EXHIBIT 99.1

EXHIBIT 99.1

Fourth Quarter 2004 Investor Presentation

Forward-Looking Statements

This presentation contains forward-looking statements relating to the financial condition, results of operations and business of First Place Financial Corp. Actual results could differ materially from those indicated. Among the important factors that could cause actual results to differ materially are interest rates, the success of the integration of acquisitions, changes in the mix of the company’s business, competitive pressures, general economic conditions and the risk factors detailed in the Company’s periodic reports and registration statements filed with the Securities and Exchange Commission. First Place Financial Corp undertakes no obligation to release revisions to these forward-looking statements or reflect events or circumstances after the date of this presentation.

This presentation contains financial information adjusted to exclude the results of certain significant transactions or events not representative of ongoing operations (“non-operating items”). A reconciliation of these non-GAAP disclosures will be filed in a form 8-K.

First Place Profile

Mutual-to-stock conversion in 1998

Based in Warren/Youngstown, OH

Largest publicly traded thrift based in Ohio

22 retail locations in Northeast OH; 5 in Southeast MI

Network of loan production offices throughout OH, MI, and IN

$2.2 billion in assets with growing geographic diversification

Market capitalization of $256 MM

Listed on Nasdaq: FPFC

Building on First Place Strengths

Comprehensive branch network in existing markets

Strong deposit market share

Strong capital base

Core expertise in mortgage banking

Growing emphasis on commercial and private

banking

Diversified non-bank affiliates

Enhanced management team

Performance Goals

EPS growth ³ 10%

ROE ³ 15%

Commercial loans to 40% of portfolio

35-40% of revenues from fees

Grow into capital structure

Strategic Plan for:

Growth, Diversification and Balance

~ Complete Transformation to Commercial Bank Profile ~

Strengthen relationship banking

Increase income from fee-based services

Expand geographically through unique bank-within-a-bank concept and strategic acquisitions

Expand commercial loan and deposit customer base to diversify assets and increase funding alternatives

Relationship Banking

Leverage strong customer base in existing markets

Add new product lines to expand relationships

Sales culture in place to deliver performance

Extend to new markets

Strategic Acquisitions

Criteria:

Midwest growth markets

Composition of the balance sheet

Accretion

Human capital

Three acquisitions in five years:

FPFC + Ravenna Savings in May 2000; FFY in Dec. 2000; Franklin in May 2004

Building a financial services company

APB Financial Group, Ltd.

Coldwell Banker First Place Real Estate

Title Works Agency, LLC

First Place Insurance Agency

Building a commercial bank:

Product and services infrastructure established

Franklin Bank acquired in May 2004

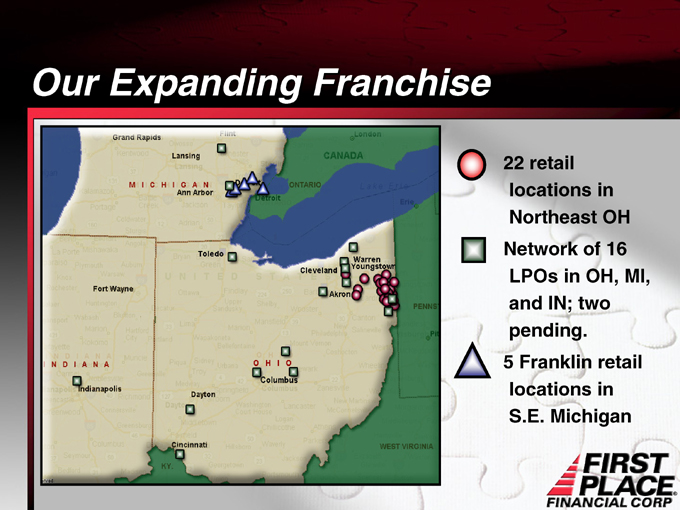

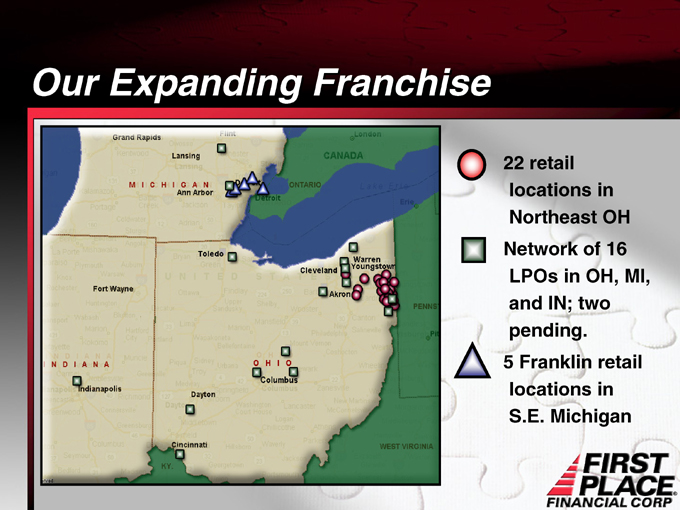

Our Expanding Franchise

22 retail locations in Northeast OH

Network of 16 LPOs in OH, MI, and IN; two pending.

