|

2 “Safe Harbor” Statement “Safe Harbor” Statement under the Private Securities Litigation Reform Act of 1995 Statements contained in this presentation which are not historical facts and which pertain to future operating results of Prosperity Bank and its subsidiaries constitute “forward-looking statements” within the meaning of the Private Securities Litigation reform Act of 1995. These forward-looking statements involve significant risks and uncertainties. Actual results may differ materially from the results discussed in these forward-looking statements. Factors that might cause such a difference include, but are not limited to, those discussed in the company’s periodic filings with the SEC. Copies of the SEC filings for Prosperity Bancshares ® may be downloaded from the Internet at no charge from www.prosperitybanktx.com. In connection with the proposed merger of American State Financial Corporation into Prosperity Bancshares, Prosperity Bancshares will file with the Securities and Exchange Commission a registration statement on Form S-4 to register the shares of Prosperity’s common stock to be issued to the shareholders of American State Financial Corporation. The registration statement will include a proxy statement/prospectus which will be sent to the shareholders of American State Financial Corporation seeking their approval of the proposed transaction. WE URGE INVESTORS AND SECURITY HOLDERS TO READ THE REGISTRATION STATEMENT ON FORM S-4, THE PROXY STATEMENT/PROSPECTUS INCLUDED WITHIN THE REGISTRATION STATEMENT ON FORM S-4 AND ANY OTHER RELEVANT DOCUMENTS TO BE FILED WITH THE SECURITIES AND EXCHANGE COMMISSION IN CONNECTION WITH THE PROPOSED TRANSACTION BECAUSE THEY CONTAIN IMPORTANT INFORMATION ABOUT PROSPERITY, AMERICAN STATE FINANCIAL CORPORATION AND THE PROPOSED TRANSACTION. |

3 Corporate Profile Corporate Profile • A Texas based Financial Holding Company with approximately $10 billion in assets • 3 rd largest Texas based commercial bank by Texas deposits • Strong balance sheet growth – 10 year CAGR of 24% loans, 22% deposits and 23% assets • Strong earnings growth – 10 year CAGR of 14% for EPS (diluted) and 27% for net income • Shareholder driven with approximately 9% inside ownership • Excellent asset quality – Net Charge Offs / Average Loans of 0.06% for three months ending December 31, 2011 • Excellent cost control – under 50% efficiency ratio • Integrated over 30 successful acquisitions over the past 16 years a Track Record of Success |

4 4Q11 Highlights 4Q11 Highlights • Net Interest Margin was 3.82% for the fourth quarter 2011 • Non- Performing Assets to Average Earning Assets remain low at 0.14% or $12.052 million • Strong Earnings of $36.406 million or $0.77 per share (diluted) and 1.50% Return on Assets for the fourth quarter 2011 • Tangible Common Equity Ratio improved to 7.00% at December 31, 2011 • Announced acquisition of Bank of Texas, Austin (total assets of $72.5 million, loans of $29.7 million and deposits of $64.2 million); First Federal Bank Texas, Tyler (total assets of $210.6 million, loans of $161.2 million and deposits of $121.2 million); and The Bank Arlington, Arlington (total assets of $37.3 million, loans of $21.3 million and deposits $32.8 million) |

February 27, 2012 Merger with American State Financial Corp. |

6 Strategic Rationale Strategic Rationale • American State merger marks Prosperity’s entry into West Texas in a significant way: – Expands Prosperity west of I-35 and creates a presence in 18 new counties, for a total of 78 counties of operation upon completion – American State is ranked in the top three by deposit market share in each of the following attractive markets: Lubbock, Abilene and Odessa – Creates ample opportunities for in-market consolidation in new markets across Texas • Creates the second largest bank focused solely on Texas with approximately $14 billion in assets: – Improves Texas deposit market share ranking to the seventh position from number nine – Significantly increases the C&I loan portfolio, increasing from approximately $440 million to over $740 million – Complementary balance sheets as American State brings high quality, low cost deposits and pristine asset quality Following the merger, Prosperity will be the 51st largest U.S. headquartered banking institution |

7 Assumptions & Impact Assumptions & Impact • Expected to be approximately 8% accretive to earnings per share • The tangible common equity ratio is restored in approximately one year • Preliminary loan mark is approximately equal to American State’s current loan loss reserve • Non-deposit fee revenue is enhanced through the merger • Through the merger Prosperity will acquire a trust department with $850 million in assets under management |

