Exhibit 99.2

KBW 6th Annual Community Bank Investors Conference July 25-27, 2005

Steven R. Lewis – Chief Executive Officer Paul S. Musgrove – Chief Financial Officer

Forward-looking Statements

When used in this presentation, or future presentations or other public or shareholder communications, in filings by First Place Financial Corp. (the Company) with the Securities and Exchange Commission, or in oral statements made with the approval of an authorized executive officer, the words or phrases “will likely result,” “are expected to,” “will continue,” “is anticipated,” “estimate,” “project” or similar expressions are intended to identify “forward-looking statements” within the meaning of the Private Securities Litigation Reform Act of 1995. Such forward-looking statements involve known and unknown risks, uncertainties and other factors, which may cause the Company’s actual results to be materially different from those indicated. Such statements are subject to certain risks and uncertainties including changes in economic conditions in the market areas the Company conducts business, which could materially impact credit quality trends, changes in laws, regulations or policies of regulatory agencies, fluctuations in interest rates, demand for loans in the market areas the Company conducts business, and competition, that could cause actual results to differ materially from historical earnings and those presently anticipated or projected. The Company wishes to caution readers not to place undue reliance on any such forward-looking statements, which speak only as of the date made. The Company undertakes no obligation to publicly release the result of any revisions that may be made to any forward-looking statements to reflect events or circumstances after the date of such statements or to reflect the occurrence of anticipated or unanticipated events.

Explanation Of Certain Non-GAAP Measures

This presentation contains certain financial information determined by methods other than with Generally Accepted Accounting Principles (GAAP). Specifically, we have provided financial measures which are based on core earnings rather than net income. Ratios and other financial measures with the word “core” in their title were computed using core earnings rather than net income. Core earnings excludes merger, integration and restructuring expense; extraordinary income or expense; income or expense from discontinued operations; and income, expense, gains and losses that are not reflective of ongoing operations or that we do not expect to reoccur. We believe that this information is useful to both investors and to management and can aid them in understanding the Company’s current performance, performance trends and financial condition. While core earnings can be useful in evaluating current performance and projecting current trends into the future, we do not believe that core earnings are a substitute for GAAP net income. We encourage investors and others to use core earnings as a supplemental tool for analysis and not as a substitute for GAAP net income. Our non-GAAP measures may not be comparable to the non-GAAP measures of other companies. In addition, future results of operations may include nonrecurring items that would not be included in core earnings. A reconciliation from GAAP net income to the non-GAAP measure of core earnings is shown in the Appendix to this presentation.

First Place Corporate Profile $2.5 billion in assets $300 million market cap

Four state market: Ohio, Michigan, Pennsylvania & Indiana with:

26 branches 15 loan offices

2 business financial centers

Market share leader in primary markets

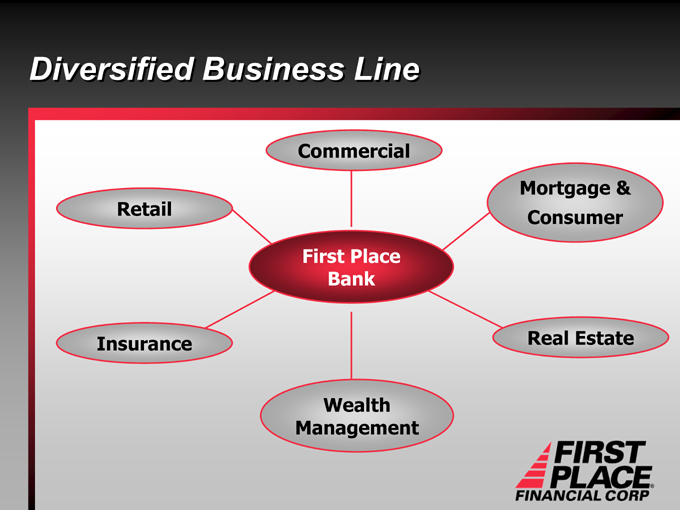

Diversified bank: commercial, retail, consumer, insurance, wealth management, and real estate

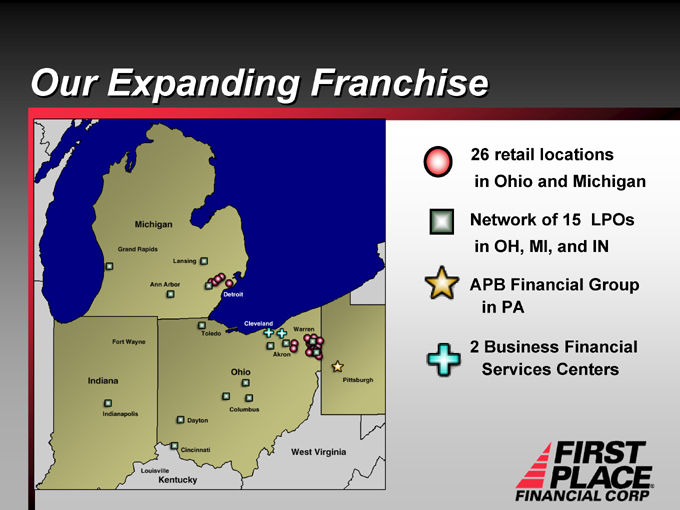

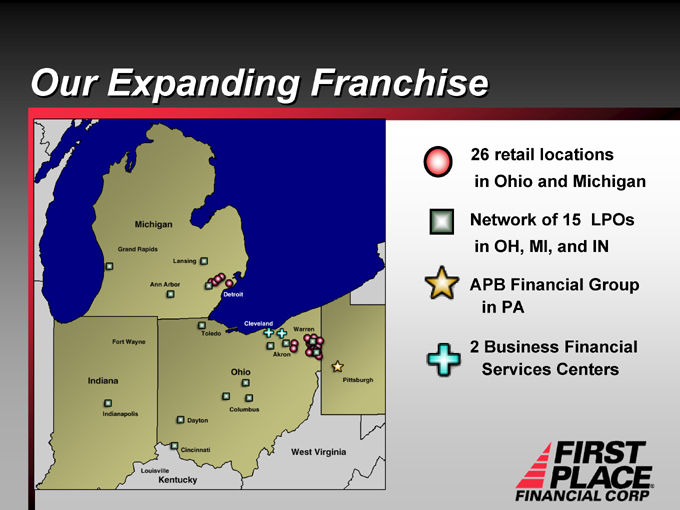

Our Expanding Franchise

26 retail locations in Ohio and Michigan

Network of 15 LPOs in OH, MI, and IN

APB Financial Group in PA

2 Business Financial Services Centers

Strategic Growth Plan

Complete FPFC’s transformation to commercial bank Grow commercial loans Grow core deposits Maintain excellent asset quality Make strategic acquisitions/Expand branch network

A Strong Management Team

Years in Banking

Steven Lewis, Chief Executive Officer 21

Albert Blank, Chief Operating Officer 21

Paul Musgrove, Chief Financial Officer 12

Craig Johnson, Michigan Regional President 23

Kenton Thompson, Ohio Regional President 26

Bruce Wenmoth, Corporate Exec. VP, Consumer Banking 22

Dominique Stoeber, Corporate Exec. VP, Retail Banking 15

Tim Beaumont, Corporate Exec. VP, Chief Credit Officer 25

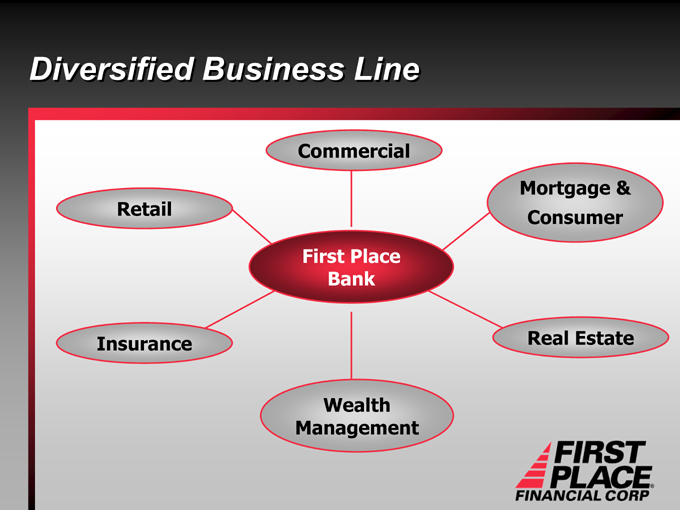

Diversified Business Line

Commercial

Mortgage & Consumer

Real Estate

Wealth Management

Insurance

Retail

First Place Bank

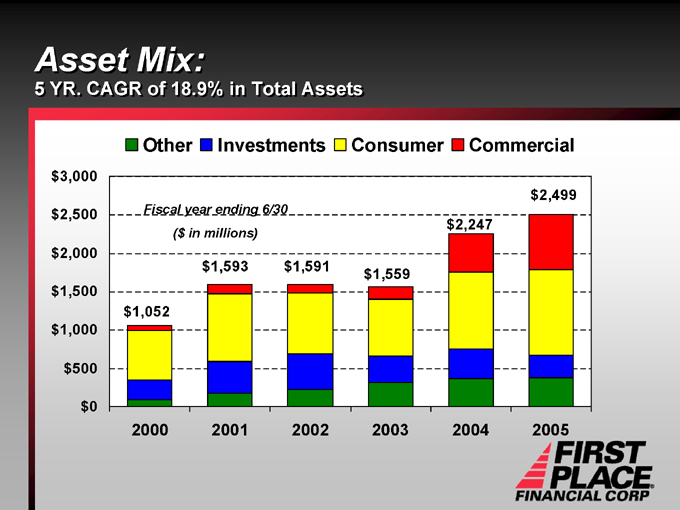

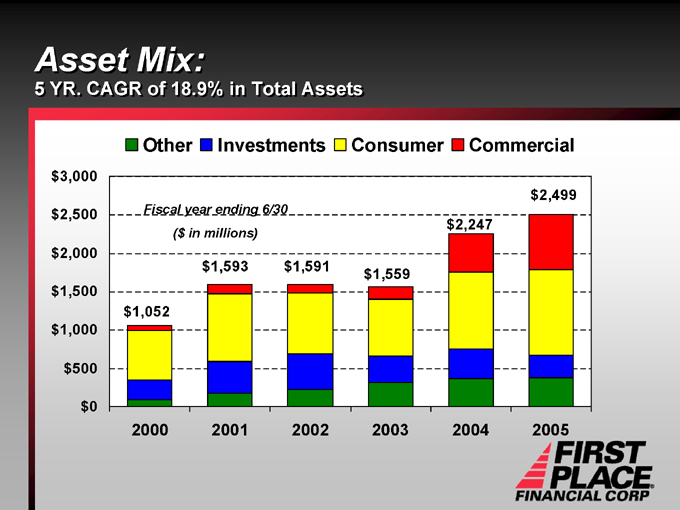

Asset Mix:

5 YR. CAGR of 18.9% in Total Assets . .

Other

Investments

Consumer

Commercial $3,000 $2,500 $2,000 $1,500 $1,000 $500 $0

Fiscal year ending 6/30

($ in millions) $1,052 $1,593 $1,591 $1,559 $2,247 $2,499

2000 2001 2002 2003 2004 2005

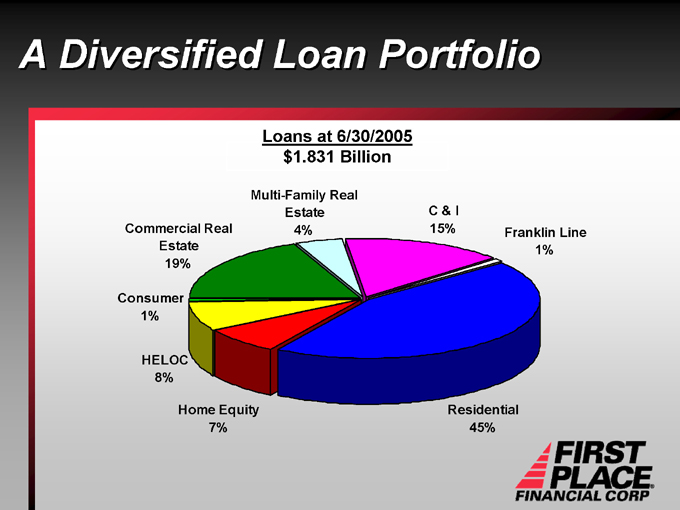

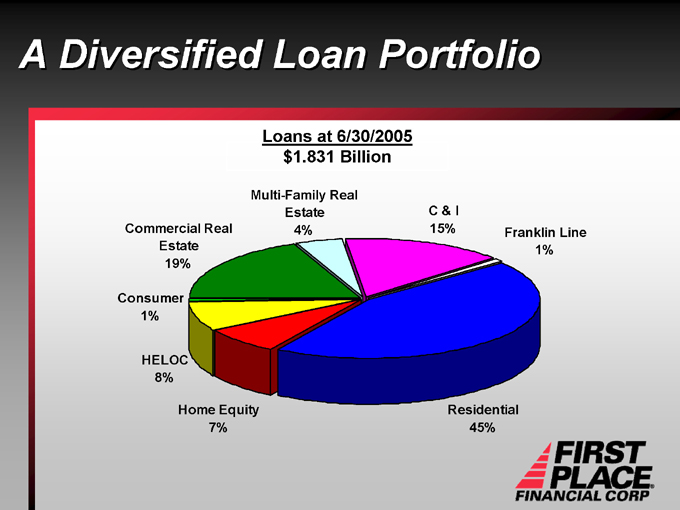

A Diversified Loan Portfolio

Loans at 6/30/2005 $1.831 Billion

Franklin Line 1%

C & I 15%

Multi-Family Real Estate 4%

Commercial Real Estate 19%

Consumer 1%

HELOC

8%

Home Equity 7%

Residential 45%

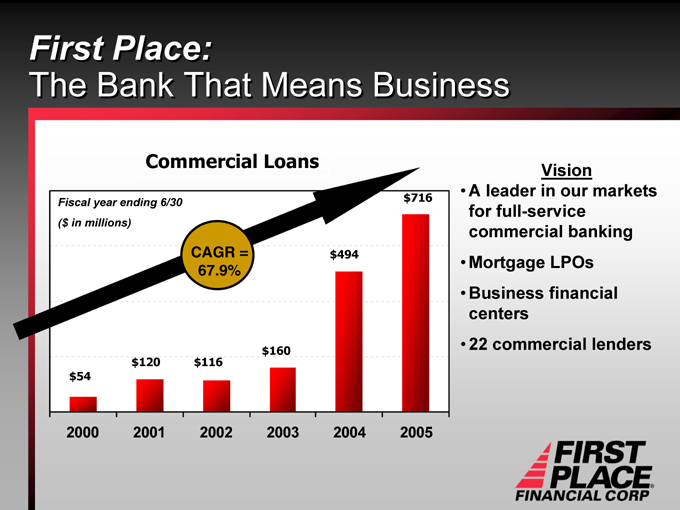

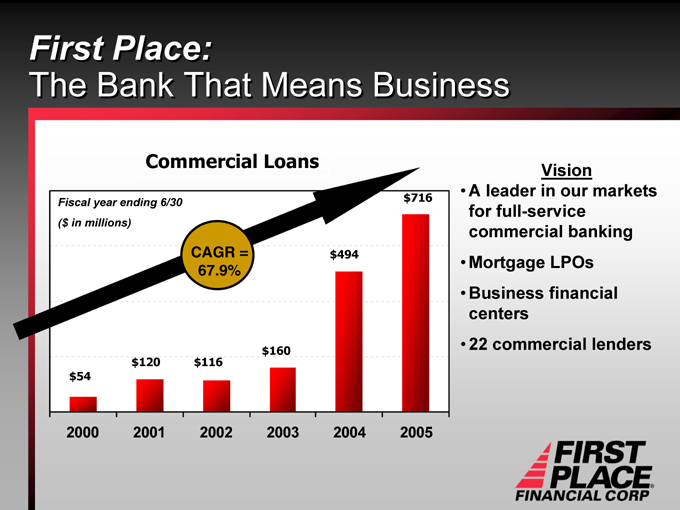

First Place:

The Bank That Means Business

Commercial Loans

Fiscal year ending 6/30 ($ in millions)

CAGR = 67.9% $716 $494 $508 $160 $116 $120 $54

2000 2001 2002 2003 2004 2005

Vision A leader in our markets for full-service commercial banking Mortgage LPOs Business financial centers 22 commercial lenders