5 Franklin retail locations in S.E. Michigan

Franklin Acquisition: A Value-Added Transaction

Provides geographic diversification

Substantial shift to a more commercial loan and deposit mix

Opportunity to cross-sell FPFC’s non-bank financial products

Estimated cost savings of $4.3 million

EPS accretive in first year

Franklin Acquisition:

Entrance Into a Growth Market

Access to one of the premier markets for high net worth

customers, demographic growth and business starts

Located in Oakland County, with highest per capita income in Michigan

#1 job producing area in Michigan

38% of Fortune 500 companies do business in Oakland County

Industry mix favors service (39%) and non-manufacturing (42%)

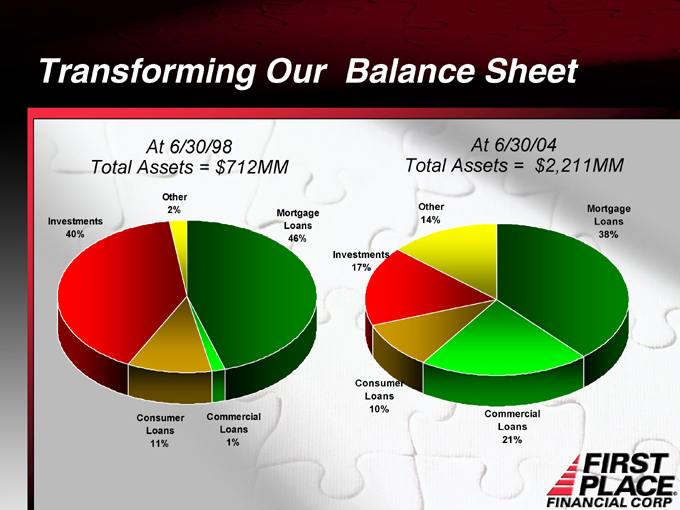

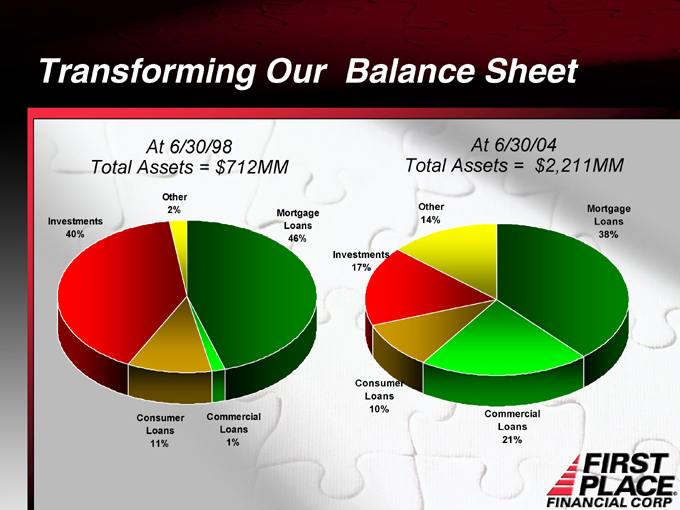

Transforming Our Balance Sheet

At 6/30/98 Total Assets = $712MM

Other 2%

Mortgage Loans 46%

Commercial Loans 1%

Consumer Loans 11%

Investments 40%

At 6/30/04 Total Assets = $2,211MM

Other 14%

Mortgage Loans 38%

Commercial Loans 21%

Consumer Loans 10%

Investments 17%

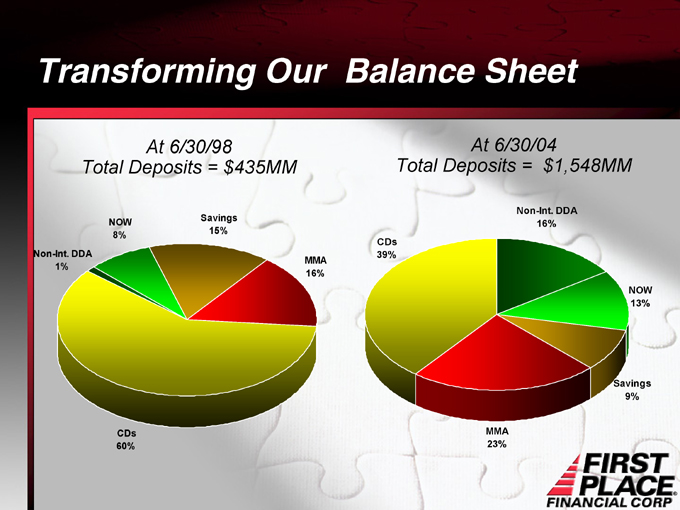

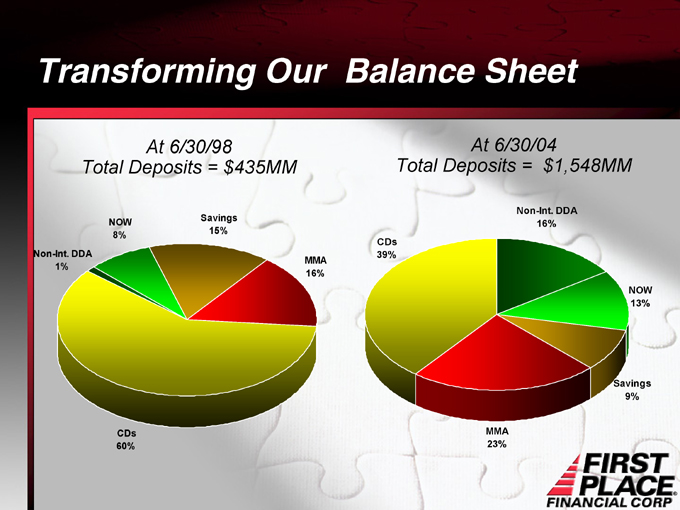

Transforming Our Balance Sheet

At 6/30/98 Total Deposits = $435MM

