Exhibit 99.2

Introduction to Monoprice

August 1, 2013

Safe Harbor

During the course of this presentation, we may provide projections or other forward-looking statements regarding future events and/or future financial performance. We wish to caution you that you should not place undue reliance on such forward-looking statements because they are just projections. Actual events or results may differ materially due to risks, uncertainties, and other factors, including, but not limited to: the successful execution of the Company’s strategic initiatives, business integration and operating plans, and marketing strategies; the timing and extent of market acceptance of products and services; and general economic, industry, and market sector conditions. We refer you to the documents Blucora files from time to time with the Securities and Exchange Commission, and in particular, the risk factors identified in Blucora’s most recent Quarterly Report on Form 10-Q.

Monoprice Acquisition Overview

August 1, 2013

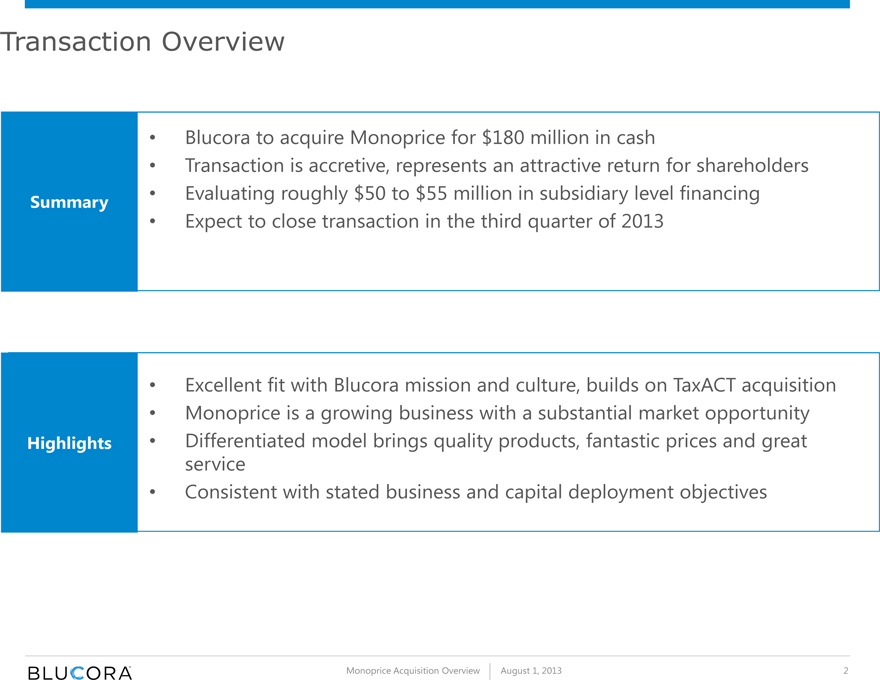

Transaction Overview

Summary

Blucora to acquire Monoprice for $180 million in cash

Transaction is accretive, represents an attractive return for shareholders Evaluating roughly $50 to $55 million in subsidiary level financing Expect to close transaction in the third quarter of 2013

Highlights

Excellent fit with Blucora mission and culture, builds on TaxACT acquisition Monoprice is a growing business with a substantial market opportunity Differentiated model brings quality products, fantastic prices and great service Consistent with stated business and capital deployment objectives

Monoprice Acquisition Overview

August 1, 2013

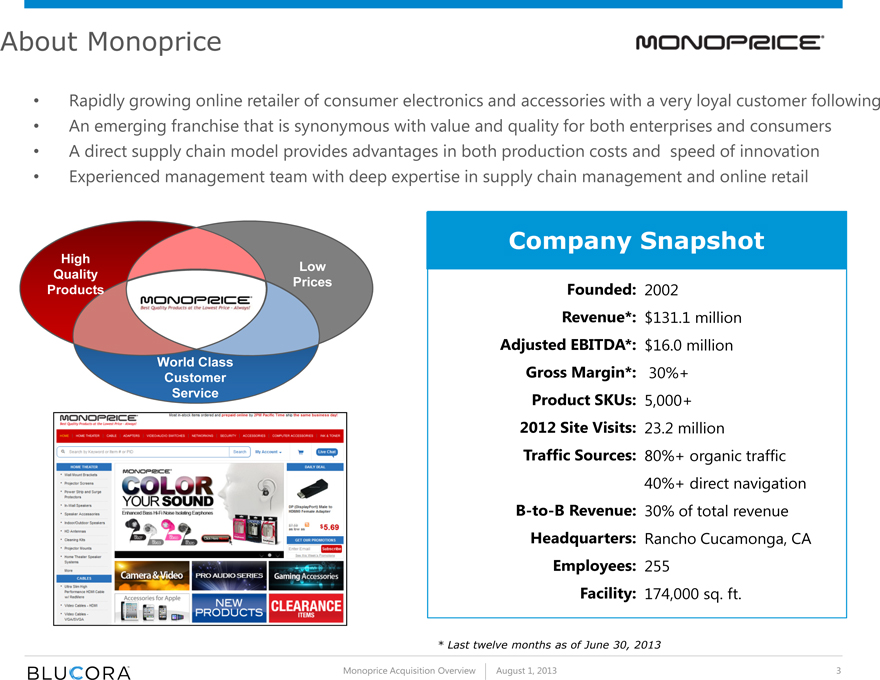

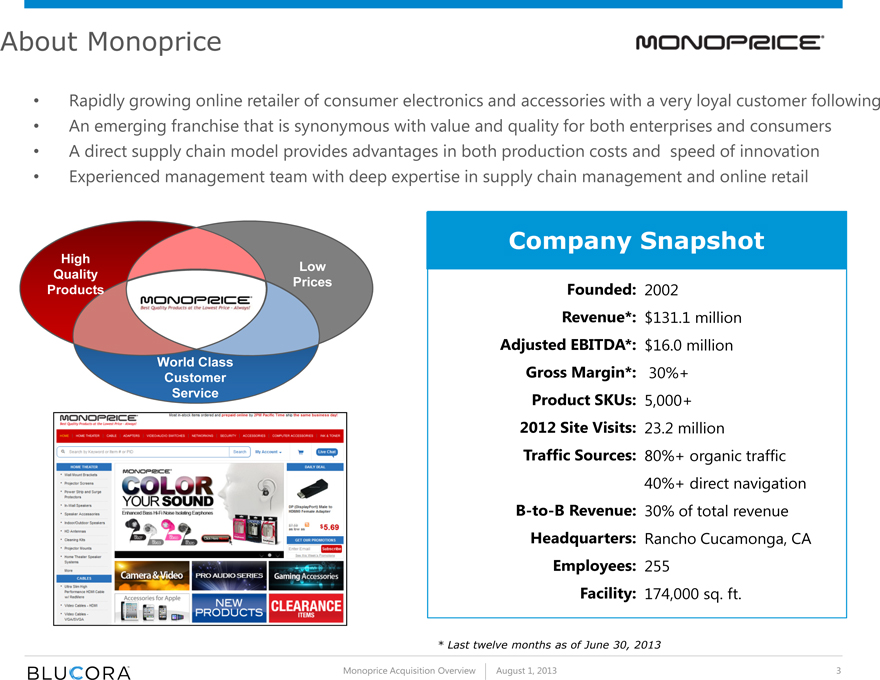

About Monoprice

Rapidly growing online retailer of consumer electronics and accessories with a very loyal customer following An emerging franchise that is synonymous with value and quality for both enterprises and consumers A direct supply chain model provides advantages in both production costs and speed of innovation Experienced management team with deep expertise in supply chain management and online retail

High Quality Products

Low Prices

World Class Customer Service

Company Snapshot

Founded: 2002

Revenue*: $131.1 million

Adjusted EBITDA*: $16.0 million Gross Margin*: 30%+ Product SKUs: 5,000+ 2012 Site Visits: 23.2 million

Traffic Sources: 80%+ organic traffic 40%+ direct navigation B-to-B Revenue: 30% of total revenue Headquarters: Rancho Cucamonga, CA

Employees: 255

Facility: 174,000 sq. ft.

