- AVTA Dashboard

- Financials

- Filings

-

Holdings

- Transcripts

-

ETFs

- Insider

- Institutional

- Shorts

-

CORRESP Filing

Avantax (AVTA) CORRESPCorrespondence with SEC

Filed: 23 Dec 08, 12:00am

December 23, 2008

VIA EDGAR

Securities and Exchange Commission

100 F Street, N.E.

Mail Stop 4561

Washington, D.C. 20549

| Attention: | Kathleen Collins |

| Barbara C. Jacobs |

| Michael Johnson |

| Patrick Gilmore |

| Re: | InfoSpace, Inc. |

| Form 10-K for Fiscal Year Ended December 31, 2007 |

| Filed February 25, 2008 |

| Form 10-Q for Fiscal Quarter Ended September 30, 2008 |

| Filed November 10, 2008 |

| File No. 000-25131 |

Dear Ms. Collins, Ms. Jacobs, Mr. Johnson and Mr. Gilmore:

InfoSpace, Inc. (the “Company”) hereby advises the staff of the Securities and Exchange Commission (the “Staff”) that the Company has received the Staff’s letter dated November 24, 2008 (the “Comment Letter”), regarding the Commission’s review of the Company’s Annual Report on Form 10-K for its fiscal year ended December 31, 2007 and its Quarterly Report on Form 10-Q for its fiscal quarter ended September 30, 2008. Our responses to each comment are provided below. For the Staff’s convenience, each comment from the Comment Letter is restated in bold italics prior to our response to such comment.

Form 10-K for the Fiscal Year Ended December 31, 2007

Business, page 3

1.We refer to prior comment 1 of our letter dated October 14, 2008. Given the information provided as well as the disclosure in your filings, we are unable to agree that InfoSpace is not substantially dependent upon its business relationships with Yahoo! and Google for the purposes of Item 601(b)(10) (ii)(B) of Regulation S-K. In this regard, we note that Yahoo! and Google have jointly accounted for over 95% of your revenues for the past few fiscal years as well as the nine-month period ended September 30, 2008. Please file your agreements with these entities. You may request confidential treatment under Rule 24b-2 for portions of these agreements. Finally, please ensure that all material terms of these agreements are set forth in your disclosure, including, but not limited to, terms relating to renewal, termination, and indemnification.

We note the Staff’s comment and advise the Staff as to the following with respect to this comment.

1

We hereby agree to file agreements with these entities in connection with our Annual Report on Form 10-K for the year ending December 31, 2008. In addition, in our future periodic reports that we file with the Commission, we will disclose all material terms of the Yahoo! and Google agreements, including, but not limited to, terms relating to renewal, termination and indemnification.

Form 10-Q for the Quarterly Period Ended September 30, 2008

The Company and Basis of Presentation

Restatement, page 6

2.We note that subsequent to the issuance of the Company’s consolidated financial statements for the year ended December 31, 2007, certain errors were identified affecting the Company’s income tax provision for the year ended December 31, 2007 and that you believe the correction of these errors is not material to the consolidated financial statements. Please provide your SAB 99 materiality analysis explaining how you determined that the errors related to the 2007 financial statements were immaterial on both a quantitative and qualitative basis. Please ensure your response addresses all of the qualitative factors outlined in SAB 99 and any other relevant factors.

We note the Staff’s comments and advise the Staff as to the following with respect to this comment.

We believe that the errors which affected the Company’s income tax provision for the year ended December 31, 2007 were not material to that year; however, we believe the errors if recorded in the three months ended September 30, 2008 would have been material to that period, and would be material to the year ended December 31, 2008.

Our analysis of materiality addressed numerous factors, including those identified in SAB 99. A summary of our analysis follows.