Savings 15%

MMA 16%

CDs 60%

Non-Int. DDA

1%

NOW 8%

At 6/30/04

Total Deposits = $1,548MM

Non-Int. DDA

16%

NOW 13%

Savings 9%

MMA 23%

CDs 39%

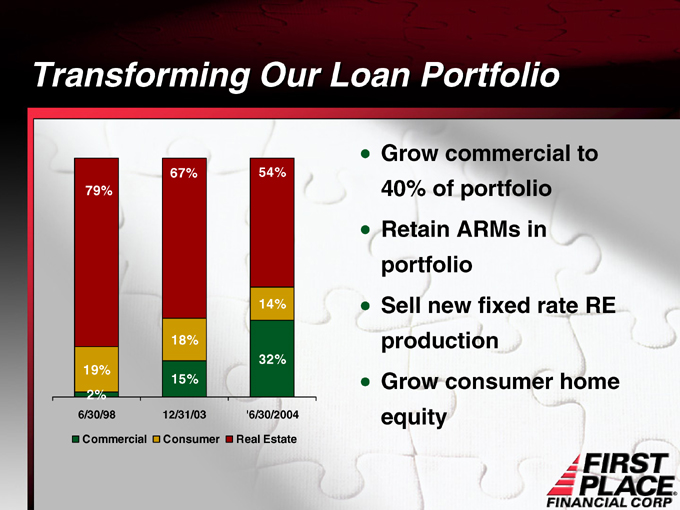

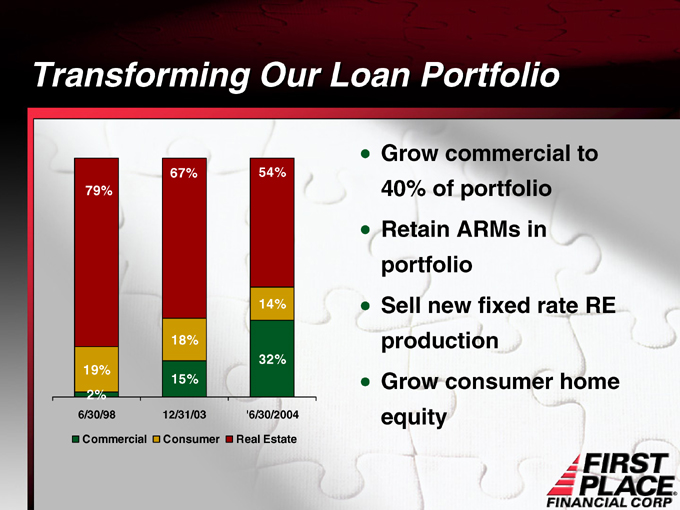

Transforming Our Loan Portfolio

Commercial Consumer Real Estate

79%

19% 2%

6/30/98

67%

18%

15%

12/31/03

54%

14%

32%

’6/30/2004

Grow commercial to 40% of portfolio

Retain ARMs in portfolio

Sell new fixed rate RE production

Grow consumer home equity

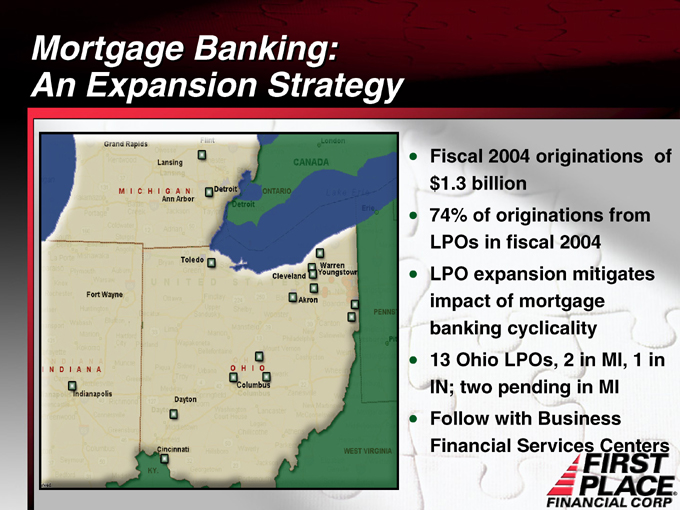

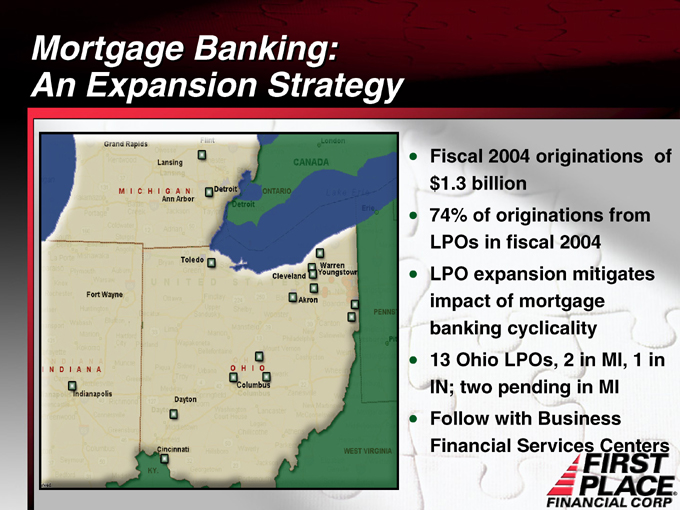

Mortgage Banking: An Expansion Strategy

Fiscal 2004 originations of $1.3 billion

74% of originations from LPOs in fiscal 2004

LPO expansion mitigates impact of mortgage banking cyclicality

13 Ohio LPOs, 2 in MI, 1 in IN; two pending in MI

Follow with Business Financial Services Centers

Business Financial Centers

Identify strong MSAs

Solon office opened in November, 2003

Bank-within-a-bank concept

Focuses on high net worth individuals, business owners, professionals

Team approach to meeting complex banking needs

Financial Performance

Delivering Strong Performance

Fiscal year ending June 30th (Dollars in millions)

