EWBC Earnings Results Third Quarter 2022 October 20, 2022

Forward-Looking Statements 2 Forward-Looking Statements This presentation contains forward-looking statements that are intended to be covered by the safe harbor for such statements provided by the Private Securities Litigation Reform Act of 1995. These statements are based on the current beliefs and expectations of the management of East West Bancorp, Inc. (the “Company”) and are subject to significant risks and uncertainties. You should not place undue reliance on these statements. Factors that could cause the Company’s actual results to differ materially from those described in the forward-looking statements include, among others, changes in the U.S. economy or local, regional and global business, economic and political conditions and geopolitical events; the impacts of the ongoing COVID-19 pandemic; changes in laws or the regulatory environment, including trade, monetary and fiscal policies and laws; and changes in the commercial and consumer real estate markets and in consumer spending and savings habits. These factors also consist of those contained in the Company’s filings with the Securities and Exchange Commission, including the “Risk Factors” section of the Company’s Annual Report on Form 10-K for the year ended December 31, 2021. When considering these forward-looking statements, you should keep in mind these risks and uncertainties, as well as any cautionary statements the Company may make. These statements speak only as of the date they are made and are based only on information then actually known to the Company. The Company does not undertake to update any forward-looking statements except as required by law. Non-GAAP Financial Measures Certain financial information in this presentation has not been prepared in accordance with U.S. generally accepted accounting principles (“GAAP”) and is presented on a non-GAAP basis. Investors should refer to the reconciliations included in this presentation and should consider the Company’s non-GAAP financial measures in addition to, not as a substitute for or superior to, measures prepared in accordance with GAAP. These measures may not be comparable to similarly titled measures used by other companies.

Highlights of Third Quarter 2022 3 Net Income $295 million Diluted EPS $2.08 Record Average Loans $46.9 billion Average Deposits $54.1 billion Average Demand Deposits $22.4 billion Record Net Interest Income $552 million Total Revenue $627 million Adj. Efficiency Ratio* 31.2% Return on Average Assets Adjusted Pre-Tax, Pre-Provision Income* & Profitability Ratio* Tangible Return on Average Tangible Equity* Return on Average Equity Adj. PTPP income* Adj. PTPP profitability ratio* $ i n m ill io n s * See reconciliation of GAAP to non-GAAP financial measures in the appendix and in the Company’s Earnings Press Releases. 1.46% 1.66% 1.86% 3Q21 2Q22 3Q22 15.7% 18.2% 20.3% 3Q21 2Q22 3Q22 17.2% 19.9% 22.2% 3Q21 2Q22 3Q22 $302 $370 $432 1.95% 2.38% 2.72% $100 $180 $260 $340 $420 3Q21 2Q22 3Q22

4 09.30.22: Strong, Well-Diversified Balance Sheet Record Loans as of 09.30.22: $47.5 billion ($ in billions) C&I Resi. mortgage & other consumerTotal CRE IB Checking & SavingsMMDADDA Time Total Deposits as of 09.30.22: $53.9 billion ($ in billions) * See reconciliation of GAAP to non-GAAP financial measures in the appendix and in the Company’s Earnings Press Releases. $15.6 33% $18.7 39% $13.2 28% $21.6 40% $12.1 22% $9.8 19% $10.4 19% $ in millions, except per share data 09.30.22 06.30.22 Cash equivalents & ST investments $ 2,794 $ 2,615 $ 179 Repo assets 893 1,423 (530) AFS debt securities 5,906 6,256 (350) HTM debt securities 3,013 3,028 (15) Total Loans 47,457 46,531 926 Allowance for loan losses (ALLL) (583) (563) (20) Net Loans $ 46,874 $ 45,968 $ 906 Other assets 3,096 3,104 (8) Total Assets $ 62,576 $ 62,394 $ 182 Customer deposits $ 53,857 $ 54,343 $ (486) Fed Funds, FHLB advances & repo funding 1,137 787 350 Long-term debt & finance lease liab. 153 153 - Other liabilities 1,768 1,502 266 Total Liabilities $ 56,915 $ 56,785 $ 130 Total Stockholders' Equity $ 5,661 $ 5,609 $ 52 Book value per share $ 40.17 $ 39.81 $ 0.36 Tangible equity* per share $ 36.80 $ 36.44 $ 0.36 Tang. equity to tang. assets ratio* 8.35% 8.29% 6 bp Q-o-Q Change

09.30.22: Strong Capital Ratios That Expanded Q-o-Q ▪ Book value per share of $40.17 as of 09.30.22: +1% Q-o-Q and +0.2% Y-o-Y. ▪ Tangible equity* per share of $36.80 as of 09.30.22: +1% Q-o-Q and +0.1% Y-o-Y. ▪ Tangible equity to tangible assets ratio* of 8.35% as of 09.30.22, +6 bps from 06.30.22. ▪ All regulatory capital ratios increased Q-o-Q. CET1 ratio of 12.3% as of 09.30.22. ▪ Dividend: 4Q22 quarterly common stock dividend of $0.40 per share, equivalent to $1.60 per share annualized. ▪ No buybacks during 3Q22. 5 **The Company has elected to use the 2020 CECL transition provision in the calculation of its September 30, 2021, June 30, 2022, and September 30, 2022 regulatory capital ratios. The Company’s September 30, 2022 regulatory capital ratios are preliminary. * See reconciliation of GAAP to non-GAAP financial measures in the appendix and in the Company’s Earnings Press Releases. 12.8% 12.8% 14.2% 8.8% 12.0% 12.0% 13.2% 9.3% 12.3% 12.3% 13.6% 9.6% CET1 capital ratio Tier 1 capital ratio Total capital ratio Leverage ratio EWBC 09.30.21 EWBC 06.30.22 EWBC 09.30.22**

Total CRE 39% Total Resi. Mortgage & Other Consumer 28% C&I 33% 6 Total Loans: C&I Loans by Industry as % of Total Loans Outstanding 09.30.22: Diversified Commercial Loan Portfolio ▪ C&I loans: $15.6bn loans O/S plus $6.6bn undisbursed commitments: $22.2bn total commitments as of 09.30.22. ▪ Portfolio well-diversified by industry. ▪ Utilization: 70% as of 09.30.22, unchanged Q-o-Q. ▪ Growth: total commitments: +1% (+4% ann.) Q-o-Q & EOP loans HFI O/S: +2% (+6% ann.) Q-o-Q. ▪ China loans O/S (mainland + Hong Kong): $2.1bn as of 09.30.22, vs. $2.2bn as of 06.30.22. Portfolio primarily consists of C&I loans, well-diversified by industry. $15.6bn 4% 12% General Manufacturing & Wholesale Private Equity Entertainment Food-related Industries: 1%; Healthcare: 1%; Consumer Goods: 1%; Oil & Gas: 1%. Real Estate related Clean Energy Technology & Life Science All Other C&I $47.5 billion Total Loans } 4% 3% 2% 2% 2%

