Exhibit 13

2004 ANNUAL REPORT

SCALING NEW HEIGHTS

FIRST PLACE FINANCIAL CORP.

2004 ANNUAL REPORT

FIRST PLACE FINANCIAL CORP.

SCALING NEW HEIGHTS

First Place Financial Corp.

185 East Market Street

P.O. Box 551

Warren, OH

44482-0551

Shareholder Letter

This past year has been an exciting and challenging one for First Place Financial Corp. We have made great strides over the past twelve months putting in place powerful strategic programs to accelerate the realization of our goal: delivering ongoing superior financial performance for our shareholders. As we move into 2005, we look forward to scaling new heights.

A lot has changed for First Place in the past five years. Once a traditional savings and loan with roots in two Ohio counties … today we have grown to provide a full range of commercial and household financial services in four Midwestern states.

We have dramatically expanded our business lines and geography to position your company for future performance.

Importantly, we have expanded services and product lines and added experienced high caliber banking industry professionals to our corporation. Mega bank consolidation is continuing, creating unique opportunities for First Place to enhance its market strength in the Midwest as a leading independent financial services corporation. Expansion into key Ohio markets continues, improving the bank’s overall mortgage and business lending opportunities.

This past year we added two loan production offices, one in Ohio and one in Indiana. We also acquired two in Michigan and introduced a wholesale mortgage banking program, which combined, generate a healthy level of mortgage loan volume. This year, we originated over $1.3 billion, an increase of 30% over the previous year, despite the slowdown in the mortgage market nationwide.

Our long term goal is to create a viable and profitable First Place presence in the Midwest by greatly expanding our mortgage and commercial lending programs into additional cities. We have identified strong growth markets and have positioned ourselves for the possibility of expanding our “bank within a bank” concept into many of these areas. This year we transitioned our first loan origination office into a fully-integrated, full-service financial center in Solon, Ohio. This office serves as our prototype as we enter new growth markets for the delivery of financial services and private banking programs to entrepreneurs, professionals and executives. In the fall of this year, we will be transitioning our North Olmsted office, and by the end of the fiscal year, our office in Columbus, Ohio.

We continue to grow our complementary non-bank affiliates with our recent acquisition of the Weigel, Lackey & Ross Agency, who specialize in employee benefit programs for individuals and businesses; which include life and health insurance, group dental programs and retirement plans.

Simultaneous to growing our Ohio banking base, we have taken the critical step of expanding our First Place footprint beyond Ohio with the strategic acquisition of Southeast Michigan based Franklin Bank. As a result of this acquisition, we have gained an abundance of low cost core deposits plus a powerful array of business product offerings. This will go a long way in satisfying the needs of our growing customer base of small and medium size business customers throughout the First Place Midwest marketing areas.

2004 Financial Performance

This year, our total return to shareholders was a respectable 9.43%. This consisted of an increase of $1.09 in market value and $0.56 in dividends. 1.10%

1.07%

104%

First Place Financial Corp. reported net income for the fiscal year ended June 30, 2004 of 0.97% $14.2 million compared with $16.7 million reported for the fiscal year ended June 30, 0.86% 2003. Diluted earnings per share were $1.09 compared to $1.29 reported last year. Return on average equity and return on average assets for fiscal 2004 were 7.46% and 0.83% compared with 9.23% and 1.08% for fiscal 2003. Earnings reflect the inclusion of $4.3 million of pre-tax expenses ($2.8 million after-tax) related to the acquisition of Franklin Bancorp Inc., which was completed on May 28, 2004. These costs were $0.22 per diluted share. Without these costs, net income for the current year would have exceeded the prior year whether measured in total dollars or on a per share basis.

0.40% 0.33% 0.29% 0.23% 0.11%

2000 2001 2002 2003 2004

Our asset quality continues to improve and remains at very acceptable levels, despite the slow recovery of our Northeast Ohio marketplace. Net charge-offs as a percent of total loans have declined for the third year in a row to 0.23% down 42% from the 2001 level. Also, non-performing assets continue to decline and as of June 30th represent just .65% of assets, a decline of more than 26% from the previous year. While charge-offs and non-performing assets have declined, the allowance for loan losses has increased to 1.10% of total loans from 1.07% in the prior year to reflect a shift in the loan portfolio composition, recognizing the substantial increase in commercial loans.

Loan Loss Reserve Net Charge-Offs

Who is Franklin Bank?

The new thinking in banking for business.That’s who. Due in part to their powerful marketing program, Franklin has expanded their deposit base to over 14,000 Southeast Michigan business customers. Now they’ll be expanding their product offerings as well – bringing the First Place retail product mix to consumers in affluent Oakland and Wayne Counties.

As Franklin introduces its new consumer programs they are also introducing new loan production offices with recent openings in Grand Blanc and Northville, Michigan. These offices are staffed with experienced loan professionals to drive growth in our commercial real estate portfolio.

The Franklin acquisition provides First Place with an outstanding opportunity to grow its overall coverage area and enhance its stream of low cost deposits while dramatically accelerating the scope of its commercial loan activity. Additionally, the acquisition provides First Place with a successful business model to follow as we launch business financial products throughout the Midwest.

Importantly, Franklin’s President, Craig Johnson, has joined the First Place management team. Mr. Johnson brings twenty plus years in commercial banking to First Place.

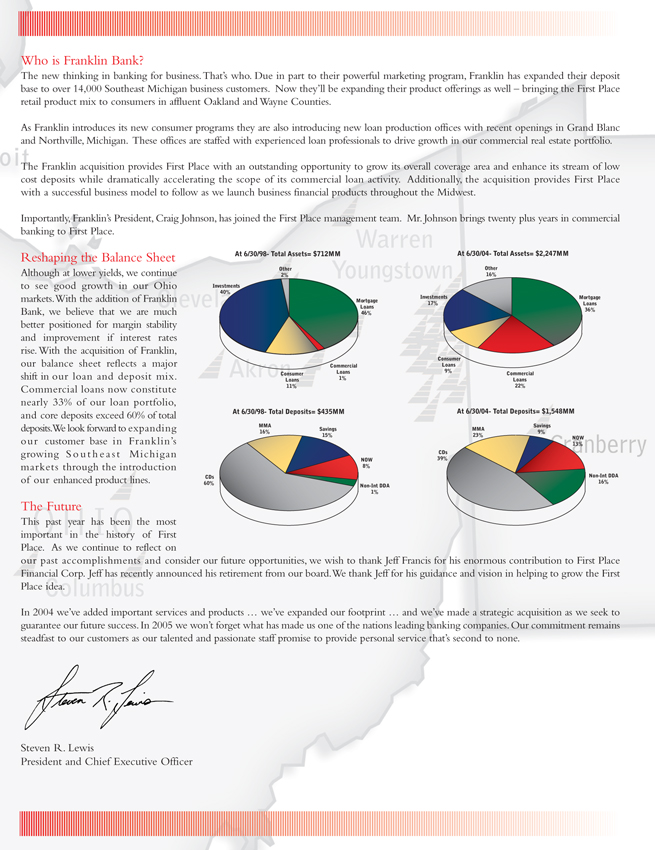

Reshaping the Balance Sheet At 6/30/98- Total Assets= $712MM At 6/30/04- Total Assets= $2,247MM

Other Other

Although at lower yields, we continue 2% 16% to see good growth in our Ohio Investments

40%

markets.With the addition of Franklin Investments Mortgage

Mortgage

17% Loans Loans 36%

Bank, we believe that we are much 46% better positioned for margin stability and improvement if interest rates rise. With the acquisition of Franklin,

Consumer

our balance sheet reflects a major Commercial Loans

Loans 9%

shift in our loan and deposit mix. Consumer Commercial

Loans 1% Loans

Commercial loans now constitute 11% 22% nearly 33% of our loan portfolio,

At 6/30/98- Total Deposits= $435MM At 6/30/04- Total Deposits= $1,548MM

and core deposits exceed 60% of total

MMA Savings

deposits.We look forward to expanding Savings MMA

16% 9% 15% 23%

our customer base in Franklin’s NOW

13%

growing S o u t h e a s t Michigan CDs

NOW 39%

markets through the introduction 8%

CDs Non-Int. DDA

of our enhanced product lines. 60% 16%

Non-Int. DDA

1%

The Future

This past year has been the most important in the history of First Place. As we continue to reflect on our past accomplishments and consider our future opportunities, we wish to

thank Jeff Francis for his enormous contribution to First Place Financial Corp. Jeff has recently announced his retirement from our board.We thank Jeff for his guidance and vision in helping to grow the First Place idea.

In 2004 we’ve added important services and products … we’ve expanded our footprint … and we’ve made a strategic acquisition as we seek to guarantee our future success. In 2005 we won’t forget what has made us one of the nations leading banking companies. Our commitment remains steadfast to our customers as our talented and passionate staff promise to provide personal service that’s second to none.

