UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

SCHEDULE 14A

Proxy Statement Pursuant to Section 14(a) of the

Securities Exchange Act of 1934 (Amendment No. )

Filed by the Registrantx

Filed by a Party other than the Registrant¨

Check the appropriate box:

| ¨ | Preliminary Proxy Statement |

| ¨ | CONFIDENTIAL, FOR USE OF THE COMMISSION ONLY (AS PERMITTED BY RULE 14a-6(e)(2)) |

| x | Definitive Proxy Statement |

| ¨ | Definitive Additional Materials |

| ¨ | Soliciting Material Pursuant to § 240.14a-12 |

METROCORP BANCSHARES, INC.

(Name of Registrant as Specified In Its Charter)

(Name of Person(s) Filing Proxy Statement, if other than the Registrant)

Payment of Filing Fee (Check the appropriate box):

| ¨ | Fee computed on table below per Exchange Act Rules 14a-6(i)(1) and 0-11. |

| | (1) | Title of each class of securities to which transaction applies: |

| | (2) | Aggregate number of securities to which transaction applies: |

| | (3) | Per unit price or other underlying value of transaction computed pursuant to Exchange Act Rule 0-11 (set forth the amount on which the filing fee is calculated and state how it was determined): |

| | (4) | Proposed maximum aggregate value of transaction: |

| ¨ | Fee paid previously with preliminary materials. |

| ¨ | Check box if any part of the fee is offset as provided by Exchange Act Rule 0-11(a)(2) and identify the filing for which the offsetting fee was paid previously. Identify the previous filing by registration statement number, or the Form or Schedule and the date of its filing. |

| | (1) | Amount Previously Paid: |

| | (2) | Form, Schedule or Registration Statement No.: |

SEC 1913 (04-05)

METROCORP BANCSHARES, INC.

9600 Bellaire Boulevard, Suite 252

Houston, Texas 77036

NOTICE OF 2008 ANNUAL MEETING OF SHAREHOLDERS

TO BE HELD ON FRIDAY, MAY 9, 2008

Shareholders of MetroCorp Bancshares, Inc.:

The 2008 Annual Meeting of Shareholders (the “Meeting”) of MetroCorp Bancshares, Inc. (the “Company”) will be held at the Company’s principal executive offices at 9600 Bellaire Boulevard, Suite 252, Houston, Texas 77036, on Friday, May 9, 2008, beginning at 10:00 a.m., local time, for the following purposes:

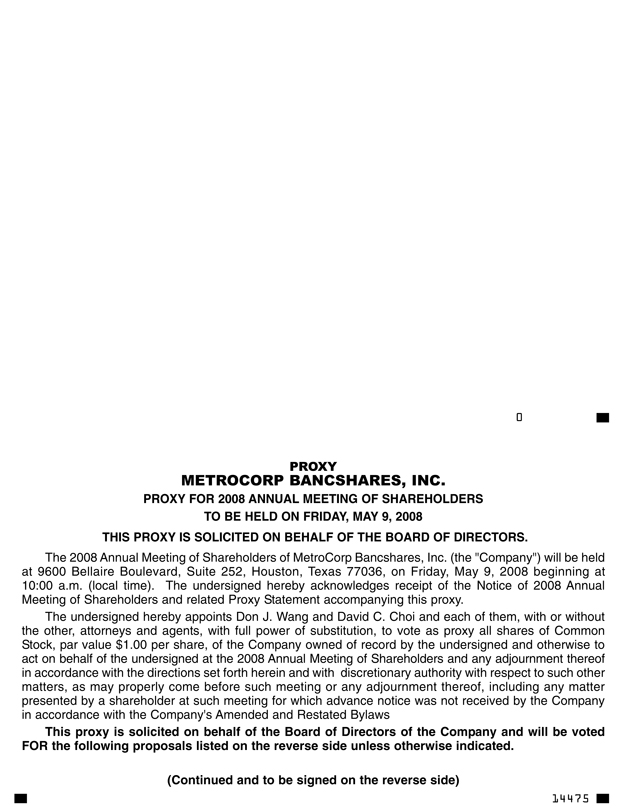

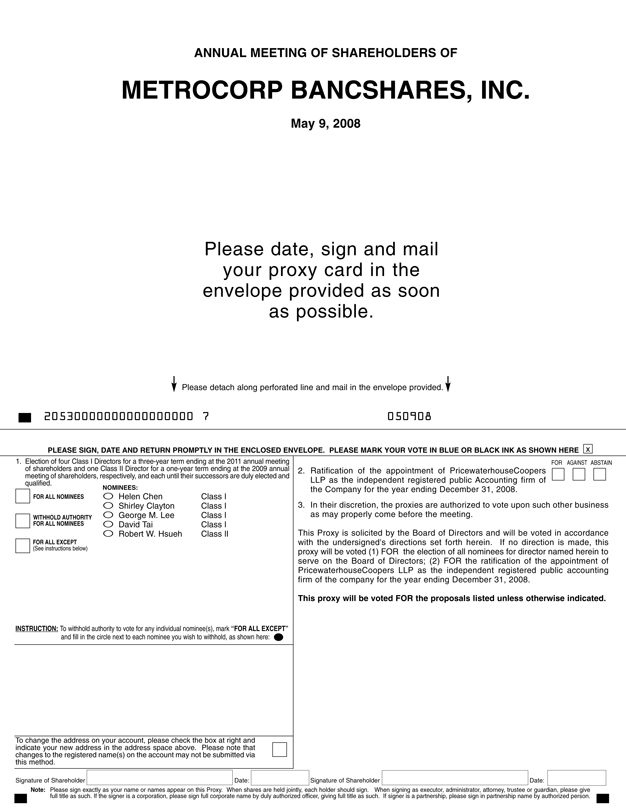

| | 1. | To elect four directors of Class I and one director of Class II to serve until the Company’s 2011 and 2009 annual meeting of shareholders, respectively, and each until their successors are duly elected and qualified or until their earlier resignation or removal; |

| | 2. | To consider and act upon a proposal to ratify the appointment of PricewaterhouseCoopers LLP as the independent registered public accounting firm of the Company for the year ending December 31, 2008; and |

| | 3. | To transact such other business as may properly come before the Meeting or any adjournment thereof. |

The close of business on March 14, 2008 has been fixed as the record date for the determination of shareholders entitled to notice of and to vote at the Meeting or any adjournments thereof. A list of shareholders entitled to vote at the Meeting will be available for inspection by any shareholder at the offices of the Company during ordinary business hours for a period of at least ten days prior to the Meeting.

You are cordially invited and urged to attend the Meeting. If you attend the Meeting, you may vote in person, regardless of whether you have given your proxy.

By order of the Board of Directors,

DON J. WANG

Chairman of the Board

Houston, Texas

April 7, 2008

YOUR VOTE IS IMPORTANT.

To ensure your representation at the Meeting, please complete, date, and sign the enclosed proxy and return it in the accompanying envelope at your earliest convenience, regardless of whether you plan to attend the Meeting. No additional postage is necessary if the proxy is mailed in the United States. The proxy is revocable at any time before it is voted at the Meeting.

METROCORP BANCSHARES, INC.

9600 Bellaire Boulevard, Suite 252

Houston, Texas 77036

PROXY STATEMENT

FOR

2008 ANNUAL MEETING OF SHAREHOLDERS

TO BE HELD ON FRIDAY, MAY 9, 2008

This Proxy Statement is being furnished in connection with the solicitation of proxies by the Board of Directors of MetroCorp Bancshares, Inc. (the “Company”) for use at the 2008 Annual Meeting of Shareholders of the Company to be held at the Company’s principal executive offices at 9600 Bellaire Boulevard, Suite 252, Houston, Texas 77036, on Friday, May 9, 2008, beginning at 10:00 a.m., local time, and any adjournment thereof (the “Meeting”) for the purposes set forth in this Proxy Statement and the accompanying Notice of 2008 Annual Meeting of Shareholders (“Notice of Meeting”). This Proxy Statement, the Notice of Meeting and the enclosed proxy will first be sent to shareholders on or about April 7, 2008.

SOLICITATION, REVOCABILITY AND VOTING OF PROXIES

Voting of Proxies

Shares of the Company’s common stock, $1.00 par value (“Common Stock”), represented at the Meeting by an executed and unrevoked proxy in the form enclosed will be voted in accordance with the instructions contained therein. If no instructions are given on an executed and returned form of proxy, the proxies intend to vote the shares represented thereby in favor of each of the proposals to be presented to and voted upon by the shareholders as set forth herein.

