Exhibit 99.1

Welcome

First Place Finishes

Welcome:

Hello Columbus!

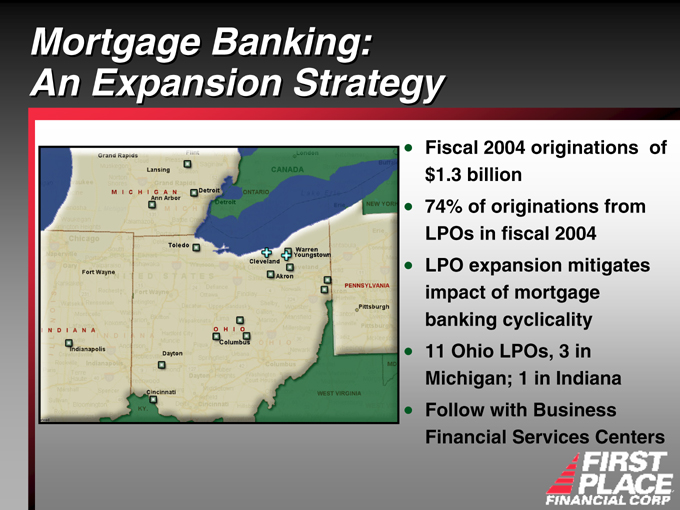

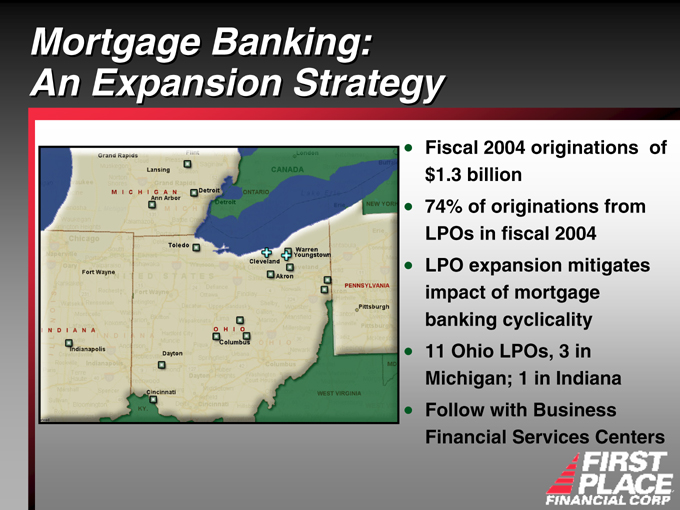

Mortgage Banking: An Expansion Strategy

Fiscal 2004 originations of $1.3 billion

74% of originations from LPOs in fiscal 2004

LPO expansion mitigates impact of mortgage banking cyclicality

11 Ohio LPOs, 3 in Michigan; 1 in Indiana

Follow with Business Financial Services Centers

A New Brand of Banking

Solon Financial Center

Building on a Successful Concept

North Olmsted Financial Center

North Olmsted Financial Center

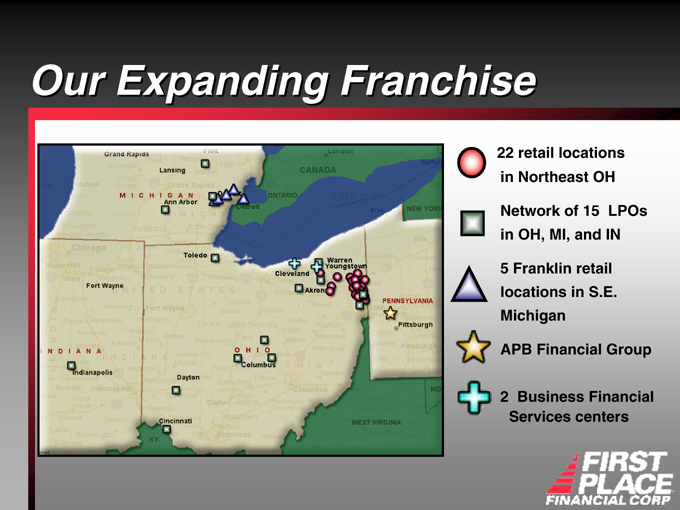

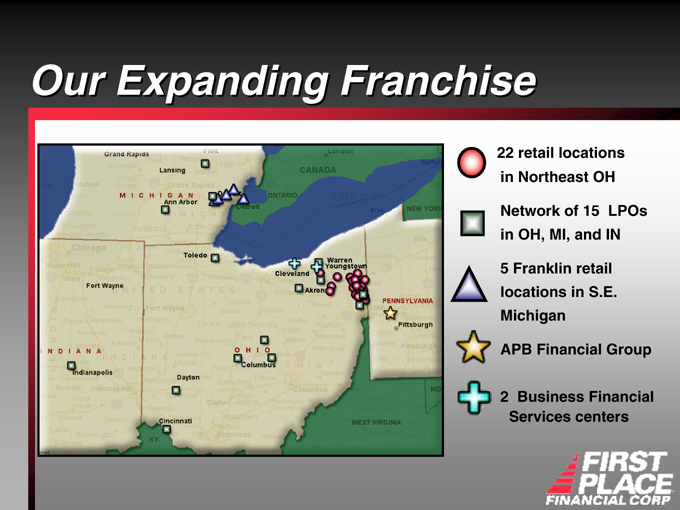

Our Expanding Franchise

22 retail locations in Northeast OH

Network of 15 LPOs in OH, MI, and IN

5 Franklin retail locations in S.E. Michigan

APB Financial Group

2 Business Financial Services centers

Private Client Services

The customized deposit & credit solutions

Individual asset management

Personal trust services

Insurance solutions

Financial planning

Welcome

Weigel Lackey and Ross Insurance Agency

First Place is our Community’s Bank

Financial Performance

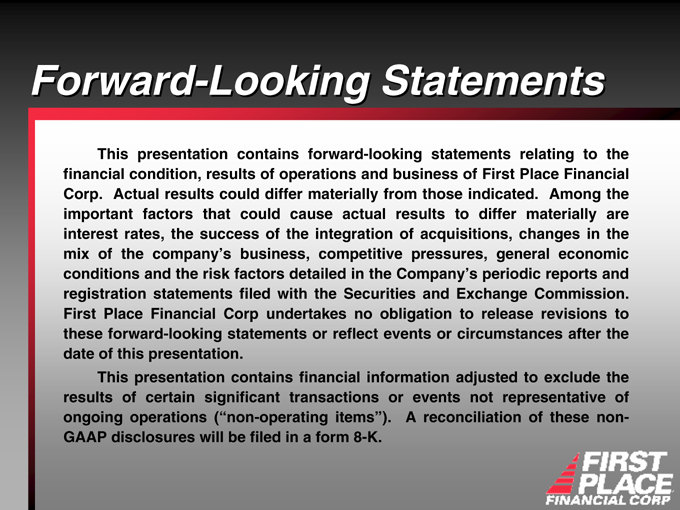

Forward-Looking Statements

This presentation contains forward-looking statements relating to the financial condition, results of operations and business of First Place Financial Corp. Actual results could differ materially from those indicated. Among the important factors that could cause actual results to differ materially are interest rates, the success of the integration of acquisitions, changes in the mix of the company’s business, competitive pressures, general economic conditions and the risk factors detailed in the Company’s periodic reports and registration statements filed with the Securities and Exchange Commission. First Place Financial Corp undertakes no obligation to release revisions to these forward-looking statements or reflect events or circumstances after the date of this presentation.

This presentation contains financial information adjusted to exclude the results of certain significant transactions or events not representative of ongoing operations (“non-operating items”). A reconciliation of these non-GAAP disclosures will be filed in a form 8-K.

