UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM N-CSR

CERTIFIED SHAREHOLDER REPORT OF REGISTERED

MANAGEMENT INVESTMENT COMPANIES

Investment Company Act file number | 811-08979 |

|

Victory Variable Insurance Funds |

(Exact name of registrant as specified in charter) |

|

3435 Stelzer Rd. Columbus, OH | | 43219 |

(Address of principal executive offices) | | (Zip code) |

|

Citi Fund Services, 3435 Stelzer Rd. Columbus, OH 43219 |

(Name and address of agent for service) |

|

Registrant’s telephone number, including area code: | 614-470-8000 | |

|

Date of fiscal year end: | 12/31/09 | |

|

Date of reporting period: | 06/30/09 | |

| | | | | | | | |

Item 1. Reports to Stockholders.

June 30, 2009

Semi Annual Report

Diversified Stock Fund

VictoryConnect.com

News, Information And Education 24 Hours A Day, 7 Days A Week

The Victory Funds site gives fund shareholders, prospective shareholders, and investment professionals a convenient way to access fund information, get guidance, and track fund performance anywhere they can access the Internet. The site includes:

• Detailed performance records

• Daily share prices

• The latest fund news

• Investment resources to help you become a better investor

• A section dedicated to investment professionals

Whether you're a potential investor searching for the fund that matches your investment philosophy, a seasoned investor interested in planning tools, or an investment professional, VictoryConnect.com has what you're looking for. Visit us anytime. We're always open.

Table of Contents

| Shareholder Letter | | | 2 | | |

|

| Financial Statements | |

|

| Schedule of Portfolio Investments | | | 3 | | |

|

| Statement of Assets and Liabilities | | | 5 | | |

|

| Statement of Operations | | | 6 | | |

|

| Statements of Changes in Net Assets | | | 7 | | |

|

| Financial Highlights | | | 8 | | |

|

| Notes to Financial Statements | | | 9 | | |

|

| Supplemental Information | |

|

| Trustee and Officer Information | | | 14 | | |

|

| Proxy Voting and Form N-Q Information | | | 16 | | |

|

| Expense Examples | | | 17 | | |

|

| Portfolio Holdings | | | 18 | | |

|

The Funds are distributed by Victory Capital Advisers Inc., which is an affiliate of KeyCorp and its subsidiaries. Victory Capital Management Inc., a member of the Key financial network, is the investment advisor to the Funds and receives a fee from the Funds for performing services for the Funds.

This report is not authorized for distribution to prospective investors unless preceded or accompanied by a current prospectus of the Victory Funds.

For additional information about any Victory Fund, including fees, expenses, and risks, view our prospectus online at VictoryConnect.com or call 1-800-539-3863. Read it carefully before you invest or send money.

The information in this report is based on data obtained from recognized services and sources and is believed to be reliable. Any opinions, projections, or recommendations in this report are subject to change without notice and are not intended as individual investment advice. Furthermore, Victory Capital Management Inc. and its affiliates, as agents for their clients, and any of its officers or employees may have a beneficial interest or position in any of the securities mentioned, which may be contrary to any opinion or projection expressed in this report. Past investment performance of markets or securities mentioned herein should not be considered to be indicative of future results.

NOT FDIC INSURED

Shares of the Victory Funds are not insured by the FDIC, are not deposits or other obligations of, or guaranteed by, KeyCorp, Victory Capital Management Inc., or their affiliates, and are subject to investment risks, including possible loss of the principal amount invested.

Call Victory at:

800-539-FUND (800-539-3863)

Visit our web site at:

www.VictoryConnect.com

1

Letter to Our Shareholders

The economic outlook has brightened considerably since the beginning of the year, thanks to swift and decisive action taken by the Federal Reserve and the U.S. Government. A variety of stimulus programs were enacted both domestically and globally to stabilize the financial markets. To date, these globally coordinated efforts have provided support and are anticipated to begin working as catalysts for future growth.

In the first quarter of 2009, the market continued its overall decline, but rallied sharply towards the end of the quarter to finish in a strong fashion. The rally continued through the second quarter, with the S&P 500 posting three consecutive months of gains for the first time since 2007. Confidence in the market continues, where expectations from analysts and the Federal Reserve predict that the economy likely will recover in the next six to nine months. The Federal Reserve has alluded to a gradual and steady recovery. Investor pessimism may be lifting as well, evidenced by flow activity in and out of various mutual fund categories. Money market funds, which many investors turned to in 2008 for their safety, have experienced net outflows year-to-date, seemingly in favor of stock and bond funds, which have seen positive net flows through June.

Current economic and investment uncertainty has begun to subside, and we continue to believe that patient investors will be rewarded over the longer-term. Absolute market valuations remain attractive relative to realistic earnings estimates, and the opportunity to invest in these undervalued companies is promising for our investors. Victory remains constructive on the longer-term outlook, albeit cognizant of the short-term risks, and continues to invest in the market with confidence. In this light, we continue to hold to our strategic plan for investment management, which is based on three key elements:

1. Consistent Performance and Investment Quality

Dedicated strategy teams maintain complete investment autonomy and consistently apply transparent, repeatable processes. Reliance on fundamental research ensures high-conviction portfolios, and state-of-the-art risk management tools are employed to ensure ongoing risk monitoring. Finally, value-added trading provides effective execution of investment decisions.

2. Client Service Excellence

Our approach is simple: communication is complete, honest, timely and straightforward – our goal is no surprises.

3. Empowerment, Ownership and Accountability

Victory has an organizational structure that fosters an environment in which investment professionals thrive, and our compensation plan is built to attract and retain industry-leading talent. Our senior management team is committed to delivering high quality investment products and services.

We appreciate your confidence in the Victory Funds. We continue to closely monitor the possibility of increased regulatory reform wrought by the tumultuous times, and will strive to embrace the programs and adopt the procedures necessary to safeguard our shareholders. If you have questions or would like further information, please feel free to contact us at 1-800-539-3863 or via our website at www.VictoryConnect.com.

Michael Policarpo II

President

The Victory Variable Insurance Funds

2

The Victory Variable Insurance Funds Schedule of Portfolio Investments

Diversified Stock Fund June 30, 2009

(Amounts in Thousands, Except for Shares) (Unaudited)

| Security Description | | Shares or

Principal

Amount | | Value | |

| Commercial Paper (3.9%): | |

| Toyota Motor Credit Corp., 0.16% (a), 7/1/09 | | $ | 1,353 | | | $ | 1,353 | | |

