Exhibit 99.1

Corporate Presentation September 11, 2009 Neil K. Warma President & CEO (OPXA: NASDAQ)

Forward‐Looking Statements Certain of the information contained herein concerning market size and industry data is based upon or derived from information provided by third‐party consultants and other industry sources. We believe that such information is accurate and that the sources from which it has been obtained are reliable. However, we cannot guarantee the accuracy of this information and have not independently verified such information. In addition, included projections and other forward‐looking information that can be identified by the use of forward‐looking terminology such as “may,” “could”, “positioning”, “potential,” “promising,” will,” “expect,” “believe,” “anticipate,” “estimate,” “plan,” or “continue,” the negative thereof or other variations thereon or comparable terminology. The projections and information are based on assumptions as to future events that are inherently uncertain and subjective. We make no representation or warranty as to whether we will attain the results projected. The projections of our future performance are based on uncertain assumptions, and our actual results may differ materially and adversely from the results set forth in the projections. You should conduct your own investigation to determine the merits and risks of the proposed investment in our securities. The projected financial information was not prepared with a view toward complying with published guidelines of the Securities and Exchange Commission or the guidelines established by the American Institute of Certified Public Accountants regarding projections, nor is the projected financial information intended to be presented in a manner consistent with financial statements prepared in accordance with generally accepted accounting principles. Our legal counsel has not compiled, audited or contributed to the creation of the projections or the underlying assumptions in any way. Therefore, none of these parties expresses an opinion or any other form of assurance with respect to such projected financial information. The information contained is accurate only as of the preparation date(s) and may change after the date(s). We disclaim any responsibility to update the information after the date appearing on the front page and we do not intend to update the information. You are urged to request any additional information you may consider necessary in making an informed investment decision. 2 Rodman & Renshaw September 11, 2009

Tovaxin® A safe and effective cell therapy treatment in clinical development for MS 3 Rodman & Renshaw September 11, 2009

From Breakthrough Technology to g gy Significant Market Opportunity Opexa is a leading cell therapy company – Patient’s own cells act as “drug” – result is powerful efficacy and reduced side effects Opexa is advancing the reality of personalized medicine – Proprietary Epitope Technology maps disease progression, allows tailored therapies p Opexa is currently in advanced clinical trials for its T‐cell therapy in Multiple Sclerosis Built around T‐cell platform with the ability to potentially generate multiple drug opportunities 4 Rodman & Renshaw September 11, 2009

Progress since November 2008 (last R&R presentation) We are 10 months into our recovery plan from clinical study design flaws, hedge fund sell offs and a challenging capital markets environment Value added milestones: Further Data Analysis: Tovaxin is emerging as a safe and effective treatment for MS and one of the most promising therapies in development for MS Financing: Closed a private offering of convertible notes which demonstrated strong support by existing investors, directors and officers Deal flow: Monetized an asset that had generated little perceived value for the company securing a $50+ million deal with Novartis for stem cell technology by Compliance: OPXA regained compliance with NASDAQ Capital Markets, elimination of going concern reference Well on our way with the recovery 5 Rodman & Renshaw September 11, 2009