The Board of Directors knows of no other matters to be presented at the Meeting. If any other matter should be presented at the Meeting upon which a vote may be properly taken, shares represented by an executed and unrevoked proxy received by the Board of Directors may be voted with respect thereto in accordance with the judgment of the proxies. The proxy also confers on the proxies the discretionary authority to vote with respect to any matter presented at the Meeting for which advance notice was not received by the Company in accordance with the Company’s Amended and Restated Bylaws.

Revocability of Proxies

Any proxy given by a record shareholder may be revoked by such shareholder at any time before it is exercised by:

| | • | | submitting to the Secretary of the Company a duly executed proxy bearing a later date; |

| | • | | delivering to the Secretary of the Company a written notice of revocation; or |

| | • | | attending the Meeting and voting in person. |

All written notices of revocation and other communications with respect to revocation or proxies should be sent to: MetroCorp Bancshares, Inc., 9600 Bellaire Boulevard, Suite 252, Houston, Texas 77036, Attention: Corporate Secretary. Any shareholder who holds shares in street name with a bank or broker must contact that bank or broker to revoke his or her proxy.

Solicitation of Proxies

This proxy solicitation is made by the Board of Directors of the Company and the cost of this solicitation of proxies is being borne by the Company. Solicitations will be made only by the use of the mail, except that, if deemed desirable, officers and regular employees of the Company may solicit proxies by telephone, telegraph or

personal calls, without being paid additional compensation for such services. The Company will reimburse brokerage houses, custodians, nominees and fiduciaries for their reasonable expenses incurred in connection with forwarding the proxy materials to the beneficial owners of the Company’s Common Stock.

Annual Report

The Company’s Annual Report to Shareholders, including consolidated financial statements, for the year ended December 31, 2007, as filed with the Securities and Exchange Commission, accompanies but does not constitute part of this Proxy Statement.

VOTING SHARES AND VOTING RIGHTS

Only holders of record of Common Stock at the close of business on March 14, 2008 (the “Record Date”) are entitled to notice of and to vote at the Meeting and any adjournments or postponements thereof. As of March 14, 2008, there were 10,846,011 shares of Common Stock outstanding, which is the only outstanding class of voting securities of the Company. A majority of the outstanding shares of Common Stock must be represented at the Meeting in person or by proxy in order to constitute a quorum for the transaction of business. Abstentions and shares held of record by a broker or nominee that are voted on any matter are included in determining whether a quorum exists. Each holder of Common Stock shall have one vote for each share of Common Stock registered, on the Record Date, in such holder’s name on the books of the Company.

Directors will be elected by a plurality of the votes cast in person or by proxy at the Meeting. Accordingly, the four Class I nominees and the one Class II nominee receiving the highest number of votes cast by the holders of Common Stock will be elected. There will be no cumulative voting in the election of directors. A broker non-vote or a withholding of authority to vote with respect to one or more nominees for director will not have the effect of a vote against such nominee or nominees. A broker non-vote occurs when a broker or other nominee of shares does not have discretionary authority to vote the shares and has not received voting instructions from its customer with respect to a particular matter.

The affirmative vote of the holders of a majority of the outstanding shares of Common Stock represented at the Meeting is required to ratify the appointment of the independent registered public accounting firm. Any abstentions will have the effect of a vote against this matter. However, broker non-votes will be deemed shares not present to vote on this matter and will not count as votes for or against this proposal and will not be included in calculating the number of votes necessary for approval of this matter.

ITEM 1.

ELECTION OF DIRECTORS

Election Procedures; Term of Office

The Board of Directors has established the size of the Board of Directors at thirteen members; however, due to the death of Tiong Ang, a Class III director, on February 4, 2008 the Board of Directors currently consists of twelve directors. The Governance and Nominating Committee has commenced a search for a replacement to fill the vacancy. In accordance with the Company’s Amended and Restated Bylaws, members of the Board of Directors are divided into three classes, Class I, Class II and Class III. The members of each class are elected for a term of office to expire at the third succeeding annual meeting of shareholders following their election. The term of office of the current Class I directors expires at the Meeting. The terms of the current Class II and Class III directors expire at the annual meeting of shareholders in 2009 and 2010, respectively.

2

The Governance and Nominating Committee has recommended to the Board of Directors and the Board of Directors has approved the nomination of Helen Chen, Shirley Clayton, George M. Lee and David Tai to fill four of the expiring Class I director positions. Each of these nominees currently serves as a Class I director. In addition, the Governance and Nominating Committee has recommended to the Board of Directors, and the Board of Directors has approved the nomination of Robert W. Hsueh, who currently serves as a Class I director and whose term expires at the Meeting, as a Class II director. If elected at the Meeting, the four Class I nominees will serve until the annual meeting of shareholders in 2011 and the one Class II nominee will serve until the annual meeting of shareholders in 2009. Accordingly, if the four nominees for Class I director and one nominee for Class II director are elected at the Meeting, the composition of the Board of Directors will be four Class I directors, five Class II directors and three Class III directors.

The four Class I nominees and the one Class II nominee receiving the affirmative vote of the holders of a plurality of the shares of Common Stock represented at the Meeting will be elected. Unless the authority to vote for the election of directors is withheld as to one or more of the nominees, all shares of Common Stock represented by proxy will be voted FOR the election of the nominees. If the authority to vote for the election of directors is withheld as to one or more but not all of the nominees, all shares of Common Stock represented by any such proxy will be voted FOR the election of the nominee or nominees, as the case may be, as to whom such authority is not withheld.

If a nominee becomes unavailable to serve as a director for any reason before the election, the shares represented by proxy will be voted for such other person, if any, as may be designated by the Board of Directors. The Board of Directors has no reason to believe that any nominee will be unavailable to serve as a director. All of the nominees have consented to being named herein and to serve if elected.

Any director vacancy occurring after the election may be filled only by a majority of the remaining directors, even if less than a quorum of the Board of Directors. A director elected to fill a vacancy will be elected for the unexpired portion of the term of his predecessor in office.

Nominees for Election

The following table sets forth the name, age and positions with the Company and its wholly owned subsidiaries, MetroBank, N.A. (“MetroBank”) and Metro United Bank (“Metro United”), of each nominee for election as a director of the Company:

| | | | |

Name | | Age | | Positions with the Company, MetroBank and Metro United |

Helen Chen | | 60 | | Class I Director of the Company; Director of MetroBank |

| | |

Shirley Clayton | | 70 | | Class I Director of the Company; Director of MetroBank; Director of Metro United |

| | |

Robert W. Hsueh | | 57 | | Class II Director Nominee, Class I Director of the Company; Director of MetroBank |

| | |

George M. Lee | | 58 | | Class I Director, Executive Vice Chairman, President and Chief Executive Officer of the Company; Director, Executive Vice Chairman and Chief Executive Officer of MetroBank; Director and Chairman of the Board of Metro United |

| | |

David Tai | | 56 | | Class I Director and Executive Vice President of the Company; Director of MetroBank; Director of Metro United |

Helen F. Chen. Ms. Chen is a Class I director of the Company and was elected as a member of the Board of Directors of MetroBank in 1989. She is the President of Metro Investment Group, Inc., an investment company that holds shares of Common Stock of the Company as its principal asset. She has served as the President of the

3

Houston Chinese Schools Association and served as Chairman of the Board of the Houston Northwest Chinese School for many years. A member of various civic organizations in Houston, Ms. Chen focuses her efforts in the Chinese community. Ms. Chen is the sister of Don J. Wang.

Shirley L. Clayton. Ms. Clayton was appointed as a Class I director of the Company and a director of MetroBank in April 2004 and serves as a member of the Company’s Audit Committee. She was appointed as a director of Metro United in October 2005. She retired as the President and CEO of Abmaxis Inc., a subsidiary of Merck & Co. From 2000 to 2003, she was the Chief Financial Officer of CBYON Inc., a surgical instrument company. Prior to joining CBYON, she was a co-founder, President and Chief Financial Officer of Raven Biotechnologies. She has been President, CEO or CFO of several technology companies, including Protein Design Labs and Genentech. From 1976 to 1981, she was with the Bank of America where she served in both lending and operations, including Head of Corporate Banking in Mountain View, California and Assistant Branch Manager. Ms. Clayton received a Masters of Business Administration degree from the Stanford Business School and a Bachelor of Arts from Smith College.

Robert W. Hsueh. Mr. Hsueh was appointed as a Class I director of the Company and a director of MetroBank in June 2007. He has been practicing International and Immigration Law in the Dallas area for the past 27 years and is currently the Managing Partner at the Law Offices of Robert Hsueh. Mr. Hsueh is currently an Arbitrator to the China International Economic and Trade Arbitration Commission, a member of the Board of Directors of the DFW International Airport, the Dallas Museum of Art, and the World Affairs Council of Greater Dallas, a member of U.S. Senators John Cornyn’s and Kay Bailey Hutchison’s Federal Judiciary Evaluation Committee, Chairman for the Dallas-China Partnership, the Hong Kong Association of Northern Texas, founding Chairman of the Greater Dallas Asian American Chamber o Commerce. Formerly, Mr. Hsueh has served as a Board member for the Texas Department of Economic Development Board and the State of Texas International Trade commission. He received a Bachelor of Law from the Soochow University and a Doctor of Jurisprudence degree from the Southern Methodist University School of Law.

