SCHEDULE 14A

(Rule 14a-101)

INFORMATION REQUIRED IN PROXY STATEMENT

SCHEDULE 14A INFORMATION

Proxy Statement Pursuant To Section 14(A) Of The

Securities Exchange Act of 1934

Filed by the Registrant x

Filed by a Party other than the Registrant ¨

Check the appropriate box:

| | | | | | |

¨ | | Preliminary Proxy Statement | | ¨ | | Confidential, For Use of the Commission Only (as permitted by Rule 14a-6(e)(2)) |

x | | Definitive Proxy Statement | | |

¨ | | Definitive Additional Materials | | |

| |

¨ | | Soliciting Material Pursuant to Rule 14a-11(c) or Rule 14a-12 |

VARSITY GROUP INC.

(Name of Registrant as Specified In Its Charter)

(Name of Person(s) Filing Proxy Statement if other than the Registrant)

Payment of Filing Fee (Check the appropriate box):

| ¨ | Fee computed on table below per Exchange Act Rules 14a-6(i)(1) and 0-11. |

| | (1) | Title of each class of securities to which transaction applies: |

| | (2) | Aggregate number of securities to which transaction applies: |

| | (3) | Per unit price or other underlying value of transaction computed pursuant to Exchange Act Rule 0-11 (set forth the amount on which the filing fee is calculated and state how it is determined): |

| | (4) | Proposed maximum aggregate value of transaction: |

| ¨ | Fee paid previously with preliminary proxy materials. |

| ¨ | Check box if any part of the fee is offset as provided by Exchange Act Rule 0-11(a)(2) and identify the filing for which the offsetting fee was paid previously. Identify the previous filing by registration statement number, or the form or schedule and the date of its filing. |

| | (1) | Amount previously paid: |

| | (2) | Form, Schedule or Registration Statement No.: |

VARSITY GROUP INC.

1850 M Street, NW, Suite 1150

Washington, D.C. 20036

NOTICE OF ANNUAL MEETING OF STOCKHOLDERS

TO BE HELD JUNE 24, 2005

To our stockholders:

Notice is hereby given that the 2005 annual meeting of stockholders of Varsity Group Inc. (the “Company”) will be held at the Mayflower Hotel, 1127 Connecticut Ave., N.W. Washington, D.C. 20036, on June 24, 2005, at 10:00 a.m. local time, for the following purposes:

| | 1. | to elect one director of the Company, for a term expiring at the 2008 annual meeting of stockholders; |

| | 2. | to ratify the selection of PricewaterhouseCoopers LLP, as the Company’s independent auditors for 2005; and |

| | 3. | to transact such other business as may properly come before the meeting or any adjournment or postponement thereof. |

Please refer to the attached proxy statement, which forms a part of this Notice and is incorporated herein by reference, for further information with respect to the business to be transacted at the annual meeting.

Only stockholders of record at the close of business on April 25, 2005 will be entitled to notice of, and to vote at, the annual meeting or any adjournment or postponement thereof. A list of such stockholders will be open for examination by any stockholder for any purpose germane to the annual meeting at the annual meeting and during normal business hours, for ten days prior to the annual meeting, at the offices of the Company, 1850 M Street, NW Suite 1150, Washington, D.C. 20036.

|

| By Order of the Board of Directors, |

|

| /s/ JACK BENSON |

Jack Benson |

Secretary |

Dated: April 29, 2005

YOUR VOTE IS VERY IMPORTANT. WHETHER OR NOT YOU EXPECT TO ATTEND THE MEETING, PLEASE SIGN AND DATE THE ENCLOSED PROXY AND MAIL IT PROMPTLY IN THE ENVELOPE PROVIDED.

VARSITY GROUP INC.

1850 M Street, NW, Suite 1150

Washington, D.C 20036

ANNUAL MEETING OF STOCKHOLDERS

JUNE 24, 2005

PROXY STATEMENT

GENERAL INFORMATION

Proxy Solicitation

This proxy statement is furnished in connection with the solicitation of proxies by our Board of Directors for use at the 2005 annual meeting of stockholders to be held at the Mayflower Hotel, 1127 Connecticut Ave., N.W., Washington, D.C. 20036, on June 24, 2005, at 10:00 a.m. local time. The purpose of the annual meeting and the matters to be acted upon are set forth in the accompanying notice of annual meeting.

We are mailing our annual report on Form 10-K for the fiscal year ended December 31, 2004, together with this proxy statement and the enclosed proxy, to stockholders entitled to vote at the annual meeting.

