | | -32 | |

Net profit from continuing operations | | 1,335 | | 2,715 | | -51 | �� |

Earnings per share (in €) | | 1.29 | | 1.89 | | -32 | |

Earnings per share, continuing operations (in €) | | 1.29 | | 2.61 | | -51 | |

(1) Adjusted for the effects of currency translation and changes in the consolidated Group, increase in revenue of 4%

(2) Including discontinued operations

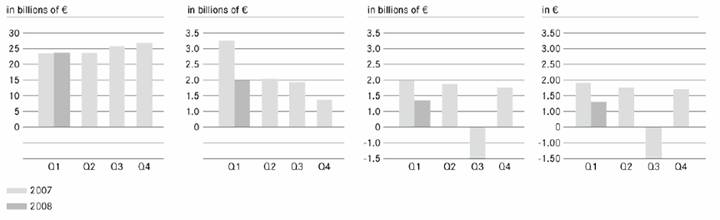

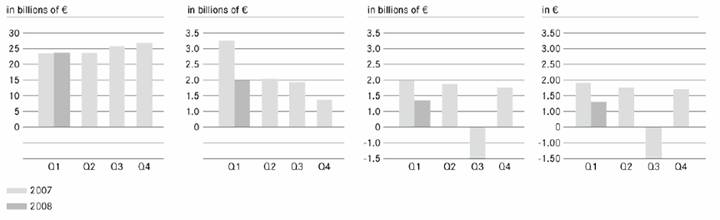

| Revenue | EBIT | Net proft (loss) | | Earnings (loss) per share |

| | | | |

|

3

Management Report

Group EBIT of €1,976 million (Q1 2007: €3,292 million)

Net profit of €1,332 million (Q1 2007: €1,972 million)

Earnings per share of €1.29 (Q1 2007: €1.89)

Revenue of €23.5 billion at prior year’s level

Full-year EBIT from ongoing operations (excluding Chrysler) expected to be well above 2007; earnings forecasts confirmed for the divisions

Business developments

World economy negatively affected by US subprime crisis

Despite the turbulence of the financial markets, the world economy expanded at a relatively robust rate overall in the first quarter. But due to the significant weakening of the US economy, rising inflation rates and further increases in raw-material prices, global growth was significantly slower than in the prior-year period. Indications of recession in the United States are increasing. But the strong growth rates of 2007 failed to continue also in Japan and Western Europe. Within Western Europe, the German economy was one of the most resistant, although growth was not as strong as in the first quarter of last year. The emerging markets continued their dynamic development, especially the booming Asian economies. An additional positive factor was that the economies of Eastern Europe and the raw-material exporting countries continued to grow.

The slowdown of global growth had an impact also on motor-vehicle markets. In the first quarter of 2008, worldwide demand for vehicles increased only slightly compared with the first quarter of the prior year. Demand for cars dropped sharply, especially in the United States. Although the German market expanded, the total number of cars sold in Western Europe in the first quarter was slightly lower than in 2007. On the other hand, the Japanese market was slightly larger than in Q1 2007. The drivers of growth in demand for cars were once again the emerging markets of Asia, especially China and India, and Eastern Europe. Demand for trucks in the United States was significantly lower than in the first quarter of 2007. However, the European market for commercial vehicles expanded slightly compared with the prior-year period. Commercial-vehicle markets continued their rapid expansion in the growth regions of Asia and in Eastern Europe.

Unit sales up by 9% in Q1 2008

In the first quarter of 2008, Daimler sold 503,800 cars and commercial vehicles worldwide, thus surpassing the figure for the prior-year period by 9%.

The Mercedes-Benz Cars division increased its overall unit sales significantly in the first quarter by 17% to 318,300 vehicles, as a result of higher unit sales by the brands Mercedes-Benz (+10%) and smart (+189%). On the other hand, due to weak demand in the United States, as expected Daimler Trucks’ sales of 107,700 vehicles were lower than the high level of Q1 2007 (-10%). Mercedes-Benz Vans increased its unit sales by 11% to 68,600 vehicles in the first quarter, primarily due to strong demand for the Sprinter. Daimler Buses also exceeded its unit sales for the prior-year quarter by 11%, selling 9,200 buses and chassis. At Daimler Financial Services, contract volume amounted to €58.3 billion at the end of the first quarter (Q1 2007: €57.1 billion).

Daimler’s revenue increased slightly from €23.4 billion to €23.5 billion in the first quarter of 2008. Adjusted for exchange-rate effects and changes in the consolidated group, revenue growth amounted to 4%.

4

Profitability

Segment profit (EBIT)

Amounts in millions of € | | Q1 2008 | | Q1 2007 | | Change in % | |

| | | | | | | |

Mercedes-Benz Cars | | 1,152 | | 792 | | +45 | |

Daimler Trucks | | 403 | | 528 | | -24 | |

Daimler Financial Services | | 168 | | 214 | | -21 | |

Vans, Buses, Other | | 371 | | 1,872 | | -80 | |

Reconciliation | | (118 | ) | (114 | ) | +4 | |

Daimler Group | | 1,976 | | 3,292 | | -40 | |

Daimler achieved EBIT of €1,976 million in the first quarter (Q1 2007: €3,292 million).

Earnings decreased primarily because EBIT in the first quarter of 2007 included a special gain of €1,563 million related to the transfer of EADS shares. In the first quarter of 2008, special gains were realized in connection with the sale of the real-estate properties at Potsdamer Platz (€449 million) and in connection with the transfer of EADS shares (€102 million). There were opposing effects from expenses of €491 million related to Chrysler.

The Mercedes-Benz Cars division improved its EBIT and thus compensated for the lower earnings recorded by Daimler Trucks and Daimler Financial Services.

The special items shown in the following table affected EBIT in the first quarters of 2008 and 2007:

Special items affecting EBIT

Amounts in millions of € | | Q1 2008 | | Q1 2007 | |

| | | | | |

Mercedes-Benz Cars | | | | | |

Financial support for suppliers | | — | | (82 | ) |

| | | | | |

Vans, Buses, Other | | | | | |

Sale of real estate (Potsdamer Platz) | | 449 | | — | |

Gains related to the transfer of shares in EADS | | 102 | | 1,563 | |

Restructuring program at Chrysler | | (94 | ) | — | |

Impairment of rights due to reduced residual values of Chrysler vehicles | | (151 | ) | — | |

Restructuring program at EADS | | — | | (114 | ) |

| | | | | |

Reconciliation | | | | | |

New management model | | (45 | ) | (51 | ) |

The Mercedes-Benz Cars division increased its first-quarter EBIT by 45% to €1,152 million and achieved a return on sales of 9.2% (Q1 2007: 6.6%).

The significant increase in earnings was mainly a result of the good development of unit sales for both the Mercedes-Benz and smart brands. Unit sales of the C-Class and the smart fortwo were particularly positive. Further efficiency advances also contributed to the EBIT improvement. Exchange-rate effects and increased raw-material prices had a negative impact on EBIT in the first quarter of 2008.

The Daimler Trucks division posted EBIT of €403 million (Q1 2007: €528 million); its return on sales was 6.4% compared with 7.2% in the prior-year quarter.

