- PB Dashboard

- Financials

- Filings

-

Holdings

- Transcripts

- ETFs

- Insider

- Institutional

- Shorts

-

8-K Filing

Prosperity Bancshares (PB) 8-KRegulation FD Disclosure

Filed: 10 Nov 08, 12:00am

Exhibit 99.1

FDIC Assisted Assumption of Deposits

Franklin Bank, SSB

Houston, Texas

November 7, 2008

“Safe Harbor” Statement

under the Private Securities Litigation Reform Act of 1999

The statements contained in this presentation which are not historical facts contain forward-looking information with respect to plans, projections, or future performance of Prosperity Bancshares, Inc. and its subsidiaries. Forward-looking statements, within the meaning of Section 21E of the Securities Exchange Act of 1934, may have been made in this document. Prosperity’s results may differ materially from those in the forward-looking statements for a variety of reasons, including actions of competitors; changes in laws and regulations; customer and consumer response to marketing; effectiveness of spending, investment or programs; and economic conditions. These factors, and others, are more fully described in Prosperity Bancshares, Inc.’s filings with the Securities and Exchange Commission.

Copies of Prosperity Bancshares, Inc.’s SEC filings are available over the Internet at no charge from www.freeedgar.com.

2 |

|

Key Terms

Transaction Prosperity to acquire:

All deposits of Franklin Bank, including $1.7 billion of brokered deposits Approximately $250 million in assets, primarily Treasury and Agency securities Transaction does not include: Assets and liabilities of Franklin Bank Corp. (Holding Company)

Senior debt, subordinated debt, trust preferred securities, preferred stock, and common stock of Franklin Bank Corp. (Holding Company)

Consideration 1.71% deposit premium or approximately $60 million cash

Divestitures None

Approvals All necessary approvals have been received

3 |

|

Strategic Rationale

Franklin deposit acquisition provides unique opportunity to expand deposit base and increase revenue returns for Prosperity shareholders

Strategic Fit:

Prosperity becomes the second largest independent bank in Texas based on deposits, behind Cullen/Frost

Greatly enhances core deposit franchise in stable markets:

Combined deposits of $7.1 billion (excluding brokered deposits) and 176 branches Expanding into the stable, low-cost deposit markets of East Texas Significantly increased market share in existing, fast-growing market of Austin

Reinforcing strong presence in the Bryan-College Station area, home of Texas A&M University

Financially Compelling:

Accretive in the first 12 months

Opportunity to grow revenue and realize significant cost savings Drive efficiencies in branch network and back office

Prosperity maintains strong capital and liquidity positions Retail deposits add to stable funding base

Ability to integrate:

Recent proven capabilities with success in First Choice, Bank of Navasota, Texas United and SNB Bancshares transactions

Over 20 successful acquisition integrations since 1998

4 |

|

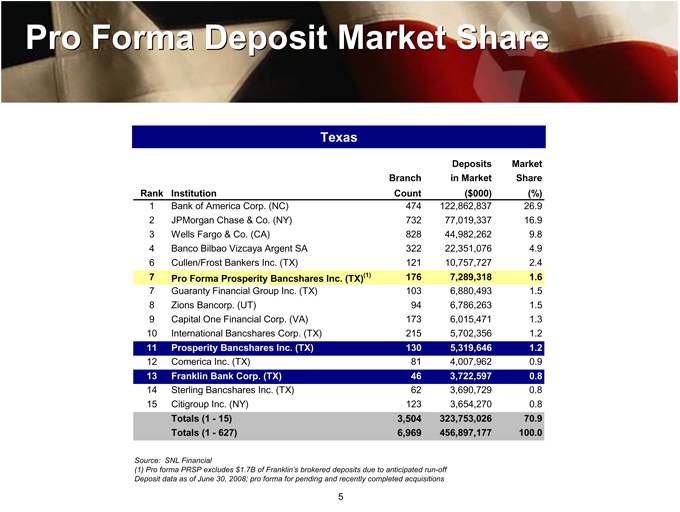

Pro Forma Deposit Market Share

Texas

Rank Institution Branch Count Deposits in Market ($000) Market Share (%)

