UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

________________________________________

SCHEDULE 14A

Proxy Statement Pursuant to Section 14(a) of the Securities

Exchange Act of 1934

________________________________________

Filed by the Registrant ☑

Filed by a Party other than the Registrant ☐

Check the appropriate box:

☐ Preliminary Proxy Statement

☐ Confidential, for Use of the Commission Only (as permitted by Rule 14a-6(e)(2))

☑ Definitive Proxy Statement

☐ Definitive Additional Materials

☐ Soliciting Material under Rule 14a-12

Foxby Corp.

(Name of Registrant as Specified in Its Charter)

(Name of Person(s) Filing Proxy Statement, if Other Than the Registrant)

Payment of Filing Fee (Check the appropriate box):

☑ No fee required.

☐ Fee computed on table below per Exchange Act Rules 14a-6(i)(1) and 0-11.

| (1) | Title of each class of securities to which transaction applies: |

| (2) | Aggregate number of securities to which transaction applies: |

| (3) | Per unit price or other underlying value of transaction computed pursuant to Exchange Act Rule 0-11 (Set forth the amount on which the filing fee is calculated and state how it was determined): |

| (4) | Proposed maximum aggregate value of transaction: |

☐ Fee paid previously with preliminary materials:

| ☐ | Check box if any part of the fee is offset as provided by Exchange Act Rule 0-11(a)(2) and identify the filing for which the offsetting fee was paid previously. Identify the previous filing by registration statement number, or the Form or Schedule and the date of its filing. |

| (1) | Amount Previously Paid: |

| (2) | Form, Schedule or Registration Statement No.: |

FOXBY CORP.

11 Hanover Square

New York, NY 10005

www.FoxbyCorp.com

NOTICE OF SPECIAL MEETING OF STOCKHOLDERS

To be held on November 17, 2020

To the Stockholders of Foxby Corp.:

Notice is hereby given that a Special Meeting of Stockholders of Foxby Corp. (the “Fund”) will be held at the offices of the Fund at 11 Hanover Square, 12th Floor, New York, New York 10005 on November 17, 2020 at 8:00 a.m., local time, for the following purpose:

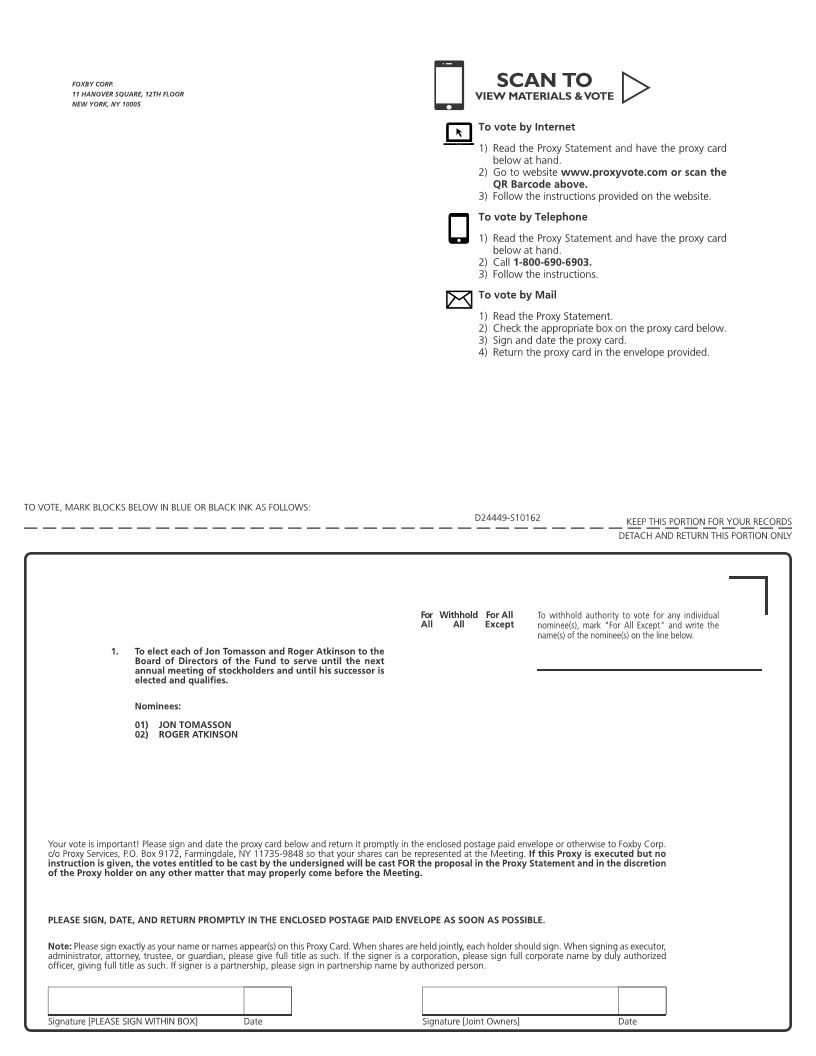

To elect each of Jon Tomasson and Roger Atkinson (the “Nominees”) to the Board of Directors (the “Board”) of the Fund to serve until the next annual meeting of stockholders and until his successor is elected and qualifies.

The Board unanimously recommends that stockholders vote FOR each Nominee named in the Proposal.

Stockholders of record at the close of business on September 29, 2020 are entitled to receive notice of and to vote at the meeting and any adjournment or postponement thereof.

By Order of the Board of Directors

Sincerely,

Russell Kamerman

Secretary

October 6, 2020

THE MEETING WILL START PROMPTLY AT 8:00 A.M., LOCAL TIME. PHOTOGRAPHIC IDENTIFICATION WILL BE REQUIRED FOR ADMISSION TO THE MEETING.

| YOUR VOTE IS IMPORTANT NO MATTER HOW MANY SHARES YOU OWN. |

| PLEASE RETURN YOUR PROXY CARD PROMPTLY. |

| |

Please indicate voting instructions on the enclosed proxy card, date and sign it, and return it in the envelope provided, which needs no postage if mailed in the United States.

|

| To avoid the additional expense of further solicitation, we ask your cooperation in mailing your proxy card promptly. |

FOXBY CORP.

11 Hanover Square

New York, NY 10005

www.FoxbyCorp.com

PROXY STATEMENT

Special Meeting of Stockholders

to be held November 17, 2020

This Proxy Statement is being furnished in connection with a solicitation of proxies by the Board of Directors (the “Board”) of Foxby Corp. (the “Fund”) to be voted at a Special Meeting of Stockholders of the Fund to be held at the offices of the Fund at 11 Hanover Square, 12th Floor, New York, New York 10005 on November 17, 2020 at 8:00 a.m., local time, and at any postponements or adjournments thereof (the “Meeting”) for the purposes set forth in the accompanying Notice of a Special Meeting of Stockholders. Only stockholders of record at the close of business on September 29, 2020 (the “Record Date”) are entitled to be present and to vote at the Meeting. As of the Record Date, the Fund had 2,610,050 shares of common stock issued and outstanding.

The expense of preparing, assembling, printing, and mailing the proxy statement, proxy card, and any other material used for the solicitation of proxies will be paid by the Fund. It is estimated that proxy materials will be mailed to stockholders on or about October 13, 2020. The Fund’s principal executive offices are located at 11 Hanover Square, New York, New York 10005.

