UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM N-CSR

CERTIFIED SHAREHOLDER REPORT OF REGISTERED

MANAGEMENT INVESTMENT COMPANIES

Investment Company Act file number 811-08985

LMP Corporate Loan Fund Inc.

(Exact name of registrant as specified in charter)

620 Eighth Avenue, 49th Floor, New York, NY 10018

(Address of principal executive offices) (Zip code)

Robert I. Frenkel, Esq.

Legg Mason & Co., LLC

100 First Stamford Place

Stamford, CT 06902

(Name and address of agent for service)

Registrant’s telephone number, including area code: (888)777-0102

Date of fiscal year end: September 30

Date of reporting period: September 30, 2014

| ITEM 1. | REPORT TO STOCKHOLDERS. |

The Annual Report to Stockholders is filed herewith.

| | |

| Annual Report | | September 30, 2014 |

LMP

CORPORATE LOAN FUND INC. (TLI)

|

| INVESTMENT PRODUCTS: NOT FDIC INSURED • NO BANK GUARANTEE • MAY LOSE VALUE |

Fund objective

The Fund’s investment objective is to maximize current income consistent with prudent efforts to preserve capital.

Letter from the chairman

Dear Shareholder,

We are pleased to provide the annual report of LMP Corporate Loan Fund Inc. for the twelve-month reporting period ended September 30, 2014. Please read on for a detailed look at prevailing economic and market conditions during the Fund’s reporting period and to learn how those conditions have affected Fund performance.

As always, we remain committed to providing you with excellent service and a full spectrum of investment choices. We also remain committed to supplementing the support you receive from your financial advisor. One way we accomplish this is through our website, www.lmcef.com. Here you can gain immediate access to market and investment information, including:

| Ÿ | | Fund prices and performance, |

| Ÿ | | Market insights and commentaries from our portfolio managers, and |

| Ÿ | | A host of educational resources. |

We look forward to helping you meet your financial goals.

Sincerely,

Kenneth D. Fuller

Chairman, President and Chief Executive Officer

October 31, 2014

| | |

| II | | LMP Corporate Loan Fund Inc. |

Investment commentary

Economic review

Since the end of the Great Recession, the U.S. economy has expanded at a slower than usual pace, compared to recent history. U.S. gross domestic product (“GDP”)i growth, as reported by the U.S. Department of Commerce’s revised figures, was 4.5% during the third quarter of 2013, its best reading since the fourth quarter of 2011. During the twelve months ended September 30, 2014 (the “reporting period”), the severe winter weather of January and February played a key role in a sharp reversal in the economy, a 2.1% contraction during the first quarter of 2014. This was the first negative GDP report in three years. Negative contributions were widespread: private inventory investment, exports, state and local government spending, nonresidential and residential fixed investment. Thankfully, this setback was very brief, as second quarter GDP growth was 4.6%, suggesting the recovery has some resilience and continues to recover from the severe consequences of the Great Recession. The second quarter rebound in GDP growth was driven by several factors, including an acceleration in personal consumption expenditures (“PCE”), increased private inventory investment and exports, as well as an upturn in state and local government spending. After the reporting period ended, the Department of Commerce’s initial estimate for third quarter GDP growth was 3.5%, driven by contributions from PCE, exports, nonresidential fixed investment and government spending.

The U.S. manufacturing sector continued to support the economy during the reporting period. Based on figures for the Institute for Supply Management’s Purchasing Managers’ Index (“PMI”)ii, U.S. manufacturing expanded during all twelve months of the reporting period (a reading below 50 indicates a contraction, whereas a reading above 50 indicates an expansion). After readings of 56.6 and 57.0 in October and November 2013, respectively, the PMI was 56.5 in December. The PMI then fell to 51.3 in January 2014, its weakest reading since May 2013. PMI peaked in August 2014, with a reading of 59.0, representing its highest reading since March 2011. While PMI dipped to 56.6 in September, fifteen of the eighteen industries within the PMI expanded during the month.

The U.S. job market improved during the reporting period. When the period began, unemployment, as reported by the U.S. Department of Labor, was 7.2%. Unemployment fell to 7.0% in November 2013 and generally declined over the next several months, reaching a low of 5.9% in September 2014. This represented the lowest level since July 2008. Falling unemployment during the period was partially due to a decline in the workforce participation rate, which was 62.7% in September 2014, its lowest level since 1978.

The Federal Reserve Board (“Fed”)iii took a number of actions as it sought to meet its dual mandate of fostering maximum employment and price stability. As has been the case since December 2008, the Fed kept the federal funds rateiv at a historically low range between zero and 0.25%. At its meeting in December 2012, prior to the beginning of the reporting period, the Fed announced that it would continue purchasing $40 billion per month of agency mortgage-backed securities (“MBS”), as well as initially purchasing $45 billion per month of longer-term Treasuries. Following the meeting that concluded on December 18, 2013, the Fed announced

| | |

| LMP Corporate Loan Fund Inc. | | III |

Investment commentary (cont’d)

that it would begin reducing its monthly asset purchases, saying “Beginning in January 2014, the Committee will add to its holdings of agency MBS at a pace of $35 billion per month rather than $40 billion per month, and will add to its holdings of longer-term Treasury securities at a pace of $40 billion per month rather than $45 billion per month.” At each of the Fed’s next six meetings (January, March, April, June, July and September 2014), it announced further $10 billion tapering of its asset purchases. Finally, at its meeting that ended on October 29, 2014, after the reporting period ended, the Fed announced that its asset purchase program had concluded. The Fed also said that it “currently anticipates that, even after employment and inflation are near mandate-consistent levels, economic conditions may, for some time, warrant keeping the target federal funds rate below levels the Committee views as normal in the longer run.”

As always, thank you for your confidence in our stewardship of your assets.

Sincerely,

Kenneth D. Fuller

Chairman, President and

Chief Executive Officer

October 31, 2014

All investments are subject to risk including the possible loss of principal. Past performance is no guarantee of future results.

| i | Gross domestic product (“GDP”) is the market value of all final goods and services produced within a country in a given period of time. |

| ii | The Institute for Supply Management’s PMI is based on a survey of purchasing executives who buy the raw materials for manufacturing at more than 350 companies. It offers an early reading on the health of the U.S. manufacturing sector. |

| iii | The Federal Reserve Board (“Fed”) is responsible for the formulation of policies designed to promote economic growth, full employment, stable prices and a sustainable pattern of international trade and payments. |

| iv | The federal funds rate is the rate charged by one depository institution on an overnight sale of immediately available funds (balances at the Federal Reserve) to another depository institution; the rate may vary from depository institution to depository institution and from day to day. |

| | |

| IV | | LMP Corporate Loan Fund Inc. |

Fund overview

Q. What is the Fund’s investment strategy?

A. The Fund’s investment objective is to maximize current income consistent with prudent efforts to preserve capital. The Fund invests primarily in floating- or variable-rate collateralized senior loans to corporations, partnerships or other business entities operating in various industries and geographic regions. Under normal market conditions, the Fund invests at least 80% of total assets in collateralized senior loans. The Fund may also invest up to 20% of total assets in uncollateralized senior loans; investment and non-investment grade corporate debt securities; U.S. government debt; money market instruments; derivatives designed to hedge risks inherent in the Fund’s portfolio; and certain other securities received in connection with investments in collateralized senior loans.

The Fund’s emphasis on long-term investing is combined with consistent monitoring and selling on early warning signs whenever possible. The core credit strategy of the Fund is to identify strong credits in stable industries through thorough analysis and research.

Legg Mason Partners Fund Advisor, LLC (“LMPFA”), the Fund’s investment manager, assumed responsibility for the day-to-day management of the Fund’s portfolio effective December 1, 2012. Following LMPFA’s assumption of the day-to-day management of the Fund’s portfolio, the Fund no longer has a subadviser. The individuals responsible for development of investment strategy, oversight and coordination of the Fund are S. Kenneth Leech, Michael C. Buchanan and Timothy J. Settel, Mr. Leech joined the Fund’s portfolio management team on March 31, 2014. Mr. Leech has been employed by Western Asset Management Company, an affiliate of LMPFA as an investment professional for more than 20 years.

Q. What were the overall market conditions during the Fund’s reporting period?

A. Most spread sectors (non-Treasuries) generated positive results and outperformed equal-durationi Treasuries over the twelve months ended September 30, 2014. Risk aversion was prevalent at times given mixed economic data, shifting monetary policy by the Federal Reserve Board (“Fed”)ii and several geopolitical issues. However, these factors were generally overshadowed by solid demand from investors looking to generate incremental yield in the low interest rate environment.

Short-term Treasury yields moved higher, whereas longer-term Treasury yields declined during the twelve months ended September 30, 2014. Two-year Treasury yields rose from 0.33% at the beginning of the period to 0.58% at the end of the period. Their peak of 0.59% occurred in mid-September 2014 and they were as low as 0.28% in late November and early December 2013. Ten-year Treasury yields were 2.64% at the beginning of the period and reached a low of 2.34% on August 15 and August 28, 2014. Their peak of 3.04% occurred on December 31, 2013 and they ended the reporting period at 2.52%.

All told, the Barclays U.S. Aggregate Indexiii, gained 3.96% for the twelve months ended September 30, 2014. For comparison purposes, the leveraged loan market, as measured by the S&P/LSTA Performing Loan Indexiv (the “Index”) returned 3.90%. While the Index generated positive results during most of the fiscal year, a portion of its gains

| | |

| LMP Corporate Loan Fund Inc. 2014 Annual Report | | 1 |

Fund overview (cont’d)

were given back toward the end of the reporting period as risk aversion increased.

Q. How did we respond to these changing market conditions?

A. A number of adjustments were made to the Fund’s portfolio during the reporting period. From a sector perspective, we increased the Fund’s allocations to Utilities1 and Consumer Cyclicals2, while reducing its allocations to Technology. Elsewhere, we increased the Fund’s exposures to securities rated CCC, whereas we pared its allocation to securities rated BB.

The use of leverage was tactically managed during the reporting period. We ended the period with leverage at roughly 34% of the gross assets of the Fund, unchanged from the beginning of the period. The use of leverage was positive for performance during the twelve months ended September 30, 2014.

Performance review

For the twelve months ended September 30, 2014, LMP Corporate Loan Fund Inc. returned 4.97% based on its net asset value (“NAV”)v and 0.52% based on its New York Stock Exchange (“NYSE”) market price per share. The S&P/LSTA Performing Loan Index and the Lipper Loan Participation Closed-End Funds Category Averagevi returned 3.90% and 5.09%, respectively, over the same time frame. Please note that Lipper performance returns are based on each fund’s NAV.

