- PB Dashboard

- Financials

- Filings

-

Holdings

- Transcripts

- ETFs

- Insider

- Institutional

- Shorts

-

8-K Filing

Prosperity Bancshares (PB) 8-KRegulation FD Disclosure

Filed: 30 Jul 08, 12:00am

Exhibit 99.1 |

2 “Safe Harbor” Statement “Safe Harbor” Statement under the Private Securities Litigation Reform Act of 1995 This presentation may contain forward-looking statements within the meaning of the securities laws that are based on current expectations, assumptions’ estimates and projections about Prosperity Bancshares ® , and its subsidiaries. These forward-looking statements are not guarantees of future performance and are subject to risks and uncertainties, many of which are outside of Prosperity’s control, that may cause actual results to differ materially from those expressed or implied by the forward-looking statements. These risks and uncertainties include but are not limited to whether Prosperity can: successfully identify acquisition targets and integrate the businesses of acquired companies and banks; continue to sustain its current internal growth rate or total growth rate; provide products and services that appeal to its customers; continue to have access to debt and equity capital markets; and achieve its sales objectives. Other risks include the possibility that credit quality could deteriorate; actions of competitors; changes in laws and regulations (including changes in governmental interpretations of regulations and changes in accounting standards); customer and consumer demand, including customer and consumer response to marketing; effectiveness of spending, investments or programs; fluctuations in the cost and availability of supply chain resources; economic conditions, including currency rate fluctuations and interest rate fluctuations; weather; and the stock price volatility associated with “small-cap” companies. These and various other factors are discussed in our most recent Annual Report on Form 10-K and other reports and statements we have filed with the SEC. Copies of the SEC filings for Prosperity Bancshares’s ® may be downloaded from the Internet at no charge from www.prosperitybanktx.com. |

3 Prosperity is . . . . Prosperity is . . . . • A $6.8 billion Texas based Financial Holding Company • 3 rd largest Texas based commercial bank by deposit size • Strong balance sheet growth – 10 year CAGR of 49% loans, 35% deposits, and 38% assets • Strong earnings growth – 10 year CAGR of 11% for EPS (diluted) and 34% for net income • Shareholder driven with approximately 11% inside ownership • Excellent asset quality – Net Charge Offs / Average Loans of 0.04% for three months ending June 30, 2008 • Excellent cost control – under 50% efficiency ratio • Since 2000, we have successfully integrated 20 accretive transactions. a Track Record of Success |

4 2 nd Quarter Highlights 2 nd Quarter Highlights • Expanding Net Interest Margin - Increased to 4.10% in 2 nd Quarter • Non- Performing Assets to Average Earning Assets decreased to 0.22% or $11.6 million • Strong Earnings of $23.437 million or $0.52 per share (diluted) or 1.43% Return on Assets in 2 nd Quarter • Stable Texas Economy - 47,700 new jobs in Texas in June 2008 • Stable Housing Market - Overall price increase was 1% in June 2008. |

5 Banking Center Network Banking Center Network Franchise – $ 6.8 billion in Assets $ 5.3 billion in Deposits $ 3.3 billion in Loans 131 Full Service Locations % of Deposits 24 in Central Texas 14 % 26 in Dallas/Fort Worth 17 % 2 in East Texas 1 % 46 in Houston CMSA 42 % 33 in South Texas 26 % The Dallas/ Fort Worth MSA is the nation’s 4th largest regional area with 6.1 million residents The Houston MSA is the nation’s 6th largest regional area with 5.6 million residents Texas has five of the nation’s top 20 cities in population: 4 Houston 7 San Antonio 9 Dallas 16 Austin 18 Fort Worth |

6 0.0% 1.0% 2.0% 3.0% 4.0% 5.0% San Antonio Area Houston Area Dallas/ Fort Worth Area Austin Area Population Growth Population Growth Population Change for 2007 Change in Population 65,880 120,544 162,250 53,925 Source: Census Bureau 0.0% 2.0% 4.0% 6.0% 8.0% 10.0% 12.0% 14.0% 16.0% 1985 1990 1995 2000 2007 United States Texas |