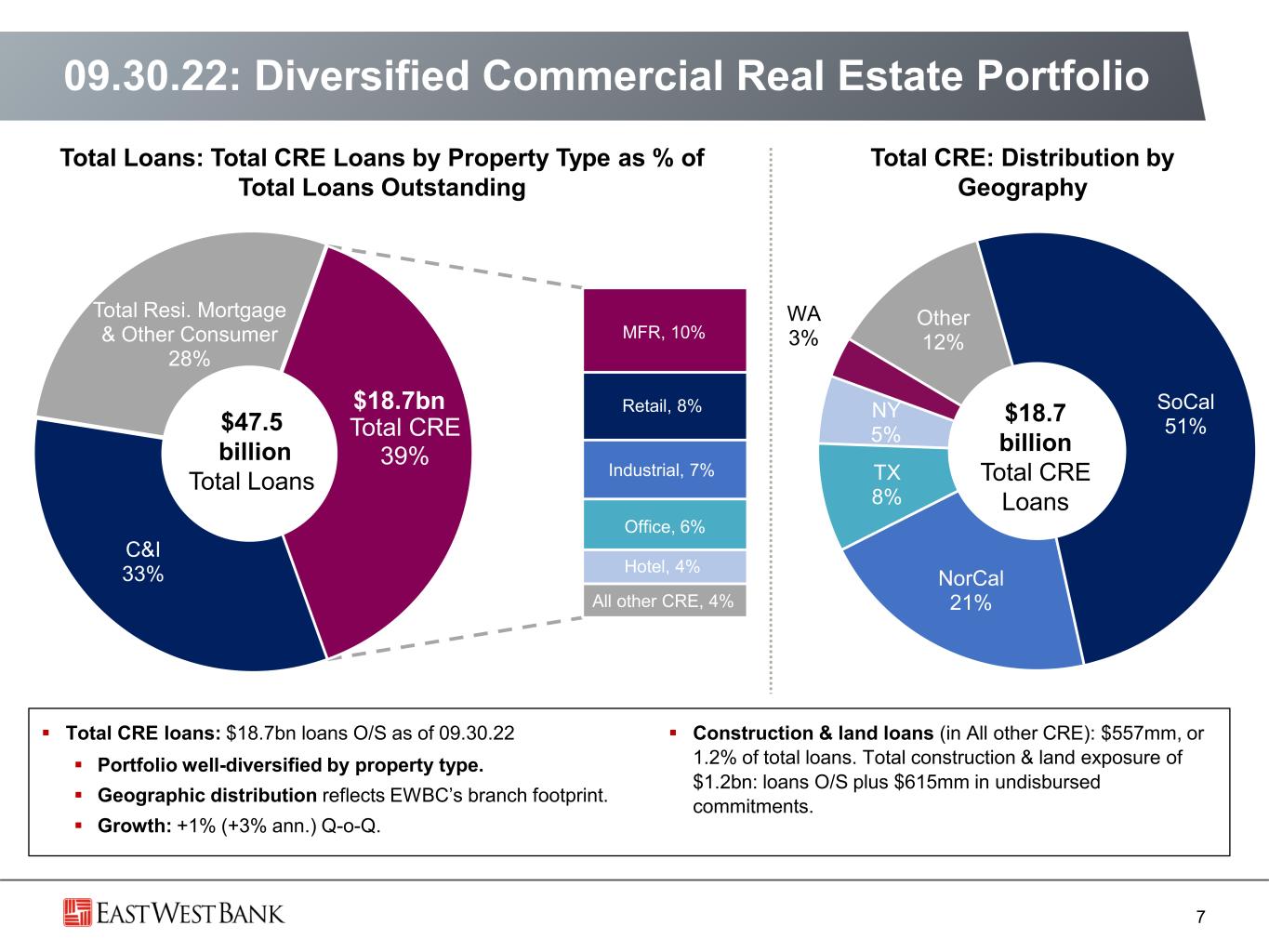

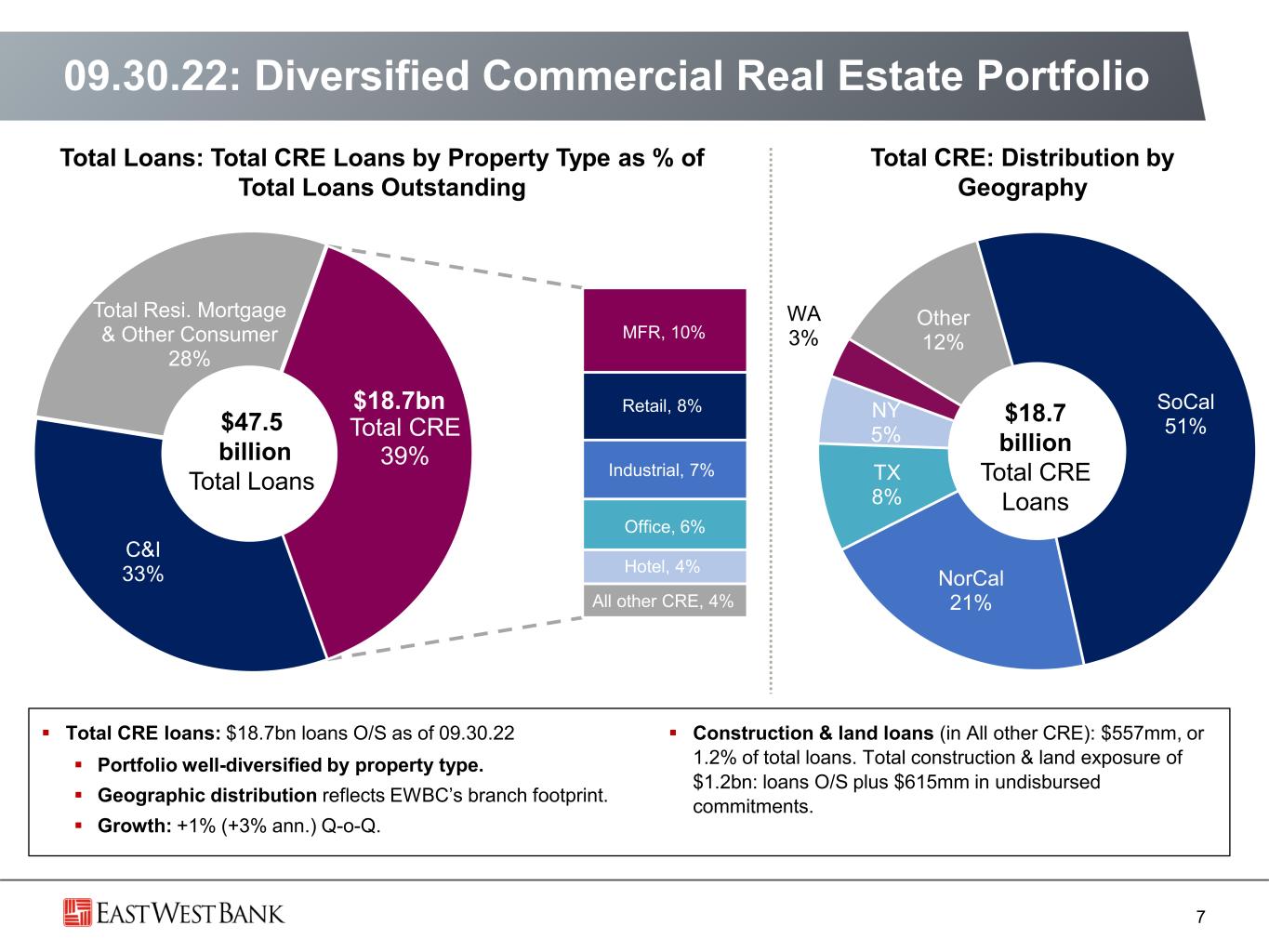

SoCal 51% NorCal 21% TX 8% NY 5% WA 3% Other 12% C&I 33% MFR, 10% Retail, 8% Industrial, 7% Office, 6% Hotel, 4% All other CRE, 4% Total Resi. Mortgage & Other Consumer 28% Total CRE 39% 09.30.22: Diversified Commercial Real Estate Portfolio 7 Total Loans: Total CRE Loans by Property Type as % of Total Loans Outstanding ▪ Total CRE loans: $18.7bn loans O/S as of 09.30.22 ▪ Portfolio well-diversified by property type. ▪ Geographic distribution reflects EWBC’s branch footprint. ▪ Growth: +1% (+3% ann.) Q-o-Q. ▪ Construction & land loans (in All other CRE): $557mm, or 1.2% of total loans. Total construction & land exposure of $1.2bn: loans O/S plus $615mm in undisbursed commitments. $18.7 billion Total CRE Loans Total CRE: Distribution by Geography $18.7bn $47.5 billion Total Loans

<=50% 42% >50% to 55% 16% >55% to 60% 16% >60% to 65% 17% >65% to 70% 6% >70% 3% Total CRE: Distribution by LTV 8 09.30.22: Low LTV Commercial Real Estate Portfolio CRE Size & LTV by Property Type 1Weighted avg. LTV based on commitment. * Construction & Land avg. size based on total commitment. ▪ High percentage of CRE loans have full recourse & personal guarantees from individuals or guarantors with substantial net worth. ▪ Many of our customers have long-term relationships with East West Bank. $2.7 million Avg. size of loan outstanding 51% Avg. LTV ($ in millions) Total Portfolio Size Weighted Avg. LTV1 Average Loan Size Multifamily 4,559$ 52% 1.6$ Retail 3,992$ 48% 2.3$ Industrial 3,475$ 49% 2.9$ Office 2,943$ 53% 3.9$ Hotel 2,099$ 54% 9.1$ Construction & Land* 557$ 58% 13.2$ Other 1,064$ 51% 3.4$ Total CRE 18,689$ 51% 2.7$

<=50% 39% >50% to 55% 13% >55% to 60% 41% >60% 7% SoCal 40% NorCal 16% NY 27% WA 8% TX 2% Other 7% 09.30.22: Low LTV Residential Mortgage Portfolio 9 Resi. Mortgage: Distribution by Geography Resi. Mortgage: Distribution by LTV $13.0 billion Resi. Mortgage Loans Outstanding $434,000 Avg. loan size* 51% Avg. LTV* ▪ Residential mortgage (SFR + HELOC): $13.0bn loans O/S as of 09.30.22. ▪ Primarily originated through East West Bank branches. ▪ Origination volume: $1.5bn in 3Q22, down 14% Q-o-Q. ▪ Resi. loans O/S growth: +4% (+17% ann.) Q-o-Q. ▪ SFR: $10.9bn loans O/S as of 09.30.22. ▪ HELOC: $2.2bn loans O/S + $3.3bn in undisbursed commitments: $5.5bn total as of 09.30.22. ▪ HELOC utilization: 40% as of 09.30.22, vs. 44% as of 06.30.22. ▪ 83% of commitments in first lien position as of 09.30.22. * Combined LTV for 1st and 2nd liens; based on commitment. Avg. size based on loan O/S for SFR and commitment for HELOC.

