QuickLinks -- Click here to rapidly navigate through this document

As filed with the Securities and Exchange Commission on July 2, 2007

Registration No. 333-

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

Form S-1

REGISTRATION STATEMENT

Under

THE SECURITIES ACT OF 1933

VIEWSONIC CORPORATION

(Exact name of registrant as specified in its charter)

| Delaware (State or other jurisdiction of incorporation or organization) | 3577 (Primary Standard Industrial Classification Code Number) | 95-4120606 (I.R.S. Employer Identification Number) |

381 Brea Canyon Road

Walnut, California 91789

(909) 444-8888

(Address, including zip code, and telephone number, including area code, of registrant's principal executive offices)

James Chu

Chairman and Chief Executive Officer

381 Brea Canyon Road

Walnut, California 91789

(909) 444-8888

(Name, address, including zip code, and telephone number, including area code, of agent for service)

Copies to:

| Eric C. Jensen, Esq. John T. McKenna, Esq. Nicole C. Brookshire, Esq. Cooley Godward Kronish LLP Five Palo Alto Square 3000 El Camino Real Palo Alto, California 94306 (650) 843-5000 | Robert J. Ranucci, Esq. Vice President, General Counsel and Secretary 381 Brea Canyon Road Walnut, California 91789 (909) 444-8888 | Alan F. Denenberg, Esq. Davis Polk & Wardwell 1600 El Camino Real Menlo Park, California 94025 (650) 752-2000 |

Approximate date of commencement of proposed sale to the public:

As soon as practicable after the effective date of this registration statement.

If any of the securities being registered on this Form are to be offered on a delayed or continuous basis pursuant to Rule 415 under the Securities Act of 1933, check the following box. o

If this Form is filed to register additional securities for an offering pursuant to Rule 462(b) under the Securities Act, check the following box and list the Securities Act registration statement number of the earlier effective registration statement for the same offering. o

If this Form is a post-effective amendment filed pursuant to Rule 462(c) under the Securities Act, check the following box and list the Securities Act registration statement number of the earlier effective registration statement for the same offering. o

If this Form is a post-effective amendment filed pursuant to Rule 462(d) under the Securities Act, check the following box and list the Securities Act registration number of the earlier effective registration statement for the same offering. o

CALCULATION OF REGISTRATION FEE

| Title of each class of securities to be registered | Proposed maximum aggregate offering price(1) | Amount of registration fee | ||

|---|---|---|---|---|

| Common Stock, $0.001 par value | $143,750,000 | $4,414 | ||

- (1)

- Estimated solely for the purpose of calculating the amount of the registration fee in accordance with Rule 457(o) under the Securities Act of 1933, as amended. Includes shares which may be purchased by the underwriters to cover over-allotments, if any.

The Registrant hereby amends this Registration Statement on such date or dates as may be necessary to delay its effective date until the Registrant shall file a further amendment that specifically states that this Registration Statement shall thereafter become effective in accordance with Section 8(a) of the Securities Act of 1933, as amended, or until the Registration Statement shall become effective on such date as the Commission, acting pursuant to said Section 8(a), may determine.

The information in this prospectus is not complete and may be changed. We may not sell these securities until the registration statement filed with the Securities and Exchange Commission is effective. This prospectus is not an offer to sell these securities and is not soliciting offers to buy these securities in any state where the offer or sale is not permitted.

Subject to completion, dated July 2, 2007

Prospectus

shares

Common stock

This is an initial public offering of common stock by ViewSonic Corporation. ViewSonic is selling shares of common stock. The selling stockholders included in this prospectus are selling an additional shares of common stock. We will not receive any proceeds from the sale of shares of common stock by the selling stockholders. The estimated initial public offering price is between $ and $ per share.

We have applied to list our common stock on The NASDAQ Global Market under the symbol "VIEW."

| Per share | Total | |||||

| Initial public offering price | $ | $ | ||||

Underwriting discounts and commissions | $ | $ | ||||

Proceeds to ViewSonic Corporation before expenses | $ | $ | ||||

Proceeds to selling stockholders before expenses | $ | $ | ||||

We and the selling stockholders have granted the underwriters an option for a period of 30 days to purchase up to additional shares of common stock.

Investing in our common stock involves a high degree of risk. See "Risk factors" beginning on page 7.

Neither the Securities and Exchange Commission nor any state securities commission has approved or disapproved these securities or determined if this prospectus is accurate or complete. Any representation to the contrary is a criminal offense.

| JPMorgan | Banc of America Securities LLC | |

Thomas Weisel Partners LLC | Needham & Company, LLC | |

, 2007

| | Page | |

|---|---|---|

| Prospectus Summary | 1 | |

| Risk factors | 7 | |

| Forward-looking statements | 26 | |

| Use of proceeds | 28 | |

| Dividend policy | 29 | |

| Capitalization | 30 | |

| Dilution | 32 | |

| Selected consolidated financial data | 34 | |

| Management's discussion and analysis of financial condition and results of operations | 36 | |

| Business | 66 | |

| Management | 81 | |

| Compensation discussion and analysis | 86 | |

| Certain relationships and related party transactions | 108 | |

| Principal stockholders | 110 | |

| Description of capital stock | 112 | |

| Shares eligible for future sale | 116 | |

| Material U.S. tax consequences for non-U.S. holders of common stock | 118 | |

| Underwriting | 122 | |

| Legal matters | 129 | |

| Experts | 129 | |

| Where you can find additional information | 129 | |

| Index to ViewSonic Corporation and Subsidiaries financial statements | F-1 |

You should rely only on the information contained in this prospectus and any free writing prospectus that we authorize to be distributed to you. We have not, and the underwriters have not, authorized anyone to provide you with information different from or in addition to that contained in this prospectus or any related free writing prospectus. If anyone provides you with different or inconsistent information, you should not rely on it. We are offering to sell, and are seeking offers to buy, shares of common stock only in jurisdictions where offers and sales are permitted. The information contained in this prospectus or any free writing prospectus is accurate only as of the date of such prospectus, regardless of the time of delivery of such prospectus or of any sale of the common stock. Our business, financial condition, results of operations and prospects may have changed since that date.

This prospectus contains market data and industry forecasts that were obtained from industry publications. We have not independently verified any of this information.

Industry publications and reports cited in this prospectus generally indicate that the information contained therein was obtained from sources believed to be reliable, but do not guarantee the accuracy and completeness of such information. Although we believe that the publications and reports are reliable, we have not independently verified the data.

Neither we nor any of the underwriters have done anything that would permit this offering or possession or distribution of this prospectus in any jurisdiction where action for that purpose is required, other than in the United States. You are required to inform yourselves about and to observe any restrictions relating to this offering and the distribution of this prospectus.

i

This summary highlights selected information appearing elsewhere in this prospectus and does not contain all the information you should consider before investing in our common stock. You should carefully read this prospectus in its entirety before investing in our common stock, including the section entitled "Risk factors," and our financial statements and related notes included elsewhere in this prospectus.

