Back to Contents

In the first six months of the year, due to increased efficiency, Fixnet managed to increase EBITDA by 11.3% in comparison with the previous year, despite declining revenues. Revenue from third parties fell by 7.0% in the first half of 2003 compared to last year. The increase in revenue from access fees, due to the strong growth in broadband lines (ADSL), was offset by a decline in revenue from retail traffic and the international wholesale business. In addition, other revenue and wholesale revenue decreased by CHF 56 million and CHF 7 million, respectively, as a result of a change in accounting policy for the presentation of revenue from Business Numbers. Prior period has not been restated as the effect is not material.

Revenue from retail traffic declined by 5.7% year-over-year. The drop was caused by Swisscom’s market share in the local area traffic falling to the level of long-distance traffic after the new numbering plan was introduced in the second quarter of 2002. In addition, Swisscom introduced a standard national tariff for the fixed network on May 1, 2002. The standard national tariff has had a slightl negative net impact on revenue. Moreover, traffic volume continued to decline due to the ongoing substitution for mobile communications and the migration from Internet traffic to business numbers. The decline could be partly compensated by an increase in revenue from fixed-to-mobile and international traffic.

The decline in revenue for wholesale traffic of CHF 121 million was primarily due to the closure of local sales outlets in several European countries in the previous year and the sale of the business activities of Swisscom North America Inc in the fourth quarter of 2002. The impact on EBITDA resulting from the discontinued or sold business operations was small as these businesses had a very low margin.

Access revenue includes charges for analog and digital lines, broadband lines (ADSL) of retail and wholesale customers and Internet subscription fees. Revenue increased by 7.4% to CHF 838 million due to the growing number of ADSL lines. The number of ADSL lines rose by 216,000 to 317,000 lines compared to last year. Of this figure, 177,000 lines were for Bluewin retail customers and 140,000 lines for customers of other providers.

Other revenue fell by CHF 60 million, of which CHF 56 million relates to a change in the policy for presentation of revenue from Business Numbers for other providers, as described above.

The decline in intersegment revenue by CHF 76 million is chiefly a result of lower volume an prices with Enterprise Solutions.

The 15.9% reduction in operating expenses is mainly due to the following effects. Firstly, savings were achieved in the areas of marketing, IT and network maintenance thanks to consistent cost management. Furthermore, personnel expenses fell as a result of the lower number of employees and the lower expenditure for job-reduction measures. In addition, operating expenses fell as a result of the change in the policy for presentation of Business Numbers for other providers, as described above and as a result of lower network costs due to the closure of sales outlets and the sale of business operations abroad.

EBITDA rose by 11.3% to CHF 1,050 million and EBITDA margin was at 36.1% (prior year 29.9%). EBIT increased by 21.4% to reach CHF 504 million.

For the year 2003, Fixnet expects a decline in revenue and a stable EBITDA compared to 2002 due to the effects described above.

Back to Contents

Mobile

| In CHF millions | | 30.6.2002 | | 30.6.2003 | | Change | |

|

|

|

|

| |

| |

| Connectivity voice | | 1 007 | | 1 034 | | 2.7 | % |

|

|

|

|

| |

| |

| Connectivity data and value-added services | | 236 | | 224 | | –5.1 | % |

|

|

|

|

| |

| |

| Base fees | | 351 | | 342 | | –2.6 | % |

|

|

|

|

| |

| |

| Other revenue | | 53 | | 76 | | 43.4 | % |

|

|

|

|

| |

| |

| Revenue from external customers | | 1 647 | | 1 676 | | 1.8 | % |

|

|

|

|

| |

| |

| Intersegment revenue | | 380 | | 356 | | –6.3 | % |

|

|

|

|

| |

| |

| Net revenue | | 2 027 | | 2 032 | | 0.2 | % |

|

|

|

|

| |

| |

| Segment expenses (incl. intercompany) | | 1 033 | | 976 | | –5.5 | % |

|

|

|

|

| |

| |

| EBITDA | | 994 | | 1 056 | | 6.2 | % |

|

|

|

|

| |

| |

| Margin as % net revenue | | 49.0 | | 52.0 | | | |

|

|

|

|

| |

| |

| Depreciation | | 130 | | 157 | | 20.8 | |

|

|

|

|

| |

| |

| EBIT | | 864 | | 899 | | 4.1 | % |

|

|

|

|

| |

| |

| Number of subscribers in thousands | | 30.6.2002 | | 30.6.2003 | | Change | |

|

|

|

|

| |

| |

| Postpaid | | 2 223 | | 2 325 | | 4.6 | % |

|

|

|

|

| |

| |

| Prepaid | | 1 265 | | 1 350 | | 6.7 | % |

|

|

|

|

| |

| |

| Total | | 3 488 | | 3 675 | | 5.4 | % |

|

|

|

|

| |

| |

| | | 30.6.2002 | | 30.6.2003 | | Change | |

|

|

|

|

| |

| |

| ARPU in CHF | | 85 | | 80 | | –5.9 | % |

| |

| |

| |

| |

| Number of SMS messages in millions | | 795 | | 902 | | 13.5 | % |

| |

| |

| |

| |

Mobile increased its revenue from third parties by 1.8% to CHF 1,676 million compared to the previous year.

The 2.7% increase in revenue for connectivity voice is primarily due to the rise in the number of subscribers. The number of subscribers was increased by a net 187,000 to 3,675,000. By contrast, the average minutes per user (AMPU) and the average revenue per user (ARPU) fell year-over-year. The decline in the ARPU is largely attributable to constant price competition in the business customer segment and changes to subscriptions by residential customers.

