UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM 10-K/A

Amendment No. 1

(Mark One)

[X] ANNUAL REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934

For the fiscal year endedDecember 31, 2008OR

[ ] TRANSITION REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934

For the transition period from __________to __________

Commission File Number000-30095

WESCORP ENERGY INC.

(Exact Name of Registrant Specified In Its Charter)

| Delaware | 98-0447716 |

| State or Other Jurisdiction of | (I.R.S. Employer |

| Incorporation or Organization | Identification No.) |

Suite 770, 435 – 4thAvenue S.W., Calgary, Alberta, Canada T2P 3A8

(Address of Principal Executive Offices) (Zip Code)

(403) 206-3990

Issuer’s Telephone Number

Securities registered pursuant to Section 12(b) of the Act:

| Title of each class | Name of each exchange on which registered |

| None | None |

Securities registered pursuant to Section 12(g) of the Act:

| Title of each class | Name of each exchange on which registered |

| Common Stock, $.0001 Par Value | OTC Bulletin Board |

Indicate by check mark if the registrant is a well-known seasoned issuer, as defined in Rule 405 of the Securities Act. Yes __ No X

Indicate by check mark if the registrant is not required to file reports pursuant to Section 13 or Section 15(d) of the Act. Yes __ NoX

Indicate by check mark whether the registrant (1) has filed all reports required to be filed by Section 13 or 15(d) of the Securities Exchange Act of 1934 during the preceding 12 months (or for such shorter period that the registrant was required to file such reports), and (2) has been subject to such filing requirements for the past 90 days. YesXNo __

Indicate by check mark if disclosure of delinquent filers pursuant to Item 405 of Regulation S-K is not contained herein, to the best of registrant's knowledge, in definitive proxy or information statements incorporated by reference in Part III of this Form 10-K or any amendment to this Form 10-K. [X]

Indicate by check mark whether the registrant is a large accelerated filer, an accelerated filer, a non-accelerated filer, or a smaller reporting company. See the definitions of “large accelerated filer,” “accelerated filer” and “smaller reporting company” in Rule 12b-2 of the Exchange Act.

| Large accelerated filer | | Accelerated filer |

| Non-accelerated filer ____ | (Do not check if a small reporting company) | Small Reporting Company__X__ |

Indicate by check mark whether the registrant is a shell company (as defined by Rule 12b-2 of the Exchange Act). Yes__ NoX

The aggregate market value of the voting common stock held by non-affiliates of the registrant at the close of business on June 30, 2008, was $30,366,657. Without asserting that any director or executive officer of the registrant, or the beneficial owner of more than five percent of the registrant’s common stock, is an affiliate, the shares of which they are the beneficial owners have been deemed to be owned by affiliates solely for this calculation.

State the number of shares outstanding of each of the issuer’s classes of common equity, as of the latest practicable date: 88,752,557 shares of common stock as of March 20, 2009.

EXPLANATORY NOTE

This Amendment No. 1 on Form 10-K/A (this “Amendment”) amends our Annual Report on Form 10-K for the fiscal year ended December 31, 2008, originally filed on April 15, 2009 (the “Original Filing”). The amended portion of the Original Filing is under Part II, Item 8 – Financial Statements and Supplementary Data. This Amendment revises the dollar amount on the lines – “Cash, end of year” and “Cash, paid for Interest” for 2008 under the “Consolidated Statements of Cash Flow”. These revisions are due to two typographical errors, recently discovered by the Company, resulting from the edgarization process.

Also included in this Amendment, pursuant to Rules 12b-15 and 13a-14 under the Exchange Act, is a currently dated certification.

Except as described above, no other changes have been made to the Original Filing. Part IV, Item 15 of the Original Filing has been amended and restated solely to include as exhibits the new certifications required by Rule 13a-14(a) under the Exchange Act. The Amendment continues to provide information as of the same dates as the Original Filing, and we have not updated the disclosures to reflect any events that occurred after the date of the Original Filing.

As used in this document, references to “Wescorp”, “our company”, “the Company”, “we”, “us”, and “our ” refer to Wescorp Energy, Inc. and its wholly-owned subsidiaries.

PART II

ITEM 8. FINANCIAL STATEMENTS AND SUPPLEMENTARY DATA

The financial statements required by this Item begin on Page F-1 of this Form 10-K, and include:

- the report of independent registered public accounting firm;

- consolidated balance sheets as of December 31, 2008 and 2007;

- consolidated statements of operations and comprehensive loss, stockholders' deficit and cash flows for the years ended December 31, 2008 and 2007; and

- notes to the consolidated financial statements.

PART IV

ITEM 15. EXHIBITS, FINANCIAL STATEMENT SCHEDULES

(a)(1) and (a)(2) Financial Statements And Financial Statement Schedules

| Audit Report of Independent Registered Public Accounting Firm | |

| Consolidated Balance Sheets | F-1 |

| Consolidated Statements of Operations and Comprehensive Loss | F-2 |

| Consolidated Statements of Stockholder Deficit | F-3 |

| Consolidated Statements of Cash Flows | F-4 |

| Notes to Consolidated Financial Statements | F-6 |

All other schedules are omitted because the required information is not applicable or is not present in amounts sufficient to require submission of the schedule or because the information required is included in the Consolidated Financial Statements and Notes thereto.

(b)Exhibits.The following exhibits are filed with or incorporated by reference into this report on Form 10-K:

| Exhibit | |

| Number | Description |

| 2.1 | Share Purchase and Subscription Agreement dated June 9, 2003 among the Company, 1049265 Alberta Ltd., Flowray, Flowstar, New Millennium Acquisitions Ltd. ("New Millennium") and Gregory Burghardt. (Incorporated by reference to the Company’s Current Report on Form 8-K/A filed with the Commission on May 12, 2004, File No. 000-30095.) |

| | |

| 2.2 | Share Purchase Agreement dated as of January 14, 2004 between the Company and the Trustee of the Epitihia Trust. |

| (Incorporated by reference to the Company’s Current Report on Form 8-K/A filed with the Commission on May 12, 2004, File No. 000-30095.) |

| | |

| 2.3 | Share Purchase Agreement dated as of January 14, 2004 between the Company and the Trustee of the Abuelo Trust. (Incorporated by reference to the Company’s Current Report on Form 8-K/A filed with the Commission on May 12, 2004, File No. 000-30095.) |

| | |

| 2.4 | Share Purchase and Subscription Amending Agreement dated January 14, 2004 among the Company, 1049265 Alberta Ltd., Flowray, Flowstar, New Millennium and Gregory Burghardt. (Incorporated by reference to the Company’s Current Report on Form 8- K/A filed with the Commission on May 12, 2004, File No. 000-30095.) |

| | |

| 2.5 | Share Purchase Agreement dated as of January 14, 2004 between the Company and Epitihia Trust. (Incorporated by reference to the Company’s Current Report on Form 8-K/A filed with the Commission on May 12, 2004, File No. 000- 30095.) |

| | |

| 2.6 | Share Purchase Agreement dated as of January 14, 2004 between the Company and Abuelo Trust. (Incorporated by reference to the Company’s Current Report on Form 8-K/A filed with the Commission on May 12, 2004, File No. 000-30095.) |

| | |

| 2.7 | Share Purchase Option Agreement dated February 10, 2004 between the Company and Olav Ellingsen (Incorporated by reference to the Company’s Current Report on Form 8-K filed with the Commission on April 9, 2004, File No. 000- 30095.) |

| | |

| 2.8 | Amending Agreement dated as of June 16, 2004 between the Company and the Trustee of the Epitihia Trust. (Incorporated by reference to the Company’s Quarterly Report on Form 10-QSB filed with the Commission on August 26, 2004, File No. 000-30095.) |

| | |

| 2.9 | Amending Agreement dated as of June 16, 2004 between the Company and the Trustee of the Abuelo Trust. (Incorporated by reference to the Company’s Quarterly Report on Form 10-QSB filed with the Commission on August 26, 2004, File No. 000-30095.) |

| | |

| 2.10 | Form of Subscription Agreement dated March 15, 2005 by and between Wescorp and the Purchaser named therein. (Incorporated by reference to the Company’s Current Report on Form 8-K filed with the Commission on March 21, 2005, File No. 000-30095.) |

| | |

| 2.11 | Form of Subscription Agreement dated April 28, 2005 between and Wescorp and the Purchaser named therein. (Incorporated by reference to the Company’s Current Report on Form 8-K filed with the Commission on April 29, 2005, File No. 000-30095.) |

| | |

| 2.12 | Form of Subscription Agreement between the Company and the United States Resident Purchaser named therein. (Incorporated by reference to the Company’s Current Report on Form 8-K filed with the Commission on December 24, 2006, File No. 000-30095.) |

| | |

| 2.13 | Form of Subscription Agreement between the Company and the Non-United States Resident Purchaser named therein. (Incorporated by reference to the Company’s Current Report on Form 8-K filed with the Commission on December 24, 2006, File No. 000-30095.) |

| | |

| 2.14 | Purchase Agreement dated March 23, 2007 between the Company and 306538 Alberta Ltd. (Incorporated by reference to the Company’s Current Report on Form 8-k filed with the Commission on March 27, 2007, File No. 000-30095.) |

| | |

| 2.15 | Agreement and Plan of Merger between the Company and Strategic Decision Sciences, USA, Inc. dated as of September 5, 2007 (Incorporated by reference to Form 8-K filed on September 11, 2007.) |