| Total Commercial Paper (Amortized Cost $1,353) | | | 1,353 | | |

| Common Stocks (96.2%): | |

| Banks (3.8%): | |

| Northern Trust Corp. | | | 13,190 | | | | 708 | | |

| PNC Financial Services Group, Inc. | | | 4,900 | | | | 190 | | |

| U.S. Bancorp | | | 23,800 | | | | 427 | | |

| | | | 1,325 | | |

| Beverages (1.3%): | |

| PepsiCo, Inc. | | | 8,581 | | | | 472 | | |

| Biotechnology (2.0%): | |

| Amgen, Inc. (b) | | | 13,300 | | | | 704 | | |

| Brokerage Services (3.0%): | |

| Charles Schwab Corp. | | | 60,190 | | | | 1,056 | | |

| Chemicals (2.0%): | |

| Monsanto Co. | | | 6,900 | | | | 513 | | |

| PPG Industries, Inc. | | | 4,274 | | | | 188 | | |

| | | | 701 | | |

| Computers & Peripherals (4.4%): | |

| Dell, Inc. (b) | | | 32,600 | | | | 447 | | |

| EMC Corp. (b) | | | 82,800 | | | | 1,085 | | |

| | | | 1,532 | | |

| Cosmetics & Toiletries (3.1%): | |

| Colgate-Palmolive Co. | | | 7,900 | | | | 559 | | |

| Estee Lauder Cos., Class A | | | 6,065 | | | | 198 | | |

| Procter & Gamble Co. | | | 6,354 | | | | 325 | | |

| | | | 1,082 | | |

| Electronics (2.1%): | |

| General Electric Co. | | | 63,685 | | | | 746 | | |

| Financial Services (0.5%): | |

| Goldman Sachs Group, Inc. | | | 1,100 | | | | 162 | | |

| Food Processing & Packaging (0.6%): | |

| H.J. Heinz Co. | | | 5,600 | | | | 200 | | |

| Health Care (2.7%): | |

| Alcon, Inc. | | | 8,200 | | | | 952 | | |

| Home Builders (1.0%): | |

| Toll Brothers, Inc. (b) | | | 19,981 | | | | 339 | | |

| Insurance (0.5%): | |

| Prudential Financial, Inc. | | | 4,723 | | | | 176 | | |

| Internet Business Services (1.4%): | |

| Juniper Networks, Inc. (b) | | | 21,300 | | | | 503 | | |

| Internet Service Provider (2.1%): | |

| Yahoo!, Inc. (b) | | | 46,148 | | | | 723 | | |

| Investment Companies (1.7%): | |

| Invesco Ltd. | | | 33,150 | | | | 591 | | |

| Security Description | |

Shares | | Value | |

| Manufacturing — Diversified (2.5%): | |

| Illinois Tool Works, Inc. | | | 4,600 | | | $ | 172 | | |

| Tyco International Ltd. | | | 27,140 | | | | 705 | | |

| | | | 877 | | |

| Media (1.2%): | |

| News Corp., Class A | | | 44,234 | | | | 403 | | |

| Medical Supplies (0.8%): | |

| Intuitive Surgical, Inc. (b) | | | 1,800 | | | | 295 | | |

| Mining (3.1%): | |

| Barrick Gold Corp. | | | 19,936 | | | | 669 | | |

| Newmont Mining Corp. | | | 9,800 | | | | 400 | | |

| | | | 1,069 | | |

| Oil & Gas Exploration — Production & Services (1.7%): | |

| Anadarko Petroleum Corp. | | | 12,952 | | | | 588 | | |

| Oil Companies — Integrated (1.4%): | |

| Hess Corp. | | | 9,238 | | | | 496 | | |

| Oilfield Services & Equipment (7.5%): | |

| Halliburton Co. | | | 53,122 | | | | 1,100 | | |

| Schlumberger Ltd. | | | 27,852 | | | | 1,507 | | |

| | | | 2,607 | | |

| Paint, Varnishes & Enamels (0.8%): | |

| The Sherwin-Williams Co. | | | 4,900 | | | | 263 | | |

| Pharmaceuticals (9.0%): | |

| Johnson & Johnson | | | 15,800 | | | | 898 | | |

| Merck & Co., Inc. | | | 32,700 | | | | 914 | | |

| Pfizer, Inc. | | | 40,600 | | | | 609 | | |

Teva Pharmaceutical Industries Ltd.,

Sponsored ADR | | | 15,000 | | | | 740 | | |

| | | | 3,161 | | |

| Restaurants (1.5%): | |

| McDonald's Corp. | | | 8,879 | | | | 510 | | |

| Retail (2.3%): | |

| Target Corp. | | | 20,300 | | | | 801 | | |

| Retail — Discount (3.2%): | |

| Wal-Mart Stores, Inc. | | | 22,800 | | | | 1,104 | | |

| Retail — Drug Stores (2.9%): | |

| CVS Caremark Corp. | | | 32,382 | | | | 1,032 | | |

| Retail — Specialty Stores (4.6%): | |

| Bed Bath & Beyond, Inc. (b) | | | 8,229 | | | | 253 | | |

| Lowe's Cos., Inc. | | | 69,953 | | | | 1,358 | | |

| | | | 1,611 | | |

| Semiconductors (6.5%): | |

| Intel Corp. | | | 62,042 | | | | 1,027 | | |

| Lam Research Corp. (b) | | | 18,300 | | | | 476 | | |

Taiwan Semiconductor Manufacturing Co. Ltd.,

Sponsored ADR | | | 83,163 | | | | 782 | | |

| | | | 2,285 | | |

See notes to financial statements.

3

The Victory Variable Insurance Funds Schedule of Portfolio Investments — continued

Diversified Stock Fund June 30, 2009

(Amounts in Thousands, Except for Shares) (Unaudited)

| Security Description | |

Shares | | Value | |

| Software & Computer Services (6.2%): | |

| Adobe Systems, Inc. (b) | | | 22,300 | | | $ | 631 | | |

| Microsoft Corp. | | | 37,500 | | | | 891 | | |

| Oracle Corp. | | | 30,200 | | | | 647 | | |

| | | | 2,169 | | |

| Steel (2.6%): | |

| Nucor Corp. | | | 20,800 | | | | 924 | | |

| Transportation Services (3.0%): | |

| United Parcel Service, Inc., Class B | | | 21,131 | | | | 1,056 | | |

| Utilities — Electric (1.5%): | |

| Exelon Corp. | | | 10,123 | | | | 518 | | |

| Utilities — Telecommunications (1.7%): | |

| AT&T, Inc. | | | 24,500 | | | | 609 | | |

| Total Common Stocks (Cost $32,560) | | | 33,642 | | |

| Total Investments (Cost $33,912) — 100.1% | | | 34,995 | | |

| Liabilities in excess of other assets — (0.1)% | | | | | | | (25 | ) | |

| NET ASSETS — 100.0% | | $ | 34,970 | | |

(a) Rate represents the effective yield at purchase.

(b) Non-income producing security.

ADR — American Depositary Receipt

See notes to financial statements.