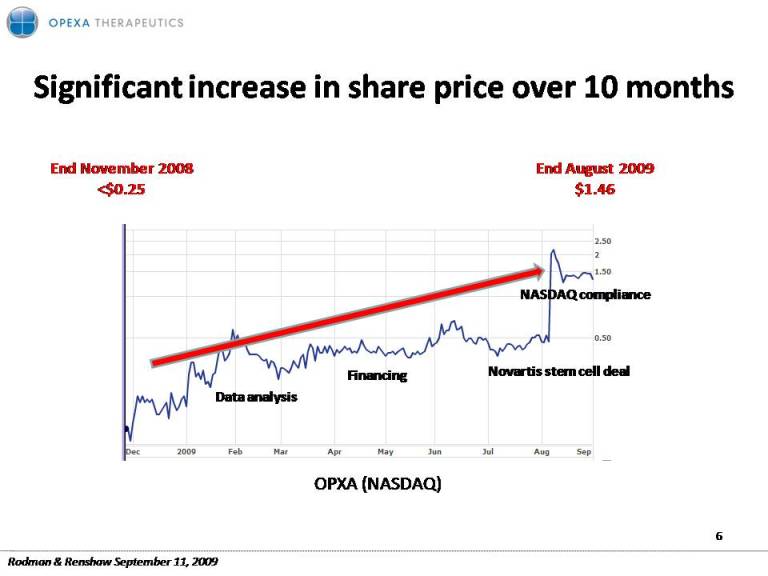

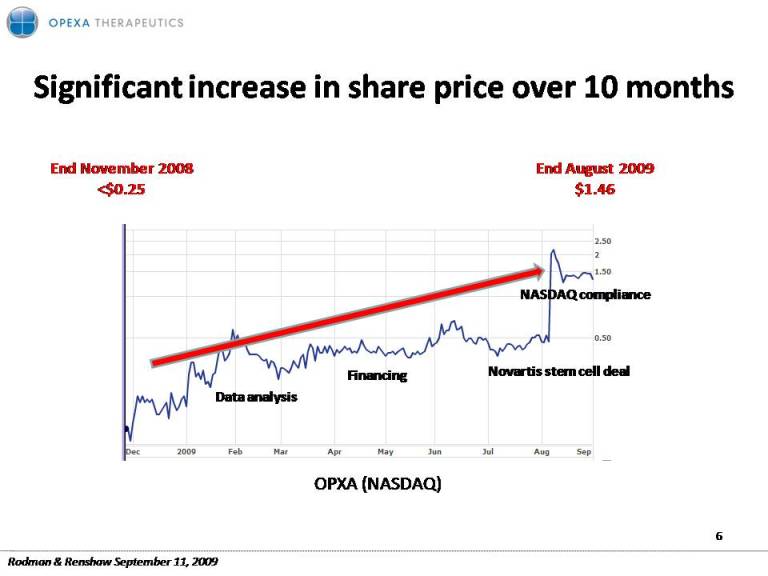

Significant 10 months increase in share price over 2008 2009 End November <$0.25 End August 2009 $1.46 NASDAQ compliance Data analysis Novartis stem cell deal Financing OPXA (NASDAQ) 6 Rodman & Renshaw September 11, 2009

Recovery Plan Shifts Strategy to Growth Company priorities for next 6‐12 6 months Focus on partnership for Tovaxin in MS Advance the planning and preparation for the second confirmatory Phase IIb clinical study with Tovaxin 7 Rodman & Renshaw September 11, 2009

