EWBC Earnings Results Fourth Quarter 2020 January 28, 2021

Forward-Looking Statements 2 Forward-Looking Statements Certain matters set forth herein (including any exhibits hereto) constitute “forward-looking statements” within the meaning of the Private Securities Litigation Reform Act of 1995, including forward- looking statements relating to our current business plans and expectations regarding future operating results. Forward-looking statements may include, but are not limited to, the use of forward-looking language, such as “likely result in,” “expects,” “anticipates,” “estimates,” “forecasts,” “projects,” “intends to,” “assumes,” or may include other similar words or phrases, such as “believes,” “plans,” “trend,” “objective,” “continues,” “remains,” or similar expressions, or future or conditional verbs, such as “will,” “would,” “should,” “could,” “may,” “might,” “can,” or similar verbs, and the negative thereof. These forward-looking statements are subject to risks and uncertainties that could cause actual results, performance or achievements to differ materially from those projected. These risks and uncertainties, some of which are beyond our control, include, but are not limited to, the impact of disease pandemics, such as the resurgences and subsequent waves of the COVID-19 pandemic, on the Company, its operations and its customers, employees and the markets in which the Company operates and in which its loans are concentrated; and the measures that international, federal, state and local governments, agencies, law enforcement and/or health authorities implement to address it, which may precipitate or exacerbate one or more of the below-mentioned and/or other risks, and significantly disrupt or prevent the Company from operating its business in the ordinary course for an extended period; changes in governmental policy and regulation, including measures taken in response to economic, business, political and social conditions, such as the Small Business Administration’s (“SBA”) Paycheck Protection Program, the Coronavirus Aid, Relief, and Economic Security Act (“CARES Act”) and any similar or related rules and regulations, the Board of Governors of the Federal Reserve System (“Federal Reserve”) efforts to provide liquidity to the United States (“U.S.”) financial system, including changes in government interest rate policies, and to provide credit to private commercial and municipal borrowers, and other programs designed to address the effects of the COVID-19 pandemic, as well as the resulting effect of all such items on the Company’s operations, liquidity and capital position, and on the financial condition of the Company’s borrowers and other customers; changes in the U.S. economy, including an economic slowdown or recession, inflation, deflation, housing prices, employment levels, rate of growth and general business conditions; changes in laws or the regulatory environment including regulatory reform initiatives and policies of the U.S. Department of Treasury, the Federal Reserve, the Federal Deposit Insurance Corporation (“FDIC”), the Office of the Comptroller of the Currency, the U.S. Securities and Exchange Commission (“SEC”), the Consumer Financial Protection Bureau (“CFPB”) and the California Department of Financial Protection and Innovation (“DFPI”) - Division of Financial Institutions, and SBA; the changes and effects thereof in trade, monetary and fiscal policies and laws, including the ongoing trade dispute between the U.S. and the People’s Republic of China; changes in the commercial and consumer real estate markets; changes in consumer spending and savings habits; fluctuations in the Company’s stock price; changes in income tax laws and regulations; the Company’s ability to compete effectively against other financial institutions in its banking markets; success and timing of the Company’s business strategies; the Company’s ability to retain key officers and employees; impact on the Company’s funding costs, net interest income and net interest margin from changes in key variable market interest rates, competition, regulatory requirements and the Company’s product mix; changes in the Company’s costs of operation, compliance and expansion; the Company’s ability to adopt and successfully integrate new technologies into its business in a strategic manner; impact of benchmark interest rate reform in the U.S. that resulted in the Secured Overnight Financing Rate (“SOFR”) selected as the preferred alternative reference rate to the London Interbank Offered Rate (“LIBOR”); impact of a communications or technology disruption, failure in, or breach of, the Company’s operational or security systems or infrastructure, or those of third parties with whom the Company does business, including as a result of cyber-attacks; and other similar matters which could result in, among other things, confidential and/or proprietary information being disclosed or misused and materially impact the Company’s ability to provide services to its clients; adequacy of the Company’s risk management framework, disclosure controls and procedures and internal control over financial reporting; future credit quality and performance, including the Company’s expectations regarding future credit losses and allowance levels; impact of adverse changes to the Company’s credit ratings from major credit rating agencies; impact of adverse judgments or settlements in litigation; impact on the Company’s international operations due to political developments, disease pandemics, wars or other hostilities that may disrupt or increase volatility in securities or otherwise affect economic conditions; heightened regulatory and governmental oversight and scrutiny of the Company’s business practices, including dealings with consumers; impact of reputational risk from negative publicity, fines and penalties and other negative consequences from regulatory violations and legal actions and from the Company’s interactions with business partners, counterparties, service providers and other third parties; impact of regulatory enforcement actions; changes in accounting standards as may be required by the Financial Accounting Standards Board (“FASB”) or other regulatory agencies and their impact on critical accounting policies and assumptions; impact of other potential federal tax changes and spending cuts; the Company’s capital requirements and its ability to generate capital internally or raise capital on favorable terms; impact on the Company’s liquidity due to changes in the Company’s ability to receive dividends from its subsidiaries; any future strategic acquisitions or divestitures; continuing consolidation in the financial services industry; changes in the equity and debt securities markets; fluctuations in foreign currency exchange rates; a recurrence of significant turbulence or disruption in the capital or financial markets, which could result in, among other things, a reduction in the availability of funding or increases in funding costs, a reduction in investor demand for mortgage loans and declines in asset values and/or recognition of other-than-temporary impairment (“OTTI”) on securities held in the Company’s available-for-sale (“AFS”) debt securities portfolio; and impact of natural or man-made disasters or calamities, such as wildfires and earthquakes, which are particular to California, or conflicts or other events that may directly or indirectly result in a negative impact on the Company’s financial performance. In addition to the risk factors enumerated above, the economic impact of the COVID-19 pandemic could cause actual outcomes to differ, possibly materially, from the Company’s forward-looking statements due to factors and future developments that are uncertain, unpredictable and in many cases beyond the Company’s control. Given the ongoing and dynamic nature of the circumstances, it is difficult to predict the full impact of the COVID-19 pandemic on the Company’s business. The extent to which the COVID-19 pandemic impacts the Company will depend on future developments that are uncertain and unpredictable, including the scope, severity and duration of the pandemic and its impact on the Company’s customers, the actions taken by governmental authorities in response to the pandemic as well as its impact on global and regional economies, and the pace of recovery when the COVID-19 pandemic subsides, among others. For a more detailed discussion of some of the factors that might cause such differences, see the Company’s Annual Report on Form 10-K for the year ended December 31, 2019 under the heading Item 1A. Risk Factors and the information set forth under Item 1A. Risk Factors in the Company’s Quarterly Reports on Form 10-Q. The Company does not undertake, and specifically disclaims any obligation to update or revise any forward-looking statements to reflect the occurrence of events or circumstances after the date of such statements except as required by law.

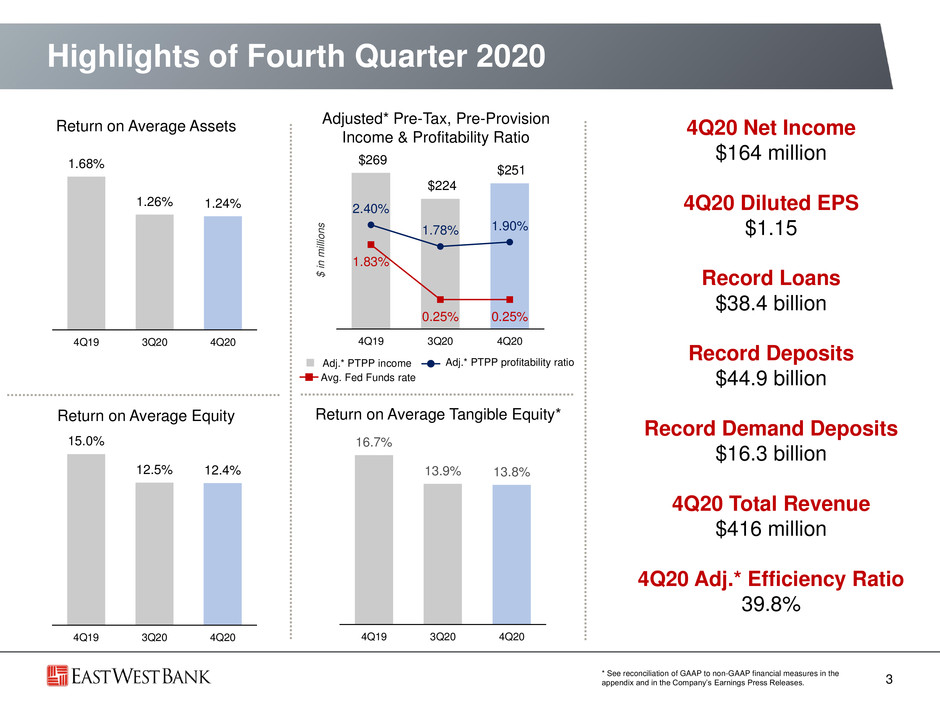

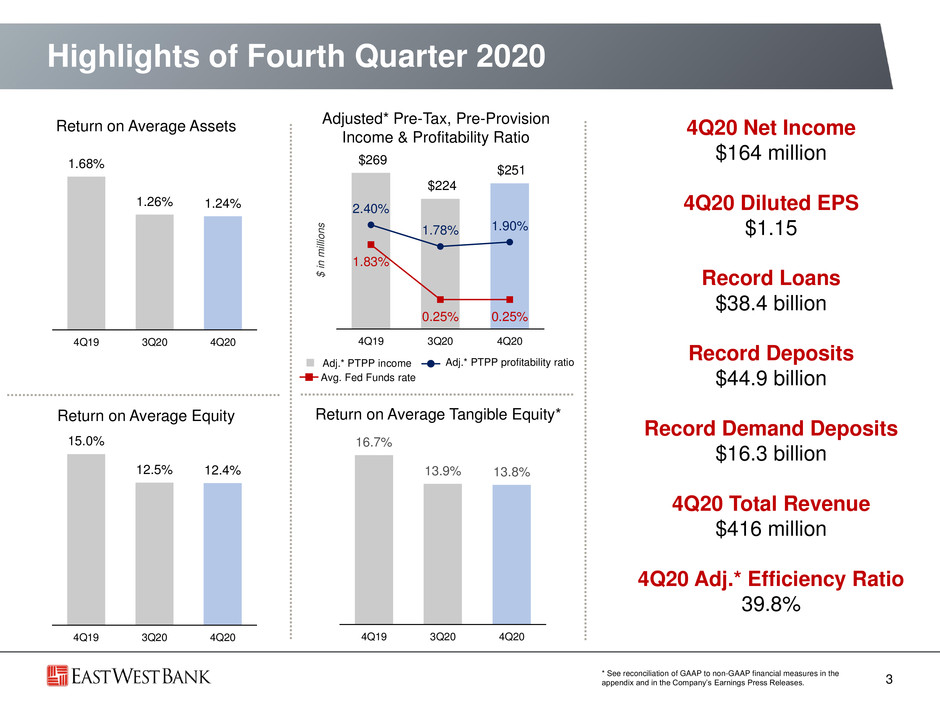

Highlights of Fourth Quarter 2020 3 4Q20 Net Income $164 million 4Q20 Diluted EPS $1.15 Record Loans $38.4 billion Record Deposits $44.9 billion Record Demand Deposits $16.3 billion 4Q20 Total Revenue $416 million 4Q20 Adj.* Efficiency Ratio 39.8% 16.7% 13.9% 13.8% 4Q19 3Q20 4Q20 1.68% 1.26% 1.24% 4Q19 3Q20 4Q20 Return on Average Assets Adjusted* Pre-Tax, Pre-Provision Income & Profitability Ratio Return on Average Tangible Equity*Return on Average Equity Adj.* PTPP income Adj.* PTPP profitability ratio Avg. Fed Funds rate 15.0% 12.5% 12.4% 4Q19 3Q20 4Q20 $269 $224 $251 2.40% 1.78% 1.90% 1.83% 0.25% 0.25% $- $50 $100 $150 $200 $250 4Q19 3Q20 4Q20 Adj.* PTPP income Adj.* PTPP profitability ratio Avg. Fed Funds rate $ i n m ill ion s * See reconciliation of GAAP to non-GAAP financial measures in the appendix and in the Company’s Earnings Press Releases.

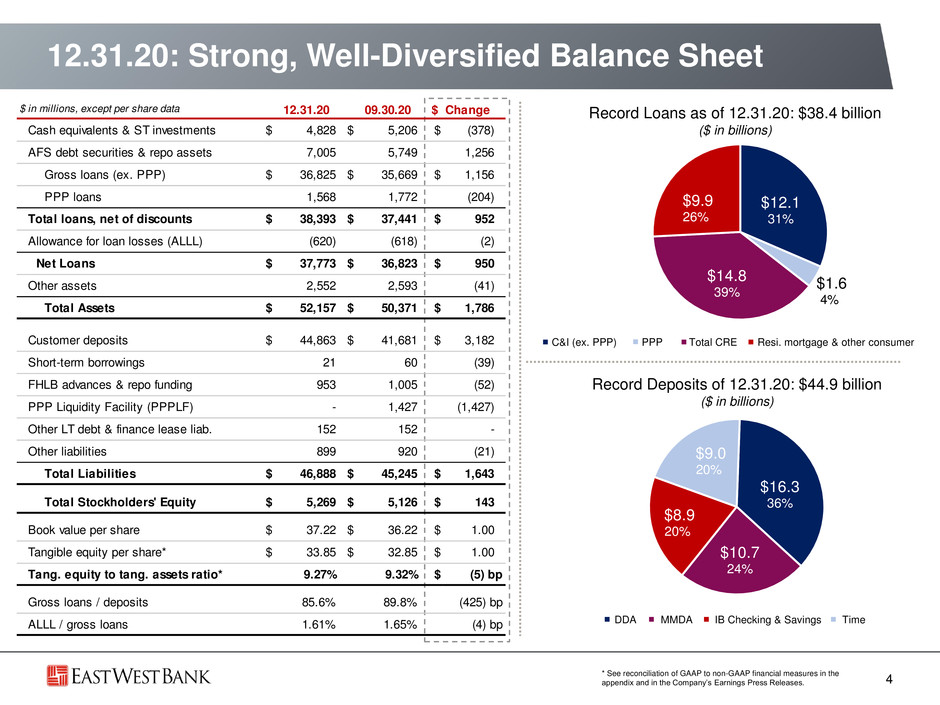

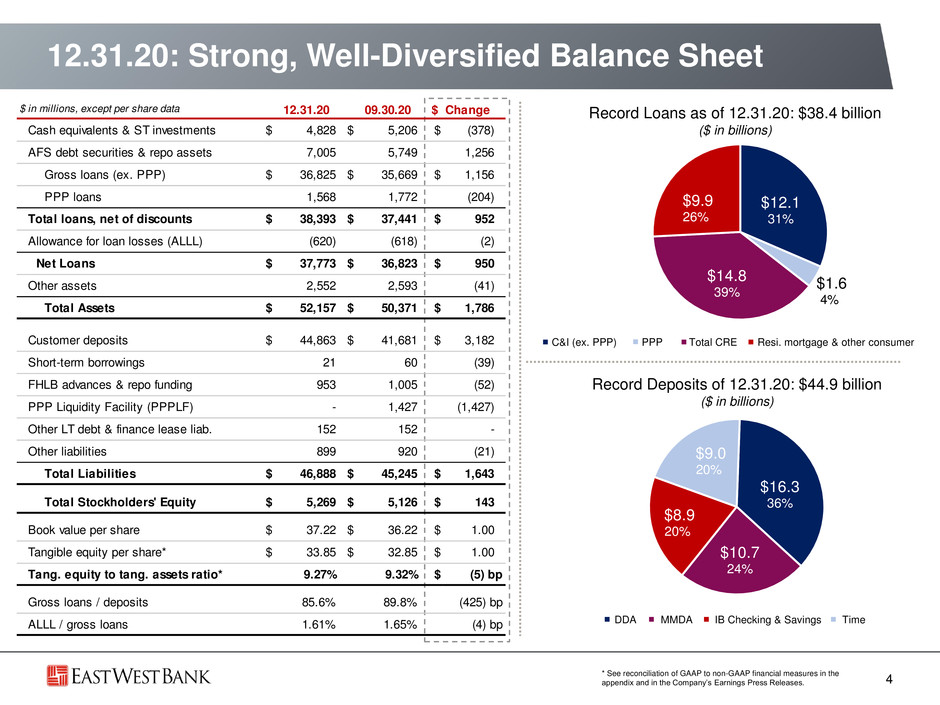

$12.1 31% $1.6 4% $14.8 39% $9.9 26% $16.3 36% $10.7 24% $8.9 20% $9.0 20% 4 12.31.20: Strong, Well-Diversified Balance Sheet Record Loans as of 12.31.20: $38.4 billion ($ in billions) C&I (ex. PPP) Resi. mortgage & other consumerTotal CREPPP IB Checking & SavingsMMDADDA Time Record Deposits of 12.31.20: $44.9 billion ($ in billions) * See reconciliation of GAAP to non-GAAP financial measures in the appendix and in the Company’s Earnings Press Releases. $ in millions, except per share data 12.31.20 09.30.20 $ Change Cash equivalents & ST investments $ 4,828 $ 5,206 $ (378) AFS debt securities & repo assets 7,005 5,749 1,256 Gross loans (ex. PPP) $ 36,825 $ 35,669 $ 1,156 PPP loans 1,568 1,772 (204) Total loans, net of discounts $ 38,393 $ 37,441 $ 952 Allowance for loan losses (ALLL) (620) (618) (2) Net Loans $ 37,773 $ 36,823 $ 950 Other assets 2,552 2,593 (41) Total Assets $ 52,157 $ 50,371 $ 1,786 Customer deposits $ 44,863 $ 41,681 $ 3,182 Short-term borrowings 21 60 (39) FHLB advances & repo funding 953 1,005 (52) PPP Liquidity Facility (PPPLF) - 1,427 (1,427) Other LT debt & finance lease liab. 152 152 - Other liabilities 899 920 (21) Total Liabilities $ 46,888 $ 45,245 $ 1,643 Total Stockholders' Equity $ 5,269 $ 5,126 $ 143 Book value per share $ 37.22 $ 36.22 $ 1.00 Tangible equity per share* $ 33.85 $ 32.85 $ 1.00 Tang. equity to tang. assets ratio* 9.27% 9.32% $ (5) bp Gross loans / deposits 85.6% 89.8% (425) bp ALLL / gross loans 1.61% 1.65% (4) bp