ASSETS

1999 $747

2000 $1,052

2001 $1,593

2002 $1,591

2003 $1,559

2004 $2,247

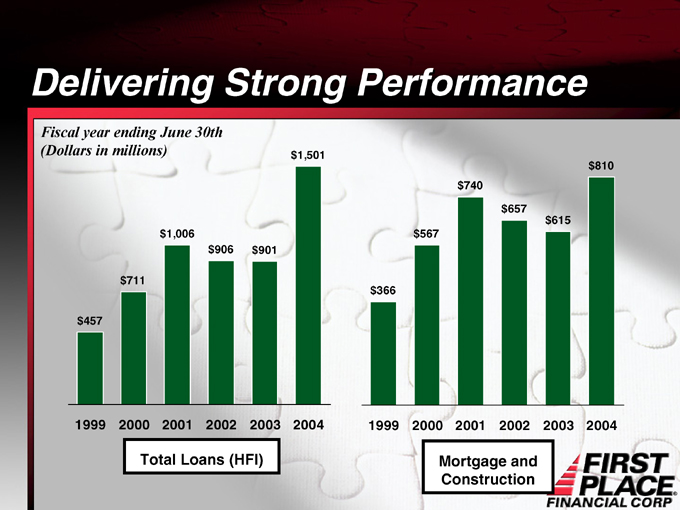

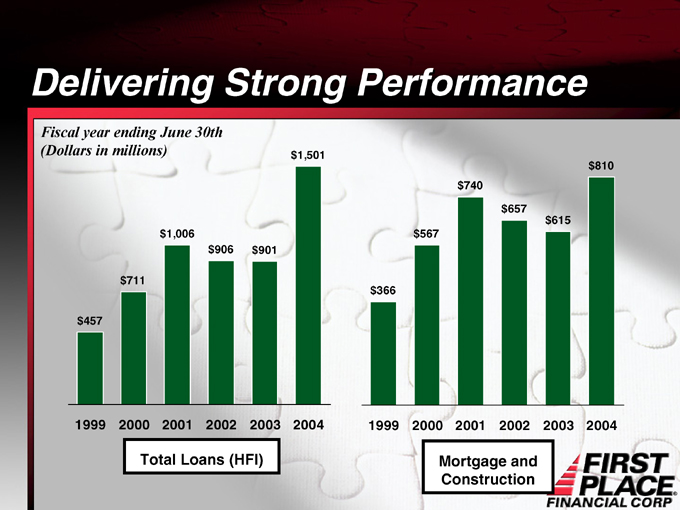

Delivering Strong Performance

Fiscal year ending June 30th (Dollars in millions)

$457

$711

$1,006

$906

$901

$1,501

1999 2000 2001 2002 2003 2004

Total Loans (HFI)

$366

$567

$740

$657

$615

$810

1999 2000 2001 2002 2003 2004

Mortgage and Construction

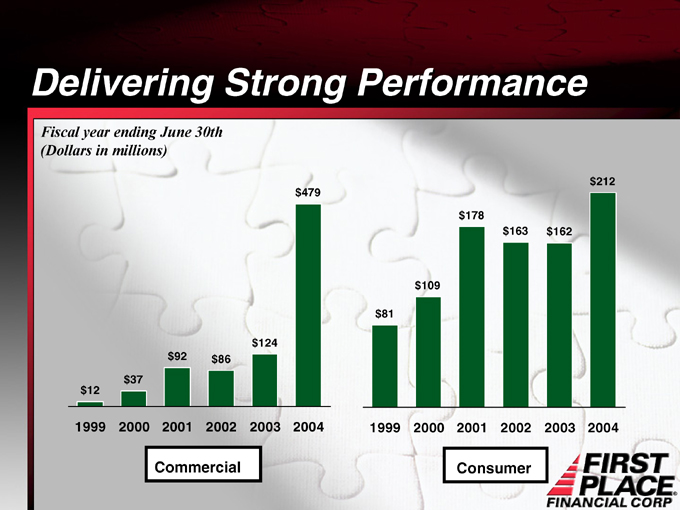

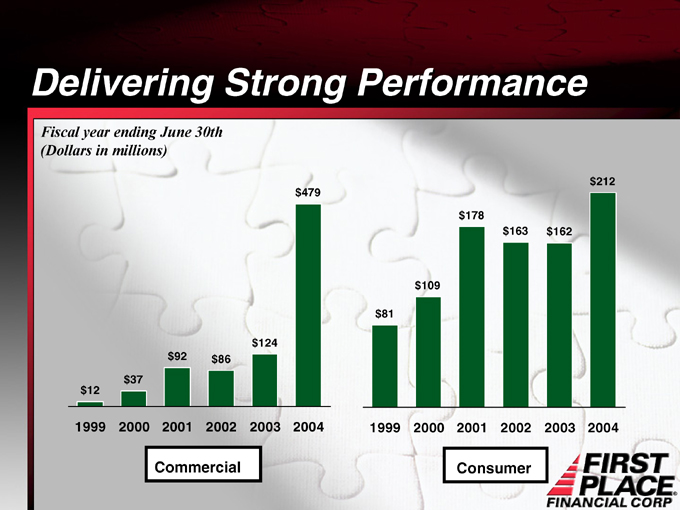

Delivering Strong Performance

Fiscal year ending June 30th (Dollars in millions)