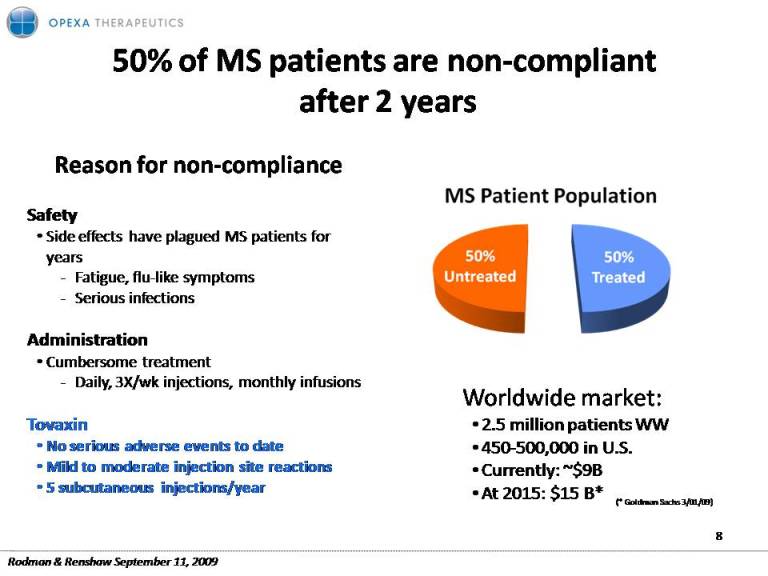

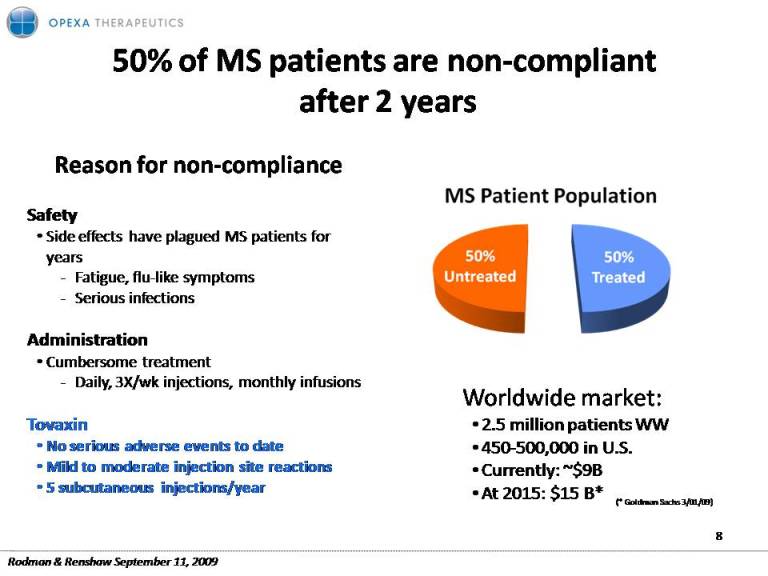

50% of MS patients are non‐compliant after 2 years Reason for non compliance non‐Safety Side effects have plagued MS patients for years ‐ Fatigue, flu‐like symptoms ‐ Serious infections Administration Cumbersome treatment ‐ Daily, 3X/wk injections, monthly infusions Worldwide market: Tovaxin No serious adverse events to date Mild to moderate injection site reactions 5 subcutaneous injections/year 2.5 million patients WW 450‐500,000 in U.S. Currently: ~$9B At 2015: $15 B* 8 (* Goldman Sachs 3/01/09) Rodman & Renshaw September 11, 2009

Tovaxin Positioning at Market 1st line treatment for first Relapsing Remitting MS, high risk CIS, and possibly Secondary Progressive MS patients Tovaxin has potential to generate significant revenue through: – Capturing non‐compliant market (currently 50% of MS patients) – Capturing newly diagnosed patients – Capturing existing market from currently marketed drugs (dissatisfied patients) Tovaxin could be used in combination with other MS therapies such as the Type I interferons and natulizumab – In clinical practice, combination therapy may be used. Submission a for RRMS expected in 2015 with a launch in 2016 of BLA is • Strong patent estate for Tovaxin – exclusivity well beyond launch. – One of the key patents issued in 2006 will continue in effect until at least 2027 9 Rodman & Renshaw September 11, 2009

Tovaxin Description Product: – An autologous immune modulating cell therapy treatment Produced by: – Isolating Myelin Reactive T‐Cells (MRTC) from patient’s blood and expanding the cells ex‐vivo to a therapeutic dose and reintroducing into the patients via five subcutaneous injections – MRTC three key myelin proteins (MOG MPB PLP) is determined to maximize reactivity to all MOG, MPB, effect Potent Immune response: – Reintroduction of attenuated T‐cells elicits targeted immune response against most highly reactive pathogenic MRTCs Over 300 patients have been treated with Tovaxin, including 150 patients in the TERMS IIb clinical study (completed late 2008) y( p ) Not one Serious Adverse Event associated with Tovaxin treatment to date 10 Rodman & Renshaw September 11, 2009

Selected Peptides for Manufacturing ‐ utilized all three key proteins ‐ TO Each individual patient’s disease profile is mapped using Opexa’s proprietary PEPTIDES USED GENERATE T CELL LINES MBP ALONE, 1% PLP ALONE, 6% technology 109 peptides are screened in the assessment of an individual’s epitope MOG ALONE, 9% PLP+MOG, 39% Peptides demonstrating the highest level of reactivity, signaling the most pathogenic, are selected for manufacturing MBP+PLP+MOG, 25% Each Tovaxin preparation is personalized to each patient’s specific peptide reactivity MBP+PLP, 9% MBP+MOG, 11% Opexa has shown that peptide reactivity occurs across all three proteins 85% of all Tovaxin preparations included peptides from at least of the proteins 11 Rodman & Renshaw September 11, 2009

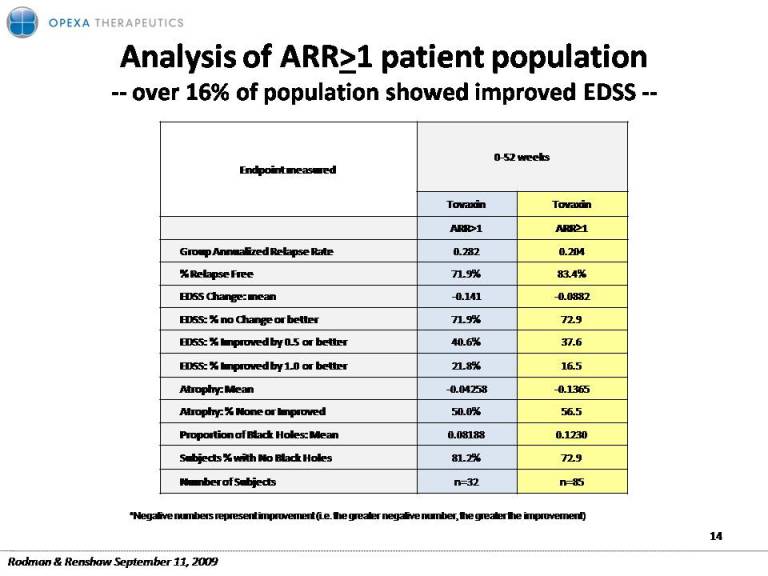

Tovaxin: Promising Efficacy Disability (EDSS) Relapse rate MRI In clinical target population ARR>1 Over 73% showed stabilization or improvement in disability ARR= 0.20 42% vs Possible neuroprotection 16.5% demonstrated sustained improvement in disability reduction vs. placebo One of lowest relapse rates of Reduction in atrophy Reduction in progression 12 any marketed drug to black holes Rodman & Renshaw September 11, 2009