4

Statement of Assets and Liabilities

The Victory Variable Insurance Funds June 30, 2009

(Amounts in Thousands, Except Per Share Amounts) (Unaudited)

| | | Diversified

Stock

Fund | |

| ASSETS: | |

| Investments, at value (Cost $33,912) | | $ | 34,995 | | |

| Cash | | | 50 | | |

| Dividends receivable | | | 43 | | |

| Receivable for capital shares issued | | | 7 | | |

| Receivable for investments sold | | | 22 | | |

| Receivable from Adviser | | | 4 | | |

| Prepaid expenses | | | 23 | | |

| Total Assets | | | 35,144 | | |

| LIABILITIES: | |

| Payable for investments purchased | | | 79 | | |

| Payable for capital shares redeemed | | | 2 | | |

| Accrued expenses and other payables: | |

| Investment advisory fees | | | 9 | | |

| Administration fees | | | 3 | | |

| Custodian fees | | | 3 | | |

| Transfer agent fees | | | 1 | | |

| Contract owner fees | | | 25 | | |

| 12b-1 fees | | | 7 | | |

| Other accrued expenses | | | 45 | | |

| Total Liabilities | | | 174 | | |

| NET ASSETS: | |

| Capital | | | 50,209 | | |

| Distributions in excess of net investment income | | | (5 | ) | |

| Accumulated net realized losses from investments | | | (16,317 | ) | |

| Net unrealized appreciation on investments | | | 1,083 | | |

| Net Assets | | $ | 34,970 | | |

| Shares (unlimited number of shares authorized with a par value of 0.001 per share) | | | 4,784 | | |

| Net asset value, offering price & redemption price per share | | $ | 7.31 | | |

See notes to financial statements.

5

Statement of Operations

The Victory Variable Insurance Funds For the Six Months Ended June 30, 2009

(Amounts in Thousands) (Unaudited)

| | | Diversified

Stock

Fund | |

| Investment Income: | |

| Interest income | | $ | 2 | | |

| Dividend income | | | 368 | | |

| Total Income | | | 370 | | |

| Expenses: | |

| Investment advisory fees | | | 48 | | |

| Administration fees | | | 15 | | |

| Contract owner fees | | | 40 | | |

| 12b-1 fees | | | 40 | | |

| Custodian fees | | | 9 | | |

| Transfer agent fees | | | 5 | | |

| Trustees' fees | | | 2 | | |

| Legal and audit fees | | | 30 | | |

| Other expenses | | | 31 | | |

| Total Expenses | | | 220 | | |

| Expenses waived/reimbursed by Adviser | | | (30 | ) | |

| Net Expenses | | | 190 | | |

| Net Investment Income | | | 180 | | |

| Realized/Unrealized Gains (Losses) from Investment Transactions: | |

| Net realized losses from investment transactions | | | (5,201 | ) | |

| Net change in unrealized appreciation/depreciation on investments | | | 6,757 | | |

| Net realized/unrealized gains from investments | | | 1,556 | | |

| Change in net assets resulting from operations | | $ | 1,736 | | |

See notes to financial statements.

6

The Victory Variable Insurance Funds Statements of Changes in Net Assets

(Amounts in Thousands)

| | | Diversified

Stock Fund | |

| | | Six Months

Ended

June 30,

2009 | | Year

Ended

December 31,

2008 | |

| | | (Unaudited) | | | |

| From Investment Activities: | |

| Operations: | |

| Net investment income | | $ | 180 | | | $ | 350 | | |

| Net realized losses from investment transactions | | | (5,201 | ) | | | (10,985 | ) | |

| Net change in unrealized appreciation/depreciation on investments | | | 6,757 | | | | (9,141 | ) | |

| Change in net assets resulting from operations | | | 1,736 | | | | (19,776 | ) | |

| Distributions to Shareholders: | |

| From net investment income | | | (178 | ) | | | (345 | ) | |

| From net realized gains | | | — | | | | (6,969 | ) | |

| Change in net assets resulting from distributions to shareholders | | | (178 | ) | | | (7,314 | ) | |

| Change in net assets from capital transactions | | | 207 | | | | 7,456 | | |

| Change in net assets | | | 1,765 | | | | (19,634 | ) | |

| Net Assets: | |

| Beginning of period | | | 33,205 | | | | 52,839 | | |

| End of period | | $ | 34,970 | | | $ | 33,205 | | |

| Distributions in excess of net investment income | | $ | (5 | ) | | $ | (7 | ) | |

| Capital Transactions: | |

| Proceeds from shares issued | | $ | 3,437 | | | $ | 10,838 | | |

| Dividends reinvested | | | 178 | | | | 7,314 | | |

| Cost of shares redeemed | | | (3,408 | ) | | | (10,696 | ) | |

| Change in net assets from capital transactions | | $ | 207 | | | $ | 7,456 | | |

| Share Transactions: | |

| Issued | | | 513 | | | | 1,086 | | |

| Reinvested | | | 26 | | | | 695 | | |

| Redeemed | | | (527 | ) | | | (1,014 | ) | |

| Change in shares | | | 12 | | | | 767 | | |

See notes to financial statements.

7

The Victory Variable Insurance Funds Financial Highlights

For a Share Outstanding Throughout Each Period

| | | Diversified Stock Fund | |

| | | Six Months

ended

June 30,

2009 | | Year

ended

December 31,

2008 | | Year

ended

December 31,

2007 | | Year

ended

December 31,

2006 | | Year

ended

December 31,

2005 | | Year

ended

December 31,

2004 | |

| | | (Unaudited) | | | | | | | | | | | |

| Net Asset Value, Beginning of Period | | $ | 6.96 | | | $ | 13.19 | | | $ | 13.09 | | | $ | 11.92 | | | $ | 10.97 | | | $ | 10.06 | | |

| Investment Activities: | |

| Net investment income | | | 0.04 | | | | 0.08 | | | | 0.08 | | | | 0.04 | | | | 0.02 | | | | 0.06 | | |

Net realized and unrealized gains

(losses) on investments | | | 0.35 | | | | (4.45 | ) | | | 1.23 | | | | 1.53 | | | | 0.94 | | | | 0.91 | | |

| Total from Investment Activities | | | 0.39 | | | | (4.37 | ) | | | 1.31 | | | | 1.57 | | | | 0.96 | | | | 0.97 | | |

| Distributions: | |

| Net investment income | | | (0.04 | ) | | | (0.08 | ) | | | (0.09 | ) | | | (0.04 | ) | | | (0.01 | ) | | | (0.06 | ) | |

| Net realized gains from investments | | | — | | | | (1.78 | ) | | | (1.12 | ) | | | (0.36 | ) | | | — | | | | — | | |

| Total Distributions | | | (0.04 | ) | | | (1.86 | ) | | | (1.21 | ) | | | (0.40 | ) | | | (0.01 | ) | | | (0.06 | ) | |

| Net Asset Value, End of Period | | $ | 7.31 | | | $ | 6.96 | | | $ | 13.19 | | | $ | 13.09 | | | $ | 11.92 | | | $ | 10.97 | | |

| Total Return (a) | | | 5.62 | % | | | (37.87 | )% | | | 9.95 | % | | | 13.68 | % | | | 8.75 | % | | | 9.67 | % | |

| Ratios/Supplemental Data: | |

| Net assets at end of period (000) | | $ | 34,970 | | | $ | 33,205 | | | $ | 52,839 | | | $ | 49,870 | | | $ | 40,646 | | | $ | 27,823 | | |

| Ratio of expenses to average net assets (b) | | | 1.20 | % | | | 1.20 | % | | | 1.24 | % | | | 1.12 | % | | | 1.40 | % | | | 1.50 | % | |

Ratio of net investment income to average

net assets (b) | | | 1.13 | % | | | 0.79 | % | | | 0.57 | % | | | 0.33 | % | | | 0.15 | % | | | 0.65 | % | |

| Ratio of expenses to average net assets (b) (c) | | | 1.39 | % | | | 1.22 | % | | | 1.24 | % | | | 1.12 | % | | | 1.47 | % | | | 1.76 | % | |

Ratio of net investment income to average

net assets (b) (c) | | | 0.94 | % | | | 0.77 | % | | | 0.57 | % | | | 0.33 | % | | | 0.08 | % | | | 0.39 | % | |

| Portfolio turnover | | | 45 | % | | | 132 | % | | | 104 | % | | | 107 | % | | | 83 | % | | | 103 | % | |

(a) Not annualized for periods less than one year.