During the twelve-month period, the Fund made distributions to common stock shareholders totaling $0.87 per share*. The performance table shows the Fund’s twelve-month total return based on its NAV and market price as of September 30, 2014. Past performance is no guarantee of future results.

| | | | |

| Performance Snapshot as of September 30, 2014 | |

| Price Per Share | | 12-Month

Total Return** | |

| $12.63 (NAV) | | | 4.97 | %† |

| $11.55 (Market Price) | | | 0.52 | %‡ |

All figures represent past performance and are not a guarantee of future results.

** Total returns are based on changes in NAV or market price, respectively. Returns reflect the deduction of all Fund expenses, including management fees, operating expenses, and other Fund expenses. Returns do not reflect the deduction of brokerage commissions or taxes that investors may pay on distributions or the sale of shares.

† Total return assumes the reinvestment of all distributions at NAV.

‡ Total return assumes the reinvestment of all distributions in additional shares in accordance with the Fund’s Dividend Reinvestment Plan.

Q. What were the leading contributors to performance?

A. Among the largest contributor to the Fund’s relative performance was its quality biases. In particular, an overweight to lower-rated CCCs and an underweight to higher rated BB loans was additive given the significant outperformance of CCC loans and the sizable underperformance of higher-rated BB loans during the period.

| 1 | Utilities consists of the following industries: Electric, Natural Gas and Other Utility. |

| 2 | Consumer Cyclicals consists of the following industries: Automotive, Entertainment, Gaming, Home Construction, Lodging, Retailers, Restaurants, Textiles and other consumer services. |

| * | For the tax character of distributions paid during the fiscal year ended September 30, 2014, please refer to page 30 of this report. |

| | |

| 2 | | LMP Corporate Loan Fund Inc. 2014 Annual Report |

Overweight positions in a number of individual securities were also beneficial, including Transportation services company Commercial Barge Line Co., industrial firm Eastman Kodak Co. and mining company Bowie Resources Holdings LLC.

From a sector perspective, an underweight in Consumer Cyclicals, the worst performing sector in the Index, along with an overweight to Energy, the second best performing sector in the Index, were the most beneficial for results.

Q. What were the leading detractors from performance?

A. The largest detractor from the Fund’s relative performance during the reporting period was its positioning in a number of sectors. In particular, an underweight to Communications, the best performing sector in the Index, along with an overweight in Transportation1, which lagged the Index, were the largest negatives for performance.

Elsewhere, several individual positions detracted from performance, including the Fund’s overweight positions in basic industries company Anchor Hocking LLC and consumer cyclical firm Gymboree Corp.

Looking for additional information?

The Fund is traded under the symbol “TLI” and its closing market price is available in most newspapers under the NYSE listings. The daily NAV is available on-line under the symbol “XTLIX” on most financial websites. Barron’s and the Wall Street Journal’s Monday edition both carry closed-end fund tables that provide additional information. In addition, the Fund issues a quarterly press release that can be found on most major financial websites as well as www.lmcef.com.

In a continuing effort to provide information concerning the Fund, shareholders may call 1-888-777-0102 (toll free), Monday through Friday from 8:00 a.m. to 5:30 p.m. Eastern Time, for the Fund’s current NAV, market price and other information.

Thank you for your investment in LMP Corporate Loan Fund Inc. As always, we appreciate that you have chosen us to manage your assets and we remain focused on achieving the Fund’s investment goals.

Sincerely,

Legg Mason Partners Fund Advisor, LLC

October 21, 2014

RISKS: The Fund invests in fixed-income securities which are subject to credit risks, including the risk of nonpayment of scheduled interest or loan payments, which could lower the Fund’s value. The Fund can normally be expected to have less significant interest rate related fluctuations in its NAV than investment companies investing primarily in fixed rate fixed-income securities (other than money market funds) because the floating or variable rate collateralized senior loans in which the Fund invests float in response to changes in prevailing market interest rates. Because floating or variable interest rates on collateralized senior loans reset periodically, however, there can be some, typically short term, dislocation between prevailing market interest rates and the interest rates paid on the Fund’s collateralized senior loans. Accordingly, the Fund’s NAV may experience related fluctuations from time to time. Similarly, a sudden and extreme increase in

| 1 | Transportation consists of the following industries: Airlines, Railroads and other transportation-related services. |

| | |

| LMP Corporate Loan Fund Inc. 2014 Annual Report | | 3 |

Fund overview (cont’d)

prevailing interest rates may cause a decline in the Fund’s NAV. The Fund may invest in foreign securities which are subject to certain risks not associated with domestic investing, such as currency fluctuations, and changes in political and economic conditions. High-yield/lower-rated securities involve greater credit and liquidity risks than investment grade securities. The Fund is non-diversified which may entail greater risks than is normally associated with more widely diversified funds.

All investments are subject to risk including the possible loss of principal. Past performance is no guarantee of future results. All index performance reflects no deduction for fees, expenses or taxes. Please note that an investor cannot invest directly in an index.

The information provided is not intended to be a forecast of future events, a guarantee of future results or investment advice. Views expressed may differ from those of the firm as a whole.

| i | Duration is the measure of the price sensitivity of a fixed-income security to an interest rate change of 100 basis points. Calculation is based on the weighted average of the present values for all cash flows. |

| ii | The Federal Reserve Board (“Fed”) is responsible for the formulation of policies designed to promote economic growth, full employment, stable prices, and a sustainable pattern of international trade and payments. |

| iii | The Barclays U.S. Aggregate Index is a broad-based bond index comprised of government, corporate, mortgage- and asset-backed issues, rated investment grade or higher, and having at least one year to maturity. |

| iv | The S&P/LSTA Performing Loan Index is a sub-index of the S&P/LSTA Leveraged Loan Index (LLI) and it is all loans excluding those in payment default. The S&P/LSTA Leveraged Loan Index tracks the current outstanding balance and spread over LIBOR for fully funded term loans. The facilities included represent a broad cross section of leveraged loans syndicated in the U.S., including dollar-denominated loans to overseas issuers. The market value return component of the Index is based on secondary market pricing received from dealers. |

| v | Net asset value (“NAV”) is calculated by subtracting total liabilities, including liabilities associated with financial leverage (if any), from the closing value of all securities held by the Fund (plus all other assets) and dividing the result (total net assets) by the total number of the common shares outstanding. The NAV fluctuates with changes in the market prices of securities in which the Fund has invested. However, the price at which an investor may buy or sell shares of the Fund is the Fund’s market price as determined by supply of and demand for the Fund’s shares. |

| vi | Lipper, Inc., a wholly-owned subsidiary of Reuters, provides independent insight on global collective investments. Returns are based on the twelve-month period ended September 30, 2014, including the reinvestment of all distributions, including returns of capital, if any, calculated among the 33 funds in the Fund’s Lipper category. |

| | |

| 4 | | LMP Corporate Loan Fund Inc. 2014 Annual Report |

Fund at a glance† (unaudited)

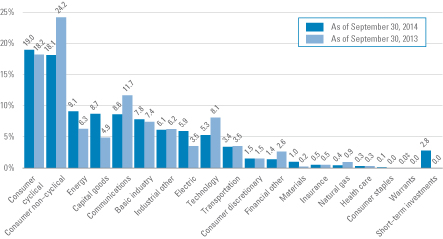

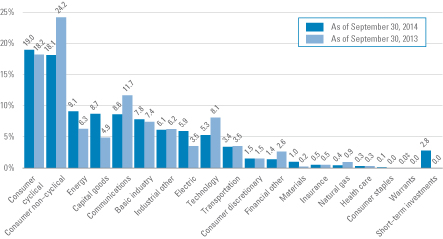

Investment breakdown (%) as a percent of total investments

| † | The bar graph above represents the composition of the Fund’s investments as of September 30, 2014 and September 30, 2013. The Fund is actively managed. As a result, the composition of the Fund’s investments is subject to change at any time. |

| ‡ | Represents less than 0.1%. |

| | |

| LMP Corporate Loan Fund Inc. 2014 Annual Report | | 5 |

Schedule of investments

September 30, 2014

LMP Corporate Loan Fund Inc.

| | | | | | | | | | | | | | | | |

| Security† | | Rate | | | Maturity

Date | | | Face

Amount | | | Value | |

| Senior Loans (a)(b) — 134.5% | | | | | | | | | | | | | | | | |

Basic Industry — 12.1% | | | | | | | | | | | | | | | | |

Alpha Natural Resources LLC, Term Loan B | | | 3.500 | % | | | 5/22/20 | | | $ | 1,686,819 | | | $ | 1,518,137 | |

Atlas Iron Ltd., Term Loan B | | | 8.750 | % | | | 12/10/17 | | | | 1,968,715 | | | | 1,958,872 | |

Bowie Resource Holdings LLC, First Lien Term Loan | | | 6.750 | % | | | 8/14/20 | | | | 1,140,000 | | | | 1,142,850 | |

Bowie Resource Holdings LLC, Second Lien Delayed Draw Term Loan | | | 11.750 | % | | | 2/16/21 | | | | 750,000 | | | | 763,125 | |

Essar Steel Algoma Inc., ABL Term Loan | | | 12.250 | % | | | 11/15/14 | | | | 987,437 | | | | 990,986 | |

Fairmount Minerals Ltd., New Term Loan B2 | | | 4.500 | % | | | 9/5/19 | | | | 386,348 | | | | 386,493 | |

FMG Resources (August 2006) Pty Ltd., New Term Loan B | | | 3.750 | % | | | 6/30/19 | | | | 510,024 | | | | 500,248 | |

Foresight Energy LLC, Term Loan B | | | 5.500 | % | | | 8/19/20 | | | | 264,167 | | | | 264,827 | |

Hi-Crush Partners LP, Term Loan B | | | 4.750 | % | | | 4/28/21 | | | | 265,665 | | | | 265,001 | |

Minerals Technologies Inc., Term Loan B | | | 4.000 | % | | | 5/9/21 | | | | 479,352 | | | | 478,678 | |

Murray Energy Corp., First Lien Term Loan | | | 5.250 | % | | | 12/5/19 | | | | 1,422,850 | | | | 1,422,139 | |

NewPage Corp., Term Loan | | | 9.500 | % | | | 2/11/21 | | | | 1,850,000 | | | | 1,856,166 | |

Oxbow Carbon LLC, Second Lien Term Loan | | | 8.000 | % | | | 1/17/20 | | | | 820,000 | | | | 829,737 | |

Peabody Energy Corp., Term Loan B | | | 4.250 | % | | | 9/24/20 | | | | 443,630 | | | | 433,510 | |

Phibro Animal Health Corp., Term Loan B | | | 4.000 | % | | | 4/16/21 | | | | 598,500 | | | | 593,263 | |

Walter Energy Inc., Term Loan B | | | 7.250 | % | | | 4/2/18 | | | | 700,000 | | | | 620,375 | |

Wausau Paper Corp., Term Loan | | | 6.500 | % | | | 7/30/20 | | | | 618,450 | | | | 611,492 | |

Xerium Technologies Inc., USD Term Loan | | | 5.750 | % | | | 5/17/19 | | | | 500,000 | | | | 502,813 | |