Overview

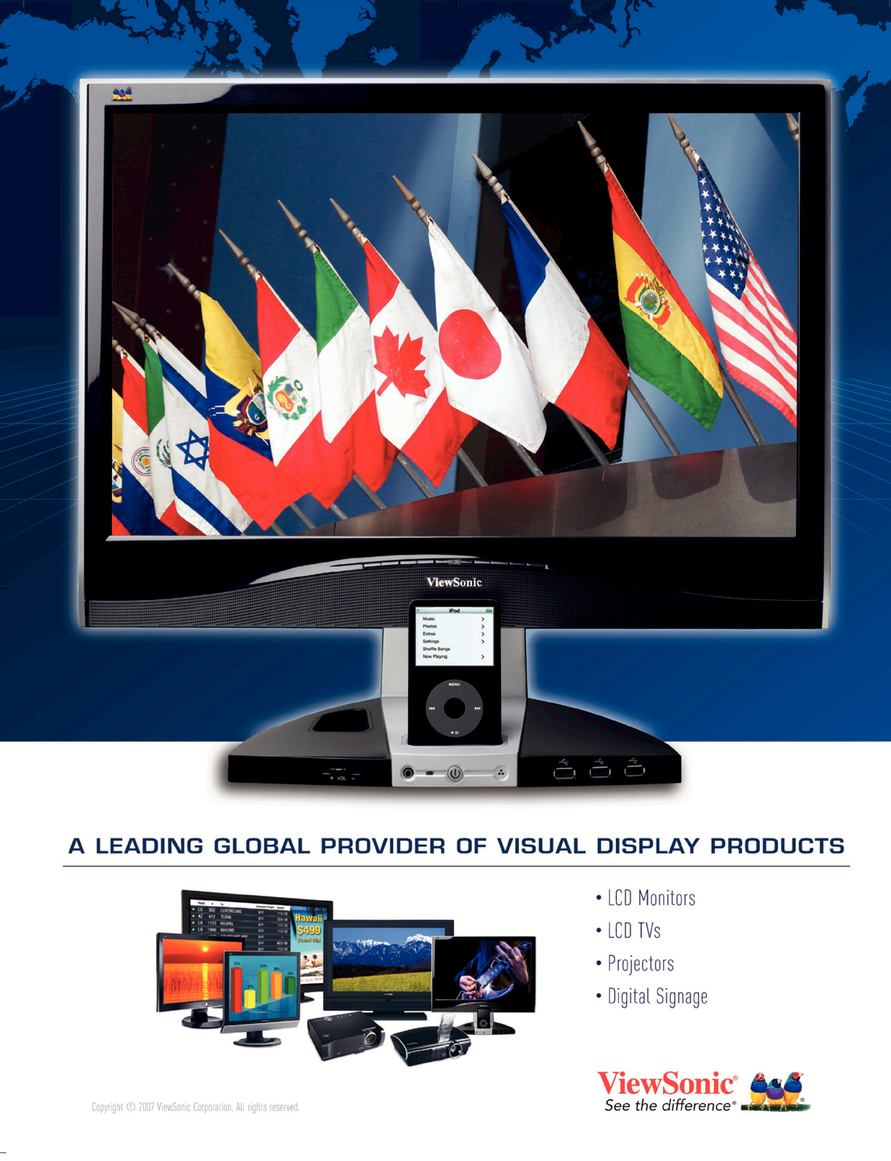

ViewSonic Corporation is a leading global provider of visual display products. We develop, market and support a broad range of innovative products including liquid crystal display, or LCD, monitors, LCD TVs, projectors, digital signage displays and other display products. We were founded in 1987 and have a 20 year history of providing innovative products with market leading technologies. We sell our products to businesses and consumers through a variety of channels, including distributors and resellers such as solution providers, value added resellers, traditional retailers and Internet retailers. We are a Fortune 1000 company, and our products are sold in over 100 countries.

Our strategy is to effectively leverage our scale, strong global brand, close supplier and channel relationships and market knowledge to introduce industry leading products and penetrate new markets. We collaborate with a network of world class component suppliers and contract manufacturers to deliver a wide array of display products for use in a variety of consumer and commercial applications. We believe our operating model allows us to quickly develop, introduce and ramp production of new products while maintaining an efficient cost structure.

We estimate our addressable display product market was $98.6 billion in 2006 and we forecast that it will grow to $135.5 billion in 2009, representing a compound annual growth rate of 11.2%. In 2006, we generated $1.6 billion in revenue, an increase of 32.4% from 2005, and shipped six million LCD monitors, an increase of 81.1% from 2005. According to DisplaySearch, we were ranked sixth worldwide in 2006 in total LCD monitor shipments, and our shipments grew faster than those of competitors ranked above us. According to a March 2007 IDC report, U.S. consumers considered us the top brand in terms of future purchases of LCD monitors and we are leveraging this brand recognition into LCD TVs and other display products.

Industry background

Several dynamics are leading to the overall increase in demand for high quality visual displays:

- •

- Digitization of media content including television, music, movies, games and photographs;

- •

- Need for form factor that optimizes space and power and maximizes productivity and efficiency; and

- •

- Proliferation of multimedia enterprise applications, many of which are best viewed in a widescreen format.

The demand for better desktop monitors continues to be driven by a replacement cycle during which older cathode ray tube, or CRT, and LCD monitors are displaced by newer high performance LCD monitors. The affordability of high quality LCD monitors has reached a level

1

where mass market deployment is taking place. The majority of end user customers view their PC system decisions as unbundled component purchases, driving the opportunity for stand alone monitor companies.

The demand for high quality TV displays is primarily driven by increasing content in HD video and media formats as well as upcoming government mandated deadlines for the conversion of analog to digital transmission. These factors, coupled with attractive prices, higher picture quality and useful life, and form factors small enough for use throughout the home, drive demand for LCD TVs as the technology of choice.

We believe the following factors have enabled us to successfully address the opportunities presented by the LCD display market:

- •

- The broad availability of emerging technologies and significant investments in infrastructure continuing to reduce the price of LCD units;

- •

- Outsourcing of manufacturing and assembly allowing for increased focus on product development; and

- •

- More efficient and diversified channels broadening access to end user customers.

These changing market dynamics are creating a strong demand among consumers and commercial end users for high quality desktop monitors, TVs and other display products.

Our solutions

Our solutions consist of high quality, innovative and visually appealing display products. We believe that our business model places us closer to the supply chain and global distribution channels giving us visibility to recognize trends in the market, quickly address the ever changing needs of our end user customers and bring products to market faster than our competition. We sell our display products within the following broad categories:

LCD monitors: We offer a comprehensive assortment of high performance and quality LCD monitors with various product lines targeted at consumer and commercial end user customers.

LCD televisions: We offer a full portfolio of LCD TVs across all major size categories, providing consumers value priced products with leading technology and high performance.

Other display products:

- •

- Digital signage displays for interactive marketing and messaging solutions commonly utilized in airports, hotels and retail and other locations; and

- •

- LCD and digital light processing projectors.

Our strengths

We believe our key strengths include:

- •

- Strong global brand name. The ViewSonic logo indicates to end user customers that our products meet our strict standards of reliability and deliver a high quality visual display experience.

2

- •

- Superior product performance. Our display products are created to have a visually appealing design and to provide superior picture quality.

- •

- Long operating history and deep market knowledge. Our 20 years of operating history gives us the depth of experience to understand the global display market and its various product and supply cycles.

- •

- Significant scale and focus on efficiency. Our significant scale allows us to leverage our large purchasing power with suppliers and effectively weather product cycles.

- •

- Global company with strong and diverse sales channel relationships. We have extensive relationships across channel partners who sell to a variety of end user customers.

Our strategy

Key elements of our strategy include the following:

- •

- Continue to expand globally and penetrate new markets and channels;

- •

- Leverage our success in the LCD monitor market into developing leading LCD TVs;

- •

- Deliver market leading and innovative products;

- •

- Continue to drive efficiency in our operating model; and

- •

- Enhance the global ViewSonic brand within the channel and with end user customers.

