UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

WASHINGTON, D.C. 20549

SCHEDULE 14A

Proxy Statement Pursuant to Section 14(a) of the Securities Exchange Act of 1934

(Amendment No. )

Filed by the Registrant ¨ Filed by a Party other than the Registrant ¨

Check the appropriate box:

¨ Preliminary Proxy Statement

¨ Confidential, for Use of the Commission Only (as permitted by Rule 14a-6(e)(2))

x Definitive Proxy Statement

¨ Definitive Additional Materials

¨ Soliciting Material Pursuant to § 240.14a-11(c) or § 240.14a-12

FIRST PLACE FINANCIAL CORP.

(Name of Registrant as Specified In Its Charter)

(Name of Person(s) Filing Proxy Statement, if other than the Registrant)

Payment of Filing Fee (Check the appropriate box):

¨ | | Fee computed on table below per Exchange Act Rules 14a-6(i)(4) and 0-11. |

| | (1) | | Title of each class of securities to which transaction applies: |

| | (2) | | Aggregate number of securities to which transaction applies: |

| | (3) | | Per unit price or other underlying value of transaction computed pursuant to Exchange Act Rule 0-11 (Set forth the amount on which the filing fee is calculated and state how it was determined): |

| | (4) | | Proposed maximum aggregate value of transaction: |

¨ Fee paid previously with preliminary materials.

¨ | | Check box if any part of the fee is offset as provided by Exchange Act Rule 0-11(a)(2) and identify the filing for which the offsetting fee was paid previously. Identify the previous filing by registration statement number, or the Form or Schedule and the date of its filing. |

| | (1) | | Amount Previously Paid: |

| | (2) | | Form, Schedule or Registration Statement No.: |

FIRST PLACE FINANCIAL CORP.

185 East Market Street

Warren, Ohio 44481

(330) 373-1221

October 14, 2002

Fellow Shareholders:

You are cordially invited to attend the Annual Meeting of Shareholders (the “Annual Meeting”) of First Place Financial Corp. (the “Company”), which will be held on Thursday, November 21, 2002, at 10:00 a.m., Eastern Time, at the Avalon Inn, 9519 East Market Street, Warren, Ohio.

The attached Notice of the Annual Meeting and the Proxy Statement describe the formal business to be transacted at the Annual Meeting. Directors and officers of the Company, as well as a representative of Crowe, Chizek and Company LLP, the Company’s independent auditors, will be present at the Annual Meeting to respond to any questions that our shareholders may have regarding the business to be transacted. In addition, the Annual Meeting will include management’s report on the Company’s financial performance for the fiscal year ended June 30, 2002.

The board of directors of the Company has determined that the matters to be considered at the Annual Meeting are in the best interests of the Company and its shareholders, and the board unanimously recommends that you vote “FOR” the nominees as directors specified under Proposal 1 and “FOR” the ratification of the appointment of Crowe, Chizek and Company LLP as independent auditors of the Company for the fiscal year ending June 30, 2003 as specified under Proposal 2.

Your vote is very important. Whether or not you expect to attend, please read the enclosed Proxy Statement and then complete, sign and return the enclosed proxy card promptly in the postage-paid envelope provided so that your shares will be represented. Your cooperation is appreciated since a majority of the Common Stock entitled to vote must be represented, either in person or by proxy, to constitute a quorum for the conduct of business.

On behalf of the board of directors and all of our employees, we thank you for your continued interest and support.

Sincerely yours,

Steven R. Lewis

President and Chief Executive Officer

FIRST PLACE FINANCIAL CORP.

185 East Market Street

Warren, Ohio 44481

(330) 373-1221

NOTICE OF ANNUAL MEETING OF SHAREHOLDERS

To Be Held on November 21, 2002

NOTICE IS HEREBY GIVEN that our 2002 Annual Meeting of Shareholders will be held on Thursday, November 21, 2002, at 10:00 a.m., Eastern Time, at the Avalon Inn, 9519 East Market Street, Warren, Ohio.

The purpose of the Annual Meeting is to consider and vote upon the following matters:

| | 1. | | The election of five (5) directors for terms of three (3) years each or until their successors are elected and qualified; |

| | 2. | | The ratification of the appointment of Crowe, Chizek and Company LLP as independent auditors of First Place for the fiscal year ending June 30, 2003; and |

| | 3. | | Such other matters as may properly come before the Annual Meeting and at any adjournments thereof, including whether or not to adjourn the Annual Meeting. |

The board of directors has established September 23, 2002, as the record date for the determination of shareholders entitled to receive notice of and to vote at the Annual Meeting and at any adjournments thereof. Only recordholders of our common stock as of the close of business on such record date will be entitled to vote at the Annual Meeting or any adjournments thereof. In the event there are not sufficient votes for a quorum or to approve or ratify any of the foregoing proposals at the time of the Annual Meeting, we may adjourn the Annual Meeting in order to permit further solicitation of proxies. A list of shareholders entitled to vote at the Annual Meeting will be available at our administrative offices, 185 East Market Street, Warren, Ohio 44481, for a period of ten days prior to the Annual Meeting and will also be available at the Annual Meeting.

By Order of the Board of Directors

J. Craig Carr

Secretary

Warren, Ohio

October 14, 2002

FIRST PLACE FINANCIAL CORP.

PROXY STATEMENT

ANNUAL MEETING OF SHAREHOLDERS

November 21, 2002

Information Concerning Solicitation and Voting

Your vote is very important. This proxy statement, proxy card and 2002 Annual Report are first being given or sent on or about October 14, 2002, to shareholders of First Place Financial Corp. in connection with the solicitation of proxies by our board of directors for the 2002 Annual Meeting of Shareholders. This proxy procedure is necessary to permit all of our shareholders, some of whom live throughout the United States and are unable to attend the Annual Meeting, to have an opportunity to vote. The board of directors encourages you to read this proxy statement thoroughly and to take this opportunity to vote on the matters to be decided at the Annual Meeting.

Voting Procedures

WHO CAN VOTE? You are entitled to vote your common stock if our records show that you held your shares as of September 23, 2002. At the close of business on that date, a total of 13,787,693 shares of common stock were outstanding and entitled to vote. Each share of common stock is entitled to one vote on each matter presented at the Annual Meeting, except as follows: as provided in our Amended and Restated Certificate of Incorporation, recordholders of common stock who own in excess of 10% of the outstanding shares of common stock (the “Limit”) are not entitled to vote any of their shares that are in excess of the Limit.

HOW DO I VOTE? Other than by attending the Annual Meeting and voting in person, shareholders are requested to vote by completing the enclosed proxy card and returning it signed and dated in the enclosed postage-paid envelope. If you hold your shares through a broker, bank or other nominee, you will receive separate instructions from the nominee describing how to vote your shares.

HOW ARE THE VOTES COUNTED? The Annual Meeting will be held if a quorum, consisting of a majority of outstanding shares of common stock entitled to vote, is represented. Broker non-votes, votes withheld and abstentions will be counted for purposes of determining whether a quorum has been reached. “Broker non-votes” occur when nominees, such as banks and brokers, holding shares on behalf of beneficial owners, do not receive voting instructions from the beneficial owners by 10 days before the Annual Meeting. In this event, the nominees may vote those shares only on matters deemed routine. On non-routine matters nominees cannot vote and there is a so-called “broker non-vote” on that matter. Because directors are elected by a plurality of the votes cast, shares that are not voted, whether by marking “ABSTAIN” on your proxy card, or held by a broker and are not voted, have no impact on the election of directors. In the event there are not sufficient votes for a quorum or to approve or ratify any proposal at the time of the Annual Meeting, the Annual Meeting may be adjourned in order to permit the further solicitation of proxies.

WHO WILL COUNT THE VOTE? Our transfer agent, Registrar and Transfer Company, will tally the vote, which will be certified by an independent Inspector of Election. After the final adjournment of the Annual Meeting, the proxies will be returned to us for safekeeping.

MATTERS TO BE PRESENTED. There are two proposals that will be presented for your consideration at the Annual Meeting:

| | • | | Election of five (5) directors; and |

| | • | | Ratification of appointment of independent auditors for 2003. |

3

We are not now aware of any matters to be presented other than those described in this proxy statement. If any matters not described in the proxy statement are properly presented at the meeting, the proxy committee will have discretionary authority to determine how to vote your shares. If the meeting is adjourned, the proxy committee can vote your shares of common stock on the new meeting date, unless you have revoked your proxy instructions.