1 |

| Bank of America Corp. (NC) 474 122,862,837 26.9 |

2 |

| JPMorgan Chase & Co. (NY) 732 77,019,337 16.9 |

3 |

| Wells Fargo & Co. (CA) 828 44,982,262 9.8 |

4 |

| Banco Bilbao Vizcaya Argent SA 322 22,351,076 4.9 |

6 |

| Cullen/Frost Bankers Inc. (TX) 121 10,757,727 2.4 |

7 |

| Pro Forma Prosperity Bancshares Inc. (TX)(1) 176 7,289,318 1.6 |

7 |

| Guaranty Financial Group Inc. (TX) 103 6,880,493 1.5 |

8 |

| Zions Bancorp. (UT) 94 6,786,263 1.5 |

9 Capital One Financial Corp. (VA) 173 6,015,471 1.3

10 International Bancshares Corp. (TX) 215 5,702,356 1.2

11 Prosperity Bancshares Inc. (TX) 130 5,319,646 1.2

12 Comerica Inc. (TX) 81 4,007,962 0.9

13 Franklin Bank Corp. (TX) 46 3,722,597 0.8

14 Sterling Bancshares Inc. (TX) 62 3,690,729 0.8

15 Citigroup Inc. (NY) 123 3,654,270 0.8

Totals (1 - 15) 3,504 323,753,026 70.9

Totals (1 - 627) 6,969 456,897,177 100.0

Source: SNL Financial

(1) Pro forma PRSP excludes $1.7B of Franklin’s brokered deposits due to anticipated run-off Deposit data as of June 30, 2008; pro forma for pending and recently completed acquisitions

5 |

|

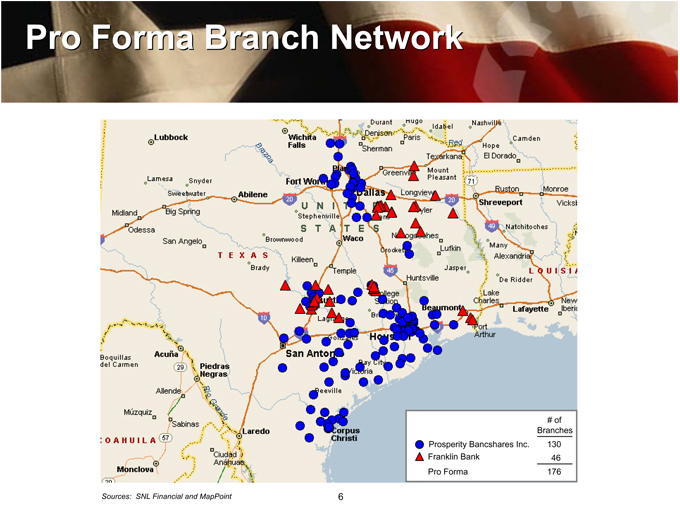

Pro Forma Branch Network

# of Branches

Prosperity Bancshares Inc. 130

Franklin Bank 46

Pro Forma 176

Sources: SNL Financial and MapPoint

6

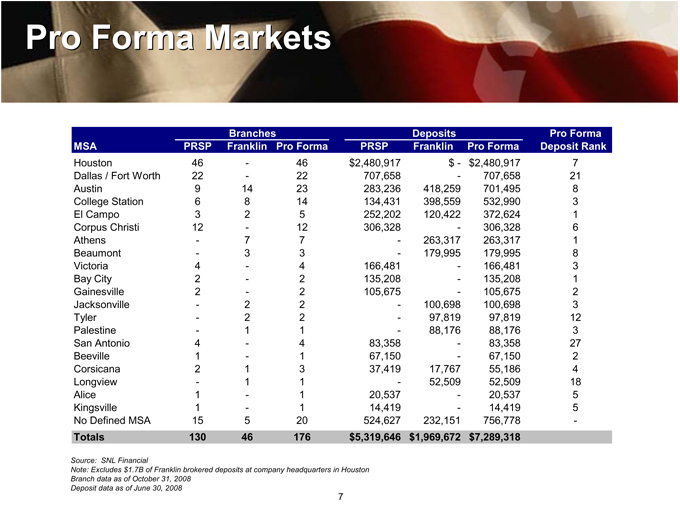

Pro Forma Markets

Branches Deposits Pro Forma

Deposit Rank

MSA PRSP Franklin Pro Forma PRSP Franklin Pro Forma

Houston 46 — 46 $2,480,917 $— $2,480,917 7

Dallas / Fort Worth 22 — 22 707,658 — 707,658 21

Austin 9 14 23 283,236 418,259 701,495 8

College Station 6 8 14 134,431 398,559 532,990 3

El Campo 3 2 5 252,202 120,422 372,624 1

Corpus Christi 12 — 12 306,328 — 306,328 6

Athens — 7 7 — 263,317 263,317 1

Beaumont — 3 3 — 179,995 179,995 8

Victoria 4 — 4 166,481 — 166,481 3

Bay City 2 — 2 135,208 — 135,208 1

Gainesville 2 — 2 105,675 — 105,675 2

Jacksonville — 2 2 — 100,698 100,698 3

Tyler — 2 2 — 97,819 97,819 12

Palestine — 1 1 — 88,176 88,176 3

San Antonio 4 — 4 83,358 — 83,358 27

Beeville 1 — 1 67,150 — 67,150 2

Corsicana 2 1 3 37,419 17,767 55,186 4

Longview — 1 1 — 52,509 52,509 18

Alice 1 — 1 20,537 — 20,537 5

Kingsville 1 — 1 14,419 — 14,419 5

No Defined MSA 15 5 20 524,627 232,151 756,778 -

Totals 130 46 176 $5,319,646 $1,969,672 $7,289,318

Source: SNL Financial

Note: Excludes $1.7B of Franklin brokered deposits at company headquarters in Houston Branch data as of October 31, 2008 Deposit data as of June 30, 2008

