Medco Health Solutions, Inc.

Accredo Health, Incorporated

Investor Presentation

February 23, 2005

Forward looking statements

This conference call and webcast contains statements that constitute forward-looking statements within the meaning of the Securities Act of 1933 and the Securities Exchange Act of 1934, both as amended by the Private Securities Litigation Reform Act of 1995. These forward-looking statements include statements regarding benefits of the proposed transaction, expected synergies, anticipated future financial and operating performance and results. These statements are based on the current expectations of management of both companies. There are a number of risks and uncertainties that could cause actual results to differ materially. For example, the companies may be unable to obtain stockholder or regulatory approvals required for the transaction; problems may arise in successfully integrating the businesses of the two companies; the transaction may involve unexpected costs; the combined company may be unable to achieve cost-cutting synergies; the businesses may suffer as a result of uncertainty surrounding the transaction; and the industry may be subject to future regulatory or legislative actions. Other unknown or unpredictable factors also could have material adverse effects on future results, performance or achievements of the two companies. This conference call includes certain non-GAAP financial measures as defined under SEC rules. As required by SEC rules, we have posted this document, including certain supplemental information, on the Investor Relation’s section of www.medco.com.

2

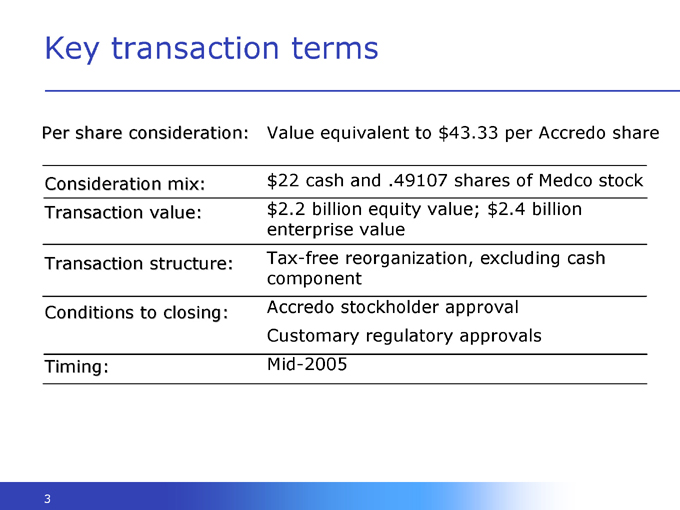

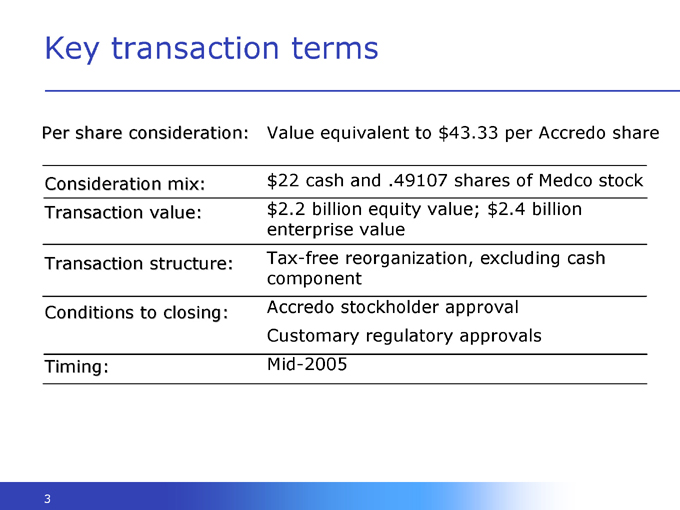

Key transaction terms

Per share consideration: Value equivalent to $43.33 per Accredo share

Consideration mix: $22 cash and .49107 shares of Medco stock

Transaction value: $2.2 billion equity value; $2.4 billion enterprise value

Transaction structure: Tax-free reorganization, excluding cash component

Conditions to closing: Accredo stockholder approval Customary regulatory approvals