CHANGING YOUR VOTE. You may revoke your proxy instructions and change your vote if you are a holder of record. To do so, you must advise our corporate secretary in writing before the proxy committee votes your shares of common stock at the Annual Meeting, deliver later proxy instructions, or attend the Annual Meeting and vote your shares in person. However, if you are a shareholder whose shares are not registered in your name or are held in “street name”, you will need to obtain a written legal proxy in your name from your recordholder (in most cases your broker or bank) to vote personally at the Annual Meeting.

COST OF PROXY SOLICITATION. We will pay the cost of this proxy solicitation. We will ask banks, brokerage houses, fiduciaries and custodians holding stock in their names for others to send proxy materials to and obtain proxies from the beneficial owners of such stock, and we will reimburse them for their reasonable expenses in doing so. In addition to soliciting proxies by mail, our directors, officers and employees may also solicit proxies personally or by telephone, without additional compensation.

ATTENDING THE ANNUAL MEETING. IF YOU ARE A BENEFICIAL OWNER OF COMMON STOCK HELD BY A BROKER, BANK OR OTHER NOMINEE, YOU WILL NEED PROOF OF OWNERSHIP TO BE ADMITTED TO THE ANNUAL MEETING. A recent brokerage statement or letter from a bank or broker are examples of proof of ownership.

OUR VOTING RECOMMENDATIONS. Our board of directors recommends that you vote “FOR” each nominee to the board of directors and “FOR” ratification of the appointment of Crowe Chizek and Company LLP as our independent auditors.

VOTING RESULTS. The preliminary voting results will be announced at the Annual Meeting. The final voting results will be published in our quarterly report on Form 10-Q for our second quarter.

PROPOSAL 1. ELECTION OF DIRECTORS

Our board of directors currently consists of sixteen directors and is divided into three classes. Each of the sixteen members of our board of directors also presently serves as a director of First Place Bank. Directors are elected for staggered terms of three years each, with the term of office of only one of the three classes of directors expiring each year. Directors serve until their successors are elected and qualified.

Following our merger with FFY Financial Corp. in December 2000, our Certificate of Incorporation was amended and restated to set the number of directors on the board of directors at sixteen directors, subject to downward adjustment under certain circumstances, including vacancies of directors (discussed below). Of the sixteen directors, eight were appointed to serve on the board by FFY Financial Corp. (“FFY Directors”) and the other eight directors were the then sitting directors of First Place (“First Place Directors”). According to the Amended and Restated Certificate of Incorporation, nominations to the board of directors are to be equally divided between nominees selected by FFY Directors and nominees selected by First Place Directors. The separate nominations of directors by FFY Directors and First Place Directors will discontinue after October 15, 2004 and nominees will be selected pursuant to the terms of the bylaws, which provide for the full board to nominate directors. Upon the resignation, removal or termination of service (collectively “Resignation”) of a director which occurs at any time until October 15, 2004, such resigning director, if initially appointed by FFY Financial Corp., will be replaced by a director selected by the FFY Directors on the board, or if such resigning director was initially appointed by First Place, then the newly appointed director will be selected by the First Place Directors on the board. If a second resignation of a director occurs at any time until October 15, 2004, then the size of the board of directors will be reduced by two members, who shall be the resigning director and one additional director. The additional director will be a First Place Director if the resigning director was a FFY Director or the additional director will be a

4

FFY Director if the resigning director was a First Place Director. After October 15, 2004, vacancies on the board will be filled according to the procedure set forth in our bylaws.

At the Annual Meeting, five directors will be elected for a three year term expiring at the 2005 Annual Meeting and until their successors are elected and qualified. The five nominees proposed for election at this Annual Meeting are as follows:

Donald Cagigas

Jeffrey L. Francis

Steven R. Lewis

Samuel A. Roth

Dr. Ronald P. Volpe

Except as discussed above, no person being nominated as a director is being proposed for election pursuant to any agreement or understandings between any such person and First Place.

THE BOARD OF DIRECTORS RECOMMENDS THAT YOU VOTE “FOR” THE ELECTION OF THE NOMINEES NAMED IN THIS PROXY STATEMENT.

Vote Required. Directors must be elected by a plurality of the votes cast by shareholders at the meeting. Votes withheld and broker non-votes for any director will not be considered in determining the outcome of the election.

In the event that any such nominee is unable to serve or declines to serve for any reason, it is intended that the proxies will be voted for the election of such other person as may be designated by the present board of directors. The board of directors has no reason to believe that any of the persons named will be unable or unwilling to serve.Unless authority to vote for the nominee is withheld, it is intended that the shares represented by the enclosed proxy card, if executed and returned, will be voted “For” the election of the nominees proposed by the board.

5

Information with Respect to the Nominees, Continuing Directors and Certain Executive Officers. The following table presents the names of the nominees and continuing directors, as well as their ages, a brief description of their recent business experience, including present occupations and employment, certain directorships held by each, the year in which each director became a director of First Place and the year in which their terms (or in the case of the nominees, their proposed terms) as director of First Place expire.

Name and Principal Occupation at Present and for Past Five Years

| | Age(1)

| | Director Since(2)

| | Expiration of Term as Director

|

NOMINEES | | | | | | |

| Donald Cagigas | | 62 | | 2000 | | 2005 |

| Mr. Cagigas has been the President of the Youngstown/Mahoning Valley United Way since April 2000. Prior to that date, he was the President of the Mahoning Valley Region of BANK ONE, NA, a position he had held since March 1988. | | | | | | |

|

| Jeffrey L. Francis | | 51 | | 2000 | | 2005 |

| Mr. Francis has been Executive Vice President and Chief Operating Officer of First Place and President and Chief Operating Officer of the Bank since December 2000. Prior to the consummation of the merger of equals with First Place, he had served as the President and Chief Executive Officer of FFY Financial Corp. since March 1996, and had been employed with FFY Financial and its predecessor since 1973. | | | | | | |

|

| Steven R. Lewis | | 44 | | 1998 | | 2005 |

| Mr. Lewis has been President and Chief Executive Officer of First Place and Chief Executive Officer of the Bank since 1997. He served as Executive Vice President from 1995 to 1997 and as Vice President and Treasurer from 1985 until 1995. | | | | | | |

|

| Samuel A. Roth | | 59 | | 2000 | | 2005 |

| Mr. Roth is the President of FirstEnergy Facilities Services Group, a holding company for the mechanical construction, contracting and energy management companies that FirstEnergy has acquired. Mr. Roth has held this position since January 1999 and prior to this he had been the President of Roth Bros., Inc. from 1966 to 1999. | | | | | | |

|

| Ronald P. Volpe, Ph.D. | | 59 | | 2000 | | 2005 |

| Dr. Volpe has been a Professor of Finance in the Williamson College of Business Administration at Youngstown State University since 1975. Dr. Volpe teaches undergraduate and graduate-level courses in Investments, Personal Financial Planning and Financial Markets and Institutions. | | | | | | |

6

Name and Principal Occupation at Present and for Past Five Years

| | Age(1)

| | Director Since(2)

| | Expiration of Term as Director

|

CONTINUING DIRECTORS | | | | | | |

| A. Gary Bitonte, M.D. | | 54 | | 2000 | | 2004 |

| Dr. Bitonte has held teaching-faculty appointments at Northeastern Ohio and Ohio University Medical (NEOUCOM) Schools since 1979. Additionally, Dr. Bitonte had a urologic surgery practice that spanned 21 years. Dr. Bitonte currently serves as a member of the Board of Trustees of the Youngstown State University Foundation as well as the NEOUCOM Foundation. | | | | | | |

|

| Marie Izzo Cartwright | | 49 | | 2000 | | 2003 |

| Ms. Cartwright has been a member of the marketing and public relations profession for 27 years and currently is a consultant with Revak & Associates, which she joined in January 2001. Prior to this, she was the Vice President of Corporate Communications and Marketing for Glimcher Properties Limited Partnership, a position she had held since October 1996. | | | | | | |

|

| George J. Gentithes | | 69 | | 1989 | | 2004 |

| Mr. Gentithes has been a consultant for T.F. Industries in Warren, Ohio since 1994. | | | | | | |

|

| Robert P. Grace | | 63 | | 1996 | | 2003 |

| Mr. Grace was Vice President and Chief Financial Officer of Salem Label Co., in Salem, Ohio from May 1996 to December 1998. Prior to that time, Mr. Grace was a principal in the accounting firm of Packer, Thomas & Co. | | | | | | |

