- AVTA Dashboard

- Financials

- Filings

-

Holdings

- Transcripts

-

ETFs

- Insider

- Institutional

- Shorts

-

CORRESP Filing

Avantax (AVTA) CORRESPCorrespondence with SEC

Filed: 2 Apr 21, 12:00am

| Sidley Austin LLP One South Dearborn Street Chicago, IL 60603 +1 312 853 7000 +1 312 853 7036 Fax

AMERICA • ASIA PACIFIC • EUROPE |

+1 312 853 7443 bberg@sidley.com |

Via EDGAR and by Email

April 2, 2021

Office of Mergers and Acquisitions

United States Securities and Exchange Commission

Division of Corporation Finance

100 F Street, N.E.

Washington, D.C. 20549-3628

Attention: Valian A. Afshar, Special Counsel

| Re: | Blucora, Inc. | |

Definitive Additional Materials filed under cover of Schedule 14A Filed on March 24, 2021 by Blucora, Inc. File No. 000-25131 |

Dear Mr. Afshar:

On behalf of our client, Blucora, Inc. (the “Company” or “we”), set forth below is our response to the comment received from the staff of the Division of Corporation Finance (the “Staff”) of the Securities and Exchange Commission (the “Commission”) by letter dated March 29, 2021, with respect to the Company’s additional definitive soliciting material filed with the Commission under cover of Schedule 14A on March 24, 2021.

For your convenience, the response is preceded by the exact text of the Staff’s comment in bold, italicized text.

| 1. | The letter distributed to the Company’s stockholders on March 24, 2021—which was filed with the Commission under cover of Schedule 14A and is publicly available on the Company’s VoteBlucora.com website—indicates that Fred DiSanto has previously served on four public company boards and sets forth the TSR of those companies during Mr. DiSanto’s tenure as a director. It appears, however, based on the disclosure set forth on page 12 of Ancora’s definitive proxy statement, that Mr. DiSanto has served on additional public company boards, including LNB Bancorp, PVF Capital Corp. and Axia NetMedia Corporation. Please revise the letter to remove the implication that the four companies highlighted in your letter are the only public companies for which Mr. DiSanto has served as a director. Please also clarify whether those three companies experienced negative TSRs during Mr. DiSanto’s tenure as a director. |

Response: The Company respectfully acknowledges the Staff’s comment.

The Company’s disclosure in its letter distributed to the Company’s stockholders on March 24, 2021 regarding Mr. DiSanto’s public directorships was in reliance on information provided to the Company by Ancora Catalyst Institutional, LP and certain other participants in the solicitation (collectively, “Ancora”) in Ancora’s nomination notice dated February 10, 2021 (the “Nomination Notice”) and in the public disclosure contained in Ancora’s definitive proxy statement filed with the Commission on March 10, 2021 (the “Ancora Proxy Statement”). The biographical information presented in the Nomination Notice and the Ancora Proxy Statement states:

“Mr. DiSanto served on each of privately held Lorain National Bank, a subsidiary of LNB Bancorp, which was later acquired by Northwest Bancshares, Inc. (NASDAQ: NWBI), a bank holding company, from October 2013 to August 2015; Park View Federal Savings Bank, which was later acquired by F.N.B. Corporation (NYSE: FNB), a financial holding company, from August 2010 to October 2013; Axia NetMedia Corporation, an operator of fiber based internet and data networks, from February 2015 to July 2016…”. (emphasis added; Ancora Definitive Proxy Statement, available at https://www.sec.gov/Archives/edgar/data/0001068875/000092189521000696/defc14a06470029_03102021.htm).

