UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM N‑CSR

CERTIFIED SHAREHOLDER REPORT OF REGISTERED

MANAGEMENT INVESTMENT COMPANIES

| | |

| Investment Company Act file number | | 811-08961 |

TIAA-CREF Life Funds

(Exact name of registrant as specified in charter)

730 Third Avenue

New York, New York 10017-3206

(Address of principal executive offices) (Zip code)

Rachael M. Zufall, Esq.

TIAA-CREF Life Funds

8500 Andrew Carnegie Boulevard

Charlotte, North Carolina 28262-8500

(Name and address of agent for service)

Registrant’s telephone number, including area code: (704) 595‑1000

Date of fiscal year end: December 31

Date of reporting period: June 30, 2024

| Item 1. | Reports to Stockholders. |

| | |

| |

Semi-Annual Shareholder Report

June 30, 2024 |

Nuveen Life Balanced Fund

(Formerly known as TIAA-CREF Life Balanced Fund)

TLBAX

Semi-Annual Report

This semi-annual shareholder report contains important information about the Nuveen Life Balanced Fund for the period of January 1, 2024 to June 30, 2024. You can find additional information at https://www.tiaa.org/public/prospectuses/. You can also request this information by contacting us at (800) 842‑2252.

What were the Fund costs for the last six months? (based on a hypothetical $10,000 investment)(1)

| | | | |

| | |

| | | Cost of a $10,000 investment | | Costs paid as a percentage of

$10,000 investment* |

| | | |

| Nuveen Life Balanced Fund | | $5 | | 0.10% |

(1) These costs do not include the expenses of the underlying funds in which the Fund invests.

* This cost is annualized.

Fund Statistics (as of June 30, 2024)

| | | | |

| |

| Fund net assets | | $ | 66,719,164 | |

| |

| Total number of portfolio holdings | | | 8 | |

| |

| Portfolio turnover (%) | | | 5% | |

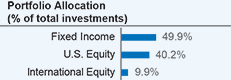

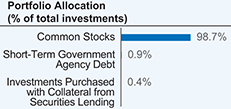

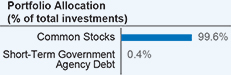

What did the Fund invest in? (as of June 30, 2024)

Availability of additional information about the Fund

You can find additional information about the Fund at https://www.tiaa.org/public/prospectuses/, including its:

| | • | | prospectus • financial statements and other information • fund holdings • proxy voting information |

You can also request this information at (800) 842‑2252.

| | |

87244V864_SAR_0624 3707287‑INV‑B‑08/25 | |  |

| | |

| |

Semi-Annual Shareholder Report

June 30, 2024 |

Nuveen Life Core Bond Fund

(Formerly known as TIAA-CREF Life Core Bond Fund)

TLBDX

Semi-Annual Report

This semi-annual shareholder report contains important information about the Nuveen Life Core Bond Fund for the period of January 1, 2024 to June 30, 2024. You can find additional information at https://www.tiaa.org/public/prospectuses/. You can also request this information by contacting us at (800) 842-2252.

What were the Fund costs for the last six months? (based on a hypothetical $10,000 investment)

| | | | |

| | |

| | | Cost of a $10,000 investment | | Costs paid as a percentage of

$10,000 investment* |

| | | |

| Nuveen Life Core Bond Fund | | $18 | | 0.35% |

* This cost is annualized.

Fund Statistics (as of June 30, 2024)

| | | | |

| |

| Fund net assets | | $ | 199,235,006 | |

| |

| Total number of portfolio holdings | | | 1,016 | |

| |

| Portfolio turnover (%) | | | 44% | |

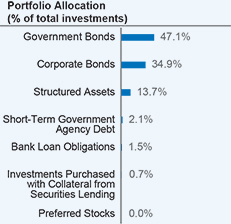

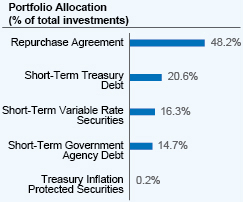

What did the Fund invest in? (as of June 30, 2024)

(1) Credit quality ratings are based on the Bloomberg Barclays methodology, which uses the median rating of those compiled by the Moody’s, Standard & Poor’s and Fitch ratings agencies. If ratings are available from only two of these agencies, the lower rating is used. When only one rating is available, that one is used. These ratings are subject to change without notice.

Availability of additional information about the Fund

You can find additional information about the Fund at https://www.tiaa.org/public/prospectuses/, including its:

| | • | | prospectus • financial statements and other information • fund holdings • proxy voting information |

You can also request this information at (800) 842‑2252.

| | |

87244V880_SAR_0624 3707307-INV-B-08/25 | |  |

| | |

| |

Semi-Annual Shareholder Report

June 30, 2024 |

Nuveen Life Core Equity Fund

(Formerly known as TIAA-CREF Life Growth & Income Fund)

TLGWX

Semi-Annual Report

This semi-annual shareholder report contains important information about the Nuveen Life Core Equity Fund for the period of January 1, 2024 to June 30, 2024. You can find additional information at https://www.tiaa.org/public/prospectuses/. You can also request this information by contacting us at (800) 842‑2252.

What were the Fund costs for the last six months? (based on a hypothetical $10,000 investment)

| | | | |

| | |

| | | Cost of a $10,000 investment | | Costs paid as a percentage of

$10,000 investment* |

| | | |

| Nuveen Life Core Equity Fund | | $26 | | 0.51% |

* This cost is annualized.

Fund Statistics (as of June 30, 2024)

| | | | |

| |

| Fund net assets | | $ | 210,732,475 | |

| |

| Total number of portfolio holdings | | | 54 | |

| |

| Portfolio turnover (%) | | | 23% | |

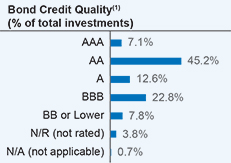

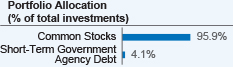

What did the Fund invest in? (as of June 30, 2024)

Availability of additional information about the Fund

You can find additional information about the Fund at https://www.tiaa.org/public/prospectuses/, including its:

| | • | | prospectus • financial statements and other information • fund holdings • proxy voting information |

You can also request this information at (800) 842‑2252.

| | |

87244V302_SAR_0624 3707323-INV-B-08/25 | |  |

| | |

| |

Semi-Annual Shareholder Report

June 30, 2024 |

Nuveen Life Growth Equity Fund

(Formerly known as TIAA-CREF Life Growth Equity Fund)

TLGQX

Semi-Annual Report

This semi-annual shareholder report contains important information about the Nuveen Life Growth Equity Fund for the period of January 1, 2024 to June 30, 2024. You can find additional information at https://www.tiaa.org/public/prospectuses/. You can also request this information by contacting us at (800) 842‑2252.

What were the Fund costs for the last six months? (based on a hypothetical $10,000 investment)

| | | | |

| | |

| | | Cost of a $10,000 investment | | Costs paid as a percentage of

$10,000 investment* |

| | | |

| Nuveen Life Growth Equity Fund | | $26 | | 0.52% |

* This cost is annualized.

Fund Statistics (as of June 30, 2024)

| | | | |

| |

| Fund net assets | | $ | 179,424,439 | |

| |

| Total number of portfolio holdings | | | 60 | |

| |

| Portfolio turnover (%) | | | 12% | |

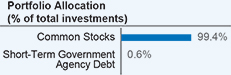

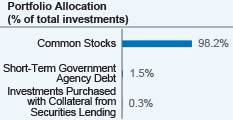

What did the Fund invest in? (as of June 30, 2024)

Availability of additional information about the Fund

You can find additional information about the Fund at https://www.tiaa.org/public/prospectuses/, including its:

| | • | | prospectus • financial statements and other information • fund holdings • proxy voting information |

You can also request this information at (800) 842‑2252.

| | |

87244V104_SAR_0624 3707346-INV-B-08/25 | |  |

| | |

| |

Semi-Annual Shareholder Report

June 30, 2024 |

Nuveen Life International Equity Fund

(Formerly known as TIAA-CREF Life International Equity Fund)

TLINX

Semi-Annual Report

This semi-annual shareholder report contains important information about the Nuveen Life International Equity Fund for the period of January 1, 2024 to June 30, 2024. You can find additional information at https://www.tiaa.org/public/prospectuses/. You can also request this information by contacting us at (800) 842‑2252.

What were the Fund costs for the last six months? (based on a hypothetical $10,000 investment)

| | | | |

| | |

| | | Cost of a $10,000 investment | | Costs paid as a percentage of

$10,000 investment* |

| | | |

| Nuveen Life International Equity Fund | | $30 | | 0.60% |

* This cost is annualized.

