Filed by Medco Health Solutions, Inc. pursuant to Rule 425

under the Securities Act of 1933 and deemed filed pursuant

to Rule 14a-12 under the Securities Exchange Act of 1934

Subject Company: Accredo Health, Incorporated

Subject Company’s Exchange Act File No.: 0-25769

Medco Health Solutions, Inc. SG Cowen & Co.

March 16, 2005

Forward looking statements

This presentation contains “forward-looking statements” as that term is defined in the Private Securities Litigation Reform Act of 1995. These statements involve risks and uncertainties that may cause results to differ materially from those set forth in the statements. No forward-looking statement can be guaranteed, and actual results may differ materially from those projected. We undertake no obligation to publicly update any forward-looking statement, whether as a result of new information, future events, or otherwise. Forward-looking statements in this presentation should be evaluated together with the many uncertainties that affect our business, particularly those mentioned in the risk factors section of the Company’s Annual Report on Form 10-K filed with the Securities and Exchange Commission.

2

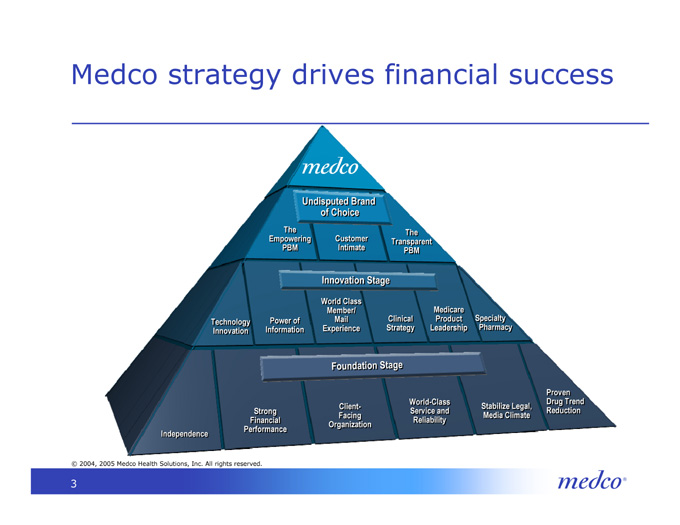

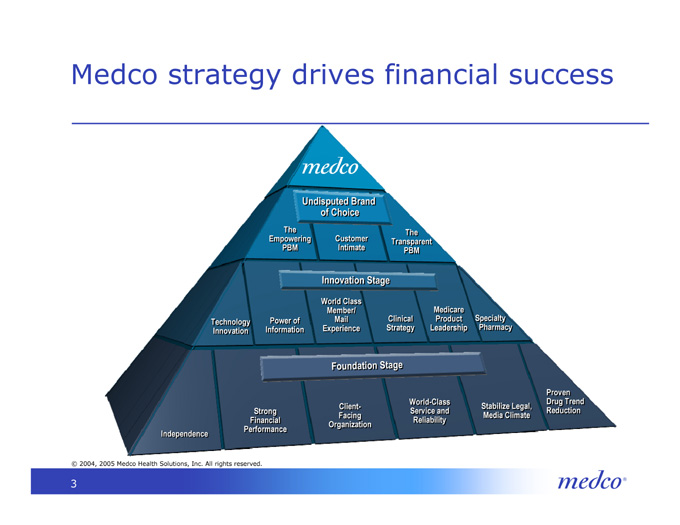

Medco strategy drives financial success

Undisputed Brand of Choice

The Transparent PBM

The Empowering PBM

Customer Intimate

Innovation Stage

World Class Member/

Mail Experience

Medicare Product Leadership

Specialty

Pharmacy

Clinical Strategy

Technology Innovation

Power of Information

Proven Drug Trend Reduction

Stabilize Legal, Media Climate

World-Class Service and Reliability

Foundation Stage

Strong Financial Performance

Client- Facing Organization

Independence

3

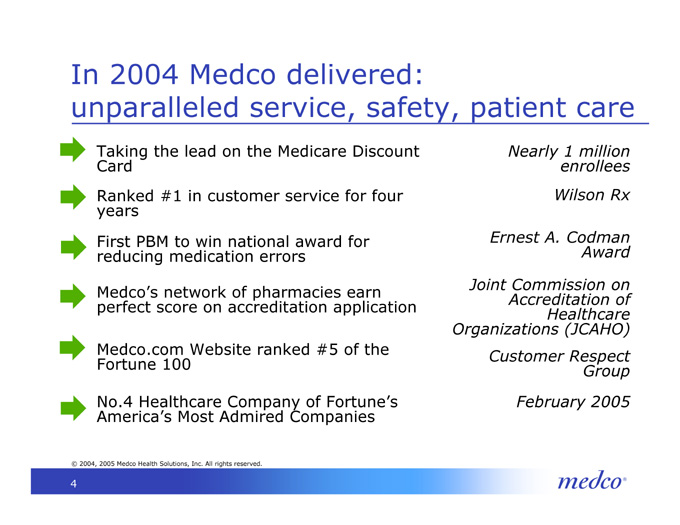

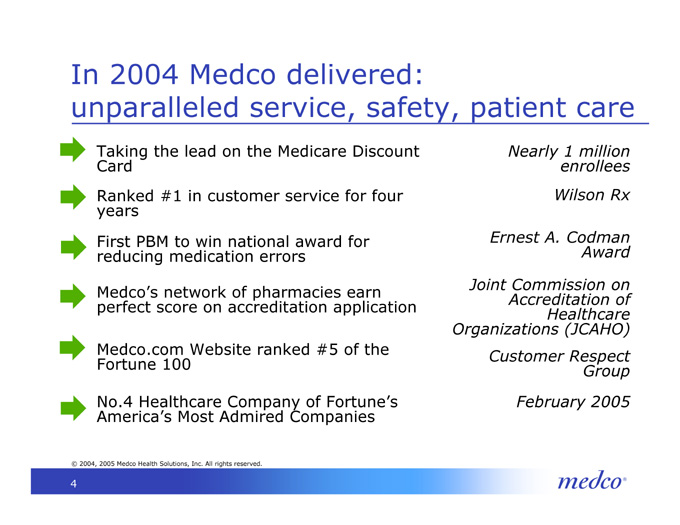

In 2004 Medco delivered: unparalleled service, safety, patient care

Taking the lead on the Medicare Discount Card

Nearly 1 million enrollees

Ranked #1 in customer service for four years

Wilson Rx

First PBM to win national award for reducing medication errors

Ernest A. Codman Award

Joint Commission on Accreditation of Healthcare Organizations (JCAHO)

Medco’s network of pharmacies earn perfect score on accreditation application

Medco.com Website ranked #5 of the Fortune 100

Customer Respect Group

No.4 Healthcare Company of Fortune’s America’s Most Admired Companies

February 2005

4

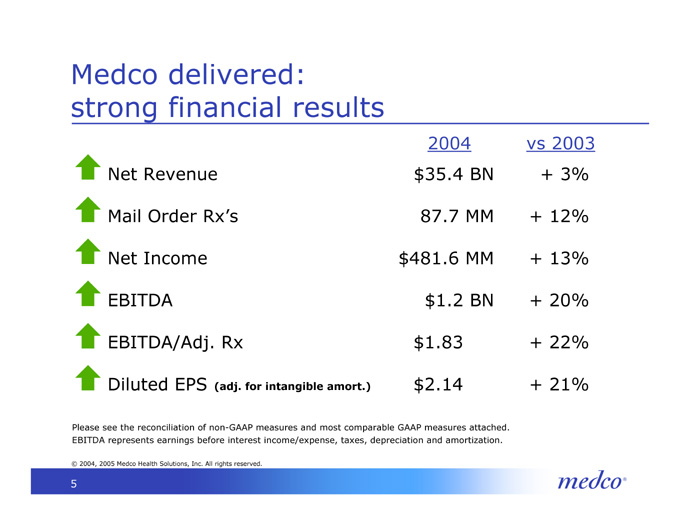

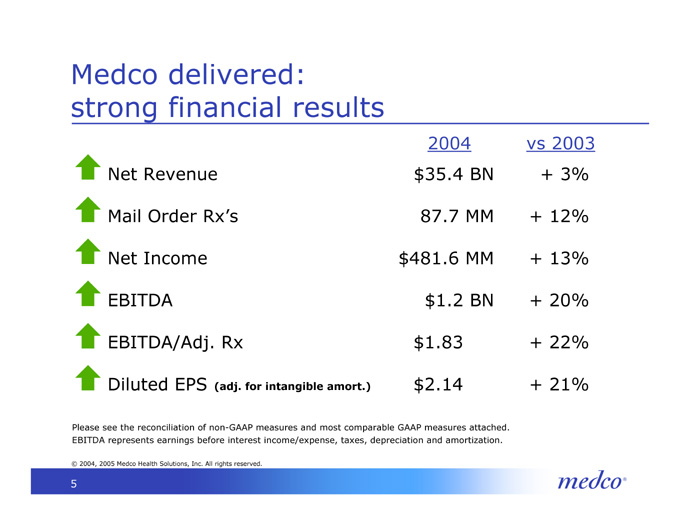

Medco delivered: strong financial results

2004

vs 2003

Net Revenue

$35.4 BN

+ 3%

Mail Order Rx’s

87.7 MM

+ 12%

Net Income

$481.6 MM

+ 13%

EBITDA

$1.2 BN

+ 20%

EBITDA/Adj. Rx

$1.83

+ 22%

Diluted EPS

$2.14

+ 21%

(adj. for intangible amort.)

Please see the reconciliation of non-GAAP measures and most comparable GAAP measures attached.

EBITDA represents earnings before interest income/expense, taxes, depreciation and amortization.