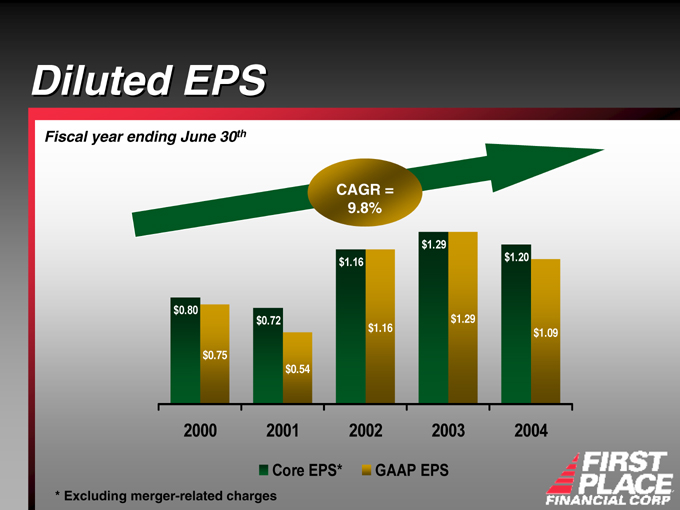

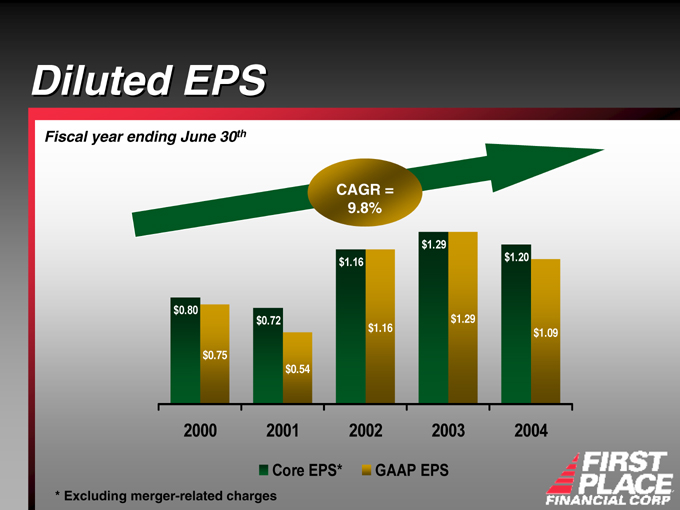

Diluted EPS

Fiscal year ending June 30th

CAGR = 9.8%

2000 2001 2002 2003 2004

Core EPS* GAAP EPS $0.80 $0.75 $0.72 $0.54 $1.16 $1.16 $1.29 $1.29 $1.20 $1.09

* Excluding merger-related charges

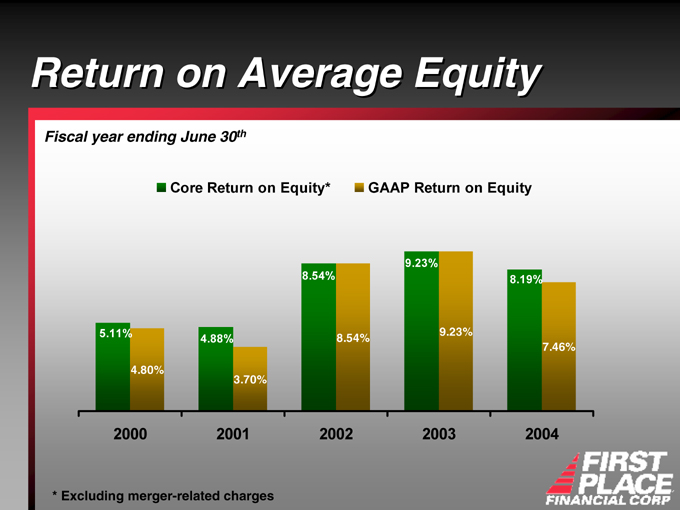

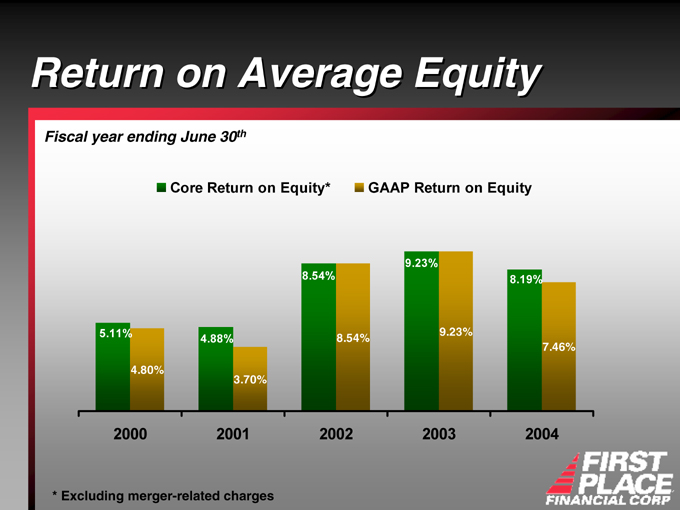

Return on Average Equity

Fiscal year ending June 30th