The decrease in earnings is primarily due to the tense economic situation in the United States and the weaker demand caused by the introduction of the EPA 07 exhaust-emission standards in the US in 2007. Earnings were also reduced in Europe due to a production loss caused by a supplier’s lack of capacity, but this production loss is to be offset during the rest of the year. Earnings were positively affected, however, by the ongoing positive sales trend in Latin America and in some of our important Asian markets. There were additional positive effects from efficiency improvements and improved product positioning.

EBIT of €168 million reported by Daimler Financial Services for the first quarter of 2008 was lower than the result for the prior-year period (Q1 2007: €214 million).

The decrease in earnings was mainly due to expenses incurred for the setup of a new financial services organization in the NAFTA region following the transfer of a majority interest in Chrysler. Increased risk costs also had a negative impact, but remained below the long-term average. There was a positive impact on earnings, however, from the increased contract volume.

EBIT of the Vans, Buses, Other segment amounted to €371 million (Q1 2007: €1,872 million). The decrease in earnings was primarily caused by the lower special gain of €102 million (Q1 2007: €1,563 million) related to the transfer of EADS shares. The sale of the real-estate properties at Potsdamer Platz resulted in a special gain of €449 million in the first quarter of 2008.

The Mercedes-Benz Vans and Daimler Buses units profited from the continued positive development of unit sales and both achieved higher earnings.

Daimler’s share of the earnings of EADS amounted to €22 million (Q1 2007: €165 million). Our 19.9% interest in Chrysler, which is accounted for using the equity method, reduced EBIT by €340 million in the first-quarter of 2008; this result includes expenses of €94 million resulting from the restructuring measures at Chrysler. As the Group generally applies the equity method of accounting for its interests in EADS and Chrysler with a three-month time lag, these figures mainly reflect the developments in the fourth quarter of 2007. These results are by no means indicative for the results to be reported by Chrysler Holding LLC due to the substantial valuation differences between US GAAP used by Chrysler and IFRS accounting used by Daimler.

In connection with the transfer of a majority interest in Chrysler, the Group retained rights contingent upon the development of economic circumstances, in particular the development of residual values of Chrysler vehicles. At the time of the Chrysler transaction, these rights were measured and recognized as an asset in an amount of €185 million. In light of falling residual

5

values of Chrysler vehicles, Daimler had to impair this asset by €151 million in the first quarter of 2008. Neither the equity result of Chrysler nor the impairment of the asset is cash effective.

The reconciliation to Group EBIT includes corporate expenses of €119 million (Q1 2007: €109 million) and eliminations of internal transactions (Q1 2008: gain of €1 million; Q1 2007: expense of €5 million).

Net interest income for the first quarter amounted to €33 million (Q1 2007: €134 million). The decrease is primarily due to the fact that the financing liabilities that were originally incurred to refinance the Chrysler business were not yet fully repaid while the Group’s liquid funds resulting from the repayment of Chrysler’s former internal financing liabilities were reinvested at relatively lower interest rates.

The income-tax expense of €674 million was similar to the prior-year level (Q1 2007: €711 million). The relatively low income-tax expense in the prior-year period was mainly the result of the tax-free gains related to the transfer of EADS shares.

Net profit from continuing operations amounted to €1,335 million (Q1 2007: €2,715 million), and was below the prior-year result primarily due to the lower special gains related to the transfer of EADS shares. Earnings per share from continuing operations were €1.29 (Q1 2007: €2.61).

Net loss from discontinued operations of €3 million (Q1 2007: €743 million) reflects, for the current reporting period, adjustments of the result from the Chrysler deconsolidation. The net loss for the prior-year period includes the operating result, the interest expense and the income-tax expense of the Chrysler activities.

Net profit amounted to €1,332 million (Q1 2007: €1,972 million), equivalent to earnings per share of €1.29 (Q1 2007: €1.89).

Cash flows

The presentation of cash flows is unchanged from the prior-year period and in the year 2007 also includes the cash flows of the discontinued Chrysler operations.

Cash provided by operating activities in the first quarter of 2008 amounted to €2.0 billion (Q1 2007: €3.9 billion). The prior-year figure included a cash inflow from the discontinued operations of €1.4 billion. Excluding the effects of the discontinued operations, compared with the prior-year quarter, cash provided by operating activities decreased by €0.5 billion. This decrease is primarily due to a stronger increase in inventories than in Q1 2007, related to normal changes in production volumes during the year at Mercedes-Benz Cars. Further, the development of inventories at Daimler Trucks in the prior-year period was positively impacted by the introduction of the EPA 07 exhaust-emission standards in the US in 2007. Additional factors reducing cash provided by operating activities were higher tax payments and increased research and development costs. Positive effects compared with the prior-year period resulted in particular from a stronger increase in trade payables and lower payments for staff-reduction actions at Mercedes-Benz Cars.

The cash flows from investing activities in the first quarter of 2008 resulted in a net cash outflow of €0.4 billion, compared with a net cash inflow of €2.0 billion in Q1 2007. The cash inflows in the prior-year period included €0.6 billion related to the discontinued activities and €3.5 billion related to the transfer of EADS shares. In the first quarter of this year, there was a cash inflow of €1.3 billion from the sale of the real-estate properties at Potsdamer Platz. Whereas investment in property, plant and equipment for the continuing operations remained nearly constant at €0.8 billion, investment in intangible assets resulted in a higher cash outflow for capitalized development expenses, in particular related to the new E-Class and engine projects. Without taking into consideration the discontinued activities, the financial services business resulted in a lower cash outflow for investing activities than in the prior-year period.

Cash used for financing activities amounted to €6.3 billion (Q1 2007: €5.1 billion). This was primarily related to the ongoing optimization of the capital structure following the separation from the Chrysler activities in the previous year. During the reporting period, therefore, further financing liabilities were repaid and the share buyback program was continued (€2.7 billion).

Cash and cash equivalents with an original maturity of three months or less were €5.4 billion lower than at December 31, 2007, after taking currency-translation effects into consideration. Total liquidity, which also includes deposits and marketable securities with an original maturity of more than three months, was reduced as planned by €5.3 billion to €11.7 billion, mainly as a result of the share buyback. Total liquidity will continue to decrease in the year 2008 due to additional actions, in particular the reduction of the existing financing liabilities.

The free cash flow of the industrial business, the parameter used by Daimler to measure financial strength, was positive but decreased significantly by €1.9 billion to €1.0 billion.

The reduction in the free cash flow was primarily due to the fact that the cash inflow last year from the transfer of EADS shares (€3.5 billion) was higher than the cash inflow this year from the sale of the real-estate properties at Potsdamer Platz (€1.3 billion). An additional factor was that the development of inventories led to higher cash outflows. However, there were positive effects on the free cash flow in particular from the discontinued activities, which had negatively impacted the free cash flow in 2007. The development of unit sales and earnings at Mercedes-Benz Vans also had positive effects.