8 Pro Forma Branch Franchise Pro Forma Branch Franchise (1) PB pro forma for pending and recently completed acquisitions: Texas Bankers, East Texas Financial Services and Bank Arlington (2) ASFC excludes one drive thru branch in Odessa and eight mobile deposit services for nursing homes that do not retain deposits Texas Deposit Market Share PB (1) (178) ASFC (2) (37) Source: SNL Financial and Microsoft MapPoint; Deposit data as of June 30, 2011 Deposits Market Branch in Market Share Rank Institution (ST) Count ($mm) (%) 1 JPMorgan Chase & Co. (NY) 676 96,001 20.0 2 Bank of America Corp. (NC) 458 77,630 16.2 3 Wells Fargo & Co. (CA) 713 51,245 10.7 4 BBVA 378 26,016 5.4 5 Cullen/Frost Bankers Inc. (TX) 133 15,188 3.2 6 Comerica Inc. (TX) 144 10,444 2.2 Pro Forma 215 10,093 2.1 7 Capital One Financial Corp. (VA) 184 9,056 1.9 8 Zions Bancorp. (UT) 96 8,499 1.8 9 Prosperity Bancshares Inc. (TX) (1) 178 7,897 1.6 10 International Bancshares Corp. (TX) 227 6,356 1.3 11 Texas Capital Bancshares Inc. (TX) 12 4,742 1.0 12 Regions Financial Corp. (AL) 87 4,505 0.9 13 BOK Financial Corp. (OK) 48 4,291 0.9 14 PlainsCapital Corp. (TX) 33 3,835 0.8 15 Citigroup Inc. (NY) 107 3,756 0.8 16 First Financial Bankshares (TX) 56 3,186 0.7 17 First National Bank Group Inc. (TX) 60 2,783 0.6 18 Woodforest Financial Group (TX) 203 2,619 0.5 19 ViewPoint Financial Group Inc (TX) 33 2,534 0.5 20 Amarillo National Bancorp Inc. (TX) 16 2,344 0.5 21 Southside Bancshares Inc. (TX) 39 2,242 0.5 22 American State Financial Corp. (TX) (2) 37 2,196 0.5 23 Broadway Bancshares Inc. (TX) 40 1,997 0.4 24 Grupo Financiero Banorte 20 1,861 0.4 25 Lone Star Natl Bcshs--TX Inc. (TX) 32 1,860 0.4 Totals (1-25) 4,010 353,085 73.6 Totals (1-591) 6,893 479,707 100.0 |

9 Balance Sheet Summary Balance Sheet Summary As Originally Reported $ in millions $0 $200 $400 $600 $800 $1,000 $1,200 $1,400 $1,600 2000 2001 2002 2003 2004 2005 2006 2007 2008 2009 2010 2011 Loans Deposits Assets Equity $0 $1,200 $2,400 $3,600 $4,800 $6,000 $7,200 $8,400 $9,600 Total footings as of 12/31/11 Loans = $3.766 Billion Deposits = $8.060 Billion Assets = $9.823 Billion 5 year CAGR Loans = 12% Deposits = 17% Assets = 16% |

10 $0.77 $0.70 $3.01 $1.94 $2.09 $2.06 $2.73 $2.41 $0.00 $0.50 $1.00 $1.50 $2.00 $2.50 $3.00 $3.50 2006 2007 2008 2009 2010 2011 4Q 2010 4Q 2011 EPS Growth Diluted EPS Growth Diluted *Excluding the non-cash after tax impairment charge related to FNMA/FLHMC preferred stock of $6.5 million, EPS was $1.94 **Excluding the non-cash after tax impairment charge related to FNMA/FLHMC preferred stock of $9.1 million, EPS was $1.86 * ** |