|

| Thomas M. Humphries | | 58 | | 1990 | | 2003 |

| Mr. Humphries has been the President of the Youngstown-Warren Regional Chamber of Commerce since April 1997. Prior to that date, he was a General Manager with Sprint Corp., a telecommunications company. | | | | | | |

|

| Earl T. Kissell | | 53 | | 2000 | | 2004 |

| Mr. Kissell was President and Chief Executive Officer of Ravenna Savings Bank from 1987 to 2000. Mr. Kissell is currently an Assistant Professor of Economics and Management at Hiram University. | | | | | | |

|

| Robert S. McGeough | | 71 | | 1973 | | 2003 |

| Mr. McGeough has been of counsel to the firm Harrington, Hoppe & Mitchell since 1997. Prior to this, he was a partner with the law firm of Hoppe, Frey, Hewitt & Milligan. | | | | | | |

|

| W. Terry Patrick | | 52 | | 2000 | | 2003 |

| Mr. Patrick has been a partner in the law firm of Friedman & Rummell Co., L.P.A. of Youngstown, Ohio since 1980 where his practice is concentrated in the areas of Business, Estate and Succession Planning. Mr. Patrick also serves as a consultant to numerous regional businesses. | | | | | | |

|

| E. Jeffrey Rossi | | 49 | | 1994 | | 2004 |

| Mr. Rossi has been a principal of E.J. Rossi & Company, a life and health insurance brokerage, located in Youngstown and Warren, Ohio since 1978. | | | | | | |

7

Name and Principal Occupation at Present and for Past Five Years

| | Age(1)

| | Director Since(2)

| | Expiration of Term as Director

|

| William A. Russell | | 54 | | 2000 | | 2004 |

| Mr. Russell has, since 1974, been the President of Canteen Service of Steel Valley, Inc., a food and vending service company that has served the surrounding five county area for over 66 years. | | | | | | |

|

| Robert L. Wagmiller | | 58 | | 2000 | | 2004 |

| Mr. Wagmiller has been a Senior Advisor at the certified public accounting firm of Hill, Barth and King, LLC since 1998. In March 2001, Mr. Wagmiller was named the Chairman of TLT Distributing, LLC (D/B/A Belmont Distributing), a major Philips Magnavox wholesaler. | | | | | | |

| (1) | | Age at June 30, 2002. |

| (2) | | Includes years of service as a director of First Place and First Place Bank. |

About the Board of Directors

The Board of Directors. First Place is governed by a board of directors and various committees of the board which meet throughout the year. Directors discharge their responsibilities at board meetings and committee meetings and also through considerable telephone contact and other communications with the chairman and others regarding matters of concern and interest to First Place. During the year ended June 30, 2002, the board of directors held twelve board meetings. All of the directors of First Place attended at least 75% of the total number of board and committee meetings held.

Directors’ Fees. Currently, all directors of First Place Bank, with exception of Mr. Lewis and Mr. Francis, receive an annual retainer of $10,000 ($13,000 for the Chairman of the Board). In addition, such directors receive a fee of $450 for each First Place Bank regular and special board meeting which they attend and $100 for each First Place Financial Corp. board meeting that they attend (held quarterly). Such directors also receive a fee of $200 for each committee meeting attended (an additional $50 to the chairman of the committee), except for strategic planning meetings, for which they receive $250. Directors may elect to defer their compensation by participating in a director’s deferred compensation plan. Directors are also eligible for stock awards under the First Place Financial Corp. 1999 Incentive Plan, however, no such awards were granted to the directors in fiscal year 2002.

Committees of the Board of Directors

The board has three principal committees. The following describes for each committee the function, current membership and number of meetings held during fiscal 2002.

Nominating Committee. The entire board of directors acts as a Nominating Committee to consider and select the nominees for director to stand for election at our Annual Meetings. Our Amended and Restated Certificate of Incorporation and Bylaws provide for shareholder nominations of directors. These provisions require such nominations to be made pursuant to timely notice in writing to our corporate secretary. The shareholder’s notice of nomination must contain all information relating to the nominee which is required to be disclosed by our Bylaws and by the Securities Exchange Act of 1934, as amended. The board of directors met one time during fiscal 2002 in its capacity as Nominating Committee.

8

Audit Committee. The Audit Committees of First Place and First Place Bank consist of Directors Wagmiller (Chairman), Bitonte, Cagigas, Gentithes, Grace and Volpe. All members of our Audit Committee are independent in accordance with the Nasdaq Stock Market listing standards. The Audit Committees are responsible for:

| | • | | Reporting to the board on the general financial condition of First Place and First Place Bank and the results of the annual audit; and |

| | • | | Overseeing that First Place’s and First Place Bank’s activities are being conducted in accordance with the Audit Committee Charter (attached to this proxy statement as Appendix A) and applicable laws and regulations. |

The Audit Committees of First Place and of First Place Bank each met six times in fiscal 2002.

Audit Committee Report

The report of the Audit Committee shall not be deemed incorporated by reference by any general statement incorporating by reference this proxy statement into any filing under the Securities Act of 1933, as amended or the Securities Exchange Act of 1934, as amended, except as to the extent that First Place specifically incorporates this information by reference, and shall not otherwise be deemed filed under such Acts.

In accordance with its written charter adopted by our board of directors on October 23, 2000, and amended on August 20, 2002, the Audit Committee (the “Committee”) assists the board of directors in fulfilling its responsibility for overseeing the quality and integrity of the accounting, auditing and financial reporting practices of First Place and First Place Bank and their system of internal controls. (A copy of the amended Audit Committee Charter is attached to this proxy statement as Appendix A.)

In discharging its oversight responsibility as to the audit process, the Committee obtained from the independent accountants a formal written statement describing all relationships between the accountants and us and the Bank that might bear on the accountants’ independence consistent with Independence Standards Board No. 1, “Independence Discussions with Audit Committees,” discussed with the accountants any relationships that may impact their objectivity and independence, and satisfied itself as to the accountants’ independence.

The Committee reviewed with our internal auditors and independent accountants the overall scope and plans for their respective audits and the results of internal audit examinations. The Committee also discussed with management, the internal auditors and the independent accountants the quality and adequacy of First Place’s and First Place Bank’s internal controls and the overall quality of First Place’s and First Place Bank’s financial reporting process.

The Committee discussed and reviewed with its independent accountants communications required by generally accepted auditing standards, including those described in Statement on Auditing Standards No. 61, as amended, “Communication with Audit Committees” and discussed and reviewed the results of the independent accountants’ examination of the consolidated financial statements. In addition, the Committee considered the compatibility of nonauditing services provided to us and our bank with the accountants’ independence in performing their auditing functions.

The Committee reviewed and discussed interim financial information contained in each quarterly report and earnings announcement with management and/or independent accountants prior to public release as necessary during fiscal 2002. The Committee reviewed the audited consolidated financial statements of First Place as of and for the year ended June 30, 2002, with management and the independent accountants. Management has the responsibility for the preparation of our consolidated financial statements and the independent accountants have the responsibility for the audit of those statements.

9

Based on the above mentioned reviews and discussions with management and the independent accountants, the Committee recommended to the board that our audited consolidated financial statements be included in its Annual Report on Form 10-K for the year ended June 30, 2002, for filing with the Securities and Exchange Commission. The Committee also recommended the appointment, subject to shareholder ratification, of the independent accountants, and our board of directors concurs with such recommendation.

The foregoing report furnished by the Audit Committee of the board whose members are:

Robert L. Wagmiller (Chairman), A. Gary Bitonte, M.D., Donald Cagigas, George J. Gentithes, Robert P. Grace and Ronald P. Volpe, Ph.D.

Compensation Committee. The Compensation Committee of First Place consists of Directors Russell (Chairman), Cartwright, Patrick and Rossi. The committee meets to establish compensation and benefits for the executive officers and to review the incentive compensation programs when necessary. This committee is also responsible for all matters regarding compensation and benefits, hiring, termination and affirmative action issues for other officers and employees of First Place and First Place Bank. The Compensation Committee of First Place met eight times in fiscal 2002.