6

Free cash flow of the industrial business

Amounts in millions of € | | Q1 2008 | | Q1 2007 | | Change in % | |

| | | | | | | |

Cash provided by operating activities | | 812 | | 1,572 | | (760 | ) |

Cash provided by (used for) investing activities | | 307 | | 772 | | (465 | ) |

Changes in cash (> 3 months) and marketable securities included in liquidity | | (85 | ) | 549 | | (634 | ) |

Free cash flow of the industrial business | | 1,034 | | 2,893 | | (1,859 | ) |

The net liquidity of the industrial business decreased by €1.3 billion to €11.7 billion.

Net liquidity of the industrial business

Amounts in millions of € | | Mar. 31,

2008 | | Dec. 31,

2007 | | Change

in % | |

| | | | | | | |

Cash and cash equivalents | | 9,415 | | 14,894 | | (5,479 | ) |

Marketable securities and term deposits | | 1,386 | | 1,276 | | 110 | |

Liquidity | | 10,801 | | 16,170 | | (5,369 | ) |

Financing liabilities | | (1,896 | ) | (5,019 | ) | 3.123 | |

Market valuation and currency hedges for financing liabilities | | 2,751 | | 1,761 | | 990 | |

Net liquidity | | 11,656 | | 12,912 | | (1,256 | ) |

The reduction is mainly a result of the share buyback. However, there was an opposing effect increasing the net liquidity of the industrial business from the positive free cash flow.

Net debt at Group level, which is primarily related to the refinancing of the leasing and sales-financing business, remained nearly unchanged. The effects from the industrial business were offset mainly by the development of exchange rates and the positive free cash flow in the financial services business.

Net debt of the Daimler Group

Amounts in millions of € | | Mar. 31,

2008 | | Dec. 31,

2007 | | Change

in % | |

| | | | | | | |

Cash and cash equivalents | | 10,228 | | 15,631 | | (5,403 | ) |

Marketable securities and term deposits | | 1,490 | | 1,424 | | 66 | |

Liquidity | | 11,718 | | 17,055 | | (5,337 | ) |

Financing liabilities | | (50,937 | ) | (54,967 | ) | 4,030 | |

Market valuation and currency hedges for financing liabilities | | 2,751 | | 1,761 | | 990 | |

Net liquidity | | (36,468 | ) | (36,151 | ) | (317 | ) |

Balance sheet structure

Compared with December 31, 2007, the balance sheet total decreased by €6.1 billion to €129.0 billion. This development was primarily due to the exchange-rate effects (€3.4 billion), but also to the repayment of financing liabilities. €61.2 billion of the balance sheet total is accounted for by the financial services business (December 31, 2007: €62.0 billion), equivalent to 47% of all of the Daimler Group’s assets and liabilities (December 31, 2007: 46%).

As capital expenditure exceeded depreciation, property, plant and equipment increased slightly to €14.7 billion, despite negative exchange-rate effects.

Equipment on operating leases and receivables from financial services decreased slightly to €58.1 billion (December 31, 2007: €58.9 billion); adjusted for the effects of currency translation, there was an increase of 3%. These items’ share of the balance sheet total amounted to 45% at the end of the quarter (December 31, 2007: 44%).

Investments accounted for using the equity method primarily comprise the carrying values of our equity interests in EADS and Chrysler. The decrease from €5.0 billion to €4.5 billion was mainly related to the Group’s proportionate share of the loss reported by Chrysler.

Inventories increased by €1.1 billion to €15.2 billion (+8%) and accounted for 12% of the balance sheet total. Adjusted for the effects of currency translation, inventories increased by 11%; the increase was mainly due to changes in production volumes during the year, which usually lead to higher inventories during the first quarter. In this context, trade receivables also increased by 8% to €6.9 billion and trade payables rose by 12% to €7.8 billion.

Other financial assets of €9.5 billion were at the same level as at the end of 2007. The increase in derivative financial instruments due to the development of exchange rates was offset by a lower volume of loans and credits granted.

Cash and cash equivalents decreased by €5.4 billion compared with December 31, 2007. This change reflects not only the cash outflow from the share buyback program, which was continued in the first quarter (€2.7 billion), but also exchange-rate effects and the discharge of financial liabilities.

With the conclusion of the sale of land and buildings at Potsdamer Platz in Berlin on February 1, 2008, the “assets held for sale” of €0.9 billion that were separately reported at the end of 2007 were derecognized. From this transaction, the Group received a cash inflow of €1.3 billion in the first quarter of 2008.

Provisions, which mainly comprise warranty, personnel and pension obligations, amounted to 15% of the balance sheet total. Due in particular to exchange-rate effects and the partial payment of the employee profit-sharing bonus, provisions decreased by €0.5 billion to €19.1 billion.

7

Financing liabilities decreased by €4.0 billion, primarily as a result of redeeming bonds as well as due to exchange-rate effects, whereas liabilities connected with the deposits from the direct banking business of the Mercedes-Benz Bank increased by €0.7 billion compared with the beginning of the year. Financing liabilities account for 39% of the balance sheet total.

Other financing liabilities decreased by €1.5 billion (-15%) to €8.6 billion. This change reflects lower accrued interest and liabilities from derivative financial instruments as well as falling liabilities related to the new management model.

The Group’s equity decreased by €1.6 billion compared with December 31, 2007. The net profit of €1.3 billion partially offset the share buyback program and exchange-rate effects. The equity ratio, adjusted for the dividend payout for the year 2007 (€1.9 billion), was at the prior-year level of 26.9% at March 31, 2008. The equity ratio for the industrial business was 44.9% (December 31, 2007: 43.5%).

Workforce

At the end of the first quarter of 2008, 273,902 people were employed by Daimler worldwide (Q1 2007: 270,986). Of this total, 166,661 were employed in Germany and 24,108 were employed in the United States (end of Q1 2007: 165,753 and 25,114 respectively).

Changes in the Supervisory Board

On April 9, 2008, the Annual Meeting of Daimler AG elected Ms. Sari Baldauf and Dr. Jürgen Hambrecht as members of the Supervisory Board to succeed Mr. Earl G. Graves and Mr. Peter A. Magowan, who stepped down at the end of 2007. Following their court appointment in February 2008, Ms. Baldauf and Dr. Hambrecht have thus now also been appointed by the shareholders as members of the Supervisory Board for the period until the Annual Meeting in 2013.

Taking effect at the end of this year’s Annual Meeting, Mr. Jörg Hofmann and Mr. Ansgar Osseforth are also new members of the Supervisory Board. They were elected as Supervisory Board members representing the employees by the employees’ voting delegates on March 12, 2008. They succeed Mr. Wolf Jürgen Röder and Mr. Gerd Rheude and are also appointed until the Annual Meeting in 2013.

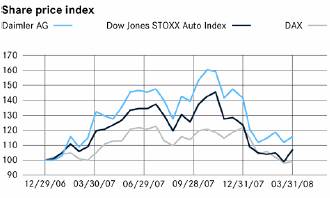

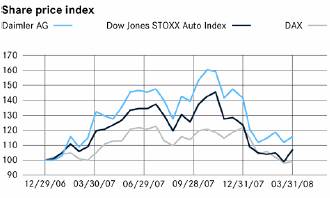

Completion of share buyback program

In exercise of the authorization granted by the Annual Meeting on April 4, 2007, the Board of Management and the Supervisory Board decided on a share buyback program on August 29, 2007.

