Exhibit 99.1

May 20, 2005

“Safe Harbor” Statement

under the Private Securities Litigation Reform Act of 1999

The statements contained in this presentation which are not historical facts contain forward-looking information with respect to plans, projections, or future performance of Prosperity Bancshares, Inc. and its subsidiaries. Forward-looking statements, within the meaning of Section 21E of the Securities Exchange Act of 1934, may have been made in this document. Prosperity’s results may differ materially from those in the forward-looking statements for a variety of reasons, including actions of competitors; changes in laws and regulations; customer and consumer response to marketing; effectiveness of spending, investment or programs; and economic conditions. These factors, and others, are more fully described in Prosperity Bancshares, Inc.’s filings with the Securities and Exchange Commission.

Copies of Prosperity Bancshares, Inc.’s SEC filings are available over the Internet at no charge from www.freeedgar.com.

2

Prosperity is . . .. .

a Track Record of Success

A $3.5 billion Texas based Financial Holding Company

Customer focused

Results oriented

Shareholder driven

Accretive acquisition

Excellent asset quality

Fast growing

Serving Houston, Dallas, Austin, Corpus Christi and many communities along the NAFTA Highway southwest of Houston.

3

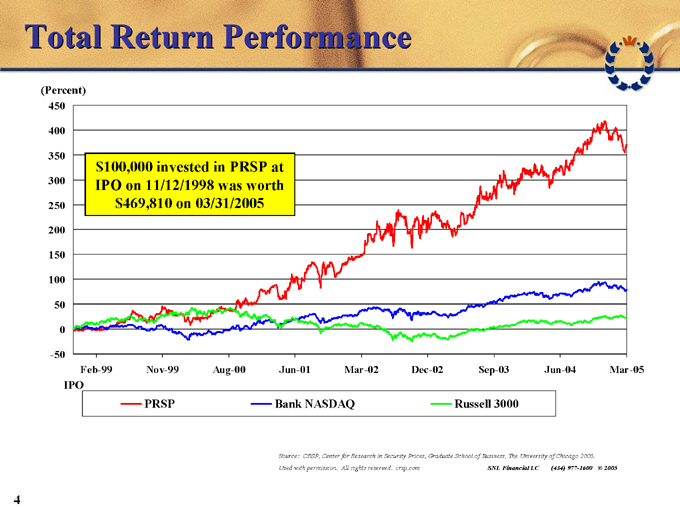

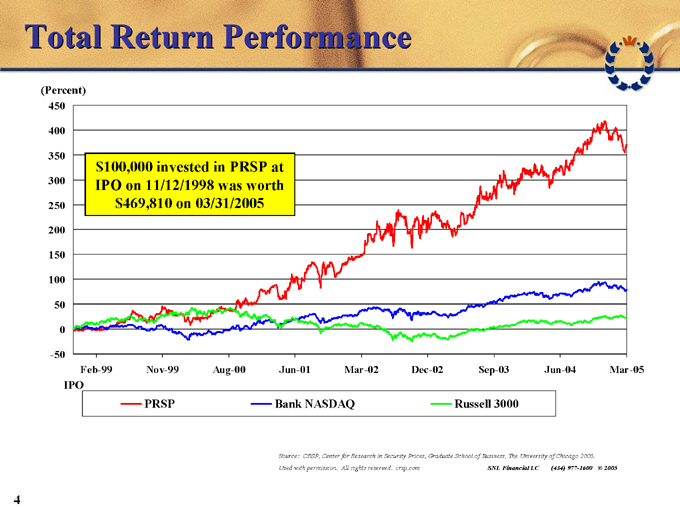

Total Return Performance

(Percent)

450 400 350 300 250 200 150 100 50 0 -50

Feb-99 Nov-99 Aug-00 Jun-01 Mar-02 Dec-02 Sep-03 Jun-04 Mar-05

IPO

PRSP Bank NASDAQ Russell 3000

$100,000 invested in PRSP at IPO on 11/12/1998 was worth $469,810 on 03/31/2005

Source: CRSP, Center for Research in Security Prices, Graduate School of Business, The University of Chicago 2005.