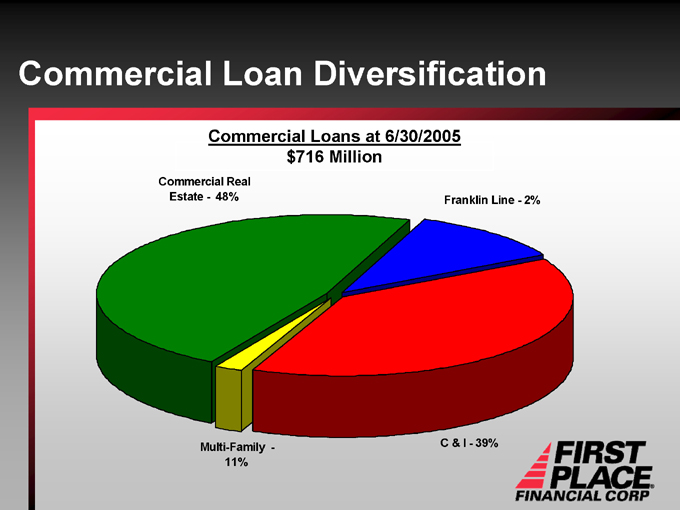

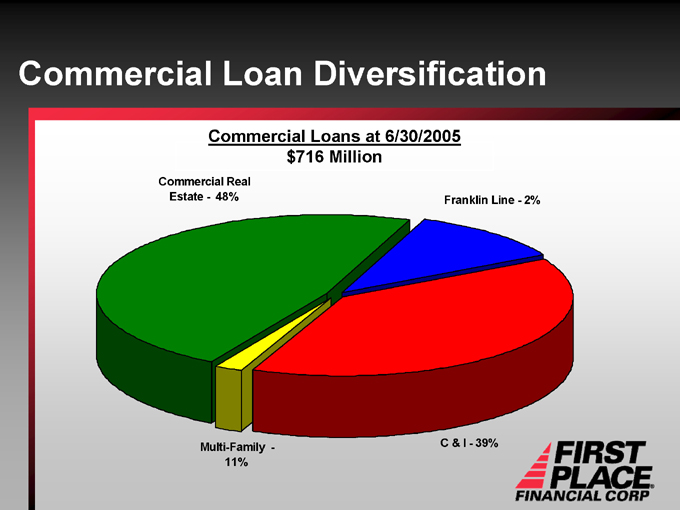

Commercial Loan Diversification

Commercial Loans at 6/30/2005 $716 Million

Commercial Real Estate—48%

Franklin Line—2%

Multi-Family—11%

C & I—39%

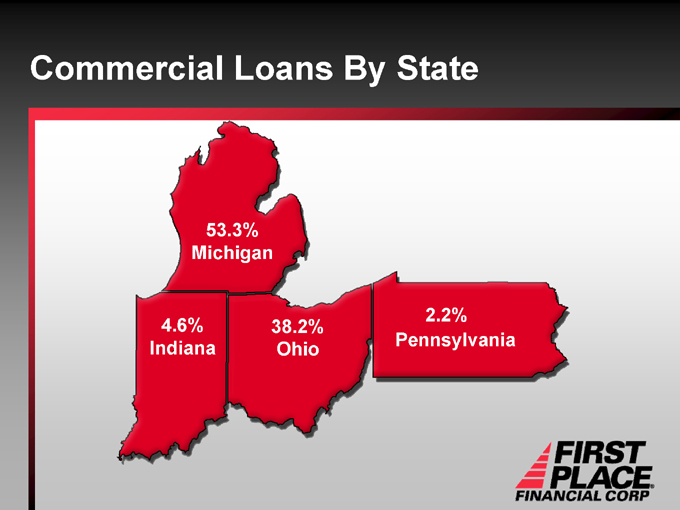

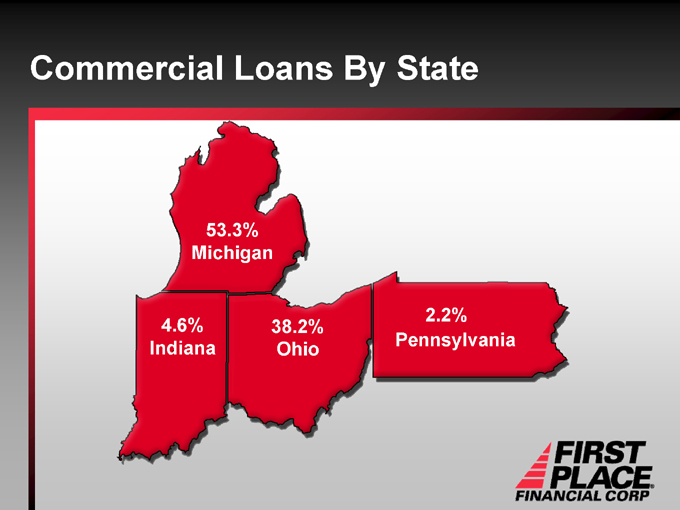

Commercial Loans By State

53.3% Michigan

4.6% Indiana

38.2% Ohio

2.2% Pennsylvania

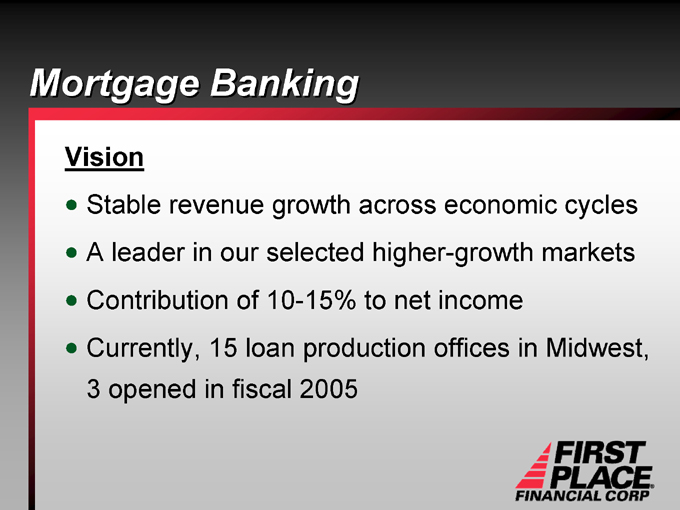

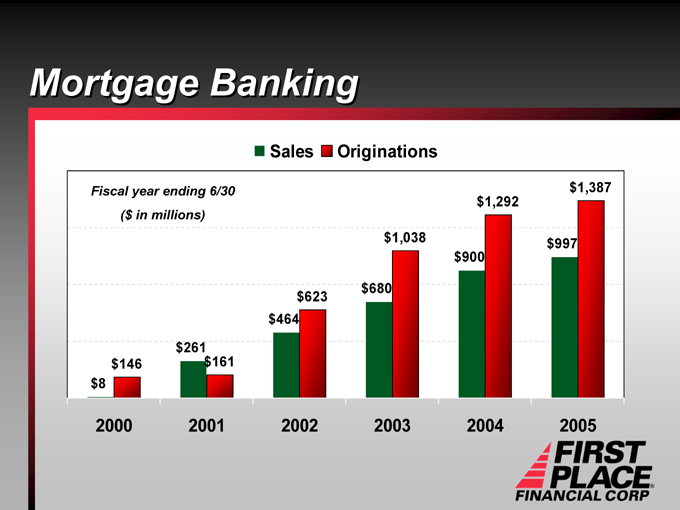

Mortgage Banking

Vision

Stable revenue growth across economic cycles A leader in our selected higher-growth markets Contribution of 10-15% to net income Currently, 15 loan production offices in Midwest, 3 opened in fiscal 2005

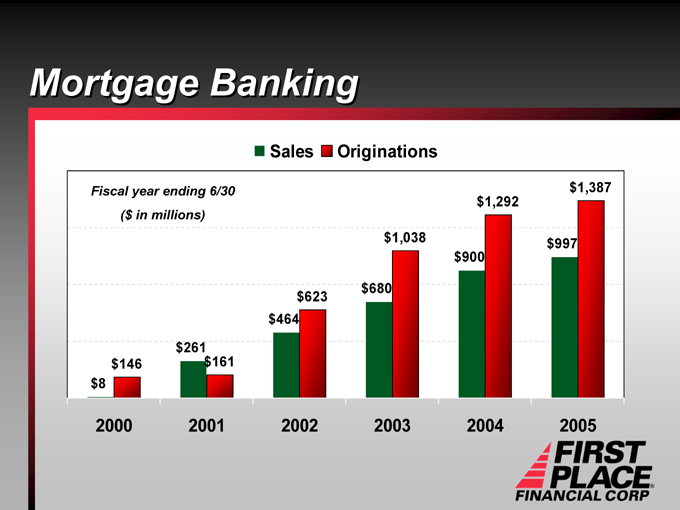

Mortgage Banking

Sales

Originations

Fiscal year ending 6/30 ($ in millions) $8 $146 $261 $161 $464 $623 $680 $1,038 $900 $1,292 $997 $1,387

2000 2001 2002 2003 2004 2005

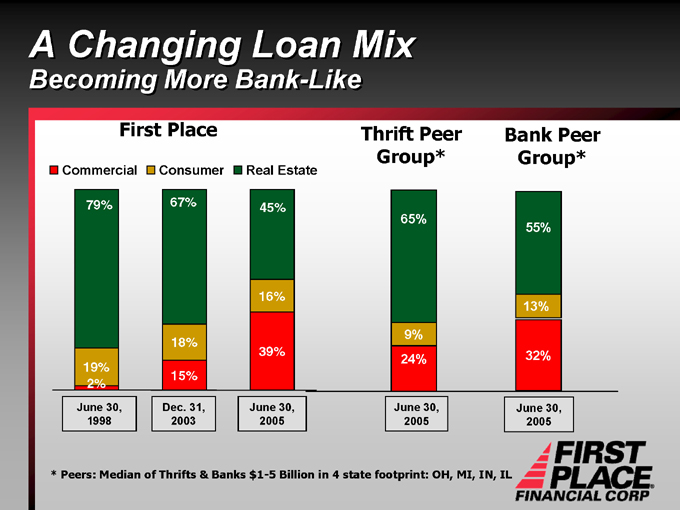

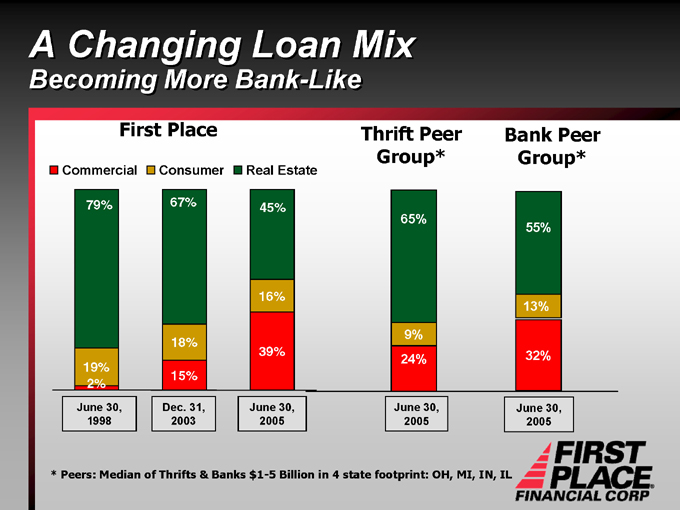

A Changing Loan Mix

Becoming More Bank-Like

First Place

Thrift Peer Group*

Bank Peer Group*

Commercial

Consumer

Real Estate

79%

19% 2%

67%

18%

15%

45%

16%

39%

65%

9% 24%

55%

13%

32%

June 30, 1998

Dec. 31, 2003

June 30, 2005

June 30, 2005

June 30, 2005

* Peers: Median of Thrifts & Banks $1-5 Billion in 4 state footprint: OH, MI, IN, IL

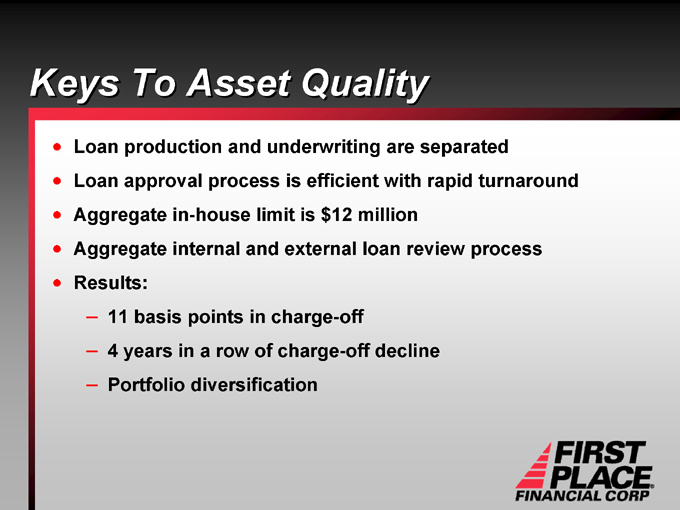

Keys To Asset Quality

Loan production and underwriting are separated Loan approval process is efficient with rapid turnaround Aggregate in-house limit is $12 million Aggregate internal and external loan review process Results:

11 basis points in charge-off

4 years in a row of charge-off decline Portfolio diversification

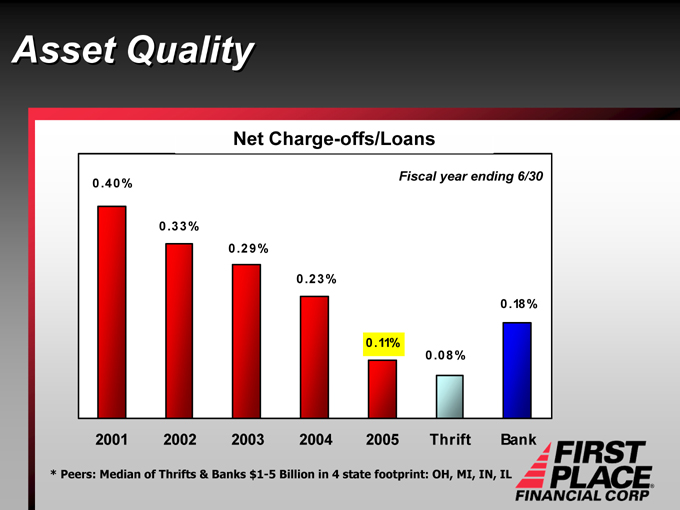

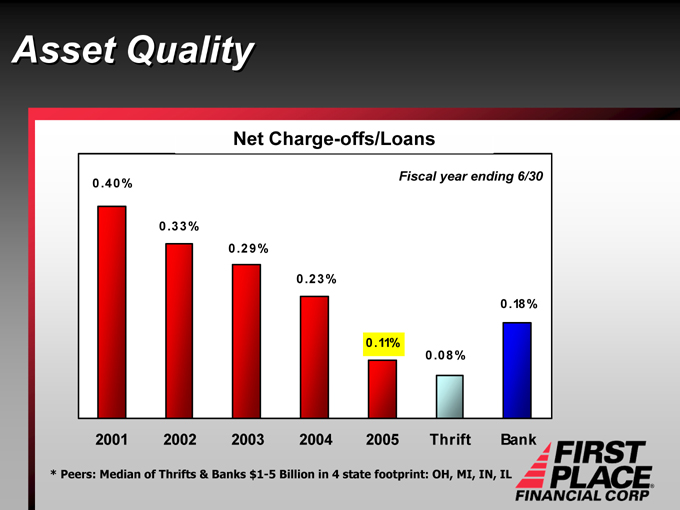

Asset Quality

Net Charge-offs/Loans

Fiscal year ending 6/30

0.40%

0.33%

0.29%

0.23%

0.11%

0.08%

0.18%

2001 2002 2003 2004 2005 Thrift Bank

* Peers: Median of Thrifts & Banks $1-5 Billion in 4 state footprint: OH, MI, IN, IL