George M. Lee. Mr. Lee was named President and Chief Executive Officer of the Company and Chief Executive Officer of MetroBank in July 2004 and Chairman of Metro United in October 2005. He has served as a Class I director of the Company and a director of MetroBank since March 1999 and was elected to serve as Executive Vice Chairman of the Board of the Company in September 2003. Prior to that, Mr. Lee served as the President and Chief Executive Officer of Erimos Pharmaceutical (formerly BioCure Medical LLC), a joint venture between a private investment group and Johns Hopkins University. Its mission is to develop and commercialize a series of patented cancer drugs that have very low toxicity. From 1997 through 2000, Mr. Lee was an investor and an active executive team member of Higher Dimensions Medical, a cutting edge high tech company involved with the development and manufacturing of puncture-proof material. Prior to this, from 1987 to 1997, he served as the Chief Operating Officer and President at different publicly-traded companies, including Hanover Direct in New York and Fingerhut Companies in Minnesota. His areas of responsibility included strategic planning and new business acquisitions. Mr. Lee received a Bachelor of Science in Econometrics from the University of Wisconsin and a Masters of Business Administration from Minnesota State University. Mr. George Lee is not related to Mr. John Lee.

David Tai. Mr. Tai is a Class I director of the Company, an organizing director of MetroBank and was appointed as a member of the Board of Directors of Metro United in October 2005. Mr. Tai is the Executive Vice President and Secretary of the Company and the President and Vice Chairman of the Board of MetroBank. Mr. Tai is a leader in the Asian-American community through his active involvement in several organizations. He has served as the President of the Taiwanese Chamber of Commerce of Greater Houston and is the Executive Advisor of the Taiwanese Chamber of Commerce of North America, an organization that has members in 25 cities across the United States, Canada and Mexico. He is also active in the World Taiwanese Chamber of Commerce and serves as its Executive Consular. In 1999, Mr. Tai was appointed as a director of the State Bar of Texas Chief Disciplinary Council’s Houston Region Grievance Council. He received a Bachelor of Business Administration degree from Fu-Jen Catholic University in Taiwan in 1974 and a Masters in Business

4

Administration degree from Murray State University in 1977. He is also a 2004 graduate of the ABA Stonier School of Banking at Georgetown University. Mr. Tai is a member of the Asian Realtors Association, the Asian Chamber of Commerce and the United Way. He is a Counselor at the Taiwanese Cultural Center. Mr. Tai is the President of the Fu-Jen Worldwide Alumni Association and the Director of the Fu-Jen University Foundation. He also serves as the Chairman of the Chopin’s Corner Foundation since 2006. Mr. Tai is the brother-in-law of Mr. John Lee.

THE BOARD OF DIRECTORS RECOMMENDS A VOTEFOR THE ELECTION OF EACH OF THE NOMINEES LISTED ABOVE FOR ELECTION TO THE BOARD OF DIRECTORS.

5

CONTINUING DIRECTORS AND EXECUTIVE OFFICERS

The following table sets forth certain information with respect to the Company’s Class II and Class III directors, whose terms of office do not expire at the Meeting, and certain officers of the Company, MetroBank and Metro United:

| | | | |

Name | | Age | | Positions with the Company, MetroBank and Metro United |

Directors: | | | | |

| | |

Krishnan Balasubramanian | | 65 | | Class III Director of the Company; Director of MetroBank |

| | |

May P. Chu | | 60 | | Class II Director of the Company; Director of MetroBank; Director of Metro United |

| | |

John Lee | | 64 | | Class II Director of the Company; Director of MetroBank |

| | |

Edward A. Monto | | 67 | | Class II Director of the Company; Director of MetroBank |

| | |

Charles Roff | | 46 | | Class III Director of the Company; Director of MetroBank |

| | |

Joe Ting | | 55 | | Class III Director of the Company; Director of MetroBank |

| | |

Don Wang | | 63 | | Class II Director and Chairman of the Board of the Company; Director and Chairman of MetroBank |

| | |

Executive officers who are not also directors: | | | | |

| | |

David Choi | | 50 | | Executive Vice President and Chief Financial Officer of the Company and MetroBank |

| | |

Mitchell W. Kitayama | | 51 | | Executive Vice President of the Company; Chief Executive Officer and Vice Chairman of Metro United |

| | |

Terrance J. Tangen | | 60 | | Chief Credit Officer and Executive Vice President of MetroBank |

Directors

Krishnan Balasubramanian. Mr. Balasubramanian was elected by the Board of Directors as a Class III director of the Company in November 2007 and elected to the Board of Directors of MetroBank in February 2008. Mr. Balasubramanian retired from Texas Instruments in 2006 after thirty-seven years of service. From 2001-2006, he was the President and Chairman of the Board of Texas Instruments, Japan, a position in which he was responsible for executive management supervision regulator matters and technological operations. Prior to 2001, Mr. Balasubramanian held various senior positions at Texas Instruments. Mr. Balasubramanian holds a Masters Degree in Electrical Engineering from the University of Rhode Island. He is currently involved in various charitable organizations.

May P. Chu. Ms. Chu is a Class II director of the Company and an organizing director of MetroBank. Ms. Chu serves on the Company’s Compensation Committee and is Chair of the Audit Committee. Additionally, Ms. Chu was appointed as a director of Metro United in January 2007. She is the founder of Signet Consulting, a bank management consulting firm specializing in regulatory issues and has served as its President for more than

6

twenty years. She received a Bachelors of Arts degree in Physics from the University of California at Berkeley and a Ph.D. in Economics from Case Western Reserve University. Ms. Chu was employed at Texas Commerce Bank and Texas Commerce Bancshares, Inc. for more than five years, first in the Economics Division and subsequently in Mergers/Acquisitions.

John Lee. Mr. Lee is a Class II director of the Company and was an organizing director of MetroBank. He is Executive Vice President of Alpha Seafood Enterprises, Inc. and serves as the Treasurer, Director and co-founder of United Oriental Capital Corporation, a Specialized Small Business Investment Company. For six years, Mr. Lee served as President and manager for numerous motels in the Houston area. Mr. Lee received a Bachelor of Arts degree in Agricultural Economics from National Chung Hsing University. He is a member of the Taiwanese Chamber of Commerce of North America. Mr. Lee is the brother-in-law of Mr. David Tai. Mr. Lee is not related to Mr. George Lee.

Edward A. Monto. Mr. Monto was elected a Class II director of the Company in 2004 and has been a director of MetroBank since 2001. Mr. Monto serves as Chair of the Compensation Committee and as a member of the Governance and Nominating Committee as well as the Audit Committee. Mr. Monto is a private investor and is President of the Board of Harris County Municipal Utility District #191. From 1997 to 2000, Mr. Monto was President and Chief Operating Officer of Reliant Energy International and from 1970 to 1996 held senior positions in marketing and business development of various oil and energy companies in the United States and abroad. He has served on the Boards of various charitable, civic and educational institutions as well as serving as Chairman of the Advisory Committee of the U.S. Export-Import Bank of the United States during 2002 and 2003. He received a Bachelor of Business Administration degree from the University of Miami.

Charles L. Roff. Mr. Roff was elected as a Class III director of the Company in 2004 and has been a director of MetroBank since 2001 and serves as a member of MetroBank’s Asset and Liability Committee and the Governance and Nominating Committee. Mr. Roff is the Vice President of Roff Resources LLC, a private investment firm and has served in that capacity since 1998. From 1995 to 1998, Mr. Roff was Vice Chairman and Director of PetroUnited Terminals, Inc., a bulk liquid storage services company. Mr. Roff received his law degree from the University of Texas School of Law in 1987 and while there, was the Scholarly Publications Editor of the Texas International Law Journal. Mr. Roff also was awarded a Bachelor of Arts degree from Wesleyan University in 1983, with high honors. He is actively involved in various charitable and civic organizations.

Joe Ting. Mr. Ting is a Class III director of the Company and has served as a director of MetroBank since 1989. He was elected as Vice Chairman of MetroBank’s Board of Directors in 1999. Mr. Ting serves as a member of the Company’s Compensation Committee and is the Chair of the Governance and Nominating Committee. He has been the President of West Plaza Management, Inc., a real estate investment company, for more than ten years, and serves on the Board of Directors of the Houston Convention Center Hotel Corporation. Mr. Ting has extensive knowledge in the plastic manufacturing industry and real estate investing. He received a Masters in Business Administration from the Florida Institute of Technology.

