Set forth below is the supplementary information memorandum prepared in accordance with the Securities Industry Act of Ghana, 2016 (Act 929) or any statutory modification or re-enactment thereof and the Securities and Exchange Commission Regulations, 2003 (L.I. 1728) or any statutory modification or re-enactment thereof and first distributed to holders of AngloGold Ashanti Limited’s ordinary shares and holders of AngloGold Ashanti Limited’s Ghanaian depositary shares in Ghana on July 27, 2023.

SUPPLEMENTARY INFORMATION MEMORANDUM

RELATING TO THE REORGANISATION OF AGA BY (AMONG OTHERS) INVITING THE HOLDERS OF SHARES ISSUED BY AGA TO EXCHANGE THEIR HOLDINGS FOR NEWLY ISSUED ORDINARY SHARES OF NEWCO AND THE LISTING (BY INTRODUCTION) OF NEW SECURITIES ON THE GHANA STOCK EXCHANGE |

| | | |

| ARRANGER | | SPONSORING BROKER |

| | | |

| |

|

| | | |

| | | |

| GHANA DEPOSITARY | | CUSTODIAN |

| | | |

| | |

| |

| |

| LEGAL ADVISER |

| |

|

| |

| IMPORTANT INFORMATION AND DISCLAIMERS |

| |

| THIS SUPPLEMENT TO THE REORGANISATION DOCUMENTS (AS DEFINED) CONTAINS IMPORTANT INFORMATION ABOUT THE IMPLEMENTATION OF THE REORGANISATION (AS DEFINED) IN GHANA AND ITS CONSEQUENCES WHICH AGA GHANA SECURITIES HOLDERS (AS DEFINED) SHOULD KNOW AND CONSIDER BEFORE TAKING A DECISION TO PARTICIPATE IN THE REORGANISATION. YOU ARE ADVISED TO READ AND UNDERSTAND THE CONTENTS OF THE SUPPLEMENT (TOGETHER WITH THE REORGANISATION DOCUMENTS) CAREFULLY AND TO CONSULT YOUR PROFESSIONAL INVESTMENT ADVISERS AND DEALERS IF YOU HAVE ANY QUESTIONS ABOUT THE CONTENTS OF THE SUPPLEMENT |

The AGA Board (as defined) has approved a reorganisation transaction which AGA intends to implement in 3 sequential, separate and fully interconditional steps under which:

| (a) | AGA will (through a distribution in specie) direct NewCo (its wholly owned subsidiary) to issue 46,000 NewCo Ordinary Shares (as defined) to the relevant AGA Shareholders on a pro rata basis, with the aggregate subscription price of USD 46,000 to be paid by AGA. As a result of: (i) such distribution in specie; (ii) the redemption by NewCo (at nominal value) of the 50,000 non-voting redeemable preference shares of GBP 1 each in the capital of NewCo held by AGA (with such shares being treated under English law as having been cancelled on redemption); and (iii) the gift of one NewCo Ordinary Share from AGA to NewCo (by the transfer of the one NewCo Ordinary Share held by AGA to NewCo for nil consideration) and the subsequent cancellation of such NewCo Ordinary Share by NewCo, NewCo will cease to be a subsidiary of AGA and will be owned by all the AGA Shareholders; |

| | |

| (b) | NewCo has made (and it is the present, non-binding intention of AGA to accept) an irrevocable offer to purchase 100% of the shares in AGAH (as defined), which holds all of the operations and assets of AGA and its subsidiaries located outside of the Republic of South Africa; and |

| | |

| (c) | AGA will implement a scheme of arrangement pursuant to sections 114(1) and 115 of the South African Companies Act (as defined), under which the relevant AGA Shareholders will exchange their AGA Ordinary Shares (as defined) for the right and obligation to receive (without any action on the part of such AGA Shareholders) the respective pro rata portions of the NewCo Ordinary Shares. |

| | |

The successful completion of the Reorganisation will result in (among others):

| (a) | the delisting of the AGA Ghana Securities (as defined) from the GSE; and |

| | |

| (b) | the listing (by introduction) of the NewCo Ghana Securities (as defined) on the GSE. |

This supplement (the Supplement), among others, complements the Reorganisation Documents by highlighting relevant information contained therein for the benefit of the AGA Ghana Securities Holders and providing additional material details related to the NewCo Ghana Securities (as defined) and the implementation of the Reorganisation in Ghana. In relation to AGA Ghana Securities Holders, all references to any of the Reorganisation Documents shall mean such Reorganisation Document as supplemented by this Supplement.

The Supplement has been reviewed and approved by the SEC in accordance with section 3 of the Securities Industry Act (as defined) and the SEC Regulations (as defined). In its review, the SEC examined the contents of this Supplement to ensure that adequate disclosures have been made. To ascertain the financial soundness or value of the NewCo Ghana Securities, prospective investors are advised to consult a dealer, investment adviser or other professional for appropriate advice.

An application has been made to the GSE for the listing of the NewCo Ghana Securities. Provisional approval has been obtained from the GSE for permission to list and trade the NewCo Ghana Securities on the main market of the GSE. Such approval is granted subject to NewCo fulfilling all listing requirements.

The GSE assumes no responsibility for the correctness of any of the statements made, opinion expressed and reports presented in this Supplement. The GSE has not verified the accuracy and truth of the contents of this Supplement or any other documents submitted to it, and the GSE will not be liable for any claim of any kind whatsoever. Approval of the issue and/or admission to trading of the NewCo Ghana Securities by the GSE is not to be taken as an indication of the merits of NewCo or any issue of the NewCo Ghana Securities.

The contents of this Supplement do not constitute, and are not to be construed as, legal, business or tax advice. Each AGA Ghana Securities Holder should consult his/her/its own independent legal adviser, financial adviser or tax adviser for legal, financial and/or tax advice in relation to the Reorganisation.

NewCo Ghana Securities Holders should also pay particular attention to the factors disclosed under Section 6.1 (Risk disclosures) in this Supplement.

| A. | GENERAL INFORMATION |

| | |

| | NewCo accepts responsibility for the information contained in this Supplement. To the best of the knowledge of NewCo (having taken all reasonable care to ensure that such is the case), the information contained in this Supplement is in accordance with the facts as at the date hereof and does not omit anything likely to affect the import of such information. |

| | |

| | To the best of the knowledge and belief of the Arranger (as defined), the Sponsoring Broker (as defined) and the Legal Advisers (as defined), the Supplement constitutes full and fair disclosure of all material facts about the Reorganisation. |

| | |

| | The distribution of this Supplement in certain jurisdictions may be restricted by law. NewCo does not represent that this Supplement may be lawfully distributed in compliance with any applicable registration or other requirement in any such jurisdiction, or pursuant to an exemption available thereunder, or assume any responsibility for facilitating any such distribution. In particular, no action has been taken by NewCo which is intended to permit an offering of any of the NewCo Ghana Securities or distribution of this Supplement in any jurisdiction where action for that purpose is required. Accordingly, no NewCo Ghana Securities may be offered or sold, directly or indirectly, and neither this Supplement nor any advertisement or other material may be distributed or published in any jurisdiction, except in circumstances that will result in compliance with any applicable laws and regulations. Persons into whose possession this Supplement may come must inform themselves about, and observe, any such restrictions. |

| | |

| | This Supplement does not constitute an offer and may not be used for the purpose of an offer or solicitation by anyone in any jurisdiction or in any circumstances in which such an offer or solicitation is not authorised or is unlawful. The Issuer and the Arranger accept no responsibility for any violation by any person of any such restrictions. |

| | |

| | This Supplement is not an offer of securities for sale in the U.S. An offer of securities in the U.S pursuant to a business combination transaction will only be made, as may be required, through a prospectus which is part of an effective registration statement filed with the United States Securities and Exchange Commission (the U.S. SEC). In connection with the Reorganisation, a registration statement on Form F-4 under the United States Securities Act of 1933, as amended (the U.S. Securities Act) has been filed with the U.S. SEC. U.S. investors and U.S. shareholders are urged to read the registration statement, as well as other documents filed with the U.S. SEC, because they will contain important information. Copies of all documents filed with the U.S. SEC regarding the Reorganisation and documents incorporated by reference may be obtained at the U.S. SEC’s website https://www.sec.gov. In addition, the effective registration statement on Form F-4 will be made available for free to AGA Shareholders. |

| | |

| | AGA Ghana Securities Holders should rely exclusively on the information contained in this Supplement and the Reorganisation Documents (which will be or have been made available to all AGA Ghana Securities Holders) when making a decision as to whether to approve the Reorganisation. No person is authorised to give any information or make any representation not contained in this Supplement or the Reorganisation Documents in connection with the Reorganisation, and, if given or made, such information or representation must not be relied upon as having been authorised by NewCo, AGA or the Arranger. |

| | The information contained in this Supplement is accurate only as of the date of the Supplement, regardless of the time of delivery of this Supplement. In the event that this Supplement is delivered to or comes into the possession of an AGA Ghana Securities Holder at any time after the date hereof, it is for, and the responsibility of, such holder to ascertain whether any supplement or amendment of the information herein contained has been made or issued, or whether updated information is available. Such updated information can be obtained from AGA’s website (https://www.anglogoldashanti.com). Information included or otherwise accessible through AGA’s website is not a part of, and is not incorporated by reference into, this Supplement. Reliance on this Supplement at any time subsequent to the date hereof without reference to any such updated information subsequent to the date of the Supplement shall be at the investor’s risk. |

| | |

| | This Supplement is to be read in conjunction with all documents specifically referred to or stated to be incorporated herein, and should be read and understood on the basis that such other documents are incorporated in and form part of this Supplement. |

