As filed with the Securities and Exchange Commission on April 10,2006 Registration No. 333-126687

UNITED STATES SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

___________________

FORM SB-2

POST-EFFECTIVE AMENDMENT NO. 2

TO

REGISTRATION STATEMENT

UNDER

THE SECURITIES ACT OF 1933

___________________

PharmaFrontiers Corp.

(Name of small business issuer on its charter)

Texas | 2834 | 76-0333165 |

| (State or Other Jurisdiction of Incorporation or Organization) | (Primary Standard Industrial Classification Code Number) | (I.R.S. Employer Identification Number) |

2635 N. Crescent Ridge Drive

The Woodlands, Texas 77381

(281) 272-9331

(Address and telephone number

of principal executive offices and principal place of business)

___________________

C. William Rouse

2635 N. Crescent Ridge Drive

The Woodlands, Texas 77381

(281) 272-9331

(Name, address and telephone number

of agent for service)

___________________

Copy to:

Michael C. Blaney

Vinson & Elkins L.L.P.

1001 Fannin, Suite 2300

Houston, TX 77002

(713) 758-2222

___________________

Approximate date of commencement of proposed sale to the public: As soon as practicable after the effective date of this registration statement.

If the securities being registered on this form are to be offered on a delayed or continuous basis pursuant to Rule 415 under the Securities Act of 1933, check the following box: x

If this form is filed to register additional securities for an offering pursuant to Rule 462(b) under the Securities Act, check the following box and list the Securities Act registration statement number of the earlier effective registration statement for the same offering: o

If this Form is a post-effective amendment filed pursuant to Rule 462(c) under the Securities Act, check the following box and list the Securities Act registration statement number of the earlier effective registration statement for the same offering: o

If this Form is a post-effective amendment filed pursuant to Rule 462(d) under the Securities Act, check the following box and list the Securities Act registration statement number of the earlier effective registration statement for the same offering: o

If delivery of the prospectus is expected to be made pursuant to Rule 434, check the following box: o

PharmaFrontiers Corp.

25,217,237 Shares of Common Stock

This prospectus relates to the resale from time to time by the selling stockholders of up to 25,217,237 shares of our common stock, including 12,723,562 shares of common stock previously issued and 12,493,678 shares of common stock issuable upon the exercise of common stock purchase warrants. A series of warrants underlying 10,411,400 shares of common stock expired on February 17, 2006. The selling stockholders may sell the shares of common stock from time to time in the principal market on which the stock is traded at the prevailing market price or in negotiated transactions.

Shares of our common stock are traded on the NASD OTC Bulletin Board under the symbol “PFTR.OB.” April 6, 2006, the last reported sales price for our common stock on the OTC Bulletin Board was $0.56 per share.

We will not receive any proceeds from the sale of the shares of our common stock covered by this prospectus.

___________________________________

Investing in our common stock involves a high degree of risk. You should read carefully this entire prospectus, including the section captioned “Risk Factors” beginning on page 3, before making a decision to purchase our stock.

___________________________________

Neither the Securities and Exchange Commission nor any state securities commission has approved or disapproved of these securities or passed upon the accuracy or adequacy of this prospectus. Any representation to the contrary is a criminal offense.

The date of this prospectus is April 10, 2006.

TABLE OF CONTENTS

Page | |

| PROSPECTUS SUMMARY | 1 |

| RISK FACTORS | 3 |

| FORWARD LOOKING STATEMENTS | 9 |

| USE OF PROCEEDS | 10 |

| PRICE RANGE OF OUR COMMON STOCK AND DIVIDEND POLICY | 10 |

| SELECTED HISTORICAL FINANCIAL DATA | 11 |

| MANAGEMENT’S DISCUSSION AND ANALYSIS OF FINANCIAL CONDITIONS AND RESULTS OF OPERATIONS | 11 |

| OUR BUSINESS | 16 |

| MANAGEMENT | 30 |

| EXECUTIVE COMPENSATION | 34 |

| SECURITY OWNERSHIP OF CERTAIN BENEFICIAL OWNERS AND MANAGEMENT | 36 |

| SELLING STOCKHOLDERS | 38 |

| CERTAIN RELATIONSHIPS AND RELATED PARTY TRANSACTIONS | 61 |

| DESCRIPTION OF SECURITIES | 61 |

| PLAN OF DISTRIBUTION | 63 |

| LEGAL MATTERS | 65 |

| EXPERTS | 65 |

| WHERE YOU CAN FIND MORE INFORMATION | 65 |

| INDEX TO FINANCIAL STATEMENTS | 67 |

| INFORMATION NOT REQUIRED IN PROSPECTUS | 69 |

You should rely only on the information contained in this prospectus. We have not authorized anyone to provide you with information that is different. This prospectus may only be used where it is legal to sell these shares of our common stock. The information in this prospectus may only be accurate as of the date of this prospectus.

This prospectus provides you with a general description of the shares of our common stock that the selling stockholders may offer. Each time a selling stockholder sells shares of our common stock, the selling stockholder is required to provide you with a prospectus containing specific information about the selling stockholder and the terms of the shares of our common stock being offered to you.

This prospectus is part of a registration statement that we filed with the Securities and Exchange Commission for a continuous offering. Under this prospectus, the selling stockholders may, from time to time, sell the shares of our common stock described in this prospectus in one or more offerings. This prospectus may be supplemented from time to time to add, update or change information in this prospectus. Any statement contained in this prospectus will be deemed to be modified or superseded for the purposes of this prospectus to the extent that a statement contained in a prospectus supplement modifies such statement. Any statement so modified will be deemed to constitute a part of this prospectus only as so modified, and any statement so modified will be deemed to constitute a part of this prospectus.

The registration statement containing this prospectus, including the exhibits to the registration statement, provides additional information about us, the selling stockholders and the shares of our common stock offered under this prospectus. The registration statement, including the exhibits, can be read on the SEC website or at the SEC offices mentioned under the heading “Where You Can Find More Information.”

-i-

PROSPECTUS SUMMARY

The following summary highlights selected information from this prospectus and does not contain all of the information that you should consider before investing in our common stock. This prospectus contains information regarding our businesses and detailed financial information. You should carefully read this entire prospectus, including the historical financial statements and related notes, before making an investment decision.

In this prospectus, “PharmaFrontiers Corp.,” the “company,” “we,” “us” or “our” refer to PharmaFrontiers Corp., a Texas corporation, and its subsidiaries, except where otherwise indicated or required by context.

Our Business

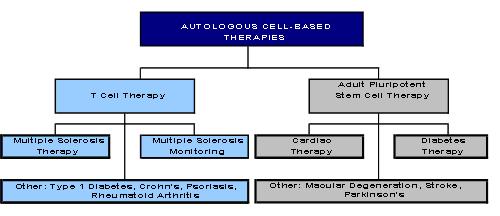

We are a biopharmaceutical company engaged in developing autologous personalized cell therapies. Our strategy is to develop and commercialize cell therapies to treat several major diseases including multiple sclerosis, cardiovascular diseases, and diabetes. We have an exclusive license to an individualized T cell therapy that is in FDA Phase I/II human dose ranging clinical trials to evaluate its safety and effectiveness in treating multiple sclerosis. We have an exclusive worldwide license for the intellectual property rights and research results of an autologous T cell vaccine for rheumatoid arthritis from the Shanghai Institutes for Biological Sciences (SIBS), Chinese Academy of Sciences of the People's Republic of China. We also have an exclusive license to a stem cell technology in which adult pluripotent stem cells are derived from monocytes obtained from the patient’s own blood. We are initially pursuing indications in heart failure and Type I diabetes with our stem cell therapy.

Autologous therapies use cells or other materials from the patient’s own body to create treatments for the patient, thus preventing rejection complications that result when “foreign” or “non-self” cells are introduced into a patient. Cellular therapies are expected to play a large role in the treatment and cure of a broad spectrum of human diseases. According to independent market researchers, cellular therapies along with their related technologies, such as diagnostics and blood banking, may exceed $30 billion by 2010.