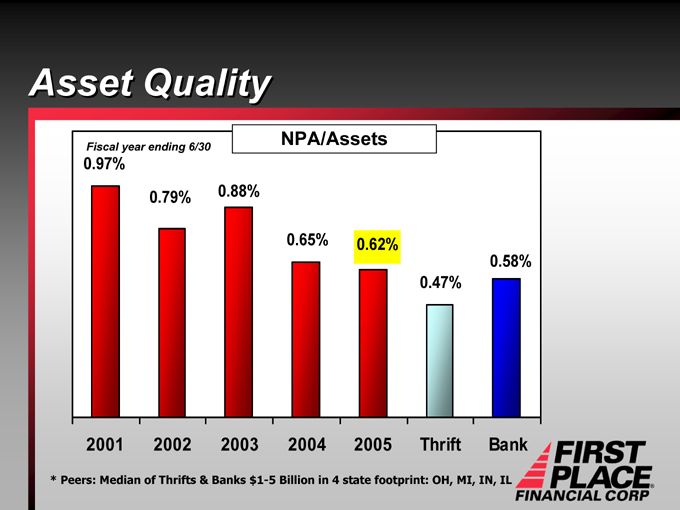

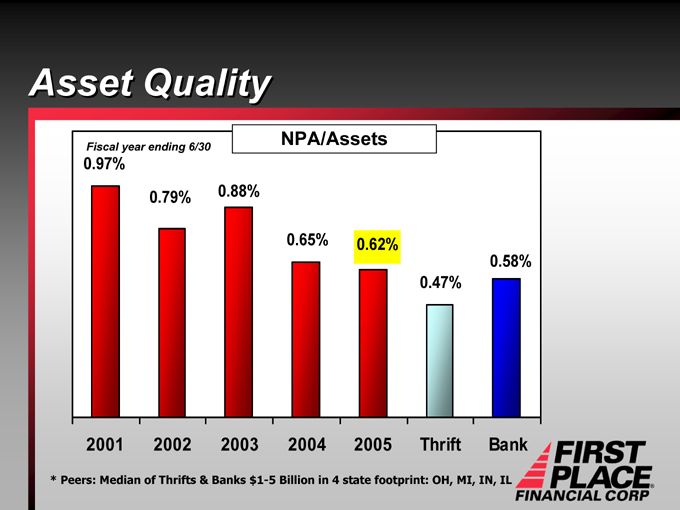

Asset Quality

NPA/Assets

Fiscal year ending 6/30

0.97%

0.79%

0.88%

0.65% 0.62%

0.47%

0.58%

2001 2002 2003 2004 2005 Thrift Bank

* Peers: Median of Thrifts & Banks $1-5 Billion in 4 state footprint: OH, MI, IN, IL

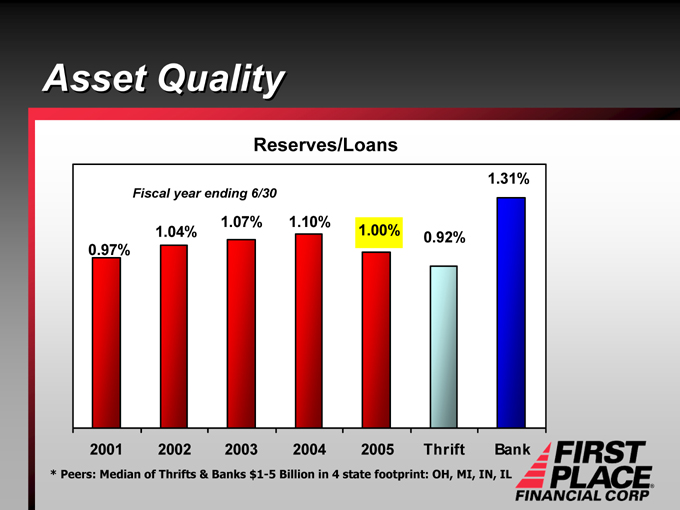

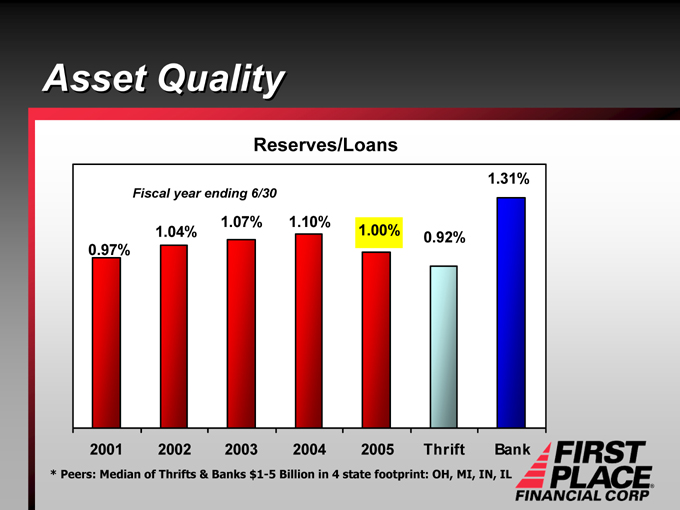

Asset Quality

Reserves/Loans

Fiscal year ending 6/30

0.97%

1.04%

1.07%

1.10%

1.00%

0.92%

1.31%

2001 2002 2003 2004 2005 Thrift Bank

* Peers: Median of Thrifts & Banks $1-5 Billion in 4 state footprint: OH, MI, IN, IL

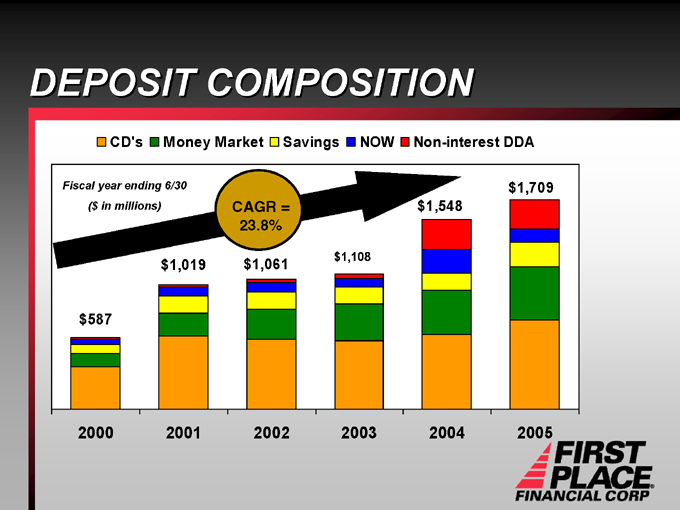

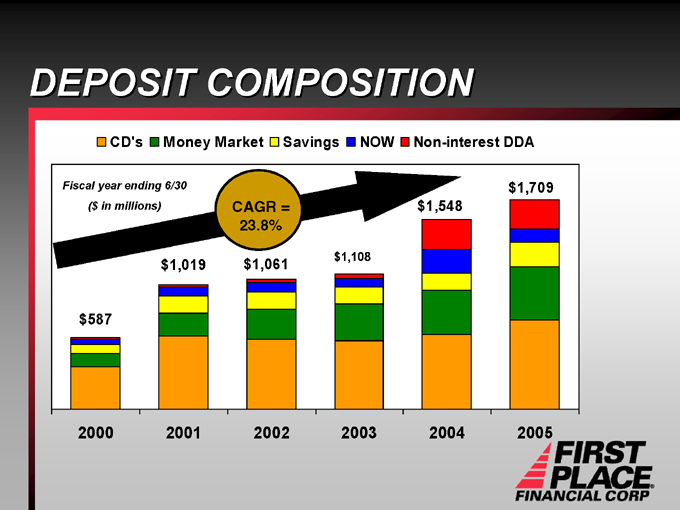

DEPOSIT COMPOSITION

CD’s

Money Market

Savings

NOW

Non-interest DDA

Fiscal year ending 6/30 ($in millions)

CAGR = 23.8% $587 $1,019 $1,061 $1,108 $1,548 $1,709

2000 2001 2002 2003 2004 2005

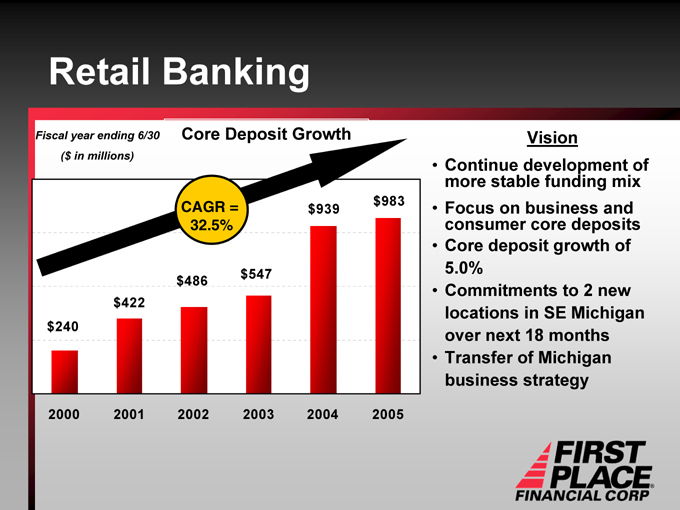

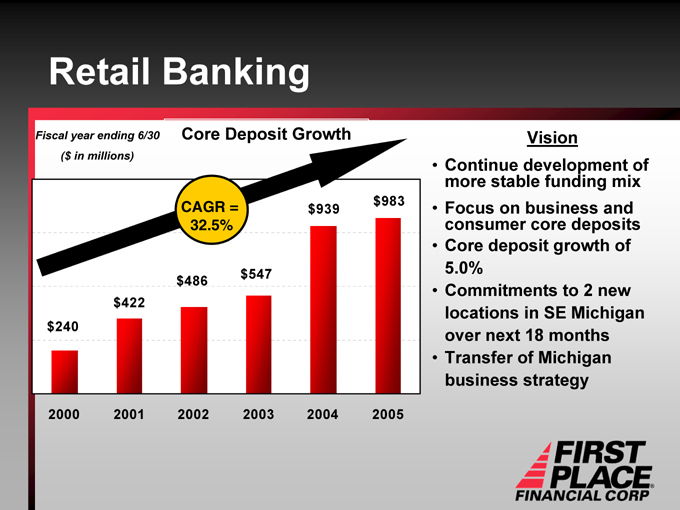

Retail Banking

Fiscal year ending 6/30 ($in millions)

Core Deposit Growth

CAGR = 32.5% $240 $422 $486 $547 $939 $983

2000 2001 2002 2003 2004 2005

Vision

Continue development of more stable funding mix Focus on business and consumer core deposits Core deposit growth of 5.0% Commitments to 2 new locations in SE Michigan over next 18 months Transfer of Michigan business strategy