Compensation Committee Report

The report of the Compensation Committee and the stock performance graph (enclosed hereafter) shall not be deemed incorporated by reference by any general statement incorporating by reference this proxy statement into any filing under the Securities Act of 1933, as amended or the Securities Exchange Act of 1934, as amended, except as to the extent that First Place specifically incorporates this information by reference, and shall not otherwise be deemed filed under such Acts.

Compensation Committee Report on Executive Compensation. Under rules established by the Securities and Exchange Commission, First Place is required to provide certain data and information in regard to the compensation and benefits provided to First Place’s chief executive officer and other executive officers of First Place and First Place Bank. The disclosure requirements for the chief executive officer and other executive officers include the use of tables and a report explaining the rationale and considerations that led to fundamental compensation decisions affecting those individuals. In fulfillment of this requirement, the Compensation Committee of the board of directors, at the direction of the board of directors, has prepared the following report for inclusion in this proxy statement.

The Committee. The responsibility for compensation matters rests with the Compensation Committee of the Board. The members of the Compensation Committee are independent directors of First Place and First Place Bank. Mr. Lewis and Mr. Francis attend committee meetings, if requested by the chairman, to present recommendations and to provide information. However, they are excused during any deliberations regarding their own compensation. The Compensation Committee met eight times during the year ended June 30, 2002. The most significant issues addressed each year by the Compensation Committee are: (1) approval of salary adjustments, if any, for senior officers of First Place and First Place Bank; (2) approval of payments under the Company’s management bonus plan; (3) approving awards under the Company’s 1999 Incentive Plan; and (4) review of evaluations of all senior executives and completion of an evaluation of Mr. Lewis’ performance in accordance with the provisions of his employment contract.

Components of Compensation. The goal of the Company’s executive compensation program is to retain, motivate and reward management through the compensation policies and awards, while aligning their interests with those of the Company and its shareholders. In furtherance of this goal, the program consists of three main components: (i) base salary; (ii) bonuses, which are primarily based on the Company’s performance and the individual performance of participating executives; and (iii) stock awards and stock options to provide long-term incentives for performance and to align executive officer and shareholder interests. First Place adopted its 1999 Incentive Plan, which provided for stock awards and stock options, in July 1999. During fiscal 2002, there were 16,736 options and 12,500 stock grants awarded under this plan. Mr. Lewis was not the recipient of any awards during fiscal 2002.

Chief Executive Officer Compensation. In determining compensation for Mr. Lewis, the Compensation Committee considered the following: (i) salary information for the chief executive officers of comparable institutions gathered from local, regional and national salary surveys; (ii) information from proxy statements of publicly traded banks and thrifts; (iii) the financial performance of First Place during the preceding year as measured by return on assets and equity, loan loss and delinquency levels, total general and administrative expenses and earnings per share, with regard to both the absolute level of such measures and as compared to peer institutions, including similar

10

publicly traded thrift holding companies, with earnings per share and return on equity being specifically included in the mathematical calculation of executive bonuses; (iv) regulatory examination comments and outside auditor’s comments received during the year; and (v) the Company’s progress toward completing a number of long-term initiatives. Mr. Lewis’ individual initiatives during fiscal 2002 included continued development of our sales and service culture, addressing unresolved issues relating to the merger of equals with FFY Financial Corp., assisting senior management in achieving the company’s financial goals, and continuing to develop affiliate operations. The compensation levels of the Bank’s other executive officers were also reviewed based upon the same criteria. During fiscal 2001, Mr. Lewis’ base salary was increased from $180,000 to $194,000, which remained in effect for fiscal 2002. Mr. Lewis’ target bonus under the Company’s bonus plan is 50% of his base salary. For fiscal 2002, Mr. Lewis’ bonus and that of other senior executives did not meet their respective target amounts as the company did not meet the earnings per share and return on equity targets established by the compensation committee.

Performance Evaluations. As noted above, during fiscal 2001, the Compensation Committee reviewed performance evaluations of the executive officers of First Place and First Place Bank that were prepared by either Mr. Lewis or Mr. Francis. Additionally, the Committee completed an evaluation of Mr. Lewis with input from members of the board of directors. Among other items, the Compensation Committee considered First Place performance statistics as objective measures of performance, as well as discussion of progress toward goals established the previous year. The entire Board reviewed the evaluation of Mr. Lewis during August 2002.

The foregoing report on executive compensation was furnished by the Compensation Committee of the Board whose members are:

William Russell (Chairman), Marie Izzo Cartwright, W. Terry Patrick and E. Jeffrey Rossi

11

Principal Shareholders

Other than those persons listed below, First Place is not aware of any person who may be considered to be the owner of more than 5% of the outstanding shares of common stock as of September 23, 2002. For the purposes of the following table and the table set forth under “What First Place’s Directors and Executive Officers Own,” a person may be considered to own any shares of common stock (1) over which he or she has, directly or indirectly, sole or shared voting or investing power, or (2) of which he or she has the right to acquire ownership, including the right to acquire ownership by the exercise of stock options, within 60 days after September 23, 2002.

Title of Class

| | Name and Address of Beneficial Owner

| | Amount and Nature Of Beneficial Ownership

| | | Percent of Class

| |

| Common Stock | | First Place Bank Employee Stock Ownership Plan (“ESOP”) 185 East Market Street Warren, Ohio 44481 | | 899,300 | (1) | | 6.5 | % |

|

| Common Stock | | First Place Bank Community Foundation 185 East Market Street Warren, Ohio 44481 | | 697,625 | (2) | | 5.0 | % |

| (1) | | The ESOP Trustee must vote all allocated shares held in the ESOP in accordance with the instructions of the participants. At September 23, 2002, 216,723 shares had been allocated under the ESOP. Under the ESOP, unallocated shares and allocated shares as to which voting instructions are not given by participants, are to be voted by the ESOP Trustee in a manner calculated to most accurately reflect the instructions received from participants regarding the allocated stock so long as such vote is in accordance with the fiduciary provisions of the Employee Retirement Income Security Act of 1974, as amended. |

| (2) | | First Place Bank Community Foundation is a private foundation that was funded with 802,625 shares of our common stock in connection with the conversion of First Place Bank from a mutual to a stock form of ownership. Pursuant to a regulatory condition imposed by the Office of Thrift Supervision in approving the formation and funding of the foundation, unless the condition is waived by the OTS, all shares of common stock held by the foundation must be voted in the same ratio as all other shares of common stock on all proposals considered by shareholders of First Place. |

12

What First Place’s Directors and Executive Officers Own

The following table provides information, as of September 23, 2002, about the shares of common stock that are owned or may be deemed to be owned by (1) each director of First Place, (2) First Place’s Chief Executive Officer and by the next five most highly paid executive officers of First Place with salary and bonus in the last fiscal year in excess of $100,000 and (3) all directors and executive officers of First Place as a group. Except as otherwise indicated, each person and each group shown in the table has sole voting and investing power over their shares.

Name

| | Title

| | Amount and Nature of Beneficial Ownership

| | | Percent of Common Stock Outstanding

| |

| W. Terry Patrick | | Chairman of the Board | | 24,625 | | | 0.2 | % |

| Steven R. Lewis | | President, Chief Executive Officer and Director | | 253,344 | (1) | | 1.8 | |

| A. Gary Bitonte, M.D. | | Director | | 139,237 | | | 1.0 | |

| Albert P. Blank | | Senior Vice President | | 19,867 | (1) | | 0.1 | |

| Donald Cagigas | | Director | | 10,000 | | | 0.1 | |

| Marie Izzo Cartwright | | Director | | 68,832 | | | 0.5 | |

| Jeffrey L. Francis | | Executive Vice President, Chief Operating Officer and Director | | 153,769 | | | 1.1 | |

| George J. Gentithes | | Director | | 74,620 | (2) | | 0.5 | |

| Robert P. Grace | | Director | | 76,580 | (2) | | 0.6 | |

| David S. Hinkle | | Senior Vice President | | 19,041 | | | 0.1 | |

| Brian E. Hoopes | | Senior Vice President | | 30,076 | (1) | | 0.2 | |

| Thomas M. Humphries | | Director | | 76,580 | (2) | | 0.6 | |

| Earl T. Kissell | | Director | | 68,383 | | | 0.5 | |

| Therese Ann Liutkus | | Chief Financial Officer | | 70,485 | | | 0.5 | |

| Robert S. McGeough | | Director | | 82,060 | (2) | | 0.6 | |

| E. Jeffrey Rossi | | Director | | 125,153 | (2) | | 0.9 | |

| Samuel A. Roth | | Director | | 38,581 | | | 0.3 | |

| William A. Russell | | Director | | 36,928 | | | 0.3 | |

| Ronald P. Volpe, Ph.D. | | Director | | 23,531 | | | 0.2 | |

| Robert L. Wagmiller | | Director | | 4,300 | | | * | |

| All directors and executive officers as a group (24 persons) | | | | 1,549,351 | (3) | | 10.8 | |

| * | | Represents less than 0.1% of outstanding common stock. |

| (1) | | Includes 35,940, 6,000 and 4,400 shares awarded to Messrs. Lewis, Blank and Hoopes, respectively, under the First Place stock incentive plan which have not yet vested, but as to which they may provide voting recommendations. |

| (2) | | Includes 8,960 shares awarded to these outside directors pursuant to the First Place stock incentive plan which have not yet vested, but as to which they may provide voting recommendations. |

| (3) | | Includes 100,540 shares awarded to the directors and executive officers as a group pursuant to the First Place stock incentive plan which have not yet vested, but as to which they may provide voting recommendations. |