Our multiple sclerosis cell therapy, Tovaxin™, is currently in Phase I/II studies. Tovaxin™ consists of modified autoreactive T cells. Multiple sclerosis is a result of a person’s own T cells attacking the myelin sheath that coats the nerve cells of the central nervous system. These T cells, that attack a person’s own body, are referred to as “autoreactive” T cells. In our treatment the T cells are taken from the patient, modified and returned to the patient. The modified T cells cause an immune response directed at the autoreactive T cells in the patient’s body. This immune response reduces the level of autoreactive T cells and potentially allows the myelin sheath to be repaired. In addition, we are evaluating whether this technology will allow us to diagnose multiple sclerosis and determine the severity of the disease through an analysis of the level of autoreactive T cells in a patient’s blood.

Two clinical studies of Tovaxin™ have reached critical milestones:

| · | The dose escalation study was designed for patients with relapsing-remitting or secondary-progressive MS, intolerant of, or having failed, current therapy. Blood was obtained from each patient from which T cells reactive to two peptides each of three proteins (MBP, PLP, and MOG) were expanded ex vivo and prepared as a trivalent formulation of MRTCs. The MRTCs were attenuated by Cesium137 irradiation prior to patients receiving subcutaneous injections of either 6-9 million cells (Dose 1) or 30-45 million cells (Dose 2) at weeks 0, 4, 12 and 20. MRTC frequencies were performed at baseline and weeks 5, 13, 21, 28 and 52. Patients were evaluated for changes in EDSS, MSIS and exacerbations. |

-1-

Tovaxin is a patient-specific therapeutic vaccination strategy for MS patients. To formulate Tovaxin T cell vaccine, the patient's own myelin peptide-specific activated T cell lines are harvested and attenuated on the day of vaccine administration.

The study's results demonstrated that MRTCs in the peripheral blood were depleted in a dose dependent manner and analyses showed reductions in all three types of MRTCs at all follow-up visits. All patients in the Dose 2 group had a 100% reduction in MRTC counts at the week five follow-up visit. Percentage reductions were greater in the Dose 2 group than in the Dose 1 group at every follow-up visit. Correlation between the reduction in overall MRTC frequencies and the physical component of the MSIS (p=0.0086) was strong. There was a trend to improved EDSS (p=0.0561). The annual relapse rate (ARR) for the patients prior two years before therapy was 1.28 and following therapy the ARR was 0.10 (92 percent reduction) adjusted for the number of months in the study. The treatment appears to be safe and well tolerated with minimal adverse events and no dose-limiting toxicities.

| · | Phase I/II extension study: The analysis of data on ten (10) patients that have been enrolled in a Phase I/II open-label extension study of Tovaxin(TM) T-Cell vaccine in worsening multiple sclerosis indicates that the treatment is safe and well-tolerated. Adverse events were mild or moderate in severity. None of the ten patients reported an MS exacerbation while on study. Analysis of myelin-reactive T-cell (MRTC) counts showed a percentage reduction from baseline at 3, 6, and 9 months, for all three types of MRTC, as well as the Total MRTC. Reductions in disease assessment disability scores were observed at all follow-up visits. No therapy induced lesions were observed on week 52 MRI's for three patients. These results suggest that MRTC vaccination is safe and well tolerated and also suggest that MRTC vaccination reduces MRTC counts, as well as EDSS and MSIS scores. |

In October 2005, the FDA approved the protocol for our Phase IIb clinical trial of Tovaxin. We intend to enroll the first patient in this pivotal Phase IIb in the first half of 2006.

Our Rheumatoid Arthritis (RA) T-cell vaccination (TCV) technology is conceptually similar to Tovaxin. RA is an autoimmune T-cell-mediated disease in which Pathogenic T-cells trigger an inflammatory autoimmune response of the synovial joints of the wrists, shoulders, knees, ankles and feet which causes pain, stiffness, and swelling around the joints. Our RA TCV technology allows the isolation of these pathogenic T-cells from synovial fluid drawn from a patient. We expand and modify these T-cells in our laboratory. The modified T-cells are injected subcutaneously into patients thereby inducing an immune response directed at the Pathogenic T-cells in the patient’s body. This immune response reduces the level of Pathogenic T-cells and potentially allows the reduction of joint swelling in RA patients. Human trials that have been conducted in China show minimal side-effects and promising efficacy measured as a reduction of joint swelling following the T-cell vaccination.

Our stem cell technology allows us to create adult pluripotent stem cells from monocytes isolated from blood drawn from the patient. We believe that these stem cells, if successfully developed, may provide the basis for therapies to treat a variety of diseases and conditions. We anticipate that our stem cell technology will have a significant competitive advantage over many of the other stem cell technologies. The peripheral blood monocytes, used by our technology to produce stem cells, have the advantage of being relatively abundant and easy and cost effective to obtain. Our technology does not have the collection and storage difficulties presented by umbilical cord blood or the controversial ethical and regulatory issues associated with embryonic stem cells. In addition, our technology is less difficult and less risky than collecting adult stem cells from tissues such as bone marrow, spinal fluid or adipose (fat) tissue. Furthermore, our stem cells are pluripotent, whereas adult stem cells used in competitive technologies are not likely to be pluripotent.

-2-

Our stem cell technology will also avoid rejection issues because it is autologous (“self”). This is as opposed to the embryonic, umbilical, and some adult stem cell technologies, which in some cases must be taken from one individual and given to another. Further, we believe our stem cell therapies will be regulated as autologous “manipulated” non-homologous use cell therapies. Thus, we use one’s own stem cells, and we therefore do not expect to encounter the same significant pre-clinical and clinical development regulatory hurdles that embryonic, umbilical, and some adult stem cells therapies are expected to face.

Initially we are conducting pre-clinical research to develop stem cell therapies to treat Type I diabetes and heart failure. We believe that with our stem cell technology plus our additional technology related to the differentiation of stem cells into islet cells, we will be able to create insulin producing islet cells derived from the patient’s own blood. We are currently conducting laboratory research and plan to move expeditiously through pre-clinical development of our diabetes stem cell therapy and, if successful, initiate human testing in 2006.

Our Executive Offices

Our principal executive and administrative office facility is located in The Woodlands, Texas at 2635 N. Crescent Ridge Drive, The Woodlands, Texas 77381 and our telephone number is (281) 272-9331. We maintain a website at www.pharmafrontierscorp.com, however the information on our website is not part of this prospectus, and you should rely only on information contained in this prospectus when making a decision as to whether or not to invest in shares of our common stock.

RISK FACTORS

The shares offered hereby have not been approved or disapproved by the SEC or the securities regulatory authority of any state, nor has any such regulatory body reviewed this memorandum for accuracy or completeness. The shares offered hereby are speculative, involve an unusually high degree of risk and should only be purchased by those who can afford to lose their entire investment. Therefore, prospective investors should carefully consider the following risk factors before purchasing the shares offered hereby.

The following factors affect our business and the industry in which we operate. The risks and uncertainties described below are not the only ones that we face. Additional risks and uncertainties not presently known or that we currently consider immaterial may also have an adverse effect on our business. If any of the matters discussed in the following risk factors were to occur, our business, financial condition, results of operations, cash flows, or prospects could be materially adversely affected.

Risks Related to Our Business

Our business is at an early stage of development.