Don J. Wang. Mr. Wang is a Class II director of the Company and an organizing director of MetroBank. Mr. Wang serves as Chairman of the Board of the Company and MetroBank. He has also served as Chairman of the Board of New Era Life Insurance Company since 1989. He also serves as a Board member of the Greater Houston Partnership since 1991 and served on the Supervisory Board of Directors of the World Trade Division and serves on the Advisory Board of Directors of Greater Houston Convention and Visitors Bureau. Mr. Wang is Chairman of the Board of the Chinese Senior Estate—HUD Senior Housing Project. He has served on the Boards of Directors of Harris County Hospital District and served on the Advisory Board Committee of the Ex-Im Bank of the U.S. in Washington, D.C. Mr. Wang has a history of community leadership in Houston. He has actively participated in the promotion of Asian businesses and has played a principal role in relationship building between the Asian and non- Asian communities in and around Houston. He held the position of President of the Chambers of Commerce of North America from 1991 to 1992 and has served as a board member of the Houston Asian

7

Chamber of Commerce. He has received many awards for his work in community relations. He received a Bachelors of Science degree from National Chung Hsing University and a Masters in Science degree from Utah State University. Mr. Wang is the brother of Ms. Helen F. Chen.

Executive Officers Who Are Not Also Directors

David C. Choi.Mr. Choi was named Executive Vice President and Chief Financial Officer of the Company and the Bank in November 2004. Mr. Choi joined the Company with over 20 years experience in finance, banking and manufacturing. Prior to joining the Company, Mr. Choi served as Vice President and Chief Financial Officer of TECO-Westinghouse Motor Company in Round Rock, Texas, where he was responsible for all financial and administrative operations since 2000. From 1988 to 1999, Mr. Choi held different positions at JP Morgan Chase Bank in Houston. He was Senior Client Manager and Vice President of International Banking since 1995, having previously served as Vice President and Trust Officer of Corporate Trust for Chase. Mr. Choi holds a Bachelor of Science in Economics and Business Administration from the University of Wisconsin, and a Master of Business Administration, with a concentration in Finance, from Michigan State University.

Mitchell W. Kitayama. Mr. Kitayama was named Executive Vice President of the Company in July of 2005 and Chief Executive Officer of Metro United in October 2005. Mr. Kitayama has over 24 years of experience in the financial services industry, serving as Treasurer at First American Bank, SSB, Bryan, Texas; CorEast Savings Bank, Richmond, Virginia; Goldome Realty Credit Corp., Buffalo, New York and First Federal Savings & Loan, Austin, Texas. From 1997 to 2005, Mr. Kitayama served as Senior Vice President and Treasurer with East West Bank in San Marino, California. Mr. Kitayama received his Masters of Business Administration and his Bachelor of Arts degrees from Baylor University.

Terrance J. Tangen. Mr. Tangen was named Executive Vice President and Chief Credit Officer of MetroBank in October 2001. Mr. Tangen has over 30 years experience in bank lending and credit. Prior to joining MetroBank, he served as a Senior Vice President and Credit Officer for Bank One. Mr. Tangen joined Bank One in 1997 as a Credit Approval Officer responsible for reviewing and approving corporate, commercial and energy loans. Prior to joining Bank One, Mr. Tangen served as Loan Supervisor for Wells Fargo Bank in Houston responsible for commercial and energy credit approval. He began his career in Denver in 1974 as a credit analyst. After 15 years as a lender, manager and Vice President of Credit Administration for two banks in that market, he moved to First Interstate Bank in Houston as a Senior Vice President and Manager of Credit Review. In 1992, he became the Senior Credit Officer for their south Texas market. He continued in that capacity through that bank’s merger with Wells Fargo in 1996. Mr. Tangen earned his Bachelor degree from the Minnesota State University — Moorhead and a Masters of Business Administration from the University of Colorado. He is also a graduate of the Pacific Coast Banking School in Seattle. Mr. Tangen is a Past President and member of the board of the Texas Chapter of RMA — The Risk Management Association.

Each executive officer of the Company is elected by the Board of Directors of the Company and holds office until his or her successor is duly elected and qualified or until his or her earlier death, resignation or removal.

DIRECTOR COMPENSATION

For 2007, directors of the Company did not receive a fee for attending Board of Directors meetings. However, members of the committees of the Company’s Board of Directors did receive a fee for meeting attendance. The members of the Audit Committee, the Compensation Committee and the Governance and Nominating Committee received a fee of $500 for each meeting attended. The same fees are paid for meetings attended by video or tele-conference. In addition, the Audit Committee Chair is paid a $10,000 annual retainer and the Compensation Committee Chair and the Governance and Nominating Committee Chair are each paid a $5,000 annual retainer in consideration of the work load experienced by the committee chairs due to greater scrutiny being placed on corporate governance.

8

Each director of the Company also serves as a director of MetroBank. In 2007, the Board of Directors of MetroBank held eight meetings. For 2007, non-employee directors of MetroBank received a fee of $1,000 for each meeting of MetroBank’s Board of Directors attended and a fee of $500 for each MetroBank committee meeting attended.

Shirley L. Clayton and May P. Chu also serve as non-employee directors of Metro United. In 2007, the Board of Directors of Metro United held seven meetings. For 2007, non-employee directors of Metro United received a fee of $1,000 for each meeting attended and a fee of $500 for each Loan Committee meeting of Metro United attended. Additionally, the Chair of the Loan Committee is paid a $5,000 annual retainer and the Vice Chair is paid a $2,500 annual retainer.

Any director of MetroBank or Metro United who lives out of town from where a Board of Directors meeting is held receives reimbursement of his or her travel expenses to attend such meetings.

The following table contains information concerning the compensation of the directors of the Company for the fiscal year ended December 31, 2007. Although certain of the named executive officers of the Company are also directors of the Company, MetroBank and/or Metro United, such officers do not receive a fee for their service on such Board(s).

Director Compensation For The Fiscal Year Ended December 31, 2007

| | | | | | |

Name | | Fees Earned or Paid in

Cash | | Total |

Krishnan Balasubramanian(1) | | $ | — | | $ | — |

Tiong Loi Ang(2) | | | — | | | — |

Helen F. Chen | | | 8,000 | | | 8,000 |

Tommy F. Chen(3) | | | 29,000 | | | 29,000 |

May P. Chu(4) | | | 34,000 | | | 34,000 |

Shirley L. Clayton(5) | | | 50,500 | | | 50,500 |

Robert W. Hsueh | | | 3,000 | | | 3,000 |

John Lee | | | 8,000 | | | 8,000 |

Edward A. Monto(6) | | | 46,600 | | | 46,600 |

John Peterson, Jr.(7) . | | | 6,500 | | | 6,500 |

Charles Roff | | | 20,500 | | | 20,500 |

Joe Ting(8) | | | 45,000 | | | 45,000 |

Don J. Wang(9) | | | 110,000 | | | 110,000 |

Daniel B. Wright(10) | | | 2,000 | | | 2,000 |

| (1) | Mr. Balasubramanian was elected to the Board of Directors effective November 27, 2007. |

| (2) | Mr. Ang passed away on February 4, 2008. |

| (3) | Mr. Chen resigned from the Board of Directors effective October 1, 2007. |

| (4) | Includes a $10,000 retainer fee for service as Chair of the Audit Committee and $5,000 in fees for service as a director of Metro United. |

| (5) | Includes $35,500 in fees for service as a director of Metro United. |

| (6) | Includes a $5,000 retainer fee for service as Chair of the Compensation Committee. |

| (7) | Mr. Peterson retired from the Board of Directors effective May 4, 2007. |

| (8) | Includes a $5,000 retainer fee for service as Chair of the Governance and Nominating Committee. |

| (9) | Represents Mr. Wang’s annual salary as Chairman of the Board of Directors. |

| (10) | Mr. Wright resigned from the Board of Directors effective March 14, 2007. |

9

CORPORATE GOVERNANCE

Meetings of the Board of Directors

The Board of Directors of the Company held nine meetings during 2007. During 2007, no incumbent director attended less than 75% of the aggregate of the (1) total number of meetings of the Board of Directors held during the period which he or she was a director and (2) total number of meetings held by committees on which such director served held during the period which he or she served as a member of such committee. Additionally, the Company encourages its directors to attend the Company’s annual meeting of shareholders. Eight members of the Company’s Board of Directors attended the Company’s 2007 annual meeting of shareholders held on May 4, 2007.