Steven R. Lewis

President and Chief Executive Officer

Management’s Discussion and Analysis of Financial Condition and Results of Operations

Selected Financial and Other Data

| | | | | | | | | | | | | | | | |

| | | At June 30,

|

| | | 2004

| | 2003

| | 2002

| | | 2001

| | 2000

|

| |

| | | (Dollars in thousands) |

Selected Financial Condition Data: | | | | | | | | | | | | | | | | |

| | | | | |

Total assets | | $ | 2,247,080 | | $ | 1,558,613 | | $ | 1,590,935 | | | $ | 1,592,787 | | $ | 1,051,577 |

Loans receivable, net | | | 1,483,993 | | | 891,842 | | | 896,541 | | | | 996,586 | | | 705,066 |

Loans held for sale | | | 47,465 | | | 65,695 | | | 16,471 | | | | 14,259 | | | 13,071 |

Allowance for loan losses | | | 16,528 | | | 9,603 | | | 9,456 | | | | 9,757 | | | 6,150 |

Nonperforming assets | | | 14,643 | | | 13,774 | | | 12,566 | | | | 15,384 | | | 7,416 |

Securities available for sale | | | 378,248 | | | 346,429 | | | 462,927 | | | | 415,270 | | | 249,638 |

Deposits | | | 1,548,011 | | | 1,108,450 | | | 1,061,393 | | | | 1,018,829 | | | 586,748 |

Borrowings | | | 414,249 | | | 235,952 | | | 247,546 | | | | 263,528 | | | 227,762 |

Repurchase agreements | | | 31,108 | | | 9,547 | | | 63,705 | | | | 91,064 | | | 75,000 |

Total shareholders’ equity | | | 223,110 | | | 182,681 | | | 185,275 | | | | 194,036 | | | 147,975 |

| |

| | | For the Years Ended June 30,

|

| | | 2004

| | 2003

| | 2002

| | | 2001

| | 2000

|

| |

| | | (Dollars in thousands) |

Summary of Earnings: | | | | | | | | | | | | | | | | |

| | | | | |

Total interest income | | $ | 85,773 | | $ | 87,394 | | $ | 105,073 | | | $ | 98,018 | | $ | 58,506 |

Total interest expense | | | 37,605 | | | 43,296 | | | 60,421 | | | | 59,463 | | | 32,657 |

| | |

|

| |

|

| |

|

|

| |

|

| |

|

|

Net interest income | | | 48,168 | | | 44,098 | | | 44,652 | | | | 38,555 | | | 25,849 |

| | | | | |

Provision for loan losses | | | 4,896 | | | 2,864 | | | 2,990 | | | | 3,125 | | | 2,294 |

| | |

|

| |

|

| |

|

|

| |

|

| |

|

|

Net interest income after provision for loan losses | | | 43,272 | | | 41,234 | | | 41,662 | | | | 35,430 | | | 23,555 |

| | | | | |

Total noninterest income (1) | | | 22,510 | | | 20,207 | | | 15,007 | | | | 3,020 | | | 2,447 |

| | | | | |

Total noninterest expense (2) (3) | | | 45,333 | | | 36,723 | | | 32,648 | | | | 30,224 | | | 15,890 |

| | |

|

| |

|

| |

|

|

| |

|

| |

|

|

| | | | | |

Income before income tax and minority interest | | | 20,449 | | | 24,718 | | | 24,021 | | | | 8,226 | | | 10,112 |

| | | | | |

Provision for income tax | | | 6,214 | | | 7,947 | | | 7,812 | | | | 1,912 | | | 3,298 |

| | | | | |

Minority interest in income (loss) of consolidated subsidiary | | | 84 | | | 79 | | | (21 | ) | | | - | | | - |

| | |

|

| |

|

| |

|

|

| |

|

| |

|

|

| | | | | |

Net income | | $ | 14,151 | | $ | 16,692 | | $ | 16,230 | | | $ | 6,314 | | $ | 6,814 |

| | |

|

| |

|

| |

|

|

| |

|

| |

|

|

| (1) | For the year ended June 30, 2001, noninterest income included $4.8 million in restructuring losses associated with the merger with FFY Financial Corp. |

| (2) | For the year ended June 30, 2001, noninterest expense included merger, integration and restructuring charges of $3.9 million for the merger with FFY Financial Corp. |

| (3) | For the year ended June 30, 2004, noninterest expense included merger, integration and restructuring expense of $2.2 million for the merger with Franklin Bancorp Inc. |

1

Management’s Discussion and Analysis of Financial Condition and Results of Operations

| | | | | | | | | | | | | | | | | | | | |

| | | For the Years Ended June 30,

| |

| | | 2004

| | | 2003

| | | 2002

| | | 2001

| | | 2000

| |

Selected Financial Ratios and Other Data: | | | | | | | | | | | | | | | | | | | | |

| | | | | |

Performance Ratios (1): | | | | | | | | | | | | | | | | | | | | |

Return on average assets | | | 0.83 | % | | | 1.08 | % | | | 0.99 | % | | | 0.47 | % | | | 0.83 | % |

Return on average equity | | | 7.46 | | | | 9.23 | | | | 8.54 | | | | 3.70 | | | | 4.80 | |

Interest rate spread | | | 2.99 | | | | 2.98 | | | | 2.61 | | | | 2.54 | | | | 2.39 | |

Net interest margin, fully taxable equivalent | | | 3.20 | | | | 3.21 | | | | 3.01 | | | | 3.16 | | | | 3.25 | |

Noninterest expense to average assets | | | 2.65 | | | | 2.38 | | | | 1.99 | | | | 2.26 | | | | 1.94 | |

Efficiency ratio | | | 63.28 | | | | 56.24 | | | | 54.49 | | | | 67.68 | | | | 56.03 | |

Average interest-earning assets to average interest-bearing liabilities | | | 108.27 | | | | 108.69 | | | | 110.38 | | | | 113.11 | | | | 121.29 | |

Dividend payout ratio | | | 51.38 | | | | 38.76 | | | | 43.10 | | | | 64.81 | | | | 44.00 | |

| | | | | |

Capital Ratios: | | | | | | | | | | | | | | | | | | | | |

Equity to total assets at end of period | | | 9.93 | | | | 11.72 | | | | 11.65 | | | | 12.19 | | | | 14.07 | |

Average equity to average assets | | | 11.09 | | | | 11.74 | | | | 11.61 | | | | 12.79 | | | | 17.34 | |

Tangible capital to adjusted total assets (2) | | | 7.25 | | | | 8.20 | | | | 8.27 | | | | 7.94 | | | | 8.75 | |

Tier 1 capital to adjusted total assets (2) | | | 7.25 | | | | 8.20 | | | | 8.27 | | | | 7.94 | | | | 8.75 | |

Tier 1 capital to risk weighted assets (2) | | | 10.48 | | | | 13.12 | | | | 14.89 | | | | 12.43 | | | | 14.46 | |

Total capital to risk weighted assets (2) | | | 12.07 | | | | 14.03 | | | | 15.97 | | | | 13.05 | | | | 15.27 | |

| | | | | |

Asset Quality Ratios: | | | | | | | | | | | | | | | | | | | | |

Nonperforming assets as a percent of total assets | | | 0.65 | | | | 0.88 | | | | 0.79 | | | | 0.97 | | | | 0.71 | |

Allowance for loan losses as a percent of loans | | | 1.10 | | | | 1.07 | | | | 1.04 | | | | 0.97 | | | | 0.86 | |

Net charge-offs to average loans | | | 0.23 | | | | 0.29 | | | | 0.33 | | | | 0.40 | | | | 0.11 | |

Allowance for loan losses as a percent of nonperforming loans | | | 142.01 | | | | 75.15 | | | | 81.11 | | | | 67.60 | | | | 93.67 | |

| | | | | |

Per Share Data: | | | | | | | | | | | | | | | | | | | | |

Basic earnings per share | | $ | 1.11 | | | $ | 1.31 | | | $ | 1.18 | | | $ | 0.54 | | | $ | 0.75 | |

Diluted earnings per share | | | 1.09 | | | | 1.29 | | | | 1.16 | | | | 0.54 | | | | 0.75 | |

Dividends declared per common share | | | 0.56 | | | | 0.50 | | | | 0.50 | | | | 0.35 | | | | 0.33 | |

Tangible book value per share at year end | | | 9.83 | | | | 11.97 | | | | 11.56 | | | | 11.39 | | | | 13.84 | |

| (1) | For the year ended June 30, 2001, the ratios include $4.8 million in restructuring losses and $3.9 million in merger, integration and restructuring charges associated with the merger with FFY Financial Corp. For the year ended June 30, 2004 the ratios include $2.2 million in merger, integration and restructuring charges associated with the merger with Franklin Bancorp Inc. |

| (2) | Regulatory capital ratios as of June 30, 2004 are the combined ratios for First Place Bank and Franklin Bank. |

2

Management’s Discussion and Analysis of Financial Condition and Results of Operations

General

First Place Financial Corp. (Company) was formed as a thrift holding company as a result of the conversion of First Place Bank (Bank), formerly known as First Federal Savings and Loan Association of Warren, from a federally-chartered mutual savings and loan association to a federally-chartered stock savings association in December of 1998.