We will pay the cost of all proxy solicitation. In addition to the solicitation of proxies by use of the mails, our officers and other employees may solicit proxies by personal interview, telephone, email message, facsimile and telegram. If any of these individuals are asked to perform these services, they will not receive compensation and the services will be performed in addition to their regular duties. We have also made arrangements with brokerage firms, banks, nominees and other fiduciaries to forward proxy solicitation material for shares held of record by them to the beneficial owners of the shares. We will reimburse any of these entities or people for their reasonable out-of-pocket expenses in forwarding the proxy solicitation materials.

This proxy statement and the enclosed proxy are first being mailed to our stockholders on or about May 5, 2005.

Voting And Revocability Of Proxies

A proxy for use at the annual meeting and a return envelope are enclosed. Any shares of our common stock, par value $0.0001 per share (the “common stock”), which are represented by a properly executed proxy that is received in time and not revoked will be voted at the annual meeting in accordance with the instructions indicated in the proxy. If no instructions are indicated, the shares will be voted “FOR” the election of the director nominee named in the proxy and “FOR” the ratification of PricewaterhouseCoopers, LLP as the Company’s independent auditors. Discretionary authority is provided in the proxy as to any matters not specifically referred to therein. Neither our board nor our officers are aware of any other matters that are likely to be brought before the annual meeting. If any other matters properly come before the annual meeting, however, the persons named in the proxy are fully authorized to vote on the matters in accordance with their judgment and discretion.

A stockholder who has given a proxy may revoke it at any time prior to its exercise at the annual meeting by (1) giving written notice of revocation to our Corporate Secretary, (2) properly submitting to us a duly executed proxy bearing a later date or (3) voting in person at the annual meeting. Your attendance at the meeting in person will not, in and of itself, constitute revocation of your proxy. All written notices of revocation or other communications with respect to revocation of proxies should be addressed to our Corporate Secretary at our principal executive offices as follows: Varsity Group Inc., 1850 M Street, NW Suite 1150, Washington, DC 20036, Attention: Corporate Secretary.

1

Voting Procedure

All holders of record of our common stock at the close of business on April 25, 2005 will be eligible to vote at the annual meeting. Each common stockholder is entitled to one vote at the annual meeting for each share they hold. Cumulative voting is not available. As of April 25, 2005 there were 16,788,829 shares of common stock outstanding.

The presence, in person or by proxy, of a majority of the outstanding shares of common stock entitled to vote will constitute a quorum for the transaction of business. Votes cast in person or by proxy, abstentions and broker non-votes (as defined below) will be tabulated by the inspectors of election and will be considered in the determination of whether a quorum is present at the annual meeting. The inspectors of election will treat shares represented by executed proxies that abstain as shares that are present and entitled to vote for purposes of determining the approval of such matter. If, with respect to any shares, a broker or other nominee submits a proxy indicating that instructions have not been received from the beneficial owners or the persons entitled to vote and that the broker or other nominee does not have discretionary authority to vote the shares (a “broker non-vote”) on one or more proposals, those shares will not be treated as present and entitled to vote for purposes of determining the approval of any proposal.

Shares may only be voted by or on behalf of the record holder of shares as indicated in our stock transfer records. If you are a beneficial stockholder but your shares are held of record by another person, such as a brokerage firm or bank, that person must vote the shares as the record holder.

No appraisal or similar rights of dissenters apply to any matter to be acted upon at the annual meeting.

PROPOSAL NO. 1

ELECTION OF DIRECTORS

Nominee For Election As Director

There is one nominee for election of Director at this meeting.

Our Amended and Restated Certificate of Incorporation and Amended and Restated Bylaws provide that the members of the Board are to be elected at the annual meeting of the stockholders. Presently, there are five board seats with no vacancies. One director is standing for re-election at this meeting. At the conclusion of the annual meeting, the number of directors that will constitute the entire Board is five.

The Board is divided into three classes, with the shareholders electing 20% of the directors this year. The directors of each class serve terms of three years. The first class includes Eric J. Kuhn whose term, if re-elected, will expire in 2008. The second class includes William J. Pade and Robert M. Holster whose terms expire in 2006. The last class includes Allen Morgan and John Kernan whose terms will expire in 2007. The Board appointed Mr. Holster to his seat on August 31, 2004 to serve an initial two year term in order to divide each class as nearly equal in number as possible.

Proposal No. 1 nominates Eric J. Kuhn for election to a new term expiring in 2008.