Timing: Mid-2005

3

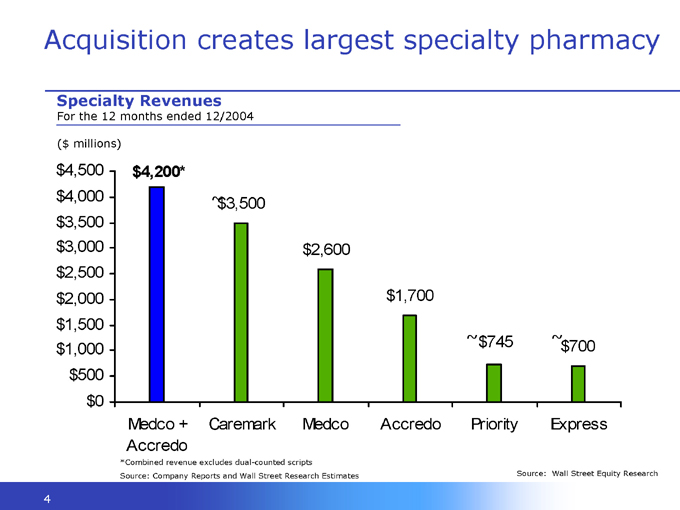

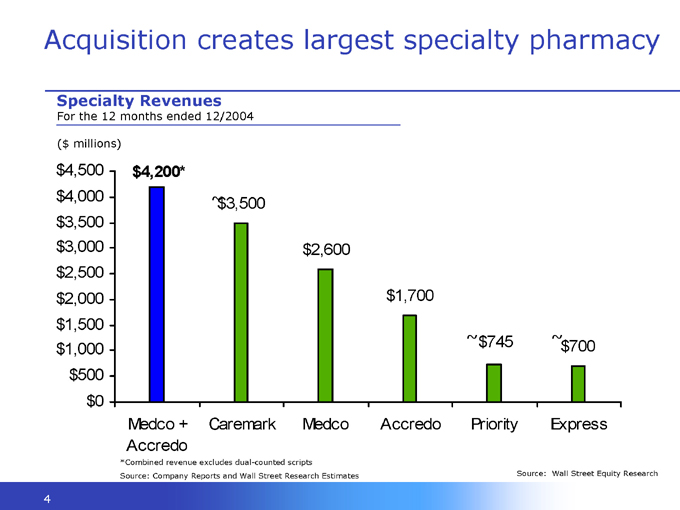

Acquisition creates largest specialty pharmacy

Specialty Revenues

For the 12 months ended 12/2004

($ millions) $4,500 $4,000 $3,500 $3,000 $2,500 $2,000 $1,500 $1,000 $500 $0

Medco + Caremark Medco Accredo Priority Express Accredo $4,200*

$ 3,500 $2,600 $1,700

$ 745

$700

*Combined revenue excludes dual-counted scripts

Source: Company Reports and Wall Street Research Estimates

Source: Wall Street Equity Research

4

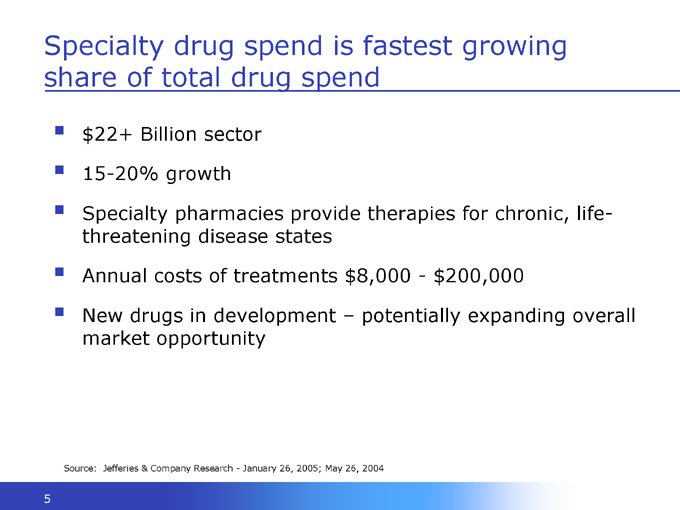

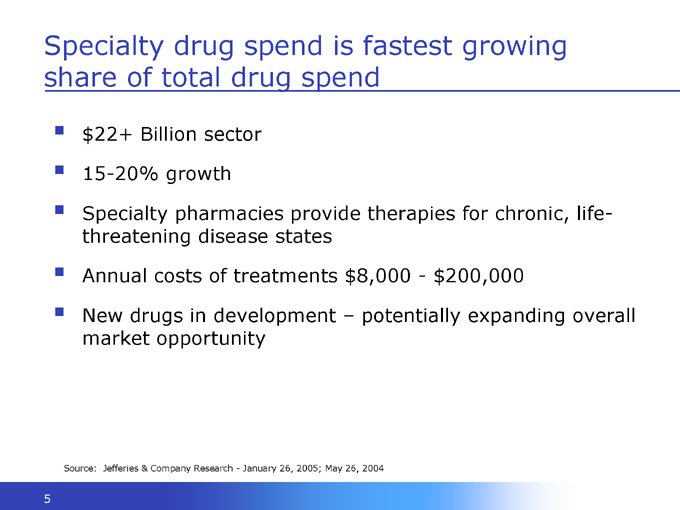

Specialty drug spend is fastest growing share of total drug spend $22+ Billion sector 15-20% growth

Specialty pharmacies provide therapies for chronic, life-threatening disease states