$479

$124

$92

$86

$37

$12

Commercial

1999 2000 2001 2002 2003 2004

$212

$178

$163

$162

$109

$81

1999 2000 2001 2002 2003 2004

Consumer

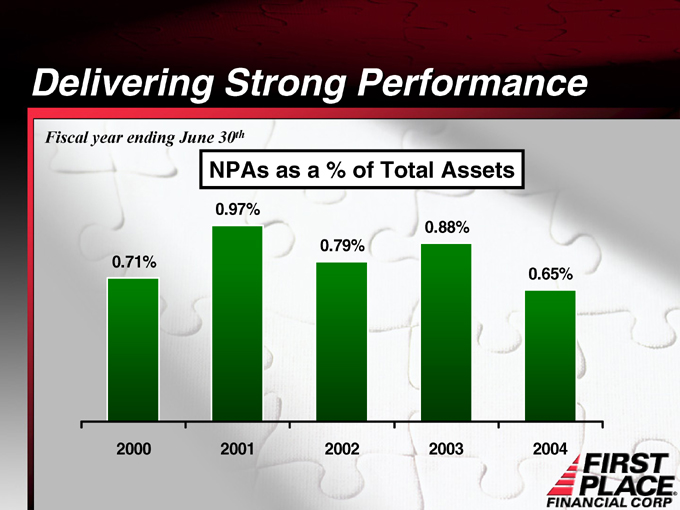

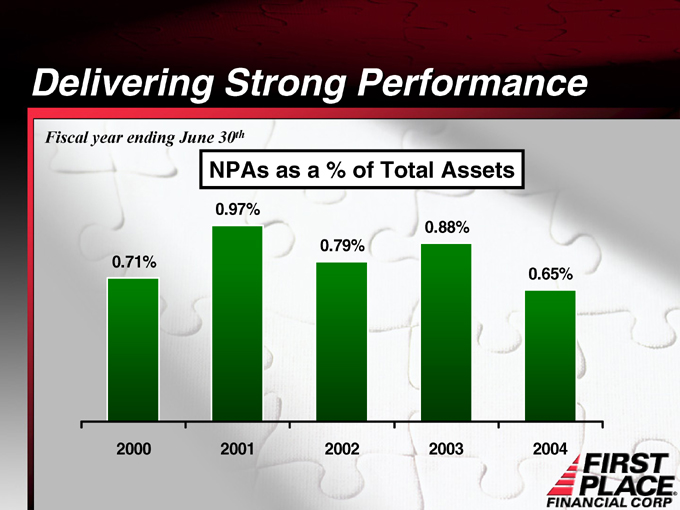

Delivering Strong Performance

Fiscal year ending June 30th

NPAs as a % of Total Assets

0.97%

0.88%

0.79%

0.71%

0.65%

2000 2001 2002 2003 2004

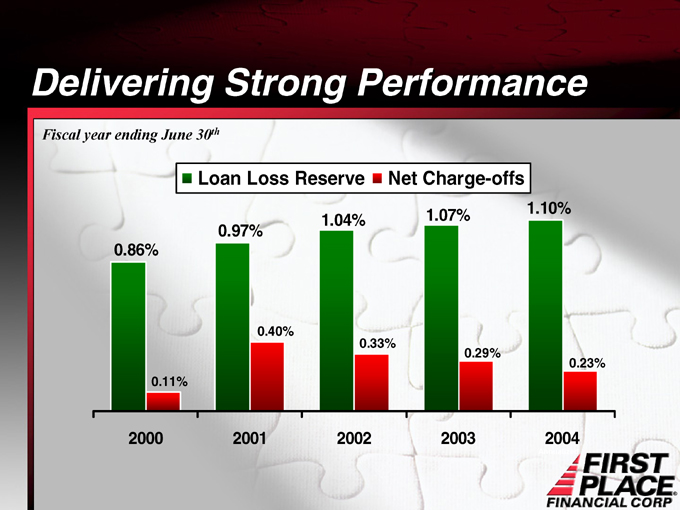

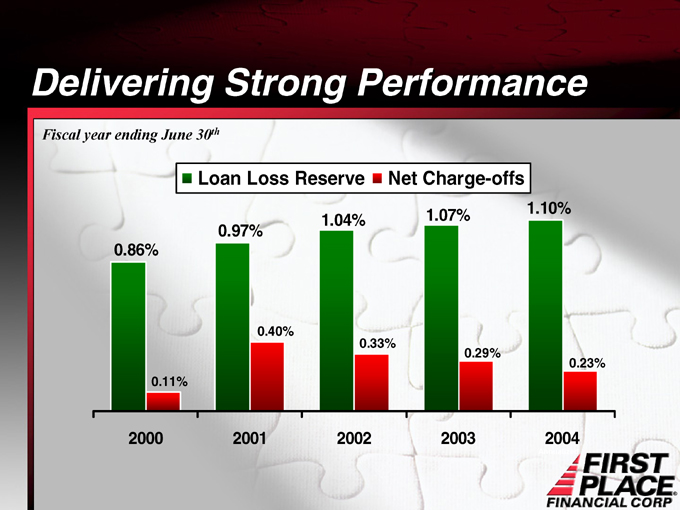

Delivering Strong Performance

Fiscal year ending June 30th

Loan Loss Reserve Net Charge-offs

1.07% 1.10%

1.04%

0.97%

0.86%

0.40%

0.33%

0.29%

0.23%

0.11%

2000 2001 2002 2003 2004

Annualized

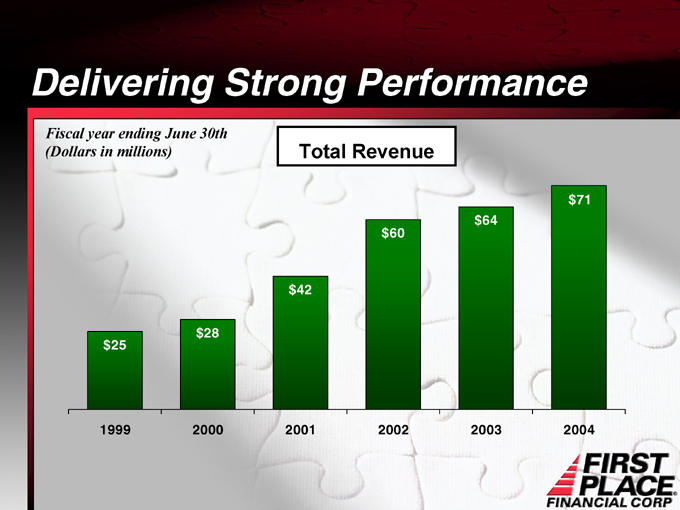

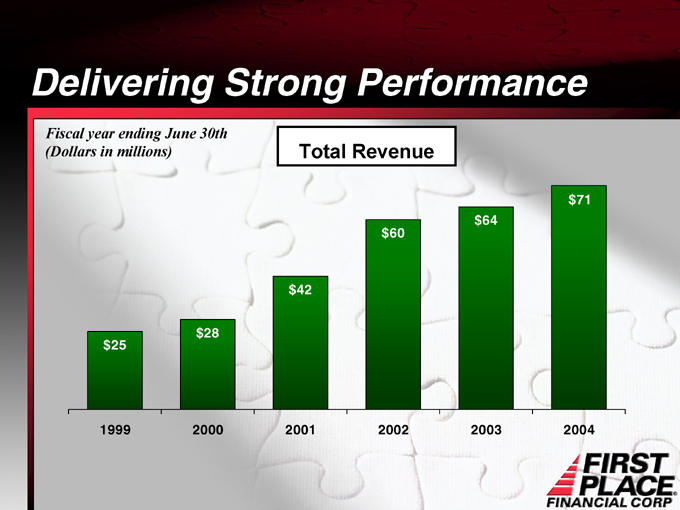

Delivering Strong Performance

Fiscal year ending June 30th (Dollars in millions)