Total Basic Industry | | | | | | | | | | | | | | | 15,138,712 | |

Capital Goods — 13.4% | |

ABC Supply Co. Inc., Term Loan | | | 3.500 | % | | | 4/16/20 | | | | 1,257,300 | | | | 1,237,183 | |

ADS Waste Holdings Inc., New Term Loan | | | 3.750 | % | | | 10/9/19 | | | | 1,016,414 | | | | 993,333 | |

Anchor Glass Container Corp., New First Lien Term Loan | | | 4.250 | % | | | 6/30/21 | | | | 400,000 | | | | 398,167 | |

BakerCorp International Inc., New Term Loan | | | 4.250 | % | | | 2/14/20 | | | | 878,883 | | | | 857,460 | |

BWAY Holding Co. Inc., New Term Loan B | | | 5.500 | % | | | 8/14/20 | | | | 1,007,475 | | | | 1,009,994 | |

Consolidated Container Co. LLC, New Second Lien Term Loan B | | | 7.750 | % | | | 1/3/20 | | | | 250,000 | | | | 243,750 | |

Consolidated Container Co. LLC, New Term Loan | | | 5.000 | % | | | 7/3/19 | | | | 1,488,608 | | | | 1,471,240 | |

CPM Acquisition Corp., First Lien Term Loan | | | — | | | | 8/29/17 | | | | 1,000,000 | | | | 1,005,625 | (c) |

DAE Aviation Holdings Inc., Second Lien Term Loan | | | 7.750 | % | | | 8/5/19 | | | | 1,000,000 | | | | 1,015,625 | |

Exopack Holdings SA, USD Term Loan B 2013 | | | 5.250 | % | | | 5/8/19 | | | | 843,625 | | | | 849,249 | |

GYP Holdings III Corp., First Lien Term Loan | | | 4.750 | % | | | 4/1/21 | | | | 1,416,450 | | | | 1,402,286 | |

PGT Inc., Term Loan B | | | — | | | | 9/22/21 | | | | 270,000 | | | | 269,663 | (c) |

Printpack Holdings Inc., Term Loan | | | 6.000 | % | | | 5/28/20 | | | | 1,057,350 | | | | 1,056,689 | |

STS Operating Inc., Term Loan | | | 4.750 | % | | | 2/19/21 | | | | 577,100 | | | | 577,731 | |

Waste Industries USA Inc., Term Loan B | | | 4.000 | % | | | 3/17/17 | | | | 1,546,125 | | | | 1,538,394 | |

See Notes to Financial Statements.

| | |

| 6 | | LMP Corporate Loan Fund Inc. 2014 Annual Report |

LMP Corporate Loan Fund Inc.

| | | | | | | | | | | | | | | | |

| Security† | | Rate | | | Maturity

Date | | | Face

Amount | | | Value | |

Capital Goods — continued | |

Wilsonart LLC, Incremental Term Loan B2 | | | 4.000 | % | | | 10/31/19 | | | $ | 119,100 | | | $ | 116,867 | |

Wilsonart LLC, Term Loan B | | | 4.000 | % | | | 10/31/19 | | | | 493,719 | | | | 485,387 | |

WP CPP Holdings LLC, First Lien Term Loan | | | 4.750 | % | | | 12/27/19 | | | | 965,369 | | | | 962,231 | |

WP CPP Holdings LLC, New Second Lien Term Loan | | | 8.750 | % | | | 4/30/21 | | | | 750,000 | | | | 754,219 | |

Zebra Technologies Corp., Term Loan B | | | — | | | | 9/30/21 | | | | 520,000 | | | | 516,100 | (c) |

Total Capital Goods | | | | | | | | | | | | | | | 16,761,193 | |

Communications — 10.2% | |

Advantage Sales & Marketing Inc., 2014 First Lien Term Loan | | | 4.250 | % | | | 7/23/21 | | | | 1,016,129 | | | | 999,935 | |

Advantage Sales & Marketing Inc., 2014 Second Lien Term Loan | | | 7.500 | % | | | 7/25/22 | | | | 140,000 | | | | 138,285 | |

Advantage Sales & Marketing Inc., Delayed Draw Term Loan | | | 4.250 | % | | | 7/23/21 | | | | 33,871 | | | | 33,331 | (c) |

Charter Communications Operating LLC, Term Loan G | | | 4.250 | % | | | 9/12/21 | | | | 550,000 | | | | 549,018 | |

Checkout Holding Corp., First Lien Term Loan | | | 4.500 | % | | | 4/9/21 | | | | 269,325 | | | | 262,592 | |

CSC Holdings Inc., New Term Loan B | | | 2.654 | % | | | 4/17/20 | | | | 438,801 | | | | 426,048 | |

Intelsat Jackson Holdings SA, Term Loan B2 | | | 3.750 | % | | | 6/30/19 | | | | 466,171 | | | | 459,664 | |

Level 3 Financing Inc., 2020 Term Loan B | | | 4.000 | % | | | 1/15/20 | | | | 310,000 | | | | 304,914 | |

Level 3 Financing Inc., New 2019 Term Loan | | | 4.000 | % | | | 8/1/19 | | | | 1,000,000 | | | | 983,906 | |

McGraw-Hill Global Education Holdings LLC, New First Lien Term Loan | | | 5.750 | % | | | 3/22/19 | | | | 805,526 | | | | 808,295 | |

NEP/NCP Holdco Inc., Incremental Term Loan | | | 4.250 | % | | | 1/22/20 | | | | 952,610 | | | | 929,985 | |

Numericable U.S. LLC, USD Term Loan B1 | | | 4.500 | % | | | 5/21/20 | | | | 332,393 | | | | 330,108 | |

Numericable U.S. LLC, USD Term Loan B2 | | | 4.500 | % | | | 5/21/20 | | | | 278,377 | | | | 276,463 | |

TWCC Holding Corp., REFI Term Loan B | | | 3.500 | % | | | 2/13/17 | | | | 697,586 | | | | 687,886 | |

Univision Communications Inc., Term Loan C3 | | | 4.000 | % | | | 3/2/20 | | | | 1,930,600 | | | | 1,896,573 | |

Univision Communications Inc., Term Loan C4 | | | 4.000 | % | | | 3/1/20 | | | | 534,558 | | | | 525,148 | |

UPC Financing Partnership, USD Term Loan AH | | | 3.250 | % | | | 6/30/21 | | | | 1,000,000 | | | | 974,625 | |

Village Roadshow Films (BVI) Ltd., Term Loan B | | | 4.750 | % | | | 11/21/17 | | | | 160,650 | | | | 161,453 | |

Virgin Media Bristol LLC, USD Term Loan B | | | 3.500 | % | | | 6/7/20 | | | | 1,000,000 | | | | 974,911 | |

William Morris Endeavor Entertainment LLC, First Lien Term Loan | | | 5.250 | % | | | 5/6/21 | | | | 199,500 | | | | 195,760 | |

Ziggo NV, USD Term Loan B1 | | | — | | | | 1/15/22 | | | | 323,698 | | | | 315,085 | (c) |

Ziggo NV, USD Term Loan B2 | | | — | | | | 1/15/22 | | | | 202,383 | | | | 196,998 | (c) |

Ziggo NV, USD Term Loan B3 | | | — | | | | 1/15/22 | | | | 343,919 | | | | 334,769 | (c) |

Total Communications | | | | | | | | | | | | | | | 12,765,752 | |

Consumer Cyclical — 29.2% | | | | | | | | | | | | | | | | |

1011778 B.C. Unlimited Liability Co., 2014 Term Loan B | | | — | | | | 9/24/21 | | | | 750,000 | | | | 745,208 | (c) |

24 Hour Fitness Worldwide Inc., New Term Loan B | | | 4.750 | % | | | 5/28/21 | | | | 399,000 | | | | 398,499 | |

Acosta Holdco Inc., 2014 Term Loan | | | — | | | | 9/26/21 | | | | 250,000 | | | | 250,622 | (c) |

See Notes to Financial Statements.

| | |

| LMP Corporate Loan Fund Inc. 2014 Annual Report | | 7 |

Schedule of investments (cont’d)

September 30, 2014

LMP Corporate Loan Fund Inc.

| | | | | | | | | | | | | | | | |

| Security† | | Rate | | | Maturity

Date | | | Face

Amount | | | Value | |

Consumer Cyclical — continued | | | | | | | | | | | | | | | | |

Activision Blizzard Inc., Term Loan B | | | 3.250 | % | | | 10/12/20 | | | $ | 688,175 | | | $ | 687,506 | |

AP NMT Acquisition BV, USD First Lien Term Loan | | | 6.750 | % | | | 7/31/21 | | | | 430,000 | | | | 421,131 | |

AP NMT Acquisition BV, USD Second Lien Term Loan | | | 10.000 | % | | | 7/31/22 | | | | 390,000 | | | | 360,506 | |

Aristocrat Leisure Ltd., Term Loan B | | | — | | | | 9/29/21 | | | | 1,350,000 | | | | 1,336,500 | (c) |

August LuxUK Holding Co. Sarl, Luxco First Lien Term Loan B2 | | | 5.000 | % | | | 4/27/18 | | | | 1,127,292 | | | | 1,127,292 | |

August U.S. Holding Co. Inc., First Lien Term Loan B2 | | | 5.000 | % | | | 4/27/18 | | | | 1,007,298 | | | | 1,007,298 | |

Autoparts Holdings Ltd., First Lien Term Loan | | | 6.500 | % | | | 7/28/17 | | | | 191,954 | | | | 192,374 | |

Brickman Group Ltd. LLC, First Lien Term Loan | | | 4.000 | % | | | 12/18/20 | | | | 637,249 | | | | 625,478 | |

Caesars Entertainment Operating Co., Extended Term Loan B6 | | | 6.948-6.949 | % | | | 3/1/17 | | | | 144,233 | | | | 131,728 | |

Caesars Entertainment Operating Co., Term Loan B7 | | | 9.750 | % | | | 1/28/18 | | | | 399,000 | | | | 379,019 | |

Caesars Entertainment Resort Properties LLC, Term Loan B | | | 7.000 | % | | | 10/12/20 | | | | 1,200,925 | | | | 1,153,188 | |

Caesars Growth Properties Holdings LLC, Term Loan | | | 6.250 | % | | | 5/8/21 | | | | 957,600 | | | | 909,959 | |

Camping World Inc., Term Loan | | | 5.750 | % | | | 2/20/20 | | | | 1,442,438 | | | | 1,447,847 | |

CCM Merger Inc., New Term Loan B | | | 4.500 | % | | | 8/8/21 | | | | 1,929,796 | | | | 1,912,910 | |

CEC Entertainment Concepts LP, Term Loan | | | 4.250 | % | | | 2/14/21 | | | | 1,031,815 | | | | 1,003,440 | |

CityCenter Holdings LLC, Term Loan B | | | 4.250 | % | | | 10/16/20 | | | | 1,718,510 | | | | 1,703,044 | |