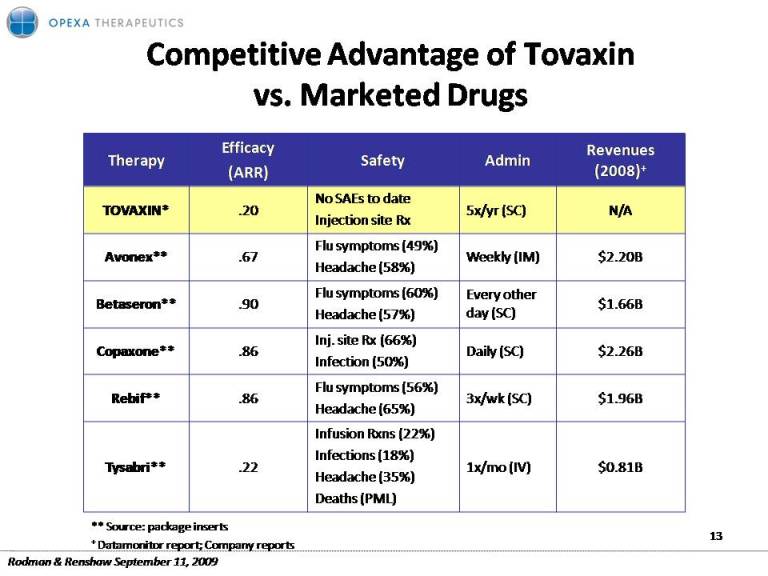

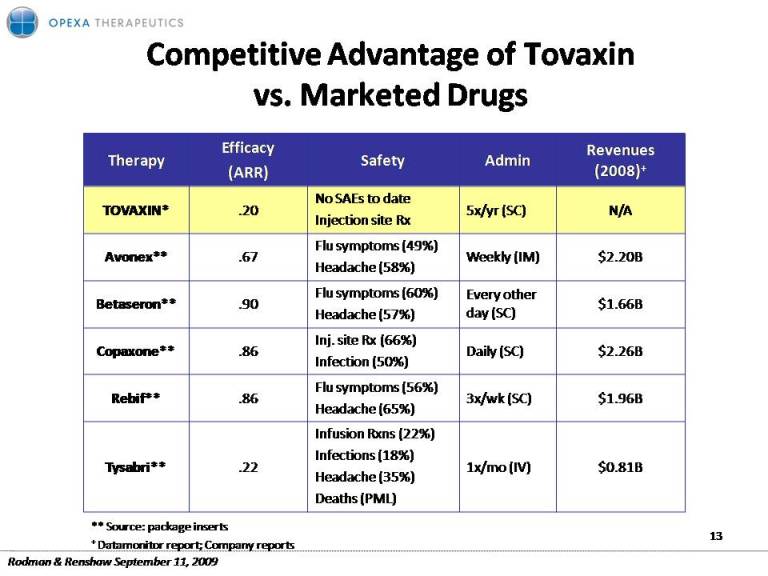

Competitive Advantage of Tovaxinvs. Marketed Drugs TOVAXIN* .20 No SAEs to date Injection site Rx 5x/yr (SC) N/A Flu symptoms (49%) Avonex** .67 Headache (58%) Weekly (IM) $2.20B Betaseron** .90 Flu symptoms (60%) Headache (57%) Every other day (SC) $1.66B Copaxone** .86 Inj. site Rx (66%) Infection (50%) Daily (SC) $2.26B Rebif** .86 Flu symptoms (56%) Headache (65%) 3x/wk (SC) $1.96B Tysabri** .22 Infusion Rxns (22%) Infections (18%) Headache (35%) ( ) 1x/mo (IV) $0.81B Deaths PML) ** Source: package inserts + Datamonitor report; Company reports 13 Rodman & Renshaw September 11, 2009