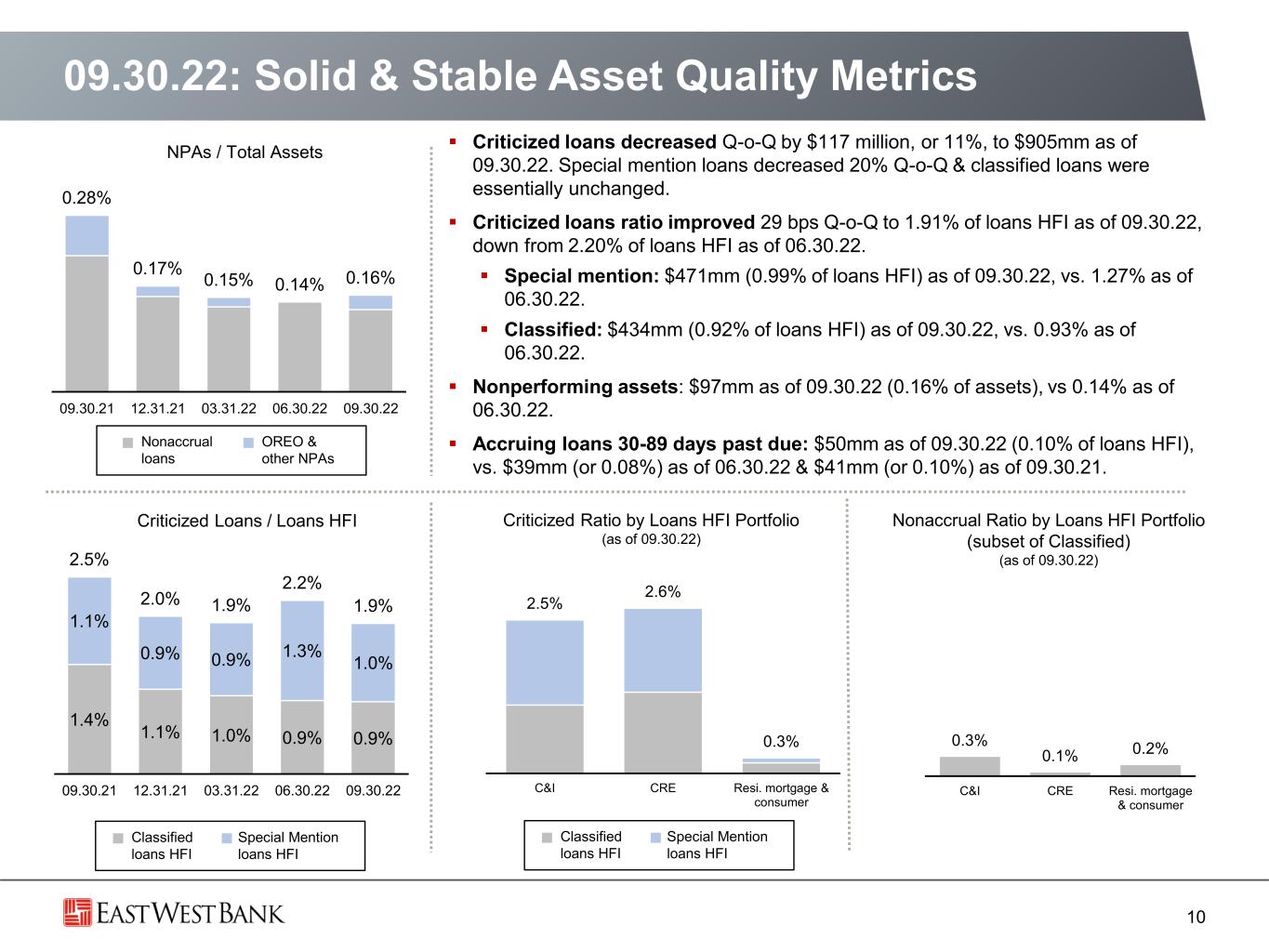

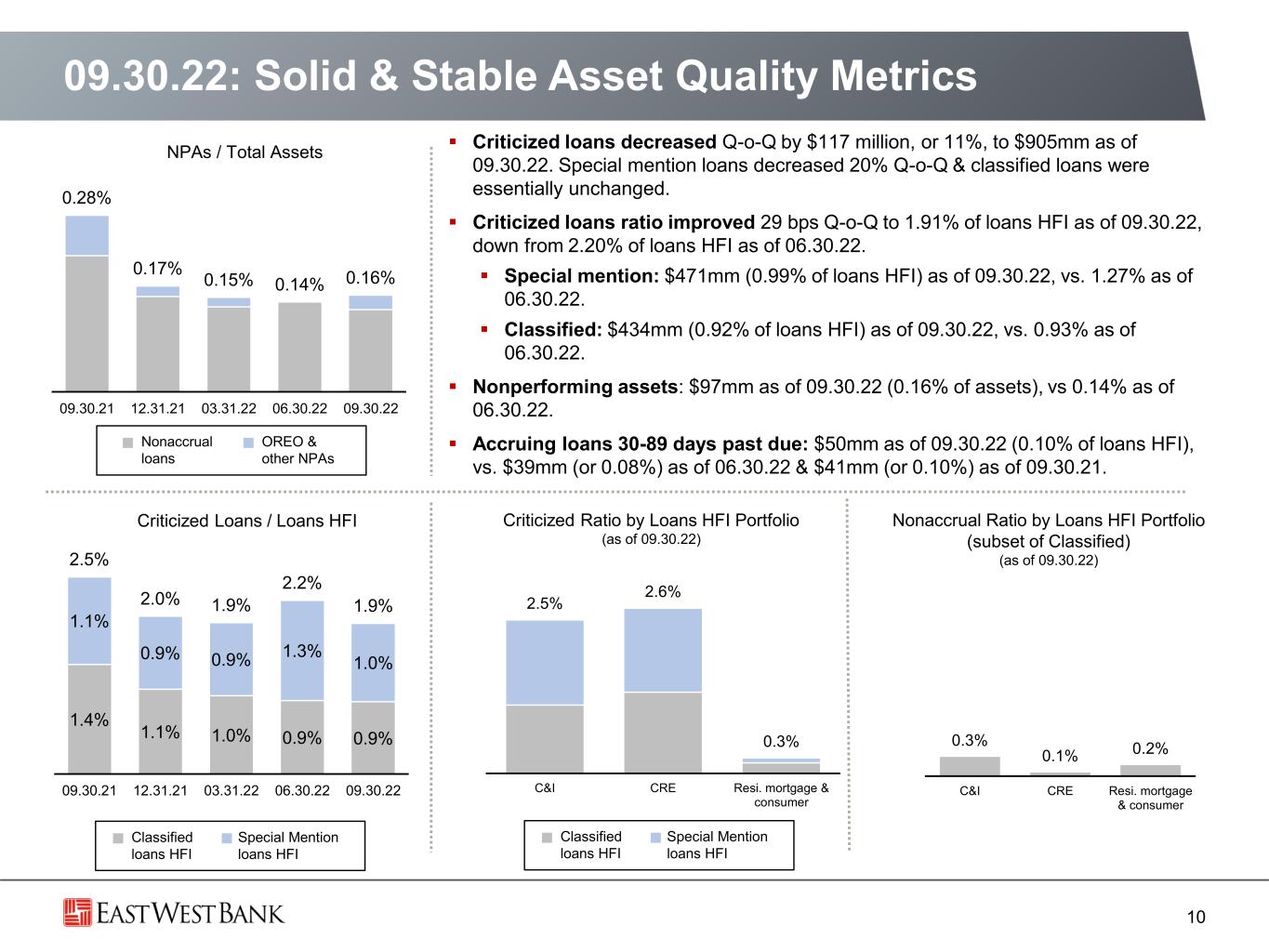

2.5% 2.6% 0.3% C&I CRE Resi. mortgage & consumer 09.30.22: Solid & Stable Asset Quality Metrics 10 Nonaccrual loans OREO & other NPAs Classified loans HFI Special Mention loans HFI Classified loans HFI Special Mention loans HFI Nonaccrual Ratio by Loans HFI Portfolio (subset of Classified) (as of 09.30.22) NPAs / Total Assets Criticized Ratio by Loans HFI Portfolio (as of 09.30.22) Criticized Loans / Loans HFI ▪ Criticized loans decreased Q-o-Q by $117 million, or 11%, to $905mm as of 09.30.22. Special mention loans decreased 20% Q-o-Q & classified loans were essentially unchanged. ▪ Criticized loans ratio improved 29 bps Q-o-Q to 1.91% of loans HFI as of 09.30.22, down from 2.20% of loans HFI as of 06.30.22. ▪ Special mention: $471mm (0.99% of loans HFI) as of 09.30.22, vs. 1.27% as of 06.30.22. ▪ Classified: $434mm (0.92% of loans HFI) as of 09.30.22, vs. 0.93% as of 06.30.22. ▪ Nonperforming assets: $97mm as of 09.30.22 (0.16% of assets), vs 0.14% as of 06.30.22. ▪ Accruing loans 30-89 days past due: $50mm as of 09.30.22 (0.10% of loans HFI), vs. $39mm (or 0.08%) as of 06.30.22 & $41mm (or 0.10%) as of 09.30.21. 1.4% 1.1% 1.0% 0.9% 0.9% 1.1% 0.9% 0.9% 1.3% 1.0% 2.5% 2.0% 1.9% 2.2% 1.9% 09.30.21 12.31.21 03.31.22 06.30.22 09.30.22 0.28% 0.17% 0.15% 0.14% 0.16% 09.30.21 12.31.21 03.31.22 06.30.22 09.30.22 0.3% 0.1% 0.2% C&I CRE Resi. mortgage & consumer

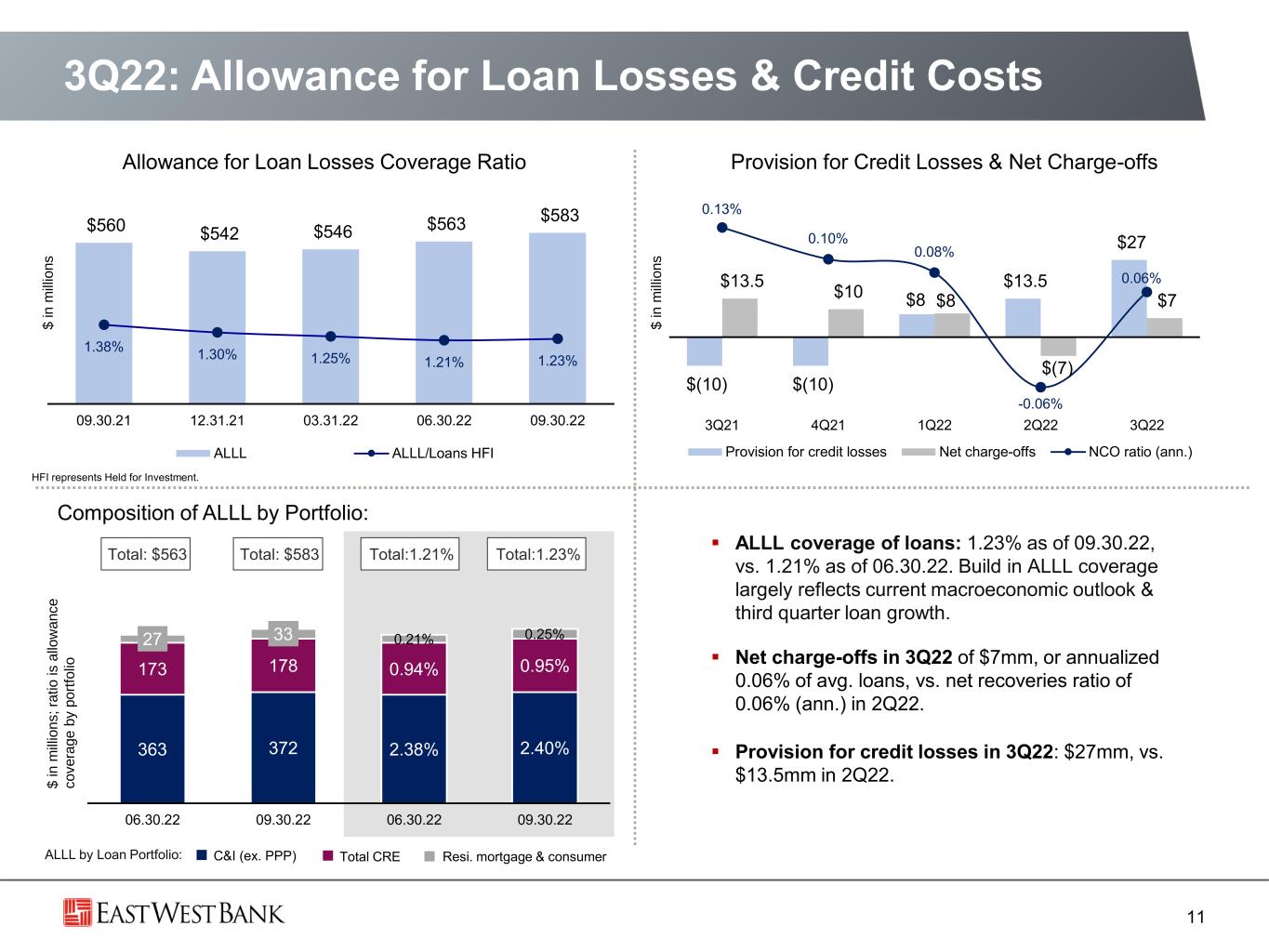

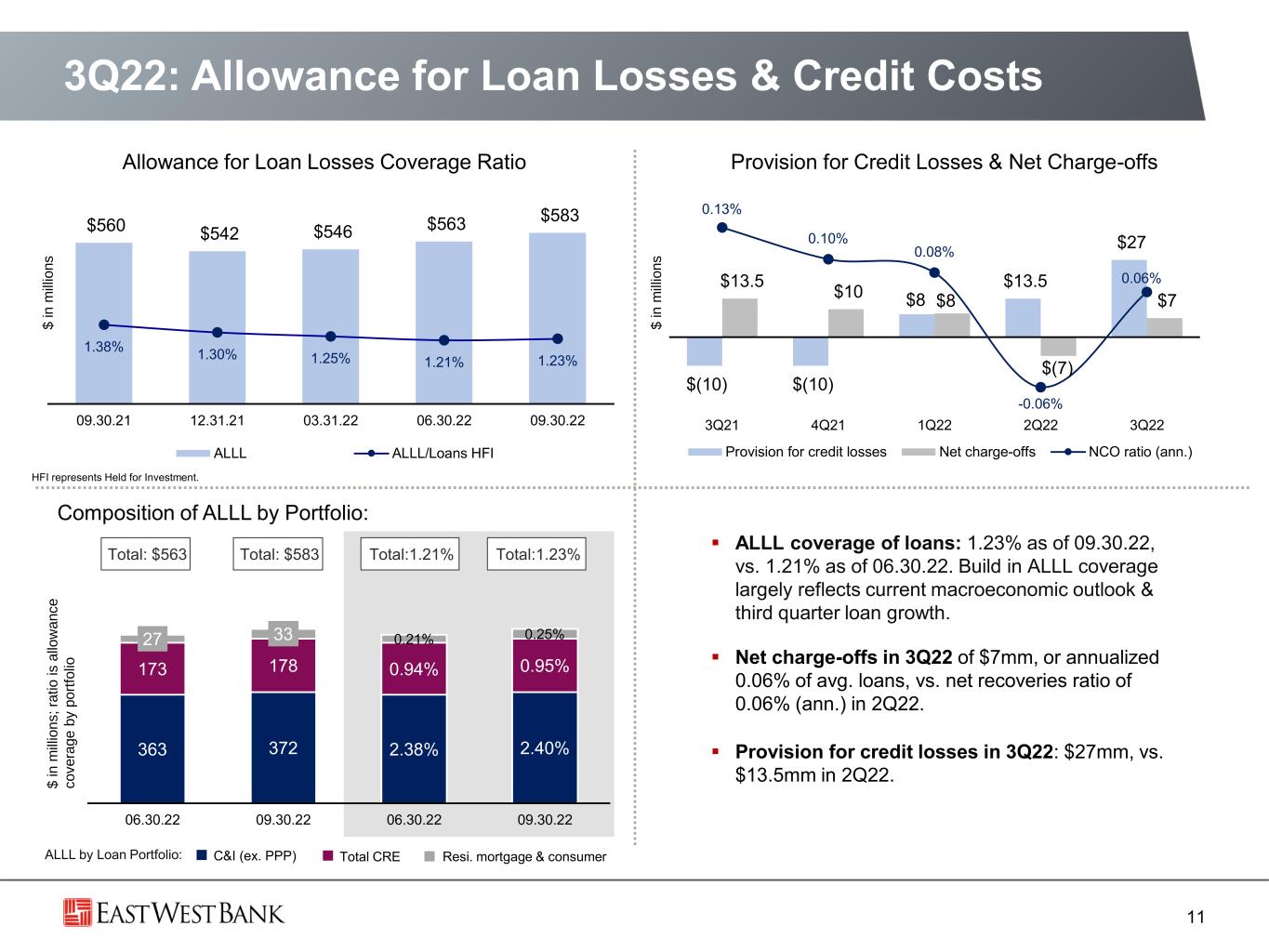

$560 $542 $546 $563 $583 1.38% 1.30% 1.25% 1.21% 1.23% 0.50% $200 $700 09.30.21 12.31.21 03.31.22 06.30.22 09.30.22 ALLL ALLL/Loans HFI ▪ ALLL coverage of loans: 1.23% as of 09.30.22, vs. 1.21% as of 06.30.22. Build in ALLL coverage largely reflects current macroeconomic outlook & third quarter loan growth. ▪ Net charge-offs in 3Q22 of $7mm, or annualized 0.06% of avg. loans, vs. net recoveries ratio of 0.06% (ann.) in 2Q22. ▪ Provision for credit losses in 3Q22: $27mm, vs. $13.5mm in 2Q22. 3Q22: Allowance for Loan Losses & Credit Costs 11 Composition of ALLL by Portfolio: Allowance for Loan Losses Coverage Ratio $ i n m ill io n s Provision for Credit Losses & Net Charge-offs $ i n m ill io n s $ i n m ill io n s ; ra ti o i s a llo w a n c e c o v e ra g e b y p o rt fo lio ALLL by Loan Portfolio: C&I (ex. PPP) Total CRE Resi. mortgage & consumer Total: $563 Total:1.21%Total: $583 Total:1.23% HFI represents Held for Investment. $(10) $(10) $8 $13.5 $27 $13.5 $10 $8 $(7) $7 0.13% 0.10% 0.08% -0.06% 0.06% -0.09% $(25) 3Q21 4Q21 1Q22 2Q22 3Q22 Provision for credit losses Net charge-offs NCO ratio (ann.) 363 372 2.38% 2.40% 173 178 0.94% 0.95% 27 33 0.21% 0.25% 06.30.22 09.30.22 06.30.22 09.30.22