CKX Inc., Term Loan B | | | 9.000 | % | | | 6/21/17 | | | | 300,000 | | | | 262,500 | |

Container Store Inc., New Term Loan B | | | 4.250 | % | | | 4/6/19 | | | | 1,224,341 | | | | 1,208,271 | |

Crossmark Holdings Inc., First Lien Term Loan | | | 4.500 | % | | | 12/20/19 | | | | 411,154 | | | | 404,986 | |

CS Intermediate Holdco 2 LLC, New Term Loan B | | | 4.000 | % | | | 4/4/21 | | | | 359,100 | | | | 355,509 | |

Equinox Holdings Inc., Repriced Term Loan B | | | 4.250 | % | | | 1/31/20 | | | | 1,024,900 | | | | 1,015,291 | |

Fitness International LLC, Term Loan B | | | 5.500 | % | | | 7/1/20 | | | | 618,175 | | | | 614,119 | |

Four Seasons Holdings Inc., New First Lien Term Loan | | | 3.500 | % | | | 6/27/20 | | | | 306,999 | | | | 302,011 | |

Gymboree Corp., Initial Term Loan | | | 5.000 | % | | | 2/23/18 | | | | 790,000 | | | | 526,667 | |

Hilton Worldwide Finance LLC, USD Term Loan B2 | | | 3.500 | % | | | 10/26/20 | | | | 656,050 | | | | 646,912 | |

INA Beteiligungsgesellschaft mbH, USD Term Loan E | | | 3.750 | % | | | 5/15/20 | | | | 530,000 | | | | 525,930 | |

J. Crew Group Inc., New Term Loan B | | | 4.000 | % | | | 3/5/21 | | | | 1,481,021 | | | | 1,409,285 | |

Kate Spade & Co., Term Loan B | | | 4.000 | % | | | 4/9/21 | | | | 260,000 | | | | 255,287 | |

La Quinta Intermediate Holdings LLC, Term Loan B | | | 4.000 | % | | | 4/14/21 | | | | 933,108 | | | | 922,144 | |

Landry’s Inc., Term Loan B | | | 4.000 | % | | | 4/24/18 | | | | 1,824,775 | | | | 1,812,800 | |

MGM Resorts International, Term Loan B | | | 3.500 | % | | | 12/20/19 | | | | 982,500 | | | | 967,148 | |

Michaels Stores Inc., Incremental 2014 Term Loan B2 | | | 4.000 | % | | | 1/28/20 | | | | 276,000 | | | | 273,033 | |

Michaels Stores Inc., Term Loan B | | | 3.750 | % | | | 1/28/20 | | | | 1,076,375 | | | | 1,056,866 | |

Mohegan Tribal Gaming Authority, New Term Loan B | | | 5.500 | % | | | 11/19/19 | | | | 1,191,000 | | | | 1,178,718 | |

Monitronics International Inc., New Term Loan B | | | 4.250 | % | | | 3/23/18 | | | | 733,119 | | | | 726,246 | |

Oceania Cruises Inc., 2020 Term Loan B | | | 5.250 | % | | | 7/2/20 | | | | 963,817 | | | | 966,226 | |

See Notes to Financial Statements.

| | |

| 8 | | LMP Corporate Loan Fund Inc. 2014 Annual Report |

LMP Corporate Loan Fund Inc.

| | | | | | | | | | | | | | | | |

| Security† | | Rate | | | Maturity

Date | | | Face

Amount | | | Value | |

Consumer Cyclical — continued | | | | | | | | | | | | | | | | |

Peppermill Casinos Inc., Term Loan B | | | 7.250 | % | | | 10/17/19 | | | $ | 912,380 | | | $ | 927,206 | |

Petco Animal Supplies Inc., New Term Loan | | | 4.000 | % | | | 11/24/17 | | | | 984,655 | | | | 977,885 | |

Realogy Corp., New Term Loan B | | | 3.750 | % | | | 3/5/20 | | | | 985,056 | | | | 971,512 | |

Regent Seven Seas Cruises Inc., New Term Loan B | | | 3.750 | % | | | 12/21/18 | | | | 958,557 | | | | 953,764 | |

Station Casinos LLC, Term Loan B | | | 4.250 | % | | | 3/2/20 | | | | 570,381 | | | | 562,253 | |

Wendy’s International Inc., New Term Loan B | | | 3.250 | % | | | 5/15/19 | | | | 679,334 | | | | 676,665 | |

William Lyon Homes Inc., Bridge Term Loan | | | — | | | | 8/12/22 | | | | 108,462 | | | | 108,462 | (c)(d) |

World Triathlon Corp., Term Loan | | | 5.250 | % | | | 6/26/21 | | | | 229,425 | | | | 229,067 | |

Total Consumer Cyclical | | | | | | | | | | | | | | | 36,630,312 | |

Consumer Non-Cyclical — 27.8% | | | | | | | | | | | | | | | | |

AdvancePierre Foods Inc., Second Lien Term Loan | | | 9.500 | % | | | 10/10/17 | | | | 1,660,000 | | | | 1,651,700 | |

Akorn Inc., Term Loan B | | | 4.500 | % | | | 4/16/21 | | | | 590,000 | | | | 589,255 | |

Alvogen Pharma U.S. Inc., New Term Loan B | | | 7.000 | % | | | 5/23/18 | | | | 1,620,823 | | | | 1,637,032 | |

Amsurg Corp., First Lien Term Loan B | | | 3.750-5.250 | % | | | 7/16/21 | | | | 648,375 | | | | 642,905 | |

Anchor Hocking LLC, New Term Loan | | | 9.500 | % | | | 5/21/20 | | | | 2,092,967 | | | | 1,636,003 | (e) |

Aramark Corp., USD Term Loan F | | | 3.250 | % | | | 2/24/21 | | | | 726,350 | | | | 713,908 | |

ARC Document Solutions Inc., Term Loan B | | | 6.250 | % | | | 12/20/18 | | | | 1,211,769 | | | | 1,220,857 | |

Big Heart Pet Brands, New Term Loan | | | 3.500 | % | | | 3/8/20 | | | | 530,988 | | | | 513,399 | |

Biomet Inc., Term Loan B2 | | | 3.655 | % | | | 7/25/17 | | | | 1,678,179 | | | | 1,669,527 | |

Candy Intermediate Holdings Inc., Term Loan | | | 7.500 | % | | | 6/18/18 | | | | 1,191,368 | | | | 1,155,627 | |

Catalent Pharma Solutions Inc., New Term Loan | | | — | | | | 12/29/17 | | | | 132,129 | | | | 132,459 | (c) |

Catalent Pharma Solutions Inc., USD Term Loan B | | | 4.500 | % | | | 5/20/21 | | | | 126,192 | | | | 126,023 | |

Convatec Inc., Term Loan | | | 4.000 | % | | | 12/22/16 | | | | 1,437,455 | | | | 1,432,963 | |

CRC Health Corp., New Term Loan | | | 5.250 | % | | | 3/29/21 | | | | 527,350 | | | | 526,251 | |

CRC Health Corp., Second Lien Term Loan | | | 9.000 | % | | | 9/28/21 | | | | 1,260,000 | | | | 1,260,787 | |

CSM Bakery Supplies LLC, First Lien Term Loan | | | 5.000 | % | | | 7/3/20 | | | | 1,019,700 | | | | 1,009,822 | |

CSM Bakery Supplies LLC, Second Lien Term Loan | | | 8.750 | % | | | 7/3/21 | | | | 1,090,000 | | | | 1,062,750 | |

DaVita HealthCare Partners Inc., Term Loan B | | | 3.500 | % | | | 6/24/21 | | | | 498,750 | | | | 493,957 | |

Dole Food Co. Inc., New Term Loan B | | | 4.500-5.750 | % | | | 11/1/18 | | | | 429,100 | | | | 426,775 | |

DS Waters of America Inc., New Term Loan | | | 5.250 | % | | | 8/30/20 | | | | 198,800 | | | | 199,670 | |

Envision Healthcare Corp., Term Loan | | | 4.000 | % | | | 5/25/18 | | | | 1,096,565 | | | | 1,087,793 | |

H.J. Heinz Co., Term Loan B1 | | | 3.250 | % | | | 6/7/19 | | | | 424,625 | | | | 419,273 | |

H.J. Heinz Co., Term Loan B2 | | | 3.500 | % | | | 6/5/20 | | | | 49,994 | | | | 49,469 | |

Hearthside Group Holdings LLC, Term Loan | | | 4.500 | % | | | 6/2/21 | | | | 329,175 | | | | 328,249 | |

JLL/Delta Dutch Newco BV, USD Term Loan | | | 4.250 | % | | | 3/11/21 | | | | 997,500 | | | | 979,332 | |

Language Line LLC, First Lien Term Loan B | | | 6.250 | % | | | 6/20/16 | | | | 1,179,941 | | | | 1,176,499 | |

Libbey Glass Inc., Term Loan B | | | 3.750 | % | | | 4/9/21 | | | | 129,675 | | | | 128,865 | |

New HB Acquisition LLC, Term Loan | | | 6.750 | % | | | 4/9/20 | | | | 1,094,500 | | | | 1,119,126 | |

See Notes to Financial Statements.

| | |

| LMP Corporate Loan Fund Inc. 2014 Annual Report | | 9 |

Schedule of investments (cont’d)

September 30, 2014

LMP Corporate Loan Fund Inc.

| | | | | | | | | | | | | | | | |

| Security† | | Rate | | | Maturity

Date | | | Face

Amount | | | Value | |

Consumer Non-Cyclical — continued | | | | | | | | | | | | | | | | |

Par Pharmaceutical Cos. Inc., Term Loan B2 | | | 4.000 | % | | | 9/30/19 | | | $ | 823,500 | | | $ | 809,603 | |

Party City Holdings Inc., Term Loan | | | 4.000 | % | | | 7/27/19 | | | | 1,927,650 | | | | 1,898,335 | |

Pharmaceutical Product Development LLC, New Term Loan B | | | 4.000 | % | | | 12/5/18 | | | | 530,699 | | | | 526,940 | |

Physiotherapy Associates Holdings Inc., Exit Term Loan | | | 11.000 | % | | | 10/10/16 | | | | 420,000 | | | | 417,900 | (e) |

Radnet Management Inc., Second Lien Term Loan | | | 8.000 | % | | | 3/25/21 | | | | 660,000 | | | | 662,475 | |

Radnet Management Inc., Term Loan B | | | 4.250 | % | | | 10/10/18 | | | | 1,054,729 | | | | 1,050,114 | |

ServiceMaster Co., 2014 Term Loan B | | | 4.250 | % | | | 7/1/21 | | | | 800,000 | | | | 789,370 | |

Shearer’s Foods Inc., First Lien Term Loan | | | 4.500 | % | | | 6/30/21 | | | | 120,000 | | | | 119,325 | |