As presented in Note 1,The Company and Basis of Presentation, of our Quarterly Report on Form 10-Q for the quarterly period ended September 30, 2008 (the “Third Quarter 10-Q”), the correction of these errors reduced our loss from continuing operations and increased our net income for the three months and year ended December 31, 2007 by $7.2 million. The below table summarizes the impact (in thousands, except for percentages):

| Quarter ended December 31, 2007 | Year ended December 31, 2007 | |||||||||||||||||||

| As previously reported | Restatement adjustment | % impact on corrected amounts | As previously reported | Restatement adjustment | % impact on corrected amounts | |||||||||||||||

Loss from continuing operations | $ | (66,677 | ) | $ | 6,262 | (10.4 | %) | $ | (90,737 | ) | $ | 6,262 | (7.4 | %) | ||||||

Income from discontinued operations | $ | 122,183 | $ | 892 | 0.7 | % | $ | 105,316 | $ | 892 | 0.8 | % | ||||||||

Net income | $ | 55,506 | $ | 7,154 | 11.4 | % | $ | 14,579 | $ | 7,154 | 32.9 | % | ||||||||

2

While the income tax errors’ impact on net income is significant on a quantitative basis, we believe the qualitative aspects of these errors outweigh the quantitative aspects and, when considered together, support a conclusion that the errors do not represent a material misstatement of our previously issued financial statements.

In evaluating materiality, we considered, among other things, SAB 99, which provides guidelines for assessing materiality. As noted in SAB 99, 5% of net income is a generally accepted threshold for materiality; however, it is neither a bright line test nor a concept found in the accounting literature or law, but more the beginning point of the analysis. Material information is considered to be that which a reasonable person would consider important enough to influence their judgment regarding the financial statements. Other factors, both quantitative and qualitative, need assessment to determine whether a misstatement is material. In particular, SAB 99 cites the following potentially relevant areas to consider in determining whether an item is material:

| 1. | Demonstrated volatility of the registrant’s stock price in the wake of such disclosures; |

| 2. | Hides a failure to meet analysts’ expectation; |

| 3. | Was due to self-dealing or misappropriation by senior management; |

| 4. | Was intentional and/or affects compliance with regulatory, loan or contractual requirements; |

| 5. | Changes a loss into income or vice versa; |

| 6. | Increased management’s compensation; |

| 7. | Masks changes in earnings or other trends; |

| 8. | Concerns a segment that is significant to the company’s operations; |

| 9. | Whether the misstatement arises from an item capable of precise measurement or whether it arises from an estimate and, if so, the degree of imprecision inherent in the estimate. |

Our analysis of each of these items is presented below.

| • | There has been no demonstrated historic volatility of the Company’s stock price in the wake of disclosures regarding errors in accounting for income taxes, because InfoSpace’s shareholders and the investment community focus primarily on Adjusted EBITDA in their evaluation and measurement of the value and performance of the Company. As an example, on February 22, 2007, after the market closed, we filed a Current Report on Form 8-K with the Commission (the “February 2007 8-K”) which disclosed that we reduced the Company’s tax benefit for 2006 by $2.4 million (or 16% of net loss for 2006), as compared to what we disclosed in our earnings release furnished to the Commission on a Current Report on Form 8-K filed on February 1, 2007. The last trade of the Company’s stock as reported on the NASDAQ Stock Market on February 22, 2007 was $22.96, and the first trade after the filing of our Current Report on Form 8-K on February 22, 2007 was for $22.91, and the last trade on that day was for $23.23, equal to a rise of $0.27 the day after our announcement, and the Company’s stock price steadily rose in the subsequent weeks. We believe that the lack of negative shareholder and investor reaction to our disclosure is, in part, due to the Company’s approximately $789 million Net Operating Loss (“NOL”) carryforward (stated in the Company’s Annual Report on Form 10-K for the Fiscal Year Ended December 31, 2007), so income tax accounting charges and benefits are seen as non-cash items and of lesser importance. The NOL is comprised of excess tax benefits (“equity”) and operating activities other than excess tax benefits (“operating”). |