The Fund prepares and mails to its stockholders financial reports, normally on a semi-annual basis. The Fund will furnish to stockholders upon request, without charge, copies of its annual report and most recent semi-annual report succeeding the annual report, if any, to any shareholder. Requests for such Annual Report should be directed to the Fund at 11 Hanover Square, 12th Floor, New York, New York 10005 or by telephone toll-free at 855-411-6432. Copies can also be obtained by visiting our website at www.FoxbyCorp.com. Copies of our annual and semi-annual reports are also available on the EDGAR Database on the Securities and Exchange Commission’s (the “SEC”) website at www.sec.gov.

Due to concerns about the coronavirus or COVID-19, we are planning for the possibility that the Meeting may be held at a physical location or virtually solely by means of remote communication or via a live webcast or that we may allow for virtual attendance. If we take this step, we will publicly announce the decision in a press release that will also be filed with the SEC as definitive additional soliciting material, and we will post the announcement and additional information on our website at www.FoxbyCorp.com as soon as practicable before the Meeting. We recommend that you monitor this website for updated information, and please check this website in advance of the Meeting to confirm the status of the Meeting before planning to attend in person.

Voting and Quorum

Stockholders are entitled to one vote for each Fund share held, and a fractional vote for each fractional Fund share held. Shares represented by executed and unrevoked proxies will be voted in accordance with the instructions on the Proxy Card. A stockholder may revoke a proxy by delivering to the Secretary of the Fund a signed proxy with a date later than the previously delivered proxy or by sending a written revocation to the Fund. To be effective, such revocation must be received prior to the Meeting. In addition, any stockholder who attends the Meeting in person may vote by ballot at the Meeting, thereby canceling any proxy previously given.

The presence in person or by proxy of stockholders entitled to cast one-third of all the votes entitled to be cast at the Meeting shall constitute a quorum. If a quorum is not present at the Meeting, the chairman of the Meeting has the power to adjourn the Meeting from time to time to a date not more than 120 days after the original record date without notice to stockholders other than announcement at the Meeting. At a reconvened Meeting, if a quorum is present, any business may be transacted that might have been transacted at the originally scheduled Meeting. Notwithstanding the presence of a quorum, in accordance with the Bylaws of the Fund, the chairman of the Meeting may recess or adjourn the Meeting to a later date and time and place without notice to stockholders other than announcement at the Meeting. A stockholder vote may be taken for one or more proposals prior to any adjournment if sufficient votes have been received for approval.

If a properly executed and returned proxy is accompanied by instructions to withhold authority to vote or represents a broker “non-vote” (that is, a proxy from a broker, bank, or other nominee indicating that such person has not received instructions from the beneficial owner or other person entitled to vote shares of the Fund on a particular matter with respect to which the broker, bank, or other nominee does not have discretionary power (collectively, “abstentions”), the Fund’s shares represented thereby will be considered to be present at the Meeting for purposes of determining the existence of a quorum for the transaction of business. Under Maryland law, abstentions in the context of a plurality vote requirement do not constitute a vote “for” or “against” the proposal and, therefore, will be disregarded in determining “votes cast” on an issue.

| THE PROPOSAL: | TO ELECT EACH OF JON TOMASSON AND ROGER ATKINSON ("THE NOMINEES") TO THE BOARD OF DIRECTORS OF THE FUND TO SERVE UNTIL THE NEXT ANNUAL MEETING OF STOCKHOLDERS AND UNTIL HIS SUCCESSOR IS ELECTED AND QUALIFIES. |

Upon the recommendation of the Board’s Nominating Committee, with the unanimous approval of the Independent Directors, the Fund’s Board approved the nomination of each Nominee to serve until the next annual meeting of stockholders and until his successor is elected and qualifies. Mr. Tomasson has served as a member of the Board since 2017, while Mr. Atkinson, if elected, will be new to the Board. Neither Nominee has been elected by shareholders previously. In the event Mr. Tomasson is not duly elected, as proposed and qualifies, he shall be deemed holding over and shall continue to manage the business and affairs of the Fund as a member of the Board until his successor is duly elected and qualifies. Unless otherwise noted, the address of record for each Board Nominee and other directors and officers is 11 Hanover Square, New York, New York 10005.

Information Regarding the Board Nominees

Set forth below is certain information regarding each Nominee for election as a Director of the Fund.

Name, Address,(1)

and Date of Birth | Position(s) Held with Fund | Term of Office and Length of Time Served | Principal Occupation(s) During the

Past 5 Years | Number of Portfolios in

Fund Complex(2) Overseen by Nominee | Other Directorships Held by Nominee During the Past 5 Years(3) |

Independent Director Nominees(4) |

Roger Atkinson January 25, 1961 | N/A | N/A(5) | Since 2007, Mr. Atkinson has served as a manager with Cell-Mark Inc., a pulp and paper trading company. His responsibilities include directing trading activity, acquisitions, and risk management.

| 1 | None |

Jon Tomasson September 20, 1958 | Director | Since 2017(5) | Mr. Tomasson serves as Chief Executive Officer of Vinland Capital Investments, LLC (since 2002), a real estate investment company that he founded, and Chief Investment Officer of NRE Capital Partners LLC (since 2019), a private real estate lending company. Prior to starting Vinland, Mr. Tomasson was a principal with Cardinal Capital Partners, a leading investor in single-tenant net-leased property, and served as a Vice President at Citigroup in the Global Real Estate Equity and Structured Finance group, part of the Real Estate Investment Bank, with both transactional and various management responsibilities. | 4 | None |

(1) | The mailing address of each Board Nominee is 11 Hanover Square, 12th Floor, New York, New York 10005. |

(2) | The Fund Complex, comprised of the Fund, Dividend and Income Fund (a closed end fund), and Midas Series Trust (an open end fund with two series), are all managed by Midas Management Corporation, the Fund’s investment manager (the “Investment Manager”) or its affiliates. |

(3) |

Refers to directorships held by each Nominee during the past five years in any company with a class of securities registered pursuant to Section 12 of the Exchange Act or any company registered as an investment company under the Investment Company Act of 1940, as amended (the “1940 Act”), excluding those within the Fund Complex. |

(4) |

An “Independent Director Nominee” is a Nominee who is not an “interested person” of the Fund, as defined under the 1940 Act. Neither the Nominees, nor their immediate family members, held any positions (other than director of one or more investment companies in the Fund Complex) with the Investment Manager, its affiliates, or any person directly or indirectly controlling, controlled by, or under common control with the Investment Manager or its affiliates, during the two most recently completed calendar years. |

(5) |

If elected, the Nominee will serve until the next annual meeting of stockholders and until his successor is elected and qualifies. |

In considering each Nominee for election, the Board evaluated each Nominee’s background and his qualifications. With respect to the specific experience, qualifications, attributes, or skills that led to the conclusion that each Nominee should be elected as a Director of the Fund, the Board considered and evaluated each Nominee’s relevant knowledge, experience, expertise, and independence. Mr. Atkinson has experience with financial, accounting, regulatory, investment, and board operational matters as a result of his current position as a manager at CellMark, Inc., a global forest products trading company, where he directs trading activity, acquisitions, and risk management, and various former positions, including serving as the sole member of Fort Vancouver Paper LLC, an international trading company, and as a result of his service as a trustee of another investment company managed by an affiliate of the Investment Manager. Mr. Tomasson has experience with financial, accounting, regulatory, investment, and board operational matters as well as monitoring investment advisers and other fund service providers through his current positions as Chief Executive Officer of Vinland Capital Investments, LLC and Chief Investment Officer of NRE Capital Partners LLC, his former positions as a principal with Cardinal Capital Partners, a Vice President at Citigroup in the Global Real Estate Equity and Structured Finance group, part of the Real Estate Investment Bank, and a director of a public company, and as a result of his service as a director or trustee of other investment companies managed by the Investment Manager and/or its affiliates. In addition, the Board considered each Nominee’s experience with financial matters as a result of his industry experience.