| | |

| B. | SUPPLEMENTS |

| | |

| | In the event of any occurrence of a significant factor after the issuance of the Supplement or material mistake or inaccuracy relating to the information included in the Supplement, NewCo may prepare a supplement to address such significant factor or material inaccuracy. Such supplement will be subject to the approval of the SEC. |

| | |

| C. | ROUNDING |

| | |

| | Some numerical figures included in this Supplement may have been subject to rounding adjustments. Accordingly, numerical figures shown as totals in certain figures may not be an arithmetic aggregation of the figures that precede them. |

| | |

| D. | DATES AND TIMES |

| | |

| | All dates and times referred to in this Supplement are references to Ghana dates and times. |

| | |

| E. | FORWARD-LOOKING STATEMENTS |

| | |

| | This Supplement includes “forward-looking statements” that reflect NewCo’s intentions, beliefs or current expectations and projections about its future results, operations, financial condition, liquidity, performance, prospects, anticipated growth, strategies, plans, opportunities, trends and the market in which it operates. |

| | |

| | These forward-looking statements are based on numerous assumptions regarding NewCo’s future business and the environment in which it expects to operate in the future. Forward-looking statements are subject to known and unknown risks, uncertainties, assumptions and other factors that could cause NewCo’s actual results, operations, financial condition, liquidity, performance, prospects, anticipated growth, strategies, plans or opportunities, as well as those of the markets it serves or intends to serve, to differ materially from those expressed in, or suggested by, forward-looking statements contained in this Supplement. |

| | |

| | The forward-looking statements speak only as of the date of this Supplement. NewCo expressly disclaims any obligation or undertaking to release publicly any updates or revisions to any forward-looking statement contained herein to reflect any change in its expectations with regard thereto or any change in events, conditions or circumstances on which any such statement is based. An investor should not place undue reliance on any forward-looking statements, and are cautioned that any forward-looking statements are not guarantees of future results, performance or achievements of NewCo. |

| F. | TRANSACTION ADVISERS |

| | |

| | Stanbic Bank Ghana LTD (Stanbic) is acting as the Arranger (as defined) for the listing of the NewCo Ghana Securities. Stanbic consents to act in the specified capacity and to its name being stated in this Supplement. Neither Stanbic nor any of its employees or principals has any material direct or indirect economic or financial interest in NewCo. |

| | |

| | SBG Securities Ghana LTD (SBG) is acting as the Sponsoring Broker (as defined) for the listing of the NewCo Ghana Securities. SBG consents to act in the specified capacity and to its name being stated in this Supplement. Neither SBG nor any of its employees or principals has any material direct or indirect economic or financial interest in NewCo. |

| | |

| | Central Securities Depository (GH) Limited (CSD) is acting as Custodian (as defined) in respect of the NewCo Ordinary Shares for the benefit of the Ghana NewCo Shareholders (as defined). CSD consents to act in the specified capacity and to its name being stated in this Supplement. Neither CSD nor any of its employees or principals has any material direct or indirect economic or financial interest in NewCo. |

| | |

| | Bentsi-Enchill, Letsa & Ankomah (BELA) is acting as Legal Advisers (as defined) to NewCo and AGA in respect of matters related to Ghanaian law. BELA consents to act in the specified capacity and to its name being stated in this Supplement and confirms that it has not withdrawn its consent to any statement or report prepared by it being included in this Supplement (in the form and context in which it is included). BELA has prepared the Legal Compliance Letter (as defined) set out under the Appendix (Legal Compliance Letter) of this Supplement. Neither BELA nor any of its employees or partners has any material direct or indirect economic or financial interest in NewCo or AGA. |

| | |

| | National Trust Holding Company Ltd (NTHC) is acting as the Ghana Depositary (as defined) in respect of the NewCo GhDSs (as defined). NTHC consents to act in the specified capacity and to its name being stated in this Supplement. Neither NTHC nor any of its employees or principals has any material direct or indirect economic or financial interest in NewCo. |

| | |

| G. | DIRECTORS’ RESPONSIBILITY STATEMENT |

| | |

| | NewCo and the NewCo Board accept responsibility for the information contained in this Supplement. |

| | |

| | This Supplement has been reviewed and approved by the NewCo Board, who, collectively and individually, accept full responsibility for the accuracy of the information given and, after making all reasonable inquiries and to the best of their knowledge and belief, confirm that there are no facts the omission of which would make any statement in the document referred to above misleading. |

| | |

| | No Director (as defined) has been involved in any of the following events: (a) a petition under bankruptcy or insolvency laws in any jurisdiction filed against such person or any partnership in which he/she is/was a partner or any corporation of which he/she is/was a director or chief executive officer (b) conviction of such person for fraud, misappropriation or breach of trust or any other similar offence and (c) such person being the subject of any order, judgement or ruling of any court of competent jurisdiction or administrative body preventing him/her from acting as an investment adviser, dealer’s representative, investment representative, a director of a financial institution or engaging in any type of business or professional activity. |

Signed for and on behalf of NewCo on 27 July 2023

/s/ Alberto Calderon | /s/ Robert Hayes |

| | |

| Alberto Calderon | Robert Hayes |

| Chairman/Director | Director |

TABLE OF CONTENTS

| IMPORTANT INFORMATION AND DISCLAIMERS | 2 |

| | |

| CORPORATE INFORMATION OF THE ISSUER | 7

|

| | |

| CONTACT DETAILS OF THE TRANSACTION ADVISERS | 8

|

| | |

| DEFINITIONS | 9

|

| | |

| KEY MILESTONES AND INDICATIVE TIMELINES FOR AGA GHANA SECURITIES HOLDERS | 14 |

| | | |

| 1. | OVERVIEW OF THE TRANSACTIONS UNDER THE REORGANISATION | 16 |

| | | |

| 2. | ACTIONS REQUIRED TO APPROVE THE REORGANISATION | 21 |

| | | |

| 3. | OVERVIEW OF THE PARTIES TO THE REORGANISATION | 27 |

| | | |

| 4. | GHANA DEPOSITARY AGREEMENT | 35 |

| | | |

| 5. | LEGAL COMPLIANCE LETTER | 37 |

| | | |

| 6. | ADDITIONAL MATERIAL INFORMATION | 38 |

| | |

| APPENDIX: LEGAL COMPLIANCE LETTER | 40 |

| | |

| BACK PAGE | 46

|

| CORPORATE INFORMATION OF THE ISSUER |

| | |

| Issuer | AngloGold Ashanti plc 4th Floor, Communications House South Street Staines-upon-Thames, Surrey TW18 4PR United Kingdom |

| | Tel: Contact: Email: | +44 (0) 203 968 3323 Robert Hayes RHayes@AngloGoldAshanti.com |

| Directors | Alberto Calderon (Executive director) Robert Hayes (Executive director) |

| | |

| Secretary | Oakwood Corporate Secretary Limited Registration No. 07038430 3rd Floor, 1 Ashley Road, Altrincham, Cheshire WA14 2DT, United Kingdom |

| | |

| Auditors | PricewaterhouseCoopers Incorporated Waterfall City Heliport, 4 Lisbon Lane Waterfall City Midrand 2090 Registration No. 1998/012055/21 |

| | |

| CONTACT DETAILS OF THE TRANSACTION ADVISERS |

| | |

| Arranger | Stanbic Bank Ghana LTD Stanbic Heights, Plot 215 South Liberation Link Airport City, Accra, Ghana |

| | Tel: | +233(0)302-610-690 |

| | Contacts:

| Kobby Bentsi-Enchill, Stacey Owusu-Ansah and Maame Efua Dadzie |

| | Emails: | Bentsi-EnchillK@stanbic.com.gh |

| | | Owusu-AnsahS@stanbic.com.gh |

| | | DadzieM2@stanbic.com.gh |

| | |

| Sponsoring Broker | SBG Securities Ghana LTD Stanbic Heights, Plot 215 South Liberation Link Airport City, Accra, Ghana |

| | Tel:

| +233-(0)302-687-670 |

| | Contact:

| Fouad Idun-Ogde, Robert Rhule |

| | Email: | idun-ogdef@stanbic.com.gh |

| | | rhuler@stanbic.com.gh |

| | |

| Legal Adviser | Bentsi-Enchill, Letsa & Ankomah 4 Momotse Avenue, Adabraka, Accra, Ghana |

| | Tel:

| +233-(0)302-208-888 |

| | Contacts:

| Seth Asante, Frank Akowuah, Sophia Sena Berdie, Jonathan Amable, and Wendy Antwi-Asimeng |

| | Emails: | seth.asante@bentsienchill.com |

| | | fnakowuah@bentsienchill.com |

| | | ssberdie@bentsienchill.com |

| | | jskamable@bentsienchill.com |

| | | wantwi-asimeng@bentsienchill.com |

| | |

| Custodian | Central Securities Depository (GH) Limited 4th Floor, Cedi House, Accra, Ghana |

| | Tel: | +233(0)302-689-313 |

| | Contact: | Kwame Addai Boa-Amponsem |

| | Email: | kwame.boa-amponsem@csd.com.gh |

| | |

| Ghana Depositary | National Trust Holding Company Limited 18 Gamel Abdul Nasser Avenue, Ringway Estates, Accra |

| | Tel: | +233 (0) 302 964 932 |

| | Contact: | Ken Mate-Kole |

| | Email: | kmatekole@nthc.com.gh |

| | |

| DEFINITIONS |

| |

| In this Supplement, unless the context clearly indicates a contrary intention, the following expressions have the following meanings: |

| Term | Definition |

| A2X | means the South African securities exchange known as the A2X Markets which is operated by A2X Solutions Proprietary Limited |