3Q22: Summary Income Statement 12 * See slide 17 for noninterest income detail by category. Comments ▪ Record net interest income: $552mm, up 17% Q-o-Q (+66% LQA). ▪ Customer-driven fee income and GOS of SBA loans: $69mm, up 7% Q-o-Q (+26% LQA). ▪ Other investment income was $(0.6)mm in 3Q22, vs $4.9mm in 2Q22, reflecting equity valuation adjustments of CRA investments. ▪ Amortization of tax credit & other investments: $20mm in 3Q22, vs. $15mm in 2Q22: Q-o-Q variability reflects the impact of investments that close in a given period. Amortization of tax credit investments expected to be approx. $30mm in 4Q22. ▪ Tax expense: YTD effective tax rate was 23% for the 9-mos of 2022. ▪ The full-year 2022 effective tax rate is expected to be approximately 22%, including impact from tax credit investments expected in 4Q22. ** See reconciliation of GAAP to non-GAAP financial measures in the appendix and in the Company’s Earnings Press Releases. 3Q22 vs. 2Q22 $ in millions, except per share data & ratios 3Q22 2Q22 $ Change % Change Total net interest income $ 551.8 $ 473.0 $ 78.8 17% Fee income & net GOS of loans* 69.0 64.8 4.2 6.5% Other 6.6 13.6 (7.0) -51% Total noninterest income $ 75.6 $ 78.4 $ (2.8) -4% Total revenue $ 627.4 $ 551.4 $ 76.0 14% Adjusted noninterest expense** $ 195.6 $ 181.4 $ 14.2 8% Amortization of tax credit & other investments + core deposit intangibles 20.4 15.5 4.9 32% Total noninterest expense $ 216.0 $ 196.9 $ 19.1 10% Provision for credit losses $ 27.0 $ 13.5 $ 13.5 100% Income tax expense 89.0 82.7 6.3 8% Effective tax rate 23% 24% -1% Net Income (GAAP) $ 295.3 $ 258.3 $ 37.0 14% Diluted EPS $ 2.08 $ 1.81 $ 0.27 15% Weigh. avg. diluted shares (in mm) 142.0 142.4 (0.4) -0.3%