The persons named in the accompanying form of proxy intend to vote each such proxy “FOR” the election of each Nominee listed above, unless a stockholder specifically indicates on a proxy the desire to withhold authority to vote for each Nominee. It is not contemplated that a Nominee will be unable to serve as a director for any reason, but if that should occur prior to the Meeting, the proxy holders reserve the right to substitute another person or persons of their choice as a Nominee. Each Nominee listed above has consented to being named in this Proxy Statement and has agreed to serve as a director if elected. See below for additional information regarding the Fund’s directors and officers.

Vote Required

As set forth in the Fund’s Bylaws, if a nominee for director is approved by a majority of the Continuing Directors (as defined in the Bylaws), a plurality of all the votes cast at a meeting at which a quorum is present shall be sufficient to elect a director. Because each Nominee for director was approved by a majority of the Continuing Directors, a plurality of all the votes cast at the Meeting shall be sufficient to elect each Nominee as a director. “Plurality of the votes” means each Nominee must receive more votes than any other candidate for the same position, but not necessarily a majority of the votes cast.

THE BOARD OF DIRECTORS UNANIMOUSLY RECOMMENDS YOU VOTE FOR EACH NOMINEE.

INFORMATION ABOUT THE FUND’S DIRECTORS AND OFFICERS

In addition to Mr. Tomasson, the Board of Directors of the Fund is currently comprised of the individuals listed below.

Name, Address,(1)

and Date of Birth | Position(s) Held with Fund | Term of Office and Length of Time Served | Principal Occupation(s) During the

Past 5 Years | Number of Portfolios in

Fund Complex(2) Overseen by Director | Other Directorships Held by Director During the Past 5 Years(3) |

Independent Directors(4) |

Peter K. Werner August 16, 1959 | Director | Since 2002

(until the next annual meeting of stockholders and until his successor is elected and qualifies)

| Since 1996, Mr. Werner has taught, directed, and coached many programs at The Governor’s Academy of Byfield, MA. Currently, he teaches economics and history at the Governor’s Academy. Previously, he held the position of Vice President in the Fixed Income Departments of Lehman Brothers and First Boston. His responsibilities included trading sovereign debt instruments, currency arbitrage, syndication, medium term note trading, and money market trading. | 4 | None |

| Interested Director |

Thomas B. Winmill, Esq.(5) P.O. Box 4 Walpole, NH 03608 June 25, 1959 | Director; Chairman, President, Chief Executive Officer, Chief Legal Officer | Since 2002

(until the next annual meeting of stockholders and until his successor is elected and qualifies) | Mr. Winmill is President, Chief Executive Officer, Chairman, Chief Legal Officer, and a Trustee or Director of the Fund, Dividend and Income Fund, and Midas Series Trust. He is President, Chief Executive Officer, and Chief Legal Officer of the Investment Manager and Bexil Advisers LLC (registered investment advisers, collectively, the “Advisers”), Bexil Securities LLC and Midas Securities Group, Inc. (registered broker-dealers, collectively, the “Broker-Dealers”), Bexil Corporation (a holding company) (“Bexil”) and Winmill & Co. Incorporated (“Winco”) (a holding company). He is a Director of Global Self Storage, Inc. (a self storage REIT) (“SELF”) and Bexil American Mortgage Inc. He is Chairman of the Investment Policy Committee of each of the Advisers (the “IPCs”), and he is the portfolio manager of the Fund, Dividend and Income Fund, Midas Fund, and Midas Magic. He is a member of the New York State Bar and the SEC Rules Committee of the Investment Company Institute.(6) | 4

| None

|

(1) | The mailing address of each Director is, except as noted otherwise, 11 Hanover Square, 12th Floor, New York, New York 10005. |

(2) | The Fund Complex is comprised of the Fund, Dividend and Income Fund (a closed end fund), and Midas Series Trust (an open end fund with two series) which are all managed by the Investment Manager or its affiliates. |

(3) | Refers to directorships held by a Director during the past five years in any company with a class of securities registered pursuant to Section 12 of the Exchange Act or any company registered as an investment company under the 1940 Act, excluding those within the Fund Complex. Directorships disclosed under this column do not include directorships disclosed under the column “Principal Occupation(s) During the Past 5 Years.” |

| (4) | An “Independent Director” is a Director who is not an “interested person” of the Fund, as defined under the 1940 Act. None of the Independent Directors, nor their immediate family members, held any positions (other than director or trustee of the investment companies in the Fund Complex) with the Investment Manager, its affiliates, or any person directly or indirectly controlling, controlled by, or under common control with the Investment Manager or its affiliates, during the two most recently completed calendar years. |

(5) | Mr. Winmill is an “interested person” as defined in the 1940 Act because of his affiliations with the Investment Manager, as noted herein. |

| (6) | Thomas B. Winmill and Mark C. Winmill are brothers. |

The executive officers of the Fund, other than those who serve as Directors, are as follows:

Name, Address(1)

and Date of Birth | Position(s) Held with Fund | | Principal Occupation(s) During the

Past 5 Years |

| | | | |

Russell Kamerman, Esq. July 8, 1982 | Chief Compliance Officer, Secretary, and General Counsel | 2014 | Chief Compliance Officer (since 2014), Secretary (since 2017), and General Counsel (since 2017) of the other investment companies in the Fund Complex, the Advisers, the Broker-Dealers, and Bexil. He is Assistant Chief Compliance Officer, Assistant Secretary, and Assistant General Counsel of SELF, Winco, and Tuxis Corporation (a real estate company) (“Tuxis”). From December 2014 to June 2017, Mr. Kamerman served as Anti-Money Laundering Officer of the other investment companies in the Fund Complex, the Advisers, Bexil, SELF, Winco and Tuxis. He is a member of the New York State Bar and the Chief Compliance Officer Committee and the Advertising Compliance Advisory Committee of the Investment Company Institute. Previously, he was an attorney in private practice focusing on regulatory, compliance, and other general corporate matters relating to the structure, formation, and operation of investment funds and investment advisers.

|

Heidi Keating March 28, 1959 | Vice President | 2002 | Vice President of the other investment companies in the Fund Complex, the Advisers, the Broker-Dealers, Bexil, SELF, Tuxis, and Winco. She is a member of the IPCs.

