SCHEDULE 14A INFORMATION

Proxy Statement Pursuant to Section 14(a) of the

Securities Exchange Act of 1934

(Amendment No. )

Filed by the Registrant x Filed by a Party other than the Registrant ¨

Check the appropriate box:

| x | Preliminary Proxy Statement |

| ¨ | Confidential for Use of the Commission Only (as permitted by Rule 14a-6[e][2]) |

| ¨ | Definitive Proxy Statement |

| ¨ | Definitive Additional Materials |

| ¨ | Soliciting Material Pursuant to § 240.14a-12 |

BERKSHIRE HATHAWAY INC.

(Name of Registrant as Specified In Its Charter)

(Name of Person(s) Filing Proxy Statement If Other Than The Registrant)

Payment of Filing Fee (Check the appropriate box):

| x | No fee required |

| ¨ | Fee computed on table below per Exchange Act Rules 14a-6(i)(4) and 0-11. |

| 1) | Title of each class of securities to which transaction applies: |

| 2) | Aggregate number of securities to which transaction applies: |

| 3) | Per unit price or other underlying value of transaction computed pursuant to Exchange Act Rule 0-11: (Set forth the amount on which the filing fee is calculated and state how it was determined.) |

| 4) | Proposed maximum aggregate value of transaction: |

| 5) | Total fee paid: |

| ¨ | Fee paid previously with preliminary materials. |

| ¨ | Check box if any part of the fee is offset as provided by Exchange Act Rule 0-11(a)(2) and identify the filing for which the offsetting fee was paid previously. Identify the previous filing by registration statement number, or the Form or Schedule and the date of its filing. |

| 1) | Amount Previously Paid: |

| 2) | Form, Schedule or Registration Statement No.: |

| 3) | Filing Party: |

| 4) | Date Filed: |

BERKSHIRE HATHAWAY INC.

3555 Farnam Street

Omaha, Nebraska 68131

NOTICE OF SPECIAL MEETING OF SHAREHOLDERS

January , 2010

TO THE SHAREHOLDERS:

Notice is hereby given that a Special Meeting of the Shareholders of Berkshire Hathaway Inc. (the “Corporation”) will be held at [ ], on January , 2010 at [time] for the following purposes:

| 1. | To approve the restatement of the Corporation’s existing Restated Certificate of Incorporation, as amended, to effect the following changes: (1) effect a 50-for-1 stock split of the Corporation’s Class B Common Stock, and, in connection with such stock split, inversely proportionally adjust the economic and voting rights of each share of Class B Common Stock and proportionally adjust the conversion yield of each share of the Corporation’s Class A Common stock, (2) increase the number of shares of Class B Common Stock that the Corporation is authorized to issue, from 55,000,000 shares to 3,225,000,000 shares, and increase the total number of shares of all classes of stock that the Corporation is authorized to issue by the number of additional shares of Class B Common Stock, from 57,650,000 shares to 3,227,650,000 shares, (3) decrease the par value of each share of Class B Common Stock from $0.1667 to $0.0033, (4) clarify the language of Article Fourth Section 2.B. of the Corporation’s existing Restated Certificate of Incorporation to provide that the Class B Common Stock may be split on the effective date of the restatement of the existing Restated Certificate of Incorporation without splitting the Class A Common Stock, and (5) remove the requirement to issue physical stock certificates for shares of Class B Common Stock upon conversion of shares of Class A Common Stock. |

| 2. | To consider and act upon any other matters that may properly come before the meeting or any adjournment or postponement thereof by or at the direction of the Board of Directors of the Corporation. |

The Board of Directors has fixed the close of business on November 30, 2009 as the record date for determining the shareholders having the right to vote at the meeting or any adjournment or postponement thereof. A list of such shareholders will be available for examination by a shareholder for any purpose germane to the meeting during ordinary business hours at the offices of the Corporation at 3555 Farnam Street, Omaha, Nebraska, during the ten days prior to the meeting.

You are encouraged to date, sign and return the enclosed proxy which is solicited by the Board of Directors of the Corporation and will be voted as indicated in the accompanying proxy statement and proxy. A return envelope is provided which requires no postage if mailed in the United States. If mailed elsewhere, foreign postage must be affixed.

By order of the Board of Directors

FORREST N. KRUTTER,Secretary

Omaha, Nebraska

[ ], 2009

In order to attend the meeting, you must present a proxy card if you are a record owner or a copy of a broker’s statement showing shares held for your benefit on November 30, 2009 if you are a beneficial-but-not-of-record owner.

BERKSHIRE HATHAWAY INC.

3555 Farnam Street

Omaha, Nebraska 68131

PROXY STATEMENT

FOR SPECIAL MEETING OF SHAREHOLDERS

January , 2010

This statement is furnished in connection with the solicitation by the Board of Directors of Berkshire Hathaway Inc. (hereinafter the “Corporation,” the “Company,” “Berkshire,” “we,” “us” and “our”) of proxies in the accompanying form for a Special Meeting of Shareholders to be held on , January , 2010 at [time] and at any adjournment or postponement thereof. This proxy statement and the enclosed form of proxy were first sent to shareholders on or about [ , 2009]. If the form of proxy enclosed herewith is executed and returned as requested, it may nevertheless be revoked at any time prior to exercise by filing an instrument revoking it or a duly executed proxy bearing a later date. Solicitation of proxies will be made at the Corporation’s expense. The Corporation will reimburse brokerage firms, banks, trustees and others for their actual out-of-pocket expenses in forwarding proxy material to the beneficial owners of its common stock.

As of the close of business on November 30, 2009, the record date for the Special Meeting (the “Record Date”), the Corporation had outstanding and entitled to vote [ ] shares of Class A Common Stock (hereinafter called “Class A Stock”) and [ ] shares of Class B Common Stock (hereinafter called “Class B Stock”). Each share of Class A Stock is entitled to one vote per share and each share of Class B Stock is entitled to one-two-hundredth (1/200th) of one vote per share on all matters submitted to a vote of shareholders of the Corporation.