| | |

| 3.1 | Restated Articles of Incorporation of the Company filed February 17, 2004. (Incorporated by reference to the Company’s Annual Report on Form 10-KSB/A filed with the Commission on May 13, 2004, File No. 000- 30095.) |

| | |

| 3.2 | Amended and Restated Bylaws. (Incorporated by reference to the Company’s Annual Report on Form 10-K filed with the Commission on April 15, 2009, File No. 000- 30095.) |

| | |

| 4.1 | Form of Common Stock Purchase Warrant dated March 15, 2005. (Incorporated by reference to the Company’s |

| | Current Report on Form 8-K filed with the Commission on March 21, 2005, File No. 000- 30095.) |

| | |

| 4.2 | Certificate for 14% Secured Convertible Debenture dated April 28, 2005 (Incorporated by reference to the Company’s Current Report on Form 8-K filed with the Commission on April 29, 2005, File No. 000- 30095.) |

| | |

| 4.3 | Form of Common Stock Purchase dated April 28, 2005. (Incorporated by reference to the Company’s Current Report on Form 8-K filed with the Commission on April 29, 2005, File No. 000-30095.) |

| | |

| 4.4 | Addendum dated February 6, 2003 to that certain Loan Agreement dated January 28, 2003 between the Company and AHC Holdings Ltd. containing Stock Purchase Warrant (Incorporated by reference to the Company’s Current Report on Form 8-K filed with the Commission on April 28, 2003, File No. 000- 30095.) |

| | |

| 4.5 | Form of Warrant issued to the United States Resident Purchaser named therein. (Incorporated by reference to the Company’s Current Report on Form 8-K filed with the Commission on December 24, 2006, File No. 000- 30095.) |

| | |

| 4.6 | Form of Warrant issued to the Non-United States Resident Purchaser named therein. (Incorporated by reference to the Company’s Current Report on Form 8-K filed with the Commission on December 24, 2006, File No. 000- 30095.) |

| | |

| 4.7 | Form of Debenture Certificate 14% Redeemable Secured Debenture issued to Non-United States Residents (Incorporated by reference to the Company’s Current Report on Form 8-K filed with the Commission on February 20, 2008.) |

| | |

| 4.8 | Form of Warrant issued to Non-United States Residents (Incorporated by reference to the Company’s Current Report on Form 8-K filed with the Commission on February 20, 2008.) |

| | |

| 10.1 | Hypothecation Agreement dated as of July 6, 2004 between the Company, the Trustee of the Epitihia Trust and Yearwood & Boyce. (Incorporated by reference to the Company’s Quarterly Report on Form 10-QSB filed with the Commission on August 26, 2004, File No. 000-30095.) |

| | |

| 10.2 | Hypothecation Agreement dated as of July 6, 2004 between the Company, the Trustee of the Abuelo Trust and Yearwood & Boyce. (Incorporated by reference to the Company’s Quarterly Report on Form 10-QSB filed with the Commission on August 26, 2004, File No. 000-30095.) |

| | |

| 10.3 | License Agreement dated and effective December 1, 2001 between Flowray and Flowstar Technologies, Inc. (Incorporated by reference to the Company’s Current Report on Form 8-K/A filed with the Commission on May 12, 2004, File No. 000-30095.) |

| | |

| 10.4 | Memorandum of Understanding, dated as of September 21, 2004 between the Company and Ellycrack AS (Incorporated by reference to Form 8-K filed on September 23, 2004.) |

| | |

| 10.5 ** | Employment Agreement dated as of September 1, 2007 by and among the Company and Douglas Biles (Incorporated by reference to Form 8-K filed on September 21, 2007.) |

| | |

| 10.6 | Letter Agreement, dated as of November 22, 2006, between the Company and Jack Huber (Incorporated by reference to the Company’s Annual Report on Form 10-KSB filed with the Commission on April 11, 2007, File No. 000-30095.) |

| | |

| 10.7 ** | Employment Agreement dated as of September 1, 2007 between the Company and Scott Shemwell (Incorporated by reference to Form 8-K filed on September 21, 2007.) |

| | |

| 10.8 ** | Consulting Agreement dated as of September 1, 2007 between the Company and Steve Cowper (Incorporated by reference to Form 8-K filed on September 21, 2007.) |

| | |

| 10.9 | Asset Purchase Agreement, dated as of December 18, 2007, by and among Wescorp Technologies Ltd., FEP Services Inc., Kyle Plante and Norman Plante (Incorporated by reference to Form 8-K filed on December 21, 2007.) |

| | |

| 10.10 | September 13, 2007 Letter Agreement between the Company and Jack Huber regarding the retirement of certain debt. (Incorporated by reference to the Company’s Annual Report on Form 10-KSB filed with the Commission on May 15, 2008, File No. 000-30095.) |

| | |

| 10.11 | December 19, 2007 Letter Agreement between the Company and Jack Huber regarding the retirement of certain debt. |

* Filed herewith.

** Management contracts or compensatory plans or arrangements.

SIGNATURES

Pursuant to the requirements of Section 13 or 15(d) of the Securities Exchange Act of 1934, the registrant has duly caused this report to be signed on its behalf by the undersigned, thereunto duly authorized.

WESCORP ENERGY INC.

By: /s/ Douglas Biles

Douglas Biles, Chief Executive Officer and Director

Date: June 1, 2009

By:/s/ Terry Mereniuk

Terry Mereniuk, Chief Financial Officer and Director (Principal Accounting Officer)

Date: June 1, 2009

EXHIBIT INDEX

| Exhibit | |

| Number | Description |

| 2.1 | Share Purchase and Subscription Agreement dated June 9, 2003 among the Company, 1049265 Alberta Ltd., Flowray, Flowstar, New Millennium Acquisitions Ltd. ("New Millennium") and Gregory Burghardt. (Incorporated by reference to the Company’s Current Report on Form 8-K/A filed with the Commission on May 12, 2004, File No. 000-30095.) |

| | |

| 2.2 | Share Purchase Agreement dated as of January 14, 2004 between the Company and the Trustee of the Epitihia Trust. (Incorporated by reference to the Company’s Current Report on Form 8-K/A filed with the Commission on May 12, 2004, File No. 000-30095.) |

| | |

| 2.3 | Share Purchase Agreement dated as of January 14, 2004 between the Company and the Trustee of the Abuelo Trust. (Incorporated by reference to the Company’s Current Report on Form 8-K/A filed with the Commission on May 12, 2004, File No. 000-30095.) |

| | |

| 2.4 | Share Purchase and Subscription Amending Agreement dated January 14, 2004 among the Company, 1049265 Alberta Ltd., Flowray, Flowstar, New Millennium and Gregory Burghardt. (Incorporated by reference to the Company’s Current Report on Form 8- K/A filed with the Commission on May 12, 2004, File No. 000-30095.) |

| | |

| 2.5 | Share Purchase Agreement dated as of January 14, 2004 between the Company and Epitihia Trust. (Incorporated by reference to the Company’s Current Report on Form 8-K/A filed with the Commission on May 12, 2004, File No. 000- 30095.) |

| | |

| 2.6 | Share Purchase Agreement dated as of January 14, 2004 between the Company and Abuelo Trust. (Incorporated by reference to the Company’s Current Report on Form 8-K/A filed with the Commission on May 12, 2004, File No. 000-30095.) |

| | |

| 2.7 | Share Purchase Option Agreement dated February 10, 2004 between the Company and Olav Ellingsen (Incorporated by reference to the Company’s Current Report on Form 8-K filed with the Commission on April 9, 2004, File No. 000- 30095.) |

| | |

| 2.8 | Amending Agreement dated as of June 16, 2004 between the Company and the Trustee of the Epitihia Trust. (Incorporated by reference to the Company’s Quarterly Report on Form 10-QSB filed with the Commission on August 26, 2004, File No. 000-30095.) |

| | |

| 2.9 | Amending Agreement dated as of June 16, 2004 between the Company and the Trustee of the Abuelo Trust. (Incorporated by reference to the Company’s Quarterly Report on Form 10-QSB filed with the Commission on August 26, 2004, File No. 000-30095.) |

| | |

| 2.10 | Form of Subscription Agreement dated March 15, 2005 by and between Wescorp and the Purchaser named therein. (Incorporated by reference to the Company’s Current Report on Form 8-K filed with the Commission on March 21, 2005, File No. 000-30095.) |

| | |

| 2.11 | Form of Subscription Agreement dated April 28, 2005 between and Wescorp and the Purchaser named therein. (Incorporated by reference to the Company’s Current Report on Form 8-K filed with the Commission on April 29, 2005, File No. 000-30095.) |

| | |

| 2.12 | Form of Subscription Agreement between the Company and the United States Resident Purchaser named therein. (Incorporated by reference to the Company’s Current Report on Form 8-K filed with the Commission on December 24, 2006, File No. 000-30095.) |

| | |

| 2.13 | Form of Subscription Agreement between the Company and the Non-United States Resident Purchaser named therein. (Incorporated by reference to the Company’s Current Report on Form 8-K filed with the Commission on December 24, 2006, File No. 000-30095.) |

| | |

| 2.14 | Purchase Agreement dated March 23, 2007 between the Company and 306538 Alberta Ltd. (Incorporated by reference to the Company’s Current Report on Form 8-k filed with the Commission on March 27, 2007, File No. 000-30095.) |