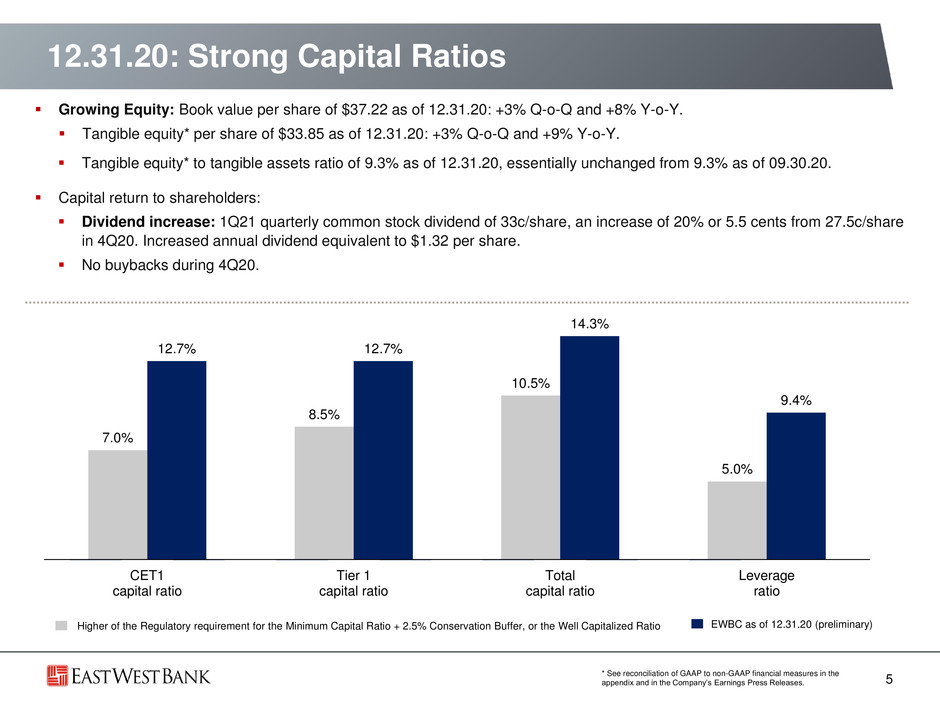

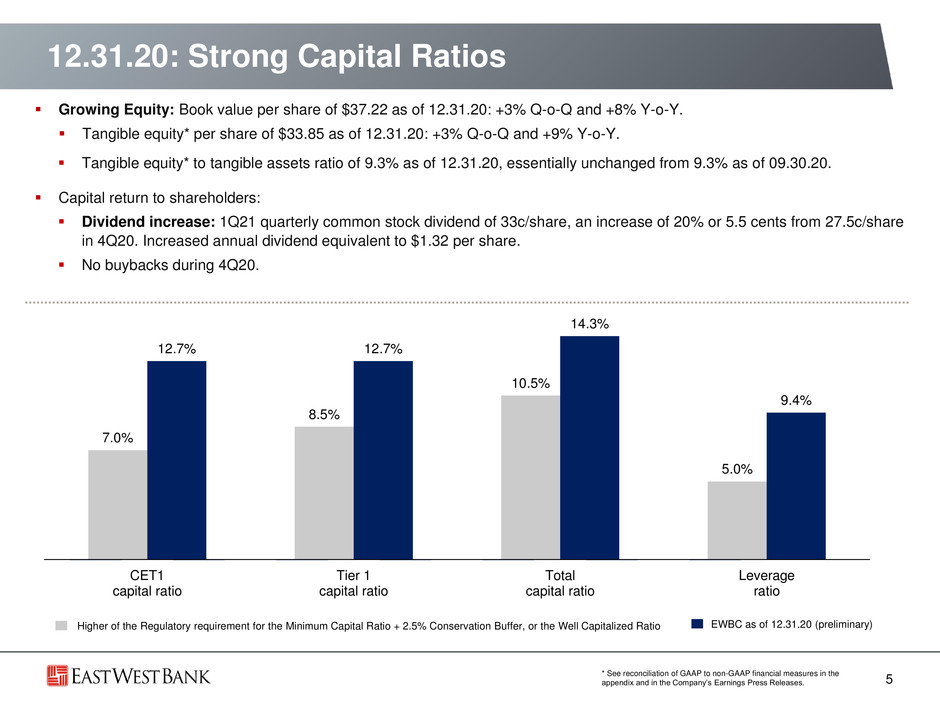

7.0% 8.5% 10.5% 5.0% 12.7% 12.7% 14.3% 9.4% CET1 capital ratio Tier 1 capital ratio Total capital ratio Leverage ratio 12.31.20: Strong Capital Ratios ▪ Growing Equity: Book value per share of $37.22 as of 12.31.20: +3% Q-o-Q and +8% Y-o-Y. ▪ Tangible equity* per share of $33.85 as of 12.31.20: +3% Q-o-Q and +9% Y-o-Y. ▪ Tangible equity* to tangible assets ratio of 9.3% as of 12.31.20, essentially unchanged from 9.3% as of 09.30.20. ▪ Capital return to shareholders: ▪ Dividend increase: 1Q21 quarterly common stock dividend of 33c/share, an increase of 20% or 5.5 cents from 27.5c/share in 4Q20. Increased annual dividend equivalent to $1.32 per share. ▪ No buybacks during 4Q20. 5 Higher of the Regulatory requirement for the Minimum Capital Ratio + 2.5% Conservation Buffer, or the Well Capitalized Ratio EWBC as of 12.31.20 (preliminary) * See reconciliation of GAAP to non-GAAP financial measures in the appendix and in the Company’s Earnings Press Releases.

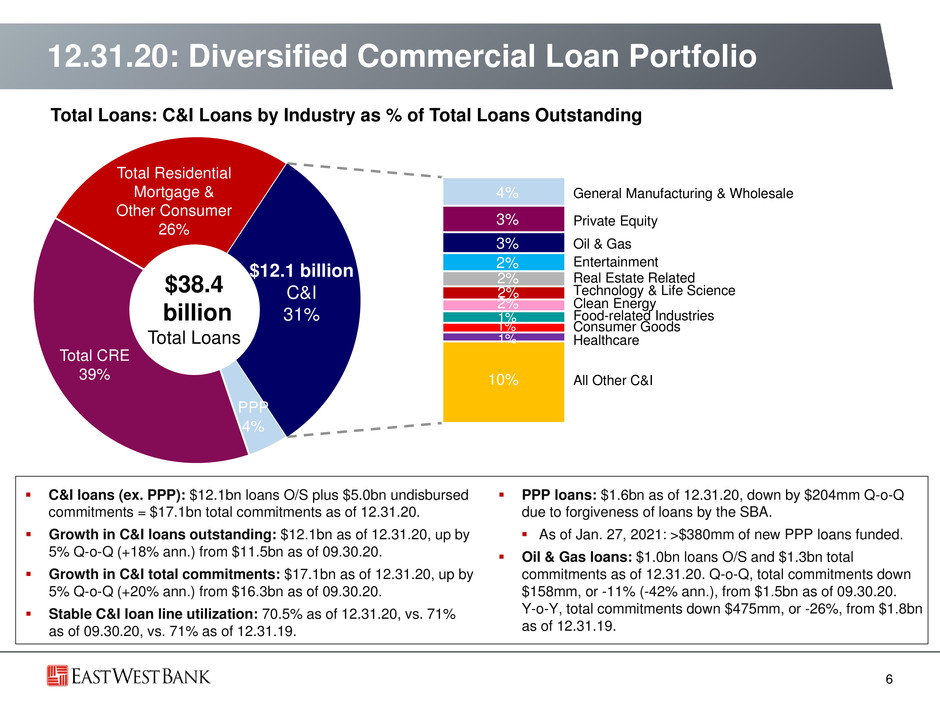

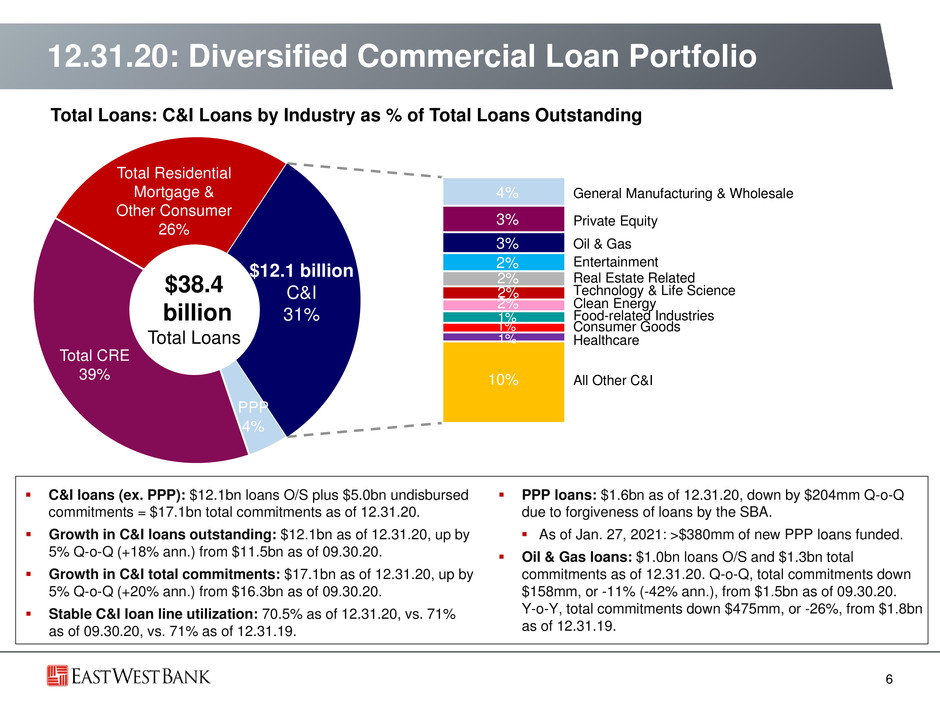

Food-related Industries General Manufacturing & Wholesale Private Equity Oil & Gas Entertainment Real Estate Related Technology & Life Science Consumer Goods Clean Energy Healthcare All Other C&I Total CRE 39% $12.1 billion C&I 31% Total Residential Mortgage & Other Consumer 26% 1% 1% 2% 3% 3% 2% 2% 10% 1% 2% 4% $38.4 billion Total Loans PPP 4% 6 Total Loans: C&I Loans by Industry as % of Total Loans Outstanding 12.31.20: Diversified Commercial Loan Portfolio ▪ C&I loans (ex. PPP): $12.1bn loans O/S plus $5.0bn undisbursed commitments = $17.1bn total commitments as of 12.31.20. ▪ Growth in C&I loans outstanding: $12.1bn as of 12.31.20, up by 5% Q-o-Q (+18% ann.) from $11.5bn as of 09.30.20. ▪ Growth in C&I total commitments: $17.1bn as of 12.31.20, up by 5% Q-o-Q (+20% ann.) from $16.3bn as of 09.30.20. ▪ Stable C&I loan line utilization: 70.5% as of 12.31.20, vs. 71% as of 09.30.20, vs. 71% as of 12.31.19. ▪ PPP loans: $1.6bn as of 12.31.20, down by $204mm Q-o-Q due to forgiveness of loans by the SBA. ▪ As of Jan. 27, 2021: >$380mm of new PPP loans funded. ▪ Oil & Gas loans: $1.0bn loans O/S and $1.3bn total commitments as of 12.31.20. Q-o-Q, total commitments down $158mm, or -11% (-42% ann.), from $1.5bn as of 09.30.20. Y-o-Y, total commitments down $475mm, or -26%, from $1.8bn as of 12.31.19.

SoCal 54% NorCal 23% NY 6% TX 7% WA 3% Other 7% 12.31.20: Diversified Commercial Real Estate Portfolio 7 Total Loans: Total CRE Loans by Property Type as % of Total Loans Outstanding ▪ Total CRE loans: $14.8bn as of 12.31.20, up by 1% Q-o-Q (+4% ann.) from $14.7bn as of 09.30.20. ▪ Construction & land loans (in All Other CRE): $600mm, or 1.6% of total loans. Total construction & land exposure of $888mm: loans O/S plus $288mm in undisbursed commitments. ▪ Geographic distribution reflects EWBC’s branch footprint. ▪ Owner-occupied CRE of $2.2bn as of 12.31.20, equivalent to 6% of total loans. $14.8 billion Total CRE loans Total CRE: Distribution by Geography Total Residential Mortgage & Other Consumer 26% C&I 31% $14.8 billion Total CRE 39% Retail, 9% Office, 7% Industrial, 6% Hotel, 5% All Other CRE, 4% MFR, 8%PPP 4% $38.4 billion Total Loans

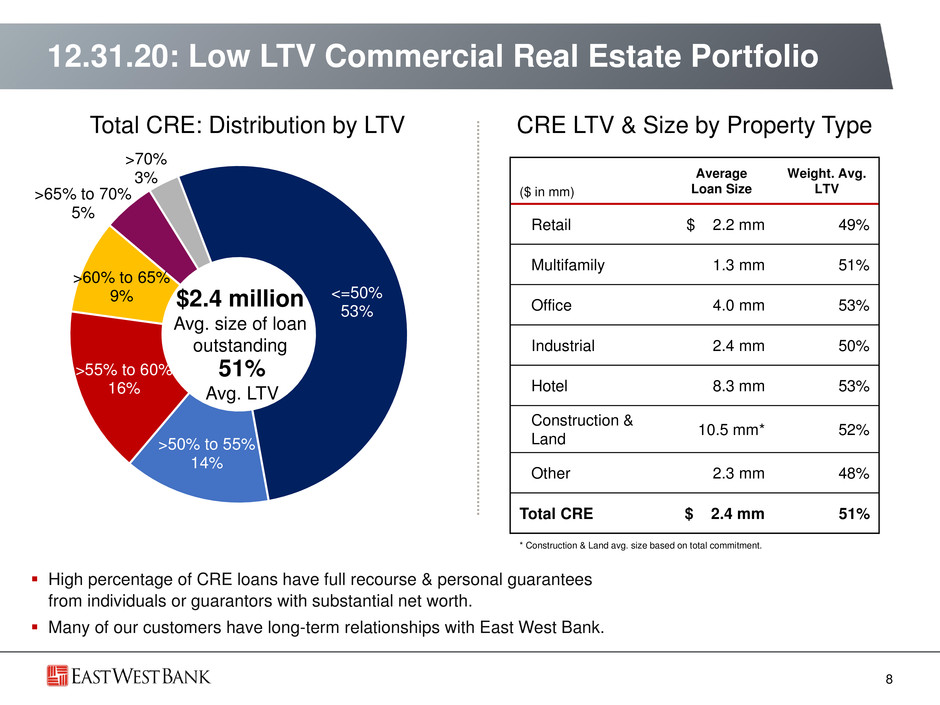

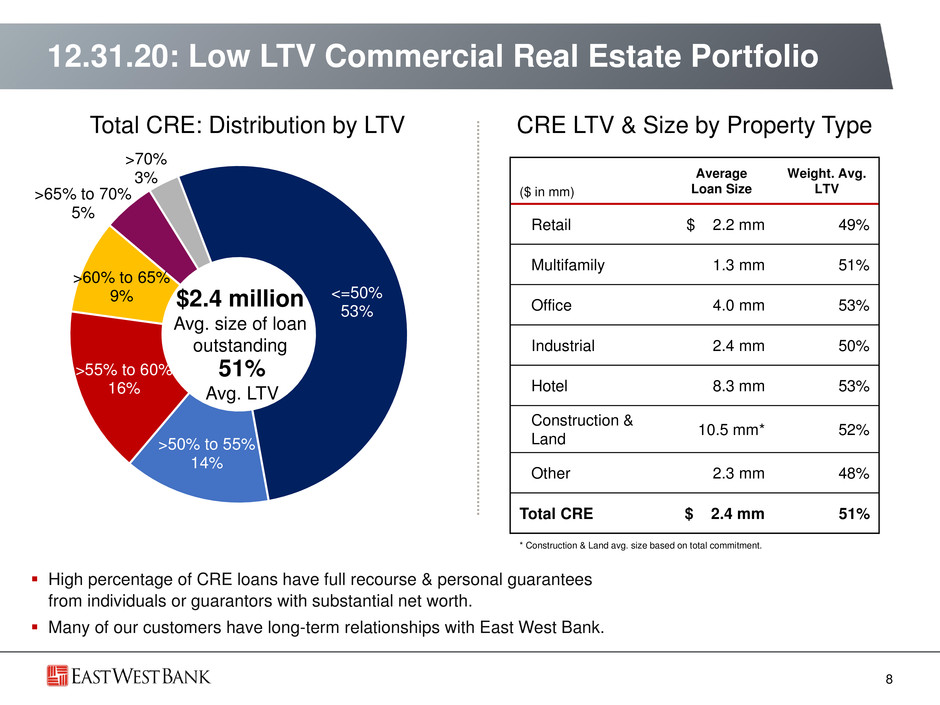

<=50% 53% >50% to 55% 14% >55% to 60% 16% >60% to 65% 9% >65% to 70% 5% >70% 3% Total CRE: Distribution by LTV 8 12.31.20: Low LTV Commercial Real Estate Portfolio ($ in mm) Average Loan Size Weight. Avg. LTV Retail $ 2.2 mm 49% Multifamily 1.3 mm 51% Office 4.0 mm 53% Industrial 2.4 mm 50% Hotel 8.3 mm 53% Construction & Land 10.5 mm* 52% Other 2.3 mm 48% Total CRE $ 2.4 mm 51% CRE LTV & Size by Property Type * Construction & Land avg. size based on total commitment. ▪ High percentage of CRE loans have full recourse & personal guarantees from individuals or guarantors with substantial net worth. ▪ Many of our customers have long-term relationships with East West Bank. $2.4 million Avg. size of loan outstanding 51% Avg. LTV