Used with permission. All rights reserved. crsp.com SNL Financial LC (434) 977-1600 © 2005

4

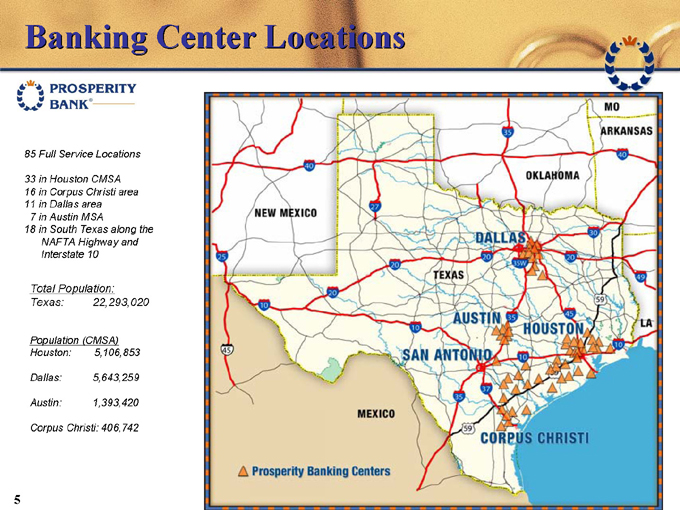

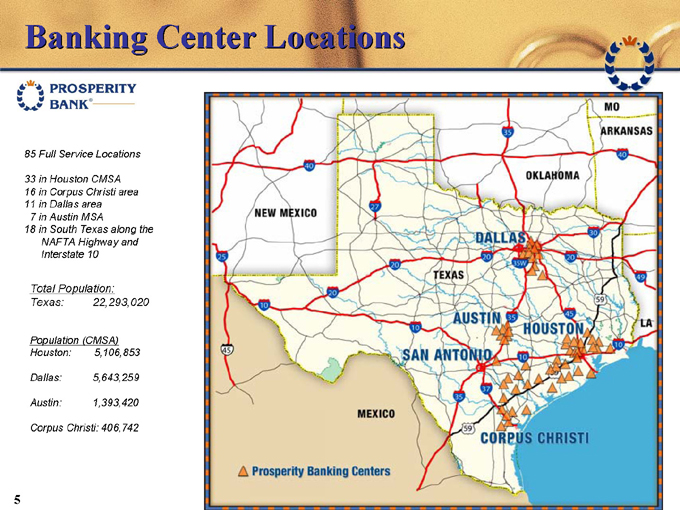

Banking Center Locations

85 Full Service Locations

33 in Houston CMSA

16 in Corpus Christi area

11 in Dallas area

7 in Austin MSA

18 in South Texas along the NAFTA Highway and Interstate 10

Total Population:

Texas: 22,293,020

Population (CMSA)

Houston: 5,106,853

Dallas: 5,643,259

Austin: 1,393,420

Corpus Christi: 406,742

5

1Q05 Highlights

1Q05 EPS up 13.2% from 1Q04

1Q05 Return on Average Tangible Equity of 33.38%

1Q05 Total Loans up 94.8% from 1Q04

1Q05 Total Deposits up 36.3% from 1Q04

1Q05 Net Income up 30.9% from 1Q04

1Q05 Total Assets up 42.1% from 1Q04

1Q05 Non-Interest Income up 23.9% from 1Q04

Completed Largest Acquisition to Date

1Q05 Organic Loan Growth of 5.5%

6

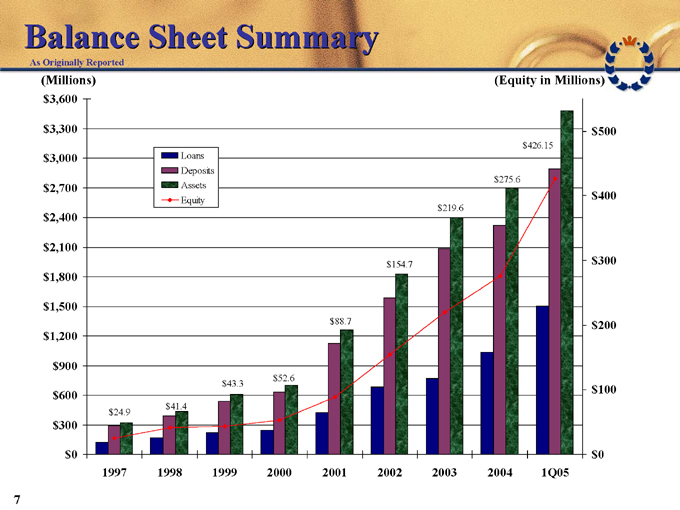

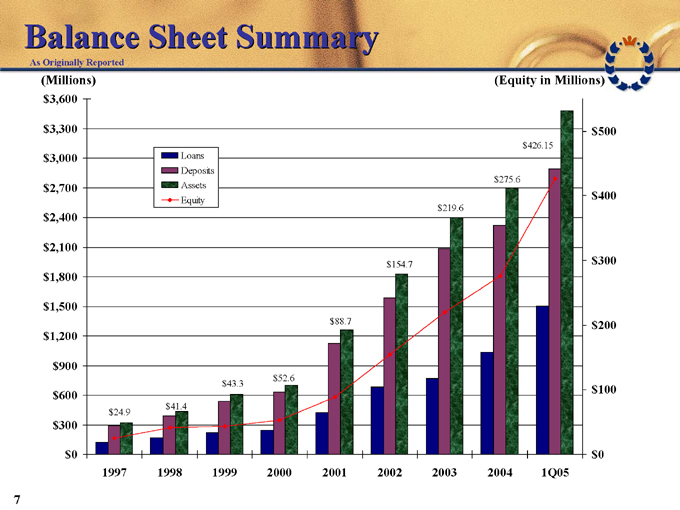

Balance Sheet Summary

As Originally Reported

(Equity in Millions)