Core Return on Equity* GAAP Return on Equity

2000 2001 2002 2003 2004

* Excluding merger-related charges

5.11%

4.80%

4.88%

3.70%

8.54%

8.54%

9.23%

9.23%

8.19%

7.46%

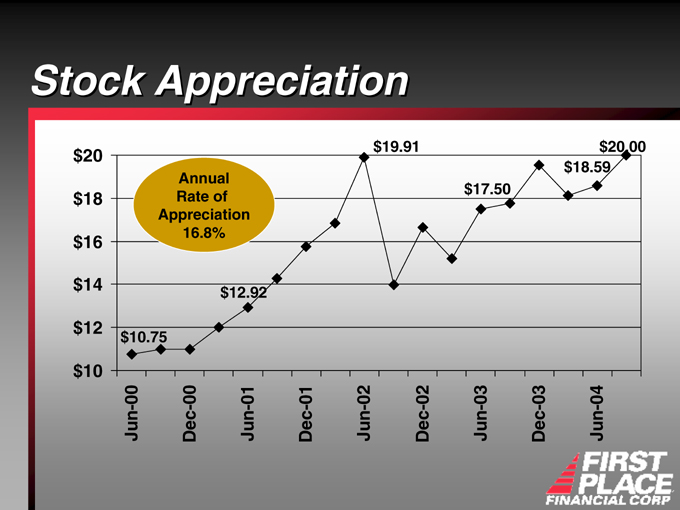

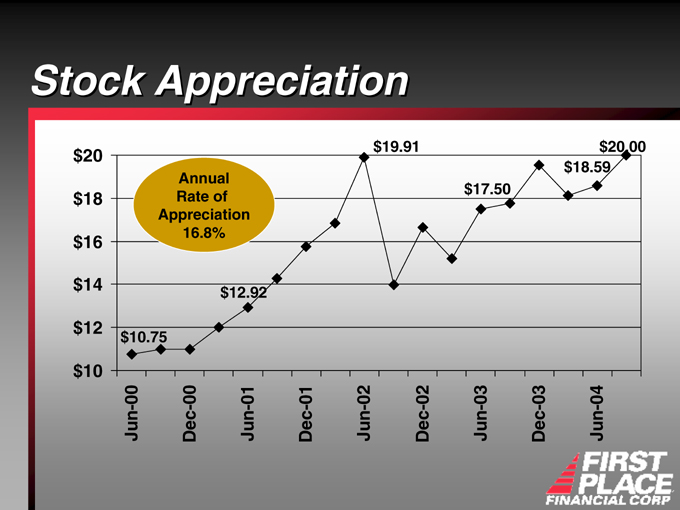

Stock Appreciation

$20 $18 $16 $14 $12 $10

Jun-00

Dec-00

Jun-01

Dec-01

Jun-02

Dec-02

Jun-03

Dec-03

Jun-04

$10.75 $12.92 $19.91 $17.50 $18.59 $20.00

Annual Rate of Appreciation 16.8%