On May 12, 2000, the Company acquired The Ravenna Savings Bank (Ravenna) in a tax-free exchange accounted for as a purchase. The Company reissued treasury stock valued at $23.9 million on the date the transaction was consummated to acquire all of the outstanding shares of Ravenna. At the date of acquisition, Ravenna was merged into the Bank.

On December 22, 2000, the Company completed the merger of equals transaction with FFY Financial Corp. (FFY). FFY was merged into the Company and FFY’s thrift subsidiary FFY Bank, was merged into the Bank. The Company issued 6,873,423 shares of common stock valued at approximately $68.3 million in the transaction with FFY. The transaction was recorded as a purchase and, accordingly, the operating results of FFY have been included in the Company’s consolidated financial statements since the date of acquisition.

The Company changed the name of its thrift subsidiary, First Federal Savings and Loan Association of Warren, to First Place Bank as part of the merger transaction with FFY.

On May 28, 2004, the Company acquired 100% of the common stock of Franklin Bancorp Inc. (Franklin) and merged Franklin into the Company. The consideration for the stock was approximately 50% cash based on $21.00 per share and 50% common stock of the Company exchanged at a ratio of 1.137 shares of First Place Financial Corp. for each share of Franklin. The cash consideration was approximately $39.815 million and the stock consideration consisted of approximately 2,156,000 shares valued at $40.765 million. Concurrent with the merger, Franklin’s wholly owned subsidiary, Franklin Bank N.A., converted from a national bank to a federally chartered thrift. As of June 30, 2004, both the Bank and Franklin Bank are wholly owned subsidiaries of the Company. The Bank had total assets of $1.677 billion and Franklin Bank had total assets of $615 million as of June 30, 2004. Effective July 2, 2004, First Place Bank and Franklin Bank were merged and will operate as a single federally-chartered stock savings association. The surviving corporation will be First Place Bank, although, it will continue to do business in Michigan under the name of Franklin Bank.

The Company is a community-oriented financial institution engaged primarily in gathering deposits to originate 1-4 family residential mortgage loans, commercial and consumer loans. The Company currently operates 27 retail locations and 16 loan production offices located in Ohio and Michigan.

Management’s discussion and analysis represents a review of the Company’s consolidated financial condition and results of operations. This review should be read in conjunction with the consolidated financial statements and footnotes. Dollars in the tables in the following sections are in thousands except per share data.

Forward-Looking Statements

When used in this Annual Report, or in future filings with the Securities and Exchange Commission, in press releases or other public or shareholder communications, or in oral statements made with the approval of an authorized executive officer, the words or phrases “will likely result”, “are expected to”, “will continue”, “is anticipated”, “estimate”, “project” or similar expressions are intended to identify “forward-looking statements” within the meaning of the Private Securities Litigation Reform Act of 1995. Such forward-looking statements involve known and unknown risks, uncertainties and other factors, which may cause the Company’s actual results to be materially different from those indicated. Such statements are subject to certain risks and uncertainties including changes in economic conditions in the market areas the Company conducts business, which could materially impact credit quality trends, changes in laws, regulations or policies of regulatory agencies, fluctuations in interest rates, demand for loans in the market areas the Company conducts business, and competition, that could cause actual results to differ materially from historical earnings and those presently anticipated or projected. The Company wishes to caution readers not to place undue reliance on any such forward-looking statements, which speak only as of the date made. The Company

3

Management’s Discussion and Analysis of Financial Condition and Results of Operations

undertakes no obligation to publicly release the result of any revisions that may be made to any forward-looking statements to reflect events or circumstances after the date of such statements or to reflect the occurrence of anticipated or unanticipated events.

Financial Condition

General. Assets at June 30, 2004 totaled $2.247 billion compared to $1.559 billion at June 30, 2003, an increase of $688 million or 44.2%. The increase was due primarily to the acquisition of Franklin Bancorp Inc. and its subsidiary Franklin Bank as of May 28, 2004. Franklin had assets of $627 million as of May 28, 2004. The following table indicates what portion of the change in First Place’s assets, liabilities and equity was due to the Franklin acquisition. Fair value adjustments and purchase accounting entries that have been pushed down to Franklin Bank are included with the Franklin Acquisition column. Explanations of changes in individual categories follow the table.

Analysis of change in asset and liability categories

| | | | | | | | | | | | | |

| | | Balance

June 30, 2003

| | Franklin

Acquisition

May 28, 2004

| | All

Other

Activity

| | | Balance

June 30, 2004

|

ASSETS | | | | | | | | | | | | | |

Cash and due from banks | | $ | 32,206 | | $ | 48,849 | | $ | (13,705 | ) | | $ | 67,350 |

Interest-bearing deposits in other banks | | | 1,650 | | | 76,385 | | | (34,134 | ) | | | 43,901 |

Securities available for sale | | | 346,429 | | | 51,870 | | | (20,051 | ) | | | 378,248 |

Loans held for sale | | | 65,695 | | | 13,015 | | | (31,245 | ) | | | 47,465 |

Loans | | | 901,445 | | | 348,286 | | | 250,790 | | | | 1,500,521 |

Less, allowance for loan losses | | | 9,603 | | | 4,506 | | | 2,419 | | | | 16,528 |

| | |

|

| |

|

| |

|

|

| |

|

|

Loans, net | | | 891,842 | | | 343,780 | | | 248,371 | | | | 1,483,993 |

Federal Home Loan Bank stock | | | 22,523 | | | 5,947 | | | 915 | | | | 29,385 |

Premises and equipment, net | | | 19,766 | | | 2,586 | | | 41 | | | | 22,393 |

Goodwill | | | 18,407 | | | 35,723 | | | 1,218 | | | | 55,348 |

Core deposits and other intangibles | | | 4,902 | | | 15,274 | | | (1,263 | ) | | | 18,913 |

Other assets | | | 155,193 | | | 33,977 | | | (89,086 | ) | | | 100,084 |

| | |

|

| |

|

| |

|

|

| |

|

|

Total assets | | $ | 1,558,613 | | $ | 627,406 | | $ | 61,061 | | | $ | 2,247,080 |

| | |

|

| |

|

| |

|

|

| |

|

|

LIABILITIES | | | | | | | | | | | | | |

Deposits | | | | | | | | | | | | | |

Non-interest bearing checking | | $ | 39,506 | | $ | 229,538 | | $ | (29,073 | ) | | $ | 239,971 |

Interest bearing checking | | | 73,125 | | | 129,529 | | | (4,497 | ) | | | 198,157 |

Savings | | | 135,819 | | | 156 | | | 5,269 | | | | 141,244 |

Money market | | | 298,788 | | | 54,602 | | | 6,125 | | | | 359,515 |

Certificates of deposit | | | 561,212 | | | 63,247 | | | (15,335 | ) | | | 609,124 |

| | |

|

| |

|

| |

|

|

| |

|

|

Total deposits | | | 1,108,450 | | | 477,072 | | | (37,511 | ) | | | 1,548,011 |

Securities sold under agreements to repurchase | | | 9,547 | | | - | | | 21,561 | | | | 31,108 |

Borrowings | | | 235,952 | | | 57,555 | | | 89,813 | | | | 383,320 |

Junior subordinated deferrable interest debentures held by affiliated trusts that issued guaranteed capital securities | | | - | | | - | | | 30,929 | | | | 30,929 |

| | | | |

Other liabilities | | | 21,983 | | | 10,476 | | | (1,857 | ) | | | 30,602 |

| | |

|

| |

|

| |

|

|

| |

|

|

Total liabilities | | | 1,375,932 | | | 545,103 | | | 102,935 | | | | 2,023,970 |

| | | | |

SHAREHOLDERS’ EQUITY | | | 182,681 | | | 82,303 | | | (41,874 | ) | | | 223,110 |

| | |

|

| |

|

| |

|

|

| |

|

|

Total liabilities and shareholders’ equity | | $ | 1,558,613 | | $ | 627,406 | | $ | 61,061 | | | $ | 2,247,080 |

| | |

|

| |

|

| |

|

|

| |

|

|

4

Management’s Discussion and Analysis of Financial Condition and Results of Operations

Loans. Total loans increased $600 million to $1.501 billion at June 30, 2004 from $901 million at June 30, 2003. The increase included $349 million from the Franklin acquisition and a $251 million net increase attributable to other activity during the year. The increase by type of loan included increases of $223 million in 1-4 family residential real estate loans, $335 million in commercial loans and $42 million in consumer loans. The Franklin acquisition included $39 million in 1-4 family residential real estate loans, $289 million in commercial loans and $21 million in consumer loans. The remaining net increases during the year were $184 million in 1-4 family residential real estate loans, $46 million in commercial loans and $21 million in consumer loans. At June 30, 2003, the loan portfolio was 64% residential real estate loans, 18% commercial loans and 18% consumer loans. The Franklin acquisition significantly increased the percentage of the portfolio invested in commercial loans. At June 30, 2004, the loan portfolio was 53% residential real estate loans, 33% commercial loans and 14% consumer loans. The Company intends to continue to increase commercial loans relative to residential real estate loans in order to increase the diversity of the loan portfolio.