| | |

| 2.15 | Agreement and Plan of Merger between the Company and Strategic Decision Sciences, USA, Inc. dated as of |

| | September 5, 2007 (Incorporated by reference to Form 8-K filed on September 11, 2007.) |

| | |

| 3.1 | Restated Articles of Incorporation of the Company filed February 17, 2004. (Incorporated by reference to the Company’s Annual Report on Form 10-KSB/A filed with the Commission on May 13, 2004, File No. 000- 30095.) |

| | |

| 3.2 | Amended and Restated Bylaws. (Incorporated by reference to the Company’s Annual Report on Form 10-K filed with the Commission on April 15, 2009, File No. 000- 30095.) |

| | |

| 4.1 | Form of Common Stock Purchase Warrant dated March 15, 2005. (Incorporated by reference to the Company’s Current Report on Form 8-K filed with the Commission on March 21, 2005, File No. 000- 30095.) |

| | |

| 4.2 | Certificate for 14% Secured Convertible Debenture dated April 28, 2005 (Incorporated by reference to the Company’s Current Report on Form 8-K filed with the Commission on April 29, 2005, File No. 000- 30095.) |

| | |

| 4.3 | Form of Common Stock Purchase dated April 28, 2005. (Incorporated by reference to the Company’s Current Report on Form 8-K filed with the Commission on April 29, 2005, File No. 000-30095.) |

| | |

| 4.4 | Addendum dated February 6, 2003 to that certain Loan Agreement dated January 28, 2003 between the Company and AHC Holdings Ltd. containing Stock Purchase Warrant (Incorporated by reference to the Company’s Current Report on Form 8-K filed with the Commission on April 28, 2003, File No. 000- 30095.) |

| | |

| 4.5 | Form of Warrant issued to the United States Resident Purchaser named therein. (Incorporated by reference to the Company’s Current Report on Form 8-K filed with the Commission on December 24, 2006, File No. 000- 30095.) |

| | |

| 4.6 | Form of Warrant issued to the Non-United States Resident Purchaser named therein. (Incorporated by reference to the Company’s Current Report on Form 8-K filed with the Commission on December 24, 2006, File No. 000- 30095.) |

| | |

| 4.7 | Form of Debenture Certificate 14% Redeemable Secured Debenture issued to Non-United States Residents (Incorporated by reference to the Company’s Current Report on Form 8-K filed with the Commission on February 20, 2008.) |

| | |

| 4.8 | Form of Warrant issued to Non-United States Residents (Incorporated by reference to the Company’s Current Report on Form 8-K filed with the Commission on February 20, 2008.) |

| | |

| 10.1 | Hypothecation Agreement dated as of July 6, 2004 between the Company, the Trustee of the Epitihia Trust and Yearwood & Boyce. (Incorporated by reference to the Company’s Quarterly Report on Form 10-QSB filed with the Commission on August 26, 2004, File No. 000-30095.) |

| | |

| 10.2 | Hypothecation Agreement dated as of July 6, 2004 between the Company, the Trustee of the Abuelo Trust and Yearwood & Boyce. (Incorporated by reference to the Company’s Quarterly Report on Form 10-QSB filed with the Commission on August 26, 2004, File No. 000-30095.) |

| | |

| 10.3 | License Agreement dated and effective December 1, 2001 between Flowray and Flowstar Technologies, Inc. (Incorporated by reference to the Company’s Current Report on Form 8-K/A filed with the Commission on May 12, 2004, File No. 000-30095.) |

| | |

| 10.4 | Memorandum of Understanding, dated as of September 21, 2004 between the Company and Ellycrack AS (Incorporated by reference to Form 8-K filed on September 23, 2004.) |

| | |

| 10.5 ** | Employment Agreement dated as of September 1, 2007 by and among the Company and Douglas Biles (Incorporated by reference to Form 8-K filed on September 21, 2007.) |

| | |

| 10.6 | Letter Agreement, dated as of November 22, 2006, between the Company and Jack Huber (Incorporated by reference to the Company’s Annual Report on Form 10-KSB filed with the Commission on April 11, 2007, File No. 000-30095.) |

| | |

| 10.7 ** | Employment Agreement dated as of September 1, 2007 between the Company and Scott Shemwell (Incorporated by reference to Form 8-K filed on September 21, 2007.) |

| | |

| 10.8 ** | Consulting Agreement dated as of September 1, 2007 between the Company and Steve Cowper (Incorporated by reference to Form 8-K filed on September 21, 2007.) |

| 10.9 | Asset Purchase Agreement, dated as of December 18, 2007, by and among Wescorp Technologies Ltd., FEP Services Inc., Kyle Plante and Norman Plante (Incorporated by reference to Form 8-K filed on December 21, 2007.) |

| | |

| 10.10 | September 13, 2007 Letter Agreement between the Company and Jack Huber regarding the retirement of certain debt. (Incorporated by reference to the Company’s Annual Report on Form 10-KSB filed with the Commission on May 15, 2008, File No. 000-30095.) |

| | |

| 10.11 | December 19, 2007 Letter Agreement between the Company and Jack Huber regarding the retirement of certain debt. (Incorporated by reference to the Company’s Annual Report on Form 10-KSB filed with the Commission on May 15, 2008, File No. 000-30095.) |

| | |

| 14.1 | Code of Ethics (Incorporated by reference to the Company’s Annual Report on Form 10-KSB filed with the Commission on April 11, 2007, File No. 000-30095.) |

| | |

| 21.1 | Schedule of Subsidiaries of the Company (Incorporated by reference to the Company’s Annual Report on Form 10- KSB filed with the Commission on May 15, 2008, File No. 000-30095.) |

| | |

| 31.1* | Certification of Chief Executive Officer pursuant to Section 302 of the Sarbanes-Oxley Act of 2002 |

| | |

| 31.2 * | Certification of Chief Financial Officer pursuant to Section 302 of the Sarbanes-Oxley Act of 2002 |

| | |

| 32.1* | Certification of Chief Executive Officer and Chief Financial Officer pursuant to 18 U.S.C. Section 1350, as adopted pursuant to Section 906 of the Sarbanes-Oxley Act of 2002 |

| * | Filed herewith. |

| | |

| ** | Management contracts or compensatory plans or arrangements. |

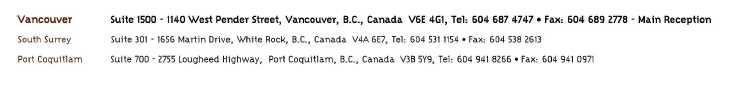

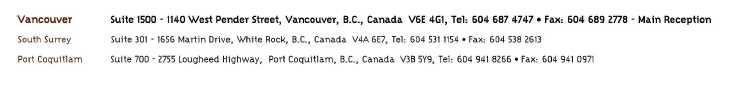

REPORT OF INDEPENDENT REGISTERED PUBLIC ACCOUNTING FIRM

To the Stockholders and Board of Directors of Wescorp Energy Inc.

We have audited the accompanying consolidated balance sheets of Wescorp Energy Inc. as of December 31, 2008 and 2007, and the related consolidated statements of operations, stockholders’ deficit and cash flows for the years then ended. These financial statements are the responsibility of the Company's management. Our responsibility is to express an opinion on these financial statements based on our audits.

We conducted our audits in accordance with the standards of the Public Company Accounting Oversight Board (United States). Those standards require that we plan and perform an audit to obtain reasonable assurance whether the financial statements are free of material misstatement. The Company is not required to have, nor were we engaged to perform, an audit of its internal control over financial reporting. Our audit included consideration of internal control over financial reporting as a basis for designing audit procedures that are appropriate in the circumstances, but not for the purpose of expressing an opinion on the effectiveness of the Company’s internal control over financial reporting. Accordingly, we express no such opinion. An audit also includes examining, on a test basis, evidence supporting the amounts and disclosures in the financial statements. An audit also includes assessing the accounting principles used and significant estimates made by management, as well as evaluating the overall financial statement presentation. We believe that our audits provide a reasonable basis for our opinion.

In our opinion, these consolidated financial statements present fairly, in all material respects, the financial position of Wescorp Energy Inc. as of as of December 31, 2008 and 2007, and the results of its operations and its cash flows for the years then ended in conformity with accounting principles generally accepted in the United States of America.

The accompanying consolidated financial statements have been prepared assuming that the Company will continue as a going concern. As discussed in Note 1 to the financial statements, the Company has not generated profits since its inception, has incurred losses in developing its business, and further losses are anticipated. The Company requires additional funds to meet its obligations and the costs of its operations. These factors raise substantial doubt about the Company’s ability to continue as a going concern. Management’s plans in this regard are described in Note 1. The financial statements do not include any adjustments that might result from the outcome of this uncertainty.