Fund Statistics (as of June 30, 2024)

| | | | |

| |

| Fund net assets | | $ | 147,786,210 | |

| |

| Total number of portfolio holdings | | | 67 | |

| |

| Portfolio turnover (%) | | | 6% | |

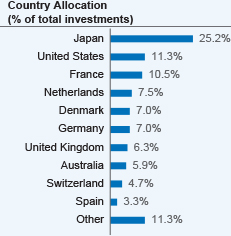

What did the Fund invest in? (as of June 30, 2024)

Availability of additional information about the Fund

You can find additional information about the Fund at https://www.tiaa.org/public/prospectuses/, including its:

| | • | | prospectus • financial statements and other information • fund holdings • proxy voting information |

You can also request this information at (800) 842‑2252.

| | |

87244V203_SAR_0624 3707354‑INV‑B‑08/25 | |  |

| | |

| |

Semi-Annual Shareholder Report

June 30, 2024 |

Nuveen Life Large Cap Responsible Equity Fund

(Formerly known as TIAA-CREF Life Social Choice Equity Fund)

TLCHX

Semi-Annual Report

This semi-annual shareholder report contains important information about the Nuveen Life Large Cap Responsible Equity Fund for the period of January 1, 2024 to June 30, 2024. You can find additional information at https://www.tiaa.org/public/prospectuses/. You can also request this information by contacting us at (800) 842‑2252.

What were the Fund costs for the last six months? (based on a hypothetical $10,000 investment)

| | | | |

| | |

| | | Cost of a $10,000 investment | | Costs paid as a percentage of

$10,000 investment* |

| | | |

| Nuveen Life Large Cap Responsible Equity Fund | | $11 | | 0.22% |

* This cost is annualized.

Fund Statistics (as of June 30, 2024)

| | | | |

| |

| Fund net assets | | $ | 95,295,451 | |

| |

| Total number of portfolio holdings | | | 151 | |

| |

| Portfolio turnover (%) | | | 34% | |

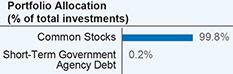

What did the Fund invest in? (as of June 30, 2024)

Availability of additional information about the Fund

You can find additional information about the Fund at https://www.tiaa.org/public/prospectuses/, including its:

| | • | | prospectus • financial statements and other information • fund holdings • proxy voting information |

You can also request this information at (800) 842‑2252.

| | |

87244V500_SAR_0624 3707361‑INV‑B‑08/25 | |  |

| | |

| |

Semi-Annual Shareholder Report

June 30, 2024 |

Nuveen Life Large Cap Value Fund

(Formerly known as TIAA-CREF Life Large-Cap Value Fund)

TLLVX

Semi-Annual Report

This semi-annual shareholder report contains important information about the Nuveen Life Large Cap Value Fund for the period of January 1, 2024 to June 30, 2024. You can find additional information at https://www.tiaa.org/public/prospectuses/. You can also request this information by contacting us at (800) 842-2252.

What were the Fund costs for the last six months? (based on a hypothetical $10,000 investment)

| | | | |

| | |

| | | Cost of a $10,000 investment | | Costs paid as a percentage of

$10,000 investment* |

| | | |

| Nuveen Life Large Cap Value Fund | | $26 | | 0.52% |

* This cost is annualized.

Fund Statistics (as of June 30, 2024)

| | | | |

| |

| Fund net assets | | $ | 82,701,939 | |

| |

| Total number of portfolio holdings | | | 87 | |

| |

| Portfolio turnover (%) | | | 11% | |

What did the Fund invest in? (as of June 30, 2024)

Availability of additional information about the Fund

You can find additional information about the Fund at https://www.tiaa.org/public/prospectuses/, including its:

| | • | | prospectus • financial statements and other information • fund holdings • proxy voting information |

You can also request this information at (800) 842‑2252.

| | |

87244V609_SAR_0624 3707375-INV-B-08/25 | |  |

| | |

| |

Semi-Annual Shareholder Report

June 30, 2024 |

Nuveen Life Money Market Fund

(Formerly known as TIAA-CREF Life Money Market Fund)

TLMXX

Semi-Annual Report

This semi-annual shareholder report contains important information about the Nuveen Life Money Market Fund for the period of January 1, 2024 to June 30, 2024. You can find additional information at https://www.tiaa.org/public/prospectuses/. You can also request this information by contacting us at (800) 842‑2252.

What were the Fund costs for the last six months? (based on a hypothetical $10,000 investment)

| | | | |

| | |

| | | Cost of a $10,000 investment | | Costs paid as a percentage of

$10,000 investment* |

| | | |

| Nuveen Life Money Market Fund | | $8 | | 0.15% |

* This cost is annualized.

Fund Statistics (as of June 30, 2024)

| | | | |

| |

| Fund net assets | | $ | 134,070,693 | |

| |

| Total number of portfolio holdings | | | 71 | |

| |

| Portfolio turnover (%) | | | 0% | |

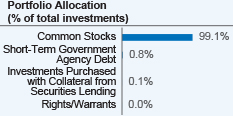

What did the Fund invest in? (as of June 30, 2024)

Availability of additional information about the Fund

You can find additional information about the Fund at https://www.tiaa.org/public/prospectuses/, including its:

| | • | | prospectus • financial statements and other information • fund holdings • proxy voting information |

You can also request this information at (800) 842‑2252.

| | |

87244V872_SAR_0624 3707388‑INV‑B‑08/25 | |  |

| | |

| |

Semi-Annual Shareholder Report

June 30, 2024 |

Nuveen Life Real Estate Securities Select Fund

(Formerly known as TIAA-CREF Life Real Estate Securities Fund)

TLRSX

Semi-Annual Report

This semi-annual shareholder report contains important information about the Nuveen Life Real Estate Securities Select Fund for the period of January 1, 2024 to June 30, 2024. You can find additional information at https://www.tiaa.org/public/prospectuses/. You can also request this information by contacting us at (800) 842-2252.

What were the Fund costs for the last six months? (based on a hypothetical $10,000 investment)

| | | | |

| | |

| | | Cost of a $10,000 investment | | Costs paid as a percentage of

$10,000 investment* |

| | | |

| Nuveen Life Real Estate Securities Select Fund | | $29 | | 0.58% |

* This cost is annualized.

Fund Statistics (as of June 30, 2024)

| | | | |

| |

| Fund net assets | | $ | 63,702,289 | |

| |

| Total number of portfolio holdings | | | 37 | |

| |

| Portfolio turnover (%) | | | 10% | |

What did the Fund invest in? (as of June 30, 2024)

Availability of additional information about the Fund

You can find additional information about the Fund at https://www.tiaa.org/public/prospectuses/, including its:

| | • | | prospectus • financial statements and other information • fund holdings • proxy voting information |

You can also request this information at (800) 842‑2252.

| | |

87244V807_SAR_0624 3707398-INV-B-08/25 | |  |

| | |

| |

Semi-Annual Shareholder Report

June 30, 2024 |

Nuveen Life Small Cap Equity Fund

(Formerly known as TIAA-CREF Life Small‑Cap Equity Fund)

TLEQX

Semi-Annual Report

This semi-annual shareholder report contains important information about the Nuveen Life Small Cap Equity Fund for the period of January 1, 2024 to June 30, 2024. You can find additional information at https://www.tiaa.org/public/prospectuses/. You can also request this information by contacting us at (800) 842-2252.

What were the Fund costs for the last six months? (based on a hypothetical $10,000 investment)

| | | | |

| | |

| | | Cost of a $10,000 investment | | Costs paid as a percentage of

$10,000 investment* |

| | | |

| Nuveen Life Small Cap Equity Fund | | $27 | | 0.53% |

* This cost is annualized.

Fund Statistics (as of June 30, 2024)

| | | | |

| |

| Fund net assets | | $ | 65,422,691 | |

| |

| Total number of portfolio holdings | | | 389 | |

| |

| Portfolio turnover (%) | | | 39% | |

What did the Fund invest in? (as of June 30, 2024)

Availability of additional information about the Fund

You can find additional information about the Fund at https://www.tiaa.org/public/prospectuses/, including its:

| | • | | prospectus • financial statements and other information • fund holdings • proxy voting information |

You can also request this information at (800) 842‑2252.

| | |

87244V708_SAR_0624 3707407‑INV‑B‑08/25 | |  |

| | |

| |

Semi-Annual Shareholder Report

June 30, 2024 |

Nuveen Life Stock Index Fund

(Formerly known as TIAA-CREF Life Stock Index Fund)

TLSTX

Semi-Annual Report

This semi-annual shareholder report contains important information about the Nuveen Life Stock Index Fund for the period of January 1, 2024 to June 30, 2024. You can find additional information at https://www.tiaa.org/public/prospectuses/. You can also request this information by contacting us at (800) 842‑2252.