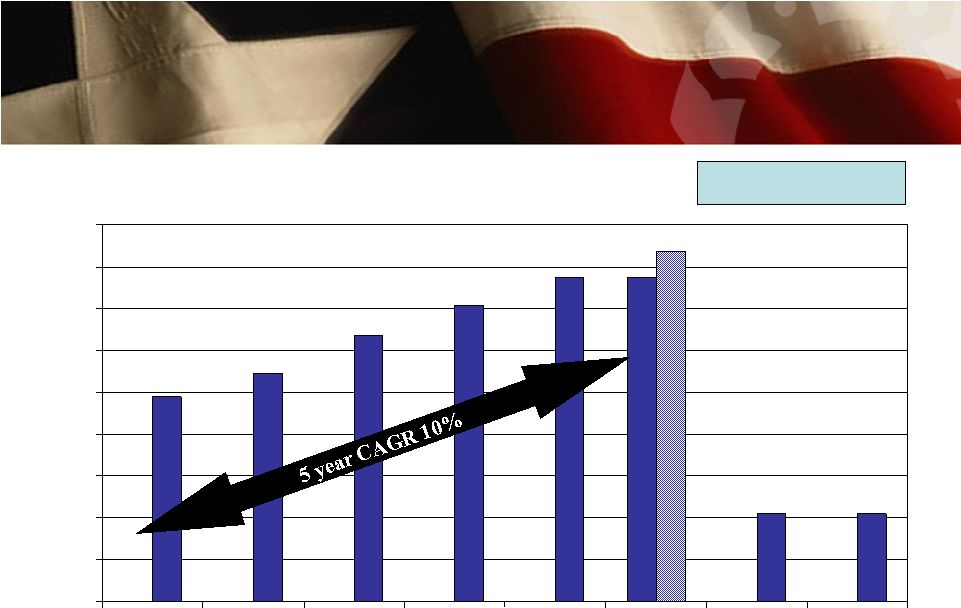

7 Balance Sheet Summary Balance Sheet Summary $0 $600 $1,200 $1,800 $2,400 $3,000 $3,600 $4,200 $4,800 $5,400 $6,000 $6,600 $7,200 1997 1998 1999 2000 2001 2002 2003 2004 2005 2006 2007 2Q08 $0 $200 $400 $600 $800 $1,000 $1,200 $1,400 Loans Deposits Assets Equity As Originally Reported $ in millions Total footings as of 6/30/08 Loans = $3.3 bil. Deposits = $5.3 bil. Assets = $6.8 bil. 5 year CAGR Loans = 36% Deposits = 26% Assets = 28% |

8 EPS Growth Diluted EPS Growth Diluted $1.22 $1.36 $1.59 $1.77 $1.94 $0.52 $0.52 $1.94 $2.09* $0.00 $0.25 $0.50 $0.75 $1.00 $1.25 $1.50 $1.75 $2.00 $2.25 2002 2003 2004 2005 2006 2007 2Q 2007 2Q 2008 * EPS without the non-cash after tax impairment charge related to FNMA/FLHMC preferred stock 5 year CAGR without non-cash impairment would be 11% |