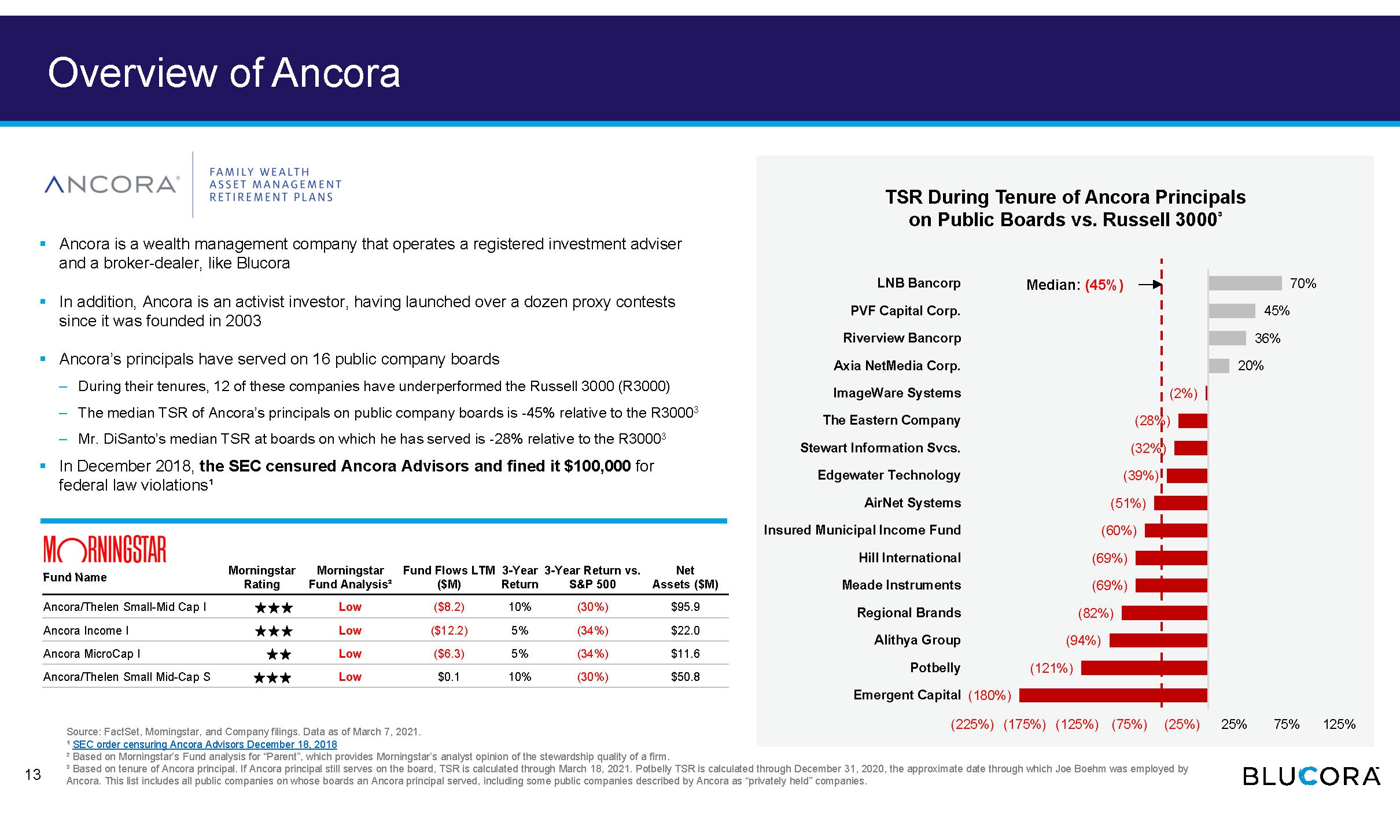

The Company understood, based on the plain meaning of the phrase “each of,” that all companies that followed were modified by the words “privately held.” Mr. DiSanto also notes that he only served on a subsidiary of LNB Bancorp and does not provide ticker svmbols for LNB Bancorp, Parkview Federal Savings Bank or Axia NetMedia Corporation, suggesting that these were not public companies at the time of Mr. DiSanto’s service on their boards of directors. However, since the Company was alerted to the facts, it has since included in the investor presentation filed with the Commission under cover of Schedule 14A on March 31, 2021 (the “Investor Presentation”) a slide that includes the TSR of LNB Bancorp, PVF Capital Corp. and Axia NetMedia Corporation during the Ancora principals’ tenure on the boards of those companies. Going forward, the Company will include these three companies in its presentation of TSR for companies on which Mr. DiSanto has served. A copy of the relevant slide from the Investor Presentation containing the corrected disclosure is attached hereto as Exhibit A.

* * * * *

Please direct any questions that you may have with respect to the foregoing or any requests for supplemental information by the Staff to Beth E. Berg at (312) 853-7443.

| Very truly yours, | |

| /s/ Beth Berg | |

| Beth Berg | |

cc: Ann Bruder, Chief Legal, Development and Administration Officer, Blucora, Inc. (by email) | |

Sidley Austin LLP is a limited liability partnership practicing in affiliation with other Sidley Austin partnerships.

Office of Mergers and Acquisitions

United States Securities and Exchange Commission

Division of Corporation Finance

April 2, 2021

Page 2

EXHIBIT A

Slide from Investor Presentation

Overview of Ancora* Ancora is a wealth management company that operates a registered investment adviser and a broker-dealer, like BlucoraTSR During Tenure of Ancora Principals on Public Boards vs. Russell 3000³* In addition, Ancora is an activist investor, having launched over a dozen proxy contests since it was founded in 2003* Ancora’s principals have served on 16 public company boards – During their tenures, 12 of these companies have underperformed the Russell 3000 (R3000) – The median TSR of Ancora’s principals on public company boards is -45% relative to the R30003 – Mr. DiSanto’s median TSR at boards on which he has served is -28% relative to the R30003 * In December 2018, the SEC censured Ancora Advisors and fined it $100,000 for federal law violations¹LNB Bancorp PVF Capital Corp. Riverview Bancorp Axia NetMedia Corp. ImageWare Systems The Eastern Company Stewart Information Svcs. Edgewater TechnologyMedian: (45%)(2%) (28%) (32%) (39%)70% 45% 36% 20%Fund Name MorningstarMorningstarFund Flows LTM 3-Year 3-Year Return vs.NetAirNet Systems Insured Municipal Income Fund Hill International Meade Instruments Regional Brands Alithya Group Potbelly Emergent Capital (180%)(51%) (60%) (69%) (69%) (82%) (94%) (121%)Source: FactSet, Morningstar, and Company filings. Data as of March 7, 2021. ¹ SEC order censuring Ancora Advisors December 18, 2018 ² Based on Morningstar’s Fund analysis for “Parent”, which provides Morningstar’s analyst opinion of the stewardship quality of a firm.(225%) (175%) (125%) (75%) (25%) 25% 75% 125%³ Based on tenure of Ancora principal. If Ancora principal still serves on the board, TSR is calculated through March 18, 2021. Potbelly TSR is calculated through December 31, 2020, the approximate date through which Joe Boehm was employed by Ancora. This list includes all public companies on whose boards an Ancora principal served, including some public companies described by Ancora as “privately held” companies.