5

Medco: investment considerations

With $21 BN in record renewals in 2004, focus on top line growth in 2005

Significant growth opportunities in mail, generics and specialty pharmacy

Well positioned to participate in Medicare Part D

Financial strength – strong balance sheet, cash-flow from operations and track record

6

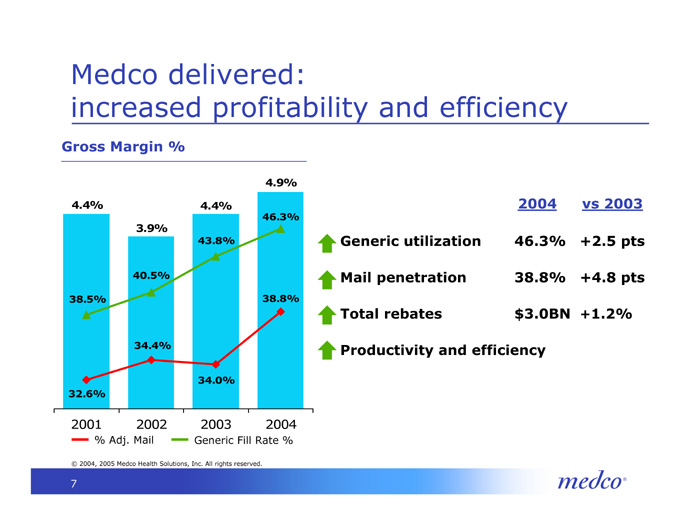

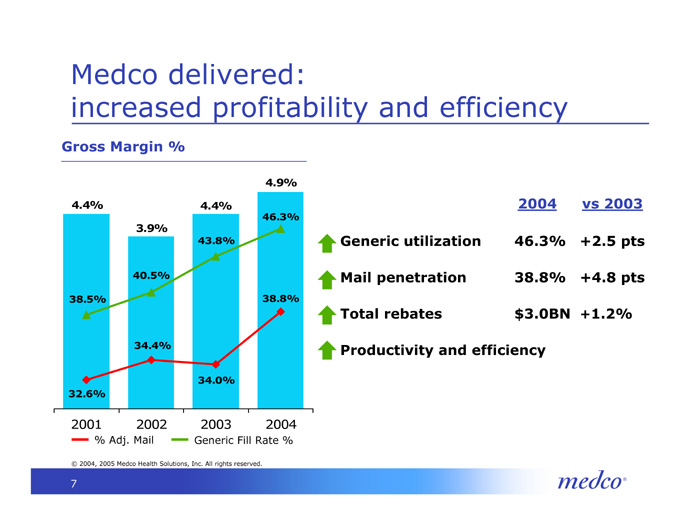

Medco delivered: increased profitability and efficiency

Gross Margin %

4.9%

2004

4.4%

vs 2003

4.4%

46.3%

3.9%

Generic utilization 46.3% +2.5 pts

Mail penetration 38.8% +4.8 pts

Total rebates $3.0BN +1.2%

Productivity and efficiency

43.8%

40.5%

38.8%

38.5%

34.4%

34.0%

32.6%

2003

2002

2001

2004

Generic Fill Rate %

% Adj. Mail

7

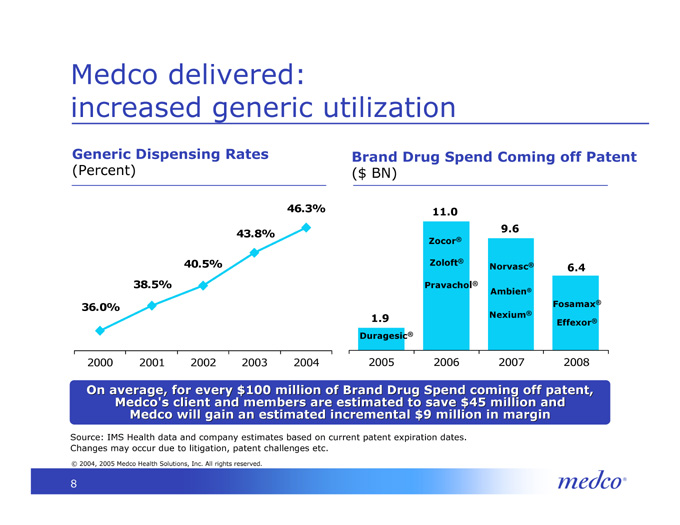

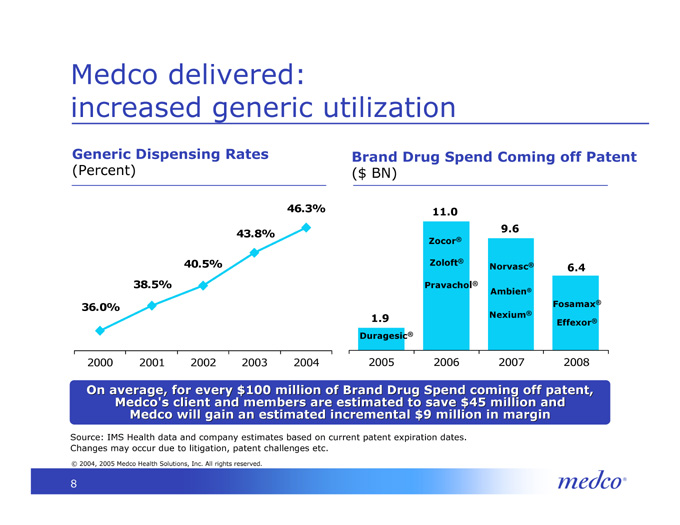

Medco delivered: increased generic utilization

Brand Drug Spend Coming off Patent

($ BN)

Generic Dispensing Rates

(Percent)

11.0

46.3%

9.6

43.8%

Zocor®

6.4

Zoloft®

Norvasc®

40.5%

Pravachol®

38.5%

Ambien®

36.0%

Fosamax®

Nexium®

1.9

Effexor®

Duragesic®

2004

2003

2002

2001

2000

2005

2006

2007

2008

On average, for every $100 million of Brand Drug Spend coming off patent, Medco’s client and members are estimated to save $45 million and Medco will gain an estimated incremental $9 million in margin

Source: IMS Health data and company estimates based on current patent expiration dates.

Changes may occur due to litigation, patent challenges etc.

8

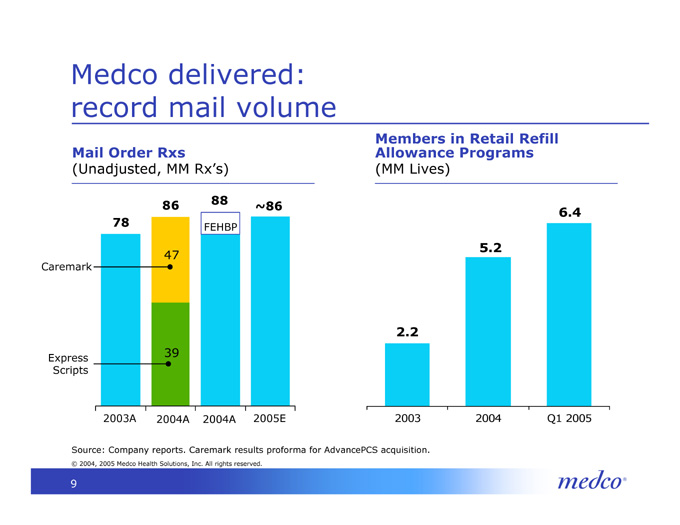

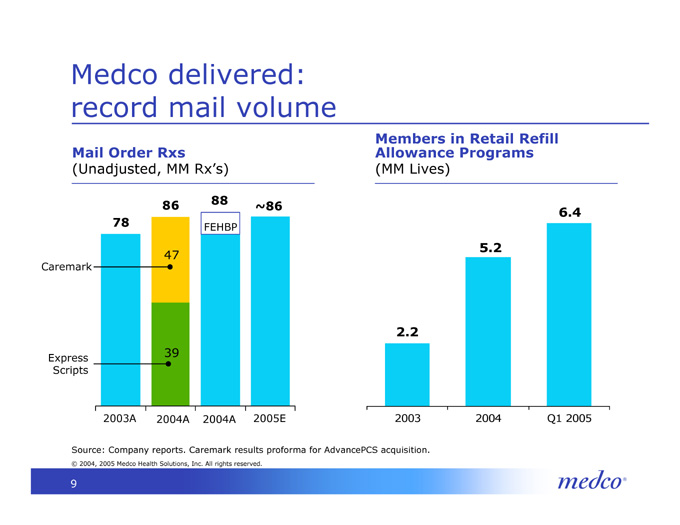

Medco delivered: record mail volume

Members in Retail Refill Allowance Programs

(MM Lives)

Mail Order Rxs

(Unadjusted, MM Rx’s)

88

~86

86

6.4

FEHBP

78

47

5.2

Caremark

2.2

Express Scripts

39

2003A

2005E

2004A

2004A

Q1 2005

2004

2003

Source: Company reports. Caremark results proforma for AdvancePCS acquisition.