Committees of the Board

The Company’s Board of Directors has three committees, the Audit Committee, the Compensation Committee, and the Governance and Nominating Committee, each of which is described below:

Audit Committee. The primary purpose of the Audit Committee is to provide independent and objective oversight with respect to the Company’s financial reports and other financial information provided to shareholders and others, the Company’s internal controls and the Company’s audit, accounting and financial reporting processes generally. The Audit Committee reports to the Board of Directors concerning such matters, appoints the independent registered public accounting firm for the Company, MetroBank and Metro United, and reviews and approves the scope of the work of the independent registered public accounting firm. The Audit Committee operates pursuant to a written charter, a copy of which is available in the corporate governance section of the Investor Relations page of the Company’s web site atwww.metrobank-na.com. During 2007, the Audit Committee held fifteen meetings.

The Audit Committee is comprised of May P. Chu (Chair), Shirley L. Clayton and Edward A. Monto each of whom the Board of Directors has determined to be an “independent director” of the Company as defined in the listing standards of the NASDAQ Global Market and in Section 10A of the Securities Exchange Act of 1934, as amended. The Board of Directors has also determined that Ms. Clayton has the requisite attributes of an “audit committee financial expert” as defined by the rules and regulations of the Securities and Exchange Commission and that such attributes were acquired through relevant education and experience, and that she is able to read and understand fundamental financial statements and has substantial business experience and a level of experience and knowledge necessary to meet the “financial sophistication” qualifications under the applicable NASDAQ rules.

Compensation Committee. The Compensation Committee is responsible for making recommendations to the Board of Directors with respect to the compensation of the Company’s executive officers and is responsible for the establishment of policies dealing with various compensation and employee benefit matters. The Compensation Committee also administers the Company’s equity incentive plans and makes recommendations to the Board of Directors as to option and award grants to employees and directors of the Company, MetroBank and Metro United under such plans. The Compensation Committee operates pursuant to a written charter, a copy of which is available in the corporate governance section of the Investor Relations page of the Company’s web site atwww.metrobank-na.com.

The Compensation Committee is comprised of Edward A. Monto (Chair), May P. Chu and Joe Ting, each of whom the Board has determined to be an “independent director” as defined by the listing standards of the NASDAQ Global Market. The Compensation Committee held six meetings in 2007.

Governance and Nominating Committee. The Governance and Nominating Committee is responsible for identifying and recommending to the Board of Directors individuals qualified to become members of the Board of Directors and identifying directors to serve on the various committees of the Board of Directors. The Governance and Nominating Committee is also responsible for shaping the Company’s corporate governance

10

policies and practices, including recommending corporate governance guidelines applicable to the Board of Directors and the Company and monitoring compliance with such guidelines. The Governance and Nominating Committee operates pursuant to a written charter, a copy of which is available in the corporate governance section of the Investor Relations page of the Company’s web site atwww.metrobank-na.com.

The Governance and Nominating Committee is comprised of Joe Ting (Chair), Edward A. Monto and Charles Roff, each of whom the Board has determined to be an “independent director” as defined by the listing standards of the NASDAQ Global Market. During 2007, the Governance and Nominating Committee held eleven meetings.

Director Independence

The Company’s Board of Directors is currently comprised of twelve directors. The Board of Directors has determined that the following directors are “independent directors” as defined in the listing standards of the NASDAQ Global Market: Krishnan Balasubramanian, May P. Chu, Shirley L. Clayton, Robert W. Hsueh, Edward A. Monto, Charles L. Roff and Joe Ting.

The independent directors of the Company hold executive sessions from time to time at the conclusion of regular meetings of the Board of Directors without the Chief Executive Officer or any other member of management present. In 2007, the independent directors held two executive sessions.

Code of Ethics

The Board of Directors has adopted a Code of Ethics that applies to all directors, officers and employees of the Company, MetroBank and Metro United, including the Company’s Chief Executive Officer and senior financial officers. A copy of the Code of Ethics is available at no charge upon written request to: MetroCorp Bancshares, Inc., 9600 Bellaire Boulevard, Suite 252, Houston, Texas 77036, Attention: Corporate Secretary.

Director Nominations Process

General

The Governance and Nominating Committee will consider nominees to serve as directors of the Company and recommend such persons to the Board of Directors. The Governance and Nominating Committee will also consider recommendations from shareholders for director candidates who appear to be qualified to serve on the Company’s Board of Directors. The Governance and Nominating Committee may choose not to consider an unsolicited recommendation if no vacancy exists on the Board of Directors and the Committee does not perceive a need to increase the size of the board. In order to avoid the unnecessary use of the directors’ resources, the Governance and Nominating Committee will consider only those director candidates recommended in accordance with the procedures set forth below.

Criteria for Director Nominees

The Governance and Nominating Committee considers the following in selecting nominees: financial, regulatory and business experience; familiarity with and participation in the local community; integrity, honesty and reputation; dedication to the Company and its shareholders; and any other factors the Governance and Nominating Committee deems relevant, including the size of the Board of Directors and regulatory disclosure obligations. The Governance and Nominating Committee considered these same criteria when they recommended the nominees for election at the Meeting.

In addition, prior to nominating an existing director for re-election to the Board of Directors, the Governance and Nominating Committee and the Board of Directors will consider and review an existing director’s board and committee meeting attendance and performance; length of board service; experience, skills and contributions that the existing director brings to the board; and such director’s independence.

11

Process for Identifying and Evaluating Director Nominees

Pursuant to its charter, the Governance and Nominating Committee is responsible for the process relating to director nominations, including identifying, interviewing and selecting individuals who may be nominated for election to the Board of Directors. The process that the Governance and Nominating Committee follows when they identify and evaluate individuals to be nominated for election to the Board of Directors is as follows:

Identification. For purposes of identifying nominees for the Board of Directors, the Governance and Nominating Committee relies on personal contacts of the members of the Board of Directors as well as their knowledge of members of MetroBank and Metro United’s local communities. The Governance and Nominating Committee will also consider director candidates recommended by shareholders in accordance with the policy and procedures discussed below. The Governance and Nominating Committee has not previously used an independent search firm in identifying nominees.

Evaluation. In evaluating potential nominees, the Governance and Nominating Committee will determine whether the candidate is eligible and qualified for service on the Board of Directors by evaluating the candidate under the selection criteria set forth above. In addition, for any new director nominee, the Governance and Nominating Committee will conduct a check of the individual’s background and will interview the candidate.

Procedures to be Followed by Shareholders

The Governance and Nominating Committee will consider shareholder nominations for election as a director at an annual meeting of shareholders if the shareholder complies with the prior notice and information provisions contained in the Company’s Amended and Restated Bylaws. To be timely, a written notice of the proposed nomination must be received by the Secretary of the Company not later than sixty (60) days prior to the meeting at which the election of directors will occur. To submit a recommendation of a director candidate to the Governance and Nominating Committee, a shareholder should submit the following information in writing, addressed to the Chairman of the Governance and Nominating Committee, care of the Corporate Secretary, at the Company’s main office:

| | • | | The name and address of the shareholder making the nomination and the name and address of the person recommended as a director nominee; |

| | • | | A representation that the shareholder is a holder of record of the Company’s Common Stock entitled to vote at the meeting and, if applicable, intends to appear in person or by proxy at the meeting to nominate the person or persons specified in the notice; |

| | • | | If applicable, description of all arrangements or understandings between the shareholder giving the notice and the recommended nominee and any other person (naming such person) pursuant to which the nomination is to be made by the shareholder; |

| | • | | All information regarding a recommended nominee that is required to be disclosed in solicitations of proxies for election of directors pursuant to Regulation 14A under the Securities Exchange Act of 1934, as amended; and |

| | • | | The written consent of the recommended nominee to being named in the proxy statement as a nominee and to serving as director of the Company if elected. |

If the Governance and Nominating Committee receives a director nomination from a shareholder or group of shareholders who (individually or in the aggregate) beneficially owned greater than 5% of the Company’s outstanding Common Stock for at least one year as of the date of such recommendation, the Company, as required by applicable securities law, will identify the nominee and the shareholder or group of shareholders recommending such nominee and will disclose in its proxy statement whether the Governance and Nominating Committee chose to nominate such nominee, as well as certain other information.

12

Shareholder Communications with the Board of Directors

The Company encourages shareholder communications to the Board of Directors and/or individual directors. Written communications may be made to the Board of Directors or to specific members of the Board of Directors by delivering them to the intended addressee, care of the Corporate Secretary, MetroCorp Bancshares, Inc., 9600 Bellaire Boulevard, Suite 252, Houston, Texas 77036. Comments or complaints relating to the Company’s accounting, internal accounting controls or auditing matters will be referred to members of the Audit Committee. Other concerns will generally be referred to the Governance and Nominating Committee.