Our business is at an early stage of development. We do not have any products in late-stage clinical trials or on the market. We are still in the early stages of identifying and conducting research on potential products. Only one of our products has progressed to the stage of being studied in human clinical trials. Our potential products will require significant research and development and preclinical and clinical testing prior to regulatory approval in the United States and other countries. We may not be able to develop any products, to obtain regulatory approvals, to enter clinical trials for any of our product candidates, or to commercialize any products. Our product candidates may prove to have undesirable and unintended side effects or other characteristics adversely

-3-

affecting their safety, efficacy or cost-effectiveness that could prevent or limit their use. Any product using any of our technology may fail to provide the intended therapeutic benefits, or achieve therapeutic benefits equal to or better than the standard of treatment at the time of testing or production.

We have a history of operating losses and do not expect to be profitable in the near future.

We have not generated any profits since our entry into the biotechnology business, have no source of revenues, and have incurred significant operating losses. We expect to incur additional operating losses for the foreseeable future and, as we increase our research and development activities, we expect our operating losses to increase significantly. We do not have any sources of revenues and may not have any in the foreseeable future.

We will need additional capital to conduct our operations and develop our products and our ability to obtain the necessary funding is uncertain.

We need to obtain significant additional capital resources from sources including equity and/or debt financings, license arrangements, grants and/or collaborative research arrangements in order to develop products and continue our business. As of December 31, 2005, we had cash and cash equivalents of approximately $2.5 million. Our current burn rate is approximately $400,000 per month excluding capital expenditures. However, this burn rate is expected to increase to $800,000 per month once the IIb clinical trails begin. We will need to raise additional capital to fund our working capital needs during the second quarter of 2006. We do not have any credit facilities available with financial institutions or any other third parties and as such we must rely upon best efforts third-party funding and we can provide no assurance that we will be successful in any future investment best efforts. The failure to raise such funds will necessitate the curtailment of operations and delay of the start of the clinical trials. The timing and degree of any future capital requirements will depend on many factors, including:

| · | the accuracy of the assumptions underlying our estimates for capital needs in 2005 and beyond; |

| · | scientific progress in our research and development programs; |

| · | the magnitude and scope of our research and development programs; |

| · | our ability to establish, enforce and maintain strategic arrangements for research, development, clinical testing, manufacturing and marketing; |

| · | our progress with preclinical development and clinical trials; |

| · | the time and costs involved in obtaining regulatory approvals; |

| · | the costs involved in preparing, filing, prosecuting, maintaining, defending and enforcing patent claims; and |

| · | the number and type of product candidates that we pursue. |

We do not have any committed sources of capital, although we have issued and outstanding warrants that, if exercised, would result in an equity capital raising transaction. Additional financing through strategic collaborations, public or private equity financings, capital lease transactions or other financing sources may not be available on acceptable terms, or at all. Additional equity financings could result in significant dilution to our stockholders. Further, if additional funds are obtained through arrangements with collaborative partners, these arrangements may require us to relinquish rights to some of our technologies, product candidates or products that we would otherwise seek to develop and commercialize ourselves. If sufficient capital is not available, we may be required to delay, reduce the scope of or eliminate one or more of our programs, any of which could have a material adverse effect on our financial condition or business prospects.

-4-

Approximately 88% of our total assets are comprised of intangible assets that are subject to review on a periodic basis to determine whether an impairment on these assets is required. An impairment would not only greatly diminish our assets, but would also require us to record a significant non-cash expense charge.

We are required under generally accepted accounting principles to review our intangible assets for impairment when events or changes in circumstances indicate the carrying value may not be recoverable. Goodwill is required to be tested for impairment at least annually. At December 31, 2005, our intangible assets, consisting of the University of Chicago license and acquired intangible assets from the Opexa acquisition that is an inseparable group of patents and licenses that can’t function independently, were approximately $26.1 million. If management determines that impairment exists, we will be required to record a significant charge to expense in our financial statements during the period in which any impairment of our goodwill is determined.

Clinical trials are subject to extensive regulatory requirements, very expensive, time-consuming and difficult to design and implement. Our products may fail to achieve necessary safety and efficacy endpoints during clinical trials.

Human clinical trials are very expensive and difficult to design and implement, in part because they are subject to rigorous regulatory requirements. The clinical trial process is also time consuming. We estimate that clinical trials of our product candidates will take at least several years to complete. Furthermore, failure can occur at any stage of the trials, and we could encounter problems that cause us to abandon or repeat clinical trials. The commencement and completion of clinical trials may be delayed by several factors, including:

| · | unforeseen safety issues; |

| · | determination of dosing issues; |

| · | lack of effectiveness during clinical trials; |

| · | slower than expected rates of patient recruitment; |

| · | inability to monitor patients adequately during or after treatment; and |

| · | inability or unwillingness of medical investigators to follow our clinical protocols. |

In addition, we or the FDA may suspend our clinical trials at any time if it appears that we are exposing participants to unacceptable health risks or if the FDA finds deficiencies in our IND submissions or the conduct of these trials.

We are dependent upon our management team and a small number of employees.

Our business strategy is dependent upon the skills and knowledge of our management team. We believe that the special knowledge of these individuals gives us a competitive advantage. If any critical employee leaves, we may be unable on a timely basis to hire suitable replacements to effectively operate our business. We also operate with a very small number of employees and thus have little or no backup capability for their activities. The loss of the services of any member of our management team or the loss of a number of other employees could have a material adverse effect on our business.

-5-

We are dependent on contract research organizations and other contractors for clinical testing and for certain research and development activities, thus the timing and adequacy of our clinical trials and such research activities are, to a certain extent, beyond our control.

The nature of clinical trials and our business strategy requires us to rely on contract research organizations, independent clinical investigators and other third party service providers to assist us with clinical testing and certain research and development activities. As a result, our success is dependent upon the success of these outside parties in performing their responsibilities. Although we believe our contractors are economically motivated to perform on their contractual obligations, we cannot directly control the adequacy and timeliness of the resources and expertise applied to these activities by our contractors. If our contractors do not perform their activities in an adequate or timely manner, the development and commercialization of our drug candidates could be delayed.

Our current research and manufacturing facility is not large enough to manufacture future stem cell and T-cell therapies.

We conduct our research and development in a 10,000 square foot facility in The Woodlands, Texas, which includes a 1,200 square foot suite of three rooms for the future manufacture of stem cell and T-cell therapies through Phase III trials. Our current facility is not large enough to conduct commercial-scale manufacturing operations. We will need to expand further our manufacturing staff and facility, obtain a new facility or contract with corporate collaborators or other third parties to assist with future drug production.

In the event that we decide to establish a commercial-scale manufacturing facility, we will require substantial additional funds and will be required to hire and train significant numbers of employees and comply with applicable regulations, which are extensive. We do not have funds available for building a manufacturing facility, and we may not be able to build a manufacturing facility that both meets regulatory requirements and is sufficient for our commercial-scale manufacturing.

We may arrange with third parties for the manufacture of our future products. However, our third-party sourcing strategy may not result in a cost-effective means for manufacturing our future products. If we employ third-party manufacturers, we will not control many aspects of the manufacturing process, including compliance by these third parties with the FDA’s current Good Manufacturing Practices and other regulatory requirements. We further may not be able to obtain adequate supplies from third-party manufacturers in a timely fashion for development or commercialization purposes, and commercial quantities of products may not be available from contract manufacturers at acceptable costs.

Patents obtained by other persons may result in infringement claims against us that are costly to defend and which may limit our ability to use the disputed technologies and prevent us from pursuing research and development or commercialization of potential products.

A number of pharmaceutical, biotechnology and other companies, universities and research institutions have filed patent applications or have been issued patents relating to cell therapy, stem cells, T-cells, and other technologies potentially relevant to or required by our expected products. We cannot predict which, if any, of such applications will issue as patents or the claims that might be allowed. We are aware that a number of companies have filed applications relating to stem cells. We are also aware of a number of patent applications and patents claiming use of stem cells and other modified cells to treat disease, disorder or injury.