The Company engages in mortgage banking as part of an overall strategy to deliver loan products to customers. As a result, the Company sells most fixed rate residential loans and some adjustable-rate residential loans. During fiscal 2004, the company originated $1.3 billion in 1-4 family residential loans and sold $0.9 billion compared to originations of $1.0 billion and sales of $0.7 billion in fiscal 2003. This increase was achieved through the addition of a loan production office, the hiring of additional commissioned loan officers and the addition of a wholesale department that purchases loans from independent originators and brokers.

Nonperforming Assets. Nonperforming assets consist of loans past due greater than 90 days, nonaccrual loans, restructured loans and repossessed assets. There were no loans at June 30, 2004 or at June 30, 2003 past due greater than 90 days and still accruing interest. Nonperforming assets totaled $14.6 million at June 30, 2004 compared to $13.8 million at June 30, 2003. At June 30, 2004, nonperforming assets consisted of $11.0 million in nonaccrual loans, $0.6 million in restructured loans and $3.0 million in repossessed assets. At June 30, 2003, nonperforming assets consisted of $11.6 million in nonaccrual loans, $1.2 million in restructured loans and $1.0 million of repossessed assets. While nonperforming assets increased $0.8 million during fiscal 2004, the ratio of nonperforming assets to total assets decreased to 0.65% at June 30, 2004, from 0.88% at June 30, 2003.

Allowance for Loan Losses. The allowance for loan losses represents management’s assessment of the estimated probable credit losses in the loan portfolio at each balance sheet date. All lending activity contains associated risks of loan losses. Management analyzes the adequacy of the allowance for loan losses regularly through reviews of the performance of the loan portfolio considering economic conditions, changes in interest rates and the effect of such changes on real estate values, changes in the composition of the loan portfolio, and trends in past due and nonperforming loans. The allowance for loan losses is a material estimate that is particularly susceptible to significant changes in the near term and is established through a provision for loan losses based on management’s evaluation of the risk inherent in the Company’s loan portfolio and the general economy. Such evaluation, which includes a review of all loans for which full collectibility may not be reasonably assured, considers among other matters, the estimated fair value of the underlying collateral, economic conditions, historical loan loss experience and other factors that management believes warrant recognition in providing for an appropriate loan loss allowance. In addition to the analysis and procedures just described, the Company utilizes an outside party to conduct an independent review of commercial and commercial real estate loans. The Company uses the results of this review to help determine the effectiveness of the existing policies and procedures, and to provide an independent assessment of the allowance for loan losses allocated to these types of loans.

At June 30, 2004, the allowance for loan losses was $16.5 million compared to $9.6 million as of June 30, 2003. The majority of this increase, $4.5 million of the total increase of $6.9 million, was due to the allowance acquired in the Franklin acquisition. The ratio of the allowance to gross loans outstanding was 1.10% at June 30, 2004, an increase from 1.07% at June 30, 2003. Net charge-offs for fiscal 2004 totaled $2.5 million compared to $2.7 million for the fiscal year ended June 30, 2003. Loans 30 days or more delinquent totaled $17.7 million as of June 30, 2004 and as of June 30, 2003. Loans 30 or more days delinquent as a percent of net loans were 1.19% as June 30, 2004 and 1.98% as of June 30, 2003. Management believes that the allowance for loan losses was appropriately stated at June 30, 2004.

5

Management’s Discussion and Analysis of Financial Condition and Results of Operations

Securities. The securities portfolio increased $32 million to $378 million at June 30, 2004, from $346 million at June 30, 2003. This change included $52 million of securities acquired in connection with the Franklin acquisition and a net decrease of $20 million due to other activity. The other activity included $73 million of purchases, $56 million of amortization and maturities, $29 million of sales and a net decrease of $8 million in market value. The declines in market value were primarily attributable to rising interest rates during fiscal 2004 and all impairment that occurred was considered to be temporary. Management believes that none of these investments which were impaired met the criteria to be considered other than temporarily impaired.

Goodwill and Intangible Assets. Goodwill increased $37 million to $55 million at June 30, 2004. The Franklin acquisition accounted for $36 million of the increase. No impairment of goodwill was recorded during the year. Core deposits and other intangibles increase $14 million to $19 million from $5 million a year earlier. The increase was primarily due to recording $15 million related to the Franklin acquisition.

Deposits. Total deposits were $1.548 billion at June 30, 2004, an increase of $440 million, compared to $1.108 billion at June 30, 2003. The Franklin acquisition added $477 million to deposits, and the remaining activity was a net decrease of $37 million. The net growth by deposit category included $201 million in noninterest-bearing checking, $125 million in interest-bearing checking, $61 million in money market accounts, $48 million in certificates of deposit and $5 million in savings accounts. Franklin’s deposits were concentrated in noninterest-bearing checking and to a lesser extent interest-bearing checking. The acquisition accounts for all of the growth in those two categories. As a result, the mix of the Company’s deposits has shifted during fiscal 2004 to include a larger percentage of core deposits, particularly checking accounts. This should result in lower deposit costs and less sensitivity to interest rate fluctuations in fiscal 2005. The Company regularly monitors competition within its market areas and structures deposit rates to remain competitive within the market and to attract and retain customers.

Borrowings. Securities sold under agreements to repurchase increased $21 million to $31 million at June 30, 2004, compared to $10 million at June 30, 2003. The increase was primarily due to $23 million of long-term repurchase agreements maturing in fiscal 2007, 2008 and 2009, which financed purchases of mortgage-backed securities with similar duration. Short-term Federal Home Loan Bank (FHLB) advances increased $77 million to $196 million at June 30, 2004 compared to $119 million at June 30, 2003. This increase funded a significant portion of the growth in loans during the fiscal year and was not attributable to the Franklin acquisition. Long-term FHLB advances increased $70 million to $187 million at June 30, 2004 compared to $117 million at June 30, 2003. The Franklin acquisition accounted for $58 million of the increase.

In December 2003, the Company issued $31 million of Junior Debentures. These debentures were issued to an unconsolidated affiliate that purchased them with the proceeds from a $30 million issue of trust preferred securities to an outside party. The proceeds of the Junior Debentures were used to fund a portion of the cash consideration for the Franklin acquisition. For additional information on the Junior Debentures see discussion of these securities under Off-Balance-Sheet Agreements in the following section. The Company uses borrowings as part of its liquidity management, cash flow, and asset/liability management. Borrowings are an alternative to raising cash through deposit growth and are used when they offer a favorable alternative to deposits in terms of rate, maturity or volume.

Capital Resources. Total shareholders’ equity increased $40 million to $223 million at June 30, 2004, compared to $183 million at June 30, 2003. This increase was primarily composed of increases of $41 million for the issuance of treasury stock to fund the stock portion of the Franklin acquisition and $14 million in net income along with decreases of $7 million for treasury stock purchases and $7 million for cash dividends. The Company’s Board of Directors authorized stock repurchase programs in March 2003 and March 2004 each for the repurchase of up to 750,000 shares of the Company’s common stock over a 12-month period in open market transactions or in privately negotiated transactions in accordance with applicable regulations of the Securities and Exchange Commission. During fiscal 2004, the Company repurchased 385,900 shares at an average price of $17.66. At June 30, 2004, there were 466,400 shares remaining under the stock buy-back program approved in March 2004. Stock repurchase programs are a component of the Company’s strategy to invest excess capital after consideration of market and economic factors, the effect on shareholder dilution, adequacy of capital, effect on liquidity and an assessment of alternative

6

Management’s Discussion and Analysis of Financial Condition and Results of Operations

investment returns. Shares repurchased by the Company may be used to meet the Company’s requirements for common shares under its dividend reinvestment plan, stock option or other stock based plans and for general corporate purposes such as expansion and acquisitions or future capital requirements.

Office of Thrift Supervision (OTS) regulations require savings institutions to maintain certain minimum levels of regulatory capital. Additionally, the regulations establish a framework for the classification of savings institutions into five categories: well-capitalized, adequately capitalized, undercapitalized, significantly undercapitalized and critically undercapitalized. Generally, an institution is considered well-capitalized if it has a core (Tier 1) capital ratio of at least 5.0% (based on adjusted total assets); a core (Tier 1) risk-based capital ratio of at least 6.0%; and a total risk-based capital ratio of at least 10.0%. At June 30, 2004, the Bank’s capital levels were above the levels required to be well capitalized, and Franklin Bank’s capital levels were above the levels required to be adequately capitalized. The Bank and Franklin Bank merged effective July 2, 2004. On a combined basis, the capital levels of both banks together were above the levels required to be well capitalized as of June 30, 2004.