9

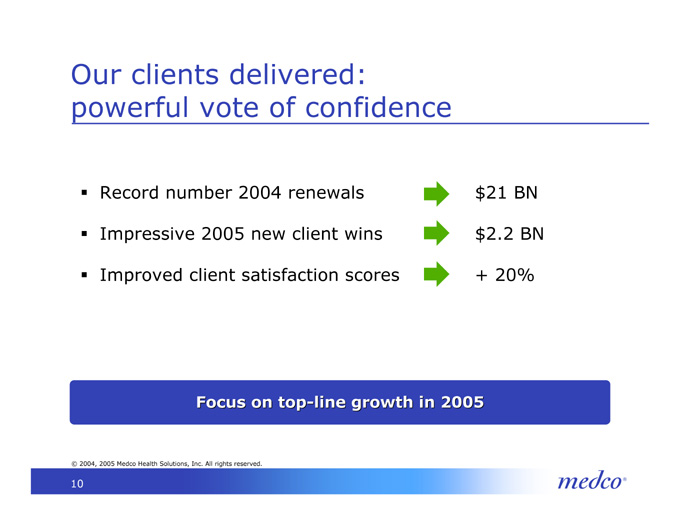

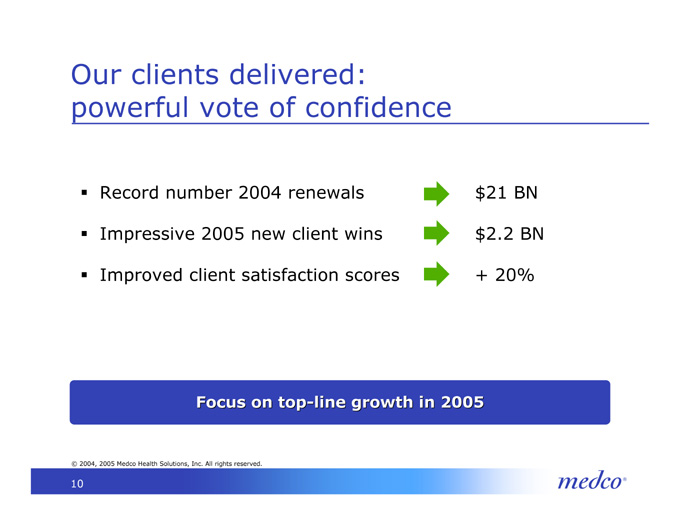

Our clients delivered: powerful vote of confidence

Record number 2004 renewals $21 BN

Impressive 2005 new client wins $2.2 BN

Improved client satisfaction scores + 20%

Focus on top-line growth in 2005

10

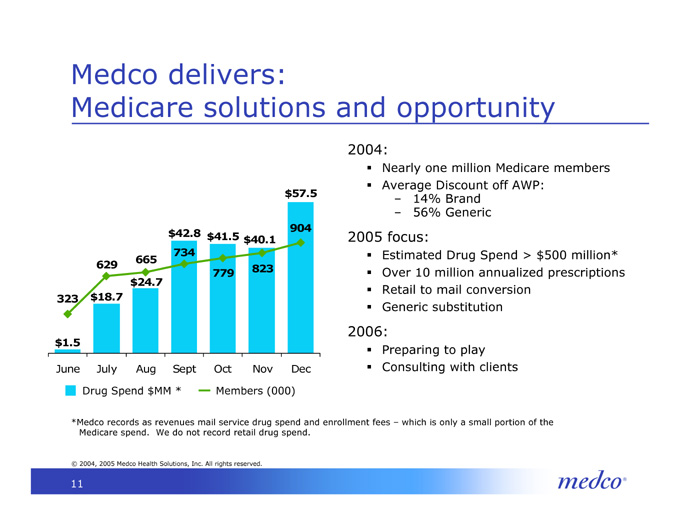

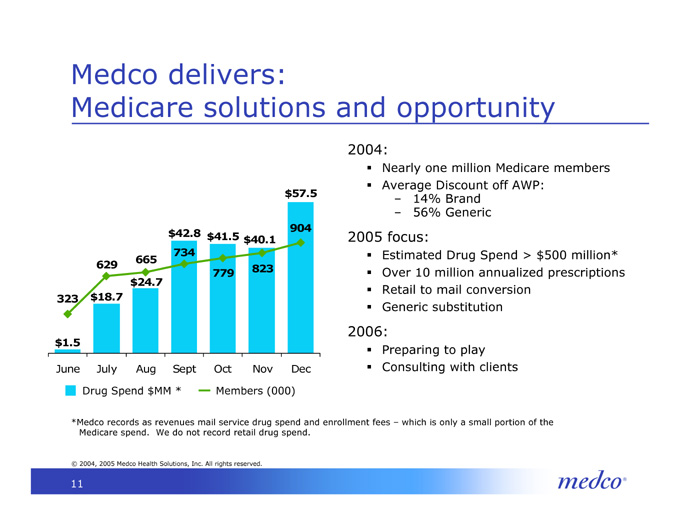

Medco delivers: Medicare solutions and opportunity

2004:

Nearly one million Medicare members

Average Discount off AWP:

14% Brand

56% Generic

2005 focus:

Estimated Drug Spend > $500 million*

Over 10 million annualized prescriptions

Retail to mail conversion

Generic substitution

2006:

Preparing to play

Consulting with clients

$57.5

$42.8

904

$40.1

$41.5

734

629

665

823

779

$24.7

$18.7

323

$1.5

Nov

Oct

Sept

Aug

July

June

Dec

Drug Spend $MM *

Members (000)

*Medco records as revenues mail service drug spend and enrollment fees – which is only a small portion of the Medicare spend. We do not record retail drug spend.

11

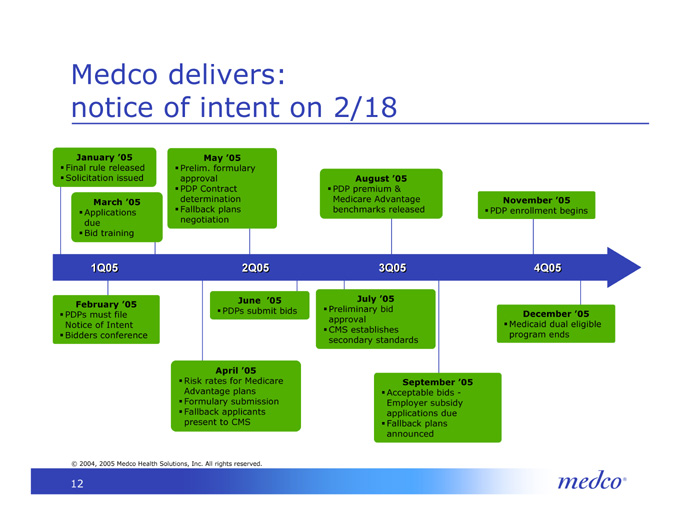

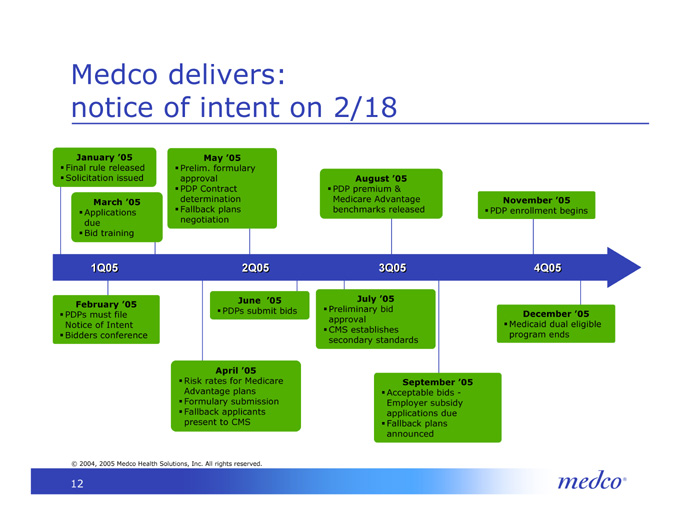

Medco delivers: notice of intent on 2/18

May ‘05

Prelim. formulary approval

PDP Contract determination

Fallback plans negotiation

January ‘05

Final rule released

Solicitation issued

August ‘05

PDP premium & Medicare Advantage benchmarks released

November ‘05

PDP enrollment begins

March ‘05

Applications due

Bid training

3Q05

1Q05

2Q05

4Q05

June ‘05

PDPs submit bids

February ‘05

PDPs must file Notice of Intent

Bidders conference

July ‘05

Preliminary bid approval

CMS establishes secondary standards

December ‘05

Medicaid dual eligible program ends

April ‘05

Risk rates for Medicare Advantage plans

Formulary submission

Fallback applicants present to CMS

September ‘05

Acceptable bids -Employer subsidy applications due

Fallback plans announced

12

Medco delivers: multiple Medicare channels & offerings

Support Medco health plan clients through their Medicare Advantage programs and other clients applying to become a Medicare Part D sponsor by serving as the pharmacy benefit manager using CMS approved tools and infrastructure

Health Plans

Assist employer clients in continuing to offer a traditional retiree prescription drug benefit that qualifies for the federal subsidy, and offer alternative approaches for employers to save under the Medicare Modernization Act

Employer Clients

13

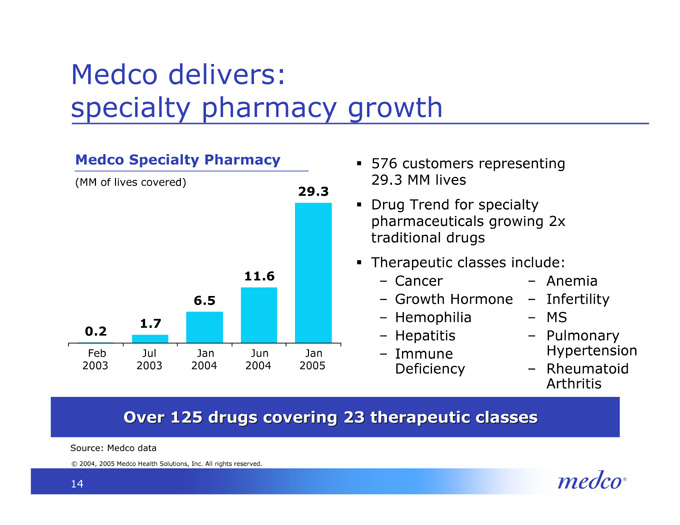

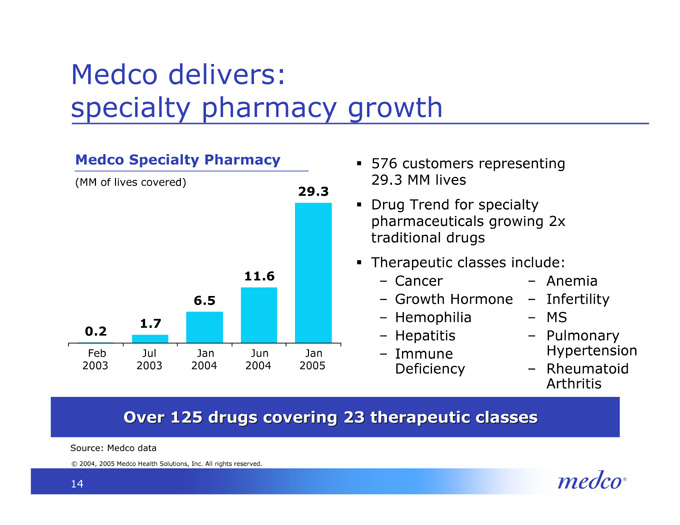

Medco delivers: specialty pharmacy growth

Medco Specialty Pharmacy

(MM of lives covered)

576 customers representing 29.3 MM lives

Drug Trend for specialty pharmaceuticals growing 2x traditional drugs

Therapeutic classes include:

Cancer

Growth Hormone

Hemophilia

Hepatitis

Immune Deficiency

29.3

Anemia

Infertility

MS

Pulmonary Hypertension

Rheumatoid Arthritis

11.6

6.5

1.7

0.2

Jan 2005

Jun 2004

Jan 2004

Jul 2003

Feb 2003

Over 125 drugs covering 23 therapeutic classes

Source: Medco data

14

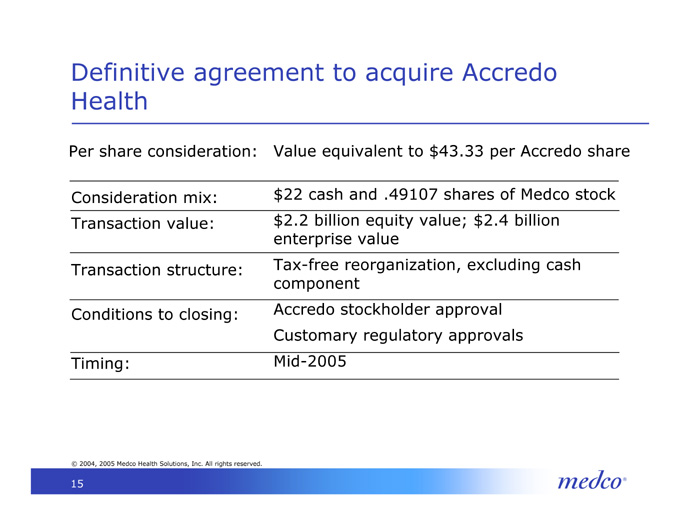

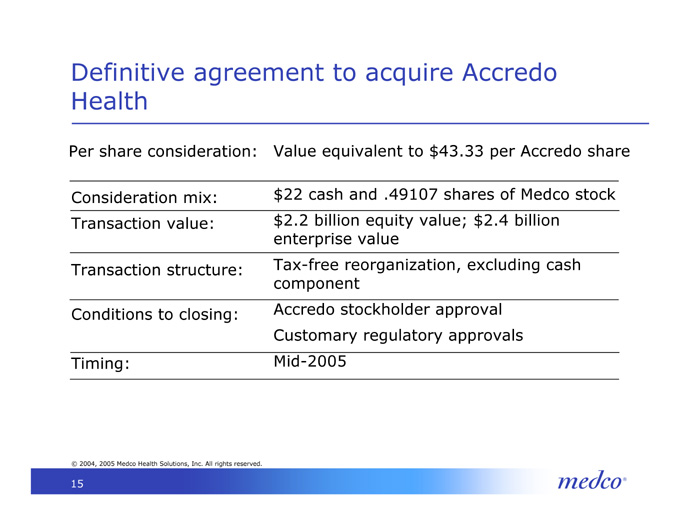

Definitive agreement to acquire Accredo Health

Value equivalent to $43.33 per Accredo share

$22 cash and .49107 shares of Medco stock

$2.2 billion equity value; $2.4 billion enterprise value

Tax-free reorganization, excluding cash component

Accredo stockholder approval

Customary regulatory approvals

Mid-2005

Per share consideration:

Consideration mix:

Transaction value:

Transaction structure:

Conditions to closing:

Timing:

15

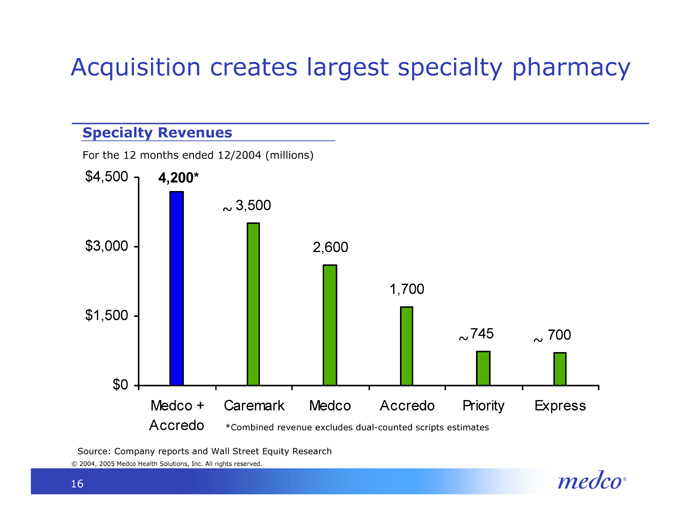

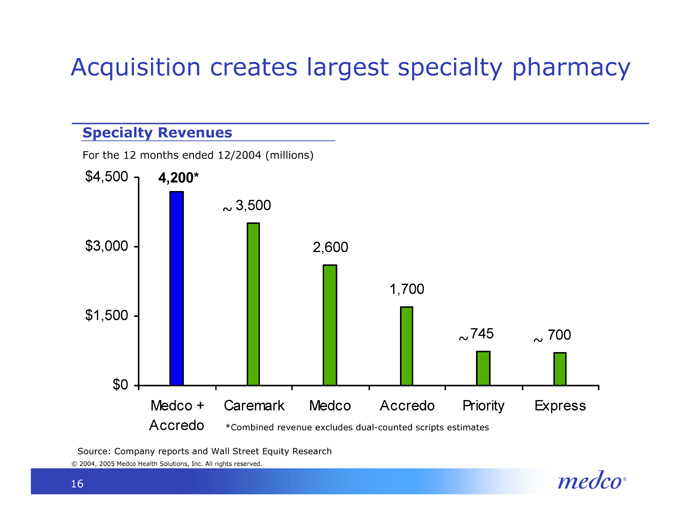

Acquisition creates largest specialty pharmacy

Specialty Revenues

For the 12 months ended 12/2004 (millions)

4,200*

$4,500

~3,500

2,600

$3,000

1,700

~$1,500

700

~745

$0

Priority

Accredo

Medco

Caremark

Medco +

Express

*Combined revenue excludes dual-counted scripts estimates

Accredo

Source: Company reports and Wall Street Equity Research

16

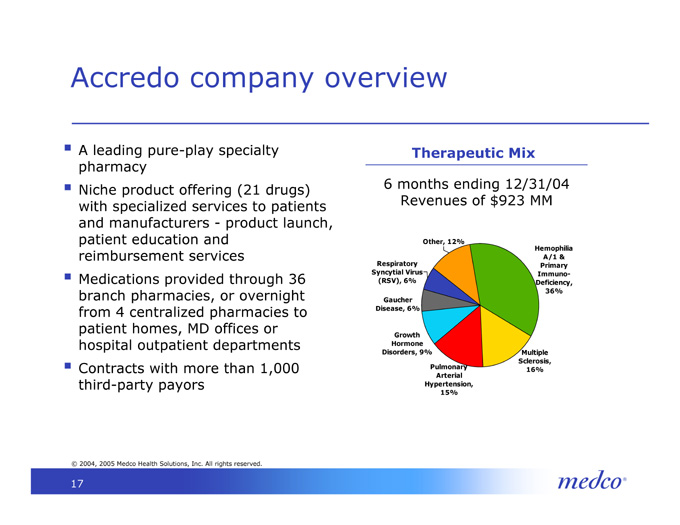

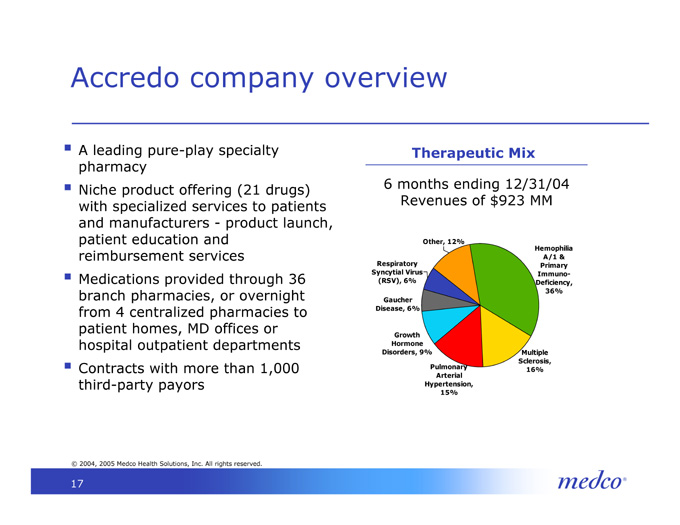

Accredo company overview

Therapeutic Mix

A leading pure-play specialty pharmacy

Niche product offering (21 drugs) with specialized services to patients and manufacturers - product launch, patient education and reimbursement services

Medications provided through 36 branch pharmacies, or overnight from 4 centralized pharmacies to patient homes, MD offices or hospital outpatient departments