Compared to last year, revenue from connectivity data and value-added services decreased by 5.1% due primarily to a change in accounting policies for the presentation of Business Numbers for other providers – from 2003 revenues from business numbers are reported net of service provider costs. In 2002, revenue would have been CHF 23 million lower. This change does not have an effect on EBITDA. Last year’s figures were not restated as the impact is not material. The number of SMS messages sent continues to increase. An increase of 13.5% was achieved compared to last year.

Operating expenses of Mobile dropped by CHF 57 million compared to the previous year. An increase in personnel expenses was offset with lower costs for terminal equipment and network costs and the effect of the change in policy for presentation of Business Numbers. The average costs per customer for customer acquisition and retention were able to be lowered year-over-year. Due to a new arrangement with Vodafone on access to its products, services and platforms, additional costs are expected in the second half of 2003. In addition, the introduction of Vodafone Live is expected in the second half of 2003.

Operating income (EBITDA) increased by CHF 62 million to CHF 1,056 million as a result of lower operating expenses. The EBITDA margin stood at 52.0% (prior year 49.0%).

Compared to last year, Mobile expects a slight increase revenue and EBITDA.

Back to Contents

Financial Review

Enterprise Solutions

| In CHF millions | | 30.6.2002 | | 30.6.2003 | | Change | |

|

|

|

|

| |

| |

| Local and long-distance traffic | | 124 | | 102 | | –17.7 | % |

|

|

|

|

| |

| |

| Fixed-to-mobile traffic | | 106 | | 104 | | –1.9 | % |

|

|

|

|

| |

| |

| International traffic | | 62 | | 53 | | –14.5 | % |

|

|

|

|

| |

| |

| Total traffic | | 292 | | 259 | | –11.3 | % |

|

|

|

|

| |

| |

| Networking | | 284 | | 274 | | –3.5 | % |

|

|

|

|

| |

| |

| Inhouse and processes | | 61 | | 48 | | –21.3 | % |

|

|

|

|

| |

| |

| Other revenue | | 67 | | 63 | | –6.0 | % |

|

|

|

|

| |

| |

| Revenue from external customers | | 704 | | 644 | | –8.5 | % |

|

|

|

|

| |

| |

| Intersegment revenue | | 77 | | 55 | | –28.6 | % |

|

|

|

|

| |

| |

| Net revenue | | 781 | | 699 | | –10.5 | % |

|

|

|

|

| |

| |

| Segment expenses (incl. intercompany) | | 717 | | 644 | | –10.2 | % |

|

|

|

|

| |

| |

| EBITDA | | 64 | | 55 | | –14.1 | % |

|

|

|

|

| |

| |

| Margin as % of net revenue | | 8.2 | | 7.9 | | | |

|

|

|

|

| |

| |

| Depreciation | | 15 | | 19 | | 26.7 | % |

|

|

|

|

| |

| |

| EBIT | | 49 | | 36 | | –26.5 | % |

|

|

|

|

| |

| |

| Traffic volume in million minutes | | 30.6.2002 | | 30.6.2003 | | Change | |

|

|

|

|

| |

| |

| Local and long distance traffic | | 1 692 | | 1 409 | | –16.7 | % |

|

|

|

|

| |

| |

| Fixed-to-mobile traffic | | 227 | | 217 | | –4.4 | % |

|

|

|

|

| |

| |

| Total national traffic | | 1 919 | | 1 626 | | –15.3 | % |

|

|

|

|

| |

| |

| International traffic | | 301 | | 259 | | –14.0 | % |

|

|

|

|

| |

| |

| Total national and international traffic | | 2 220 | | 1 885 | | –15.1 | % |

|

|

|

|

| |

| |

Revenue from third parties fell by 8.5% to CHF 644 million compared to last year. Revenue and volumes fell in national traffic, as was the case for Fixnet, largely due to the new numbering plan introduced last year, the standard national tariff and the substitution for mobile communications. The decline in networking revenue is primarily a result of lower revenue from leased lines.

Compared with last year, operating expenses fell by 10.2%. The decline is mainly a result of lower volume and prices with Fixnet. Operating expenses include expenditure for job-reduction measures amounting to CHF 32 million (prior year CHF 11 million).

The EBITDA fell by CHF 9 million to CHF 55 million compared to last year. Excluding the costs of job-reduction measures, the EBITDA would have been CHF 12 million higher than in the previous year.

For the whole of 2003 lower revenue is expected due to the new numbering plan introduced in 2002, the decline in revenue from leased lines and the general downward pressure on prices resulting from fierce competition. EBITDA is anticipated to remain at the same level as last year through cost saving measures.

Back to Contents

debitel

| In CHF millions | 30.6.2002 | | 30.6.2003 | | Change | |

|

|

|

| |

| |

| Germany | 1 307 | | 1 526 | | 16.8 | % |

|

|

|

| |

| |

| International | 611 | | 651 | | 6.5 | % |

|

|

|

| |

| |

| Net revenue | 1 918 | | 2 177 | | 13.5 | % |

|

|

|

| |

| |

| Segment expenses (incl. intercompany) | 1 833 | | 2 131 | | 16.3 | % |

|

|

|

| |

| |

| EBITDA | 85 | | 46 | | –45.9 | % |

|

|

|

| |

| |

| Margin as % of net revenue | 4.4 | | 2.1 | | | |

|

|

|

| |

| |

| Depreciation | 30 | | 33 | | 10.0 | % |

|

|

|

| |

| |

| EBIT before amortization of goodwill | 55 | | 13 | | –76.4 | % |

|

|

|

| |

| |

| Amortization of goodwill | 137 | | 84 | | –38.7 | % |

|

|

|

| |

| |

| EBIT | (82 | ) | (71 | ) | –13.4 | % |

|

|

|

| |

| |

| | | | | | | |

| Number of subscribers at in thousands | 30.6.2002 | | 30.6.2003 | | Change | |

|

|

|

| |

| |

| Germany | 7 332 | | 7 916 | | 8.0 | % |

|

|

|

| |

| |

| International | 2 300 | | 2 278 | | –1.0 | % |

|

|

|

| |

| |

| Total | 9 632 | | 10 194 | | 5.8 | % |

|

|

|

| |

| |

debitel boosted revenue by 13.5% compared to last year (11.1% in local currency terms). Since the beginning of the year the number of subscribers has increased by a net 133,000 to 10.2 million. The number of subscribers in Germany increased by net 187,000 whereas the number of international subscribers fell by net 54,000. The number of subscribers in Germany has increased mainly in the postpaid segment.