* | | Last twelve months as of June 30, 2013 |

Monoprice Acquisition Overview

August 1, 2013

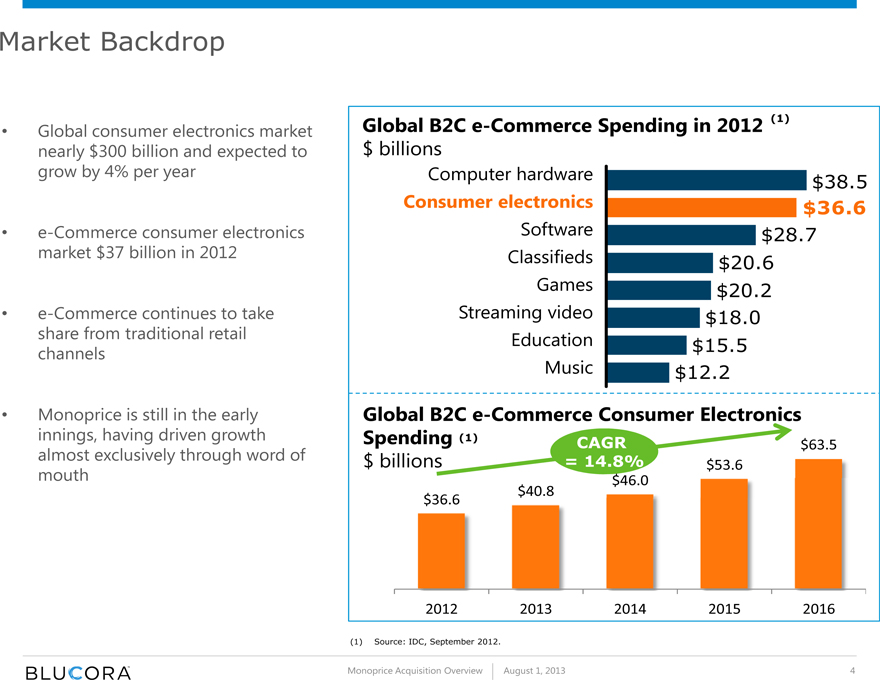

Market Backdrop

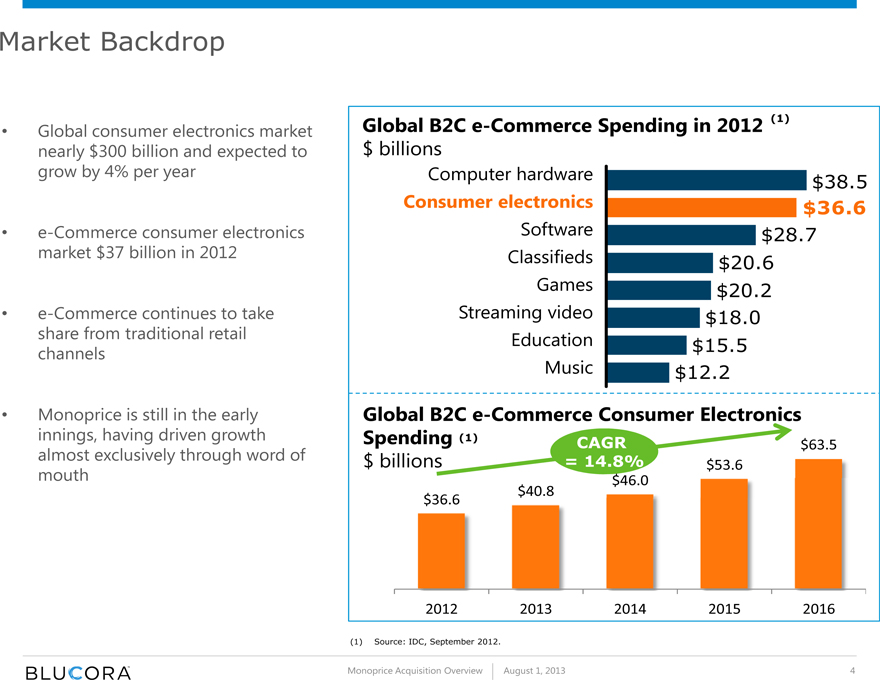

Global consumer electronics market nearly $300 billion and expected to grow by 4% per year

e-Commerce consumer electronics market $37 billion in 2012

e-Commerce continues to take share from traditionpal retail channels

Monoprice is still in the early innings, having driven growth almost exclusively through word of mouth