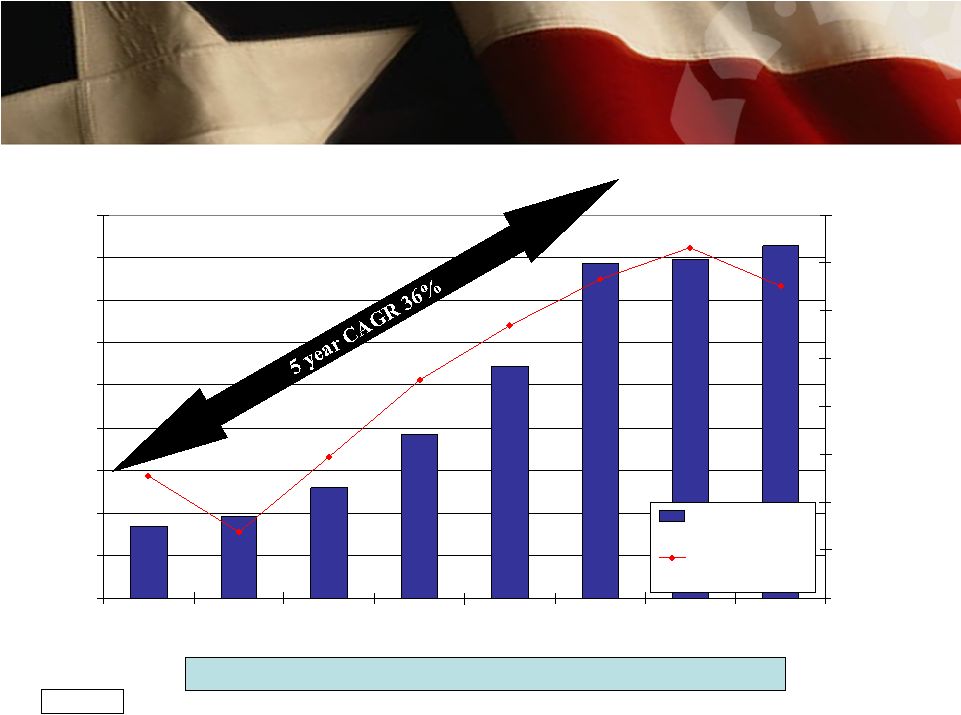

9 Loan Growth Loan Growth $0 $400 $800 $1,200 $1,600 $2,000 $2,400 $2,800 $3,200 $3,600 2002 2003 2004 2005 2006 2007 2Q07 2Q08 30.00% 35.00% 40.00% 45.00% 50.00% 55.00% 60.00% 65.00% 70.00% Loans Loan / Deposit Ratio $ in millions Loan/ deposit ratio increased from 37% at 12/31/03 to 63% at 12/31/07 |