| | |

| AGA | means AngloGold Ashanti Limited (Registration No.1944/017354/06), a public company duly incorporated in accordance with the company laws of South Africa |

| | |

| AGA Board | means the board of directors of AGA |

| | |

| Ghana Depositary Agreement | means the AngloGold Ashanti Ghana depositary securities agreement dated 26 April 2004 and entered into between AGA, the Depositary and Barclays Bank Ghana Limited (as custodian) for the purpose of establishing the Ghana Depositary Programme |

| | |

| AGA Ghana Registrar | means NTHC, acting in its capacity as registrar of the Ghana AGA Ordinary Shares |

| | |

| AGA Ghana Securities | means the Ghana AGA Ordinary Shares and the AGA GhDSs |

| | |

| AGA Ghana Securities Holder | means any holder of any AGA Ghana Securities |

| | |

| AGA GhDS | means Ghanaian depositary securities representing AGA Ordinary Shares at a ratio of 1 AGA Ordinary Share to 100 such Ghanaian depositary securities, which are issued under the terms of the Ghana Depositary Programme and listed and traded on the GSE |

| | |

| AGA GhDS Holder | means a Certificated AGA GhDS Holder or a Dematerialised AGA GhDS Holder |

| | |

| AGA Ordinary Shares | means the ordinary shares, with a par value of ZAR 0.25 (twenty-five cents) each, in the issued share capital of AGA |

| | |

| AGA Register | means the register of shareholders of AGA, which includes the Ghana AGA Register |

| | |

| AGA Shareholder | means a holder of AGA Ordinary Shares |

| | |

| AGAH Sale | means the transaction summarised under Section 1.1.2 (The AGAH Sale) below |

| | |

| Affiliates | means, in relation to a corporate body, its subsidiary, its holding company, or any other subsidiary or holding company of its holding company, and Affiliate shall be construed accordingly |

| | |

| Applicable Law | means any law or regulation of any governmental or other regulatory authority which governs the Reorganisation or any relevant Person, and Applicable Laws shall be construed accordingly |

| | |

| Appraisal Rights | means the dissenting shareholders’ appraisal rights remedy afforded to shareholders in terms of section 164 of the South African Companies Act |

| | |

| Arranger | means Stanbic, which is acting as the arranger in relation to the listing of the NewCo Ghana Securities on the GSE, and Arranger shall be construed accordingly |

| | |

| BELA | means Bentsi-Enchill, Letsa & Ankomah, a firm of legal practitioners licensed by the General Legal Council of Ghana and operating in Ghana |

| | |

| Central Securities Depository or CSD | means the Central Securities Depository (GH) Limited, a private company limited by shares and duly incorporated under laws of Ghana (or its nominee) |

| | |

| Certificated AGA GhDSs | means AGA GhDSs that have not been Dematerialised and to which title is evidenced by a Document of Title |

| | |

| Term | Definitions |

| Certificated AGA GhDS Holder | means the holder of a Certificated AGA GhDS |

| | |

| Certificated Ghana AGA Ordinary Shares | means issued Ghana AGA Ordinary Shares that have not been Dematerialised and to which title is evidenced by a Document of Title |

| | |

| Certificated Ghana AGA Shareholder | means the holder of a Certificated Ghana AGA Ordinary Share |

| | |

| CSD | means Central Securities Depository (GH) Limited |

| | |

| CSD Account | has the meaning given to it under Section 2.3.4.1 below |

| | |

| Custodian | means the CSD, acting as custodian for the Ghana NewCo Shareholders by holding their NewCo Ordinary Shares through an account held by a central securities depository participant in South Africa |

| | |

| Dematerialised | means the process by which securities held in certificated form are converted to or held in electronic form as uncertificated securities |

| | |

| Dematerialised AGA GhDSs | means AGA GhDSs which are Dematerialised |

| | |

| Dematerialised AGA GhDS Holder | means the holder of a Dematerialised AGA GhDS |

| | |

| Dematerialised Ghana AGA Ordinary Shares | means Ghana AGA Ordinary Shares which are Dematerialised |

| | |

| Dematerialised Ghana AGA Shareholder | means the holder of a Dematerialised Ghana AGA Ordinary Share |

| | |

| Directors | mean the directors of AGA and/or NewCo from time to time, and Director means any of them (as applicable in the relevant context) |

| | |

| Document of Title | means the original physical document of title such as a share certificate or duly executed share transfer form or transfer deed constituting or representing valid legal title to the AGA Ghana Securities |

| | |

| DTC | means the Depositary Trust Company |

| | |

| Encumbrance | means any mortgage, charge, lien, pledge, hypothecation, assignment by way of security, deposit by way of security or any other agreement or arrangement (whether conditional or not and whether relating to existing or to future assets), having the effect of providing a security interest to a creditor or any agreement or arrangement to give any form of a secured claim to a creditor but excluding statutory preferences and any security interest arising by operation of law |

| | |

| F-4 Prospectus | means the final prospectus dated 10 July 2023 relating to the registration statement on Form F-4 initially filed by NewCo with the U.S. Securities and Exchange Commission on 23 June 2023 in respect of the registration of the NewCo Ordinary Shares |

| | |

| Foreign Exchange Act | means the Foreign Exchange Act, 2006 (Act 723) |

| | |

| Form of Proxy | means the form of proxy (yellow) which is circulated together with the Shareholder Circular |

| | |

| Form of Transfer and Surrender | means the form of transfer and surrender (blue) which is circulated together with the Shareholder Circular |

| | |

| GBP | means pound sterling, the official currency of the United Kingdom |

| | |

| Ghana | means the Republic of Ghana |

| | |

| Ghana AGA Ordinary Shares | means the AGA Ordinary Shares recorded on the Ghana AGA Register |

| | |

| Term | Definition |

| Ghana AGA Register | means the register of Ghana AGA Shareholders, as maintained by the AGA Ghana Registrar |

| | |

| Ghana AGA Shareholders | means Certificated Ghana AGA Shareholders and Dematerialised Ghana AGA Shareholders |

| | |

| Ghana Depositary | means NTHC, which acts as the depositary in respect of the Ghana Depositary Program |

| | |

| Ghana Depositary Programme | means the Ghanaian depositary securities programme established under the terms of the Ghana Depositary Agreement |

| | |

| Ghana NewCo Ordinary Shares | means the NewCo Ordinary Shares to be held by the Custodian for the purpose of making book-entry interests in such NewCo Ordinary Shares available in Ghana |

| | |

| Ghana NewCo Shareholders | means the holders of the Ghana NewCo Ordinary Shares |

| | |

| GHS | means the Ghana Cedi, the official currency of Ghana or any successor currency |

| | |

| Group | means (prior to the implementation of the Reorganisation) AGA and its subsidiaries, and (subsequent to the implementation of the Reorganisation) NewCo and its subsidiaries, as the context requires

|

| | |

| GSE | means the Ghana Stock Exchange

|

| | |

| Implementation Agreement | means the agreement titled “Implementation Agreement” and entered into on 12 May 2023 between AGA and NewCo in respect of the implementation of the Reorganisation |

| | |

| Income Tax Act | means the Income Tax Act of Ghana, 2015 (Act 896) (as amended) or any statutory modification or re-enactment thereof |

| | |

| JSE | means the Johannesburg Stock Exchange |

| | |

| Last Practicable Date | means 15 June 2023, being the last practicable date, before the issue of this Supplement |

| | |

| Legal Advisers | means BELA |

| | |

| Legal Compliance Letter | means the legal compliance letter prepared and issued by BELA in relation to compliance of the listing of the NewCo Ghana Securities with Ghanaian law requirements, and which is set out under the Appendix (Legal Compliance Letter) below |

| | |

| NewCo | means AngloGold Ashanti plc (Registration No. 14654651), a public limited company duly incorporated in accordance with the laws of England and Wales |

| | |

| NewCo Articles | means the articles of association of NewCo |

| | |

| NewCo Board | means the board of directors of NewCo |

| | |

| NewCo Ghana Securities | means the Ghana NewCo Ordinary Shares and the NewCo GhDSs |

| | |

| NewCo Ghana Securities Holder | means a holder of any NewCo Ghana Securities |

| | |

| NewCo GhDS | means the Ghanaian depositary securities representing Ghana NewCo Ordinary Shares at a ratio of 1 Ghana NewCo Ordinary Share to 100 such Ghanaian depositary securities, which are (to be) issued pursuant to the Ghana Depositary Programme and listed and traded on the GSE |

| | |

| NewCo Ordinary Shares | means ordinary shares with a nominal value of USD 1 each in the share capital of NewCo |

| | |

| NewCo Shareholder | means owners of a beneficial interest in the NewCo Ordinary Shares in the form of book-entry interests created for the trading of the NewCo Ordinary Shares on a Dematerialised basis |

| | |

| Term | Definition |

| NYSE | means the New York Stock Exchange |

| | |

| Irrevocable Offer to Purchase | means the document titled “Irrevocable Offer to Purchase”, signed by NewCo and delivered to AGA on or about 12 May 2023, in terms of which, inter alia, NewCo irrevocably offers, in favour of AGA, to purchase all (and not part only) of 100% of the issued share capital of AGAH |

| | |

| Pre-Listing Statement | means the statement dated 7 July 2023 and prepared and filed by NewCo in connection with the secondary listing of the NewCo Ordinary Shares on the JSE |

| | |

| Person | means any natural person, corporation, company, partnership, firm, voluntary association, joint venture, trust, unincorporated organisation, governmental authority or body or any other entity (whether acting in an individual, fiduciary or other capacity) and, where applicable, that Person’s legal and personal representatives, successors and permitted assigns |