(b) Annualized for periods less than one year.

(c) During the period, certain fees were reduced and/or reimbursed. If such fee reductions and/or reimbursements had not occurred, the ratios would have been as indicated.

See notes to financial statements.

8

Notes to Financial Statements

The Victory Variable Insurance Funds June 30, 2009

(Unaudited)

1. Organization:

The Victory Variable Insurance Funds (the "Trust") was organized as a Delaware statutory trust on February 11, 1998. The Trust is a diversified open-end management investment company registered under the Investment Company Act of 1940, as amended (the "1940 Act"). The Trust is authorized to issue an unlimited number of shares, which are units of beneficial interest with a par value of $0.001. The Trust currently offers shares of one fund: the Diversified Stock Fund (the "Fund"). The Fund offers a single class of shares: Class A Shares. Sales of shares of the Fund may only be made to separate accounts of various life insurance companies. The Fund seeks to provide long-term growth of capital.

Under the Trust's organizational documents, its officers and trustees are indemnified against certain liabilities arising out of the performance of their duties to the Fund. In addition, in the normal course of business, the Fund enters into contracts with its vendors and others that provide for general indemnifications. The Fund's maximum exposure under these arrangements is unknown, as this would involve future claims that may be made against the Fund. However, based on experience, the Fund expects that risk of loss to be remote.

2. Significant Accounting Policies:

The following is a summary of significant accounting policies followed by the Trust in the preparation of its financial statements. The policies are in conformity with accounting principles generally accepted in the United States of America ("GAAP"). The preparation of financial statements requires management to make estimates and assumptions that affect the reported amounts of assets and liabilities at the date of the financial statements and the reported amounts of income and expenses for the period. Actual results could differ from those estimates.

Securities Valuation:

Portfolio securities listed or traded on domestic securities exchanges, including American Depositary Receipts ("ADRs"), are valued at the closing price on the exchange or system where the security is principally traded or at the Nasdaq Official Closing Price. If there have been no sales for that day on the exchange or system, a security is valued at the last available bid quotation on the exchange or system where the security is principally traded. Debt securities of U.S. issuers (other than short-term investments maturing in 60 days or less), including corporate and municipal securities, are valued on the basis of bid valuations provided by dealers or an independent pricing service approved by the Trust's Board of Trustees (the "Board"). Short-term investments maturing in 60 days or less are valued at amortized cost, which approximates market value. Investments in other open-end investment companies are valued at net asset value. Investmen ts for which there are no such quotations, or for which quotations do not appear reliable, are valued at fair value as determined in good faith by the Pricing Committee under the direction of the Board.

Effective January 1, 2008, the Fund began applying the standard established under Statement of Financial Accounting Standards ("SFAS") No. 157, "Fair Value Measurements" ("SFAS 157"). This standard establishes a single authoritative definition of fair value, sets out a framework for measuring fair value, and requires additional disclosures about fair value measurements. One key component of the implementation of SFAS 157 includes the development of a three-tier fair value hierarchy. The basis of the tiers is dependant upon the various "inputs" used to determine the value of the Fund's investments. These inputs are summarized in the three broad levels listed below:

• Level 1 — quoted prices in active markets for identical securities.

• Level 2 — other significant observable inputs (including quoted prices for similar securities or interest rates, applicable to those securities, etc.).

• Level 3 — significant unobservable inputs (including the Fund's own assumptions in determining the fair value of investments).

The inputs or methodology used for valuing investments are not necessarily an indication of the risk associated with investing in those investments.

The following is a summary of the inputs used to value the Fund's investments as of June 30, 2009 (amounts in thousands) (the breakdown, by category, of common stock is disclosed in the Schedule of Portfolio Investments):

| | | LEVEL 1 —

Quoted Prices | | LEVEL 2 —

Other Significant

Observable Inputs | | Total | |

| Common Stock | | $ | 33,642 | | | $ | — | | | $ | 33,642 | | |

| Commercial Paper | | | — | | | | 1,353 | | | | 1,353 | | |

Securities Transactions and Related Income:

Changes in holdings of portfolio securities are accounted for no later than one business day following the trade date. For financial reporting purposes, however, portfolio security transactions are accounted for on trade date on the last business day of the reporting period. Interest income is recognized on the accrual basis and includes, where applicable, the amortization of premium or accretion of

Continued

9

Notes to Financial Statements — continued

The Victory Variable Insurance Funds June 30, 2009

(Unaudited)

discount. Dividend income is recorded on the ex-dividend date. Gains or losses realized on sales of securities are determined by comparing the identified cost of the security lot sold with the net sales proceeds.

Repurchase Agreements:

The Fund may acquire securities subject to repurchase agreements from financial institutions such as banks and broker-dealers, which the Fund's investment adviser deems creditworthy under guidelines approved by the Board. Under a repurchase agreement, the seller agrees to repurchase such securities at a mutually agreed-upon date and price. The repurchase price generally equals the price paid by the Fund plus interest negotiated on the basis of current short-term rates, which may be more or less than the rate on the underlying securities. The repurchase agreements are collateralized by various corporate, U.S. Government and government-backed securities, with a value of not less than the repurchase price (including interest). If the counter-party defaults, and the fair value of the collateral declines, realization of the collateral by the Fund may be delayed or limited and/or result in additional costs. Securities subject to repurchase agreeme nts are held by the Fund's custodian or another qualified custodian or in the Financial Reserve/Treasury book-entry system.

Securities Purchased on a When-Issued Basis:

The Fund may purchase securities on a "when-issued" basis. When-issued securities are securities purchased for delivery beyond normal settlement periods at a stated price and/or yield, thereby involving the risk that the price and/or yield obtained may be more or less than those available in the market when delivery takes place. At the time the Fund makes the commitment to purchase a security on a when-issued basis, the Fund records the transaction and reflects the value of the security in determining net asset value. No interest accrues to the Fund until the transaction settles and payment takes place. Normally, the settlement date occurs within one month of the purchase. A segregated account is established and the Fund maintains cash and marketable securities at least equal in value to commitments for when-issued securities. These values are included in amounts payable for investments purchased on the accompanying statement of assets and l iabilities. As of June 30, 2009, the Fund had no outstanding "when-issued" purchase commitments.

