UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

WASHINGTON, D.C. 20549

SCHEDULE 14A

Proxy Statement Pursuant to Section 14(a) of the Securities

Exchange Act of 1934 (Amendment No. )

Filed by the Registrant x

Filed by a Party other than the Registrant ¨

Check the appropriate box:

¨ Preliminary Proxy Statement ¨ CONFIDENTIAL, FOR USE OF THE COMMISSION ONLY (AS PERMITTED BY RULE 14A-6(E)(2)) |

x Definitive Proxy Statement

¨ Definitive Additional Materials

¨ Soliciting Material Pursuant to Section 240.14a-11(c) or Section 240.14a-12

METROCORP BANCSHARES, Inc.

(Name of Registrant as Specified In Its Certificate)

(Name of Person(s) Filing Proxy Statement, if other than the Registrant)

Payment of Filing Fee (Check the appropriate box):

¨ Fee | | computed on table below per Exchange Act Rules 14a-6(i)(4) and 0-11. |

| | 1) | | Title of each class of securities to which transaction applies: |

| | 2) | | Aggregate number of securities to which transaction applies: |

| | 3) | | Per unit price or other underlying value of transaction computed pursuant to Exchange Act Rule 0-11 (Set forth the amount on which the filing fee is calculated and state how it was determined): |

| | 4) | | Proposed maximum aggregate value of transaction: |

¨ Fee paid previously with preliminary materials.

¨ | | Check box if any part of the fee is offset as provided by Exchange Act Rule 0-11(a)(2) and identify the filing for which the offsetting fee was paid previously. Identify the previous filing by registration statement number, or the Form or Schedule and the date of its filing. |

| | 1) | | Amount Previously Paid: |

| | 2) | | Form, Schedule or Registration Statement No.: |

Notes:

Reg. § 240.14a-101

SEC 1913 (3-99)

METROCORP BANCSHARES, INC.

9600 Bellaire Boulevard, Suite 252

Houston, Texas 77036

NOTICE OF THE 2002 ANNUAL MEETING OF SHAREHOLDERS

TO BE HELD ON FRIDAY, MAY 24, 2002

Shareholders of MetroCorp Bancshares, Inc.:

The 2002 Annual Meeting of Shareholders (the “Meeting”) of MetroCorp Bancshares, Inc. (the “Company”) will be held at the Company’s principal executive offices at 9600 Bellaire Boulevard, Suite 252, Houston, Texas 77036, on Friday, May 24, 2002, beginning at 10:00 a.m. (local time), for the following purposes:

| | 1. | | To elect four directors of Class I to serve on the Board of Directors of the Company until the Company’s 2005 Annual Meeting of Shareholders and until their successors are duly elected and qualified; |

| | 2. | | To consider and act upon a proposal to amend the MetroCorp Bancshares, Inc. 1998 Stock Incentive Plan to increase the number of shares of Common Stock issuable thereunder from 200,000 to 700,000 shares; |

| | 3. | | To consider and act upon a proposal to ratify the appointment of Deloitte & Touche LLP as the independent auditors of the books and accounts of the Company for the year ending December 31, 2002; and |

| | 4. | | To transact such other business as may properly come before the meeting or any adjournment thereof. |

The close of business on April 15, 2002 has been fixed as the record date for the determination of shareholders entitled to notice of and to vote at the Meeting or at any adjournments thereof. A list of shareholders entitled to vote at the Meeting will be available for inspection by any shareholder at the offices of the Company during ordinary business hours for a period of at least ten days prior to the Meeting.

You are cordially invited and urged to attend the Meeting. If you are unable to attend the Meeting, you are requested to sign and date the enclosed proxy and return it promptly in the enclosed envelope. If you attend the Meeting, you may vote in person, regardless of whether you have given your proxy. Your proxy may be revoked at any time before it is voted.

| | By | order of the Board of Directors, |

Houston, Texas

April 22, 2002

YOUR VOTE IS IMPORTANT.

To ensure your representation at the Meeting, please complete, date, and sign the enclosed proxy and return it in the accompanying envelope at your earliest convenience, regardless of whether you plan to attend the Meeting. No additional postage is necessary if the proxy is mailed in the United States. The proxy is revocable at any time before it is voted at the Meeting.

METROCORP BANCSHARES, INC.

9600 Bellaire Boulevard, Suite 252

Houston, Texas 77036

April 22, 2002

PROXY STATEMENT

FOR

THE 2002 ANNUAL MEETING OF SHAREHOLDERS

TO BE HELD ON FRIDAY, MAY 24, 2002

INTRODUCTION

This Proxy Statement is being furnished in connection with the solicitation of proxies by the Board of Directors of MetroCorp Bancshares, Inc. (the “Company”) for use at the 2002 Annual Meeting of Shareholders of the Company to be held at the Company’s principal executive offices at 9600 Bellaire Boulevard, Suite 252, Houston, Texas 77036, on Friday, May 24, 2002 beginning at 10:00 a.m. (local time), and any adjournment thereof (the “Meeting”) for the purposes set forth in this Proxy Statement and the accompanying Notice of 2002 Annual Meeting of Shareholders (“Notice of Meeting”). This Proxy Statement, the Notice of Meeting and the enclosed form of proxy will first be sent to shareholders on or about April 22, 2002.

Voting of Proxies

This Proxy Statement is furnished to the shareholders of the Company for solicitation of proxies on behalf of the Board of Directors of the Company for use at the Meeting, and at any and all adjournments thereof. The purpose of the Meeting and the matters to be acted upon are set forth herein and in the accompanying Notice of Meeting.

Shares represented at the Meeting by an executed and unrevoked proxy in the form enclosed will be voted in accordance with the instructions contained therein. If no instructions are given on an executed and returned form of proxy, the proxies intend to vote the shares represented thereby in favor of each of the proposals to be presented to and voted upon by the shareholders as set forth herein.

The Board of Directors knows of no other matters to be presented at the Meeting. If any other matter should be presented at the Meeting upon which a vote may be properly taken, shares represented by an executed and unrevoked proxy received by the Board of Directors may be voted with respect thereto in accordance with the judgment of the proxies. The proxy also confers on the proxies the discretionary authority to vote with respect to any matter presented at the Meeting for which advance notice was not received by the Company in accordance with the Company’s Amended and Restated Bylaws.

Revocability of Proxies

Any proxy given by a record shareholder may be revoked by such shareholder at any time before it is exercised by submitting to the Secretary of the Company a duly executed proxy bearing a later date, delivering to the Secretary of the Company a written notice of revocation, or attending the Meeting and voting in person. If you hold your shares in street name with a bank or broker, you must contact your bank or broker if you wish to revoke your proxy.

Solicitation

The cost of this solicitation of proxies is being borne by the Company. Solicitations will be made only by the use of the mail, except that, if deemed desirable, officers and regular employees of the Company may solicit proxies by telephone, telegraph or personal calls, without being paid additional compensation for such services. Brokerage houses, custodians, nominees and fiduciaries will be requested to forward the proxy soliciting material to the beneficial owners of the common stock, par value $1.00 per share, of the Company (the “Common Stock”) held of record by such persons, and the Company will reimburse them for their reasonable expenses incurred in this connection.

Annual Report

The Company’s Annual Report to Shareholders, including financial statements, for the fiscal year ended December 31, 2001, as filed with the Securities and Exchange Commission, accompanies but does not constitute part of this Proxy Statement.

VOTING SHARES AND VOTING RIGHTS

Only holders of record of Common Stock at the close of business on April 15, 2002 (the “Record Date”), are entitled to notice of and to vote at the Meeting and any adjournments or postponements thereof. At April 9, 2002, there were outstanding 7,012,879 shares of Common Stock, which is the only outstanding class of voting securities of the Company. A majority of the outstanding shares of Common Stock must be represented at the Meeting in person or by proxy in order to constitute a quorum for the transaction of business. Each holder of Common Stock shall have one vote for each share of Common Stock registered, on the Record Date, in such holder’s name on the books of the Company.

The affirmative vote of the holders of a plurality of the outstanding shares of Common Stock represented at the Meeting is required to elect a director. There will be no cumulative voting in the election of directors. Accordingly, the four persons receiving the greatest number of votes will be elected as directors. Votes withheld and broker non-votes with respect to one or more nominees for director will have no effect in the election of directors.