-6-

If third party patents or patent applications contain claims infringed by either our licensed technology or other technology required to make and use our potential products and such claims are ultimately determined to be valid, there can be no assurance that we would be able to obtain licenses to these patents at a reasonable cost, if at all, or be able to develop or obtain alternative technology. If we are unable to obtain such licenses at a reasonable cost, we may not be able to develop some products commercially. There can be no assurance that we will not be obliged to defend ourselves in court against allegations of infringement of third party patents. Patent litigation is very expensive and could consume substantial resources and create significant uncertainties. An adverse outcome in such a suit could subject us to significant liabilities to third parties, require disputed rights to be licensed from third parties, or require us to cease using such technology.

If we are unable to obtain future patents and other proprietary rights our operations will be significantly harmed.

Our ability to compete effectively is dependent in part upon obtaining patent protection relating to our technologies. The patent positions of pharmaceutical and biotechnology companies, including ours, are uncertain and involve complex and evolving legal and factual questions. The coverage sought in a patent application can be denied or significantly reduced before or after the patent is issued. Consequently, we do not know whether the patent applications for our technology will result in the issuance of patents, or if any future patents will provide significant protection or commercial advantage or will be circumvented by others. Since patent applications are secret until the applications are published (usually eighteen months after the earliest effective filing date), and since publication of discoveries in the scientific or patent literature often lags behind actual discoveries, we cannot be certain that the inventors of our licensed patents were the first to make the inventions covered by the patent applications or that the licensed patent applications were the first to be filed for such inventions. There can be no assurance that patents will issue from the patent applications or, if issued, that such patents will be of commercial benefit to us, afford us adequate protection from competing products, or not be challenged or declared invalid.

Our competition includes fully integrated biopharmaceutical and pharmaceutical companies that have significant advantages over us.

The markets for therapeutic stem cell products, multiple sclerosis products, and rheumatoid arthritis products are highly competitive. We expect that our most significant competitors are fully integrated pharmaceutical companies and more established biotechnology companies. These companies are developing stem cell-based products and they have significantly greater capital resources and expertise in research and development, manufacturing, testing, obtaining regulatory approvals, and marketing than we currently do. Many of these potential competitors are further along in the process of product development and also operate large, company-funded research and development programs. As a result, our competitors may develop more competitive or affordable products, or achieve earlier patent protection or product commercialization than we are able to achieve. Competitive products may render any products or product candidates that we develop obsolete.

If we fail to meet our obligations under our license agreements, we may lose our rights to key technologies on which our business depends.

Our business depends on three licenses from third parties. Additionally, any business relating to a T cell vaccine for rheumatoid arthritis depends upon a license from the Shanghai Institute for Biological Science. These third party license agreements impose obligations on us, such as payment obligations and obligations to diligently pursue development of commercial products under the licensed patents. If a licensor believes that we have failed to meet our obligations under a l icense agreement, the licensor could

-7-

seek to limit or terminate our license rights, which could lead to costly and time-consuming litigation and, potentially, a loss of the licensed rights. During the period of any such litigation, our ability to carry out the development and commercialization of potential products could be significantly and negatively affected. If our license rights were restricted or ultimately lost, our ability to continue our business based on the affected technology platform could be severely adversely affected.

Restrictive and extensive government regulation could slow or hinder our production of a cellular product.

The research and development of stem cell therapies is subject to and restricted by extensive regulation by governmental authorities in the United States and other countries. The process of obtaining U.S. Food and Drug Administration, or FDA, and other necessary regulatory approvals is lengthy, expensive and uncertain. We may fail to obtain the necessary approvals to continue our research and development, which would hinder our ability to manufacture or market any future product.

To be successful, our product candidates must be accepted by the health care community, which can be very slow to adopt or unreceptive to new technologies and products.

Our product candidates, if approved for marketing, may not achieve market acceptance since hospitals, physicians, patients or the medical community in general may decide to not accept and utilize these products. The product candidates that we are attempting to develop represent substantial departures from established treatment methods and will compete with a number of more conventional drugs and therapies manufactured and marketed by major pharmaceutical companies. The degree of market acceptance of any of our developed products will depend on a number of factors, including:

| · | our establishment and demonstration to the medical community of the clinical efficacy and safety of our product candidates; |

| · | our ability to create products that are superior to alternatives currently on the market; |

| · | our ability to establish in the medical community the potential advantage of our treatments over alternative treatment methods; and |

| · | reimbursement policies of government and third-party payers. |

If the health care community does not accept our products for any of the foregoing reasons, or for any other reason, our business would be materially harmed.

Risks Related to Our Common Stock

There is currently a limited market for our common stock, and any trading market that exists in our common stock may be highly illiquid and may not reflect the underlying value of the Company’s net assets or business prospects.

Although our common stock is currently traded on the OTC Bulletin Board, there is currently a limited market for our common stock and there can be no assurance that an improved market will ever develop. Investors are cautioned not to rely on the possibility that an active trading market may develop.

As our share price is volatile, we may be or become the target of securities litigation, which is costly and time-consuming to defend.

-8-

In the past, following periods of market volatility in the price of a company’s securities or the reporting of unfavorable news, security holders have often instituted class action litigation. If the market value of our common stock experiences adverse fluctuations and we become involved in this type of litigation, regardless of the outcome, we could incur substantial legal costs and our management’s attention could be diverted from the operation of our business, causing our business to suffer.

Our "blank check" preferred stock could be issued to prevent a business combination not desired by management or our current majority shareholders.

Our articles of incorporation authorize the issuance of "blank check" preferred stock with such designations, rights and preferences as may be determined by our board of directors without shareholder approval. Our preferred stock could be utilized as a method of discouraging, delaying, or preventing a change in our control and as a method of preventing shareholders from receiving a premium for their shares in connection with a change of control.

Future sales of our common stock in the public market could lower our stock price.

We may sell additional shares of common stock in subsequent public or private offerings. We may also issue additional shares of common stock to finance future acquisitions. We cannot predict the size of future issuances of our common stock or the effect, if any, that future issuances and sales of shares of our common stock will have on the market price of our common stock. Sales of substantial amounts of our common stock (including shares issued in connection with an acquisition), or the perception that such sales could occur, may adversely affect prevailing market prices for our common stock.

We presently do not intend to pay cash dividends on our common stock.

We currently anticipate that no cash dividends will be paid on the common stock in the foreseeable future. While our dividend policy will be based on the operating results and capital needs of the business, it is anticipated that all earnings, if any, will be retained to finance the future expansion of the our business. Therefore, prospective investors who anticipate the need for immediate income by way of cash dividends from their investment should not purchase the shares offered in this offering.

FORWARD LOOKING STATEMENTS

This Prospectus contains forward-looking statements within the meaning of Section 27A of the Securities Act of 1933. These statements relate to future events and/or future financial performance and involve known and unknown risks, uncertainties and other factors that may cause the actual results, levels of activity, performance or achievements of the Company or the industry in which it operates to be materially different from any future results, levels of activity, performance or achievements expressed or implied by the forward-looking statements. These risks and other factors include those listed under “Risk Factors” and those described elsewhere in this Memorandum.

In some cases, you can identify forward-looking statements by the Company’s use of terms such as “may,” “will,” “should,” “expects,” “plans,” “anticipates,” “believes,” “estimates,” “predicts,” “potential,” or the negative of these terms or other comparable terminology. These statements are only predictions. Actual events or results may differ materially. In evaluating these statements, you should specifically consider various factors, including the risks outlined under “Risk Factors.” These factors may cause the Company’s actual results to differ materially from any forward-looking statement.

Although the Company believes that the expectations reflected in the forward-looking statements are reasonable, it cannot guarantee future results, levels of activity, performance, or achievements. Moreover, neither the Company nor any other person assumes responsibility for the accuracy and completeness of these forward-looking statements. The Company does not intend to update any of the forward-looking statements after the date of this Memorandum to conform prior statements to actual results.