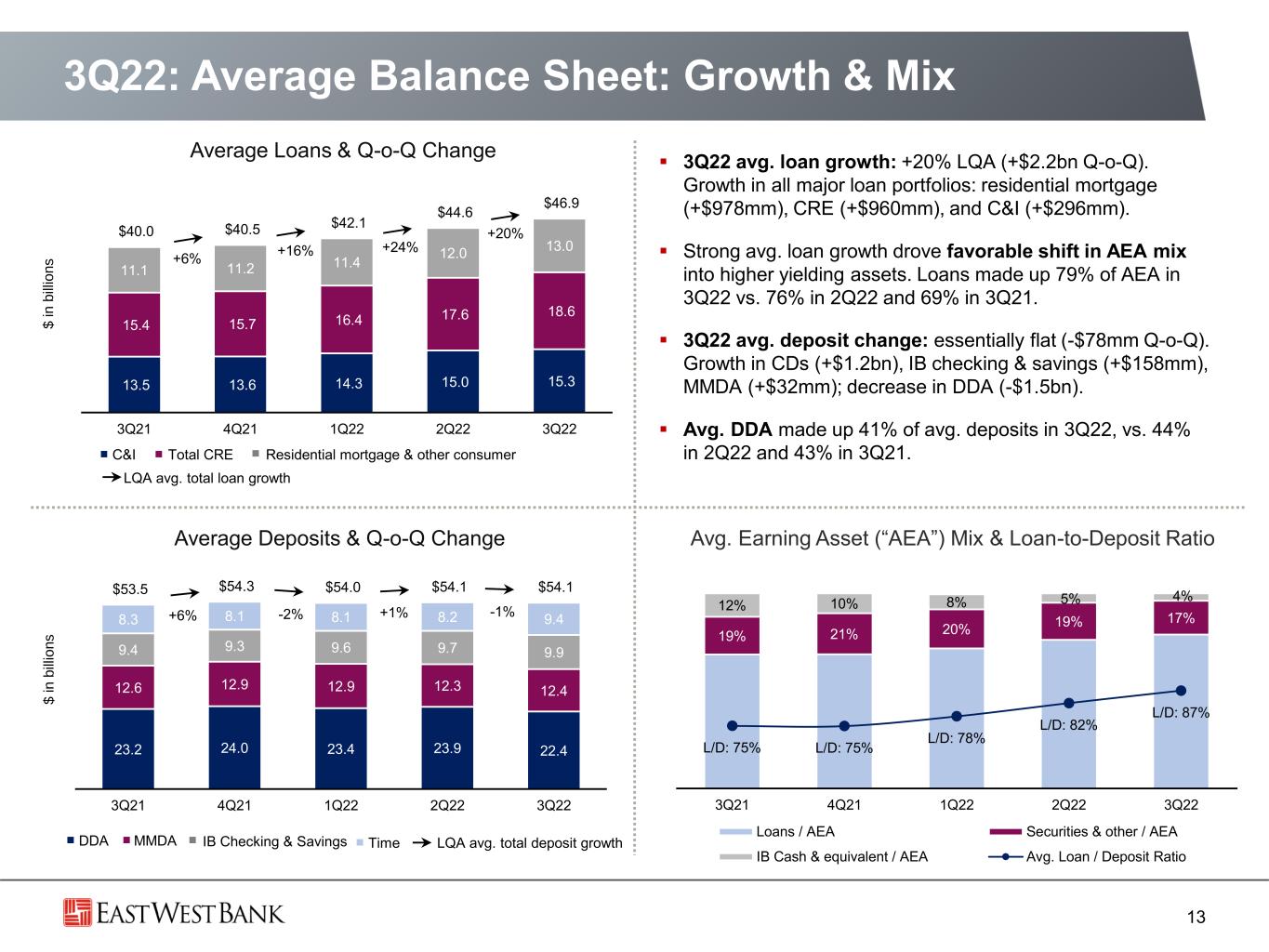

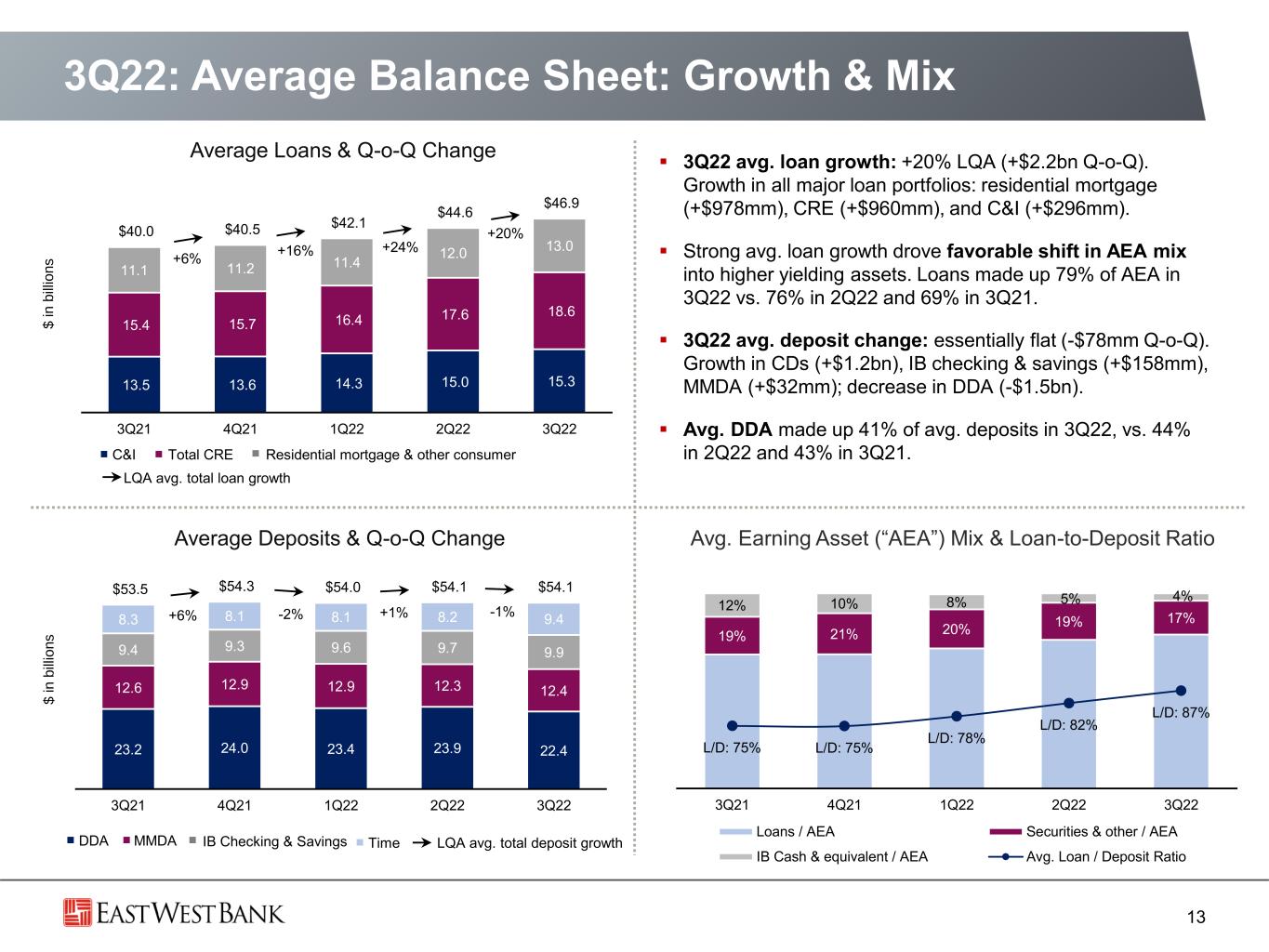

23.2 24.0 23.4 23.9 22.4 12.6 12.9 12.9 12.3 12.4 9.4 9.3 9.6 9.7 9.9 8.3 8.1 8.1 8.2 9.4 $53.5 $54.3 $54.0 $54.1 $54.1 3Q21 4Q21 1Q22 2Q22 3Q22 13.5 13.6 14.3 15.0 15.3 15.4 15.7 16.4 17.6 18.6 11.1 11.2 11.4 12.0 13.0 $40.0 $40.5 $42.1 $44.6 $46.9 3Q21 4Q21 1Q22 2Q22 3Q22 3Q22: Average Balance Sheet: Growth & Mix 13 ▪ 3Q22 avg. loan growth: +20% LQA (+$2.2bn Q-o-Q). Growth in all major loan portfolios: residential mortgage (+$978mm), CRE (+$960mm), and C&I (+$296mm). ▪ Strong avg. loan growth drove favorable shift in AEA mix into higher yielding assets. Loans made up 79% of AEA in 3Q22 vs. 76% in 2Q22 and 69% in 3Q21. ▪ 3Q22 avg. deposit change: essentially flat (-$78mm Q-o-Q). Growth in CDs (+$1.2bn), IB checking & savings (+$158mm), MMDA (+$32mm); decrease in DDA (-$1.5bn). ▪ Avg. DDA made up 41% of avg. deposits in 3Q22, vs. 44% in 2Q22 and 43% in 3Q21. $ i n b ill io n s Average Loans & Q-o-Q Change +16% +24% +6% LQA avg. total loan growth C&I Total CRE Residential mortgage & other consumer Average Deposits & Q-o-Q Change Avg. Earning Asset (“AEA”) Mix & Loan-to-Deposit Ratio LQA avg. total deposit growthDDA MMDA IB Checking & Savings Time $ i n b ill io n s -1%-2% +1%+6% +20% 19% 21% 20% 19% 17% 12% 10% 8% 5% 4% L/D: 75% L/D: 75% L/D: 78% L/D: 82% L/D: 87% 3Q21 4Q21 1Q22 2Q22 3Q22 Loans / AEA Securities & other / AEA IB Cash & equivalent / AEA Avg. Loan / Deposit Ratio

3Q22: Net Interest Income & Net Interest Margin 14 ▪ 3Q22 record net interest income: $552mm, +17% Q-o-Q (+66% LQA) from $473mm in 2Q22. ▪ 3Q22 NIM expansion: 3.68%, +45 bps Q-o-Q. ▪ Q-o-Q increase in NIM: higher loan (+63 bps) and other earning asset yields (+8 bps), combined with favorable average earning asset mix shift (+7 bps), partially offset by funding mix shift (-2 bps) & higher cost of IB funding (-31 bps). ▪ Changes in yields and rates reflected rising benchmark interest rates during the year, as well as asset sensitivity of variable-rate loan portfolio. Impact to NIM from Q-o-Q Change in Yields, Rates & Balance Sheet Mix $ i n m ill io n s 2Q22 NIM 3Q22 NIM Avg. earning asset mix shift +63 bps +8 bps 2Q22 NIM: 3.23% Net Interest Income & Net Interest Margin Higher loan yields 3Q22 NIM: 3.68% +7 bps Higher other AEA yields -31 bps Higher IB funding cost $396 $406 $416 $473 $552 2.70% 2.73% 2.87% 3.23% 3.68% 0.25% 0.25% 0.29% 0.93% 2.35% 3Q21 4Q21 1Q22 2Q22 3Q22 NII NIM Avg. Fed Funds Rate -2 bps Funding mix shift

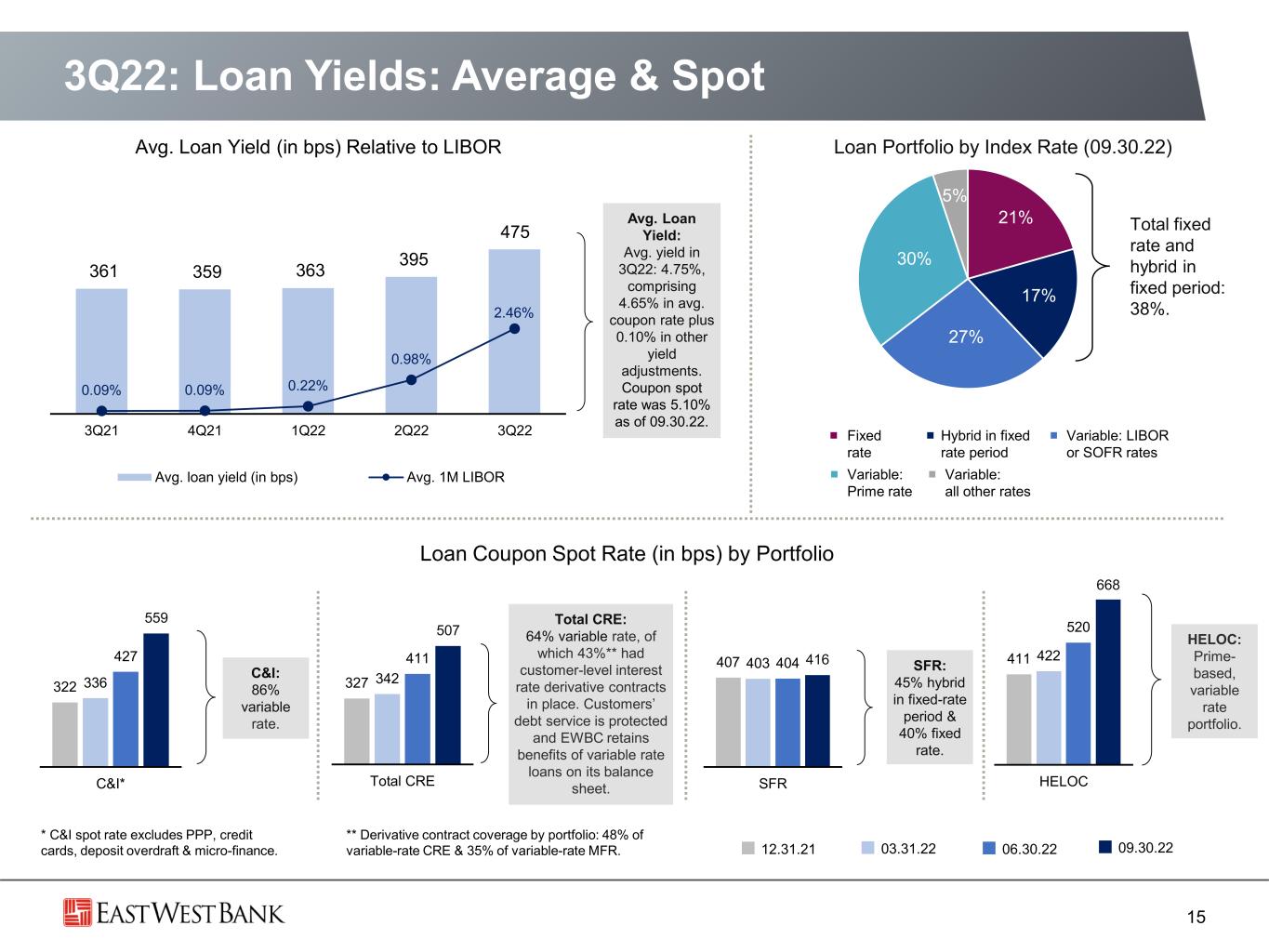

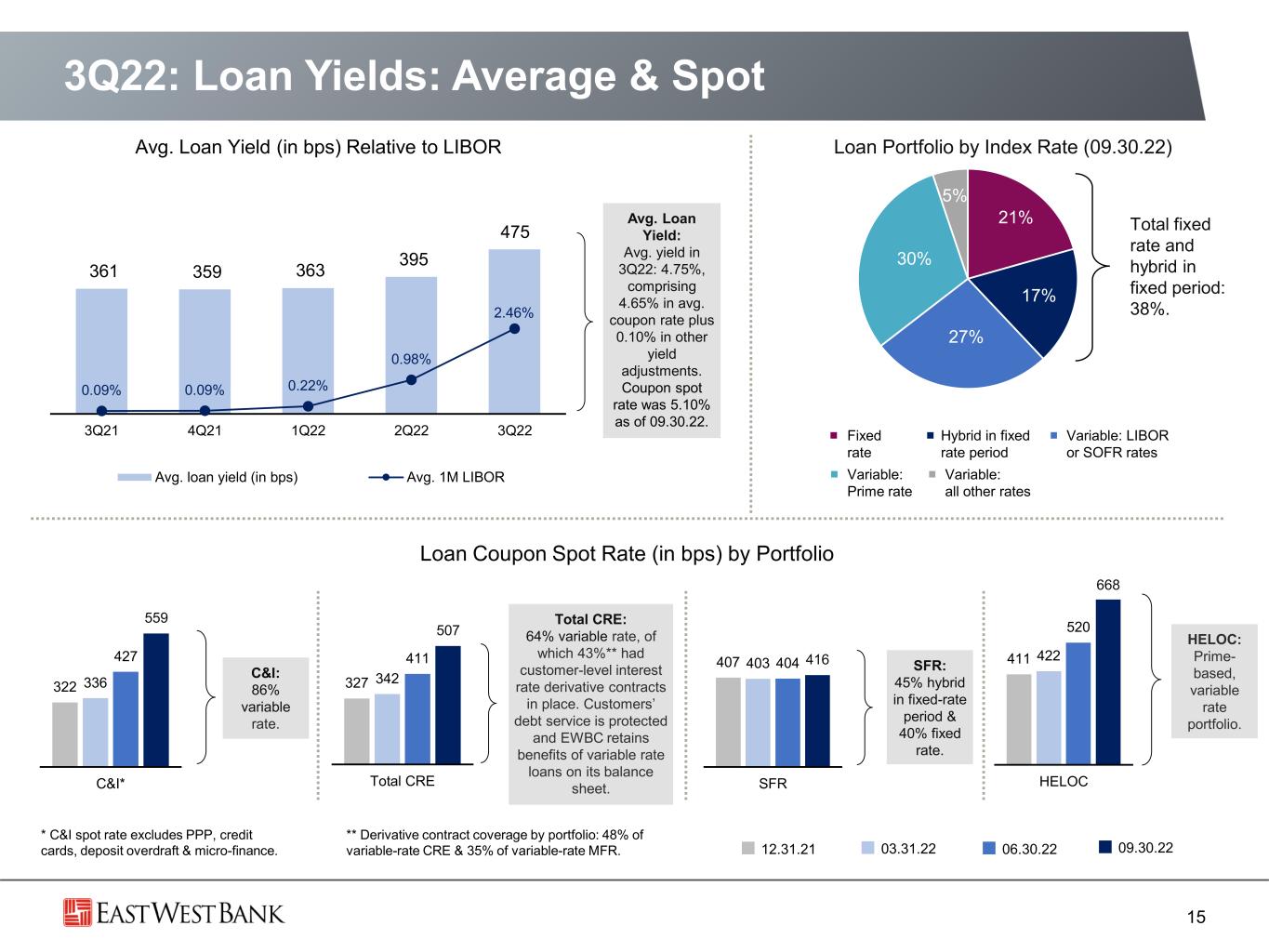

3Q22: Loan Yields: Average & Spot 15 Loan Coupon Spot Rate (in bps) by Portfolio * C&I spot rate excludes PPP, credit cards, deposit overdraft & micro-finance. Avg. Loan Yield (in bps) Relative to LIBOR 12.31.21 03.31.22 Total fixed rate and hybrid in fixed period: 38%. Variable: LIBOR or SOFR rates Hybrid in fixed rate period Fixed rate Variable: Prime rate Variable: all other rates Loan Portfolio by Index Rate (09.30.22) 06.30.22 C&I: 86% variable rate. Total CRE: 64% variable rate, of which 43%** had customer-level interest rate derivative contracts in place. Customers’ debt service is protected and EWBC retains benefits of variable rate loans on its balance sheet. SFR: 45% hybrid in fixed-rate period & 40% fixed rate. HELOC: Prime- based, variable rate portfolio. Avg. Loan Yield: Avg. yield in 3Q22: 4.75%, comprising 4.65% in avg. coupon rate plus 0.10% in other yield adjustments. Coupon spot rate was 5.10% as of 09.30.22. 322 336 427 559 C&I* 327 342 411 507 Total CRE 407 403 404 416 SFR 411 422 520 668 HELOC 09.30.22 ** Derivative contract coverage by portfolio: 48% of variable-rate CRE & 35% of variable-rate MFR. 21% 17% 27% 30% 5% 361 359 363 395 475 0.09% 0.09% 0.22% 0.98% 2.46% 0 400 3Q21 4Q21 1Q22 2Q22 3Q22 Avg. loan yield (in bps) Avg. 1M LIBOR