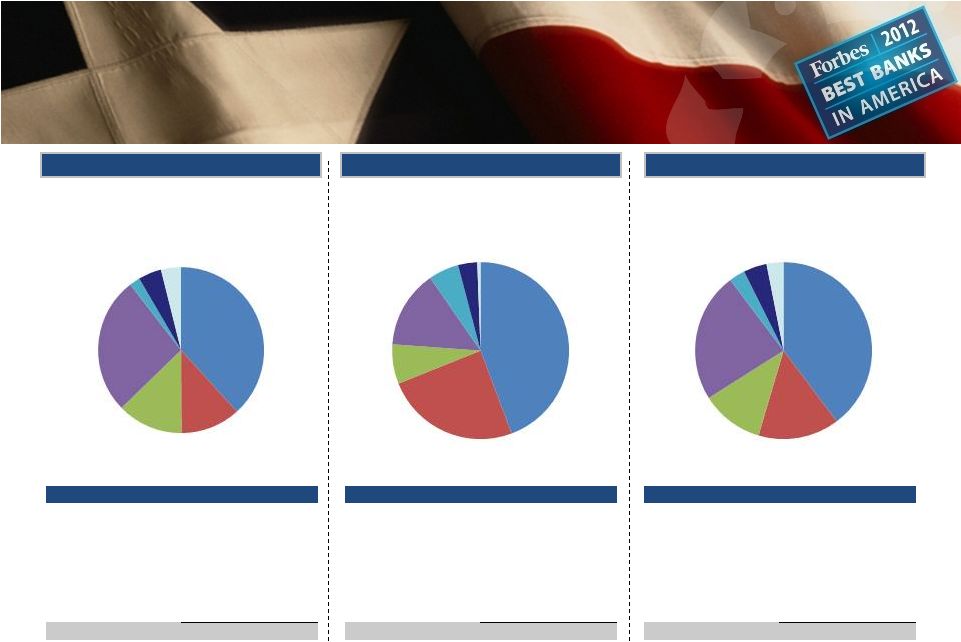

11 Pro Forma Deposit Composition Pro Forma Deposit Composition Prosperity Bancshares, Inc. American State Financial Corporation Pro Forma Deposit Portfolio ($000) % of Total Non-interest Bearing DDA 1,972,226 $ 24.5% Interest Bearing DDA 1,532,701 19.0% MMA & Savings 2,557,023 31.7% CD's & IRA's<100m 968,806 12.0% CD's & IRA's>100m 1,029,498 12.8% Total Deposits 8,060,254 $ 100.0% Cost of Total Deposits 0.44% Deposit Portfolio ($000) % of Total Non-interest Bearing DDA 561,065 $ 22.8% Interest Bearing DDA 574,094 23.3% MMA & Savings 642,744 26.1% CD's & IRA's<100m 249,553 10.1% CD's & IRA's>100m 432,073 17.6% Total Deposits 2,459,529 $ 100.0% Cost of Total Deposits 0.42% Deposit Portfolio ($000) % of Total Non-interest Bearing DDA 2,533,291 $ 24.1% Interest Bearing DDA 2,106,795 20.0% MMA & Savings 3,199,767 30.4% CD's & IRA's<100m 1,218,359 11.6% CD's & IRA's>100m 1,461,571 13.9% Total Deposits 10,519,783 $ 100.0% Cost of Total Deposits 0.44% Source: PB’s 4 Quarter 2012 Earnings Release and company documents for American State; Data as of December 31, 2011; Cost of deposits as of quarter ended December 31, 2011 th |

12 Net Interest Margin * Net Interest Margin * 4.02% 4.06% 3.82% 4.02% 3.99% 3.97% 4.00% 4.24% 4.08% 4.09% 4.20% 3.98% 3.60% 3.70% 3.80% 3.90% 4.00% 4.10% 4.20% 4.30% 1Q09 2Q09 3Q09 4Q09 1Q10 2Q10 3Q10 4Q10 1Q11 2Q11 3Q11 4Q11 Net Interest Margin for 2008 = 3.96% Net Interest Margin for 2009 = 4.08% Net Interest Margin for 2010 = 4.04% Net Interest Margin for 2011 = 3.98% * Tax equivalent- annualized |