The nominee has indicated that he intends to continue to serve as a director if elected at the annual meeting. Approval of the nominee requires the affirmative vote of a plurality of the votes of the shares present in person or represented by proxy at the annual meeting and entitled to vote on the election of directors. In the event that the nominee should become unable or unwilling to serve as a director, it is the intention of the persons named in the proxy to vote for the election of such substitute nominee for the office of director as the Board may recommend.

OUR BOARD RECOMMENDS THAT OUR STOCKHOLDERS VOTE “FOR” THE ELECTION OF THE NOMINEE TO SERVE AS DIRECTOR.

2

Set forth below is information with respect to our current directors:

| | | | |

Name

| | Age

| | Position

|

Term Expiring in 2005 | | | | |

Eric J. Kuhn | | 34 | | Chief Executive Officer Chairman of the Board |

| | |

Terms Expiring in 2006 | | | | |

William J. Pade (1) (2) (3) | | 54 | | Director |

Robert M. Holster (2) (3) | | 58 | | Director |

| | |

Terms Expiring in 2007 | | | | |

John T. Kernan (1) (2) | | 59 | | Director |

Allen L. Morgan (1) (3) | | 52 | | Director |

| (1) | Member of the compensation and stock option committee. |

| (2) | Member of the audit committee. |

| (3) | Member of the nominating and corporate governance committee. |

Eric J. Kuhn co-founded Varsity Group Inc. and has served as our Chief Executive Officer and Chairman of the Board since our inception. He has also served as our President since June 1999. From August 1997 to April 1998, Mr. Kuhn practiced law at Greenberg Traurig Hoffman Lippoff Rosen and Quentel P.A. in Miami, Florida, and from September 1996 to July 1997, practiced law at Kaye Scholer LLP in New York, New York. Mr. Kuhn received a B.A. with honors from Haverford College in 1993 and a J.D. with honors from The George Washington University Law School in 1996.

John T. Kernan has served as a Director since March 2002. Mr. Kernan served as Chairman and Chief Executive Officer of Lightspan Inc, a leading provider of curriculum-based educational software and Internet products and services used both in school and at home, from September 1993 until November 2003. Mr. Kernan currently serves on the Board of Plato Learning (NASDAQ: TUTR). Prior to co-founding Lightspan, Mr. Kernan served as Chairman and Chief Executive Officer of Jostens Learning Corporation, an educational software company. Mr. Kernan holds a Bachelor of Science from Loyola College.

Allen L. Morgan has served as a Director since February 1999. Since January 1999, Mr. Morgan has been a General Partner or Managing Director of Mayfield, a venture capital fund. From May 1997 to December 1998, Mr. Morgan was a partner in the corporate department of Latham & Watkins LLP in Menlo Park, California. From November 1982 to May 1997, Mr. Morgan was an associate and a partner in the corporate department of Wilson, Sonsini, Goodrich & Rosati P.C. in Palo Alto, California. In 2004, Mr. Morgan joined the Board of ValueVision Media (NASDAQ: VVTV). He received an A.B. from Dartmouth College in 1976, a B.A. and M.A. from Oxford University in 1978 and 1983, respectively, and a J.D. from the University of Virginia in 1981.

William J. Pade is a partner of Oak Hill Capital Management, a private equity firm with offices in New York, NY, and in Menlo Park, CA where he focuses primarily on investments in the technology and telecommunications sectors. Prior to joining Oak Hill, Mr. Pade spent 26 years at McKinsey & Company, where he was a Director and Managing Partner of McKinsey’s Silicon Valley Office, which was the center of the Firm’s global High Technology sector. Prior to that, he was based in London, U.K., where he led McKinsey’s High Technology and Telecom practice in Europe. He holds a B.A. from Harvard College and an M.B.A. from Harvard Business School, and he is a board member of several corporations and not for profit organizations in Silicon Valley.

Robert M. Holsterwill become Chief Executive Officer of HMS Holdings Corp. (NASDAQ: HMSY) effective May 1, 2005, relinquishing his current role as President and Chief Operating Officer on that same date. HMSY provides cost containment and reporting services for government healthcare programs. Prior to joining

3

HMSY, Mr. Holster was President and Chief Executive Officer of HHL Financial Services Inc., a healthcare accounts receivable management company. Previously, Mr. Holster served in a number of executive positions including Chief Financial Officer of Macmillan, Inc. and Controller of Pfizer Laboratories, a division of Pfizer, Inc. He is a board member of Hi-Tech Pharmacal, Inc. (NASDAQ: HITK) and HMSY. Mr. Holster holds a B.S. from the University of Connecticut and an M.B.A. from Columbia University.