/s/ DMCL

DALE MATHESON CARR-HILTON LABONTELLP

CHARTERED ACCOUNTANTS

Vancouver, Canada

March 20, 2009

| WESCORP ENERGY INC. |

| CONSOLIDATED BALANCE SHEETS |

| | | December 31, | | | December 31, | |

| | | 2008 | | | 2007 | |

| ASSETS | | | | | | |

| CURRENT ASSETS | | | | | | |

| Cash | $ | 429,171 | | $ | 455,872 | |

| Accounts receivable, net of allowance for doubtful | | | | | | |

| accounts of $18,813 and $20,109, respectively | | 992,105 | | | 700,316 | |

| Inventories (Note 3) | | 621,353 | | | 754,412 | |

| Short-term investment (Note 4) | | - | | | 1,472,223 | |

| Prepaid expenses | | 193,951 | | | 274,793 | |

| TOTAL CURRENT ASSETS | | 2,236,580 | | | 3,657,616 | |

| | | | | | | |

| PROPERTY AND EQUIPMENT, net (Note 5) | | 731,335 | | | 861,136 | |

| | | | | | | |

| OTHER ASSETS | | | | | | |

| Investments (Note 6) | | 29,592 | | | 568,425 | |

| Other receivables | | - | | | 84,940 | |

| TOTAL OTHER ASSETS | | 29,592 | | | 653,365 | |

| | | | | | | |

| TOTAL ASSETS | $ | 2,997,507 | | $ | 5,172,117 | |

| | | | | | | |

| LIABILITIES AND STOCKHOLDERS' EQUITY | | | | | | |

| CURRENT LIABILITIES | | | | | | |

| Accounts payable and accrued liabilities | $ | 4,665,407 | | $ | 2,214,392 | |

| Current portion of notes payable (Note 8) | | 1,290,550 | | | 1,086,670 | |

| Agreement payable (Note 9) | | 296,000 | | | 352,000 | |

| Due to related parties (Note 14) | | 201,397 | | | 951,370 | |

| Related party note payable (Note 14) | | 1,924,681 | | | 1,924,681 | |

| Convertible debenture (Note 10) | | 2,250,000 | | | - | |

| Debentures payable (Note 10) | | 382,905 | | | 400,700 | |

| TOTAL CURRENT LIABILITIES | | 11,010,940 | | | 6,929,813 | |

| | | | | | | |

| NOTES PAYABLE, net of current portion (Note 8) | | 16,708 | | | 1,229,212 | |

| | | | | | | |

| CONVERTIBLE DEBENTURE (Note 10) | | - | | | 2,250,000 | |

| | | | | | | |

| COMMITMENTS AND CONTINGENCIES (Notes 1 and 13) | | | | | | |

| | | | | | | |

| SUBSEQUENT EVENTS (NOTE 19) | | | | | | |

| | | | | | | |

| STOCKHOLDERS' EQUITY (DEFICIT) | | | | | | |

| Preferred stock, 50,000,000 shares authorized, $0.0001 | | | | | | |

| par value; no shares issued (Note 11) | | | | | | |

| Common stock, 250,000,000 shares authorized, $0.0001 | | | | | | |

| par value; 88,152,557 and 75,238,223 shares | | | | | | |

| issued and outstanding, respectively (Note 11) | | 8,815 | | | 7,521 | |

| Additional paid-in capital | | 38,745,266 | | | 32,388,025 | |

| Deferred compensation | | (57,418 | ) | | (98,301 | ) |

| Private placement and warrant subscriptions | | 188,664 | | | 1,250,000 | |

| Subscription receivable | | (22,500 | ) | | (22,500 | ) |

| Shares issuable | | 166,462 | | | 221,889 | |

| Accumulated other comprehensive income (loss) | | 78,328 | | | (104,809 | ) |

| Accumulated deficit | | (47,137,758 | ) | | (38,878,733 | ) |

| TOTAL STOCKHOLDERS' EQUITY (DEFICIT) | | (8,030,141 | ) | | (5,236,908 | ) |

| | | | | | | |

| TOTAL LIABILITIES AND | | | | | | |

| STOCKHOLDERS' EQUITY | $ | 2,997,507 | | $ | 5,172,117 | |

The accompanying notes are an integral part of these consolidated financial statements.

| WESCORP ENERGY INC. |

| CONSOLIDATED STATEMENTS OF OPERATIONS AND COMPREHENSIVE LOSS |

| | | Year Ended December 31, | |

| | | 2008 | | | 2007 | |

| | | | | | | |

| REVENUES | $ | 4,496,954 | | $ | 3,141,115 | |

| | | | | | | |

| COST OF SALES | | 2,689,793 | | | 1,820,234 | |

| | | | | | | |

| GROSS PROFIT | | 1,807,161 | | | 1,320,881 | |

| | | | | | | |

| EXPENSES | | | | | | |

| Wages and benefits | | 2,449,533 | | | 1,865,867 | |

| Wages stock based (Note 12) | | 493,200 | | | 540,000 | |

| Consulting | | 599,865 | | | 1,021,405 | |

| Consulting stock based (Note 12) | | 233,000 | | | 252,500 | |

| Research and development | | 654,238 | | | 656,718 | |

| Amortization of technology | | - | | | 516,646 | |

| Office | | 691,282 | | | 502,418 | |

| Advertising and investor relations | | 643,441 | | | 507,751 | |

| Advertising and investor relations - stock based (Note 12) | | 226,600 | | | - | |

| Travel | | 412,066 | | | 415,158 | |

| Legal and accounting | | 330,349 | | | 367,540 | |

| Insurance | | 133,924 | | | 132,598 | |

| Depreciation and amortization | | 296,167 | | | 95,407 | |

| Interest, finance and bank charges | | 533,568 | | | 275,490 | |

| Directors fees | | 159,939 | | | 80,301 | |

| Interest accreted on financial instruments | | 604,076 | | | 22,323 | |

| TOTAL OPERATING EXPENSES | | 8,461,248 | | | 7,252,122 | |

| | | | | | | |

| LOSS FROM OPERATIONS | | (6,654,087 | ) | | (5,931,241 | ) |

| | | | | | | |

| OTHER INCOME (EXPENSE) | | | | | | |

| Research and development acquired (Note 16) | | - | | | (10,968,821 | ) |

| Penalty for late delivery of shares (Note 9) | | (1,416,476 | ) | | (1,442,383 | ) |

| Registration rights payment | | - | | | (424,839 | ) |

| Impairment of technology (Note 7) | | - | | | (2,177,970 | ) |

| Foreign currency translation gain | | 41,755 | | | 34,327 | |

| Interest and other income | | 47,746 | | | 56,454 | |

| Gain on settlement of debt | | 290,000 | | | - | |

| Gain on disposal of investments | | 37,838 | | | 1,661,815 | |

| Loss on impairment in value of investment | | (538,186 | ) | | - | |

| Write down of other receivables | | (68,540 | ) | | - | |

| Gain on disposition of assets | | 925 | | | 14,320 | |

| TOTAL OTHER INCOME (EXPENSE) | | (1,604,938 | ) | | (13,247,097 | ) |

| | | | | | | |

| NET LOSS | $ | (8,259,025 | ) | $ | (19,178,338 | ) |

| | | | | | | |

| OTHER COMPREHENSIVE INCOME (LOSS) | | | | | | |

| Foreign currency translation gain | | 127,137 | | | 145,016 | |

| Unrealized gain on financial instruments | | 56,000 | | | 48,000 | |

| Unrealized loss on available-for-sale investments | | - | | | (1,557,038 | ) |

| | | 183,137 | | | (1,364,022 | ) |

| | | | | | | |

| OTHER COMPREHENSIVE INCOME (LOSS) | $ | (8,075,888 | ) | $ | (20,542,360 | ) |

| | | | | | | |

| BASIC AND DILUTED NET LOSS PER SHARE | $ | (0.10 | ) | $ | (0.35 | ) |

| | | | | | | |

| WEIGHTED AVERAGE NUMBER COMMON SHARES | | | | | | |

| OUTSTANDING - BASIC AND DILUTED | | 78,966,351 | | | 54,939,621 | |

The accompanying notes are an integral part of these consolidated financial statements.

| WESCORP ENERGY INC. |

| CONSOLIDATED STATEMENTS OF STOCKHOLDERS' DEFICIT |

| | | | | | | | | | | | | | | | | | | | | Funds | | | | | | Accumulated | | | Total | |

| | | Common Stock | | | | | | | | | | | | | | | Received | | | | | | Other | | | Stockholders' | |

| | | Number | | | | | | Additional | | | Deferred | | | Shares | | | Subscription | | | for Exercise | | | Accumulated | | | Comprehensive | | | Equity | |

| | | of Shares | | | Amount | | | Paid-in Capital | | | Compensation | | | Issuable | | | Receivable | | | of Warrants | | | Deficit | | | Income (Loss) | | | (Deficit) | |