Contracts with more than 1,000 third-party payors

6 months ending 12/31/04

Revenues of $923 MM

Hemophilia

Other, 12%

Respiratory

A/1 &

Syncytial Virus

Primary

(RSV), 6%

Immuno-

Deficiency,

36%

Gaucher

Disease, 6%

Growth

Hormone

Multiple

Disorders, 9%

Pulmonary

Sclerosis,

Arterial

16%

Hypertension,

15%

17

Accredo operates under three brands

One product line

Hybrid dispensing

HTC, DTC & MC sales

Nurse/Pharmacist team

High service model

Differentiate with service model

Six product lines

Local dispensing

Physician & MC sales

Hands on nursing

Highest service model

Differentiate with service model & restricted access

Fourteen product lines

Centralized dispensing

Manufacturer sales

Pharmacist team

Lower service model

Differentiate with service & restricted access

18

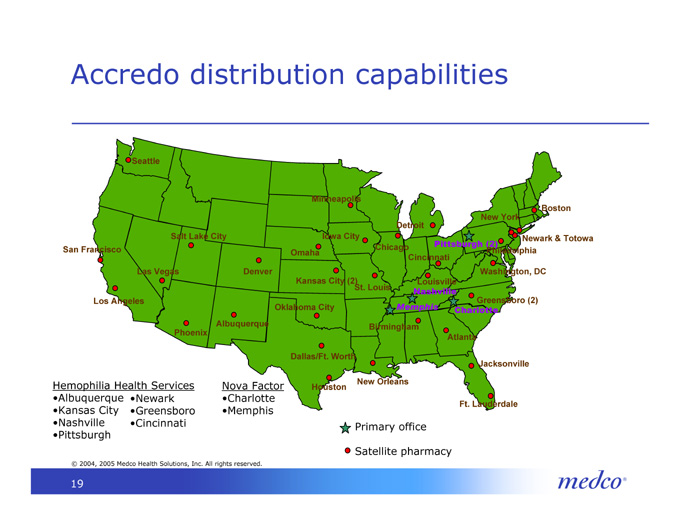

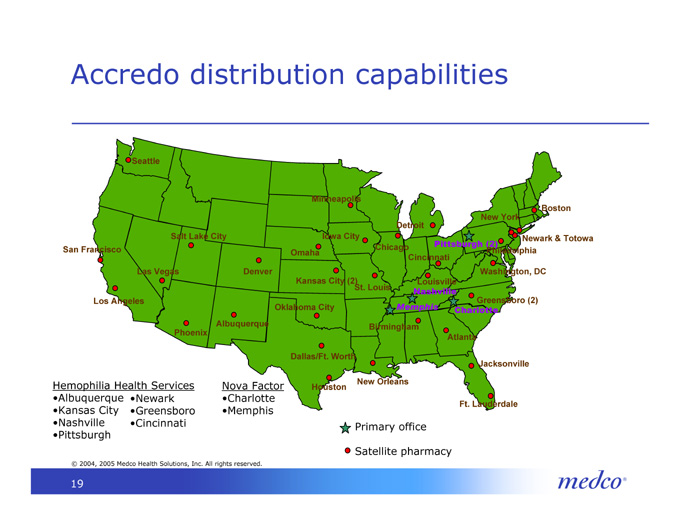

Accredo distribution capabilities

Seattle

Minneapolis

Boston

Detroit

New York

Iowa City

Salt Lake City

Newark & Totowa

Chicago

Pittsburgh (2)

San Francisco

Omaha

Cincinnati

Philadelphia

Las Vegas

Denver

Washington, DC

Kansas City (2)

Louisville

St. Louis

Nashville

Los Angeles

Greensboro (2)

Memphis

Oklahoma City

Charlotte

Albuquerque

Birmingham

Phoenix

Atlanta

Dallas/Ft. Worth

Jacksonville

New Orleans

Nova Factor

Charlotte

Memphis

Houston

Hemophilia Health Services

Albuquerque

Kansas City

Nashville

Pittsburgh

Newark

Greensboro

Cincinnati

Ft. Lauderdale

Primary office

Satellite pharmacy

19

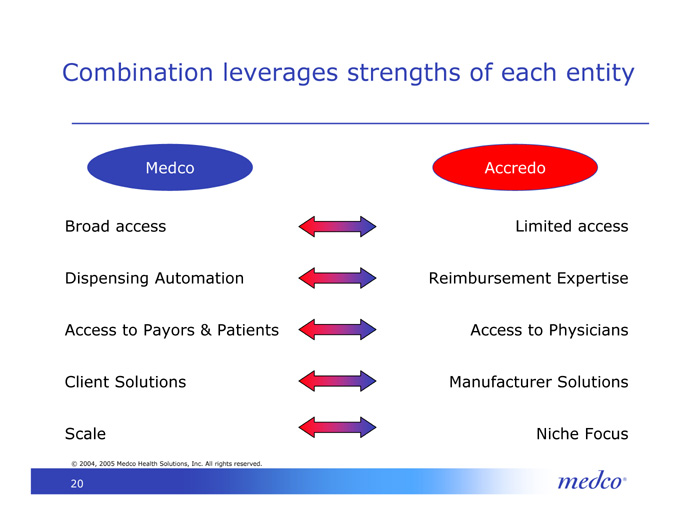

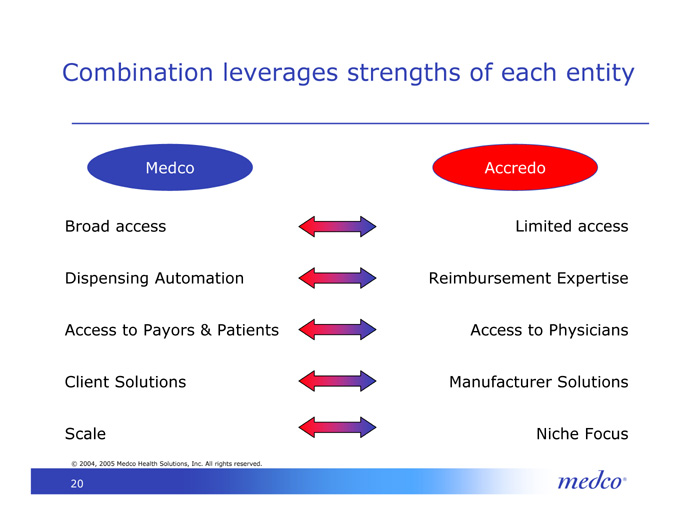

Combination leverages strengths of each entity

Medco

Accredo

Limited access

Reimbursement Expertise

Access to Physicians

Manufacturer Solutions

Niche Focus

Broad access

Dispensing Automation

Access to Payors & Patients

Client Solutions

Scale

20

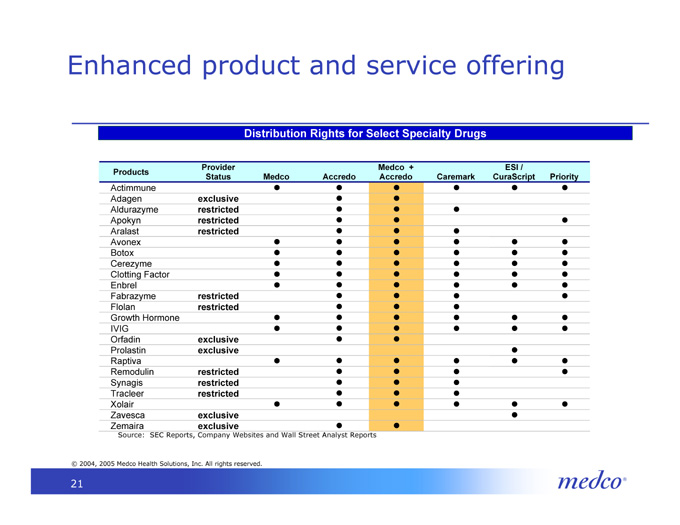

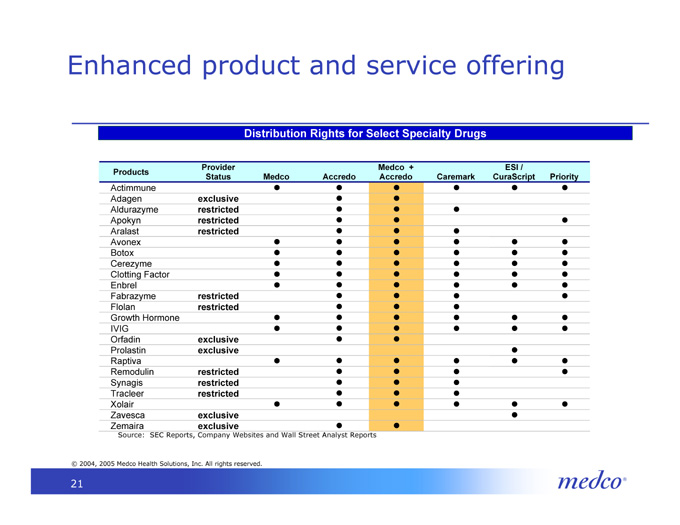

Enhanced product and service offering

Distribution Rights for Select Specialty Drugs

Source: SEC Reports, Company Websites and Wall Street Analyst Reports

Products

Provider

Status

Medco

Accredo

Medco

+

Accredo

Caremark

ESI /

CuraScript

Priority

Actimmune

Adagen

exclusive

Aldurazyme

restricted

Apokyn

restricted

Aralast

restricted

Avonex

Botox

Cerezyme

Clotting Factor

Enbrel

Fabrazyme

restricted

Flolan

restricted

Growth Hormone

IVIG

Orfadin

exclusive

Prolastin

exclusive

Raptiva

Remodulin

restricted

Synagis

restricted

Tracleer

restricted

Xolair

Zavesca

exclusive

Zemaira

exclusive

21

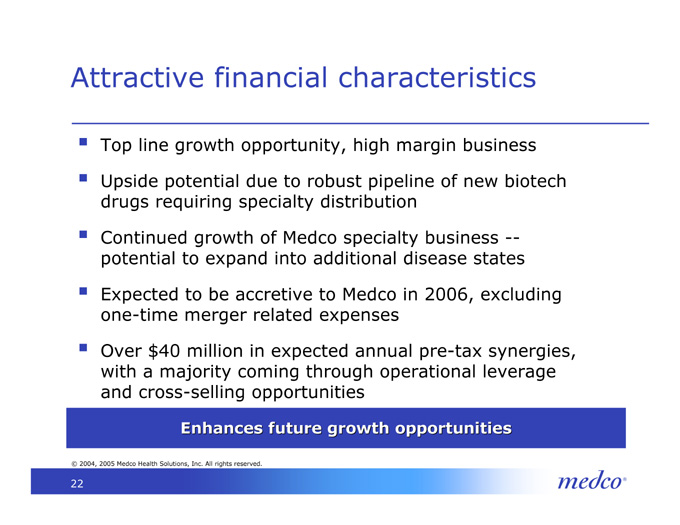

Attractive financial characteristics

Top line growth opportunity, high margin business

Upside potential due to robust pipeline of new biotech drugs requiring specialty distribution

Continued growth of Medco specialty business — potential to expand into additional disease states

Expected to be accretive to Medco in 2006, excluding one-time merger related expenses

Over $40 million in expected annual pre-tax synergies, with a majority coming through operational leverage and cross-selling opportunities