By March 28, 2008, a total of 99,768,314 shares representing €267 million of the share capital had been bought back. This is equivalent to nearly 10% of the share capital at the time when the program was approved by the Annual Meeting. A total amount of €6.2 billion was applied to acquire the shares. 49.8 million shares of the total were bought back in the first quarter of 2008 for €2.7 billion. The shares were cancelled after being bought back without any reduction in the share capital.

On April 9, 2008, the Annual Meeting granted further authorization to buy back Daimler’s own shares up to a maximum of 10% of the share capital.

Outlook

The statements made in the Outlook section of this Interim Report are based on the current assumptions of the Daimler management. In turn, these assumptions are based on the expectations for general economic developments described below, which are in line with appraisals made by renowned economic research institutions and the targets set by our divisions. Expectations for future business developments reflect the opportunities and risks arising from the market conditions and competitive situations as the year progresses.

With regard to existing opportunities and risks, we refer to the statements made in our Annual Report 2007 and the notes on forward-looking statements at the end of this Management Report.

For full-year 2008, Daimler assumes that the growth of the world economy will at first continue to lose impetus due to the currently rather unfavorable conditions, but that it should accelerate again towards the end of the year. This expectation is based on the assumption that the substantial interest-rate reductions and economic program initiated in the United States will prevent the US economy from entering a sustained slump, allowing an economic revival in the second half of the year. If the measures taken by the US Federal Reserve and the US government are effective, Japan and Western Europe should also maintain most of their current expansionary impetus. Overall growth in the emerging markets is likely to be slightly lower than last year at approximately 6.5%. In total, growth of 3% seems possible for the global economy from today’s perspective (2007: 4.0%). The biggest individual risks for the achievement of this growth target are a deep recession in the United States and even sharper inflation of raw-material prices.

8

This less favorable economic situation than last year is also affecting the motor-vehicle markets. Expectations have worsened especially in the three major sales regions, and above all for the volume car segments. The premium segment, in which we are active, is usually less volatile – especially in the United States. It can be assumed that demand for automobiles will be significantly lower than in 2007 in the United States, will remain flat in Western Europe, and will rise only slightly in Japan. The emerging markets of Asia, Latin America and Eastern Europe are likely to remain the growth drivers of worldwide demand. Daimler anticipates a strong increase in demand for cars in these regions also in the year 2008. With regard to commercial vehicles, we expect moderate growth of the overall European market due to the robust development of demand for medium and heavy trucks. In the North American market, we do not see any signs of recovery at present. We therefore assume that a cyclical recovery of demand for trucks will commence at the earliest in the second half of the year – depending on economic developments. In Japan, we anticipate demand for commercial vehicles in full-year 2008 at the same level as in 2007. The commercial-vehicle markets of China, Southeast Asia and Eastern Europe should enjoy above-average growth.

Based on the divisions’ planning, Daimler expects its total unit sales to increase in the year 2008 (2007: 2.1 million vehicles).

Despite the currently difficult overall market situation in the United States, Mercedes-Benz Cars expects to further increase its worldwide unit sales in 2008, thus surpassing the record level of the prior year. The full availability of the sedan and station-wagon versions of the new C-Class and of the new smart fortwo will make a decisive contribution to this development. Mercedes-Benz Cars expects to achieve a renewed increase in EBIT in 2008.

The Daimler Trucks division anticipates rising unit sales for full-year 2008. This will result on the one hand from the positive development of some Asian markets and on the other hand from higher unit sales in Europe – primarily due to the growth of markets in Eastern Europe. Based on these unit-sales expectations and the ongoing implementation of our Global Excellence program, we assume that the division’s earnings in full-year 2008 will be higher than in the prior year.

Due to the strong demand for the Sprinter and the positive sales trend of the Vito/Viano, Mercedes-Benz Vans expects a significant increase in unit sales and a new unit-sales record in the year 2008. Daimler Buses also expects a continuation of strong demand and is therefore confident that it will match the high level of unit sales achieved in the prior year.

Daimler Financial Services anticipates a moderate increase in its business volume as the year progresses. Despite the expenses connected with setting up its own financial services organization in North America, Daimler Financial Services continues to assume that it will achieve a return on equity of at least 14% in full-year 2008.

We assume that the Daimler Group’s total revenue will increase moderately in full-year 2008 (2007: €99.4 billion).

The number of employees at the end of the year is expected to be similar to the number a year earlier.

On the basis of the divisions’ confirmed projections, in 2008 we expect the Daimler Group to post EBIT from ongoing operations of well above the prior-year level. Effects related to Chrysler are not included therein. In the year 2007, earnings included positive contributions in particular from the transfer of shares in EADS and negative contributions from Chrysler and related to the new management model.

Forward-looking statements in this Interim Report:

This interim report contains forward-looking statements that reflect our current views about future events. The words “anticipate,” “assume,” “believe,” “estimate,” “expect,” “intend,” “may,” “plan,” “project,” “should” and similar expressions are used to identify forward-looking statements. These statements are subject to many risks and uncertainties, including an economic downturn or slow economic growth in important economic regions, especially in Europe or North America; the effects of the subprime crisis which could result in a weaker demand for our products particularly in the U.S. but as well in the European market; changes in currency exchange rates and interest rates; the introduction of competing products and the possible lack of acceptance of our products or services; price increases in fuel, raw materials, and precious metals; disruption of production due to shortages of materials, labor strikes or supplier insolvencies; a decline in resale prices of used vehicles; the business outlook for Daimler Trucks, which may be affected if the U.S. and Japanese commercial vehicle markets experience a sustained weakness in demand for a longer period than expected; the effective implementation of cost reduction and efficiency optimization programs; the business outlook of Chrysler, in which we hold an equity interest, including its ability to successfully implement its restructuring plans; the business outlook of EADS, in which we hold an equity interest, including the financial effects of delays in and potentially lower volumes of future aircraft deliveries; changes in laws, regulations and government policies, particularly those relating to vehicle emissions, fuel economy and safety, the resolution of pending governmental investigations and the outcome of pending or threatened future legal proceedings; and other risks and uncertainties, some of which we describe under the heading “Risk Report” in Daimler’s most recent Annual Report and under the headings “Risk Factors” and “Legal Proceedings” in Daimler’s most recent Annual Report on Form 20-F filed with the Securities and Exchange Commission. If any of these risks and uncertainties materialize, or if the assumptions underlying any of our forward-looking statements prove incorrect, then our actual results may be materially different from those we express or imply by such statements. We do not intend or assume any obligation to update these forward-looking statements. Any forward-looking statement speaks only as of the date on which it is made.