Securities Lending:

The Fund may, from time to time, lend securities from its portfolio to broker-dealers, banks, financial institutions and other institutional borrowers approved by the Board. The Fund will limit its securities lending activity to 33 1/3% of its total assets. KeyBank National Association ("KeyBank"), the Fund's custodian and an affiliate of Victory Capital Management Inc., the Fund's investment adviser ("VCM" or the "Adviser"), serves as the lending agent for the Trust pursuant to a Securities Lending Agency Agreement (the "Lending Agreement"), for which it receives a fee. KeyBank's fee is computed monthly in arrears and is 25% of the sum of all interest, dividends and other distributions earned from the investment of collateral in investments, as approved by the Board, net of rebates paid by KeyBank to borrowers and net of brokerage commissions, if any, incurred in making or liquidating the investments. For the six month period ended June 30, 2009, KeyBank received $93 (amount in thousands) in total from the Trust, Victory Portfolios and Victory Institutional Funds (collectively the "Victory Trusts") for its services as lending agent. Under guidelines established by the Board, the Fund must maintain loan collateral (with KeyBank) at all times in an amount equal to at least 100% of the current market value of the loaned securities in the form of cash or U.S. Government obligations, to secure the return of the loaned securities.

Initial value of loan collateral shall be no less than 102% of the market value of the loaned securities plus the accrued interest on debt securities. KeyBank, at the direction of the Adviser, consistent with the Trust's securities lending guidelines, may invest the collateral in short-term debt instruments that the Adviser has determined present minimal credit risks. There is a risk of delay in receiving collateral or in receiving the securities loaned or even a loss of rights in the collateral should the borrower of the securities fail financially.

By lending its securities, the Fund can increase its income by continuing to receive interest or dividends on the loaned securities as well as investing the cash collateral in short-term U.S. Government securities, repurchase agreements, or other short-term securities. The cash collateral, or short-term investments purchased with such collateral, is recorded as an asset of the Fund, offset by a corresponding liability to return all collateral as cash at the termination of the securities loan(s). Fixed income securities received as collateral are not recorded as an asset or liability of the Trust because the Fund does not have effective control of such securities. Loans are subject to termination by the Trust or the borrower at any time.

During the six month period ended, June 30, 2009, the Fund had no outstanding securities on loan.

Dividends to Shareholders:

Dividends from net investment income are declared and paid quarterly for the Fund. Distributable net realized capital gains, if any, are declared and distributed at least annually. The amounts of dividends from net investment income and of distributions from net realized gains are determined in accordance with federal income tax regulations which may differ from GAAP. These "book/tax" differences are either considered temporary or permanent in nature. To the extent these differences are permanent in nature (i.e. reclass of market discounts and gain/loss), such amounts are reclassified within the components of net assets based on their federal tax-basis treatment; temporary differences do not require reclassification. To the extent dividends and distributions exceed net investment income and net realized capital gains for tax purposes, they are reported as distributions of capital. Net investment losses incurred by the Fund may be reclassifie d as an offset to capital in the accompanying statement of assets and liabilities.

Continued

10

Notes to Financial Statements — continued

The Victory Variable Insurance Funds June 30, 2009

(Unaudited)

Federal Income Taxes:

It is the policy of the Fund to continue to qualify as a regulated investment company by complying with the provisions available to certain investment companies, as defined in applicable sections of the Internal Revenue Code, and to make distributions of net investment income and net realized capital gains sufficient to relieve it from all, or substantially all, federal income taxes.

The Fund complies with Financial Accounting Standards Board ("FASB") Interpretation No. 48, Accounting for Uncertainty in Income Taxes ("FIN 48"). FIN 48 provides guidance for how uncertain tax positions should be recognized, measured, presented and disclosed in the financial statements. FIN 48 requires the affirmative evaluation of tax positions taken or expected to be taken in the course of preparing the Fund's tax return to determine whether it is more-likely-than-not (i.e., greater than 50-percent) that each tax position will be sustained upon examination by a taxing authority based on the technical merits of the position. A tax position that meets the more-likely-than-not recognition threshold is measured to determine the amount of benefit to recognize in the financial statements. Differences between tax positions taken in a tax return and amounts recognized in the financial statements will generally result in an increase in a liability for taxes payable (or a reduction of a tax refund receivable), including the recognition of any related interest and penalties as an operating expense. FIN 48 includes a review of tax positions taken in tax years that remain subject to examination by all major tax jurisdictions, including federal (i.e., the last four tax year ends and the interim tax period since then). FIN 48 did not impact the Fund's net assets or result of operations. Management believes that there is no tax liability resulting from unrecognized tax benefits related to uncertain tax positions taken.

Withholding taxes on interest, dividend and capital gains as a result of certain investments in ADRs by the Fund have been provided for in accordance with each applicable country's tax rules and rates.

New Accounting Standards:

In March 2008, Financial Accounting Standards Board ("FASB") issued SFAS No. 161, "Disclosures about Derivative Instruments and Hedging Activities" ("SFAS 161"). SFAS 161 requires enhanced disclosures about the Fund's derivative and hedging activities, including how such activities are accounted for and their effect on the Fund's financial position, performance and cash flows. The Fund was not impacted by adopting this standard.

3. Purchases and Sales of Securities:

Purchases and sales of securities (excluding short-term securities) for the six months ended June 30, 2009 were as follows (amounts in thousands):

| Fund Name | | Purchases

(excluding U.S.

Government

Securities) | | Sales

(excluding U.S.

Government

Securities) | | Purchases

of U.S.

Government

Securities | | Sales

of U.S.

Government

Securities | |

| Diversified Stock Fund | | $ | 14,867 | | | $ | 13,542 | | | $ | — | | | $ | — | | |

4. Investment Advisory, Administration, and Distribution Agreements:

Investment advisory services are provided to the Fund by VCM, a wholly owned subsidiary of KeyBank. Under the terms of the Investment Advisory Agreement, the Adviser is entitled to receive fees at an annual rate of 0.30% of the average daily net assets of the Fund.

KeyBank, serving as custodian for the Fund, receives custodian fees computed at the annual rate of 0.013% of the first $10 billion of the Victory Trusts' average daily net assets, 0.0113% of the Victory Trusts' average daily net assets between $10 billion and $12.5 billion and 0.0025% of the Victory Trusts' average daily net assets greater than $12.5 billion. Average daily net assets for this computation does not include International Fund and International Select Fund'. The Trust reimburses KeyBank for all of its reasonable out-of-pocket expenses incurred in providing custody services.

VCM also serves as the Fund's administrator and fund accountant. Under an Administration and Fund Accounting Agreement, the Trust and The Victory Portfolios (collectively the "Trusts") pay VCM a fee at the annual rate of 0.108% of the first $8 billion of the aggregate net assets of the Trusts; plus 0.078% of the aggregate net assets of the Trusts between $8 billion and $10 billion; plus 0.075% of the aggregate net assets of the Trusts between $10 billion and $12 billion; plus 0.065% of the aggregate net assets of the Trusts greater than $12 billion, for providing certain administrative and fund accounting services to the Trusts' series.

Citi Fund Services Ohio, Inc. ("Citi") acts as sub-administrator and sub-fund accountant to the Fund and receives a fee under a Sub-Administration Agreement between VCM and Citi. VCM pays Citi a fee for providing these services. The Trust also reimburses VCM and Citi for all of their reasonable out-of-pocket expenses incurred in providing these services.