Annual costs of treatments $8,000—$200,000

New drugs in development – potentially expanding overall market opportunity

Source: Jefferies & Company Research—January 26, 2005; May 26, 2004

5

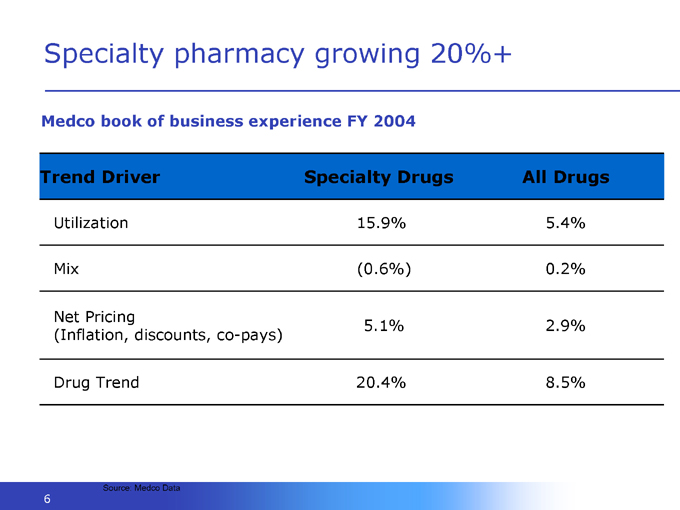

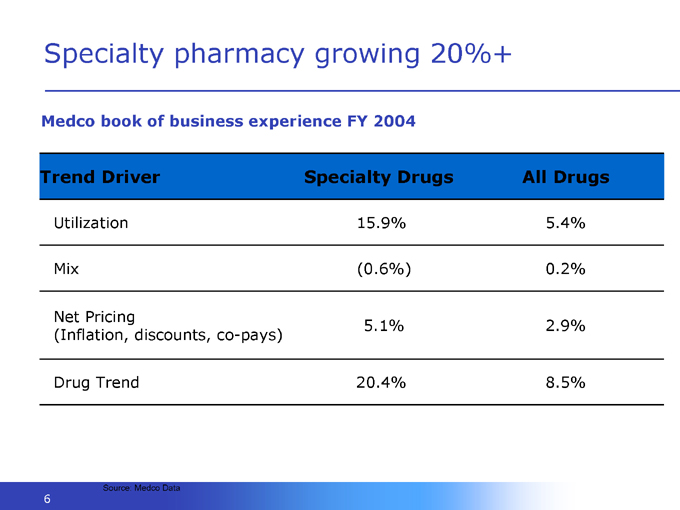

Specialty pharmacy growing 20%+

Medco book of business experience FY 2004

Trend Driver Specialty Drugs All Drugs

Utilization 15.9% 5.4%

Mix (0.6%) 0.2%

Net Pricing

5.1% 2.9%

(Inflation, discounts, co-pays)