The 16.8% revenue growth in Germany is primarily due to an increase in merchandising revenue and the increase in the number of subscribers.

The operating income (EBITDA) declined by CHF 39 million compared to last year. The decrease is mainly due to the costs incurred for customer acquisition in connection with the increase in the number of subscribers and a lower ARPU.

In 2002, an impairment of the goodwill of debitel of CHF 702 million was recorded. This gives rise to an annual reduction in the future goodwill amortization charge of approximately CHF 104 million.

For the current year debitel expects higher total revenue due to the higher number of subscribers but a lower EBITDA. The lower EBITDA is largely attributable to the customer acquisition costs incurred to increase the number of subscribers and a lower ARPU.

Back to Contents

Financial Review

Other

| In CHF millions | 30.6.2002 | | 30.6.2003 | | Change | |

|

|

|

| |

| |

| Swisscom Systems AG | 197 | | 175 | | –11.2 | % |

|

|

|

| |

| |

| Swisscom IT Services AG | 101 | | 105 | | 4.0 | % |

|

|

|

| |

| |

| Swisscom Broadcast AG | 84 | | 75 | | –10.7 | % |

|

|

|

| |

| |

| Billag AG | 25 | | 26 | | 4.0 | % |

|

|

|

| |

| |

| Other revenue | 2 | | 1 | | –50.0 | % |

|

|

|

| |

| |

| Revenue from external customers | 409 | | 382 | | –6.6 | % |

|

|

|

| |

| |

| Intersegment revenue | 307 | | 274 | | –10.7 | % |

|

|

|

| |

| |

| Net revenue | 716 | | 656 | | –8.4 | % |

|

|

|

| |

| |

| Segment expenses (incl. intercompany) | 607 | | 543 | | –10.5 | % |

|

|

|

| |

| |

| EBITDA | 109 | | 113 | | 3.7 | % |

|

|

|

| |

| |

| Margin as % of net revenue | 15.2 | | 17.2 | | | |

|

|

|

| |

| |

| Depreciation | 106 | | 81 | | –23.6 | % |

|

|

|

| |

| |

| EBIT before amortization of goodwill | 3 | | 32 | | 966.7 | % |

|

|

|

| |

| |

| Amortization of goodwill | 11 | | 16 | | 45.5 | % |

|

|

|

| |

| |

| EBIT | (8 | ) | 16 | | 300.0 | % |

|

|

|

| |

| |

|

The segment Other includes the Group companies Swisscom Systems AG, Swisscom IT Services AG, Swisscom Broadcast AG, Billag AG and Swisscom Eurospot AG.

Revenue from external customers fell by 6.6% compared to the previous year. This reduction is largely due to the lower revenue of Swisscom Systems AG from the rental and service of private branch exchanges (PBXs).

Cost savings enabled operating expenses to be reduced by 10.5%. Operating expenses include job-reduction costs of CHF 4 million (prior year CHF 4 million).

Swisscom Eurospot AG will incur costs in connection with the set-up of the international wireless LAN business in the second half of 2003.

As Swisscom Systems AG recorded costs of CHF 80 million for termination benefits in the fourth quarter of 2002, EBITDA of segment Other in 2003 will be higher than in 2002.

Back to Contents

Corporate

| In CHF millions | 30.6.2002 | | 30.6.2003 | | Change | |

|

|

|

| |

| |

| Revenue from external customers | 39 | | 32 | | –17.9 | % |

|

|

|

| |

| |

| Intersegment revenue | 314 | | 301 | | –4.1 | % |

|

|

|

| |

| |

| Net revenue | 353 | | 333 | | –5.7 | % |

|

|

|

| |

| |

| Segment expenses (incl. intercompany) | 280 | | 222 | | –20.7 | % |

|

|

|

| |

| |

| EBITDA | 73 | | 111 | | 52.1 | % |

|

|

|

| |

| |

| Margin as % of net revenue | 20.7 | | 33.3 | | | |

|

|

|

| |

| |

| Depreciation | 30 | | 30 | | – | |

|

|

|

| |

| |

| EBIT | 43 | | 81 | | 88.4 | % |

|

|

|

| |

| |

|

The segment Corporate encompasses the headquarters divisions, Group company shared services, the real estate company and the employment company WORK_LINK.

Operating income rose by CHF 38 million to CHF 111 million compared to the previous year. The rise is mainly due to the reversal of a provision for dismantlement and restoration of CHF 22 million, that is no longer required.