EXECUTIVE COMPENSATION AND OTHER MATTERS

Compensation Discussion and Analysis

Overview of Compensation Program

The Compensation Committee of the Board of Directors is responsible for developing and making recommendations to the Board of Directors with respect to the Company’s executive compensation policies. Edward A. Monto, May P. Chu and Joe Ting, each of whom the Board of Directors has determined to be an independent director, as defined in the NASDAQ Global Market listing standards, serve on the Compensation Committee. This discussion and analysis describes the components of the Company’s compensation program for its named executive officers and describes the basis on which the 2007 compensation determinations were made by the Compensation Committee with respect to the named executive officers of the Company.

Role of Executives in Establishing Compensation

The Chief Executive Officer along with management reviews the performance of the named executive officers (other than the Chief Executive Officer) of the Company and based on such review, the Chief Executive Officer makes recommendations to the Compensation Committee regarding the compensation amounts payable to such named executive officers of the Company. The Compensation Committee evaluates the performance of the Chief Executive Officer in consultation with the non-management members of the Board of Directors in light of the Company’s corporate goals and objectives and based on such evaluation, determines and approves the Chief Executive Officer’s compensation level. The Chief Executive Officer is not involved with any aspect of determining his own pay.

Compensation Committee Activity

In addition to its role with executive compensation matters, the Compensation Committee, pursuant to the provisions of the Company’s stock awards and incentive plans, has authority to determine the employees and directors of the Company, MetroBank and Metro United to whom stock options or other awards shall be granted, the number of shares to be granted to each individual and certain terms of the option or award grant. The Compensation Committee makes recommendations to the Board of Directors with respect to stock awards to be granted to the employees and directors of the Company, MetroBank and Metro United (other than the Chief Executive Officer). The Compensation Committee also has authority to interpret the plans, amend the plans and to rescind rules and regulations relating to the plans.

The Compensation Committee has delegated to the Company’s management the administration of the Purchase Plan (as defined below) in accordance with the guidelines approved by the Board of Directors.

13

Compensation Philosophy

The compensation philosophy of the Company incorporates the basic principle that executive compensation should be related directly to corporate performance and increases in shareholder value, while ensuring that key employees are motivated and retained. The following objectives guide the decision-making for the Compensation Committee:

| | • | | The Company must provide a competitive total compensation package to attract and retain key executives; |

| | • | | The compensation packages and programs must be strategically aligned with the annual budget as well as the Company’s long-term business objectives; and |

| | • | | The compensation packages must include a variable or performance component to ensure a link between executive remuneration and the Company’s overall performance, thereby aligning executive compensation with the interest of shareholders. |

Peer Groups

The Compensation Committee reviews the compensation of the Chief Executive Officer and the other named executive officers relative to the compensation paid to similarly situated executives at banking organizations that are considered to be peer banking organizations. The peer group was compiled by Chairman’s Council, Inc., an independent firm engaged by the Compensation Committee, and includes eighteen (18) peer group banking organizations with total assets ranging from $1.0 billion to $4.8 billion as of December 31, 2006. The peer group was chosen because of each banking organizations’ relative size as measured by total assets. The Compensation Committee believes that the peer group of banking organizations is representative of the sector in which the Company operates.

The Compensation Committee believes that the compensation paid to similarly situated executives should be a point of reference for measurement, but not the determinative factor for setting the compensation of the Company’s named executive officers. Because the comparative compensation information is just one of the criteria used in setting named executive officer compensation, the Compensation Committee has discretion in determining the nature and extent of its use. Further, given the limitations associated with comparative pay information for setting individual executive compensation, including the difficulty of assessing and comparing wealth accumulation through equity gains and post employment amounts, the Compensation Committee may elect to not use the comparative compensation information at all in the course of making compensation decisions. During 2007, the Compensation Committee elected to use the comparative compensation information in a limited manner in making compensation decisions related to the Chief Executive Officer’s compensation.

Setting Executive Compensation

In reviewing the 2007 compensation of each of the named executive officers, the Compensation Committee reviewed all components of their respective compensation, including base salary, annual cash incentives, long- term equity incentive compensation, accumulated realized and unrealized stock option gains, the dollar value to the executive and cost to the Company of all perquisites and other personal benefits and the projected payout obligations that may be owed in certain circumstances under existing employment and letter agreements.

Executive Compensation—Elements

The Company’s compensation programs for executive officers are primarily comprised of the following components:

| | • | | a non-equity cash incentive program; |

14

| | • | | a long-term equity incentive program; |

| | • | | a contributory savings 401(k) plan; and |

| | • | | various perquisites and other personal benefits. |

Base Salary

Salaries provide the named executive officers with a base level of monthly income and help achieve the objectives outlined above by attracting and retaining strong talent. Base salary levels for all named executive officers were reviewed during 2007 and adjustments were approved by the Compensation Committee. For all named executive officers, other than the Chief Executive Officer, the Compensation Committee considered the recommendation of the Chief Executive Officer and management, tenure of service, scope of the position, including current job responsibilities, the named executive officer’s individual performance and contribution to the Company and such other factors as the Compensation Committee deemed appropriate. The base salary level for the Chief Executive Officer is set forth in his employment agreement and is reviewed at least annually by the Compensation Committee and may be adjusted upward in the discretion of the Compensation Committee. Factors that the Compensation Committee considers in the review include the overall performance of the Company, peer group compensation information, current job responsibilities, an evaluation of his individual performance and such other factors as the Compensation Committee deemed appropriate. On the basis of the Compensation Committee’s review, the named executive officers’ base salaries as of December 31, 2007 reflect an average 1.65% increase over their collective base salaries as of December 31, 2006 and are considered by the Compensation Committee to be competitive and in the median range of comparative salaries of other banking organizations included in the Company’s peer group.

Non-Equity Cash Incentive Program

The annual compensation of the Company’s named executive officers consists primarily of a base salary and an annual cash incentive. The annual cash incentive is designed to help achieve the objectives of the compensation program by rewarding the executive officers for the attainment of profitable growth and stable financial and operating conditions. Pursuant to the Company’s non-equity cash incentive program, Incentive By Objective (the “IBO”), an executive officer of the Company is eligible to receive a certain percentage (which varies by position within the Company) of his base salary as an annual cash incentive. The annual cash incentive awarded to the Company’s named executive officers (excluding the Chief Executive Officer) may be an amount up to 50% of their current base salaries. The size of the cash incentive award is dependent on a combination of the Company’s performance and the officer’s individual performance in a particular year based upon certain Company and individual performance targets. The weight given to Company performance targets and individual performance targets varies by the officer’s position within the Company. The Company’s performance indicators are established annually and contain a component for financial performance, customer retention and growth and process improvement of the subsidiary banks as a applicable. With respect to the overall Company performance target, each component is assigned a specified weight. For 2007, financial performance carried a 35% weight, customer retention and growth carried a 35% weight and process improvement carried a 30% weight. In addition to an IBO cash incentive award, the Compensation Committee may also award discretionary cash bonuses to the named executive officers. Based upon 2007 performance with respect to customer retention and growth, the named executive officers (other than the Chief Executive Officer) earned an annual cash incentive bonus for 2007, which averaged 25.92% of their aggregate base salaries. None of the named executive officers received a discretionary cash bonus for 2007.

With respect to the cash incentive for the Chief Executive Officer, Mr. Lee has been provided with an incentive compensation plan that allows him to earn up to 100% of his base salary as cash incentive compensation based on certain predetermined performance measures set forth in his employment agreement.Performance at expected or budgeted performance levels consistent with opportunities in the market place will result in incentive compensation of 50% of his base salary, while the maximum incentive compensation will be earned for superior performance results. The performance criteria may include, but not be limited to, earnings per

15

share growth, asset growth, operating efficiency, return on equity, loan concentration, asset durability and overall performance evaluation by the Board of Directors. In addition to any amounts payable to Mr. Lee pursuant to the incentive compensation plan, the Compensation Committee may also grant Mr. Lee a discretionary cash bonus. Based upon 2007 performance, Mr. Lee earned a cash incentive for 2007 equal to $142,500 or 50% of his base salary and did not receive a discretionary cash bonus.

Long-Term Equity Incentive Awards

The Company maintains an equity compensation program for its executive officers, including the named executive officers, and other key employees, in order to attract and retain key employees and enable those persons to participate in the long-term success of the Company. The Compensation Committee believes that these key employees will carry the main responsibility for increased growth, asset quality and profitability of the Company into the future. Historically, stock options have been the Company’s primary form of long-term equity incentive compensation. As of December 31, 2007, 922,575 options were outstanding under the Company’s 1998 Plan (as defined below) and 2007 Plan (as defined below), 498,375 of which were held by named executive officers. In 2007, the Company began awarding shares of restricted stock to its key employees pursuant to its 2007 Plan. As of December 31, 2007, 20,100 shares of restricted stock have been granted, 7,000 shares of which were granted to named executive officers.