Contractual Obligations and Off-Balance-Sheet Arrangements

Contractual Obligations. The Company uses a variety of funding sources to finance its earning assets and other activities. These contractual obligations have various terms and maturities that may require the outlay of cash in the future. The following table summarizes those obligations as of June 30, 2004 by type and by payment date. The amounts represent the amounts contractually due and do not include any interest, premiums, discounts or other similar carrying value adjustments. Additional information on the terms of these obligations can be found in the referenced note to the consolidated financial statements. Dollars are in thousands.

| | | | | | | | | | | | | | | | | |

| | | Financial Statement Note Reference

| | One Year or Less

| | One to Three Years

| | Three to To Five Years

| | Over Five Years

| | Total

|

Deposits without a stated maturity | | | | $ | 938,887 | | $ | - | | $ | - | | $ | - | | $ | 938,887 |

Lease obligations | | 7 | | | 2,042 | | | 3,479 | | | 2,262 | | | 981 | | | 8,764 |

Certificates of deposit | | 9 | | | 290,850 | | | 245,078 | | | 71,587 | | | 1,609 | | | 609,124 |

Securities sold under agreement to repurchase | | 10 | | | 8,358 | | | 8,250 | | | 14,500 | | | - | | | 31,108 |

Borrowings | | 11 | | | 225,630 | | | 41,550 | | | 32,875 | | | 80,567 | | | 380,622 |

Junior subordinated debentures | | 12 | | | - | | | - | | | - | | | 30,929 | | | 30,929 |

Purchase obligations | | 17 | | | 540 | | | 1,080 | | | 450 | | | - | | | 2,070 |

| | | | |

|

| |

|

| |

|

| |

|

| |

|

|

Total | | | | $ | 1,466,307 | | $ | 299,437 | | $ | 121,674 | | $ | 114,086 | | $ | 2,001,274 |

| | | | |

|

| |

|

| |

|

| |

|

| |

|

|

Off-Balance-Sheet Arrangements. The Company regularly engages in business practices that give rise to obligations or interests that are not fully included in the statements of financial position. They include commitments to make loans, commitments to sell loans, guarantees under letters of credit, interests in securities or derivatives used to hedge the value of loans held for sale and the use of wholly-owned unconsolidated special purpose entities which act as trusts to facilitate the sale of debt securities to the public.

As a lending institution, the Company makes commitments to lend money before loans are disbursed in order to serve the needs of borrowers. At June 30, 2004, the Company had commitments to make loans totaling $219 million including $116 million in commitments to make new loans and $103 million in unused lines and letters of credit. These loan commitments are similar in form and terms to loans already recorded on the books and do not present credit risks that are different from the credit risks in the existing loan portfolio. The Company does have interest rate risk on loan commitments and loans held for sale between the time a rate commitment is made to the borrower and the time the company contracts for the sale of the loan. This risk is minimized by issuing commitments to sell loans or mortgage-backed securities to offset this interest rate risk. At June 30, 2004, the Company had $63 million in mortgage loan commitments that are in the form of obligations to sell mortgage backed securities of like maturity and coupon to the loan commitments.

7

Management’s Discussion and Analysis of Financial Condition and Results of Operations

The Company issues standby letters of credit for commercial customers to third parties to guarantee the performance of customers to those third parties. If the customer fails to perform, the Company performs in its place and treats the funds advanced as an interest-bearing loan. Therefore, these standby letters of credit represent the same risk to the Company as a loan to that commercial loan customer would. At June 30, 2004, the Company had $2.5 million in standby letters of credit outstanding with an average remaining term of 29 months. While no liability has been recorded for the nominal amount of this obligation, the fair value of this obligation has been recorded in the form of unearned fees.

In December 2003, the Company formed two affiliated trusts that issued $30.0 million of Guaranteed Capital Trust Securities. These affiliates used the equity capital from the Company and the proceeds of the Guaranteed Capital Trust Securities to purchase $30.9 million in Junior Subordinated Deferrable Interest Debentures from the Company. The affiliates have no other operations. Based on the structure, nature and purpose of these affiliated trusts, the Company has accounted for them using the equity method, and therefore they have not been included in the consolidated financial statements. The Company has guaranteed the securities issued by the affiliated trusts; however, this guarantee is recorded as a liability of the Company in the form of the Junior Subordinated Deferrable Interest Debentures.

8

Management’s Discussion and Analysis of Financial Condition and Results of Operations

Comparison of Results of Operations for Years Ended June 30, 2004 and 2003

General. The Company recorded net income for the year ended June 30, 2004 of $14.2 million, a decrease of 15.0% or $2.5 million, from net income of $16.7 million for the year ended June 30, 2003. Diluted earnings per share for the year ended June 30, 2004 were $1.09, a decrease of 15.5% compared to $1.29 for the year ended June 30, 2003. The decrease in net income and earnings per share was due primarily to increases in non-interest expense and the provision for loan losses, which were both impacted by merger related expenses. For fiscal 2004, returns on average equity (“ROE”) and average assets (“ROA”) were 7.46% and 0.83%, respectively, compared to 9.23% and 1.08% for fiscal 2003.

Net Interest Income. The table below, in the section titledAverage Balances, Interest Rates, and Yields provides important information on factors impacting net interest income and should be read in conjunction with this discussion of net interest income. Interest income for the year ended June 30, 2004 totaled $85.8 million, a decrease of $1.6 million from $87.4 million for the year ended June 30, 2003. Interest income on loans totaled $71.9 million for the year ended June 30, 2004 compared to $69.7 million for the year ended June 30, 2003, an increase of $2.2 million. The increase in interest income on loans was primarily due to an increase of $199.6 million in the average balance of loans partially offset by a reduction in the average yield on loans of 1.05% to 6.16% for fiscal 2004 compared to 7.21% for the prior fiscal year. The increase in average loan balances was primarily due to the addition of commissioned loan officers, the addition of one new loan production office in fiscal 2004, the addition of three loan production offices in fiscal 2003, which were operating for a full year in fiscal 2004 and to a lesser extent the Franklin acquisition. Interest rates during fiscal 2004 continued to remain at historically low levels resulting in a high level of refinance activity, which reduced the average yield on loans, compared to fiscal 2003. Interest income on mortgage-backed and other securities decreased $3.8 million and totaled $13.9 million for the year ended June 30, 2003 compared to $17.7 million for the prior year. The increase in interest income on mortgage-backed and other securities was due to a $58 million increase in the average balance, partially offset by a 31 basis point decline in average rate.

Interest expense for the year ended June 30, 2004 was $37.6 million, a decrease of $5.7 million from $43.3 million for the prior year ended June 30, 2003. Interest expense on deposits decreased by $5.6 million to $25.2 million for the year ended June 30, 2004 from $30.8 million for the year ended June 30, 2003. The decrease in interest expense on deposits was primarily due to a decline in the average cost of interest-bearing deposits from 2.91% for the prior year ended June 30, 2003 to 2.32% for the year ended June 30, 2004, a decline of 59 basis points. Average interest-bearing deposit balances increased $31.8 million to $1,089.0 million for the year ended June 30, 2004 compared to $1,057.2 million for the year ended June 30, 2003. The increase was due to growth in interest-bearing checking and money market accounts partially offset by a decline in higher-costing time deposits. Interest expense on repurchase agreements declined $0.6 million to $0.7 million from $1.3 million for the prior year primarily due to a reduction in the average cost of repurchase agreements as higher rate instruments matured and were replaced by lower rate instruments. Interest expense on borrowings was $10.7 million for the year ended June 30, 2004, a decrease of $0.6 million from the prior year. The decrease was the net effect of a 1.79% decrease in the average rate and an $84.7 million decrease in the average balance. Substantially all of the increase in the average balance occurred in short-term FHLB advances, which substantially lowered the average cost of borrowings. In addition, the average cost of borrowings declined due to a decline in interest rate swap expense of $0.9 million to $2.6 million from $3.5 million in the prior year. The interest rate swaps were redeemed on August 9, 2002 at the fair value of $12.6 million and a loss in other comprehensive income, net of tax, of $8.2 million was recorded that will be amortized to interest expense over the remaining original terms of the individual interest rate swap contracts. The amount amortized to expense in future periods is expected to be less than what the net interest cost would have been in each period under the prevailing lower interest rate environment that existed at the time the interest rate swaps were redeemed. Approximately 60% of this expense will be recognized within the first three fiscal years beginning in the year ended June 30, 2003 with the remainder to be recognized in essentially equal annual increments through fiscal year 2010. Additional information can be found in the notes to the consolidated financial statements.

9

Management’s Discussion and Analysis of Financial Condition and Results of Operations

Net interest income for the year ended June 30, 2004 totaled $48.2 million versus $44.1 million for the year ended June 30, 2003, an increase of $4.1 million. This increase was primarily due to a $134.6 million increase in interest-earning assets. Both asset yields and liability costs declined during fiscal 2004 as paid off loans and maturing liabilities were replaced by new instruments at lower interest rates. The Company was able to hold the levels of interest rate spread and net interest margin within one basis point of prior year levels by changing the mix of assets to include relatively more loans and less securities and by utilizing low cost short-term borrowings to finance growth.