13

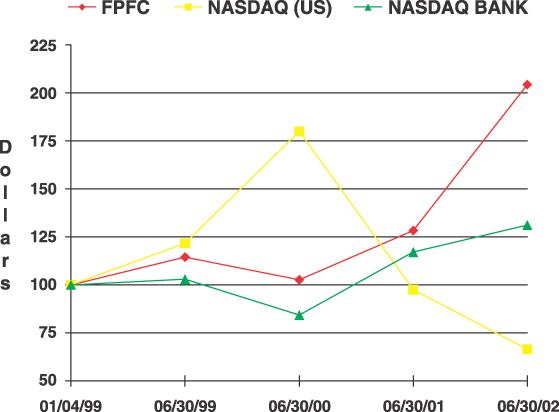

Stock Performance Graph

The following graph shows a comparison of cumulative total shareholder return on First Place’s common stock based on the market price of the common stock with the cumulative total return of companies on the Nasdaq Stock Market (U.S.) Index and Nasdaq Bank Stock Index for the period beginning on January 4, 1999, the day our common stock began trading, through June 30, 2002. The graph was derived from a limited period of time, and, as a result, may not be indicative of possible future performance of our common stock.

FIRST PLACE FINANCIAL CORP.

TOTAL RETURN PERFORMANCE

| | | 01/04/99

| | 06/30/99

| | 06/30/00

| | 06/30/01

| | 06/30/02

|

| First Place Financial Corp. | | 100.00 | | 114.53 | | 102.70 | | 128.42 | | 204.35 |

| Nasdaq Stock Market Index | | 100.00 | | 121.77 | | 180.03 | | 97.59 | | 66.55 |

| Nasdaq Bank Stock Index | | 100.00 | | 102.97 | | 84.43 | | 117.13 | | 131.27 |

Notes:

| A. | | The lines represent yearly index levels derived from compounded daily returns that include all dividends. |

| B. | | The indexes are reweighted daily, using the market capitalization on the previous trading day. |

| C. | | If the interval is not a trading day, the preceding trading day is used. |

| D. | | The index level for all series was set to 100.00 on January 4, 1999. |

14

Summary Compensation Table

The following table shows, for the fiscal years ended June 30, 2002, 2001 and 2000, the cash compensation paid by us, as well as certain other compensation paid or accrued for those years, to the chief executive officer and the next five most highly paid executive officers of First Place who received salary and bonus in excess of $100,000 during the year ended June 30, 2002.

| | | Fiscal Year

| | Annual Compensation

| | Long Term Compensation

|

Name and Principal Position

| | | Salary

($)(1)

| | Bonus

($)

| | Other Annual Compensation ($)(2)

| | Restricted Stock Awards

($)(3)

| | Securities Underlying Options/ SARs

(#)

| | LTIP Payouts ($)(4)

| | All Other Compensation ($)(5)

|

| Steven R. Lewis | | 2002 | | $ | 194,000 | | $ | 76,460 | | — | | | — | | — | | — | | $ | 34,280 |

| President and Chief Executive Officer | | 2001 2000 | | | 183,768 156,126 | | | 88,015 20,000 | | — — | | $ | — 1,106,278 | | — 224,000 | | — — | | | 33,440 35,893 |

|

| Jeffrey L. Francis(6) | | 2002 | | | 189,000 | | | 77,100 | | — | | | — | | — | | — | | | 6,624 |

| Exec Vice Pres. and Chief Operating Officer | | 2001 2000 | | | 189,000 188,508 | | | 62,107 40,000 | | — — | | | — 256,250 | | — 50,000 | | — — | | | 139,514 35,859 |

|

| Albert P. Blank(8) | | 2002 | | | 150,075 | | | 40,812 | | — | | | 124,875 | | — | | — | | | 1,150 |

| Senior Vice President | | 2001 | | | 82,635 | | | 24,690 | | — | | | — | | 30,000 | | — | | | 767 |

|

| Therese Ann Liutkus(7) | | 2002 | | | 143,742 | | | 39,658 | | — | | | — | | — | | — | | | 5,220 |

| Chief Financial Officer | | 2001 2000 | | | 101,388 80,606 | | | 24,278 15,000 | | — — | | | — 51,250 | | — — | | — — | | | 95,470 23,368 |

|

| David S. Hinkle(9) | | 2002 | | | 94,500 | | | 25,699 | | — | | | — | | — | | — | | | 4,171 |

| Senior Vice President | | 2001 2000 | | | 83,691 80,857 | | | 24,390 18,225 | | — — | | | — 51,250 | | — — | | — — | | | 89,725 25,916 |

|

| Brian E. Hoopes | | 2002 | | | 94,500 | | | 25,699 | | — | | | — | | — | | — | | | 21,206 |

| Senior Vice President | | 2001 2000 | | | 82,635 69,200 | | | 24,690 27,000 | | — — | | | — 135,438 | | — 33,600 | | — — | | | 22,177 5,184 |

| (1) | | Under Annual Compensation, the column titled “Salary” includes amounts deferred pursuant to First Place Bank’s 401(k) Plan. |

| (2) | | There were no (a) perquisites over the lesser of $50,000 or 10% of the individual’s total salary and bonus for the last year, (b) payments of above-market preferential earnings on deferred compensation, (c) payments of earnings with respect to long-term incentive plans prior to settlement or maturation, (d) tax payment reimbursements, or (e) preferential discounts on stock. |

| (3) | | At June 30, 2002, the value of unvested shares of restricted stock granted to Mr. Lewis, Mr. Blank and Mr. Hoopes, 53,910, 7,500 and 6,600 shares, respectively, were $1,073,348, $149,325 and $131,406, respectively, which were calculated by multiplying the total number of unvested shares of restricted stock by the closing market price of our common stock on June 30, 2002. The shares of restricted stock were granted to Mr. Lewis and Mr. Hoopes on July 2, 1999 and vest at a rate of 20% each year over five years, beginning on July 2, 2000. The shares of restricted stock were granted to Mr. Blank on April 16, 2002 and vest at a rate of 20% each year over five years, beginning on July 2, 2002. There were no unvested shares of restricted stock remaining for the other executives listed. |

| (4) | | For fiscal years 2002, 2001 and 2000, First Place Bank had no long-term incentive plans in existence. Accordingly, there were no payments or awards under any long-term incentive plan. |

| (5) | | Other compensation includes matching contributions under First Place Bank’s 401(k) Savings Plan and term life insurance premiums. Other compensation for Mr. Lewis and Mr. Hoopes include allocations from First Place Bank’s ESOP. In fiscal 2001, other compensation for Mr. Francis, Ms. Liutkus and Mr. Hinkle include final allocations from FFY Financial Corp.’s ESOP and 401(k) Savings Plan and in fiscal 2000 other compensation for Mr. Francis, Ms. Liutkus and Mr. Hinkle include the annual allocation from FFY Financial Corp.’s ESOP |