Shearer’s Foods Inc., Second Lien Term Loan | | | 7.750 | % | | | 6/30/22 | | | | 590,000 | | | | 585,575 | |

Stater Bros. Markets, Term Loan B | | | 4.750 | % | | | 5/12/21 | | | | 400,000 | | | | 399,500 | |

Sun Products Corp., New Term Loan | | | 5.500 | % | | | 3/23/20 | | | | 1,957,806 | | | | 1,853,390 | |

Visant Corp., New Term Loan | | | 7.000 | % | | | 9/23/21 | | | | 810,000 | | | | 800,213 | |

WNA Holdings Inc., USD Second Lien Term Loan | | | 8.500 | % | | | 12/7/20 | | | | 1,600,000 | | | | 1,596,000 | |

Total Consumer Non-Cyclical | | | | | | | | | | | | | | | 34,899,016 | |

Electric — 9.1% | | | | | | | | | | | | | | | | |

Astoria Generating Co. Acquisitions LLC, New Term Loan | | | 9.250 | % | | | 10/26/17 | | | | 1,828,833 | | | | 1,863,123 | |

Atlantic Power LP, 2014 Term Loan B | | | 4.750 | % | | | 2/24/21 | | | | 304,060 | | | | 302,539 | |

EFS Cogen Holdings I LLC, Term Loan B | | | 3.750 | % | | | 12/17/20 | | | | 254,791 | | | | 254,579 | |

EIF Channelview Cogeneration LLC, Term Loan B | | | 4.250 | % | | | 5/8/20 | | | | 306,737 | | | | 308,462 | |

Empire Generating Co. LLC, Term Loan B | | | 5.250 | % | | | 3/12/21 | | | | 952,431 | | | | 944,098 | |

Empire Generating Co. LLC, Term Loan C | | | 5.250 | % | | | 3/12/21 | | | | 66,783 | | | | 66,198 | |

Energy Future Intermediate Holding Co. LLC, DIP Term Loan | | | 4.250 | % | | | 6/19/16 | | | | 1,150,000 | | | | 1,146,406 | |

Equipower Resources Holdings LLC, Term Loan C | | | 4.250 | % | | | 12/31/19 | | | | 1,190,855 | | | | 1,187,382 | |

Exgen Texas Power LLC, Term Loan B | | | 5.750 | % | | | 9/16/21 | | | | 870,000 | | | | 867,281 | |

La Frontera Generation LLC, Term Loan | | | 4.500 | % | | | 9/30/20 | | | | 494,461 | | | | 489,825 | |

Northeast Wind Capital II LLC, Term Loan B | | | 5.000 | % | | | 11/11/20 | | | | 1,658,069 | | | | 1,678,795 | |

Panda Patriot LLC, Term Loan B1 | | | 6.750 | % | | | 12/19/20 | | | | 310,000 | | | | 317,750 | |

Panda Temple II Power LLC, New Term Loan B | | | 7.250 | % | | | 4/3/19 | | | | 250,000 | | | | 254,610 | |

Star West Generation LLC, New Term Loan B | | | 4.250 | % | | | 3/13/20 | | | | 562,874 | | | | 559,356 | |

Windsor Financing LLC, Term Loan B | | | 6.250 | % | | | 12/5/17 | | | | 1,171,350 | | | | 1,206,490 | |

Total Electric | | | | | | | | | | | | | | | 11,446,894 | |

Energy — 7.7% | | | | | | | | | | | | | | | | |

EP Energy LLC, Term Loan B3 | | | 3.500 | % | | | 5/24/18 | | | | 1,000,000 | | | | 987,292 | |

Expro Holdings UK 3 Ltd., Term Loan | | | — | | | | 9/2/21 | | | | 1,460,000 | | | | 1,456,350 | (c) |

FTS International Inc., New Term Loan B | | | 5.750 | % | | | 4/16/21 | | | | 148,364 | | | | 148,642 | |

KCA Deutag U.S. Finance LLC, Term Loan | | | 6.250 | % | | | 5/13/20 | | | | 1,217,575 | | | | 1,220,619 | |

Pacific Drilling SA, Term Loan B | | | 4.500 | % | | | 6/4/18 | | | | 987,500 | | | | 959,726 | |

Paragon Offshore Finance Co., Term Loan B | | | 3.750 | % | | | 7/18/21 | | | | 280,000 | | | | 266,700 | |

See Notes to Financial Statements.

| | |

| 10 | | LMP Corporate Loan Fund Inc. 2014 Annual Report |

LMP Corporate Loan Fund Inc.

| | | | | | | | | | | | | | | | |

| Security† | | Rate | | | Maturity

Date | | | Face

Amount | | | Value | |

Energy — continued | | | | | | | | | | | | | | | | |

Quicksilver Resources Inc., New Second Lien Term Loan | | | 7.000 | % | | | 6/21/19 | | | $ | 600,000 | | | $ | 544,500 | |

RGL Reservoir Operations Inc., First Lien Term Loan | | | 6.000 | % | | | 8/14/21 | | | | 360,000 | | | | 357,750 | |

Samson Investment Co., New Second Lien Term Loan | | | 5.000 | % | | | 9/25/18 | | | | 1,000,000 | | | | 973,875 | |

TerraForm Power Operating LLC, Term Loan | | | 4.750 | % | | | 7/23/19 | | | | 119,700 | | | | 120,199 | |

TPF II LC LLC, New Term Loan B | | | — | | | | 9/11/21 | | | | 1,390,000 | | | | 1,390,000 | (c) |

TPF II LC LLC, Term Loan B | | | 6.500 | % | | | 8/21/19 | | | | 1,213,784 | | | | 1,231,991 | |

Total Energy | | | | | | | | | | | | | | | 9,657,644 | |

Financial Other — 1.7% | | | | | | | | | | | | | | | | |

BATS Global Markets Inc., New Term Loan | | | 5.000 | % | | | 1/31/20 | | | | 1,043,373 | | | | 1,022,506 | |

Flying Fortress Inc., New Term Loan | | | 3.500 | % | | | 6/30/17 | | | | 900,000 | | | | 894,937 | |

TransUnion LLC, New USD Term Loan | | | 4.000 | % | | | 4/9/21 | | | | 258,700 | | | | 255,251 | |

Total Financial Other | | | | | | | | | | | | | | | 2,172,694 | |

Industrial Other — 8.3% | | | | | | | | | | | | | | | | |

Allflex Holdings III Inc., New First Lien Term Loan | | | 4.250 | % | | | 7/17/20 | | | | 881,100 | | | | 875,042 | |

Allflex Holdings III Inc., New Second Lien Term Loan | | | 8.000 | % | | | 7/19/21 | | | | 990,000 | | | | 988,763 | |

Eastman Kodak Co., Exit Second Lien Term Loan | | | 10.750 | % | | | 9/3/20 | | | | 290,000 | | | | 292,716 | |

Eastman Kodak Co., Exit Term Loan | | | 7.250 | % | | | 9/3/19 | | | | 1,082,046 | | | | 1,089,993 | |

Gates Global Inc., Term Loan B | | | 4.250 | % | | | 7/5/21 | | | | 380,000 | | | | 374,164 | |

Generac Power Systems Inc., Term Loan B | | | 3.250 | % | | | 5/31/20 | | | | 1,411,250 | | | | 1,389,623 | |

Intelligrated Inc., First Lien Term Loan | | | 4.500 | % | | | 7/30/18 | | | | 779,601 | | | | 768,882 | |

Laureate Education Inc., Term Loan B | | | 5.000 | % | | | 6/15/18 | | | | 1,719,331 | | | | 1,654,856 | |

Lineage Logistics Holdings LLC, 2014 Term Loan | | | 4.500 | % | | | 4/7/21 | | | | 624,363 | | | | 615,778 | |

Mirror Bidco Corp., New Term Loan | | | 4.250 | % | | | 12/28/19 | | | | 1,798,614 | | | | 1,778,380 | |

Silver II U.S. Holdings LLC, Term Loan | | | 4.000 | % | | | 12/13/19 | | | | 359,292 | | | | 353,566 | |

Southwire Co., Term Loan | | | 3.250 | % | | | 2/10/21 | | | | 218,900 | | | | 216,574 | |

Total Industrial Other | | | | | | | | | | | | | | | 10,398,337 | |

Insurance — 0.8% | | | | | | | | | | | | | | | | |

MPH Acquisition Holdings LLC, Term Loan | | | 4.000 | % | | | 3/31/21 | | | | 963,636 | | | | 942,677 | |

Natural Gas — 0.5% | | | | | | | | | | | | | | | | |

Houston Fuel Oil Co. LLC, Term Loan B | | | 4.250 | % | | | 8/19/21 | | | | 570,000 | | | | 566,200 | |

Southcross Energy Partners LP, First Lien Term Loan | | | — | | | | 8/4/21 | | | | 120,000 | | | | 120,300 | (c) |

Total Natural Gas | | | | | | | | | | | | | | | 686,500 | |

Technology — 8.1% | | | | | | | | | | | | | | | | |

CompuCom Systems Inc., REFI Term Loan B | | | 4.250 | % | | | 5/11/20 | | | | 1,011,275 | | | | 980,937 | |

Expert Global Solutions Inc., Term Loan B | | | 8.500 | % | | | 4/3/18 | | | | 849,396 | | | | 850,457 | |

First Data Corp., Extended 2021 Term Loan | | | 4.155 | % | | | 3/24/21 | | | | 500,000 | | | | 493,750 | |

First Data Corp., New 2018 Extended Term Loan | | | 3.655 | % | | | 3/23/18 | | | | 1,250,000 | | | | 1,227,865 | |

First Data Corp., New 2018 Term Loan | | | 3.655 | % | | | 9/24/18 | | | | 500,000 | | | | 490,938 | |

See Notes to Financial Statements.

| | |

| LMP Corporate Loan Fund Inc. 2014 Annual Report | | 11 |

Schedule of investments (cont’d)

September 30, 2014

LMP Corporate Loan Fund Inc.

| | | | | | | | | | | | | | | | |

| Security† | | Rate | | | Maturity

Date | | | Face

Amount | | | Value | |

Technology — continued | | | | | | | | | | | | | | | | |

InfoGroup Inc., New Term Loan | | | 6.750 | % | | | 5/25/18 | | | $ | 942,287 | | | $ | 890,461 | |

Infor (U.S.) Inc., USD Term Loan B5 | | | 3.750 | % | | | 6/3/20 | | | | 1,183,753 | | | | 1,158,450 | |

Interactive Data Corp., 2014 Term Loan | | | 4.750 | % | | | 5/2/21 | | | | 648,375 | | | | 645,538 | |

Ipreo Holdings LLC, New Term Loan B | | | 4.250 | % | | | 7/16/21 | | | | 150,000 | | | | 147,000 | |

Kronos Inc., Initial Incremental Term Loan | | | 4.500 | % | | | 10/30/19 | | | | 842,666 | | | | 839,090 | |