10

Management’s Discussion and Analysis of Financial Condition and Results of Operations

Average Balances, Interest Rates and Yields. The following table presents for the periods indicated the total dollar amount of fully taxable equivalent interest income from average interest-earning assets and the resultant yields, as well as the interest expense on average interest-bearing liabilities, expressed in both dollars and rates.

| | | | | | | | | | |

For the Years Ended June 30,

| | 2004

| |

| | Average

Outstanding

Balance

| | | Interest

Earned/ Paid

| | Yield/

Rate

| |

| (Dollars in thousands) | | | | | | | | | | |

| | | |

Assets | | | | | | | | | | |

Interest-earning assets: | | | | | | | | | | |

Loans receivable, net(2) | | $ | 1,169,251 | | | $ | 72,031 | | 6.16 | % |

Mortgage-backed and related securities(1) | | | 120,066 | | | | 5,383 | | 4.48 | |

Securities(1) (2) | | | 219,243 | | | | 8,335 | | 3.80 | |

Other earning assets | | | 5,379 | | | | 50 | | 0.93 | |

Federal Home Loan Bank stock | | | 23,371 | | | | 938 | | 4.01 | |

| | |

|

|

| |

|

| | | |

Total interest-earning assets | | | 1,537,310 | | | | 86,737 | | 5.64 | |

Cash and cash equivalents | | | 35,741 | | | | | | | |

Other assets | | | 149,400 | | | | | | | |

Allowance for loan losses | | | (11,163 | ) | | | | | | |

| | |

|

|

| | | | | | |

Total assets | | $ | 1,711,288 | | | | | | | |

| | |

|

|

| | | | | | |

| | | |

Liabilities and Shareholders’ Equity | | | | | | | | | | |

Interest-bearing liabilities: | | | | | | | | | | |

Interest-bearing checking and money market accounts | | $ | 395,790 | | | $ | 4,934 | | 1.25 | % |

Savings accounts | | | 135,498 | | | | 788 | | 0.58 | |

Time deposits | | | 557,746 | | | | 19,517 | | 3.50 | |

Repurchase agreements | | | 26,087 | | | | 735 | | 2.82 | |

Borrowings | | | 288,349 | | | | 10,737 | | 3.72 | |

Junior subordinated deferrable interest debentures held by

trusts that issued guaranteed capital securities | | | 16,457 | | | | 894 | | 5.43 | |

| | |

|

|

| |

|

| | | |

Total interest-bearing liabilities | | | 1,419,927 | | | | 37,605 | | 2.65 | |

Noninterest-bearing deposits | | | 60,647 | | | | | | | |

Other liabilities | | | 41,016 | | | | | | | |

| | |

|

|

| | | | | | |

Total liabilities | | | 1,521,590 | | | | | | | |

Shareholders’ equity | | | 189,698 | | | | | | | |

| | |

|

|

| | | | | | |

Total liabilities and shareholders’ equity | | $ | 1,711,288 | | | | | | | |

| | |

|

|

| |

|

| |

|

|

Net interest income/interest rate spread | | | | | | $ | 49,132 | | 2.99 | % |

| | | | | | |

|

| |

|

|

| | | |

Net interest margin | | | | | | | | | 3.20 | % |

| | | | | | | | | |

|

|

| | | |

Average interest-earning assets to interest-bearing liabilities | | | | | | | | | 108.27 | % |

| | | | | | | | | |

|

|

| (1) | Includes unamortized discounts and premiums. Average balance is computed using the carrying value of securities. The average yield has been computed using the historical amortized cost average balance for available for sale securities. |

| (2) | Average yields are stated on a fully taxable equivalent basis. |

11

Management’s Discussion and Analysis of Financial Condition and Results of Operations

| | | | | | | | | | | | | | | | | | | | |

| | |

| | | 2003

| |

| | |

| | | 2002

| |

| |

| | | Average

Outstanding

Balance

| | | Interest

Earned/

Paid

| | Yield/

Rate

| | | Average

Outstanding

Balance

| | | Interest

Earned/

Paid

| | Yield/

Rate

| |

| | | | | | | | | | | | | | | | | | | | | |

| | | | | | |

| | | | | | | | | | | | | | | | | | | | | |

| | | | | | | | | | | | | | | | | | | | | |

| | | $ | 969,692 | | | $ | 69,871 | | 7.21 | % | | $ | 1,004,318 | | | $ | 79,319 | | 7.90 | % |

| | | | 139,521 | | | | 7,265 | | 5.21 | | | | 229,079 | | | | 13,806 | | 6.03 | |

| | | | 257,824 | | | | 10,045 | | 3.90 | | | | 205,851 | | | | 10,215 | | 4.96 | |

| | | | 13,768 | | | | 255 | | 1.85 | | | | 66,341 | | | | 1,722 | | 2.60 | |

| | | | 21,937 | | | | 945 | | 4.31 | | | | 20,869 | | | | 1,134 | | 5.43 | |

| | |

|

|

| |

|

| | | | |

|

|

| |

|

| | | |

| | | | 1,402,742 | | | | 88,381 | | 6.33 | | | | 1,526,458 | | | | 106,196 | | 6.98 | |

| | | | 35,659 | | | | | | | | | | 34,605 | | | | | | | |

| | | | 111,136 | | | | | | | | | | 85,643 | | | | | | | |

| | | | (9,502 | ) | | | | | | | | | (9,677 | ) | | | | | | |

| | |

|

|

| | | | | | | |

|

|

| | | | | | |

| | | $ | 1,540,035 | | | | | | | | | $ | 1,637,029 | | | | | | | |

| | |

|

|

| | | | | | | |

|

|

| | | | | | |

| | | | | | |

| | | | | | | | | | | | | | | | | | | | | |

| | | | | | | | | | | | | | | | | | | | | |

| | | $ | 348,348 | | | $ | 5,732 | | 1.65 | % | | $ | 300,846 | | | $ | 7,073 | | 2.35 | % |

| | | | 134,028 | | | | 1,216 | | 0.91 | | | | 135,243 | | | | 2,479 | | 1.83 | |

| | | | 574,803 | | | | 23,822 | | 4.14 | | | | 599,232 | | | | 30,159 | | 5.03 | |

| | | | 28,776 | | | | 1,252 | | 4.35 | | | | 90,645 | | | | 4,893 | | 5.40 | |

| | | | 204,654 | | | | 11,274 | | 5.51 | | | | 256,911 | | | | 15,817 | | 6.16 | |

| | | | | | | | | | | | | | | | | | | | | |

| | |

|

|

| |

|

| | | | |

|

|

| |

|

| | | |

| | | | 1,290,609 | | | | 43,296 | | 3.35 | | | | 1,382,877 | | | | 60,421 | | 4.37 | |

| | | | 36,622 | | | | | | | | | | 28,133 | | | | | | | |

| | | | 32,027 | | | | | | | | | | 35,923 | | | | | | | |

| | |

|

|

| | | | | | | |

|

|

| | | | | | |

| | | | 1,359,258 | | | | | | | | | | 1,446,933 | | | | | | | |

| | | | 180,777 | | | | | | | | | | 190,096 | | | | | | | |

| | |

|

|

| | | | | | | |

|

|

| | | | | | |

| | | $ | 1,540,035 | | | | | | | | | $ | 1,637,029 | | | | | | | |

| | |

|

|

| |

|

| |

|

| |

|

|

| |

|

| |

|

|

| | | | | | | $ | 45,085 | | 2.98 | % | | | | | | $ | 45,775 | | 2.61 | % |

| | | | | | |

|

| |

|

| | | | | |

|

| |

|

|

| | | | | | |

| | | | | | | | | | 3.21 | % | | | | | | | | | 3.01 | % |

| | | | | | | | | |

|

| | | | | | | | |

|

|

| | | | | | |

| | | | | | | | | | 108.69 | % | | | | | | | | | 110.38 | % |

| | | | | | | | | |

|

| | | | | | | | |

|

|

12

Management’s Discussion and Analysis of Financial Condition and Results of Operations

Rate/Volume Analysis of Net Interest Income. The following table presents the dollar amount of changes in fully tax equivalent interest income and interest expense for major components of interest-earning assets and interest-bearing liabilities. It distinguishes between the increase or decrease related to changes in balances and/or changes in interest rates. For each category of interest-earning assets and interest-bearing liabilities, information is provided on changes attributable to (i) changes in volume (i.e., changes in volume multiplied by old rate) and (ii) changes in rate (i.e., changes in rate multiplied by old volume). For purposes of this table, changes attributable to both rate and volume, which cannot be segregated, have been allocated proportionately to the change due to volume and the change due to rate.

| | | | | | | | | | | | | | | | | | | | | | | | |

| | | Year Ended June 30, 2004 Compared to Year Ended June 30, 2003

| | | Year Ended June 30, 2003 Compared to Year Ended June 30, 2002

| |

| | | Increase (Decrease) Due to | | | Increase (Decrease) Due to | |

| | | Volume

| | | Rate

| | | Net

| | | Volume

| | | Rate

| | | Net

| |

| | | (Dollars in thousands) | |

Interest-Earning Assets: | | | | | | | | | | | | | | | | | | | | | | | | |

Loans receivable, net | | $ | 13,190 | | | $ | (11,030 | ) | | $ | 2,160 | | | $ | (2,674 | ) | | $ | (6,774 | ) | | $ | (9,448 | ) |

Mortgage-backed and related securities | | | (939 | ) | | | (943 | ) | | | (1,882 | ) | | | (4,853 | ) | | | (1,688 | ) | | | (6,541 | ) |

Securities | | | (1,460 | ) | | | (250 | ) | | | (1,710 | ) | | | 2,271 | | | | (2,441 | ) | | | (170 | ) |