15

| | and 401(k) Savings Plan. FFY Financial Corp.’s ESOP and 401(k) Savings Plan were terminated pursuant to the merger. |

| (6) | | Mr. Francis’ 2001 compensation includes $92,500 in salary and $20,000 in bonus paid by FFY Financial Corp. prior to the consummation of the merger of equals with First Place on December 22, 2000. Mr. Francis’ 2000 compensation information is from when he was President and Chief Executive Officer of FFY Financial Corp. |

| (7) | | Ms. Liutkus’ 2001 compensation includes $55,283 in salary and $7,500 in bonus paid by FFY Financial Corp. prior to the consummation of the merger of equals with First Place on December 22, 2000. Ms. Liutkus’ 2000 compensation information is from when she was Treasurer and Chief Financial Officer of FFY Financial Corp. |

| (8) | | Mr. Blank was hired in November 2000. |

| (9) | | Mr. Hinkle’s 2001 compensation includes $40,794 in salary and $9,000 in bonus paid by FFY Financial Corp. prior to the consummation of the merger of equals with First Place on December 22, 2000. Mr. Hinkle’s 2000 compensation information is from when he was a Senior Vice President of FFY Financial Corp. |

Aggregated Option Exercises and Year-End Option Value Table

The following table sets forth information concerning the number and value of stock options held by the named executive officers at June 30, 2002, measured in terms of the $19.91 closing price of our common stock on June 30, 2002.

| | | Value Realized from Exercise of Options in the Current Fiscal Year

| | Number of Unexercised Options/SARs at June 30, 2002

| | Value of Unexercised

In-the-Money Options/SARs at June 30, 2002(1)

|

Name

| | Shares Acquired on Exercise (#)

| | Value Realized ($)

| | Exercisable (#)

| | Unexercisable (#)

| | Exercisable ($)

| | Unexercisable ($)

|

| Steven R. Lewis | | — | | | — | | 134,400 | | 89,600 | | $ | 1,021,104 | | $ | 680,736 |

| Jeffrey L. Francis | | 51,551 | | $ | 599,101 | | 73,286 | | — | | | 855,312 | | | — |

| Albert P. Blank | | — | | | — | | 12,000 | | 18,000 | | | 100,920 | | | 151,380 |

| Therese Ann Liutkus | | 2,000 | | | 22,680 | | 25,283 | | — | | | 325,581 | | | — |

| David S. Hinkle | | 10,750 | | | 65,575 | | — | | — | | | — | | | — |

| Brian E. Hoopes | | — | | | — | | 20,160 | | 13,440 | | | 153,166 | | | 102,110 |

| (1) | | The difference between the aggregate option exercise price and the fair market value of the underlying shares at June 30, 2002. |

16

Equity Compensation Plan Information

The following table sets forth information regarding the securities authorized for issuance under equity compensation plans as of June 30, 2002.

Plan Category

| | Number of Securities to be Issued Upon Exercise of Outstanding Options, Warrants and Rights

| | Weighted-Average Exercise Price of Outstanding Options, Warrants and Rights

| | Number of Securities Remaining Available for Future Issuance under Equity Compensation Plans (excluding Securities Reflected in Column (a))

|

| Equity compensation plans approved by shareholders | | 1,258,548 | | $ | 15.63 | | 162,313 |

| Equity compensation plans not approved by shareholders | | — | | | — | | — |

| | |

| |

|

| |

|

| Total | | 1,258,548 | | $ | 15.63 | | 162,313 |

| | |

| |

|

| |

|

Employment and Change in Control Agreements

First Place Bank and First Place have entered into employment agreements with Steven R. Lewis, Chief Executive Officer of First Place Bank and the President and Chief Executive Officer of First Place and Jeffrey L. Francis, the President and Chief Operating Officer of First Place Bank and Executive Vice President and Chief Operating Officer of First Place. These employment agreements are intended to ensure that First Place Bank and First Place will be able to maintain a stable and competent management base. The continued success of First Place Bank and First Place depends to a significant degree on the skills and competence of Mr. Lewis and Mr. Francis.

Mr. Lewis’ employment agreements are for a three-year term. The First Place Bank employment agreement provides that, commencing on the first anniversary date and continuing each anniversary date thereafter, First Place Bank’s board of directors may extend the agreement for an additional year so that the remaining term shall be three years, unless written notice of non-renewal is given by the bank’s board of directors after conducting a performance evaluation of Mr. Lewis. The term of the First Place employment agreement shall be extended on a daily basis unless written notice of non-renewal is given by the First Place board of directors. Under the employment agreements, Mr. Lewis’ base salary will be reviewed annually. The current base salary under the employment agreements for Mr. Lewis is $194,000. In addition to the base salary, the employment agreements provide for, among other things, participation in stock benefit plans and other fringe benefits applicable to executive personnel.

The agreements provide for termination by First Place Bank or First Place for cause as defined in the employment agreements, at any time. In the event First Place Bank or First Place chooses to terminate Mr. Lewis’ employment for any reasons other than for cause, or in the event of Mr. Lewis’ resignation upon: (i) failure to re-elect Mr. Lewis to his current offices; (ii) a material change in Mr. Lewis’ functions, duties or responsibilities; (iii) a relocation of Mr. Lewis’ principal place of employment by more than 50 miles; (iv) a material reduction in the benefits and perquisites to Mr. Lewis from those being provided as of the effective date of the employment agreements, unless consented to by the Executive; (v) liquidation or dissolution of First Place Bank or First Place; or (vi) a breach of the agreement by First Place Bank or First Place, Mr. Lewis or, in the event of death, Mr. Lewis’ beneficiary, would be entitled to receive an amount equal to the remaining base salary payments due to Mr. Lewis and the contributions that would have been made on Mr. Lewis’ behalf to any employee benefit plans of First Place Bank or First Place during the remaining term of the employment agreements. First Place Bank and First Place would also continue to pay for Mr. Lewis’ life, health and dental coverage for the remaining term of the employment agreements. Upon any termination of Mr. Lewis, he is subject to a one-year non-competition agreement. Based on the current base salary and other annual contributions to employee benefit plans, if Mr. Lewis’s term of employment had been ended in the event of termination as of June 30, 2002, he would have been entitled to $584,252.

17

Under the employment agreements, if involuntary termination or under certain circumstances, voluntary termination follows a change in control of First Place Bank or First Place as defined in the employment agreements, Mr. Lewis, or, in the event of Mr. Lewis’ death, his beneficiary, would be entitled to a severance payment equal to the greater of: (i) the payments due for the remaining terms of the agreement; or (ii) three times the average of the five preceding taxable years’ annual compensation. First Place Bank and First Place would also continue Mr. Lewis’ life, health and dental coverage for 36 months. Notwithstanding that both First Place Bank and First Place employment agreements provide for a severance payment in the event of a change in control, Mr. Lewis would only be entitled to receive a severance payment under one agreement. For the purposes of determining the term of the First Place Bank employment agreement and the benefits to be paid as described in this paragraph, the board of directors of First Place Bank shall annually review the agreement and Mr. Lewis’ performance for the purpose of determining whether to deem the employment agreement extended for an additional year such that the remaining term for these purposes shall be three years. First Place’s employment agreement shall be deemed extended for these purposes on a daily basis unless written notice of non-renewal is given by the board of directors.

Payments to Mr. Lewis under First Place Bank’s employment agreement will be guaranteed by First Place in the event that payments or benefits are not paid by First Place Bank. Payment under First Place’s employment agreement would be made by First Place. All reasonable costs and legal fees paid or incurred by Mr. Lewis pursuant to any dispute or question of interpretation relating to the employment agreements shall be paid by First Place Bank or First Place, respectively, if Mr. Lewis is successful on the merits pursuant to a legal judgment, arbitration or settlement. The employment agreements also provide that First Place Bank and First Place shall indemnify Mr. Lewis to the fullest extent allowable under federal and Delaware law, respectively. Based on current salary and other cash bonus/incentive compensation, if Mr. Lewis’s employment had been terminated as of June 30, 2002, due to change of control, he would have been entitled to receive a lump sum cash payment of approximately $847,000.

Mr. Francis’ employment agreement provides for a five-year term. The agreement provides that on each anniversary date the term shall be extended one year provided that we have not given written notice that the term will not be extended and provided that Mr. Francis has not received an unsatisfactory performance review by the board of directors. The agreement provides for a base salary that shall be increased from time to time in accordance with amounts of salary approved by the board of directors. The base salary was increased from $189,000 to $197,500 effective July 1, 2002. In addition to the base salary, the agreement provides for participation in bonuses, stock benefit plans, and other fringe benefit plans applicable to executive personnel.