Board Of Directors and Committees Of The Board

Independence of the Board of Directors. After review of all relevant transactions and relationships between each director, or certain of his family members, and the Company, its senior management and its independent auditors, the Board has affirmatively determined that Mr. Kernan, Mr. Morgan, Mr. Pade and Mr. Holster are independent directors within the meaning of Section 4200(a)(15) of the Nasdaq listing standards. In addition, for purposes of Audit Committee membership, our Board has determined that Mr. Kernan, Mr. Pade and Mr. Holster are independent directors as required by Section 4350(d)(2) of the Nasdaq listing standards. The Company’s securities are currently listed on the NASDAQ National Market, and, pursuant to applicable SEC rules, we have used the Nasdaq listing standards in determining the independence of our directors.

The Board held six meetings during the Company’s 2004 fiscal year. During fiscal year 2004, each director attended all of the meetings of the Board held during the period he served as a director and the meetings held by each committee of the Board on which he served (during the period for which he served).

The Board currently has a standing Audit Committee, a standing Compensation and Stock Option Committee and a standing Nominating and Corporate Governance committee. Below is a description of each committee of the Board of Directors. The charter of each committee can be found at our corporate website located at http://www.varsity-group.com.

Audit Committee. The Audit Committee, consisting of Mr. Kernan, Mr. Pade and Mr. Holster, assists the Board of Directors in fulfilling its responsibility to oversee management’s conduct of the review of the Company’s financial reporting process, including the selection of the Company’s independent auditors, fees to be paid to our independent auditors and the review of the financial reports and other financial information provided by the Company to any governmental or regulatory body, the public or other users thereof, the Company’s systems of internal accounting and financial controls, the annual independent audit of the Company’s financial statements and the Company’s legal compliance and ethics programs as established by management and the Board. The Audit Committee held four meetings during the Company’s 2004 fiscal year.

The Board has determined that each member of the Audit Committee is independent as defined by Nasdaq and the applicable SEC rules and that Mr. Holster qualifies as an “audit committee financial expert” as defined by the SEC’s rules.

The Audit Committee reviewed and discussed the audited financial statements with management. Based on such review and discussions, the Audit Committee recommended to the Board that the audited financial statements be included in our annual report on Form 10-K for the fiscal year ended December 31, 2004, for filing with the SEC.

Compensation and Stock Option Committee. The Compensation and Stock Option Committee determines the salaries and benefits for our employees, consultants, directors and other individuals compensated by the Company. In addition, the Compensation and Stock Option Committee administers our stock option plan. The Compensation and Stock Option Committee consists of Mr. Morgan, Mr. Kernan, and Mr. Pade. The Compensation and Stock Option Committee held four meetings during the Company’s 2004 fiscal year.

Nominating and Corporate Governance Committee. The Nominating and Corporate Governance Committee, consisting of Mr. Morgan, Mr. Pade and Mr. Holster, oversees the director nomination process and the Company’s corporate governance functions. The Committee has the primary responsibility for identifying,

4

reviewing and evaluating candidates to serve as directors of the Company, consistent with criteria approved by the Board. The Committee recommends to the Board candidates for election to the Board of Directors, makes recommendations to the Board regarding the membership of the committees of the Board, and assesses the independence of directors.

The Board has established guidelines for evaluating nominees for director. The qualifications that the Board seeks include: (i) a review of the background and skills of the candidate, it being in the best interests of the Company to have a Board of Directors comprised of outstanding individuals with diverse backgrounds and expertise; (ii) a review of the other directorships and commitments of the individual to make certain that he or she will have adequate time to devote to the affairs of the Company; and (iii) the Committee shall consider the importance of having at least one independent director with significant experience and expertise in related industries and at least one independent director with significant experience and expertise in finance, and such other attributes as shall be relevant in constituting a Board that also satisfies the requirements imposed by the SEC and applicable listing exchanges. The Board may modify these guidelines from time to time and will consider other factors as appropriate.