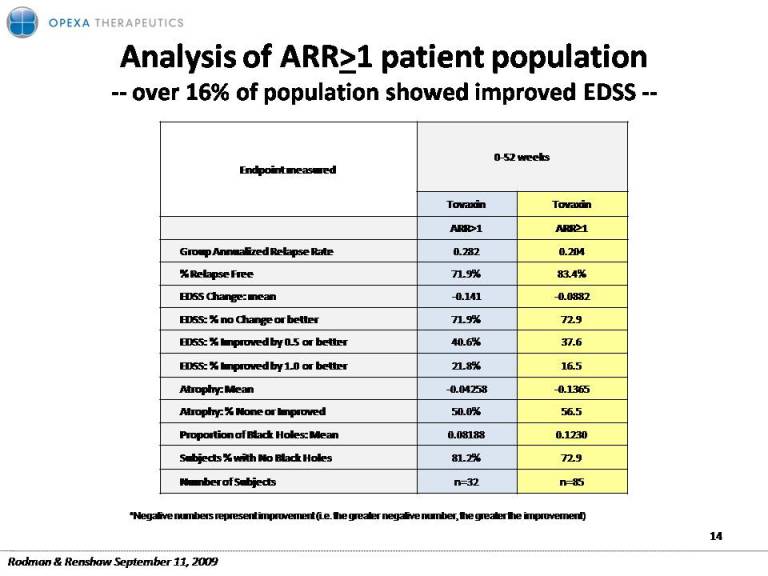

Analysis of ARR>1 patient population ‐‐ over 16% of population showed improved EDSS ‐‐ 0‐52 weeks Endpoint measured Tovaxin Tovaxin ARR>1 ARR≥1 l d l Group Annualized Relapse Rate 0.282 0.204 % Relapse Free 71.9% 83.4% EDSS Change: mean ‐0.141 ‐0.0882 EDSS: % no Change or better 71.9% 72.9 EDSS: % Improved by 0.5 or better 40.6% 37.6 EDSS: % Improved by 1.0 or better 21.8% 16.5 Atrophy: Mean ‐0.04258 ‐0.1365 Atrophy: % None Improved 50 0% 56 5 or 50.0% 56.5 Proportion of Black Holes: Mean 0.08188 0.1230 Subjects % with No Black Holes 81.2% 72.9 Number of Subjects n=32 n=85 *Negative numbers represent improvement (i.e. the greater negative number, the greater the improvement) 14 Rodman & Renshaw September 11, 2009