-9-

USE OF PROCEEDS

The selling stockholders will receive all of the proceeds from any sales of shares of our common stock. We will not receive any of the proceeds from any such sale by any selling stockholder. See “Selling Stockholders.”

PRICE RANGE OF OUR COMMON STOCK AND DIVIDEND POLICY

Shares of our common stock are traded on the National Association of Securities Dealers Inc. Over the Counter Bulletin Board under the symbol “PFTR.OB”. Our Common Stock trades on a limited, sporadic and volatile basis. As of April 5, 2006, the last reported sales price of our common stock on the OTC Bulletin Board was $0.60. As of March 31, 2006, there were 20,967,035 shares of our common stock outstanding that were held of record by 566 persons.

The following table sets forth, for the periods indicated, the range of high and low bid information for our common stock. These quotations reflect inter-dealer prices, without retail mark-up, mark-down or commission, and may not represent actual transactions.

Price Ranges | ||||||||||

High | Low | |||||||||

Fiscal Year Ended December 31, 2004 | ||||||||||

| First Quarter | 0.03 | 0.01 | ||||||||

| Second Quarter | 14.25 | 0.01 | ||||||||

| Third Quarter | 8.15 | 6.50 | ||||||||

| Fourth Quarter | 9.50 | 5.90 | ||||||||

Fiscal Year Ended December 31, 2005 | ||||||||||

| First Quarter | 8.70 | 4.50 | ||||||||

| Second Quarter | 5.50 | 2.46 | ||||||||

| Third Quarter | 1.41 | 1.25 | ||||||||

| Fourth Quarter | 0.63 | 0.59 | ||||||||

| Fiscal Year Ended December 31, 2006 | ||||||||||

| First Quarter | 0.62 | 0.55 | ||||||||

Holders of shares of common stock will be entitled to receive cash dividends when, as and if declared by our Board of Directors, out of funds legally available for payment thereof. However, if dividends are not declared by our Board of Directors, no dividends shall be paid. We have not paid any dividends on our common stock since our inception.

We do not anticipate that any cash dividends will be paid in the foreseeable future. While our dividend policy will be based on the operating results and capital needs of the business, we anticipate that all earnings, if any, will be retained to finance our future expansion. Therefore, prospective investors who anticipate the need for immediate income by way of cash dividends from their investment should not purchase the shares offered by this prospectus.

-10-

SELECTED HISTORICAL FINANCIAL DATA

The following selected consolidated financial data should be read in conjunction with “Management’s Discussion and Analysis of Financial Condition and Results of Operations” and our consolidated financial statements and related notes included elsewhere in this prospectus. The selected consolidated financial data in this section is not intended to replace the consolidated financial statements and accompanying footnotes. The selected consolidated balance sheet data as of December 31, 2005 and 2004 have been derived from our audited consolidated financial statements included elsewhere in this prospectus. Historical results are not necessarily indicative of the results to be expected in the future.

Year Ended December 31, | Year Ended December 31, | ||||||

2005 | 2004 | ||||||

Consolidated Statements of Operations Data: | |||||||

| Revenues | $ | - | $ | - | |||

| Operating Expenses: | |||||||

General and administrative | $ | 550,178 | $ | 572,534 | |||

Depreciation and amortization | 1,735,209 | 264,819 | |||||

Research and development | 9,892,253 | 2,465,634 | |||||

Loss on disposal of assets | 22,810 | 457,122 | |||||

Net operating loss | (12,200,450 | ) | (3,760,109 | ) | |||

Interest Income | 81,930 | 5,992 | |||||

Other Income | 28,174 | 2,379 | |||||

Interest expense | (7,323,851 | ) | (868,926 | ) | |||

Net loss | $ | (19,414,197 | ) | $ | (4,620,664 | ) | |

Net loss per common share, basic and diluted | $ | (1.24 | ) | $ | (0.73 | ) | |

Weighted average number of common shares outstanding, basic and diluted | 15,648,365 | 6,309,145 | |||||

As of December 31, | |||||||

2005 | 2004 | ||||||

Consolidated Balance Sheet Data: | |||||||

Cash and cash equivalents and prepaid expenses | 2,743,190 | 946,329 | |||||

Intangible assets | 26,130, 441 | 26,791,073 | |||||

Fixed Assets | 479,996 | 341,984 | |||||

Other assets | 388,210 | - | |||||

Total assets | 29,741,837 | 28,079,386 | |||||

Current liabilities | 2,429,776 | 4,883,165 | |||||

Common stock | 1,030,977 | 502,992 | |||||

Total stockholders’ equity | 27,312,061 | 23,196,221 | |||||

MANAGEMENT’S DISCUSSION AND ANALYSIS

OF FINANCIAL CONDITIONS AND RESULTS OF OPERATIONS

The following discussion of our financial condition and results of operations should be read together with the consolidated financial statements and related notes that are included elsewhere in this prospectus. This discussion may contain forward-looking statements based upon current expectations that involve risks and uncertainties. Our actual results may differ materially from those anticipated in these forward-looking statements as a result of various factors, including those set forth under “Risk Factors”, “Disclosure Regarding Forward-Looking Statements” or in other parts of this prospectus. We undertake no obligation to update any information in our forward-looking statements except as required by law.

-11-

Overview

We are a development-stage company and have a limited operating history. Our predecessor company for financial reporting purposes was formed on January 22, 2003 to acquire rights to our adult stem cell technology. In November 2004 we acquired Opexa Pharmaceuticals, Inc. and its multiple sclerosis treatment technology. We are still developing all of our technology, and to date, we have not generated any revenues from our operations. As we continue to execute our operations plan, we expect our development and operating expenses to increase.

Research and development. We have made and expect to continue to make substantial investments in research and development in order to develop and market our technology. Research and development costs consist primarily of general and administrative and operating expenses related to research and development activities. We expense research and development costs as incurred. Property, plant and equipment for research and development that has an alternative future use is capitalized and the related depreciation is expensed as research and development costs. We expect our research and development expense to increase as we continue to invest in the development of our technology.

General and administrative. General and administrative expenses consist primarily of salaries and benefits, office expense, professional services fees, and other corporate overhead costs. We anticipate increases in general and administrative expenses as we continue to develop and prepare for commercialization of our technology

Results of Operations

Comparison of Year Ended December 31, 2005 with the Year Ended December 31, 2004

Net Sales.

We recorded no sales for the twelve months ended December 31, 2005 and 2004.

General and Administrative Expenses

Our general and administrative expenses during the twelve months ended December 31, 2005, was $550,178 as compared to $572,534 for the twelve months ended December 31, 2004. General and administrative expenses consist primarily of salaries and benefits, office expense, professional services fees, and other corporate overhead costs. We anticipate increases in general and administrative expenses as we continue to develop and prepare for commercialization of our technology

Research and Development Expense

Research and development expense was $9,892,253 for the twelve months ended December 31, 2005, as compared to $2,465,634 the twelve months ended December 31, 2004. The increase in expenses was primarily due the acquisition of Opexa and the assumption of its operations and research and development programs as well as our Phase I/II clinical trials for Tovaxin, stem cell development and pre-clinical costs, the hiring of personnel and other expenses associated with the increase in research and development efforts. We have made and expect to continue to make substantial investments in research and development in order to develop and market our technology. Research and development costs consist primarily of general and administrative and operating expenses related to research and development activities. We expense research and development costs as incurred. Property, plant and equipment for research and development that has an alternative future use is capitalized and the related depreciation is expensed as research and development costs. We expect our research and development expense to increase as we continue to invest in the development of our technology.

-12-

Interest Expense

Interest expense was $7,323,851 for the twelve months ended December 31, 2005 compared to $868,926 for the twelve months ended December 31, 2004. The increase is primarily related to the amortization of the remaining discount under the beneficial conversion feature of the 15% exchangeable convertible promissory notes (the “Notes”); in 2005 the accrued interest on the Notes was converted into shares of Common Stock.