Kronos Inc., Second Lien Term Loan | | | 9.750 | % | | | 4/30/20 | | | | 275,000 | | | | 283,938 | |

Sophia LP, 2014 Term Loan B | | | 4.000 | % | | | 7/19/18 | | | | 288,966 | | | | 285,427 | |

Syniverse Holdings Inc., Term Loan | | | 4.000 | % | | | 4/23/19 | | | | 1,175,787 | | | | 1,158,150 | |

Vertafore Inc., Second Lien Term Loan | | | 9.750 | % | | | 10/27/17 | | | | 800,000 | | | | 808,500 | |

Total Technology | | | | | | | | | | | | | | | 10,260,501 | |

Transportation — 5.3% | | | | | | | | | | | | | | | | |

American Airlines Inc., Exit Term Loan | | | 3.750 | % | | | 6/27/19 | | | | 522,290 | | | | 514,021 | |

Commercial Barge Line Co., First Lien Term Loan | | | 7.500 | % | | | 9/23/19 | | | | 916,050 | | | | 921,203 | |

Commercial Barge Line Co., Second Lien Term Loan | | | 10.750 | % | | | 3/22/20 | | | | 790,000 | | | | 801,850 | |

Delta Air Lines Inc., New Term Loan B | | | 3.250 | % | | | 4/20/17 | | | | 1,073,840 | | | | 1,063,002 | |

Hertz Corp., Term Loan B2 | | | 3.000 | % | | | 3/11/18 | | | | 1,063,800 | | | | 1,034,545 | |

Syncreon Global Finance (U.S.) Inc., Term Loan B | | | 5.250 | % | | | 10/28/20 | | | | 1,579,322 | | | | 1,567,477 | |

U.S. Airways Group Inc., New Term Loan B1 | | | 3.500 | % | | | 5/23/19 | | | | 554,400 | | | | 542,758 | |

United Airlines Inc., New Term Loan B | | | 3.500 | % | | | 4/1/19 | | | | 236,400 | | | | 232,263 | |

Total Transportation | | | | | | | | | | | | | | | 6,677,119 | |

Total Senior Loans (Cost — $169,979,097) | | | | | | | | | | | | | | | 168,437,351 | |

| Corporate Bonds & Notes — 13.3% | | | | | | | | | | | | | | | | |

| Consumer Discretionary — 2.0% | | | | | | | | | | | | | | | | |

Hotels, Restaurants & Leisure — 0.3% | | | | | | | | | | | | | | | | |

Paris Las Vegas Holding LLC/Harrah’s Las Vegas LLC/Flamingo Las Vegas Holding LLC, Senior Secured Notes | | | 8.000 | % | | | 10/1/20 | | | | 460,000 | | | | 455,400 | (f) |

Media — 1.7% | | | | | | | | | | | | | | | | |

Carmike Cinemas Inc., Secured Notes | | | 7.375 | % | | | 5/15/19 | | | | 500,000 | | | | 532,500 | |

CSC Holdings LLC, Senior Notes | | | 6.750 | % | | | 11/15/21 | | | | 90,000 | | | | 96,206 | |

DISH DBS Corp., Senior Notes | | | 6.750 | % | | | 6/1/21 | | | | 190,000 | | | | 204,725 | |

DISH DBS Corp., Senior Notes | | | 5.000 | % | | | 3/15/23 | | | | 190,000 | | | | 182,756 | |

National CineMedia LLC, Senior Notes | | | 7.875 | % | | | 7/15/21 | | | | 1,000,000 | | | | 1,085,000 | |

Total Media | | | | | | | | | | | | | | | 2,101,187 | |

Total Consumer Discretionary | | | | | | | | | | | | | | | 2,556,587 | |

| Consumer Staples — 0.2% | | | | | | | | | | | | | | | | |

Food & Staples Retailing — 0.1% | | | | | | | | | | | | | | | | |

Beverages & More Inc., Senior Secured Notes | | | 10.000 | % | | | 11/15/18 | | | | 80,000 | | | | 75,500 | (f) |

See Notes to Financial Statements.

| | |

| 12 | | LMP Corporate Loan Fund Inc. 2014 Annual Report |

LMP Corporate Loan Fund Inc.

| | | | | | | | | | | | | | | | |

| Security† | | Rate | | | Maturity

Date | | | Face

Amount | | | Value | |

Food Products — 0.1% | | | | | | | | | | | | | | | | |

Simmons Foods Inc., Secured Notes | | | 7.875 | % | | | 10/1/21 | | | $ | 190,000 | | | $ | 188,575 | (f) |

Total Consumer Staples | | | | | | | | | | | | | | | 264,075 | |

| Energy — 4.6% | | | | | | | | | | | | | | | | |

Energy Equipment & Services — 0.2% | | | | | | | | | | | | | | | | |

Atwood Oceanics Inc., Senior Notes | | | 6.500 | % | | | 2/1/20 | | | | 220,000 | | | | 226,600 | |

Oil, Gas & Consumable Fuels — 4.4% | | | | | | | | | | | | | | | | |

Antero Resources Finance Corp., Senior Notes | | | 5.375 | % | | | 11/1/21 | | | | 110,000 | | | | 109,862 | |

California Resources Corp., Senior Notes | | | 5.000 | % | | | 1/15/20 | | | | 580,000 | | | | 590,150 | (f) |

Globe Luxembourg SCA, Senior Secured Notes | | | 9.625 | % | | | 5/1/18 | | | | 490,000 | | | | 521,850 | (f) |

Gulfport Energy Corp., Senior Notes | | | 7.750 | % | | | 11/1/20 | | | | 100,000 | | | | 104,750 | (f) |

MEG Energy Corp., Senior Notes | | | 6.500 | % | | | 3/15/21 | | | | 750,000 | | | | 772,500 | (f) |

Murray Energy Corp., Senior Secured Notes | | | 9.500 | % | | | 12/5/20 | | | | 1,175,000 | | | | 1,298,375 | (f) |

Rice Energy Inc., Senior Notes | | | 6.250 | % | | | 5/1/22 | | | | 290,000 | | | | 284,200 | (f) |

Sanchez Energy Corp., Senior Notes | | | 7.750 | % | | | 6/15/21 | | | | 70,000 | | | | 75,250 | |

Swift Energy Co., Senior Notes | | | 7.125 | % | | | 6/1/17 | | | | 80,000 | | | | 80,100 | |

Teine Energy Ltd., Senior Notes | | | 6.875 | % | | | 9/30/22 | | | | 1,740,000 | | | | 1,716,075 | (f) |

Total Oil, Gas & Consumable Fuels | | | | | | | | | | | | | | | 5,553,112 | |

Total Energy | | | | | | | | | | | | | | | 5,779,712 | |

| Financials — 0.4% | | | | | | | | | | | | | | | | |

Banks — 0.1% | | | | | | | | | | | | | | | | |

CIT Group Inc., Senior Notes | | | 5.000 | % | | | 8/1/23 | | | | 170,000 | | | | 169,150 | |

Real Estate Management & Development — 0.3% | | | | | | | | | | | | | | | | |

Howard Hughes Corp., Senior Notes | | | 6.875 | % | | | 10/1/21 | | | | 350,000 | | | | 363,125 | (f) |

Total Financials | | | | | | | | | | | | | | | 532,275 | |

| Health Care — 0.4% | | | | | | | | | | | | | | | | |

Health Care Providers & Services — 0.4% | | | | | | | | | | | | | | | | |

Acadia Healthcare Co. Inc., Senior Notes | | | 5.125 | % | | | 7/1/22 | | | | 170,000 | | | | 166,600 | (f) |

Fresenius Medical Care U.S. Finance Inc., Senior Notes | | | 6.500 | % | | | 9/15/18 | | | | 50,000 | | | | 55,125 | (f) |

Fresenius Medical Care U.S. Finance Inc., Senior Notes | | | 5.750 | % | | | 2/15/21 | | | | 30,000 | | | | 31,800 | (f) |

Universal Hospital Services Inc., Secured Notes | | | 7.625 | % | | | 8/15/20 | | | | 270,000 | | | | 255,150 | |

Total Health Care | | | | | | | | | | | | | | | 508,675 | |

| Industrials — 1.0% | | | | | | | | | | | | | | | | |

Airlines — 0.6% | | | | | | | | | | | | | | | | |

American Airlines, Pass-Through Trust, Senior Secured Bonds | | | 5.600 | % | | | 7/15/20 | | | | 656,801 | | | | 676,505 | (f) |

Building Products — 0.0% | | | | | | | | | | | | | | | | |

Griffon Corp., Senior Notes | | | 5.250 | % | | | 3/1/22 | | | | 50,000 | | | | 47,812 | |

Electrical Equipment — 0.1% | | | | | | | | | | | | | | | | |

WESCO Distribution Inc., Senior Notes | | | 5.375 | % | | | 12/15/21 | | | | 160,000 | | | | 159,600 | |

See Notes to Financial Statements.

| | |

| LMP Corporate Loan Fund Inc. 2014 Annual Report | | 13 |

Schedule of investments (cont’d)

September 30, 2014

LMP Corporate Loan Fund Inc.

| | | | | | | | | | | | | | | | |

| Security† | | Rate | | | Maturity

Date | | | Face

Amount | | | Value | |

Road & Rail — 0.3% | | | | | | | | | | | | | | | | |

Florida East Coast Holdings Corp., Senior Secured Notes | | | 6.750 | % | | | 5/1/19 | | | $ | 350,000 | | | $ | 357,875 | (f) |

Total Industrials | | | | | | | | | | | | | | | 1,241,792 | |

| Materials — 1.6% | | | | | | | | | | | | | | | | |

Chemicals — 0.3% | | | | | | | | | | | | | | | | |

Eagle Spinco Inc., Senior Subordinated Notes | | | 4.625 | % | | | 2/15/21 | | | | 150,000 | | | | 144,563 | |

Omnova Solutions Inc., Senior Notes | | | 7.875 | % | | | 11/1/18 | | | | 188,000 | | | | 191,760 | |

Total Chemicals | | | | | | | | | | | | | | | 336,323 | |

Containers & Packaging — 1.1% | | | | | | | | | | | | | | | | |

Ardagh Packaging Finance PLC/Ardagh MP Holdings USA Inc., Senior Notes | | | 6.000 | % | | | 6/30/21 | | | | 200,000 | | | | 192,500 | (f) |

Ardagh Packaging Finance PLC/Ardagh MP Holdings USA Inc., Senior Secured Notes | | | 3.234 | % | | | 12/15/19 | | | | 760,000 | | | | 738,150 | (f)(g) |

BWAY Holding Co., Senior Notes | | | 9.125 | % | | | 8/15/21 | | | | 270,000 | | | | 272,700 | (f) |

Reynolds Group Issuer Inc./Reynolds Group Issuer LLC/Reynolds Group Issuer (Luxembourg) SA, Senior Secured Notes | | | 5.750 | % | | | 10/15/20 | | | | 220,000 | | | | 224,950 | |