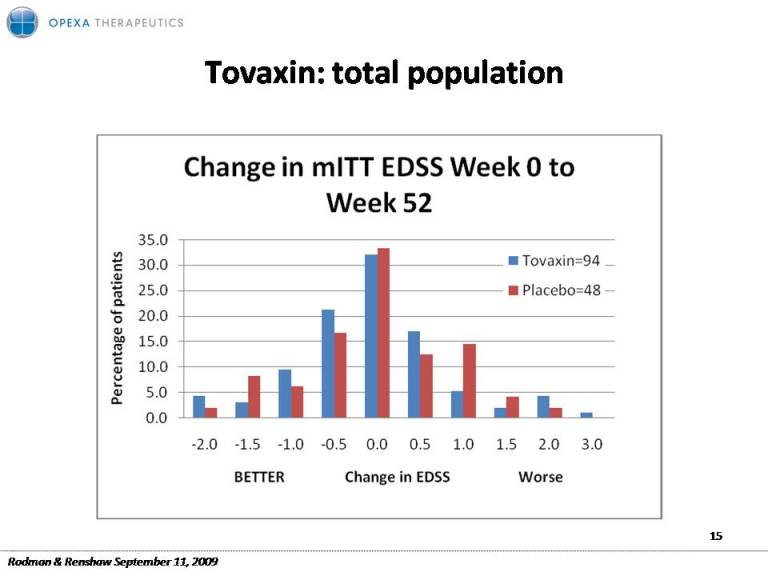

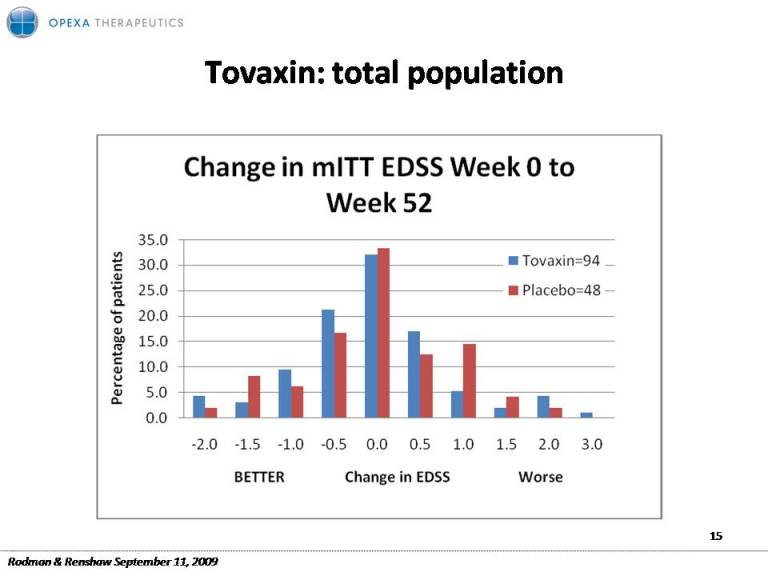

Tovaxin: population total 15 Rodman & Renshaw September 11, 2009

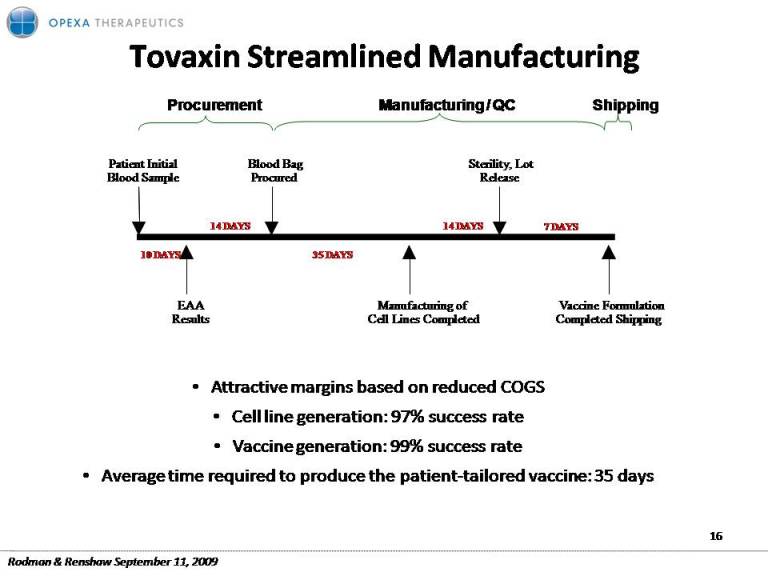

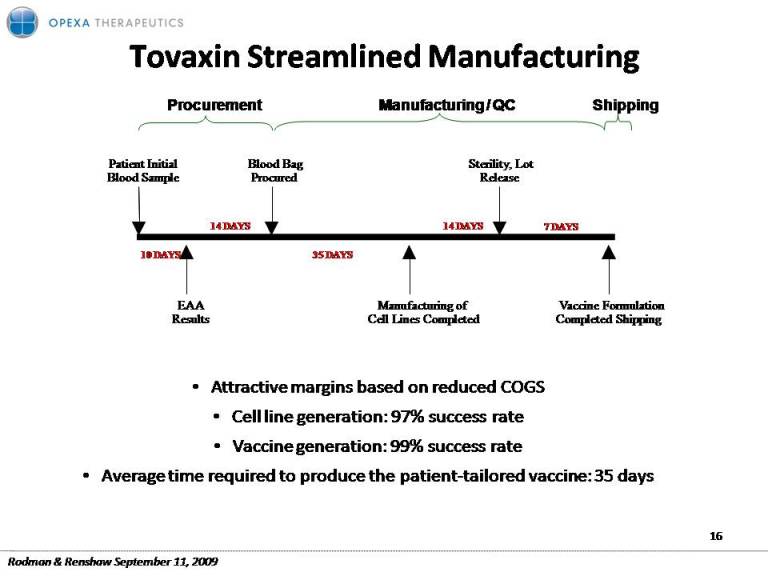

Tovaxin Streamlined Manufacturing Bag Sterility Lot Procurement Patient Initial Shipping Manufacturing / QC Blood Procured Sterility, Release 14 DAYS 14 DAYS Blood Sample 7 DAYS EAA Results Manufacturing of Cell Lines Completed Vaccine Formulation Completed Shipping 35 DAYS 10 DAYS Attractive margins based on reduced COGS C ll li i Cell line generation: 97% success rate Vaccine generation: 99% success rate Average time required to produce the patient‐tailored vaccine: 35 days 16 Rodman & Renshaw September 11, 2009

External Validation Supports Inherent Value pp Opexa’s drug in development for multiple sclerosis, Tovaxin®, has been positively received: “I have seen remarkable effect from this intervention, with only one recorded relapse in 18 months…”, physician treating Tovaxin patients in TERMS trial “ Tovaxin freed me from wheelchair/walker dependency…. my body emphatically demonstrated Tovaxin works and it works superbly!” patient on Tovaxin “ Tovaxin, to my family, has been a shining star or ray of hope!”….. “I have done quite well on it”, patient on Tovaxin “ f “…the drug Tovaxin seems to be a miracle.” sister of patient on Tovaxin “Tovaxin treatment alone worked where all other treatments faltered.” patient on Tovaxin 17 Rodman & Renshaw September 11, 2009