What were the Fund costs for the last six months? (based on a hypothetical $10,000 investment)

| | | | |

| | |

| | | Cost of a $10,000 investment | | Costs paid as a percentage of

$10,000 investment* |

| | | |

| Nuveen Life Stock Index Fund | | $5 | | 0.09% |

* This cost is annualized.

Fund Statistics (as of June 30, 2024)

| | | | |

| |

| Fund net assets | | $ | 837,908,611 | |

| |

| Total number of portfolio holdings | | | 2,700 | |

| |

| Portfolio turnover (%) | | | 1% | |

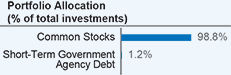

What did the Fund invest in? (as of June 30, 2024)

Availability of additional information about the Fund

You can find additional information about the Fund at https://www.tiaa.org/public/prospectuses/, including its:

| | • | | prospectus • financial statements and other information • fund holdings • proxy voting information |

You can also request this information at (800) 842‑2252.

| | |

87244V401_SAR_0624 3707418‑INV‑B‑08/25 | |  |

Not applicable to this filing.

| Item 3. | Audit Committee Financial Expert. |

Not applicable to this filing.

| Item 4. | Principal Accountant Fees and Services. |

Not applicable to this filing.

| Item 5. | Audit Committee of Listed Registrants. |

Not applicable to this registrant.

| (a) | Schedule of Investments is included as part of the financial statements filed under Item 7 of this Form N-CSR. |

| Item 7. | Financial Statements and Financial Highlights for Open-End Management Investment Companies. |

Item

7.

Financial

Statements

and

Financial

Highlights

for

Open-

End

Management

Investment

Companies

See

Notes

to

Financial

Statements

(Unaudited)

SHARES

DESCRIPTION

VALUE

NUVEEN

LIFE

FUNDS—99.9%(a)

FIXED

INCOME—49.8%

3,620,866

Nuveen

Life

Core

Bond

Fund

$

33,239,547

TOTAL

FIXED

INCOME

33,239,547

INTERNATIONAL

EQUITY—9.9%

660,503

Nuveen

Life

International

Equity

Fund

6,591,818

TOTAL

INTERNATIONAL

EQUITY

6,591,818

U.S.

EQUITY—40.2%

308,203

Nuveen

Life

Core

Equity

Fund

6,684,912

314,487

Nuveen

Life

Growth

Equity

Fund

6,657,699

269,306

Nuveen

Life

Large

Cap

Value

Fund

5,394,204

102,404

Nuveen

Life

Real

Estate

Securities

Select

Fund

1,355,830

92,218

Nuveen

Life

Small

Cap

Equity

Fund

1,339,928

121,122

Nuveen

Life

Stock

Index

Fund

5,385,104

TOTAL

U.S.

EQUITY

26,817,677

TOTAL

AFFILIATED

INVESTMENT

COMPANIES

66,649,042

(Cost

$55,146,655)

TOTAL

INVESTMENTS—99.9%

66,649,042

(Cost

$55,146,655)

OTHER

ASSETS

&

LIABILITIES,

NET—0.1%

70,122

NET

ASSETS—100.0%

$

66,719,164

(a)

The

Fund

invests

its

assets

in

the

affiliated

Nuveen

Life

Funds.

See

Notes

to

Financial

Statements

(Unaudited)

PRINCIPAL

DESCRIPTION

REFERENCE

RATE

&

SPREAD

RATE

MATURITY

DATE

VALUE

LONG-TERM

INVESTMENTS

-

96.0%

BANK

LOAN

OBLIGATIONS

-

1.5%

CAPITAL

GOODS

-

0.1%

$

62,001

(a)

Centuri

Group,

Inc

TSFR1M

+

2.500%

7.958

%

08/27/28

$

62,087

94,589

(a)

TransDigm,

Inc

TSFR3M

+

0.028%

8.085

03/22/30

94,875

TOTAL

CAPITAL

GOODS

156,962

COMMERCIAL

&

PROFESSIONAL

SERVICES

-

0.1%

70,043

(a)

Dun

&

Bradstreet

Corp

TSFR1M

+

2.750%

8.096

01/18/29

70,174

36,440

(a)

EAB

Global,

Inc

TSFR1M

+

3.500%

8.944

08/16/28

36,449

20,977

(a)

GFL

Environmental,

Inc

TSFR3M

+

2.500%

7.826

05/31/27

21,044

TOTAL

COMMERCIAL

&

PROFESSIONAL

SERVICES

127,667

CONSUMER

DISCRETIONARY

DISTRIBUTION

&

RETAIL

-

0.0%

62,109

(a)

CNT

Holdings

I

Corp

TSFR3M

+

3.500%

8.830

11/08/27

62,333

TOTAL

CONSUMER

DISCRETIONARY

DISTRIBUTION

&

RETAIL

62,333

CONSUMER

SERVICES

-

0.1%

37,213

(a)

1011778

BC

ULC

TSFR1M

+

0.018%

7.578

09/20/30

37,166

232,049

(a)

Motion

Finco

Sarl

TSFR3M

+

0.035%

8.835

11/12/29

232,397

TOTAL

CONSUMER

SERVICES

269,563

ENERGY

-

0.0%

19,695

(a)

Oryx

Midstream

Services

Permian

Basin

LLC

TSFR1M

+

3.000%

8.441

10/05/28

19,732

TOTAL

ENERGY

19,732

FINANCIAL

SERVICES

-

0.0%

39,488

(a)

Trans

Union

LLC

TSFR1M

+

2.000%

7.344

12/01/28

39,548

TOTAL

FINANCIAL

SERVICES

39,548

FOOD,

BEVERAGE

&

TOBACCO

-

0.0%

57,101

(a)

Triton

Water

Holdings,

Inc

TSFR3M

+

3.250%

8.846

03/31/28

57,186

TOTAL

FOOD,

BEVERAGE

&

TOBACCO

57,186

HEALTH

CARE

EQUIPMENT

&

SERVICES

-

0.4%

96,858

(a)

Global

Medical

Response,

Inc

TSFR1M

+

5.500%

10.848

10/31/28

94,000

37,918

(a)

ICU

Medical,

Inc

TSFR3M

+

2.500%

7.985

01/08/29

37,992

34,541

(a)

Medline

Borrower

LP

TSFR1M

+

2.750%

8.094

10/23/28

34,649

86,916

(a)

Phoenix

Newco,

Inc

TSFR1M

+

3.250%

8.708

11/15/28

87,201

514,184

(a)

Surgery

Center

Holdings,

Inc

TSFR1M

+

0.028%

8.089

12/19/30

516,146

TOTAL

HEALTH

CARE

EQUIPMENT

&

SERVICES

769,988

INSURANCE

-

0.3%

434,030

(a)

BroadStreet

Partners,

Inc

TSFR1M

+

3.250%

8.594

06/13/31

433,379

99,741

(a)

Ryan

Specialty

Group

LLC

TSFR1M

+

2.500%

8.094

09/01/27

100,376

37,924

(a)

USI,

Inc

TSFR3M

+

0.028%

8.085

09/27/30

37,972

TOTAL

INSURANCE

571,727

MATERIALS

-

0.1%

54,716

(a)

Clydesdale

Acquisition

Holdings,

Inc

TSFR1M

+

3.680%

9.119

04/13/29

54,903

47,129

(a)

Ecovyst

Catalyst

Technologies

LLC

TSFR3M

+

2.500%

7.930

06/09/28

47,175

14,772

(a)

TricorBraun

Holdings,

Inc

TSFR1M

+

3.250%

8.708

03/03/28

14,767

TOTAL

MATERIALS

116,845

REAL

ESTATE

MANAGEMENT

&

DEVELOPMENT

-

0.0%

2,528

(a)

Cushman

&

Wakefield

plc

TSFR1M

+

2.750%

8.208

08/21/25

2,533

50,542

(a)

Cushman

&

Wakefield

US

Borrower

LLC

TSFR1M

+

0.033%

8.679

01/31/30

50,605

TOTAL

REAL

ESTATE

MANAGEMENT

&

DEVELOPMENT

53,138

SOFTWARE

&

SERVICES

-

0.1%

34,519

(a)

Boxer

Parent

Co,

Inc

TSFR1M

+

4.000%

9.344

12/29/28

34,633

19,051

(a)