| | |

| Reorganisation | means the series of inter-conditional transaction steps (as summarised and in the sequence presented under Section 1.1 (Summary of the relevant transactions)) which will be implemented to procure that NewCo is established as the new holding company of the Group, with its primary listing on the NYSE and (among others) a secondary listing on the GSE |

| | |

| Reorganisation Consideration Record Date | means latest by 3pm on the date set by the AGA Board as being the “record date” on which an AGA Shareholder must be recorded in the AGA Register in order to participate in the Spin-Off and the Scheme |

| | |

| Reorganisation Documents | means the Implementation Agreement, Irrevocable Offer to Purchase, Pre-Listing Statement, Shareholder Circular and any other document designated as such, and Reorganisation Document shall be construed accordingly |

| | |

| Reorganisation Documents Record Date | means the date indicated as such in the table “Key Milestones and Indicative Timelines for AGA Ghana Securities Holders”, being the date on which an AGA Ghana Securities Holder must be recorded in the Ghana AGA Register or (in the case of a holder of a composite AGA GhDS) the register of the Ghana Depositary, to be eligible to be eligible to receive the Reorganisation Documents to be circulated by the AGA Ghana Registrar |

| | |

| Scheme | means the transaction summarised under Section 1.1.3 (The Scheme) below |

| | |

| SEC | means the Securities and Exchange Commission of Ghana |

| | |

| Securities Industry Act | means the Securities Industry Act of Ghana, 2016 (Act 929) or any statutory modification or re-enactment thereof |

| | |

| SEC Regulations | means the Securities and Exchange Commission Regulations, 2003 (L.I. 1728) or any statutory modification or re-enactment thereof |

| | |

| Shareholder Circular | means the shareholder circular dated 7 July 2023 and issued by AGA in connection with the Reorganisation |

| | |

| Shareholders’ Meeting | has the meaning assigned to it under Section 2.1 (Details of the AGA Shareholders Meeting) below |

| | |

| Shareholders’ Meeting Notice | has the meaning assigned to it under Section 2.1 (Details of the AGA Shareholders Meeting) below |

| | |

| South Africa | means the Republic of South Africa |

| | |

| South African Companies Act | means the South African Companies Act, No. 71 of 2008, as amended |

| | |

| Spin-Off | means the transaction summarised under Section 1.1.1 (The Spin-Off) below |

| | |

| U.S. | means the United States of America |

| | |

| United Kingdom or U.K. | means the United Kingdom of Great Britain and Northern Ireland, as constituted from time to time |

| | |

| USD | means U.S. Dollars, the official currency of the U.S. |

| Term | Definition |

| | |

| Voting Last Day to Trade | means the date indicated as such in the table “Key Milestones and Indicative Timelines for AGA Ghana Securities Holders” |

| | |

| Voting Record Date | means the date indicated as such in the table “Key Milestones and Indicative Timelines for AGA Ghana Securities Holders”, being the date on which an AGA Ghana Securities Holder must be recorded in the Ghana AGA Register or (in the case of a holder of a composite AGA GhDS) the register of the Ghana Depositary, to be eligible to attend and/or vote (give voting instructions to the Ghana Depositary for use) at the Shareholders’ Meeting |

| | |

| ZAR | means the South African Rand, being the lawful currency of South Africa |

| | |

| KEY MILESTONES AND INDICATIVE TIMELINES FOR AGA GHANA SECURITIES HOLDERS |

| | | |

| Activity | Date | Time |

Date on which Ghana AGA Shareholders must be recorded in the Ghana AGA Register to receive the Reorganisation Documents (Reorganisation Documents Record Date) | 21 July | 4 pm |

| | | |

| Circulation of Reorganisation Documents to Ghana AGA Shareholders | Latest by 27 July | 9 am |

| | | |

| Last date for verifying the identity of Ghana AGA Shareholders and granting them access to the platform for the Shareholders’ Meeting | 16 August 2023 | 12 noon |

| | | |

Last day to trade in Ghana AGA Ordinary Shares in order to be recorded in the Ghana AGA Register on the Voting Record Date (Voting Last Day to Trade) | 7 August | 4 pm |

| | | |

| Last day to trade in AGA GhDSs in order to be qualified to instruct the Ghana Depositary on the Voting Record Date | 7 August | 4 pm |

| | | |

| Voting Record Date (for Ghana AGA Shareholders and AGA GhDSs with composite AGA GhDSs) | 11 August | 9 am |

| | | |

| For administrative purposes, date by which Forms of Proxy for the Shareholders’ Meeting are requested to be lodged with AGA Ghana Registrar | 16 August | 12 noon |

| | | |

| Last date and time for Ghana AGA Shareholders to give notice to AGA objecting to the special resolution to approve the Scheme and/or the AGAH Sale (under Section 164 of the South African Companies Act, this must be at any time before the relevant votes take place) | 18 August | Any time before the vote on each resolution |

| | | |

| Shareholders’ Meeting | 18 August | 12 noon |

| | | |

| Results of Shareholders’ Meeting released by announcement on the GSE | 21 August | 9 am |

| | | |

| Results of Shareholders’ Meeting published in national newspapers | 22 August | N/A |

| | | |

| If the Reorganisation is approved by the required number of AGA Shareholders |

| Last day for AGA Shareholders who voted against the Scheme and/or AGAH Sale to require AGA to seek court approval for the Scheme and/or AGAH Sale in terms of Section 115(3)(a) of the South African Companies Act | 25 August | N/A |

| | | |

| Last day for AGA to send notice of the adoption of the special resolutions to approve the Scheme and/or the AGAH Sale to dissenting AGA Shareholders, in accordance with Section 164(4) of the South African Companies Act | 1 September | 2 pm |

| | | |

| Last day for an AGA Shareholder who voted against the Scheme and/or AGAH Sale to apply to court for leave to apply for a review of the Scheme and/or AGAH Sale in terms of Section 115(3)(b) of the South African Companies Act | 1 September | N/A |

| | | |

| Last day for an AGA Shareholder who gave notice to AGA objecting to the Scheme and/or AGAH Sale in terms of Section 164 of the South African Companies Act, to make a demand against AGA as contemplated in Section 164(7) of the South African Companies Act (assuming AGA provides the notice contemplated in Section 164(4) of the South African Companies Act on the last possible day) | 29 September | 2 pm |

| | | |

| If there is no court approval or review of the Scheme or the AGAH Sales such that the Reorganisation becomes unconditional |

| Finalisation date for the announcement that the Reorganisation is unconditional in every respect released on the GSE and to the media | 12 September | 8 am |

| | | |

| Last day to trade in AGA Ghana Securities in order to receive the NewCo Ghana Securities to be issued pursuant to the Reorganisation | 19 September | 4 pm |

| | | |

| Trading of AGA Ghana Securities on the GSE is suspended | 20 September | 8 am |

| | | |

Record Date on which AGA Ghana Securities Holders must be recorded in the Ghana AGA Register and the register maintained by the Ghana Depositary to receive the NewCo Ghana Securities (Reorganisation Consideration Record Date) | 22 September | 3 pm |

| | | |

| Implementation date of the Reorganisation – AGA Ghana Securities are debited from the relevant CSD Accounts | 25 September | 8 am |

| | | |

| Primary listing of NewCo (NewCo Ordinary Shares) on NYSE | 25 September | 1.30 pm |

| | | |

| The account held by the CSD with the relevant central securities depository participant in South Africa is credited with book-entry interest reflecting NewCo Ordinary shares | 26 September | Prior to commencement of trading |

| | | |

| CSD reflects corresponding book-entry interests in the CSD Accounts of the Ghana NewCo Shareholders (i.e. the Ghana AGA Shareholders as at the Reorganisation Consideration Record Date) | 26 September | Prior to commencement of trading |

| | | |

| CSD credits NewCo GhDSs into the relevant CSD Accounts of the AGA GhDS Holders | 26 September | Prior to commencement of trading |

| | | |

| Secondary listing of Ghana NewCo Ordinary Shares and NewCo GhDSs | 26 September | 10 am |

| | | |

| Delisting of Ghana AGA Ordinary Shares and AGA GhDSs | 27 September | 8 am |

| | | |

All dates provided are subject to change by the Sponsoring Broker in consultation with the NewCo Board (subject to obtaining the approval of the SEC). Any changes will be published in a national daily newspaper not later than 72 hours after receipt of approval from the SEC for such changes.