Equity Incentive Plans

The Company maintains two equity incentive plans, the MetroCorp Bancshares, Inc. 2007 Stock Awards and Incentive Plan (“2007 Plan”) and the MetroCorp Bancshares, Inc. 1998 Stock Incentive Plan (“1998 Plan”) (collectively, the “Incentive Plans”). Shares of stock may be issued under both plans from unissued common stock or treasury stock.

The 1998 Plan authorizes the issuance of up to 1,050,000 shares of Common Stock under both “non qualified” and “incentive” stock options and performance shares of Common Stock. Non-qualified options and incentive stock options will be granted at no less than the fair market value of the Common Stock and must be exercised within ten years unless the applicable award agreement specifies a shorter term. Performance shares are certificates representing the right to acquire shares of Common Stock upon the satisfaction of performance goals established by the Company. Holders of performance shares have all of the voting, dividend and other rights of shareholders of the Company, subject to the terms of the award agreement relating to such shares. If the performance goals are achieved, the performance shares will vest and may be exchanged for shares of Common Stock. If the performance goals are not achieved, the performance shares may be forfeited. As of December 31, 2007, there were 10,125 options available for future grant under the 1998 Plan. In 2007, the Company granted options to acquire 122,210 shares of Common Stock pursuant to the 1998 Plan. No performance shares have been awarded under the Incentive Plan since inception.

The 2007 Plan authorizes the issuance of up to 350,000 shares of Common Stock, and provides for the granting of incentive stock options, nonqualified stock options, stock appreciation rights, restricted stock awards, performance awards, phantom stock awards or any combination of the foregoing. Restricted stock may be granted with or without payment except to the extent required by law and awards are subject to performance or service restrictions as determined by the Compensation Committee. The recipient of restricted stock is entitled to voting rights and dividends on the common stock prior to the lapsing of the forfeiture restrictions with respect to such stock. As of December 31, 2007, there were 313,610 shares available for future grant under the 2007 Plan. In 2007, the Company granted options to acquire 16,290 shares of Common Stock and 20,100 shares of restricted stock pursuant to the 2007 Plan.

Purchase Plan

Although not an equity incentive plan, the Company also maintains the 1998 Employee Stock Purchase Plan (“Purchase Plan”), which authorizes the offer and sale of up to 300,000 shares of Common Stock to employees of

16

the Company and its subsidiaries (other than executive officers) at a pre-established discount from the market price of the Common Stock. The Purchase Plan is implemented through ten annual offerings. Each year the Board of Directors determines the number of shares to be offered under the Purchase Plan, if any. Pursuant to the Purchase Plan, the offering price per share is an amount equal to 85% of the closing price of a share of Common Stock on the business day immediately prior to the commencement of such offering. In each offering, each employee may purchase a number of whole shares of Common Stock with an aggregate value equal to 20% of the employee’s base salary, but not in excess of $10,000, divided by the offering price. The employee pays for the Common Stock either immediately or through a payroll deduction program over a period of up to one year, at the employee’s option. The first annual offering under the Purchase Plan began in the second quarter of 1999. As of December 31, 2007, 63,658 shares have been issued under the Purchase Plan since inception. No shares have been offered in connection with the Purchase Plan since 2006.

Contributory Savings 401(k) Plan

The Company provides for a 401(k) tax-deferred profit sharing plan for all employees, including the named executive officers, pursuant to which the Company matches each participant’s contributions up to a maximum of 5% for MetroBank and 6% for Metro United of such employee’s annual compensation.

Perquisites and Other Personal Benefits

Perquisites and other personal benefits represent a small part of the Company’s executive compensation program. The named executive officers are eligible to participate in the Company’s employee benefits plans, which are generally available to all Company employees. The Compensation Committee reviews the perquisites and other personal benefits provided to the named executive officers annually, and offer such benefits after consideration of the business need. The primary perquisites provided by the Company in 2007 include a car allowance, the payment of certain life insurance premiums and the payment of certain health and dental insurance premiums.

Tax and Accounting Implications

Stock-Based Compensation.The Company accounts for stock-based compensation, including options granted pursuant to the 1998 Plan and options and restricted stock awards granted pursuant to its 2007 Plan, in accordance with the requirements of SFAS No. 123R, which the Company adopted effective January 1, 2006.

Deductibility of Executive Compensation.Under Section 162(m) of the Internal Revenue Code, a limitation was placed on tax deductions of any publicly-held corporation for individual compensation to certain executives of such corporation exceeding $1,000,000 in any taxable year, unless the compensation is performance-based. The Company has no individuals with non-performance based compensation paid in excess of the Internal Revenue Code Section 162(m) tax deduction limit.

Nonqualified Deferred Compensation.If an executive is entitled to nonqualified deferred compensation benefits that are subject to Section 409A of the Internal Revenue Code, and such benefits do not comply with Section 409A, then the benefits are taxable in the first year they are not subject to a substantial risk of forfeiture. In such case, the recipient is subject to regular federal income tax, interest and an additional federal income tax of 20% of the benefit includible in income.

17

Summary Compensation Table

The following table provides certain summary information concerning compensation paid or accrued by the Company to or on behalf of the Company’s Chief Executive Officer, Chief Financial Officer and the other three most highly compensated executive officers of the Company or its subsidiary banks (determined as of the end of the last fiscal year) (the “named executive officers”) for the last two fiscal years ended December 31, 2007:

Summary Compensation Table for the Last Two Fiscal Years Ended December 31, 2007

| | | | | | | | | | | | | | | | | | | | | |

Name and Principal Position | | Year | | Salary | | Stock

Awards(1) | | Option

Awards(2) | | Non-Equity

Incentive Plan

Compensation(3) | | All Other

Compensation | | | Total |

George M. Lee | | 2007 | | $ | 285,000 | | $ | — | | $ | 94,436 | | $ | 142,500 | | $ | 31,985 | (4) | | $ | 553,921 |

| | | | | | | |

President and Chief Executive Officer of the Company; Chief Executive Officer of MetroBank | | 2006 | | | 274,041 | | | — | | | 20,164 | | | 335,000 | | | 18,150 | (4) | | | 647,355 |

| | | | | | | |

David C. Choi | | 2007 | | $ | 177,028 | | $ | 7,505 | | $ | 66,859 | | $ | 60,702 | | $ | 31,050 | (5) | | $ | 343,144 |

| | | | | | | |

Chief Financial Officer and Executive Vice President of the Company and MetroBank | | 2006 | | | 169,375 | | | — | | | 7,310 | | | 101,250 | | | 16,106 | (5) | | | 294,041 |

| | | | | | | |

Mitchell W. Kitayama | | 2007 | | $ | 180,000 | | $ | 16,418 | | $ | 102,269 | | $ | — | | $ | 33,634 | (6) | | $ | 332,321 |

| | | | | | | |

Executive Vice President of the Company; Chief Executive Officer of Metro United | | 2006 | | | 180,000 | | | — | | | 14,621 | | | 85,000 | | | 19,754 | (6) | | | 274,375 |

| | | | | | | |

David Tai | | 2007 | | $ | 204,061 | | $ | 7,505 | | $ | 53,166 | | $ | 69,840 | | $ | 33,533 | (7) | | $ | 368,105 |

| | | | | | | |

Executive Vice President and Secretary of the Company; President of MetroBank | | 2006 | | | 198,758 | | | — | | | 7,310 | | | 110,000 | | | 19,126 | (7) | | | 335,194 |

| | | | | | | |

Terrance J. Tangen | | 2007 | | $ | 178,953 | | $ | 7,505 | | $ | 38,652 | | $ | 61,290 | | $ | 31,374 | (8) | | $ | 317,774 |

| | | | | | | |

Chief Credit Officer and Executive Vice President of MetroBank | | 2006 | | | 173,344 | | | — | | | 7,310 | | | 97,500 | | | 17,402 | (8) | | | 295,556 |

| (1) | Represents the dollar amount recognized for financial statement reporting purposes for the fiscal year ended December 31, 2007 in accordance with Financial Accounting Standards Board Statement No. 123R for restricted stock awards granted pursuant to the Company’s 2007 Plan and thus may include amounts from awards granted in and prior to 2007. Assumptions used in the calculation of these amounts are included in Note 15 to the Company’s consolidated financial statements for the fiscal year ended December 31, 2007 included in the Company’s Annual Report on Form 10-K filed with the Securities and Exchange Commission on March 12, 2008. During 2007, each of Messrs. Choi, Tai and Tangen were awarded 1,000 shares of restricted stock with a full grant value of $19,400 and Mr. Kitayama was awarded 4,000 shares of restricted stock with a full grant value of $67,880. |