Camelot

US

Acquisition

LLC

TSFR1M

+

2.750%

8.094

01/31/31

19,108

34,017

(a)

Epicor

Software

Corp

TSFR1M

+

0.053%

8.594

05/30/31

34,201

37,918

(a)

Instructure

Holdings,

Inc

TSFR3M

+

2.750%

8.355

10/30/28

37,942

See

Notes

to

Financial

Statements

Portfolio

of

Investments

(continued)

Portfolio

of

Investments

(continued)

PRINCIPAL

DESCRIPTION

REFERENCE

RATE

&

SPREAD

RATE

MATURITY

DATE

VALUE

SOFTWARE

&

SERVICES—continued

$

80,790

(a)

Rackspace

Finance

LLC

TSFR1M

+

0.053%

8.186

%

05/15/28

$

37,279

17,596

(a)

Rackspace

Finance

LLC

TSFR1M

+

0.053%

11.692

05/15/28

17,871

38,019

(a)

Sedgwick

Claims

Management

Services,

Inc

TSFR1M

+

3.500%

9.094

02/24/28

38,108

57,324

(a)

UKG,

Inc

TSFR1M

+

3.250%

8.576

02/10/31

57,606

TOTAL

SOFTWARE

&

SERVICES

276,748

TELECOMMUNICATION

SERVICES

-

0.0%

50,000

(a)

Virgin

Media

Bristol

LLC

TSFR1M

+

2.500%

8.656

03/31/31

47,901

TOTAL

TELECOMMUNICATION

SERVICES

47,901

TRANSPORTATION

-

0.1%

77,306

(a)

Air

Canada

TSFR3M

+

2.500%

7.847

03/21/31

77,512

15,000

(a)

Mileage

Plus

Holdings

LLC

TSFR3M

+

0.053%

10.744

06/21/27

15,324

53,659

(a)

SkyMiles

IP

Ltd

TSFR3M

+

3.750%

9.075

10/20/27

55,022

TOTAL

TRANSPORTATION

147,858

UTILITIES

-

0.2%

163,712

(a)

Talen

Energy

Supply

LLC

TSFR3M

+

0.035%

8.818

05/17/30

165,758

133,944

(a)

Talen

Energy

Supply

LLC

TSFR3M

+

0.035%

8.827

05/17/30

135,619

TOTAL

UTILITIES

301,377

TOTAL

BANK

LOAN

OBLIGATIONS

3,018,573

(Cost

$2,998,808)

CORPORATE

BONDS

-

34.5%

AUTOMOBILES

&

COMPONENTS

-

1.2%

70,000

(b)

Clarios

Global

LP

6.750

05/15/28

70,844

5,000

Dana,

Inc

5.375

11/15/27

4,887

25,000

Dana,

Inc

4.250

09/01/30

21,824

200,000

Ford

Motor

Credit

Co

LLC

6.950

03/06/26

203,230

200,000

Ford

Motor

Credit

Co

LLC

7.350

03/06/30

211,659

200,000

(b),(c)

Ford

Otomotiv

Sanayi

AS.

7.125

04/25/29

201,820

100,000

General

Motors

Co

6.125

10/01/25

100,520

350,000

General

Motors

Financial

Co,

Inc

2.750

06/20/25

340,196

50,000

General

Motors

Financial

Co,

Inc

6.050

10/10/25

50,180

275,000

General

Motors

Financial

Co,

Inc

5.000

04/09/27

272,193

75,000

(c)

General

Motors

Financial

Co,

Inc

5.850

04/06/30

75,918

50,000

General

Motors

Financial

Co,

Inc

5.750

02/08/31

50,133

300,000

General

Motors

Financial

Co,

Inc

5.600

06/18/31

297,755

100,000

Goodyear

Tire

&

Rubber

Co

5.250

04/30/31

91,738

200,000

(b)

Hyundai

Capital

Services,

Inc

2.125

04/24/25

194,397

150,000

(b)

ZF

North

America

Capital,

Inc

6.875

04/14/28

152,902

TOTAL

AUTOMOBILES

&

COMPONENTS

2,340,196

BANKS

-

7.6%

200,000

(b)

Banco

de

Credito

e

Inversiones

S.A.

2.875

10/14/31

170,636

200,000

(b)

Banco

del

Estado

de

Chile

7.950

N/A(d)

206,600

200,000

Banco

Santander

S.A.

6.350

03/14/34

200,143

200,000

Banco

Santander

S.A.

9.625

N/A(d)

221,701

200,000

Bancolombia

S.A.

8.625

12/24/34

204,250

200,000

(b)

Bangkok

Bank

PCL

3.466

09/23/36

166,352

200,000

(b)

Bank

Hapoalim

BM

3.255

01/21/32

179,570

200,000

(b)

Bank

Leumi

Le-Israel

BM

3.275

01/29/31

185,056

1,000,000

Bank

of

America

Corp

2.592

04/29/31

864,616

700,000

Bank

of

America

Corp

5.288

04/25/34

692,653

350,000

Bank

of

America

Corp

5.468

01/23/35

349,646

350,000

Bank

of

America

Corp

2.676

06/19/41

244,540

400,000

Bank

of

America

Corp

6.100

N/A(d)

398,834

55,000

Bank

of

Montreal

3.803

12/15/32

51,676

200,000

Barclays

plc

3.330

11/24/42

143,594

200,000

Barclays

plc

9.625

N/A(d)

216,818

200,000

(b)

BBVA

Bancomer

S.A.

8.450

06/29/38

206,135

150,000

(b)

BNP

Paribas

S.A.

2.819

11/19/25

148,132

See

Notes

to

Financial

Statements

PRINCIPAL

DESCRIPTION

REFERENCE

RATE

&

SPREAD

RATE

MATURITY

DATE

VALUE

BANKS—continued

$

300,000

(b)

BNP

Paribas

S.A.

1.904

%

09/30/28

$

267,834

200,000

(b)

BNP

Paribas

S.A.

7.750

N/A(d)

201,703

200,000

(b)

BNP

Paribas

S.A.

7.375

N/A(d)

199,501

350,000

CitiBank

NA

5.570

04/30/34

355,567

150,000

Citigroup,

Inc

3.200

10/21/26

143,051

125,000

Citigroup,

Inc

4.300

11/20/26

121,931

80,000

Citigroup,

Inc

4.125

07/25/28

76,794

140,000

Citigroup,

Inc

2.572

06/03/31

120,165

775,000

Citigroup,

Inc

6.270

11/17/33

811,683

175,000

Citigroup,

Inc

7.625

N/A(d)

182,206

100,000

Citigroup,

Inc

4.000

N/A(d)

95,768

325,000

(b)

Cooperatieve

Rabobank

UA

1.339

06/24/26

311,308

200,000

(b)

Credit

Agricole

S.A.

8.125

N/A(d)

202,940

150,000

Deutsche

Bank

AG.

5.371

09/09/27

150,254

150,000

Deutsche

Bank

AG.

6.819

11/20/29

155,998

200,000

HSBC

Holdings

plc

4.292

09/12/26

196,486

50,000

HSBC

Holdings

plc

2.013

09/22/28

44,903

225,000

HSBC

Holdings

plc

7.390

11/03/28

237,941

200,000

(c)

HSBC

Holdings

plc

8.000

N/A(d)

210,050

550,000

HSBC

Holdings

plc

6.000

N/A(d)

531,079

200,000

ING

Groep

NV

6.500

N/A(d)

197,805

200,000

JPMorgan

Chase

&

Co

2.301

10/15/25

197,990

125,000

JPMorgan

Chase

&

Co

4.323

04/26/28

121,942

400,000

JPMorgan

Chase

&

Co

5.581

04/22/30

406,336

275,000

JPMorgan

Chase

&

Co

3.702

05/06/30

257,133

75,000

JPMorgan

Chase

&

Co

1.953

02/04/32

61,004

125,000

JPMorgan

Chase

&

Co

4.912

07/25/33

121,405

650,000

JPMorgan

Chase

&

Co

5.350

06/01/34

647,120

100,000

JPMorgan

Chase

&

Co

6.254

10/23/34

106,061

300,000

JPMorgan

Chase

&

Co

5.766

04/22/35

307,802

50,000

JPMorgan

Chase

&

Co

2.525

11/19/41

34,064

250,000

JPMorgan

Chase

&

Co

3.157

04/22/42

186,038

160,000

JPMorgan

Chase

&

Co

3.650

N/A(d)

151,338

100,000

JPMorgan

Chase

&

Co

5.000

N/A(d)

99,714

363,000

JPMorgan

Chase

&

Co

6.100

N/A(d)