Other earning assets | | | (113 | ) | | | (92 | ) | | | (205 | ) | | | (1,075 | ) | | | (392 | ) | | | (1,467 | ) |

Federal Home Loan Bank stock | | | 60 | | | | (67 | ) | | | (7 | ) | | | 55 | | | | (244 | ) | | | (189 | ) |

| | |

|

|

| |

|

|

| |

|

|

| |

|

|

| |

|

|

| |

|

|

|

| | | | | | |

Total interest-earning assets | | | 10,738 | | | | (12,382 | ) | | | (1,644 | ) | | | (6,276 | ) | | | (11,539 | ) | | | (17,815 | ) |

| | |

|

|

| |

|

|

| |

|

|

| |

|

|

| |

|

|

| |

|

|

|

| | | | | | |

Interest-Bearing Liabilities: | | | | | | | | | | | | | | | | | | | | | | | | |

Interest-bearing checking and money market accounts | | | 716 | | | | (1,514 | ) | | | (798 | ) | | | 994 | | | | (2,335 | ) | | | (1,341 | ) |

Savings accounts | | | 13 | | | | (441 | ) | | | (428 | ) | | | (22 | ) | | | (1,241 | ) | | | (1,263 | ) |

Time deposits | | | (693 | ) | | | (3,612 | ) | | | (4,305 | ) | | | (1,187 | ) | | | (5,150 | ) | | | (6,337 | ) |

Repurchase agreements | | | (108 | ) | | | (409 | ) | | | (517 | ) | | | (2,834 | ) | | | (807 | ) | | | (3,641 | ) |

Borrowings | | | 3,784 | | | | (4,321 | ) | | | (537 | ) | | | (2,991 | ) | | | (1,552 | ) | | | (4,543 | ) |

Junior subordinated deferrable interest debentures held by trusts that issued guaranteed capital securities | | | 894 | | | | - | | | | 894 | | | | - | | | | - | | | | - | |

| | |

|

|

| |

|

|

| |

|

|

| |

|

|

| |

|

|

| |

|

|

|

| | | | | | |

Total interest-bearing liabilities | | | 4,606 | | | | (10,297 | ) | | | (5,691 | ) | | | (6,040 | ) | | | (11,085 | ) | | | (17,125 | ) |

| | |

|

|

| |

|

|

| |

|

|

| |

|

|

| |

|

|

| |

|

|

|

| | | | | | |

Net change in net interest income | | $ | 6,132 | | | $ | (2,085 | ) | | $ | 4,047 | | | $ | (236 | ) | | $ | (454 | ) | | $ | (690 | ) |

| | |

|

|

| |

|

|

| |

|

|

| |

|

|

| |

|

|

| |

|

|

|

Provision for Loan Losses. The provision for loan losses was $4.9 million for fiscal 2004, which was an increase of $2.0 million from fiscal 2003 expense of $2.9 million. The majority of that increase was due to a $1.5 million provision related to the Franklin Bank loan portfolio. That charge was recorded after the merger took place to reflect a change in the approach to managing credit issues at Franklin and to conform Franklin’s practices to those that First Place Bank has used successfully to manage credit risk. The remaining increase of $0.5 million was due to growth in the loan portfolio and a change in the mix of loans to include relatively more commercial loans in fiscal 2004 compared to fiscal 2003.

Noninterest Income. Noninterest income increased 11% to $22.5 million in the year ended June 30, 2004 from $20.2 million for the prior year ended June 30, 2003. The increase was due primarily to an improvement in income from loan servicing. Loan servicing income is composed of the current fees generated from the servicing of sold loans less the current amortization of mortgage servicing rights (MSRs) and the adjustment for any change in the allowance for impairment of MSRs, which are valued at the lower of cost or market. The valuation of MSRs is a critical accounting policy and the Company utilizes the services of an independent firm to determine market value. Both the amortization and the valuation of MSRs are sensitive to movements in

13

Management’s Discussion and Analysis of Financial Condition and Results of Operations

interest rates. Both amortization and impairment valuation allowances tend to increase as rates fall and tend to decrease as rates rise. However, the level of amortization is a function of interest rates over the period while the level of impairment valuation allowances is a function of interest rates at the end of the period. Historically low interest rates over the past two years and volatility in rates recently have resulted in the increased variability of loan servicing income over the past two years. The table below shows how the change in the impairment of MSRs impacts loan servicing income.

| | | | | | |

| | | Year ended June 30,

| |

| | | 2004

| | | 2003

| |

Loan servicing income (loss) | | | | | | |

Loan servicing revenue net of amortization | | $ (2,088 | ) | | $ (2,594 | ) |

Change in impairment of MSRs | | 2,099 | | | (2,397 | ) |

| | |

|

| |

|

|

Total loan servicing income (loss) | | $ 11 | | | $ (4,991 | ) |

| | |

|

| |

|

|

The reduction of the loss in loan servicing revenue net of amortization in the current year compared to the prior year was due to a slowdown in amortization of servicing rights due to loan payoffs. The change in impairment was due to interest rates being significantly higher at June 30, 2004 than they were at June 30, 2003. The effective yield on the ten-year US Treasury note, a primary factor in pricing fixed rate mortgage products, is up more that 100 basis points at June 30, 2004 compared to June 30, 2003. The remaining allowance for impairment of MSRs at June 30, 2004 was $0.3 million.

Gains from the sale of loans totaled $8.5 million for the current fiscal year, a decline of $4.9 million from $13.4 million in the prior year. Gains in the current year averaged 94 basis points on $905 million of loan sales compared to gains averaging 197 basis points on $680 million of loan sales in the prior year. Sales margins were higher in fiscal 2003 as interest rates were on a downward trend throughout most of the year. Rates have trended upward through fiscal 2004 resulting in a narrowing of margins on the gain on sale of loans. Service charges and fees on deposit accounts increased $0.7 million to $5.8 million for fiscal 2004 compared to $5.1 million for the prior year. These fees represent a stable source of income that is expected to grow as deposit balances grow. Revenues from non-bank businesses increased $1.2 million for fiscal 2004 compared to fiscal 2003. This was primarily due to including a full year of revenue from two affiliates, APB Financial Group, Ltd. and majority ownership in Title Works, LLC both acquired January 2003.

Noninterest Expense. Noninterest expense for the year ended June 30, 2004 totaled $45.3 million compared to $36.7 million for the year ended June 30, 2003, an increase of $8.6 million or 23%. The Company has undertaken a number of expansion initiatives over the past two years which have resulted in significant increases in noninterest expense. These initiatives have also resulted in significant increases in residential loan originations and other non-bank income. The initiatives include having a full year of expenses for TitleWorks, APB, loan production offices in Cincinnati, Toledo and Hudson, Ohio, a financial center in Solon, Ohio and adding a wholesale residential lending department. Each of these initiatives were new in fiscal 2003 and only included a partial year of revenue and expense. In addition, the current year included one month’s expense from the Franklin acquisition. These initiatives particularly impacted salaries and benefits and occupancy expenses and to a lesser extent marketing and other expense. Salaries and benefits expense increased $3.3 million to $21.7 million for the current fiscal year compared to $18.4 million for the prior year. Occupancy expenses were $6.5 million for the year ended June 30, 2004, an increase of $0.7 million over expense of $5.8 million for the prior fiscal year. Merger, integration and restructuring expense related to the Franklin acquisition was $2.2 million in fiscal 2004 compared to no expense in the prior year. These expenses included personnel, data processing, travel, and consulting expenses for legal, accounting and other services. Other noninterest expenses increased $1.2 million to $7.3 million for the current fiscal year compared to $6.1 million in the prior year. This increase was primarily due to a $0.8 million charge related to aged outstanding reconciling items in the Bank’s primary correspondent bank account. It was determined that these reconciling items were not likely to be recovered due to their age.

Provision for Income Taxes. Income tax for the current fiscal year was $6.2 million, a decrease of $1.7 million from the prior year expense of $7.9 million. The decline was due to a decline in pretax income and a decline in the effective tax rate to

14

Management’s Discussion and Analysis of Financial Condition and Results of Operations

30.4% for fiscal 2004 from 32.2% for fiscal 2003. The lower effective tax rate was primarily due to permanent tax benefits recognized related to the Company’s employee stock ownership plan.

Comparison of Results of Operations for Years Ended June 30, 2003 and 2002

General. The Company recorded net income for the year ended June 30, 2003 of $16.7 million, an increase of 2.8% or $0.5 million, from net income of $16.2 million for the year ended June 30, 2002. Diluted earnings per share for the year ended June 30, 2003 were $1.29, an increase of 11.2% compared to $1.16 for the year ended June 30, 2002. The increase on a per share basis was due primarily to an increase in non-interest revenues and a reduction in shares outstanding arising from treasury stock purchases. For fiscal 2003, returns on average equity (“ROE”) and average assets (“ROA”) were 9.23% and 1.08%, respectively, compared to 8.54% and 0.99% for fiscal 2002.