7 |

|

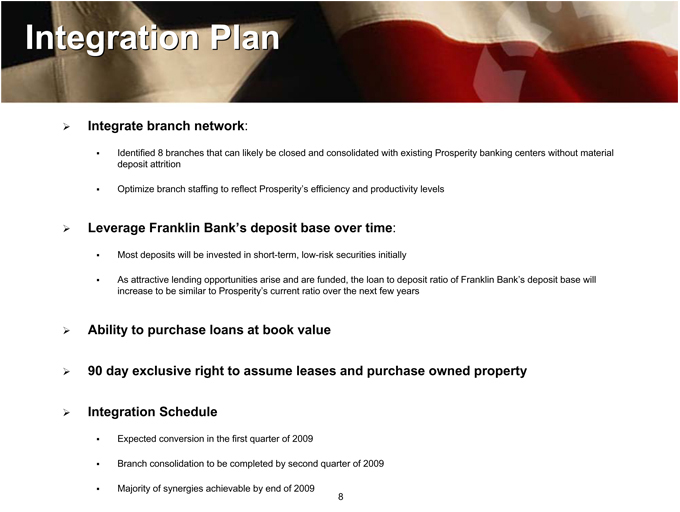

Integration Plan

Integrate branch network:

Identified 8 branches that can likely be closed and consolidated with existing Prosperity banking centers without material deposit attrition

Optimize branch staffing to reflect Prosperity’s efficiency and productivity levels

Leverage Franklin Bank’s deposit base over time:

Most deposits will be invested in short-term, low-risk securities initially

As attractive lending opportunities arise and are funded, the loan to deposit ratio of Franklin Bank’s deposit base will increase to be similar to Prosperity’s current ratio over the next few years

Ability to purchase loans at book value

90 day exclusive right to assume leases and purchase owned property

Integration Schedule

Expected conversion in the first quarter of 2009

Branch consolidation to be completed by second quarter of 2009

Majority of synergies achievable by end of 2009

8 |

|

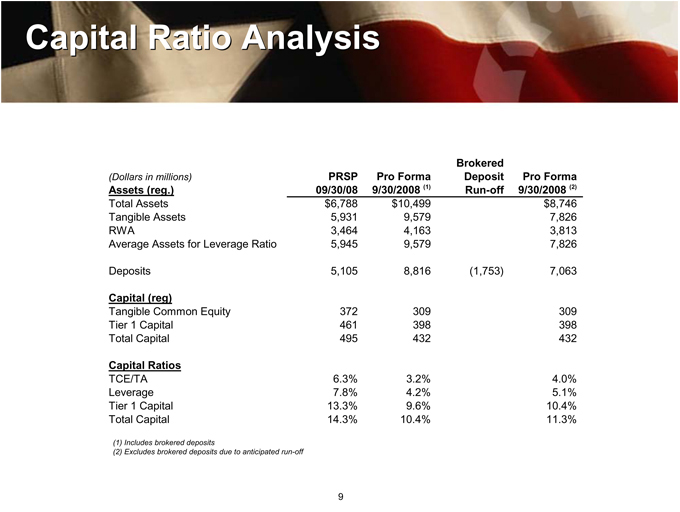

Capital Ratio Analysis

(Dollars in millions) PRSP 09/30/08 Pro Forma 9/30/2008 (1) Brokered Deposit Run-off Pro Forma 9/30/2008 (2)

Assets (reg.)

Total Assets $6,788 $10,499 $8,746

Tangible Assets 5,931 9,579 7,826

RWA 3,464 4,163 3,813

Average Assets for Leverage Ratio 5,945 9,579 7,826

Deposits 5,105 8,816 (1,753) 7,063

Capital (reg)

Tangible Common Equity 372 309 309

Tier 1 Capital 461 398 398

Total Capital 495 432 432

Capital Ratios

TCE/TA 6.3% 3.2% 4.0%

Leverage 7.8% 4.2% 5.1%

Tier 1 Capital 13.3% 9.6% 10.4%

Total Capital 14.3% 10.4% 11.3%

(1) |

| Includes brokered deposits |

(2) |

| Excludes brokered deposits due to anticipated run-off |

9

Contact Information

Corporate Headquarters

Prosperity Bank Plaza

4295 San Felipe

Houston, Texas 77027

Investor Contacts

David Zalman

Chairman & Chief Executive Officer

979.543.2200

david.zalman@prosperitybanktx.com

281.269.7199 Telephone

281.269-7222 Fax

www.prosperitybanktx.com

Dan Rollins

President & Chief Operating Officer

281.269.7199

dan.rollins@prosperitybanktx.com

David Hollaway

Chief Financial Officer

979.543.2200

david.hollaway@prosperitybanktx.com

10