The Nominating and Corporate Governance Committee will seek nominees through a variety of sources, including suggestions by directors and management, business contacts of Committee members and other directors, and such other sources, as the Committee believes appropriate. The Committee may also retain a search firm if the Committee believes that to be appropriate. The Committee will consider the general guidelines summarized above, the current composition of the Board, which areas of qualification and expertise would best enhance the composition of the Board, the experience, expertise and other qualifications of candidates, the number of other commitments of candidates, whether the candidate would qualify as independent under applicable rules, and such other considerations as the Committee believes to be appropriate. The Committee has the flexibility to determine the most appropriate interviewing and referencing process. The Committee recommends nominees to the independent members of the Board. A majority of the independent members of the Board select the nominees. These nominations are then submitted for ratification by the full Board.

The Nominating and Corporate Governance Committee will consider director candidates recommended by stockholders. To date, the Committee has not received any director nominee from stockholders, other than from stockholders who are directors. The Committee does not intend to alter the manner in which it evaluates candidates, including the minimum criteria set forth above, based on whether or not the candidate was recommended by a stockholder. The Committee will also evaluate whether candidates suggested by stockholders are identified with any particular issue to such an extent that their ability to effectively represent all of the stockholders on a broad variety of issues might be compromised. Stockholders who wish to recommend individuals for consideration by the Committee to become nominees for election to the Board may do so by delivering a written recommendation to the Corporate Secretary at the Company’s principal executive office at least six months before the next annual meeting. Submissions must include the candidate’s name, contact information and biographical information; a description of any relationships between the stockholder making the suggestion and the candidate; any information that would be required to be disclosed about the candidate in the proxy statement if the candidate is nominated by the Board; the candidate’s consent to a background review by the Committee and to being included in the proxy statement if nominated; and the name and contact information of the stockholders suggesting the nominee, and the number of shares of the Company’s stock held by those stockholders.

Stockholder Communications with the Board of Directors

The Company has adopted a formal process by which stockholders may communicate with the Board or any director. Any such communications should be mailed care of our Corporate Secretary to our executive offices at 1850 M Street, NW, Suite 1150, Washington, DC 20036. Additional information regarding stockholder communications is available on our website at http://www.varsity-group.com.

5

Code of Ethics

The Company has adopted a code of business conduct ethics, which apply to all officers, directors and employees. The policies are available on our website at http://www.varsity-group.com. If the Company makes any substantive amendments to these policies or grants any waiver from the policies to any executive officer or director, we will disclose the nature of the amendment or waiver on our website.

Annual Meeting Attendance

The policy of the Board of Directors is that all directors attend the annual meeting of stockholders, absent compelling circumstances that prevent attendance. All directors attended the annual meeting of stockholders held in 2004.

Director Compensation

Except for reimbursement for reasonable travel expenses relating to attendance at board meetings and the granting of stock options or restricted stock awards, directors are not compensated for their services as directors. Our directors receive option grants under our stock option plan.

Section 16(a) Beneficial Ownership Reporting Compliance

To the Company’s knowledge, during the 2004 fiscal year all officers and directors filed the necessary ownership statements consistent with the requirements listed in Section 16 of the Securities Exchange Act of 1934.

PROPOSAL NO. 2

RATIFICATION OF APPOINTMENT OF INDEPENDENT AUDITORS

PricewaterhouseCoopers LLP has served as the Company’s independent auditors since October 1999 and has been appointed by the Audit Committee to continue as the Company’s independent auditors for the fiscal year ending December 31, 2005. Stockholder ratification of the selection of PricewaterhouseCoopers LLP as the Company’s independent auditors is not mandatory; however, the Board is submitting the selection of PricewaterhouseCoopers LLP to the stockholders for ratification as a matter of good corporate practice. In the event that ratification of this selection of auditors is not approved by a majority of the shares of Common Stock voting at the Annual Meeting in person or by proxy, the Audit Committee will reconsider its selection of auditors.

Ratification of the selection of PricewaterhouseCoopers LLP as our independent auditors for the year ending December 31, 2005 requires the affirmative vote of a majority of the outstanding shares of common stock represented at and entitled to vote at the meeting.

OUR BOARD RECOMMENDS THAT OUR STOCKHOLDERS VOTE “FOR” RATIFICATION OF THE APPOINTMENT OF PRICEWATERHOUSECOOPERS LLP AS OUR INDEPENDENT AUDITORS FOR THE FISCAL YEAR ENDING DECEMBER 31, 2005.