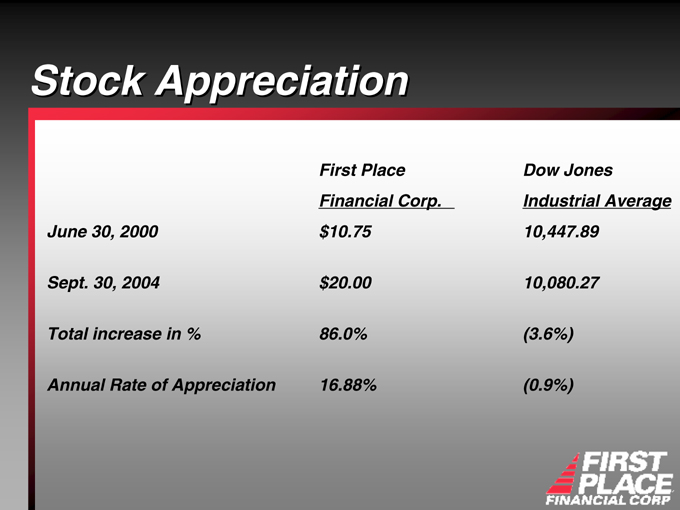

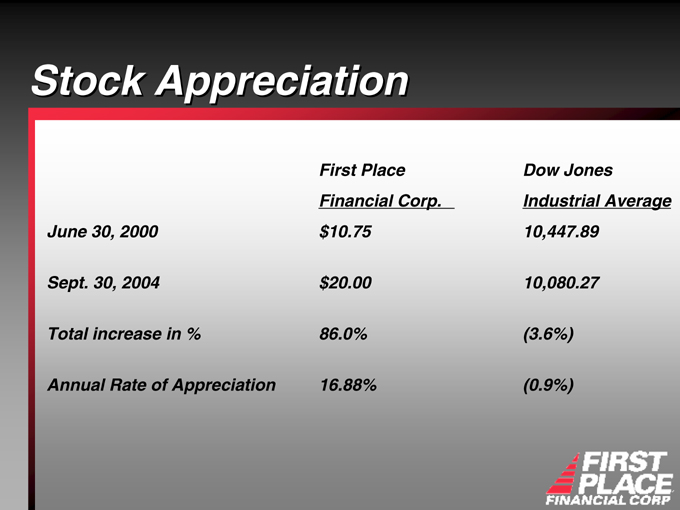

Stock Appreciation

First Place Financial Corp. Dow Jones Industrial Average

June 30, 2000 $ 10.75 10,447.89

Sept. 30, 2004 $ 20.00 10,080.27

Total increase in % 86.0% (3.6%)

Annual Rate of Appreciation 16.88% (0.9%)

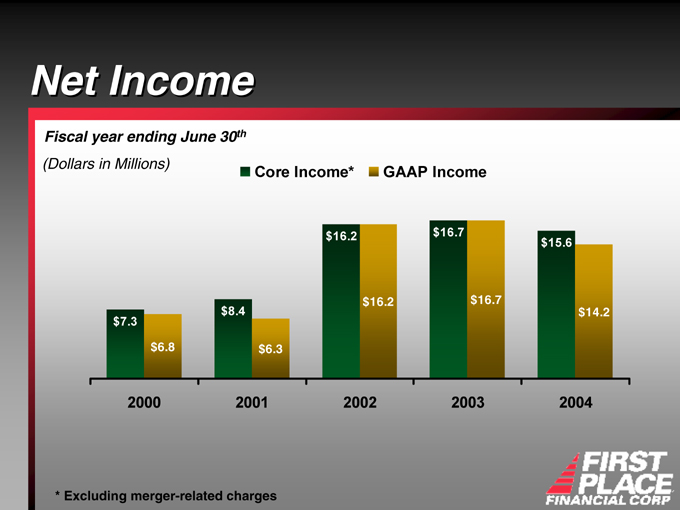

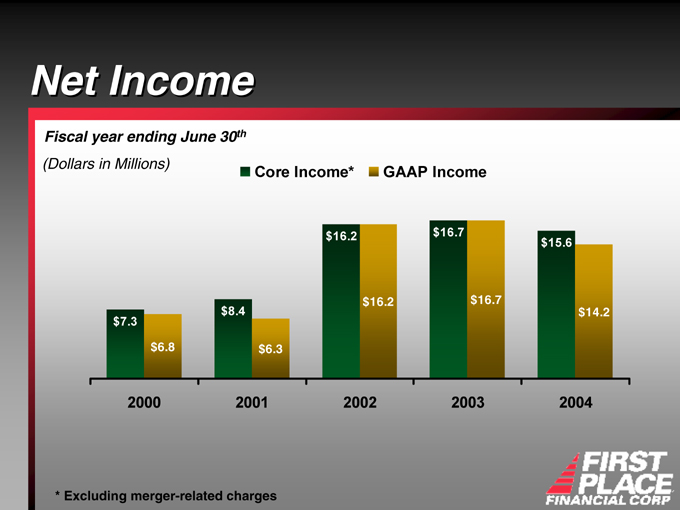

Net Income

Fiscal year ending June 30th

(Dollars in Millions)