Citi also serves as the Fund's Transfer Agent. Under the terms of the Transfer Agent Agreement, Citi receives a fee that is calculated daily at the annual rate of 0.02% of the first $8 billion of the aggregate net assets of the Trusts; plus 0.015% of the aggregate net assets of the Trusts between $8 billion and $16 billion; plus 0.01% of the aggregate net assets of the Trusts between $16 billion and $20 billion; plus

Continued

11

Notes to Financial Statements — continued

The Victory Variable Insurance Funds June 30, 2009

(Unaudited)

0.005% of the aggregate net assets of the Trusts greater than $20 billion. In addition, Citi is entitled to reimbursement of out-of-pocket expenses incurred in providing transfer agent services.

Victory Capital Advisers, Inc. (the "Distributor"), an affiliate of the Adviser, serves as distributor for the continuous offering of the shares of the Fund pursuant to a Distribution Agreement between the Distributor and the Trust.

Pursuant to the Trust's Distribution and Service Plan, the Fund pays the Distributor a monthly distribution and service fee, at an annual rate of 0.25% of the average daily net assets of the Fund. The Distributor may pay a 12b-1 fee to life insurance companies for activities primarily intended to result in the sale of Fund shares to life insurance companies for the purpose of funding variable annuity contracts and variable life insurance policies or to provide services to owners of variable annuity contracts and variable life insurance policies whose contracts or policies are funded with shares of the Fund, which services are not otherwise provided by life insurance companies and paid for with fees charged by life insurance companies.

The Fund has adopted a form of Contract Owner Administrative Services Agreement. A contract owner servicing agent performs a number of services for its customers who hold contracts offered by separate accounts that invest in the Fund, such as establishing and maintaining accounts and records, processing additional contract units attributable to Fund dividend payments, arranging for bank wires, assisting in transactions, and changing account information. For these services, Class A Shares of the Fund pay a fee at an annual rate of up to 0.25% of its average daily net assets serviced by the agent. The Fund may enter into these agreements with KeyBank and its affiliates, and with other financial institutions that provide such services. Contract owner servicing agents may waive all or a portion of their fee. (Not all agents may provide all services listed above.)

The Adviser, Citi or other service providers may waive or reimburse fees to assist the Fund in maintaining a competitive expense ratio. Waivers and reimbursements applicable to the Fund are not available to be recouped at a future time.

5. Risks:

The Fund will be subject to credit risk with respect to the amount it expects to receive from counterparties to financial instruments entered into by the Fund. The Fund may be negatively impacted if counterparty becomes bankrupt or otherwise fails to perform its obligations due to financial difficulties. The Fund may experience significant delays in obtaining any recovery in bankruptcy or other reorganization proceeding and the Fund may obtain only limited recovery or may obtain no recovery in such circumstances. The Fund typically enters into transactions with counterparties whose credit ratings are investment grade, as determined by a nationally recognized statistical rating organization, or, if unrated, judged by the Adviser to be of comparable quality.

6. Line of Credit:

The Victory Trusts (except International Fund and International Select Fund) participate in a short-term, demand note "Line of Credit" agreement with KeyCorp, an affiliate of the Adviser. Under the agreement, the Victory Trusts may borrow up to $150 million. The purpose of the agreement is to meet temporary or emergency cash needs, including redemption requests that might otherwise require the untimely disposition of securities. KeyCorp receives an annual commitment fee of 30 basis points on $150 million for providing the Line of Credit. Prior to June 1, 2009, KeyCorp's annual commitment fee was eight basis points on $200 million for providing the Line of Credit. For the six months ended June 30, 2009, the Victory Trusts paid approximately $102 to KeyCorp for the Line of Credit fee (amount in thousands). Each fund of the Victory Trusts (except International Fund and International Select Fund) pays a pro-rata portion of this commitment fee pl us any interest on amounts borrowed. At June 30, 2009, the Fund had no loans outstanding with KeyCorp.

7. Federal Income Tax Information:

The tax character of current year distribution paid and the tax basis of the current components of accumulated earnings (deficit) will be determined at the end of the current tax year ending December 31, 2009.

The tax character of distributions paid during the fiscal year ended December 31, 2008 was as follows (total distributions paid may differ from the Statement of Changes in Net Assets because for tax purposes, dividends are recognized when actually paid) (amounts in thousands):

| | | Distributions paid from | | | |

| | | Ordinary

Income | | Net

Long Term

Capital

Gains | | Total

Distributions

Paid | |

| Diversified Stock Fund | | $ | 3,120 | | | $ | 4,194 | | | $ | 7,314 | | |

Continued

12

Notes to Financial Statements — continued

The Victory Variable Insurance Funds June 30, 2009

(Unaudited)

As of December 31, 2008, the components of accumulated earnings/(deficit) on a tax basis were as follows (total distributions paid may differ from the Statement of Assets and Liabilities because for tax purposes, dividends are recognized when actually paid) (amounts in thousands):

| | | Undistributed

Ordinary

Income | | Undistributed

Long-Term

Capital Gains | | Accumulated

Capital

and Other

Losses | | Unrealized

Appreciation/

(Depreciation)* | | Total

Accumulated

Earnings/

(Deficit) | |

| Diversified Stock Fund | | $ | — | | | $ | — | | | $ | (9,609 | ) | | $ | (7,180 | ) | | $ | (16,789 | ) | |

* The difference between the book-basis unrealized appreciation/(depreciation) is primarily attributable to the tax deferral of losses on wash sales.

As of December 31, 2008, the Fund had capital loss carryforwards to offset future net capital gains, if any, to the extent provided by Treasury obligations of $4,936 (amount in thousands), expiring 2016.

Under current tax law, capital losses realized after October 31 may be deferred and treated as occurring on the first day of the following fiscal year. The Fund has elected to defer $4,673 (amount in thousands) in losses which will be treated as arising of the first day of the fiscal year to end December 31, 2009.

The cost basis for federal income tax purposes, gross unrealized appreciation, gross unrealized depreciation and net unrealized appreciation/depreciation is as follows (amounts in thousands):

| | | Cost of

Investments for

Federal Tax

Purposes | | Gross

Unrealized

Appreciation | | Gross

Unrealized

Depreciation | | Net Unrealized

Appreciation/

(Depreciation)* | |

| Diversified Stock Fund | | $ | 34,916 | | | $ | 2,595 | | | $ | (2,516 | ) | | $ | 79 | | |

* The difference between the book-basis unrealized appreciation/(depreciation) is primarily attributable to the tax deferral of losses on wash sales.

8. Other Information:

On December 3, 2008, the Victory Portfolios (the "Funds") dismissed PricewaterhouseCoopers LLP as its independent registered public accounting firm. The Funds' Audit Committee and Board of Trustees participated in and approved the decision to change its independent registered public accounting firm.

The reports of PricewaterhouseCoopers LLP on the Funds' financial statements for the past two fiscal years contained no adverse opinion or disclaimer of opinion and were not qualified or modified as to uncertainty, audit scope, or accounting principle.

During the two most recent fiscal years and through December 3, 2008, there have been no disagreements with PricewaterhouseCoopers LLP on any matter of accounting principles or practices, financial statement disclosure, or auditing scope or procedure, which disagreements if not resolved to the satisfaction of PricewaterhouseCoopers LLP would have caused them to make reference thereto in their reports on the financial statements for such years.

The Funds engaged Ernst & Young LLP as its new independent registered public accounting firm as of December 3, 2008.