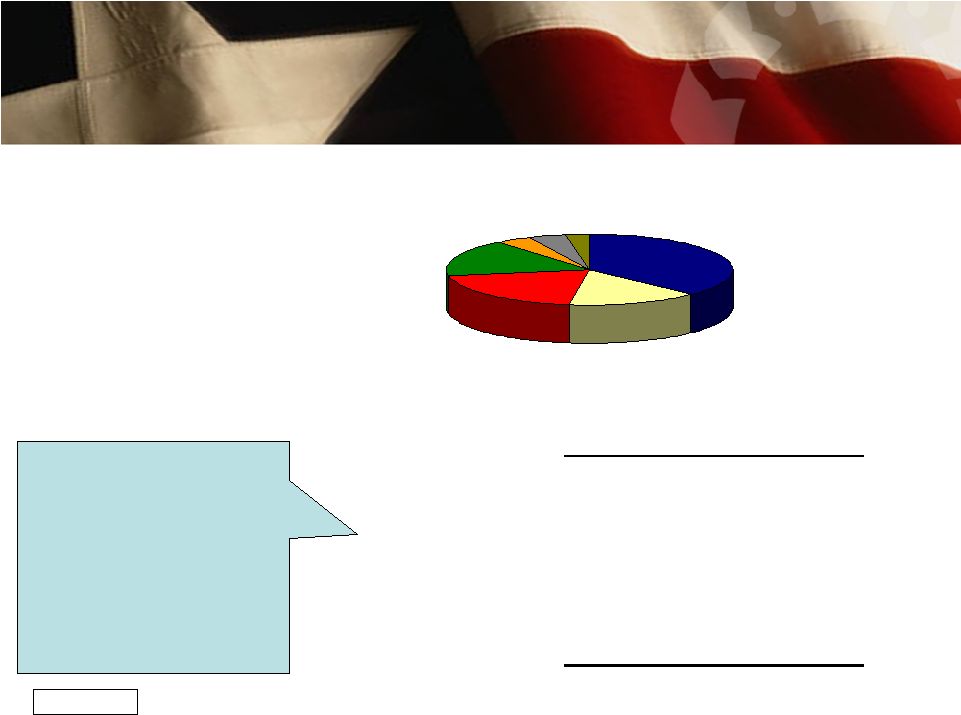

10 Loan Portfolio Loan Portfolio Home Equity 2.9% Agriculture 4.1% Consumer 3.8% 1-4 Family Residential 17.2% Commercial 14.7% Construction 19.9% Commercial R.E. 37.4% $ in thousands Loans/ Deposits: 62.6% June 30, 2008 Amount Commercial R.E. $ 1,241,873 37.4 % Commercial 486,817 14.2 Construction 658,669 19.9 1-4 Family Residential 568,376 17.2 Consumer 126,397 4.3 Agriculture 135,422 4.1 Home Equity 95,774 2.9 Gross Loans $ 3,313,328 100.0 % % of total Construction Loan Breakout Approximate $ in million Single Family: $225 Land Development: $130 Raw Land: $135 Lots: $100 Commercial/ Other: $69 |

11 Asset Quality – NPA*/ Loans + OREO * Includes loans past due 90 days and still accruing Asset Quality – NPA*/ Loans + OREO * Includes loans past due 90 days and still accruing 0.49% 0.05% 0.09% 0.17% 0.13% 0.38% 0.00% 0.35% 0.35% 1.18% 0.83% 1.02% 0.97% 0.83% 0.65% 1.00% 0.00% 0.20% 0.40% 0.60% 0.80% 1.00% 1.20% 2001 2002 2003 2004 2005 2006* 2007 2Q07 2Q08 PRSP NPA*/Loans + OREO Peer NPA*/Loans + OREO Source: SNL Financial Texas Peer Group Includes: CFR, EBTX, FFIN, FBTX, IBOC, MCBI, SBSI, SNBI, SBIB, SBIT, TCBI, TRBS & TXUI * SNBI, SBIT, TRBS & TXUI have been acquired and were excluded from 2006 & 2007 |

12 Net Interest Margin * Net Interest Margin * 4.10% 4.03% 4.12% 4.07% 3.93% 3.93% 3.82% 4.09% 3.82% 3.60% 3.70% 3.80% 3.90% 4.00% 4.10% 4.20% 2Q06 3Q06 4Q06 1Q07 2Q07 3Q07 4Q07 1Q08 2Q08 * Tax equivalent- annualized Net Interest Margin for 2006 - 3.80% and for 2007 - 4.06% |

13 Contact Information Contact Information 979.543.2200 david.hollaway@prosperitybanktx.com Chief Financial Officer David Hollaway 281.269.7199 dan.rollins@prosperitybanktx.com www.prosperitybanktx.com President & Chief Operating Officer 281.269-7222 Fax Dan Rollins 281.269.7199 Telephone 979.543.2200 david.zalman@prosperitybanktx.com Houston, Texas 77027 Chairman & Chief Executive Officer 4295 San Felipe David Zalman Prosperity Bank Plaza Investor Contacts Corporate Headquarters |

2 nd Quarter Earnings |

15 Supplemental Data |

16 Supplemental Supplemental Data The Houston MSA is the nation’s 6 th largest regional area with 5.6 million residents The Dallas/ Fort Worth MSA is the nation’s 4 th largest regional area with 6.1 million residents Texas has five of the nation’s top 20 cities for population:* Houston #4, San Antonio #7, Dallas #9, Austin #16, Ft. Worth #18 April 2008 Unemployment Rate**: Dallas/ Fort Worth MSA 3.9%, Houston MSA 3.8%, Austin MSA 3.3%, San Antonio 3.6%, Texas 3.9%, U.S. 4.8% There are approximately 650 banks in Texas (125 are greater than $300 million in asset size); Dallas/ Fort Worth MSA has roughly 110 independent banks (25 are over $300 million in asset size) and the Houston MSA has about 70 independent banks (20 are over $300 million in asset size)*** * Source: July 2006 U.S. Census Bureau; **Source: Texas Workforce Commission (data not seasonally adjusted); ***Source FDIC |