Core Income* GAAP Income

$7.3 $6.8 $8.4 $6.3 $16.2 $16.2 $16.7 $16.7 $15.6 $14.2

2000 2001 2002 2003 2004

* Excluding merger-related charges

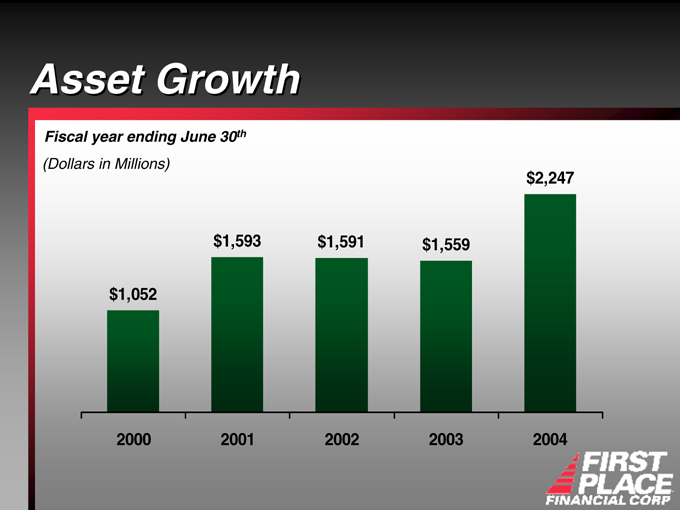

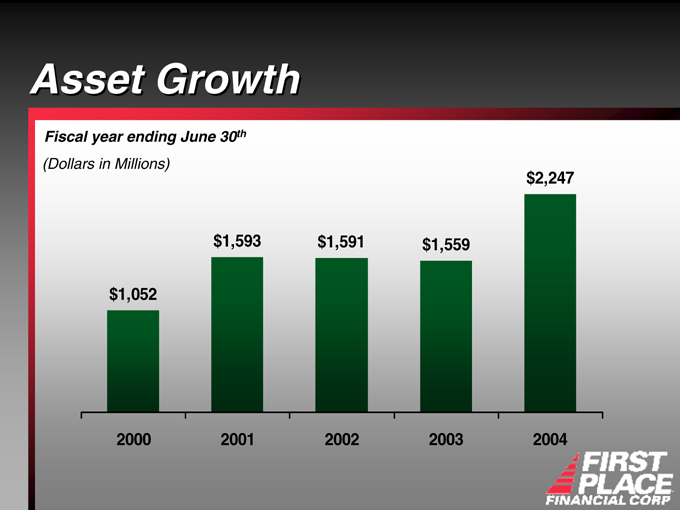

Asset Growth

Fiscal year ending June 30th

(Dollars in Millions)