Job-reduction measures

| In CHF millions | 30.6.2002 | | 30.6.2003 | | Change | |

|

|

|

| |

| |

| Fixnet | 62 | | 48 | | (14 | ) |

|

|

|

| |

| |

| Mobile | – | | – | | – | |

|

|

|

| |

| |

| Enterprise Solutions | 11 | | 32 | | 21 | |

|

|

|

| |

| |

| debitel | – | | – | | – | |

|

|

|

| |

| |

| Other 1) | 4 | | 4 | | – | |

|

|

|

| |

| |

| Group Headquarters 2) | 6 | | 2 | | (4 | ) |

|

|

|

| |

| |

| Reversal of provision 2) | (17 | ) | – | | 17 | |

|

|

|

| |

| |

| Elimination WORK_LINK 2) | (30 | ) | (56 | ) | (26 | ) |

|

|

|

| |

| |

| Total expense for job cuts | 36 | | 30 | | (6 | ) |

|

|

|

| |

| |

| Costs of the partially retired 2) | 3 | | 4 | | 1 | |

|

|

|

| |

| |

| Personnel expenses WORK_LINK 2) | 10 | | 19 | | 9 | |

|

|

|

| |

| |

| Total expense of job-reduction measures | 49 | | 53 | | 4 | |

|

|

|

| |

| |

1) Swisscom Systems AG CHF 0 million (prior year CHF 1 million); Swisscom IT Services AG CHF 4 million (prior year CHF 3 million).

2) Included in the Corporate segment (2003: CHF –31 million; 2002: CHF –28 million).

Costs relating to job-reduction measures are recorded by the individual segments. These expenditures amounted to CHF 86 million in first half of 2003 (previous year CHF 83 million), of which CHF 56 million (previous year CHF 30 million) relates to employees who were transferred to WORK_LINK. As these expenses do not meet the criteria for recognition under IFRS, CHF 56 million (previous year CHF 30 million) has been eliminated in the segment Corporate.

In the first half of 2003, CHF 19 million (previous year CHF 10 million) was incurred for WORK_LINK participants and was included in salaries and wages. In addition, a provision of CHF 17 million was reversed in 2002.

Back to Contents

Financial Review

Income taxes

Income tax expenses totaled CHF 302 million in the first half of 2003, which represents an effective average tax rate of 20.1% (prior year 29.6%). After the implementation of the holding structure in the course of the previous year, the average tax rate decreased. In the first quarter of 2002 income taxes were still charged at higher tax rates.

Affiliated companies

In the previous year, income from the shareholding in AUCS Communication Services (NL) in connection with a management contract with Infonet Services Corp. valid until September 30, 2002 is included in the item equity in net income of affiliated companies. There is no such income in 2003, which gave rise to the reduction in the income from affiliated companies. The remaining investment in affiliated companies mainly comprises the indirect shareholding held in Cesky Telecom (CK) via TelSource N.V. (NL).

Cesky Telecom decided to pay a dividend in the second quarter of 2003. Swisscom’s share amounts to CZK 2,450 million (CHF 119 million). The dividend will be disbursed in the fourth quarter of 2003. This dividend will not have an effect on Swisscom’s operating result.

Unit.Net AG, in which Swisscom has a 49.9% shareholding, was unable to reach its business targets as a result of a difficult economic environment and decided to discontinue its business operations. Swisscom recorded a charge of CHF 14 million, representing the write-down of its investment and liquidation costs, in the first half of 2003.

Capital expenditure

At CHF 535 million, of which CHF 293 million was incurred by Fixnet and CHF 183 million by Mobile, capital expenditure was CHF 21 million higher than in the previous year. For 2003, Swisscom expects capital expenditure of around CHF 1,300 million.

Equity free cash flow

Swisscom has the policy of paying out its available funds (equity free cash flow) to its shareholders. The equity free cash flow results from net cash flow provided by operating activities, less net capital expenditure, net proceeds from sale and purchase of investments, repayment of financial liabilities (excl. leasing liabilities) and dividend payments to minority interests. In the first half of 2003, the equity free cash flow amounted to CHF 498 million (previous year CHF 311 million). Included as deductions in the first half of 2003 are the repayment of the loan outstanding to the Swiss Post of CHF 750 million and the dividends paid to minority interests of CHF 392 million. No such payments are expected in the second half of 2003.

Minority interests

Minority interests mainly relates to the 25% share of Vodafone in Swisscom Mobile AG. The minority share of profits amounted to CHF 204 million (previous year CHF 147 million) in the first half year. In the first half of 2003 CHF 392 million (prior year CHF 302 million) were distributed to the minority interests.

Outlook

In the light of the tense market situation Swisscom expects a slight decline in revenue for the current year. Thanks to consistent cost management, Swisscom expects operating income before interest, taxes and depreciation (EBITDA) to at least equal 2002 (CHF 4,400 million). Capital expenditure is expected to be approximately CHF 1,300 million in 2003.

Back to Contents

Consolidated income statements

| | | unaudited

| |

| In CHF millions, except per share amount | | 1.4.–30.6.2002 | | 1.4.–30.6.2003 | | 1.1.–30.6.2002 | | 1.1.–30.6.2003 | |

| |

| |

| |

| |

| Net revenue | | 3 612 | | 3 637 | | 7129 | | 7154 | |

| |

| |

| |

| |

| Other operating income | | 48 | | 60 | | 100 | | 98 | |

| |

| |

| |

| |

| | | | | | | | | | |

|

| |

| |

| |

| |

| Total | | 3 660 | | 3 697 | | 7 229 | | 7 252 | |

| |

| |

| |

| |

| | | | | | | | |

| |

| |

| |

| |

| Goods and services purchased | | 1 205 | | 1 162 | | 2 365 | | 2 294 | |

| |

| |

| |

| |

| Personnel expenses | | 671 | | 615 | | 1 307 | | 1 269 | |

| |

| |

| |

| |

| Other operating expenses | | 684 | | 652 | | 1 289 | | 1 258 | |

| |

| |

| |

| |

| Depreciation | | 392 | | 392 | | 780 | | 792 | |

| |

| |

| |

| |

| Amortization | | 106 | | 91 | | 207 | | 174 | |

| |

| |

| |

| |

| Total operating expenses | | 3 058 | | 2 912 | | 5 948 | | 5 787 | |

| |

| |

| |

| |

| | | | | | | | | | |

|

| |

| |

| |

| |

| Operating income | | 602 | | 785 | | 1 281 | | 1 465 | |

| |

| |

| |

| |

| Financial expense | | (101 | ) | (10 | ) | (173 | ) | (80 | ) |

| |

| |

| |

| |

| Financial income | | 60 | | 30 | | 113 | | 61 | |

| |

| |

| |

| |

| | | | | | | | | | |

|

| |

| |

| |

| |

| Income before income taxes, equity in net income of affiliated | | | | | | | | | |