Global B2C e-Commerce Spending in 2012 (1) $ billions

Computer hardware

Consumer electronics

Software

Classifieds

Games

Streaming video

Education

Music

$38.5 $36.6 $28.7 $20.6 $20.2 $18.0 $15.5 $12.2

Global B2C e-Commerce Consumer Electronics Spending (1) CAGR

$63.5

$ billions = 14.8% $53.6

$46.0

$40.8

$36.6

2012 2013 2014 2015 2016

(1) | | Source: IDC, September 2012. |

Monoprice Acquisition Overview

August 1, 2013

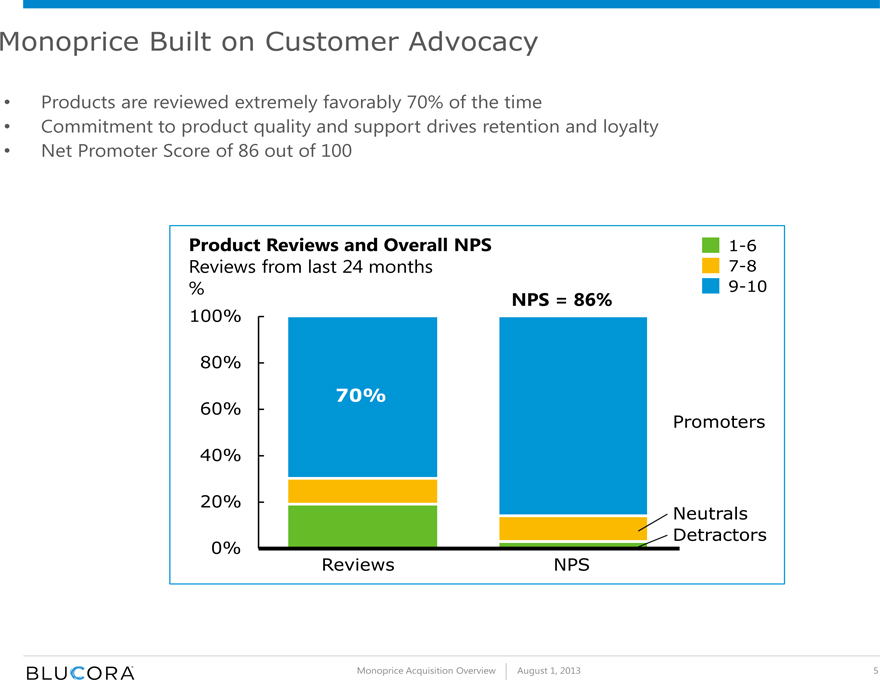

Monoprice Built on Customer Advocacy

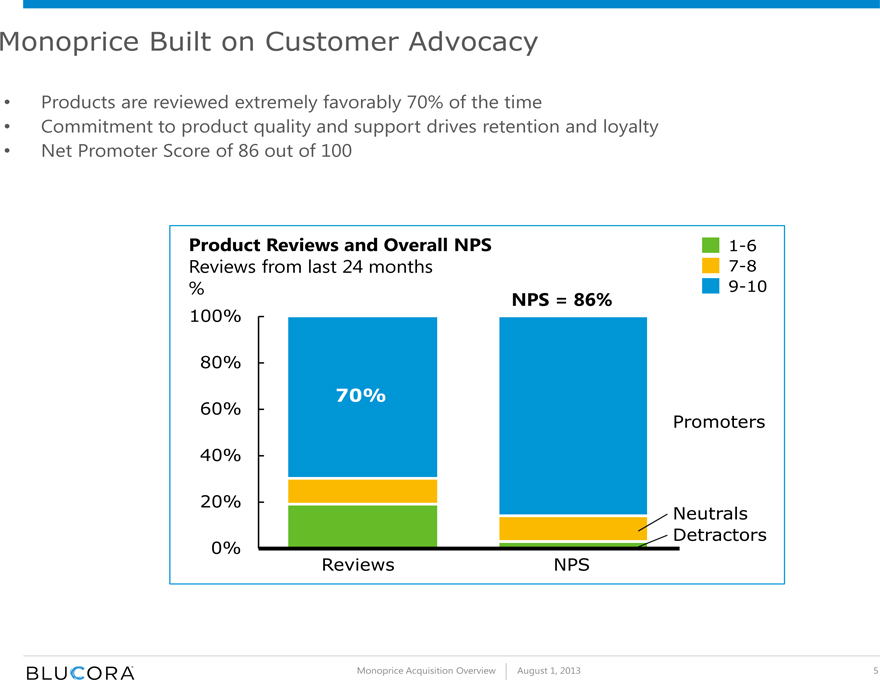

Products are reviewed extremely favorably 70% of the time

Commitment to product quality and support drives retention and loyalty Net Promoter Score of 86 out of 100

Product Reviews and Overall NPS

Reviews from last 24 months %

NPS = 86%

1-6

7-8

9-10

100% 80% 60% 40% 20% 0%

70%

Promoters

Reviews

NPS

Neutrals Detractors

Monoprice Acquisition Overview

August 1, 2013

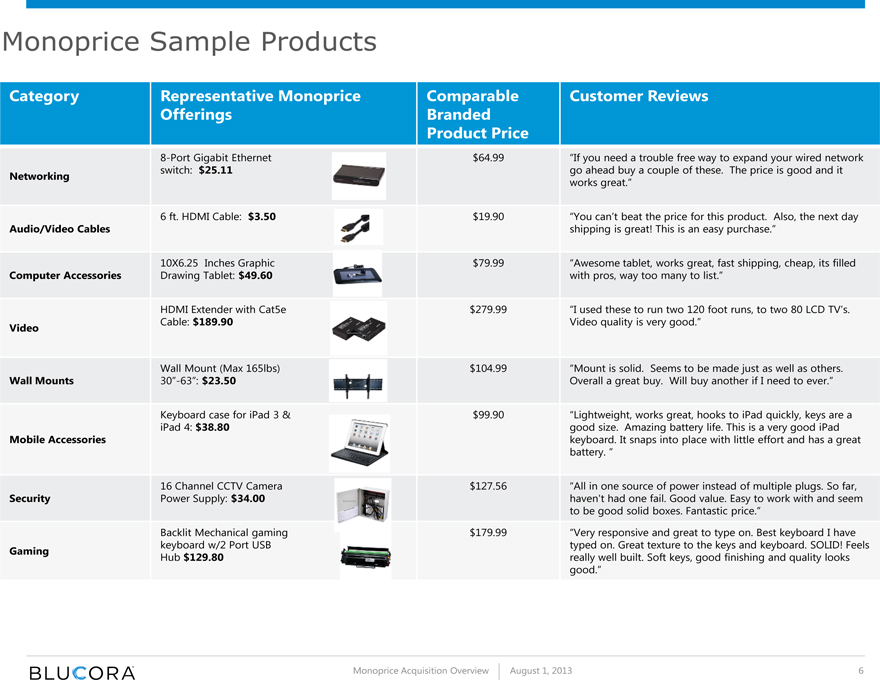

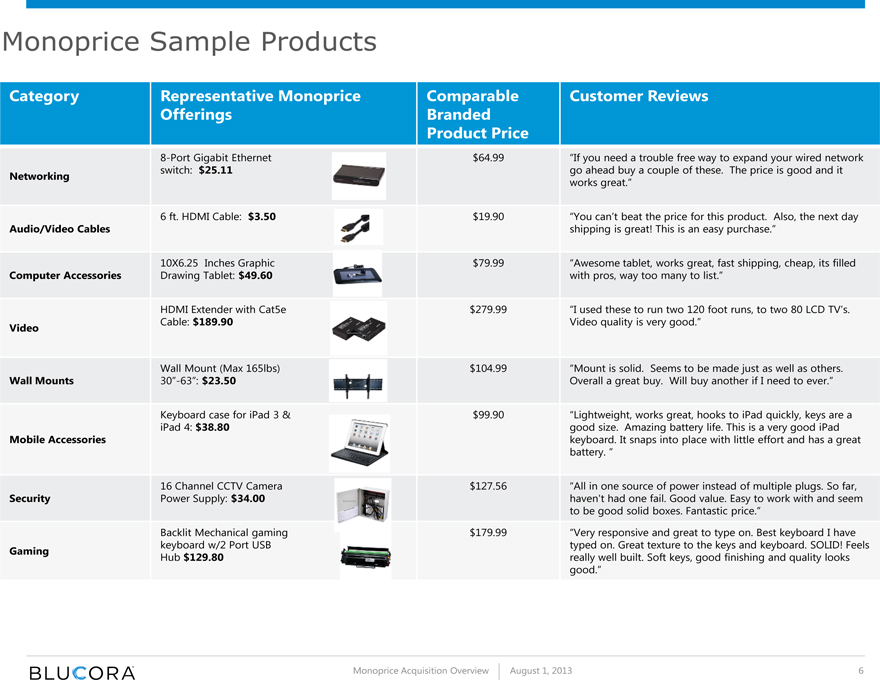

Monoprice Sample Products

Category Representative Monoprice Comparable Customer Reviews

Offerings Branded

Product Price

8-Port Gigabit Ethernet $64.99 “If you need a trouble free way to expand your wired network

Networking switch: $25.11 go ahead buy a couple of these. The price is good and it

works great.”

6 ft. HDMI Cable: $3.50 $19.90 “You can’t beat the price for this product. Also, the next day

Audio/Video Cables shipping is great! This is an easy purchase.”

10X6.25 Inches Graphic $79.99 “Awesome tablet, works great, fast shipping, cheap, its filled

Computer Accessories Drawing Tablet: $49.60 with pros, way too many to list.”