The agreement provides for termination at any time by us or by our bank for cause as defined in the agreement. In the event First Place Bank or First Place chooses to terminate Mr. Francis’ employment for any reasons other than for cause, or in the event of Mr. Francis’ resignation upon: (i) failure to re-elect Mr. Francis to his current offices; (ii) a material change in Mr. Francis’ functions, duties, or responsibilities; (iii) a relocation of Mr. Francis’s principal place of employment by more than thirty-five (35) miles; (iv) a reduction in salary or a material adverse change in the perquisites benefits, contingent benefits, or vacation; (v) a material permanent increase in the required hours of work or workload; or (vi) a failure of the board of directors to elect him to his current offices with First Place or First Place Bank or any action by the board of directors removing him from such offices, the contract provides that we shall, during the lesser period of the remaining term of the agreement or three (3) years following the date of termination, as liquidated damages, (i) pay monthly to Mr. Francis one-twelfth of his salary at the annual rate in effect immediately prior to the date of termination and one-twelfth of the average annual amount of cash bonus and cash incentive compensation based on the average amounts of such compensation earned by Mr. Francis for the two fiscal years preceding the date of termination; and (ii) maintain substantially the same group life insurance, hospitalization, medical, dental, prescription drug and other health benefits, and long-term disability insurance (if any) for the benefit of Mr. Francis and his dependants and beneficiaries who would have been eligible for such benefits if Mr. Francis had not suffered an involuntary termination and on terms substantially as favorable to Mr. Francis including amounts of coverage and deductibles and other costs to him in effect immediately prior to such involuntary termination. The contract further provides that in the event Mr. Francis becomes entitled to liquidated damages as set forth above, (i) First Place’s obligation with respect to cash damages shall be reduced by the amount of Mr. Francis’s cash income, if any, earned from providing personal services during the liquidated damage period; and (ii) First Place’s obligation to maintain health coverage shall be reduced to the extent, if any, that Mr. Francis receives such benefits, on no less favorable terms, from another employer during the liquidated damage period.

The contract further provides that in the event that Mr. Francis experiences an involuntary termination within the six months preceding, at the time of, or within 24 months following a change in control, in addition to the benefits described above, First Place shall pay Mr. Francis in cash an amount equal to 299% of Mr. Francis’ “base amount” as determined under section 280G of the Code, less the acceleration and lapse value of options granted to

18

Mr. Francis by First Place that are taken into account in the determination of “parachute payments” under 280G(b)(2) of the Internal Revenue Service Code (the “Code”) by virtue of vesting acceleration or deemed vesting acceleration in connection with such change in control. In the event that any payments or benefits provided or to be provided to Mr. Francis pursuant to the contract, in combination with payments or benefits, if any, from other plans or arrangements maintained by First Place, constitute “excess parachute payments” under section 280G of the Code and are subject to excise tax under Sec. 4999 of the Code, First Place shall pay to Mr. Francis in cash an additional amount equal to the amount of the Gross Up Payment as defined in the contract.

The contract provides that First Place shall pay all legal fees and related expenses incurred by Mr. Francis in the event that he contests or disputes any termination of employment or seeks to obtain or enforce any right or benefit provided by the contract or by any other plan or arrangement maintained by First Place under which he may be entitled to receive benefits, provided that Mr. Francis prevails with respect to the matters in dispute in any action initiated by Mr. Francis or it is determined that Mr. Francis acted reasonably and in good faith with respect to any action initiated by First Place.

Based on his current salary and cash bonus/incentive compensation, if his employment had been terminated as of June 30, 2002, under circumstances entitling him to severance pay as described above, he would have been entitled to receive a lump sum payment of approximately $943,400. In addition, Mr. Francis would be entitled to monthly payments of approximately $22,300 for three years.

First Place Bank and First Place have entered into two-year change in control agreements with certain other executive officers of First Place Bank and First Place, none of whom are covered by employment contracts. The change in control agreements provide that commencing on the first anniversary date and continuing on each anniversary thereafter, First Place Bank’s change in control agreements may be renewed by our bank’s board of directors for an additional year. First Place’s change in control agreements are similar to First Place Bank’s change in control agreements, except that the term of First Place’s change in control agreements shall be extended on a daily basis. The change in control agreements provide that in the event involuntary termination or, in certain circumstances, voluntary termination follows a change in control of First Place Bank or First Place, executive officers would be entitled to receive a severance payment equal to two times his or her average annual compensation for the five years preceding the termination. First Place Bank would also continue to pay for the executive officers’ life and health insurance coverage for 24 months following termination. Payments to executive officers under First Place Bank’s change in control agreements are guaranteed by First Place in the event that payments of benefits are not paid by First Place Bank.

In addition, First Place and First Place Bank are subject to change in control agreements with certain officers that were assumed by First Place and First Place Bank following the merger of equals with FFY Financial Corp. The assumed change in control agreements were entered into in September 1998 and remain in effect through December 22, 2002. The change in control agreements provide that in the event of voluntary termination for good reason by the executive or involuntary termination by First Place or First Place Bank within 24 months following the change in control of FFY Bank or FFY Financial Corp., the executive will be entitled to the following severance benefits: (1) payment of salary through the date of termination at the rate in effect at the time notice of termination is given to the executive; (2) a lump sum payment in cash, within 25 days after the later of the date of the change in control or the date of termination, in an amount equal to up to 100% of the executive’s base annual salary in effect prior to the date that the notice of termination is given, excluding any bonus, less the aggregate present value of the payments of benefits, if any, in the nature of compensation for the benefit of the executive arising under any other agreements with First Place or First Place Bank, which constitute “parachute payments” under Section 280G of the Code. The executive will not be entitled to the severance benefits under the change in control agreement if such executive is terminated by First Place or First Place Bank for cause.

In the event of a change in control, total payments to officers under these change in control agreements, based solely on current base salary and excluding any benefits under any employee benefit plan which may be payable, would be approximately $1,822,200.

Additional Information About Our Directors and Executive Officers

Section 16(a) Beneficial Ownership Reporting Compliance. Section 16(a) of the Securities Exchange Act of 1934 requires First Place’s officers (as defined in regulations promulgated by the Securities and Exchange Commission thereunder) and directors, and persons who own more than ten percent of a registered class of our common stock, to file reports of ownership and changes in ownership with the Securities and Exchange Commission.

19

Officers, directors and greater than ten percent shareholders are required by Securities and Exchange Commission regulations to furnish First Place with copies of all Section 16(a) forms they file.

Based solely on a review of copies of all such reports of ownership furnished to First Place, or written representations that no forms were necessary, we believe that there were two Form 4 filings that were inadvertently filed late, one by Mr. Hinkle and the second by Mr. Hoopes. Each of the late Form 4 filings were reporting a single transaction for the sale of common stock. The Form 4 filings were subsequently filed with the Securities and Exchange Commission. All other filing requirements applicable to our officers, directors, and greater than ten percent beneficial owners were complied with during the fiscal year.

Transactions with Certain Related Persons. Federal regulations require that all loans or extensions of credit to executive officers and directors must be made on substantially the same terms, including interest rates and collateral, as those prevailing at the time for comparable transactions with the general public and must not involve more than the normal risk of repayment or present other unfavorable features. In addition, loans made to a director or executive officer in excess of the greater of $25,000 or 5% of our bank’s capital and surplus (up to a maximum of $500,000) must be approved in advance by a majority of the disinterested members of the board of directors.

First Place Bank currently offers directors, officers and full-time employees of the Company, who satisfy certain criteria and the general underwriting standards of First Place Bank, mortgage loans with interest rates which may be up to 1/2% below the rates offered to First Place Bank’s other customers, (the “employee loan rate”). The program also offers a 1% interest rate discount on motor vehicle loans, other than motorcycles. Loan application fees are waived for all employee loan rate loans. With the exception of employee loan rate loans, First Place Bank currently makes loans to its executive officers, directors and employees on the same terms and conditions offered to the general public. Loans made by First Place Bank to its directors and executive officers are made in the ordinary course of business, on substantially the same terms, including collateral, as those prevailing at the time for comparable transactions with other persons and do not involve more than the normal risk of collectibility or present other unfavorable features. All such loans were made by First Place Bank in the ordinary course of business, with no favorable terms (except for employee loan rate loans) and such loans do not involve more than the normal risk of collectibility or present unfavorable features.