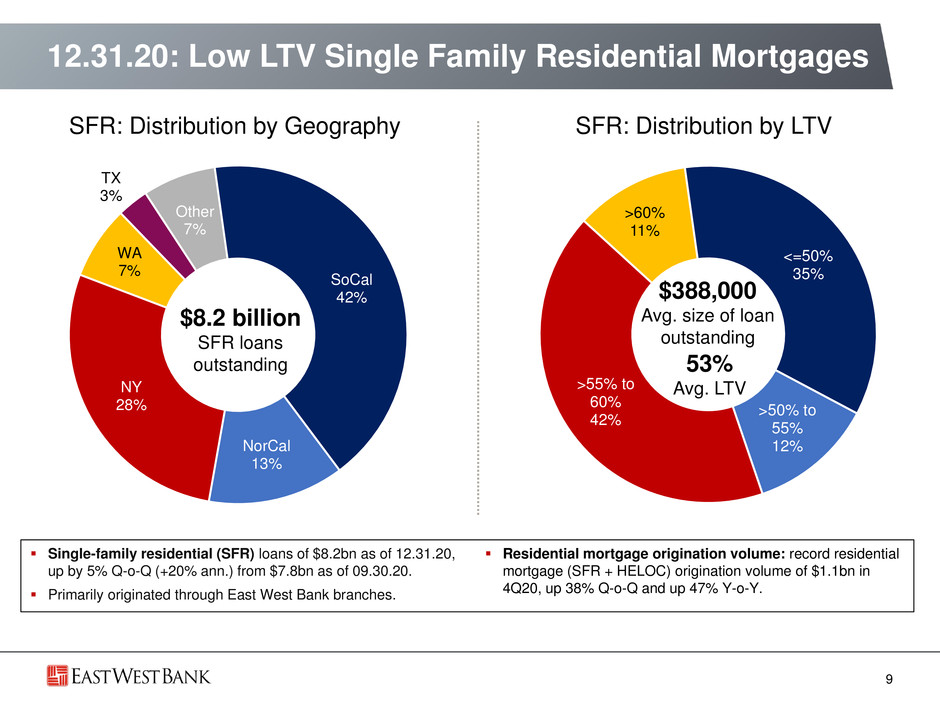

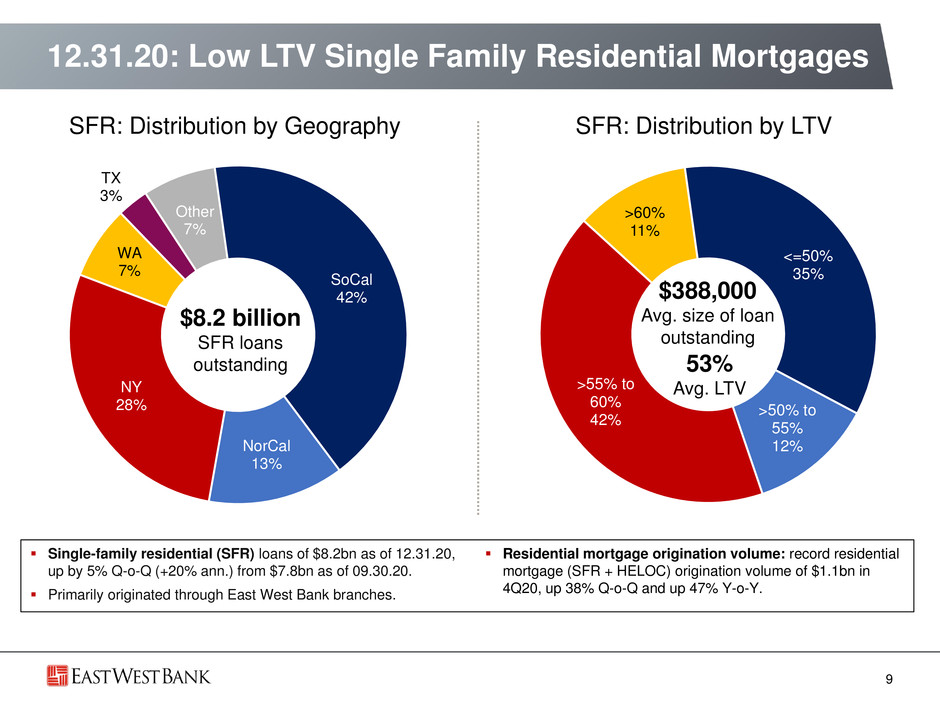

<=50% 35% >50% to 55% 12% >55% to 60% 42% >60% 11% SoCal 42% NorCal 13% NY 28% WA 7% TX 3% Other 7% 12.31.20: Low LTV Single Family Residential Mortgages 9 SFR: Distribution by Geography SFR: Distribution by LTV $8.2 billion SFR loans outstanding $388,000 Avg. size of loan outstanding 53% Avg. LTV ▪ Single-family residential (SFR) loans of $8.2bn as of 12.31.20, up by 5% Q-o-Q (+20% ann.) from $7.8bn as of 09.30.20. ▪ Primarily originated through East West Bank branches. ▪ Residential mortgage origination volume: record residential mortgage (SFR + HELOC) origination volume of $1.1bn in 4Q20, up 38% Q-o-Q and up 47% Y-o-Y.

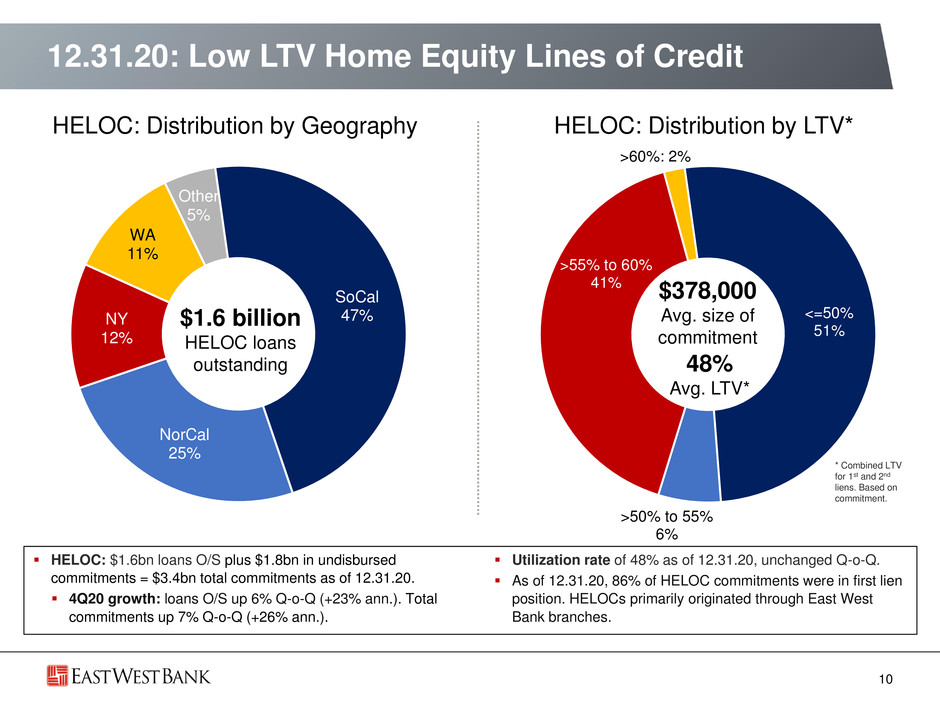

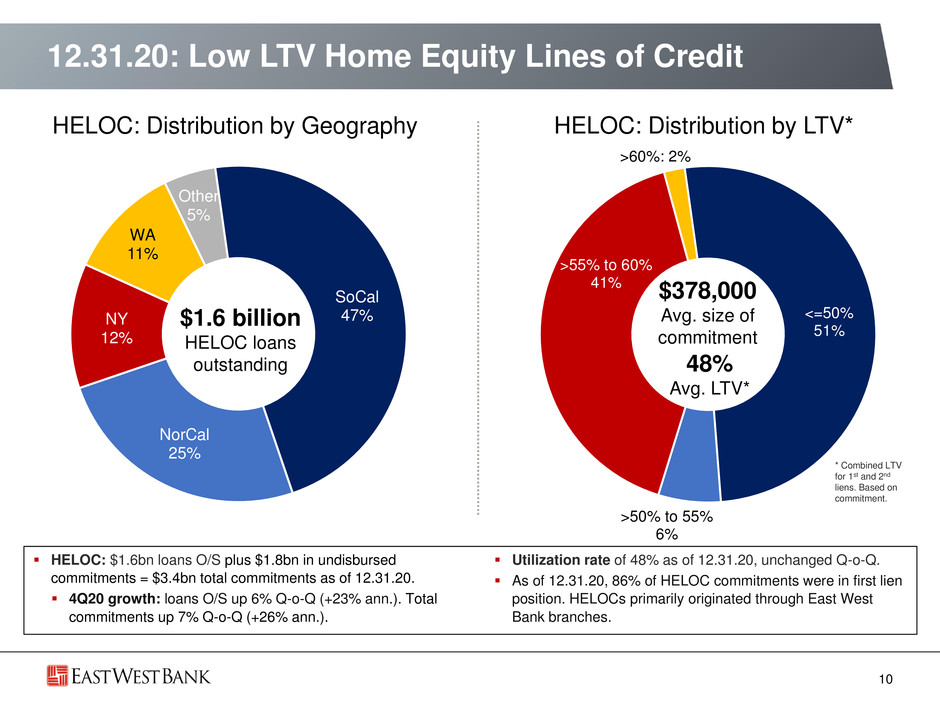

SoCal 47% NorCal 25% NY 12% WA 11% Other 5% <=50% 51% >50% to 55% 6% >55% to 60% 41% >60%: 2% 12.31.20: Low LTV Home Equity Lines of Credit 10 HELOC: Distribution by Geography HELOC: Distribution by LTV* ▪ HELOC: $1.6bn loans O/S plus $1.8bn in undisbursed commitments = $3.4bn total commitments as of 12.31.20. ▪ 4Q20 growth: loans O/S up 6% Q-o-Q (+23% ann.). Total commitments up 7% Q-o-Q (+26% ann.). ▪ Utilization rate of 48% as of 12.31.20, unchanged Q-o-Q. ▪ As of 12.31.20, 86% of HELOC commitments were in first lien position. HELOCs primarily originated through East West Bank branches. * Combined LTV for 1st and 2nd liens. Based on commitment. $378,000 Avg. size of commitment 48% Avg. LTV* $1.6 billion HELOC loans outstanding

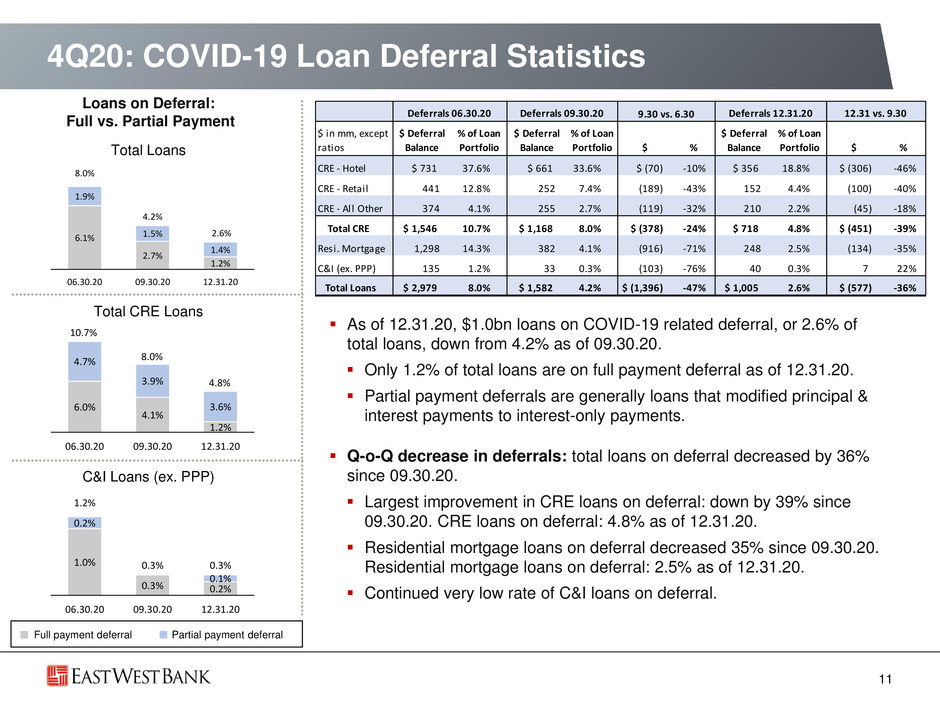

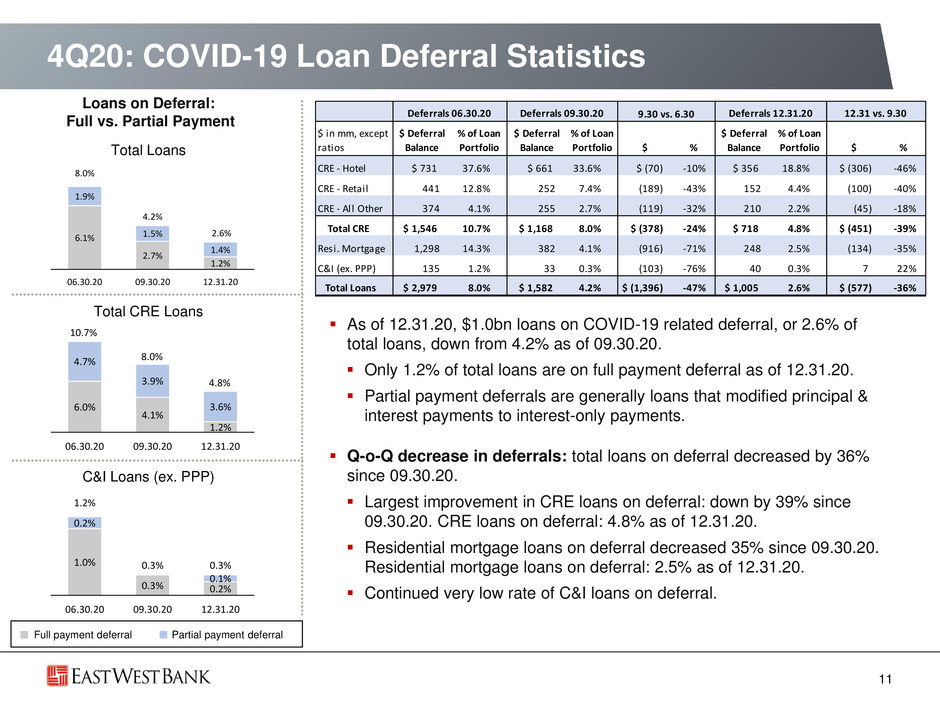

0.2%0.3% 1.0% 0.1% 0.2% 0.3%0.3% 1.2% 12.31.2009.30.2006.30.20 4Q20: COVID-19 Loan Deferral Statistics 11 Total Loans Total CRE Loans C&I Loans (ex. PPP) Loans on Deferral: Full vs. Partial Payment Full payment deferral Partial payment deferral ▪ As of 12.31.20, $1.0bn loans on COVID-19 related deferral, or 2.6% of total loans, down from 4.2% as of 09.30.20. ▪ Only 1.2% of total loans are on full payment deferral as of 12.31.20. ▪ Partial payment deferrals are generally loans that modified principal & interest payments to interest-only payments. ▪ Q-o-Q decrease in deferrals: total loans on deferral decreased by 36% since 09.30.20. ▪ Largest improvement in CRE loans on deferral: down by 39% since 09.30.20. CRE loans on deferral: 4.8% as of 12.31.20. ▪ Residential mortgage loans on deferral decreased 35% since 09.30.20. Residential mortgage loans on deferral: 2.5% as of 12.31.20. ▪ Continued very low rate of C&I loans on deferral. 1.2% 2.7% 6.1% 1.4% 1.5% 1.9% 2.6% 4.2% 8.0% 12.31.2009.30.2006.30.20 1.2% 4.1% 6.0% 3.6% 3.9% 4.7% 4.8% 8.0% 10.7% 12.31.2009.30.2006.30.20 Deferrals 06.30.20 Deferrals 09.30.20 9.30 vs. 6.30 Deferrals 12.31.20 12.31 vs. 9.30 $ in mm, except ratios $ Deferral Balance % of Loan Portfolio $ Deferral Balance % of Loan Portfolio $ % $ Deferral Balance % of Loan Portfolio $ % CRE - Hotel $ 731 37.6% $ 661 33.6% $ (70) -10% $ 356 18.8% $ (306) -46% CRE - Retail 441 12.8% 252 7.4% (189) -43% 152 4.4% (100) -40% CRE - All Other 374 4.1% 255 2.7% (119) -32% 210 2.2% (45) -18% Total CRE $ 1,546 10.7% $ 1,168 8.0% $ (378) -24% $ 718 4.8% $ (451) -39% Resi. Mortgage 1,298 14.3% 382 4.1% (916) -71% 248 2.5% (134) -35% C&I (ex. PPP) 135 1.2% 33 0.3% (103) -76% 40 0.3% 7 22% Total Loans $ 2,979 8.0% $ 1,582 4.2% $ (1,396) -47% $ 1,005 2.6% $ (577) -36%