3

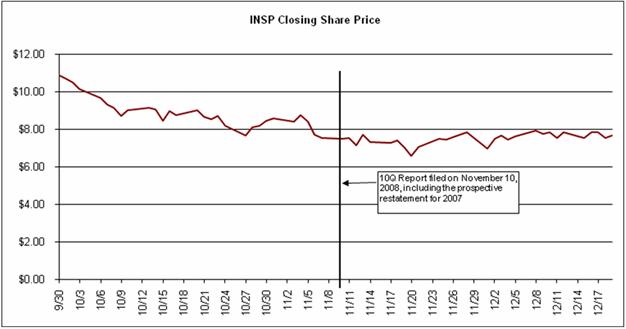

When we disclosed our income tax errors in our Third Quarter 10-Q, filed with the SEC before the market opened on November 10, 2008, there again was no discernable reaction from the investing community. On November 10, 2008, the opening sale of the Company’s stock on the NASDAQ Stock Market transacted at $7.60 per share, which was $0.10 higher than it closed on November 7, 2008 (the last trading day prior to the filing of our Third Quarter 10-Q), and the closing price on November 10, 2008 was $7.49, which was $0.01 lower than the closing price on November 7, 2008 of $7.50. The aforementioned income tax errors had no impact on the Company’s cash and are excluded from cash-based measurements such as Adjusted EBITDA for any period, and therefore these adjustments have not caused volatility in the stock price.

The chart below presents the trend of InfoSpace’s stock price immediately before and after the February 2007 8-K filing.

4

A chart below presents the trend of InfoSpace’s stock price immediately before and after the Third Quarter 10-Q filing.

| • | We believe that revenue and Adjusted EBITDA are the most meaningful measures of the Company’s performance for investors and analysts in light of the large non-cash tax impacts caused by the deferred tax asset valuation allowance adjustments and discontinued operations in recent years. As such, we believe that an increase to net income due to the correction of these income tax errors would not be viewed as a material event by the investor community, and would not have contributed to a failure to meet investment analyst expectations. Adjusted EBITDA is presented to our management and investors as a meaningful metric to measure and assess the Company’s performance and expected performance (forward-looking guidance) in our quarterly earnings press releases, although it is not a measure defined in generally accepted accounting principles (“GAAP”). As such, Adjusted EBITDA is a prominent metric in discussions and presentations to our Board of Directors and Audit Committee. We believe that investment community analysts value the Company as a multiple of Adjusted EBITDA based upon expected revenue growth plus our cash balance. We examined analyst reports on the Company issued in the second half of 2008, which validated our expectation that analysts utilize this valuation methodology with respect to the Company, including those issued by Stanford, Wedbush, Thomas Weisel Partners, B | Riley, Kaufman Bros., Needham and RBC Capital Markets. As a result, in conference calls and other interactions with analysts, there have been no substantive questions or comments related to income tax expense or the income tax provision and its impact to net income. Rather, analysts and the investment community are focused on the fact that the NOL allows the Company to pay nominal cash taxes, which from time to time has been evident in analyst discounted cash flow models for valuation, and/or the possibility that an acquirer may value the NOL as an asset in a transaction to shield the acquirer’s future earnings from cash taxes. |

5

| • | For the years 2006 and 2007, the income tax expenses and benefits have been significant due to the release of a valuation allowance in 2006 and the reapplication of a full valuation allowance in 2007. Additionally, we considered that the operating and equity NOLs have a complex relationship with the method used to relieve and reapply the valuation allowance, and that complexity contributed to the income tax volatility. As a result, we believe that the Company’s income taxes tend to be further discounted in importance by the investing community. |

| • | None of the income tax errors were intentional or due to self-dealing or misappropriation by senior management. In fact, these errors resulted in the understatement of net income in the three months and year ended December 31, 2007 and an overstatement of net loss from continuing operations. |

| • | None of the income tax errors affected compliance with regulatory requirements and/or contractual requirements. |

| • | None of the income tax errors, individually or in aggregate, change a loss into income or vice versa for the three months and year ended December 31, 2007, including loss from continuing operations. As stated above, there is no impact to Adjusted EBITDA as a result of these income tax errors. |

| • | Management incentive compensation is based on revenue and EBITDA, and was not affected by the income tax errors. |

| • | The income tax errors do not mask trends, including earnings. The table below presents the Company’s income (loss) from continuing operations before taxes, income tax benefit (expense) and net income (loss) for the previous four years (amounts in thousands): |

| Year ended December 31, | ||||||||||||||||||

| 2004 | 2005 | 2006 | 2007 As previously reported | 2007 As adjusted | ||||||||||||||