6

SECURITY OWNERSHIP

Security ownership of directors, executive officers and principal stockholders

The following table sets forth information regarding beneficial ownership of our common stock as of April 25, 2005, by:

| | • | | each person, or group of affiliated persons, who we know beneficially owns more than five percent in the aggregate of the outstanding shares of our common stock; |

| | • | | each of our executive officers named in the Summary Compensation Table; |

| | • | | each of our directors; and |

| | • | | all directors and executive officers as a group. |

Under the rules of the Securities and Exchange Commission, beneficial ownership includes voting or investment power with respect to securities and includes the shares issuable under stock options or warrants that are exercisable within 60 days of April 25, 2005. Shares issuable under stock options or warrants are deemed outstanding for computing the percentage of the person holding options but are not outstanding for computing the percentage of any other person. As of April 25, 2005, 16,788,829 shares of common stock were outstanding.

Unless otherwise indicated, the address for each listed stockholder is: c/o Varsity Group Inc., 1850 M Street, N.W. Suite 1150, Washington, D.C. 20036. To our knowledge, except as indicated in the footnotes to this table and pursuant to applicable community property laws, the persons named in the table have sole voting power and investment power with respect to all shares of common stock. As indicated, in certain instances this disclosure is provided solely by reference to public reports.

| | | | | |

| | | Shares of Common Stock

Beneficially Owned

| |

Name of Beneficial Owner

| | Number

| | Percentage

| |

Eric J. Kuhn (1) | | 2,642,318 | | 14.6 | % |

Allen L. Morgan (2) | | 2,570,164 | | 15.2 | % |

Mayfield Fund (3) | | 2,176,894 | | 13.0 | % |

The Carlyle Group (4) | | 1,612,628 | | 9.6 | % |

Jack M Benson (5) | | 897,000 | | 5.1 | % |

John Kernan (6) | | 210,000 | | 1.2 | % |

William J. Pade (7) | | 97,222 | | 0.6 | % |

Robert M. Holster (7) | | 62,500 | | 0.4 | % |

Directors and executive officers as a group (6 persons) | | 6,489,161 | | 33.3 | % |

| (1) | Includes 1,261,435 shares subject to options exercisable within 60 days of April 25, 2005. |

| (2) | Includes 1,834,789 shares held by Mayfield IX, 96,568 shares held by Mayfield Associates Fund IV, 245,537 shares held by the Varsity Book Trust, a revocable trust, and 393,270 held directly by Mr. Morgan. The shares held directly by Mr. Morgan include 130,000 shares subject to options exercisable within 60 days of April 25, 2005. Except for those shares held by Mr. Morgan, Mr. Morgan disclaims beneficial ownership of all other shares except to the extent of any pecuniary interest therein. |

| (3) | Includes 1,834,789 shares held by Mayfield IX, 96,568 shares held by Mayfield Associates Fund IV and 245,537 shares held by the Varsity Books Trust, a revocable trust. Mayfield IX Management LLC is the general partner of Mayfield IX and Mayfield Associates Fund IV, both of which are Delaware limited partnerships. Mr. Morgan, one of our directors, is a nonmanaging member of Mayfield IX Management LLC. He has no management authority with respect to Mayfield IX Management and disclaims beneficial |

7

| | ownership of our shares held directly by Mayfield IX Management, Mayfield IX, and Mayfield Associates Fund IV except to the extent of any pecuniary interest therein. Mayfield Fund, L.P.’s address is 2800 Sand Hill Road, Menlo Park, California 94025. |

| (4) | Based solely on an amended Schedule 13G filed February 10, 2005. The Carlyle Group includes 484,614 shares held by Carlyle Venture Partners, L.P., 101,167 shares held by C/S Venture Investors, L.P., 75,471 shares held by Carlyle Venture Coinvestment L.L.C. and 64,271 shares held by Carlyle U.S. Venture Partners, L.P., as well as 887,105 shares currently outstanding held by B&T Enterprises, L.L.C., a limited liability company. TC Group, L.L.C., an affiliate of The Carlyle Group, is the manager of B&T Enterprises, L.L.C. and has sole control over the voting and disposition of the shares held by B&T Enterprises, L.L.C. TC Group, L.L.C. disclaims beneficial ownership of any of the shares held by B&T Enterprises, L.L.C. TCG Ventures, Ltd, an affiliate of The Carlyle Group, is the general partner of both Carlyle Venture Partners, L.P. and C/S Venture Investors, L.P. TCG Ventures, L.L.C., an affiliate of The Carlyle Group, is the general partner of both Carlyle Venture Coinvestment L.L.C. and Carlyle U.S. Venture Partners, L.P. The Carlyle Group’s address is 1001 Pennsylvania Avenue, N.W., Suite 220 South, Washington, D.C. 20004. |

| (5) | Includes 851,000 shares subject to options exercisable within 60 days of April 25, 2005. This figure also includes 25,000 shares issuable upon exercise of outstanding warrants, all of which are exercisable within 60 days of April 25, 2005 at an exercise price of $1.06 per share held by Birdwood Capital, L.L.C., a limited liability company, but beneficially owned by Mr. Benson. |

| (6) | Includes 130,000 shares subject to options exercisable within 60 days of April 25, 2005. |

| (7) | All shares subject to options exercisable within 60 days of April 25, 2005. |