Drug Trend 20.4% 8.5%

Source: Medco Data

6

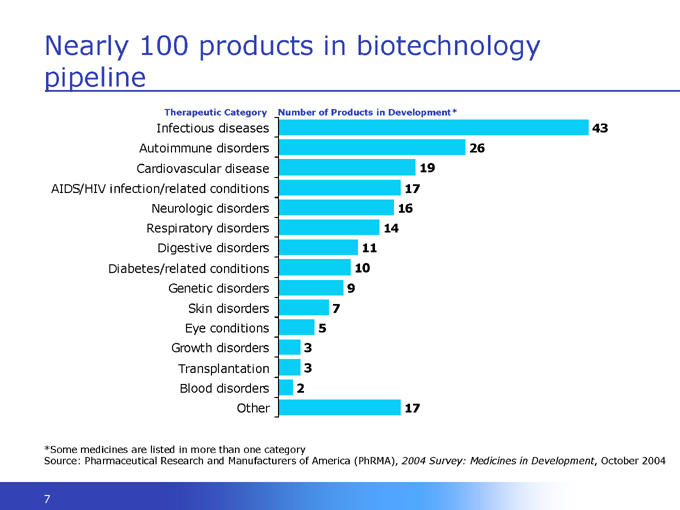

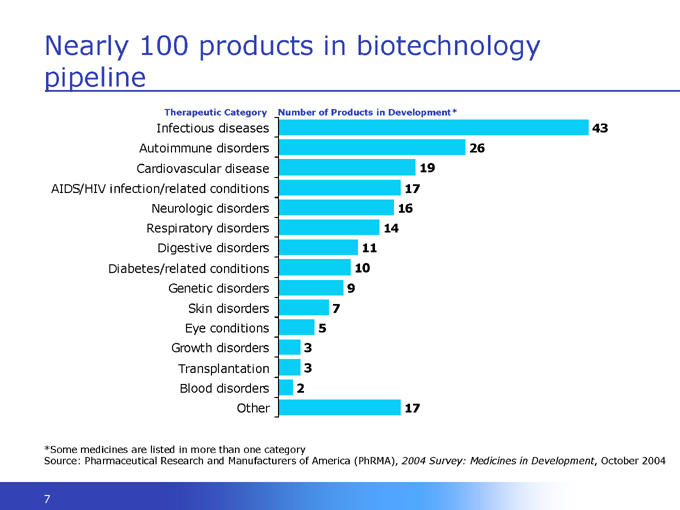

Nearly 100 products in biotechnology pipeline

Therapeutic Category

Infectious diseases Autoimmune disorders Cardiovascular disease AIDS/HIV infection/related conditions Neurologic disorders Respiratory disorders Digestive disorders Diabetes/related conditions Genetic disorders Skin disorders Eye conditions Growth disorders Transplantation Blood disorders Other

Number of Products in Development*

43

26

19

17

16

14

11

10

9

7

5

3

3

2

17

*Some medicines are listed in more than one category

Source: Pharmaceutical Research and Manufacturers of America (PhRMA), 2004 Survey: Medicines in Development, October 2004

7

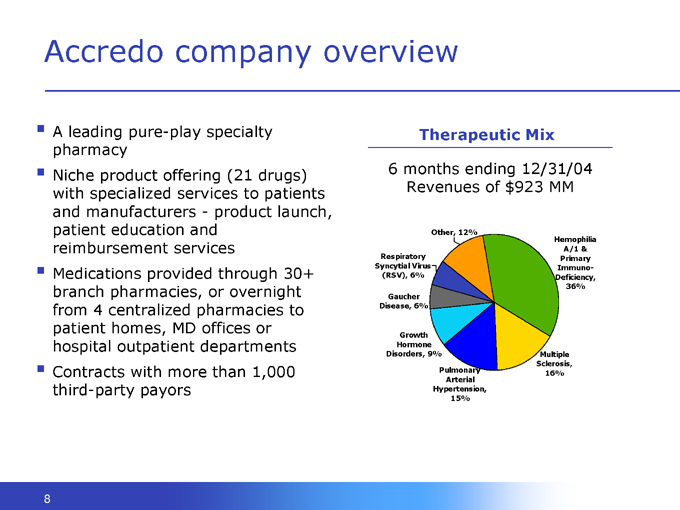

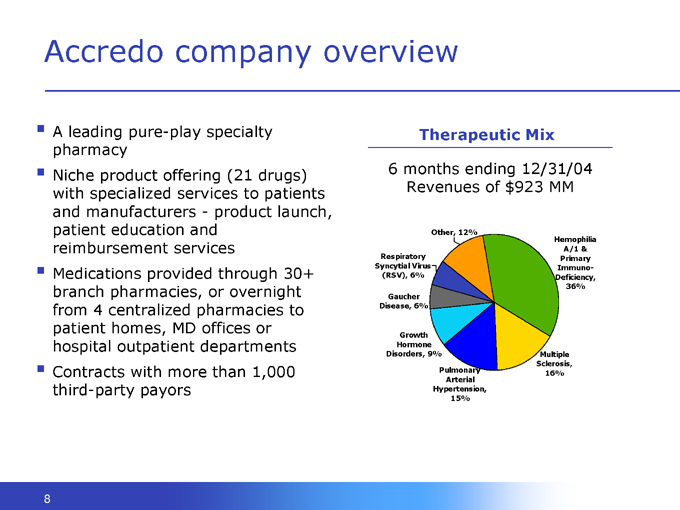

Accredo company overview

A leading pure-play specialty pharmacy Niche product offering (21 drugs) with specialized services to patients and manufacturers—product launch, patient education and reimbursement services Medications provided through 30+ branch pharmacies, or overnight from 4 centralized pharmacies to patient homes, MD offices or hospital outpatient departments Contracts with more than 1,000 third-party payors

Therapeutic Mix

6 months ending 12/31/04 Revenues of $923 MM

Other, 12%

Respiratory Syncytial Virus (RSV), 6%

Gaucher Disease, 6%

Growth Hormone Disorders, 9%

Pulmonary Arterial Hypertension, 15%

Multiple Sclerosis, 16%

Hemophilia A/1 & Primary Immuno-Deficiency, 36%

8

Accredo operates under three brands

Six product lines Local dispensing Physician & MC sales Hands on nursing Highest service model Differentiate with service model & restricted access

One product line Hybrid dispensing HTC, DTC & MC sales Nurse/Pharmacist team High service model Differentiate with service model

Fourteen product lines Centralized dispensing Manufacturer sales Pharmacist team Low service model Differentiate with service & restricted access