(Millions)

$3,600 $3,300 $3,000 $2,700 $2,400 $2,100 $1,800 $1,500 $1,200 $900 $600 $300 $0

1997 1998 1999 2000 2001 2002 2003 2004 1Q05

$500 $400 $300 $200 $100 $0 $24.9 $41.4 $43.3 $52.6 $88.7 $154.7 $219.6 $275.6 $426.15

Loans Deposits Assets Equity

7

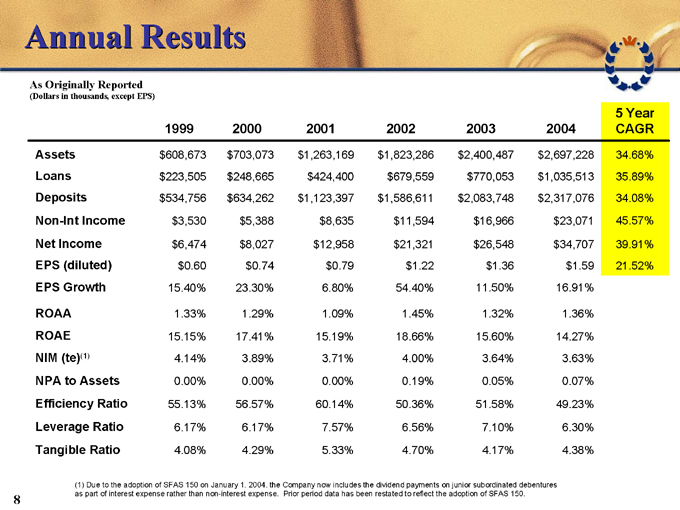

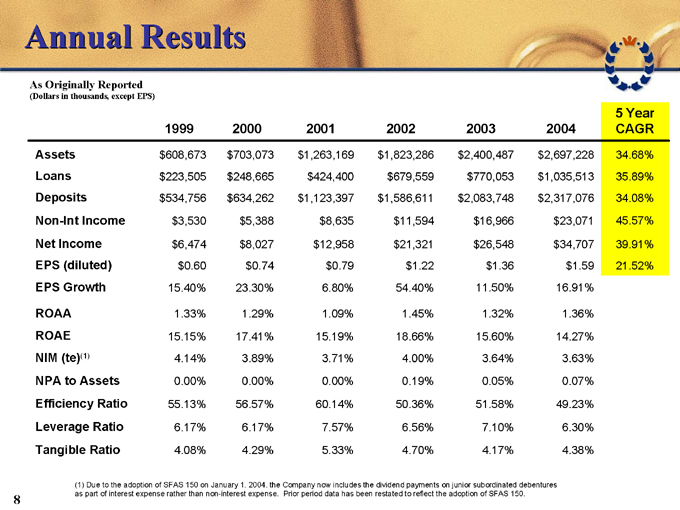

Annual Results

As Originally Reported

(Dollars in thousands, except EPS)

5 Year

1999 2000 2001 2002 2003 2004 CAGR

Assets $608,673 $703,073 $1,263,169 $1,823,286 $2,400,487 $2,697,228 34.68%

Loans $223,505 $248,665 $424,400 $679,559 $770,053 $1,035,513 35.89%

Deposits $534,756 $634,262 $1,123,397 $1,586,611 $2,083,748 $2,317,076 34.08%

Non-Int Income $3,530 $5,388 $8,635 $11,594 $16,966 $23,071 45.57%

Net Income $6,474 $8,027 $12,958 $21,321 $26,548 $34,707 39.91%

EPS (diluted) $0.60 $0.74 $0.79 $1.22 $1.36 $1.59 21.52%

EPS Growth 15.40% 23.30% 6.80% 54.40% 11.50% 16.91%

ROAA 1.33% 1.29% 1.09% 1.45% 1.32% 1.36%

ROAE 15.15% 17.41% 15.19% 18.66% 15.60% 14.27%

NIM (te)(1) 4.14% 3.89% 3.71% 4.00% 3.64% 3.63%

NPA to Assets 0.00% 0.00% 0.00% 0.19% 0.05% 0.07%

Efficiency Ratio 55.13% 56.57% 60.14% 50.36% 51.58% 49.23%

Leverage Ratio 6.17% 6.17% 7.57% 6.56% 7.10% 6.30%

Tangible Ratio 4.08% 4.29% 5.33% 4.70% 4.17% 4.38%

(1) Due to the adoption of SFAS 150 on January 1, 2004, the Company now includes the dividend payments on junior subordinated debentures as part of interest expense rather than non-interest expense. Prior period data has been restated to reflect the adoption of SFAS 150.