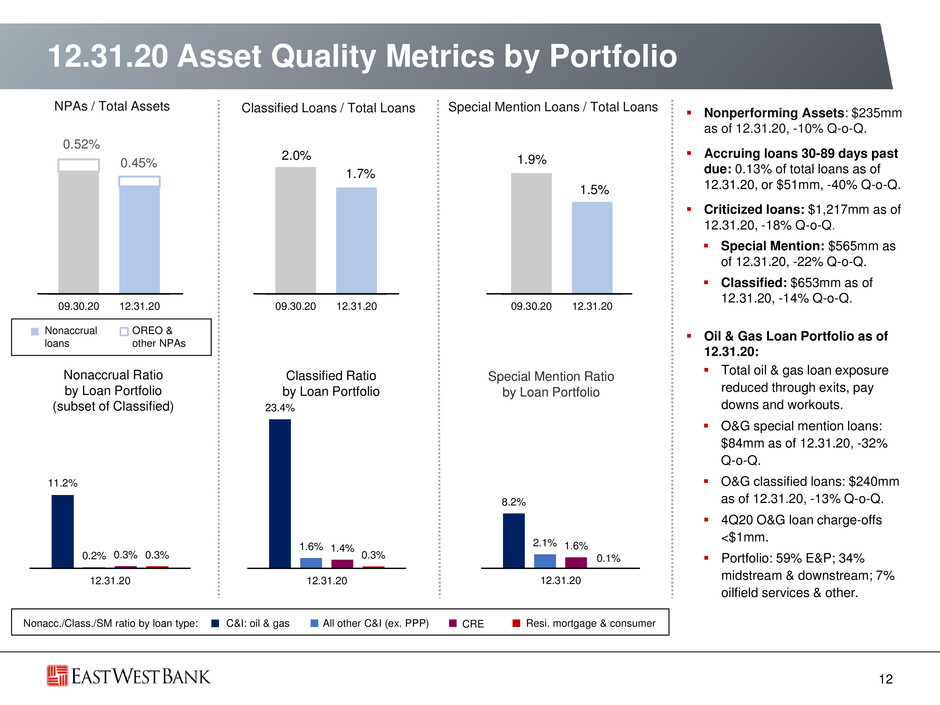

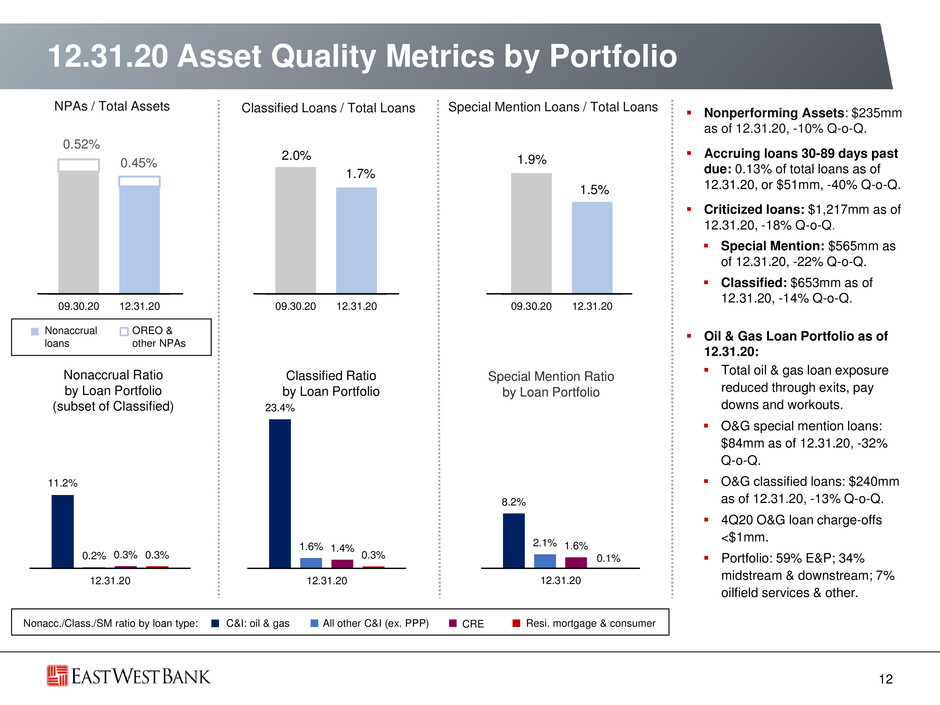

NPAs / Total Assets Nonaccrual loans OREO & other NPAs Nonaccrual Ratio by Loan Portfolio (subset of Classified) 12.31.20 Asset Quality Metrics by Portfolio 12 Classified Loans / Total Loans Special Mention Loans / Total Loans Special Mention Ratio by Loan Portfolio Classified Ratio by Loan Portfolio ▪ Nonperforming Assets: $235mm as of 12.31.20, -10% Q-o-Q. ▪ Accruing loans 30-89 days past due: 0.13% of total loans as of 12.31.20, or $51mm, -40% Q-o-Q. ▪ Criticized loans: $1,217mm as of 12.31.20, -18% Q-o-Q. ▪ Special Mention: $565mm as of 12.31.20, -22% Q-o-Q. ▪ Classified: $653mm as of 12.31.20, -14% Q-o-Q. ▪ Oil & Gas Loan Portfolio as of 12.31.20: ▪ Total oil & gas loan exposure reduced through exits, pay downs and workouts. ▪ O&G special mention loans: $84mm as of 12.31.20, -32% Q-o-Q. ▪ O&G classified loans: $240mm as of 12.31.20, -13% Q-o-Q. ▪ 4Q20 O&G loan charge-offs <$1mm. ▪ Portfolio: 59% E&P; 34% midstream & downstream; 7% oilfield services & other. C&I: oil & gas CREAll other C&I (ex. PPP) Resi. mortgage & consumerNonacc./Class./SM ratio by loan type: 8.2% 2.1% 1.6% 0.1% 12.31.20 23.4% 1.6% 1.4% 0.3% 12.31.20 11.2% 0.2% 0.3% 0.3% 12.31.20 0.52% 0.45% 09.30.20 12.31.20 2.0% 1.7% 09.30.20 12.31.20 1.9% 1.5% 09.30.20 12.31.20

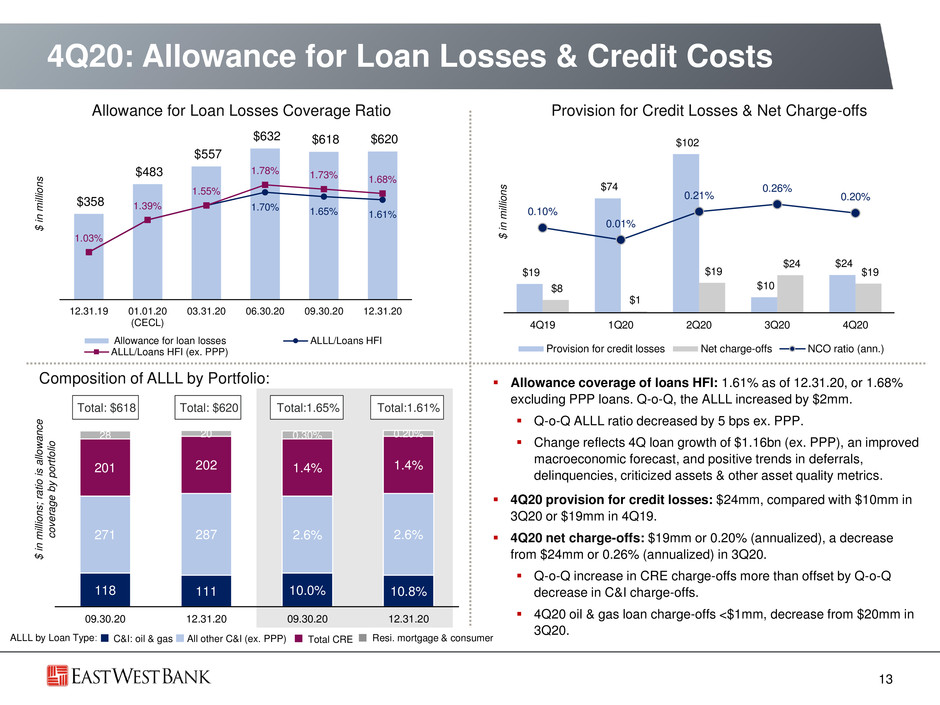

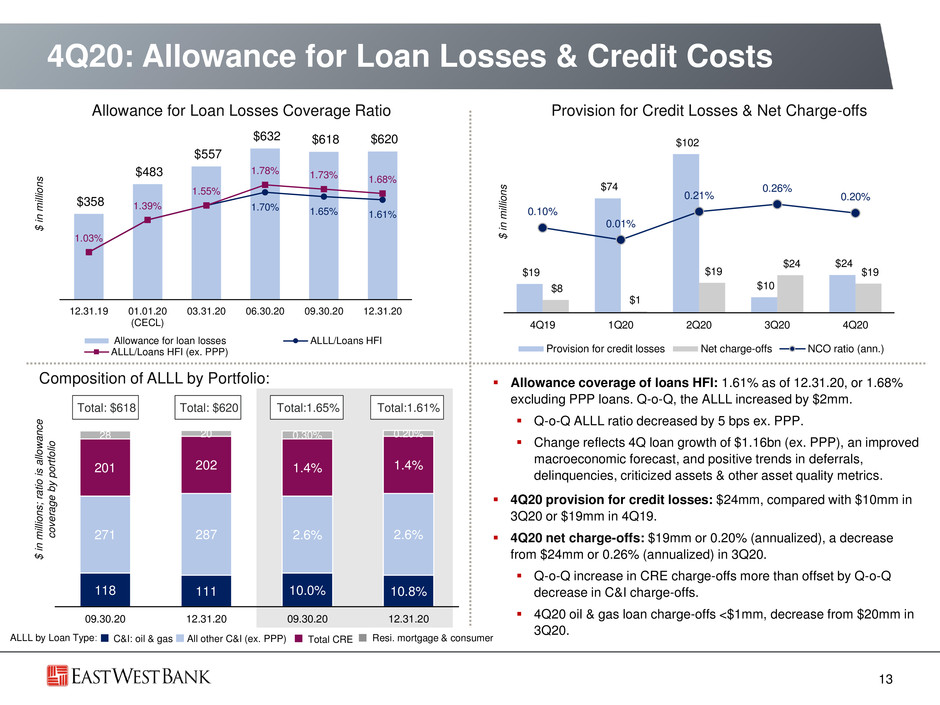

118 111 10.0% 10.8% 271 287 2.6% 2.6% 201 202 1.4% 1.4% 28 20 0.30% 0.20% 09.30.20 12.31.20 09.30.20 12.31.20 Residential mortgage & other consumer Total CRE C&I: all other C&I (ex. PPP) C&I: oil & gas $19 $74 $102 $10 $24 $8 $1 $19 $24 $19 0.10% 0.01% 0.21% 0.26% 0.20% 4Q19 1Q20 2Q20 3Q20 4Q20 Provision for credit losses Net charge-offs NCO ratio (ann.) ALLL by Loan Type: ▪ Allowance coverage of loans HFI: 1.61% as of 12.31.20, or 1.68% excluding PPP loans. Q-o-Q, the ALLL increased by $2mm. ▪ Q-o-Q ALLL ratio decreased by 5 bps ex. PPP. ▪ Change reflects 4Q loan growth of $1.16bn (ex. PPP), an improved macroeconomic forecast, and positive trends in deferrals, delinquencies, criticized assets & other asset quality metrics. ▪ 4Q20 provision for credit losses: $24mm, compared with $10mm in 3Q20 or $19mm in 4Q19. ▪ 4Q20 net charge-offs: $19mm or 0.20% (annualized), a decrease from $24mm or 0.26% (annualized) in 3Q20. ▪ Q-o-Q increase in CRE charge-offs more than offset by Q-o-Q decrease in C&I charge-offs. ▪ 4Q20 oil & gas loan charge-offs <$1mm, decrease from $20mm in 3Q20. 4Q20: Allowance for Loan Losses & Credit Costs 13 Composition of ALLL by Portfolio: Allowance for Loan Losses Coverage Ratio $ i n m ill ion s Provision for Credit Losses & Net Charge-offs $ i n m ill ion s Total: $618 $ i n m ill ion s ; ratio i s a llowan c e c o v erage b y portfol io Total:1.65%Total: $620 Total:1.61% C&I: oil & gas Total CREAll other C&I (ex. PPP) Resi. mortgage & consumer $358 $483 $557 $632 $618 $620 1.70% 1.65% 1.61% 1.03% 1.39% 1.55% 1.78% 1.73% 1.68% 12.31.19 01.01.20 (CECL) 03.31.20 06.30.20 09.30.20 12.31 20 Allowance for loan losses ALLL/Loans HFI ALLL/Loans HFI (ex. PPP)