Total Revenue

$71

$64

$60

$42

$28

$25

1999 2000 2001 2002 2003 2004

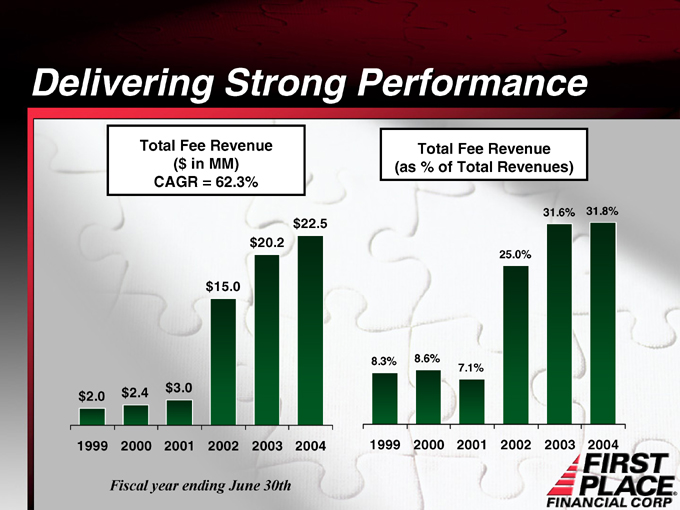

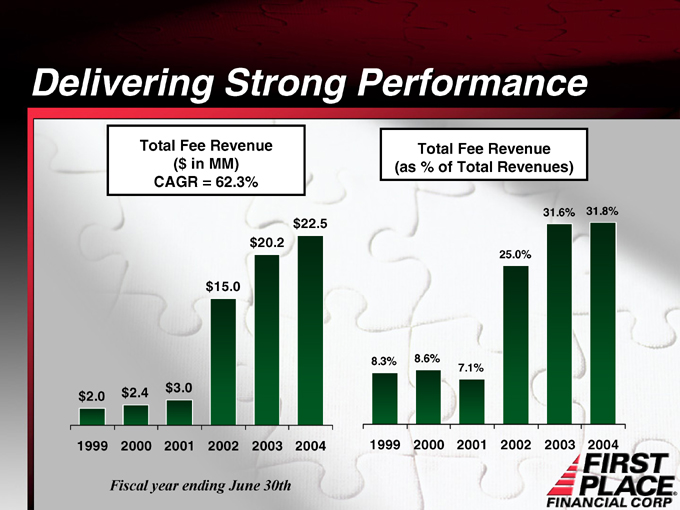

Delivering Strong Performance

Total Fee Revenue ($ in MM) CAGR = 62.3%

$22.5

$20.2

$15.0

$2.4 $3.0

$2.0

1999 2000 2001 2002 2003 2004

Fiscal year ending June 30th

Total Fee Revenue (as % of Total Revenues)