The presence at the meeting, in person or by proxy, of the following shall constitute a quorum for the transaction of business: (1) the holders of Class A Stock and Class B Stock holding in the aggregate a majority of the voting power of the Corporation’s outstanding stock entitled to vote, (2) the holders of a majority of the outstanding shares of Class A Stock, and (3) the holders of a majority of the outstanding shares of Class B Stock. A majority of the voting power of the outstanding Class A Stock and Class B Stock, voting together as a single class, a majority of the outstanding Class A Stock, voting as a separate class, and a majority of the outstanding Class B Stock, voting as a separate class, are required to approve the proposed restatement of the Corporation’s Restated Certificate of Incorporation, as amended. A majority of votes properly cast upon any other question shall decide the question. Abstentions and broker non-votes will count for purposes of establishing a quorum but will not count as votes cast, and accordingly will have the effect of votes against the proposed restatement of the Corporation’s Restated Certificate of Incorporation. Shareholders who send in proxies but attend the meeting in person may vote directly if they prefer and withdraw their proxies or may allow their proxies to be voted with the similar proxies sent in by other shareholders.

IMPORTANT NOTICE REGARDING THE AVAILABILITY OF PROXY MATERIALS FOR THE SHAREHOLDER MEETING TO BE HELD ON JANUARY , 2010.

The Proxy Statement for the Special Meeting of Shareholders to be held on January , 2010 is available at [www.berkshirehathaway.com/eproxy].

1. APPROVAL OF RESTATEMENT OF CURRENT RESTATED CERTIFICATE OF INCORPORATION

The Board of Directors has unanimously approved, has declared to be advisable and is recommending to the shareholders of the Corporation for approval, the restatement of the Corporation’s existing Restated Certificate of Incorporation, as amended (the “Current Certificate”) to effect the following changes: (1) effect a 50-for-1 stock split of the Corporation’s Class B Stock, and, in connection with such stock split, inversely proportionally adjust the economic and voting rights of each share of Class B Stock and proportionally adjust the conversion yield of each share of the Corporation’s Class A Stock, (2) increase the number of shares of Class B Stock that the Corporation is authorized to issue, from 55,000,000 shares to 3,225,000,000 shares, and increase the total number of shares of all classes of stock that the Corporation is authorized to issue by the number of additional shares of Class B Stock, from 57,650,000 total shares to 3,227,650,000 total shares, (3) decrease the par value of each share of Class B Stock from $0.1667 to $0.0033, (4) clarify the language of Article Fourth Section 2.B. of the Current Certificate to provide that the Class B Stock may be split on the effective date of the restatement of the Current Certificate without splitting the Class A Stock, and (5) remove the requirement to issue physical stock certificates for shares of Class B Common Stock upon conversion of shares of Class A Stock (the proposed restatement of the Current Certificate to effect all of these changes, which is attached hereto as Exhibit A, the “Restated Certificate”).

In addition to the changes described above, the Restated Certificate will incorporate all prior amendments to the Current Certificate, which prior amendments have already been approved and are on file in Delaware as part of the documents constituting the Current Certificate. The changes proposed to be made to the Current Certificate are marked as additions or deletions in Exhibit A. The summary contained herein of the changes to be effected by the Restated Certificate should be read in conjunction with and is qualified in its entirety by reference to the full text of the Restated Certificate set forth in Exhibit A.

If the Restated Certificate is approved by (1) a majority of the voting power of the outstanding Class A Stock and Class B Stock, voting together as a single class, (2) a majority of the outstanding Class A Stock, voting as a separate class, and (3) a majority of the outstanding Class B Stock, voting as a separate class, the Restated Certificate will become effective upon filing with the Delaware Secretary of State and the occurrence of the effective time specified at the time of such filing, which is expected to occur promptly after the Special Meeting.

Purpose and Effects of the Changes Proposed to the Current Certificate

The proposed Restated Certificate would effect a 50-for-1 stock split of the Corporation’s Class B Stock. As a result, at the effective time of the Restated Certificate, each outstanding share of Class B Stock will be subdivided into fifty (50) shares of Class B Stock. The Restated Certificate includes inversely proportional adjustments to the economic and voting rights of the Class B Stock, which are necessary to leave holders of Class B Stock with the same economic and voting rights relative to Class A Stock upon the split of each share of Class B Stock into 50 shares of Class B Stock. In each place where the Current Certificate specifies that a share of Class B Stock is entitled to one-thirtieth (1/30th) of that to which a share of Class A Stock is entitled, this ratio will be changed to one-fifteen-hundredth (1/1,500th). The voting power of each share of Class B Stock will be decreased from the current ratio of one-two-hundredth (1/200th) of the vote of one share of Class A Stock to one-ten-thousandth (1/10,000th) of the vote of one share of Class A Stock. In addition, the par value of each share of Class B Stock will be changed to $0.0033 from the current par value of $0.1667 per share of Class B Stock. Similarly, certain changes are necessary to leave holders of Class A Stock with the same economic rights relative to the Class B Stock upon the effectiveness of the Class B stock split. The Restated Certificate proportionally adjusts the conversion yield of each share of the Corporation’s Class A Stock, so that upon the effectiveness of the stock split, each share of Class A Stock may be converted into one thousand five hundred (1,500) shares of Class B Stock rather than thirty (30) shares of Class B Stock, and proportionally increases from thirty (30) to one thousand five hundred (1,500) the number of shares of Class B Stock that must be reserved for conversion of each outstanding share of Class A Stock.