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| Balance, December 31, 2006 | | 52,195,230 | | $ | 5,218 | | $ | 21,332,583 | | $ | - | | $ | - | | $ | (97,500 | ) | $ | 382,354 | | $ | (19,700,395 | ) | $ | 1,259,213 | | $ | 3,181,473 | |

| Warrants exercised at $0.25 per share | | 200,000 | | | 20 | | | 49,980 | | | - | | | - | | | - | | | - | | | - | | | - | | | 50,000 | |

| Warrants exercised at $0.35 per share | | 570,000 | | | 57 | | | 199,443 | | | - | | | - | | | - | | | (199,500 | ) | | - | | | - | | | - | |

| Proceeds received from common stock issued for private | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| placement at $0.50 per unit | | - | | | - | | | - | | | - | | | - | | | 85,000 | | | - | | | - | | | - | | | 85,000 | |

| Common stock issued to settle accounts payable at $0.44 per share | | 321,059 | | | 32 | | | 141,234 | | | - | | | - | | | - | | | - | | | - | | | - | | | 141,266 | |

| Common stock issued to settle accounts payable at $0.50 per share | | 532,624 | | | 53 | | | 266,259 | | | - | | | - | | | - | | | - | | | - | | | - | | | 266,312 | |

| Common stock issued for private placement at $0.50 per unit | | 20,000 | | | 2 | | | 9,998 | | | - | | | - | | | (10,000 | ) | | - | | | - | | | - | | | - | |

| Common stock issued to settle wages payable at $0.352 per share | | 171,103 | | | 17 | | | 60,211 | | | - | | | - | | | - | | | (60,228 | ) | | - | | | - | | | - | |

| Common stock issued for director's fees at $0.48 per share | | 250,000 | | | 25 | | | 119,975 | | | (120,000 | ) | | - | | | - | | | - | | | - | | | - | | | - | |

| Amortization of deferred share compensation | | - | | | - | | | - | | | 36,032 | | | - | | | - | | | - | | | - | | | - | | | 36,032 | |

| Common stock issued pursuant to terms of cashless warrant at | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| $0.49 per share | | 73,780 | | | 7 | | | 36,145 | | | - | | | - | | | - | | | - | | | - | | | - | | | 36,152 | |

| Common stock issued for consulting fees at $0.497 per share | | 200,000 | | | 20 | | | 99,314 | | | - | | | - | | | - | | | (99,334 | ) | | - | | | - | | | - | |

| Common stock issued for consulting fees at $0.452 per share | | 200,000 | | | 20 | | | 90,380 | | | - | | | - | | | - | | | - | | | - | | | - | | | 90,400 | |

| Common stock issued for consulting fees at $0.452 per share | | 100,000 | | | 10 | | | 43,990 | | | (14,333 | ) | | - | | | - | | | - | | | - | | | - | | | 29,667 | |

| Common shares issued to investors in pivate placement relating | | | | | | | | | | | - | | | - | | | | | | | | | | | | | | | | |

| to delay in share registration | | 849,677 | | | 85 | | | 424,754 | | | - | | | - | | | - | | | - | | | - | | | - | | | 424,839 | |

| Common stock issued to settle debt at $0.46 per share | | 3,654,750 | | | 365 | | | 1,680,820 | | | - | | | - | | | - | | | - | | | - | | | - | | | 1,681,185 | |

| Common stock isssued for acquisition of Strategic Decision | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| Sciences (USA) Inc. | | 2,000,000 | | | 200 | | | 799,800 | | | - | | | - | | | - | | | - | | | - | | | - | | | 800,000 | |

| Common stock isssued for acquisition of assets from FEP | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| Services Inc. | | 13,900,000 | | | 1,390 | | | 6,281,410 | | | - | | | - | | | - | | | - | | | - | | | - | | | 6,282,800 | |

| Legal fees related to private placement | | - | | | - | | | (15,771 | ) | | - | | | - | | | - | | | - | | | - | | | - | | | (15,771 | ) |

| Financing fees on private placement | | - | | | - | | | (125,000 | ) | | - | | | - | | | - | | | 62,500 | | | - | | | - | | | (62,500 | ) |

| Foreign currency translation gain | | - | | | - | | | - | | | - | | | - | | | - | | | - | | | - | | | 145,016 | | | 145,016 | |

| Unrealized gain on adjustment of agreement payable to fair | | | | | - | | | - | | | - | | | - | | | - | | | - | | | - | | | | | | | |

| market value | | | | | | | | | | | | | | | | | | | | | | | | | | 48,000 | | | 48,000 | |

| Unrealized holding loss on available-for-sale securities | | - | | | - | | | - | | | - | | | - | | | - | | | - | | | - | | | (1,557,038 | ) | | (1,557,038 | ) |

| Stock-based compensation | | - | | | - | | | 792,500 | | | - | | | - | | | - | | | - | | | - | | | - | | | 792,500 | |

| Proceeds received from exercise of warrants prior to issuance | | - | | | - | | | - | | | - | | | - | | | - | | | 136,097 | | | - | | | - | | | 136,097 | |

| Proceeds received from private placement prior to issuance | | - | | | - | | | - | | | - | | | 1,250,000 | | | - | | | - | | | - | | | - | | | 1,250,000 | |

| Fair value of warrants attached to debt issued in December 2007 | | - | | | - | | | 100,000 | | | - | | | - | | | - | | | - | | | - | | | - | | | 100,000 | |

| Net loss | | - | | | - | | | - | | | - | | | - | | | - | | | - | | | (19,178,338 | ) | | - | | | (19,178,338 | ) |

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| Balance, December 31, 2007 | | 75,238,223 | | $ | 7,521 | | $ | 32,388,025 | | $ | (98,301 | ) | $ | 1,250,000 | | $ | (22,500 | ) | $ | 221,889 | | $ | (38,878,733 | ) | $ | (104,809 | ) | $ | (5,236,908 | ) |

| Common stock issued for private placement at $0.50 per unit | | 2,500,000 | | | 250 | | | 1,249,750 | | | - | | | (1,250,000 | ) | | - | | | - | | | - | | | - | | | - | |

| Common stock issued for private placement at $0.40 per unit | | 5,226,584 | | | 523 | | | 2,090,111 | | | - | | | - | | | - | | | - | | | - | | | - | | | 2,090,634 | |

| Common stock issued for consulting fees at $0.36 per share | | 100,000 | | | 10 | | | 35,990 | | | - | | | - | | | - | | | - | | | - | | | - | | | 36,000 | |

| Common stock issued for investor relation fees at $0.396 per share | | 100,000 | | | 10 | | | 39,590 | | | - | | | - | | | - | | | - | | | - | | | - | | | 39,600 | |

| Common stock issued for investor relation fees at $0.36 per share | | 375,000 | | | 38 | | | 134,962 | | | - | | | - | | | - | | | - | | | - | | | - | | | 135,000 | |

| Fair value of common stock issued for financing fees at $0.50 | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| per share | | 125,000 | | | 13 | | | 62,487 | | | - | | | - | | | - | | | (62,500 | ) | | - | | | - | | | - | |

| Common stock issued for consulting fees at $0.351 per share | | 200,000 | | | 20 | | | 70,180 | | | - | | | - | | | - | | | - | | | - | | | - | | | 70,200 | |

| Common stock issued for director's fees at $0.28 per share | | 50,000 | | | 5 | | | 13,995 | | | (3,500 | ) | | - | | | - | | | - | | | - | | | - | | | 10,500 | |

| Shares to be issued for director's fees at $0.37 per share | | - | | | - | | | - | | | - | | | 111,000 | | | - | | | - | | | - | | | - | | | 111,000 | |

| Amortization of deferred share compensation | | - | | | - | | | - | | | 44,383 | | | - | | | - | | | - | | | - | | | - | | | 44,383 | |

| Common stock issued to settle wages payable at $0.2176 per share | | 377,203 | | | 38 | | | 82,041 | | | - | | | - | | | - | | | (82,079 | ) | | - | | | - | | | - | |

| Common stock issued to settle debt at $0.40 per share | | 2,385,547 | | | 239 | | | 953,980 | | | - | | | - | | | - | | | - | | | - | | | - | | | 954,219 | |

| Common stock issued to settle amounts owing to related parties | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| at $0.40 per share | | 1,475,000 | | | 148 | | | 589,852 | | | - | | | - | | | - | | | - | | | - | | | - | | | 590,000 | |

| Fair value of warrants attached to debt issued in year | | - | | | - | | | 109,465 | | | - | | | - | | | - | | | - | | | - | | | - | | | 109,465 | |

| Stock-based compensation | | - | | | - | | | 952,800 | | | - | | | - | | | - | | | - | | | - | | | - | | | 952,800 | |

| Proceeds received from exercise of warrants prior to issuance | | - | | | - | | | - | | | - | | | - | | | - | | | 89,152 | | | - | | | - | | | 89,152 | |

| Proceeds received from private placement prior to issuance | | - | | | - | | | - | | | - | | | 77,664 | | | - | | | - | | | - | | | - | | | 77,664 | |

| Financing fees on private placement | | - | | | - | | | (25,000 | ) | | - | | | - | | | - | | | - | | | - | | | - | | | (25,000 | ) |

| Legal fees related to private placement | | - | | | - | | | (2,962 | ) | | - | | | - | | | - | | | - | | | - | | | - | | | (2,962 | ) |

| Foreign currency translation gain | | - | | | - | | | - | | | - | | | - | | | - | | | - | | | - | | | 127,137 | | | 127,137 | |

| Unrealized gain on adjustment of agreement payable to fair | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| market value | | - | | | - | | | - | | | - | | | - | | | - | | | - | | | - | | | 56,000 | | | 56,000 | |

| Net loss | | - | | | - | | | - | | | - | | | - | | | - | | | - | | | (8,259,025 | ) | | - | | | (8,259,025 | ) |

| Balance, December 31, 2008 | | 88,152,557 | | $ | 8,815 | | $ | 38,745,266 | | $ | (57,418 | ) | $ | 188,664 | | $ | (22,500 | ) | $ | 166,462 | | $ | (47,137,758 | ) | $ | 78,328 | | $ | (8,030,141 | ) |

The accompanying notes are an integral part of these consolidated financial statements.