| companies and minority interests | | 561 | | 805 | | 1 221 | | 1 446 | |

| |

| |

| |

| |

| | | | | | | | | | |

|

| |

| |

| |

| |

| Income tax expense | | (184 | ) | (160 | ) | (361 | ) | (302 | ) |

| |

| |

| |

| |

| | | | | | | | | | |

|

| |

| |

| |

| |

| Income before equity in net income of affiliated | | | | | | | | | |

| companies and minority interests | | 377 | | 645 | | 860 | | 1 144 | |

| |

| |

| |

| |

| | | | | | | | | | |

|

| |

| |

| |

| |

| Equity in net income of affiliated companies | | 45 | | 6 | | 67 | | 12 | |

| |

| |

| |

| |

| Minority interests | | (62 | ) | (108 | ) | (147 | ) | (204 | ) |

| |

| |

| |

| |

| | | | | | | | | | |

|

| |

| |

| |

| |

| Net income | | 360 | | 543 | | 780 | | 952 | |

| |

| |

| |

| |

| | | | | | | | | | |

|

| |

| |

| |

| |

| Earnings per share (in CHF) | | 5.44 | | 8.20 | | 11.27 | | 14.38 | |

| |

| |

| |

| |

| | | | | | | | | | |

|

| |

| |

| |

| |

| Average number of shares outstanding (in thousands) | | 66 203 | | 66 203 | | 69 223 | | 66 203 | |

| |

| |

| |

| |

| |

Back to Contents

Consolidated balance sheet (condensed)

| | | | unaudited | |

| | | |

| |

| In CHF millions | 31.12.2002 | | 30.6.2003 | |

| |

| |

| Assets | | | | |

|

| |

| |

| | | | | |

|

| |

| |

| Current assets | | | | |

|

| |

| |

| Cash and cash equivalents | 1 682 | | 1 334 | |

|

| |

| |

| Current financial assets | 285 | | 264 | |

|

| |

| |

| Other current assets | 3 048 | | 3 129 | |

|

| |

| |

| Current income tax assets | 178 | | 22 | |

|

| |

| |

| Total current assets | 5 193 | | 4 749 | |

|

| |

| |

| | | | | |

|

| |

| |

| Non-current assets | | | | |

|

| |

| |

| Property, plant and equipment | 7 536 | | 7 223 | |

|

| |

| |

| Investments in affiliated companies | 691 | | 652 | |

|

| |

| |

| Goodwill and other intangible assets | 1 544 | | 1 562 | |

|

| |

| |

| Non-current financial assets | 1 584 | | 1 504 | |

|

| |

| |

| Deferred tax assets | 410 | | 330 | |

|

| |

| |

| Total non-current assets | 11 765 | | 11 271 | |

|

| |

| |

| | | | | |

|

| |

| |

| Total assets | 16 958 | | 16 020 | |

|

| |

| |

| | | | | |

|

| |

| |

| Liabilities and shareholders’ equity | | | | |

|

| |

| |

| | | | | |

|

| |

| |

| Current liabilities | | | | |

|

| |

| |

| Short-term debt | 1 016 | | 224 | |

|

| |

| |

| Current tax liabilities | 121 | | 178 | |

|

| |

| |

| Other current liabilities | 2 826 | | 2 669 | |

|

| |

| |

| Total current liabilities | 3 963 | | 3 071 | |

|

| |

| |

| | | | | |

|

| |

| |

| Long-term liabilities | | | | |

|

| |

| |

| Long-term debt | 2 697 | | 2 622 | |

|

| |

| |

| Accrued pension cost | 1 101 | | 1 059 | |

|

| |

| |

| Deferred tax liabilities | 296 | | 320 | |

|

| |

| |

| Other long-term liabilities | 806 | | 782 | |

|

| |

| |

| Total long-term liabilities | 4 900 | | 4 783 | |

|

| |

| |

| | | | | |

|

| |

| |

| Total liabilities | 8 863 | | 7 854 | |

|

| |

| |

| | | | | |

|

| |

| |

| Minority interests | 796 | | 608 | |

|

| |

| |

| | | | | |

|

| |

| |

| Shareholders’ equity | 7 299 | | 7 558 | |

|

| |

| |

| | | | | |

|

| |

| |

| Total liabilities and shareholders’ equity | 16 958 | | 16 020 | |

|

| |

| |

| |

Back to Contents

Consolidated cash flow statement (condensed)

| | | | | unaudited | |

| | | | |

| |

| In CHF millions | | 30.6.2002 | | 30.6.2003 | |

|

|

| |

| |

| Operating income before interest, taxes and depreciation (EBITDA) | | 2 268 | | 2 431 | |

|

|

| |

| |

| Change in working capital and other cash flows from operating activities | | (359 | ) | (141 | ) |