HDMI Extender with Cat5e $279.99 “I used these to run two 120 foot runs, to two 80 LCD TV’s.

Video Cable: $189.90 Video quality is very good.”

Wall Mount (Max 165lbs) $104.99 “Mount is solid. Seems to be made just as well as others.

Wall Mounts 30”-63”: $23.50 Overall a great buy. Will buy another if I need to ever.”

Keyboard case for iPad 3 & $99.90 “Lightweight, works great, hooks to iPad quickly, keys are a

iPad 4: $38.80 good size. Amazing battery life. This is a very good iPad

Mobile Accessories keyboard. It snaps into place with little effort and has a great

battery. “

16 Channel CCTV Camera $127.56 “All in one source of power instead of multiple plugs. So far,

Security Power Supply: $34.00 haven’t had one fail. Good value. Easy to work with and seem

to be good solid boxes. Fantastic price.”

Backlit Mechanical gaming $179.99 “Very responsive and great to type on. Best keyboard I have

keyboard w/2 Port USB typed on. Great texture to the keys and keyboard. SOLID! Feels

Gaming Hub $129.80 really well built. Soft keys, good finishing and quality looks

good.”

Monoprice Acquisition Overview

August 1, 2013

6

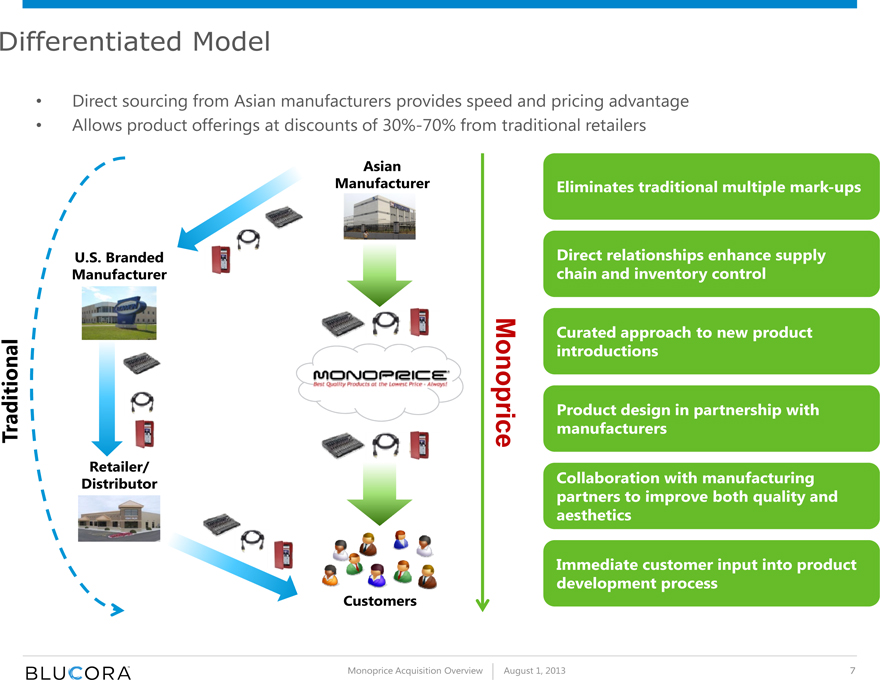

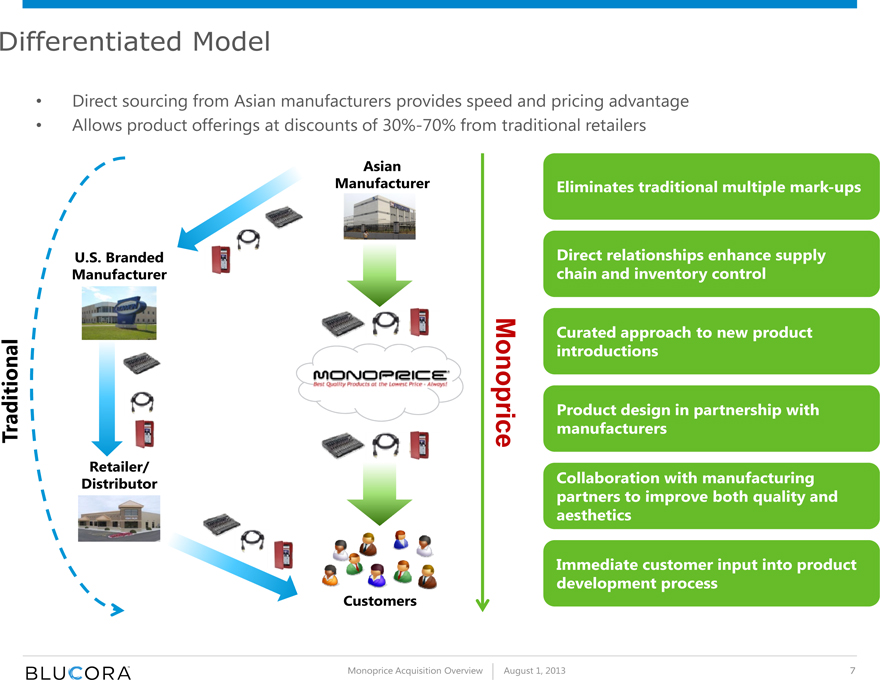

Differentiated Model

Direct sourcing from Asian manufacturers provides speed and pricing advantage Allows product offerings at discounts of 30%-70% from traditional retailers