Revenue | $ | 120,673 | $ | 144,003 | $ | 153,800 | $ | 140,537 | $ | 140,537 | ||||||||

Operating expenses | 97,068 | 120,616 | 198,456 | 227,712 | 227,712 | |||||||||||||

Operating income (loss) | 23,605 | 23,387 | (44,656 | ) | (87,175 | ) | (87,175 | ) | ||||||||||

Gain (loss) on investments | 425 | 154 | — | (2,117 | ) | (2,117 | ) | |||||||||||

Other income, net | 5,374 | 89,418 | 19,581 | 18,226 | 18,226 | |||||||||||||

Income (loss) from continuing operations before tax benefit (expense) | 29,404 | 112,959 | (25,075 | ) | (71,066 | ) | (71,066 | ) | ||||||||||

Income tax benefit (expense) | — | 24,154 | 29,060 | (19,671 | ) | (13,409 | ) | |||||||||||

Income (loss) from continuing operations | 29,404 | 137,113 | 3,985 | (90,737 | ) | (84,475 | ) | |||||||||||

Discontinued operations | 52,997 | 22,255 | (19,073 | ) | 105,316 | 106,208 | ||||||||||||

Net income (loss) | $ | 82,401 | $ | 159,368 | $ | (15,088 | ) | $ | 14,579 | $ | 21,733 | |||||||

6

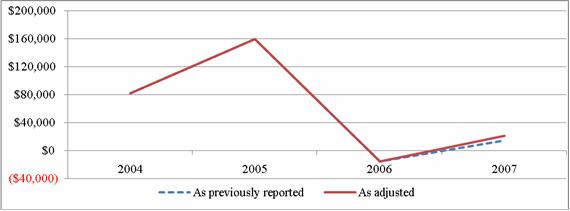

The chart below presents the Company’s income (loss) from continuing operations:

The chart below presents the Company’s net income (loss):

The volatility of net income (loss) is largely the result of fluctuations in the valuation allowance for the Company’s deferred tax assets (2005 through 2007) and discontinued operations as well as other significant non-recurring items, such as the derivative legal settlement gain in 2005 (included in “Other income, net”), employee expenses related to the cash distributions to shareholders in 2007 (included in “Operating expenses”) and restructuring events in 2006 and in 2007 (included in “Operating expenses”). This volatility in net income (loss) due to significant non-recurring items provides evidence that the impact of these errors is not masking meaningful trends in the business. Further, these errors have no impact to pretax income/loss from continuing operations or on EBITDA-based measures.

| • | As of January 1, 2008, we considered the Company to be organized as a single reporting segment and a single operating unit structure, and have not reported segment information since 2007. Accordingly, the income tax errors have no impact on segment reporting. |

7

| • | The income tax errors arose from items of precise measurement, but we believe the nature of the errors and adjustments are discounted in importance by the investing community due to their largely non-cash nature, and the income tax errors did not materially contribute to changing the trend from losses to profits. |

| • | In concluding that the income tax errors are not material, we also considered the impact to the Company’s balance sheet as of December 31, 2007 and the statement of cash flows for the year then ended. For the balance sheet, we noted that the errors, either individually or in aggregate, were not greater than 5% of total assets (or $33.6 million), that the adjustments are primarily impacting shareholders’ equity, and that they have an insignificant impact on working capital (an increase in working capital of $160,000, which represents approximately 0.1% of the Company’s working capital, as reported, of $163.4 million at December 31, 2007). For the statement of cash flows, we noted that the errors, either individually or in aggregate, were not greater than 10% (or $9.6 million) of the average cash flows from operating activities for the past three years, omitting years with negative cash flows from operations. Additionally, we noted that the adjustments, which were non-cash in nature, have no net impact on cash. |

Although we believe that the errors identified are not material to the previously issued financial statements for the three months and year ended December 31, 2007, due to our expectation that no significant events such as those that occurred in 2007 will occur in 2008, we believe that the correction of the errors in 2008 would be considered material to 2008 and, in accordance with Staff Accounting Bulletin No. 108,Considering the Effects of Prior Year Misstatements when Quantifying Misstatements in Current Year Financial Statements, the Company is restating its financial statements prospectively upon reissuance of those financial statements in future filings.