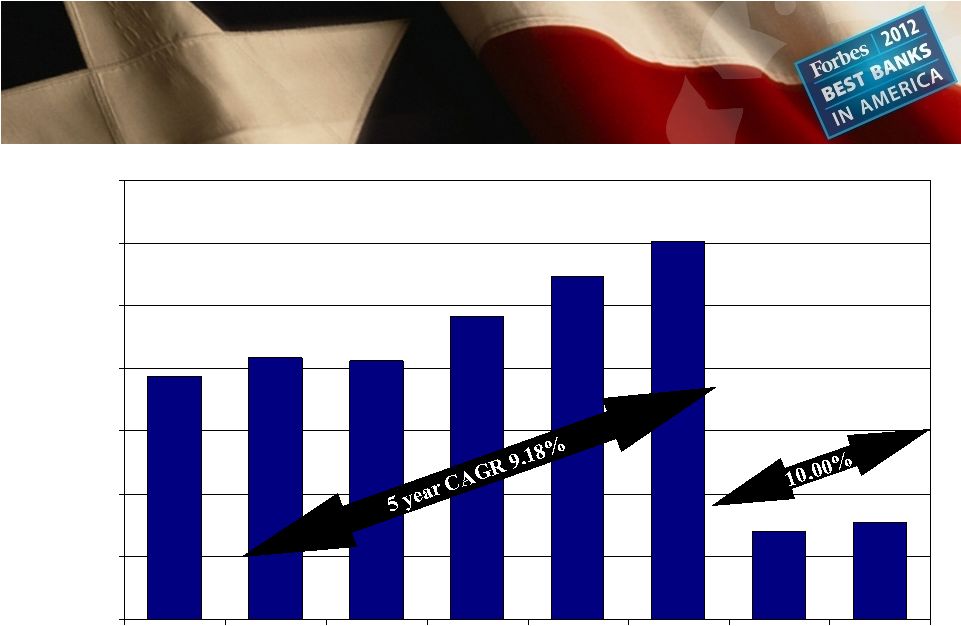

$0 $500 $1,000 $1,500 $2,000 $2,500 $3,000 $3,500 $4,000 2004 2005 2006 2007 2008 2009 2010 4Q10 4Q11 30.00% 35.00% 40.00% 45.00% 50.00% 55.00% 60.00% 65.00% 70.00% Loans Loan / Deposit Ratio 13 Loan Growth Loan Growth $ in millions |

14 Pro Forma Loan Composition Pro Forma Loan Composition Prosperity Bancshares, Inc. American State Financial Corporation Pro Forma Loan Portfolio ($000) % of Total Commercial R.E. 1,441,226 $ 38.3% Commercial 439,854 11.7% Construction 482,140 12.8% 1-4 Family Residential 1,007,266 26.7% Consumer 78,187 2.1% Agriculture 170,234 4.5% Home Equity 146,999 3.9% Gross Loans 3,765,906 $ 100.0% Yield on Loans 5.70% Loan Portfolio ($000) % of Total Commercial R.E. 537,051 $ 44.3% Commercial 298,219 24.6% Construction 87,575 7.2% 1-4 Family Residential 172,364 14.2% Consumer 66,944 5.5% Agriculture 42,466 3.5% Home Equity 7,271 0.6% Gross Loans 1,211,890 $ 100.0% Yield on Loans 5.24% Loan Portfolio ($000) % of Total Commercial R.E. 1,978,277 $ 39.7% Commercial 738,073 14.8% Construction 569,715 11.4% 1-4 Family Residential 1,179,630 23.7% Consumer 145,131 2.9% Agriculture 212,700 4.3% Home Equity 154,270 3.1% Gross Loans 4,977,796 $ 100.0% Yield on Loans 5.59% Home Equity 3.9% Agriculture 4.5% Consumer 2.1% 1-4 Family Residential 26.7% Construction 12.8% Commercial 11.7% Commercial R.E. 38.3% th Agriculture 3.5% Consumer 5.5% 1-4 Family Residential 14.2% Construction 7.2% Commercial 24.6% Commercial R.E. 44.3% Home Equity 0.6% Agriculture 4.3% Home Equity 3.1% Consumer 2.9% 1-4 Family Residential 23.7% Construction 11.4% Commercial 14.8% Commercial R.E. 39.7% Source: PB’s 4 Quarter 2012 Earnings Release and company documents for American State; Data as of December 31, 2011; Yield on loans as of quarter ended December 31, 2011 |