Corporate information

We were incorporated in the State of California as an S corporation in July 1987 and reincorporated in the State of Delaware as an S corporation in August 1998. In April 1999, we elected to convert from an S corporation to a C corporation. The address of our principal executive office is 381 Brea Canyon Road Walnut, CA 91789, and our telephone number is (909) 444-8888. Our website address is www.viewsonic.com. We do not incorporate the information on our website into this prospectus, and you should not consider it part of this prospectus. As used in this prospectus, references to "ViewSonic," "our," "us" and "we" refer to ViewSonic Corporation unless the context requires otherwise.

Our registered trademarks, among others, include ViewSonic®, ViewSonic's distinctive three bird logo, product names such as Optiquest® and corporate taglines such as See the Difference®. All other trademarks, trade names and service marks appearing in this prospectus are the property of their respective owners.

3

| Common stock offered by ViewSonic | shares | |

Common stock offered by selling stockholders | shares | |

Common stock to be outstanding after this offering | shares | |

Use of proceeds | To support sales and marketing activities and fund working capital and other general corporate purposes. | |

Over-allotment option | We have granted the underwriters a 30-day option to purchase up to shares of common stock to cover over-allotments, if any, and the selling stockholders have granted the underwriters a 30-day option to purchase up to shares of common stock to cover over-allotments, if any. | |

Proposed Nasdaq Global Market symbol | VIEW |

The number of shares of common stock that will be outstanding immediately after this offering is based on 357,894,666 shares of common stock outstanding as of March 31, 2007 and excludes:

- •

- 30,041,990 shares of common stock issuable upon the exercise of outstanding options with a weighted average exercise price of $0.42 per share; and

- •

- 12,344,299 additional shares of common stock reserved for future issuance under our 2004 Equity Incentive Plan.

In April 2007, a former vendor returned 3,000,000 shares of our common stock to us pursuant to a settlement agreement.

Except as otherwise indicated, all information in this prospectus assumes:

- •

- a -for- reverse stock split of our common stock and preferred stock to be effected prior to the closing of this offering;

- •

- the conversion of all our outstanding shares of preferred stock into 3,300,000 shares of common stock prior to the closing of this offering;

- •

- the filing of our amended and restated certificate of incorporation, which will occur immediately prior to the closing of this offering; and

- •

- no exercise of the underwriters' over-allotment option.

4

Summary consolidated financial data

The following table summarizes our consolidated financial data. We have derived the following summary of our consolidated statements of operations data for the years ended December 31, 2004, 2005 and 2006 from our audited consolidated financial statements appearing elsewhere in this prospectus. The consolidated statement of operations data for the three months ended March 31, 2006 and 2007 and consolidated balance sheet data as of March 31, 2007 have been derived from our unaudited financial statements appearing elsewhere in this prospectus. Our historical results are not necessarily indicative of the results that may be expected in the future and the results for the three months ended March 31, 2007 are not necessarily indicative of results to be expected for the full year. The summary of our consolidated financial data set forth below should be read together with our financial statements and the related notes to those statements, as well as "Management's discussion and analysis of financial condition and results of operations," appearing elsewhere in this prospectus.

| | Years ended December 31, | Three months ended March 31, | ||||||||||||||||

|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|

| (in thousands, except per share data) | 2004 | 2005 | 2006 | 2006 | 2007 | |||||||||||||

| Consolidated statements of operations data: | ||||||||||||||||||

| Net sales | $ | 1,104,333 | $ | 1,200,190 | $ | 1,589,090 | $ | 326,794 | $ | 409,838 | ||||||||

| Cost of sales | 1,003,960 | 1,085,011 | 1,444,905 | 296,578 | 376,490 | |||||||||||||

| Gross profit | 100,373 | 115,179 | 144,185 | 30,216 | 33,348 | |||||||||||||

| Selling, general and administrative expenses | 117,338 | 105,349 | 120,606 | 26,907 | 29,044 | |||||||||||||

| Income (loss) from operations | (16,965 | ) | 9,830 | 23,579 | 3,309 | 4,304 | ||||||||||||

| Other income (expense): | ||||||||||||||||||

| Interest income (expense), net | (1,291 | ) | 287 | (198 | ) | 157 | (164 | ) | ||||||||||

| Other income (expense), net | 2,542 | (4,266 | ) | 3,764 | 1,336 | 174 | ||||||||||||

| Total other income (expense), net | 1,251 | (3,979 | ) | 3,566 | 1,493 | 10 | ||||||||||||

| Income (loss) from continuing operations before income taxes | (15,714 | ) | 5,851 | 27,145 | 4,802 | 4,314 | ||||||||||||

| Provision (benefit) for income taxes | (3,293 | ) | 14,659 | 2,954 | 1,226 | 344 | ||||||||||||

| Income (loss) from continuing operations | (12,421 | ) | (8,808 | ) | 24,191 | 3,576 | 3,970 | |||||||||||

| Loss from discontinued operations(1) | (5,989 | ) | — | — | — | — | ||||||||||||

| Net gain on disposal of discontinued operations(1) | 2,153 | 475 | — | — | — | |||||||||||||

| Net income (loss) | (16,257 | ) | (8,333 | ) | 24,191 | 3,576 | 3,970 | |||||||||||

| Preferred stock accretion | (1,372 | ) | (1,524 | ) | (48 | ) | (48 | ) | — | |||||||||

| Net income (loss) available to common stockholders | $ | (17,629 | ) | $ | (9,857 | ) | $ | 24,143 | $ | 3,528 | $ | 3,970 | ||||||

| Basic earnings (loss) per share: | ||||||||||||||||||

| Continuing operations | $ | (0.04 | ) | $ | (0.03 | ) | $ | 0.07 | $ | 0.01 | $ | 0.01 | ||||||

| Discontinued operations | (0.02 | ) | — | — | — | — | ||||||||||||

| Gain on disposal of discontinued operations | 0.01 | — | — | — | — | |||||||||||||

| Total basic earnings (loss) per share | $ | (0.05 | ) | $ | (0.03 | ) | $ | 0.07 | $ | 0.01 | $ | 0.01 | ||||||

| Diluted earnings (loss) per share | ||||||||||||||||||

| Continued operations | $ | (0.04 | ) | $ | (0.03 | ) | $ | 0.07 | $ | 0.01 | $ | 0.01 | ||||||

| Discontinued operations | (0.02 | ) | — | — | — | — | ||||||||||||

| Gain on disposal of discontinued operations | 0.01 | — | — | — | — | |||||||||||||

| Total diluted earnings (loss) per share | $ | (0.05 | ) | $ | (0.03 | ) | $ | 0.07 | $ | 0.01 | $ | 0.01 | ||||||

| Basic weighted average shares outstanding(2) | 353,917 | 353,969 | 354,279 | 354,059 | 354,595 | |||||||||||||

| Diluted weighted average shares outstanding(2) | 353,917 | 353,969 | 360,432 | 360,764 | 360,993 | |||||||||||||

5

| | As of March 31, 2007 | |||||

|---|---|---|---|---|---|---|

| (in thousands) | Actual | Pro forma as adjusted(3) | ||||

| Consolidated balance sheet data: | ||||||

| Cash and cash equivalents | $ | 33,906 | $ | |||

| Total assets | 569,615 | |||||

| Long-term debt, net of current portion | 43,000 | |||||

| Total stockholders' equity | 67,743 | |||||

- (1)

- The operations of two of our majority-owned subsidiaries were discontinued during 2004. See note 16 of the notes to our audited consolidated financial statements appearing elsewhere in this prospectus.

- (2)

- Please see note 15 to the notes to our audited consolidated financial statements appearing elsewhere in this prospectus for an explanation of the method used to calculate basic and diluted net loss per common share and pro forma basic and diluted net loss per common share.