| WESCORP ENERGY INC. |

| CONSOLIDATED STATEMENTS OF CASH FLOWS |

| | | Years Ended December 31, | |

| | | 2008 | | | 2007 | |

| CASH FLOWS FROM OPERATING ACTIVITIES: | | | | | | |

| Net loss | $ | (8,259,025 | ) | $ | (19,178,338 | ) |

| Adjustments to reconcile net loss | | | | | | |

| to net cash used in operating activities: | | | | | | |

| Depreciation and amortization | | 296,167 | | | 95,407 | |

| Amortization of technology | | - | | | 516,646 | |

| Stock-based compensation | | 952,800 | | | 792,500 | |

| Common stock issued for registration rights payment | | - | | | 424,839 | |

| Common stock issued to pay penalties for late delivery of shares | | - | | | 964,385 | |

| Research and development acquired (Note 16) | | - | | | 10,968,821 | |

| Interest accreted on financial instruments | | 604,076 | | | 22,323 | |

| Write down of other receivables | | 68,540 | | | - | |

| Gain on disposition of assets | | (925 | ) | | (14,320 | ) |

| Gain on disposal of investment | | (37,838 | ) | | (1,661,815 | ) |

| Loss on impairment in value of investment | | 538,186 | | | - | |

| Impairment of technology | | - | | | 2,177,970 | |

| Fair value of common stock issued for services | | 402,300 | | | 156,219 | |

| Gain on forgiveness of debt | | (290,000 | ) | | - | |

| Amortization of deferred share compensation | | 44,383 | | | 36,032 | |

| Changes in operating assets and liabilities: | | | | | | |

| Restricted cash | | - | | | 171,000 | |

| Accounts receivable | | (291,789 | ) | | (4,871 | ) |

| Inventories | | 133,059 | | | 298,846 | |

| Prepaid expenses | | 80,842 | | | 228,471 | |

| Accounts payable and accrued liabilities | | 2,551,015 | | | 1,241,558 | |

| Net cash used in operating activities | | (3,208,209 | ) | | (2,764,327 | ) |

| CASH FLOWS FROM INVESTING ACTIVITIES: | | | | | | |

| Decrease (increase) in short-term investment | | 1,472,223 | | | (1,472,223 | ) |

| Purchase of property and equipment | | (166,367 | ) | | (229,490 | ) |

| Proceeds from disposition of investment | | 38,485 | | | - | |

| Proceeds from disposition of assets | | 925 | | | 15,162 | |

| Cash expended on FEP acquisition (net) | | - | | | (131,789 | ) |

| Net cash used in investing activities | | 1,345,266 | | | (1,818,340 | ) |

| CASH FLOWS FROM FINANCING ACTIVITIES: | | | | | | |

| Payments on notes payable | | (1,591,912 | ) | | (412,137 | ) |

| Proceeds from notes payable | | 1,205,982 | | | 364,343 | |

| Proceeds from debentures payable | | 460,000 | | | 2,649,520 | |

| Repayments on debentures payable | | (488,519 | ) | | - | |

| Increase in amounts due to related parties | | 130,027 | | | 285,841 | |

| Proceeds received from exercise of warrants prior to issuing shares | | 89,152 | | | 136,097 | |

| Proceeds from subscriptions receivable | | - | | | 85,000 | |

| Proceeds from issuance of common stock | | 2,090,634 | | | 50,000 | |

| Proceeds received from private placement | | 77,664 | | | 1,250,000 | |

| Private placement issuance costs | | (27,962 | ) | | (78,271 | ) |

| Net cash provided by financing activities | | 1,945,066 | | | 4,330,393 | |

| Effect of exchange rates | | (108,824 | ) | | 208,913 | |

| Net increase (decrease) in cash | | (26,701 | ) | | (43,361 | ) |

| Cash, beginning of year | | 455,872 | | | 499,233 | |

| Cash, end of year | $ | 429,171 | | $ | 455,872 | |

| SUPPLEMENTAL CASH FLOW DISCLOSURES: | | | | | | |

| Cash paid for: | | | | | | |

| Interest | $ | 179,315 | | $ | 217,505 | |

| Income taxes | $ | - | | $ | - | |

The accompanying notes are an integral part of these consolidated financial statements.

| WESCORP ENERGY INC. |

| CONSOLIDATED STATEMENTS OF CASH FLOWS(Continued) |

| | | Years Ended December 31, | |

| | | 2008 | | | 2007 | |

| | | | | | | |

| NON-CASH INVESTING AND FINANCING ACTIVITIES: | | | | | | |

| | | | | | | |

| Shares issued to settle accounts payable | $ | 82,079 | | $ | 407,578 | |

| Common stock issued to settle debt | $ | 954,219 | | $ | 1,681,185 | |

| Common stock issued to settle related party balances | $ | 590,000 | | $ | - | |

| Private placement issuance costs | $ | - | | $ | 62,500 | |

| Share subscription receivable | $ | - | | $ | 22,500 | |

| Proceeds from issuance of common stock pursuant to acquisition | | | | | | |

| agreement | $ | - | | $ | 6,282,800 | |

| Purchase of intellectual property | $ | - | | $ | (10,682,166 | ) |

| Proceeds from disposition of investment | $ | - | | $ | 2,192,277 | |

| Purchase of property and equipment | $ | - | | $ | (589,700 | ) |

| | | | | | | |

| Proceeds from issuance of note payable pursuant to acquisition agreement | $ | - | | $ | 2,665,000 | |

The accompanying notes are an integral part of these consolidated financial statements.

| |

| WESCORP ENERGY INC. |

| NOTES TO CONSOLIDATED FINANCIAL STATEMENTS |

| December 31, 2008 |

| |

NOTE 1–BASIS OF PRESENTATION

Wescorp Energy Inc. (“Wescorp” or the “Company”) was incorporated in Delaware on August 11, 1998. The Company acquires, develops, and commercializes technologies that are designed to improve the management, environmental and economic performance of field operations for energy producers. The Company’s business model is to acquire, fund and develop new systems and technologies in this field through investments in companies or products where early stage product development has been completed.

Flowstar Technologies Inc. and Flowray Inc. (collectively called “Flowstar”) are involved in the development of products for the petroleum and gas industries. The primary source of revenue for the Company is from the sale of DCR systems, related accessories, and service of the systems. The DCR system consists of a turbine based flow measurement signal generating device, temperature and pressure probes, and a flow computer, which performs the corrected flow calculations for natural gas.

The Company acquired assets, used in the business of cementing and stimulation chemical products, late in 2007, which have added a secondary source of revenue in 2008.

The Company’s year end is December 31. The Company is headquartered in Calgary, Alberta, Canada.

Going Concern

These consolidated financial statements have been prepared under the assumption that the Company will continue on a going concern basis and that it will be able to realize assets and discharge liabilities in the normal course of business. As reported in the accompanying financial statements, the Company has a working capital deficiency of $8,774,360 at December 31, 2008 and has incurred an accumulated deficit of $47,137,758 through December 31, 2008. The Company has changed its focus to acquire, develop, and commercialize technologies that are designed to improve the management, environmental and economic performance of field operations in the oil and gas industries which may, if successful, assist to mitigate the factors which raise substantial doubt about the Company’s ability to continue as a going concern. The financial statements do not include any adjustments relating to the recoverability, secured creditor realizations and classification of recorded assets, or the amounts and classification of liabilities that might be necessary in the event the Company cannot continue as a going concern.

The Company’s continuance as a going concern is dependent upon its ability to raise financing and generate sufficient revenue to achieve profitable operations in the future. Management believes the Company will attain these goals by expanding its revenue base, seeking additional capital from new equity or debt securities offerings that will provide funds needed to increase liquidity, fund internal growth and fully implement its business plan.

Through the next fiscal year, management estimates that significant additional funding is necessary to continue operations, expand Canadian markets and develop markets in the United States for the Flowstar technology, maintain and expand the marketing and sales of the Company’s new chemical business, and create and develop the market for the water remediation technologies acquired in December 2007. The timing and amount of capital requirements will depend on a number of factors, including demand for products and services and the availability of opportunities for international expansion through affiliations and other business relationships.

NOTE 2 – SUMMARY OF SIGNIFICANT ACCOUNTING POLICIES

Use of Estimates

The preparation of financial statements in conformity with U.S. generally accepted accounting principles requires management to make estimates and assumptions that affect the reported amounts of assets and liabilities and disclosure of contingent assets and liabilities at the date of the financial statements and the reported amounts of revenues and expenses during the reporting period. The Company regularly evaluates estimates and assumptions. The Company bases its estimates and assumptions on current facts, historical experience and various other factors it believes to be reasonable under the circumstances, the results of which form the basis for making judgments about the carrying values of assets and liabilities and the accrual of costs and expenses that are not readily apparent from other sources. The actual results experienced by the Company may differ materially and adversely from the Company’s estimates. To the extent there are material differences between the estimates and the actual results, future results of operations will be affected. The most significant estimates with regard to these financial statements relate to determining the useful lives of equipment and intangible assets, fair values of investment and technology rights, fair value of financial instruments, fair value of monetary transactions, fair value of stock-based compensation and deferred income tax rates.

Concentration of Cash and Credit Risk

The Company maintains its cash in commercial accounts at major Canadian and U.S. financial institutions. At times, amounts maintained exceed Federal Deposit Insurance Corporation insured limits.

Financial instruments, which potentially subject the Company to concentration of credit risk, consist primarily of trade receivables. The Company carries its accounts receivable at net realizable value. On a periodic basis, the Company evaluates its accounts receivable and considers the need for an allowance for doubtful accounts, based on past and expected collections, and current credit conditions. Such losses have not been significant and have been within management’s expectations. The Company's policy is to accrue interest on trade receivables at the discretion of management.

During the year ended December 31, 2008, sales to three customers accounted for 22%, 22%, and 10% of net sales, respectively. During the year ended December 31, 2007, sales to two customers accounted for 19% and 10% of net sales, respectively.