Net loss

We had a net loss for the year ended December 31, 2005, of $19,414,197 or ($1.24) per share (basic and diluted), compared with a net loss of $4,620,664 or ($.73) per share (basic and diluted), for the twelve months ended December 31, 2004. The increase in net loss is due primarily to the amortization of the remaining discount under the beneficial conversion feature of the Notes and the accrued interest on the Notes that was converted into shares of common stock, along with start-up of operations which included the hiring of new employees, directors and scientific advisory board members. These individuals have agreements with us that provide for salary payments. The increase in net loss is also attributable to the acquisition of Opexa Pharmaceuticals and the assumption of its operations and research and development programs. Also included are professional fees incurred from legal, accounting, and consulting services to secure and expand our license patent claims. Anticipated future expenses include research and development, professional and consulting fees, and expenses associated with the expansion of the office and laboratory/manufacturing facilities.

Liquidity and Capital Resources

Since our inception, the Company has financed its operations from the sale of its debt and equity securities (including the issuance of its securities in exchange for goods and services) to accredited investors. Between September 2004 and February 2005, the Company privately placed an aggregate principal amount of $6.1 million of Bridge Notes. In June 3, 2005, the Company exchanged its Bridge Notes aggregating approximately $6.7 million in principal and interest for 4,433,598 units at a purchase price of $1.50 per unit; each unit comprised of one share of common stock and three separate types of warrants to purchase a total of 2.75 shares of common stock as follows: a series A warrant for 1.25 shares with an exercise price of $2.00 which expired on February 17, 2006; a series B warrant for one-half of a share with an exercise price of $2.90 which expires on October 17, 2006; and a Series C Warrant for one share with an exercise price of $4.00 that expires on May 25, 2010.

In June 2005, the Company completed a private placement of approximately $5.08 million to accredited investors by issuing 3,387,217 units at a purchase price of $1.50 per unit; each unit identical to those issued in the Bridge Note exchange. On July 18, 2005 the Company completed a follow-on private placement of approximately $760,000 to accredited investors and issued 507,292 additional units at a purchase price of $1.50 per unit.

As of December 31, 2005, the Company had cash of approximately $2.5 million. Our current burn rate is approximately $400,000 per month excluding capital expenditures. Although our burn rate is expected to increase to $800,000 per month once the Phase IIb clinical trails begin, we do not intend to start the Phase 2b until we have raised additional capital. We will need to raise additional capital to fund our working capital needs during the second quarter of 2006. We do not have any credit facilities available with financial institutions or any other third parties and as such we must rely upon best efforts third-party debt or equity funding and we can provide no assurance that we will be successful in any funding effort. The failure to raise such funds will necessitate the curtailment of operations and delay of the start of the clinical trials.

-13-

Contractual Commitments

In October 2005 the Company leased a facility to house its executive offices and research facilities for a term of ten years with two options for an additional five years each at the then prevailing market rate. The 10,200 sq. ft. facility is located on 3 acres at 2635 N. Crescent Ridge Drive in The Woodlands, TX. This location provides space for pipeline development through R & D; a specialized Flow Cytometry and Microscopy lab; support of clinical trials with GMP manufacturing Suites; Quality Systems management with Quality Control Laboratory, Regulatory Affairs, Quality Assurance; as well as administrative support space. There is 2,500 sq. ft. of space still available for future build-out. The facility including the property is leased for a term of ten years with two options for an additional five years each at the then prevailing market rate.

Off-Balance Sheet Arrangements

As of December 31, 2005, we had no off-balance sheet arrangements.

Related Party Transactions

For more information on these transactions, please read “Certain Relationships and Related Party Transactions,” in this prospectus.

Critical Accounting Policies

Our discussion and analysis of our financial condition and results of operations is based on our consolidated financial statements, which have been prepared in accordance with accounting principles generally accepted in the United States of America. The preparation of these consolidated financial statements requires us to make estimates and judgments that affect the reported amounts of assets, liabilities and expenses. We base our estimates on historical experience and on various other assumptions that we believe to be reasonable under the circumstances, the results of which form the basis for making judgments about the carrying values of assets and liabilities that are not readily apparent from other sources. Actual results may differ from these estimates under different assumptions or conditions. We believe the following critical accounting policies affect our most significant judgments and estimates used in preparation of our consolidated financial statements.

Reverse Acquisition. We treated the merger of PharmaFrontiers Corp. into Sportan as a reverse acquisition. Pursuant to the guidance in Appendix B of SEC Accounting Disclosure Rules and Practices Official Text, the “merger of a private operating company into a non-operating public shell corporation with nominal net assets typically results in the owners and management of the private company having actual or effective operating control of the combined company after the transaction, with the shareholders of the former public shell continuing only as passive investors. These transactions are considered by the staff to be capital transactions in substance, rather than business combinations. That is, the transaction is equivalent to the issuance of stock by the private company for the net monetary assets of the shell corporation, accompanied by a recapitalization.” Accordingly, the reverse acquisition has been accounted for as a recapitalization. For accounting purposes, the original PharmaFrontiers Corp. is considered the acquirer in the reverse acquisition. The historical financial statements are those of the original PharmaFrontiers Corp. Earnings per share for periods prior to the merger are restated to reflect the number of equivalent shares received by the acquiring company.

-14-

Impairment of Long-Lived Assets. We review long-lived assets and certain identifiable assets for impairment whenever events or changes in circumstances indicate that the carrying amount of an asset may not be recoverable. If the sum of the expected future undiscounted cash flows is less than the carrying amount of the asset, further impairment analysis is performed. An impairment loss is measured as the amount by which the carrying amount exceeds the fair value of assets.

Stock-Based Compensation. We have adopted FAS No. 123, “Accounting for Stock-Based Compensation” for non-cash stock-based compensation issued to employees, directors and non-employees for goods or services. FAS No. 123 allows companies to continue to measure compensation costs for employees and directors using the intrinsic value method as prescribed by APB Opinion 25; however, the fair value method must be used to measure compensation costs issued to non-employees. FAS No. 123 states that the fair value method of accounting for stock-based compensation is preferable to the intrinsic value method; therefore, we use the fair value method to measure all stock-based compensation, including stock-based compensation to our employees and directors. Under this method, compensation cost is measured at the fair value of the award on the applicable measurement date. See Note 1 of the Notes to Consolidated Financial Statements for the pro forma net income and net income per share amounts, for Fiscal 2004 through Fiscal 2005, as if the Company had used a fair-value-based method similar to the methods required under SFAS 123R to measure compensation expense for employee stock incentive awards. The Company is evaluating the terms and structure of its current share based payments and does not expect the adoption to have a significant, adverse impact on the consolidated statements of income and net income per share as it relates to current granted options and warrants as of the date of the adoption.

Consolidation of Variable Interest Entities. In January 2003, the FASB issued Interpretation No. 46(R) (“FIN 46”), Consolidation of Variable Interest Entities. FIN 46 addresses consolidation by business enterprises of variable interest entities (formerly special purpose entities). In general, a variable interest entity is a corporation, partnership, trust or any other legal structure used for business purposes that either (a) does not have equity investors with voting rights or (b) has equity investors that do not provide sufficient financial resources for the entity to support its activities. The objective of FIN 46 is not to restrict the use of variable interest entities, but to improve financial reporting by companies involved with variable interest entities. FIN 46 requires a variable interest entity to be consolidated by a company if that company is subject to a majority of the risk of loss from the variable interest entity’s activities or entitled to receive a majority of the entity’s residual returns or both. The consolidation requirements are effective for the first period that ends after March 15, 2004; the Company elected to adopt the requirements effective for the reporting period ending December 31, 2005. The adoption of FIN 46 had no effect on the consolidated financial statements.