Item 2. Management’s Discussion and Analysis of Financial Condition and Results of Operations

Critical Accounting Policies and Estimates

Fair Value Measurements, page 18

3. We note in your disclosure related to your auction rate securities that you used a discounted cash-flow valuation model that relies on certain unobservable inputs, including the holding period and discount rates applied to future cash flows, to value these securities. We also note that at September 30, 2008, you held $5.1 million of auction rate securities issued by various insurance companies that have no maturity date and, in the event of default, you are entitled to receive non-convertible preferred shares in the issuer. Provide us with the assumptions used in your cash flow model to value these auction rate securities, including how these assumptions were determined, and how these assumptions differed from your valuations of other auction rate securities held by the Company. Additionally, tell us how you considered providing more robust disclosure related to the differences in your valuations of each type of auction rate security held by the Company.

We note the Staff’s comment and advise the Staff as to the following with respect to this comment.

8

The assumptions that we used to value the $5.1 million of auction rate securities (also known as “auction rate preferred securities” or “ARPS”) were determined with the assistance of professional valuation consultants and are presented below:

| a. | The periodic payment as determined by the offering documents of each security which, in the event of failed auctions, requires a premium above the London Interbank Offered Rate ranging from 150 to 200 basis points, computed based on the ARPS’ face values; |

| b. | A discount rate primarily based on the historical Credit Default Swap (“CDS”) rate of the ARPS issuer, which ranged from 12% to 65% per annum; and |

| c. | A term of forty years, which discounted the ARPS’ maturity values to effectively zero, reflecting their lack of a maturity date. |

Those ARPS assumptions were less complex than those assumptions used for the remaining ARS that we hold, for which we reported a fair value of $13.1 million at September 30, 2008.

For those remaining auction rate securities (“ARS”), monoline insurance companies are obligated to fund the periodic payments as well as the payment at maturity of the full principal in the event of an ARS trust’s default. We calculated discounted cash flows for both the monoline insurer payments and the ARS trust payments and weighted each cash flow by the estimated probability of trust default. For the monoline insurer payments, we based the discount rate on their historical CDS rates, and the terms were based on the ARS maturity dates, which ranged from 2025 to 2050. For the ARS trust payments, we based the discount rate on the collateral quality, the proportion of leverage in trusts and the historical CDS rates of comparable companies. For the ARS trusts, the model’s term was our estimated term to a liquidity event which returned the full principal, which ranged from six to twenty-eight years. The perpetual term for the ARPS, the monoline insurers’ guarantees and collateral quality for the remaining ARS are the primary differences between the valuation models for the two types of these securities that we hold, which we have disclosed in the notes to our unaudited condensed consolidated financial statements in the Third Quarter 10-Q, in “Note 2: Fair Value Measurements.” During the process of preparing disclosures relating to the valuation of our ARS, we considered the disclosure requirements of Statement of Financial Accounting Standards No. 157 (“SFAS 157”),Fair Value Measurements, issued by the Financial Accounting Standards Board and the sample illustrative letters provided to certain public companies by the Commission in March and September 2008 on disclosure requirements regarding the application of SFAS 157 in Management’s Discussion and Analysis of Financial Condition and Results of Operations. In light of the Staff’s comments, we also plan to disclose the ranges of interest rates, terms and discount rates used in our models, and how we determined them, in our Annual Report on Form 10-K for the year ended December 31, 2008 that we will file with the Commission.