363,353

175,000

JPMorgan

Chase

&

Co

6.875

N/A(d)

180,751

200,000

Lloyds

Banking

Group

plc

7.500

N/A(d)

199,928

250,000

M&T

Bank

Corp

3.500

N/A(d)

208,625

250,000

(b)

NBK

SPC

Ltd

1.625

09/15/27

229,688

125,000

PNC

Financial

Services

Group,

Inc

6.200

N/A(d)

124,514

200,000

Toronto-Dominion

Bank

4.285

09/13/24

199,344

100,000

Toronto-Dominion

Bank

3.625

09/15/31

95,202

200,000

Truist

Financial

Corp

4.950

N/A(d)

195,905

100,000

US

Bancorp

4.839

02/01/34

94,804

375,000

Wells

Fargo

&

Co

2.393

06/02/28

345,371

100,000

Wells

Fargo

&

Co

6.303

10/23/29

103,771

125,000

(c)

Wells

Fargo

&

Co

7.625

N/A(d)

133,113

250,000

Wells

Fargo

&

Co

3.900

N/A(d)

239,231

TOTAL

BANKS

15,077,466

CAPITAL

GOODS

-

1.1%

25,000

(b)

Beacon

Roofing

Supply,

Inc

6.500

08/01/30

25,225

450,000

Boeing

Co

2.196

02/04/26

422,944

75,000

Boeing

Co

5.705

05/01/40

69,147

300,000

Boeing

Co

5.805

05/01/50

270,360

50,000

(b)

Chart

Industries,

Inc

7.500

01/01/30

51,668

62,000

(b)

H&E

Equipment

Services,

Inc

3.875

12/15/28

55,941

200,000

Honeywell

International,

Inc

5.250

03/01/54

194,071

150,000

L3Harris

Technologies,

Inc

5.400

07/31/33

149,527

50,000

Lockheed

Martin

Corp

1.850

06/15/30

42,121

100,000

Lockheed

Martin

Corp

5.200

02/15/64

94,546

175,000

Northrop

Grumman

Corp

3.250

01/15/28

164,811

See

Notes

to

Financial

Statements

Portfolio

of

Investments

(continued)

PRINCIPAL

DESCRIPTION

REFERENCE

RATE

&

SPREAD

RATE

MATURITY

DATE

VALUE

CAPITAL

GOODS—continued

$

175,000

Raytheon

Technologies

Corp

4.125

%

11/16/28

$

168,455

50,000

Raytheon

Technologies

Corp

2.250

07/01/30

42,703

150,000

Raytheon

Technologies

Corp

6.000

03/15/31

156,247

200,000

(b)

Sociedad

Quimica

y

Minera

de

Chile

S.A.

6.500

11/07/33

208,985

80,000

(b)

TransDigm,

Inc

6.875

12/15/30

81,668

15,000

(b)

WESCO

Distribution,

Inc

7.250

06/15/28

15,269

55,000

(b)

Windsor

Holdings

III

LLC

8.500

06/15/30

57,403

TOTAL

CAPITAL

GOODS

2,271,091

COMMERCIAL

&

PROFESSIONAL

SERVICES

-

0.3%

40,000

(b)

ADT

Corp

4.875

07/15/32

36,732

15,000

(b)

ASGN,

Inc

4.625

05/15/28

14,146

35,000

(b)

Garda

World

Security

Corp

7.750

02/15/28

35,647

65,000

(b)

GFL

Environmental,

Inc

5.125

12/15/26

64,372

200,000

(b)

GTCR

W-2

MERGER

SUB

LLC

7.500

01/15/31

208,531

50,000

(b)

Prime

Security

Services

Borrower

LLC

5.750

04/15/26

49,620

26,000

(b)

Prime

Security

Services

Borrower

LLC

3.375

08/31/27

24,057

70,000

(b)

Prime

Security

Services

Borrower

LLC

6.250

01/15/28

68,980

75,000

Verisk

Analytics,

Inc

3.625

05/15/50

53,934

100,000

Waste

Management,

Inc

2.500

11/15/50

59,799

TOTAL

COMMERCIAL

&

PROFESSIONAL

SERVICES

615,818

CONSUMER

DISCRETIONARY

DISTRIBUTION

&

RETAIL

-

0.6%

25,000

(b)

Asbury

Automotive

Group,

Inc

4.625

11/15/29

23,107

50,000

(b)

Asbury

Automotive

Group,

Inc

5.000

02/15/32

45,300

100,000

AutoZone,

Inc

1.650

01/15/31

80,204

150,000

Home

Depot,

Inc

4.950

06/25/34

148,437

32,000

Kohl's

Corp

4.625

05/01/31

26,769

80,000

(b)

LCM

Investments

Holdings

II

LLC

4.875

05/01/29

74,778

40,000

(b)

LCM

Investments

Holdings

II

LLC

8.250

08/01/31

41,739

45,000

(b)

Lithia

Motors,

Inc

4.625

12/15/27

42,926

175,000

Lowe's

Cos,

Inc

4.250

04/01/52

137,536

50,000

(b)

Macy's

Retail

Holdings

LLC

6.125

03/15/32

47,748

38,000

(b)

Magic

Mergeco,

Inc

5.250

05/01/28

30,400

125,000

O'Reilly

Automotive,

Inc

3.600

09/01/27

119,082

250,000

O'Reilly

Automotive,

Inc

1.750

03/15/31

201,442

200,000

(b)

Prosus

NV

4.193

01/19/32

176,429

15,000

(b)

Wand

NewCo

3,

Inc

7.625

01/30/32

15,492

TOTAL

CONSUMER

DISCRETIONARY

DISTRIBUTION

&

RETAIL

1,211,389

CONSUMER

DURABLES

&

APPAREL

-

0.0%

50,000

Newell

Brands,

Inc

6.375

09/15/27

49,307

TOTAL

CONSUMER

DURABLES

&

APPAREL

49,307

CONSUMER

SERVICES

-

0.3%

150,000

(b)

Churchill

Downs,

Inc

6.750

05/01/31

150,812

6,000

(b)

Hilton

Domestic

Operating

Co,

Inc

5.750

05/01/28

5,970

74,000

(b)

Hilton

Domestic

Operating

Co,

Inc

3.625

02/15/32

64,038

100,000

(b)

Hilton

Grand

Vacations

Borrower

Escrow

LLC

6.625

01/15/32

100,468

20,000

(b)

International

Game

Technology

plc

4.125

04/15/26

19,470

60,000

(b)

International

Game

Technology

plc

6.250

01/15/27

60,196

20,000

(b)

Light

&

Wonder

International,

Inc

7.500

09/01/31

20,665

25,000

(b),(c)

Marriott

Ownership

Resorts,

Inc

4.500

06/15/29

22,972

50,000

(b)

NCL

Corp

Ltd

5.875

03/15/26

49,431

TOTAL

CONSUMER

SERVICES

494,022

CONSUMER

STAPLES

DISTRIBUTION

&

RETAIL

-

0.3%

70,000

(b)

Albertsons

Cos,

Inc

6.500

02/15/28

70,332

60,000

Kroger

Co

3.875

10/15/46

45,207

50,000

SYSCO

Corp

6.000

01/17/34

52,481

100,000

SYSCO

Corp

3.150

12/14/51

65,434

100,000

Walmart,

Inc

1.050

09/17/26

92,184

200,000

Walmart,

Inc

1.800

09/22/31

164,787

See

Notes

to

Financial

Statements

PRINCIPAL

DESCRIPTION

REFERENCE

RATE

&

SPREAD

RATE

MATURITY

DATE

VALUE

CONSUMER

STAPLES

DISTRIBUTION

&

RETAIL—continued

$

175,000

Walmart,

Inc

4.500

%

04/15/53

$

154,895

TOTAL

CONSUMER

STAPLES

DISTRIBUTION

&

RETAIL

645,320

ENERGY

-

3.6%

100,000

(b)

Antero

Midstream

Partners

LP

6.625

02/01/32

100,900

19,000

(b)

Archrock

Partners

LP

6.250

04/01/28

18,817

100,000

Cenovus

Energy,

Inc

2.650

01/15/32

82,708

150,000

Cheniere

Energy

Partners

LP

3.250

01/31/32

128,029

150,000

(b)

Cheniere

Energy

Partners

LP

5.750

08/15/34

150,598

35,000

(b)

Civitas

Resources,

Inc

8.375

07/01/28

36,674

30,000

(b)

Civitas

Resources,

Inc

8.625

11/01/30

32,167

40,000

(b)

Civitas

Resources,

Inc

8.750

07/01/31

42,838

65,000

(b)

CNX

Resources

Corp

7.250

03/01/32

66,259

150,000

Diamondback

Energy,

Inc

4.400

03/24/51

119,812

35,000

(b)

DT

Midstream,

Inc

4.125

06/15/29

32,335

30,000

(b)

DT

Midstream,

Inc

4.375

06/15/31

27,325

45,000

Ecopetrol

S.A.