Berkshire does not have enough authorized but unissued shares of Class B Stock to subdivide each outstanding share of Class B Stock into fifty (50) shares of Class B Stock. In addition, Berkshire does not have enough authorized but unissued shares of Class B Stock to permit conversions of outstanding shares of Class A Stock to shares of Class B Stock on a post-split basis or to be able to issue each currently authorized but unissued share of Class A Stock, in light of the requirement that we keep reserved the number of shares of Class B Stock issuable upon conversion of each outstanding share of Class A Stock. The Restated Certificate would increase the number of shares of Class B Stock that the Corporation is authorized to issue, from 55,000,000 shares to 3,225,000,000 shares. This increase would provide us with sufficient authorized and unissued shares of Class B Stock for each of these purposes, based on our outstanding shares of Class A Stock and Class B Stock as of the date of this proxy statement. To permit this increase in the number of authorized shares of Class B Stock, the proposed Restated Certificate would also increase the total number of shares of all classes of stock that the Corporation is authorized to issue by the number of additional authorized shares of Class B Stock, from 57,650,000 shares to 3,227,650,000 shares.

The proposed Restated Certificate would also clarify the language of Article Fourth Section 2.B. in the Current Certificate to provide that the Class B Stock may be split on the effective date of the Restated Certificate without splitting the Class A Stock.

In addition, the proposed Restated Certificate would remove the requirement to issue physical stock certificates for shares of Class B Stock upon conversion of shares of Class A Stock. However, holders of Class B Stock will still be permitted to hold physical stock certificates representing their Class B Stock if they elect to do so.

Except as stated above, the Restated Certificate does not include any amendments to the powers, preferences, rights, qualifications, limitations or restrictions of the Class A Stock or the Class B Stock.

Except for the proposed stock split that is the subject of this proxy statement, the Corporation has no present plans, arrangements, commitments, agreements, or intent to issue any of the additional shares of Class B Stock that will be authorized by adoption of the Restated Certificate, other than upon conversion of Class A Stock or in connection with issuance of post-split Class B Stock in our proposed acquisition of Burlington Northern Santa Fe Corporation (“BNSF”).

The proposed Class B stock split is intended to reduce the issuance of fractional shares to BNSF shareholders in our proposed acquisition of BNSF, and to facilitate the rollover of certain BNSF equity compensation awards into equity compensation awards with respect to Class B Stock. However, the Corporation’s Board of Directors believes that the split is advisable regardless of the BNSF transaction, and thus the Class B stock split is not contingent on the closing of the BNSF acquisition and, if approved by our shareholders, is expected to be effective prior to the date of such closing.

The Corporation will apply for listing of the new shares of Class B Stock to be issued on the New York Stock Exchange.

As of the Record Date, there were [ ] shares of Class B Stock outstanding and held by our shareholders. If the Restated Certificate is approved by our shareholders, as a result of the 50-for-1 Class B Stock split, and based on the number of outstanding shares of Class B Stock as of the Record Date, we estimate there would be approximately [ ] shares of Class B Stock issued and outstanding immediately after such stock split. Therefore, after the 50-for-1 stock split, the total shares of Class B Stock issued and outstanding would be approximately [ ], out of a total of 3,225,000,000 authorized shares of Class B Stock . As noted above, additional shares of Class B Stock (and Class A Stock) will be issued in connection with our proposed acquisition of BNSF.

Adoption of the Restated Certificate, including the proposed stock split, will not affect the proportionate economic rights or voting power of existing shareholders, as the aggregate share holdings of each shareholder will continue to represent the same percentage interest in the Company with the same relative rights between our Class A Stock and our Class B Stock.

The 50-for-1 split of Class B Stock should be tax-free under the Internal Revenue Code of 1986, as amended. The holding period of the Class B Stock received pursuant to the split, for purposes of determining whether capital gain or loss on a sale or exchange is long-term or short-term, will include the period during which the shareholder held his or her pre-split Class B Stock. A shareholder who receives Class B Stock pursuant to the split must allocate the basis of the existing Class B Stock among the shares received pursuant to the split in proportion to the relative fair market value of such shares on the date of distribution. This discussion should not be considered as tax or investment advice, and the tax consequences of the Class B Stock split may not be the same for all holders of Class B Stock. Shareholders should consult their own tax advisors regarding their individual federal, state, local and foreign tax consequences.

IMPORTANT NOTE: SHARES OF CLASS B STOCK HELD IN BOOK ENTRY FORM WILL BE AUTOMATICALLY EXCHANGED UPON THE EFFECTIVENESS OF THE CLASS B STOCK SPLIT. IF YOUR SHARES OF CLASS B STOCK ARE NOT HELD IN BOOK ENTRY FORM, YOU MAY DEPOSIT YOUR CLASS B STOCK CERTIFICATE WITH YOUR STOCK BROKER OR WITH OUR TRANSFER AGENT, WELLS FARGO SHAREOWNER SERVICES, BY DECEMBER 28, 2009 SO THAT YOUR SHARES OF CLASS B STOCK WILL AUTOMATICALLY BE EXCHANGED. YOU MAY SEND YOUR CLASS B STOCK CERTIFICATE TO WELLS FARGO SHAREOWNER SERVICES AT EITHER OF THE ADDRESSES BELOW WITH A REQUEST THAT THE CERTIFICATE BE DEPOSITED INTO BOOK ENTRY FORM. THE METHOD OF DELIVERY IS AT YOUR OPTION AND YOUR RISK. IT IS RECOMMENDED THAT CLASS B STOCK CERTIFICATES BE DELIVERED VIA A REGISTERED METHOD AND INSURED FOR 2% OF THE VALUE OF YOUR CLASS B STOCK REPRESENTED BY SUCH CERTIFICATE.

By Mail To: | By Overnight courier or Hand Delivery To: | |

Wells Fargo Shareowner Services | Wells Fargo Shareowner Services | |

P.O. Box 64854 | 161 North Concord Exchange | |

St. Paul, MN 55164-0854 | South St. Paul, MN 55075 | |

OTHERWISE, UPON THE EFFECTIVENESS OF THE CLASS B STOCK SPLIT, CERTIFICATES REPRESENTING SHARES OF CLASS B STOCK ISSUED PRIOR TO THE CLASS B STOCK SPLIT WILL EVIDENCE THE POST-SPLIT NUMBER OF SHARES OF CLASS B STOCK, BUT FOR TRADING AND DELIVERY PURPOSES, YOU WILL HAVE TO SUBMIT YOUR CLASS B STOCK CERTIFICATE(S) TO WELLS FARGO SHAREOWNER SERVICES TO RECEIVE THE SHARES OF CLASS B STOCK YOU ARE ENTITLED TO AS A RESULT OF THE CLASS B STOCK SPLIT.