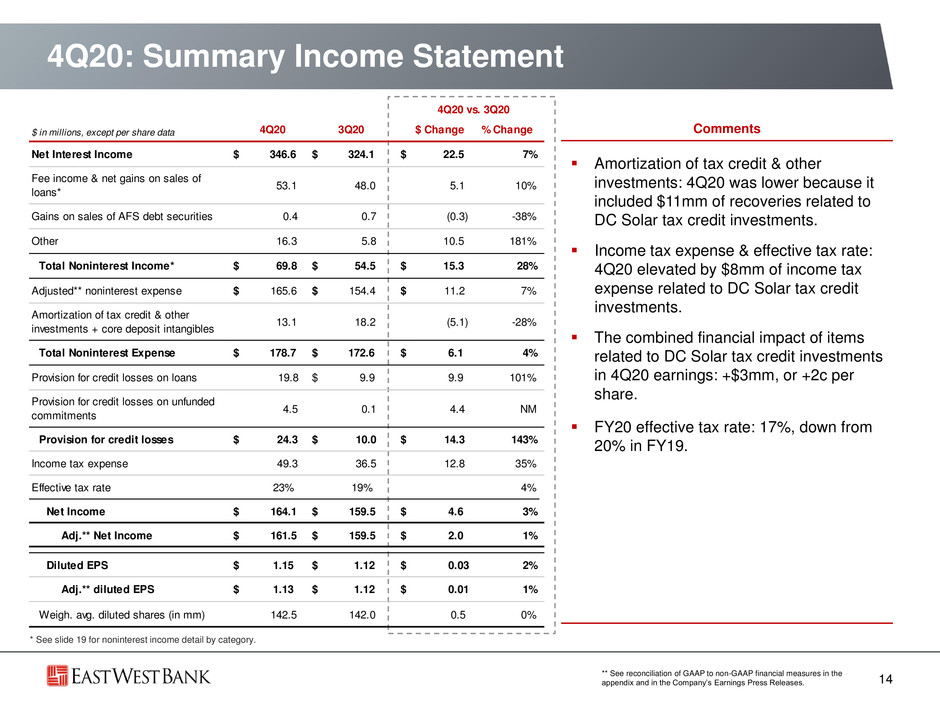

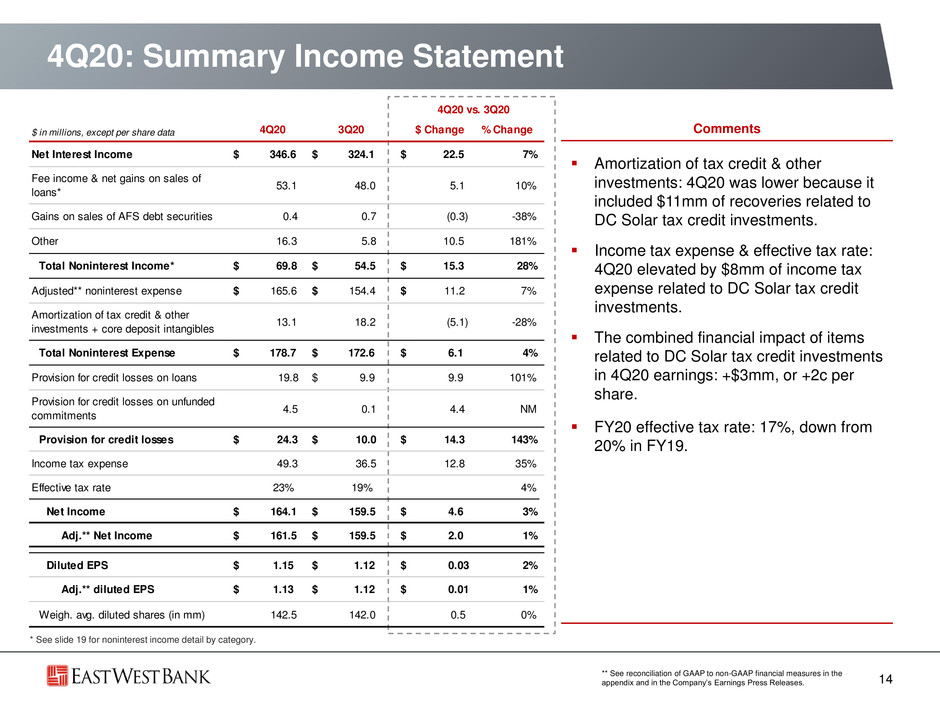

4Q20: Summary Income Statement 14 * See slide 19 for noninterest income detail by category. Comments ▪ Amortization of tax credit & other investments: 4Q20 was lower because it included $11mm of recoveries related to DC Solar tax credit investments. ▪ Income tax expense & effective tax rate: 4Q20 elevated by $8mm of income tax expense related to DC Solar tax credit investments. ▪ The combined financial impact of items related to DC Solar tax credit investments in 4Q20 earnings: +$3mm, or +2c per share. ▪ FY20 effective tax rate: 17%, down from 20% in FY19. ** See reconciliation of GAAP to non-GAAP financial measures in the appendix and in the Company’s Earnings Press Releases. 4Q20 vs. 3Q20 $ in millions, except per share data 4Q20 3Q20 $ Change % Change Net Interest Income $ 346.6 $ 324.1 $ 22.5 7% Fee income & net gains on sales of loans* 53.1 48.0 5.1 10% Gains on sales of AFS debt securities 0.4 0.7 (0.3) -38% Other 16.3 5.8 10.5 181% Total Noninterest Income* $ 69.8 $ 54.5 $ 15.3 28% Adjusted** noninterest expense $ 165.6 $ 154.4 $ 11.2 7% Amortization of tax credit & other investments + core deposit intangibles 13.1 18.2 (5.1) -28% Total Noninterest Expense $ 178.7 $ 172.6 $ 6.1 4% Provision for credit losses on loans 19.8 $ 9.9 9.9 101% Provision for credit losses on unfunded commitments 4.5 0.1 4.4 NM Provision for credit losses $ 24.3 $ 10.0 $ 14.3 143% Income tax expense 49.3 36.5 12.8 35% Effective tax rate 23% 19% 4% Net Income $ 164.1 $ 159.5 $ 4.6 3% Adj.** Net Income $ 161.5 $ 159.5 $ 2.0 1% Diluted EPS $ 1.15 $ 1.12 $ 0.03 2% Adj.** diluted EPS $ 1.13 $ 1.12 $ 0.01 1% Weigh. avg. diluted shares (in mm) 142.5 142.0 0.5 0%

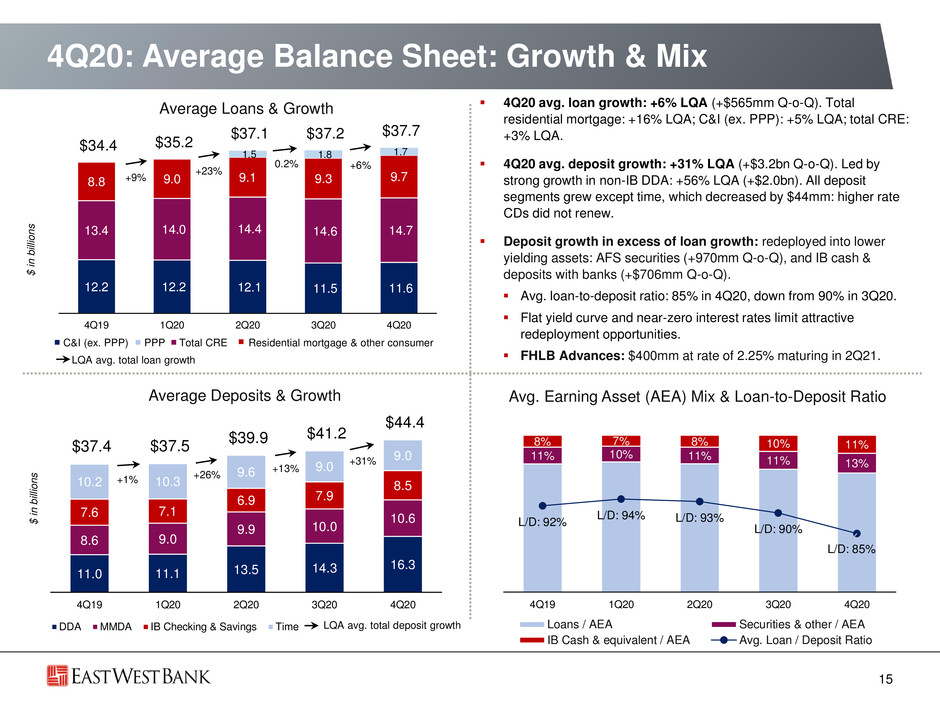

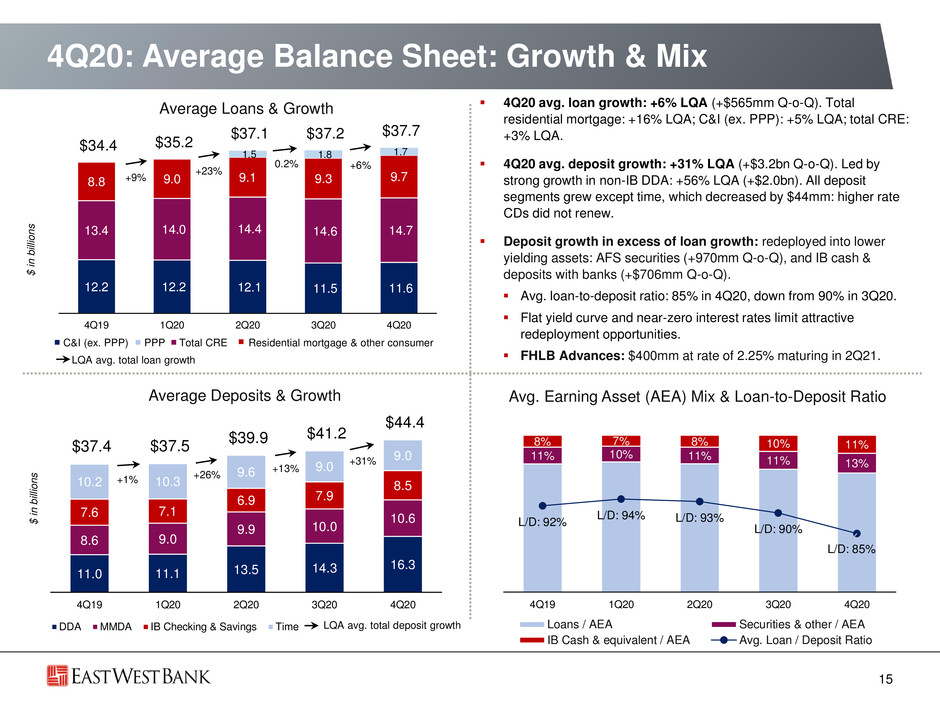

12.2 12.2 12.1 11.5 11.6 13.4 14.0 14.4 14.6 14.7 8.8 9.0 9.1 9.3 9.7 1.5 1.8 1.7 $34.4 $35.2 $37.1 $37.2 $37.7 4Q19 1Q20 2Q20 3Q20 4Q20 11.0 11.1 13.5 14.3 16.3 8.6 9.0 9.9 10.0 10.67.6 7.1 6.9 7.9 8.50 0 3 9.6 9.0 9.0 $37.4 $37.5 $39.9 $41.2 $44.4 4Q19 1Q20 2Q20 3Q20 4Q20 DDA MMDA IB Checking & Savings Time 11% 10% 11% 11% 13% 8% 7% 8% 10% 11% L/D: 92% L/D: 94% L/D: 93% L/D: 90% L/D: 85% 4Q19 1Q20 2Q20 3Q20 4Q20 Loans / AEA Securities & other / AEA IB Cash & equivalent / AEA Avg. Loan / Deposit Ratio 4Q20: Average Balance Sheet: Growth & Mix 15 ▪ 4Q20 avg. loan growth: +6% LQA (+$565mm Q-o-Q). Total residential mortgage: +16% LQA; C&I (ex. PPP): +5% LQA; total CRE: +3% LQA. ▪ 4Q20 avg. deposit growth: +31% LQA (+$3.2bn Q-o-Q). Led by strong growth in non-IB DDA: +56% LQA (+$2.0bn). All deposit segments grew except time, which decreased by $44mm: higher rate CDs did not renew. ▪ Deposit growth in excess of loan growth: redeployed into lower yielding assets: AFS securities (+970mm Q-o-Q), and IB cash & deposits with banks (+$706mm Q-o-Q). ▪ Avg. loan-to-deposit ratio: 85% in 4Q20, down from 90% in 3Q20. ▪ Flat yield curve and near-zero interest rates limit attractive redeployment opportunities. ▪ FHLB Advances: $400mm at rate of 2.25% maturing in 2Q21. $ i n b ill ion s Average Loans & Growth 0.2% +9% +23% +6% LQA avg. total loan growth C&I (ex. PPP) Total CRE Residential mortgage & other consumerPPP Average Deposits & Growth $ i n b ill ion s LQA avg. total deposit growth +1% +26% +13% +31% Avg. Earning Asset (AEA) Mix & Loan-to-Deposit Ratio

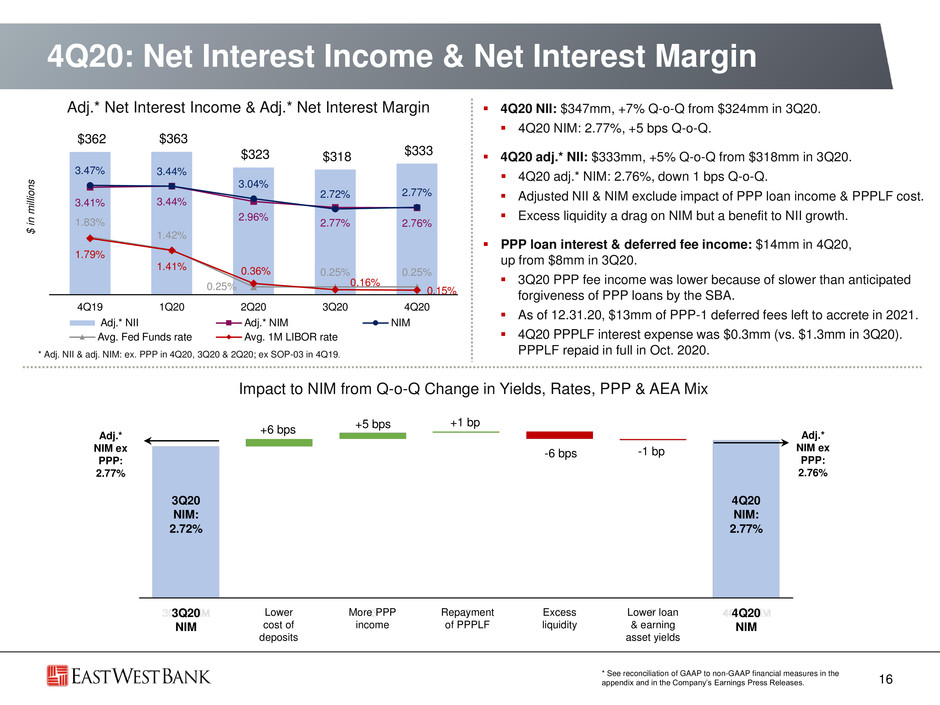

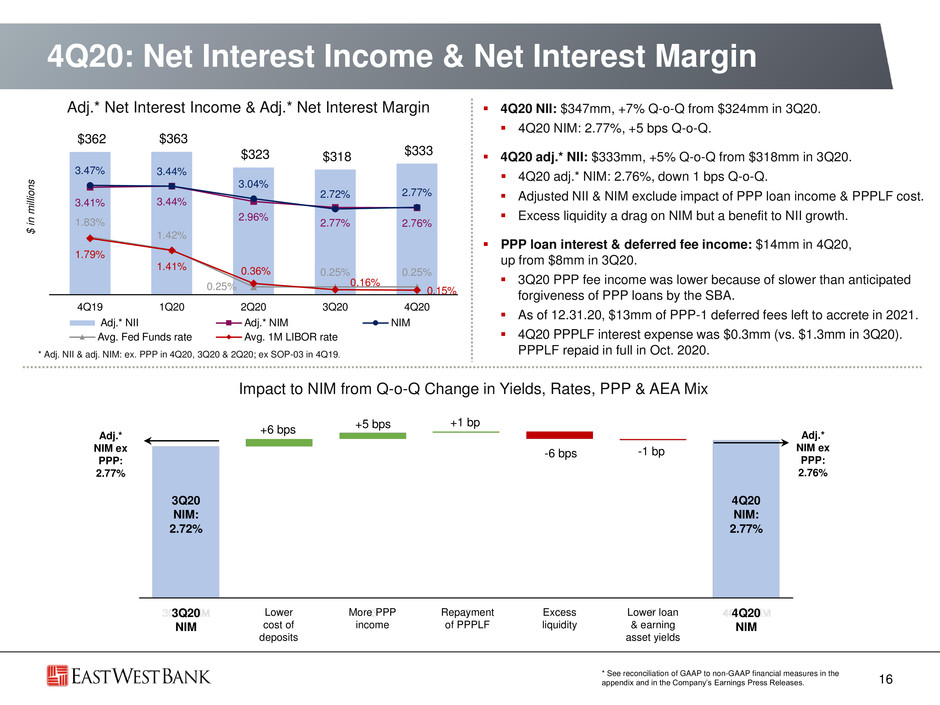

$362 $363 $323 $318 $333 3.41% 3.44% 2.96% 2.77% 2.76% 3.47% 3.44% 3.04% 2.72% 2.77% 1.83% 1.42% 0.25% 0.25% 0.25% 1.79% 1.41% 0.36% 0.16% 0.15% 4Q19 1Q20 2Q20 3Q20 4Q20 Adj.* NII Adj.* NIM NIM Avg. Fed Funds rate Avg. 1M LIBOR rate 4Q20: Net Interest Income & Net Interest Margin 16 ▪ 4Q20 NII: $347mm, +7% Q-o-Q from $324mm in 3Q20. ▪ 4Q20 NIM: 2.77%, +5 bps Q-o-Q. ▪ 4Q20 adj.* NII: $333mm, +5% Q-o-Q from $318mm in 3Q20. ▪ 4Q20 adj.* NIM: 2.76%, down 1 bps Q-o-Q. ▪ Adjusted NII & NIM exclude impact of PPP loan income & PPPLF cost. ▪ Excess liquidity a drag on NIM but a benefit to NII growth. ▪ PPP loan interest & deferred fee income: $14mm in 4Q20, up from $8mm in 3Q20. ▪ 3Q20 PPP fee income was lower because of slower than anticipated forgiveness of PPP loans by the SBA. ▪ As of 12.31.20, $13mm of PPP-1 deferred fees left to accrete in 2021. ▪ 4Q20 PPPLF interest expense was $0.3mm (vs. $1.3mm in 3Q20). PPPLF repaid in full in Oct. 2020. Impact to NIM from Q-o-Q Change in Yields, Rates, PPP & AEA Mix Adj.* Net Interest Income & Adj.* Net Interest Margin $ i n m ill ion s * Adj. NII & adj. NIM: ex. PPP in 4Q20, 3Q20 & 2Q20; ex SOP-03 in 4Q19. 3Q20 NIM 4Q20 NIM Lower cost of deposits Adj.* NIM ex PPP: 2.77% +6 bps +5 bps +1 bp -6 bps -1 bp 3Q20 NIM: 2.72% 4Q20 NIM: 2.77% Adj.* NIM ex PPP: 2.76% More PPP income Repayment of PPPLF Excess liquidity Lower loan & earning asset yields * See reconciliation of GAAP to non-GAAP financial measures in the appendix and in the Company’s Earnings Press Releases.