Enhances future growth opportunities

22

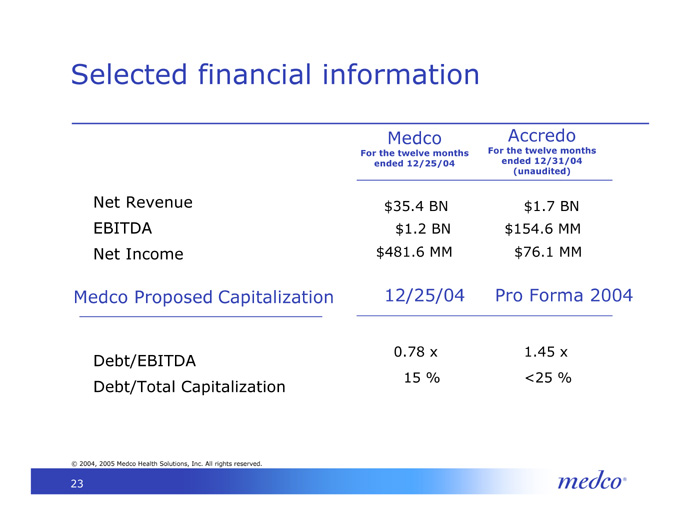

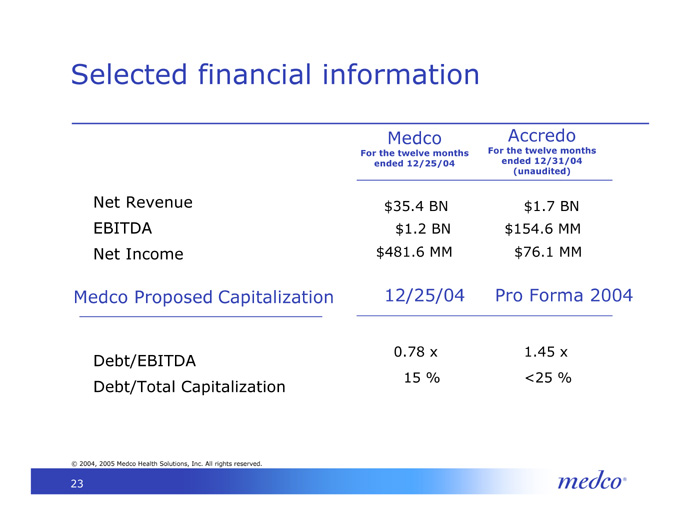

Selected financial information

Medco

For the twelve months

ended 12/25/04

Accredo

For the twelve months

ended 12/31/04

(unaudited)

Net Revenue

EBITDA

Net Income

Debt/EBITDA

Debt/Total Capitalization

$35.4 BN $1.7 BN

$1.2 BN $154.6 MM

$481.6 MM $76.1 MM

12/25/04 Pro Forma 2004

0.78 x 1.45 x

15 % <25 %

Medco Proposed Capitalization

23

medco

Additional Information on Accredo Transaction

In connection with the proposed transaction, Medco intends to file a registration statement, including a proxy statement of Accredo Health, Incorporated and other materials with the Securities and Exchange Commission (SEC). Investors are urged to read the registration statement and other materials when they are available because they contain important information. Investors will be able to obtain free copies of the registration statement and proxy statement, when they become available, as well as other filings containing information about Medco and Accredo, at the SEC’s Internet site (http://www.sec.gov). These documents also may be accessed and downloaded for free from Medco’s Investor Relations Web site, www.medco.com, or obtained for free by directing a request to Medco Health Solutions, Inc. Investor Relations Department, 100 Parson Pond Drive, F1-6, Franklin Lakes, NJ, 07417. Copies of Accredo’s filings may be accessed and downloaded for free at Accredo’s Investor Relations Web site, www.accredohealth.net, or obtained for free by directing a request to Accredo Health, Incorporated Investor Relations, 1640 Century Center Parkway, Memphis, TN, 38134.

Medco, Accredo and their respective directors and executive officers and other members of management and employees may be deemed to be participants in the solicitation of proxies from Accredo stockholders in respect of the proposed transaction. Information regarding Medco’s directors and executive officers is available in Medco’s proxy statement for its 2004 annual meeting of stockholders, dated March 19, 2004, and information regarding Accredo’s directors and executive officers is available in Accredo’s proxy statement, dated Oct. 19, 2004, for its 2004 annual meeting of stockholders. Additional information regarding the interests of such potential participants will be included in the registration and proxy statement and the other relevant documents filed with the SEC when they become available.

25

Use of Non-GAAP Measures

Medco calculates and uses EBITDA and EBITDA per adjusted prescription as indicators of its ability to generate cash from reported operating results. These measurements are used in concert with net income, and cash flows from operations, which measures actual cash generated in the period. In addition, the company believes that EBITDA and EBITDA per adjusted prescription are supplemental measurement tools used by analysts and investors to help evaluate overall operating performance and the ability to incur and service debt and make capital expenditures. EBITDA does not represent funds available for our discretionary use and is not intended to represent or to be used as a substitute for net income or cash flows from operations data as measured under U.S. generally accepted accounting principles. The items excluded from EBITDA but included in the calculation of the company’s reported net income are significant components of the statements of income, and must be considered in performing a comprehensive assessment of overall financial performance. EBITDA, and the associated year-to-year trends, should not be considered in isolation. Medco’s calculation of EBITDA may not be consistent with calculations of EBITDA used by other companies.

Medco uses earnings per share excluding amortization expense as a supplemental measure of operating performance. The amortization is associated with intangible assets that substantially arose in connection with the acquisition of Medco by Merck & Co., Inc. in 1993 that were pushed down to Medco’s balance sheet. The company believes that earnings per share excluding amortization of intangibles is a useful measure because of the significance of this non-cash item and to enhance comparability with its peers.

26

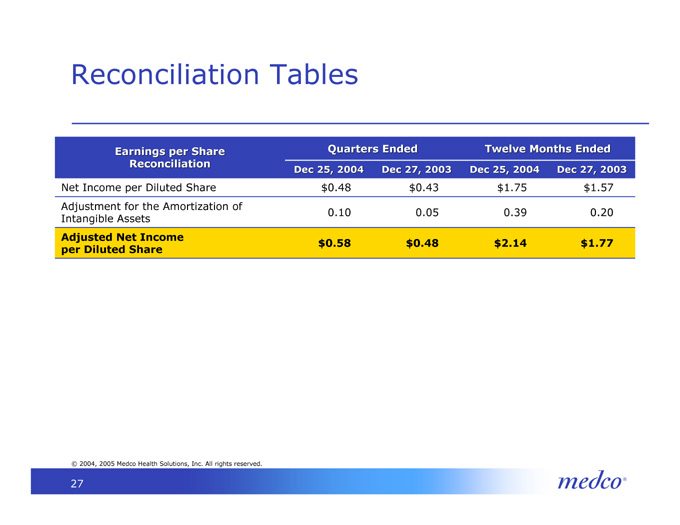

Reconciliation Tables

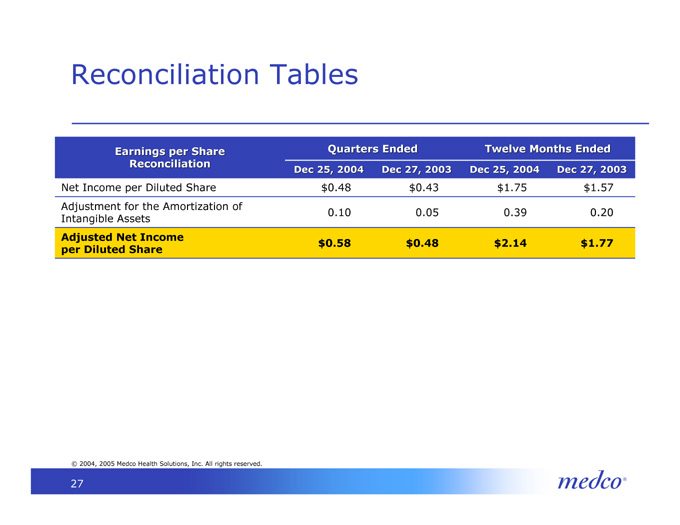

Earnings per Share Reconciliation

Quarters Ended

Twelve Months Ended

Dec 27, 2003

Dec 27, 2003

Dec 25, 2004

Dec 25, 2004

Net Income per Diluted Share

$0.48

$0.43

$1.75

$1.57

0.05

0.39

0.20

Adjustment for the Amortization of Intangible Assets

0.10

Adjusted Net Income per Diluted Share

$0.58

$0.48

$2.14

$1.77

27

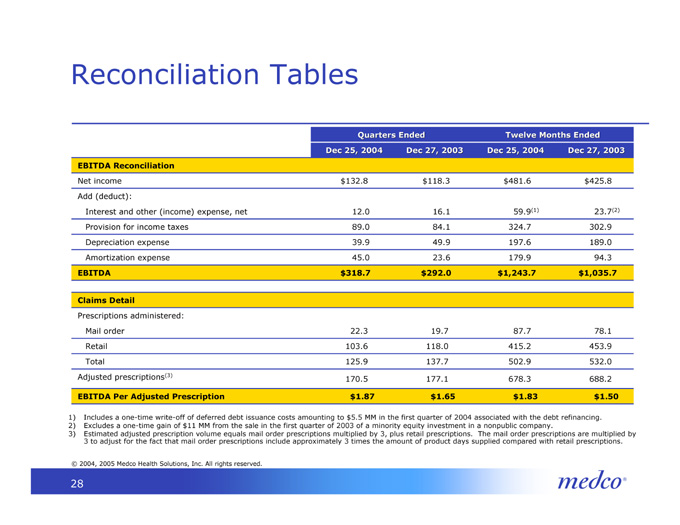

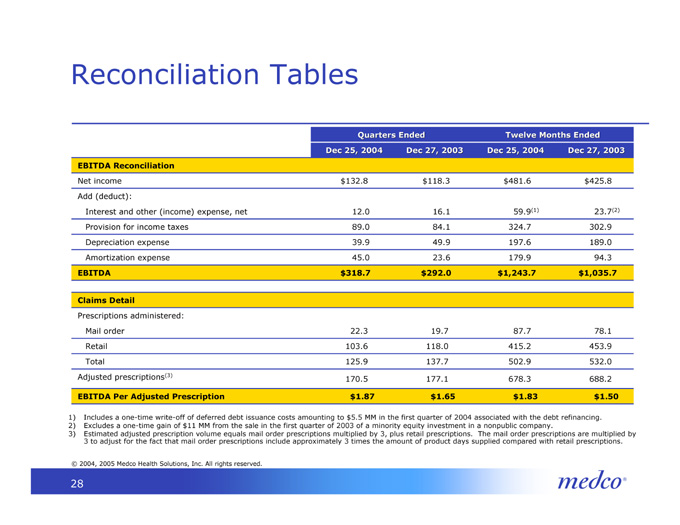

Reconciliation Tables

Quarters Ended

Twelve Months Ended

Dec 25, 2004

Dec 27, 2003

Dec 25, 2004

Dec 27, 2003

EBITDA Reconciliation

Net income

$132.8

$118.3

$481.6

$425.8

Add (deduct):

Interest and other (income) expense, net

12.0

16.1

59.9(1)

23.7(2)

Provision for income taxes

89.0

84.1

324.7

302.9

Depreciation expense

39.9

49.9

197.6

189.0

Amortization expense

45.0

23.6

179.9

94.3

EBITDA

$318.7

$292.0

$1,243.7

$1,035.7

Claims Detail

Prescriptions administered:

Mail order

22.3

19.7

87.7

78.1

Retail

103.6

118.0

415.2

453.9

Total

125.9

137.7

502.9

532.0

Adjusted prescriptions(3)

170.5

177.1

678.3

688.2

EBITDA Per Adjusted Prescription

$1.87

$1.65

$1.83

$1.50

1) Includes a one-time write-off of deferred debt issuance costs amounting to $5.5 MM in the first quarter of 2004 associated with the debt refinancing.