| 1. | OVERVIEW OF THE TRANSACTIONS UNDER THE REORGANISATION |

| | |

| | The statements in this Section 1 (Overview of the Transactions under the Reorganisation) are summaries of the relevant text in the Reorganisation Documents, and are subject to, the more detailed provisions of the Reorganisation Documents. For a full appreciation of the Reorganisation, AGA Ghana Securities Holders are urged to read the Reorganisation Documents in their entirety. |

| | |

| 1.1 | SUMMARY OF THE RELEVANT TRANSACTIONS |

| | |

| 1.1.1 | THE SPIN OFF |

| | |

| | AGA will effect a distribution in specie to the AGA Shareholders who are recorded as such in the AGA Register on the Reorganisation Consideration Record Date and who, by such date, have: |

| | |

| | (a) | not timeously delivered an Appraisal Rights demand to AGA in terms of section 164(5) to (8) of the South African Companies Act; or |

| | | |

| | (b) | timeously delivered an Appraisal Rights demand to AGA in terms of section 164(5) to (8) of the South African Companies Act but have had their rights reinstated in terms of section 164(10) of the South African Companies Act. |

| | |

| | Pursuant to this transaction, AGA will direct NewCo to issue 46,000 NewCo Ordinary Shares to the relevant AGA Shareholders on a pro rata basis with the aggregate subscription price of USD 46,000 paid by AGA. |

| | |

| | NewCo will redeem the 50,000 non-voting redeemable preference shares of GBP 1 each in the capital of NewCo and held by AGA, as a result of which such shares will automatically be treated as having been cancelled under English law. |

| | |

| | AGA will gift one NewCo Ordinary Share to NewCo by transferring such NewCo Ordinary Share (which was issued to AGA upon the incorporation of NewCo) to NewCo for nil consideration. NewCo will then take the necessary steps to cancel such NewCo Ordinary Share. |

| | |

| 1.1.2 | THE AGAH SALE |

| | |

| | NewCo has made (and AGA has the present, non-binding intention to accept) an irrevocable offer to AGA to purchase 100% of the issued shares in AGAH. If completed, the sale will constitute a disposal of all or a greater part of the assets or undertaking of AGA and will be subject to approval under Chapter 5 of the South African Companies Act in terms of sections 112 and 115 of the South Companies Act. The terms of NewCo’s irrevocable offer to AGA are stated in the Irrevocable Offer to Purchase. |

| | |

| 1.1.3 | THE SCHEME |

| | |

| | AGA intends to implement a scheme of arrangement in terms of sections 114(1) and 115 of the South African Companies Act between AGA and the AGA Shareholders, pursuant to which NewCo will acquire all of the issued AGA Ordinary Shares from the AGA Shareholders in consideration for the right and obligation of such AGA Shareholders to receive (ipso facto and without any action on the part of such AGA Shareholders) NewCo Ordinary Shares in proportion to their holding of AGA Ordinary Shares. |

| 1.2 | IMPLEMENTATION OF THE REORGANISATION |

| | |

| 1.2.1 | Conditions to the implementation of the Reorganisation |

| | |

| | The Implementation Agreement contains provisions related to the implementation of the Reorganisation, including suspensive conditions which must be fulfilled prior to the implementation of the Reorganisation and certain representations and warranties given by each of AGA and NewCo in relation to the Reorganisation. The conditions include the approval of the AGAH Sale and the Scheme by the AGA Shareholders. AGA will not request the AGA Shareholders to approve the Spin-Off. If all the conditions are not fulfilled or fulfilment is not waived (to the extent permitted by Applicable Law and the Implementation Agreement), the Reorganisation will not be implemented. Failure or inability to implement any one or more of the Spin-Off, the AGAH Sale and the Scheme will result in the failure of all of the steps comprising the Reorganisation and any steps already completed shall be unwound. The conditions have been set out in more detail under paragraph 7 of the Shareholder Circular. |

| | |

| 1.2.2 | Results of the implementation of the Reorganisation |

| | |

| | Upon the successful implementation of the Reorganisation: |

| | |

| | (a) | each AGA Shareholder will own one NewCo Ordinary Share for each AGA Ordinary Share held on the Reorganisation Consideration Record Date (subject to any adjustments to reflect the exercise of Appraisal Rights); |

| | | |

| | (b) | the existing AGA Shareholders will beneficially own the same percentage of NewCo Ordinary Shares as they held of AGA Ordinary Shares on the Reorganisation Consideration Record Date (subject to any adjustments to reflect the exercise of Appraisal Rights); |

| | | |

| | (c) | NewCo will be the listed ultimate parent company of the Group and each of AGA and AGAH will be a direct, wholly-owned subsidiary of NewCo. The business carried out by NewCo and its subsidiaries immediately following the implementation of the Reorganisation will be the same as the business carried out by AGA and its subsidiaries immediately prior to the implementation of the Reorganisation; |

| | | |

| | (d) | the AGA Shareholders will, instead of holding shares in a South Africa incorporated company, now hold shares in a United Kingdom incorporated company which is, among others, subject to English company law; |

| | | |

| | (e) | the NewCo Ordinary Shares to be issued pursuant to the Reorganisation will have a primary listing on the NYSE and secondary listings on the JSE, the A2X and the GSE; |

| | | |

| | (f) | the AGA Ordinary Shares will be delisted from the JSE and the GSE; |

| | | |

| | (g) | the securities accounts of the relevant AGA GhDSs holders will be debited of their entire holding of AGA GhDSs and credited with a proportionate holding of NewCo GhDSs; and |

| | | |

| | (h) | the NewCo GhDSs will be listed on the GSE and the AGA GhDSs will be delisted. |

| | | |

| 1.3 | DIAGRAMMATIC PRESENTATION OF CHANGES TO THE GROUP |

| | |

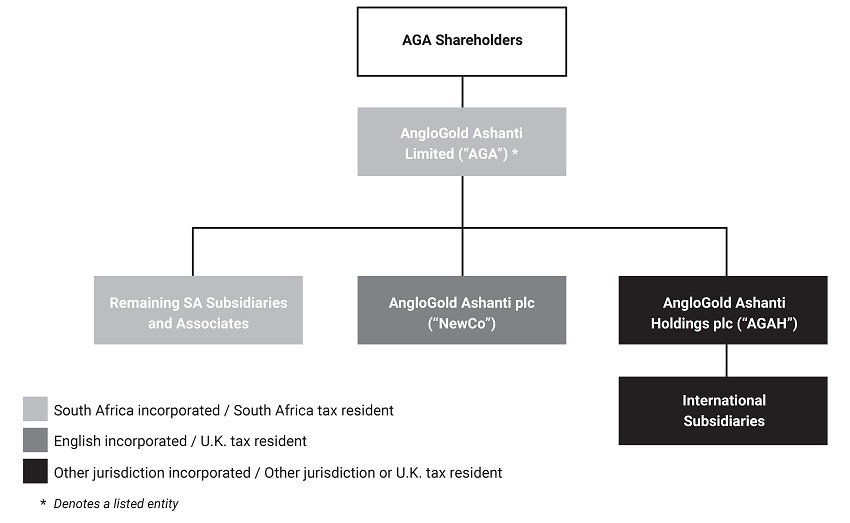

| 1.3.1 | Pre-implementation of the Reorganisation |

| | |

| | The diagram below indicates (in simplified form) the organisational structure of the Group immediately prior to the implementation of the Reorganisation. |

|

| Chart 1: Simplified organisational structure of the Group pre-Reorganisation |

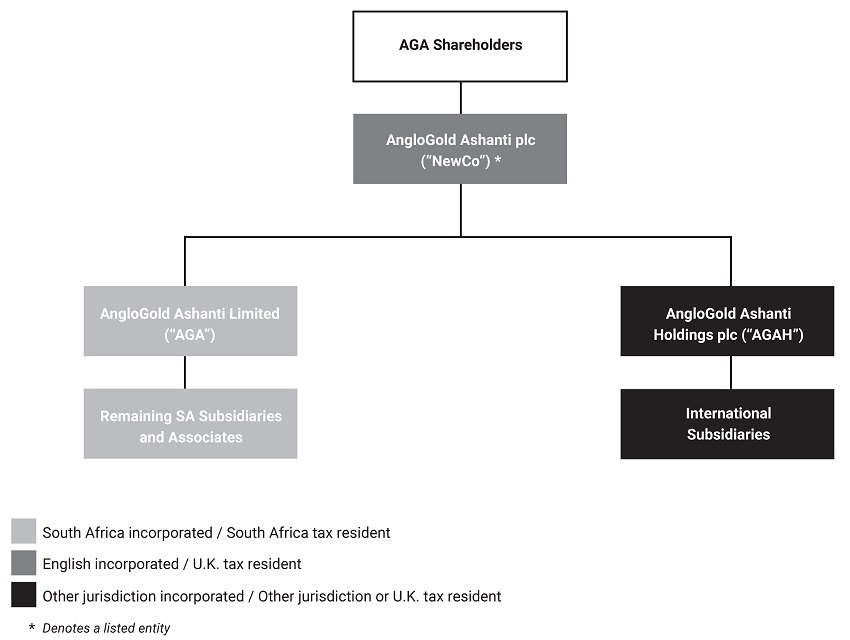

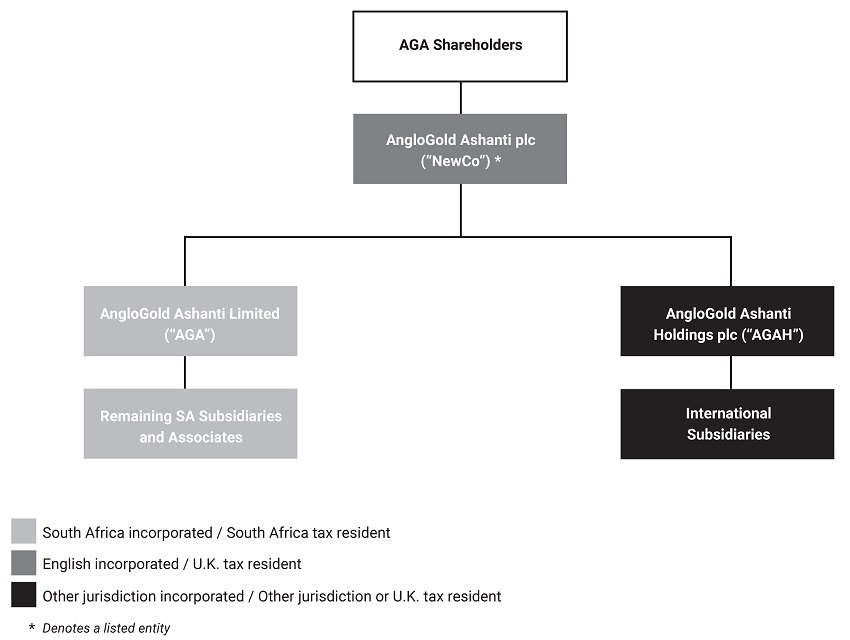

| 1.3.2 | Post implementation of the Reorganisation |

| | |

| | The diagram below indicates (in simplified form) the organisational structure of the Group immediately after the implementation of the Reorganisation. |