9

Mercedes-Benz Cars

Unit sales up by 17%

Strong demand for new products

Many new models unveiled at auto shows in Detroit and Geneva

EBIT improves to €1,152 million (Q1 2007: €792 million)

Amounts in millions of € | | Q1 2008 | | Q1 2007 | | Change in % | |

| | | | | | | |

EBIT | | 1,152 | | 792 | | +45 | |

Revenue | | 12,497 | | 12,070 | | +4 | |

Unit sales | | 318,285 | | 271,058 | | +17 | |

Production | | 350,711 | | 303,487 | | +16 | |

Employees (March 31) | | 97,948 | | 98,379 | | -0 | |

Unit sales | | Q1 2008 | | Q1 2007 | | Change in % | |

| | | | | | | |

Total | | 318,285 | | 271,058 | | +17 | |

Western Europe | | 178,474 | | 159,487 | | +12 | |

Germany | | 73,813 | | 72,165 | | +2 | |

United States | | 67,219 | | 54,669 | | +23 | |

Japan | | 9,474 | | 10,311 | | -8 | |

Other markets | | 63,118 | | 46,591 | | +35 | |

Increases in unit sales, revenue and EBIT

In the first quarter of this year, Mercedes-Benz Cars increased its unit sales by 17% to 318,300 vehicles, thus setting a new record for the first quarter. Revenue grew by 4% to €12.5 billion. EBIT improved by a further 45% to €1.2billion.

Strong demand for new products

The Mercedes-Benz brand increased its unit sales by 10% to 284,000 vehicles, thus achieving a new record for the first quarter. The smart brand almost tripled its unit sales from 10,800 to 31,200 cars.

The S-Class was once again the clear market leader in the luxury segment, with 24,400 units sold worldwide in the first quarter. 44,200 E-Class cars were sold, fewer than in the prior-year quarter for lifecycle reasons (Q1 2007: 55,200). Deliveries of the C-Class increased by 57% to 113,300 vehicles. The C-Class sedan was thus once again the world’s market leader in its segment. Unit sales of the M-/R-/GL- and G-Class increased by 3% to 38,200 vehicles, while sales of 63,900 A-/B-Class cars were slightly below the prior-year level for lifecycle reasons (Q1 2007: 66,200).

In Western Europe, Mercedes-Benz Cars’ unit sales rose by 12% to 178,500 vehicles. In the United States, shipments increased by 23% to 67,200 units; the Mercedes-Benz brand posted a 13% increase in unit sales. In the first quarter of 2008, during which the smart fortwo was launched in the USA, 5,300 models were already sold in that market.

Numerous new models unveiled

In January, Mercedes-Benz presented the vision of the GLK and the new generation of the SLK at the North American International Auto Show in Detroit. During the Mercedes-Benz Fashion Week in Berlin at the end of January, we unveiled the new CLC coupe; the turbo diesel versions of this car consume less than six liters of fuel per hundred kilometers.

At the Geneva Motor Show at the beginning of March, we unveiled the new generations of the SL roadster and the CLS four-door coupe, which is now even more attractive as a result of various technical and design modifications. In Geneva, we also presented the BlueEFFICIENCY models C 180, C 200 CDI and the C 350 CGI with direct gasoline injection, whose fuel consumption is up to 12% lower than that of the previous comparable models – with unchanged comfort and typical Mercedes safety levels.

Mercedes-Benz unveiled three SUVs at the 2008 New York International Auto Show in the middle of March: the R 320 BlueTEC, the ML 320 BlueTEC and the GL 320 BlueTEC. Thanks to their modern diesel engines, all three of these vehicles fulfill the strict US Bin 5 emission limits and also have the potential to meet the future Euro 6 regulations. Mercedes-Benz also presented the new generation of the M-Class in New York.

Breakthrough with lithium-ion battery

We are the first manufacturer worldwide to succeed in adapting lithium-ion technology to the high demands of automotive applications. Already next year, we will launch the S 400 BlueHYBRID – the first series-production car with a lithium-ion battery. In the future, lithium-ion batteries will be used in our clean and efficient hybrid, electric and fuel-cell vehicles.

Continuous optimization of operating activities

We continue to work on long-term structural and process-oriented improvements in the line organization. This includes the effective use of the Mercedes-Benz module system and product development with a strong focus on production processes. The results are ongoing quality enhancements and continuous advances in productivity.

The ramp-up of production levels of the new C-Class station wagon was completed at the Bremen plant during the first quarter of 2008. The focus is now on preparing for the production start-up of the new Mercedes-Benz GLK. In this context, we will profit from the process optimizations.

10

Daimler Trucks

Unit sales of 107,700 trucks are lower than in Q1 2007, as expected

Presentation of new generation of Mercedes-Benz Actros

First Mercedes-Benz and Mitsubishi Fuso trucks with hybrid drive handed over to customers in Europe

EBIT lower than in prior-year quarter due to market developments in the United States

Amounts in millions of € | | Q1 2008 | | Q1 2007 | | Change in % | |

| | | | | | | |

EBIT | | 403 | | 528 | | -24 | |

Revenue | | 6,327 | | 7,290 | | -13 | |

Unit sales | | 107,728 | | 119,218 | | -10 | |

Production | | 113,320 | | 123,350 | | -8 | |

Employees (March 31) | | 80,580 | | 80,566 | | +0 | |

Unit sales | | Q1 2008 | | Q1 2007 | | Change in % | |

| | | | | | | |

Total | | 107,728 | | 119,218 | | -10 | |

Western Europe | | 16,740 | | 18,855 | | -11 | |

Germany | | 6,722 | | 8,825 | | -24 | |

United States | | 21,204 | | 40,042 | | -47 | |

Latin America (excluding Mexico) | | 13,294 | | 11,017 | | +21 | |

Asia | | 35,713 | | 29,124 | | +23 | |

Other markets | | 20,777 | | 20,180 | | +3 | |

Earnings impacted by market situation in the United States

Daimler Trucks sold 107,700 vehicles worldwide in the first quarter of 2008 (Q1 2007: 119,200). The decrease is primarily due to the significantly lower sales volume in the USA and a supplier bottleneck in Germany. Revenue decreased from €7.3 billion to €6.3 billion, while EBIT for the period amounted to €403 million (Q1 2007: €528 million).

Unit sales higher in Latin America and Asia, lower in Europe and the NAFTA region

The Trucks Europe/Latin America unit (Mercedes-Benz) sold 33,800 vehicles in the first quarter, once again achieving the high level of the prior-year quarter. Growth was particularly strong in Latin America (+25%). Due to a production loss caused by a supplier’s lack of capacity, unit sales were lower than in Q1 2007 in Germany (-26%) and thus also in Western Europe (-13%). We assume, however, that we will be able to compensate for this production loss before the end of this year.

Trucks NAFTA (Freightliner, Sterling, Western Star, Thomas Built Buses) sold 27,500 vehicles, which was significantly fewer than in the prior-year quarter (Q1 2007: 46,200). In the first quarter of 2008, there was a significant negative impact on demand from the economic slowdown in the USA. In addition, the introduction of the US emission standard EPA 07 had led to purchases being brought forward until the first quarter of 2007 and a subsequent drop in demand from the large fleet operators. In the first quarter of 2007, it was still possible to register trucks in the United States that only fulfilled the previous emission standards.

Trucks Asia (Mitsubishi Fuso) increased its first-quarter unit sales by 18% to 46,500 vehicles. Significant growth was recorded in Indonesia (the biggest Asian market for Trucks Asia after Japan), Taiwan and the Middle East. Outside Japan, unit sales increased by 46%. In Japan, however, unit sales decreased sharply for market-cycle reasons (-32%). In Europe, we

expanded assembly capacity at our plant in Tramagal in Portugal due to the strong demand for the Canter. During the first quarter, sales of the Canter commenced in the Eastern European markets of Hungary, Bulgaria, Slovenia, Croatia, Serbia, Bosnia and Montenegro.