|

Donald Klimoski II, Esq. September 24, 1980 | Assistant Secretary, Assistant General Counsel, and Assistant Chief Compliance Officer

| 2017 | Assistant Secretary, Assistant General Counsel, and Assistant Chief Compliance Officer of the other investment companies in the Fund Complex, the Advisers, the Broker-Dealers, and Bexil. He is Chief Compliance Officer, Secretary, and General Counsel of SELF, Winco, and Tuxis. He is a member of the New York, New Jersey and Patent Bars and the Compliance Advisory Committee of the Investment Company Institute. Previously, he served as Associate General Counsel of Commvault Systems, Inc. Prior to that, he was an associate at Sullivan & Cromwell LLP, where his practice focused on mergers and acquisitions, securities law, corporate governance, intellectual property and related matters.

|

Thomas O’Malley July 22, 1958 | Chief Accounting Officer, Chief Financial Officer, Treasurer, and Vice President | 2005 | Chief Accounting Officer, Chief Financial Officer, Vice President, and Treasurer of the other investment companies in the Fund Complex, the Advisers, the Broker- Dealers, Bexil, SELF, Tuxis, and Winco. He is a certified public accountant.

|

Mark C. Winmill(3) November 26, 1957 | Vice President | 2012 | Vice President of the other investment companies in the Fund Complex and the Investment Manager. He is a member of the IPCs. He is President, Chief Executive Officer, Chairman, and a Director of SELF and Tuxis. He is Executive Vice President and a Director of Winco, and a principal of the Broker-Dealers. |

(1) | The mailing address of each officer, except as noted otherwise, is 11 Hanover Square, 12th Floor, New York, New York 10005. |

(2) | Officers hold their positions with the Fund until a successor has been duly elected and qualifies. Officers are generally elected annually at the December meeting of the Board. The officers were last elected on December 11, 2019. |

(3) | Thomas B. Winmill and Mark C. Winmill are brothers. |

Ownership of Fund Shares

The following table sets forth ownership of the Fund’s outstanding shares by the Fund’s Directors, each Nominee, and named executive officers, as well as the number of outstanding shares beneficially owned by all of the Directors, each Nominee, and named executive officers as a group. Amounts owned reflect ownership as of September 1, 2020.

Name of Beneficial Owner | Amount and Nature of Beneficial Ownership | Percent of Outstanding Shares |

Roger Atkinson | 0 | 0% |

Thomas O’Malley | 0 | 0% |

Jon Tomasson | 0 | 0% |

Peter K. Werner | 0 | 0% |

Thomas B. Winmill | 638,788(1) | 24.47% |

Trustees, Nominees, and Named Executive Officers as a Group (5 persons) | 638,788 | 24.47% |

| (1) | Thomas B. Winmill has indirect beneficial ownership of 638,588 of these shares, as a result of his status as a controlling person of Winco and Midas Securities Group, Inc., the direct beneficial owner. Mr. Thomas B. Winmill disclaims beneficial ownership of these shares. The foregoing is referred to herein as the “TBW Ownership Disclosure.” |

Based on the filings with the SEC, the following stockholders owned beneficially or of record more than 5% of the outstanding shares of the Fund as of September 1, 2020:

Name and Address of Owner(1) | Amount and Nature of Ownership |

Approximate Percentage of the Fund's Total Outstanding Shares |

Thomas B. Winmill 11 Hanover Square New York, New York 10005 | 638,788 shares(2) (200 shares represents record ownership; 638,588 shares represents beneficial ownership)

| 24.47% |

Midas Securities Group, Inc. 11 Hanover Square New York, New York 10005

| 638,588 shares (represents beneficial ownership) | 24.47% |

Winmill & Co. Incorporated 11 Hanover Square New York, New York 10005 | 638,588 shares(3) (represents beneficial ownership) | 24.47% |

(1) | Unless otherwise noted, the address of each person is 11 Hanover Square, 12th Floor, New York, NY 10005. |

(2) | See the TBW Ownership Disclosure. |

(3) | Winmill & Co. Incorporated has indirect beneficial ownership of these shares, as a result of its status as a controlling person of Midas Securities Group, Inc., the direct beneficial owner. |

The following table sets forth information describing the dollar range of equity securities beneficially owned by each Director and/or Nominee in the Fund and in all investment companies in the aggregate within the Fund Complex overseen and/or to be overseen by each Director and/or Nominee as of September 1, 2020:

| Name of Director or Board Nominee | Dollar Range of Equity Securities in the Fund | Aggregate Dollar Range of Equity Securities in All Registered Investment Companies Overseen by Director in Fund Complex |

| Independent Director Nominees: | | |

| Roger Atkinson | $0 | $10,001-$50,000 |

| Jon Tomasson | $0 | $0 |

| | | |

| Independent Director: | | |

| Peter K. Werner | $0 | $10,001-$50,000 |

| | | |

| Interested Director: | | |

| Thomas B. Winmill | Over $100,000(1) | over $100,000 |

(1) See the TBW Ownership Disclosure (as defined herein).

As of September 1, 2020, no independent director or his immediate family members owned beneficially or of record any securities of, or had any direct or indirect material interest in, the Investment Manager, or any person controlling, controlled by or under common control with the Investment Manager.

The Investment Manager, located at 11 Hanover Square, New York, New York 10005, is a wholly owned subsidiary of WCI. During the fiscal year ended December 31, 2019, the Fund paid the Investment Manager investment management fees of $91,618. The Investment Manager also provides at cost certain administrative services to the Fund. During the fiscal year ended December 31, 2019, the Fund incurred expenses of $9,225 due to the Investment Manager for providing at cost certain administrative services.

Compensation of Fund Directors

Effective April 1, 2020, the basis of compensation for the Independent Directors is a quarterly retainer of $100, a fee of $400 for each quarterly Board meeting attended, $500 for each special meeting attended, $500 for each committee meeting attended, an additional $500 for each committee meeting attended by the chair of such committee, and $2,000 for each stockholders’ meeting attended. Each Independent Director is reimbursed for reasonable travel and out-of-pocket expenses associated with attending such meetings. The Fund currently has no bonus, profit sharing, pension, or retirement plan for the Independent Directors. The Fund’s Interested Director and executive officers are eligible for bonuses from the Investment Manager and may participate in a qualified retirement plan offered by the Investment Manager. Although pursuant to the Fund’s investment management agreement, the Fund reimburses the Investment Manager for providing at cost certain administrative services (including, but not limited to compliance and accounting services), no current officer or Director of the Fund who is also a manager, officer, or employee of the Investment Manager or its affiliates receives any remuneration from the Fund (compensation of the Chief Compliance Officer by the Investment Manager is subject to the approval of the Fund’s Board, including a majority of the Independent Directors).