Inventories

Inventories consist of raw materials and finished goods which are stated at the lower of cost, determined on a weighted average basis, or net realizable values. The cost of finished goods includes other direct manufacturing costs.

Equipment

Equipment is stated at cost. Depreciation is provided using the straight-line method over two to six years. Leasehold improvements are amortized using the straight-line method over the estimated useful life of the asset or the term of the lease, whichever is shorter. Maintenance and repairs are expensed as incurred. Replacements and betterments are capitalized.

The Company evaluates the recoverability of property and equipment when changes in events or circumstances indicate that such assets might be impaired. The Company determines impairment by comparing the undiscounted future cash flows estimated to be generated by these assets to their respective carrying amounts. Management has determined that no impairment has occurred as of December 31, 2008.

Investments

For publicly traded investments the Company follows Statement of Financial Accounting Standards (“SFAS”) No. 115 “Accounting for Certain Investments in Debt and Equity Securities”. Under this method the Company’s investment in publicly traded securities are classified as available-for-sale securities and are reported at fair value. Fair value is based on quoted market prices as of the end of the reporting period. Unrealized gains and losses on these investments are reported net of related income tax effects in accumulated other comprehensive income or loss, a separate component of stockholders’ equity, and are credited or charged to net income when realized.

Investments in securities for which market values are not readily determinable and the Company does not have the ability to exercise significant influence in the underlying company are carried at cost unless impairment is otherwise indicated. Dividends and other distributions of earnings, if any, are included in income when declared. The Company periodically evaluates the carrying value of its investments, which are recorded at the lower of cost or estimated net realizable value.

Revenue and Cost Recognition

The Company recognizes revenue when the customer has accepted delivery of the product, has agreed it meets their requirements, when no significant contractual obligations for completion remain, and collection is reasonably assured. Revenue is reported net of a provision for estimated product returns. The Company follows EITF Issue 00-10, “Accounting for Shipping and Handling Fees and Costs” (“Issue 00-10”). Issue 00-10 requires that all amounts billed to customers related to shipping and handling should be classified as revenues. The Company sells its products directly, using in-house sales employees. Cost of sales is primarily made up of direct product costs, shipping and handling.

Product Warranties

The Company sells the majority of its products with one-year unconditional repair or replacement warranties. Warranty expense is included in cost of sales. Management does not consider the Company to be at significant risk for warranty claims.

Income Taxes

Income taxes are determined using the liability method in accordance with Statement of Financial Accounting Standards (“SFAS”) No. 109, Accounting for Income Taxes. Deferred tax assets and liabilities are recognized for the future tax consequences attributable to differences between the financial statement carrying amounts of existing assets and liabilities and their respective tax basis. Deferred tax assets and liabilities are measured using the enacted tax rates expected to apply to taxable income in the years in which those temporary differences are expected to be recovered or settled. The effect on deferred tax assets and liabilities of a change in tax rates is recognized in income in the period that includes that date of enactment. In addition, a valuation allowance is established to reduce any deferred tax asset for which it is determined that it is more likely than not that some portion of the deferred tax asset will not be realized.

In June 2006, the FASB issued Interpretation No. 48, “Accounting for Uncertainty in Income Taxes, an interpretation of FASB Statement No. 109” (“FIN 48”). FIN 48 clarifies the accounting for uncertainty in income taxes by prescribing a two-step method of first evaluating whether a tax position has met a more likely than not recognition threshold and, second, measuring that tax position to determine the amount of benefit to be recognized in the financial statements. FIN 48 provides guidance on the presentation of such positions within a classified balance sheet as well as on de-recognition, interest and penalties, accounting in interim periods, disclosure and transition. FIN 48 was adopted by the company January 1, 2007. The adoption of this statement did not have a material effect on the Company's financial statements.

Earnings Per Share

Basic earnings per share is computed in accordance with SFAS No. 128, “Earnings Per Share”. Under this method basic earnings per share is computed by dividing net income available to common shareholders by the weighted average common shares outstanding for the period. Diluted earnings per share reflect the potential dilution of securities that could share in the earnings of an entity similar to fully diluted earnings per share. Although there were common stock options and warrants outstanding at December 31, 2008 and 2007, they were not included in the calculation of earnings per share because they would have been considered anti-dilutive.

Stock-Based Compensation

The Company records compensation expense in the financial statements for share based payments using the fair value method pursuant to the Financial Accounting Standards Board Statement (“FASB”) No. 123R. The fair value of share-based compensation to employees will be determined using the Black-Scholes option valuation model at the time of grant. Fair value for common shares issued for goods or services rendered by non-employees are measured based on the fair value of the goods and services received. Share-based compensation is expensed with a corresponding increase to share capital. Upon the exercise of the stock options, the consideration paid is recorded as an increase in share capital.

Fair Value of Financial Instruments

The estimated fair values for financial instruments under statement of Financial Accounting Standards (“SFAS”) No. 107,Disclosures about Fair Value of Financial Instruments, are determined at discrete points in time based on relevant market information. These estimates involve uncertainties and cannot be determined with precision. The estimated fair value of cash, accounts receivable, prepaid expenses, other receivables, accounts payable, other liabilities, agreement payable, obligation to issue shares, due to related parties and convertible debentures approximates their carrying value due to their short-term nature.

Foreign Currency Translation

The Company’s reporting currency is the United States dollar. The Company’s functional currency for its operating subsidiaries is the Canadian dollar. The Company has adopted SFAS No. 52, “Foreign Currency Translation”. Under this method, monetary assets and liabilities denominated in foreign currencies are translated into United States dollars at rates of exchange in effect at the balance sheet date. Gains or losses are included in results of operations for the year. Non-monetary assets, and liabilities, denominated in foreign currencies are translated at rates of exchange in effect at the date of the transaction. Items recorded in revenue and expenses arising from transactions are translated at an average exchange rate for the year.

Long-Lived assets

In accordance with SFAS No. 144, “Accounting for the Impairment or Disposal of Long-Lived Assets", the carrying value of intangible assets and other long-lived assets is reviewed on a regular basis for the existence of facts or circumstances that may suggest impairment. The Company recognizes impairment when the sum of the expected undiscounted future cash flows is less than the carrying amount of the asset. Impairment losses, if any, are measured as the excess of the carrying amount of the asset over its estimated fair value.

Reclassifications

Certain amounts from prior periods have been reclassified to conform to the current period presentation

Recently Issued Accounting Pronouncements

In May 2008, the FASB issued SFAS No. 162, "The Hierarchy of Generally Accepted Accounting Principles" (“SFAS 162”). The statement identifies the sources of accounting principles and establishes a hierarchy for selecting those principles to prepare financial statements in accordance with U.S. GAAP. The statement is effective 60 days following the SEC's approval of the Public Fund Accounting Oversight Board (PCAOB) amendments to AU Section 411, "The Meaning of Present Fairly in Conformity with Generally Accepted Accounting Principles." The Company is currently evaluating the impact of SFAS 162, but does not expect the adoption of the pronouncement will have a material impact on its financial position, results of operation, or cash flows.

In February 2007, the FASB issued Statement of Financial Accounting Standards (“SFAS”) No. 159, “The Fair Value Option for Financial Assets and Financial Liabilities — Including an amendment of FASB Statement No. 115” (“SFAS No. 159”). SFAS No. 159 permits entities to choose to measure many financial instruments and certain other items at fair value. SFAS No. 159 is effective for fiscal years beginning after November 15, 2007 and, as such, the Company adopted the provisions of SFAS 159 as of January 1, 2008. The Company chose not to elect the fair value option to measure its financial assets and liabilities existing at January 1, 2008 that had not been previously carried at fair value, or of financial assets and liabilities it transacted in the year ended December 31, 2008. Therefore, the adoption of SFAS No. 159 had no effect on the Company’s financial statements.

In September 2006, the FASB issued SFAS No. 157, “Fair Value Measurements” (“SFAS No. 157”). SFAS No. 157 provides a common definition of fair value to be applied to existing generally accepted accounting principles (“GAAP”) requiring the use of fair value measures, establishes a framework for measuring fair value and enhances disclosure about fair value measures under other accounting pronouncements, but does not change existing guidance as to whether or not an asset or liability is carried at fair value. SFAS No. 157 is effective for financial statements issued for fiscal years beginning after November 15, 2007 for all financial assets and liabilities, and any other assets and liabilities that are recognized or disclosed at fair value on a recurring basis. For nonfinancial assets and liabilities, SFAS No. 157 is effective for financial statements issued for fiscal years beginning after November 15, 2008. The Company’s adoption of the provisions of SFAS No. 157 as of January 1, 2008 did not have a material effect on its results of operations, financial position, or cash flows.

In December 2007, the EITF reached a consensus on Issue No. 07-1, “Accounting for Collaborative Arrangements” (“EITF No. 07-1”). The EITF concluded on the definition of a collaborative arrangement, and that revenues and costs incurred with third parties in connection with collaborative arrangements would be presented gross or net based on the criteria in EITF No. 99-19 and other accounting literature. Based on the nature of the arrangement, payments to or from collaborators would be evaluated, and its terms, the nature of the entity’s business, and whether those payments are within the scope of other accounting literature would be presented. Companies are also required to disclose the nature and purpose of collaborative arrangements, along with the accounting policies, and the classification and amounts of significant financial statement amounts related to the arrangements. Activities in the arrangement conducted in a separate legal entity should be accounted for under other accounting literature; however, required disclosure under EITF No. 07-1 applies to the entire collaborative agreement. EITF No. 07-1 is effective for fiscal years beginning after December 15, 2008 and is to be applied retrospectively to all periods presented for all collaborative arrangements existing as of the effective date. The Company plans to adopt the provisions of EITF No. 07-1 as of January 1, 2009 and does not expect the adoption to have a material effect on its results of operations, financial position, or cash flows.