| | |

| Chart 2: Simplified organisational structure of the Group post-Reorganisation |

| 1.4 | LEGAL BASIS FOR THE REORGANISATION |

| | |

| | The AGA Board unanimously approved the proposal of the Reorganisation at a meeting held on 11 May 2023. The Reorganisation requires the prior approval of: |

| | |

| | (a) | the AGA Shareholders. This is being sought pursuant to the Shareholders’ Meeting; |

| | | |

| | (b) | the SEC on the basis that it involves an invitation to the holders of publicly listed corporate securities to (i) dispose of their securities, and (ii) acquire new corporate securities; and |

| | | |

| | (c) | the Bank of Ghana on the basis that (pursuant to operational guidelines issued by the Bank of Ghana under the Foreign Exchange Act) the prior approval of the Bank of Ghana is required for the issue of capital market instruments by non-resident persons in Ghana. |

| | | |

| 1.5 | RATIONALE BEHIND THE REORGANISATION |

| | | |

| 1.5.1 | In resolving to approve the Reorganisation, the AGA Board consulted with AGA’s management and legal, financial and tax advisors, and considered the following positive factors: |

| | | |

| | (a) | enhancing access to deeper pools of capital – changing the primary listing of the Group from the JSE to the NYSE will increase access to deeper pools of capital and broaden the Group’s appeal to North American and other international investors. This enhanced position could generate incremental demand and share trading liquidity. AGA expects the broader investment appeal and related shift in regulatory environment to enhance the Group’s strategic and financing flexibility; |

| | | |

| | (b) | improving the Group’s competitive position in line with its global peers – major global gold mining peers with primary listings in North America have significantly higher valuations and greater trading liquidity on U.S. exchanges than the Group does. AGA believes that a change in primary listing to the NYSE will increase the Group’s proximity to North American institutional investors and analysts, which is expected to improve valuation comparisons to North American peers and enhance share trading liquidity; |

| | | |

| | (c) | redomiciling to a leading, low-risk jurisdiction where the Group has a corporate presence – as a result of the Reorganisation, all of the Group’s operating entities will be held under NewCo, a United Kingdom incorporated entity which is subject to English company law. AGA believes this will provide an efficient legal, regulatory and tax framework for the Group and its shareholders which is expected to enhance strategic and financing flexibility, thereby broadening the appeal of the Group to investors. AGA expects to build upon the existing corporate infrastructure, relationships and knowledge of the Group in the United Kingdom, which stems from the management of AGAH (AGA’s principal holding company subsidiary) having been tax resident and headquartered in the United Kingdom since 2017; |

| | | |

| | (d) | minimal disruption to existing stakeholders – in addition to a primary listing of the NewCo Ordinary Shares on the NYSE, NewCo will seek secondary listings on the JSE and A2X, and a secondary listing on the GSE. As a result, the Group will continue to build upon already established listings and pools of liquidity. Furthermore, the Group proposes no changes to the membership of the AGA Board or to management, who remain focused on executing the Group’s strategy. The Reorganisation is not expected to result in any job losses and certain core corporate functions servicing the Group are expected to maintain a presence in South Africa. In addition the transaction costs and expenses of implementing the Reorganisation which are largely tied to factors such as the fair market value of AGAH (which in turn is related to, and driven by factors similar to that which determine, AGA’s market capitalization) and the ZAR/USD exchange rate, in each case on the date of implementation of the Reorganisation, are expected to be non-recurring. Based on current legislation, an assumed market capitalisation of AGA of ZAR 186,115 million, an AGA share price of ZAR 444 and a ZAR/USD exchange rate of 18.19, each as of 19 June 2023, these transaction costs and expenses are estimated to be approximately USD482 million, representing approximately 5% of the market capitalisation of AGA, consisting of tax costs payable in South Africa and Australia of approximately USD422 million as well as transaction expenses; |

| | (e) | continuity of shareholding structure – the Reorganisation will allow existing AGA Shareholders to maintain their investment in the Group in the same percentages as they held prior to the implementation of the Reorganisation (subject to any adjustments to reflect the exercise of appraisal rights); |

| | | |

| | (f) | tax treatment – the Reorganisation is not expected to be subject to U.S. federal or South African income tax generally, or to U.K. income tax or corporation tax for Non-U.K. Holders (as defined in the Shareholder Circular) and is expected to be broadly tax neutral for the Group on a going-forward basis, following the payment of one-off transaction taxes in South Africa and Australia; and |

| | | |

| | (g) | accounting treatment - for accounting purposes, the Reorganisation does not result in a business combination as defined under IFRS 3 “Business Combinations”. This is because no party to the Reorganisation can be identified as an accounting acquirer in the transaction and the Reorganisation does not result in any change in ownership, economic substance or carrying values for the Group. As such, the consolidated financial statements of the successor (i.e. NewCo) will reflect that the Reorganisation is in substance a continuation of the Group and the consolidated financial statements of the predecessor (i.e. AGA) will become the comparative consolidated financial statements of that successor, adjusted for any reclassification between share capital and other reserves as of the date of implementation of the Reorganisation. |

| | |

| 1.5.2 | The AGA Board considered the following negative factors and risks; |

| | |

| | (a) | significant costs and expenses – the Group will incur significant nonrecurring transaction costs and expenses (expected to be around 5% of the market capitalisation of AGA) in connection with the implementation of the Reorganisation. Further, the Reorganisation is not expected to result in any significant cost savings or synergies for the Group, despite the other benefits outlined under Section 1.5.1 above; and |

| | | |

| | (b) | risk of failure to implement the Reorganisation timely – failure to timely implement the Reorganisation could negatively affect the market price of AGA Ordinary Shares. |

| | | |

| 1.6 | REORGANISATION DOCUMENTS |

| | | |

| | All AGA Shareholders are bound by, and are deemed to have knowledge of, all the provisions of the Reorganisation Documents and the various documents referred to or incorporated therein. Copies of all the Reorganisation Documents are available for inspection during usual business hours at the offices of the AGA Ghana Registrar and on the website of AGA at https://www.anglogoldashanti.com. |

| 2. | ACTIONS REQUIRED TO APPROVE THE REORGANISATION |

| | |

| 2.1 | DETAILS OF THE AGA SHAREHOLDERS MEETING |

| | |

| | AGA has convened a meeting of the AGA Shareholders (the Shareholders’ Meeting) which will be conducted entirely by electronic communication on Friday 18 August 2023 at 12:00 noon, or such other date, time and/or location as determined and announced in accordance with Applicable Law. The Meeting Specialist Proprietary Limited (TMS) (which has been appointed by AGA to host the Shareholders’ Meeting) will provide AGA and the AGA Shareholders with access to its electronic communication platform (the Platform) to enable all AGA Shareholders who are present at the Shareholders’ Meeting to communicate concurrently with each other and exercise their voting rights at the Shareholders’ Meeting. AGA has appointed TMS and the AGA Ghana Registrar to verify the identity of any person who wishes to attend and vote at the Shareholders’ Meeting (either as an AGA Shareholder (or AGA Shareholder’s representative) or as a proxy for an AGA Shareholder) and that person will only be granted access to the Platform after providing reasonably satisfactory evidence of identification to the AGA Ghana Registrar and TMS. Any person who wishes to attend the Shareholders’ Meeting is entitled to contact the AGA Ghana Registrar and TMS at any time prior to the conclusion of the Shareholders’ Meeting to be verified and provided with access to the Platform. However, to avoid any delays in being provided with access to the Platform, all relevant Ghana AGA Shareholders are encouraged to contact the AGA Ghana Registrar by email at kmatekole@nthc.com.gh (and copied to TMS at proxy@tmsmeetings.co.za) as soon as possible, but not later than 12 noon on 16 August 2023. |

| | |

| | At the Shareholders’ Meeting, the AGA Shareholders will be requested to consider and, if deemed fit, to pass, with or without modification, the resolutions set out in the notice issued by AGA to convene the Shareholders’ Meeting (a form of which has been circulated with and forms part of the Shareholder Circular) (the Shareholders’ Meeting Notice). The Shareholders’ Meeting Notice and Reorganisation Documents will be circulated to all Ghana AGA Shareholders as at the Reorganisation Documents Record Date. If you hold Ghana AGA Ordinary Shares through a broker, nominee or other intermediary arrangement, kindly contact such broker, nominee or intermediary concerning your rights in respect of receiving the Reorganisation Documents and participating in the Shareholders’ Meeting. |