Launch of the new-generation Mercedes-Benz Actros

In January, we presented the third generation of the Mercedes-Benz Actros heavy truck. This vehicle has been further improved with a large number of individual modifications affecting economy, comfort and design. With the Mercedes PowerShift transmission, the Actros is the only heavy truck with fully automatic transmission supplied as standard equipment. Since the launch of the first generation of the Actros in 1996, more than 550,000 of this vehicle have been sold in over 100 countries.

The first hybrid trucks handed over to customers in Europe

With a Mercedes-Benz Atego BlueTec Hybrid and a Mitsubishi Fuso Canter Eco Hybrid, Daimler handed over the first hybrid trucks to a customer in Europe. DHL, a subsidiary of Deutsche Post World Net, will at first use the vehicles in test operations in the express business in the United Kingdom and mail transport in Germany. In the coming months, additional hybrid vehicles from Daimler will be integrated into the DHL fleet. This is another step in the implementation of the Shaping Future Transportation initiative that we started in November 2007.

Indian government approves joint venture with the Hero Group

As expected, at the end of March the Indian authorities granted their approval for the joint venture between Daimler Trucks and the Hero Group. The closing of the joint-venture agreement subsequently took place in April. The first step is to be the local assembly of light, medium and heavy commercial vehicles for the Indian volume market.

11

Daimler Financial Services

Further increase in contract volume

“Captive #1” program with worldwide focus

Separation from Chrysler Financial completed in the United States

EBIT lower than in Q1 2007

Amounts in millions of € | | Q1 2008 | | Q1 2007 | | Change in % | |

| | | | | | | |

EBIT | | 168 | | 214 | | -21 | |

Revenue | | 2,243 | | 2,152 | | +4 | |

New business | | 6,655 | | 6,788 | | -2 | |

Contract volume | | 58,254 | | 57,109 | | +2 | |

Employees (March 31) | | 7,281 | | 6,763 | | +8 | |

Increase in worldwide contract volume

Daimler Financial Services increased its contract volume by 2% to €58.3 billion in the first quarter of 2008. In the first quarter of 2008, 15 subsidiaries (mainly in Eastern Europe and Asia) were fully consolidated for the first time. Adjusted for these consolidation effects and for exchange-rate effects, the increase was 7%. New business of €6.7 billion was 2% below the prior-year level. After adjusting for the two aforementioned factors, there was also a decrease of 2%. EBIT of €168 million was lower than in the prior-year quarter.

With its “Captive #1” program, Daimler Financial Services intends to become one of the world’s best captive financial services providers in terms of efficiency as well as customer and dealer satisfaction. In order to achieve this goal, we are currently standardizing our global product and system architecture. We also plan to achieve further growth by improving our penetration of existing markets with innovative new products and by entering new markets.

Expansion of activities in the Europe, Africa & Asia/Pacific region

Contract volume in the Europe, Africa & Asia/Pacific region increased by 8% to €35.3 billion. We achieved the strongest growth in Germany, Poland and Japan.

In Germany, the Mercedes-Benz Bank successfully continued its growth development. Its portfolio of €16.3 billion at the end of the first quarter of 2008 was 3% above the prior-year level. In order to support the sales of the C-Class and E-Class, a new financial services product was introduced for private customers and corporate clients that includes an inexpensive service contract in addition to the leasing or financing contract. In the direct banking business, our attractive rates for overnight money accounts and fixed-interest accounts led to customers’ funds on those accounts increasing from €3.5 billion to €4.8 billion.

Within the context of realigning our car leasing and financing business with corporate clients, we sold our French fleet management company because a large part of its portfolio consisted of large fleets with a high proportion of cars from other manufacturers. In the future, Daimler Financial Services’ main focus will be on managing small and medium-sized fleets that primarily comprise vehicles from the Daimler Group.

Daimler Financial Services developed special insurance offers during the first quarter for purchasers of the new Mercedes-Benz Actros in order to support this vehicle’s launch. Particularly attractive conditions are offered for customers who choose the Actros safety packages.

Daimler Financial Services supports launch of smart fortwo in the United States

In the Americas region, contract volume amounted to €23.0 billion at the end of the first quarter (Q1 2007: €24.3 billion). Adjusted for exchange-rate effects, the portfolio grew by 10%.

Daimler Financial Services supported the market launch of the new smart fortwo in the United States during the first quarter. Dealers were offered special financing packages and end-customers were offered attractive insurance policies including service packages for repairs, tires and wheels, as well as theft insurance.

At the beginning of April, the IT systems of Daimler Financial Services and Chrysler Financial were separated. We have thus now completed the separation that became necessary following the transfer of a majority interest in Chrysler to Cerberus.

12

Vans, Buses, Other

Ongoing great success of Mercedes-Benz Sprinter

Growth in unit sales for Daimler Buses

EBIT of €371 million (Q1 2007: €1,872)

Amounts in millions of € | | Q1 2008 | | Q1 2007 | | Change in % | |

| | | | | | | |

EBIT | | 371 | | 1,872 | | -80 | |

Revenue segment | | 3,448 | | 2,882 | | +20 | |

Vans | | 2,335 | | 2,060 | | +13 | |

Buses | | 919 | | 813 | | +13 | |

Unit sales Vans | | 68,626 | | 61,703 | | +11 | |

Unit sales Buses | | 9,177 | | 8,302 | | +11 | |

The Vans, Buses, Other segment primarily comprises the Mercedes-Benz Vans and Daimler Buses units, our equity interests in Chrysler Holding LLC and EADS, and our real-estate activities.

The first-quarter EBIT of the Vans, Buses, Other segment amounted to €371 million (Q1 2007: €1,872 million).

Mercedes-Benz Vans

The Mercedes-Benz Vans unit increased its unit sales by 11% to 68,600 in the first quarter of 2008, thus setting a new record.

Due to the strong demand for the Sprinter, production capacities continued to be fully utilized at the German plants in Düsseldorf and Ludwigsfelde as well as in Buenos Aires, Argentina. In the first quarter of 2008, 42,400 Sprinters were sold worldwide, surpassing the very high figure for the prior-year period by 18%.

First-quarter sales of the Vito/Viano models totaled 25,100 units, once again exceeding the record figure of the prior-year quarter, in this case by 1%. And sales of 1,100 units of the Vario model were 23% higher than in Q1 2007.

Daimler Buses

The Daimler Buses unit sold 9,200 buses and chassis in the first quarter of this year, exceeding the high level of the prior-year quarter by 11%. The market development in Brazil was one of the factors behind a 19% increase in unit sales in Latin America to 5,700 vehicles. Due to the ongoing good economic situation in Brazil, the production capacities of our plant in Sao Bernardo do Campo are fully utilized.

The positive business development of 2007 continued also in Europe. Demand for buses of the Mercedes-Benz and Setra brands was unusually high for a first quarter. In Western Europe, unit sales increased by 41% to 1,000 units.