$1,052 $1,593 $1,591 $1,559 $2,247

2000 2001 2002 2003 2004

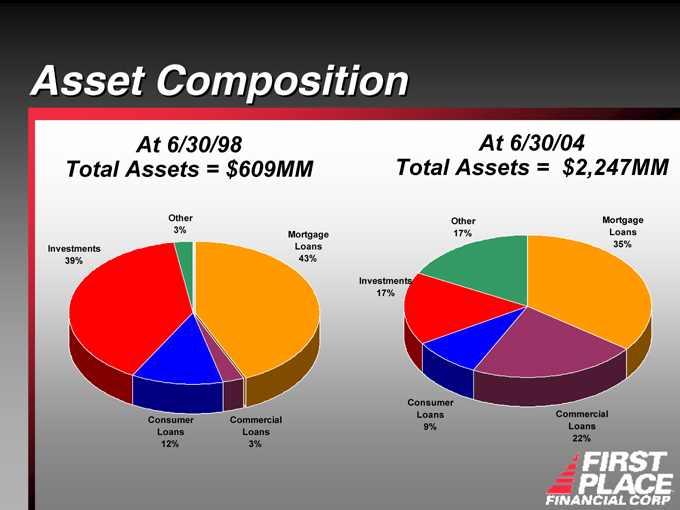

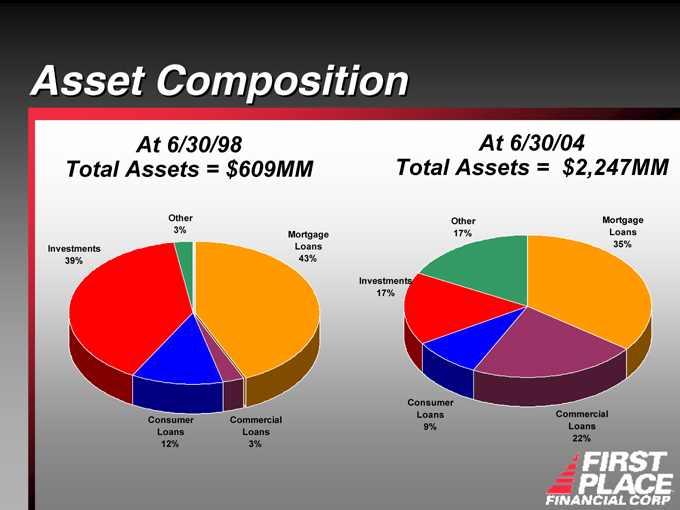

Asset Composition

At 6/30/98 Total Assets = $609MM

At 6/30/04 Total Assets = $2,247MM

Investments 39%

Other 3%

Mortgage Loans 43%

Commercial Loans 3%

Consumer Loans 12%

Investments 17%

Other 17%

Mortgage Loans 35%

Consumer Loans 9%

Commercial Loans 22%

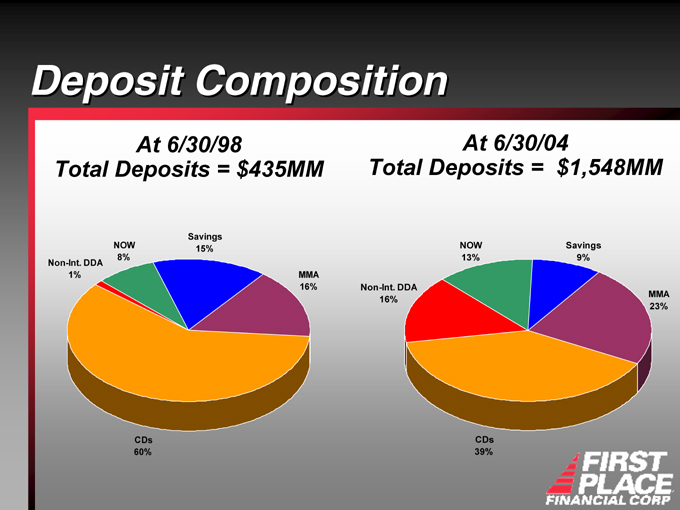

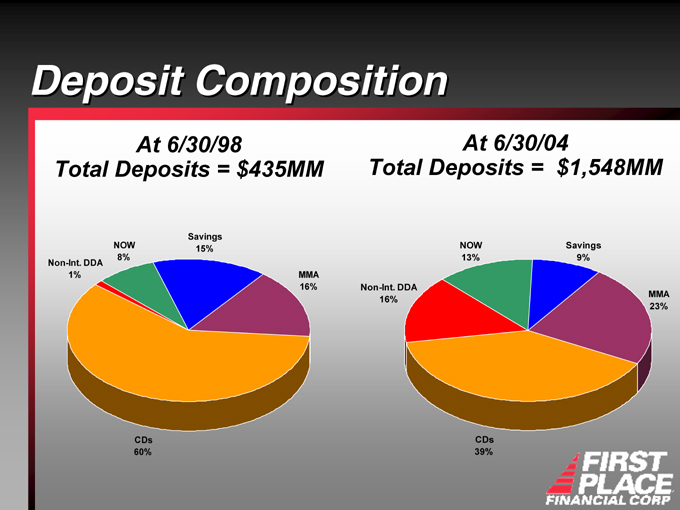

Deposit Composition

At 6/30/98 Total Deposits = $435MM

At 6/30/04

Total Deposits = $1,548MM

Non-Int. DDA 1%

NOW 8%

Savings 15%

MMA 16%

CDs 60%

Non-Int. DDA 16%

NOW 13%

Savings 9%

MMA 23%

CDs 39%

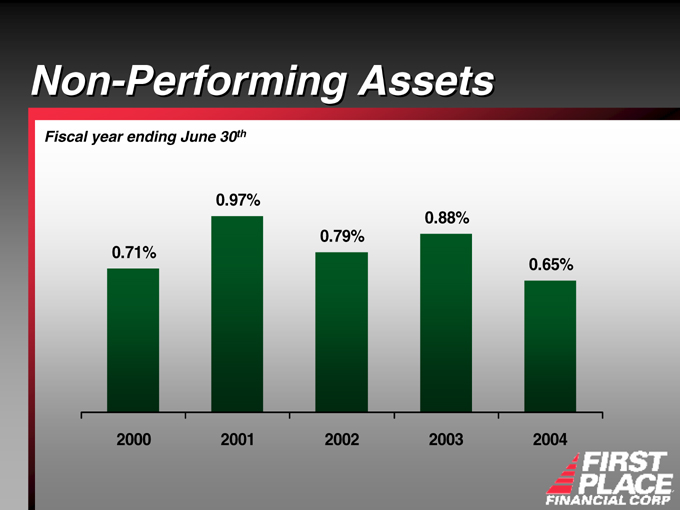