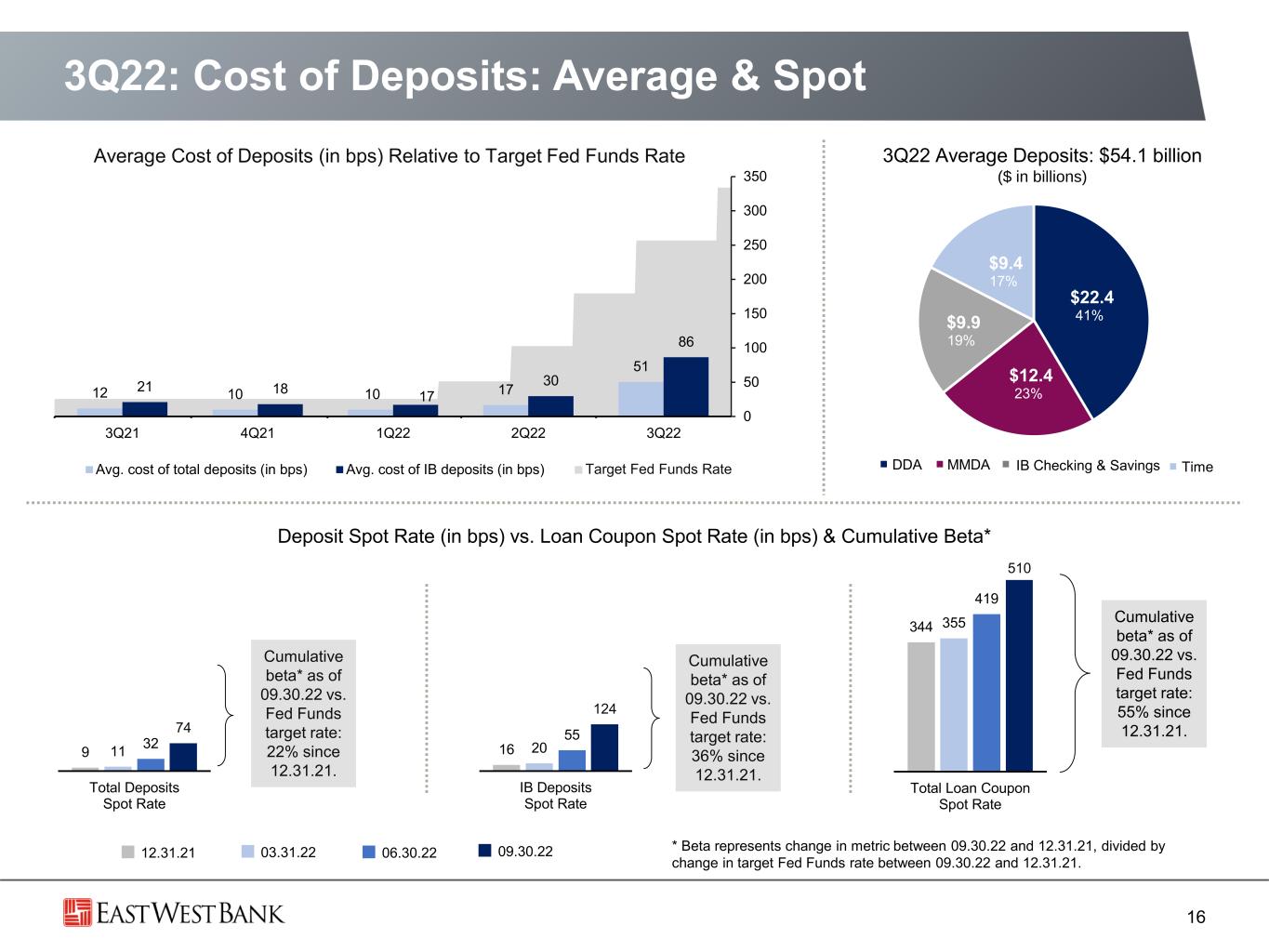

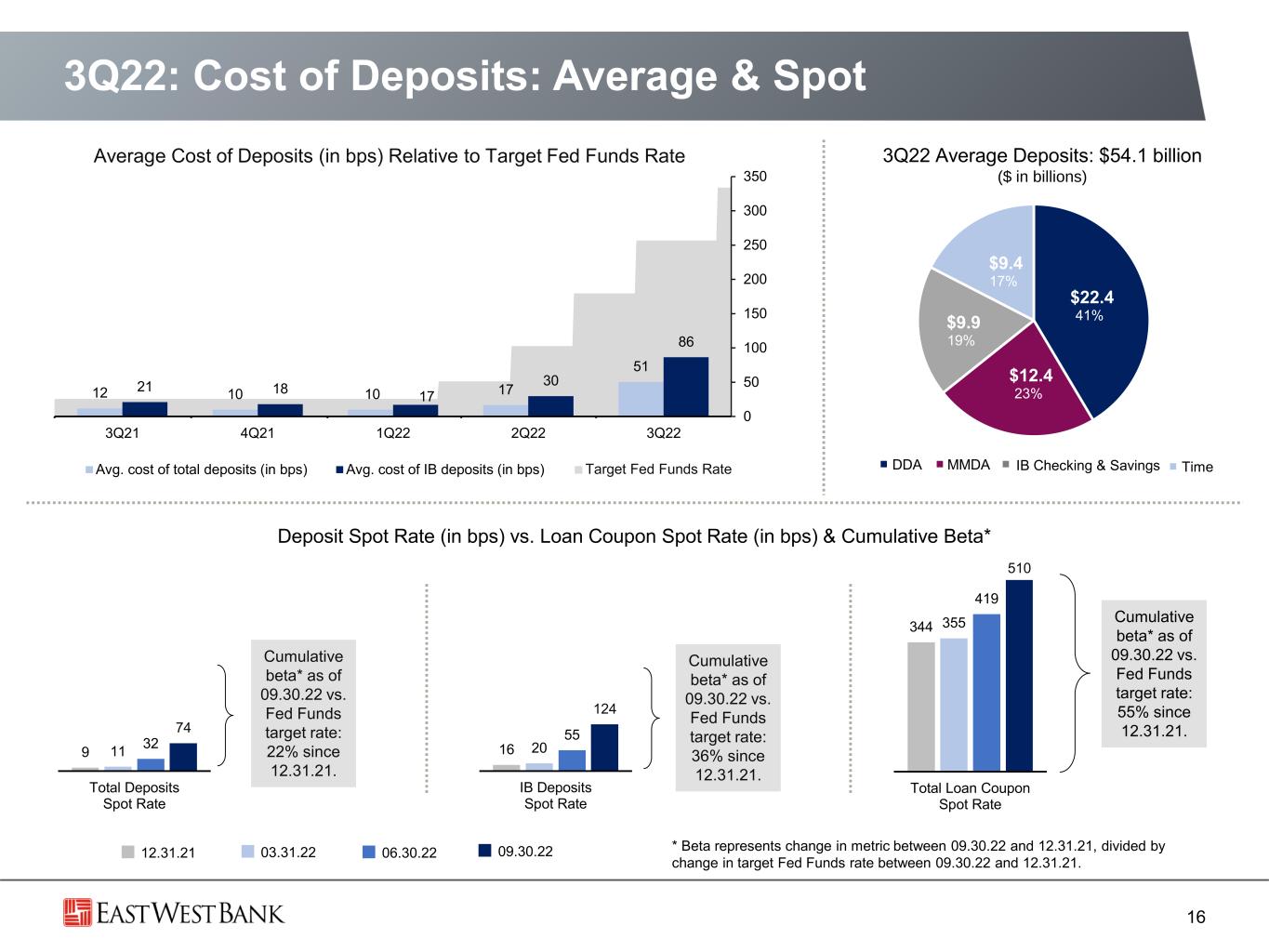

7/1/2021 10/1/2021 1/1/2022 4/1/2022 7/1/2022 12 10 10 17 51 21 18 17 30 86 0 50 100 150 200 250 300 350 3Q21 4Q21 1Q22 2Q22 3Q22 Avg. cost of total deposits (in bps) Avg. cost of IB deposits (in bps) Target Fed Funds Rate 3Q22 Average Deposits: $54.1 billion ($ in billions) 3Q22: Cost of Deposits: Average & Spot 16 Average Cost of Deposits (in bps) Relative to Target Fed Funds Rate Deposit Spot Rate (in bps) vs. Loan Coupon Spot Rate (in bps) & Cumulative Beta* DDA MMDA IB Checking & Savings Time Cumulative beta* as of 09.30.22 vs. Fed Funds target rate: 22% since 12.31.21. Cumulative beta* as of 09.30.22 vs. Fed Funds target rate: 36% since 12.31.21. Cumulative beta* as of 09.30.22 vs. Fed Funds target rate: 55% since 12.31.21. * Beta represents change in metric between 09.30.22 and 12.31.21, divided by change in target Fed Funds rate between 09.30.22 and 12.31.21. $22.4 41% $12.4 23% $9.9 19% $9.4 17% 12.31.21 03.31.22 06.30.22 09.30.22 344 355 419 510 Total Loan Coupon Spot Rate 16 20 55 124 IB Deposits Spot Rate 9 11 32 74 Total Deposits Spot Rate

19 22 24 18 20 20 13 11 10 6 7 95 4 4 2 1 2 $63 $65 $69 3Q21 2Q22 3Q22 Gain on Loans IRC Revenue Wealth Management Fees Foreign Exchange Income Lending Fees Deposit Account Fees 3Q22: Noninterest Income Detail ▪ Total noninterest income: $76mm in 3Q22, compared with $78mm in 2Q22. ▪ Fee income and net gains on sales of loans: $69mm in 3Q22: up 7% Q-o-Q (+26% ann.) and up 10% Y-o-Y. ▪ Q-o-Q increases in wealth management fees, deposit account fees, gain on sale of SBA loans, interest rate contracts revenue, and lending fees. ▪ Q-o-Q decrease in foreign exchange income. 17 Interest Rate Contracts (“IRC”) and Other Derivative Income Detail ($ in millions) 3Q21 2Q22 3Q22 Revenue $ 4.7 $ 3.5 $ 4.0 MTM 2.5 6.3 4.8 Total $ 7.2 $ 9.8 $ 8.8 * Fee income excludes MTM adjustments related to IRC and other derivatives; net gains on sales of securities; other investment income and other income. Fee Income* & Net Gains on Sales of Loans $ i n m ill io n s

$469 $551 $627 35.6% 32.9% 31.2% 3Q21 2Q22 3Q22 Total Revenue Adj. efficiency ratio* 3Q22: Operating Expense & Efficiency 18 Adjusted Noninterest Expense* $ i n m ill io n s Total Revenue & Adjusted Efficiency Ratio* ▪ 3Q22 noninterest expense: $216mm. ▪ 3Q22 adj. noninterest expense*: $196mm, +8% Q-o-Q, driven by higher compensation and employee benefits. ▪ Positive operating leverage: 3Q22 total revenue growth (+14% Q-o-Q) exceeded expense growth. ▪ Improving efficiency: adj. efficiency ratio* was 31% in 3Q22, vs. 33% in 2Q22. ▪ Consistently achieving industry-leading operating efficiency. * See reconciliation of GAAP to non-GAAP financial measures in the appendix and in the Company’s Earnings Press Releases. 106 113 128 16 15 16 12 10 11 9 11 12 24 32 29 $167 $181 $196 3Q21 2Q22 3Q22 All other Deposit related expenses Computer software & Data processing Occupancy & Equipment Comp and employee benefits

