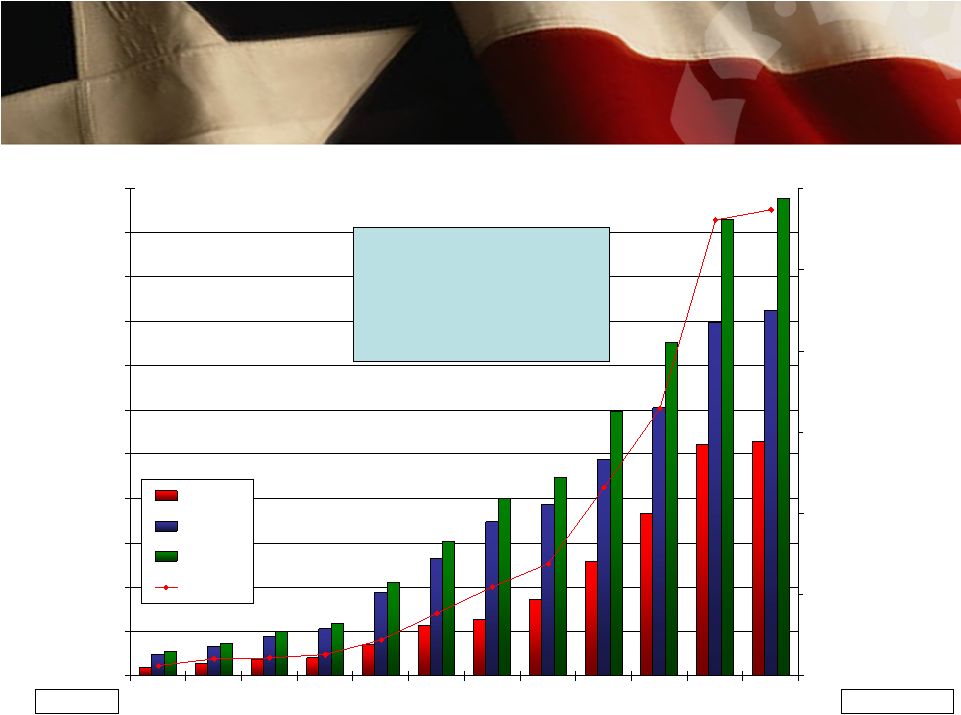

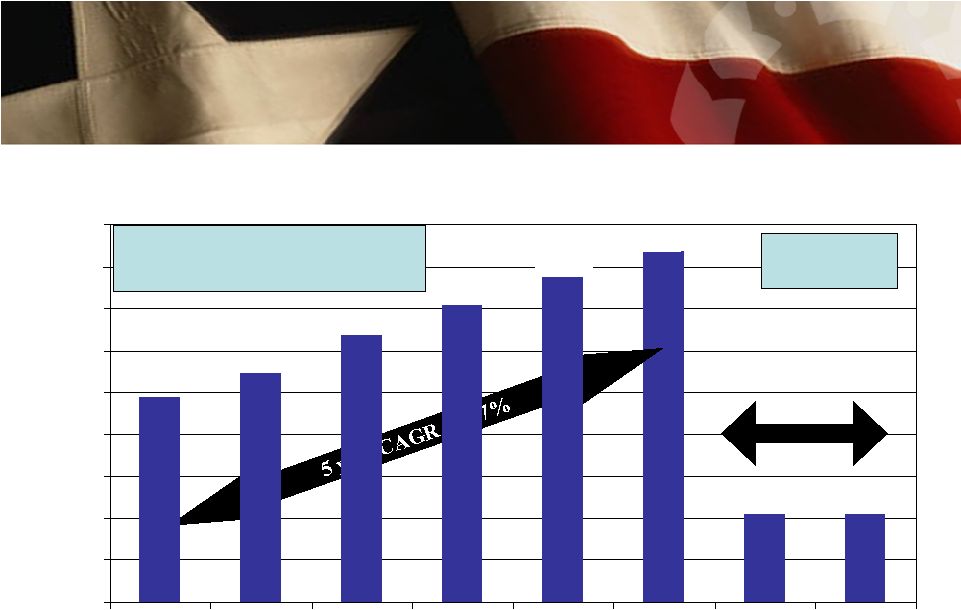

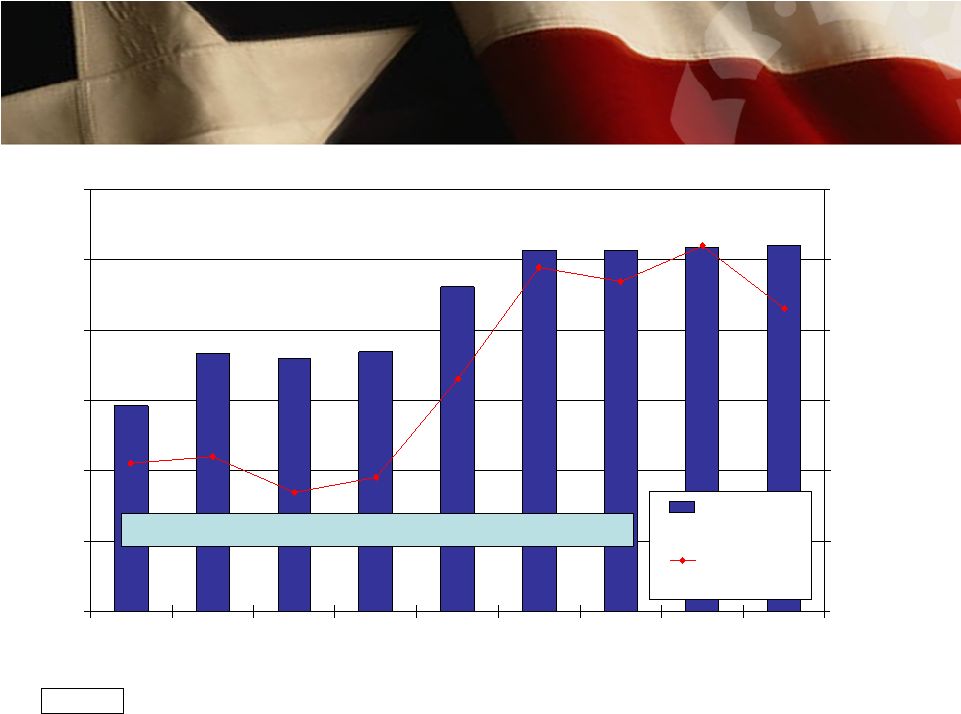

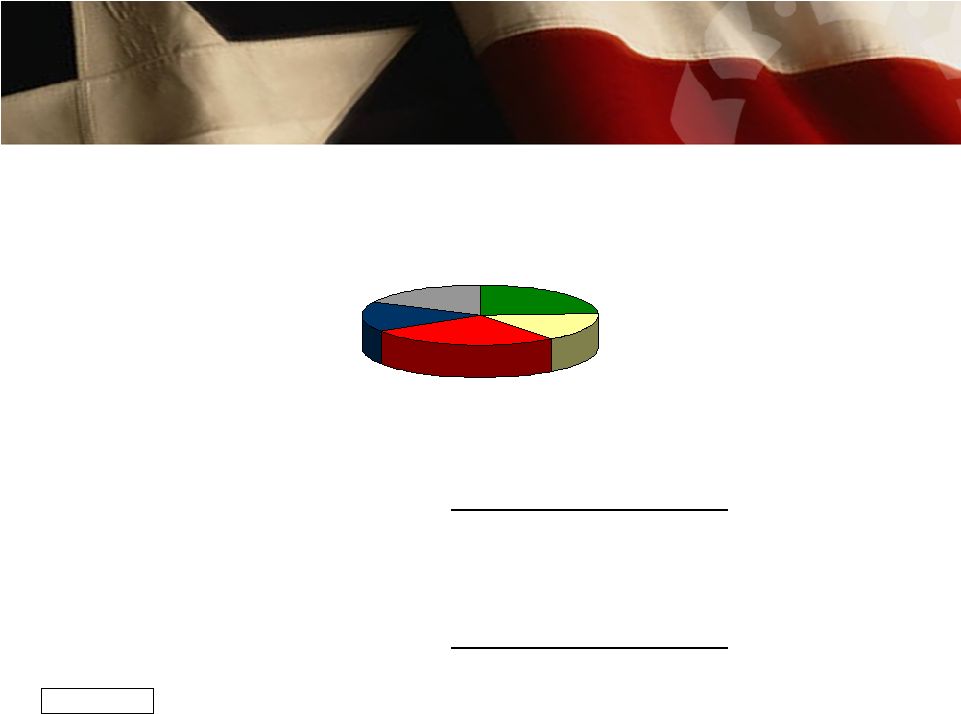

21 PRSP Acquisitions PRSP Acquisitions Branch Acquisitions Date of Announcement Seller # of Branches Branch Type Branch Locale State Amount of Deposits Transferred ($000) Deposit Premium ($000) Premium/ Deposits (%) Assets Transferred: Loan? Yor N 10/22/2007 Banco Popular North America 6 Bank TX 140,000 NA 10.1 Yes 6/15/2000 Compass Bancshares, Inc. 5 Bank TX 87,000 NA NA Yes 2/27/1998 Grimes County Capital Corporation 1 Bank TX 5,900 250 4.24 No 3/30/1997 Wells Fargo & Company 1 Bank TX NA NA NA No 3/11/1996 Victoria Bankshares, Inc. 1 Bank TX 46,000 NA NA Yes At Announcement Date of Announcement Seller City State Type Consideration Accounting Method PRSP Assets ($000) Sellers' Assets ($000) Sellers' Assets Contribution (%) Deal Value ($000) 2/7/2008 1st Choice