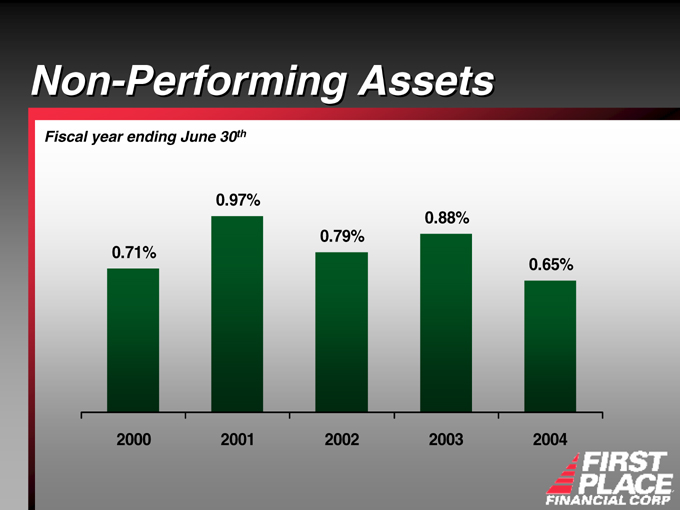

Non-Performing Assets

Fiscal year ending June 30th

2000 2001 2002 2003 2004

0.71%

0.97%

0.79%

0.88%

0.65%

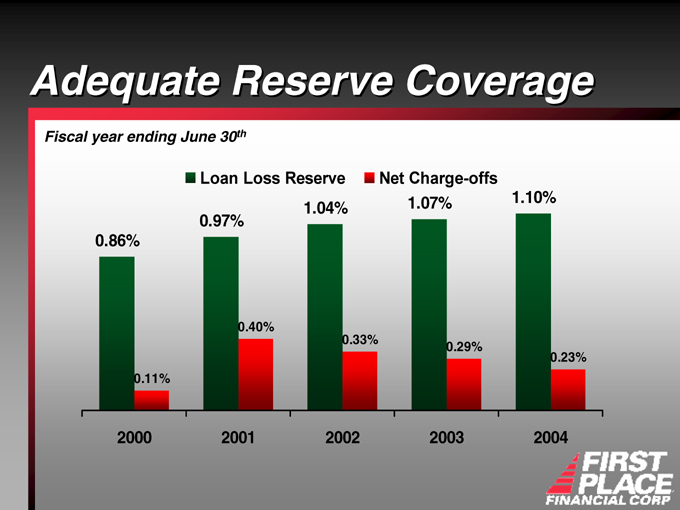

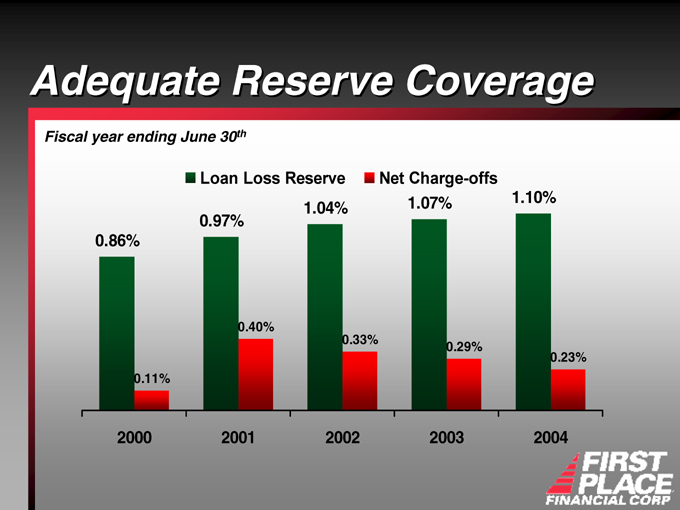

Adequate Reserve Coverage

Fiscal year ending June 30th

Loan Loss Reserve Net Charge-offs

0.86%

0.11%

0.97%

0.40%

1.04%

0.33%

1.07%

0.29%

1.10%

0.23%

2000

2001

2002

2003

2004

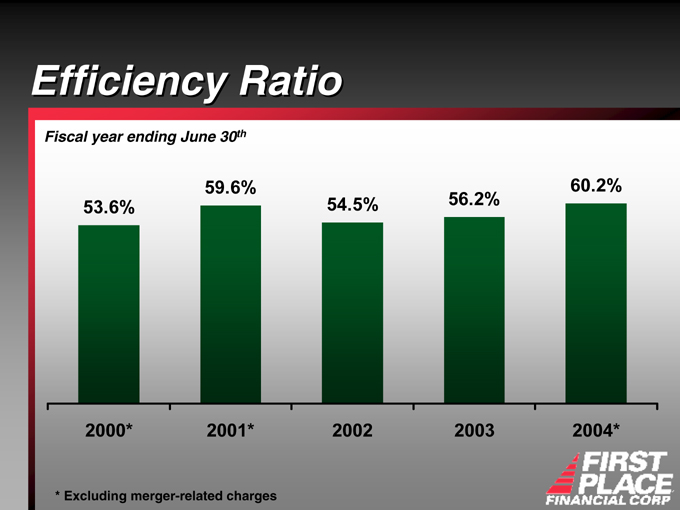

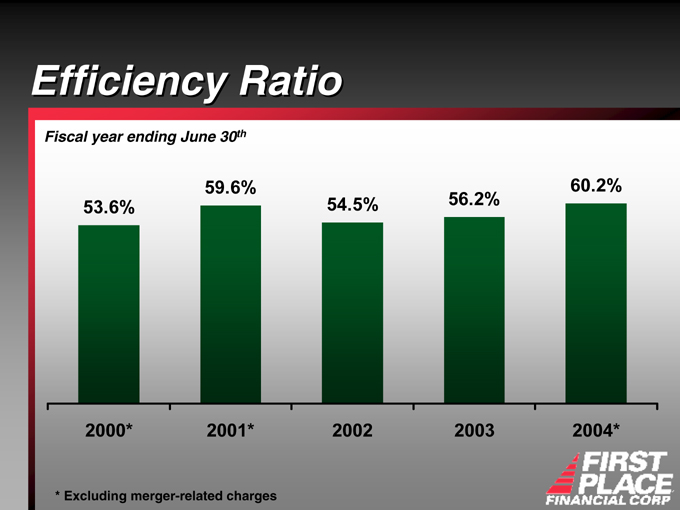

Efficiency Ratio

Fiscal year ending June 30th

2000* 2001* 2002 2003 2004*

* Excluding merger-related charges

53.6%

59.6%

54.5%

56.2%

60.2%

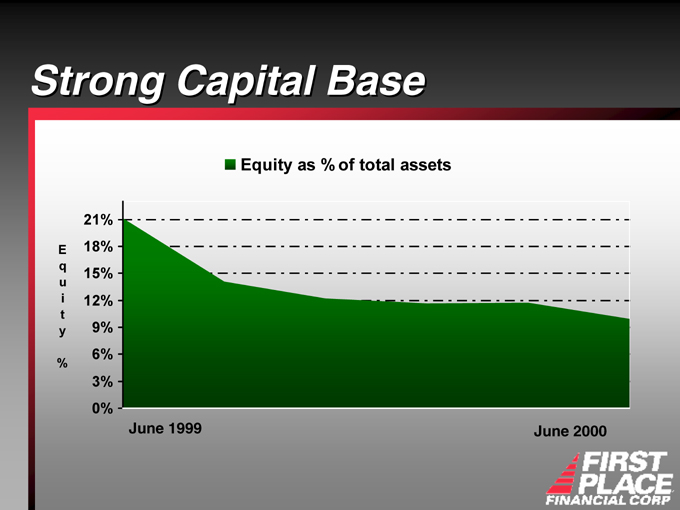

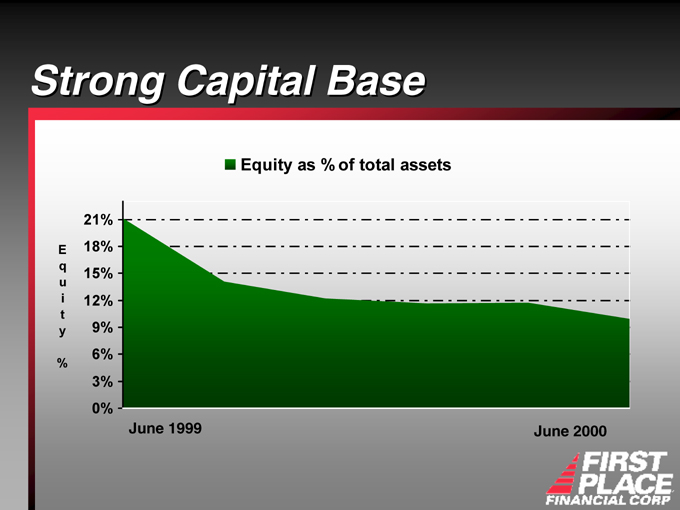