9. Subsequent Events:

The Fund has evaluated subsequent events through August 14, 2009, which is the date these financial statements were issued, and there are no subsequent events to report.

13

The Victory Variable Insurance Funds Supplemental Information

(Unaudited)

Trustee and Officer Information

Board of Trustees.

Overall responsibility for management of the Trust rests with the Board. The Trust is managed by the Board, in accordance with the laws of the State of Delaware. There are currently eleven Trustees, nine of whom are not "interested persons" of the Trust within the meaning of that term under the 1940 Act ("Independent Trustees"), and two of whom are "interested persons" of the Trust within the meaning of that term under the 1940 Act ("Interested Trustees"). The Trustees, in turn, elect the officers of the Trust to actively supervise its day-to-day operations.

The following tables list the Trustees, their year of birth, position with the Trust, length of time served, principal occupations during the past five years and any directorships of other investment companies or companies whose securities are registered under the Securities Exchange Act of 1934, as amended, or who file reports under that Act. Each Trustee oversees one portfolio in the Trust, one portfolio in The Victory Institutional Funds and 22 portfolios in The Victory Portfolios, each a registered investment company that, together with the Trust, comprise the Victory Fund Complex. Each Trustee's address is c/o The Victory Portfolios, 3435 Stelzer Road, Columbus, Ohio 43219. Each Trustee has an indefinite term.

| Name (Year of Birth) | | Position Held

with the Trust | | Date

Commenced

Service | | Principal Occupation

During Past 5 Years | | Other Directorships

Held in

Public Companies | |

| Independent Trustees. | | | | | | | | | |

|

| Mr. David Brooks Adcock (1951) | | Trustee | | February 2005 | | General Counsel, Duke University and Duke University Health System (1982-2006). | | Hospital Partners of America. | |

|

| Mr. Nigel D. T. Andrews (1947) | | Vice Chair and Trustee | | August 2002 | | Retired (since 2001). | | Chemtura Corporation; Old Mutual plc. | |

|

| Ms. E. Lee Beard (1951) | | Trustee | | February 2005 | | President Principal Owner (since 2003) The Henlee Group. | | None. | |

|

| Ms. Lyn Hutton (1950) | | Trustee | | March 2002 | | Chief Investment Officer, The Commonfund for Nonprofit Organizations (since January 2003). | | None. | |

|

| Mr. John L. Kelly (1953) | | Trustee | | July 2008 | | Managing Director, JL Thornton & Co. Financial Consultant (since 2003). | | None. | |

|

| Ms. Karen F. Shepherd (1940) | | Trustee | | August 2001 | | Retired. | | UBS Bank USA; OC Tanner Co. | |

|

| Mr. Leigh A. Wilson (1944) | | Chair and Trustee | | February 1998 | | Chief Executive Officer, Third Wave Associates (p/k/a New Century Living, Inc.) (full service independent living for senior citizens); Director, The Mutual Fund Directors Forum (since 2004). | | Chair, Old Mutual Advisor II Funds (23 portfolios) and Old Insurance (8 Portfolios); Trustee, Old Mutual Funds III (12 Portfolios). | |

|

| Independent Advisory Trustees. | | | | | | | | | |

|

| Ms. Teresa C. Barger (1955) | | Advisory Trustee | | December 2008 | | Chief Investment Officer/Chief Executive Officer, Cartica Capital LLC (since 2007); Director of the Corporate Governance and Capital Markets Advisory Department for the World Bank and International Finance Corporation (2004-2007). | | None. | |

|

| Mr. David L. Meyer (1957) | | Advisory Trustee | | December 2008 | | Retired (since 2008); Chief Operating Officer, Investment & Wealth Management Division, PNC Financial Services Group (Mercantile Bankshares Corp. prior to March 2007) (since 2002). | | None. | |

|

Continued

14

The Victory Variable Insurance Funds Supplemental Information — continued

(Unaudited)

| Name (Year of Birth) | | Position Held

with the Trust | | Date

Commenced

Service | | Principal Occupation

During Past 5 Years | | Other Directorships

Held in

Public Companies | |

| Interested Trustees. | |

|

| Mr. David C. Brown (1972) | | Trustee | | July 2008 | | Chief Operating Officer, Victory Capital Management, Inc. (since July 2004); Chief Financial Officer and Chief Operating Officer, Gartmore Emerging Managers (February 1999-July 2004). | | None. | |

|

| Mr. Thomas W. Bunn (1953) | | Trustee | | July 2008 | | Retired (since February 2009); Vice Chair, KeyCorp National Banking (July 2005-February 2009); Senior Executive Vice President of Key's Corporate Finance Group (March 2002-July 2005). | | None. | |

|

Messres Brown and Bunn are "Interested Persons" by reason of their relationship with KeyCorp.

The Statement of Additional Information includes additional information about the Trustees of the Trust and is available, without charge, by calling 1-800-539-3863.

Officers.

The officers of the Trust, their year of birth, the length of time served and their principal occupations during the past five years, are detailed in the following table. Each individual holds the same position with the other registered investment companies in the Victory Fund Complex, and each officer serves until the earlier of his or her resignation, removal, retirement, death, or the election of a successor. The mailing address of each officer of the Trust is 3435 Stelzer Road, Columbus, Ohio 43219-3035. Except for the Chief Compliance Officer, the officers of the Trust receive no compensation directly from the Trust for performing the duties of their offices.

| Name (Year of Birth) | | Position with

the Trust | | Date

Commenced

Service | | Principal Occupation During Past 5 Years | |

| Mr. Michael Policarpo, II (1974) | | President | | May 2008 (Officer since May 2006) | | Managing Director of the Adviser (since July 2005); Vice President of Finance, Gartmore Global Investments (August 2004-July 2005); Chief Financial Officer Advisor Services, Gartmore Global Investments Inc. (August 2003-August 2004). | |

|

| Mr. Peter W. Scharich (1964) | | Vice President | | May 2008 | | Managing Director, Mutual Fund Administration, the Adviser (since January 2006); Managing Director, Strategy, the Adviser (March 2005-January 2006); Chief Financial Officer, the Adviser (September 2002-March 2005). | |

|

| Mr. Christopher K. Dyer (1962) | | Secretary | | February 2006 | | Head of Mutual Fund Administration, the Adviser. | |

|

| Mr. Jay G. Baris (1954) | | Assistant Secretary | | February 1998 | | Partner, Kramer Levin Naftalis & Frankel LLP. | |

|

| Mr. Christopher E. Sabato (1968) | | Treasurer | | May 2006 | | Senior Vice President, Fund Administration, Citi. | |

|

| Mr. Michael J. Nanosky (1966) | | Anti-Money Laundering Compliance Officer and Identity Theft Officer | | February 2009 | | Vice President and Chief Compliance Officer, CCO Services of Citi Fund Services Inc. (since 2008); Vice President and Managing Director of Regulatory Compliance, National City Bank-Allegiant Asset Management (2004-2008); Vice President and Director of Fund Administration and Compliance, National City Bank-Allegiant Asset Management (2002-2004). | |

|

| Mr. Edward J. Veilleux (1943) | | Chief Compliance Officer | | October 2005 | | President of EJV Financial Services (mutual fund consulting) since 2002. | |

|

Continued

15

The Victory Variable Insurance Funds Supplemental Information — continued

(Unaudited)

Proxy Voting and Form N-Q Information

Proxy Voting:

Information regarding the policies and procedures that the Fund uses to determine how to vote proxies relating to portfolio securities is available without charge, upon request, by calling 1-800-539-3863. The information is also included in the Trust's Statement of Additional Information, which is available on the Fund's website at www.victoryconnect.com and on the Securities and Exchange Commission's website at www.sec.gov.