The following table sets forth certain information regarding compensation of the Directors and certain officers, if any, who received compensation (in excess of a threshold amount) from the Fund for the fiscal year ended December 31, 2019:

| Name of Person and Position | Aggregate Compensation From Fund | Total Compensation from Fund and Fund Complex |

Independent Director/Nominees:(1) | | |

Jon Tomasson | $3,500 | $44,375 |

Peter K. Werner | $4,500 | $46,375 |

| | | |

| Interested Director: | | |

Thomas B. Winmill, Trustee, President, Chief Executive Officer, Chairman, and Chief Legal Officer | $0 | $0 |

| | | |

Officer: | | |

Russell Kamerman, Chief Compliance Officer, Secretary, and General Counsel(2) | $2,948 | $120,052 |

(1) | Effective April 1, 2019 through March 31, 2020, the basis of compensation for the Independent Directors was a quarterly retainer of $100, a fee of $400 for each quarterly Board meeting attended, $500 for each special meeting attended, $500 for each committee meeting attended, and $2,000 for each shareholders’ meeting attended. Effective April 1, 2019 through December 11, 2019, Independent Directors were paid $1,000 per annum per committee chaired and effective December 12, 2019 through March 31, 2020, Independent Trustees were paid $500 per committee meeting attended. The total compensation Roger Atkinson received from Dividend and Income Fund for the fiscal year ended December 31, 2019 was $ 29,375. |

(2) | Represents the portion of Mr. Kamerman’s compensation that the Investment Manager received as reimbursements from the Fund and Fund Complex for the provision of Mr. Kamerman’s services at cost. |

Current Board Leadership Structure and Oversight Responsibilities

The Board is responsible for the oversight of the Fund’s operations. The Board is currently composed of three members, two of whom are Independent Directors. As described below, the Board has established four standing committees, Audit, Nominating, Executive, and Continuing Directors, and may establish ad hoc committees or working groups from time to time, to assist the Board in fulfilling its oversight responsibilities. The inclusion of all Independent Directors as members of the Audit and Nominating Committees allows all such Directors to participate in the full range of the Board’s oversight duties, including oversight of risk management processes discussed below.

The Directors have designated Mr. Thomas Winmill to serve as the Chairman of the Board (the “Chairman”). Mr. Winmill has been active in investment management for over 20 years as a portfolio manager, chief executive officer, general counsel, chief legal officer, compliance officer, and in other capacities. The Chairman presides at each Board meeting, establishes the agenda for Board meetings, and acts as the primary liaison between the Independent Directors and Fund management. The Chairman of the Board is an “interested person” of the Fund (as such term is defined in the 1940 Act). The Independent Directors have not appointed a lead Independent Director. The Independent Directors believe that the utilization of an interested person as Chairman provides an efficient structure for them to coordinate with Fund management in carrying out their responsibilities. The Independent Directors also regularly meet among themselves and the Chairman plays an important role in communicating with them in identifying matters of special interest to be addressed by Fund management and the Board. The Chairman may also perform such other functions as may be requested by the Directors from time to time. Designation as Chairman does not impose on such Director any duties or standards greater than or different from other Directors. The Directors believe that the Board’s leadership structure, taking into account, among other things, its committee structure, which permits certain areas of responsibility to be allocated to the Independent Directors, is appropriate given the characteristics and circumstances of the Fund.

Risk Oversight

The operation of an investment company generally involves a variety of risks including, among others, investment, compliance, operational and valuation risks. As part of its oversight of the Fund, the Board oversees risk management through various regular Board and committee activities. As part of its regular oversight of the Fund, the Board, directly and/or through its committees, reviews reports from, among others, the Fund’s management, including the Fund’s Chief Compliance Officer, the Investment Manager, the Fund’s independent registered public accounting firm (“IRPAF”), outside legal counsel, and others, as appropriate, regarding risks faced by the Fund and the risk management programs of the Investment Manager and certain service providers. Different processes, procedures and controls are employed with respect to different types of risks. The conduct of the Fund’s day-to-day risk management functions are generally delegated to the Investment Manager and other service providers to the Fund. The Investment Manager and other service providers have their own, independent interest in risk management, and their policies and methods of risk management will depend on their functions and business models. Although the risk management programs of the Investment Manager and the service providers are designed to be effective, there is no guarantee that they will anticipate or mitigate all risks. Not all risks that may affect the Fund can be identified, eliminated, or mitigated and some risks may not be anticipated or may be beyond the control of the Board or the Investment Manager, its affiliates, or other service providers. The Board may, at any time and in its discretion, change the manner in which it conducts risk oversight.

Qualification of Board of Directors

Each Director’s background and his oversight and service as a member of the boards of the other investment companies in the Fund Complex was evaluated in determining whether he should serve as a Director of the Fund. With respect to the specific experience, qualifications, attributes, or skills that led to the conclusion that each person should serve as a Director of the Fund, each Director’s relevant knowledge, experience, expertise, and independence was considered and evaluated. Mr. Werner has experience with financial, accounting, regulatory, investment, and board operational matters as well as monitoring investment advisers and other fund service providers through his former position as Vice President in the Fixed Income Departments of Lehman Brothers and First Boston and as a result of his service as an Independent Director and Director for more than 15 years of the other investment companies in the Fund Complex. Mr. Tomasson has experience with financial, accounting, regulatory, investment, and board operational matters through his current position as Chief Executive Officer of Vinland Capital Investments, LLC and Chief Investment Officer of NRE Capital Partners LLC, his former positions as a principal with Cardinal Capital Partners, a Vice President at Citigroup in the Global Real Estate Equity and Structured Finance group, part of the Real Estate Investment Bank, and a director of a public company, and as a result of his service as an Independent Director and Director of the other investment companies in the Fund Complex. Thomas Winmill has experience with financial, accounting, regulatory, investment, and board operational matters as well as monitoring investment advisers and other fund service providers as a result of his service as an officer and interested Director and Director for more than 20 years of the other investment companies in the Fund Complex.

The Board believes that the significance of each Director’s experience, qualifications, attributes or skills is an individual matter (meaning that experience important for one Director may not have the same value for another) and that these factors are best evaluated at the Board level, with no single Director, or particular factor, being indicative of Board effectiveness. The Board considers the complementary individual skills and experience of the individual Directors in the broader context of the Board’s overall composition so that the Board, as a body, possesses the appropriate (and appropriately diverse) skills and experience to oversee the business of the Fund. References to the qualifications, attributes and skills of Directors are presented pursuant to disclosure requirements of the SEC, do not constitute holding out the Board or any Director as having any special expertise or experience, and shall not impose any greater responsibility or liability on any such person or on the Board by reason thereof.

Board Committees

Audit Committee. The Board has an Audit Committee comprised of all of the Independent Directors. The purpose of the Audit Committee is to meet with the Fund’s independent registered public accounting firm (“IRPAF”) to review its financial reporting, external audit matters, and fees charged by the IRPAF and to evaluate the independence of the IRPAF. The Audit Committee is also responsible for recommending the selection, retention, or termination of the IRPAF and to review any other relevant matter to seek to provide integrity and accuracy in the Fund’s financial reporting. The Audit Committee met three times during the fiscal year ended December 31, 2019. A current copy of the Fund’s Audit Committee Charter is available on the Fund’s website at www.FoxbyCorp.com.

Nominating Committee. The Board also has a Nominating Committee, comprised of all the Independent Directors. The primary purposes and responsibilities of the Nominating Committee are (i) to identify individuals qualified to become members of the Board in the event that a position is vacated or created, (ii) to consider all candidates proposed to become members of the Board, subject to the procedures and policies set forth in the Fund’s Nominating Committee Charter, Articles of Incorporation and/or Bylaws, each as may be amended from time to time (“Governing Documents”), or resolutions of the Board, (iii) to select and nominate, or recommend for nomination by the Board, candidates for election as Directors and (iv) to set any necessary standards or qualifications for service on the Board. The Nominating Committee did not meet during the fiscal year ended December 31, 2019. A current copy of the Nominating Committee Charter is available on the Fund’s website at www.FoxbyCorp.com.