PLEASE DO NOT DESTROY YOUR EXISTING CLASS B STOCK CERTIFICATES, OR RETURN SUCH CERTIFICATES TO THE CORPORATION. A SEPARATE LETTER OF TRANSMITTAL WITH INSTRUCTIONS REGARDING THE EXCHANGE OF YOUR EXISTING CERTIFICATES REPRESENTING CLASS B STOCK WILL BE MAILED TO YOU UPON APPROVAL BY OUR SHAREHOLDERS OF THE RESTATED CERTIFICATE. YOU CAN CONTACT WELLS FARGO SHAREOWNER SERVICES AT (877) 602-7411 FOR ADDITIONAL INFORMATION.

Recommendation of the Board of Directors

The Board of Directors has determined that the changes to be effected by the Restated Certificate attached hereto as Exhibit A are in the best interests of the Company and its shareholders. The Board of Directors has unanimously approved and declared advisable the proposed Restated Certificate and recommends that the shareholders vote to approve the Restated Certificate.

Return of this Proxy

When the accompanying proxy is properly executed and returned, the shares it represents will be voted in accordance with the directions indicated thereon or, if no direction is indicated, the shares will be voted in favor the Restated Certificate.

Security Ownership of Certain Beneficial Owners and Management

Warren E. Buffett, whose address is 3555 Farnam Street, Omaha, NE 68131, and the Bill & Melinda Gates Foundation Trust, whose address is 1551 Eastlake Avenue E., Seattle, WA 98102, are the only holders known to the Corporation to be the beneficial owner of more than 5% of the Corporation’s Class A or Class B Stock. Beneficial ownership of the Corporation’s Class A and Class B Stock on November 13, 2009 by Mr. Buffett and by any other executive officers and directors of the Corporation who own shares is shown in the following table:

Name | Title of Class Of Stock | Shares Beneficially Owned(1) | Percentage of Outstanding Stock of Respective Class(1) | Percentage of Aggregate Voting Power of Class A and Class B (1) | Percentage of Aggregate Economic Interest of Class A and Class B (1) | |||||||

Warren E. Buffett | Class A | 350,000 | 33.1 | |||||||||

| Class B | 1,500,618 | 10.1 | 31.6 | (2) | 25.8 | |||||||

Howard G. Buffett | Class A | 1,406 | (3) | 0.1 | ||||||||

| Class B | 16,821 | (3) | 0.1 | 0.1 | 0.1 | |||||||

Susan L. Decker | Class A | — | * | |||||||||

| Class B | 10 | * | * | * | ||||||||

William H. Gates III | Class A | 4,350 | (4) | 0.4 | ||||||||

| Class B | 1,605,796 | (4) | 10.8 | 1.0 | 3.7 | |||||||

David S. Gottesman | Class A | 19,210 | (5) | 1.8 | ||||||||

| Class B | 46,389 | (5) | 0.3 | 1.7 | 1.3 | |||||||

Charlotte Guyman | Class A | 100 | * | |||||||||

| Class B | 12 | * | * | * | ||||||||

Donald R. Keough | Class A | 70 | (6) | * | ||||||||

| Class B | — | * | * | * | ||||||||

Charles T. Munger | Class A | 13,181 | 1.2 | |||||||||

| Class B | — | * | 1.2 | 0.9 | ||||||||

Thomas S. Murphy | Class A | 1,137 | 0.1 | |||||||||

| Class B | 22 | * | 0.1 | 0.1 | ||||||||

Ronald L. Olson | Class A | 284 | (7) | * | ||||||||

| Class B | 300 | (7) | * | * | * | |||||||

Walter Scott, Jr. | Class A | 100 | (8) | * | ||||||||

| Class B | — | * | * | * | ||||||||

Directors and executive | Class A | 389,838 | 36.9 | |||||||||

officers as a group | Class B | 3,169,958 | 21.4 | 35.9 | 31.9 |

| * | less than 0.1%. |

| (1) | Beneficial owners exercise both sole voting and sole investment power unless otherwise stated. Each share of Class A Stock is currently convertible into thirty shares of Class B Stock at the option of the shareholder. As a result, pursuant to Rule 13d-3(d)(1) of the Securities Exchange Act of 1934, a shareholder is deemed to have beneficial ownership of the shares of Class B Stock which such shareholder may acquire upon conversion of the Class A Stock. In order to avoid overstatement, the amount of Class B Stock beneficially owned does not take into account such shares of Class B Stock which may be acquired upon conversion (an amount which is equal to 30 times the number of shares of Class A Stock held by a shareholder). The percentage of outstanding Class B Stock is based on the total number of shares of Class B Stock outstanding as of November 13, 2009 and does not take into account shares of Class B Stock which may be issued upon conversion of Class A Stock. |

| (2) | Mr. Buffett has entered into a voting agreement with Berkshire providing that, should the combined voting power of Berkshire shares as to which Mr. Buffett has or shares voting and investment power exceed 49.9% of Berkshire’s total voting power, he will vote those shares in excess of that percentage proportionately with votes of the other Berkshire shareholders. |

| (3) | Includes 1,396 Class A shares and 16,772 Class B shares held by a private foundation and for which Mr. Buffett possesses voting and investment power but with respect to which Mr. Buffett disclaims any beneficial interest. |

| (4) | Includes 4,050 shares held by a single-member limited liability company of which Mr. Gates is the sole member and 1,605,796 Class B shares owned by the Bill & Melinda Gates Foundation Trust of which Mr. Gates and his wife are co-trustees but with respect to which Mr. and Mrs. Gates disclaim any beneficial interest. |