- (3)

- The consolidated balance sheet data on a pro forma as adjusted basis gives effect to the automatic conversion of all outstanding shares of our convertible preferred stock into common stock upon the closing of this offering and reflects the sale of shares of our common stock by us in this offering at an assumed initial public offering price of $ per share, after deducting underwriting discounts and commissions and estimated offering expenses payable by us. We will not receive any proceeds from the sale of shares of common stock by the selling stockholders. Each $1.00 increase (decrease) in the assumed initial public offering price of $ per share would increase (decrease) each of cash and cash equivalents, working capital, total assets and total stockholders' equity by approximately $ million, assuming that the number of shares offered by us, as set forth on the cover page of this prospectus, remains the same, and after deducting underwriting discounts and commissions and estimated offering expenses payable by us. We may also increase or decrease the number of shares we are offering. Each increase (decrease) of one million shares in the number of shares offered by us would increase (decrease) each of cash and cash equivalents, working capital, total assets and total stockholders' equity by approximately $ million assuming that the assumed initial public offering price remains the same, and after deducting underwriting discounts and commissions and estimated offering expenses payable by us. The pro forma as adjusted information discussed above is illustrative only and will change based on the actual initial public offering price and other terms of this offering determined at pricing.

6

An investment in our common stock involves a high degree of risk. You should carefully consider the following risks, as well as all of the other information contained in this prospectus, before investing in our common stock. If any of the following possible events actually occurs, our business, business prospects, cash flow, results of operations or financial condition could be harmed. In this case, the trading price of our common stock could decline, and you might lose all or part of your investment in our common stock. In assessing these risks, you should also refer to the other information contained in this prospectus, including our consolidated financial statements and related notes. Additional risks and uncertainties not presently known to us or that we currently deem immaterial may also harm our business.

Risks related to our business

Our revenue and profitability are likely to fluctuate from period to period and are often difficult to predict for particular periods due to factors beyond our control. If we are unable to sustain our growth rate or manage any future growth effectively our financial results could suffer and our stock price could decline.

We have experienced significant growth in a short period of time. Our revenues increased from $1.2 billion in 2005 to $1.6 billion in 2006 and we may not achieve similar or any growth in future periods. You should not rely on our operating results for any prior quarterly or annual periods as an indication of our future operating performance. If we are unable to achieve future levels of revenue or operating income as anticipated by investors or analysts, our stock price could decline.

Our results of operations for any quarter or year are not necessarily indicative of results to be expected in future periods. Our operating results have historically been, and are expected to continue to be, subject to quarterly and yearly fluctuations as a result of a number of factors, including:

- •

- The introduction and market acceptance of new technologies or products by us or our competitors;

- •

- Variations in product costs and the mix of regional contribution and products sold;

- •

- Adverse changes in the supply of components such as LCD panels, including oversupply and undersupply;

- •

- The size and timing of product orders, which, in turn, will often depend upon the success of our distributors and resellers, business or specific products;

- •

- Changes in our pricing policies or those of our competitors;

- •

- Adverse changes in the conditions in the markets for display products;

- •

- The size and timing of capital expenditures by commercial end user customers;

- •

- Our inventory practices and those of our distributors and resellers;

- •

- The level of returns or price protection we experience in a given period;

7

- •

- Conditions in the broader markets for information technology;

- •

- Adverse changes in the credit quality of our customers and suppliers;

- •

- The impact of acquired businesses and technologies; and

- •

- Changes in the terms of our contracts with our customers or suppliers.

These factors could harm our business and operating results.

We derive a large percentage of our revenue from sales of LCD monitors and any decline in demand for these products could harm our ability to generate revenue.

We derive a large percentage of our revenue from sales of LCD monitors. As a result, we are particularly vulnerable to fluctuations in demand for these products, whether as a result of consumer preferences, market demand, competition, product obsolescence, technological change, budget constraints of consumers or other factors. If our revenue derived from sales of LCD monitors were to decline significantly, our business and operating results would be adversely affected. Replacement of older CRT monitors with LCD monitors has been one of the factors driving our sales of LCD monitors, and as such replacement becomes largely complete our sales could be harmed.

The market for LCD monitors has historically experienced significant shifts in production capacity and LCD panel pricing caused by suppliers entering or leaving the market or increasing capacity for certain panel sizes. Demand patterns also vary seasonally and geographically based on consumer demand, product pricing and other factors. We are also subject to competition from competing display technologies as well as emerging or future display technologies. The success of competing display technologies could substantially reduce the demand for our LCD monitors.

Our industry is highly competitive and price competition may significantly reduce our revenues and profits.

Competitive factors in the LCD display industry include product features, price, product quality, breadth and reliability, price and performance characteristics, end user support, marketing and channel capability as well as corporate reputation and brand strength. We have substantial experience competing in the LCD monitor market. However, we are a new entrant to the LCD TV market and, therefore, we are just beginning to establish our competitive position. We believe that competition will have the effect of continually reducing the average selling price, or ASP, of our products over time. The average selling price, or ASP, of our LCD monitors declined 20.9% in the first quarter of 2007 compared to the first quarter of 2006 and declined 21.7% in 2006 compared to 2005. We expect price competition to increase in future periods and such price competition may significantly reduce our revenues and gross margins in future periods.

The display provider industry has low barriers to entry and we expect new competitors to emerge. In the LCD monitor market and other commercial product markets we compete with PC manufacturers and other branded display companies. In the LCD TV market we compete with traditional TV manufacturers and established consumer electronic companies, as well as more recent entrants to the branded LCD TV market. In contrast, in the manufacturing and development portion of the display provider industry, the need to make significant capital

8

equipment and research and development expenditures has caused higher barriers to entry. A significant increase in the number of display providers coupled with a relatively fixed number of suppliers could result in increased supply costs or diminished capacity, both of which could harm our business.

Some of our competitors have substantially longer operating histories, greater assets and name recognition, as well as greater financial, marketing, technical and other resources, than we do. Due to vertical integration and other factors, some of our competitors may have lower operating costs than we do. These advantages may allow our competitors to, among other things: undertake more extensive marketing initiatives, implement and sustain more aggressive pricing, obtain more favorable pricing or allocations from suppliers or cross subsidize their display operations from their other operations. Consequently, our products may not remain competitive relative to those of our competitors. To the extent we are unable to effectively compete against our competitors for any of these reasons or otherwise, our business would be harmed.

The ASP of our products typically decreases over the life of the product, which can negatively affect our gross margin.

The markets in which we compete are subject to technological advances with frequent new product releases and price competition. As a result, the price at which we can sell our products typically declines over the life of the products. The ASPs of our LCD monitors decreased 21.7% in 2006 compared to 2005 and declined 20.9% in the first quarter of 2007 compared to the first quarter of 2006. These decreases were primarily due to increased production capacities of LCD panel manufacturers, aggressive price competition and product mix. In recent years, the decline in the ASP for LCD monitors has been faster than the decline in our product-sourcing costs and this has resulted in decreased margins. If ASPs continue to decline, our revenue and gross margins could decline.

In order to prevent excessive erosion of our gross margins, we need to continually manage our product costs and our inventory. To manage product costs, we must collaborate with our contract manufacturers to engineer the most cost-effective design for our products. In addition, we must carefully manage the price paid for components used in our products, as well as our freight and inventory holding costs. We also need to continually introduce new products with more attractive sales prices and gross margins in order to maintain our overall gross margins. We may not be able to reduce our product costs when there is a shortage of key components or when component prices otherwise rise. If we are unable to manage the cost of older products or successfully introduce new products with higher gross margins, our net sales will decrease and our gross margins will decline to an even greater degree than we have experienced in the past.