The 20,000th Mercedes-Benz Citaro city bus and the 500th Setra TopClass 400 double-decker bus were delivered in the first quarter of 2008. Furthermore, in January we delivered to customers the first new TopClass 400 buses with additional safety features.

Chrysler

Chrysler LLC sold 453,900 vehicles in the United States in the first quarter (Q1 2007: 537,200). In the markets outside the NAFTA region, Chrysler increased its unit sales by 9% to 57,300 vehicles.

The activities relating to Chrysler’s international sales organization have been placed into separate companies, which have been prepared for transfer to Chrysler.

With the separation of IT systems at the beginning of April, the separation from Chrysler Financial has now been completed.

The other guarantees granted by Daimler to Chrysler decreased as planned in the first quarter of 2008 by US$ 0.3 billion to US$ 0.7 billion. The deposit placed by Chrysler as collateral on an escrow account decreased by US$ 0.1 billion to US$ 0.4 billion.

EADS

Airbus, a subsidiary of EADS, delivered 123 airplanes to its customers in the first quarter (Q1 2007: 115). Orders received were significantly above the prior-year figure at 420 units (Q1 2007: 134). The order backlog numbered 3,693 aircraft at March 31, 2008 (March 31, 2007: 2,540). EADS will publish its first-quarter figures on May 14, 2008.

13

Daimler AG and Subsidiaries

Unaudited Consolidated Statements of Income

| | Consolidated | | Industrial Business | | Daimler Financial Services | |

in millions of €, except per share amounts | | Q1 2008 | | Q1 2007 | | Q1 2008 | | Q1 2007 | | Q1 2008 | | Q1 2007 | |

Revenue | | 23,455 | | 23,370 | | 21,212 | | 21,218 | | 2,243 | | 2,152 | |

Cost of sales | | (17,926 | ) | (18,243 | ) | (16,060 | ) | (16,485 | ) | (1,866 | ) | (1,758 | ) |

Gross profit | | 5,529 | | 5,127 | | 5,152 | | 4,733 | | 377 | | 394 | |

Selling expenses | | (1,992 | ) | (1,992 | ) | (1,910 | ) | (1,922 | ) | (82 | ) | (70 | ) |

General administrative expenses | | (928 | ) | (877 | ) | (793 | ) | (764 | ) | (135 | ) | (113 | ) |

Research and non-capitalized development costs | | (782 | ) | (739 | ) | (782 | ) | (739 | ) | — | | — | |

Other operating income, net | | 614 | | 108 | | 603 | | 104 | | 11 | | 4 | |

Share of profit (loss) from companies accounted for using the equity method, net | | (253 | ) | 1,621 | | (254 | ) | 1,622 | | 1 | | (1 | ) |

Other financial income (expense), net | | (212 | ) | 44 | | (208 | ) | 44 | | (4 | ) | — | |

Earnings before interest and taxes (EBIT) (1) | | 1,976 | | 3,292 | | 1,808 | | 3,078 | | 168 | | 214 | |

Interest income (expense), net | | 33 | | 134 | | 36 | | 136 | | (3 | ) | (2 | ) |

Profit before income taxes | | 2,009 | | 3,426 | | 1,844 | | 3,214 | | 165 | | 212 | |

Income tax expense | | (674 | ) | (711 | ) | (595 | ) | (627 | ) | (79 | ) | (84 | ) |

Net profit from continuing operations | | 1,335 | | 2,715 | | 1,249 | | 2,587 | | 86 | | 128 | |

Net profit (loss) from discontinued operations | | (3 | ) | (743 | ) | (3 | ) | (907 | ) | — | | 164 | |

Net profit | | 1,332 | | 1,972 | | 1,246 | | 1,680 | | 86 | | 292 | |

Minority interest | | (41 | ) | (23 | ) | | | | | | | | |

Profit attributable to shareholders of Daimler AG | | 1,291 | | 1,949 | | | | | | | | | |

| | | | | | | | | | | | | |

Earnings (loss) per share

for profit attributable to shareholders of Daimler AG | | | | | | | | | | | | | |

Basic | | | | | | | | | | | | | |

Net profit from continuing operations | | 1.29 | | 2.61 | | | | | | | | | |

Net loss from discontinued operations | | · | | (0.72 | ) | | | | | | | | |

Net profit | | 1.29 | | 1.89 | | | | | | | | | |

Diluted | | | | | | | | | | | | | |

Net profit from continuing operations | | 1.29 | | 2.60 | | | | | | | | | |

Net loss from discontinued operations | | · | | (0.72 | ) | | | | | | | | |

Net profit | | 1.29 | | 1.88 | | | | | | | | | |

(1) EBIT includes expenses from the compounding of provisions (2008: €113 million; 2007: €102 million).

The accompanying notes are an integral part of these Unaudited Interim Consolidated Financial Statements

14

Daimler AG and Subsidiaries

Consolidated Balance Sheets

| | Consolidated | | Industrial Business | | Daimler Financial Services | |

Amounts in millions of € | | At March 31,

2008 | | At Dec. 31, 2007 | | At March 31,

2008 | | At Dec. 31,

2007 | | At March 31,

2008 | | At Dec. 31,

2007 | |

| | (unaudited) | | | | (unaudited) | | (unaudited) | | (unaudited) | | (unaudited) | |

Assets | | | | | | | | | | | | | |

Intangible assets | | 5,284 | | 5,202 | | 5,202 | | 5,128 | | 82 | | 74 | |

Property, plant and equipment | | 14,705 | | 14,650 | | 14,650 | | 14,600 | | 55 | | 50 | |

Equipment on operating leases | | 18,901 | | 19,638 | | 7,961 | | 8,186 | | 10,940 | | 11,452 | |

Investments accounted for using the equity method | | 4,454 | | 5,034 | | 4,423 | | 4,845 | | 31 | | 189 | |

Receivables from financial services | | 22,983 | | 22,933 | | — | | — | | 22,983 | | 22,933 | |

Other financial assets | | 2,829 | | 3,044 | | 2,653 | | 2,817 | | 176 | | 227 | |

Deferred tax assets | | 1,741 | | 1,882 | | 1,474 | | 1,613 | | 267 | | 269 | |

Other assets | | 527 | | 480 | | 371 | | 339 | | 156 | | 141 | |

Total non-current assets | | 71,424 | | 72,863 | | 36,734 | | 37,528 | | 34,690 | | 35,335 | |

Inventories | | 15,223 | | 14,086 | | 14,866 | | 13,604 | | 357 | | 482 | |

Trade receivables | | 6,901 | | 6,361 | | 6,609 | | 6,135 | | 292 | | 226 | |

Receivables from financial services | | 16,209 | | 16,280 | | — | | — | | 16,209 | | 16,280 | |

Cash and cash equivalents | | 10,228 | | 15,631 | | 9,415 | | 14,894 | | 813 | | 737 | |

Other financial assets | | 6,719 | | 6,583 | | 165 | | 77 | | 6,554 | | 6,506 | |

Other assets | | 2,317 | | 2,368 | | 20 | | (68 | ) | 2,297 | | 2,436 | |

Sub-total current assets | | 57,597 | | 61,309 | | 31,075 | | 34,642 | | 26,522 | | 26,667 | |