| | |

| 2.2 | OVERVIEW OF AGA GHANA SECURITIES HOLDERS |

| | |

| 2.2.1 | Types of AGA Ghana Securities |

| | |

| | The types of AGA Ghana Securities are as follows: |

| | |

| | (a) | Certificated AGA GhDSs; |

| | | |

| | (b) | Certificated Ghana AGA Ordinary Shares |

| | | |

| | (c) | Dematerialised AGA GhDSs; and |

| | | |

| | (d) | Dematerialised Ghana AGA Ordinary Shares. |

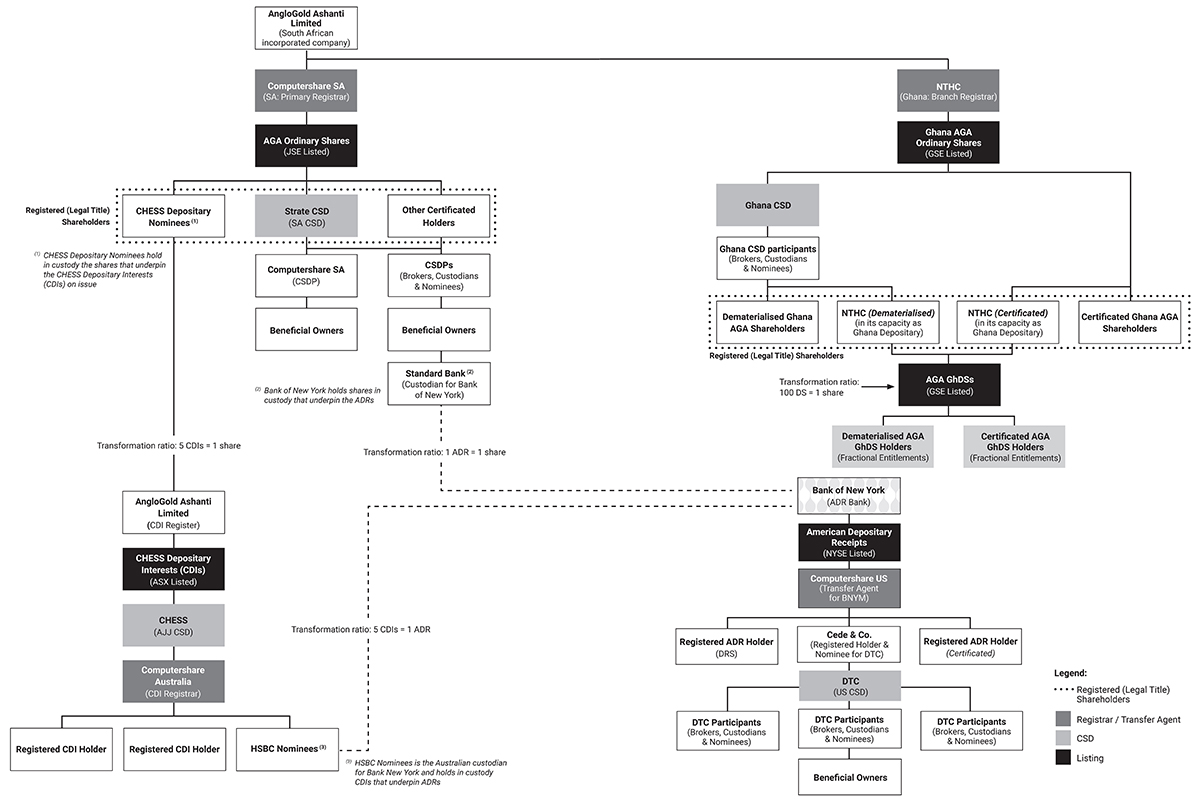

| 2.2.2 | Diagrammatic presentation of AGA Ghana Securities |

| | |

| Chart 3: Structure of the AGA Ghana Securities |

| | |

| 2.3 | AGA GHANA SECURITIES HOLDERS ENTITLED TO PARTICIPATE IN THE AGA SHAREHOLDERS MEETING |

| | |

| 2.3.1 | Certificated Ghana AGA Shareholders |

| | |

| | 2.3.1.1 | As the holder of AGA Ordinary Shares in certificated form, you may participate in the Shareholders’ Meeting by electronic communication as outlined in the Shareholders’ Meeting Notice. |

| | | |

| | 2.3.1.2 | If you do not wish (or are unable) to participate in the Shareholders’ Meeting personally, you may appoint one or more proxies (who do not need to be AGA Shareholders) to participate in your place by completing the Form of Proxy in accordance with the instructions therein, and returning it together with proof of identification (i.e. valid identity document such as Ghana card or passport) and authority to do so (where acting in a representative capacity), to the AGA Ghana Registrar by email (at kmatekole@nthc.com.gh) or by hand delivery or courier to its physical address (at Martco House, Okai-Mensah Link, Off Kwame Nkrumah Avenue, Adabraka) by no later than 48 hours before the shareholders meeting. The Form of Proxy may also be handed to the chairman of the Shareholders’ Meeting, at any time before the commencement of the voting at the Shareholders’ Meeting. |

| | | |

| | 2.3.1.3 | To receive the Ghana NewCo Ordinary Shares, you shall be required to surrender the Documents of Title in respect of all your Ghana AGA Ordinary Shares to the AGA Ghana Registrar and comply with Section 2.3.4 (Opening a CSD Account) below to open a CSD Account by no later than 4pm on the Reorganisation Consideration Record Date. |

| | | |

| | 2.3.1.4 | You may surrender your Documents of Title by completing the Form of Surrender and Transfer in accordance with its instructions and ensuring that the completed Form of Surrender and Transfer, together with the relevant Documents of Title, are received by the AGA Ghana Registrar no later than 10am on the Reorganisation Consideration Record Date. |

| | | |

| | 2.3.1.5 | If you fail to surrender your Documents of Title and create a CSD Account in accordance with Section 2.3.1.3 and Section 2.1.3.4 above: |

| | | (a) | (in the event that the Reorganisation is approved at the Shareholders’ Meeting and regardless of whether you voted in favour of the Reorganisation) you shall still be required to surrender your Documents of Title and shall be unable to trade or undertake any subsequent action in relation to your Certificated Ghana AGA Ordinary Shares. Further, Ghana NewCo Ordinary Shares proportionate to your holding under the Certificated Ghana AGA Ordinary Shares will be credited into an omnibus CSD Account holding the interests of all Certificated Ghana AGA Shareholders who failed to comply with the requirements of this Section 2.3.1 (Certificated Ghana AGA Shareholders) until such time as you open a CSD Account; or |

| | | | |

| | | (b) | (in the event that the Reorganisation is not approved at the Shareholders’ Meeting) book-entry interests attributable to your Certificated Ghana AGA Ordinary Shares will be credited into an omnibus CSD Account holding the interests of all Certificated Ghana AGA Shareholders who failed to open a CSD Account. Thereafter, you shall be unable to trade or undertake any subsequent action in relation to your Ghana AGA Ordinary Shares until such time that you notify the AGA Ghana Registrar of the details of your CSD Account and have your Dematerialised Ghana AGA Ordinary Shares credited into your CSD Account. |

| | | | |

| | 2.3.1.6 | Kindly note that if the Reorganisation is implemented, you shall be required to surrender your Documents of Title (regardless of whether you voted in favour of the Reorganisation). |

| | |

| 2.3.2 | Dematerialised Ghana AGA Shareholders |

| | | |

| | 2.3.2.1 | You may participate in the Shareholders’ Meeting by electronic communication as outlined in the Shareholders’ Meeting Notice. |

| | | |

| | 2.3.2.2 | If you do not wish (or are unable) to participate in the Shareholders’ Meeting personally, you may appoint one or more proxies (who do not need to be AGA Shareholders) to participate in your place by completing the Form of Proxy in accordance with the instructions therein, and returning it together with proof of identification (i.e. valid identity document such as Ghana card or passport) and authority to do so (where acting in a representative capacity), to the AGA Ghana Registrar by email (at kmatekole@nthc.com.gh) or by hand delivery or courier to its physical address (at Martco House, Okai-Mensah Link, Off Kwame Nkrumah Avenue, Adabraka) by no later than 48 hours before the shareholders meeting. The Form of Proxy may also be handed to the chairman of the Shareholders’ Meeting, at any time before the commencement of the voting at the Shareholders’ Meeting. |

| | | |

| | 2.3.2.3 | In the event that the Reorganisation is implemented, you will have your CSD Account debited with your Dematerialised Ghana AGA Ordinary Shares and credited with Ghana NewCo Ordinary Shares. Should the Reorganisation not be implemented, you will retain your Dematerialised Ghana AGA Ordinary Shares and will not be entitled to receive any Ghana NewCo Ordinary Shares. |

| | | |

| 2.3.3 | AGA GhDS Holders |

| | | |

| | 2.3.3.1 | Under the terms of the Ghana Depositary Agreement, the right to vote at general meetings of AGA is limited to AGA GhDS Holders holding a composite AGA GhDSs (i.e. 100 AGA GhDSs). Such AGA GhDS Holders are required to exercise their voting rights by written instruction to the Ghana Depositary, directing the Ghana Depositary on how to vote in respect of the Ghana AGA Ordinary Shares that the composite AGA GhDSs represent. |

| | | |

| | 2.3.3.2 | If you are an AGA GhDS Holder, you should receive a voting instruction request from the Ghana Depositary informing you of the record date by which you are required to instruct the Ghana Depositary as to the exercise of the voting rights attributable to the number of Ghana AGA Ordinary Shares which your composite AGA GhDSs represent (the GhDS Instruction Date). |

| | | |

| | 2.3.3.3 | If you do not provide the Ghana Depositary with your voting instructions in a timeous manner, the Ghana AGA Ordinary Shares underlying your AGA GhDSs will (subject to Section 2.3.3.4 below) not be counted to establish a quorum to open the Shareholders’ Meeting, voted in respect of the proposed resolutions, or taken into account in calculating whether the requisite majority required to approve the proposed resolutions has been achieved. |

| APPENDIX: LEGAL COMPLIANCE LETTER |

C269

25 July 2023

Securities and Exchange Commission

30, Third Circular Road, Cantonments

Accra, Ghana

Attention: The Director-General

Ghana Stock Exchange

5th Floor, Cedi House, Liberia Road

Accra, Ghana

Attention: The Managing Director

Dear Sirs,

OPINION OF GHANA LEGAL COUNSEL IN RELATION TO PROPOSED REORGANISATION OF ANGLOGOLD ASHANTI LIMITED AND THE LISTING (BY INTRODUCTION) OF NEW EQUITY SECURITIES OF ANGLOGOLD ASHANTI PLC ON THE GHANA STOCK EXCHANGE