Strong Capital Base

Equity as % of total assets

Equity %

21% 18% 15% 12% 9% 6% 3% 0%

June 1999

June 2000

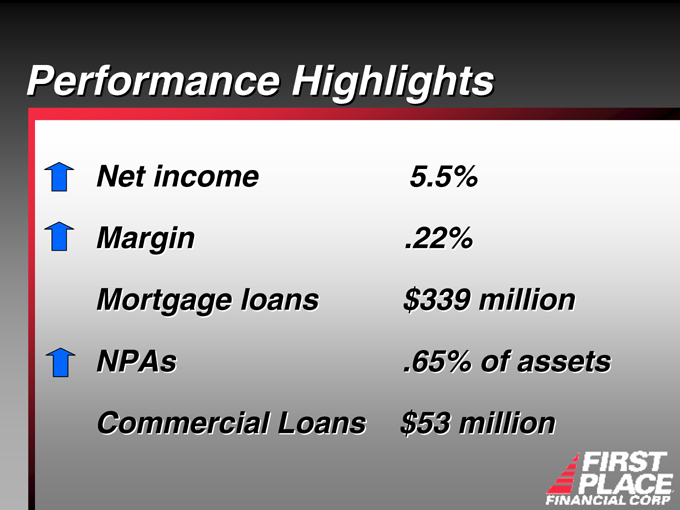

Fiscal 2005 First Quarter Results

Performance Highlights

Net income 5.5%

Margin .22%

Mortgage loans $339 million

NPAs .65% of assets

Commercial Loans $53 million

Challenges & Strategies

Demographic Shifts

Efficiency

Sarbanes Oxley

Funding

Key Investment Appeals

Transitioning to commercial bank portfolio Expanding into new markets and business lines Strong mortgage banking expertise Capital base to support diversification and growth Proven merger experience Management Team

Achieve Our Objectives

Thank you!

George Gentithes and Jeff Francis

Thank You