We seek to mitigate the risk of declining ASPs by obtaining promotional pricing incentives from our contract manufacturers. A supplier's willingness to give us a pricing incentive and the amount of the pricing incentive are typically based on the competitiveness of the market, the volatility of the price of our key product components and the quantity of historical purchases of these components from suppliers. Pricing incentives generally do not require us to commit to future component purchases from suppliers. We record the reimbursement from our vendors for these promotional pricing incentives when we are released by the supplier from legal liability for the payment of the product purchases. If we are unable to obtain promotional

9

pricing incentives or if these incentives are discontinued, our gross margins may decline and our business could be harmed.

Our operating expenses are relatively fixed and we may have limited ability to reduce expenses quickly in response to any revenue shortfalls or declines in product demand.

Our operating costs are relatively fixed and we can adjust them downward only over a period of several quarters. As we typically recognize a substantial portion of our revenues in the last month of each quarter, we may not be able to adjust our variable operating expenses in a timely manner in response to any revenue shortfalls. Our inability to reduce operating expenses quickly in response to revenue shortfalls or declines in product demand would negatively impact our financial results.

The market for our products historically has experienced seasonal shifts in demand due to changes in buying patterns by our customers. Buying patterns vary geographically, and the impact on our operating results in a given period may vary depending on our actual or anticipated level of activity in the relevant region. We tend to experience higher net sales in the second half of the year due to a strong buying season by distributors and resellers attributable to the holiday season in the Americas. Our seasonality is moderated through slightly different seasonal variations in our three regions.

If we are unable to license third-party technology our ability to offer competitive products could be harmed and our cost of sales could increase.

We have no patented technology. We rely on third parties to obtain non-exclusive software license rights to technologies that are incorporated into and necessary for the operation and functionality of our products. We also license technology necessary to comply with various data compression, broadcast and wireless standards. Because the intellectual property we license is available from third parties, barriers to entry for our competitors are lower than if we owned exclusive rights to the technology we license and use or if we had separately developed patented technology. In some cases, the owners of the intellectual property that we license routinely license the same intellectual property to our competitors. If a competitor enters into an exclusive arrangement with any of our third-party technology providers, our ability to develop and sell products containing that technology could be severely limited. Our licenses often require royalty payments or other consideration to third parties. Our success will depend in part on our continued ability to have access to these technologies on commercially reasonable terms. If we are unable to license the necessary technology, we may be forced to acquire or develop alternative technologies of lower quality or performance standards. This could limit and delay our ability to offer competitive products and increase our costs of production. As a result, our gross margins, market share and operating results could be harmed.

Intellectual property litigation and infringement claims could cause us to incur significant expenses or prevent us from selling our products.

Many of our products are designed to include software or other intellectual property we non-exclusively license from third parties. Competitors' protected technologies may be unavailable to us or be made available to us only on unfavorable terms and conditions. It may be necessary in the future to seek or renew licenses relating to various aspects of our products. We may not be able to obtain or renew from third parties the licenses that we need on

10

commercially reasonable terms, or at all. There are a large number of patents in our field and new patents issue frequently. We do not attempt to determine in advance whether a product or any of its components infringe the patent rights of others.

We frequently receive claims alleging infringement of patents or other intellectual property rights and expect to continue to receive such claims. We are currently involved in several such proceedings. Many cases involve multiple products and multiple providers as defendants. In other cases we may and have been the only defendant. Pursuant to our agreements with our suppliers and manufacturers, we generally seek indemnification in connection with such claims, but such indemnification is not available in all cases and we may only partially recover the costs we incur in defending such claims. In addition, we regularly enter into distribution agreements that include indemnification provisions under which we could be subject to costs and/or damages in the event of an infringement claim against us or an indemnified third party and which could harm our business. Any claim of infringement by a third party, even one without merit, could cause us to incur substantial costs defending against such claim and could distract our management from running our business. Furthermore, a party making such a claim, if successful, could secure a judgment that requires us to pay substantial damages. A judgment could also include a permanent injunction or other court order that would prevent us from offering one or more products. In addition, we might be required to seek a license for the use of such intellectual property, which may not be available on commercially reasonable terms, or at all. Alternatively, we may be required to develop or obtain access to non-infringing technology, which would require significant effort and expense and may ultimately be unsuccessful. Additionally, in recent years individuals and groups have begun purchasing intellectual property assets for the sole purpose of making claims of infringement and attempting to extract settlements from target companies. Any of these events could harm our business.

We order components and tooling in advance of anticipated customer demand. If we are unable to correctly predict fluctuations in component supply and demand, our business will be harmed.

Substantially all of our sales are made on the basis of purchase orders rather than long-term agreements. As a result, we generally commit to purchase products without having received advance purchase commitments from our distributors and resellers. Our inventory purchases are made based upon future demand forecasts. These forecasts are based upon assumptions about future product demand that may prove to be inaccurate. Because we typically need sufficient lead-time in purchasing our products, we may not be able to reduce our purchase commitments in a timely manner in response to any reductions in our forecasts or in the level of purchase orders from distributors or resellers. In addition, the LCD display industry is characterized by rapidly fluctuating supply levels and pricing due to changes in production capacity, seasonality, purchasing levels by large suppliers and other factors. If we are unable to accurately predict or adapt to changes in LCD pricing, supply or demand, we may purchase an excess of materials at a high price or fail to purchase sufficient materials at a low price. If there is a higher incidence of inventory obsolescence of LCD panels or other product components, rapidly changing technology and customer requirements or an increase of the supply of products in the marketplace, we could be subject to excess or obsolete inventories or under-utilized tooling. If any of these events occur, we could be required to take corresponding

11

inventory write-downs or tooling write-offs, which would impair our financial results and our gross margins.

If we do not effectively manage and predict our sales channel inventory and product mix, we may incur inventory write downs or lose sales from having too few products or the wrong mix of products.

If we are unable to properly monitor, control and manage our sales channel inventory and maintain an appropriate level and mix of products with our distributors and resellers and within our sales channels, we may incur increased and unexpected costs associated with our inventory. We must manage inventory held by our distributors and resellers because inventory held by them could result in excessive returns and lower our future revenue and gross margin. Distributors and resellers may increase orders during periods of product shortages in order to ensure adequate allocation, cancel orders if their inventory is too high or delay orders in anticipation of new products. They may also adjust orders based on competitor product introductions and incentives and seasonal buying patterns. Further, our distributors and resellers sell our competitors' products as well as ours and may have an incentive to exercise greater efforts to sell our competitors' products. We generally allow distributors and resellers to return a limited amount of our products in exchange for other products. Under our price protection policy, subject to certain conditions, if we reduce the list price of a product, we issue a credit in an amount equal to the reduction for each of the products held in inventory by our distributors and resellers. If our distributors and resellers are unable to sell their inventory in a timely manner, we may lower the price of the products, or these parties may exchange the products for newer products. If demand for our products falls, we could have excess inventory and be unable to sell such excess inventory in a timely manner and may need to reduce the prices on our products or, alternatively, we could end up with too few products and be unable to satisfy demand. If these events occur, we could incur increased expenses associated with writing off excessive or obsolete inventory or lose sales.

If we are unable to effectively manage our component and material requirements among our third-party component suppliers and contract manufacturers, we may experience delays in the manufacturing of our products and the costs of our products may increase.