8

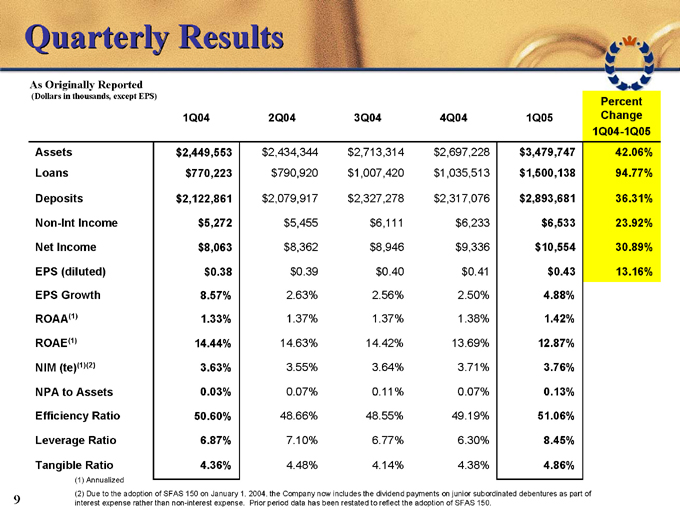

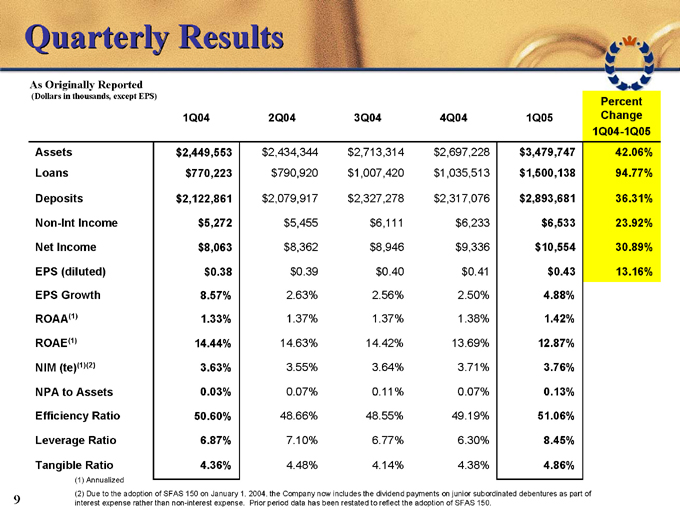

Quarterly Results

As Originally Reported

(Dollars in thousands, except EPS)

1Q04 2Q04 3Q04 4Q04 1Q05 Percent Change 1Q04-1Q05

Assets $2,449,553 $2,434,344 $2,713,314 $2,697,228 $3,479,747 42.06%

Loans $770,223 $790,920 $1,007,420 $1,035,513 $1,500,138 94.77%

Deposits $2,122,861 $2,079,917 $2,327,278 $2,317,076 $2,893,681 36.31%

Non-Int Income $5,272 $5,455 $6,111 $6,233 $6,533 23.92%

Net Income $8,063 $8,362 $8,946 $9,336 $10,554 30.89%

EPS (diluted) $0.38 $0.39 $0.40 $0.41 $0.43 13.16%

EPS Growth 8.57% 2.63% 2.56% 2.50% 4.88%

ROAA(1) 1.33% 1.37% 1.37% 1.38% 1.42%

ROAE(1) 14.44% 14.63% 14.42% 13.69% 12.87%

NIM (te)(1)(2) 3.63% 3.55% 3.64% 3.71% 3.76%

NPA to Assets 0.03% 0.07% 0.11% 0.07% 0.13%

Efficiency Ratio 50.60% 48.66% 48.55% 49.19% 51.06%

Leverage Ratio 6.87% 7.10% 6.77% 6.30% 8.45%

Tangible Ratio 4.36% 4.48% 4.14% 4.38% 4.86%

(1) Annualized

(2) Due to the adoption of SFAS 150 on January 1, 2004, the Company now includes the dividend payments on junior subordinated debentures as part of interest expense rather than non-interest expense. Prior period data has been restated to reflect the adoption of SFAS 150.