15% 16% 7%28% 30% 4% 453 468 476 576 �� 377 356 463 435 343 343 447 430 347 346 433 431 C&I (ex. PPP) Total CRE SFR HELOC 1Q20 2Q20 3Q20 4Q20 4.71% 3.90% 3.70% 3.69% 4.42% 3.25% 3.25% 3.25% 1.41% 0.36% 0.16% 0.15% 1Q20 2Q20 3Q20 4Q20 4Q20: Average Loan Yields 17 Adj.* Avg. Loan Yield vs. Prime & LIBOR Adj.* avg. loan yield Avg. 1M LIBOR Rate Avg. Prime Rate Loan Portfolio by Index Rate (12.31.20) Average Loan Yield (in bps) by Portfolio in 2020 ▪ 4Q20 avg. loan yield: 3.68% (vs. 3.60% in 3Q20). Ex. PPP, adj.* avg. loan yield down 1 bp 3.69% in 4Q20 (vs. 3.70% in 3Q20). ▪ Variable-rate portfolio already repriced earlier in 2020: nearly 90% of variable rate loans linked to benchmark interest rates with duration of 3M or less, primarily Prime or 1-month LIBOR. ▪ Q-o-Q, stable yield on C&I, CRE and HELOC loan portfolios between 4Q20 and 3Q20. ▪ Relatively stable SFR yield: lower rate sensitivity for EWBC’s core SFR product. Between 1Q20 and 4Q20, the SFR yield declined by only 43 bps, compared to benchmark interest rate decreases of 100+ basis points. Total fixed and hybrid in fixed period 31% (ex PPP). Variable: LIBOR rates Hybrid in fixed rate period Fixed rate Variable: Prime rate Variable: all other rates PPP C&I: 71% LIBOR or Prime w/ weigh. avg. reset: 1 mo. (80% of C&I ex PPP). CRE: 75% LIBOR or Prime w/ weigh. avg. reset: 1 mo. SFR: 51% Hybrid in fixed-rate period. 32% Fixed rate. HELOC: Prime- based w/ weigh. avg. reset: 1 mo. GAAP Yield: 3.98% GAAP Yield: 3.60% GAAP Yield: 3.68% * See reconciliation of GAAP to non-GAAP financial measures in the appendix and in the Company’s Earnings Press Releases.

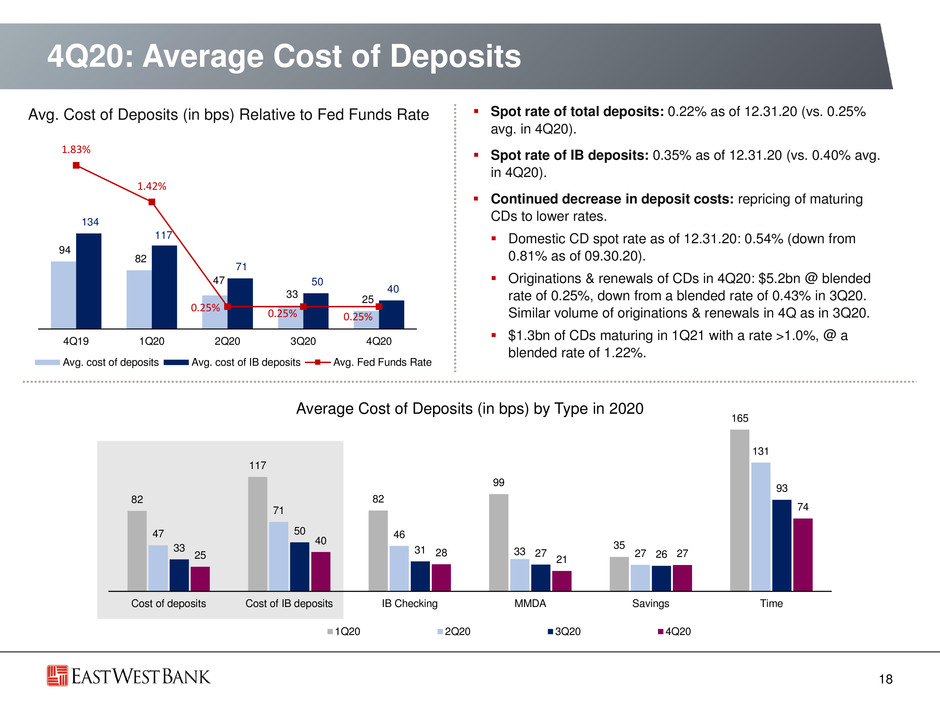

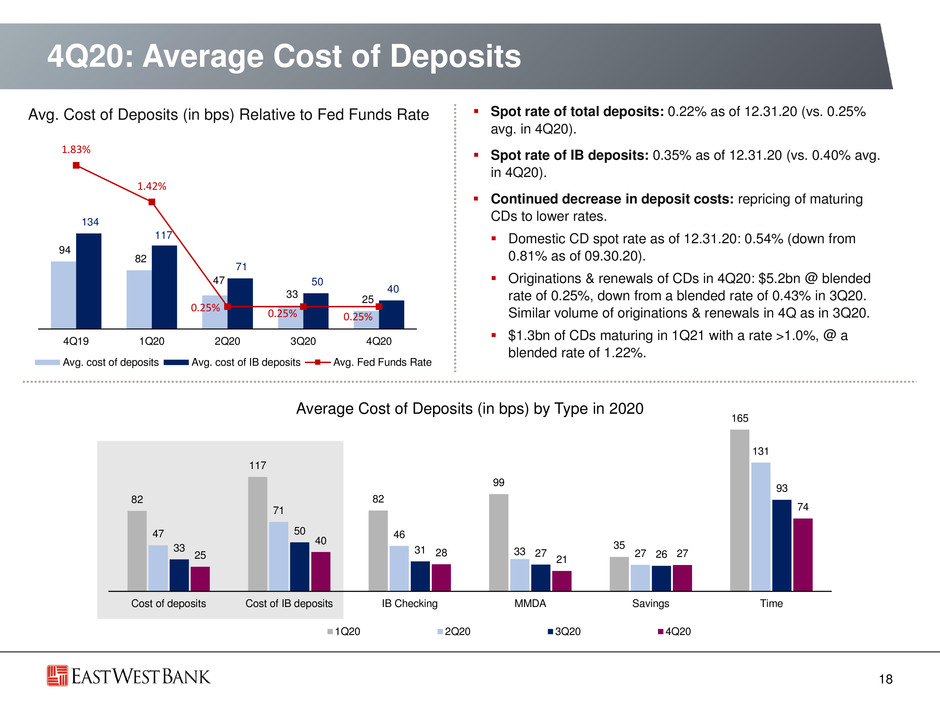

94 82 47 33 25 134 117 71 50 40 1.83% 1.42% 0.25% 0.25% 0.25% 4Q19 1Q20 2Q20 3Q20 4Q20 Avg. cost of deposits Avg. cost of IB deposits Avg. Fed Funds Rate 4Q20: Average Cost of Deposits 18 Avg. Cost of Deposits (in bps) Relative to Fed Funds Rate ▪ Spot rate of total deposits: 0.22% as of 12.31.20 (vs. 0.25% avg. in 4Q20). ▪ Spot rate of IB deposits: 0.35% as of 12.31.20 (vs. 0.40% avg. in 4Q20). ▪ Continued decrease in deposit costs: repricing of maturing CDs to lower rates. ▪ Domestic CD spot rate as of 12.31.20: 0.54% (down from 0.81% as of 09.30.20). ▪ Originations & renewals of CDs in 4Q20: $5.2bn @ blended rate of 0.25%, down from a blended rate of 0.43% in 3Q20. Similar volume of originations & renewals in 4Q as in 3Q20. ▪ $1.3bn of CDs maturing in 1Q21 with a rate >1.0%, @ a blended rate of 1.22%. Average Cost of Deposits (in bps) by Type in 2020 82 117 82 99 35 165 47 71 46 33 27 131 33 50 31 27 26 93 25 40 28 21 27 74 Cost of deposits Cost of IB deposits IB Checking MMDA Savings Time 1Q20 2Q20 3Q20 4Q20

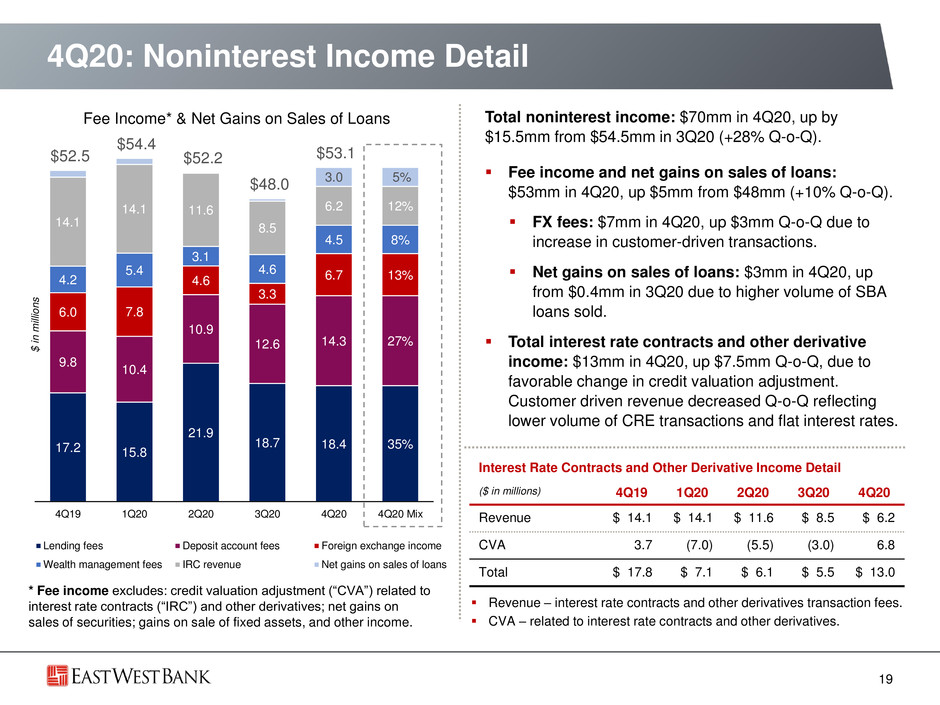

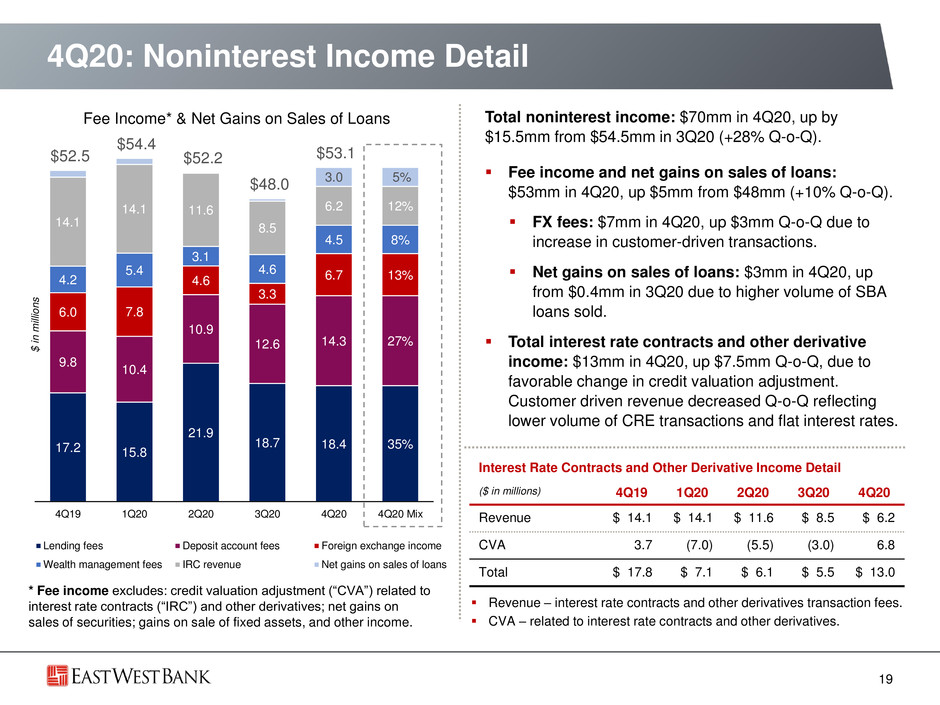

4Q20: Noninterest Income Detail 17.2 15.8 21.9 18.7 18.4 35% 9.8 10.4 10.9 12.6 14.3 27% 6.0 7.8 4.6 3.3 6.7 13%4.2 5.4 3.1 4.6 4.5 8% 14.1 14.1 11.6 8.5 6.2 12% 3.0 5% $52.5 $54.4 $52.2 $48.0 $53.1 0.0 10.0 20.0 30.0 40.0 50.0 60.0 4Q19 1Q20 2Q20 3Q20 4Q20 4Q20 Mix Lending fees Deposit account fees Foreign exchange income Wealth management fees IRC revenue Net gains on sales of loans Total noninterest income: $70mm in 4Q20, up by $15.5mm from $54.5mm in 3Q20 (+28% Q-o-Q). ▪ Fee income and net gains on sales of loans: $53mm in 4Q20, up $5mm from $48mm (+10% Q-o-Q). ▪ FX fees: $7mm in 4Q20, up $3mm Q-o-Q due to increase in customer-driven transactions. ▪ Net gains on sales of loans: $3mm in 4Q20, up from $0.4mm in 3Q20 due to higher volume of SBA loans sold. ▪ Total interest rate contracts and other derivative income: $13mm in 4Q20, up $7.5mm Q-o-Q, due to favorable change in credit valuation adjustment. Customer driven revenue decreased Q-o-Q reflecting lower volume of CRE transactions and flat interest rates. 19 Interest Rate Contracts and Other Derivative Income Detail ($ in millions) 4Q19 1Q20 2Q20 3Q20 4Q20 Revenue $ 14.1 $ 14.1 $ 11.6 $ 8.5 $ 6.2 CVA 3.7 (7.0) (5.5) (3.0) 6.8 Total $ 17.8 $ 7.1 $ 6.1 $ 5.5 $ 13.0 * Fee income excludes: credit valuation adjustment (“CVA”) related to interest rate contracts (“IRC”) and other derivatives; net gains on sales of securities; gains on sale of fixed assets, and other income. ▪ Revenue – interest rate contracts and other derivatives transaction fees. ▪ CVA – related to interest rate contracts and other derivatives. Fee Income* & Net Gains on Sales of Loans $ i n m ill ion s

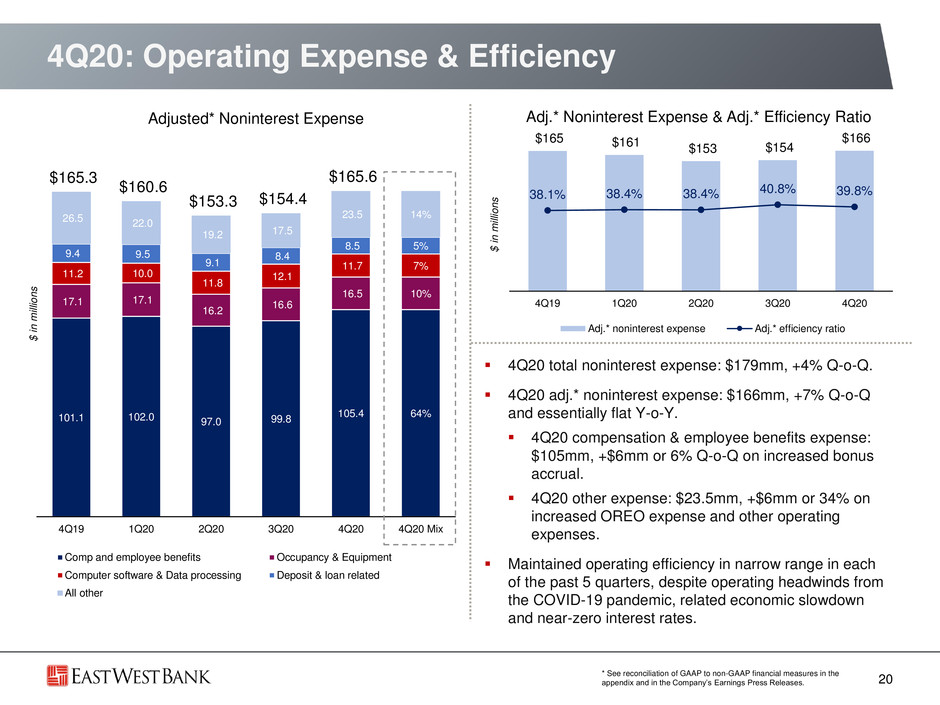

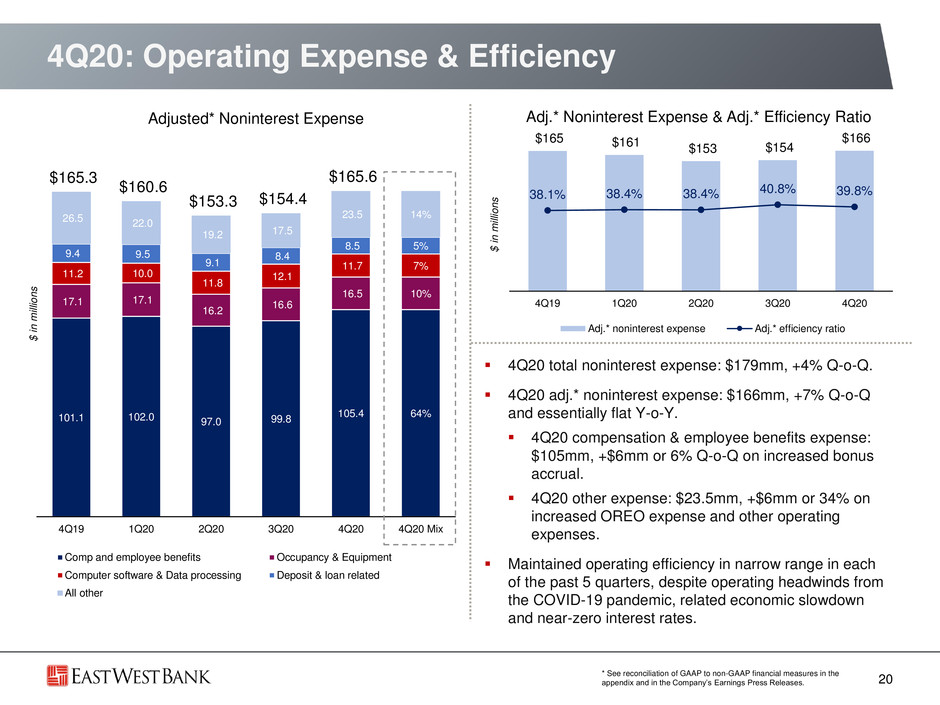

101.1 102.0 97.0 99.8 105.4 64% 17.1 17.1 16.2 16.6 16.5 10% 11.2 10.0 11.8 12.1 11.7 7% 9.4 9.5 9.1 8.4 8.5 5% 26.5 22.0 19.2 17.5 23.5 14% $165.3 $160.6 $153.3 $154.4 $165.6 4Q19 1Q20 2Q20 3Q20 4Q20 4Q20 Mix Comp and employee benefits Occupancy & Equipment Computer software & Data processing Deposit & loan related All other 4Q20: Operating Expense & Efficiency 20 Adjusted* Noninterest Expense $ i n m ill ion s Adj.* Noninterest Expense & Adj.* Efficiency Ratio ▪ 4Q20 total noninterest expense: $179mm, +4% Q-o-Q. ▪ 4Q20 adj.* noninterest expense: $166mm, +7% Q-o-Q and essentially flat Y-o-Y. ▪ 4Q20 compensation & employee benefits expense: $105mm, +$6mm or 6% Q-o-Q on increased bonus accrual. ▪ 4Q20 other expense: $23.5mm, +$6mm or 34% on increased OREO expense and other operating expenses. ▪ Maintained operating efficiency in narrow range in each of the past 5 quarters, despite operating headwinds from the COVID-19 pandemic, related economic slowdown and near-zero interest rates. $ i n m ill ion s $165 $161 $153 $154 $166 38.1% 38.4% 38.4% 40.8% 39.8% 0.0% 70.0% $- $170 4Q19 1Q20 2 20 3Q20 4Q20 Adj.* noninterest expense Adj.* efficiency ratio * See reconciliation of GAAP to non-GAAP financial measures in the appendix and in the Company’s Earnings Press Releases.