The affirmative vote of the holders of a majority of the outstanding shares of Common Stock represented at the Meeting is required to approve the amendment to the Company’s 1998 Stock Option plan and ratify the appointment of the auditors. Abstentions will have the effect of a vote against such matters. However, broker non-votes will be deemed shares not present to vote on such matters and will not count as votes for or against the proposals and will not be included in calculating the number of votes necessary for approval of such matters.

ITEM 1.

ELECTION OF DIRECTORS

Election Procedures; Term of Office

The Board of Directors currently consists of ten directors. In accordance with the Company’s Amended and Restated Bylaws, members of the Board of Directors are divided into three classes, Class I, Class II and Class III. The members of each class are elected for a term of office to expire at the third succeeding annual meeting of shareholders following their election. The term of office of the current Class I directors expires at the Meeting. The terms of the current Class II and Class III directors expire at the annual meeting of shareholders in 2003 and 2004, respectively. The four Class I nominees, if elected at the Meeting, will serve until the annual meeting of shareholders in 2005 and until their successors are duly elected and qualified.

The Board of Directors has nominated Allen D. Brown, David Tai, Helen F. Chen and George M. Lee for election as Class I directors at the Meeting. Ms. Chen and Mr. Tai, were elected as Class I directors in 1998. Mr. Lee was elected as a Class I director in April 1999 and Mr. Brown was appointed as a Class I director in December 2001. Each of the nominees has consented to being named in this Proxy Statement and to serve if elected.

2

The Class I nominees receiving the affirmative vote of the holders of a plurality of the shares of Common Stock represented at the Meeting will be elected. Unless the authority to vote for the election of directors is withheld as to one or more of the nominees, all shares of Common Stock represented by proxy will be votedFOR the election of the nominees. If the authority to vote for the election of directors is withheld as to one or two but not all of the nominees, all shares of Common Stock represented by any such proxy will be votedFOR the election of the nominee or nominees, as the case may be, as to whom such authority is not withheld. If a nominee becomes unavailable to serve as a director for any reason before the election, the persons designated by proxy will be voted for such other person, if any, as may be designated by the Board of Directors. The Board of Directors has no reason to believe that any nominee will be unavailable to serve as a director.

Any director vacancy occurring after the election may be filled only by a majority of the remaining directors, even if less than a quorum of the Board of Directors. A director elected to fill a vacancy will be elected for the unexpired portion of the term of his predecessor in office.

Nominees for Election

The following table sets forth certain information with respect to each nominee for election as a director of the Company:

Name

| | Age

| | Positions with the Company and MetroBank, N.A. (the “Bank”)

|

| Allen D. Brown | | 51 | | Class I Director and President of the Company; Director and Chief Executive Officer of the Bank |

| Helen F. Chen | | 54 | | Class I Director of the Company; Director of the Bank |

| George M. Lee | | 53 | | Class I Director of the Company; Director of the Bank |

| David Tai | | 50 | | Class I Director, Executive Vice President and Secretary of the Company; Vice Chairman of the Board and President of the Bank |

Allen D. Brown. Mr. Brown joined the Company as President and the Bank as Chief Executive Officer in August 2001 and was appointed a director of the Company and the Bank in December 2001. Mr. Brown started his career with Continental Illinois National Bank and Trust Company of Chicago in 1978 In 1984 he became Senior Vice President of First National Bank and Trust of Oklahoma City, with approximately $3 billion in assets, which became First Interstate Bank of Oklahoma in 1985, where Mr. Brown became Executive Vice President. In 1988, Mr. Brown transferred to First Interstate Bank of Texas as Executive Vice President and in 1991 became Executive Vice President of First Interstate Bancorp. From October 1996 to August 2001, Mr. Brown was associated with the Redstone Group and during that time assumed the role of President/CEO of two affiliated Houston commercial banks. In these various banking assignments, Brown gained extensive credit, business development and management experience. He received a Bachelors of Science in Business from Mississippi State University and his MBA in Finance from Vanderbilt University. Mr. Brown, a former Peace Corp volunteer in Ecuador, is active in the community having served on the United Way of the Texas Gulf Coast Board and he currently serves on the Southern Region and the Sam Houston Area Council Boards of the Boy Scouts of America.

Helen F. Chen. Ms. Chen is a Class I director of the Company and has served as a director of the Bank since 1989. She is the President of Metro Investment Group, Inc., an investment company that holds shares of Common Stock of the Company as its principal asset. She is the President of the Houston Chinese Schools

3

Association and the Principal of the Houston Northwest Chinese School, where she served as Chairman of the Board from 1977 to 1991. A member of various civic organizations in Houston, Ms. Chen focuses her efforts on the Chinese community. Ms. Chen is the sister of Don J. Wang. Ms. Chen is not related to Mr. Tommy F. Chen.

George M. Lee. Mr. Lee was appointed as a Class I director of the Company and a director of the Bank in March 1999. Mr. Lee serves as the President and CEO of BioCure Medical LLC, which is based out of Minnesota. BioCure Medical LLC is a joint venture between a private investment group and the Johns Hopkins University. Its mission is to develop and commercialize a patented cancer drug that has very low toxicity. He oversees the management of product development, marketing, and financial activities. Mr. Lee resigned as the Senior Marketing Vice President of Higher Dimensions Medical in April 2000. However, he continued to be an investor to the company. Prior to this, from 1995 to 1997, he served as the Chief Operating Officer of the Noel Group Companies, a travel insurance company. From 1991 to 1994, Mr. Lee was a Senior Vice President of Fingerhut Companies and concurrently served as the President and Chief Operating Officer of its largest subsidiary, Comb Corporation. From 1987 to 1990, Mr. Lee was a Group Vice President of Hanover Direct, where he was responsible for four divisions and new business development. He received a Bachelors of Science in Econometrics from the University of Wisconsin. Mr. Lee is a resident of Minnesota. Mr. Lee is not related to Mr. John Lee.

David Tai. Mr. Tai is a Class I director of the Company and has served as a director of the Bank since 1988. Mr. Tai is the Executive Vice President and Secretary of the Company and the President and Vice Chairman of the Board of the Bank. Mr. Tai is a leader in the Asian-American community through his active involvement in several organizations. He has served as the President of the Taiwanese Chamber of Commerce of Greater Houston and is the Executive Advisor of the Taiwanese Chamber of Commerce of North America, an organization that has members in 25 cities across the United States, Canada and Mexico. He is also active in the World Taiwanese Chamber of Commerce and serves as its Executive Consular. In 1999, Mr. Tai was appointed as a director of the State Bar of Texas Chief Disciplinary Council’s Houston Region Grievance Council. He received a Bachelor of Business Administration degree from Fu-Jen Catholic University in Taiwan in 1974 and a Masters in Business Administration degree from Murray State University in 1977. Mr. Tai is a member of the Asian Realtors Association, the Asian Chamber of Commerce and the United Way. He is a Counselor at the Taiwanese Cultural Center. Mr. Tai is the brother-in-law of Mr. John Lee.

THE BOARD OF DIRECTORS RECOMMENDS A VOTEFOR THE ELECTION OF EACH OF THE NOMINEES LISTED ABOVE AS CLASS I DIRECTORS

4

CONTINUING DIRECTORS AND EXECUTIVE OFFICERS

The following table sets forth certain information with respect to the Company’s Class II and Class III directors, whose terms of office do not expire at the Meeting, and certain officers of the Company:

Name

| | Positions

| | Age

|

| Tiong Loi Ang | | Class III Director of the Company | | 70 |

| Tommy F. Chen | | Class III Director of the Company; Director of the Bank | | 64 |

| May P. Chu | | Class II Director of the Company; Director of the Bank | | 54 |

| Allen L. Cournyer | | Executive Vice President and Chief Information Officer of the Company; Executive Vice President, Chief Operations Officer and Chief Information Officer of the Bank | | 53 |

| John Lee | | Class II Director of the company; Director of the Bank | | 58 |

| David D. Rinehart | | Chief Financial Officer and Executive Vice President of the Company and the Bank | | 60 |

| Terrance J. Tangen | | Chief Credit Officer and Executive Vice President of the Bank | | 54 |

| Joe Ting | | Class III Director of the Company; Vice Chairman of the Board of the Bank | | 49 |

| Don J. Wang | | Class II Director, Chairman of the Board of the Company and the Bank | | 58 |

Tiong Loi Ang. Mr. Ang was elected as a Class III director of the Company in April 2000. Mr. Ang has been involved in real estate development in Malaysia, Hong Kong, China and the United States for more than the past five years. Mr. Ang is the Chairman of the Board and the controlling shareholder of Gaumnitz, Inc. Gaumnitz, Inc. owns the building in which the Company’s corporate headquarters and the Bank’s Bellaire branch is located.