17 Financial Highlights Financial Highlights As Originally Reported (Dollars in thousands, except EPS) RATIOS $26.44 $24.69 $25.54 $20.26 $16.69 $12.32 $10.49 Book value per share $7.79 $6.75 $7.42 $6.62 $6.48 $4.96 $4.53 Tangible book value per share 46.17% 46.19% 46.29% 45.29% 48.93% 49.45% 51.82% Efficiency Ratio 5.87% 14.11% 13.13% 8.09% 32.34% 8.72%* 1.49%* $90,635* $200,435 $52,923 2007 6.04% 13.67% 12.70% 7.87% 26.93% 7.96% 1.43% $23,437 $53,971 $13,066 2Q08 5.48% 14.18% 12.36% 7.57% 32.04% 8.54% 1.47% $22,993 $51,344 $13,845 2Q07 4.17% 16.90% 15.82% 7.10% 29.94% 15.60% 1.32% $26,548 $64,499 $16,966 2003 5.24% 14.55% 13.55% 7.76% 31.53% 10.24% 1.44% $61,725 $138,145 $33,982 2006 4.38% 14.67% 13.56% 6.30% 33.41% 14.27% 1.36% $34,707 $81,967 $23,071 2004 5.46% 16.37% 15.34% 7.83% 29.88% 11.56% 1.42% $47,860 $110,897 $30,021 2005 Tier I Risk Capital Total Risk Capital Net Interest Income Tangible Ratio Leverage Ratio Non-Interest Income ROAE – tangible ROAE ROAA Net Income (1) Due to the adoption of SFAS 150 on January 1, 2004, the Company now includes the dividend payments on junior subordinated debentures as part of interest expense rather than non-interest expense. Prior period data has been restated to reflect the adoption of SFAS 150. * Net Income, ROAA, and ROAE does not include the non-cash after tax impairment charge related to FNMA/FLHMC preferred stock of $6.5 million. |