Research and Development. The costs of materials and equipment or facilities that are acquired or constructed for research and development activities and that have alternative future uses are capitalized as tangible assets when acquired or constructed. The cost of such materials consumed in research and development activities and the depreciation of such equipment or facilities used in those activities are research and development costs. However, the costs of materials, equipment, or facilities acquired or constructed for research and development activities that have no alternative future uses are considered research and development costs and are expensed at the time the costs are incurred.

-15-

OUR BUSINESS

Overview

We are a biopharmaceutical company engaged in developing autologous personalized cell therapies. Our strategy is to develop and commercialize cell therapies to treat several major diseases including multiple sclerosis, cardiovascular diseases, and diabetes. We have an exclusive license to an individualized T cell therapy that is in FDA Phase I/II human dose ranging clinical trials to evaluate its safety and effectiveness in treating multiple sclerosis. We also have an exclusive license to a stem cell technology in which adult pluripotent stem cells are derived from monocytes obtained from the patient’s own blood. We are initially pursuing indications in heart failure and Type I diabetes with our stem cell therapy.

Our lead product, Tovaxin™, is a T-cell-based therapeutic vaccine for MS, offering a unique and personalized approach to treating the disease by inducing an immune response against the pathogenic myelin autoreactive T-cells. Tovaxin has just been accepted by the U.S. Food and Drug Administration’s (FDA) Center for Biologics Evaluation and Research (CBER) for a Phase IIb clinical study, entitled “A Multicenter, Randomized, Double-Blind, Placebo-Controlled Study of Subcutaneous Tovaxin™ in Subjects with Clinically Isolated Syndrome or Relapsing Remitting Multiple Sclerosis” following two successful Phase I/II open-label studies. The results from two Tovaxin Phase I/II clinical trials provided safety and effectiveness information. Human trials have shown that the our T-cell vaccination (TCV) safely induces immune responses that deplete and regulate myelin autoreactive T-cells, thus stabilizing the disease and it is the first MS drug to demonstrate sustained improvement in many of the patients and sustained reversal of disability in some of the patients that were treated. Moreover, we are evaluating T-cell assay technology, which can be used to monitor T-cell therapy and may have the potential for early diagnosis of MS.

We also hold the exclusive worldwide license to adult pluripotent stem cells derived from peripheral blood monocytes that allow for the isolation, propagation, and differentiation into cells and tissues for patient-specific cell-based therapies. We are currently pursuing indications for congestive heart failure (CHF) and Type 1 diabetes (T1D) with its stem cell technology. We expect to conduct basic research to determine the potential use of its stem cells in other indications, such as macular degeneration, stroke, and Parkinson’s disease.

Overview of PharmaFrontiers Corp Technologies and Programs

-16-

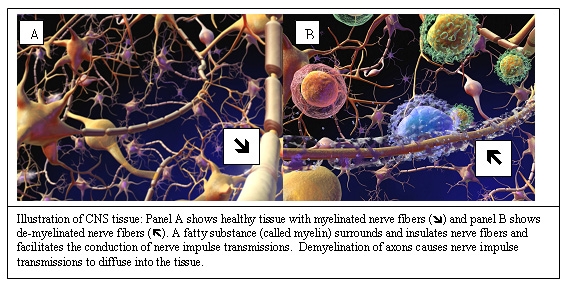

In the United States, approximately 400,000 people suffer from multiple sclerosis, a chronic progressive autoimmune disease of the central nervous system (CNS) that is caused by myelin autoreactive T-cells progressively eroding the myelin that surrounds and insulates nerve fibers of the brain and spinal cord. Globally, there are approximately 2.5 million MS patients representing a drug market in excess of $4 billion. The US markets accounted for 50 per cent of global MS sales in 2004, at US$2.3 billion. MS remains a challenging autoimmune disease to study because the pathophysiologic mechanisms are diverse, and the chronic, unpredictable course of the disease makes it difficult to determine whether the favorable effects of short-term treatment will be sustained. Therapies that can prevent or stop the progression of disease and allow reversal of the neurological damage and disability caused by the disease represent the greatest unmet need in MS.

In recent years, the understanding of MS pathogenesis has evolved to comprise an initial, T-cell-mediated inflammatory activity followed by selective demyelination (erosion of the myelin coating of the nerve fibers) and then neurodegeneration. The discovery of disease-relevant immune responses has accelerated the development of targeted therapeutic products for the treatment of the early stages of MS. Healthy individuals have been found to have autoreactive T-cells, which recognize a variety of self-antigens (e.g., myelin basic protein [MBP], proteolipid protein [PLP], and myelin oligodendrocyte glycoprotein [MOG]) as part of the normal T-cell repertoire and circulate naturally in the periphery without causing an autoimmune disease.

Some subjects unfortunately who have the appropriate genetic background have increased susceptibility for the in vivo activation and clonal expansion of myelin autoreactive T-cells. These myelin autoreactive T-cells may remain dormant, but at some point they are activated in the periphery, possibly by molecular mimicry (i.e., recognition of epitopes that are common to autoantigens and microbial antigens as exogenous triggers), thus enabling them to cross the blood-brain barrier (BBB) and infiltrate the healthy tissue of the brain and spinal cord. The cascade of pathogenic events leads to demyelination of axons, which causes nerve impulse transmissions to diffuse into the tissue.

|

Current Therapy for Multiple Sclerosis

Current MS disease modifying drugs on the market are only palliative and generally work through a mechanism of immunomodulation or immunosuppression. These therapies for MS are dominated by three forms of interferon that require frequent subcutaneous or intramuscular injections. Copaxone is an immunomodulator composed of a random copolymer of amino acids that is administered daily. Novantrone (mitoxanthrone) is an immunosuppressive drug that can only be given four times per year with a life

-17-

time limit of 8 to 12 doses. All of the current therapies only slow the progression of MS and they have significant patient compliance challenges because of the dosing schedule, limited decrease in relapse rate, side effects profile (e.g., the interferon formulations produce severe flu-like symptoms, injection site reactions, infection and neutralizing antibodies (range from 5% to 45%) are developed that limits the efficacy of treatment; copaxone causes significant injection site reactions; while novantrone causes infections, bone marrow suppression, nausea, hair thinning, bladder infections, and mouth sores). These drugs must be administered daily to weekly and they reduce relapses by about 38-75% (as compared to a patient’s prior 2-year history).

Tysabri, a selective adhesion molecule inhibitor (an alpha 4 integrin antagonist), represents another class of MS drugs which works by preventing immune system cells (all leukocytes carrying the alpha 4 integrin glycoprotein on their surface) from crossing the BBB and move into the CNS. Unfortunately, Tysabri blocks the movement of all inflammatory T-cells not just the myelin autoreactive T-cells and leaves patients at a risk of life threatening infections. Tysabri with a reduction in relapse rates of 67% (versus placebo) was still expected to generate $2 to 3 billion in peak annual sales in an existing products market of approximately $4 billion had it not been for the severe side effects.

A number of companies have committed resources to research and development programs to develop novel MS drug therapies. These programs represent incremental improvements over current therapy and their mechanisms of action are similar to current therapy. Tovaxin is the only whole T-cell based vaccination strategy that safely and effectively eliminates the myelin autoreactive T-cells and induces immune tolerance with the potential to prevent the disease or stop disease progression and perhaps to allow the reversal of disease symptoms and progression to severe disability.

In our open-label Phase I/II studies, Tovaxin has shown a reduction in relapses in excess of 90% with virtually no side effects based on only 4 injections annually administered over 3-4 months. Furthermore, approximately 40% of the MS patients treated with Tovaxin demonstrated a reversal of disability as measured by the Kurtzke Expanded Disability Status Scale (EDSS; a method of quantifying disability of MS patients) while the remainder of patients (except for one relapse) experienced no progression of disease. Based on the results of the Phase I/II studies a Phase IIb clinical trial to study Tovaxin therapy in early (clinically isolated syndrome (CIS) and early relapsing remitting (RR)) MS patients has been cleared by the FDA and is scheduled to be initiated the first half of 2006.