Bancorp, Inc. Houston TX Bank Mixed Purchase 6,372,343 313,900 4.69 66.2 05/01/07 The Bank of Navasota Navasota TX Bank Common Stock Purchase 6,247,926 72,300 1.14 17.1 07/19/06 Texas United Bancshares, Inc. La Grange TX Bank Common Stock Purchase 4,547,220 1,818,000 27.82 357.1 11/16/05 SNB Bancshares, Inc. Houston TX Bank Mixed Purchase 3,493,972 1,121,747 24.30 242.7 09/12/05 Grapeland Bancshares, Inc. Grapeland TX Bank Common Stock Purchase 3,479,747 73,000 2.15 7.3 10/26/04 FirstCapital Bankers, Inc. Corpus Christi TX Thrift Common Stock Purchase 2,709,169 773,566 22.21 135.7 05/12/04 Village Bank and Trust Austin TX Thrift Cash Purchase 2,449,553 110,400 4.31 20.2 04/26/04 Liberty Bank Austin TX Thrift Mixed Purchase 2,449,553 186,000 7.06 42 10/06/03 First State Bank of North Texas Dallas TX Bank Mixed Purchase 2,078,532 93,900 4.32 21.3 07/21/03 Mainbancorp Dallas TX Bank Mixed Purchase 1,983,277 195,700 8.98 39.7 