31.6% 31.8%

25.0%

8.3% 8.6%

7.1%

1999 2000 2001 2002 2003 2004

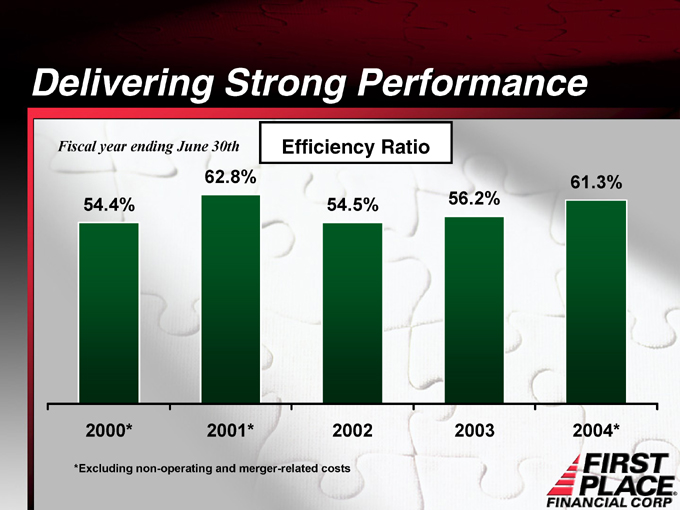

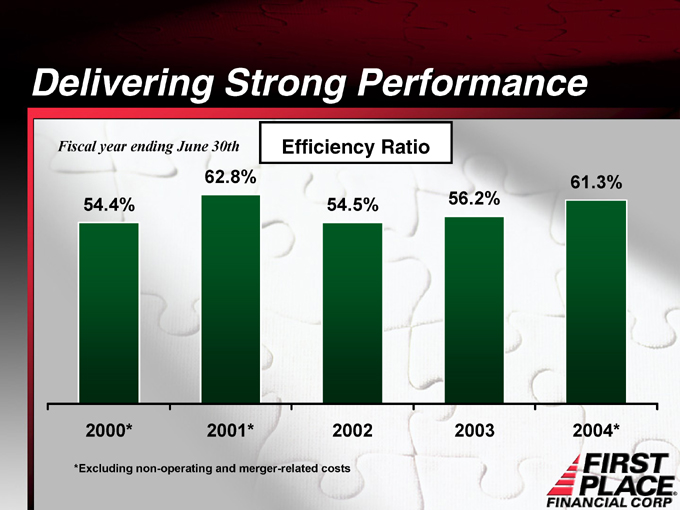

Delivering Strong Performance

Fiscal year ending June 30th

Efficiency Ratio

62.8% 61.3%

54.4% 54.5% 56.2%

2000* 2001* 2002 2003 2004*

*Excluding non-operating and merger-related costs

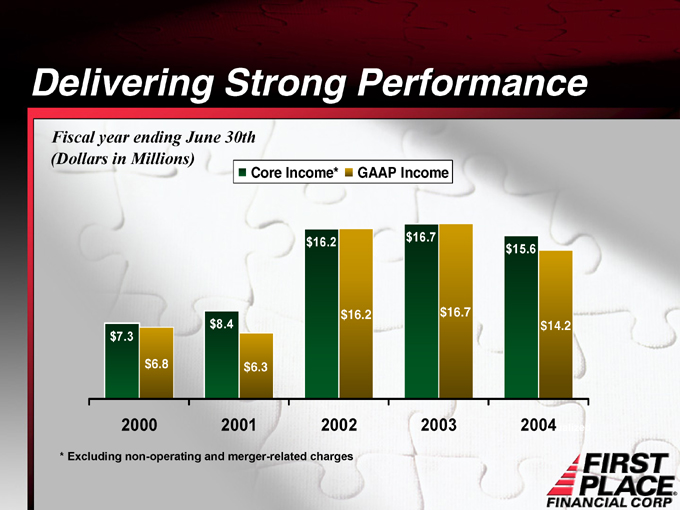

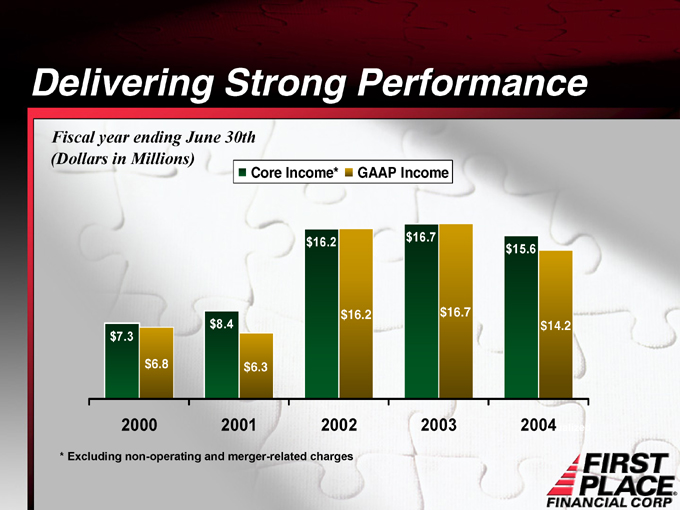

Delivering Strong Performance

Fiscal year ending June 30th (Dollars in Millions)