| (5) | Includes 12,899 Class A shares and 46,389 Class B shares as to which Mr. Gottesman or his wife has shared voting power and 11,603 Class A shares and 45,726 Class B shares as to which Mr. Gottesman or his wife has shared investment power. Mr. Gottesman has a pecuniary interest in 10,022 Class A shares included herein. |

| (6) | Does not include 8 Class A shares owned by Mr. Keough’s wife. |

| (7) | Includes 154 Class A shares held by three trusts for which Mr. Olson is sole trustee but with respect to which Mr. Olson disclaims any beneficial interest. |

| (8) | Does not include 10 Class A shares owned by Mr. Scott’s wife. |

2. OTHER MATTERS

As of the date of this statement your management knows of no business to be presented to the meeting that is not referred to in the accompanying notice. As to other business that may properly come before the meeting, it is intended that proxies properly executed and returned will be voted in respect thereof at the discretion of the person voting the proxies in accordance with his or her best judgment.

Proposals of Shareholders

Any shareholder proposal intended to be considered for inclusion in the proxy statement for presentation at the 2010 Annual Meeting must have been received by the Corporation by November 17, 2009. The proposal must have been in accordance with the provisions of Rule 14a-8 promulgated by the Securities and Exchange Commission under the Securities Exchange Act of 1934. Shareholders who intend to present a proposal at the 2010 Annual Meeting without including such proposal in the Corporation’s proxy statement must provide the Corporation notice of such proposal no later than February 1, 2010. The Corporation reserves the right to reject, rule out of order, or take other appropriate action with respect to any proposal that does not comply with these and other applicable requirements.

By order of the Board of Directors

FORREST N. KRUTTER,Secretary

Omaha, Nebraska

[ , 2009]

EXHIBIT A

RESTATED CERTIFICATE OF INCORPORATION AS AMENDED OF

BERKSHIRE HATHAWAY INC.

(Originally incorporated on June 16, 1998

under the name NBH, Inc.)

Berkshire Hathaway Inc., a corporation organized and existing under the laws of the State of Delaware (the “Corporation”), hereby certifies as follows:

1. This Restated Certificate of Incorporation has been duly adopted in accordance with the provisions of Sections 241 and 245 of the General Corporation Law of the State of Delaware by the Board of Directors of the Corporation without a vote of the stockholders of the Corporation. The Corporation has not received any payment for any of its stock.

2. The text of the Restated Certificate of Incorporation is hereby restated to read in its entirety as follows:

FIRST: The name of the Corporation is Berkshire Hathaway Inc.

SECOND: The registered office of the Corporation in the State of Delaware is located at No. 1209 Orange Street in the City of Wilmington, County of New Castle. The name and address of its registered agent is The Corporation Trust Company, Corporation Trust Center, 1209 Orange Street, Wilmington, Delaware 19801.

THIRD: The purpose of the Corporation is to engage in any lawful act or activity for which corporations may be organized under the General Corporation Law of the State of Delaware.

FOURTH: The total number of shares of all classes of stock that the Corporation is authorized to issue is57,650,000,3,227,650,000, of which 1,650,000 shares shall be Class A Common Stock,55,000,0003,225,000,000 shall be Class B Common Stock, and 1,000,000 shares shall be Preferred Stock. Shares of Preferred Stock shall have no par value. Each share of Class A Common Stock shall have a par value of $5.00. Each share of Class B Common Stock shall have a par value of $0.1667.0.0033. The Class A Common Stock and the Class B Common Stock shall sometimes hereinafter be referred to collectively as the “Common Stock.” At the effective time of this Restated Certificateof Incorporation, each one (1) issued share of Class B Common Stock shall be subdivided into fifty (50) shares of Class B Common Stock.

1.Preferred Stock. The Board of Directors is authorized, subject to limitations prescribed by law and the limitation on authorized Preferred Stock stated above in this

1

Article FOURTH, to provide for the issuance of shares of Preferred Stock in one or more series, and, by filing a certificate pursuant to the applicable law of the State of Delaware, to establish from time to time the number of shares to be included in any series, and to fix the designation, powers, preferences and rights of the shares of each such series and the qualifications, limitations or restrictions thereof.

The authority of the Board of Directors with respect to each series of Preferred Stock shall include, but not be limited to, determination of the following:

(a) The number of shares constituting that series and the distinctive designation of that series;

(b) The dividend rate on the shares of that series, whether dividends shall be cumulative, and, if so, from which date or dates and the relative rights of priority, if any, of payment of dividends on shares of that series;

(c) Whether that series shall have voting rights, in addition to the class voting rights provided by law, and, if so, the terms of such voting rights;

(d) Whether that series shall have conversion privileges, and, if so, the terms and conditions of such conversion, including provision for adjustment of the conversion rate in such events as the Board of Directors shall determine;

(e) Whether or not the shares of that series shall be redeemable, and, if so, the terms and conditions of such redemption, including the date or dates upon or after which they shall be redeemable, and the amount per share payable in case of redemption, which amount may vary under different conditions and at different redemption dates;

(f) Whether that series shall have a sinking fund for the redemption or purchase of shares of that series, and, if so, the terms and amount of such sinking fund;

(g) The rights of the shares of that series in the event of voluntary or involuntary liquidation, dissolution or winding up of the Corporation, and the relative rights of priority, if any, of payment of shares of that series; and

(h) Any other absolute or relative rights, preferences or limitations of that series.

Dividends on outstanding shares of Preferred Stock shall be paid or declared and set apart for payment before any dividends shall be paid or declared and set apart for payment on shares of Common Stock with respect to the same dividend period.