Executive Committee. The Board has an Executive Committee comprised of Thomas Winmill, and which may meet from time to time, the function of which is to exercise the powers of the Board between meetings of the Board to the extent permitted by law to be delegated and not delegated by the Board to any other committee. The Executive Committee did not meet during the fiscal year ended December 31, 2019.

Continuing Directors. The Board has a committee of Continuing Directors, as defined in the Fund’s Bylaws, which may meet from time to time, to take such actions as are required by the Governing Documents of the Fund. The Committee of Continuing Directors is currently comprised of Messrs. Tomasson, Werner, and Winmill. If Mr. Atkinson is elected to the Board, he too will be a member of the Committee of Continuing Directors. The Committee of Continuing Directors did not meet during the fiscal year ended December 31, 2019.

Director Attendance at Meetings

The Fund had four regular Board meetings, no special Board meetings, three Audit Committee meetings, no special committee meetings, no Nominating Committee meetings, no Executive Committee meetings, and no Committee of Continuing Directors meetings during the Fund’s most recently completed fiscal year ended December 31, 2019. For the fiscal year ended December 31, 2019, each of the Directors currently in office attended at least 75% of the total number of meetings of the Board and of all Committees of the Board held during the period in which he served. The Fund does not have a formal policy regarding attendance by Directors at meetings of stockholders but encourages such attendance.

Audit Committee Report

Tait, Weller & Baker LLP (“TWB”), 1818 Market Street, Philadelphia, Pennsylvania 19103, was the IRPAF for the Fund for the fiscal years ended December 31, 2018 and December 31, 2019 and is the IRPAF for the fiscal year ending December 31, 2020. Representatives of TWB are not expected to attend the Meeting but have been given the opportunity to make a statement if they so desire and are expected to be available to respond to appropriate questions.

The Board has adopted and approved a formal written charter for the Audit Committee, which sets forth the Audit Committee’s responsibilities. As required by the Audit Committee Charter, the Audit Committee has received the written disclosures and the letter from TWB required by applicable requirements of the Public Company Accounting Oversight Board regarding TWB’s communications with the Audit Committee concerning independence and has discussed with TWB its independence with respect to the Fund. The Fund has been advised by TWB that neither the firm nor any of its partners had a direct financial or material indirect financial interest in the Fund as of February 20, 2020.

The Fund’s financial statements for the fiscal year ended December 31, 2019 were audited by TWB. The Audit Committee has reviewed and discussed the Fund’s audited financial statements with Fund management and TWB, and discussed with TWB the matters required to be discussed by the applicable requirements of the Public Company Accounting Oversight Board and the SEC. Based on the foregoing review and discussions, the Audit Committee recommended to the Board (and the Board approved) that the Fund’s audited financial statements be included in the Fund’s annual report for the Fund’s fiscal year ended December 31, 2019 and filed with the SEC.

Peter K. Werner, Chairman of the Audit Committee

Jon Tomasson

Audit and Non-Audit Fees

The SEC’s auditor independence rules require the Audit Committee of the Fund to pre-approve (a) all audit and permissible non-audit services provided by the Fund’s IRPAF directly to the Fund and (b) those permissible non-audit services provided by the Fund’s IRPAF to the Investment Manager and any entity controlling, controlled by, or under common control with the Investment Manager that provides ongoing services to the Fund (“Affiliated Service Providers”), if the services relate directly to the operations and financial reporting of the Fund. The Fund has no Affiliated Service Providers other than the Investment Manager and its affiliates.

The following table sets forth the aggregate fees billed for professional services rendered by TWB to the Fund for the fiscal years ended December 31, 2018 and 2019:

| Fiscal Year Ended December 31 | Audit Fees | Audit Related Fees | Tax Fees | All Other Fees |

| 2018 | $14,500 | $2,000 | $4,500 | $0 |

| 2019 | $14,750 | $2,500 | $4,500 | $0 |

Audit Fees include the aggregate fees billed for each of the last two fiscal years for professional services rendered by TWB for the audit of the Fund’s annual financial statements or services that are normally provided by the accountant in connection with statutory and regulatory filings or engagements.

Audit Related Fees include the aggregate amounts billed by TWB reasonably related to the performance of the audit of the Fund’s financial statements, including the issuance of a report on internal controls and review of periodic reporting.

Tax Fees include the aggregate fees billed for professional services rendered by TWB in connection with tax compliance, tax advice, and tax planning.

All Other Fees include the aggregate fees billed for products and services provided by TWB other than audit, audit-related, and tax services.

The aggregate non-audit fees billed by TWB for services rendered to the Fund, and rendered to the Fund’s Investment Manager, and any entity controlling, controlled by, or under common control with the Investment Manager that provides ongoing services to the Fund for each of the last two fiscal years of the Fund were $36,500 in 2019 and $36,000 in 2018.

Policy on Audit Committee Pre-Approval of Audit and Non-Audit Services

Pursuant to the Audit Committee Charter, the Audit Committee shall consider for pre-approval any audit and non-audit services proposed to be provided by TWB to the Fund, and any non-audit services proposed to be provided by TWB to the Fund’s Investment Manager and/or its affiliates, if the engagement relates directly to the Fund’s operations or financial reporting. In those situations when it is not convenient to obtain full Audit Committee approval, the Chairman of the Audit Committee is delegated the authority to grant pre-approvals of audit, audit-related, tax, and all other services so long as all such pre-approved decisions are reviewed with the full Audit Committee at its next scheduled meeting. Such pre-approval of non-audit services proposed to be provided by the auditors to the Fund is not necessary, however, under the following circumstances: (1) all such services do not aggregate to more than 5% of total revenues paid by the Fund to the auditors in the fiscal year in which services are provided, (2) such services were not recognized as non-audit services at the time of the engagement, and (3) such services are brought to the attention of the Audit Committee, and approved by the Audit Committee, prior to the completion of the audit. No audit, audit-related, tax, or other services provided by TWB were approved pursuant to paragraph (c)(7)(i)(C) of Rule 2-01 of Regulation S-X for the fiscal years ended December 31, 2018 and December 31, 2019, respectively.

The Audit Committee has determined that the provision of non-audit services that were rendered by TWB to the Investment Manager, and any entity controlling, controlled by, or under common control with the Investment Manager that provides ongoing services to the Fund that were not pre-approved pursuant to paragraph (c)(7)(ii) of Rule 2-01 of Regulation S-X, is compatible with maintaining TWB’s independence.

Information Regarding the Fund’s Process for Identifying and Nominating Director Candidates

In identifying potential nominees for the Board, the Nominating Committee may consider candidates recommended by one or more of the following sources: (i) the Fund’s current Directors, (ii) the Fund’s officers, (iii) the Investment Manager, (iv) the Fund’s stockholders and (v) any other source the Nominating Committee deems to be appropriate. The Nominating Committee will not consider self-nominated candidates. The Nominating Committee may, but is not required to, retain a third party search firm at the Fund’s expense to identify potential candidates. The Nominating Committee believes the Board may benefit from diversity of background, experience, and views among its members, and may consider this a factor in evaluating the composition of the Board, but has not adopted any specific policy in this regard.