9

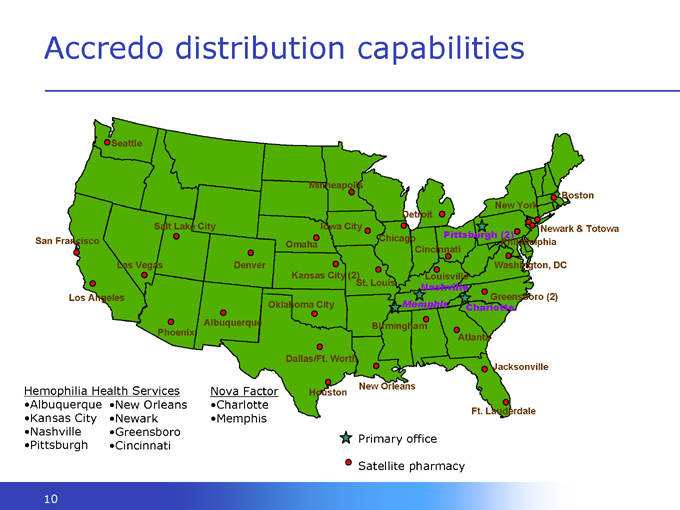

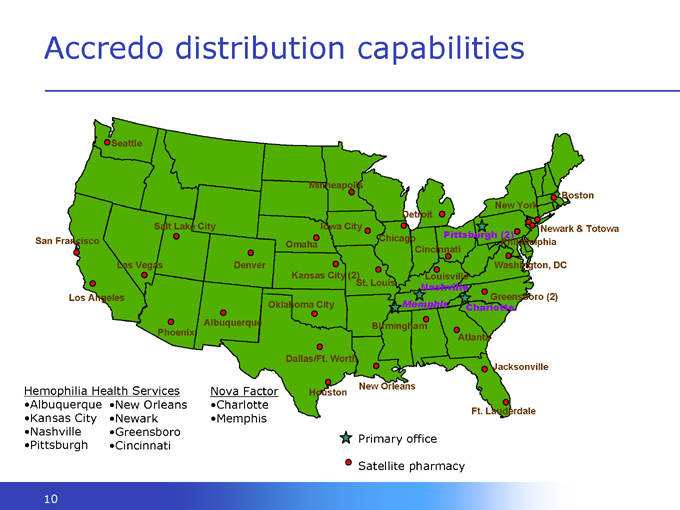

Accredo distribution capabilities

Seattle San Francisco Los Angeles Las Vegas Salt Lake City Minneapolis Iowa City Omaha Denver Phoenix Albuquerque Oklahoma City

Kansas City (2) Dallas/Ft. Worth Chicago Nova Factor Charlotte New Orleans St. Louis Birmingham Detroit New York Boston Newark & Totowa