The Preferred Stock shall be preferred over the Common Stock as to assets, and in the event of any liquidation or dissolution or winding up of the Corporation (whether voluntary or involuntary), the holders of the Preferred Stock shall be entitled to receive out of the assets of the Corporation available for distribution to its shareholders, whether

2

from capital, surplus or earnings, the amount specified for each particular series, together with any dividends accrued or in arrears, for every share of their holdings of Preferred Stock before any distribution of the assets shall be made to the holders of Common Stock, and shall be entitled to no other or further distribution. If upon any voluntary or involuntary liquidation, dissolution or winding up of the Corporation, the assets available for distribution to holders of shares of Preferred Stock of all series shall be insufficient to pay such holders the full preferential amount to which they are entitled, then such assets shall be distributed ratably among the shares of all series of Preferred Stock in accordance with the respective preferential amounts (including unpaid cumulative dividends, if any, as provided by the Board of Directors) payable with respect thereto.

Neither the consolidation nor merger of the Corporation with or into any other corporation, nor any sale, lease, exchange or conveyance of all or any part of the property, assets or business of the Corporation shall be deemed to be a liquidation, dissolution or winding up of the Corporation within the meaning of this Article FOURTH.

2.Class A Common Stock and Class B Common Stock. The powers, preferences, and rights of the Class A Common Stock and Class B Common Stock, and the qualifications, limitations and restrictions thereof, are fixed as follows:

A.Issuance; Payment and Assessability. The shares of Class A Common Stock and Class B Common Stock may be issued by the Corporation from time to time for such consideration, having a value not less than par value, as may be fixed from time to time by the Board of Directors of the Corporation. Any and all shares of Class A Common Stock and Class B Common Stock so issued for which the consideration so fixed has been paid or delivered to the Corporation shall be deemed fully paid stock and shall not be liable to any further call or assessment thereon, and the holders of said shares shall not be liable for any further payments in respect of such shares.

B.Dividends; Distributions; Stock Splits. Holders of Class A Common Stock shall be entitled to such dividends or other distributions (including liquidating distributions) per share, whether in cash, in kind, in stock (including a stock split) or by any other means, when and as may be declared by the Board of Directors of the Corporation out of assets or funds of the Corporation legally available therefor. Holders of Class B Common Stock shall be entitled to dividends or other distributions (including liquidating distributions) per share, whether in cash, in kind, in stock, or by any other means, equal to one-thirtiethfifteen-hundredth (1/301,500th) of the amount per share declared by the Board of Directors of the Corporation for each share of Class A Common Stock, (except in the case of a stock split effected by dividend or amendment to this Restated Certificate of Incorporation, or a stock dividend of shares of Class A Common Stock to holders of Class A Common Stock and shares of Class B Common Stock to holders of Class B Common Stock, in which case holders of Class B Common Stock shall be entitled to receive, on a per share basis, the number of shares of Class B Common Stock equal to the number of shares of Class A Common Stock received on a per

3

share basis by the holders of Class A Common Stock), and such dividends or distributions with respect to the Class B Common Stock shall be paid in the same form and at the same time as dividends or distributions with respect to the Class A Common Stock;provided, however, that, in the event of a stock split or stock dividend, holders of Class A Common Stock shall receive shares of Class A Common Stock and holders of Class B Common Stock shall receive shares of Class B Common Stock, unless otherwise specifically designated by resolution of the Board of Directors. Notwithstanding anything to the contrary contained in this Section 2.B. of Article FOURTH, the Corporation may effect a 50-for-1 stock split of only the Class B Common Stock (with no accompanying split of the Class A Common Stock) at the effective time of this Restated Certificate of Incorporation.

C.Voting. Each holder of Class A Common Stock shall be entitled to one (1) vote for each share of Class A Common Stock standing in his name on the books of the Corporation. Each holder of Class B Common Stock shall be entitled to one-two-hundredthten-thousandth (1/20010,000th) of one vote for each share of Class B Common Stock standing in his name on the books of the Corporation. Unless otherwise required by the Delaware General Corporation Law, the Class A Common Stock and the Class B Common Stock shall vote as a single class with respect to all matters submitted to a vote of shareholders of the Corporation.

D.Conversion. Each share of Class A Common Stock may, at the option of the holder of record thereof and without payment of any consideration, be converted intothirty (30one thousand five hundred (1,500) fully paid and nonassessable shares of Class B Common Stock. Any such conversion may be effected by any holder of Class A Common Stock surrendering such holder’s certificate or certificates for the Class A Common Stock to be converted, duly endorsed, at the office of the Corporation or any transfer agent for the Class A Common Stock, together with a written notice to the Corporation that such holder elects to convert all or a specified whole number of shares of Class A Common Stock and stating the name or names in which such holder desires the certificate or certificates for the Class B Common Stock to be issued. If so required by the Corporation, any certificate for shares surrendered for conversion shall be accompanied by instruments of transfer, in form satisfactory to the Corporation, duly executed by the holder of such shares or the duly authorized representative of such holder. Promptly thereafter, the Corporation shall issue and deliver or cause to be issuedand deliveredto such holder or such holder’s nominee or nominees, a certificate or certificates for the number of shares of Class B Common Stock to which such holder shall be entitled as herein provided. Such conversion shall be deemed to have been made at the close of business on the date of receipt by the Corporation or any such transfer agent of such certificate or certificates for Class A Common Stock and such notice, and the person or persons entitled to receive the Class B Common Stock issuable on such conversion shall be treated for all purposes as the record holder or holders of such Class B Common Stock on that date.

4

The issuance of certificates for shares of Class B Common Stockissuableupon the conversion of shares of Class A Common Stock shall be made without charge to the converting holder; provided, however, that if any certificate is to be issued in a name other than that of the record holder of the shares being converted, the Corporation shall not be required to issue or deliver any such certificate unless and until the person requesting the issuance thereof shall have paid to the Corporation the amount of any tax that may be payable with respect to any transfer involved in the issuance and delivery of such certificate or has established to the satisfaction of the Corporation that such tax has been paid.

The Corporation covenants that it will at all times reserve and keep available, solely for the purpose of issuance upon conversion of the outstanding shares of Class A Common Stock, a number of shares of Class B Common Stock equal tothirty (30one thousand five hundred (1,500) times the number of shares of Class A Common Stock then outstanding, in addition to the number of shares of Class B Common Stock then outstanding;provided, however, that nothing herein shall be construed to preclude the Corporation from satisfying its obligation to issue shares of Class B Common Stock upon conversion of Class A Common Stock by delivery of purchased or redeemed shares of Class B Common Stock which are held in the treasury of the Corporation.