Pursuant to the Fund’s Governing Documents, to qualify as a nominee for a Directorship or election as a Director, an individual, at the time of nomination or election as the case may be, (i)(A) shall be a resident United States citizen and have substantial expertise, experience or relationships relevant to the business of the Fund, (B) shall have a master’s degree in economics, finance, business administration or accounting, a graduate professional degree in law from an accredited university or college in the United States or the equivalent degree from an equivalent institution of higher learning in another country, or a certification as a public accountant in the United States, or be deemed an “audit committee financial expert” as such term is defined in the Sarbanes-Oxley Act of 2002 (or other applicable law); (C) shall not serve as a director or officer of another closed end investment company unless such company is sponsored or managed by the Fund’s Investment Manager or by an affiliate of the Investment Manager; and (D) shall not serve or have served within the past 3 years as a director of any closed end investment company which, while such individual was serving as a director or within one year after the end of such service, ceased to be a closed end investment company registered under the 1940 Act, unless such individual was initially nominated for election as a director by the board of directors of such closed end investment company, or (ii) shall be a current Director of the Fund. In addition, to qualify as a nominee for a Directorship or election as a Director, (i) an incumbent nominee shall not have violated any provision of the Conflicts of Interest and Corporate Opportunities Policy (the “Policy”), adopted by the Board on July 8, 2003, as subsequently amended or modified, and (ii) an individual who is not an incumbent Director shall not have a relationship, hold any position or office or otherwise engage in, or have engaged in, any activity that would result in a violation of the Policy if the individual were elected as a Director. In addition, to qualify as a nominee for a Directorship or election as a Director at the time of nomination or election as the case may be, a person shall not, if elected as a Director, cause the Fund to be in violation of, or not in compliance with, applicable law, regulation or regulatory interpretation, or the Fund’s Governing Documents, or any general policy adopted by the Board regarding either retirement age or the percentage of interested persons and non-interested persons to comprise the Board.

The Nominating Committee of the Board, in its sole discretion, shall determine whether an individual satisfies the foregoing qualifications. Any individual not so nominated by the Nominating Committee of the Board shall be deemed not to satisfy the foregoing qualifications, unless the Nominating Committee adopts a resolution setting forth the affirmative determination that such individual satisfied the foregoing qualifications. Any individual who does not satisfy the qualifications set forth herein, unless waived by the Committee, shall not be eligible for nomination or election as a Director and the selection and nomination, or recommendation for nomination by the Board, of candidates for election by the Committee shall be deemed to be its determination such qualifications are satisfied or waived for such candidate.

The Nominating Committee will also consider and evaluate nominee candidates properly submitted by stockholders on the basis of the same criteria used to consider and evaluate candidates recommended by other sources. Nominee candidates proposed by stockholders will be considered properly submitted for consideration by the Nominating Committee only if the qualifications and procedures set forth in Appendix A of the Nominating Committee Charter, as it may be amended from time to time by the Nominating Committee or the Board, are met and followed (recommendations not properly submitted will not be considered by the Nominating Committee).

A candidate for nomination as a Director submitted by a stockholder will not be deemed to be properly submitted to the Nominating Committee for its consideration unless the following qualifications have been met and procedures followed:

| (1) | A stockholder or group of stockholders (referred to in either case as a “Nominating Stockholder”) that, individually or as a group, has beneficially owned at least 5% of the Fund’s common stock for at least two years prior to the date the Nominating Stockholder submits a candidate for nomination as a Director may submit one candidate to the Nominating Committee for consideration at a meeting of stockholders. |

| (2) | The Nominating Stockholder must submit any such recommendation (a “Stockholder Recommendation”) in writing to the Fund, to the attention of the Secretary, at the address of the principal executive offices of the Fund. |

| (3) | The Stockholder Recommendation must be delivered to or mailed and received at the principal executive offices of the Fund not less than 90 days nor more than 120 days before the first anniversary date of the Fund’s proxy statement released to stockholders in connection with the most recent stockholders meeting at which Directors were considered for election. |

| (4) | The Stockholder Recommendation must include: (i) a statement in writing setting forth (A) the name, date of birth, business address, and residence address of the person recommended by the Nominating Stockholder (the “candidate”); (B) any position or business relationship of the candidate, currently or within the preceding five years, with the Nominating Stockholder or an Associated Person of the Nominating Stockholder (as defined herein); (C) the class or series and number of all shares of the Fund owned of record or beneficially by the candidate, as reported to such Nominating Stockholder by the candidate; (D) any other information regarding the candidate that is required to be disclosed about a nominee in a proxy statement or other filing required to be made in connection with the solicitation of proxies for election of Directors pursuant to Section 20 of the 1940 Act and the rules and regulations promulgated thereunder; (E) whether the Nominating Stockholder believes that the candidate is or will be an “interested person” of the Fund (as defined in the 1940 Act) and, if believed not to be an “interested person,” information regarding the candidate that will be sufficient for the Fund to make such determination; and (F) information as to the candidate’s knowledge of the investment company industry, experience as a director or senior officer of public companies, directorships on the boards of other registered investment companies and educational background; (ii) the written and signed consent of the candidate to be named as a nominee and to serve as a Director if elected; (iii) the written and signed agreement of the candidate to complete a directors’ and officers’ questionnaire if elected; (iv) the Nominating Stockholder’s consent to be named as such by the Fund; (v) the class or series and number of all shares of the Fund owned beneficially and of record by the Nominating Stockholder and any Associated Person of the Nominating Stockholder and the dates on which such shares were acquired, specifying the number of shares owned beneficially but not of record by each, and stating the names of each as they appear on the Fund’s record books and the names of any nominee holders for each; and (vi) a description of all arrangements or understandings between the Nominating Stockholder, the candidate and/or any other person or persons (including their names) pursuant to which the recommendation is being made by the Nominating Stockholder. “Associated Person of the Nominating Stockholder” as used in this paragraph 4 means any person required to be identified pursuant to clause (vi) and any other person controlling, controlled by or under common control with, directly or indirectly, (a) the Nominating Stockholder or (b) any person required to be identified pursuant to clause (vi). |

| (5) | The Nominating Committee may require the Nominating Stockholder to furnish such other information as it may reasonably require or deem necessary to verify any information furnished pursuant to paragraph 4 above or to determine the qualifications and eligibility of the candidate proposed by the Nominating Stockholder to serve on the Board. If the Nominating Stockholder fails to provide such other information in writing within seven days of receipt of written request from the Nominating Committee, the recommendation of such candidate as a nominee will be deemed not properly submitted for consideration, and will not be considered, by the Nominating Committee. |

A detailed description of the criteria used by the Nominating Committee as well as information required to be provided by stockholders submitting candidates for consideration by the Nominating Committee are included in the Nominating Committee Charter. The Nominating Committee Charter, as amended, was approved by the Board on December 13, 2018.

ADDITIONAL INFORMATION

Delinquent Section 16(a) Reports

Section 16(a) of the Exchange Act and Section 30(h) of the 1940 Act in combination require the Fund’s Directors, officers, Investment Manager, affiliates of the Investment Manager, and persons who beneficially own more than 10% of the Fund’s outstanding securities (“Reporting Persons”), to file reports of ownership and changes in ownership with the SEC. Such persons are required by SEC regulations to furnish the Fund with copies of all such filings. Based on the Fund’s review of Forms 3 and 4 and amendments thereto furnished to the Fund during its most recent fiscal year and Forms 5 and amendments thereto furnished to the Fund with respect to its most recent fiscal year, the Fund believes that the Reporting Persons complied with the filing requirements of Section 16(a) of the Exchange Act.