9

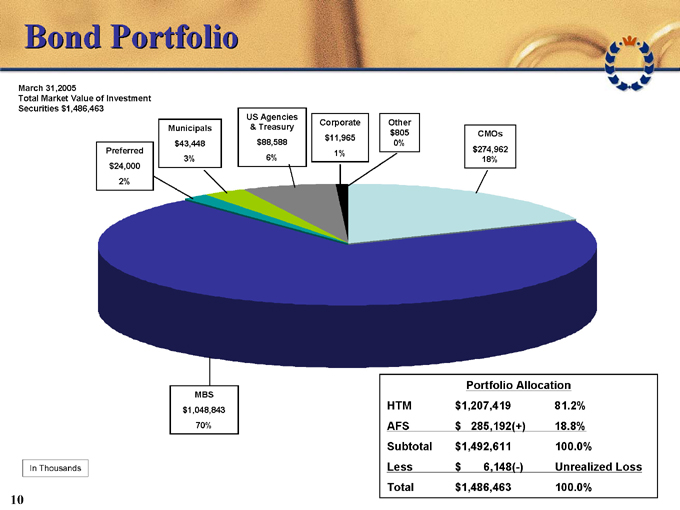

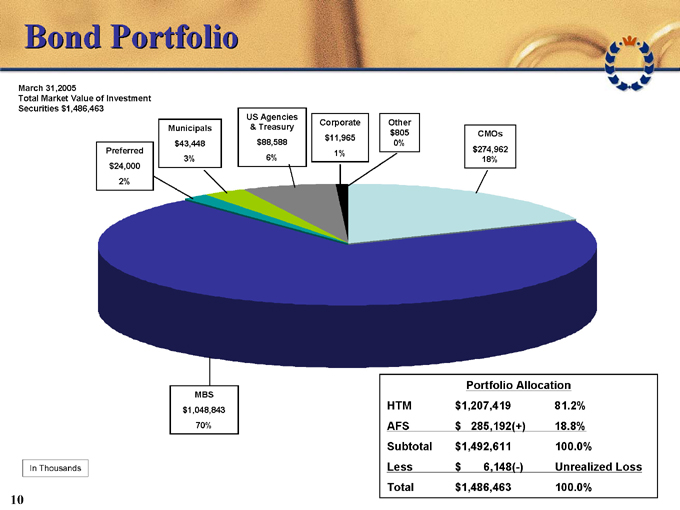

Bond Portfolio

March 31, 2005

Total Market Value of Investment Securities $1,486,463

Preferred $24,000 2%

Municipals $43,448 3%

US Agencies & Treasury $88,588 6%

Corporate $11,965 1%

Other $805 0%

CMOs $274,962 18%

MBS $1,048,843 70%

In Thousands

Portfolio Allocation

HTM $1,207,419 81.2%

AFS $285,192(+) 18.8%

Subtotal $1,492,611 100.0%

Less $6,148(-) Unrealized Loss

Total $1,486,463 100.0%

10

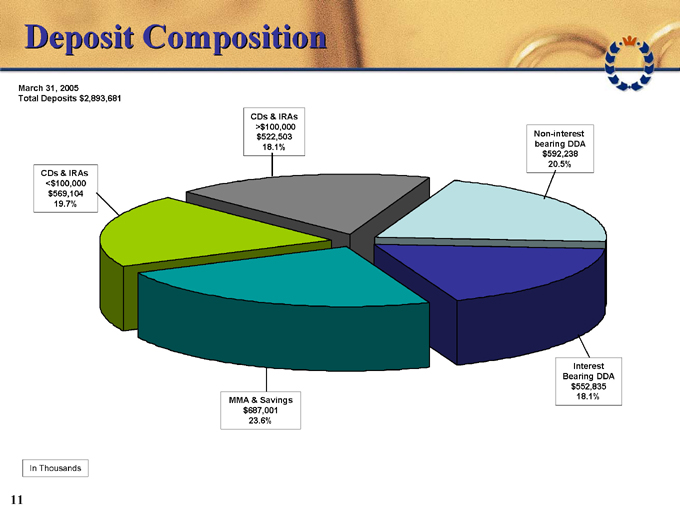

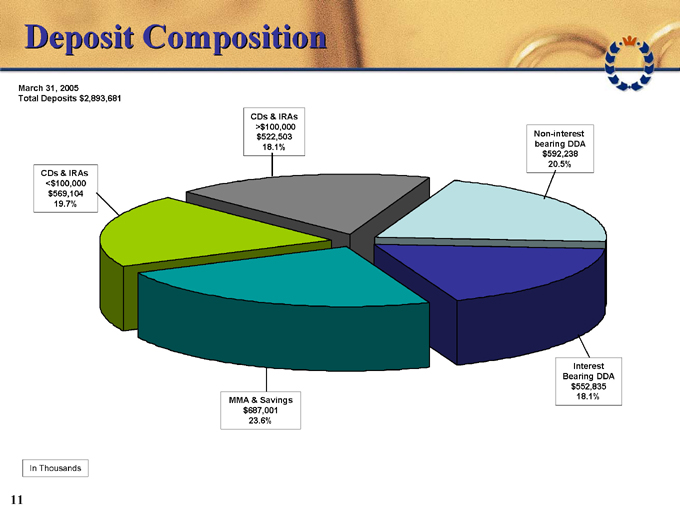

Deposit Composition

March 31, 2005

Total Deposits $2,893,681

CDs & IRAs <$100,000 $569,104 19.7%

CDs & IRAs >$100,000 $522,503 18.1%