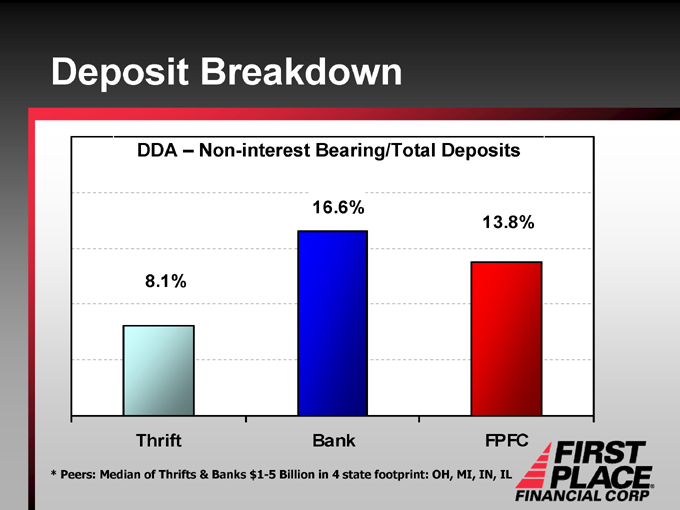

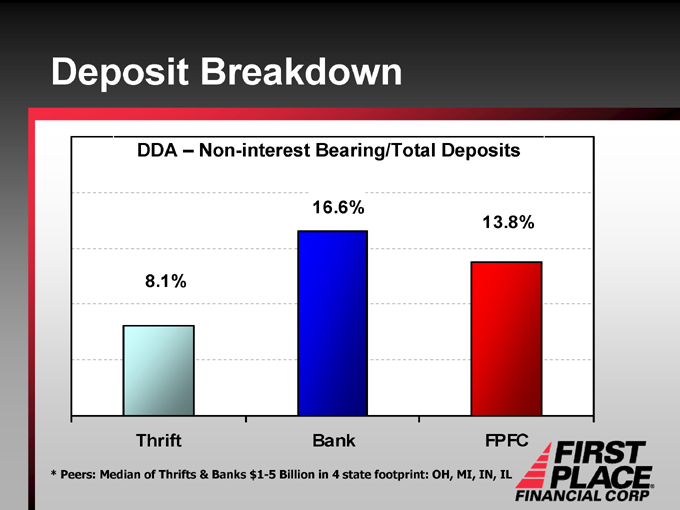

Deposit Breakdown

DDA – Non-interest Bearing/Total Deposits

8.1%

16.6%

13.8%

Thrift Bank FPFC

* Peers: Median of Thrifts & Banks $1-5 Billion in 4 state footprint: OH, MI, IN, IL

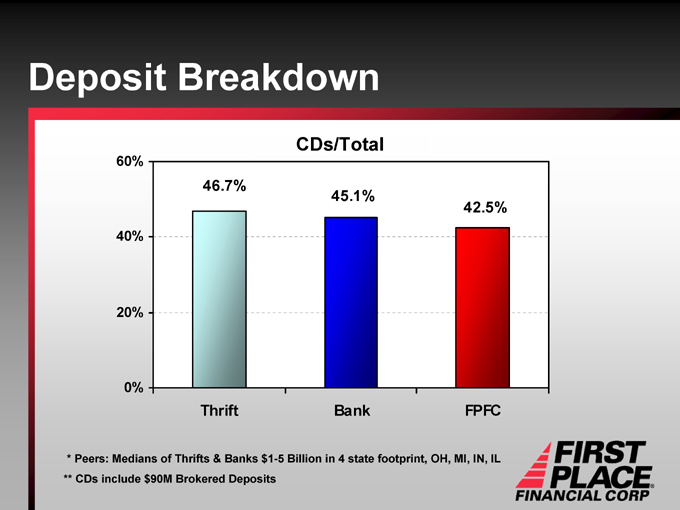

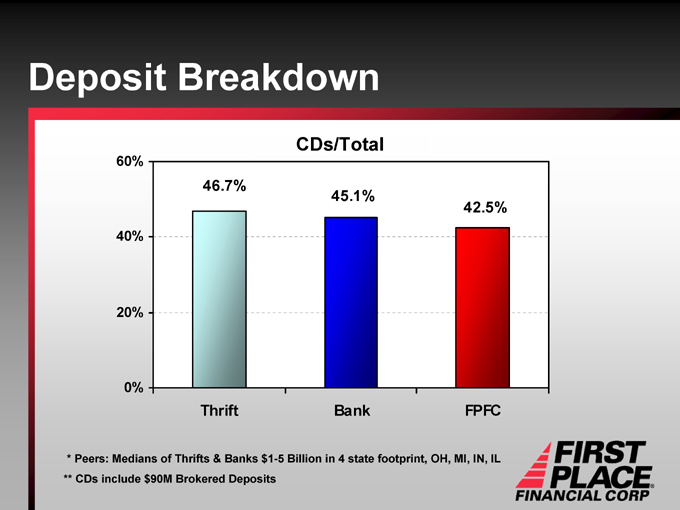

Deposit Breakdown

CDs/Total

60% 40% 20% 0%

46.7%

45.1%

42.5%

Thrift Bank FPFC

* Peers: Medians of Thrifts & Banks $1-5 Billion in 4 state footprint, OH, MI, IN, IL ** CDs include $90M Brokered Deposits

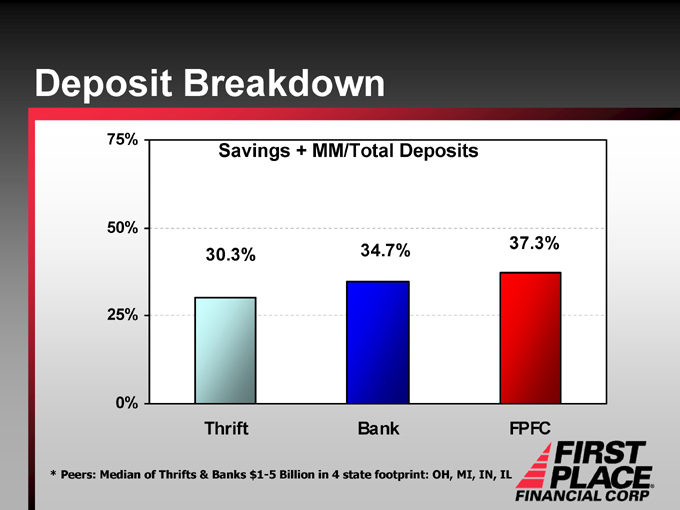

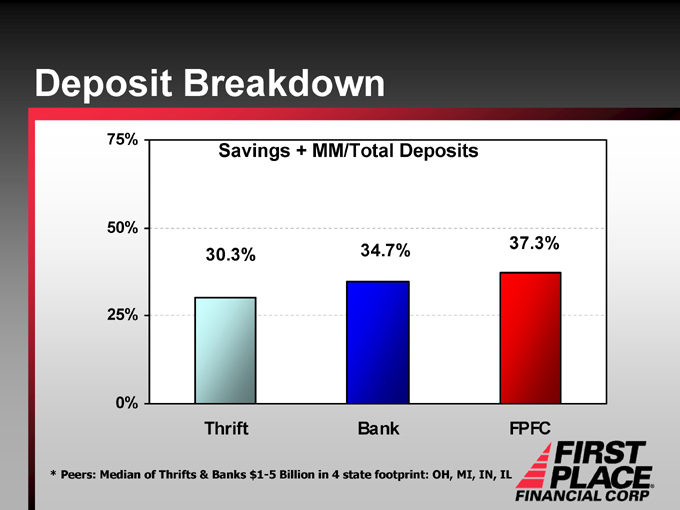

Deposit Breakdown

75% 50% 25% 0%

Savings + MM/Total Deposits

30.3%

34.7%

37.3%

Thrift

Bank

FPFC

* Peers: Median of Thrifts & Banks $1-5 Billion in 4 state footprint: OH, MI, IN, IL

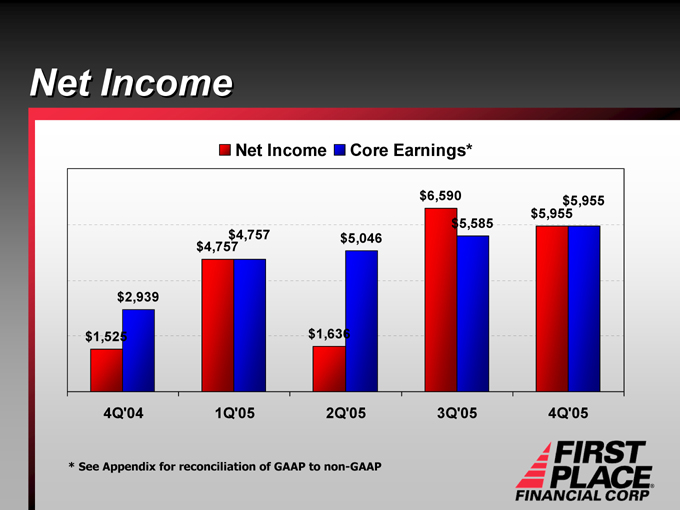

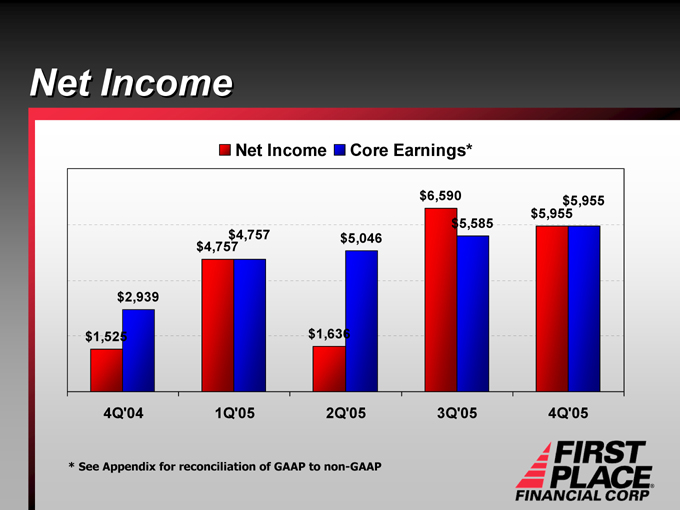

Net Income

Net Income

Core Earnings* $1,525 $2,939 $4,757 $4,757 $1,636 $5,046 $6,590 $5,585 $5,955 $5,955