CERTAIN INFORMATION WITH RESPECT TO EXECUTIVE OFFICERS

Set forth below is information with respect to our current executive officers:

| | | | |

Name

| | Age

| | Position

|

Eric J. Kuhn | | 34 | | Chief Executive Officer and Chairman of the Board |

Jack M Benson | | 38 | | Chief Financial Officer, Vice President for Corporate Development |

The principal occupations and positions for at least the past five years of the executive officers named above are as follows:

Eric J. Kuhn – please see the information included above under the caption “Board of Directors”.

Jack M Benson has served as our Chief Financial Officer, Vice President for Corporate Development and Secretary since August 2001. He served as our Vice President for Finance and Operations from August 2000 to August 2001. From 1999 to August 2000, Mr. Benson was a Principal at Birdwood Capital, L.L.C., a venture-consulting firm. Before joining Birdwood, Mr. Benson served as our Director of Strategic Partnerships. From 1997 to 1999, Mr. Benson was a consultant at Dean & Company, a strategic management-consulting firm. Mr. Benson received a B.A. from Colgate University in 1988 and a M.B.A. from the Darden Graduate School of Business at the University of Virginia in 1997.

8

EXECUTIVE COMPENSATION

Summary Compensation Table

The following table sets forth the compensation paid to the Chief Executive Officer of the Company and to each of the other executive officers (the “Named Executive Officers”) for fiscal years 2004, 2003, and 2002.

| | | | | | | | | | | | | | |

| | | | | Annual Compensation

| | Long Term

Compensation Awards

| | Other

|

Name and Principal Position

| | Year

| | Salary

($)

| | Bonus ($)

| | Other Annual

Compensation

($)

| | Restricted

Stock

Awards

($)

| | # of

Securities

Underlying

Options (#)

| | All Other

Compensation

($)

|

Eric J. Kuhn Chief Executive Officer | | 2004

2003

2002 | | 210,000

195,000

180,000 | | —

50,000

36,000 | | —

—

— | | —

—

— | | 300,000

100,000

350,000 | | 900

900

900 |

| | | | | | | |

Jack M Benson Chief Financial Officer | | 2004

2003

2002 | | 180,000

170,000

160,000 | | 21,000

50,000

25,000 | | —

—

— | | —

—

— | | 225,000

—

180,000 | | 580

420

660 |

Stock Option Grants In Fiscal Year 2004

| | | | | | | | | | | | | | | | |

| | | Individual Grants

| | | | |

Name

| | Number of

Securities

Underlying

Options

Granted

| | % of Total

Options

Granted to

Employees

in 2004

| | | Ave.

Exercise

Price ($/SH)

| | Expiration Date

| | Potential Realizable Value at Assumed Annual Rate of Stock Price Appreciation for

Option Term (1)

|

| | | | | | 5% ($)

| | 10% ($)

|

Eric J. Kuhn | | 300,000 | | 27 | % | | $ | 5.43 | | 3/10/14 to 12/10/14 | | $ | 1,025,098 | | $ | 2,579,800 |

Jack M Benson | | 225,000 | | 20 | % | | $ | 5.14 | | 3/10/14 to 12/10/14 | | $ | 726,688 | | $ | 1,841,569 |

| (1) | The dollar amounts under these columns are the result of calculations based on the market price on the date of grant at the 5% and 10% rates required applicable regulations of the Securities and Exchange Commission and, therefore, are not intended to forecast possible future appreciation, if any, of the Common Stock price. |

Option Exercise And Fiscal Year-End Option Values

2004 Fiscal Year-End Values

| | | | | | | | | |

| | | Aggregated Option/SAR

Exercises

| | Option Values

|

Name

| | Shares

Acquired

on Exercise

| | Value

Realized ($)

| | Number of Securities

Underlying Unexercised

Options at Fiscal Year-End (#)

(Exercisable/Unexercisable)

| | Value of Unexercised In-the-Money Options at Fiscal Year-End ($)

(Exercisable/Unexercisable)

|

Eric J. Kuhn | | — | | — | | 1,261,435 / 359,999 | | $ | 6,682,590 / $2,977,192 |

| | | | |

Jack M Benson | | — | | — | | 851,000 / 225,000 | | $ | 7,037,770 / $1,860,750 |

On October 2, 1998, we adopted the 1998 Stock Plan, under which incentive stock options, non-qualified stock options or stock rights, or any combination thereof may be granted to our employees. There presently are 7.5 million shares authorized under the Stock Plan, subject to increase on an annual basis under an “evergreen” provision of the plan.