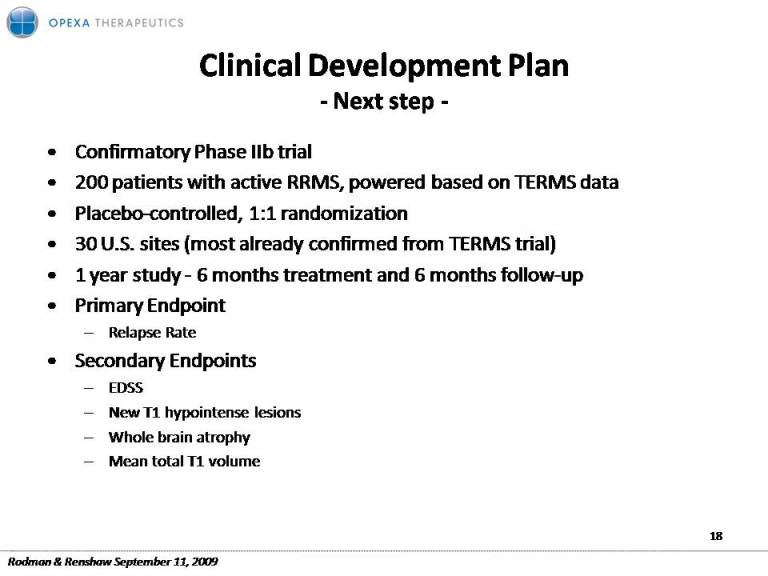

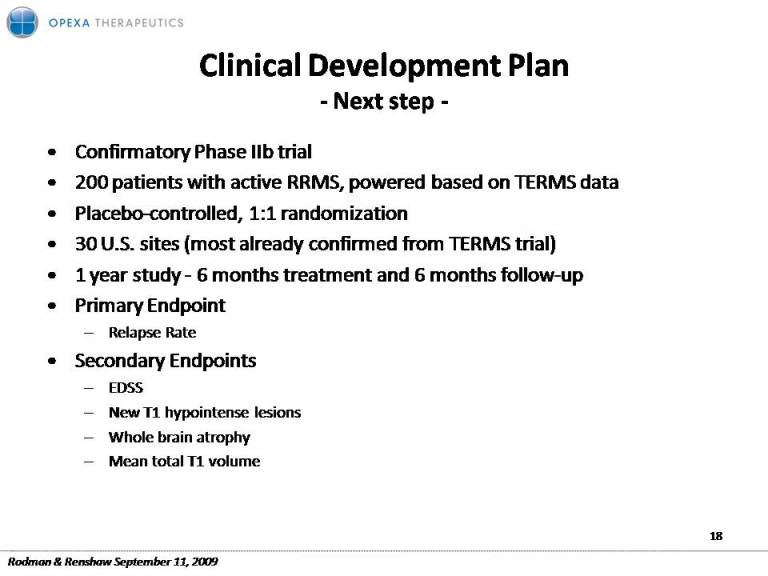

Clinical Development Plan ‐ Next step ‐ Confirmatory Phase IIb trial 200 patients with active RRMS, powered based on TERMS data Placebo‐controlled, 1:1 randomization 30 U S confirmed U.S. sites (most already from TERMS trial) 1 year study ‐ 6 months treatment and 6 months follow‐up Primary Endpoint R l R t – Relapse Rate Secondary Endpoints – EDSS New – T1 hypointense lesions – Whole brain atrophy – Mean total T1 volume 18 Rodman & Renshaw September 11, 2009

Tovaxin Clinical Development Completed the 150 patient landmark Tovaxin for Early Relapsing Multiple S l i (TERMS) Ph li i l d i l Sclerosis Phase IIb clinical study in late 2008 Data from this clinical study show compelling evidence that Relapsing Remitting MS (RRMS) patients treated with Tovaxin saw overall clinical, MRI, and immunological benefits over the placebo group Second confirmatory IIb clinical study in preparation Second Phase IIb (RRMS) 2010-2011 2008 First Phase IIb (TERMS) Analysis, Planning & Partnering EOP2 FDA 2009 Timing of second IIb study dependent on securing the necessary capital – Partnering discussions progressing 19 Rodman & Renshaw September 11, 2009