4Q’04 1Q’05 2Q’05 3Q’05 4Q’05

* See Appendix for reconciliation of GAAP to non-GAAP

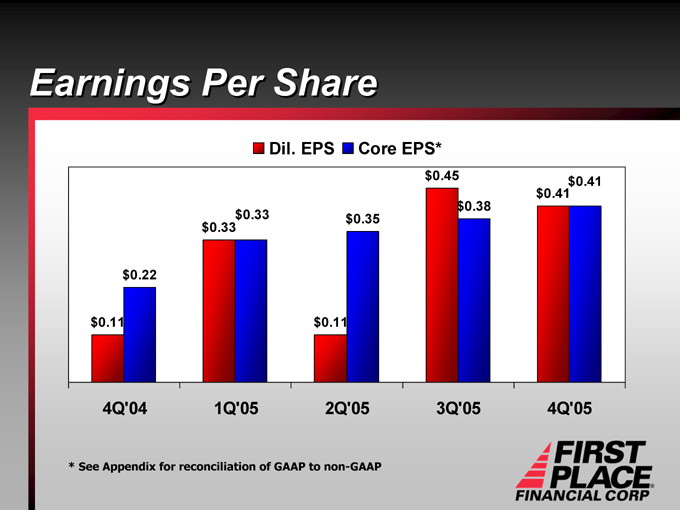

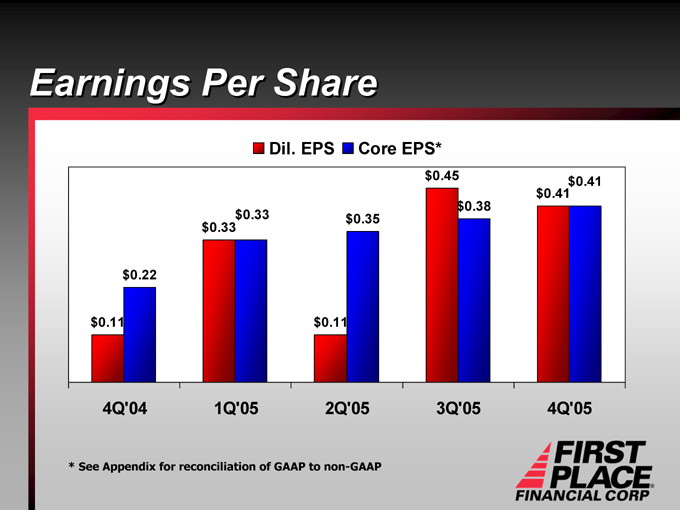

Earnings Per Share

Dil. EPS

Core EPS* $0.11 $0.22 $0.33 $0.33 $0.11 $0.35 $0.45 $0.38 $0.41 $0.41

4Q’04 1Q’05 2Q’05 3Q’05 4Q’05

* See Appendix for reconciliation of GAAP to non-GAAP

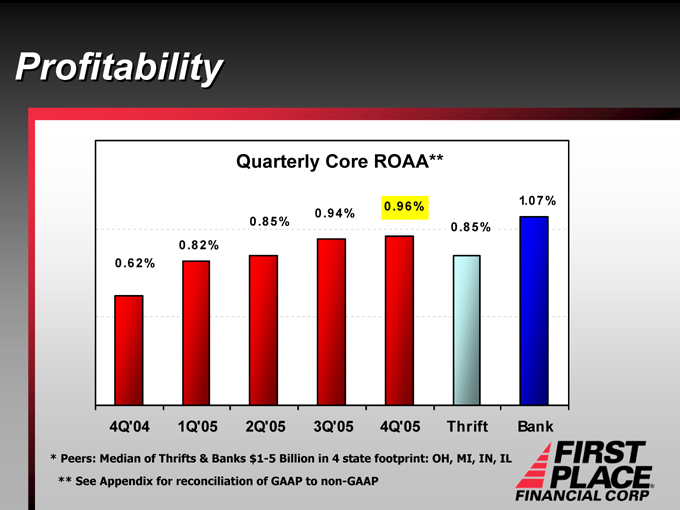

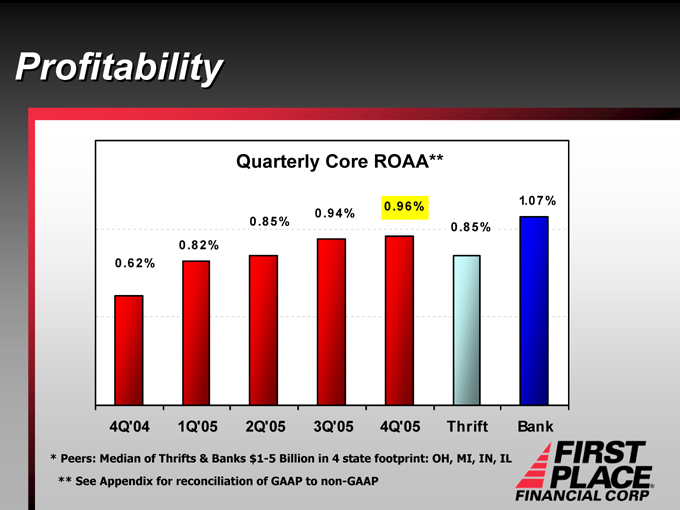

Profitability

Quarterly Core ROAA**

0.62%

0.82%

0.85%

0.94%

0.96%

0.85%

1.07%

4Q’04 1Q’05 2Q’05 3Q’05 4Q’05 Thrift Bank

* Peers: Median of Thrifts & Banks $1-5 Billion in 4 state footprint: OH, MI, IN, IL

** See Appendix for reconciliation of GAAP to non-GAAP

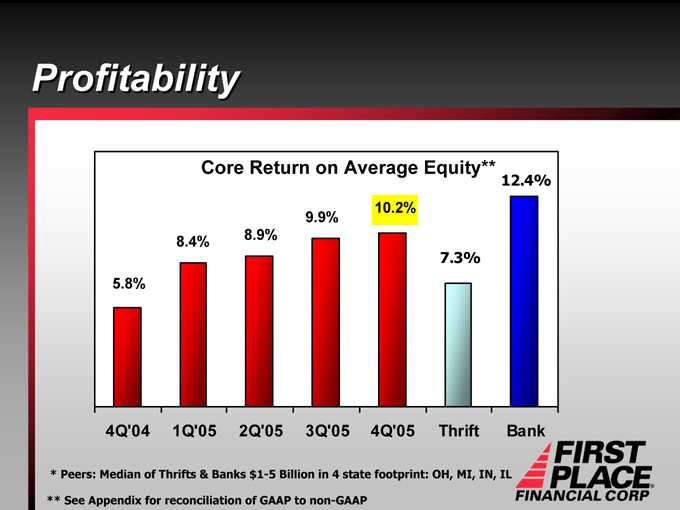

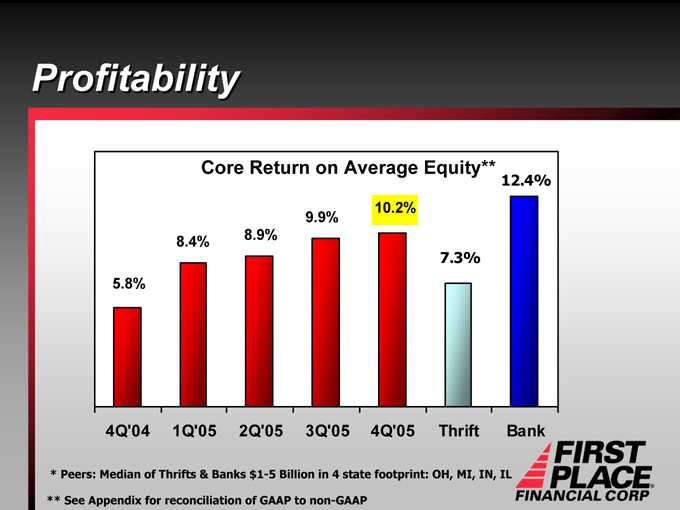

Profitability

Core Return on Average Equity**

5.8%

8.4%

8.9%

9.9%

10.2%

7.3%

12.4%

4Q’04 1Q’05 2Q’05 3Q’05 4Q’05 Thrift Bank

* Peers: Median of Thrifts & Banks $1-5 Billion in 4 state footprint: OH, MI, IN, IL

** See Appendix for reconciliation of GAAP to non-GAAP

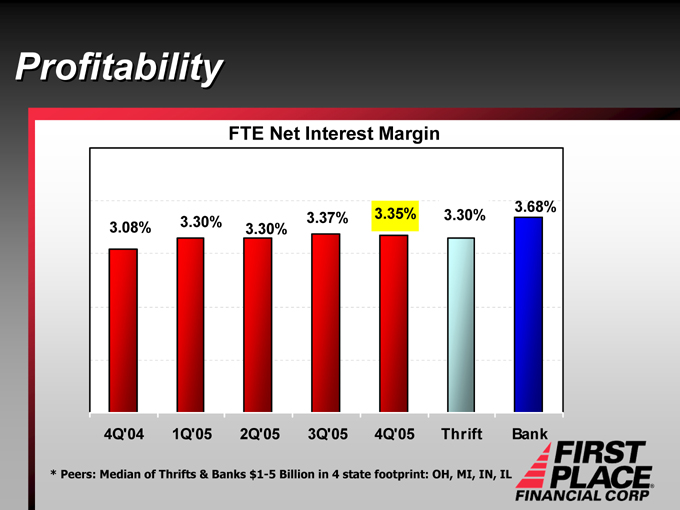

Profitability

Quarterly Core Tangible ROAE*

7.3%

12.6%

13.1%

14.4%

14.6%

4Q’04 1Q’05 2Q’05 3Q’05 4Q’05

* See Appendix for reconciliation of GAAP to non-GAAP

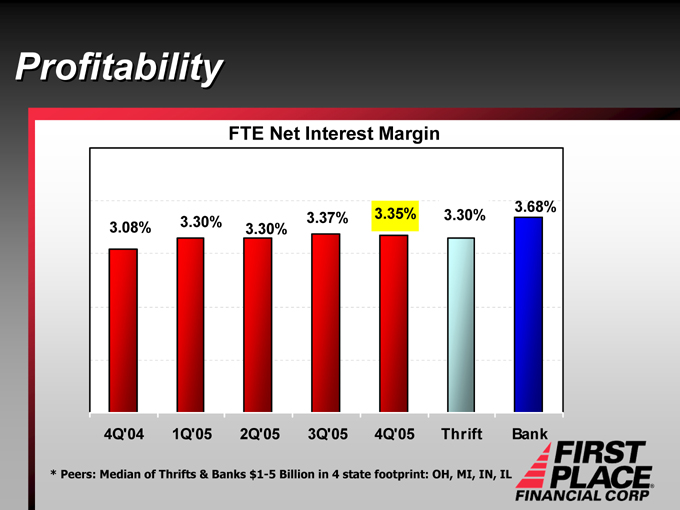

Profitability

FTE Net Interest Margin

3.08%

3.30%

3.30%

3.37%

3.35%

3.30%

3.68%

4Q’04 1Q’05 2Q’05 3Q’05 4Q’05 Thrift Bank

* Peers: Median of Thrifts & Banks $1-5 Billion in 4 state footprint: OH, MI, IN, IL