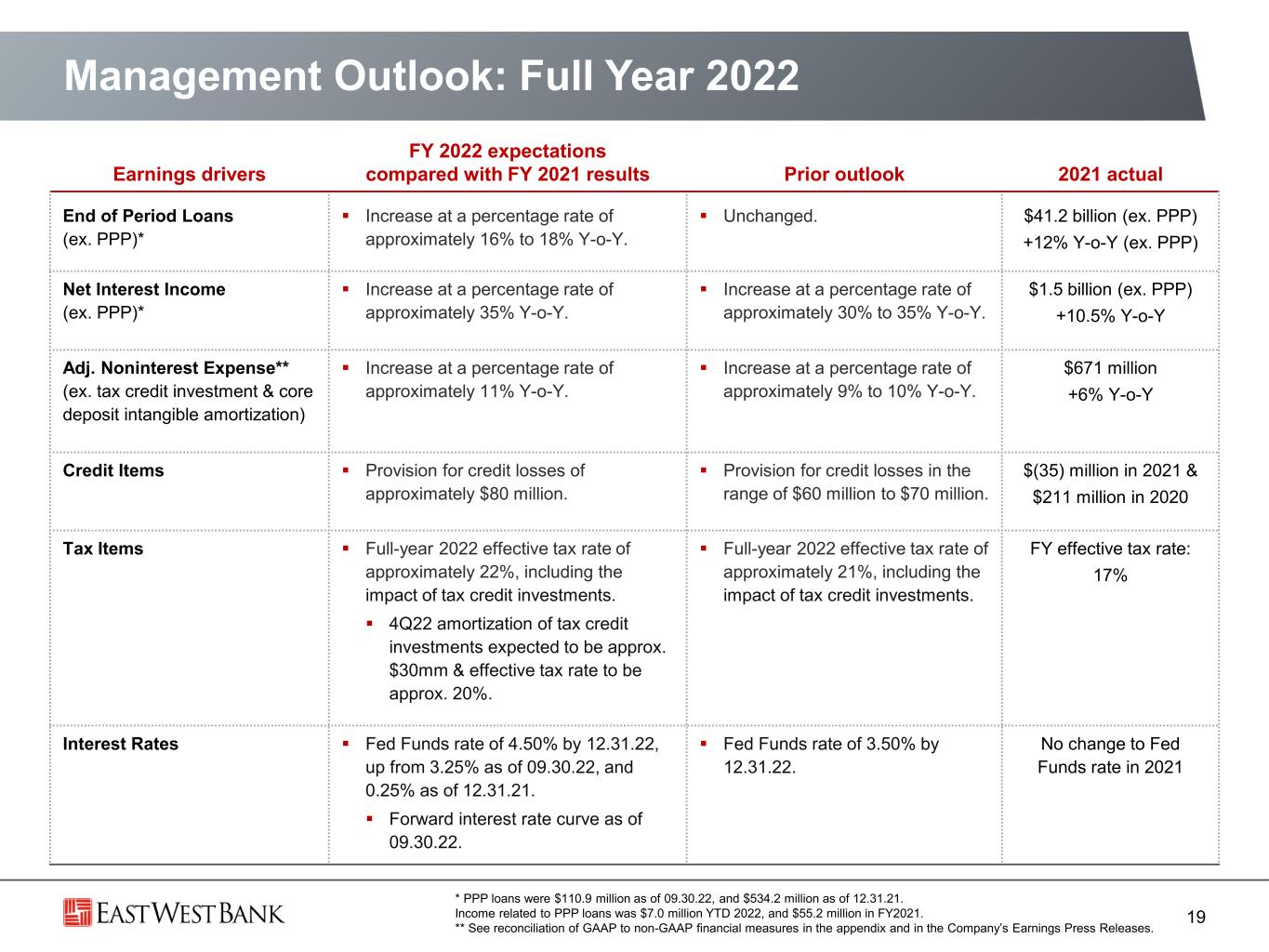

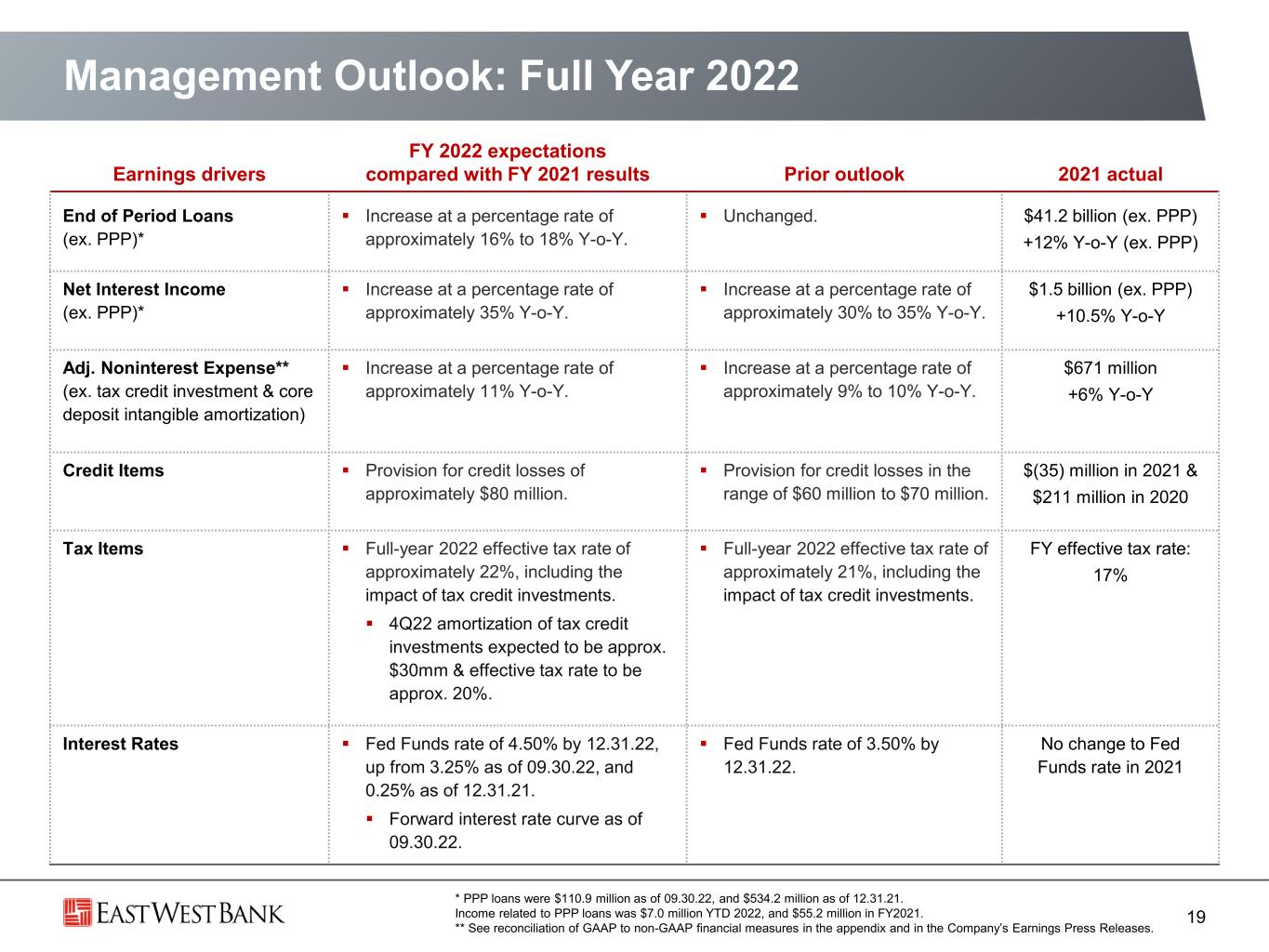

Management Outlook: Full Year 2022 19 Earnings drivers FY 2022 expectations compared with FY 2021 results Prior outlook 2021 actual End of Period Loans (ex. PPP)* ▪ Increase at a percentage rate of approximately 16% to 18% Y-o-Y. ▪ Unchanged. $41.2 billion (ex. PPP) +12% Y-o-Y (ex. PPP) Net Interest Income (ex. PPP)* ▪ Increase at a percentage rate of approximately 35% Y-o-Y. ▪ Increase at a percentage rate of approximately 30% to 35% Y-o-Y. $1.5 billion (ex. PPP) +10.5% Y-o-Y Adj. Noninterest Expense** (ex. tax credit investment & core deposit intangible amortization) ▪ Increase at a percentage rate of approximately 11% Y-o-Y. ▪ Increase at a percentage rate of approximately 9% to 10% Y-o-Y. $671 million +6% Y-o-Y Credit Items ▪ Provision for credit losses of approximately $80 million. ▪ Provision for credit losses in the range of $60 million to $70 million. $(35) million in 2021 & $211 million in 2020 Tax Items ▪ Full-year 2022 effective tax rate of approximately 22%, including the impact of tax credit investments. ▪ 4Q22 amortization of tax credit investments expected to be approx. $30mm & effective tax rate to be approx. 20%. ▪ Full-year 2022 effective tax rate of approximately 21%, including the impact of tax credit investments. FY effective tax rate: 17% Interest Rates ▪ Fed Funds rate of 4.50% by 12.31.22, up from 3.25% as of 09.30.22, and 0.25% as of 12.31.21. ▪ Forward interest rate curve as of 09.30.22. ▪ Fed Funds rate of 3.50% by 12.31.22. No change to Fed Funds rate in 2021 * PPP loans were $110.9 million as of 09.30.22, and $534.2 million as of 12.31.21. Income related to PPP loans was $7.0 million YTD 2022, and $55.2 million in FY2021. ** See reconciliation of GAAP to non-GAAP financial measures in the appendix and in the Company’s Earnings Press Releases.