Net Interest Income. The table above, in the section titledAverage Balances, Interest Rates, and Yields provides important information on factors impacting net interest income and should be read in conjunction with this discussion of net interest income. Interest income for the year ended June 30, 2003 totaled $87.4 million, a decrease of $17.7 million from $105.1 million for the year ended June 30, 2002. Interest income on loans totaled $69.7 million for the year ended June 30, 2003 compared to $79.3 million for the year ended June 30, 2002, a decrease of $9.6 million. The decrease in interest income on loans was primarily due to a reduction in the average yield on loans of 69 basis points to 7.21%. Market interest rates continued at historically low levels throughout the fiscal year, which created an environment favorable for residential 1-4 family mortgage holders to refinance their existing mortgage or to secure a mortgage on a new residence. The accelerated prepayments of higher yielding mortgages contributed to the overall decline in the yield on the loan portfolio. Average loan balances, including loans held for sale, decreased $34.6 million to $969.7 million compared to the prior fiscal year. The decrease was primarily due to a reduction in mortgage loan balances, partially offset by an increase in commercial loan balances. Interest income on securities decreased $6.4 million and totaled $16.5 million for the year ended June 30, 2003 compared to $22.9 million for the prior year. The decrease in interest income on securities was due to a 116 basis point decline in the average yield on the security portfolio and also due to a $37.6 million decrease in average balances, from $434.9 million for the year ended June 30, 2002 to $397.3 million for the year ended June 30, 2003. Interest income from other earning assets, primarily federal funds sold, decreased $1.4 million due to a decrease in average balances of $52.5 million to $13.8 million for fiscal 2003 and also due to a 75 basis point decline in the average yield.

Interest expense for the year ended June 30, 2003 was $43.3 million, a decrease of $17.1 million from $60.4 million for the prior year ended June 30, 2002. A reduction in average balances of interest-bearing liabilities of $92.3 million and a reduction in the average rate paid on interest-bearing liabilities of 102 basis points contributed to the decrease. Interest expense on deposits decreased by $8.9 million from $39.7 million for the year ended June 30, 2002 to $30.8 million for the year ended June 30, 2003. The decrease in interest expense on deposits was primarily due to a decline in the average cost of interest-bearing deposits from 3.83% for the prior year ended June 30, 2002 to 2.91% for the year ended June 30, 2003, a decline of 92 basis points. Average interest-bearing deposit balances increased $21.9 million to $1,057.2 million for the year ended June 30, 2003 compared to $1,035.3 million for the year ended June 30, 2002. The increase was due to growth in money market accounts partially offset by a decline in higher-costing time deposits. Interest expense on borrowed funds was $11.3 million for the year ended June 30, 2003, a decrease of $4.5 million from the prior year. The decrease was primarily due to a combination of lower average balances of FHLB advances and reduced expense from interest rate swaps that were terminated during the year. The expense recorded for the year ended June 30, 2003 attributable to the interest rate swaps was $3.5 million compared to $5.5 million for the year ended June 30, 2002. The interest rate swaps were redeemed on August 9, 2002 at the fair value of $12.6 million, which was recorded as a component of other comprehensive income in shareholders’ equity, for a loss of $8.2 million net of tax. The loss is amortized to interest expense over the remaining original terms of the individual interest rate swap contracts. The amount amortized to expense in future periods is expected to be less than what the net interest cost would have been in each period under the prevailing lower interest rate environment that existed at the time the interest rate swaps were redeemed. Approximately 60% of

15

Management’s Discussion and Analysis of Financial Condition and Results of Operations

this expense will be recognized within the first three fiscal years beginning in the year ended June 30, 2003 with the remainder to be recognized in essentially equal annual increments through fiscal year 2010. Additional information can be found in the notes to the consolidated financial statements and in the Comparison of Results of Operations for Years Ended June 30, 2002 and 2001. Interest expense on repurchase agreements declined $3.6 million to $1.3 million from $4.9 million for the prior year ended June 30, 2002. The decrease was due to a reduction in average balances caused by the scheduled maturity of the repurchase agreements.

Net interest income for the year ended June 30, 2003 totaled $44.1 million versus $44.7 million for the year ended June 30, 2002, a slight decrease of $0.6 million or 1.3%. The net interest margin increased 20 basis points from 3.01% for the year ended June 30, 2002 to 3.21% for the year ended June 30, 2003. The improvement in the net interest margin occurred from a reduction of low-yielding earning assets, a favorable shift in the deposit mix to lower cost deposits and a favorable impact of terminating the interest rate swaps.

Noninterest Income. Noninterest income increased 35% to $20.2 million in the year ended June 30, 2003 from $15.0 million for the prior year ended June 30, 2002. The increase was due primarily to gains on the sale of mortgage loans and revenues from non-bank businesses acquired in June, 2002 and January, 2003, as discussed below, offset by a net loss from loan servicing income. Gains from the sale of loans totaled $13.4 million for the current fiscal year compared to $7.3 million in the prior year. The gains on loan sales were aided by the continuation throughout the year of low mortgage interest rates, which resulted in high levels of residential mortgage origination activity. For fiscal 2003, mortgage loan sales totaled $680.1 million compared to $464.4 million in the prior year, an increase of $215.7 million. The full-year net loss in loan servicing income was $5.0 million for the year ended June 30, 2003 compared to a net loss in the prior year of $0.6 million. Included in the current year were $2.4 million of non-cash charges for impairment to the valuation of the mortgage servicing rights, or MSRs. Similar valuation adjustments to mortgage servicing rights for fiscal 2002 were negligible. Additionally, amortization of the related capitalized servicing asset is charged against servicing income. Amortization was accelerated throughout fiscal 2003 as a result of rapid prepayments of serviced loans, which contributed to the overall level of losses on loan servicing income. The valuation of MSRs is a critical accounting policy and the Company utilizes the services of two outside firms to support the valuation process. At June 30, 2003, the value of the MSRs was 0.69% of the loans being serviced.

Acquisitions of non-bank businesses contributed to an increase in noninterest income during fiscal 2003. They include Coldwell Banker The Brokers Realty Group (June, 2002); the remaining one-third interest in Coldwell Banker First Place Real Estate Ltd. (July 2002); APB Financial Group, Ltd. (January 2003); and the majority ownership in Title Works, LLC (January 2003). These acquisitions added $3.1 million to other noninterest income for fiscal 2003 compared to the prior year.

Service charge income increased to $5.1 million in the year ended June 30, 2003, an increase of $0.7 million from $4.4 million for the year ended June 30, 2002. The increase was primarily attributable to revenues generated by transaction accounts. The Company reported net gains on sales of securities for fiscal year 2003 of $1.1 million compared to net gains of $1.6 million for fiscal year 2002. During the current year, the Company sold certain securities that were anticipated to have very rapid prepayments due to continued low interest rates.

Noninterest Expense. Noninterest expense for the year ended June 30, 2003 totaled $36.7 million compared to $32.6 million for the year ended June 30, 2002, an increase of $4.1 million. The non-bank business acquisitions referenced above contributed $2.2 million to the increase in noninterest expense, as described more fully below. Salaries and benefits expense increased $2.1 million to $18.4 million for the current fiscal year compared to $16.3 million for the prior year. The non-bank business acquisitions contributed $1.1 million to the increase in salaries and benefits expense. The balance of the increase was due to other increases in wages, health benefits and other employee benefits. Occupancy expenses were $5.8 million for the year ended June 30, 2003, an increase of $0.5 million over the prior fiscal year. Non-bank businesses added $0.4 million to occupancy expense for the year ended June 30, 2003. Loan expenses were $1.5 million for the year ended June 30, 2003 compared to $0.9 million for the year ended June 30, 2002. The increase was attributable to the higher volumes of mortgage loans originated. Other noninterest

16

Management’s Discussion and Analysis of Financial Condition and Results of Operations

expenses increased $0.9 million to $7.1 million for the current fiscal year attributable primarily to the non-bank businesses acquired. The efficiency ratio was 56.2% for the current fiscal year compared to 54.5% for the prior fiscal year.

Asset/Liability Management and Market Risk

The Company, like other financial institutions, is subject to market risk. Market risk is the type of risk that occurs when a company suffers economic loss due to changes in the market value of various types of assets or liabilities. As a financial institution, the Company makes a profit by accepting and managing various risks with credit risk and interest rate risk being the most significant. Interest rate risk is the Company’s primary market risk. It is the risk that occurs when changes in market interest rates will result in a reduction in net interest income or net interest margin because interest-bearing assets and interest-bearing liabilities mature at different intervals and reprice at different times. Asset/liability management is the measurement and analysis of the Company’s exposure to changes in net interest income due to changes in interest rates. The objective of the Company’s asset/liability management function is to balance the goal of maximizing net interest income with the control of risks in the areas of liquidity, safety, capital adequacy and earnings volatility. In general, the Company’s customers seek loans with long-term fixed rates and deposit products with shorter maturities which creates a mismatch of asset and liability maturities. The Company’s primary strategy to counteract this mismatch is to sell the majority of long-term fixed rate loans within 90 days after they are closed. The Company manages this risk and other aspects of interest rate risk on a continuing basis through a number of functions including review of monthly financial results, rate setting, cash forecasting and planning, budgeting and an Asset/Liability Committee.