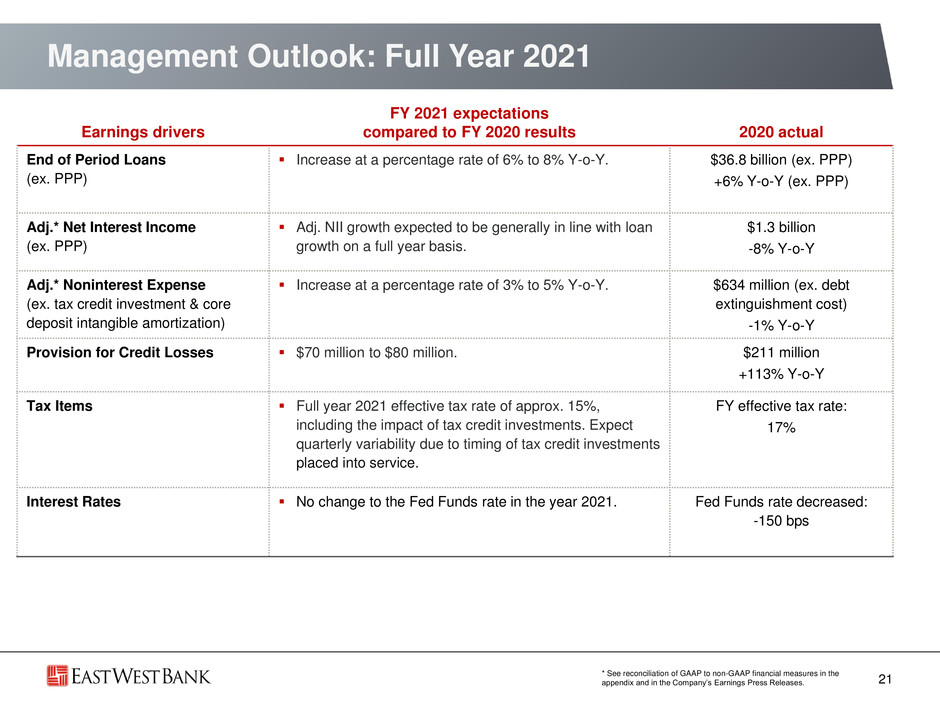

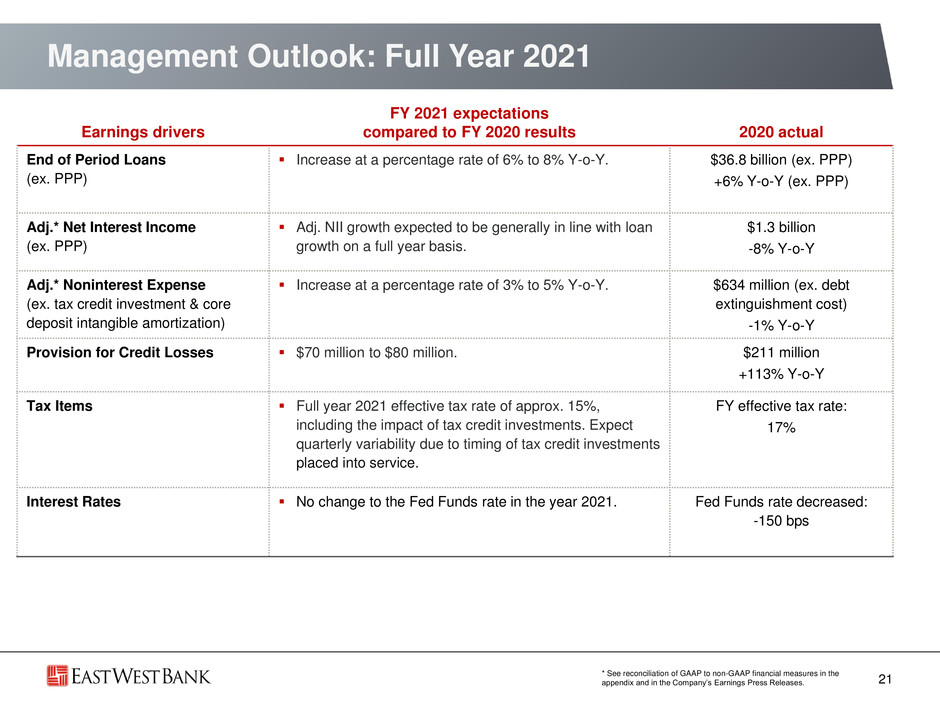

Management Outlook: Full Year 2021 21 Earnings drivers FY 2021 expectations compared to FY 2020 results 2020 actual End of Period Loans (ex. PPP) ▪ Increase at a percentage rate of 6% to 8% Y-o-Y. $36.8 billion (ex. PPP) +6% Y-o-Y (ex. PPP) Adj.* Net Interest Income (ex. PPP) ▪ Adj. NII growth expected to be generally in line with loan growth on a full year basis. $1.3 billion -8% Y-o-Y Adj.* Noninterest Expense (ex. tax credit investment & core deposit intangible amortization) ▪ Increase at a percentage rate of 3% to 5% Y-o-Y. $634 million (ex. debt extinguishment cost) -1% Y-o-Y Provision for Credit Losses ▪ $70 million to $80 million. $211 million +113% Y-o-Y Tax Items ▪ Full year 2021 effective tax rate of approx. 15%, including the impact of tax credit investments. Expect quarterly variability due to timing of tax credit investments placed into service. FY effective tax rate: 17% Interest Rates ▪ No change to the Fed Funds rate in the year 2021. Fed Funds rate decreased: -150 bps * See reconciliation of GAAP to non-GAAP financial measures in the appendix and in the Company’s Earnings Press Releases.

APPENDIX

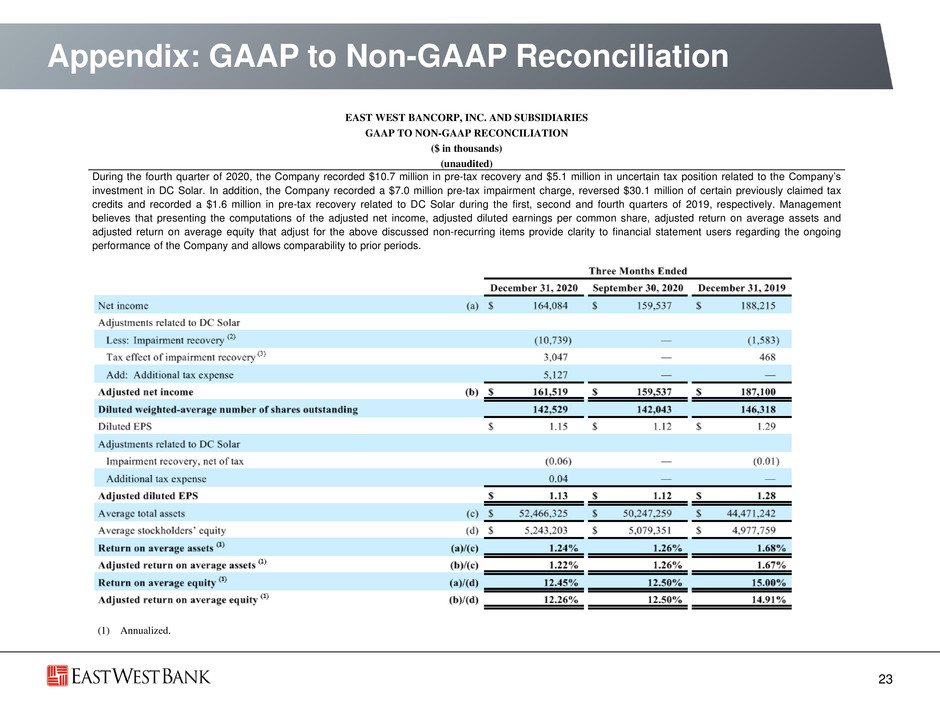

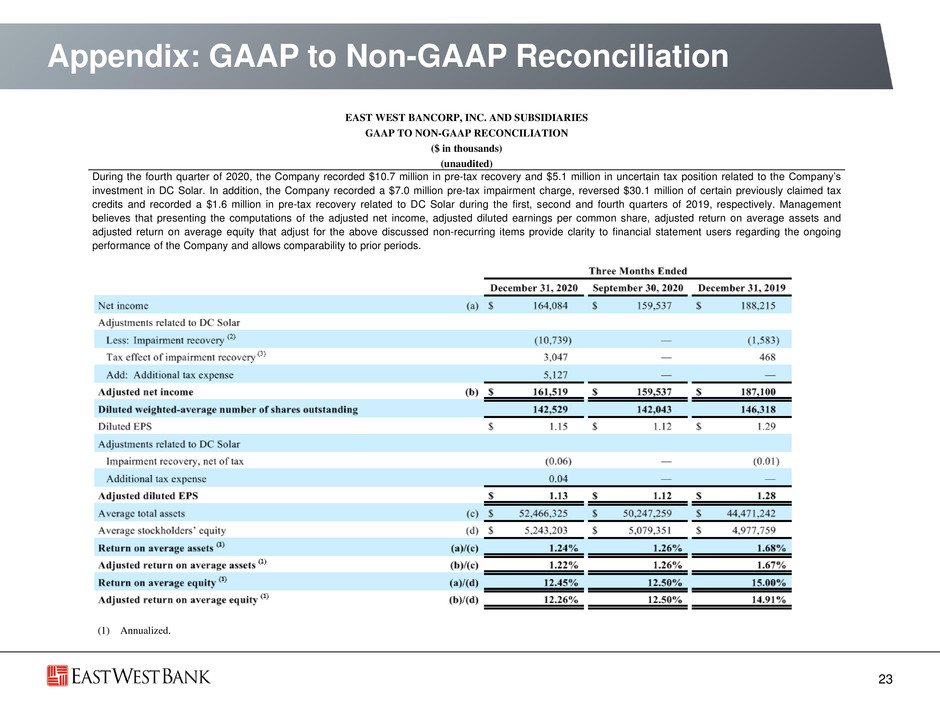

Appendix: GAAP to Non-GAAP Reconciliation 23 EAST WEST BANCORP, INC. AND SUBSIDIARIES GAAP TO NON-GAAP RECONCILIATION ($ in thousands) (unaudited) During the fourth quarter of 2020, the Company recorded $10.7 million in pre-tax recovery and $5.1 million in uncertain tax position related to the Company’s investment in DC Solar. In addition, the Company recorded a $7.0 million pre-tax impairment charge, reversed $30.1 million of certain previously claimed tax credits and recorded a $1.6 million in pre-tax recovery related to DC Solar during the first, second and fourth quarters of 2019, respectively. Management believes that presenting the computations of the adjusted net income, adjusted diluted earnings per common share, adjusted return on average assets and adjusted return on average equity that adjust for the above discussed non-recurring items provide clarity to financial statement users regarding the ongoing performance of the Company and allows comparability to prior periods. (1) Annualized.

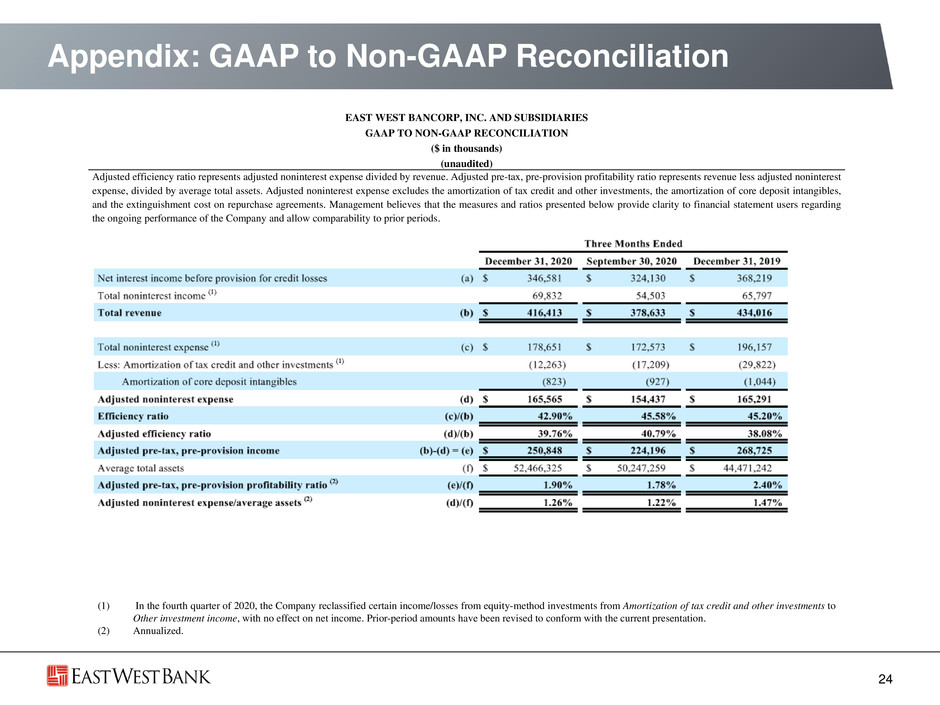

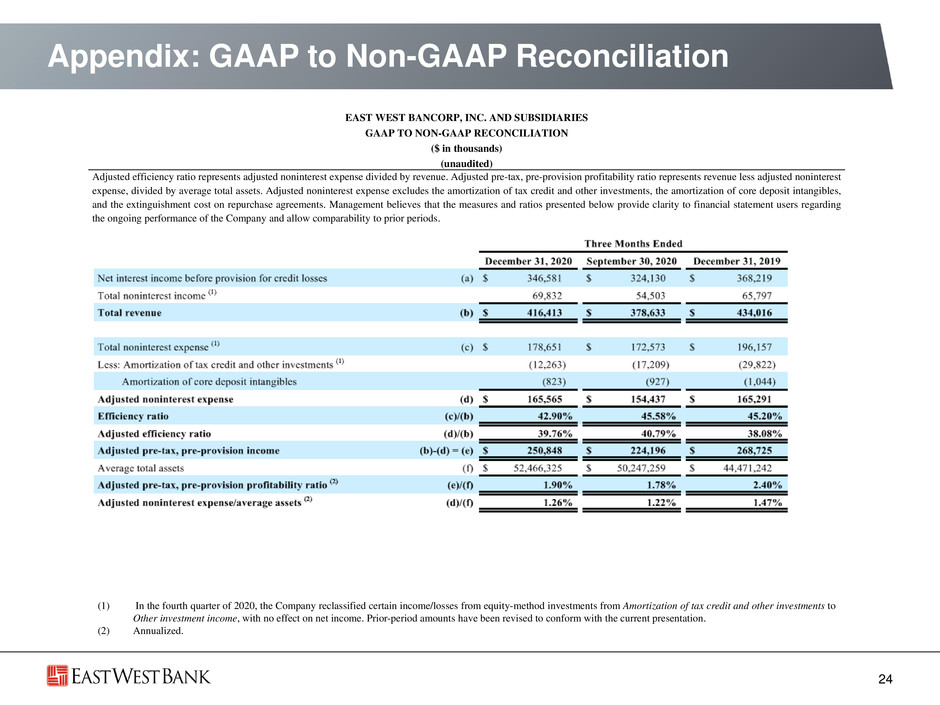

Appendix: GAAP to Non-GAAP Reconciliation 24 EAST WEST BANCORP, INC. AND SUBSIDIARIES GAAP TO NON-GAAP RECONCILIATION ($ in thousands) (unaudited) Adjusted efficiency ratio represents adjusted noninterest expense divided by revenue. Adjusted pre-tax, pre-provision profitability ratio represents revenue less adjusted noninterest expense, divided by average total assets. Adjusted noninterest expense excludes the amortization of tax credit and other investments, the amortization of core deposit intangibles, and the extinguishment cost on repurchase agreements. Management believes that the measures and ratios presented below provide clarity to financial statement users regarding the ongoing performance of the Company and allow comparability to prior periods. (1) In the fourth quarter of 2020, the Company reclassified certain income/losses from equity-method investments from Amortization of tax credit and other investments to Other investment income, with no effect on net income. Prior-period amounts have been revised to conform with the current presentation. (2) Annualized.