Non-interest bearing DDA $592,238 20.5%

Interest Bearing DDA $552,835 18.1%

MMA & Savings $687,001 23.6%

In Thousands

11

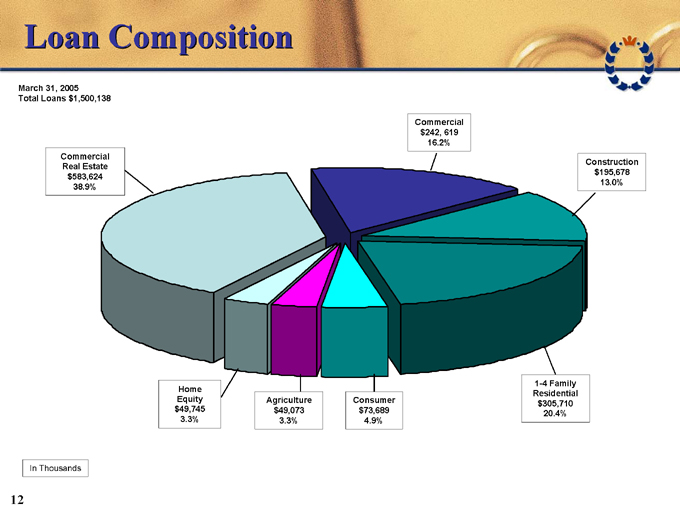

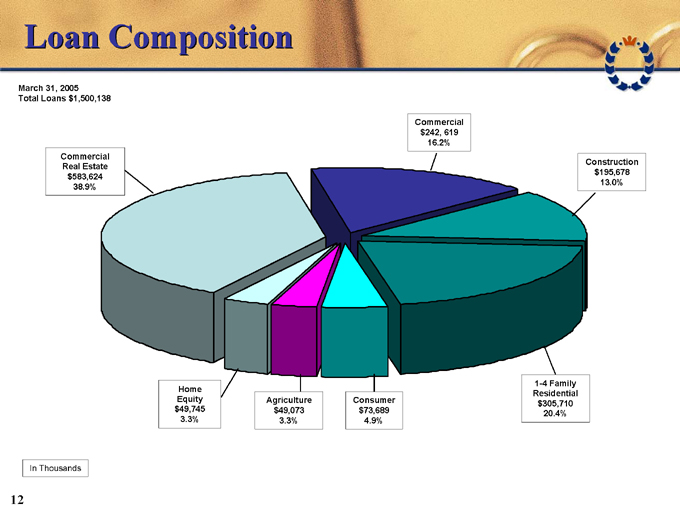

Loan Composition

March 31, 2005 Total Loans $1,500,138

Commercial Real Estate $583,624 38.9%

Commercial $242, 619 16.2%

Construction $195,678 13.0%

1-4 Family Residential $305,710 20.4%

Consumer $73,689 4.9%

Agriculture $49,073 3.3%

Home Equity $49,745 3.3%

In Thousands

12

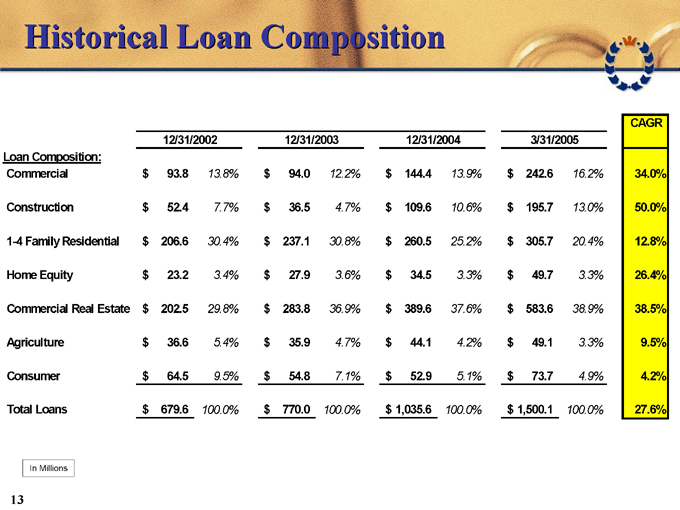

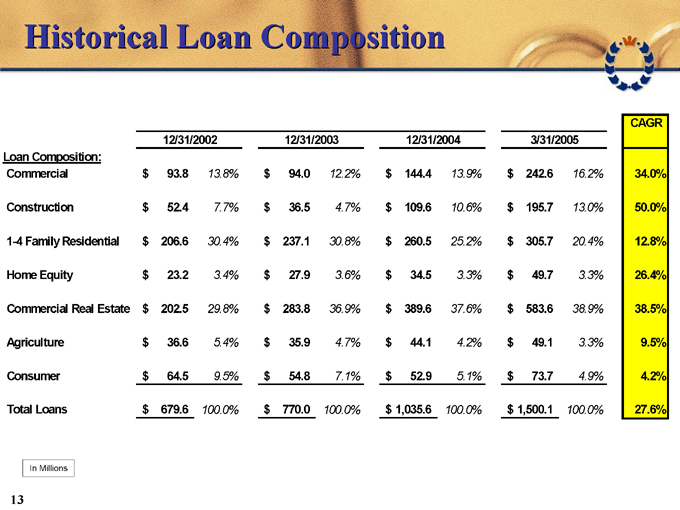

Historical Loan Composition

12/31/2002 12/31/2003 12/31/2004 3/31/2005 CAGR

Loan Composition:

Commercial $93.8 13.8% $94.0 12.2% $144.4 13.9% $242.6 16.2% 34.0%