03/05/03 BankDallas SSB Dallas TX Thrift Cash Purchase 1,822,256 40,716 2.19 7 02/03/03 Abrams Centre Bancshares, Inc. Dallas TX Bank Cash Purchase 1,822,256 95,388 4.97 16.3 08/15/02 First National Bank of Bay City Bay City TX Bank Cash Purchase 1,360,356 28,174 2.03 5 07/15/02 Southwest Bank Holding Company Dallas TX Bank Cash Purchase 1,289,637 127,055 8.97 21 05/02/02 Paradigm Bancorporation, Incorporated Houston TX Bank Common Stock Purchase 1,289,637 259,262 16.74 41.6 04/26/02 First State Bank Needville TX Bank Cash Purchase 1,289,637 17,539 1.36 3.7 02/22/02 Texas Guaranty Bank, N.A. Houston TX Bank Cash Purchase 1,262,152 75,019 5.61 11.8 11/08/00 Commercial Bancshares, Inc. Houston TX Bank Common Stock Pooling 693,079 401,271 36.67 53.3 06/21/99 South Texas Bancshares, Inc. Beeville TX Bank Cash Purchase 461,903 142,091 23.53 23.4 6/5/1998 Union State Bank East Bernard TX Bank Cash Purchase 339,287 79,174 18.92 17.6 |