As of June 30, 2002, twelve of our bank’s executive officers and directors had a total of eighteen loans outstanding, totaling approximately $2.34 million in the aggregate. All but one of the loans currently outstanding to executive officers and directors are receiving the employee loan rate. Fourteen of the loans are secured by the borrower’s principal residence and four of the loans were made to immediate family members of the executive officers or directors, who were also employees of the Bank at the time the loan was originated, where the loans are secured by the immediate family member’s principal residence.

Compensation Committee Interlocks and Insider Participation. The Compensation Committee is made up of four directors: Ms. & Messrs. Russell (Chairman), Cartwright, Patrick and Rossi. No member of the Committee is, or was during 2002, an executive officer of another company whose board of directors has a comparable committee on which one of our executive officers serves.

PROPOSAL 2. RATIFICATION OF FIRST PLACE INDEPENDENT AUDITORS

Our independent auditors for the fiscal year ended June 30, 2002 were Crowe, Chizek and Company LLP. With the recommendation of our audit committee, our board of directors has re-appointed Crowe, Chizek and Company LLP to continue as independent auditors for First Place Bank and First Place for the year ending June 30, 2003, subject to ratification of such appointment by the shareholders. The affirmative vote of a majority of the number of votes entitled to be cast by the common stock represented at the meeting is needed to ratify the appointment.

20

The following aggregate fees were billed to us for professional services rendered by our independent auditors during the fiscal year ended June 30, 2002:

| Audit Fees | | | | | $ | 96,000 |

| Financial Information Systems Design and Implementation Fees | | | | | | -0- |

| All Other Non-Audit Fees | | | | | | |

| Tax return preparation | | $ | 23,475 | | | |

| Consulting services (tax planning, tax effect of stock options and merger related) | | | 20,240 | | | |

| Professional consulting services relating to information systems security assessment | | | 48,157 | | | |

| Professional services relating to employee benefit plans | | | 15,331 | | | 107,203 |

| | |

|

| |

|

|

| TOTAL FEES | | | | | $ | 203,203 |

Representatives of Crowe, Chizek and Company LLP will be present at the Annual Meeting. They will be given an opportunity to make a statement if they desire to do so and will be available to respond to appropriate questions from shareholders present at the Annual Meeting.

Unless marked to the contrary, the shares represented by the enclosed proxy card will be voted for ratification of the appointment of Crowe, Chizek and Company LLP as our independent auditors.

THE BOARD OF DIRECTORS RECOMMENDS THAT YOU VOTE “FOR” RATIFICATION OF THE APPOINTMENT OF CROWE, CHIZEK AND COMPANY LLP AS OUR INDEPENDENT AUDITORS.

ADDITIONAL INFORMATION FOR FIRST PLACE SHAREHOLDERS

Shareholder Proposals

To be considered for inclusion in our proxy statement and form of proxy relating to the 2003 Annual Meeting of Shareholders, a shareholder proposal must be received by our corporate secretary at the address set forth on the Notice of Annual Meeting of Shareholders not later than June 17, 2003. Any such proposal will be subject to 17 C.F.R.§ 240.14a-8 of the Rules and Regulations under the Exchange Act.

Notice of Business to be Conducted at an Annual Meeting

Our bylaws provide an advance notice procedure for a shareholder to properly bring business before an Annual Meeting. The shareholder must give written advance notice to our corporate secretary not less than ninety (90) days before the date originally fixed for such meeting; provided, however, that in the event that less than one hundred (100) days notice or prior public disclosure of the date of the meeting is given or made to shareholders, notice by the shareholder to be timely must be received not later than the close of business on the tenth day following the date on which our notice to shareholders of the Annual Meeting date was mailed or such public disclosure was made. The advance notice by shareholders must include the shareholder’s name and address as they appear on our record of shareholders, a brief description of the proposed business, the reason for conducting such business at the Annual Meeting, the class and number of shares of common stock that are beneficially owned by such shareholder and any material interest of such shareholder in the proposed business. In the case of nominations to the board of directors, certain information regarding the nominee must be provided. Nothing in this paragraph shall be deemed to require us to include in the proxy statement or the proxy card relating to an Annual Meeting any shareholder proposal which does not meet all of the requirements for inclusion established by the Securities and Exchange Commission in effect at the time such proposal is received.

21

Other Matters Which May Properly Come Before the Meeting

Our board of directors knows of no business which will be presented for consideration at the Annual Meeting other than as stated in the Notice of Annual Meeting of Shareholders. If, however, other matters are properly brought before the Annual Meeting, it is the intention of the persons named in the accompanying proxy to vote the shares represented thereby on such matters in accordance with their best judgment.

Whether or not you intend to be present at the Annual Meeting, you are urged to return your proxy card promptly. If you are then present at the Annual Meeting and wish to vote your shares in person, your original proxy may be revoked by voting at the Annual Meeting. However, if you are a shareholder whose shares are not registered in your own name, you will need appropriate documentation from your recordholder to vote personally at the Annual Meeting.

A copy of our Annual Report on Form 10-K (without exhibits) for the year ended June 30, 2002, as filed with the Securities and Exchange Commission, will be furnished without charge to our shareholders of record upon written request to First Place Financial Corp., 185 East Market Street, Warren, Ohio 44481.

By Order of the Board of Directors

J. Craig Carr

Secretary

Warren, Ohio

October 14, 2002

22

Appendix A

FIRST PLACE FINANCIAL CORP.

FIRST PLACE BANK

CHARTER OF THE AUDIT COMMITTEE OF THE BOARD OF DIRECTORS

I. PURPOSE

The Audit Committee for First Place Financial Corporation (the “Corporation”) and First Place Bank (the “Bank”) is composed solely of directors who are independent of management and free from any relationship that would interfere with the exercise of independent judgment.

The primary function of the Audit Committee is to assist the Board of Directors (the “Board”) in monitoring the integrity of the financial statements of the Corporation, monitoring the Corporation’s compliance with legal and regulatory requirements and the reviewing of the independence and performance of the Corporation’s internal and external auditors. Consistent with this function, the Audit Committee should encourage continuous improvement of, and should foster adherence to, the Corporation’s policies, procedures and practices at all levels.

The Audit Committee will primarily fulfill these responsibilities by carrying out the activities enumerated in Section V of this Charter.

II. COMPOSITION

The Audit Committee shall be comprised of six directors as determined by the Board, each of whom shall be independent directors1, and free from any relationship that, in the opinion of the Board, would interfere with the exercise of his or her independent judgment as a member of the Committee. All Members of the Committee shall have a working familiarity with basic finance and accounting practices, and at least one member of the Committee shall have accounting and related financial management expertise. Committee members may enhance their familiarity with finance and accounting by participating in educational programs conducted by the Corporation, the Bank or outside consultants.

The members of the Audit Committee shall be appointed by the Board at the annual organizational meeting and shall serve until their successors are duly elected and qualified. Unless a Chairman is elected by the full Board, the members of the Committee may designate a Chairman by majority vote of the full Audit Committee.

III. PRACTICES

In carrying out its responsibilities, the Audit Committee will adopt practices which will enable the Committee to best react to changing conditions and to ensure that the Corporation’s accounting and reporting practices, the system of internal controls, and the fiduciary activities conducted are in accordance with all requirements. The Committee shall have the authority to retain special legal, accounting or other consultants to advise the Committee. The Committee will follow-up with management on outstanding audit issues reported by the independent accountants to

1 | | The exchanges have established 5 criteria for assessing independence: |

| | • | | Former employees. Must be a minimum of three years. |

| | • | | Family members of former employees. Must be a minimum of three years. |

| | • | | Director compensation. NASD/AMEX limit compensation from the Company (excluding direct board compensation) to $60,000 per year – NYSE does not have any requirements regarding compensation. |

| | • | | Business relationships. The NYSE does not allow business relationships that impair the director’s business judgment. NASD/AMEX define the extent of business relationships that impair independence – if the director’s employer receives revenue in excess of $200,000 per year, or 5 percent of its total revenue, the director is not considered independent. |

| | • | | None of the exchanges allow cross-directorships – an audit committee member’s compensation cannot be impacted by an employee of the Company. NYSE rules allow one former employee, or one family member of a former employee, to be an audit committee member (with less than three years separation) if it is determined by the Board to be in the Company’s best interest. NASD/AMEX allow all independence rules to be waived for one member as long as he/she is not a current employee or family member. This would generally need to be approved by the Board and disclosed in the Company’s next proxy statement. The NYSE requires annual written affirmation of the Audit Committee independence. |

A-1

come to a satisfactory resolution.

IV. MEETINGS