E. Mergers, Consolidations, Reclassifications and Certain Other Transactions (1) Not withstanding any other provisions of this Restated Certificate of Incorporation, and in addition to any approval required by law or by this Restated Certificate of Incorporation, and except as otherwise expressly provided in Section 2.E.(2) of this Article FOURTH:

(i) any merger or consolidation of the Corporation with or into any other entity; or (ii) any reclassification of securities (including any forward stock split or reverse stock split effected by amendment to this Restated Certificate of Incorporation), or recapitalization of the Corporation, or any other transaction or series of transactions which has the effect, directly or indirectly, of increasing, as compared to the outstanding shares of Class B Common Stock, the proportionate number of shares outstanding or aggregate voting power of the outstanding shares of any other class of equitysecurity’essecurities, or any class of securities convertible into any class of equity securities, of the Corporation;

shall require the affirmative vote of the holders of a majority of the outstanding shares of Class B Common Stock.

(2) The provisions of Section 2.E.(1) of this Article FOURTH shall not be applicable to any particular Business Combination, and such Business Combination shall require only such approval as is required by law or any other provision of this Restated Certificate of Incorporation, if (i) no consideration is to be received by holders of Class A Common Stock on account of their Class A Common Stock, no change is to be made to the terms of either the Class A Common Stock or the Class B Common Stock, and neither the Class A Common Stock nor the Class B Common Stock is to be exchanged for or converted into any other securities or consideration or canceled, (ii) the holders of Class A Common

5

Stock and Class B Common Stock are entitled to receive the same number of shares of stock (on a per share basis), consisting solely of, in the case of holders of Class A Common Stock, either Class A Common Stock or stock with the same or equivalent powers, preferences, rights, qualifications, limitations and restrictions as the Class A Common Stock, and, in the case of holders of Class B Common Stock, either Class B Common Stock or stock with the same or equivalent powers, preferences, rights, qualifications, limitations and restrictions as the Class B Common Stock, or (iii) the following conditions shall have been met:

(a) the consideration to be received by holders of Class B Common Stock shall be paid in the same form and at the same time as that received by holders of Class A Common Stock; and

(b) (x) the amount of cash, (y) the amount of stock, and (z) the fair market value, as of the date (the “Consummation Date”) of the consummation of the Business Combination, of the consideration other than cash and stock (the “Other Consideration”) to be received per share by holders of Class B Common Stock, shall respectively be at least 1/301,500th of the amount of cash, at least 1/301,500th of the amount of stock, and at least 1/301,500th of the fair market value (as of the applicable Consummation Date) of such Other Consideration, to be received per share by holders of Class A Common Stock.

The term “Business Combination” as used in this Article FOURTH shall mean any transaction which is referred to in clauses (i) or (ii) of Section 2.E.(1) of this Article FOURTH.

(3) The Board of Directors of the Corporation shall have the power and duty to determine compliance with this Article FOURTH, including, without limitation, (i) whether the applicable conditions set forth in Section 2.E.(1) have been met with respect to any Business Combination, and (ii) whether the amount of cash, the amount of stock and the fair market value of the Other Consideration to be received by holders of Class B Common Stock meets the conditions set forth in Section 2.E.(2)(b).

(4) Notwithstanding any other provisions of this Restated Certificate of Incorporation or any provision of law which might otherwise permit a lesser vote or no vote, but in addition to any affirmative vote of the holders of any particular class or series of stock required by law or this Restated Certificate of Incorporation, the affirmative vote of the holders of a majority of the outstanding shares of Class B Common Stock shall be required to alter, amend or repeal this Section 2.E. of this Article FOURTH, including by merger, consolidation or otherwise (other than by a merger or consolidation that does not otherwise require a separate vote of the holders of Class B Common Stock under Section 2.E.2. of this Article FOURTH).

FIFTH: The following additional provisions are in furtherance and not limitation of any power, privilege or purpose conferred or permitted by law, this certificate or the by-laws:

6

1. Except as may be otherwise expressly required by law, or the provisions of this Certificate or the by-laws, the Board of Directors of the Corporation shall have and may exercise, transact, manage, promote and carry on all of the powers, authorities, businesses, objectives and purposes of the Corporation.

2. The election of directors need not be by ballot unless the by-laws so require.

3. The Board of Directors of the Corporation is authorized and empowered to make, alter, amend and repeal the by-laws of the Corporation in any manner not inconsistent with the laws of the State of Delaware.

4. The Board of Directors may fix from time to time the compensation of its members.

5. The Corporation may indemnify or insure or both indemnify and insure any person who is or was a director, officer, employee or agent of the Corporation or, at its request, of another corporation, partnership, joint venture, trust or other enterprise, to the full extent provided or permitted by its by-laws, as from time to time amended, and to the full extent to which those indemnified may now or hereafter be entitled under any law, agreement, vote of stockholders or disinterested directors or otherwise.

SIXTH: No contract or other transaction between the Corporation and any other corporation, and no act of the Corporation shall in any way be affected or invalidated by the fact that any of the directors of the Corporation are pecuniarily or otherwise interested in or are directors or officers of such other corporation. Any director individually, or any firm of which such director may be a member, may be a party to or may be pecuniarily or otherwise interested in any contract or transaction of the Corporation, provided that the fact that he or such firm is so interested shall be disclosed or shall have been known to the Board of Directors, or a majority thereof; and any director of the Corporation, who is also a director or officer of such other corporation, or is so interested, may be counted in determining the existence of a quorum at any meeting of the Board of Directors of the Corporation which shall authorize such contract or transaction, and may vote thereat to authorize any such contract or transaction, with like force and effect, as if he were not such director or officer of such other corporation or not so interested,

SEVENTH: Any action which would otherwise be required or permitted to be taken by the vote of stockholders at a meeting thereof may instead be taken by the written consent of stockholders who would be entitled to vote upon such action if such a meeting were held having not less than the percentage of the total number of votes which would have been required to take such action at such a meeting.