Pittsburgh (2) Washington, DC Greensboro (2) Nashville Memphis Charlotte Atlanta

Jacksonville Houston Ft. Lauderdale Philadelphia Louisville

Hemophilia Health Services

Kansas City Nashville Pittsburgh Albuquerque

New Orleans Newark Greensboro Cincinnati

Memphis

Primary office

Satellite pharmacy

10

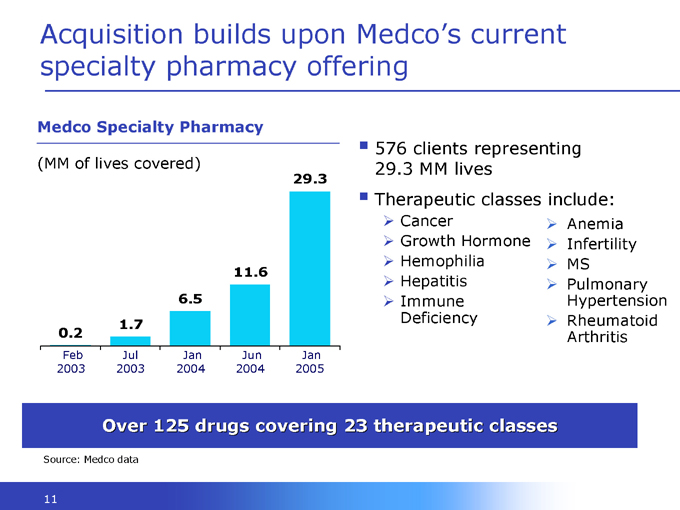

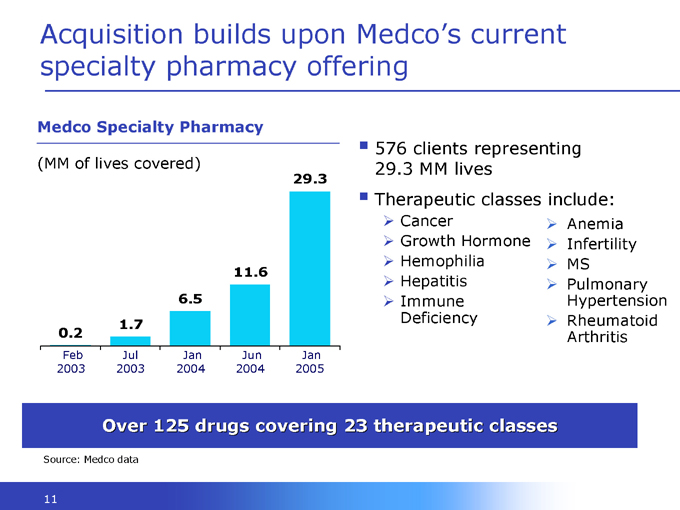

Acquisition builds upon Medco’s current specialty pharmacy offering

Medco Specialty Pharmacy

(MM of lives covered)

29.3

11.6 6.5 1.7 0.2

Feb Jul Jan Jun Jan 2003 2003 2004 2004 2005

576 clients representing 29.3 MM lives Therapeutic classes include:

Cancer

Growth Hormone Hemophilia Hepatitis Immune Deficiency

Anemia Infertility MS Pulmonary Hypertension Rheumatoid Arthritis

Over 125 drugs covering 23 therapeutic classes

Source: Medco data

11

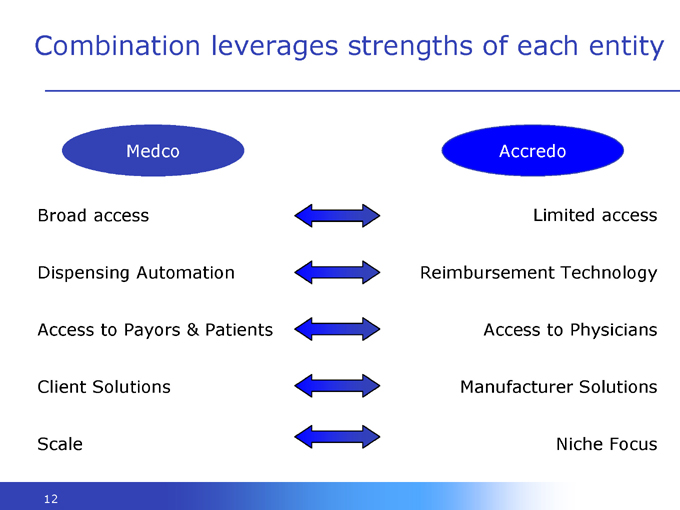

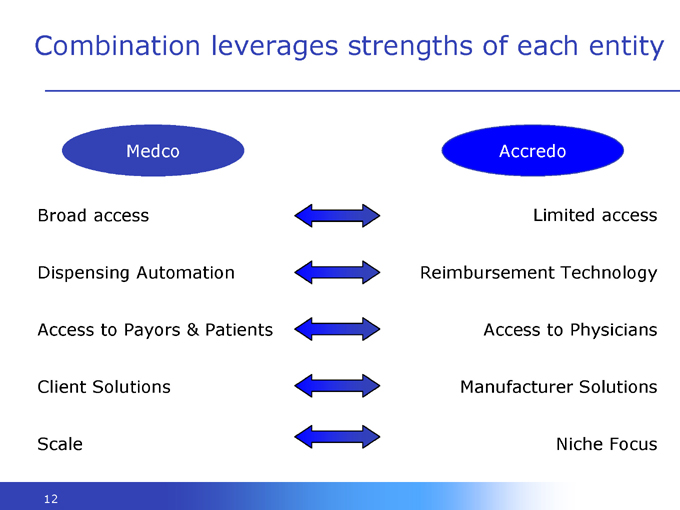

Combination leverages strengths of each entity

Medco

Broad access

Dispensing Automation Access to Payors & Patients Client Solutions Scale

Accredo

Limited access Reimbursement Technology Access to Physicians Manufacturer Solutions Niche Focus

12

Complementary products and services

Significant cross-selling opportunity

Up-sell Medco drugs to Accredo patients Up-sell Medco specialty drugs to Accredo clients

Enhance critical reimbursement expertise and clinical support Early involvement with pipeline drugs enhances manufacturer relationships and visibility on new products