Tommy F. Chen. Mr. Chen is a Class III director of the Company and an organizing director of the Bank. Mr. Chen serves on the Company’s Compensation Committee. Since 1983, he has been the owner of the Downtown Texaco (Subway) Station. He was an aerospace engineer at NASA for three years and worked for Chevron Oil Company and Amoco Oil Company for six years. Mr. Chen has held a real estate brokers license in Texas since 1981. He received a Bachelors degree from the University of Taiwan, a Masters degree in Physics from Clark University in Worcester, Massachusetts and a Masters degree and a Ph.D. in Electrical Engineering from the University of Oklahoma. Mr. Chen serves as a director on the Chinatown Community Development Board and is a member of the Taiwanese Chamber of Commerce of North America. Mr. Chen is not related to Ms. Helen F. Chen.

May P. Chu. Ms. Chu is a Class II director of the Company and an organizing director of the Bank. Ms. Chu serves on the Company’s Compensation Committee and Audit Committee. She is the founder of Signet Consulting, a bank management consulting firm specializing in regulatory issues and has served as its President for more than the past five years. She received a Bachelors degree in Physics from the University of California at Berkeley and a Ph.D. in Economics from Case Western Reserve University. Ms. Chu was employed at Texas Commerce Bank and Texas Commerce Bancshares, Inc. for more than five years, first in the Economics Division and subsequently in Mergers/Acquisitions.

5

Allen L. Cournyer. Mr. Cournyer was named Executive Vice President, Chief Information Officer and Chief Operations Officer of the Bank in April 2000 and Executive Vice President and Chief Information Officer of the Company in October 2000. Mr. Cournyer is responsible for the Bank’s branch operations and technology for its 14 full-service branches. Before joining the Bank, Mr. Cournyer was President of Extraco Institutional Services a $630 million financial services company, located in Temple, Texas, where he was responsible for technology, deposit and loan operations. From 1996 until 1998, he was partner and President of Platform Technologies, a company which provides retail banking software to community banks. Prior to this, Mr. Cournyer worked with a Texas subsidiary of JP Morgan Chase (formally Texas Commerce Bank) for more than 20 years where he last served as a Senior Vice President and manager of retail banking for the technology, operations and administration groups until his departure in 1995. He began his career with Cullen Frost Bank in San Antonio in 1967.

John Lee. Mr. John Lee is a Class II director of the Company and an organizing director of the Bank. He is Executive Vice President of Alpha Seafood Enterprises, Inc. and serves as the Treasurer, Director and co-founder of United Oriental Capital Corporation, a Specialized Small Business Investment Company. For six years, Mr. Lee served as President and manager for numerous motels in the Houston area. Mr. Lee received a Bachelors degree in Economics from National Chung Hsing University. He is a member of the Taiwanese Chamber of Commerce of North America. Mr. John Lee is the brother-in-law of Mr. David Tai. Mr. John Lee is not related to Mr. George M. Lee.

David D. Rinehart. Mr. Rinehart was named Executive Vice President and Chief Financial Officer of the Company and the Bank in November 2001. Mr. Rinehart has over 28 years experience in financial institutions. Before joining the Bank, Mr. Rinehart served as President and Chief Executive Officer of First Federal Savings Bank in Bryan, Texas. From 1988 to 1999, Mr. Rinehart was Executive Vice President and Chief Financial Officer of Fort Bend Holding Corporation and its $320 million subsidiary bank until its merger into Southwest Bancorporation of Texas in March 1999. Mr. Rinehart received a Bachelor of Science in Business Administration at Miami University in Oxford, Ohio with a major in accounting.

Terrance J. Tangen. Mr. Tangen was named Executive Vice President and Chief Credit Officer of the Bank in October 2001. Mr. Tangen has over 27 years experience in bank lending and credit. Prior to joining the Bank, he served as a Senior Vice President and Credit Officer for Bank One providing credit approval for loans generated in those markets by a bank team of three market managers. Mr. Tangen joined Bank One in 1997 as a Credit Approval Officer responsible for reviewing and approving corporate, commercial and energy loans. Prior to joining Bank One, Mr. Tangen served as Loan Supervisor for Wells Fargo Bank in Houston responsible for commercial and energy credit approval. He began his career in Denver in 1974 as a credit analyst. After 15 years as a lender, manager and Vice President of Credit Administration for two banks in that market, he moved to First Interstate Bank in Houston as a Senior Vice President and Manager of Credit Review. In 1992, he became the Senior Credit Officer for their south Texas market. He continued in that capacity through the bank’s merger with Wells Fargo in 1996. Mr. Tangen earned his bachelor’s degree from the University of Minnesota—Moorhead and a Masters of Business Administration from the University of Colorado He is also a graduate of the Pacific Coast Banking School in Seattle. Mr. Tangen is the Immediate Past President and member of the board of the Texas Chapter of RMA—The Risk Management Association.

Joe Ting. Mr. Ting is a Class III director of the Company and has served as a director of the Bank since 1989. He was elected Vice Chairman of the Bank’s Board of Directors in 1999. Mr. Ting has been the President of West Plaza Management, Inc., a real estate management company for more than the past five years. Mr. Ting has extensive knowledge in the plastic manufacturing industry and real estate investments. Mr. Ting is a member of the Taiwanese Chamber of Commerce of North America. He received a Masters in Business Administration degree from the Florida Institute of Technology.

Don J. Wang. Mr. Wang is a Class II director of the Company and an organizing director of the Bank. Mr. Wang serves as Chairman of the Board of the Company and the Bank. Mr. Wang has also been Chairman of the Board of New Era Life Insurance Company since 1989. Mr. Wang served as President of the Taiwanese Chamber of Commerce of North America in 1992 and as a Board Member of the Greater Houston Partnership. Mr. Wang has served on the Harris County Hospital District Board of Managers, the Board of Directors of the Hope Shelter/Abused Children Program and the Advisory Board of the Chinese Community Center. He is Chairman of the Chinese Senior Estates/Senior Housing Project and Co-Chairman of the Asian and Pacific Island Division of the United Way. Mr. Wang also served on the Advisory Committee of the Ex-Im Bank in 1998 and is active in the

6

Houston Image Group. On April 29, 1993, former Mayor Bob Lanier proclaimed “Don J. Wang Day” in Houston in honor of Mr. Wang’s abundant achievements in the realm of Asian community relations. He received a Bachelors of Science degree from National Chung Hsing University and a Masters in Science degree from Utah State University. Mr. Wang is the brother of Ms. Helen F. Chen.

Each officer of the Company is elected by the Board of Directors of the Company and holds office until his successor is duly elected and qualified or until his or her earlier death, resignation or removal.

Meetings and Committees of the Board of Directors

The Board of Directors of the Company held four meetings during 2001. No director attended less than 75% of the aggregate of the (i) total number of meetings of the Board and (ii) total number of meetings held by committees on which he served, except Tiong Loi Ang.

Audit Committee. The primary purpose of the Company’s Audit Committee is to provide independent and objective oversight with respect to the Company’s financial reports and other financial information provided to shareholders and others, the Company’s internal controls and the Company’s audit, accounting and financial reporting processes generally. The Audit Committee reports to the Board of Directors concerning such matters. During 2001, the Audit Committee held four meetings. The Audit Committee is comprised of Messrs. Ang and George Lee, and Ms. Chu, each of whom is an independent director of the Company as defined as defined in Rule 4200(a)(14) of the listing standards of the National Association of Securities Dealers, Inc.

Compensation Committee. The Compensation Committee currently consists of Ms. Chu and Messrs. Chen and Ting, each of whom is an outside director. The Compensation Committee is responsible for making recommendations to the Board of Directors with respect to the compensation of the Company’s executive officers and is responsible for the establishment of policies dealing with various compensation and employee benefit matters. The Compensation Committee also administers the Company’s stock option and stock award plans and makes recommendations to the Board of Directors as to option and award grants to Company employees under such plans. During 2001, the Compensation Committee held three meetings.

Compensation Committee Interlocks and Insider Participation

The Compensation Committee consists of May P. Chu, Tommy F. Chen and Joe Ting, each of whom is an outside director of the Company. During 2001, no member of the Compensation Committee was an officer or employee of the Company or the Bank and no member formerly has served as an officer of the Company or the Bank during the past five years.