|

|

| |

| |

| Decrease in accured pension costs | | (22 | ) | (42 | ) |

|

|

| |

| |

| Interest (paid) received net | | (30 | ) | (25 | ) |

|

|

| |

| |

| Income tax (paid) benefit | | (148 | ) | 9 | |

|

|

| |

| |

| Net cash provided by operating activities | | 1 709 | | 2 232 | |

|

|

| |

| |

| | | | | | |

|

|

| |

| |

| Capital expenditure | | (514 | ) | (535 | ) |

|

|

| |

| |

| Investments in subsidiaries and affiliated companies | | (116 | ) | (57 | ) |

|

|

| |

| |

| Proceeds from sale of affiliated companies | | 34 | | – | |

|

|

| |

| |

| Purchase and sale of current financial assets, net | | 1 746 | | 6 | |

|

|

| |

| |

| Other cash flows from investing activities, net | | 12 | | 14 | |

|

|

| |

| |

| Net cash (expenditure) from investing activities | | 1 162 | | (572 | ) |

|

|

| |

| |

| | | | | | |

|

|

| |

| |

| Repayment of debt, net | | (562 | ) | (850 | ) |

|

|

| |

| |

| Purchase of treasury stock | | (4 264 | ) | – | |

|

|

| |

| |

| Dividends paid | | (728 | ) | (795 | ) |

|

|

| |

| |

| Dividends paid to minority interests | | (302 | ) | (392 | ) |

|

|

| |

| |

| Net cash used in financing activities | | (5 856 | ) | (2 037 | ) |

|

|

| |

| |

| | | | | | |

|

|

| |

| |

| Net decrease in cash and cash equivalents | | (2 985 | ) | (377 | ) |

|

|

| |

| |

| Cash and cash equivalents at beginning of year | | 3 788 | | 1 682 | |

|

|

| |

| |

| Translation adjustments to cash and cash equivalents | | (2 | ) | 29 | |

|

|

| |

| |

| Cash and cash equivalents at end of the period | | 801 | | 1 334 | |

|

|

| |

| |

Back to Contents

Consolidated statement of shareholders’ equity

| | unaudited | |

| |

| |

In CHF millions | | Share capital | | Additional paid-in capital | | Retained earnings | | Treasury stock | | Fair value and other reserves | | Total shareholders’ equity | |

| |

| Balance at December 31, 2001 | | 1 250 | | 2 395 | | 8 711 | | (2 | ) | (285 | ) | 12 069 | |

|

|

|

|

|

|

|

|

|

|

|

|

| |

| Translation adjustments | | – | | – | | – | | – | | 54 | | 54 | |

|

|

|

|

|

|

|

|

|

|

|

|

| |

| Fair value adjustments | | – | | – | | – | | – | | (48 | ) | (48 | ) |

|

|

|

|

|

|

|

|

|

|

|

|

| |

| Profits not recognized in income statement | | – | | – | | – | | – | | 6 | | 6 | |

|

|

|

|

|

|

|

|

|

|

|

|

| |

| Share buy back | | (125 | ) | (1 823 | ) | (2 316 | ) | – | | – | | (4 264 | ) |

|

|

|

|

|

|

|

|

|

|

|

|

| |

| Dividends relating to 2001 | | – | | – | | (728 | ) | – | | – | | (728 | ) |

|

|

|

|

|

|

|

|

|

|

|

|

| |

| Net income | | – | | – | | 780 | | – | | – | | 780 | |

|

|

|

|

|

|

|

|

|

|

|

|

| |

| Balance at June 30, 2002 | | 1 125 | | 572 | | 6 447 | | (2 | ) | (279 | ) | 7 863 | |

|

|

|

|

|

|

|

|

|

|

|

|

| |

| | | | | | | | | | | | | | |

|

|

|

|

|

|

|

|

|

|

|

|

| |

| Balance at December 31, 2002 | | 596 | | 572 | | 6 491 | | (1 | ) | (359 | ) | 7 299 | |

|

|

|

|

|

|

|

|

|

|

|

|

| |

| Translation adjustments | | – | | – | | – | | – | | 144 | | 144 | |

|

|

|

|

|

|

|

|

|

|

|

|

| |

| Fair value adjustments | | – | | – | | – | | – | | (42 | ) | (42 | ) |

|

|

|

|

|

|

|

|

|

|

|

|

| |

| Profits not recognized in income statement | | – | | – | | – | | – | | 102 | | 102 | |

|

|

|

|

|

|

|

|

|

|

|

|

| |

| Dividends relating to 2002 | | – | | – | | (795 | ) | – | | – | | (795 | ) |

|

|

|

|

|

|

|

|

|

|

|

|

| |

| Net income | | – | | – | | 952 | | – | | – | | 952 | |

|

|

|

|

|

|

|

|

|

|

|

|

| |

| Balance at June 30, 2003 | | 596 | | 572 | | 6 648 | | (1 | ) | (257 | ) | 7 558 | |

|

|

|

|

|

|

|

|

|

|

|

|

| |

Back to Contents

Notes to the Consolidated Interim Statements

1 Accounting principles

The unaudited consolidated interim statements have been drawn up in accordance with International Accounting Standard (IAS) 34 “Interim Financial Reporting”. The same accounting principles apply as were used for the consolidated financial statements for 2002.

Certain amounts for the previous year have been reclassified to facilitate comparison.

2 Results by segment

The “Fixnet” segment covers national and international traffic for residential customers, access charges for residential and business customers as well as revenue from the sale of terminal equipment. Additionally, the segment covers utilization of the Swisscom fixed network by other national and international providers and international wholesale activities. The segment also comprises Bluewin AG, Swisscom Directories AG, Telecom FL AG, payphone services, operator services and the cards business.

“Mobile” covers the provision of mobile telephony, data and value-added services and network utilization charges.

“Enterprise Solutions” covers national and international telephony as well as value-added service for business customers, leased lines, telehousing, hosting and communications solutions.

The “debitel” segment reflects the business activities of the debitel Group.