Builds on existing, highly successful relationship

13

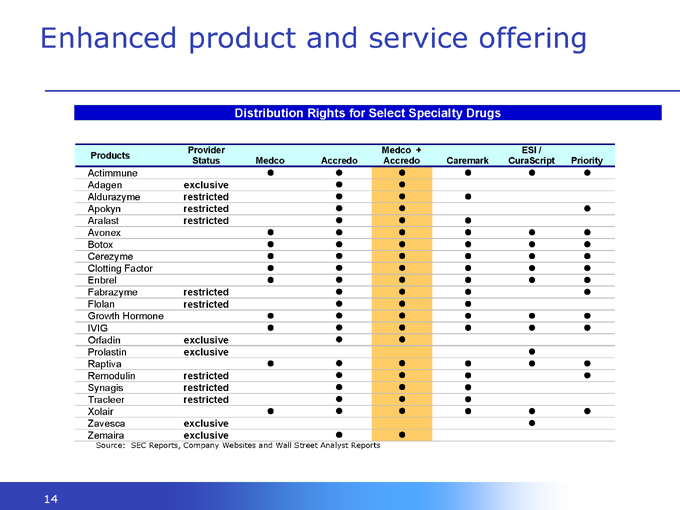

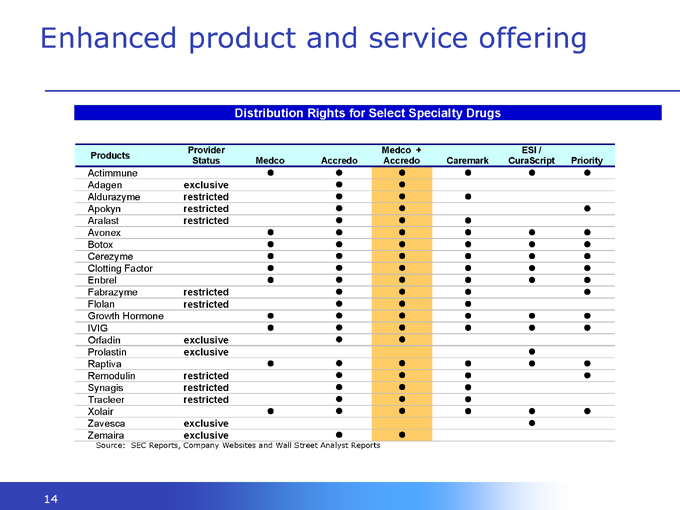

Enhanced product and service offering

Distribution Rights for Select Specialty Drugs

Provider Medco + ESI / Products Status Medco Accredo Accredo Caremark CuraScript Priority

Actimmune

Adagen exclusive

Aldurazyme restricted

Apokyn restricted

Aralast restricted

Avonex

Botox

Cerezyme

Clotting Factor

Enbrel

Fabrazyme restricted

Flolan restricted

Growth Hormone

IVIG

Orfadin exclusive

Prolastin exclusive

Raptiva

Remodulin restricted

Synagis restricted

Tracleer restricted

Xolair

Zavesca exclusive

Zemaira exclusive

Source: SEC Reports, Company Websites and Wall Street Analyst Reports

14

Attractive financial characteristics

Internal growth rates and margins at attractive levels Upside potential due to robust pipeline of new biotech drugs requiring specialty distribution

Continued growth of Medco specialty business —potential to expand into additional disease states

Enhances future growth opportunities

15

Overview of expected financial benefits

Top line growth opportunity, high margin business Expected to be accretive to Medco in 2006, excluding onetime merger related expenses

Over $40 million in expected annual pre-tax synergies, with a majority coming through operational leverage and cross-selling opportunities