Director Compensation

Directors of the Company do not receive a fee for attending scheduled Board of Directors meetings; however, for the 2001 fiscal year, the Company’s directors received a fee of $500 for each Company committee meeting attended. The Board of Directors of the Bank meets monthly. There are currently twelve directors of the Bank, nine of whom are also directors of the Company. For the 2001 fiscal year, non-employee directors of the Bank received a fee of $850 for each meeting of the Bank’s Board of Directors attended and a fee of $500 for each Bank committee meeting attended.

Prior to 1998, the Bank paid its directors, including directors who were officers of the Bank, an annual bonus based on the Bank’s performance during the previous year. In 1998, the Bank replaced this director bonus policy with the Non-Employee Director Stock Bonus Plan (“Non-Employee Director Plan”). The Company assumed the plan in the holding company formation in 1998. The Executive Bonus Plan, which was established in 2000, was terminated in 2001 prior to the issuance of any awards under such plan. The Company does not plan to pay cash bonuses to directors in the future and will only pay stock bonuses to directors pursuant to the Non-Employee Director Plan.

The Non-Employee Director Plan provides for the grant of up to 12,000 shares of Common Stock annually for each of the 1998 through 2002 calendar years if the Company achieves a return on average equity of 13.0% or greater for that year. The shares are allocated among the non-employee directors by the Company’s Non-Employee

7

Director Bonus Committee, based on each director’s performance during the applicable year. For the years ended December 31, 1998 and 1999, an aggregate of 24,000 shares were issued under this plan. Based on the Company’s return on average equity for the years ended December 31, 2000 and 2001, no additional shares have been issued.

EXECUTIVE COMPENSATION AND OTHER MATTERS

Summary Compensation Table

The following table provides certain summary information concerning compensation paid or accrued by the Company to or on behalf of the Company’s President and each of the other five most highly compensated executive officers of the Company (determined as of the end of the last fiscal year) (the “Named Executive Officers”) for each of the three fiscal years ended December 31, 2001:

| | | Annual Compensation

| | Long-Term Compensation

| | |

Name and Principal Position

| | Year

| | Salary

| | Bonus

| | | Other Annual Compensation(1)

| | Securities Underlying Options

| | All Other Compensation(2)

|

| Allen D. Brown(3) | | 2001 | | $ | 92,051 | | — | | | — | | 100,000 | | $ | 829 |

President of the Company and Chief Executive Officer of the Bank | | | | | | | | | | | | | | | |

|

| Allen Cournyer | | 2001 | | | 155,000 | | 25,000 | | | — | | — | | | 7,720 |

| Executive Vice President, Chief | | 2000 | | | 114,021 | | 46,530 | | | — | | 10,000 | | | 2,577 |

Information Officer of the Company and Executive Vice President, Chief Operations Officer and Chief Information Officer of the Bank | | | | | | | | | | | | | | | |

|

| David D. Rinehart(4) | | 2001 | | | 20,990 | | — | | | — | | 20,000 | | | — |

Chief Financial Officer and Executive Vice President of the Company and the Bank | | | | | | | | | | | | | | | |

|

| David Tai | | 2001 | | | 150,000 | | 125,000 | | | — | | — | | | 10,500 |

| Executive Vice President and | | 2000 | | | 130,000 | | — | | | — | | — | | | 5,440 |

Secretary of the Company; President and Vice Chairman of the Board of the Bank | | 1999 | | | 127,500 | | 20,000 | | | — | | 20,000 | | | 6,140 |

|

| Terrance J. Tangen(5) | | 2001 | | | 41,250 | | 50,000 | (6) | | — | | 35,000 | | | — |

Chief Credit Officer and Executive Vice President of the Bank | | | | | — | | | | | | | | | | |

|

| Don Wang | | 2001 | | | 110,000 | | 125,000 | | | — | | — | | | 9,664 |

| Chairman of the Company and the | | 2000 | | | 130,000 | | — | | | — | | — | | | 5,440 |

| Bank | | 1999 | | | 130,000 | | — | | | — | | 20,000 | | | 5,440 |

| (1) | | Does not include amounts attributable to miscellaneous benefits received by the Named Executive Officers. In the opinion of management of the Company, the costs to the Company of providing such benefits to any individual executive officer did not exceed the lesser of $50,000 or 10% of the total annual salary and bonus reported for the officer. |

| (2) | | Consists of matching contributions made by the Company to the 401(k) Plan for the benefit of each respective executive officer. |

| (3) | | Mr. Brown joined the Company on August 20, 2001. |

| (4) | | Mr. Rinehart joined the Company on November 13, 2001. |

| (5) | | Mr. Tangen joined the Bank on October 1, 2001. |

| (6) | | Represents a bonus paid to Mr. Tangen upon his joining the Bank. |

8

Employment and Other Compensation Agreements

On August 6, 2001, the Company entered into a five-year employment agreement with Allen D. Brown, subject to one-year renewal option periods. The employment agreement is designed to assist the Company in maintaining a stable and competent leadership base. The employment agreement provides for a minimum annual salary of $250,000. The Board of Directors will review the salary at least annually and may increase the salary at its sole discretion. The employment agreement also provides for the grant of options to acquire 100,000 shares of Common Stock on Mr. Brown’s first day of employment with the Company. The options were granted under the Company’s 1998 Stock Incentive Plan and will vest 20% annually. Additionally, options to acquire 10,000 to 20,000 shares of Common Stock will be granted to Mr. Brown annually based on performance of the Company and Mr. Brown.

In the event of a change of control and the involuntary termination of Mr. Brown, the Company will pay (1) his salary for the remainder, if any, of the calendar month in which such termination is effective and for twenty-four (24) consecutive calendar months thereafter, and (2) an amount equal to two times his Incentive Compensation, as defined below, for the previous fiscal year. Beginning in fiscal 2002, the Company’s Board of Directors intends to provide Mr. Brown with a formal incentive compensation plan pursuant to which Mr. Brown could earn up to 100% of his base salary if certain predetermined performance measures as set forth in the compensation plan are achieved (“Incentive Compensation”). In addition, medical and life insurance will be paid for by the Company for one (1) year following termination in the event of a change of control.

For the purpose of the employment agreement, a “change of control” is defined as any event whereby (a) the Bank or the Company shall not be the surviving entity in any merger or consolidation (or survives only as a subsidiary of an entity other than a previously wholly-owned subsidiary of the Company); (b) the Bank or the Company sells, leases or exchanges or agrees to sell, lease or exchange all or substantially all of its assets to any other persons or entities (other than to a wholly-owned subsidiary of the Company); or (c) the total sale or dissolution of the Company or Bank.

Based on his current salary, if Mr. Brown had been terminated as of December 31, 2001 because of a change of control, he would have been entitled to receive twenty-four (24) consecutive monthly payments of $20,833. In addition, medical and life insurance would be paid by the Company for one (1) year following termination.

If Mr. Brown’s employment is terminated by the Company for cause or if Mr. Brown voluntarily resigns, Mr. Brown will be entitled to receive all accrued and unpaid salary through the date of termination. Mr. Brown will not be entitled to receive any Incentive Compensation for the fiscal year in which the termination occurs.

If Mr. Brown’s employment is terminated by the Company as a result of death, Mr. Brown’s estate will be entitled to receive all accrued and unpaid salary through the end of the month in which his death occurred and the prorated portion of his Incentive Compensation for that fiscal year, if any. If Mr. Brown’s employment is terminated by the Company as a result of disability, Mr. Brown will be entitled to receive all accrued and unpaid salary through the end of the month in which the termination is effective and for the succeeding three months, or until disability insurance benefits commence.

In addition to the employment agreement with Mr. Brown, the Bank has entered into letter agreements with Messrs. Cournyer, Rinehart, Tai and Tangen, each a Named Executive Officer. The respective letter agreements provide that (1) in the event of involuntary termination or a decrease in employment status as a result of a change of control of the Bank or (2) in the event of termination by the Company other than for cause, disability or moral turpitude, each respective officer will be paid an amount equal to eighteen (18) months current salary and a specified amount of his stock options will fully vest and become exercisable. With respect to the number of stock options subject to accelerated vesting, Mr. Rinehart’s agreement provides for 20,000 options, Mr. Tangen’s agreement provides for 35,000 options and each of Messrs. Cournyear’s and Tai’s agreements provide for all options previously granted. Based on current salaries, Messrs. Cournyer, Rinehart, Tai and Tangen would be entitled to receive an amount equal to eighteen monthly payments of $12,917, $12,917, $16,250 and $13,750, respectively.