APPENDIX

Appendix: GAAP to Non-GAAP Reconciliation 21 EAST WEST BANCORP, INC. AND SUBSIDIARIES GAAP TO NON-GAAP RECONCILIATION ($ in thousands) (unaudited) The Company uses certain non-GAAP financial measures to provide supplemental information regarding the Company’s performance. Adjusted efficiency ratio represents adjusted noninterest expense divided by revenue. Adjusted pre-tax, pre-provision profitability ratio represents total revenue less adjusted noninterest expense, divided by average total assets. Adjusted noninterest expense excludes the amortization of tax credit and other investments and the amortization of core deposit intangibles. Management believes that the measures and ratios presented below provide clarity to financial statement users regarding the ongoing performance of the Company and allow comparability to prior periods. (1) Annualized Three Months Ended September 30, 2022 June 30, 2022 September 30, 2021 Net interest income before provision for (reversal of) credit losses $ 551,809 $ 472,952 $ 395,706 Total noninterest income 75,552 78,444 73,109 Total revenue (a) $ 627,361 $ 551,396 $ 468,815 Total noninterest expense (b) $ 215,973 $ 196,860 $ 205,384 Less: Amortization of tax credit and other investments (19,874) (14,979) (38,008) Amortization of core deposit intangibles (485) (488) (705) Adjusted noninterest expense (c) $ 195,614 $ 181,393 $ 166,671 Efficiency ratio (b)/(a) 34.43% 35.70% 43.81% Adjusted efficiency ratio (c)/(a) 31.18% 32.90% 35.55% Adjusted pre-tax, pre-provision income (a)-(c) = (d) $ 431,747 $ 370,003 $ 302,144 Average total assets (e) $ 63,079,444 $ 62,232,841 $ 61,359,533 Adjusted pre-tax, pre-provision profitability ratio (1) (d)/(e) 2.72% 2.38% 1.95% Adjusted noninterest expense/average assets (1) (c)/(e) 1.23% 1.17% 1.08%

Appendix: GAAP to Non-GAAP Reconciliation 22 EAST WEST BANCORP, INC. AND SUBSIDIARIES GAAP TO NON-GAAP RECONCILIATION ($ in thousands) (unaudited) The Company uses certain non-GAAP financial measures to provide supplemental information regarding the Company’s performance. Tangible equity and tangible equity to tangible assets ratio are non-GAAP financial measures. Tangible equity and tangible assets represent stockholders’ equity and total assets, respectively, which have been reduced by goodwill and other intangible assets. Given that the use of such measures and ratios is more prevalent in the banking industry, and such measures and ratios are used by banking regulators and analysts, the Company has included them below for discussion. (1) Includes core deposit intangibles and mortgage servicing assets. September 30, 2022 June 30, 2022 September 30, 2021 Stockholders’ equity (a) $ 5,660,668 $ 5,609,482 $ 5,690,201 Less: Goodwill (465,697) (465,697) (465,697) Other intangible assets (1) (8,667) (8,537) (9,849) Tangible equity (b) $ 5,186,304 $ 5,135,248 $ 5,214,655 Total assets (c) $ 62,576,061 $ 62,394,283 $ 60,959,110 Less: Goodwill (465,697) (465,697) (465,697) Other intangible assets (1) (8,667) (8,537) (9,849) Tangible assets (d) $ 62,101,697 $ 61,920,049 $ 60,483,564 Total stockholders’ equity to total assets ratio (a)/(c) 9.05% 8.99% 9.33% Tangible equity to tangible assets ratio (b)/(d) 8.35% 8.29% 8.62%

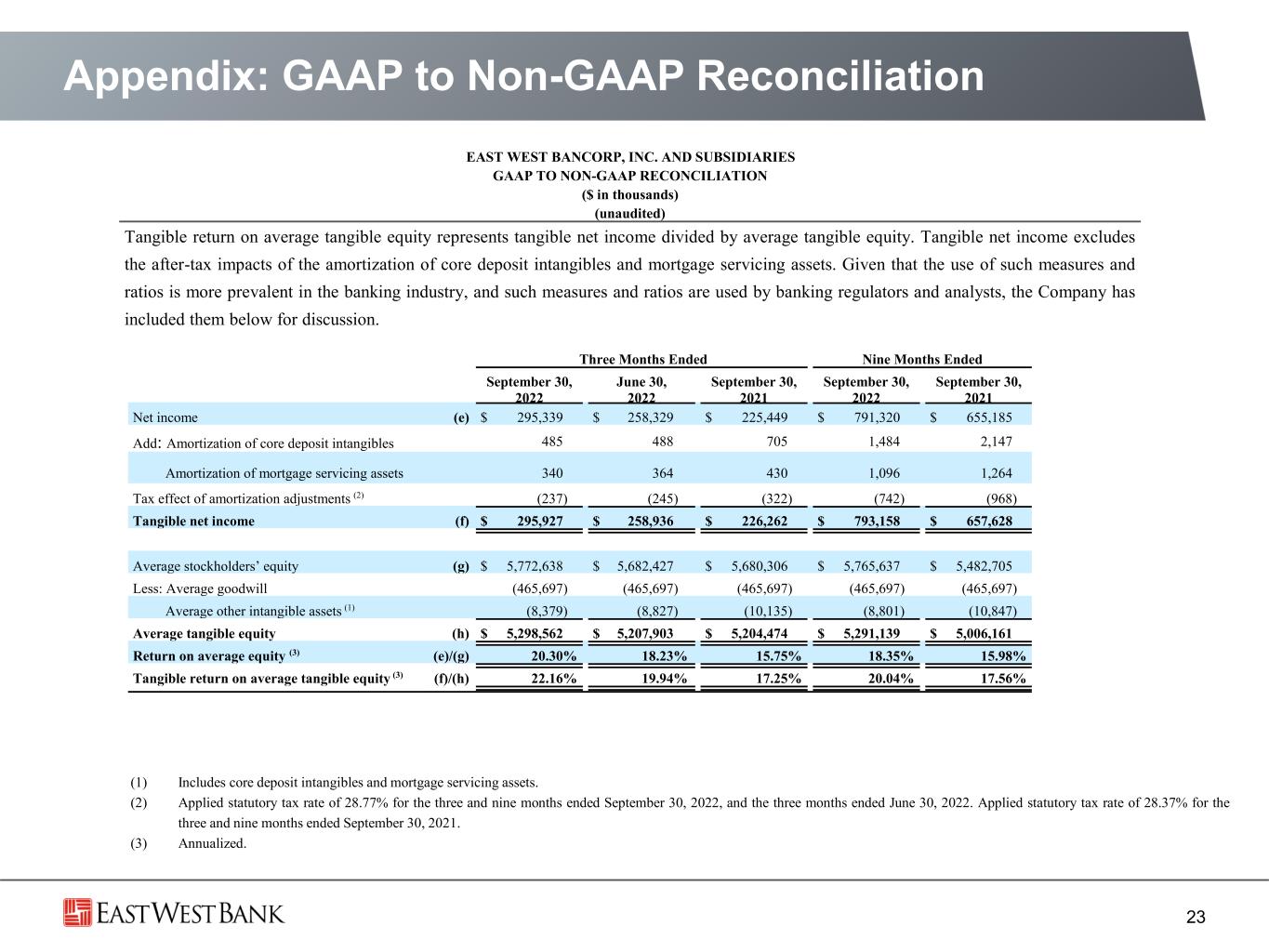

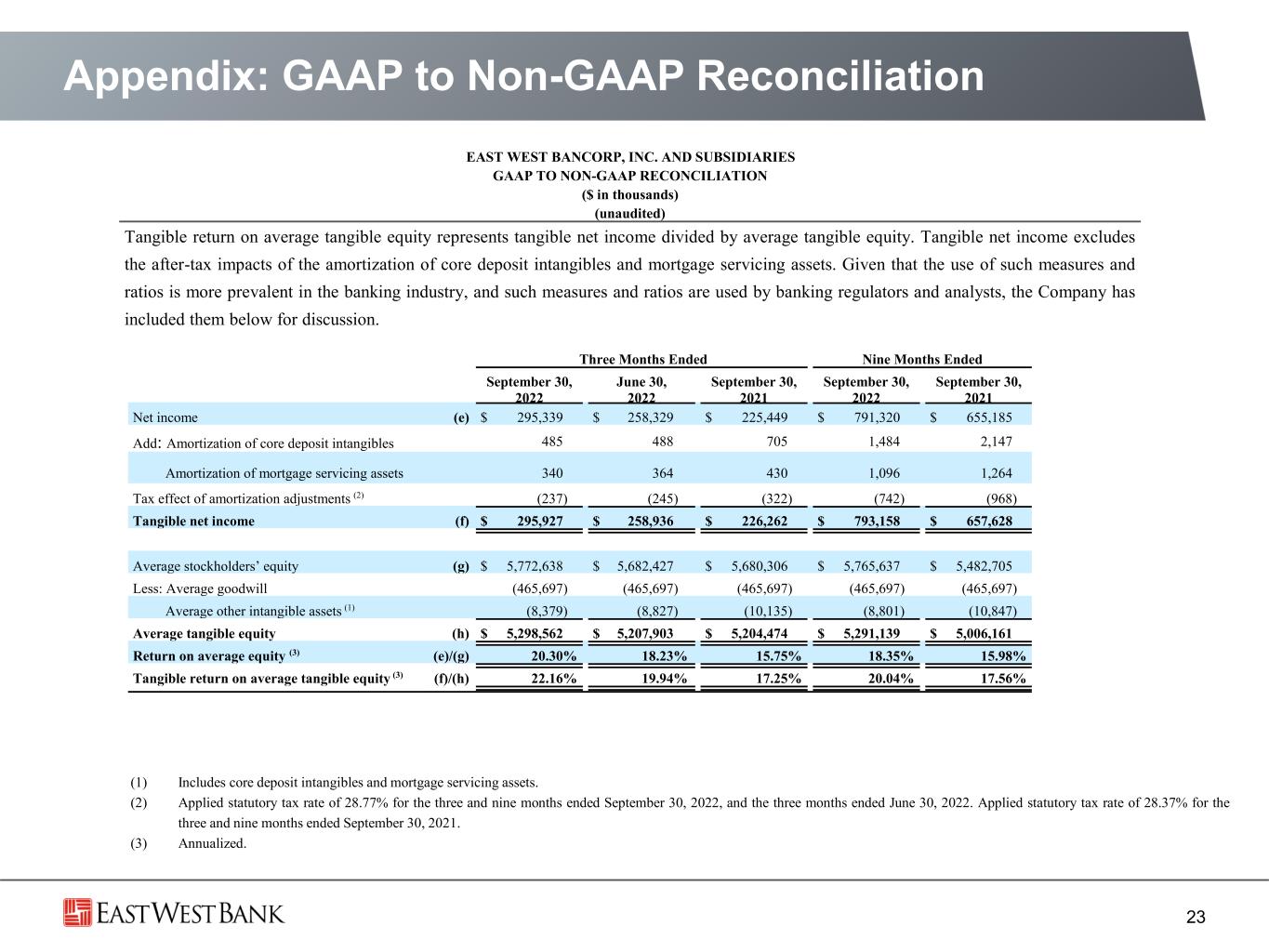

Appendix: GAAP to Non-GAAP Reconciliation 23 EAST WEST BANCORP, INC. AND SUBSIDIARIES GAAP TO NON-GAAP RECONCILIATION ($ in thousands) (unaudited) Tangible return on average tangible equity represents tangible net income divided by average tangible equity. Tangible net income excludes the after-tax impacts of the amortization of core deposit intangibles and mortgage servicing assets. Given that the use of such measures and ratios is more prevalent in the banking industry, and such measures and ratios are used by banking regulators and analysts, the Company has included them below for discussion. (1) Includes core deposit intangibles and mortgage servicing assets. (2) Applied statutory tax rate of 28.77% for the three and nine months ended September 30, 2022, and the three months ended June 30, 2022. Applied statutory tax rate of 28.37% for the three and nine months ended September 30, 2021. (3) Annualized. Three Months Ended Nine Months Ended September 30, 2022 June 30, 2022 September 30, 2021 September 30, 2022 September 30, 2021 Net income (e) $ 295,339 $ 258,329 $ 225,449 $ 791,320 $ 655,185 Add: Amortization of core deposit intangibles 485 488 705 1,484 2,147 Amortization of mortgage servicing assets 340 364 430 1,096 1,264 Tax effect of amortization adjustments (2) (237) (245) (322) (742) (968) Tangible net income (f) $ 295,927 $ 258,936 $ 226,262 $ 793,158 $ 657,628 Average stockholders’ equity (g) $ 5,772,638 $ 5,682,427 $ 5,680,306 $ 5,765,637 $ 5,482,705 Less: Average goodwill (465,697) (465,697) (465,697) (465,697) (465,697) Average other intangible assets (1) (8,379) (8,827) (10,135) (8,801) (10,847) Average tangible equity (h) $ 5,298,562 $ 5,207,903 $ 5,204,474 $ 5,291,139 $ 5,006,161 Return on average equity (3) (e)/(g) 20.30% 18.23% 15.75% 18.35% 15.98% Tangible return on average tangible equity (3) (f)/(h) 22.16% 19.94% 17.25% 20.04% 17.56%