We provide our third-party component suppliers and contract manufacturers with a rolling forecast of demand, which they use to determine their material and component requirements. Lead times for ordering materials and components vary significantly and depend on various factors, such as the specific supplier, contract terms and demand and supply for a component at a given time. Although the cost of key components tends to vary inversely with the supply of these components, conditions of over-supply can still be associated with higher costs and conditions of shortage can still be associated with lower costs. Some of our components have long lead times. Regardless of the accuracy of our forecasts, our contract manufacturers may be unable to meet our product timing, volume and price requirements. Alternatively, our contract manufacturers may be unable to utilize the components they have purchased. The cost of the components used in our products tends to drop rapidly as volumes increase and the technologies mature. Therefore, if our contract manufacturers are unable to promptly use components purchased on our behalf, our cost of producing products may be higher than that of our competitors, due to an over-supply of higher-priced components. If they are unable to use certain components, we may need to reimburse them for any losses they incur.

12

Our implementation of strategic initiatives may strain our operations and increase our operating expense.

We have implemented strategic initiatives designed to focus our resources on improving supply chain and logistics efficiency, simplifying our business processes to maximize operating efficiencies, growing sales in regional markets and expanding core product offerings. We will continue to explore additional opportunities to improve operating efficiencies. The undertaking of these initiatives may strain our existing management, information systems, employee workforce, operational capability and financial controls or may adversely affect our ability to effectively work with suppliers, contract manufacturers, distributors or resellers. If we fail to successfully implement these initiatives or encounter unexpected difficulties during their implementation, we may not be successful in reducing costs, or we may adversely impact our ability to increase product offerings and increase revenues, in either case harming our business.

We are subject to risks associated with our worldwide operations, which may harm our business.

We generated 62% of our total consolidated net sales from customers outside of the United States in the first quarter of 2007 and 64% in 2006. Sales to customers outside the United States subject us to a number of risks associated with conducting business internationally including the following:

- •

- International economic and political conditions;

- •

- Changes in, or impositions of, legislative or regulatory requirements;

- •

- Duties, tariffs or other barriers to trade;

- •

- Delays or additional costs resulting from the need for permits or export licenses for certain technology;

- •

- Exchange controls or changes in exchange rates which could make our products more expensive;

- •

- Tax laws, regulations and treaties, including U.S. taxes on foreign operations and repatriation of funds;

- •

- Longer payment cycles for sales in foreign countries and difficulties in collecting accounts receivable; and

- •

- Additional burdens in complying with a variety of foreign laws.

Any one of the foregoing factors could cause our business, operating results and financial condition to suffer.

We have recently implemented an international structure designed to reflect our global operations and address the various tax regimes in which we operate. Future changes in international and U.S. tax laws, regulations and treaties, or the failure of our international structure to operate or be treated as expected, could increase our effective tax rate and result in additional tax liabilities.

13

Our operating results may be harmed by fluctuations in foreign currency exchange rates.

Historically, sales of our products have benefited from effects of the weakening U.S. dollar, which make our products more affordable in several markets. We buy a majority of our products from our suppliers in U.S. dollars and sell a significant amount of our products in other foreign currencies. However, in periods of a strengthening U.S. dollar, our revenues measured in U.S. dollars are negatively impacted, while our cost of sales remains fairly constant, resulting in lower gross profit. In addition, we must manage our account receivables and inventory balances in order to limit our foreign currency exposure to a strengthening U.S. dollar.

Hedging foreign currencies can be difficult, especially if the currency is not freely traded. We do not currently engage in any hedging transactions and we cannot predict the impact of future exchange rate fluctuations on our operating results.

If disruptions in our transportation network occur or our shipping costs substantially increase, our operating expense could increase and our financial results could be negatively impacted.

We are highly dependent upon the transportation systems we use to ship our products, including surface, ocean and airfreight and on the operations of the Port of Los Angeles. Our attempt to closely match our inventory levels to our product demand intensifies the need for our transportation systems to function effectively and without delay. The transportation network is subject to disruption from a variety of causes, including labor disputes or port strikes, acts of war or terrorism and natural disasters. If our delivery times increase unexpectedly due to these or any other reasons, our inability to deliver products on time could result in delayed or lost revenue. In addition, our transportation costs will likely continue to increase due to increased fuel prices. A prolonged transportation disruption or a significant increase in the cost of freight could severely disrupt our business and harm our operating results.

If we do not succeed in executing our growth strategies in our target international markets, our revenues may not increase.

Our strategies include further expansion of our business in international markets in which we currently operate, including Brazil, China, India, Russia and Eastern Europe. In many of these markets, we face barriers in the form of long-standing relationships between our potential customers and their local suppliers, as well as protective regulations. In addition, pursuing international growth opportunities may require us to make significant investments long before we realize returns on the investments, if any. Increased investments may result in expenses growing at a faster rate than revenues. Our overseas investments in current and targeted international markets could be adversely affected by:

- •

- Reversals or delays in the opening of foreign markets to new participants;

- •

- Economic instability, such as higher interest rates and inflation, which could reduce our customers' ability to obtain financing for consumer electronics or which could make our products more expensive in those countries;

- •

- Difficulties hiring and retaining employees;

- •

- Employment and severance issues, including possible employee turnover or labor unrest;

14

- •

- Restrictions on foreign investment or the repatriation of profits or invested capital;

- •

- Nationalization of local industries;

- •

- Changes in export or import restrictions, duties and tariffs;

- •

- Transportation delays or interruptions and other effects of less developed infrastructures;

- •

- Potential loss of proprietary information as a result of piracy, misappropriation or laws that may be less protective of our intellectual property rights than those in the United States;

- •

- Difficulties in coordinating the activities of our geographically dispersed and culturally diverse operations;

- •

- Changes in the tax system or rate of taxation in the countries where we do business; and

- •

- Economic, social, political and perceived or actual health risks.

For example, in the fourth quarter of 2005, Russia, unexpectedly, temporarily prohibited and then delayed the importation of LCD and CRT monitors resulting in lost sales and inventory write-downs.

In addition, difficulties in international financial markets and economies, particularly in emerging markets, could adversely affect demand from customers in the affected countries. Because of these factors, we may not succeed in expanding our business in international markets. This could hurt our business growth prospects and results of operations.

If we fail to maintain and/or expand our sales channels, our revenue may decline.

To maintain and grow our market share, sales and brand, we must maintain and expand our sales channels. We currently sell our products through distributors and resellers. We have no minimum purchase commitments or long-term contracts with any of these third parties. Our agreements are generally non-exclusive and generally may be terminated by either party, at its discretion, with 30 days notice.

Retailers have limited shelf space and promotional budgets, and competition is intense for these resources. A competitor with more extensive product lines and stronger brand identity may have greater bargaining power with these retailers. The competition for retail shelf space is expected to increase, which will require us to increase our marketing expenditures to maintain current levels of retail shelf space. As we are a relatively new entrant to the LCD TV market, we must also convince retailers of the value of our offerings for the LCD TV market. If we fail to secure retail shelf space for our LCD TVs we will lose sales of such products to our competitors, as most LCD TVs are sold through this channel.

We must also continuously monitor and evaluate emerging sales channels. If we fail to establish a presence in an important developing sales channel, our business could be harmed. If we are unable to establish relationships in emerging sales channels, our sales could decline and we would lose market share.

15

We rely on a limited number of distributors and resellers for most of our sales, and changes in price, purchasing or return patterns and failure to maintain or establish new distributor and reseller relationships in existing and new sales channels could lower our revenue or gross margins.

We sell our products through distributors such as Ingram Micro Inc., Tech Data Corporation and SYNNEX Corporation, and resellers, such as solution providers, value added resellers, traditional retailers and Internet retailers. We expect that a majority of our net sales will continue to come from sales to a relatively small number of customers for the foreseeable future. Ingram Micro Inc. represented 11% of total consolidated net sales in 2006 and Tech Data Corporation has represented more than 10% of total consolidated net sales in prior years. We have no minimum purchase commitments or long-term contracts with any of our distributors or resellers. Our distributors and resellers could decide at any time to discontinue, decrease or delay their purchases of our products.