9

Option Grants During 2001

The following table sets forth certain information concerning stock options granted to the Named Executive Officers during fiscal year 2001:

| | | Option Grants in Last Fiscal Year | | |

| | | Individual Grants

| | |

| | Number of Securities Underlying Options Granted

| | Percent of Total Options Granted to Employees in Fiscal Year(1)

| | Exercise Price Per Share

| | Expiration Date

| | Potential Realizable Value at Assumed Annual Rates of Stock Price Appreciation for Option Term(2)

|

Name

| | | | | | 5%

| | 10%

|

| Allen D. Brown | | 100,000 | | 62.06% | | $ | 11.47 | | Aug. 20, 2011 | | $ | 721,342 | | $ | 1,828,022 |

| David D. Rinehart | | 20,000 | | 12.41% | | | 10.86 | | Nov. 14, 2011 | | | 136,596 | | | 346,160 |

| Terrance J. Tangen | | 35,000 | | 21.72% | | | 11.25 | | Oct. 9, 2011 | | | 247,627 | | | 627,536 |

| (1) | | Options to purchase 161,140 shares of Common Stock were granted to the Company’s employees during the year ended December 31, 2001. |

| (2) | | These amounts represent certain assumed rates of appreciation based on the actual option term and annual compounding from the date of the grant. Actual gains, if any, on stock option exercises and Common Stock holdings are dependent on future performance of the Common Stock and overall stock market conditions. There can be no assurance that the stock appreciation amounts reflected in this table will be achieved. |

Stock Option Exercises and Fiscal Year-End Option Values

The following table sets forth certain information concerning the number and value of unexercised options held by the Named Executive Officers at December 31, 2001:

| | | Shares Acquired on Exercise

| | Value Realized(1)

| | Number of Securities Underlying Unexercised Options at December 31, 2001

| | Value of Unexercised In-the Money Options at December 31, 2001(2)

| |

Name

| | | | Exercisable

| | Unexercisable

| | Exercisable

| | Unexercisable

| |

| Allen D. Brown | | — | | — | | — | | 100,000 | | | — | | | (3 | ) |

|

| Allen L. Cournyer | | — | | — | | 3,000 | | 7,000 | | $ | 11,850 | | $ | 27,650 | |

|

| David D Rinehart | | — | | — | | — | | 20,000 | | | — | | | 6,800 | |

|

| David Tai | | — | | — | | 20,000 | | — | | | 4,000 | | | — | |

|

| Terrance J. Tangen | | — | | — | | — | | 35,000 | | | — | | | (3 | ) |

|

| Don J. Wang | | — | | — | | 20,000 | | — | | | 4,000 | | | — | |

| (1) | | The “value realized” represents the difference between the exercise price of the option shares and the market price of the option shares on the date of exercise without considering any taxes which may have been owed. |

| (2) | | The value of the unexercised options is calculated based on the closing price of the Common Stock as reported on the Nasdaq National Market on December 31, 2001 of $11.20. |

| (3) | | No value is given because the exercise price of the unexercised options is greater than the closing price of the Common Stock as reported on the Nasdaq Stock Market on December 31, 2001. |

10

Stock Plans

The Company’s stock option, stock purchase and stock award plans were originally developed and instituted by the Bank and assumed by the Company in the holding company formation in 1998. Except for a non-qualified stock option plan for the six founding directors of the Bank, each of the stock option and stock award plans and the stock purchase plan were approved by the shareholders of the Bank in 1998.

The Company has options issued and outstanding to five of the six founding directors of the Bank to purchase 100,000 shares of Common Stock pursuant to the 1998 Director Stock Option Agreement (“Founding Director Plan”). Pursuant to the Founding Director Plan, each of the five participants was granted non-qualified options to purchase 20,000 shares of Common Stock at a price of $11.00 per share. A total of 20,000 options which were initially granted to one of the founding directors were canceled upon his resignation as a director. The options must be exercised by July 24, 2003. Of the six founding directors of the Bank, the five participants (Tommy F. Chen, May P. Chu, John Lee, David Tai and Don J. Wang) currently serve as directors of the Company and the Bank.

The Company’s Non-Employee Director Stock Bonus Plan (“Non-Employee Director Plan”) authorizes the issuance of up to 60,000 shares of Common Stock to the directors of the Company who do not serve as an officer of the Company. Under the Non-Employee Director Plan, up to 12,000 shares of Common Stock may be issued each year for a five year period if the Company achieves certain return on equity ratios with no shares to be issued if the Company’s return on equity is below 13.0%. Shares will be allocated among the non-employee directors by the Company’s Non-Employee Director Bonus Committee, based on each director’s performance during the applicable year. There have been an aggregate of 24,000 shares issued under the Non-Employee Director Plan for the years ended December 31, 1999 and 1998.

The Company’s 1998 Stock Incentive Plan (“Incentive Plan”) authorizes the issuance of up to 200,000 shares of Common Stock under both “non-qualified” and “incentive” stock options and performance shares of Common Stock. Non-qualified options and incentive stock options will be granted at no less than the fair market value of the Common Stock and must be exercised within seven years. Performance shares are certificates representing the right to acquire shares of Common Stock upon the satisfaction of performance goals established by the Company. Holders of performance shares have all of the voting, dividend and other rights of shareholders of the Company, subject to the terms of the award agreement relating to such shares. If the performance goals are achieved, the performance shares will vest and may be exchanged for shares of Common Stock. If the performance goals are not achieved, the performance shares may be forfeited. Options to acquire 161,140 shares of Common Stock were granted under the Incentive Plan in 2001. As of December 31, 2001, options to acquire 199,400 shares of Common Stock were outstanding under the Incentive Plan and no options remained available for grant. However, the Board of Directors has proposed an amendment to the Incentive Plan to increase the number of shares reserved for issuance under such plan to 700,000 shares. See “Item 2.—Approval of Increase in Shares Issuable Under the Company’s 1998 Stock Incentive Plan.”

The Company’s 1998 Employee Stock Purchase Plan (“Purchase Plan”) authorizes the offer and sale of up to 200,000 shares of Common Stock to employees of the Company and its subsidiaries. The Purchase Plan will be implemented through ten annual offerings. Each year the Board of Directors will determine the number of shares to be offered under the Purchase Plan; provided that in any one year the offering may not exceed 20,000 shares plus any unsubscribed shares from prior years. The offering price per share will be an amount equal to 90% of the closing trading price of a share of Common Stock on the business day immediately prior to the commencement of such offering. In each offering, each employee may purchase a number of whole shares of Common Stock that are equal to 20% of the employee’s base salary divided by the offering price. Pursuant to the Purchase Plan, the employee pays for the Common Stock either immediately or through a payroll deduction program over a period of up to one year, at the employee’s option. The first annual offering under the Purchase Plan began in the second quarter of 1999. As of December 31, 2001, there have been 16,139 shares issued under this plan.

11

Benefit Plan

The Company has established a defined contributory profit sharing plan pursuant to Internal Revenue Code Section 401(k) covering substantially all employees (the “Plan”). The Plan provides for pretax employee contributions up to 15% of annual compensation. The Company matches each participant’s contributions to the Plan up to 4% of such participant’s salary. The Company made contributions before expenses to the Plan of $308,000, $291,000, and $271,000 in 2001, 2000 and 1999, respectively.

BOARD COMPENSATION COMMITTEE REPORT ON EXECUTIVE COMPENSATION

The Compensation Committee of the Board of Directors is responsible for developing and making recommendations to the Board with respect to the Company’s executive compensation policies. The following is a report from the Compensation Committee which sets forth the components of the Company’s executive officer compensation program and describes the basis on which the 2001 compensation determinations were made with respect to the executive officers of the Company and the Bank, including the Named Executive Officers.

Compensation Policy

The Company’s executive compensation policy incorporates the basic principle that executive compensation should be related directly to corporate performance and increases in shareholder value, while ensuring that key employees are motivated and retained. The following objectives serve as guidelines for compensation decisions:

| | • | | The Company must provide a competitive total compensation package in order to attract and retain key executives; |

| | • | | The compensation packages and programs must be strategically aligned with the annual budget as well as the Company’s long-term business objectives; and |

| | • | | The compensation packages must include a variable or performance component to ensure a link between executive remuneration and the Company’s overall performance, thereby aligning executive compensation with the interest of shareholders. |

Executive Compensation

The Company’s compensation programs for executive officers are comprised of four parts as follows:

(1) Base Pay. Base salary levels are determined mainly through comparison with salaries of executive officers in similarly situated positions at banking organizations of a size similar to the Company’s with some attention given to the geographic location of such banking organizations. Surveys are utilized to assist in determining the base salary ranges of those persons having similar responsibilities at other financial institutions. Individual performance evaluations are considered, including a perception of the executive’s potential to increase responsibilities. All executive base salary levels, which are generally reviewed annually, are considered by the Compensation Committee to be competitive and in the median range of comparative salaries of other banking organizations. The Company has historically reviewed salaries annually and, if appropriate, has adjusted such salaries.