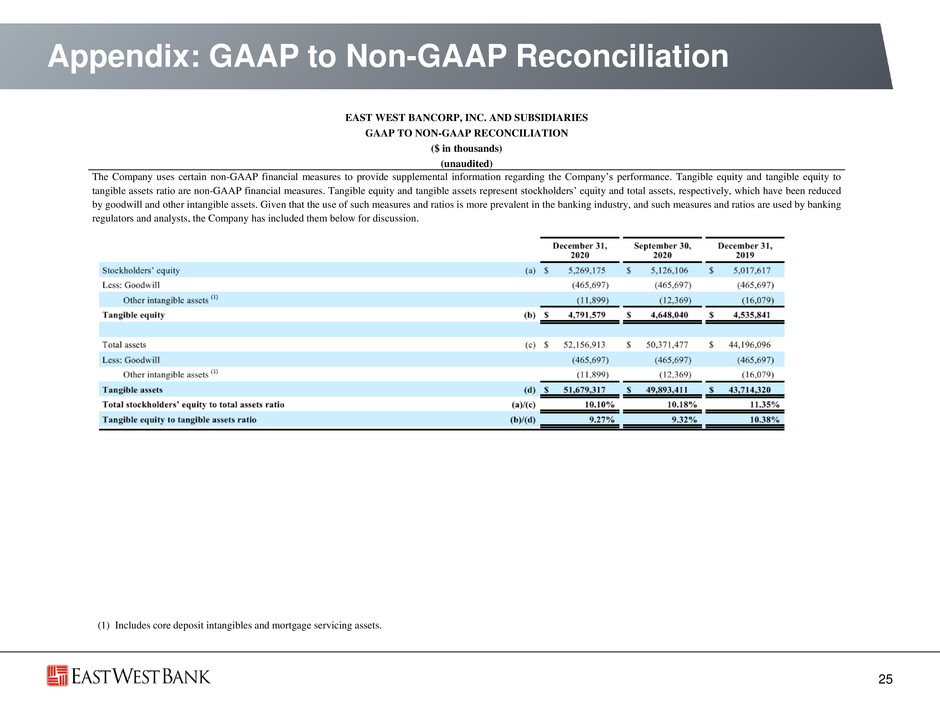

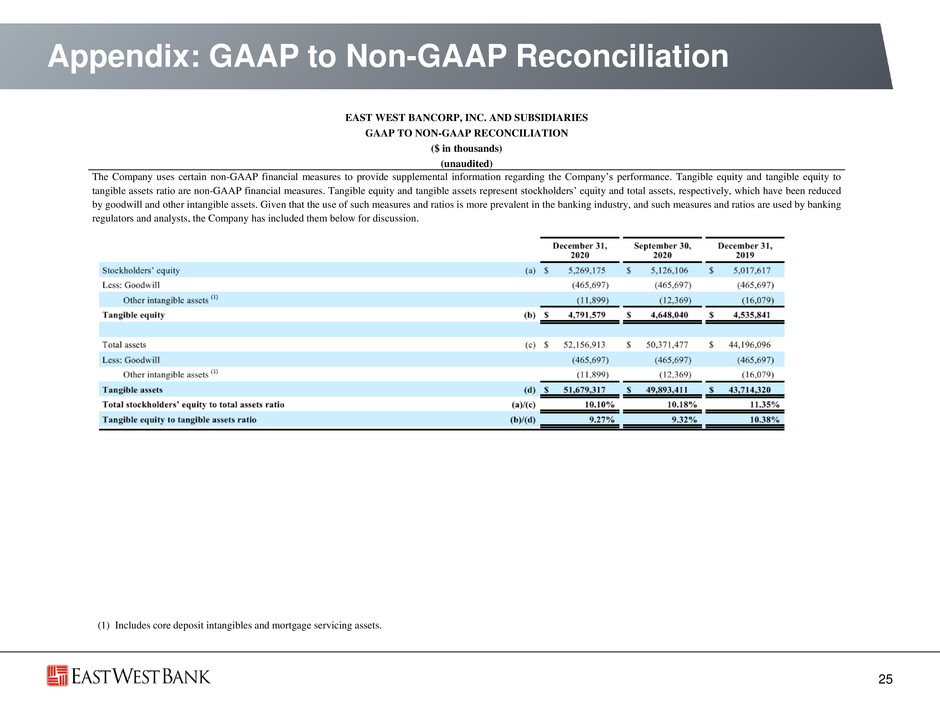

Appendix: GAAP to Non-GAAP Reconciliation 25 EAST WEST BANCORP, INC. AND SUBSIDIARIES GAAP TO NON-GAAP RECONCILIATION ($ in thousands) (unaudited) The Company uses certain non-GAAP financial measures to provide supplemental information regarding the Company’s performance. Tangible equity and tangible equity to tangible assets ratio are non-GAAP financial measures. Tangible equity and tangible assets represent stockholders’ equity and total assets, respectively, which have been reduced by goodwill and other intangible assets. Given that the use of such measures and ratios is more prevalent in the banking industry, and such measures and ratios are used by banking regulators and analysts, the Company has included them below for discussion. (1) Includes core deposit intangibles and mortgage servicing assets.

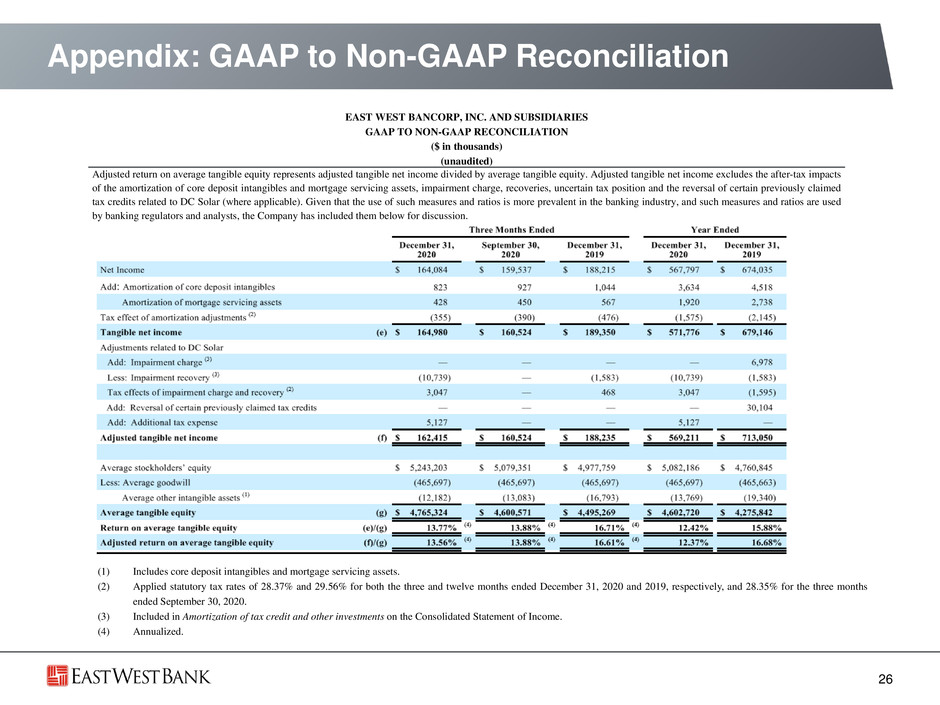

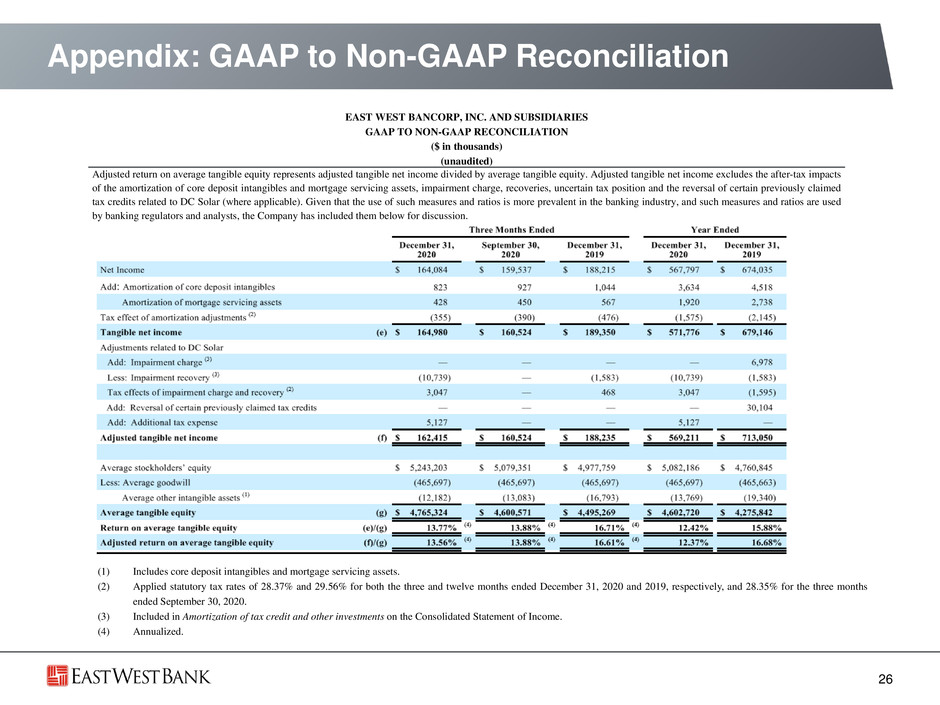

Appendix: GAAP to Non-GAAP Reconciliation 26 EAST WEST BANCORP, INC. AND SUBSIDIARIES GAAP TO NON-GAAP RECONCILIATION ($ in thousands) (unaudited) Adjusted return on average tangible equity represents adjusted tangible net income divided by average tangible equity. Adjusted tangible net income excludes the after-tax impacts of the amortization of core deposit intangibles and mortgage servicing assets, impairment charge, recoveries, uncertain tax position and the reversal of certain previously claimed tax credits related to DC Solar (where applicable). Given that the use of such measures and ratios is more prevalent in the banking industry, and such measures and ratios are used by banking regulators and analysts, the Company has included them below for discussion. (1) Includes core deposit intangibles and mortgage servicing assets. (2) Applied statutory tax rates of 28.37% and 29.56% for both the three and twelve months ended December 31, 2020 and 2019, respectively, and 28.35% for the three months ended September 30, 2020. (3) Included in Amortization of tax credit and other investments on the Consolidated Statement of Income. (4) Annualized.

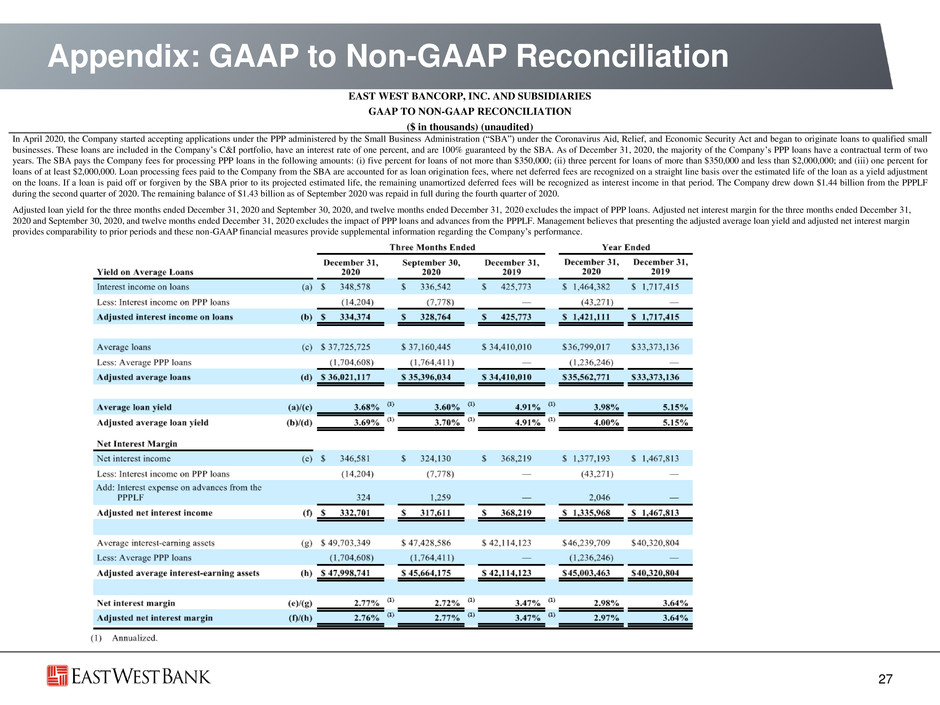

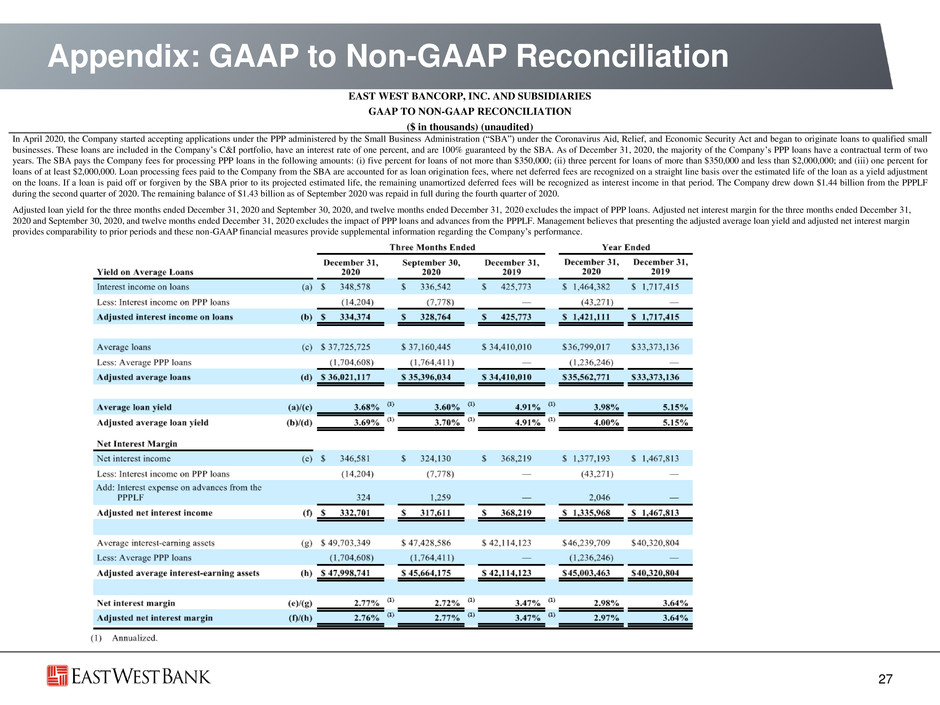

27 Appendix: GAAP to Non-GAAP Reconciliation EAST WEST BANCORP, INC. AND SUBSIDIARIES GAAP TO NON-GAAP RECONCILIATION ($ in thousands) (unaudited) In April 2020, the Company started accepting applications under the PPP administered by the Small Business Administration (“SBA”) under the Coronavirus Aid, Relief, and Economic Security Act and began to originate loans to qualified small businesses. These loans are included in the Company’s C&I portfolio, have an interest rate of one percent, and are 100% guaranteed by the SBA. As of December 31, 2020, the majority of the Company’s PPP loans have a contractual term of two years. The SBA pays the Company fees for processing PPP loans in the following amounts: (i) five percent for loans of not more than $350,000; (ii) three percent for loans of more than $350,000 and less than $2,000,000; and (iii) one percent for loans of at least $2,000,000. Loan processing fees paid to the Company from the SBA are accounted for as loan origination fees, where net deferred fees are recognized on a straight line basis over the estimated life of the loan as a yield adjustment on the loans. If a loan is paid off or forgiven by the SBA prior to its projected estimated life, the remaining unamortized deferred fees will be recognized as interest income in that period. The Company drew down $1.44 billion from the PPPLF during the second quarter of 2020. The remaining balance of $1.43 billion as of September 2020 was repaid in full during the fourth quarter of 2020. Adjusted loan yield for the three months ended December 31, 2020 and September 30, 2020, and twelve months ended December 31, 2020 excludes the impact of PPP loans. Adjusted net interest margin for the three months ended December 31, 2020 and September 30, 2020, and twelve months ended December 31, 2020 excludes the impact of PPP loans and advances from the PPPLF. Management believes that presenting the adjusted average loan yield and adjusted net interest margin provides comparability to prior periods and these non-GAAP financial measures provide supplemental information regarding the Company’s performance.