Governing Documents

The Fund’s Board has continuously availed itself of methods specifically provided by, or consistent with, Maryland law and the 1940 Act to protect the Fund and its stockholders. Accordingly, certain provisions in the Fund’s Governing Documents could have the effect of, among other things, depriving the owners of shares in the Fund of opportunities to sell their shares at a premium over prevailing market prices by discouraging a third party from seeking to obtain control of the Fund in a tender offer or similar transaction or bringing litigation against the Fund and/or any director, officer, employee or affiliate thereof. The overall effect of these provisions is to, among other things, render more difficult the accomplishment of a merger or the assumption of control by a principal stockholder. These provisions of the Governing Documents of the Fund may be regarded as “anti-takeover” provisions. The foregoing summary is subject to the Governing Documents of the Fund, which are on file with the SEC and available on the Fund’s website www.FoxbyCorp.com The Fund is also subject to certain Maryland law provisions, including those which have been enacted since the inception of the Fund, that make it more difficult for non-incumbents to gain control of the Board.

In addition to the use of the mails, proxies may be solicited personally, by telephone, or by other means, and the Fund may pay persons holding its shares in their names or those of their nominees for their expenses in sending soliciting materials to their principals. The Fund will bear the cost of soliciting proxies. Stockholders requiring further information with respect to telephonic voting instructions or the proxy generally should contact the Fund or the Fund’s transfer agent. Any stockholder giving a proxy may revoke it at any time before it is exercised by submitting to the Fund a written notice of revocation or a subsequently executed proxy or by attending the meeting and voting in person.

Discretionary Authority; Submission Deadlines for Stockholder Proposals

Although no business may come before the Meeting other than that specified in the Notice of Special Meeting of Stockholders, shares represented by executed and unrevoked proxies will confer discretionary authority to vote on matters which the Fund did not have notice of a reasonable time prior to mailing this Proxy Statement to stockholders.

An annual meeting of stockholders for the election of Directors and the transaction of such other business within the powers of the Fund and that may properly come before the meeting shall be held at such date, time and place as the Board, or any duly constituted committee of the Board, shall determine, unless there is no requirement under the 1940 Act, the listing requirements of the stock exchange or market where the Fund’s stock is listed, or other applicable law that any such meeting be held. Stockholders who wish to submit proposals for inclusion in the proxy statement for a subsequent stockholder meeting should mail their written proposals to the Fund, to the attention of the Fund’s Secretary, Russell Kamerman, 11 Hanover Square, New York, New York 10005, within a reasonable time before such meeting in accordance with the Fund’s Governing Documents. The submission by a stockholder of a proposal for inclusion in the proxy statement or presentation at the Meeting does not guarantee that it will be included or presented. Stockholder proposals are subject to certain requirements under the federal securities laws and the Maryland General Corporation Law and must be submitted in accordance with the Fund’s Bylaws.

The foregoing description of the procedures for a Fund shareholder properly to make a nomination for election to the Board or to propose other business for the Fund is only a summary and is not complete. The submission by a stockholder of a proposal for inclusion in the proxy statement or presentation at the Meeting does not guarantee that it will be included or presented. Stockholder proposals are subject to certain requirements under the federal securities laws and Maryland General Corporation Law and must be submitted in accordance with the Fund’s Governing Documents, the Nominating Committee Charter and Appendix A thereto, the Policy, and other applicable laws and/or documents. Copies of the Fund’s Governing Documents, including the provisions which concern the requirements for stockholder nominations and proposals, and the provisions which concern the eligibility of a stockholder to make a nomination or proposal of other business, are available on the EDGAR Database on the SEC’s website at www.sec.gov. The Fund will furnish, without charge, a copy of its Governing Documents to a stockholder upon request, which may be requested by writing to the Fund’s Secretary, Russell Kamerman, at 11 Hanover Square, 12th Floor, New York, New York 10005. Any stockholder of the Fund considering making a nomination or other proposal should carefully review and comply with the applicable provisions of the Fund’s Governing Documents.

Stockholder Communications with the Board

The Fund’s Board has adopted a process for stockholders to send communications to the Board. To communicate with the Board or an individual director of the Fund, a stockholder must send a written communication to that Fund's principal office at the address listed in the Notice of Special Meeting of Stockholders accompanying this Proxy Statement, addressed to the Board of the Fund or the individual director. Such communications must be signed by the stockholder and identify the number of shares held by the stockholder. All stockholder communications received in accordance with this process will be forwarded to the Board or the individual director. Any stockholder proposal submitted pursuant to Rule 14a-8 under the Securities Exchange Act of 1934, as amended, must continue to meet all the requirements of Rule 14a-8.

The address of the Investment Manager is 11 Hanover Square, 12th Floor, New York, New York 10005. The Investment Manager provides investment advisory and administrative services to the Fund. The Investment Manager is responsible for the management of the Fund’s portfolio and provides the necessary personnel, facilities, equipment and certain other services necessary to the operation of the Fund.

Any Purchases or Sales of Securities of the Investment Manager, its Parents, or Subsidiaries

Since the beginning of the most recently completed fiscal year, no Director or Nominee has made any purchases or sales of securities of the Investment Manager or its parents, or subsidiaries of either, except as follows: in accordance with the Notice of Grant of Incentive Stock Option Award dated as of August 6, 2014 to Mr. Thomas Winmill, effective August 6, 2019, he elected to exercise the right to purchase 12,000 shares of Bexil at the price of $7.92 per share. Transactions involving securities in an amount not exceeding one percent of the outstanding securities of the Investment Manager or its parents, or subsidiaries of either, may be omitted. There is no arrangement or understanding with respect to the composition of the Board or of the Investment Manager, or with respect to the selection of appointment of any person to any office with either such company.

Attendance at the Meeting

All stockholders who choose to attend the Meeting in person will need to present a valid government-issued photo identification (e.g., a driver’s license, state identification card or passport) at the door to be admitted to the Meeting. Additionally, if you hold your shares in a brokerage account or in the name of a bank or other holder of record and you plan to attend the Meeting, you will also need to obtain and present a copy of your brokerage account statement (which you can obtain from your broker) reflecting your ownership of the Fund’s shares as of the Record Date and/or a legal proxy.

Notice to Banks, Broker/Dealers, and Voting Trustees and Their Nominees

Please advise the Fund’s transfer agent, Securities Transfer Corporation, at 1-469-633-0101 whether other persons are the beneficial owners of the shares for which proxies are being solicited and, if so, the number of copies of this Proxy Statement and other soliciting material you wish to receive in order to supply copies to the beneficial owners of shares.

One document (i.e., an annual or semi-annual report, or set of proxy soliciting materials) may be delivered to multiple stockholders at the same address unless you request otherwise. You may request that we deliver separate copies, a single copy (if multiple copies are received at the same address), and/or additional copies of these documents by calling toll free 855-411-6432 or writing to the Fund at 11 Hanover Square, 12th Floor, New York, New York 10005.

It is important that proxies be returned promptly. Therefore, stockholders who do not expect to attend the meeting in person are urged to complete, sign, date and return the enclosed proxy card in the enclosed postage paid envelope.