(2) Cash Bonus. Although the Company does not have a bonus program, the Compensation Committee may pay discretionary bonuses to executive officers, including Named Executive Officers, based on their individual performance in a particular year. For the year ended December 31, 2001, discretionary bonuses were paid in February 2002 to certain executive officers based on such persons performance during 2001. In addition, the Board of Directors granted a $125,000 bonus to each of Don Wang and David Tai, each a Named Executive Officer, in recognition of the Company’s profitable performance and stock price through the second quarter 2001.

(3) Contributory Savings 401(k) Plan. The Company provides for a 401(k) tax-deferred profit sharing plan for all employees, including executive officers, pursuant to which the Company matches each participant’s

12

contributions up to a maximum of 4% of such employee’s annual compensation.

(4) Stock Options. During 1998, the shareholders of the Company approved the 1998 Stock Incentive Plan which authorizes the issuance of up to 200,000 shares of Common Stock under “non-qualified” and “incentive” stock options and performance shares of Common Stock to certain key employees. Such options will be exercisable based on a vesting schedule. The Compensation Committee believes that these key employees will carry the main responsibility for increased growth, asset quality and profitability of the Company into the future. Options to acquire 155,000 shares of common stock were granted to the Named Executive Officers during 2001.

Through the above-mentioned programs, the Compensation Committee believes that a significant portion of the remuneration packages of executive officers are linked to the Company’s performance and shareholder interests. The Compensation Committee will continue to review the elements of the plans in place and adjust these plans as needed to ensure that the total compensation program meets the Company’s objectives and philosophy as described above.

2001 Chief Executive Compensation

During 2001, Don J. Wang, the Company’s Chairman of the Board also served as the Company’s President until August 2001. The Compensation Committee reviewed Mr. Wang’s compensation package, including his compensation history, the factors set forth in this report with respect to compensation of executive officers, the salary levels of persons in similar positions at banks of comparable size in the Houston and Gulf Coast areas, and the Company’s performance. Based upon such information, the Compensation Committee set Mr. Wang’s salary for 2001 at $110,000. Based on the Company’s performance and stock price through the second quarter of 2001, the Board of Directors awarded Mr. Wang a bonus of $125,000 for 2001. In addition, Mr. Wang received $9,664 in matching contributions made to the 401(k) Plan and an annual car allowance of $6,500.

Effective August 6, 2001, the Company entered into an employment agreement with Allen D. Brown who was appointed President of the Company and Chief Executive Officer of the Bank. The employment agreement provides for an annual salary for Mr. Brown of $250,000 for 2001, subject to increases, and a grant of options under the Company’s 1998 Stock Incentive Plan to acquire 100,000 shares of Common Stock. The specific provisions of the employment agreement is discussed under “Employment and Other Compensation Agreements.” In addition, Mr. Brown received $829 in matching contributions made to the 401(k) Plan and an annual car allowance of $3,000.

| | Th | e Compensation Committee |

AUDIT COMMITTEE REPORT

Notwithstanding anything to the contrary set forth in any of the Company’s previous or future filings under the Securities Act of 1933 or the Securities Exchange Act of 1934 that might incorporate this Proxy Statement or future filings with the Securities and Exchange Commission, in whole or in part, the following report shall not be deemed to be incorporated by reference into any such filing.

In accordance with its written charter adopted by the Company’s Board of Directors, the Company’s Audit Committee assists the Board in fulfilling its responsibility for oversight of the quality and integrity of the accounting, auditing and financial reporting practices of the Company. The Audit Committee is comprised of Tiong Loi Ang, May P. Chu and George M. Lee, each of whom is an independent director of the Company as defined in Rule 4200(a)(14) of the National Association of Securities Dealers’ listing standards. During the year ended December 31, 2001, the Chairman of the Audit Committee, as representative of the Audit Committee, reviewed and discussed the interim financial information contained in the quarterly earnings announcements with the Chief Financial Officer and the independent auditors before their release to the public.

13

In discharging its oversight responsibility as to the audit process, the Audit Committee obtained from the independent auditors a formal written statement describing all relationships between the auditors and the Company that might bear on the auditor’s independence consistent with Independence Standards Board Standard No. 1,“Independence Discussions with Audit Committees,”discussed with the auditors any relationships that may impact their objectivity and independence and satisfied itself as to the auditor’s independence. The Audit Committee also discussed with management, the internal auditors and the independent auditors the quality and adequacy of the Company’s internal controls. The Audit Committee reviewed with both the independent and the internal auditors their audit plans, audit scope and identification of audit risks.

The Audit Committee discussed and reviewed with the independent auditors all communications required by generally accepted auditing standards, including those described in Statement on Auditing Standards No. 61, as amended.“Communication with Audit Committees”and, with and without management present, discussed and reviewed the results of the internal audit examinations.

The Audit Committee reviewed the audited financial statements of the Company as of and for the year ended December 31, 2001 with management and the independent auditors. Management has the responsibility for the preparation of the Company’s financial statements and the independent auditors have the responsibility for the examination of those statements.

Based on the above–mentioned review and discussions with management and the independent auditors, the Audit Committee recommended to the Board that the Company’s audited financial statements be included in its Annual Report on Form 10–K for the year ended December 31, 2001 filed with the Securities and Exchange Commission. The Audit Committee also recommended the reappointment, subject to shareholder ratification, of the independent auditors and the Board concurred in such recommendation.

PRINCIPAL ACCOUNTING FIRM FEES

Audit Fees

The aggregate fees billed to the Company for professional services rendered by Deloitte & Touche LLP in connection with the audit of the Company’s consolidated financial statements as of and for the year ended December 31, 2001 and limited reviews of the Company’s unaudited consolidated interim financial statements included in the Company’s Quarterly Reports on Form 10-Q for the fiscal year ending December 31, 2001 were $135,420.

Financial Information Systems Design and Implementation Fees

During the year ended December 31, 2001, Deloitte & Touche did not render any professional services to the Company in connection with the design and implementation of financial information systems.

All Other Fees

In addition to the fees described above, the aggregate fees billed to the Company for services rendered by Deloitte & Touche LLP during the year ended December 31, 2001 were $43,700. The Audit Committee has considered whether the provision of these non-audit services is compatible with maintaining the independence of Deloitte & Touche LLP.

14

INTERESTS OF MANAGEMENT AND OTHERS IN CERTAIN TRANSACTIONS

Don J. Wang, the Company’s Chairman of the Board, is a principal shareholder and Chairman of the Board of New Era Insurance Company (“New Era”). New Era is the agency used by the Company for the insurance coverage the Company provides to employees of the Company and the Bank and their dependents. The insurance coverage consists of medical, dental, life, accidental death and dismemberment and long-term disability insurance. The Company paid New Era $1,154,752 and $1,142,086 for such insurance during the years ended December 31, 2001 and 2000, respectively.

Tiong Loi Ang, a Class III director of the Company, is Chairman of the Board and the controlling shareholder of Gaumnitz, Inc. Gaumnitz, Inc. owns the buildings in which the Company’s corporate headquarters and the Bank’s Bellaire branch are located and has entered into lease agreements for these locations with the Company. The lease covering the Company’s headquarters is for a term of four years and nine months commencing February 1, 2002 at a net rent of $24,833 per month. The lease covering the Bank’s Bellaire branch is for a term of four years and eleven months commencing January 1, 1997 at a net rent of $10,503 per month. For these respective lease agreements, the Company paid Gaumnitz, Inc. $424,030 and $400,000 during the years ended December 31, 2001 and 2000, respectively.