Item 4. Controls and Procedures, page 27

4. We note that as of September 30, 2008, your Chief Executive Officer and your Chief Financial Officer have concluded that your disclosure controls and procedures were effective notwithstanding your identification of certain errors identified affecting the Company’s income tax provision that resulted in the restatement of the Company’s financial statements as of December 31, 2007. Tell us

9

how your Chief Executive Officer and your Chief Financial Officer considered the errors identified in concluding that your disclosure controls and procedures were effective. Additionally, tell us how you considered these errors in determining whether a material weakness or significant deficiency continued to exist as of December 31, 2007 and as of September 30, 2008.

We note the Staff’s comments and advise the Staff as to the following with respect to this comment.

In determining whether a material weakness or significant deficiency existed as of December 31, 2007 or September 30, 2008, our Chief Executive Officer and our Chief Financial Officer considered the nature of the errors and reviewed the internal control over financial reporting relating to our accounting for income taxes. During this review of our internal control over financial reporting related to our income tax accounting, we concluded that deficiencies in our income tax provision work paper preparation existed as of December 31, 2007 and September 30, 2008. As a result, we concluded that a significant deficiency in our internal control over financial reporting related to our income tax accounting existed as of December 31, 2007 and September 30, 2008, which we are remediating.

We further considered whether these deficiencies in internal control rose to the level of a material weakness, and concluded that they did not. Our evaluation was based on several factors. For the same reasons as cited above with respect to our evaluation of the impact of the income tax errors on the financial statements, we did not deem the errors that resulted from these deficiencies to have caused a material error in our financial statements. We also considered whether a material error could have resulted from these deficiencies, as further discussed in the following paragraph.

Temporary differences that were not accurately stated in our original 2007 tax provision resulted in correcting entries to the tax provision, with a corresponding entry to additional paid-in capital (“APIC”). This is due to our reestablishment of a full valuation allowance in 2007 against our remaining deferred tax assets due to the uncertainty of future taxable income subsequent to the sale of the online directory and mobile businesses in the fourth quarter 2007, which must be recorded through the tax provision, and our utilization of NOL carryforwards that must be recorded to APIC under GAAP. As a result, we considered that the largest error in the 2007 tax provision relates to our election with respect to ordering of our recognition of the benefit of NOL carryforwards, which can be done under GAAP ordering rules or “tax law ordering” rules, and which is a policy decision under GAAP. Pursuant to our GAAP ordering policy decision, we misapplied the equity NOL before applying the alternative minimum tax (“AMT”) credit. Additionally, this error is limited in quantitative terms to the actual amount of the error identified in 2007 since the amount of AMT credit utilized in 2007 was a function of previous years’ regular tax and AMT, which was a known and fixed amount at the beginning of 2007. Also, this issue is limited to 2007, since the utilization of the Company’s remaining AMT credits in the future will only occur upon full utilization of the Company’s equity NOLs and will then be recorded to APIC rather than in the tax provision, meaning a similar error is not likely to occur in the foreseeable future. Our remaining temporary differences are not complex, and the likelihood of an error in excess of the actual error that occurred in 2007 was considered to be remote based on our evaluation of all of the above factors. Considering all of these factors collectively, our Chief Executive Officer and our Chief Financial Officer concluded that our disclosure controls and procedures were effective, as our financial statements have been materially correct for all periods presented, including those presented in our Annual Report on Form 10-K for the year ended December 31, 2007 and the Third Quarter 10-Q.

10

In connection with the foregoing responses to the Staff’s Letter, we hereby acknowledge that:

| • | The Company is responsible for the adequacy and accuracy of the disclosure in the filing; |

| • | Staff comments or changes to disclosure in response to Staff comments do not foreclose the Commission from taking any action with respect to the filing; and |

| • | The Company may not assert Staff comments as a defense in any proceeding initiated by the Commission or any person under the federal securities laws of the United States. |

We appreciate the Staff’s comments and request that the Staff contact the undersigned at (425) 201-6100 with any questions or comments regarding this letter.

Respectfully Submitted,

INFOSPACE, INC. |

| /s/ David B. Binder |

| David B. Binder |

| Chief Financial Officer |

11