6.875

04/29/30

43,221

200,000

Ecopetrol

S.A.

4.625

11/02/31

163,690

250,000

Enbridge,

Inc

5.700

03/08/33

251,966

150,000

Enbridge,

Inc

5.750

07/15/80

141,548

33,000

(b)

Energean

Israel

Finance

Ltd

4.875

03/30/26

31,102

100,000

Energy

Transfer

LP

2.900

05/15/25

97,548

150,000

Energy

Transfer

LP

4.950

06/15/28

148,018

100,000

Energy

Transfer

LP

6.550

12/01/33

105,978

50,000

Energy

Transfer

LP

5.550

05/15/34

49,484

25,000

Energy

Transfer

LP

5.400

10/01/47

22,365

100,000

Energy

Transfer

LP

6.250

04/15/49

99,479

125,000

Energy

Transfer

LP

5.000

05/15/50

106,102

150,000

Energy

Transfer

LP

5.950

05/15/54

146,065

100,000

Energy

Transfer

Operating

LP

5.500

06/01/27

100,284

6,000

(b)

EnLink

Midstream

LLC

5.625

01/15/28

5,964

100,000

Enterprise

Products

Operating

LLC

3.700

02/15/26

97,429

100,000

Enterprise

Products

Operating

LLC

4.250

02/15/48

81,738

100,000

Enterprise

Products

Operating

LLC

4.200

01/31/50

80,185

100,000

Enterprise

Products

Operating

LLC

3.200

02/15/52

66,448

25,000

Enterprise

Products

Operating

LLC

3.300

02/15/53

16,837

100,000

(b)

EQM

Midstream

Partners

LP

4.500

01/15/29

94,372

35,000

(b)

EQM

Midstream

Partners

LP

6.375

04/01/29

35,354

25,000

(b)

EQT

Corp

3.125

05/15/26

23,890

200,000

(b)

Galaxy

Pipeline

Assets

Bidco

Ltd

2.625

03/31/36

162,500

50,000

Genesis

Energy

LP

8.000

01/15/27

51,123

50,000

Genesis

Energy

LP

8.250

01/15/29

51,617

10,000

(b)

Hilcorp

Energy

I

LP

5.750

02/01/29

9,677

25,000

(b)

Hilcorp

Energy

I

LP

6.000

04/15/30

24,149

9,000

(b)

Hilcorp

Energy

I

LP

6.000

02/01/31

8,590

100,000

(b)

Hilcorp

Energy

I

LP

8.375

11/01/33

106,576

100,000

(b)

Kinetik

Holdings

LP

6.625

12/15/28

101,596

40,000

(b)

Kodiak

Gas

Services

LLC

7.250

02/15/29

41,003

275,000

Marathon

Oil

Corp

5.300

04/01/29

276,131

75,000

Marathon

Petroleum

Corp

3.800

04/01/28

71,466

100,000

Marathon

Petroleum

Corp

5.000

09/15/54

84,908

450,000

MPLX

LP

2.650

08/15/30

387,780

125,000

MPLX

LP

4.700

04/15/48

102,818

34,000

Murphy

Oil

Corp

5.875

12/01/27

33,958

33,000

Occidental

Petroleum

Corp

5.500

12/01/25

32,916

200,000

(b)

Oleoducto

Central

S.A.

4.000

07/14/27

185,379

100,000

ONEOK,

Inc

4.500

03/15/50

79,098

67,000

(b)

Parkland

Corp

4.500

10/01/29

61,325

200,000

(b)

Pertamina

Persero

PT

1.400

02/09/26

186,795

100,000

Petroleos

Mexicanos

5.950

01/28/31

80,586

67,000

Petroleos

Mexicanos

6.700

02/16/32

56,098

200,000

(b)

Petronas

Energy

Canada

Ltd

2.112

03/23/28

180,205

See

Notes

to

Financial

Statements

Portfolio

of

Investments

(continued)

PRINCIPAL

DESCRIPTION

REFERENCE

RATE

&

SPREAD

RATE

MATURITY

DATE

VALUE

ENERGY—continued

$

200,000

Phillips

66

2.150

%

12/15/30

$

167,060

100,000

Phillips

66

3.300

03/15/52

65,378

200,000

(b)

Qatar

Petroleum

2.250

07/12/31

167,021

175,000

Sabine

Pass

Liquefaction

LLC

5.875

06/30/26

175,701

200,000

(b)

Saudi

Arabian

Oil

Co

2.250

11/24/30

168,371

125,000

Sunoco

Logistics

Partners

Operations

LP

4.000

10/01/27

120,008

23,000

Sunoco

LP

4.500

05/15/29

21,510

25,000

Targa

Resources

Partners

LP

6.500

07/15/27

25,178

150,000

TotalEnergies

Capital

International

S.A.

3.127

05/29/50

101,140

50,000

TotalEnergies

Capital

S.A.

5.488

04/05/54

49,308

75,000

TotalEnergies

Capital

S.A.

5.638

04/05/64

74,264

200,000

TransCanada

Trust

5.500

09/15/79

183,546

18,000

(b)

Transocean,

Inc

8.750

02/15/30

18,898

25,000

USA

Compression

Partners

LP

6.875

09/01/27

25,047

100,000

(b)

Venture

Global

Calcasieu

Pass

LLC

4.125

08/15/31

89,736

90,000

(b)

Venture

Global

LNG,

Inc

8.125

06/01/28

92,719

100,000

(b)

Venture

Global

LNG,

Inc

9.875

02/01/32

108,842

300,000

Williams

Cos,

Inc

5.650

03/15/33

302,737

TOTAL

ENERGY

7,180,287

EQUITY

REAL

ESTATE

INVESTMENT

TRUSTS

(REITS)

-

1.7%

150,000

Agree

LP

2.000

06/15/28

132,497

100,000

Alexandria

Real

Estate

Equities,

Inc

3.950

01/15/28

95,726

100,000

Alexandria

Real

Estate

Equities,

Inc

4.900

12/15/30

97,869

100,000

Alexandria

Real

Estate

Equities,

Inc

1.875

02/01/33

75,233

100,000

American

Tower

Corp

2.950

01/15/25

98,435

50,000

American

Tower

Corp

3.375

10/15/26

47,752

150,000

American

Tower

Corp

3.800

08/15/29

139,423

175,000

American

Tower

Corp

2.900

01/15/30

154,273

50,000

American

Tower

Corp

2.100

06/15/30

41,893

50,000

American

Tower

Corp

1.875

10/15/30

40,707

200,000

Brixmor

Operating

Partnership

LP

3.850

02/01/25

197,825

100,000

Brixmor

Operating

Partnership

LP

2.250

04/01/28

89,223

50,000

CubeSmart

LP

2.250

12/15/28

44,026

150,000

Essential

Properties

LP

2.950

07/15/31

123,405

50,000

Essex

Portfolio

LP

3.000

01/15/30

44,413

110,000

Extra

Space

Storage

LP

2.400

10/15/31

90,375

175,000

Healthcare

Realty

Holdings

LP

3.875

05/01/25

171,644

125,000

Healthcare

Realty

Holdings

LP

3.500

08/01/26

119,744

50,000

Healthcare

Realty

Holdings

LP

3.100

02/15/30

43,722

100,000

Healthcare

Realty

Holdings

LP

2.400

03/15/30

82,409

100,000

Healthcare

Realty

Holdings

LP

2.050

03/15/31

77,379

100,000

Highwoods

Realty

LP

3.875

03/01/27

94,814

50,000

Highwoods

Realty

LP

2.600

02/01/31

39,942

155,000

(b)

Iron

Mountain,

Inc

7.000

02/15/29

157,727

100,000

Kimco

Realty

OP

LLC

3.250

08/15/26

95,203

50,000

Kite

Realty

Group

LP

5.500

03/01/34

48,884

100,000

Kite

Realty

Group

Trust

4.750

09/15/30

95,516

200,000

Mid-America

Apartments

LP

2.750

03/15/30

177,002

100,000

Mid-America

Apartments

LP

1.700

02/15/31

80,235

100,000

Mid-America

Apartments

LP

2.875

09/15/51

61,884

67,000

MPT

Operating

Partnership

LP

3.500

03/15/31

43,658

100,000

NNN

REIT,

Inc

5.600

10/15/33

99,497

50,000

Regency

Centers

LP

3.900

11/01/25

48,862

100,000

Regency

Centers

LP

3.600

02/01/27

95,986

100,000

Regency

Centers

LP

2.950

09/15/29

89,769

87,000

SITE

Centers

Corp

3.625

02/01/25

85,845

TOTAL

EQUITY

REAL

ESTATE

INVESTMENT

TRUSTS

(REITS)