Core Income* GAAP Income

$16.2 $16.7

$15.6

$16.2 $16.7

$8.4 $14.2

$7.3

$6.8 $6.3

2000 2001 2002 2003 2004

Annualized

* Excluding non-operating and merger-related charges

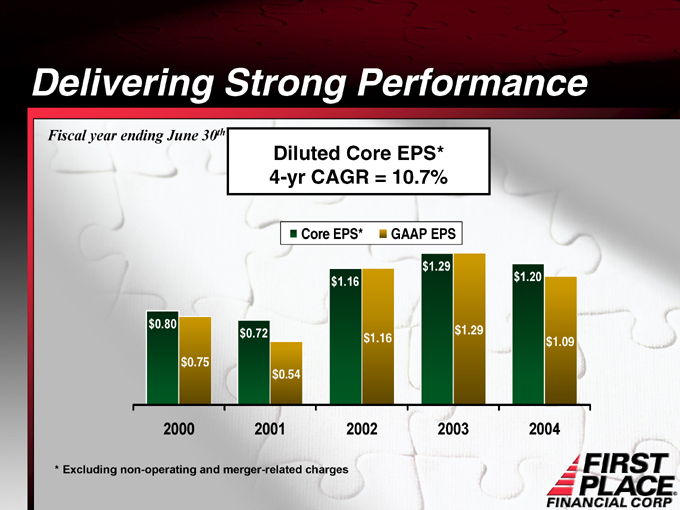

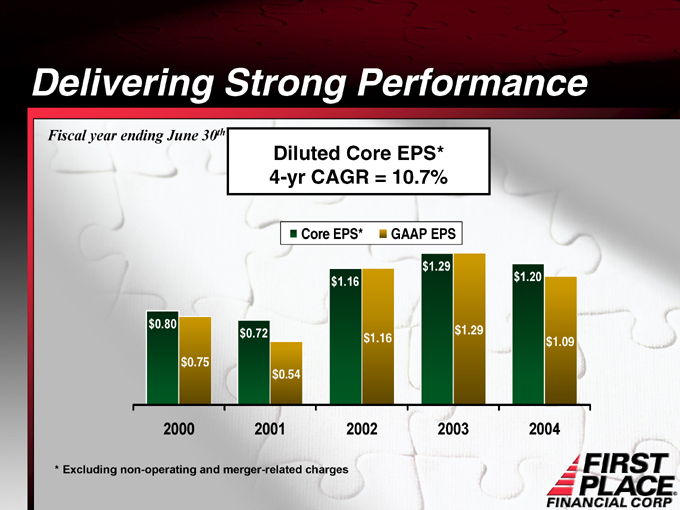

Delivering Strong Performance

Fiscal year ending June 30th

Diluted Core EPS* 4-yr CAGR = 10.7%

Core EPS* GAAP EPS

$1.29

$1.16 $1.20

$0.80 $1.29

$0.72 $1.16

$1.09

$0.75

$0.54

2000 2001 2002 2003 2004

* Excluding non-operating and merger-related charges

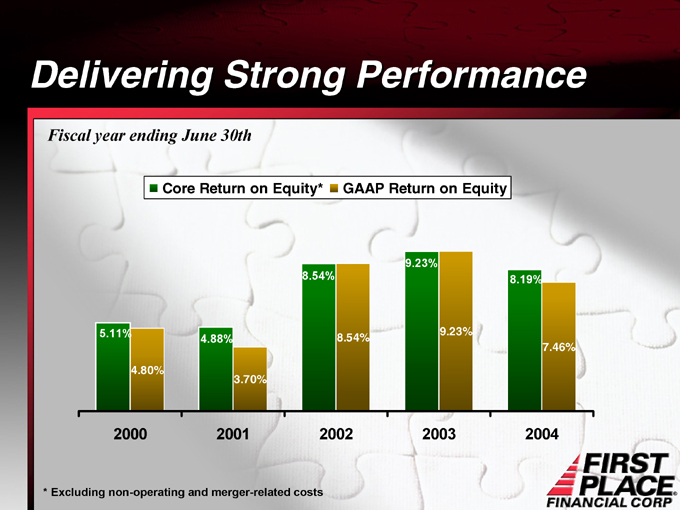

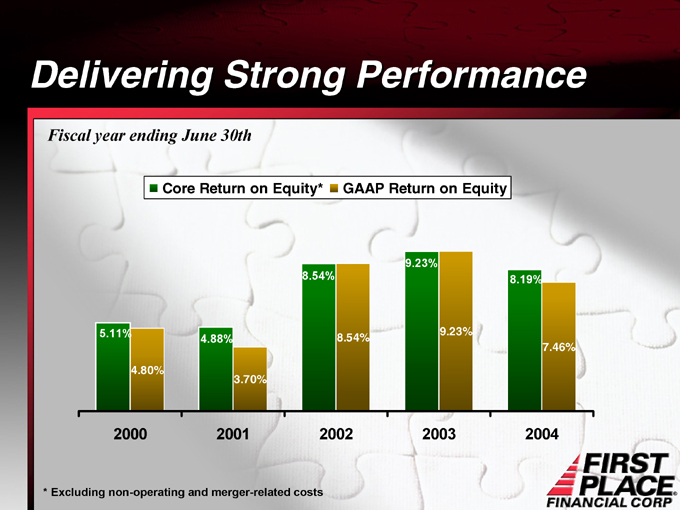

Delivering Strong Performance

Fiscal year ending June 30th

Core Return on Equity* GAAP Return on Equity

9.23%

8.54% 8.19%

5.11% 9.23%

4.88% 8.54%

7.46%

4.80%

3.70%

2000 2001 2002 2003 2004

* Excluding non-operating and merger-related costs

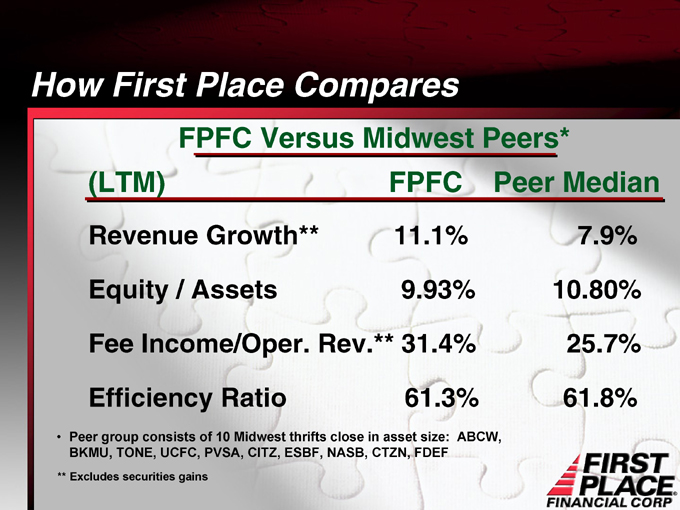

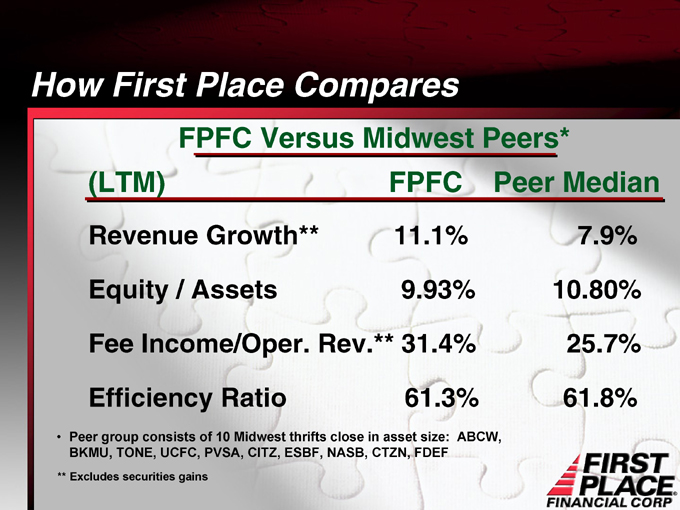

How First Place Compares

FPFC Versus Midwest Peers*

(LTM) FPFC Peer Median

Revenue Growth** 11.1% 7.9%

Equity / Assets 9.93% 10.80%

Fee Income/Oper. Rev.** 31.4% 25.7%

Efficiency Ratio 61.3% 61.8%

• Peer group consists of 10 Midwest thrifts close in asset size: ABCW, BKMU, TONE, UCFC, PVSA, CITZ, ESBF, NASB, CTZN, FDEF

** Excludes securities gains

Key Investment Appeals

Transitioning to commercial bank portfolio

Expanding into new markets and business lines

Strong mortgage banking expertise with

significant market share

Capital base to support diversification and growth

Proven merger experience

Unique organic growth model (Bank within a Bank)

Achieve Our Objectives