Information relating to how the Fund voted proxies related to portfolio securities during the most recent twelve months ended June 30 is available on the Fund's website at www.victoryconnect.com and on the Security and Exchange Commission's website at www.sec.gov.

Availability of Schedules of Investments:

The Trust files its complete schedule of investments with the Securities and Exchange Commission for the first and third quarters of each fiscal year on Form N-Q. Forms N-Q are available on the Securities and Exchange Commission's website at www.sec.gov. You may also review or, for a fee, copy those documents by visiting the Securities and Exchange Commission's Public Reference Room in Washington D.C. Information on the operation of the Public Reference Room can be obtained by calling the Securities and Exchange Commission at 1-202-551-8090.

Continued

16

The Victory Variable Insurance Funds Supplemental Information — continued

(Unaudited)

Expense Examples

As a shareholder of the Fund, you may incur ongoing costs, including management fees, distribution and service (12b-1) fees; and other Fund expenses. These examples are intended to help you understand your ongoing costs (in dollars) of investing in the Fund and to compare these costs with the ongoing costs of investing in other mutual funds.

These examples are based on an investment of $1,000 invested at the beginning of the period and held for the entire period from January 1, 2009 through June 30, 2009.

Actual Expenses

The table below provides information about actual account values and actual expenses. You may use the information below, together with the amount you invested, to estimate the expenses that you paid over the period. Simply divide your account value by $1,000 (for example, an $8,600 account value divided by $1,000 = 8.6), then multiply the result by the number in the table under the heading entitled "Expenses Paid During Period" to estimate the expenses you paid on your account during this period.

| | | Beginning

Account Value

1/1/09 | | Ending

Account Value

6/30/09 | | Expenses Paid

During Period*

1/1/09-6/30/09 | | Expense Ratio

During Period**

1/1/09-6/30/09 | |

| Diversified Stock Fund | | $ | 1,000.00 | | | $ | 1,056.20 | | | $ | 6.12 | | | | 1.20 | % | |

* Expenses are equal to the average account value times the Fund's annualized expense ratio multiplied by the number of days in the most recent fiscal half-year divided by the number of days in the fiscal year.

** Annualized.

Hypothetical Example for Comparison Purposes

The table below provides information about hypothetical account values and hypothetical expenses based on the Fund's actual expense ratio and an assumed rate of return of 5% per year before expenses, which is not the Fund's actual return. The hypothetical account values and expenses may not be used to estimate the actual ending account balance or expenses you paid for the period. You may use this information to compare this 5% hypothetical example with the 5% hypothetical examples that appear in the shareholder reports of other funds.

Please note that the expenses shown in the table are meant to highlight your ongoing costs. Therefore, the table will not help you determine the relative total costs of owning different funds.

| | | Beginning

Account Value

1/1/09 | | Ending

Account Value

6/30/09 | | Expenses Paid

During Period*

1/1/09-6/30/09 | | Expense Ratio

During Period**

1/1/09-6/30/09 | |

| Diversified Stock Fund | | $ | 1,000.00 | | | $ | 1,018.84 | | | $ | 6.01 | | | | 1.20 | % | |

* Expenses are equal to the average account value times the Fund's annualized expense ratio multiplied by the number of days in the most recent fiscal half-year divided by the number of days in the fiscal year.

** Annualized.

Continued

17

The Victory Variable Insurance Funds Supplemental Information — continued

(Unaudited)

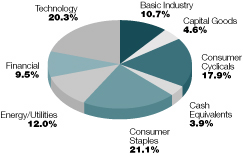

Portfolio Holdings

(As a Percentage of Total Investments)

Continued

18

Call Victory at:

800-539-FUND (800-539-3863) | | Visit our web site at:

www.VictoryConnect.com | |

|

1WF-SEMI-AR 8/09

Item 2. Code of Ethics.

Not applicable – only for annual reports.

Item 3. Audit Committee Financial Expert.

Not applicable – only for annual reports.

Item 4. Principal Accountant Fees and Services.

Not applicable – only for annual reports.

Item 5. Audit Committee of Listed Registrants.

Not applicable.

Item 6. Schedule of Investments.

(a) Not applicable.

(b) Not applicable.

Item 7. Disclosure of Proxy Voting Policies and Procedures for Closed-End Management Investment Companies.

Not applicable.

Item 8. Portfolio Managers of Closed-End Management Investment Companies.

Not applicable.

Item 9. Purchases of Equity Securities by Closed-End Management Investment Company and Affiliated Purchasers.

Not applicable.

Item 10. Submission of Matters to a Vote of Security Holders.

Not applicable.

Item 11. Controls and Procedures.

(a)The registrant’s principal executive officer and principal financial officer have concluded, based on their evaluation of the registrant’s disclosure controls and procedures as conducted within 90 days of the filing date of this report, that these disclosure controls and procedures are adequately designed and are operating effectively to ensure that information required to be disclosed by the registrant on Form N-CSR is recorded, processed, summarized and reported within the time periods specified in the Securities and Exchange Commission’s rules and forms.

(b)There were no changes in the registrant’s internal control over financial reporting (as defined in Rule 30a-3(d) under the Act (17 CFR 270.30a-3(d)) that occurred during the second fiscal quarter of the period covered by this report that have materially affected or are reasonably likely to materially affect, the registrant’s internal control over financial reporting.

Item 12. Exhibits.

(a)(1) Not applicable - Only effective for annual reports.

(a)(2) Certifications pursuant to Rule 30a-2(a) are attached hereto.

(a)(3) Not applicable.

(b) Certifications pursuant to Rule 30a-2(b) are furnished herewith.

SIGNATURES

Pursuant to the requirements of the Securities Exchange Act of 1934 and the Investment Company Act of 1940, the registrant has duly caused this report to be signed on its behalf by the undersigned, thereunto duly authorized.

(Registrant) | Victory Variable Insurance Funds |

| |

By (Signature and Title)* | /s/ Christopher E. Sabato |

| Christopher E. Sabato, Treasurer |

| |

Date | August 14, 2009 | |

| | | | | |

Pursuant to the requirements of the Securities Exchange Act of 1934 and the Investment Company Act of 1940, this report has been signed below by the following persons on behalf of the registrant and in the capacities and on the dates indicated.

By (Signature and Title)* | /s/ Michael Policarpo II |

| Michael Policarpo II, President |

| |

Date | August 14, 2009 | |

| |

By (Signature and Title)* | /s/ Christopher E. Sabato |

| Christopher E. Sabato, Treasurer |

| |

Date | August 14, 2009 | |

| | | | | |

* Print the name and title of each signing officer under his or her signature.