3,322,797

FINANCIAL

SERVICES

-

2.6%

250,000

AerCap

Ireland

Capital

DAC

3.000

10/29/28

227,193

150,000

AerCap

Ireland

Capital

DAC

3.850

10/29/41

117,310

See

Notes

to

Financial

Statements

PRINCIPAL

DESCRIPTION

REFERENCE

RATE

&

SPREAD

RATE

MATURITY

DATE

VALUE

FINANCIAL

SERVICES—continued

$

225,000

Bank

of

New

York

Mellon

Corp

4.700

%

N/A(d)

$

221,032

185,000

(c)

Capital

One

Financial

Corp

3.950

N/A(d)

170,247

200,000

Charles

Schwab

Corp

5.375

N/A(d)

197,755

30,000

(b)

Compass

Group

Diversified

Holdings

LLC

5.250

04/15/29

28,454

100,000

(b)

Corebridge

Financial,

Inc

6.050

09/15/33

102,556

75,000

Corebridge

Financial,

Inc

5.750

01/15/34

75,498

200,000

Deutsche

Bank

AG.

6.000

N/A(d)

189,308

150,000

Discover

Bank

2.450

09/12/24

148,953

250,000

Discover

Bank

2.700

02/06/30

214,605

100,000

(b)

Equitable

Financial

Life

Global

Funding

1.400

07/07/25

95,797

85,000

(b)

FirstCash,

Inc

6.875

03/01/32

84,989

80,000

Fiserv,

Inc

3.500

07/01/29

73,962

100,000

Fiserv,

Inc

5.450

03/15/34

99,374

200,000

Goldman

Sachs

Group,

Inc

3.500

04/01/25

196,941

300,000

Goldman

Sachs

Group,

Inc

4.482

08/23/28

293,194

150,000

Goldman

Sachs

Group,

Inc

5.851

04/25/35

153,649

50,000

Goldman

Sachs

Group,

Inc

4.411

04/23/39

44,212

100,000

Goldman

Sachs

Group,

Inc

3.436

02/24/43

75,515

150,000

Goldman

Sachs

Group,

Inc

7.500

N/A(d)

157,157

40,000

(b)

HAT

Holdings

I

LLC

8.000

06/15/27

41,586

50,000

Icahn

Enterprises

LP

5.250

05/15/27

46,931

38,000

Icahn

Enterprises

LP

4.375

02/01/29

32,492

200,000

(b),(c)

Indian

Railway

Finance

Corp

Ltd

3.249

02/13/30

179,868

150,000

Morgan

Stanley

2.720

07/22/25

149,718

125,000

Morgan

Stanley

2.188

04/28/26

121,393

475,000

Morgan

Stanley

3.125

07/27/26

454,118

100,000

Morgan

Stanley

5.449

07/20/29

100,617

250,000

Morgan

Stanley

5.250

04/21/34

246,089

100,000

Morgan

Stanley

5.424

07/21/34

99,496

75,000

Morgan

Stanley

5.831

04/19/35

76,881

50,000

Navient

Corp

5.500

03/15/29

45,651

60,000

Northern

Trust

Corp

4.600

N/A(d)

58,065

15,000

(b)

PennyMac

Financial

Services,

Inc

7.875

12/15/29

15,468

15,000

Springleaf

Finance

Corp

5.375

11/15/29

14,068

175,000

State

Street

Corp

6.700

N/A(d)

176,043

150,000

UBS

Group

AG.

3.750

03/26/25

147,930

125,000

(b)

UBS

Group

AG.

1.305

02/02/27

116,537

200,000

(b)

UBS

Group

AG.

3.179

02/11/43

142,645

50,000

Visa,

Inc

2.700

04/15/40

36,433

TOTAL

FINANCIAL

SERVICES

5,269,730

FOOD,

BEVERAGE

&

TOBACCO

-

1.4%

75,000

Anheuser-Busch

Cos

LLC

4.700

02/01/36

71,503

200,000

Anheuser-Busch

Cos

LLC

4.900

02/01/46

184,392

380,000

Anheuser-Busch

InBev

Worldwide,

Inc

4.750

01/23/29

377,845

325,000

Anheuser-Busch

InBev

Worldwide,

Inc

5.000

06/15/34

322,496

200,000

BAT

Capital

Corp

2.259

03/25/28

179,194

100,000

BAT

Capital

Corp

4.906

04/02/30

97,466

200,000

BAT

International

Finance

plc

4.448

03/16/28

193,624

200,000

(b)

Bimbo

Bakeries

USA,

Inc

6.050

01/15/29

205,565

175,000

(b)

Cia

Cervecerias

Unidas

S.A.

3.350

01/19/32

152,175

100,000

Constellation

Brands,

Inc

4.400

11/15/25

98,612

100,000

Constellation

Brands,

Inc

3.700

12/06/26

96,620

100,000

Constellation

Brands,

Inc

3.150

08/01/29

90,690

100,000

Constellation

Brands,

Inc

2.875

05/01/30

88,253

100,000

Constellation

Brands,

Inc

2.250

08/01/31

82,081

100,000

Diageo

Capital

plc

2.125

10/24/24

98,894

100,000

Kraft

Heinz

Foods

Co

4.375

06/01/46

81,328

300,000

Philip

Morris

International,

Inc

5.250

02/13/34

294,320

35,000

(b)

Post

Holdings,

Inc

6.250

02/15/32

35,045

See

Notes

to

Financial

Statements

Portfolio

of

Investments

(continued)

PRINCIPAL

DESCRIPTION

REFERENCE

RATE

&

SPREAD

RATE

MATURITY

DATE

VALUE

FOOD,

BEVERAGE

&

TOBACCO—continued

$

75,000

(b)

Primo

Water

Holdings,

Inc

4.375

%

04/30/29

$

69,095

TOTAL

FOOD,

BEVERAGE

&

TOBACCO

2,819,198

HEALTH

CARE

EQUIPMENT

&

SERVICES

-

1.0%

50,000

Boston

Scientific

Corp

2.650

06/01/30

43,890

35,000

Centene

Corp

2.450

07/15/28

31,074

180,000

Centene

Corp

3.000

10/15/30

153,912

40,000

(b)

CHS

5.250

05/15/30

32,980

55,000

Cigna

Group

3.200

03/15/40

40,684

300,000

CVS

Health

Corp

4.780

03/25/38

267,845

150,000

CVS

Health

Corp

5.050

03/25/48

129,241

50,000

(b)

DaVita,

Inc

4.625

06/01/30

45,181

100,000

Elevance

Health,

Inc

2.250

05/15/30

85,684

100,000

Elevance

Health,

Inc

5.125

02/15/53

91,981

160,000

HCA,

Inc

5.625

09/01/28

161,427

350,000

HCA,

Inc

3.625

03/15/32

308,302

300,000

Humana,

Inc

2.150

02/03/32

239,374

50,000

Humana,

Inc

5.875

03/01/33

50,862

100,000

McKesson

Corp

5.100

07/15/33

99,779

10,000

Tenet

Healthcare

Corp

4.625

06/15/28

9,510

80,000

Tenet

Healthcare

Corp

4.375

01/15/30

74,157

240,000

UnitedHealth

Group,

Inc

2.300

05/15/31

201,377

TOTAL

HEALTH

CARE

EQUIPMENT

&

SERVICES

2,067,260

HOUSEHOLD

&

PERSONAL

PRODUCTS

-

0.2%

75,000

Church

&

Dwight

Co,

Inc

2.300

12/15/31

62,376

40,000

(b)

Coty,

Inc

6.625

07/15/30

40,592

250,000

Haleon

US

Capital

LLC

3.375

03/24/27

238,558

TOTAL

HOUSEHOLD

&

PERSONAL

PRODUCTS

341,526

INSURANCE

-

1.7%

62,000

(b)

Acrisure

LLC

4.250

02/15/29

56,320

85,000

(b)

Alliant

Holdings

Intermediate

LLC

6.750

04/15/28

85,135

200,000

(b)

Allianz

SE

6.350

09/06/53

205,850

150,000

Aon

Corp

5.350

02/28/33

148,990

200,000

(b)