Opexa’s with Novartis Opexa s Stem Cell Agreement • Bringing value to an early stage asset – Significant increase in share price on day of announcement g p y Completed a deal with Novartis whereby Novartis acquired Opexa’s stem cell technology – Early stage program demonstrating ability to convert adult peripheral blood mononuclear program, cells into pancreatic‐like cells (monocyte derived islets) Overall deal potentially worth $50M Important to Opexa was the upfront and immediate payments totaling $4 million Opexa to receive possible clinical and sales milestones + royalties, and manufacturing rights Allows Opexa to maintain clear focus on Tovaxin (Tovaxin/T‐cell technology was not included as part of the Novartis agreement) $4 million to contribute to preparation and planning of Tovaxin clinical development 20 Rodman & Renshaw September 11, 2009

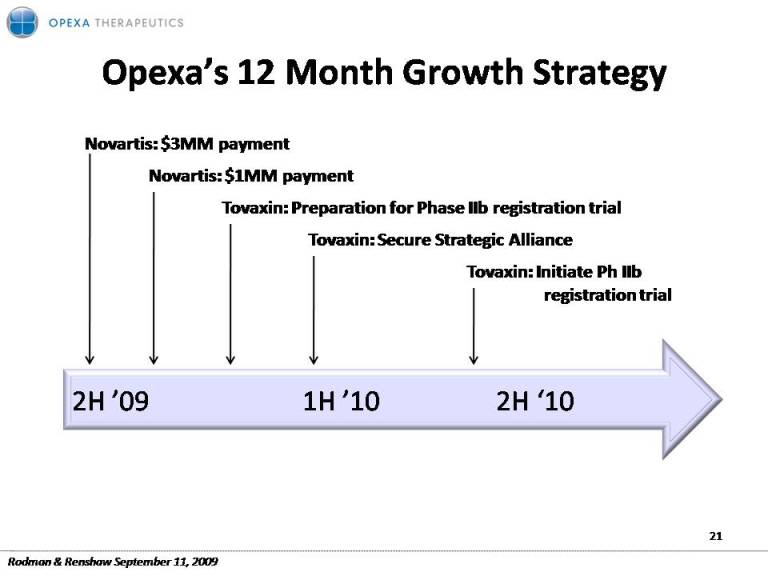

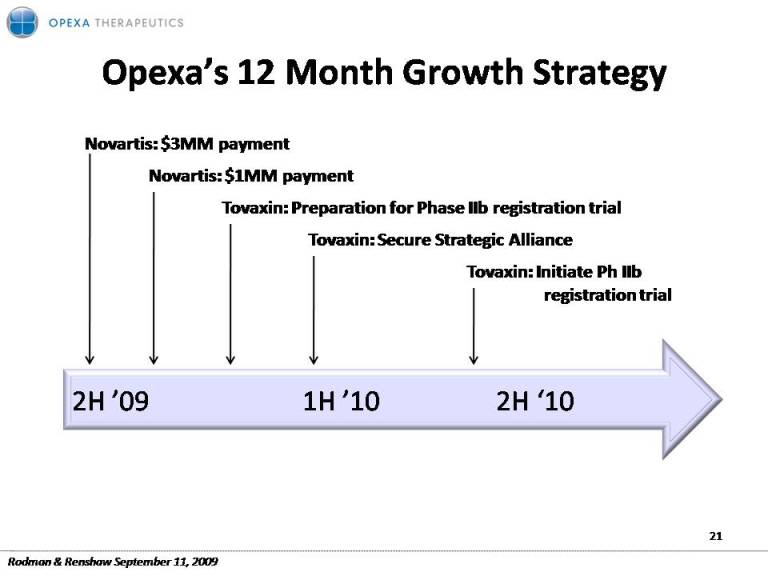

Opexa’s 12 Month Growth Opexa s Strategy Novartis: $3MM payment Tovaxin: Preparation for Phase IIb registration trial Tovaxin: Secure Strategic Alliance Novartis: $1MM payment g Tovaxin: Initiate Ph IIb registration trial 2H ’09 1H ’10 2H ‘10 21 Rodman & Renshaw September 11, 2009

Stock Information Stock Exchange NASDAQ Stock Symbol OPXA y Basic Shares Outstanding 12.3 million $50 Current Market Capitalization ~$50‐60 million 52 week range $0.09‐$5.66 22 Rodman & Renshaw September 11, 2009

Summary Opexa planned recovery has gone well, achieving key milestones in a challenging economic climate Focus is on progressing Tovaxin through clinical development Partnership discussions are ongoing Tovaxin is well positioned in MS ‐ a critical market with significant unmet need and market potential Tovaxin competitive advantage Setting new benchmarks in safety Lowest ARR of most marketed drugs, improvement in disability and possible neuroprotection Personalized targeting specific root cause of MS therapy Patient compliant: 5 sc injections/year – addresses patient compliance concerns Streamlined process; leverages standardized distribution and logistic channels, strong margins projected at launch 23 Rodman & Renshaw September 11, 2009