The segment “Other” covers mainly Swisscom Systems AG, Swisscom IT Services AG, Swisscom Broadcast AG, Billag AG and Swisscom Eurospot AG.

“Corporate” includes headquarters, Group company shared services, the real estate company, the employment company WORK_LINK for employees affected by job cuts and expenses that cannot be directly allocated to another segment.

Back to Contents

Notes to the Consolidated Interim Statements

| | unaudited | |

| |

| |

| In CHF millions | | | | | | | | | | | | | | | | |

| 30.6.2002 | Fixnet | | Mobile | | Enterprise

Solutions | | debitel | | Other | | Corporate | | Elimination | | Total | |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| |

| Net revenue from external customers | 2 412 | | 1 647 | | 704 | | 1 918 | | 409 | | 39 | | – | | 7 129 | |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| |

| Intersegment revenue | 742 | | 380 | | 77 | | – | | 307 | | 314 | | (1 820 | ) | – | |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| |

| Net revenue | 3 154 | | 2 027 | | 781 | | 1 918 | | 716 | | 353 | | (1 820 | ) | 7 129 | |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| |

| | | | | | | | | | | | | | | | | |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| |

| Segment expenses | (2 211 | ) | (1 033 | ) | (717 | ) | (1 833 | ) | (607 | ) | (280 | ) | 1 820 | | (4 861 | ) |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| |

| Operating income before | | | | | | | | | | | | | | | | |

| depreciation (EBITDA) | 943 | | 994 | | 64 | | 85 | | 109 | | 73 | | – | | 2 268 | |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| |

| Margin in % | 29.9 | | 49.0 | | 8.2 | | 4.4 | | 15.2 | | 20.7 | | – | | 31,8 | |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| |

| | | | | | | | | | | | | | | | | |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| |

| Depreciation and amortization | (527 | ) | (130 | ) | (15 | ) | (30 | ) | (106 | ) | (30 | ) | – | | (838 | ) |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| |

| Operating income before goodwill | | | | | | | | | | | | | | | | |

| amortization | 416 | | 864 | | 49 | | 55 | | 3 | | 43 | | – | | 1 430 | |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| |

| | | | | | | | | | | | | | | | | |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| |

| Amortization of goodwill | (1 | ) | – | | – | | (137 | ) | (11 | ) | – | | – | | (149 | ) |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| |

| Operating income (EBIT) | 415 | | 864 | | 49 | | (82 | ) | (8 | ) | 43 | | – | | 1 281 | |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| |

| | unaudited | |

| |

| |

| In CHF millions | | | | | | | | | | | | | | | | |

| 30.6.2003 | Fixnet | | Mobile | | Enterprise

Solutions | | debitel | | Other | | Corporate | | Elimination | | Total | |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| |

| Net revenue from external customers | 2 243 | | 1 676 | | 644 | | 2 177 | | 382 | | 32 | | – | | 7 154 | |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| |

| Intersegment revenue | 666 | | 356 | | 55 | | – | | 274 | | 301 | | (1 652) | | – | |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| |

| Net revenue | 2 909 | | 2 032 | | 699 | | 2 177 | | 656 | | 333 | | (1 652) | | 7 154 | |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| |

| | | | | | | | | | | | | | | | | |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| |

| Segment expenses | (1 859) | | (976 | ) | (644 | ) | (2 131) | | (543 | ) | (222 | ) | 1 652 | | (4 723) | |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| |

| Operating income before | | | | | | | | | | | | | | | | |

| depreciation (EBITDA) | 1 050 | | 1 056 | | 55 | | 46 | | 113 | | 111 | | – | | 2 431 | |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| |

| Margin in % | 36.1 | | 52.0 | | 7.9 | | 2.1 | | 17.2 | | 33.3 | | – | | 34,0 | |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| |

| | | | | | | | | | | | | | | | | |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| |

| Depreciation and amortization | (542 | ) | (157 | ) | (19 | ) | (33 | ) | (81 | ) | (30 | ) | – | | (862 | ) |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| |

| Operating income before goodwill | | | | | | | | | | | | | | | | |

| amortization | 508 | | 899 | | 36 | | 13 | | 32 | | 81 | | – | | 1 569 | |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| |

| | | | | | | | | | | | | | | | | |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| |

| Amortization of goodwill | (4 | ) | – | | – | | (84 | ) | (16 | ) | – | | – | | (104 | ) |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| |

| Operating income (EBIT) | 504 | | 899 | | 36 | | (71 | ) | 16 | | 81 | | – | | 1 465 | |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| |

Back to Contents

3 Debt

| | | | unaudited | |

| | | |

| |

| In CHF millions | 31.12.2002 | | 30.6.2003 | |

|

| |

| |

| Long-term debt | | | | |

|

| |

| |

| Swiss Post loan | 750 | | – | |

|

| |

| |

| Financial liability from cross-border tax lease arrangements | 1 463 | | 1 477 | |

|

| |

| |

| Finance lease obligation | 1 192 | | 1 175 | |

|

| |

| |

| Other long-term debt | 42 | | 30 | |

|

| |

| |

| Total | 3 447 | | 2 682 | |

|

| |

| |

| Less current portion | (750 | ) | (60 | ) |

|

| |

| |

| Total long-term debt | 2 697 | | 2 622 | |

|

| |

| |

| | | | | |

|

| |

| |

| Short-term debt | | | | |

|

| |

| |

| Current portion of long-term debt | 750 | | 60 | |

|

| |

| |

| Other short-term debt | 266 | | 164 | |

|

| |

| |

| Total short-term debt | 1 016 | | 224 | |

|

| |

| |

4 Capital reduction

On May 6, 2003, the Shareholders’ Meeting approved a capital reduction of CHF 8 per share totalling CHF 530 million. The amount was repaid on August 19, 2003.