Ardonagh

Finco

Ltd

7.750

02/15/31

197,713

75,000

Arthur

J

Gallagher

&

Co

5.750

03/02/53

72,719

75,000

Berkshire

Hathaway

Finance

Corp

2.875

03/15/32

65,685

75,000

Berkshire

Hathaway

Finance

Corp

3.850

03/15/52

57,974

400,000

Hartford

Financial

Services

Group,

Inc

2.800

08/19/29

355,199

50,000

Hartford

Financial

Services

Group,

Inc

4.300

04/15/43

42,191

50,000

Hartford

Financial

Services

Group,

Inc

2.900

09/15/51

31,449

55,000

(b)

HUB

International

Ltd

7.250

06/15/30

56,382

50,000

(b)

Liberty

Mutual

Group,

Inc

3.951

10/15/50

36,354

50,000

MetLife,

Inc

5.000

07/15/52

45,549

115,000

MetLife,

Inc

3.850

N/A(d)

111,304

130,000

(b)

Panther

Escrow

Issuer

LLC

7.125

06/01/31

131,487

150,000

PartnerRe

Finance

B

LLC

4.500

10/01/50

136,175

300,000

Prudential

Financial,

Inc

5.125

03/01/52

278,884

100,000

Prudential

Financial,

Inc

6.500

03/15/54

100,948

100,000

Reinsurance

Group

of

America,

Inc

3.900

05/15/29

93,735

150,000

Reinsurance

Group

of

America,

Inc

5.750

09/15/34

149,456

200,000

(b)

Swiss

Re

Finance

Luxembourg

S.A.

5.000

04/02/49

192,500

100,000

Verisk

Analytics,

Inc

5.250

06/05/34

98,463

300,000

(a),(b)

Vitality

Re

XIV

Ltd

3-Month

US

Treasury

Bill

+

3.500%

8.855

01/05/27

304,650

250,000

(a),(b)

Vitality

Re

XV

Ltd

3-Month

US

Treasury

Bill

+

2.500%

7.868

01/07/28

249,675

TOTAL

INSURANCE

3,304,787

MATERIALS

-

1.6%

100,000

Albemarle

Corp

4.650

06/01/27

98,390

200,000

(b)

Alpek

SAB

de

C.V.

3.250

02/25/31

168,671

150,000

Amcor

Flexibles

North

America,

Inc

2.630

06/19/30

128,693

200,000

Amcor

Flexibles

North

America,

Inc

2.690

05/25/31

168,058

See

Notes

to

Financial

Statements

PRINCIPAL

DESCRIPTION

REFERENCE

RATE

&

SPREAD

RATE

MATURITY

DATE

VALUE

MATERIALS—continued

$

200,000

AngloGold

Ashanti

Holdings

plc

3.750

%

10/01/30

$

174,521

200,000

(b)

Antofagasta

plc

6.250

05/02/34

207,140

95,000

(b)

Arsenal

AIC

Parent

LLC

8.000

10/01/30

99,693

19,000

(b)

Avient

Corp

5.750

05/15/25

18,948

38,000

Ball

Corp

2.875

08/15/30

32,282

225,000

Berry

Global,

Inc

1.570

01/15/26

211,389

150,000

Berry

Global,

Inc

1.650

01/15/27

136,606

200,000

(b)

Celulosa

Arauco

y

Constitucion

S.A.

4.250

04/30/29

186,089

200,000

(b)

Cemex

SAB

de

C.V.

5.450

11/19/29

196,510

200,000

(b)

Freeport

Indonesia

PT

5.315

04/14/32

193,951

65,000

(b)

Mineral

Resources

Ltd

9.250

10/01/28

68,220

100,000

Nutrien

Ltd

2.950

05/13/30

88,492

200,000

(b)

OCP

S.A.

3.750

06/23/31

172,149

200,000

(b)

Orbia

Advance

Corp

SAB

de

C.V.

1.875

05/11/26

186,429

200,000

(b)

POSCO

4.500

08/04/27

194,864

30,000

(b)

Sealed

Air

Corp

7.250

02/15/31

30,888

200,000

(b)

St.

Marys

Cement,

Inc

Canada

5.750

04/02/34

196,250

50,000

(b)

SunCoke

Energy,

Inc

4.875

06/30/29

45,298

100,000

(b)

Tronox,

Inc

4.625

03/15/29

90,269

200,000

(b)

UltraTech

Cement

Ltd

2.800

02/16/31

168,788

TOTAL

MATERIALS

3,262,588

MEDIA

&

ENTERTAINMENT

-

1.3%

100,000

(b)

CCO

Holdings

LLC

5.125

05/01/27

96,015

100,000

(c)

Charter

Communications

Operating

LLC

4.400

04/01/33

88,154

225,000

Charter

Communications

Operating

LLC

6.550

06/01/34

225,075

350,000

Charter

Communications

Operating

LLC

4.800

03/01/50

256,756

150,000

Comcast

Corp

4.150

10/15/28

145,213

300,000

Comcast

Corp

3.200

07/15/36

242,405

500,000

Comcast

Corp

2.887

11/01/51

311,947

200,000

(b)

CSC

Holdings

LLC

11.250

05/15/28

174,177

40,000

(b)

DIRECTV

Holdings

LLC

5.875

08/15/27

37,623

15,000

Lamar

Media

Corp

3.625

01/15/31

13,193

33,000

(b)

News

Corp

3.875

05/15/29

30,376

110,000

(b)

Sirius

XM

Radio,

Inc

4.000

07/15/28

99,369

50,000

(b)

Sirius

XM

Radio,

Inc

4.125

07/01/30

42,706

50,000

Time

Warner

Cable

LLC

5.875

11/15/40

43,383

200,000

Warnermedia

Holdings,

Inc

3.755

03/15/27

189,884

100,000

Warnermedia

Holdings,

Inc

4.054

03/15/29

92,349

275,000

Warnermedia

Holdings,

Inc

5.050

03/15/42

223,687

200,000

(c)

Weibo

Corp

3.375

07/08/30

174,731

TOTAL

MEDIA

&

ENTERTAINMENT

2,487,043

PHARMACEUTICALS,

BIOTECHNOLOGY

&

LIFE

SCIENCES

-

1.1%

200,000

AbbVie,

Inc

5.050

03/15/34

199,415

150,000

AbbVie,

Inc

4.050

11/21/39

130,290

100,000

AbbVie,

Inc

5.400

03/15/54

98,882

400,000

Amgen,

Inc

5.250

03/02/33

398,834

250,000

Amgen,

Inc

5.650

03/02/53

246,211

30,000

(b)

Avantor

Funding,

Inc

4.625

07/15/28

28,548

75,000

Danaher

Corp

2.800

12/10/51

47,350

250,000

Gilead

Sciences,

Inc

5.250

10/15/33

251,827

100,000

Gilead

Sciences,

Inc

2.600

10/01/40

68,920

100,000

Gilead

Sciences,

Inc

5.550

10/15/53

99,846

100,000

Merck

&

Co,

Inc

2.750

12/10/51

62,518

200,000

(b)

Organon

Finance LLC

5.125

04/30/31

179,650

400,000

Pfizer

Investment

Enterprises

Pte

Ltd

5.300

05/19/53

385,807

TOTAL

PHARMACEUTICALS,

BIOTECHNOLOGY

&

LIFE

SCIENCES

2,198,098

REAL

ESTATE

MANAGEMENT

&

DEVELOPMENT

-

0.0%

28,000

Kennedy-Wilson,

Inc

4.750

03/01/29

23,956

See

Notes

to

Financial

Statements

Portfolio

of

Investments

(continued)

PRINCIPAL

DESCRIPTION

REFERENCE

RATE

&

SPREAD

RATE

MATURITY

DATE

VALUE

REAL

ESTATE

MANAGEMENT

&

DEVELOPMENT—continued

$

29,000

Kennedy-Wilson,

Inc

5.000

%

03/01/31

$

23,716

TOTAL

REAL

ESTATE

MANAGEMENT

&

DEVELOPMENT

47,672

SEMICONDUCTORS

&

SEMICONDUCTOR

EQUIPMENT

-

0.4%

365,000

(b)

Broadcom,

Inc

4.926

05/15/37

343,287

115,000

NVIDIA

Corp

2.000

06/15/31

96,637

100,000

NXP

BV

3.400

05/01/30

90,607

125,000

NXP

BV

3.125

02/15/42

87,926

200,000

(b)

TSMC

Global

Ltd

1.000

09/28/27

175,819

TOTAL

SEMICONDUCTORS

&

SEMICONDUCTOR

EQUIPMENT

794,276

SOFTWARE

&

SERVICES

-

0.7%

105,000