Construction $52.4 7.7% $36.5 4.7% $109.6 10.6% $195.7 13.0% 50.0%

1-4 Family Residential $206.6 30.4% $237.1 30.8% $260.5 25.2% $305.7 20.4% 12.8%

Home Equity $23.2 3.4% $27.9 3.6% $34.5 3.3% $49.7 3.3% 26.4%

Commercial Real Estate $202.5 29.8% $283.8 36.9% $389.6 37.6% $583.6 38.9% 38.5%

Agriculture $36.6 5.4% $35.9 4.7% $44.1 4.2% $49.1 3.3% 9.5%

Consumer $64.5 9.5% $54.8 7.1% $52.9 5.1% $73.7 4.9% 4.2%

Total Loans $679.6 100.0% $770.0 100.0% $1,035.6 100.0% $1,500.1 100.0% 27.6%

In Millions

13

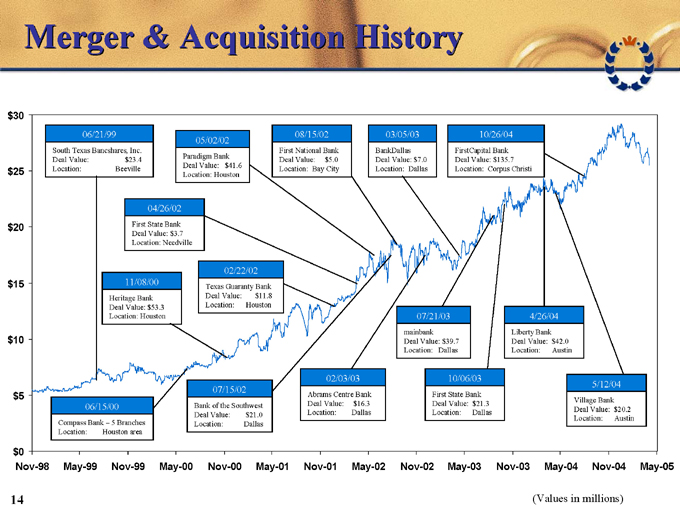

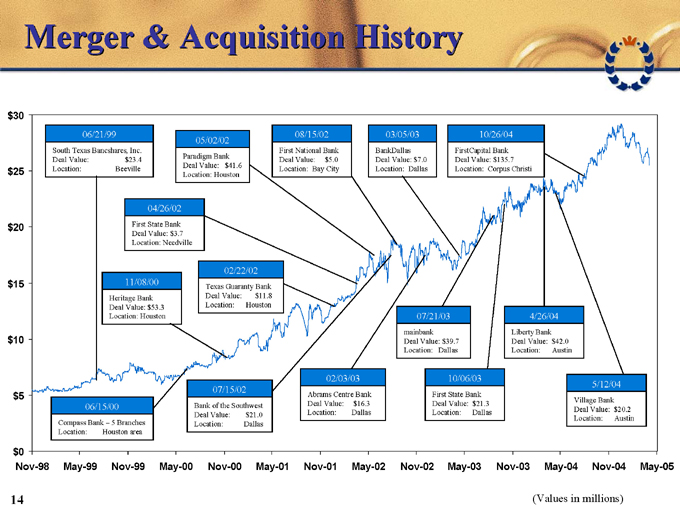

Merger & Acquisition History

$30 $25 $20 $15 $10 $5 $0

Nov-98 May-99 Nov-99 May-00 Nov-00 May-01 Nov-01 May-02 Nov-02 May-03 Nov-03 May-04 Nov-04 May-05