Back to Contents

Shareholder information

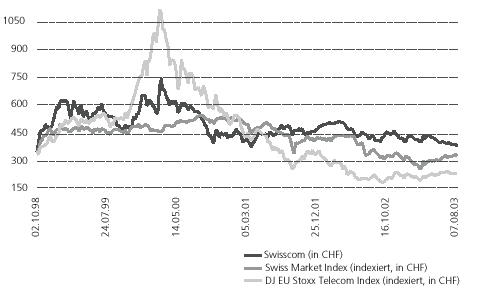

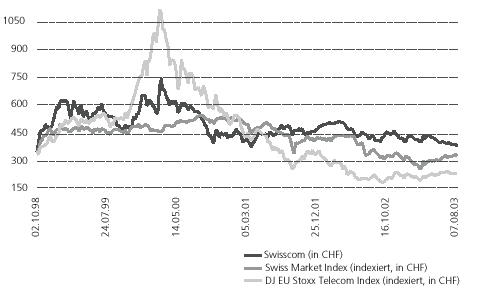

Swisscom share price on the Swiss Exchange (in CHF)

|

|

|

|

31.12. 2002–30.6.2003 | virt-x | | NYSE |

|

|

|

|

| Closing price at 31.12.2002 | CHF 400.50 | | USD 28.51 |

|

|

|

|

| 1.1. – 30.6.2003 | virt-x | | NYSE |

|

|

|

|

| Closing price at 30.6.2003 1) | CHF 385.00 | | USD 28.34 |

|

|

|

|

| Year high 1) | CHF 438.50 | | USD 32.23 |

|

|

|

|

| Year low 1) | CHF 381.50 | | USD 28.05 |

|

|

|

|

| Total trading volume | 12 463 182 | | 2 149 100 |

|

|

|

|

| Dailey average | 102 157 | | 17 331 |

|

|

|

|

| Total volume in millions | CHF 5 040.31 | | USD 65.11 |

|

|

|

|

| Dailey average in millions | CHF 41.31 | | USD 0.53 |

|

|

|

|

Source: Bloomberg

1) prices paid

Share information

The share capital consists of 66,203,261 registered shares, of which the Swiss Confederation holds 41,531,200 registered shares (62.7%). The nominal value per registered share stood at CHF 9 on June 30, 2003. A reduction in the nominal value of CHF 8 per share was decided at the regular Shareholders’ Meeting in 2003. The repayment made on August 19, 2003 results in a nominal value of CHF 1. At June 30, 2003, 24,672,061 registered shares (37.3%) were distributed among 75,283 shareholders. The unattributed share average is around 12%.

One vote is granted for each share. Voting rights can only be exercised if the shareholder has been entered into the share register of Swisscom with a voting right. The administrative board can reject the entry of a shareholder with a voting right in the share register if the respective shareholder’s voting rights exceed 5% of the share capital.

Financial calendar

| November 20, 2003 | Interim report 3rd quarter 2003 |

| March 24, 2004 | Annual results 2003 |

| April 27, 2004 | Shareholders’ Meeting, Lucerne |

| April 30, 2004 | Dividend payment |

Back to Contents

Stock markets

Swisscom shares are traded on the pan-European blue-chip platform virt-x under the symbol “SCMN” (security no. 874251) and in the form of American depository shares (ADS) at a ratio of 1:10 on the New York Stock Exchange under the symbol “SCM” (security number 949527).

|

Stock Exchange | Bloomberg | Reuters | Telekurs |

|

| virt-x, London | SCMN VX | SCMN.VX | SCMN.VTX |

|

| NYSE, New York | SCM US | SCM.N | SCM.NYS |

|

Return policy

Swisscom’s policy is to distribute the freely available funds (equity free cash flow) each year. The funds available for such payment consist of net cash flow provided by operating activities, less net capital expenditure, net proceeds from sale and purchase of investments, repayment of financial liabilities (excl. leasing liabilities) and dividend payments to minority interests. The disbursement is made via a dividend which amounts to about half of the net income adjusted for one-time transactions, and is supplemented by either a share buy back or – as is the case for the last time in 2003 – a reduction in capital (par value). Share buy backs need not take place at the same time as dividend payouts.

Back to Contents

The Consolidated Financial Statements are available in English, German and French. The German version is binding.

Forward-looking statements

This communication contains statements that constitute “forward-looking statements”. In this communication, such forward-looking statements include, without limitation, statements relating to our financial condition, results of operations and business and certain of our strategic plans and objectives. Because these forward-looking statements are subject to risks and uncertainties, actual future results may differ materially from those expressed in or implied by the statements. Many of these risks and uncertainties relate to factors which are beyond Swisscom’s ability to control or estimate precisely, such as future market conditions, currency fluctuations, the behavior of other market participants, the actions of governmental regulators and other risk factors detailed in Swisscom’s past and future filings and reports filed with the U.S. Security and Exchange Commission and posted on our websites. Readers are cautioned not to put undue reliance on forward-looking statements, which speak only of the date of this communication. Swisscom disclaims any intention or obligation to update and revise any forward-looking statements, whether as a result of new information, future events or otherwise

Back to Contents

| For general information

Swisscom AG

Group Communications

CH-3050 Bern |

| T+ | 41 31 342 36 78 |

| F+ | 41 31 342 27 79 |

| E | swisscom@swisscom.com |

| | |

| For financial information

Swisscom AG

Investor Relations

CH-3050 Bern |

| T+ | 41 31 342 25 38 |

| F+ | 41 31 342 64 11 |

| E | investor.relations@swisscom.com |

| 830.957.7 e |