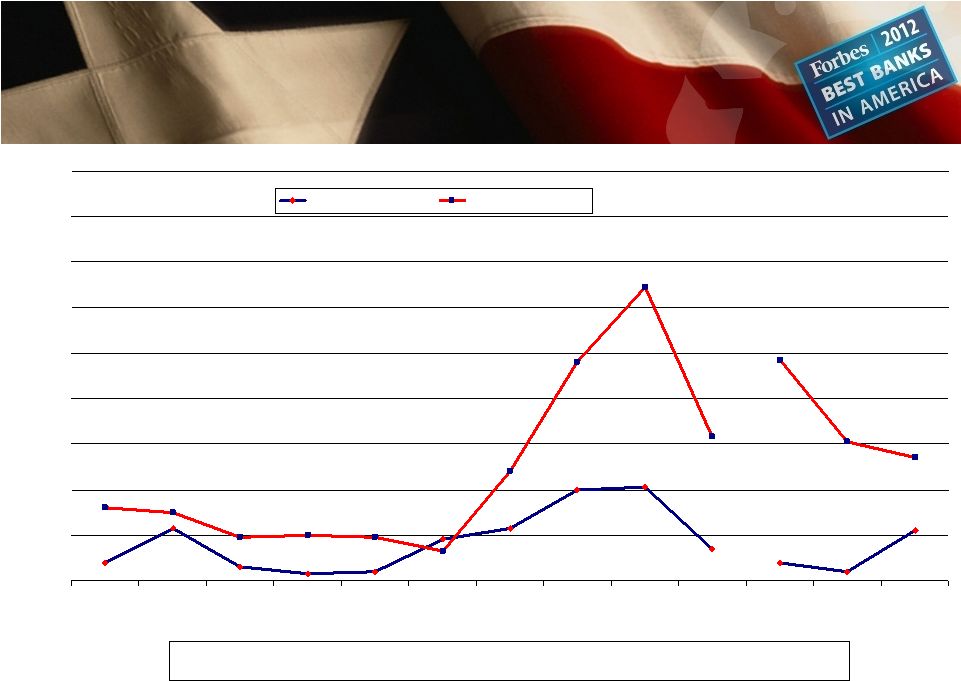

Asset Quality – NPA*/ Loans + OREO * Includes loans past due 90 days and still accruing Asset Quality – NPA*/ Loans + OREO * Includes loans past due 90 days and still accruing 0.32% 2.30% 0.45% 0.48% 0.40% 0.49% 0.05% 0.09% 0.17% 0.13% 0.38% 0.32% 0.36% 0.45% 3.91% 3.63% 0.84% 0.83% 1.18% 1.02% 0.70% 0.97% 2.26% 2.30% 2.95% 3.91% 0.00% 0.50% 1.00% 1.50% 2.00% 2.50% 3.00% 3.50% 4.00% 4.50% 5.00% 2002 2003 2004 2005 2006^ 2007^ 2008^ 2009^ 2010^ 2011 4Q10^ 3Q11^ 4Q11^ PRSP NPA*/Loans + OREO Peer NPA*/Loans + OREO Source: SNL Financial Texas Peer Group Includes: CFR, EBTX, FFIN, FBTX, IBOC, MCBI, SBSI, SNBI, SBIB, SBIT, TCBI, TRBS & TXUI ^ SNBI, SBIT, TRBS & TXUI have been acquired and were excluded from 2006 & 2007 and FBTX failed and was excluded from 2008 NOTE: 15 |

Asset Quality – NCO/ Average Loans Asset Quality – NCO/ Average Loans 0.14% 0.40% 0.23% 0.18% 0.04% 0.03% 0.23% 0.08% 0.41% 0.06% 0.22% 0.04% 0.08% 0.63% 0.32% 0.96% 0.48% 0.13% 0.19% 0.20% 0.19% 0.30% 1.29% 0.54% 0.61% 0.97% 0.00% 0.20% 0.40% 0.60% 0.80% 1.00% 1.20% 1.40% 1.60% 1.80% 2002 2003 2004 2005 2006^ 2007^ 2008^ 2009^ 2010^ 2011 4Q10^ 3Q11^ 4Q11^ PRSP NCO / Loans Peer NCO / Loans Source: SNL Financial Texas Peer Group Includes: CFR, EBTX, FFIN, FBTX, IBOC, MCBI, SBSI, SNBI, SBIB, SBIT, TCBI, TRBS & TXUI ^ SNBI, SBIT, TRBS & TXUI have been acquired and were excluded from 2006 & 2007 and FBTX failed and was excluded from 2008 (Annualized) 16 |

KBW Conference 3/1/12 |