16

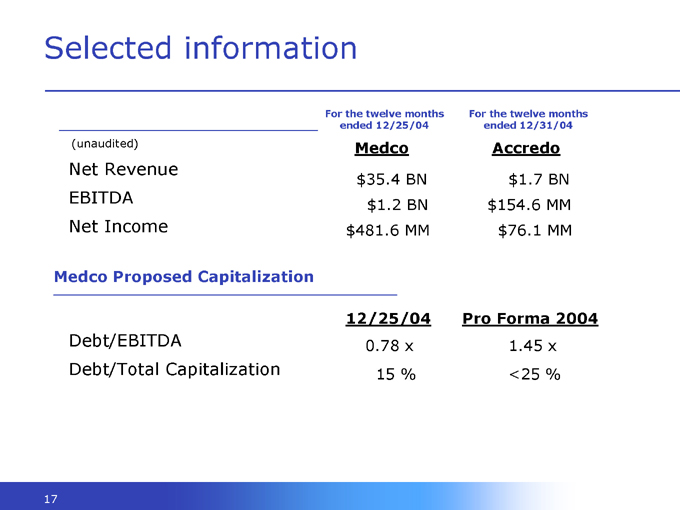

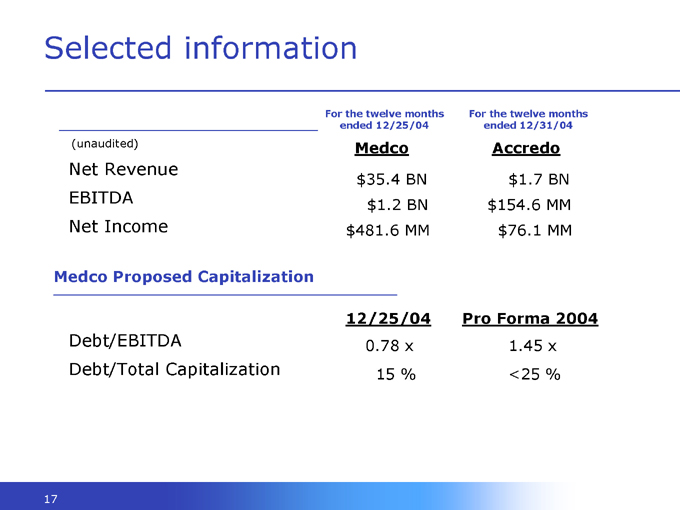

Selected information

For the twelve months For the twelve months

ended 12/25/04 ended 12/31/04

(unaudited) Medco Accredo

Net Revenue

$35.4 BN $1.7 BN

EBITDA $1.2 BN $154.6 MM

Net Income $481.6 MM $76.1 MM

Medco Proposed Capitalization

12/25/04 Pro Forma 2004

Debt/EBITDA 0.78 x 1.45 x

Debt/Total Capitalization 15 % <25 %

17

Transaction summary

Robust pipeline of new specialty products and additional indications will continue to drive utilization Specialty pharmaceuticals will continue to have significant financial impact in the coming years Specialty patients also use traditional medications and benefit from integration Accelerates Medco’s top line growth strategy and adds high margin business Extends Accredo’s scale, distribution platform, customer service and client base

Strong financial profile, expected to be accretive in near term

18

medco®

Additional Information

In connection with the proposed transaction, Medco intends to file a registration statement, including a proxy statement of Accredo Health, Incorporated and other materials with the Securities and Exchange Commission (SEC). Investors are urged to read the registration statement and other materials when they are available because they contain important information. Investors will be able to obtain free copies of the registration statement and proxy statement, when they become available, as well as other filings containing information about Medco and Accredo, at the SEC’s Internet site (http://www.sec.gov).These documents also may be accessed and downloaded for free from Medco’s Investor Relations Web site, www.medco.com, or obtained for free by directing a request to Medco Health Solutions, Inc.

Investor Relations Department, 100 Parson Pond Drive, F1-6, Franklin Lakes, NJ, 07417. Copies of Accredo’s filings may be accessed and downloaded for free at Accredo’s Investor Relations Web site, www.accredohealth.net, or obtained for free by directing a request to Accredo Health, Incorporated Investor Relations, 1640 Century Center Parkway, Memphis, TN, 38134.

Medco, Accredo and their respective directors and executive officers and other members of management and employees may be deemed to be participants in the solicitation of proxies from Accredo stockholders in respect of the proposed transaction. Information regarding Medco’s directors and executive officers is available in Medco’s proxy statement for its 2004 annual meeting of stockholders, dated March 19, 2004,and information regarding Accredo’s directors and executive officers is available in Accredo’s proxy statement, dated Oct. 19, 2004, for its 2004 annual meeting of stockholders. Additional information regarding the interests of such potential participants will be included in the registration and proxy statement and the other relevant documents filed with the SEC when they become available.

20

Use of Non-GAAP Measures

Use of Non-GAAP Measures

Medco calculates and uses EBITDA and EBITDA per adjusted prescription as indicators of its ability to generate cash from reported operating results. These measurements are used in concert with net income, and cash flows from operations, which measures actual cash generated in the period. In addition, the company believes that EBITDA and EBITDA per adjusted prescription are supplemental measurement tools used by analysts and investors to help evaluate overall operating performance and the ability to incur and service debt and make capital expenditures. EBITDA does not represent funds available for our discretionary use and is not intended to represent or to be used as a substitute for net income or cash flows from operations data as measured under U.S. generally accepted accounting principles. The items excluded from EBITDA but included in the calculation of the company’s reported net income are significant components of the statements of income, and must be considered in performing a comprehensive assessment of overall financial performance. EBITDA, and the associated year-to-year trends, should not be considered in isolation. Medco’s calculation of EBITDA may not be consistent with calculations of EBITDA used by other companies.

EBITDA per adjusted prescription is calculated by dividing EBITDA by the adjusted prescription volume for the period. This measure is used as an indicator of Medco’s EBITDA performance on a per-unit basis, providing insight into the cash-generating potential of each prescription. EBITDA per adjusted prescription reflects the level of efficiency in the business model and is further impacted by changes in prescription mix between retail and mail, as well as the relative representation of brand-name and generic drugs.

Medco uses earnings per share excluding amortization expense as a supplemental measure of operating performance. The amortization is associated with intangible assets that substantially arose in connection with the acquisition of Medco by Merck & Co., Inc. in 1993 that were pushed down to Medco’s balance sheet. The company believes that earnings per share excluding the amortization of these intangibles is a useful measure because of the significance of this non-cash item and to enhance comparability with its peers.

21