Many of the directors, executive officers and principal shareholders of the Company (i.e., those who own 10% or more of the Common Stock) and their associates, which include corporations, partnerships and other organizations in which they are officers or partners or in which they and their immediate families have at least a 5% interest, are customers of the Bank. During 2001, the Bank made loans in the ordinary course of business to many of the directors, executive officers and principal shareholders of the Company and their associates, all of which the Company believes were on substantially the same terms, including interest rates and collateral, as those prevailing at the time for comparable transactions with persons unaffiliated with the Company and did not involve more than the normal risk of collectibility or present other unfavorable features. Loans to directors, executive officers and principal shareholders of the Company are subject to limitations contained in the Federal Reserve Act, the principal effect of which is to require that extensions of credit by the Bank to executive officers, directors and principal shareholders satisfy the foregoing standards. On December 31, 2001, all of such loans aggregated $6.1 million, which was approximately 9.9% of the Company’s Tier 1 capital at such date. The Company expects to have such transactions or transactions on a similar basis with its directors, executive officers and principal shareholders and their associates in the future.

15

BENEFICIAL OWNERSHIP OF COMMON STOCK BY

MANAGEMENT OF THE COMPANY AND PRINCIPAL SHAREHOLDERS

The following table sets forth certain information regarding the beneficial ownership of the Company Common Stock as of March 27, 2002 by (i) directors and the Named Executive Officers of the Company, (ii) each person who is known by the Company to own beneficially 5% or more of the Common Stock and (iii) all directors and Named Executive Officers as a group. Unless otherwise indicated, based on information furnished by such shareholders, management believes that each person has sole voting and dispositive power over the shares indicated as owned by such person and the address of each shareholder is the same as the address of the Company.

Name

| | Number of Shares

| | | Percentage Beneficially Owned(1)

|

Principal Shareholders | | | | | |

| Metro Investment Group, Inc.(2) | | 491,557 | | | 7.01% |

| Siah Chin Leong(3) | | 474,316 | | | 6.76% |

| Leslie Looi Meng(4) | | 398,004 | | | 5.68% |

Shou Chiun Ting(5) | | 382,519 | | | 5.45% |

Directors and Executive Officers | | | | | |

| Tiong Loi Ang | | 103,381 | (6) | | 1.47% |

| Allen D. Brown | | 1,100 | | | * |

| Helen F. Chen | | 565,852 | (7) | | 8.07% |

| Tommy F. Chen | | 198,815 | (8) | | 2.83% |

| May P. Chu | | 113,264 | (9) | | 1.61% |

| Allen L. Cournyer | | 580 | | | * |

| George M. Lee | | 1,000 | | | * |

| John Lee | | 156,576 | (10) | | 2.23% |

| David D. Rinehart | | 500 | | | * |

| David Tai | | 279,775 | (11) | | 3.98% |

| Terrance J. Tangen | | 500 | | | * |

| Joe Ting | | 73,771 | (12) | | 1.05% |

| Don J. Wang | | 551,365 | (13) | | 7.84% |

Directors and Named Executive Officers as a Group (13 persons) | | 2,046,479 | | | 28.77% |

| * | | Indicates ownership that does not exceed 1.0%. |

| (1) | | The percentage of beneficially owned was calculated based on 7,012,879 shares of Common Stock outstanding. The percentage assumes the exercise by the shareholder or group named in each row of all options for the purchase of Common Stock held by such shareholder or group and exercisable within 60 days. |

| (2) | | Metro Investment Group, Inc.’s address is 16607 Southern Oaks Drive, Houston, Texas 77069. Director Helen F. Chen is the controlling shareholder and President of Metro Investment Group, Inc. and has voting and investment control of the shares. |

| (3) | | Siah Chin Leong’s address is c/o Vincent, Ltd., 321 Orchard Rd., 8-06 Singapore 239-193. |

| (4) | | Leslie Looi Meng’s address is 327 River Valley Road #16-02, Casuarina Yong An Park, Singapore 238-359. |

| (5) | | Mr. Shou Chiun Ting’s address is 2825 Wilcrest, Suite 200, Houston, Texas 77042. Includes 172,936 held of record by Luxor Holding Corporation over which Mr. Shou Chiun Ting has voting and investment control. Shou Chiun Ting is the father of Director Joe Ting. |

16

| (6) | | Includes 40,054 shares held of record by Mr. Ang’s spouse and 26,539 shares held of record by Gaumnitz, Inc., of which Mr. Ang is Chairman of the Board and has voting and investment control. |

| (7) | | Includes 491,557 shares held of record by Metro Investment Group, Inc. of which Ms. Chen is the President and has voting and investment control. |

| (8) | | Includes 20,000 shares which may be acquired within 60 days pursuant to the Founding Director Plan and 78,976 shares held of record by Mr. Chen’s spouse. |

| (9) | | Includes 20,000 shares which may be acquired within 60 days pursuant to the Founding Director Plan. |

| (10) | | Includes 20,000 shares which may be acquired within 60 days pursuant to the Founding Director Plan. |

| (11) | | Includes 20,000 shares which may be acquired within 60 days pursuant to the Founding Director Plan. |

| (12) | | Includes 2,263 shares held of record by each of Mr. Ting’s three minor children. |

| (13) | | Includes 20,000 shares which may be acquired under the Founding Director Plan, 428,524 shares held of record by two trusts, 3,124 shares held of record by Mr. Wang’s spouse, and 9,551 shares held of record by a non-profit corporation over which Mr. Wang has voting and investment control. |

17

PERFORMANCE GRAPH

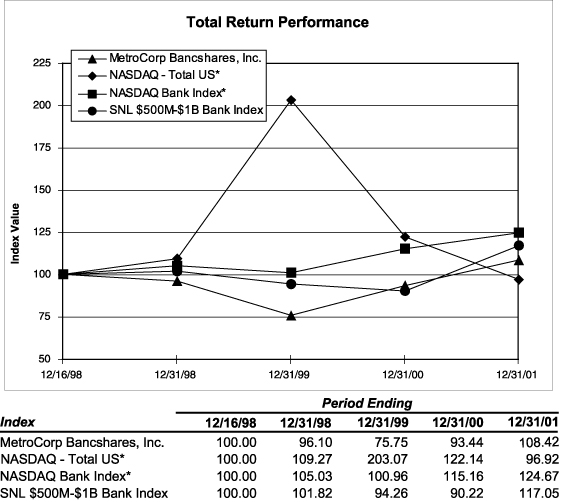

The following Stock Performance Graph compares the cumulative total shareholder return on the Company’s Common Stock for the period from December 16, 1998, when the Common Stock was first listed on the Nasdaq National Market, to December 31, 2001, with the cumulative total return of the Nasdaq Stock Market (Total US) Index (“Nasdaq Index”), the Nasdaq Bank Index and the SNL $1 Billion to $5 Billion Bank Asset- Size Index (“SNL Index”) for the same period. Dividend reinvestment has been assumed. The Stock Performance Graph assumes $100 invested on December 16, 1998 in the Company’s Common Stock, the Nasdaq Index, the Nasdaq Bank Index and the SNL Index.

Beginning in 1999, the Company selected the SNL Index to replace the Nasdaq Bank Index in its Performance Graph to be included in the proxy statements for its annual meetings of shareholders. Although both indices are included in the performance graph below, the Company will use the SNL Index going forward. Management believes that the SNL Index includes banks and bank holding companies which are more similar in asset size to, and therefore, more representative of, the Company. The historical stock price performance for the Company’s stock shown on the graph below is not necessarily indicative of future stock performance.

Composite of Partial Period Cumulative Total Return

The Nasdaq Stock Market (US) Index, the

Nasdaq Bank Index, the SNL Bank Index and MetroCorp Bancshares, Inc.

| * | | Source: CRSP, Center for Research in Security Prices, Graduate School of Business, The University of Chicago 2002. Used with permission. All rights reserved. crsp.com. |

18

SECTION 16(a) BENEFICIAL OWNERSHIP REPORTING COMPLIANCE

Section 16(a) of the Securities Exchange Act of 1934, as amended (the “Exchange Act”), requires the Company’s directors and officers and persons who own more than 10% of a registered class of the Company’s equity securities, to file reports of ownership and reports of changes in ownership of such with the Securities and Exchange Commission (the “Commission”). Officers, directors and greater than 10% shareholders are required by regulation to furnish the Company with copies of all Section 16(a) forms they file. Based solely on the Company’s review of the copies of such reports furnished to it and representations from certain reporting persons that they have complied with the relevant filing requirements, the Company believes that all Section 16(a) reporting requirements applicable to it’s officers, directors and greater than 10% shareholders were complied with during the year ended December 31, 2001, except that Allen D. Brown was late in filing two reports covering two transactions and Terrance R. Tangen was late in filing one report.

ITEM 2.