In addition, the prices that distributors and resellers pay for our products are subject to negotiation and change frequently. If any of our major distributors or resellers change their purchasing patterns or refuse to pay the prices that we set for our products, our net sales and operating results could be negatively impacted. If our distributors and resellers increase the size of their product orders without sufficient lead time for us to process the order, our ability to fulfill product demand would be compromised. In addition, because our accounts receivable are concentrated within a small group of distributors and resellers, the failure of any of them to pay on a timely basis, or at all, would reduce our cash flow.

We generally recognize revenue to distributors and resellers when risk of loss is transferred to such third party. To the extent that return rates from our customers or price protection exceed historical averages, revenues from future periods will be reduced.

We depend on a limited number of third-party component suppliers and contract manufacturers for the manufacture of our products. If these third parties experience any delay, disruption or quality control problems in their operations, we could lose market share and revenues, and our reputation may be harmed.

All of our products are manufactured, assembled, tested and packaged by contract manufacturers, as we have no manufacturing or testing facilities. We rely on component suppliers and contract manufacturers to procure components and, in some cases, subcontract engineering work. There are a limited number of manufacturers of LCD panels, and we do not expect this number to increase significantly. Some of our products are manufactured by a single contract manufacturer. Our component suppliers and contract manufacturers are primarily located in mainland China, Taiwan and Thailand and may be subject to disruption by earthquakes, typhoons and other natural disasters, epidemics, pandemics, as well as political, social or economic instability. We do not have any long-term contracts with any of these third-party component suppliers and contract manufacturers. Product pricing is generally negotiated on an order-by-order basis. Our contracts with our component suppliers and contract manufacturers, including those contracts containing provisions that may be materially favorable to us, are generally terminable for any reason and by either party with 90 days notice. If our component suppliers and contract manufacturers encounter financial or other business difficulties, if their strategic objectives change, or if they perceive us to no longer be an attractive customer, they may no longer assist us in our product development efforts, and our business could be harmed.

16

The loss of the services provided by any of our primary contract manufacturers or a change in material terms could cause a significant disruption in operations, delays in product shipments and an adverse impact on our cash flow. Qualifying a new contract manufacturer and commencing volume production is expensive and time consuming.

Our reliance on third-party component suppliers and contract manufacturers also exposes us to the following risks over which we have limited or no control:

- •

- Inability to procure key required components for our finished products to meet customer demand;

- •

- Loss of access to capacity from one or more panel manufacturers or increased competition if such manufacturers elect to directly provide display devices to distributors, resellers or in other markets.

- •

- Unexpected increases in manufacturing and repair costs;

- •

- Unexpected reductions in payment terms;

- •

- Interruptions in shipments if one of our manufacturers is unable to complete production or experiences delays;

- •

- Inability to control the quality of finished products;

- •

- Inability to control delivery schedules;

- •

- Inability to obtain favorable pricing;

- •

- Unpredictability of manufacturing yields; and

- •

- Potential lack of adequate capacity to manufacture all or some of the products we require.

If our new products fail to achieve broad market acceptance on a timely basis we will not be able to compete effectively and we will be unable to increase or maintain net sales and gross margins.

We operate in a highly competitive, quickly changing environment. We are dependent upon sufficient demand and broad market acceptance for LCD display products. Our future success depends on our ability to develop and introduce new products and product enhancements that achieve broad market acceptance in the business and home markets. Our future success will depend in large part upon our ability to:

- •

- Identify demand trends in the business and home display markets and quickly develop, manufacture and sell products that satisfy these demands;

- •

- Manage our cost structure to enable us to bring new products to market at competitive prices;

- •

- Respond effectively to new product announcements from our competitors by designing competitive products, either internally or through the use of third parties;

- •

- Provide compatibility and interoperability of our products with products offered by other vendors and new technologies as they emerge;

17

- •

- Efficiently access the display technology needed for our products to have broad market acceptance and respond rapidly to shifts in the display technology towards new or different display technologies;

- •

- Manage our product offerings either as stand-alone products or in combination with other products or services, or in some other manner; and

- •

- Respond effectively to unexpected shifts in market demand towards display and PC products sold together under the same brand or away from stand-alone displays.

If a different or new display technology other than LCD achieves broad market acceptance and we are unable to shift to this new or different display technology, our business could be harmed.

Most of our revenue is currently derived from the sale of products utilizing LCD display technology. Different technologies are also currently available and these include plasma, Liquid Crystal on Silicon and Organic Light Emitting Diode. New display technologies are under development and may be commercialized in the future. Our success will depend in part on our continued ability to offer products utilizing a display technology that has broad market appeal on commercially reasonable terms. If we are unable to shift or obtain the necessary technology, we may be forced to acquire or develop alternative technology of lower quality or performance standards. This could limit and delay our ability to offer competitive products and increase our costs of production. If a different or new display technology proves to have broad market acceptance and we are unable to access or bring to market products using this new or different display technology, we could lose market share and our revenue, gross margins and operating results could be harmed.

Confidentiality agreements with employees and others may not adequately prevent disclosure of proprietary information.

We generally enter into confidentiality and invention assignment agreements with our employees and contractors, and nondisclosure agreements with our distributors, resellers, suppliers and contract manufacturers to limit access to, and disclosure of, our proprietary information. These agreements may not effectively prevent disclosure of confidential information and may not provide an adequate remedy in the event of unauthorized disclosure of confidential information. In addition, others may independently discover our trade secrets and proprietary information, and in such cases we could not assert any trade secret rights against such party. Costly and time consuming litigation could be necessary to enforce and determine the scope of our proprietary rights, and failure to obtain or maintain trade secret protection could adversely affect our competitive business position.

Our products are complex and may require modifications to resolve undetected errors or unforeseen failures, which could lead to an increase in our warranty claims and costs, a loss of customers, or a decline in market acceptance of our products.

Our products are complex and may contain undetected errors or experience unforeseen failures when first introduced or as new versions are released. These errors could cause us to incur significant warranty and re-engineering costs, divert the attention of our engineering personnel from product development efforts, and cause significant customer relations and business reputation problems. We also have received, and expect to continue to receive, claims alleging the sale by us of defective products. If we deliver products with defects, our credibility

18

and the market acceptance and sales of our future products could be harmed. Defects could also lead to liability for defective products as a result of lawsuits against us or against our distributors and resellers. We also agree to indemnify our distributors and resellers in some circumstances against liability from defects in our products. A successful product liability claim could require us to make significant damages payments.

Changes in the way we do business and volatility in our industry could require us to raise additional capital.

Although we believe that our existing cash balances, credit facilities, anticipated cash flows from operations and the net proceeds of this offering will be sufficient to meet our operating and capital requirements for at least the next 12 months, we may be required to raise additional capital through either equity or debt financing, which may not be available on favorable terms, or at all. Factors that could adversely affect our cash used or generated from operations and, as a result, our need to seek additional borrowings or capital include:

- •

- Differences between payment terms for the purchase of key components and the sale of finished products;

- •

- Need to enter into early-pay or pre-pay arrangements to secure lower pricing and capacity for key components or finished products;

- •

- Significantly decreased demand for and market acceptance of our products;

- •

- Need to make significant investments in order to successfully develop our next-generation products;

- •

- Competitive pressures resulting in lower than expected average selling prices;

- •

- Adverse changes in component pricing or payment terms with our distributors and resellers or our contract manufacturers and suppliers; or

- •

- Acquisitions of businesses or complementary technologies.