Traditional

Monoprice

U.S. Branded Manufacturer

Asian Manufacturer

Retailer/ Distributor

Customers

Eliminates traditional multiple mark-ups

Direct relationships enhance supply chain and inventory control

Curated approach to new product introductions

Product design in partnership with manufacturers

Collaboration with manufacturing partners to improve both quality and aesthetics

Immediate customer input into product development process

Monoprice Acquisition Overview

August 1, 2013

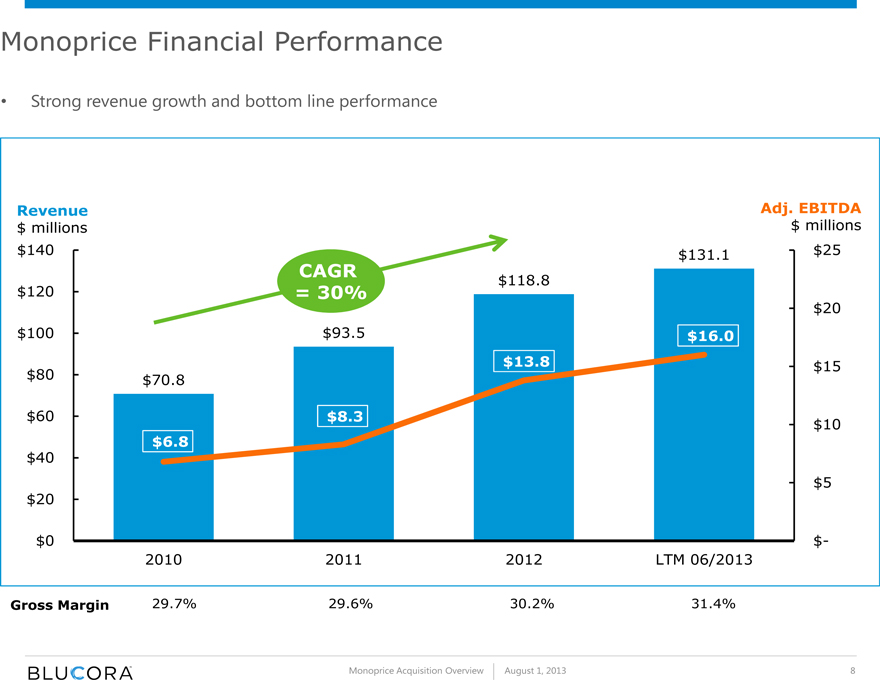

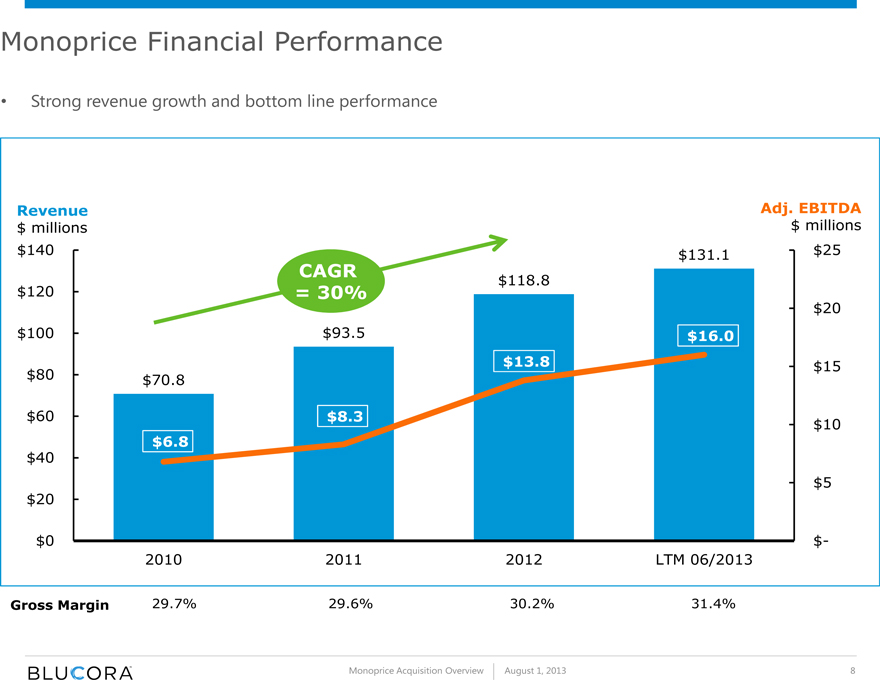

Monoprice Financial Performance

Strong revenue growth and bottom line performance

Revenue Adj. EBITDA

$ millions $ millions

$140 $131.1 $25

CAGR $118.8

$120 = 30%

$20

$100 $93.5 $16.0

$13.8 $15

$80 $70.8

$60 $8.3 $10

$6.8

$40

$5

$20

$0 $-

2010 2011 2012 LTM 06/2013

Gross Margin 29.7% 29.6% 30.2% 31.4%

Monoprice Acquisition Overview

August 1, 2013

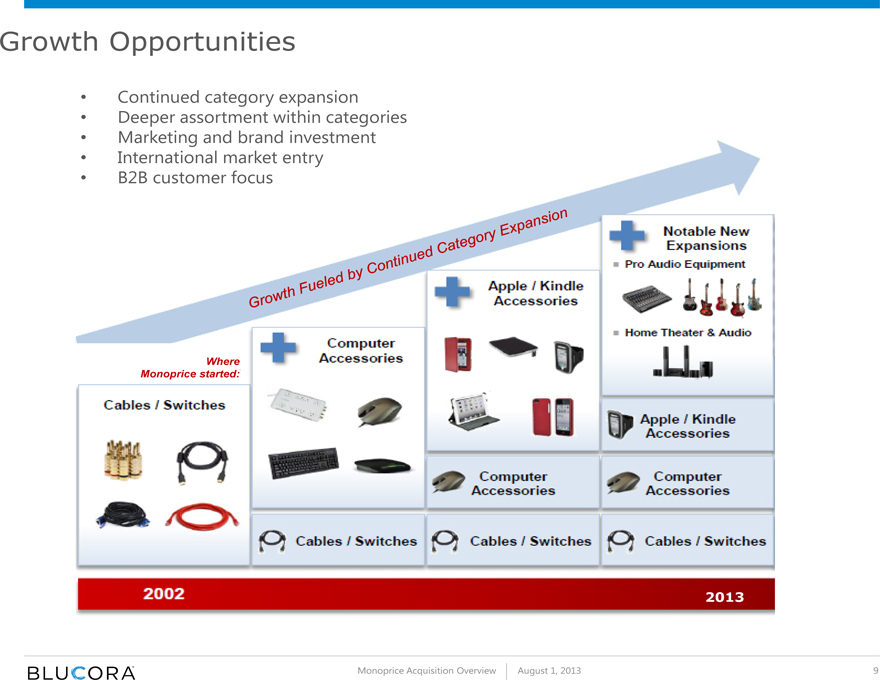

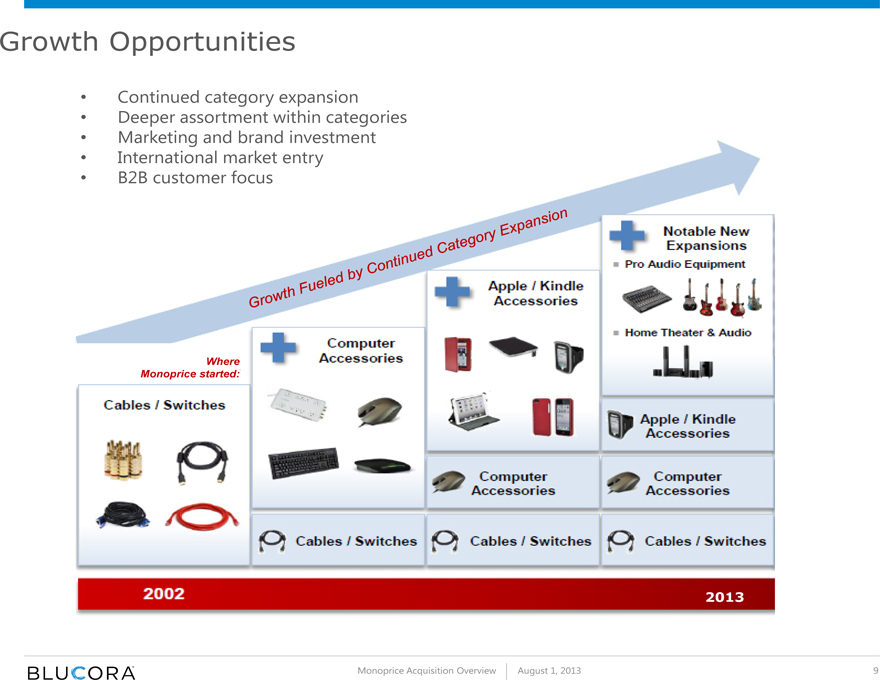

Growth Opportunities

Continued category expansion Deeper assortment within categories Marketing and brand investment International market entry B2B customer focus

Where

Monoprice started:

2002 2013

Monoprice Acquisition Overview

August 1, 2013

9

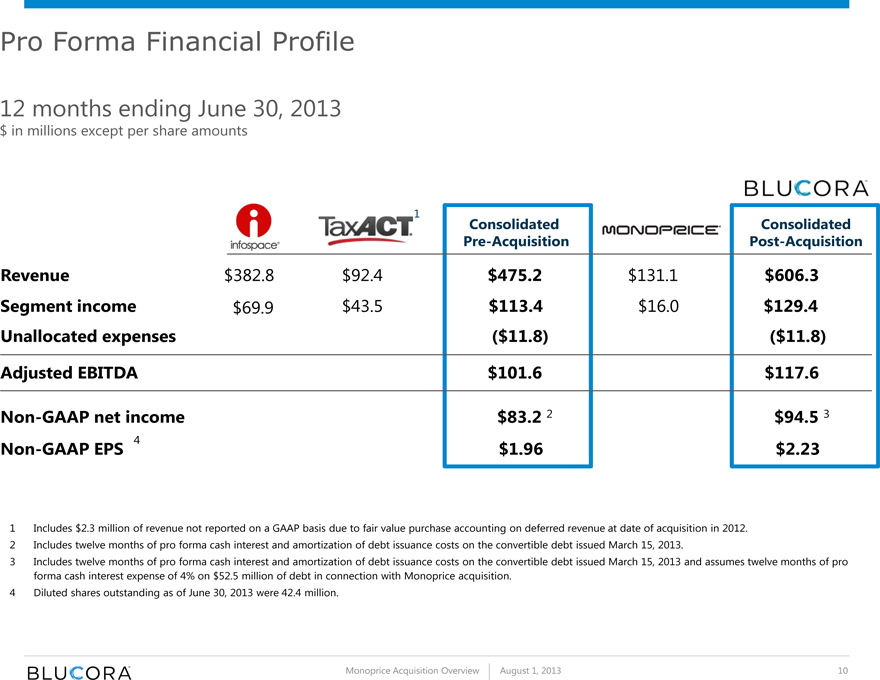

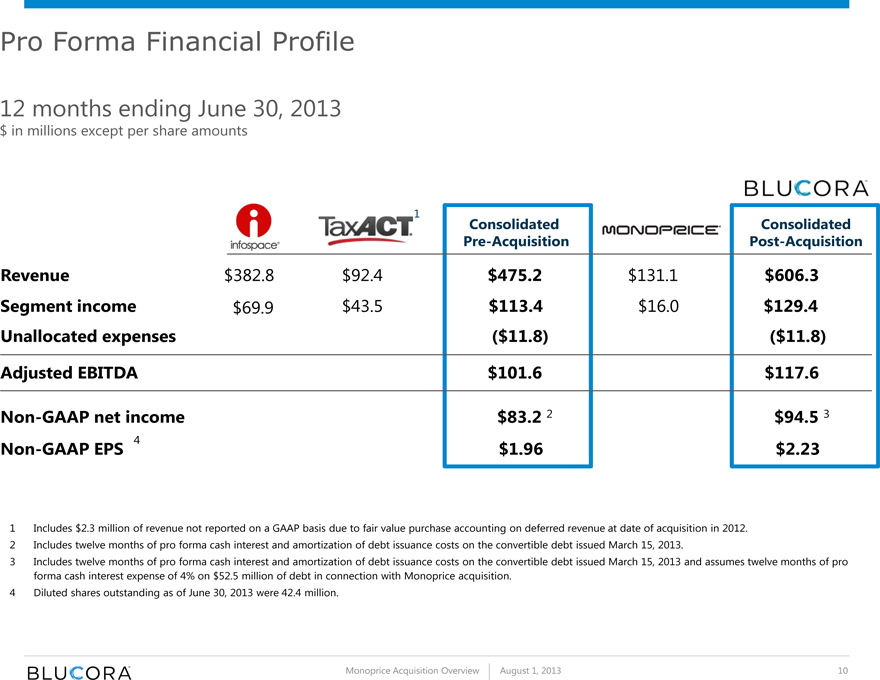

Pro Forma Financial Profile

12 months ending June 30, 2013

$ in millions except per share amounts 1

Consolidated Consolidated

Pre-Acquisition Post-Acquisition

Revenue $382.8 $ 92.4 $475.2 $131.1 $606.3

Segment income $69.9 $ 43.5 $113.4 $16.0 $129.4

Unallocated expenses ($11.8) ($11.8)

Adjusted EBITDA $101.6 $117.6

Non-GAAP net income $83.2 2 $94.5 3

Non-GAAP EPS 4 $1.96 $2.23

1 Includes $2.3 million of revenue not reported on a GAAP basis due to fair value purchase accounting on deferred revenue at date of acquisition in 2012.

2 Includes twelve months of pro forma cash interest and amortization of debt issuance costs on the convertible debt issued March 15, 2013.

3 Includes twelve months of pro forma cash interest and amortization of debt issuance costs on the convertible debt issued March 15, 2013 and assumes twelve months of pro forma cash interest expense of 4% on $52.5 million of debt in connection with Monoprice acquisition.