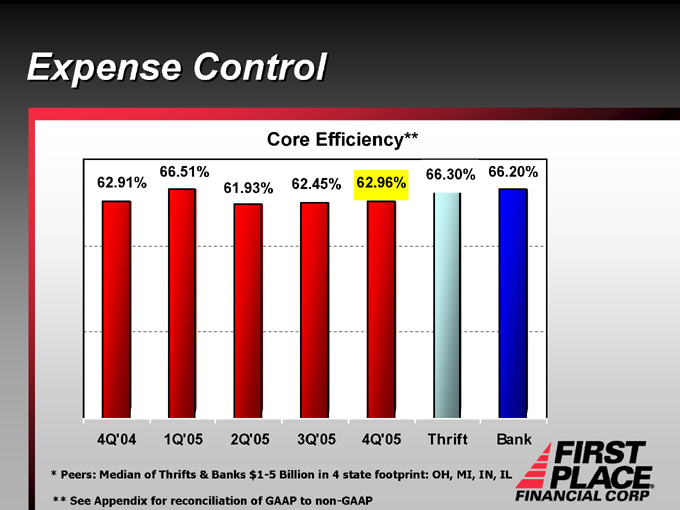

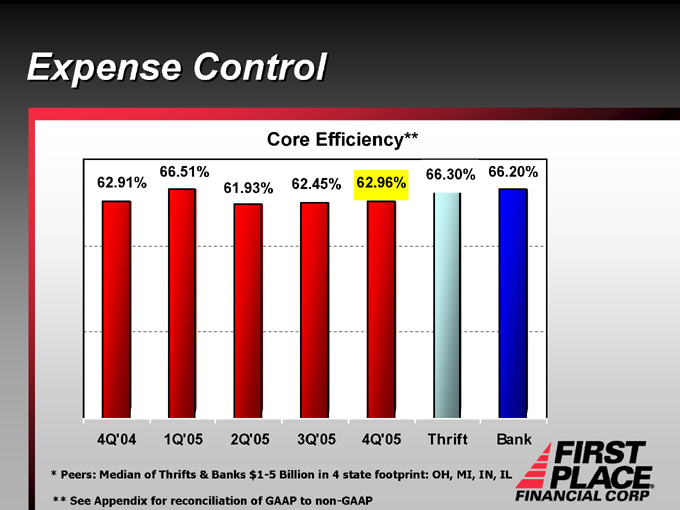

Expense Control

Core Efficiency**

62.91%

66.51%

61.93%

62.45%

62.96%

66.30%

66.20%

4Q’04 1Q’05 2Q’05 3Q’05 4Q’05 Thrift Bank

* Peers: Median of Thrifts & Banks $1-5 Billion in 4 state footprint: OH, MI, IN, IL

** See Appendix for reconciliation of GAAP to non-GAAP

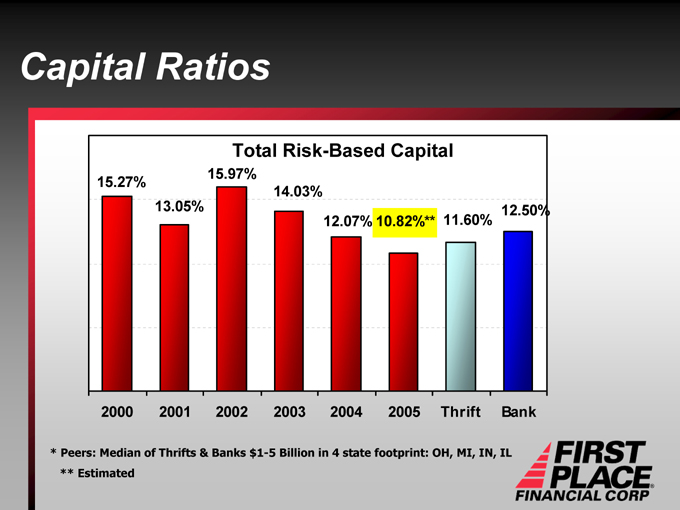

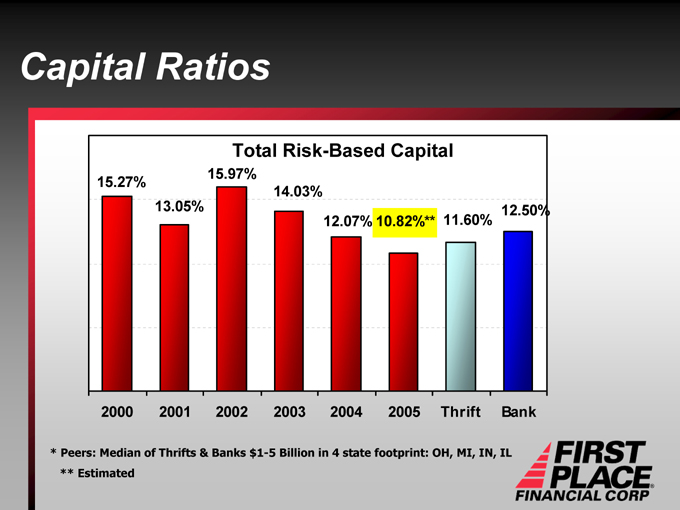

Capital Ratios

Total Risk-Based Capital

15.27%

13.05%

15.97%

14.03%

12.07%

10.82%**

11.60%

12.50%

2000 2001 2002 2003 2004 2005 Thrift Bank

* Peers: Median of Thrifts & Banks $1-5 Billion in 4 state footprint: OH, MI, IN, IL

** Estimated

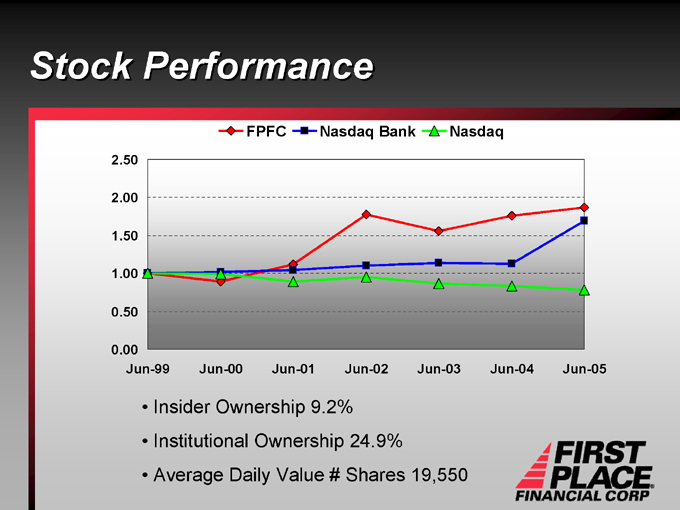

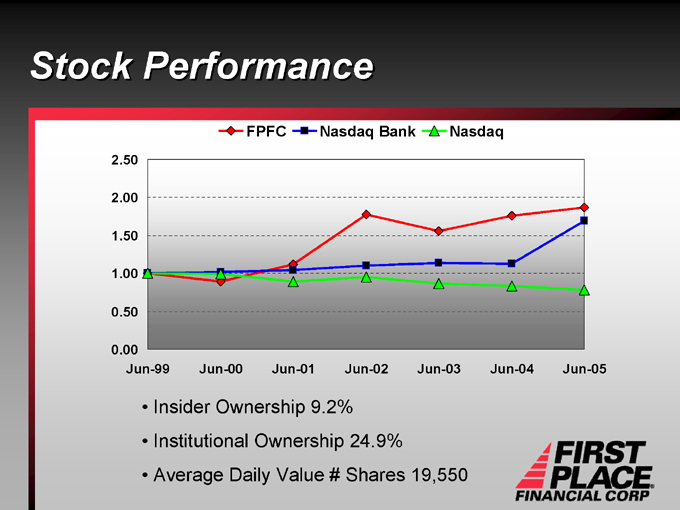

Stock Performance

FPFC

Nasdaq Bank

Nasdaq

2.50 2.00 1.50 1.00 0.50 0.00

Jun-99 Jun-00 Jun-01 Jun-02 Jun-03 Jun-04 Jun-05

Insider Ownership 9.2% Institutional Ownership 24.9% Average Daily Value # Shares 19,550

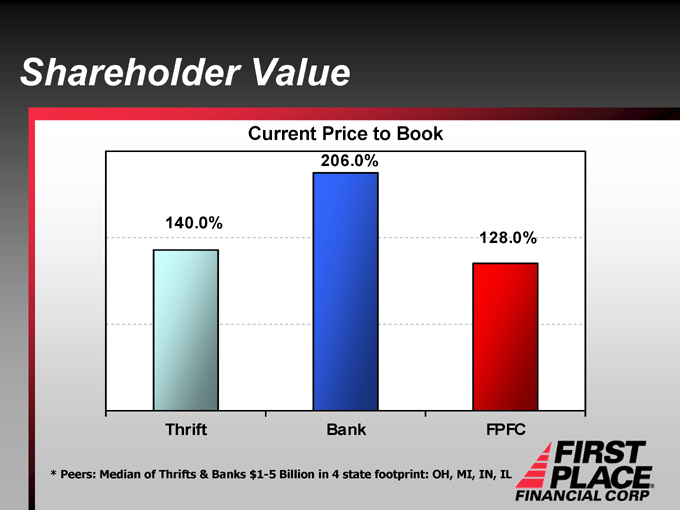

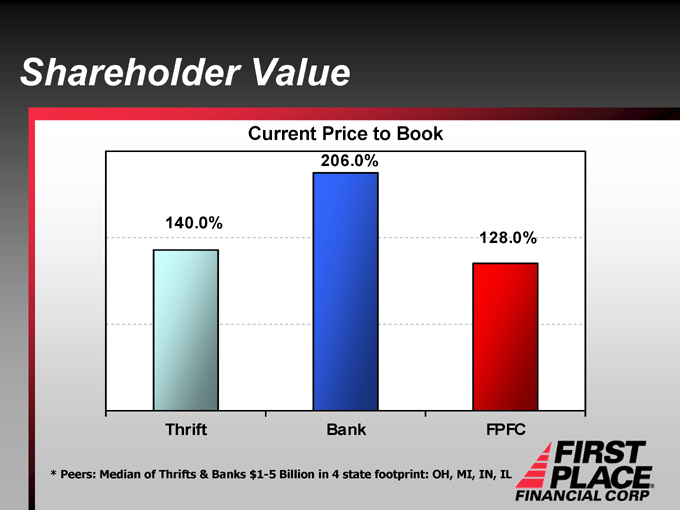

Shareholder Value

Current Price to Book

140.0%

206.0%

128.0%

Thrift Bank FPFC

* Peers: Median of Thrifts & Banks $1-5 Billion in 4 state footprint: OH, MI, IN, IL