2) Excludes a one-time gain of $11 MM from the sale in the first quarter of 2003 of a minority equity investment in a nonpublic company.

3) Estimated adjusted prescription volume equals mail order prescriptions multiplied by 3, plus retail prescriptions. The mail order prescriptions are multiplied by 3 to adjust for the fact that mail order prescriptions include approximately 3 times the amount of product days supplied compared with retail prescriptions.

28

SG Cowen & Co. 25th Annual Health Care Conference Panel Discussion

Dr. Robert Epstein

Medco Health Solutions, Inc.

March 16, 2005

Forward looking statements

This presentation contains “forward-looking statements” as that term is defined in the Private Securities Litigation Reform Act of 1995. These statements involve risks and uncertainties that may cause results to differ materially from those set forth in the statements. No forward-looking statement can be guaranteed, and actual results may differ materially from those projected. We undertake no obligation to publicly update any forward-looking statement, whether as a result of new information, future events, or otherwise. Forward-looking statements in this presentation should be evaluated together with the many uncertainties that affect our business, particularly those mentioned in the risk factors section of the Company’s Annual Report on Form 10-K filed with the Securities and Exchange Commission.

2

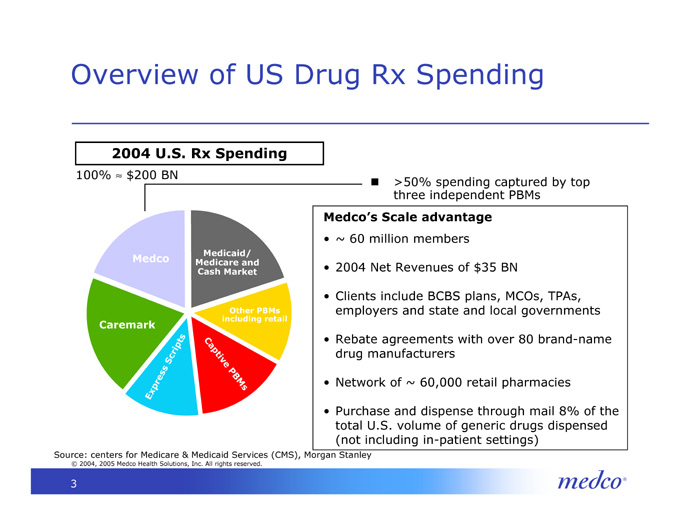

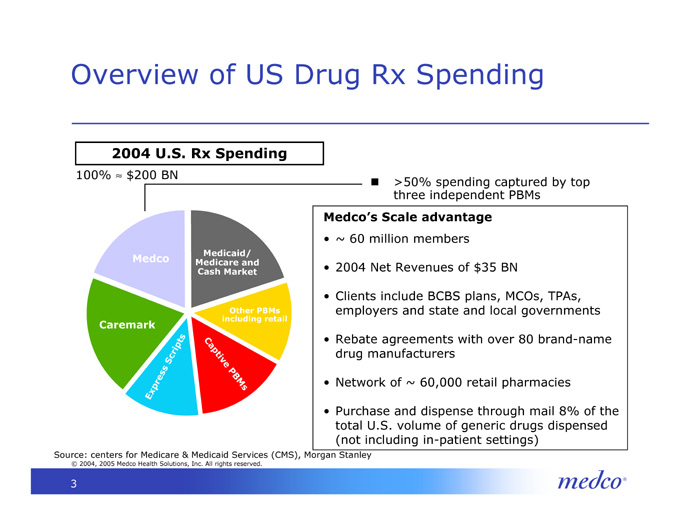

Overview of US Drug Rx Spending

2004 U.S. Rx Spending

>50% spending captured by top three independent PBMs

100% $200 BN

Medco’s Scale advantage

~ 60 million members

2004 Net Revenues of $35 BN

Clients include BCBS plans, MCOs, TPAs, employers and state and local governments

Rebate agreements with over 80 brand-name drug manufacturers

Network of ~ 60,000 retail pharmacies

Purchase and dispense through mail 8% of the total U.S. volume of generic drugs dispensed (not including in-patient settings)

Medco

Medicaid/ Medicare and Cash Market

Other PBMs including retail

Caremark

Express Scripts

Captive PBMs

Source: centers for Medicare & Medicaid Services (CMS), Morgan Stanley

3

Plan Designs 2005 New twists on old themes

Member cost share approaching 30% for many employers

Deductibles – separate for pharmacy

Coinsurance – split in various ways

Tiering – 4 tier getting more common

Networks – customized

Mail service – copay differentials

Generics – Member Pays Difference

Source: Medco Data on file

4

Plan Designs 2005 Newer ideas – not much traction yet

Reverse copays

Reference pricing

Evidence-based formulary tiering

OTC coverage

Consumer directed health plan products – drug alone or combined

5

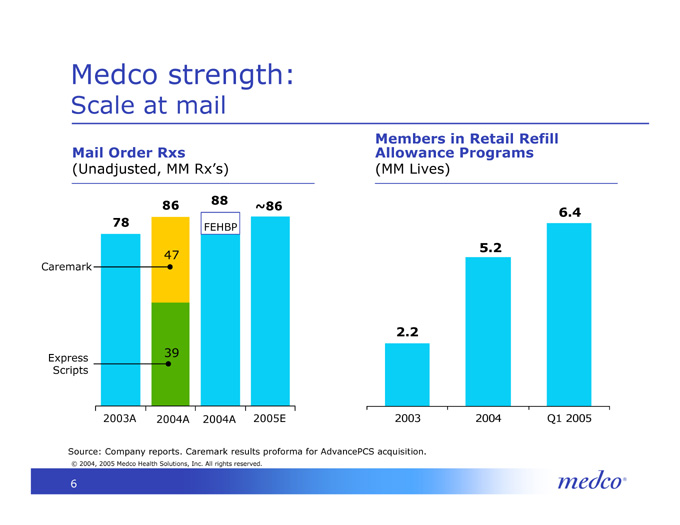

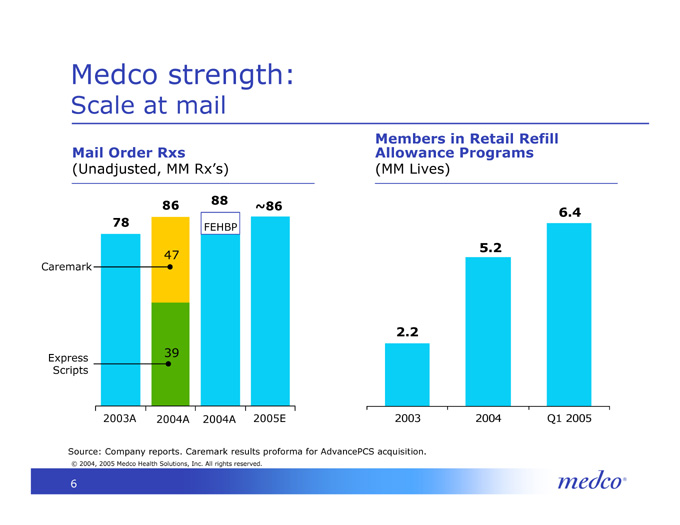

Medco strength: Scale at mail

Members in Retail Refill Allowance Programs

(MM Lives)

Mail Order Rxs

(Unadjusted, MM Rx’s)

88

~86

86

6.4

FEHBP

78

47

5.2

Caremark

2.2

Express Scripts

39

2003A

2005E

2004A

2004A

Q1 2005

2004

2003

Source: Company reports. Caremark results proforma for AdvancePCS acquisition.