18 PRSP Acquisitions PRSP Acquisitions Branch Acquisitions Date of Announcement Seller # of Branches Branch Type Branch Locale State Amount of Deposits Transferred ($000) Deposit Premium ($000) Premium/ Deposits (%) Assets Transferred: Loan? Yor N 1 10/22/2007 Banco Popular North America 6 Bank TX 140,000 NA 10.1 Yes 2 6/15/2000 Compass Bancshares, Inc. 5 Bank TX 87,000 NA NA Yes 3 2/27/1998 Grimes County Capital Corporation 1 Bank TX 5,900 250 4.24 No 4 3/30/1997 Wells Fargo & Company 1 Bank TX NA NA NA No 5 3/11/1996 Victoria Bankshares, Inc. 1 Bank TX 46,000 NA NA Yes At Announcement Date of Announcement Seller City State Type Consideration Accounting Method PRSP Assets ($000) Sellers' Assets ($000) Sellers' Assets Contribution (%) Deal Value ($000) 1 2/7/2008 1st Choice Bancorp, Inc. Houston TX Bank Mixed Purchase 6,372,343 313,900 4.69 66.2 2 05/01/07 The Bank of Navasota Navasota TX Bank Common Stock Purchase 6,247,926 72,300 1.14 17.1 3 07/19/06 Texas United Bancshares, Inc. La Grange TX Bank Common Stock Purchase 4,547,220 1,818,000 27.82 357.1 4 11/16/05 SNB Bancshares, Inc. Houston TX Bank Mixed Purchase 3,493,972 1,121,747 24.30 242.7 5 09/12/05 Grapeland Bancshares, Inc. Grapeland TX Bank Common Stock Purchase 3,479,747 73,000 2.15 7.3 6 10/26/04 FirstCapital Bankers, Inc. Corpus Christi TX Thrift Common Stock Purchase 2,709,169 773,566 22.21 135.7 7 05/12/04 Village Bank and Trust Austin TX Thrift Cash Purchase 2,449,553 110,400 4.31 20.2 8 04/26/04 Liberty Bank Austin TX Thrift Mixed Purchase 2,449,553 186,000 7.06 42.0 9 10/06/03 First State Bank of North Texas Dallas TX Bank Mixed Purchase 2,078,532 93,900 4.32 21.3 10 07/21/03 Mainbancorp Dallas TX Bank Mixed Purchase 1,983,277 195,700 8.98 39.7 11 03/05/03 BankDallas SSB Dallas TX Thrift Cash Purchase 1,822,256 40,716 2.19 7.0 12 02/03/03 Abrams Centre Bancshares, Inc. Dallas TX Bank Cash Purchase 1,822,256 95,388 4.97 16.3 13 08/15/02 First National Bank of Bay City Bay City TX Bank Cash Purchase 1,360,356 28,174 2.03 5.0 14 07/15/02 Southwest Bank Holding Company Dallas TX Bank Cash Purchase 1,289,637 127,055 8.97 21.0 15 05/02/02 Paradigm Bancorporation, Incorporated Houston TX Bank Common Stock Purchase 1,289,637 259,262 16.74 41.6 16 04/26/02 First State Bank Needville TX Bank Cash Purchase 1,289,637 17,539 1.36 3.7 17 02/22/02 Texas Guaranty Bank, N.A. Houston TX Bank Cash Purchase 1,262,152 75,019 5.61 11.8 18 11/08/00 Commercial Bancshares, Inc. Houston TX Bank Common Stock Pooling 693,079 401,271 36.67 53.3 19 06/21/99 South Texas Bancshares, Inc. Beeville TX Bank Cash Purchase 461,903 142,091 23.53 23.4 20 6/5/1998 Union State Bank East Bernard TX Bank Cash Purchase 339,287 79,174 18.92 17.6 |

19 Historical Loan Composition Historical Loan Composition $ in millions CAGR Loan Composition Commercial $ 93.8 13.8% $ 94.0 12.2% $ 144.4 13.9% $ 222.8 14.4% $ 297.7 13.7% $ 453.6 14.5% 36.2% Construction $ 52.4 7.7% $ 36.5 4.7% $ 109.6 10.6% $ 206.7 13.4% $ 433.2 19.9% $ 683.2 21.7% 67.1% 1-4 Family Residential $ 206.6 30.4% $ 237.1 30.8% $ 260.5 25.2% $ 313.2 20.3% $ 377.0 17.3% $ 526.3 16.7% 20.6% Home Equity $ 23.2 3.4% $ 27.9 3.6% $ 34.5 3.3% $ 58.7 3.8% $ 63.4 2.9% $ 93.9 3.0% 32.3% Commercial Real Estate $ 202.5 29.8% $ 283.8 36.9% $ 389.6 37.7% $ 619.3 40.3% $ 881.1 40.5% $ 1,148.7 36.6% 41.9% Agriculture $ 36.6 5.4% $ 35.9 4.7% $ 44.1 4.2% $ 56.3 3.6% $ 57.4 2.6% $ 114.0 3.6% 25.5% Consumer $ 64.5 9.5% $ 54.8 7.1% $ 52.9 5.1% $ 65.1 4.2% $ 66.7 3.1% $ 123.2 3.9% 13.8% Total Loans $ 679.6 100.0% $ 770.0 100.0% $ 1,035.6 100.0% $ 1,542.1 100.0% $ 2,176.5 100.0% $ 3,142.9 100.0% 35.8% 12/31/2002 12/31/2007 12/31/2006 12/31/2003 12/31/2004 12/31/2005 |