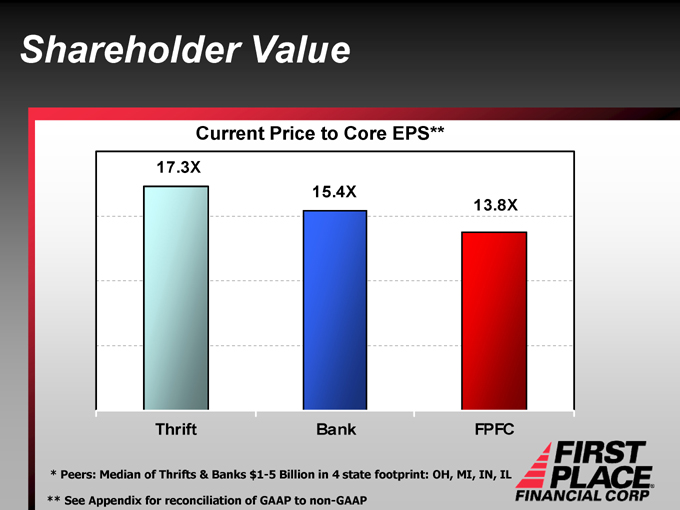

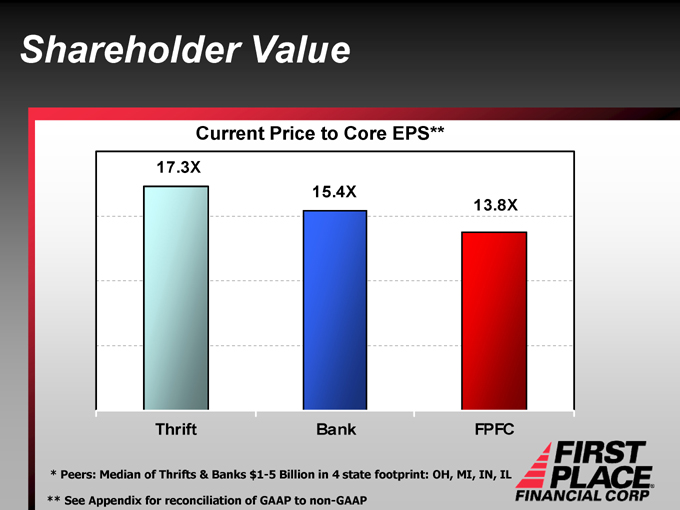

Shareholder Value

Current Price to Core EPS**

17.3X

15.4X

13.8X

Thrift Bank FPFC

* Peers: Median of Thrifts & Banks $1-5 Billion in 4 state footprint: OH, MI, IN, IL

** See Appendix for reconciliation of GAAP to non-GAAP

Growth Strategy:

Acquisitions and New Branches

Bank acquisition strategies

Within FPFC’s 4-state footprint Accretive to EPS in first full year

Assist in transformation into a commercial bank

Strategies for branch expansion

Sustainable and measured growth in 4- state footprint 24-36 months minimum profitability requirement

Expansion of mortgage LPO network into higher-growth Midwest markets Fee-based businesses to diversify of product line

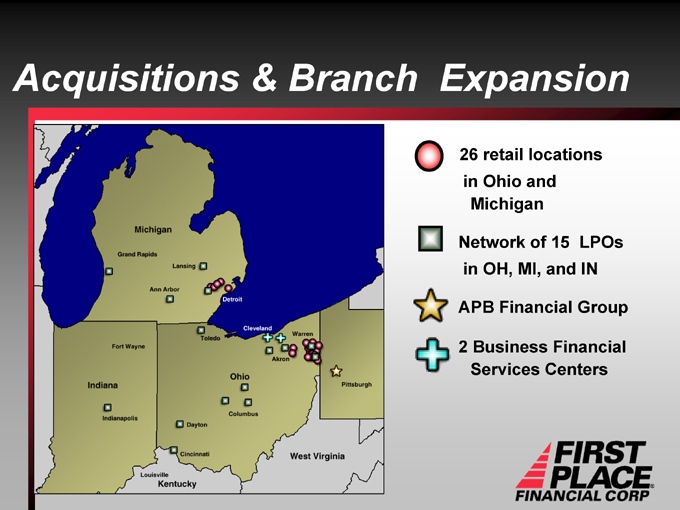

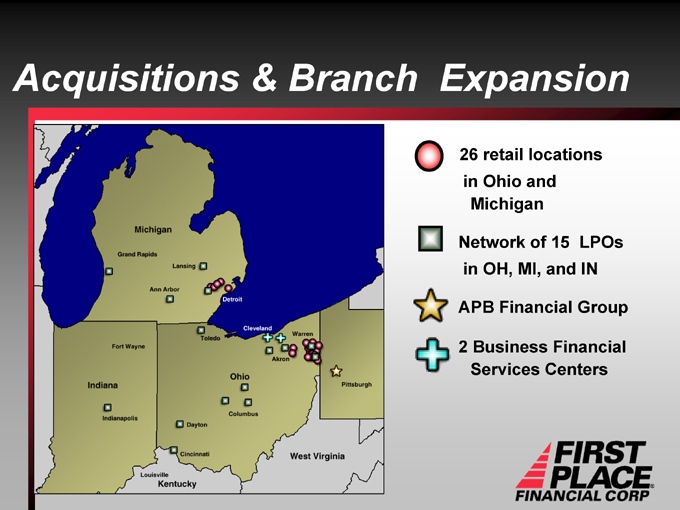

Acquisitions & Branch Expansion

26 retail locations in Ohio and Michigan

Network of 15 LPOs in OH, MI, and IN

APB Financial Group

2 Business Financial Services Centers

Fiscal 2006 Strategic Goals

Actual Performance

Fiscal 2006 Fiscal 2005

Core EPS Growth Greater than 10% 22%

Balance Sheet Growth 11% 11.2%

Commercial Loan Growth 15% 41%

Core Deposit Growth 7% 5%

ROE (core) Greater than 10% 9.35%

ROA (core) More than 1.0% 0.89%

Total Risk-Based Capital 11%-12% 10.82% *

Efficiency Ratio (core) Less than 61% 63.39%

Loan Loss Reserve/Loans More than 1.0% 1.00%

Net Charge-offs / Loans Under 20 bps 0.11%

* Estimated

Investment Appeals

Proven management team Diversified balance sheet

Asset-sensitive to interest-rate risk Positive earning trends Strong asset quality Strong quality of earnings Diversified markets Commercial loan growth Core deposit growth

The Bank That Means Business

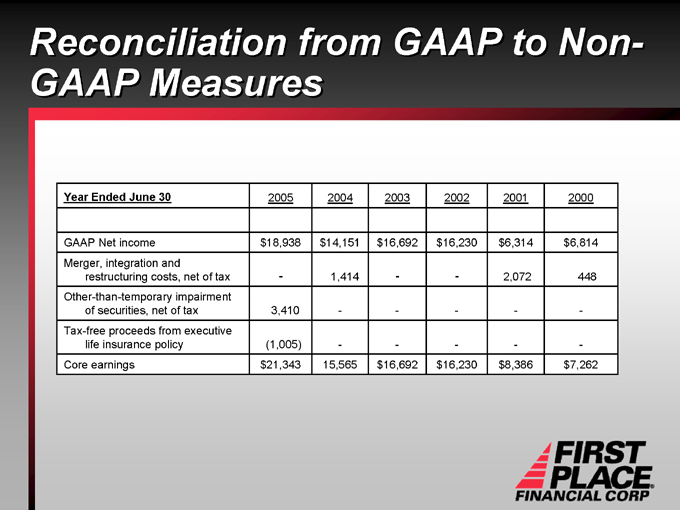

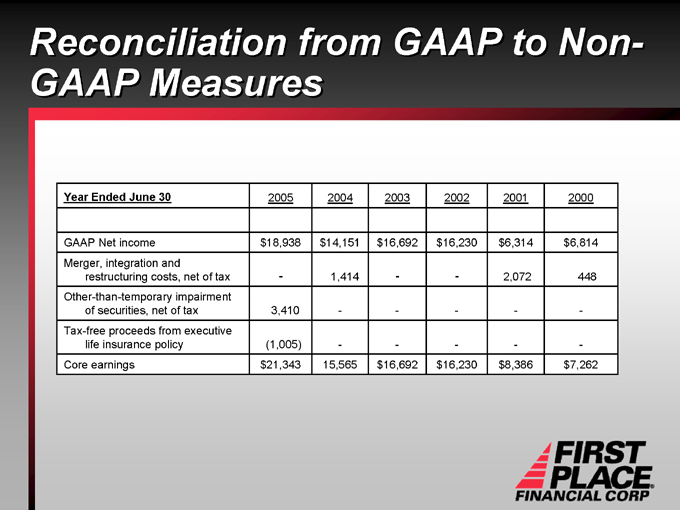

Reconciliation from GAAP to Non-GAAP Measures

Year Ended June 30 2005 2004 2003 2002 2001 2000

GAAP Net income $18,938 $14,151 $16,692 $16,230 $6,314 $6,814

Merger, integration and

restructuring costs, net of tax - 1,414 - - 2,072 448

Other-than-temporary impairment

of securities, net of tax 3,410 - - - - -

Tax-free proceeds from executive

life insurance policy (1,005) - - - - -

Core earnings $21,343 15,565 $16,692 $16,230 $8,386 $7,262

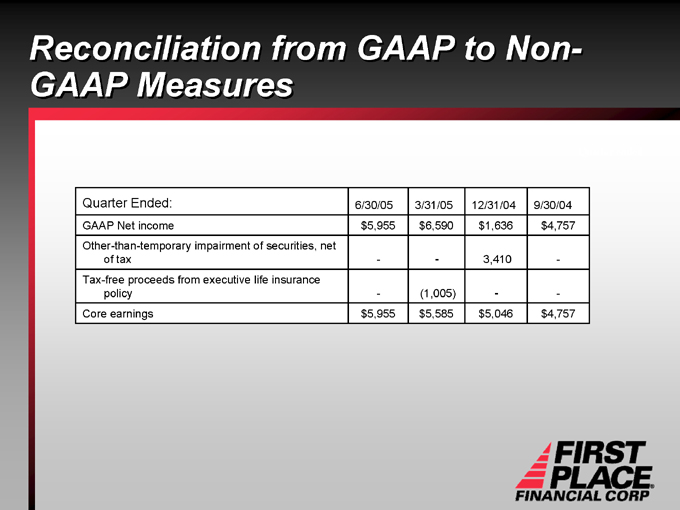

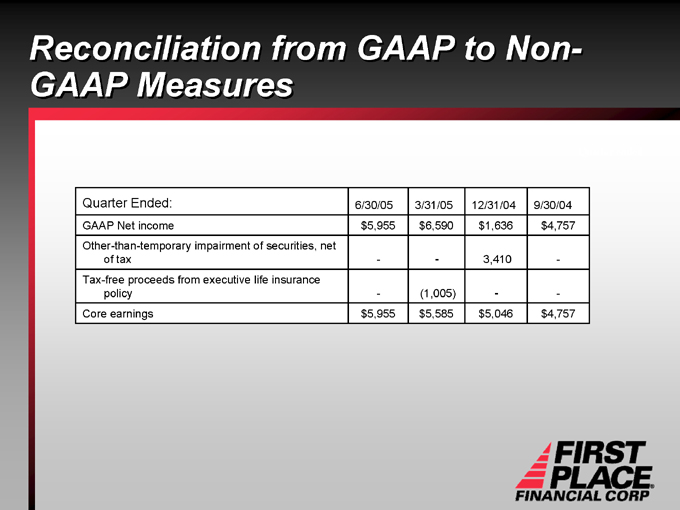

Reconciliation from GAAP to Non-GAAP Measures

Quarter Ended: 6/30/05 3/31/05 12/31/04 9/30/04

GAAP Net income $5,955 $6,590 $1,636 $4,757

Other-than-temporary impairment of securities, net

of tax - - 3,410 -

Tax-free proceeds from executive life insurance

policy - (1,005) - -

Core earnings $5,955 $5,585 $5,046 $4,757