6

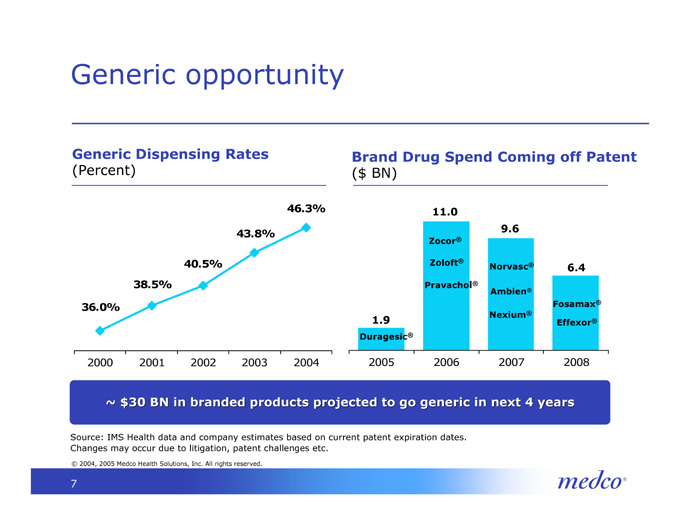

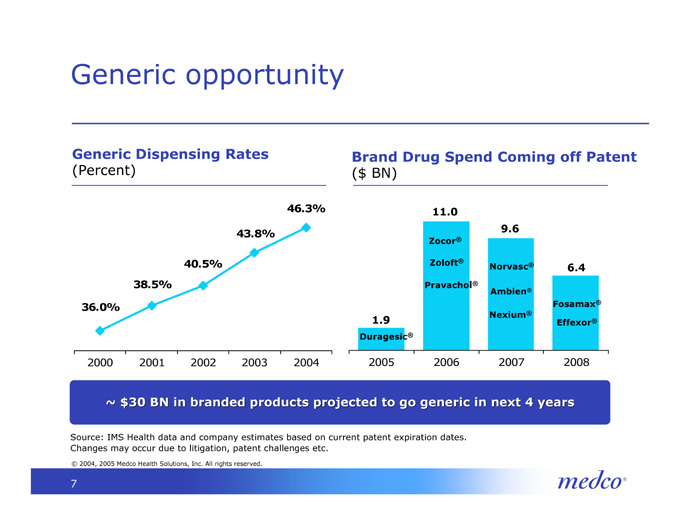

Generic opportunity

Brand Drug Spend Coming off Patent

($ BN)

Generic Dispensing Rates

(Percent)

11.0

46.3%

9.6

43.8%

Zocor®

6.4

Zoloft®

Norvasc®

40.5%

Pravachol®

38.5%

Ambien®

36.0%

Fosamax®

1.9

Nexium®

Effexor®

Duragesic®

2004

2003

2002

2001

2000

2005

2006

2007

2008

~ $30 BN in branded products projected to go generic in next 4 years

Source: IMS Health data and company estimates based on current patent expiration dates.

Changes may occur due to litigation, patent challenges etc.

7

Medicare vs. Commercial Formulary- some initial thoughts

Drugs excluded

anorexia, weight loss, weight gain, fertility, cosmetic purposes, hair growth, coughs/cold symptoms, prescription vitamins, barbiturates, benzodiazepines

Drugs included

all non self-administered injectibles when not covered by Part B

chemotherapies

gamma globulins

vaccines

total parenteral nutrition

Off-label uses

American Hospital Formulary Service Drug Information

United States Pharmacopeia-Drug Information

DRUGDEX Information System

American Medical Association Drug Evaluations

8

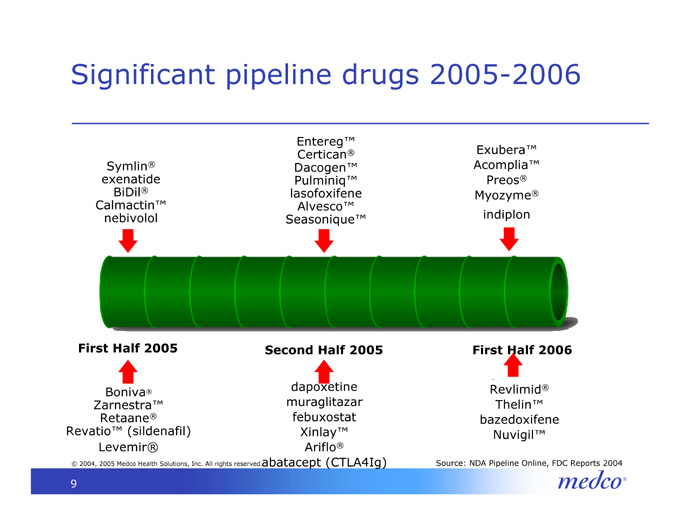

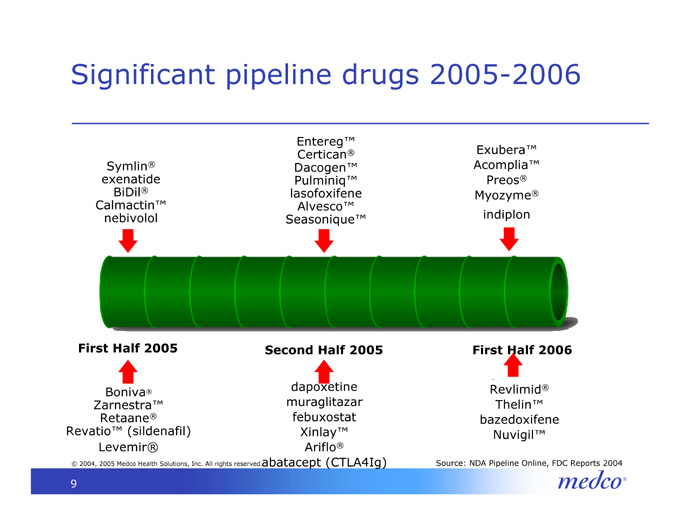

Significant pipeline drugs 2005-2006

Entereg™

Certican®

Dacogen™

Pulminiq™

lasofoxifene

Alvesco™

Seasonique™

Exubera™

Acomplia™

Preos®

Myozyme®

indiplon

Symlin®

exenatide

BiDil®

Calmactin™

nebivolol

First Half 2006

Second Half 2005

First Half 2005

Boniva®

Zarnestra™

Retaane®

Revatio™ (sildenafil)

Levemir®

Revlimid®

Thelin™

bazedoxifene

Nuvigil™

dapoxetine

muraglitazar

febuxostat

Xinlay™

Ariflo®

abatacept (CTLA4Ig)

Source: NDA Pipeline Online, FDC Reports 2004

9

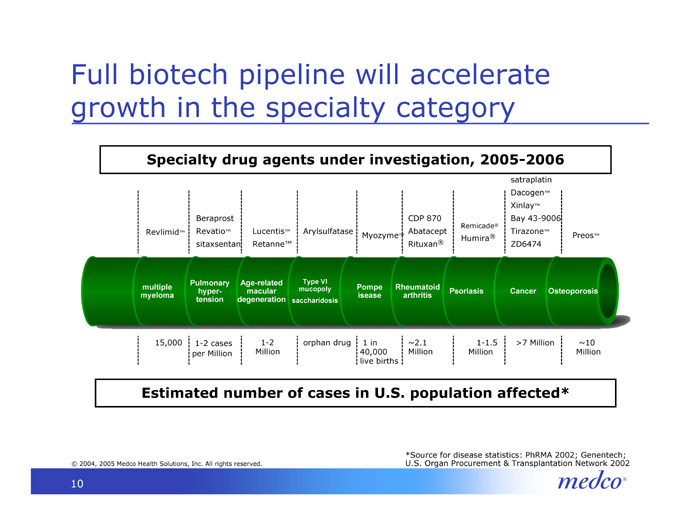

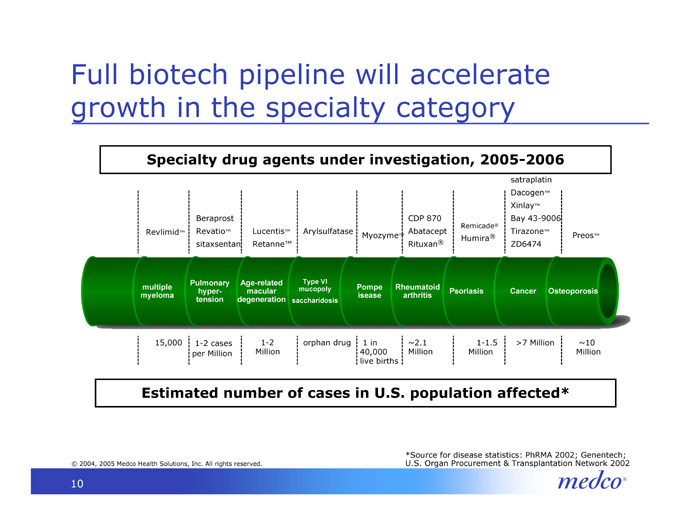

Full biotech pipeline will accelerate growth in the specialty category

Specialty drug agents under investigation, 2005-2006

satraplatin

Dacogen™

Xinlay™

Bay 43-9006

Tirazone™

ZD6474

Beraprost

Revatio™

sitaxsentan

Lucentis™

Retanne™

Myozyme™

Preos™

CDP 870

Abatacept

Rituxan®

Remicade®

Humira®

Revlimid™

Arylsulfatase

Age-related macular degeneration

Pulmonary hyper- tension

Rheumatoid arthritis

Pompe isease

multiple myeloma

Type VI mucopoly

saccharidosis

Cancer

Psoriasis

Osteoporosis

1-2

Million

orphan drug

1 in 40,000 live births

1-1.5 Million

>7 Million

~10 Million

15,000

~2.1

Million

1-2 cases per Million

Estimated number of cases in U.S. population affected*

*Source for disease statistics: PhRMA 2002; Genentech; U.S. Organ Procurement & Transplantation Network 2002

10

medco

Additional Information on Accredo Transaction

In connection with the proposed transaction, Medco intends to file a registration statement, including a proxy statement of Accredo Health, Incorporated and other materials with the Securities and Exchange Commission (SEC). Investors are urged to read the registration statement and other materials when they are available because they contain important information. Investors will be able to obtain free copies of the registration statement and proxy statement, when they become available, as well as other filings containing information about Medco and Accredo, at the SEC’s Internet site (http://www.sec.gov). These documents also may be accessed and downloaded for free from Medco’s Investor Relations Web site, www.medco.com, or obtained for free by directing a request to Medco Health Solutions, Inc. Investor Relations Department, 100 Parson Pond Drive, F1-6, Franklin Lakes, NJ, 07417. Copies of Accredo’s filings may be accessed and downloaded for free at Accredo’s Investor Relations Web site, www.accredohealth.net, or obtained for free by directing a request to Accredo Health, Incorporated Investor Relations, 1640 Century Center Parkway, Memphis, TN, 38134.

Medco, Accredo and their respective directors and executive officers and other members of management and employees may be deemed to be participants in the solicitation of proxies from Accredo stockholders in respect of the proposed transaction. Information regarding Medco’s directors and executive officers is available in Medco’s proxy statement for its 2004 annual meeting of stockholders, dated March 19, 2004, and information regarding Accredo’s directors and executive officers is available in Accredo’s proxy statement, dated Oct. 19, 2004, for its 2004 annual meeting of stockholders. Additional information regarding the interests of such potential participants will be included in the registration and proxy statement and the other relevant documents filed with the SEC when they become available.

12