06/21/99

South Texas Bancshares, Inc. Deal Value: $23.4 Location: Beeville

05/02/02

Paradigm Bank Deal Value: $41.6 Location: Houston

08/15/02

First National Bank Deal Value: $5.0 Location: Bay City

03/05/03

BankDallas Deal Value: $7.0 Location: Dallas

10/26/04

FirstCapital Bank Deal Value: $135.7 Location: Corpus Christi

04/26/02

First State Bank Deal Value: $3.7 Location: Needville

11/08/00

Heritage Bank Deal Value: $53.3 Location: Houston

02/22/02

Texas Guaranty Bank Deal Value: $11.8 Location: Houston

06/15/00

Compass Bank – 5 Branches Location: Houston area

07/15/02

Bank of the Southwest Deal Value: $21.0 Location: Dallas

02/03/03

Abrams Centre Bank Deal Value: $16.3 Location: Dallas

07/21/03

mainbank Deal Value: $39.7 Location: Dallas

10/06/03

First State Bank Deal Value: $21.3 Location: Dallas

4/26/04

Liberty Bank Deal Value: $42.0 Location: Austin

5/12/04

Village Bank Deal Value: $20.2 Location: Austin

(Values in millions)

14

PRSP Completed Acquisitions

All announced bank acquisitions

At Announcement

Announce Date Seller City State Type Consideration Accounting Method PRSP Assets ($000) Sellers Assets ($000) Sellers’ Asset Contribution (%) Deal Value ($000)

10/26/2004 FirstCapital Bankers, Inc. Corpus Christi TX Thrift Common Stock Purchase 2,709,169 773,566 22.21 135.7

05/12/2004 Village Bank and Trust Austin TX Thrift Cash Purchase 2,449,553 110,400 4.31 20.2

04/26/2004 Liberty Bank Austin TX Thrift Mixed Purchase 2,449,553 186,000 7.06 42.0

12/09/2003 First State Bank of North Texas Dallas TX Bank Mixed Purchase 2,078,532 93,900 4.32 21.3

11/01/2003 Mainbancorp Dallas TX Bank Mixed Purchase 1,983,277 195,700 8.98 39.7

03/05/2003 BankDallas SSB Dallas TX Thrift Cash Purchase 1,822,256 40,716 2.19 7.0

02/03/2003 Abrams Centre Bancshares, Inc. Dallas TX Bank Cash Purchase 1,822,256 95,388 4.97 16.3

08/15/2002 First National Bank of Bay City Bay City TX Bank Cash Purchase 1,360,356 28,174 2.03 5.0

07/15/2002 Southwest Bank Holding Company Dallas TX Bank Cash Purchase 1,289,637 127,055 8.97 21.0

05/02/2002 Paradigm Bancorporation, Incorporated Houston TX Bank Common Stock Purchase 1,289,637 259,262 16.74 41.6

04/26/2002 First State Bank Needville TX Bank Cash Purchase 1,289,637 17,754 1.36 3.7

02/22/2002 Texas Guaranty Bank, N.A. Houston TX Bank Cash Purchase 1,262,152 75,019 5.61 11.8

11/08/2000 Commercial Bancshares, Inc. Houston TX Bank Common Stock Pooling 693,079 401,271 36.67 53.3

06/21/1999 South Texas Bancshares, Inc. Beeville TX Bank Cash Purchase 461,903 142,091 23.53 23.4

06/05/1998 Union State Bank East Bernard TX Bank Cash Purchase 339,287 79,174 18.92 17.6

Branch Acquisitions

Announce Date Seller # of Brchs Branch Type Branch Locale State Amount of Deposits Transferred ($000) Deposit Premium ($000) Premium/ Deposits (%) Assets Transferred: Loans? Y or N

06/15/00 Compass Bancshares, Inc. 5 Bank TX 87,000 NA NA Yes

02/27/98 Grimes County Capital Corporation 1 Bank TX 5,900 250 4.24 No

03/30/97 Wells Fargo & Company 1 Bank TX NA NA NA No

03/11/96 Victoria Bankshares, Inc. 1 Bank TX 46,000 NA NA Yes

15

Why Invest in PRSP?

Excellent asset quality

+

Continuing operating efficiencies

+

Expanding non-interest income

+

High-growth Texas operations

Superior Long-term returns

16

Contact Information

Corporate Headquarters

Prosperity Bank Plaza

4295 San Felipe

Houston, Texas 77027

713.693.9300 Telephone

713.693.9309 Fax

www.prosperitybanktx.com

Investor Contacts

David Zalman

Chief Executive Officer

979.543.2200

david.zalman@prosperitybanktx.com

David Hollaway

Chief Financial Officer

979.543.2200

david.hollaway@prosperitybanktx.com

Dan Rollins

Senior Vice President

713.693.9300

dan.rollins@prosperitybanktx.com

17