Total Containers & Packaging | | | | | | | | | | | | | | | 1,428,300 | |

Metals & Mining — 0.2% | | | | | | | | | | | | | | | | |

St. Barbara Ltd., Senior Secured Notes | | | 8.875 | % | | | 4/15/18 | | | | 270,000 | | | | 228,150 | (f) |

Total Materials | | | | | | | | | | | | | | | 1,992,773 | |

| Telecommunication Services — 3.1% | | | | | | | | | | | | | | | | |

Diversified Telecommunication Services — 1.9% | | | | | | | | | | | | | | | | |

CenturyLink Inc., Senior Notes | | | 5.625 | % | | | 4/1/20 | | | | 100,000 | | | | 103,525 | |

Inmarsat Finance PLC, Senior Notes | | | 4.875 | % | | | 5/15/22 | | | | 100,000 | | | | 98,000 | (f) |

Intelsat Jackson Holdings SA, Senior Notes | | | 7.250 | % | | | 10/15/20 | | | | 500,000 | | | | 530,000 | |

Telecom Italia SpA, Senior Notes | | | 5.303 | % | | | 5/30/24 | | | | 200,000 | | | | 196,750 | (f) |

TW Telecom Holdings Inc., Senior Notes | | | 6.375 | % | | | 9/1/23 | | | | 300,000 | | | | 336,750 | |

Wind Acquisition Finance SA, Senior Secured Notes | | | 4.750 | % | | | 7/15/20 | | | | 1,150,000 | | | | 1,106,875 | (f) |

Total Diversified Telecommunication Services | | | | | | | | | | | | | | | 2,371,900 | |

Wireless Telecommunication Services — 1.2% | | | | | | | | | | | | | | | | |

Level 3 Escrow II Inc., Senior Notes | | | 5.375 | % | | | 8/15/22 | | | | 200,000 | | | | 197,500 | (f) |

SoftBank Corp., Senior Notes | | | 4.500 | % | | | 4/15/20 | | | | 550,000 | | | | 550,688 | (f) |

Sprint Corp., Senior Notes | | | 7.875 | % | | | 9/15/23 | | | | 610,000 | | | | 648,125 | (f) |

T-Mobile USA Inc., Senior Notes | | | 6.542 | % | | | 4/28/20 | | | | 80,000 | | | | 82,300 | |

Total Wireless Telecommunication Services | | | | | | | | | | | | | | | 1,478,613 | |

Total Telecommunication Services | | | | | | | | | | | | | | | 3,850,513 | |

Total Corporate Bonds & Notes (Cost — $16,677,418) | | | | | | | | | | | | | | | 16,726,402 | |

See Notes to Financial Statements.

| | |

| 14 | | LMP Corporate Loan Fund Inc. 2014 Annual Report |

LMP Corporate Loan Fund Inc.

| | | | | | | | | | | | | | | | |

| Security† | | | | | | | | Shares | | | Value | |

| Common Stocks — 1.8% | | | | | | | | | | | | | | | | |

| Consumer Discretionary — 0.2% | | | | | | | | | | | | | | | | |

Automobiles — 0.2% | | | | | | | | | | | | | | | | |

Dayco Products LLC | | | | | | | | | | | 4,912 | | | $ | 245,600 | (d) |

| Energy — 1.6% | | | | | | | | | | | | | | | | |

Oil, Gas & Consumable Fuels — 1.6% | | | | | | | | | | | | | | | | |

SemGroup Corp., Class A Shares | | | | | | | | | | | 24,938 | | | | 2,076,587 | |

Total Common Stocks (Cost — $687,305) | | | | | | | | | | | | | | | 2,322,187 | |

| | | | |

| | | | | | Expiration

Date | | | Warrants | | | | |

| Warrants — 0.0% | | | | | | | | | | | | | | | | |

Everyware Global Inc. (Cost — $0) | | | | | | | 7/30/21 | | | | 24,971 | | | | 0 | *(d)(e)(h) |

Total Investments before Short-Term Investments (Cost — $187,343,820) | | | | 187,485,940 | |

| | | | |

| | | Rate | | | Maturity

Date | | | Face

Amount | | | | |

| Short-Term Investments — 4.4% | | | | | | | | | | | | | | | | |

Repurchase Agreements — 4.4% | | | | | | | | | | | | | | | | |

State Street Bank & Trust Co. repurchase agreement dated 9/30/14; Proceeds at maturity — $5,469,000; (Fully collateralized by U.S. government agency obligations, 2.000% due 1/30/23; Market value — $5,578,632) (Cost — $5,469,000) | | | 0.000 | % | | | 10/1/14 | | | $ | 5,469,000 | | | | 5,469,000 | |

Total Investments — 154.0% (Cost — $192,812,820#) | | | | | | | | | | | | 192,954,940 | |

Auction Rate Cumulative Preferred Stock, at Liquidation Value — (27.9)% | | | | | | | | (35,000,000 | ) |

Liabilities in Excess of Other Assets — (26.1)% | | | | | | | | | | | | | | | (32,415,719 | ) |

Total Net Assets — 100.0% | | | | | | | | | | | | | | $ | 125,539,221 | |

| † | Securities held by the Fund are subject to a lien, granted to the lenders, to the extent of the borrowing outstanding and any additional expenses. |

| * | Non-income producing security. |

| (a) | Interest rates disclosed represent the effective rates on collateralized and uncollateralized senior loans. Ranges in interest rates are attributable to multiple contracts under the same loan. |

| (b) | Senior loans may be considered restricted in that the Fund ordinarily is contractually obligated to receive approval from the agent bank and/or borrower prior to the disposition of a senior loan. |

| (c) | All or a portion of this loan is unfunded as of September 30, 2014. The interest rate for fully unfunded term loans is to be determined. |

| (d) | Security is valued in good faith in accordance with procedures approved by the Board of Directors (See Note 1). |

| (e) | Illiquid security (unaudited). |

| (f) | Security is exempt from registration under Rule 144A of the Securities Act of 1933. This security may be resold in transactions that are exempt from registration, normally to qualified institutional buyers. This security has been deemed liquid pursuant to guidelines approved by the Board of Directors, unless otherwise noted. |

See Notes to Financial Statements.

| | |

| LMP Corporate Loan Fund Inc. 2014 Annual Report | | 15 |

Schedule of investments (cont’d)

September 30, 2014

LMP Corporate Loan Fund Inc.

| (g) | Variable rate security. Interest rate disclosed is as of the most recent information available. |

| (h) | Value is less than $1. |

| # | Aggregate cost for federal income tax purposes is $193,430,588. |

| | |

Abbreviations used in this schedule: |

| REFI | | — Refinancing |

| Second Lien | | — Subordinate Lien to First Lien |

| Term | | — Term loan typically with a First Lien on specified assets |

See Notes to Financial Statements.

| | |

| 16 | | LMP Corporate Loan Fund Inc. 2014 Annual Report |

Statement of assets and liabilities

September 30, 2014

| | | | |

|

| Assets: | |

Investments, at value (Cost — $192,812,820) | | $ | 192,954,940 | |

Cash | | | 225,155 | |

Receivable for securities sold | | | 7,415,035 | |

Interest receivable | | | 1,471,316 | |

Prepaid expenses | | | 32,085 | |

Total Assets | | | 202,098,531 | |

| |

| Liabilities: | | | | |

Loan payable (Note 5) | | | 30,500,000 | |

Payable for securities purchased | | | 10,507,519 | |

Investment management fee payable | | | 118,584 | |

Interest payable | | | 23,320 | |

Distributions payable to auction rate cumulative preferred stockholders | | | 5,913 | |

Directors’ fees payable | | | 2,510 | |

Accrued expenses | | | 401,464 | |

Total Liabilities | | | 41,559,310 | |

Series A and B Auction Rate Cumulative Preferred Stock (700 shares authorized

and issued at $25,000 per share for each series) (Note 7) | | | 35,000,000 | |

| Total Net Assets | | $ | 125,539,221 | |

| |

| Net Assets: | | | | |

Par value ($0.001 par value; 9,935,917 shares issued and outstanding;

50,000,000 common shares authorized) | | $ | 9,936 | |

Paid-in capital in excess of par value | | | 141,667,319 | |

Undistributed net investment income | | | 2,633,341 | |

Accumulated net realized loss on investments | | | (18,913,495) | |

Net unrealized appreciation on investments | | | 142,120 | |

| Total Net Assets | | $ | 125,539,221 | |

| |

| Shares Outstanding | | | 9,935,917 | |

| |

| Net Asset Value | | | $12.63 | |

See Notes to Financial Statements.

| | |

| LMP Corporate Loan Fund Inc. 2014 Annual Report | | 17 |

Statement of operations

For the Year Ended September 30, 2014

| | | | |

|

| Investment Income: | |

Interest | | $ | 10,028,845 | |

Dividends | | | 88,286 | |

Total Investment Income | | | 10,117,131 | |

| |

| Expenses: | | | | |

Investment management fee (Note 2) | | | 1,550,434 | |

Interest expense (Note 5) | | | 326,425 | |

Audit and tax fees | | | 125,240 | |

Legal fees | | | 124,586 | |

Excise tax (Note 1) | | | 108,091 | |

Transfer agent fees | | | 29,554 | |

Shareholder reports | | | 29,421 | |

Stock exchange listing fees | | | 24,837 | |

Rating agency fees | | | 22,658 | |

Directors’ fees | | | 22,299 | |

Commitment fees (Note 5) | | | 19,772 | |

Auction participation fees (Note 7) | | | 17,704 | |

Auction agent fees | | | 17,600 | |

Fund accounting fees | | | 12,846 | |

Custody fees | | | 8,583 | |

Insurance | | | 3,587 | |

Miscellaneous expenses | | | 16,279 | |

Total Expenses | | | 2,459,916 | |

Less: Fee waivers and/or expense reimbursements (Note 2) | | | (96,902) | |

Net Expenses | | | 2,363,014 | |

| Net Investment Income | | | 7,754,117 | |

| |

| Realized and Unrealized Gain (Loss) on Investments (Notes 1 and 3): | | | | |

Net Realized Gain from Investment Transactions | | | 554,175 | |

Change in Net Unrealized Appreciation (Depreciation) from Investments | | | (1,975,436) | |

| Net Loss on Investments | | | (1,421,261) | |

Distributions Paid to Auction Rate Cumulative Preferred Stockholders

from Net Investment Income (Notes 1 and 7) | | | (37,840) | |

| Increase in Net Assets from Operations | | $ | 6,295,016 | |

See Notes to Financial Statements.