18

| (2) | Represents the dollar amount recognized for financial statement reporting purposes for the fiscal year ended December 31, 2007 in accordance with Financial Accounting Standards Board Statement No. 123R for stock options granted pursuant to the Company’s 1998 Plan and 2007 Plan and thus may include amounts from options granted in and prior to 2007 and 2006. Assumptions used in the calculation of these amounts are included in Note 15 to the Company’s consolidated financial statements for the fiscal year ended December 31, 2007 included in the Company’s Annual Report on Form 10-K filed with the Securities and Exchange Commission on March 12, 2008. During 2007, each of Messrs. Lee, Choi, Kitayama, Tai and Tangen were granted options to acquire 30,000, 5,000, 5,000, 9,000 and 5,000 shares of Common Stock, respectively. |

| (3) | The amounts reported in this column reflect the cash payments earned in 2007 and 2006, respectively, by the named executive officers under the Company’s annual cash incentive program, which is discussed in more detail under the section captioned “Non-Equity Cash Incentive Program” above. |

| (4) | The 2007 amount includes a car allowance of $6,000, 401(k) matching contributions of $14,550, payment of medical/dental insurance premiums of $10,223 and payment of the premium on a life insurance policy for the benefit of Mr. Lee of $1,212. The 2006 amount includes a car allowance of $6,000, 401(k) matching contribution of $11,192 and payment of the premium on a life insurance policy for the benefit of Mr. Lee of $958. |

| (5) | The 2007 amount includes a car allowance of $6,000, 401(k) matching contribution of $13,465, payment of medical/dental insurance premiums of $11,193 and payment of the premium on a life insurance policy for the benefit of Mr. Choi of $350. The 2006 amount includes a car allowance of $6,000, 401(k) matching contribution of $9,888 and payment of the premium on a life insurance policy for the benefit of Mr. Choi of $218. |

| (6) | The 2007 amount includes a car allowance of $9,000, 401(k) matching contribution of $5,250, payment of medical/dental insurance premiums of $18,826 and payment of the premium on a life insurance policy for the benefit of Mr. Kitayama of $397. The 2006 amount includes a car allowance of $9,000, 401(k) matching contribution of $225, payment of the premium on a life insurance policy for the benefit of Mr. Kitayama of $864, and payment of the premium for health insurance for Mr. Kitayama’s dependents of $9,665. |

| (7) | The 2007 amount includes a car allowance of $6,000, 401(k) matching contribution of $15,505, payment of medical/dental insurance premiums of $11,193 and payment of the premium on a life insurance policy for the benefit of Mr. Tai of $794. The 2006 amount includes a car allowance of $6,000, 401(k) matching contribution of $12,490 and payment of the premium on a life insurance policy for the benefit of Mr. Tai of $636. |

| (8) | The 2007 amount includes a car allowance of $6,000, 401(k) matching contribution of $13,474, payment of medical/dental insurance premiums of $11,193 and payment of the premium on a life insurance policy for the benefit of Mr. Tangen of $665. The 2006 amount includes a car allowance of $6,000, 401(k) matching contribution of $10,873 and payment of the premium on a life insurance policy for the benefit of Mr. Tangen of $529. |

19

Grants of Plan-Based Awards

The following table contains information concerning each grant of an award made to each named executive officer under any plan during the fiscal year ended December 31, 2007:

Grants of Plan-Based Awards Table for the Fiscal Year Ended December 31, 2007

| | | | | | | | | | | | | | | | | | |

Name | | Estimated future payments under

non-equity incentive plan awards(1) | | Grant

Date | | All other

option

awards;

number of

securities

underlying

options(2) | | All other

stock

awards:

number of

shares of

stock | | Exercise

or base

price of

option

awards | | Grant

date fair

value of

stock and

option

awards |

| | Target | | Maximum | | | | | |

George M. Lee | | $ | 142,500 | | $ | 285,000 | | 07/20/07 | | 30,000 | | — | | $ | 19.90 | | $ | 177,108 |

| | | | | | | |

David C. Choi | | | 60,703 | | | 89,269 | | 01/25/07 05/25/07 | | 5,000 — | | — 1,000 | | | 19.80 — | | | 31,250 19,400 |

Mitchell W. Kitayama | | | — | | | 90,000 | | 01/25/07 08/06/07 | | 5,000 — | | — 4,000 | | | 19.80 — | | | 31,250 67,880 |

David Tai. | | | 69,840 | | | 102,706 | | 01/25/07 05/25/07 | | 9,000 — | | — 1,000 | | | 19.80 — | | | 56,250 19,400 |

Terrance J. Tangen | | | 61,290 | | | 90,133 | | 01/25/07 05/25/07 | | 5,000 — | | — 1,000 | | | 19.80 — | | | 31,250 19,400 |

| (1) | The amounts set forth in these columns reflect the annual cash incentive compensation amounts that potentially could have been earned during 2007 under the Company’s cash incentive program based upon the achievement of certain performance goals in accordance with the incentive program and Mr. Lee’s Employment Agreement. The amounts of annual cash incentive compensation earned in 2007 have been determined and were paid in January 2008. The amounts paid are included in the “Non-Equity Incentive Compensation” column of the Summary Compensation table. |

| (2) | The amounts set forth in this column reflect the actual amount of stock options granted to the named executive officers pursuant to the 1998 Plan and 2007 Plan. These options vest over a three-year-period beginning on the first anniversary of the grant date at a rate of 30%, 30% and 40% per year and expire between 7 to 10 years from the grant date. |

20

Outstanding Equity Awards

The following table contains information concerning the unexercised options and other equity incentive plan awards for each named executive officer as of the December 31, 2007:

Outstanding Equity Awards for the Fiscal Year Ended December 31, 2007

| | | | | | | | | | | | | | |

| | | Option Awards | | Stock Awards |

Name | | Number of Securities

Underlying Unexercised

Options | | Option

Exercise

Price | | Option

Expiration

Date | | Number

of

Shares

of

Stock

That

Have

Not

Vested | | Market

Value of

Shares

of

Stock

That

Have

Not

Vested(1) |

| | Exercisable | | Unexercisable | | | | |

George M. Lee | | 150,000 24,375 18,000 9,000 — — | | — — 12,000 21,000 13,710 16,290 | | $ | 10.0067 14.0333 15.0000 21.0867 19.9000 19.9000 | | 07/21/2014 01/27/2012 07/21/2012 07/20/2013 07/19/2014 07/19/2017 | | — | | $ | — |

| | | | | | |

David C. Choi | | 15,000 9,000 4,500 2,250 — | | — 6,000 3,000 5,250 5,000 | | | 12.7200 13.2000 16.0267 17.7067 19.8000 | | 11/02/2011 06/09/2012 08/09/2012 04/02/2013 01/24/2017 | | 1,000 | | | 13,000 |

| | | | | | |

Mitchell W. Kitayama | | 22,500 4,500 — | | 15,000 10,500 5,000 | | | 14.2333 17.7067 19.8000 | | 07/13/2012 04/02/2013 01/24/2017 | | 4,000 | | | 52,000 |

| | | | | | |

David Tai | | 15,000 4,500 2,250 — | | — 3,000 5,250 9,000 | | | 11.1867 16.0267 17.7067 19.8000 | | 09/09/2011 08/09/2012 04/02/2013 01/24/2017 | | 1,000 | | | 13,000 |

| | | | | | |

Terrance Tangen | | 52,500 7,500 7,500 4,500 2,250 — | | — — — 3,000 5,250 5,000 | | | 7.5000 8.7333 11.1867 16.0267 17.7067 19.8000 | | 10/22/2011 06/19/2010 09/09/2011 08/09/2012 04/02/2013 01/24/2017 | | 1,000 | | | 13,000 |

| (1) | Calculated by multiplying the closing price of the Company’s Common Stock on the NASDAQ Global Market on December 31, 2007 of $13.00 per share by the number of shares of restricted stock granted to such named executive officer. |

Potential Payments Upon Termination or Change-In-Control

The Company considers the establishment and maintenance of a sound and vital management team to be essential to protecting and enhancing its best interests and those of its shareholders. In this regard, the Company recognizes that the possibility of a change in control may exist and that such possibility, and the uncertainty and questions which it may raise among the named executive officers, may result in the departure or distraction of the named executive officers to the Company’s detriment and that of its shareholders. Accordingly, the Company’s

21

Board of Directors has taken steps to reinforce and encourage the continued attention and dedication of the Company’s named executive officers to their assigned duties without distraction in the face of the potentially disturbing circumstances arising from the possibility of a change in control. More specifically, the Company entered into an employment agreement with each of George M. Lee and Mitchell W. Kitayama on January 26, 2007 and July 15, 2005, respectively, and MetroBank entered into letter agreements with each of David Tai, David Choi and Terry Tangen on February 14, 2005.