20 Deposit Composition Deposit Composition Non-interest bearing DDA 24.3% MMA & Savings 27.6% Interest Bearing DDA 14.2% CDs & IRAs <$100,000 15.9% CDs & IRAs >$100,000 18.0% $ in thousands 2Q08 Cost of Deposits- 2.01% June 30, 2008 Amount Non-interest bearing DDA $ 1,285,493 24.3 % Interst Bearing DDA 750,214 14.2 MMA & Savings 1,465,525 27.6 CD's & IRA's<100m 840,744 15.9 CD's & IRA's>100m 954,658 18.0 Total Deposits $ 5,296,634 100.0 % % of total |

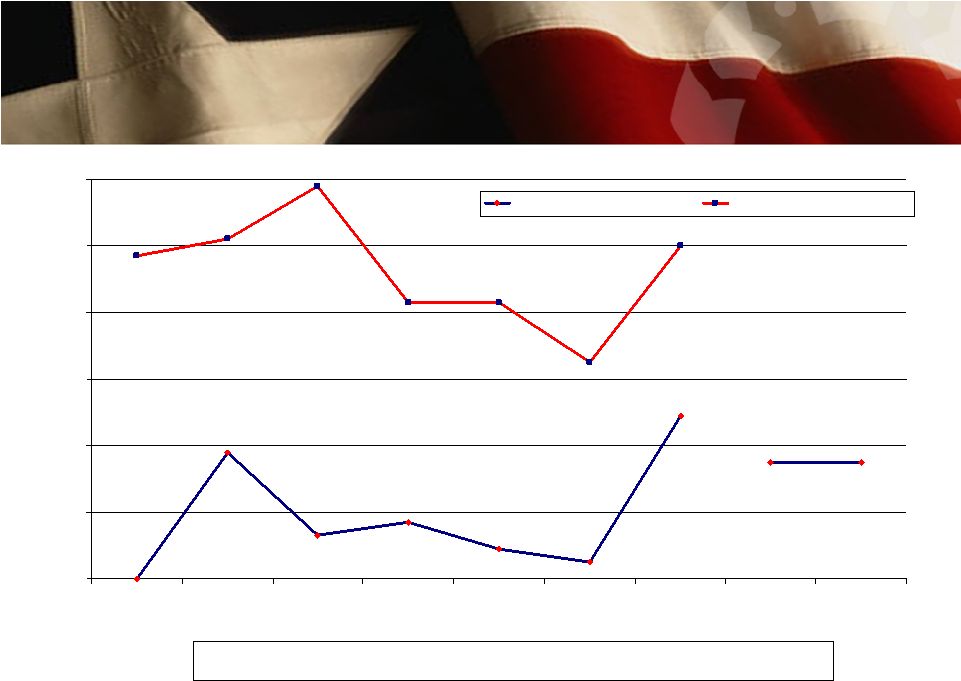

21 Asset Quality - NCO/Average Loans Asset Quality - NCO/Average Loans 0.23% 0.04% 0.54% 0.15% 0.10% 0.04% 0.03% 0.06% 0.08% 0.06% 0.02% 0.19% 0.20% 0.19% 0.30% 0.32% 0.00% 0.10% 0.20% 0.30% 0.40% 0.50% 0.60% 2001 2002 2003 2004 2005 2006* 2007* 2Q07 2Q08 PRSP NCO / Loans Peer NCO / Loans Source: SNL Financial Texas Peer Group Includes: CFR, EBTX, FFIN, FBTX, IBOC, MCBI, SBSI, SNBI, SBIB, SBIT, TCBI, TRBS & TXUI * SNBI, SBIT, TRBS & TXUI have been acquired and were excluded from 2006 & 2007 |

2 nd Quarter Earnings - KBW |