| 1. | INTRODUCTION |

| | |

| 1.1 | Basis of instruction |

| | | | |

| | 1.1.1 | We have acted as Ghanaian legal counsel to AngloGold Ashanti Limited (AGA) a company incorporated under the laws of South Africa with registration number 1944/017354/06 and AngloGold Ashanti Plc (New Co), a company incorporated under the laws of England and Wales with company number 14654651 in connection with the Reorganisation (as defined in the Ghana Supplement (as defined below)). |

| | |

| | 1.1.2 | Unless otherwise indicated, all expressions defined in the Ghana Supplement (as defined under paragraph 1.2.1.3 below) have the same meanings when used in this opinion. |

| | |

| | 1.1.3 | This opinion supersedes our opinion dated 12 July 2023 and issued to the addressees in respect of the subject matter herein. |

| | | | |

| 1.2 | Documents examined |

| | |

| | 1.2.1 | For the purpose of giving this opinion, we have examined final draft and/or executed versions of the following documents (the Reorganisation Documents): |

| | |

| | | 1.2.1.1 | the pre-listing statement dated 7 July 2023 and prepared by NewCo in connection with the secondary listing of the shares of NewCo on the Johnnesburg Stock Exchange; |

| | |

| | | 1.2.1.2 | the combined shareholder circular dated 7 July 2023 and issued by AGA in connection with the Reorganisation; |

CONFIDENTIAL

| | | 1.2.1.3 | the supplementary information memorandum to be issued by NewCo (on behalf of AGA and NewCo) in connection with the Reorganisation and the GSE Listing (the Ghana Supplement); and |

| | | | |

| | | 1.2.1.4 | the registration statement on Form F-4 (US SEC File No. 333- 272867) initially filed by NewCo with the United States Securities and Exchange Commission on 23 June 2023 in connection with the primary listing of the shares of NewCo on the New York Stock Exchange. |

| | | | |

| | 1.2.2 | In addition, we have examined originals or copies certified to our satisfaction of the following documents: |

| | | | |

| | | 1.2.2.1 | the letter dated 29 June 2023 and issued by Stanbic Bank Ghana (Stanbic) (acting on behalf of NewCo and AGA) to the Securities and Exchange Commission (the SEC) (the SEC Application Letter); |

| | | | |

| | | 1.2.2.2 | the letter from the SEC dated 17 July 2023 2023 and granting the requests under the SEC Application Letter (the SEC Approval Letter); |

| | | | |

| | | 1.2.2.3 | the letter dated 29 June 2023 and issued by SBG Securities LTD to the Ghana Stock Exchange (the GSE) regarding, among others, an application for the listing of the NewCo Ghana Securities on the GSE (the GSE Application Letter); |

| | | | |

| | | 1.2.2.4 | the letter from the GSE dated 24 July 2023 and granting the requests under the GSE Application Letter (the GSE Approval Letter); and |

| | | | |

| | | 1.2.2.5 | the letter dated 5 July 2023 and issued by us (on behalf of NewCo) to the Bank of Ghana regarding the issuance of the NewCo Ghana Securities to the NewCo Ghana Securities Holders (the BoG Application Letter). |

| | | | |

| 1.3 | Scope and purpose of the opinion |

| | | | |

| | 1.3.1 | We are qualified to practise law in Ghana. This opinion is limited to matters of Ghanaian law as in force and applied at the date of this opinion. We have not investigated the laws of any country other than Ghana and we express no opinion on the laws of any other jurisdiction. |

| | | | |

| | 1.3.2 | This opinion is given on the basis of the assumptions set out in Schedule A (Assumptions) and is subject to the qualifications set out in Schedule B (Qualifications). |

| | | | |

| 2. | OPINION |

| | | | |

| | Based on the preceding paragraphs, we are of the opinion that: |

| | | | |

| 2.1 | Regulatory approvals, consents and notifications |

| | | | |

| | 2.1.1 | Under section 304(1) of the Companies Act, 2019 (Act 992) (the Companies Act), a person inviting the public in Ghana to dispose of the shares of a public |

CONFIDENTIAL

| | | company must deliver a prospectus to the SEC for examination and approval. The Reorganisation involves an invitation to the AGA Ghana Securities Holders to dispose of their holdings by transferring their Ghana AGA Ordinary Shares to NewCo and receiving a proportionate number of Ghana NewCo Ordinary Shares. NewCo has (on behalf of itself and AGA) complied with this requirement by delivering the Ghana Supplement to the SEC for approval. |

| | | | |

| | 2.1.2 | The SEC is mandated to authorise and regulate the issuance of securities in Ghana by foreign issuers in accordance with section 3(l) of the Securities Industry Act, 2016 (Act 929) (as amended) (the Securities Industry Act). The SEC has (through the SEC Approval Letter) authorised NewCo to issue the NewCo securities in Ghana. |

| | | | |

| | 2.1.3 | The Ghana Supplement is required to be approved by the SEC in accordance with section 3(k) of the Securities Industry Act and regulation 51(1) of the Securities and Exchange Commission Regulations, 2003 (L.I. 1728) (the SEC Regulations). The SEC has (through the SEC Approval Letter) approved the Ghana Supplement. |

| | | | |

| | 2.1.4 | The application for the listing of the NewCo Ghana Securities on the GSE is required to be approved by the GSE in accordance with the listing rules of the GSE dated 2006 (the GSE Listing Rules). The GSE has (through the GSE Approval Letter) granted its approval for the listing of the NewCo Ghana Securities. |

| | | | |

| | 2.1.5 | The prior approval of the Bank of Ghana is required for the issuance of securities in Ghana by a non-resident person such as NewCo. NewCo has (through the BoG Application Letter) requested for the approval of the Bank of Ghana to issue the NewCo Ghana Securities. |

| | | | |

| | 2.1.6 | The voluntary delisting of the AGA Ghana Securities from the GSE requires 60 calendar days’ prior notice to the GSE. AGA has satisfied this requirement through the GSE Application Letter, which notified the GSE of the intention to delist the AGA Ghana Securities. |

| | | | |

| | 2.1.7 | Apart from the approvals referred to under this paragraph 2.1, no regulatory approvals, consents, licensing or authorisations are required for the Reorganisation. |

| | | | |

| 2.2 | Ghana Supplement |

| | | | |

| | 2.2.1 | Subject to the requirements in respect of which waivers have been granted under the SEC Approval Letter, the Ghana Supplement complies with the relevant disclosure requirements and provisions of the SEC Regulations. |

| | | | |

| | 2.2.2 | Subject to the requirements in respect of which waivers have been granted under the GSE Approval Letter, the Ghana Supplement and the application for the listing of the NewCo Ghana Securities comply with the relevant provisions of the GSE Listing Rules. |

| | | | |

| | 2.2.3 | The Ghana Supplement is exempted from complying with the requirements of Schedule 10 of the Companies Act because the invitation being made pursuant to the Reorganisation is exclusively limited to the existing holders of the AGA Ghana Securities. |

CONFIDENTIAL

| 2.3 | Taxes and stamp duty |

| | | | |

| | 2.3.1 | The statements in the Ghana Supplement regarding taxation in Ghana are correct in all material respects. |

| | | | |

| | 2.3.2 | The Ghana Supplement is not subject to stamp duty under the Stamp Duty Act, 2005 (Act 689). |

| | | | |

| 2.4 | Registrations and filings |

| | | | |

| | 2.4.1 | No registration or filing is required at any registry for the Ghana Supplement to be valid, binding and enforceable in accordance with its terms. |

| | | | |

| | 2.4.2 | Notwithstanding paragraph 2.4.1 above, the Ghana Supplement is required to be filed with the Office of the Registrar of Companies, in accordance with the Companies Act. There will be no adverse legal effect on the Ghana Supplement if it is not duly filed. |

Yours faithfully,

/s/ Seth Asante

Seth Asante

(Partner and Head of Financial Institutions and Capital Markets)

Bentsi-Enchill, Letsa & Ankomah

CONFIDENTIAL

Schedule A

Assumptions

In giving this opinion, we have assumed (and this opinion is given on the basis) that:

| 1. | all original documents supplied to us are complete, authentic and up-to-date, and that all copy documents supplied to us are complete and conform to the originals; |

| | |

| 2. | if there is any requirement in any jurisdiction (other than Ghana) which might affect the legality, binding effect and enforceability of the Reorganisation Documents and the transactions contemplated thereunder in such jurisdiction, such requirement has been satisfied; and |

| | |

| 3. | all disclosures made to us by AGA and NewCo (and as reflected in the Ghana Supplement) are materially correct as at the date of this opinion and no event has occurred which undermines or may undermine the correctness of those disclosures. |

We have found nothing to indicate that the above assumptions are not justified.

CONFIDENTIAL

Schedule B

Qualifications

This opinion is subject to the following qualifications:

| 1. | we have not independently verified the information contained in the Reorganisation Documents. Accordingly, nothing contained in the Reorganisation Documents is to be construed (or shall be relied upon) as a promise, warranty or representation (whether to the past or the future) by us, regarding the accuracy or completeness of such information at any time; |

| | |

| 2. | as at the date of this certificate, the BoG has not granted the approval being sought under the BoG Application Letter; |

| | |

| 3. | the enforcement of the Ghana Supplement may be limited by any laws relating to insolvency, reorganisation, moratorium or other similar laws affecting creditors’ rights generally; and |

| | |

| 4. | any claims may be or become barred under laws relating to the limitation of actions or may be or become subject to set-off or counterclaim. |