We also may require additional capital for other purposes not presently contemplated. If we are unable to obtain sufficient capital, we could be required to curtail our sales and marketing expenditures, which could harm our business. If we should require capital in excess of our current availability and if we were unable to raise additional capital, our business could be harmed.

If we fail to comply with government regulations, including those promulgated by the Federal Communications Commission, the European Union's Restriction of Certain Hazardous Substances Directive, or RoHS, and Waste Electrical and Electronic Equipment Directive, or WEEE, our business may be harmed.

We are subject to local laws and regulations in various regions in which we operate. We could become subject to liabilities as a result of a failure to comply with applicable laws and incur substantial costs from complying with existing, new, modified or more stringent requirements. For instance, in the United States we are subject to rules enforced by the Federal Communications Commission, or FCC, regarding televisions containing high-definition tuners. The FCC has notified us that importation declarations indicate that we may have violated

19

certain FCC rules with respect to the transition requirements for selling televisions containing high-definition tuners and may be subject to fines.

In the European Union, or EU, there are two particular directives, RoHS and WEEE, which we believe may have a material impact on our business. RoHS restricts the distribution of certain substances, including lead, within the EU and became effective on July 1, 2006. RoHS requires us to eliminate and/or reduce the level of specified hazardous materials from our products and requires us to maintain and publish a detailed list of all chemical substances in our products. WEEE requires us to take back and recycle all products we manufacture or import into the EU at our own expense and became effective in August 2005 for most EU countries and at varying dates thereafter for other EU countries whose implementation of the European WEEE Directive was subsequent to August 2005. The United Kingdom is the most recent country to implement the WEEE Directive and its regulations became effective in January 2007. If we fail to, or do not fully, comply with the EU directives our business may be harmed. For example,

- •

- We may be unable to procure appropriate RoHS compliant material in sufficient quantity and quality and/or be unable to incorporate it into our product procurement processes without compromising product quality and/or harming our cost structure;

- •

- We may not be able to sell non-compliant products into the EU or to any customer whose end products will be sold into the EU, which may result in reduced sales; or

- •

- We may face excess and obsolete inventory risk related to non-compliant inventory that we may continue to hold for which there is reduced demand and we may need to write down such inventory.

We depend on our founder and other executive officers, and if we are not able to retain them, our business will suffer.

James Chu, our founder, Chairman of the Board, Chief Executive Officer and majority stockholder and other executive officers, possess specialized knowledge with respect to our business and our operations. Consequently, the loss of Mr. Chu, in particular, and our other executive officers could harm our business. We do not carry key man life insurance on any of our executive officers.

Any acquisition we make could disrupt our business and harm our financial condition and operations.

We have made strategic acquisitions of businesses, technologies and other assets in the past. While we have no current agreements or commitments with respect to any acquisition, we may in the future acquire businesses, product lines or technologies. In the event of any future acquisition, we may not ultimately strengthen our competitive position or achieve our goals, or they may be viewed negatively by customers, financial markets or investors and we could:

- •

- Issue stock that would dilute our current stockholders' percentage ownership;

- •

- Incur debt and assume other liabilities; and

- •

- Incur amortization expenses related to goodwill and other intangible assets and/or incur large and immediate write-offs.

20

Acquisitions also involve numerous risks, including:

- •

- Problems integrating the acquired operations, technologies or products with our own;

- •

- Diversion of management's attention from our core business;

- •

- Assumption of unknown liabilities;

- •

- Adverse effects on existing business relationships with suppliers and customers;

- •

- Increased accounting and financial reporting compliance risk;

- •

- Risks associated with entering new markets; and

- •

- Potential loss of key employees.

We may not be able to successfully integrate any businesses, products, technologies or personnel that we might acquire in the future, which could harm our business.

Risks related to our common stock and this offering

The market price of our common stock may be highly volatile and investors may not be able to resell their shares at or above the initial public offering price.

Prior to this offering, there has not been a public market for our common stock. Although we have applied to have our common stock listed on The Nasdaq Global Market, an active trading market for our common stock may not develop or, if it develops, may not be maintained after this offering. The initial public offering price for the shares will be determined by negotiations between us and representatives of the underwriters and may not be indicative of prices that will prevail in the open market. Investors may not be able to sell their shares quickly or at the market price.

The trading price of our common stock is likely to be highly volatile and could be subject to wide fluctuations in price in response to various factors, many of which are beyond our control, including:

- •

- Actual or anticipated variations in our quarterly operating results;

- •

- New products introduced or announced by us or our competitors, and the timing of these introductions or announcements;

- •

- Actual or anticipated changes in earnings estimates or recommendations by securities analysts;

- •

- Announcements by us or our competitors of significant acquisitions, strategic partnerships, joint ventures or capital commitments;

- •

- General economic and market conditions and other factors that may be unrelated to our operating performance or the operating performance of our competitors;

- •

- Changes in market valuations of similar companies;

- •

- Sales of common stock or other securities by us or our stockholders in the future;

21

- •

- Additions or departures of management personnel; and

- •

- Trading volume of our common stock.

In addition, if the market for technology stocks or the stock market in general experiences loss of investor confidence, the trading price of our common stock could decline for reasons unrelated to our business, financial condition or operating results. The trading price of our common stock might also decline in reaction to events that affect other companies in our industry even if these events do not directly affect us. Each of these factors, among others, could harm the value of your investment in our common stock. Some companies that have had volatile market prices for their securities have had securities class action lawsuits filed against them. If a suit were filed against us, regardless of its merits or outcome, it could result in substantial costs and divert management's attention and resources from our business.

James Chu, our founder, Chairman of the Board and Chief Executive Officer, and his affiliates beneficially own a majority of our common stock and will be able to exercise significant influence over matters subject to stockholder approval.

As of March 31, 2007, James Chu, our founder, Chairman of the Board and Chief Executive Officer, together with his affiliates, beneficially owned 87.2% of our common stock and upon the closing of this offering, Mr. Chu and his affiliates will continue to beneficially own % of our outstanding common stock. Accordingly, even after this offering, Mr. Chu and his affiliates will be able to exert a significant degree of influence over our management and affairs and control matters requiring stockholder approval, including the election of our board of directors and approval of significant corporate transactions. This concentration of ownership could have the effect of delaying or preventing a change in our control or otherwise discouraging a potential acquirer from attempting to obtain control of us, which in turn could depress the market value of our common stock.

We will continue to incur significant costs as a public company, and our management will be required to devote substantial time to new compliance initiatives.

We will continue to incur significant legal, accounting and other compliance expenses following this offering. In addition, the Sarbanes-Oxley Act of 2002, as well as rules subsequently implemented by the Securities and Exchange Commission and The NASDAQ Global Market, impose various requirements on public companies, including requiring the establishment and maintenance of effective disclosure and financial controls and changes in corporate governance practices. Our management and other personnel devote a substantial amount of time to these compliance initiatives. Moreover, these rules and regulations have increased our legal and financial compliance costs and will continue to make some activities more time-consuming and costly. We expect director and officer liability insurance to be expensive, and we may be required to incur substantial costs to maintain the same or similar coverage in the future.

The Sarbanes-Oxley Act of 2002 requires, among other things, that we maintain effective internal control over financial reporting and disclosure controls and procedures. In particular, in 2007 we must perform system and process evaluation and testing of our internal control over financial reporting to allow management and our independent registered public accounting firm to report on the effectiveness of our internal control over financial reporting, as required by Section 404 of the Sarbanes-Oxley Act of 2002. If we or our independent registered public

22

accounting firm determine that we have a material weakness in our internal control over financial reporting our stock price may decline. As a result of our compliance with Section 404, we will incur substantial accounting expense and expend significant management efforts.

Future sales of our common stock in the public market could cause our stock price to decline.