Assets held for sale (Potsdamer Platz) | | — | | 922 | | — | | 922 | | — | | — | |

Total current assets | | 57,597 | | 62,231 | | 31,075 | | 35,564 | | 26,522 | | 26,667 | |

Total assets | | 129,021 | | 135,094 | | 67,809 | | 73,092 | | 61,212 | | 62,002 | |

| | | | | | | | | | | | | |

Equity and liabilities | | | | | | | | | | | | | |

Share capital | | 2,766 | | 2,766 | | | | | | | | | |

Capital reserves | | 10,216 | | 10,221 | | | | | | | | | |

Retained earnings | | 21,230 | | 22,656 | | | | | | | | | |

Other reserves | | 906 | | 1,075 | | | | | | | | | |

Treasury shares | | — | | — | | | | | | | | | |

Equity attributable to shareholders of Daimler AG | | 35,118 | | 36,718 | | | | | | | | | |

Minority interest | | 1,520 | | 1,512 | | | | | | | | | |

Total equity | | 36,638 | | 38,230 | | 32,395 | | 33,840 | | 4,243 | | 4,390 | |

Provisions for pensions and similar obligations | | 3,867 | | 3,852 | | 3,700 | | 3,686 | | 167 | | 166 | |

Provisions for income taxes | | 1,721 | | 1,761 | | 1,721 | | 1,761 | | — | | — | |

Provisions for other risks | | 6,055 | | 6,129 | | 5,922 | | 5,984 | | 133 | | 145 | |

Financing liabilities | | 28,355 | | 31,867 | | 8,971 | | 11,905 | | 19,384 | | 19,962 | |

Other financial liabilities | | 1,483 | | 1,673 | | 1,407 | | 1,515 | | 76 | | 158 | |

Deferred tax liabilities | | 1,053 | | 673 | | (1,919 | ) | (2,091 | ) | 2,972 | | 2,764 | |

Deferred income | | 1,808 | | 1,855 | | 1,304 | | 1,351 | | 504 | | 504 | |

Other liabilities | | 105 | | 114 | | 104 | | 114 | | 1 | | — | |

Total non-current liabilities | | 44,447 | | 47,924 | | 21,210 | | 24,225 | | 23,237 | | 23,699 | |

Trade payables | | 7,757 | | 6,939 | | 7,540 | | 6,730 | | 217 | | 209 | |

Provisions for income taxes | | 592 | | 548 | | (1,053 | ) | (1,180 | ) | 1,645 | | 1,728 | |

Provisions for other risks | | 6,877 | | 7,272 | | 6,628 | | 7,026 | | 249 | | 246 | |

Financing liabilities | | 22,582 | | 23,100 | | (7,075 | ) | (6,886 | ) | 29,657 | | 29,986 | |

Other financial liabilities | | 7,152 | | 8,442 | | 5,968 | | 7,329 | | 1,184 | | 1,113 | |

Deferred income | | 1,286 | | 1,341 | | 742 | | 777 | | 544 | | 564 | |

Other liabilities | | 1,690 | | 1,272 | | 1,454 | | 1,205 | | 236 | | 67 | |

Sub-total current liabilities | | 47,936 | | 48,914 | | 14,204 | | 15,001 | | 33,732 | | 33,913 | |

Liabilities held for sale (Potsdamer Platz) | | — | | 26 | | — | | 26 | | — | | — | |

Total current liabilities | | 47,936 | | 48,940 | | 14,204 | | 15,027 | | 33,732 | | 33,913 | |

Total equity and liabilities | | 129,021 | | 135,094 | | 67,809 | | 73,092 | | 61,212 | | 62,002 | |

The accompanying notes are an integral part of these Unaudited Interim Consolidated Financial Statements

15

Daimler AG and Subsidiaries

Unaudited Consolidated Statements of Changes in Equity

| | | | | | | | Other reserves | | | | Equity | | | | | |

Amounts in millions of € | | Share

capital | | Capital

reserves | | Retained

earnings | | Currency

translation

adjustment | | Financial

assets

available-

for-sale | | Derivative

financial

instruments | | Treasury

shares | | attributable

to share-

holders of

Daimler AG | | Minority

interests | | Total

equity | |

Balance at January 1, 2007 | | 2,673 | | 8,613 | | 23,702 | | 382 | | 544 | | 1,011 | | — | | 36,925 | | 421 | | 37,346 | |

Net profit | | — | | — | | 1,949 | | — | | — | | — | | — | | 1,949 | | 23 | | 1,972 | |

Income (expenses) recognized directly in equity | | — | | — | | — | | (120 | ) | (143 | ) | (403 | ) | — | | (666 | ) | (2 | ) | (668 | ) |

Deferred taxes on income (expenses) recognized directly in equity | | — | | — | | — | | — | | 2 | | 158 | | — | | 160 | | 1 | | 161 | |

Total income (expense) for the period | | — | | — | | 1,949 | | (120 | ) | (141 | ) | (245 | ) | — | | 1,443 | | 22 | | 1,465 | |

Dividends | | — | | — | | — | | — | | — | | — | | — | | — | | (2 | ) | (2 | ) |

Share-based payments | | — | | 22 | | — | | — | | — | | — | | — | | 22 | | — | | 22 | |

Issue of new shares | | 3 | | 47 | | — | | — | | — | | — | | — | | 50 | | — | | 50 | |

Acquisition of treasury shares | | — | | — | | — | | — | | — | | — | | (16 | ) | (16 | ) | — | | (16 | ) |

Issue of treasury shares | | — | | — | | — | | — | | — | | — | | 16 | | 16 | | — | | 16 | |

Other | | — | | 1 | | — | | — | | — | | — | | — | | 1 | | 1,065 | | 1,066 | |

Balance at March 31, 2007 | | 2,676 | | 8,683 | | 25,651 | | 262 | | 403 | | 766 | | — | | 38,441 | | 1,506 | | 39,947 | |

| | | | | | | | | | | | | | | | | | | | | |

Balance at January 1, 2008 | | 2,766 | | 10,221 | | 22,656 | | (418 | ) | 319 | | 1,174 | | — | | 36,718 | | 1,512 | | 38,230 | |

Net profit | | — | | — | | 1,291 | | — | | — | | — | | — | | 1,291 | | 41 | | 1,332 | |

Income (expenses) recognized directly in equity | | — | | — | | — | | (613 | ) | (35 | ) | 664 | | — | | 16 | | (66 | ) | (50 | ) |

Deferred taxes on income (expenses) recognized directly in equity | | — | | — | | — | | — | | 6 | | (191 | ) | — | | (185 | ) | 21 | | (164 | ) |

Total income (expense) for the period | | — | | — | | 1,291 | | (613 | ) | (29 | ) | 473 | | — | | 1,122 | | (4 | ) | 1,118 | |

Dividends | | — | | — | | — | | — | | — | | — | | — | | — | | (1 | ) | (1 | ) |

Share-based payments | | — | | (7 | ) | — | | — | | — | | — | | — | | (7 | ) | — | | (7 | ) |

Issue of new shares | | — | | 1 | | — | | — | | — | | — | | — | | 1 | | — | | 1 | |