In April 2008, the FASB issued FSP No. SFAS 142-3, “Determination of the Useful Life of Intangible Assets” (“SFAS 142-3”). In determining the useful life of intangible assets, SFAS 142-3 removes the requirement to consider whether an intangible asset can be renewed without substantial cost or material modifications to the existing terms and conditions and, instead, requires an entity to consider its own historical experience in renewing similar arrangements. SFAS 142-3 also requires expanded disclosure related to the determination of intangible asset useful lives SFAS 142-3 is effective for financial statements issued for fiscal years beginning after December 15, 2008. The Company is currently evaluating the effect, if any, the adoption of SFAS 142-3 will have on its results of operations, financial position, or cash flows.

In June 2008, the EITF reached a consensus Issue No. 07-5, “Determining Whether an Instrument (or Embedded Feature) Is Indexed to an Entity’s Own Stock (“EITF No. 07-5”). EITF No. 07-5 was issued to clarify how to determine whether certain instruments or features are indexed to an entity’s own stock under EITF Issue No. 01-6, “The Meaning of Indexed to a Company’s Own Stock” (“EITF No. 01-6”). The consensus in EITF No. 07-5 applies to any freestanding financial instrument or embedded feature that has the characteristics of a derivative as defined in FSP No. SFAS 133, “Accounting for Derivative Instruments and Hedging Activities” (“SFAS 133”). The consensus in EITF No. 07-5 supersedes EITF No. 01-6 and is effective for financial statements issued for fiscal years beginning after December 15, 2008, and interim periods within those fiscal years. The Company is currently evaluating the effect, if any, the adoption of EITF No. 07-5 will have on its results of operations, financial position or cash flows.

Other pronouncements issued by the FASB or other authoritative accounting standards groups with future effective dates are either not applicable or are not expected to be significant to the financial statements of the Company.

NOTE 3 – INVENTORIES

The components of inventory at December 31, 2008 and 2007 were as follows:

| | | 2008 | | | 2007 | |

| Finished goods | $ | 566,134 | | $ | 724,926 | |

| Raw materials | | 55,219 | | | 29,486 | |

| | $ | 621,353 | | $ | 754,412 | |

The inventory has been pledged as security for the short-term debentures (See Note 10).

NOTE 4 – SHORT-TERM INVESTMENT

During the second quarter of 2007 the Company invested approximately $1,316,577 (CAD $1,400,000) in a debenture certificate. This investment was redeemed during the year ended December 31, 2008.

NOTE 5 – EQUIPMENT

Equipment consisted of the following as at December 31, 2008 and 2007:

| | | 2008 | | | 2007 | |

| Automotive equipment | $ | 117,977 | | $ | 129,537 | |

| Computer hardware | | 67,376 | | | 58,161 | |

| Computer software | | 155,426 | | | 76,045 | |

| Furniture and fixtures | | 26,918 | | | 26,918 | |

| Leasehold improvements | | 51,996 | | | 40,061 | |

| Office equipment | | 50,930 | | | 48,252 | |

| Tools and equipment | | 811,430 | | | 748,273 | |

| | | 1,282,053 | | | 1,127,247 | |

| Less: accumulated depreciation | | 550,718 | | | 266,111 | |

| | $ | 731,335 | | $ | 861,136 | |

Depreciation expense for the years ended December 31, 2008 and 2007 was $296,167 and $95,407, respectively.

NOTE 6 – INVESTMENTS

The components of investments at December 31, 2008 and 2007 were as follows:

| | | 2008 | | | 2007 | |

| Ellycrack AS | $ | - | | $ | 538,186 | |

| Eureka Oil AS | | 15,840 | | | 15,840 | |

| Tarblaster AS | | 13,752 | | | 14,399 | |

| | $ | 29,592 | | $ | 568,425 | |

Investment in Ellycrack AS

The Company has approximately13.45% of the issued and outstanding common stock of Ellycrack AS (“Ellycrack”), a privately held company in Norway.

At December 31, 2008, management has not been able to obtain satisfactory evidence to support the carrying value of the investment in Ellycrack AS. As a result, the value of the Company’s investment in Ellycrack AS has been fully impaired resulting in an impairment loss on the investment in the amount of $538,186 for the year ended December 31, 2008.

Investment in Eureka Oil AS

The Company holds 66,667 common shares of Eureka Oil AS (“Eureka”), a privately held company in Norway.

Investment in Tarblaster AS

As at December 31, 2007, the Company, held 900,000 common shares of Tarblaster AS (“Tarblaster”), a privately held company in Norway. During the year ended December 31, 2008, the Company sold 40.500 common shares of Tarblaster for proceeds of $38,485.

NOTE 7 – TECHNOLOGY

The Company holds DCR technology rights through its subsidiaries Flowstar and Vasjar (See Note 9). At December 31, 2007, management determined that future economic benefits of the Company’s DCR technology are negligible. Consequently, the balance of the value of the technology was fully impaired resulting in an impairment loss on the Company’s DCR technology in the amount of $2,177,970 for the year ended December 31, 2007.

NOTE 8 – NOTES PAYABLE

The following comprise the Company’s notes payable at December 31, 2008 and 2007:

| | | 2008 | | | 2007 | |

| Note payable – Interest at 0.0%, and secured by automotive assets of Flowstar, payable $569 per | | | | | | |

| month, principal only, due July 2008 | $ | - | | $ | 4,698 | |

| Note payable – Interest at 9.45%, compounded monthly and secured by automotive assets | | | | | | |

| of Flowstar, payable $368 per month, principal and interest, due July 2010 | | 6,469 | | | 12,500 | |

| Note payable – Interest at 0.90%, compounded monthly and secured by automotive assets of | | | | | | |

| Flowstar, payable $597 per month, principal and interest, due September 2010 | | 12,442 | | | 24,122 | |

| Note payable – Interest at 0.0%, and secured by automotive assets of Flowstar, payable $785 per | | | | | | |

| month, principal only, due November 2009 | | 8,640 | | | 22,387 | |

| Notes payable – Interest at 0.0%, unsecured, due on demand | | 22,475 | | | 22,475 | |

| Note payable – Interest at 10.0%, unsecured, due on demand | | 910,578 | | | - | |

| Note payable – Interest at 14.0%, unsecured, due on demand | | 300,000 | | | - | |

| Note payable – Interest at 0.0%, unsecured, due on demand | | 46,654 | | | - | |

| Notes payable – Interest at 0.0%, unsecured, payable in four equal installments on June 18, 2008, | | | | | | |

| December 18, 2008, June 18, 2009 and December 18, 2009 | | - | | | 2,197,658 | |

| Notes payable – Interest at 6.09%, secured by software license | | - | | | 32,042 | |

| Total notes payable | | 1,307,258 | | | 2,315,882 | |

| Less current portion | | 1,290,550 | | | 1,086,670 | |

| | $ | 16,708 | | $ | 1,229,212 | |

In December 2007, an unsecured note, bearing interest at a rate of 0.0%, in the amount of approximately $2,696,980 (CAD $2,665,000) was issued (see Note 16). The fair value of this note was computed as $2,183,635 using an interest rate of 18.0% which represents the incremental borrowing rate of the Company. This has resulted in $513,345 being recorded as a debt discount which was amortized over the life of the note. The Company has recorded the adjustment to the fair value of the note as a decrease to research and development acquired in the Statement of Operations and Comprehensive Income. During the year ended December 31, 2008, this note was repaid with cash in the amount of $1,474,963 (CAD $1,502,458) and shares in the amount of $954,219 (CAD $1,162,542). As a result, the Company recorded an interest expense of for the year ended December 31, 2008 in the amount of $402,911 (2007 - $14,023).

Future minimum payments on notes payable are as follows:

| Years ending December 31, | | | |

| 2009 | $ | 20,225 | |

| 2010 | | 7,952 | |

| | $ | 28,177 | |

NOTE 9 –AGREEMENT PAYABLE

In connection with the acquisition of Flowstar, the Company concluded the acquisition of 100% of the outstanding shares of Vasjar, a British Virgin Islands company, in 2004. Vasjar’s wholly-owned subsidiary Quadra owns the rights to the technology related to the DCR 900 system.

The purchase called for the Company to issue 2,400,000 common shares, and an additional minimum 2,080,000 common shares issued over three years (480,000 on or before April 1, 2005, 800,000 on or before April 1, 2006, and 800,000 on or before April 1, 2007).

In consideration of the purchase of all the outstanding shares of Vasjar, the Company issued shares (and will issue additional shares), all of which are required to be registered for resale upon delivery, as follows:

- Tranche 1: an aggregate of 2,400,000 shares of common stock of the Company issued on April 28, 2004; and

- Tranche 2: up to an aggregate of 2,080,000 additional shares of common stock of the Company as follows:

Stage One. On or before April 1, 2005, the Company was required to issue 480,000 additional shares based on sales achieved in the year ended December 31, 2004. These shares were issued during the year ended December 31, 2006.