Tovaxin™ for Multiple Sclerosis

Tovaxin works selectively on the myelin autoreactive T-cells by harnessing the body’s natural immune defense system and feedback mechanisms to deplete these T-cells and induce favorable immune regulatory responses which rebalance the immune system. Tovaxin induces immune responses that deplete (Appendix C) and regulate the myelin autoreactive pro-inflammatory T-cells that cause the inflammation and erosion of the myelin sheath resulting in MS. Specifically, Tovaxin is manufactured by taking the MRTCs from the blood, expanding them to a therapeutic dose ex-vivo, and attenuating them with gamma irradiation to prevent DNA replication. These attenuated MRTCs are then injected subcutaneously into the body in large quantities. The body recognizes specific T-cell receptor molecules of these MRTCs as foreign and mounts an immune response reaction against them, not only destroying the injected attenuated MRTCs, but also the circulating, myelin autoreactive T-cells carrying the peptide-specific T-cell receptor molecules. In addition, T-cell activation molecules on the surface of the activated MRTCs used as vaccine induce favorable immune regulatory responses, which promote anti-inflammatory responses. Because the therapy uses an individual’s own cells, the only directly identifiable side effect is injection site reaction in a small percentage of the patients. These reactions clear within 24 hours. Clinical studies indicate that following TCV therapy the body does not attack normal T-cells so the patient is not put at peril for side effects and life threatening infections.

-18-

Tovaxin consists of a trivalent formulation (MBP, PLP and MOG) of attenuated myelin-peptide reactive T-cells (MRTCs) which targets only the myelin-specific subset of T-cells. Current therapies on the market and under development do not eliminate the MRTCs and are, therefore, only a palliative treatment to reduce the frequency and occurrence of MS symptoms. The current iteration of Tovaxin is a trivalent formulation, which uses six peptides (two each from three myelin proteins) to select the MRTCs. This formulation is very pharmacologically active with only minimal local and systemic side effects. Tovaxin, a whole T-cell vaccine, is a completely new class of drug for MS that works in concert with the body’s immune regulatory system to suppress the T-cell-mediated inflammatory activity and deplete the MRTCs.

This same technology platform will have application in other T-cell mediated diseases such as Crohn’s disease, psoriasis, rheumatoid arthritis and type 1diabetes.

Tovaxin™ Intellectual Property

Tovaxin is protected by a series of patents and patent applications. There is also substantial know-how surrounding the Tovaxin manufacturing process that should be patentable.

The technology was discovered by Dr. Jingwu Zhang of Baylor College of Medicine in Houston. We have an exclusive, worldwide license from the Baylor College of Medicine to develop and commercialize three technology areas for MS, namely T-cell vaccination, peptides, and diagnostics. Under the License Agreement with the Baylor College of Medicine, we have rights to a total of 7 patents (2 U.S. and 5 foreign) and 69 patent applications (6 U.S., 62 foreign, and 1 Patent Cooperation Treaty [PCT]).

The license was granted to us by Baylor in exchange for common stock in Opexa Pharmaceuticals, Inc. (acquired by us in November 2004). The key terms of the agreement are: exclusive, worldwide, and a 2% royalty on net sales of licensed products. The royalty decreases after the aggregate net sales exceed $500 million. There are no other performance or payment terms in the license. We also have a separate consulting agreement with the inventor, Dr. Jingwu Zhang, which grants us the right of first refusal on all future discoveries made by Dr. Zhang.

Tovaxin™ Manufacturing

We manufacture our TCV therapy in our own GMP facility. The TCV technology is similar to that of traditional microbial vaccine technology, where the pathogen (or the attenuated derivative) is used to derive the protective antigens necessary to induce protective immune responses. In preparing a TCV therapy, the myelin autoreactive T-cells causing the disease are taken from the blood, specifically identified, and expanded ex vivo by incubating these T-cells with MBP, PLP, and MOG-selected peptides in the presence of antigen-presenting cells and growth factors. Myelin-peptide reactive T-cells are grown to therapeutic levels and cryopreserved. Prior to use, the MRTCs are expanded, formulated, and attenuated (by irradiation) to render them incompetent to replicate but viable for therapy. These attenuated T-cells are administered subcutaneously through a series of injections. A single draw of a 500 ml bag of blood is sufficient to provide a full year’s therapeutic regime of Tovaxin.

-19-

We have improved the manufacturing process of Tovaxin. Based on a new process, turnaround (receipt of blood from the patient and return Tovaxin to the patient) is decreased from 12 to 5 weeks and it is anticipated that the material and labor costs of an annual course of therapy will be approximately $4,000. Current therapies are priced at $16,000 to $25,000 annually. The price of newer therapies with better safety and efficacy profiles are anticipated to be priced at $20,000 to $25,000 annually.

We have also validated supply chain logistics improvements that make manufacturing with a regional central facility economical. The viability of blood MRTCs from the time the blood is drawn from the patient to receipt at the processing facility has been established at a minimum of 24 hours, which is sufficient for anywhere in the United States and, likely, Canada. Experiments are underway to determine whether blood MRTCs viability can be extended to at least 72 hours. Stability on the final TCV formulation for injection into patients has already been established at 72 hours. We are actively conducting experiments to improve the stability profile of Tovaxin.

We have developed a supply chain agreement with Lifeblood Biological Services (Memphis, TN) in which Lifeblood will manage blood collection and shipment to our manufacturing facility using the same infrastructure that is used to collect transfusable products. We will manage direct shipment of the TCV to the investigator for administration to patient.

Clinical Development of Tovaxin™

The intent of our clinical development program is to position Tovaxin as first-line therapy for MS. Improvements in efficacy combined with the inherent safety of the treatment make this goal realistic. If successful, Tovaxin would be the first product that specifically targets the “root cause” of MS—the myelin autoreactive T-cells. Compared to other treatments available, this therapy is individualized autologous, easier to tolerate and potentially places the disease into remission. If patients are treated early enough in the disease course, this therapy may prevent progression to more serious forms of MS and possibly allows the reversal of disease. Furthermore, Tovaxin seems to be appropriate to be combined with existing therapies to form a therapeutic cocktail that could be used over the entire life cycle of a patient as other treatments are added or replaced. Remyelination therapies should be easier to develop and implement following the depletion and regulation of the myelin autoreactive T-cells.

The clinical effectiveness of whole T-cell vaccines has evolved from 1990 to 2005 due to formulation improvements. There are three primary myelin proteins (MBP, MOG and PLP) that have been implicated in T-cell pathogenesis of MS. In the early 1990’s, Dr. Zhang used monovalent MBP-reactive T cell formulations to treat patients in an open-label clinical trial, which demonstrated an excellent safety profile and a 40% reduction in Annualized Relapse Rate (ARR; a primary outcome measure for licensing MS therapies) (Table 1). Patients treated in Israel with a divalent (MBP, MOG) formulation had an excellent safety profile and reduced ARR by 55% (Table 1). Most recently, patients treated in our Phase I/II open-label studies with trivalent (MBP, MOG, and PLP) formulations had an excellent safety profile and reduced ARR by 93% (Table 1). In the upcoming Phase IIb trial, a new formulation refinement will be implemented that is expected to further improve efficacy.

-20-

Table 1. Comparison of Annual Relapse Rate Reductions with T-Cell Vaccine Formulations | |||

T-Cell Vaccine Formulation | Peptide Formulation | Annual Relapse Rate Reduction (%)* | Number Patients |

| Monovalent | MBP | 40 | 114 |

| Divalent | MBP, MOB | 55 | 20 |

| Trivalent | MBP, MOG, PLP | 93 | 16 |

| Patient-Specific** | Variable based on patient-specific T-cells | TBD*** | 150 |