| | |

| 18 | | LMP Corporate Loan Fund Inc. 2014 Annual Report |

Statements of changes in net assets

| | | | | | | | |

| For the Years Ended September 30, | | 2014 | | | 2013 | |

| | |

| Operations: | | | | | | | | |

Net investment income | | $ | 7,754,117 | | | $ | 7,671,105 | |

Net realized gain | | | 554,175 | | | | 3,008,479 | |

Change in net unrealized appreciation (depreciation) | | | (1,975,436) | | | | (1,154,727) | |

Distributions paid to auction rate cumulative preferred stockholders

from net investment income | | | (37,840) | | | | (53,090) | |

Increase in Net Assets from Operations | | | 6,295,016 | | | | 9,471,767 | |

| | |

| Distributions to Shareholders From (Note 1): | | | | | | | | |

Net investment income | | | (8,644,248) | | | | (8,639,791) | |

Decrease in Net Assets From Distributions to Shareholders | | | (8,644,248) | | | | (8,639,791) | |

| | |

| Fund Share Transactions: | | | | | | | | |

Reinvestment of distributions (0 and 13,844 shares issued, respectively) | | | — | | | | 179,787 | |

Increase in Net Assets From Fund Share Transactions | | | — | | | | 179,787 | |

Increase (Decrease) in Net Assets | | | (2,349,232) | | | | 1,011,763 | |

| | |

| Net Assets: | | | | | | | | |

Beginning of year | | | 127,888,453 | | | | 126,876,690 | |

End of year* | | $ | 125,539,221 | | | $ | 127,888,453 | |

*Includesundistributed net investment income of: | | | $2,633,341 | | | | $2,975,746 | |

See Notes to Financial Statements.

| | |

| LMP Corporate Loan Fund Inc. 2014 Annual Report | | 19 |

Statement of cash flows

For the Year Ended September 30, 2014

| | | | |

|

Increase (Decrease) in Cash:

Cash Provided (Used) by Operating Activities: | |

Net increase in net assets resulting from operations | | $ | 6,332,856 | |

Adjustments to reconcile net increase in net assets resulting from operations

to net cash provided (used) by operating activities: | | | | |

Purchases of portfolio securities | | | (119,748,479) | |

Sales of portfolio securities | | | 130,519,918 | |

Net purchases, sales and maturities of short-term investments | | | (5,469,000) | |

Payment-in-kind | | | (9,342) | |

Net amortization of premium (accretion of discount) | | | 449,192 | |

Increase in receivable for securities sold | | | (1,916,424) | |

Increase in interest receivable | | | (174,805) | |

Decrease in prepaid expenses | | | 3,663 | |

Decrease in payable for securities purchased | | | (6,000,906) | |

Decrease in investment management fee payable | | | (823) | |

Increase in Directors’ fees payable | | | 2,473 | |

Decrease in interest payable | | | (3,694) | |

Increase in accrued expenses | | | 272,689 | |

Net realized gain on investments | | | (554,175) | |

Change in unrealized depreciation of investments | | | 1,975,436 | |

Net Cash Provided by Operating Activities* | | | 5,678,579 | |

| |

| Cash Flows from Financing Activities: | | | | |

Distributions paid on common stock | | | (8,644,248) | |

Distributions paid on auction rate cumulative preferred stock | | | (38,625) | |

Net Cash Used in Financing Activities | | | (8,682,873) | |

| Net Decrease in Cash | | | (3,004,294) | |

Cash at Beginning of Year | | | 3,229,449 | |

Cash at End of Year | | $ | 225,155 | |

| |

| Non-Cash Investing Activities: | | | | |

Non-cash exchange of securities | | $ | 174,258 | |

| * | Included in operating expenses is cash of $330,119 paid for interest on borrowings. |

See Notes to Financial Statements.

| | |

| 20 | | LMP Corporate Loan Fund Inc. 2014 Annual Report |

Financial highlights

| | | | | | | | | | | | | | | | | | | | |

| For a share of capital stock outstanding throughout each year ended September 30: | |

| | | 20141 | | | 20131 | | | 2012 | | | 2011 | | | 2010 | |

| | | | | |

| Net asset value, beginning of year | | | $12.87 | | | | $12.79 | | | | $11.72 | | | | $11.97 | | | | $11.23 | |

| | | | |

| Income (loss) from operations: | | | | | | | | | | | | | | | | | |

Net investment income | | | 0.78 | | | | 0.77 | | | | 0.85 | | | | 0.80 | | | | 0.59 | |

Net realized and unrealized gain (loss) | | | (0.15) | | | | 0.19 | | | | 1.02 | | | | (0.37) | | | | 0.69 | |

Distributions paid to auction rate cumulative preferred stockholders from net investment income | | | (0.00) | 2 | | | (0.01) | | | | (0.01) | | | | (0.01) | | | | (0.01) | |

Total income from operations | | | 0.63 | | | | 0.95 | | | | 1.86 | | | | 0.42 | | | | 1.27 | |

| | | |

| Less distributions from: | | | | | | | | | | | | | |

Net investment income | | | (0.87) | | | | (0.87) | | | | (0.79) | | | | (0.67) | | | | (0.53) | |

Total distributions | | | (0.87) | | | | (0.87) | | | | (0.79) | | | | (0.67) | | | | (0.53) | |

| | | | | |

| Net asset value, end of year | | | $12.63 | | | | $12.87 | | | | $12.79 | | | | $11.72 | | | | $11.97 | |

| | | | | |

| Market price, end of year | | | $11.55 | | | | $12.35 | | | | $13.41 | | | | $10.69 | | | | $11.14 | |

Total return, based on NAV3,4 | | | 4.97 | % | | | 7.61 | % | | | 16.46 | % | | | 3.54 | % | | | 11.92 | % |

Total return, based on Market Price5 | | | 0.52 | % | | | (1.46) | % | | | 34.03 | % | | | 1.48 | % | | | 20.34 | % |

| | | | | |

| Net assets, end of year (millions) | | | $126 | | | | $128 | | | | $127 | | | | $116 | | | | $119 | |

| | | | |

| Ratios to average net assets:6 | | | | | | | | | | | | | | | | | |

Gross expenses | | | 1.92 | % | | | 1.93 | % | | | 1.88 | % | | | 1.92 | % | | | 2.03 | % |

Net expenses7 | | | 1.84 | 8 | | | 1.86 | 8 | | | 1.88 | | | | 1.92 | | | | 2.03 | |

Net investment income | | | 6.04 | | | | 5.96 | | | | 6.86 | | | | 6.39 | | | | 5.17 | |

| | | | | |

| Portfolio turnover rate | | | 63 | % | | | 121 | % | | | 68 | % | | | 98 | % | | | 61 | % |

| | | |

| Auction Rate Cumulative Preferred Stock: | | | | | | | | | | | | | |

Total Amount Outstanding (000s) | | | $35,000 | | | | $35,000 | | | | $35,000 | | | | $35,000 | | | | $35,000 | |

Asset Coverage Per Share | | | 72,915 | | | | 73,812 | | | | 73,426 | | | | 69,374 | | | | 74,029 | |

Involuntary Liquidating Preference Per Share9 | | | 25,000 | | | | 25,000 | | | | 25,000 | | | | 25,000 | | | | 25,000 | |

| | | | |

| Supplemental data: | | | | | | | | | | | | | | | | | |

Loans Outstanding, End of Year (000s) | | | $30,500 | | | | $30,500 | | | | $30,500 | | | | $30,500 | | | | $25,500 | |

Asset Coverage for Loan Outstanding | | | 626 | % | | | 634 | % | | | 631 | % | | | 596 | % | | | 703 | % |

Weighted Average Loan (000s) | | | $30,500 | | | | $30,500 | | | | $30,500 | | | | $28,336 | | | | $25,500 | |

Weighted Average Interest Rate on Loans | | | 1.07 | % | | | 1.14 | % | | | 1.18 | % | | | 1.31 | % | | | 1.61 | % |

| 1 | Per share amounts have been calculated using the average shares method. |

| 2 | Amount represents less than $0.005 per share. |

| 3 | Performance figures may reflect compensating balance arrangements, fee waivers and/or expense reimbursements. In the absence of compensating balance arrangements, fee waivers and/or expense reimbursements, the total return would have been lower. Past performance is no guarantee of future results. |

See Notes to Financial Statements.

| | |

| LMP Corporate Loan Fund Inc. 2014 Annual Report | | 21 |

Financial highlights (cont’d)

| 4 | The total return calculation assumes that distributions are reinvested at NAV. Prior to January 1, 2012, the total return calculation assumed the reinvestment of all distributions in accordance with the Fund’s dividend reinvestment plan. Past performance is no guarantee of future results. |

| 5 | The total return calculation assumes that distributions are reinvested in accordance with the Fund’s dividend reinvestment plan. Past performance is no guarantee of future results. |

| 6 | Calculated on the basis of average net assets of common stock shareholders. Ratios do not reflect the effect of dividend payments to preferred stockholders. |

| 7 | The impact of compensating balance arrangements, if any, was less than 0.01%. |

| 8 | Reflects fee waivers and/or expense reimbursements. |

| 9 | Excludes accumulated and unpaid distributions. |

See Notes to Financial Statements.

| | |

| 22 | | LMP Corporate Loan Fund Inc. 2014 Annual Report |

Notes to financial statements

1. Organization and significant accounting policies

LMP Corporate Loan Fund Inc. (the “Fund”) was incorporated in Maryland and is registered as a non-diversified, closed-end management investment company under the Investment Company Act of 1940, as amended (the “1940 Act”). The Fund’s investment objective is to maximize current income consistent with prudent efforts to preserve capital.

The following are significant accounting policies consistently followed by the Fund and are in conformity with U.S. generally accepted accounting principles (“GAAP”). Estimates and assumptions are required to be made regarding assets, liabilities and changes in net assets resulting from operations when financial statements are prepared. Changes in the economic environment, financial markets and any other parameters used in determining these estimates could cause actual results to differ. Subsequent events have been evaluated through the date the financial statements were issued.

(a) Investment valuation. The valuations for fixed income securities are typically the prices supplied by independent third party pricing services, which may use market prices or broker/dealer quotations or a variety of valuation techniques and methodologies. The independent third party pricing services use inputs that are observable such as issuer details, interest rates, yield curves, prepayment speeds, credit risks/spreads, default rates and quoted prices for similar securities. Short-term fixed income securities that will mature in 60 days or less are valued at amortized cost, unless it is determined that using this method would not reflect an investment’s fair value. Equity securities for which market quotations are available are valued at the last reported sales price or official closing price on the primary market or exchange on which they trade. If independent third party pricing services are unable to supply prices for a portfolio investment, or if the prices supplied are deemed by the manager to be unreliable, the market price may be determined by the manager using quotations from one or more broker/dealers or at the transaction price if the security has recently been purchased and no value has yet been obtained from a pricing service or pricing broker. When reliable prices are not readily available, such as when the value of a security has been significantly affected by events after the close of the exchange or market on which the security is principally traded, but before the Fund calculates its net asset value, the Fund values these securities as determined in accordance with procedures approved by the Fund’s Board of Directors.