EIGHTH: No director of this Corporation shall have personal liability to the Corporation or any of its stockholders for monetary damages for breach of fiduciary duty as a director. The foregoing provision shall not eliminate or limit the liability of a director (i) for any breach of the director’s duty of loyalty to the Corporation or its stockholders, (ii) for acts or omissions not in good faith or which involve intentional misconduct or a

7

knowing violation of law, (iii) under Section 174 of the General Corporation Law of the State of Delaware or (iv) for any transaction from which the director derived an improper personal benefit. In the event that the General Corporation Law of the State of Delaware is amended after approval of this Article by the stockholders so as to authorize corporate action further eliminating or limiting the liability of directors, the liability of a director of this Corporation shall thereupon be eliminated or limited to the fullest extent permitted by the General Corporation Law of the State of Delaware, as so amended from time to time. The provisions of this Article shall not be deemed to limit or preclude indemnification of a director by the Corporation for any liability of a director which has not been eliminated by the provisions of this Article.

8

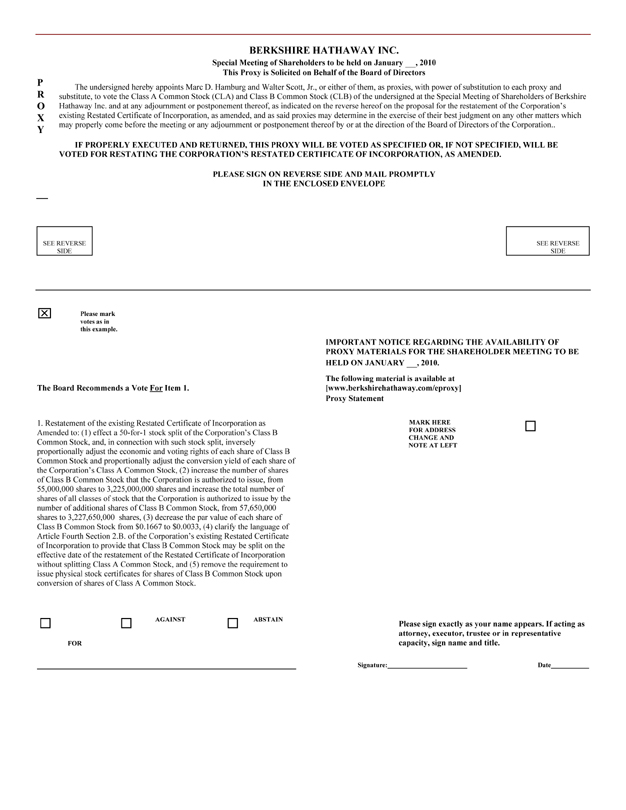

PROXY

BERKSHIRE HATHAWAY INC.

Special Meeting of Shareholders to be held on January __, 2010

This Proxy is Solicited on Behalf of the Board of Directors

The undersigned hereby appoints Marc D. Hamburg and Walter Scott, Jr., or either of them, as proxies, with power of substitution to each proxy and substitute, to vote the Class A Common Stock (CLA) and Class B Common Stock (CLB) of the undersigned at the Special Meeting of Shareholders of Berkshire Hathaway Inc. and at any adjournment or postponement thereof, as indicated on the reverse hereof on the proposal for the restatement of the Corporation’s existing Restated Certificate of Incorporation, as amended, and as said proxies may determine in the exercise of their best judgment on any other matters which may properly come before the meeting or any adjournment or postponement thereof by or at the direction of the Board of Directors of the Corporation.

IF PROPERLY EXECUTED AND RETURNED, THIS PROXY WILL BE VOTED AS SPECIFIED OR, IF NOT SPECIFIED, WILL BE VOTED FOR RESTATING THE CORPORATION’S RESTATED CERTIFICATE OF INCORPORATION, AS AMENDED.

PLEASE SIGN ON REVERSE SIDE AND MAIL PROMPTLY

IN THE ENCLOSED ENVELOPE

SEE REVERSE

SIDE SEE REVERSE

SIDE

? Please mark

votes as in

this example.

IMPORTANT NOTICE REGARDING THE AVAILABILITY OF PROXY MATERIALS FOR THE SHAREHOLDER MEETING TO BE HELD ON JANUARY __, 2010.

The Board Recommends a Vote For Item 1. The following material is available at [www.berkshirehathaway.com/eproxy]

Proxy Statement

1. Restatement of the existing Restated Certificate of Incorporation as Amended to: (1) effect a 50-for-1 stock split of the Corporation’s Class B Common Stock, and, in connection with such stock split, inversely proportionally adjust the economic and voting rights of each share of Class B Common Stock and proportionally adjust the conversion yield of each share of the Corporation’s Class A Common Stock, (2) increase the number of shares of Class B Common Stock that the Corporation is authorized to issue, from 55,000,000 shares to 3,225,000,000 shares and increase the total number of shares of all classes of stock that the Corporation is authorized to issue by the number of additional shares of Class B Common Stock, from 57,650,000 shares to 3,227,650,000 shares, (3) decrease the par value of each share of Class B Common Stock from $0.1667 to $0.0033, (4) clarify the language of Article Fourth Section 2.B. of the Corporation’s existing Restated Certificate of Incorporation to provide that Class B Common Stock may be split on the effective date of the restatement of the Restated Certificate of Incorporation without splitting Class A Common Stock, and (5) remove the requirement to issue physical stock certificates for shares of Class B Common Stock upon conversion of shares of Class A Common Stock. MARK HERE

FOR ADDRESS

CHANGE AND

NOTE AT LEFT ?

? FOR ? AGAINST ? ABSTAIN Please sign exactly as your name appears. If acting as attorney, executor, trustee or in representative capacity, sign name and title.

Signature: Date