4 | | Diluted shares outstanding as of June 30, 2013 were 42.4 million. |

Monoprice Acquisition Overview

August 1, 2013

10

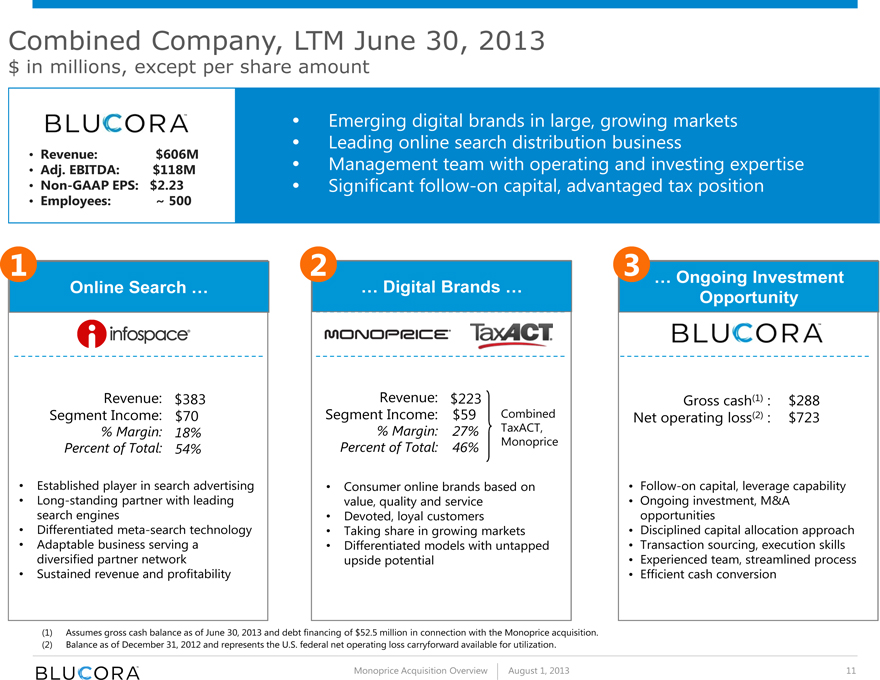

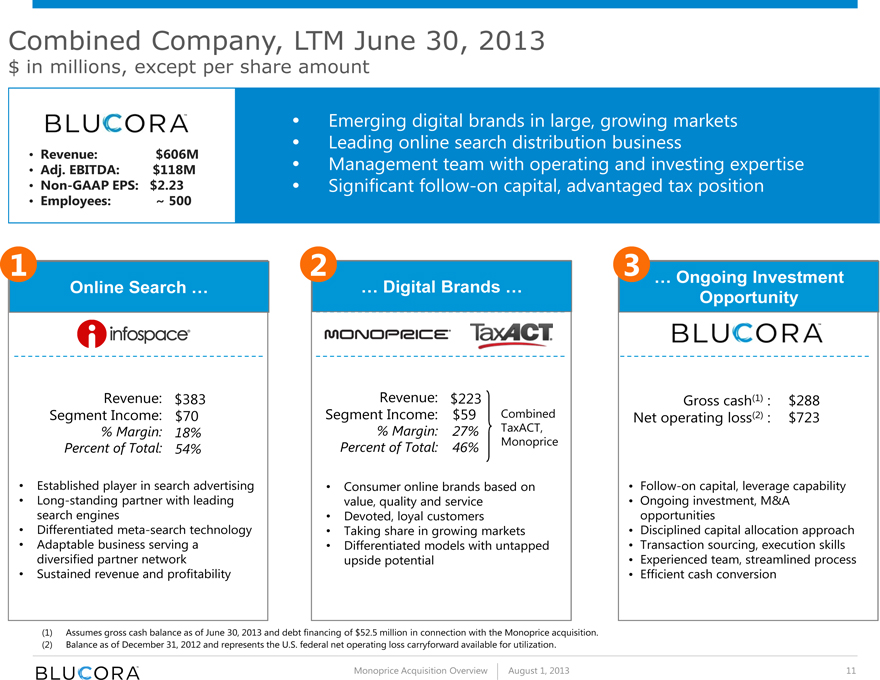

Combined Company, LTM June 30, 2013

$ in millions, except per share amount

Revenue: $606M Adj. EBITDA: $118M Non-GAAP EPS: $2.23 Employees: ~ 500

Emerging digital brands in large, growing markets Leading online search distribution business Management team with operating and investing expertise Significant follow-on capital, advantaged tax position 1

Online Search …

Revenue: $383 Segment Income: $70

% Margin: 18% Percent of Total: 54%

Established player in search advertising Long-standing partner with leading search engines Differentiated meta-search technology Adaptable business serving a diversified partner network Sustained revenue and profitability 2

… Digital Brands …

Revenue: $223

Segment Income: $59 Combined

% Margin: 27% TaxACT, Percent of Total: 46% Monoprice

Consumer online brands based on value, quality and service

Devoted, loyal customers

Taking share in growing markets

Differentiated models with untapped upside potential 3

… Ongoing Investment Opportunity

Gross cash(1) : $288 Net operating loss(2) : $723

Follow-on capital, leverage capability

Ongoing investment, M&A opportunities

Disciplined capital allocation approach

Transaction sourcing, execution skills

Experienced team, streamlined process

Efficient cash conversion

(1) Assumes gross cash balance as of June 30, 2013 and debt financing of $52.5 million in connection with the Monoprice acquisition. (2) Balance as of December 31, 2012 and represents the U.S. federal net operating loss carryforward available for utilization.

Monoprice Acquisition Overview

August 1, 2013

11

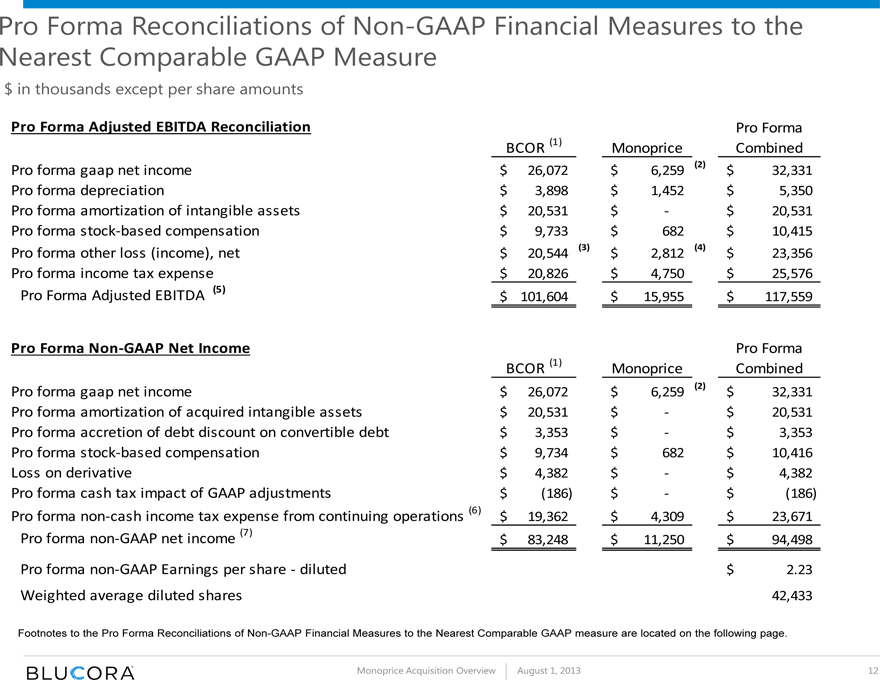

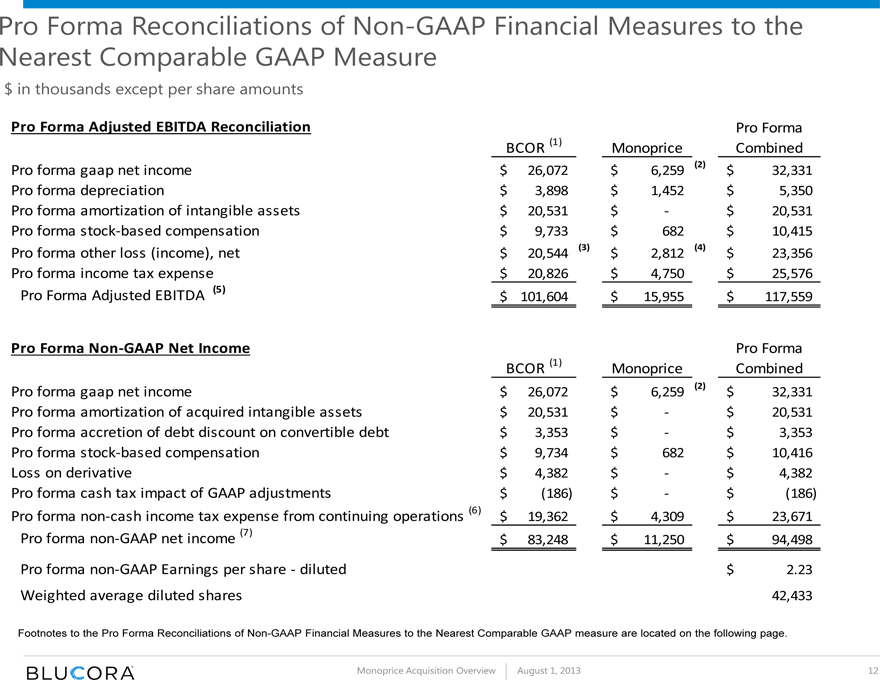

Pro Forma Reconciliations of Non-GAAP Financial Measures to the Nearest Comparable GAAP Measure