APPROVAL OF INCREASE IN SHARES ISSUABLE UNDER THE

COMPANY’S 1998 STOCK INCENTIVE PLAN

On January 18, 2002, the Board of Directors approved an amendment (the “Amendment”) to the Company’s 1998 Stock Incentive Plan (the “1998 Plan”), increasing the number of shares of Common Stock issuable thereunder from 200,000 shares to 700,000 shares, and recommended that the 1998 Plan, as so amended, be submitted to the Company’s shareholders for approval at the Annual Meeting. The 1998 Plan was originally approved by the Bank’s shareholders on November 25, 1998 and assumed by the Company in the holding company formation. The following summary of the material features of the 1998 Plan is qualified in its entirety by reference to the copy of the plan (as proposed to be amended) attached as Appendix A to the Proxy Statement. The only change proposed to be made to the 1998 Plan is the increase in shares issuable under the 1998 Plan from 200,000 shares to 700,000 shares.

Purpose of the Amendment

The Company believes that it has been able to attract highly qualified personnel in part through the use of option grants, and that it is desirable to have the continued flexibility to attract additional personnel, if needed, and to retain and reward exceptional performance by employees through additional option grants. The Company believes that options should be widely distributed. The Company has used the 1998 Plan and other stock plans for this purpose. As of December 31, 2001, options to purchase 199,400 shares of Common Stock were outstanding and no additional options remained available for grant. Accordingly, the Board of Directors approved the Amendment in order to maintain the 1998 Plan as a continuing source of employee incentives.

Administration

The Company’s Compensation Committee administers the 1998 Plan and has sole authority to select the employees (“Optionees”) eligible to receive grants of options (“Options”) that are either incentive stock options (“Incentive Stock Options”) within the meaning of Section 422(b) of the Internal Revenue Code of 1986, as amended (the “Code”), options that do not constitute incentive stock options (“Nonstatutory Stock Options”) or Performance Shares. The 1998 Plan, as proposed to be amended, provides for the grant of awards to acquire 700,000 shares of Common Stock (subject to certain adjustments in the event of stock dividends, stock splits and certain other events). The committee which administers the 1998 Plan must be comprised solely of non-employee directors (within the meaning Rule 16b-3 promulgated by the Securities and Exchange Commission). The Compensation Committee selects the officers and key employees of the Company to whom options or performance shares may be granted and determines the vesting and other terms of the agreements representing such options or performance shares, as the case may be.

Stock Options

The exercise price of options granted under the 1998 Plan is determined by the Compensation Committee, but in the case of an Incentive Stock Option, the exercise price shall not be less than the fair market value of the Common Stock on the date the option is granted. In addition, the Compensation Committee has advised the

19

Company that it will not grant any Nonstatutory Stock Option having an exercise price that is less than the fair market value of the Common Stock on the date the option is granted. No person may receive any Incentive Stock Option if, at the time of grant such person owns directly or indirectly more than 10% of the total combined voting power of the Company unless the option price is at least 110% of the fair market value of the Common Stock and such Incentive Stock Option is by its terms not exercisable after the expiration of five years from the date of grant. There is also a $100,000 limit on the value of stock (determined at the time of grant) covered by Incentive Stock Options that first became exercisable by an optionee in any calendar year. No option may be granted more than ten years after the effective date of the 1998 Plan, which is November 25, 1998, the date of its adoption by the Board of Directors. Each option expires on the tenth anniversary of the date of grant, except for options that may be granted pursuant to the second sentence of this paragraph. Shares covered by grants of stock options under the 1998 Plan may be issued by the Company from authorized but unissued stock, from shares previously issued and reacquired by the Company, or any combination of such sources.

Performance Awards

Performance shares are certificates representing the right to acquire shares of Common Stock upon the satisfaction of performance goals established by the Company. Performance shares may be granted based on past or future performance. Performance targets established by the committee may relate to corporate, group, unit or individual performance and may be established in terms of cash flow, net asset value, earnings or any other measures or standards determined by the committee. Holders of performance shares have all of the voting dividend and other rights of shareholders of the Company, subject to the terms of the award agreement relating to such shares. If the performance goals are achieved, the performance shares will vest and may be exchanged for shares of Common Stock. If the performance goals are not achieved, the performance shares may be forfeited, in the committee’s discretion.

Amendment and Termination

The Board of Directors may amend or terminate the 1998 Plan at any time, except that it may not make any amendment which would (i) increase the maximum number of shares of Common Stock which may be issued pursuant to the provisions of the Plan (other than adjustments for reason of a stock dividend or distribution, recapitalization, merger, consolidation, split-up, combination, exchange of shares or similar events) or (ii) extend the term of the 1998 Plan, without the approval of the Company’s shareholders. Except with respect to options or performance shares then outstanding, if not sooner terminated, the 1998 Plan shall terminate and no further options or performance shares shall be granted after the expiration of ten years from the date of its adoption.

Recapitalization or Change in Control

The 1998 Plan includes customary provisions providing for proportionate adjustments in the number of shares subject to outstanding options and the option exercise prices in the event of stock dividends, stock splits and other events. In addition, upon the occurrence of a merger or consolidation in which the Company is not the surviving corporation, or a sale or disposition of substantially all of the Company’s assets, the committee may direct that one of the following occurs: (i) all outstanding options shall be converted into options to acquire shares of the successor entity with the same terms as the options immediately prior to the merger or consolidation, (ii) all outstanding options and performance shares shall become immediately exercisable or (iii) all outstanding options shall be canceled as of the effective date of the merger, provided that each option holder shall have the right to exercise such options for a period of not less than 30 days prior to the effective date of the merger, consolidation or sale of assets.

Tax Effects of Participation in the Plan

Status of Options. The federal income tax consequences both to the Optionee and the Company of options granted under the 1998 Plan differ depending on whether an Option is an Incentive Stock Option or a Nonstatutory Stock Option.

Nonstatutory Stock Options. No federal income tax is imposed on the Optionee upon the grant of a Nonstatutory Stock Option. Generally, upon the exercise of a Nonstatutory Stock Option, the Optionee will be treated as receiving compensation taxable as ordinary income in the year of exercise, in an amount equal to the

20

excess of the fair market value of the shares at the time of exercise over the option price paid for such shares. Upon a subsequent disposition of the shares received upon exercise of a Nonstatutory Stock Option, any difference between the amount realized on the disposition and the basis of the shares (option price plus any ordinary income recognized) would be treated as long-term or short-term capital gain or loss, depending on the holding period of the shares. Upon an Optionee’s exercise of a Nonstatutory Stock Option, the Company may claim a deduction for compensation paid at the same time and in the same amount as compensation income is recognized to the Optionee.

Incentive Stock Options. No federal income tax is imposed on the Optionee upon the grant or exercise of an Incentive Stock Option. The difference between the exercise price and the fair market value of the shares on the exercise date will, however, be included in the calculation of the Optionee’s alternative minimum tax liability, if any. If the Optionee does not dispose of shares acquired pursuant to the exercise of an Incentive Stock Option within two years from the date the Option was granted or within one year after the shares were transferred to him, no income is recognized by the Optionee by reason of the exercise of the Option, and the difference between the amount realized upon a subsequent disposition of the shares and the option price of the shares would be treated as long-term capital gain or loss. In such event, the Company would not be entitled to any deduction in connection with the grant or exercise of the Option or the disposition of the shares so acquired. If an Optionee disposes of shares acquired pursuant to his exercise of an Incentive Stock Option prior to the end of the two-year or one-year holding periods noted above, the disposition would be treated as a disqualifying disposition and the Optionee would be treated as having received, at the time of disposition, compensation taxable as ordinary income equal to the excess of the fair market value of the shares at the time of exercise (or, in the case of a sale in which a loss would be recognized, the amount realized on such sale, if less) over the option price. Any amount realized in excess of the fair market value of the shares at the time of exercise would be treated as long-term or short-term capital gain, depending on the holding period of the shares. In such event, the Company may claim a deduction for compensation paid at the same time and in the same amount as compensation is treated as received by the Optionee.

Performance Shares. Generally, a holder of performance shares will not recognize income when granted performance shares, unless the performance shares vest immediately and have no substantial restrictions or limitations. If the performance shares vest only upon the satisfaction of certain performance criteria, a holder will recognize ordinary income only when the performance shares vest and any restrictions regarding forfeiture are removed. The Company will generally be allowed to deduct from its taxes the amount of ordinary income a holder of performance shares must recognize.

Plan Benefits