$ in thousands except per share amounts

Pro Forma Adjusted EBITDA Reconciliation Pro Forma

BCOR (1) Monoprice Combined

Pro forma gaap net income $ 26,072 $ 6,259 (2) $ 32,331

Pro forma depreciation $ 3,898 $ 1,452 $ 5,350

Pro forma amortization of intangible assets $ 20,531 $ ? $ 20,531

Pro forma stock?based compensation $ 9,733 $ 682 $ 10,415

Pro forma other loss (income), net $ 20,544 (3) $ 2,812 (4) $ 23,356

Pro forma income tax expense $ 20,826 $ 4,750 $ 25,576

Pro Forma Adjusted EBITDA (5) $ 101,604 $ 15,955 $ 117,559

Pro Forma Non?GAAP Net Income Pro Forma

BCOR (1) Monoprice Combined

Pro forma gaap net income $ 26,072 $ 6,259 (2) $ 32,331

Pro forma amortization of acquired intangible assets $ 20,531 $ ? $ 20,531

Pro forma accretion of debt discount on convertible debt $ 3,353 $ ? $ 3,353

Pro forma stock?based compensation $ 9,734 $ 682 $ 10,416

Loss on derivative $ 4,382 $ ? $ 4,382

Pro forma cash tax impact of GAAP adjustments $ (186) $ ? $ (186)

Pro forma non?cash income tax expense from continuing operations (6) $ 19,362 $ 4,309 $ 23,671

Pro forma non?GAAP net income (7) $ 83,248 $ 11,250 $ 94,498

Pro forma non?GAAP Earnings per share ? diluted $ 2.23

Weighted average diluted shares 42,433

Footnotes to the Pro Forma Reconciliations of Non-GAAP Financial Measures to the Nearest Comparable GAAP measure are located on the following page.

Monoprice Acquisition Overview

August 1, 2013

12

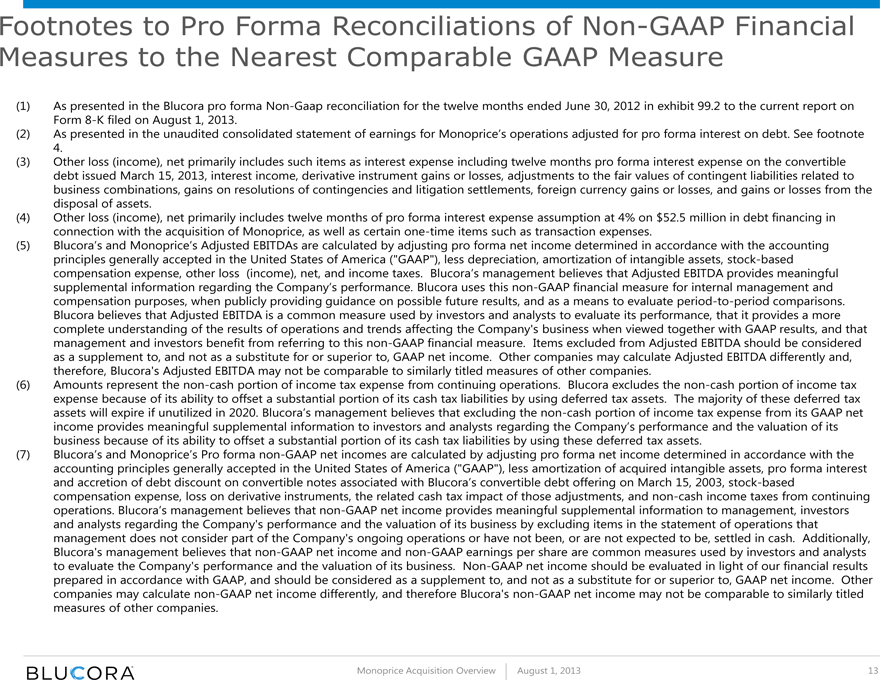

Footnotes to Pro Forma Reconciliations of Non-GAAP Financial Measures to the Nearest Comparable GAAP Measure

(1) As presented in the Blucora pro forma Non-Gaap reconciliation for the twelve months ended June 30, 2012 in exhibit 99.2 to the current report on Form 8-K filed on August 1, 2013.

(2) As presented in the unaudited consolidated statement of earnings for Monoprice’s operations adjusted for pro forma interest on debt. See footnote 4.

(3) Other loss (income), net primarily includes such items as interest expense including twelve months pro forma interest expense on the convertible debt issued March 15, 2013, interest income, derivative instrument gains or losses, adjustments to the fair values of contingent liabilities related to business combinations, gains on resolutions of contingencies and litigation settlements, foreign currency gains or losses, and gains or losses from the disposal of assets.

(4) Other loss (income), net primarily includes twelve months of pro forma interest expense assumption at 4% on $52.5 million in debt financing in connection with the acquisition of Monoprice, as well as certain one-time items such as transaction expenses.

(5) Blucora’s and Monoprice’s Adjusted EBITDAs are calculated by adjusting pro forma net income determined in accordance with the accounting principles generally accepted in the United States of America (“GAAP”), less depreciation, amortization of intangible assets, stock-based compensation expense, other loss (income), net, and income taxes. Blucora’s management believes that Adjusted EBITDA provides meaningful supplemental information regarding the Company’s performance. Blucora uses this non-GAAP financial measure for internal management and compensation purposes, when publicly providing guidance on possible future results, and as a means to evaluate period-to-period comparisons.

Blucora believes that Adjusted EBITDA is a common measure used by investors and analysts to evaluate its performance, that it provides a more complete understanding of the results of operations and trends affecting the Company’s business when viewed together with GAAP results, and that management and investors benefit from referring to this non-GAAP financial measure. Items excluded from Adjusted EBITDA should be considered as a supplement to, and not as a substitute for or superior to, GAAP net income. Other companies may calculate Adjusted EBITDA differently and, therefore, Blucora’s Adjusted EBITDA may not be comparable to similarly titled measures of other companies.

(6) Amounts represent the non-cash portion of income tax expense from continuing operations. Blucora excludes the non-cash portion of income tax expense because of its ability to offset a substantial portion of its cash tax liabilities by using deferred tax assets. The majority of these deferred tax assets will expire if unutilized in 2020. Blucora’s management believes that excluding the non-cash portion of income tax expense from its GAAP net income provides meaningful supplemental information to investors and analysts regarding the Company’s performance and the valuation of its business because of its ability to offset a substantial portion of its cash tax liabilities by using these deferred tax assets.

(7) Blucora’s and Monoprice’s Pro forma non-GAAP net incomes are calculated by adjusting pro forma net income determined in accordance with the accounting principles generally accepted in the United States of America (“GAAP”), less amortization of

acquired intangible assets, pro forma interest and accretion of debt discount on convertible notes associated with Blucora’s convertible debt offering on March 15, 2003, stock-based compensation expense, loss on derivative instruments, the related cash tax impact of those adjustments, and non-cash income taxes from continuing operations. Blucora’s management believes that non-GAAP net income provides meaningful supplemental information to management, investors and analysts regarding the Company’s performance and the valuation of its business by excluding items in the statement of operations that management does not consider part of the Company’s ongoing operations or have not been, or are not expected to be, settled in cash. Additionally, Blucora’s management believes that non-GAAP net income and non-GAAP earnings per share are common measures used by investors and analysts to evaluate the Company’s performance and the valuation of its business. Non-GAAP net income should be evaluated in light of our financial results prepared in accordance with GAAP, and should be considered as a supplement to, and not as a substitute for or superior to, GAAP net income. Other companies may calculate non-GAAP net income differently, and therefore Blucora’s non-GAAP net income may not be comparable to similarly titled measures of other companies.

Monoprice Acquisition Overview

August 1, 2013

13