9

The following table summarizes equity compensation plans as of December 31, 2004.

| | | | | | | |

Plan Category

| | Number of securities

to be issued upon exercise

of outstanding options,

warrants and rights (thousands) (a)

| | Weighted-average

exercise price of

outstanding options,

warrants and rights (b)

| | Number of securities remaining

available for future issuance

under equity compensation plans

(excluding securities reflected in

column (thousands) (c)

|

Equity compensation plans approved by security holders | | 4,454 | | $ | 3.74 | | 888 |

Equity compensation plans not approved by security holders | | — | | | — | | — |

| | |

| |

|

| |

|

Total | | 4,454 | | | | | 888 |

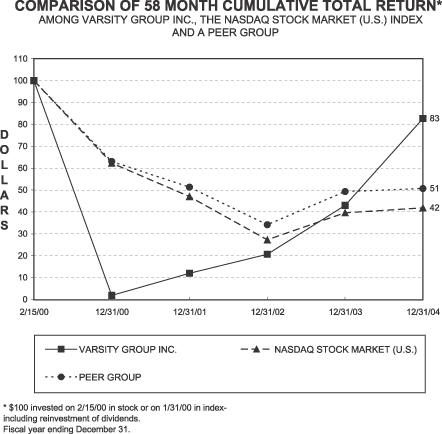

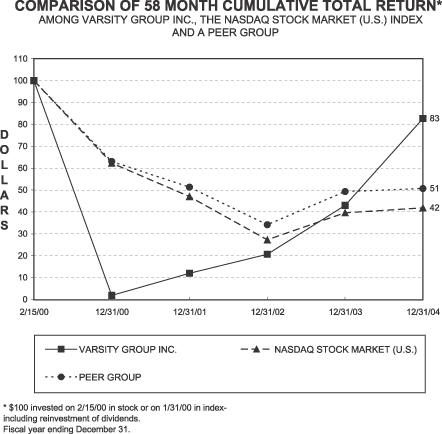

The following graph compares our cumulative total stockholder return on the common stock (no dividends have been paid thereon) with the cumulative total return of the Nasdaq Stock Market (US) index and a self determined peer group comprised of issuers in the same industry from February 15, 2000 (the date of our IPO) through December 31, 2004. The comparison assumes an investment of $100 on February 15, 2000 in our common stock and each of the foregoing indices.

The historical market performance of the common stock shown in the graph is not necessarily indicative of future stock performance. The stock performance graph shall not be deemed incorporated by reference by any general statement incorporating by reference this proxy statement into any filing under the Securities Act of 1933 or the Securities Exchange Act of 1934, and shall not otherwise be deemed filed under these acts.

10

Agreements Regarding Employment

We have entered into employment agreements with Mr. Kuhn and Mr. Benson.

Mr. Kuhn:

Compensation. The compensation of Mr. Kuhn is determined by the Board of Directors provided that, according to his employment agreement, Mr. Kuhn will receive a salary of not less than $232,500 per year. Effective January 2005 the Board of Directors determined that Mr. Kuhn would receive an annual salary of $232,500. In addition, Mr. Kuhn is eligible for cash performance bonuses.

Stock Option Grants. The board of directors may grant stock options to Mr. Kuhn.

Termination of Agreements. Mr. Kuhn’s agreement may be terminated with or without cause by either Mr. Kuhn or us. If we terminate the agreement of Mr. Kuhn with cause, or if he resigns without good reason, he is only entitled to his base salary through the date of termination. If we terminate the agreement of Mr. Kuhn without cause or if Mr. Kuhn resigns for good reason, he is entitled to his base salary through the date of termination, together with his pro-rata bonus. In lieu of any further salary or bonus payments to Mr. Kuhn, we will pay an amount equal to twelve months’ salary, payable in twelve equal installments after termination of his employment. If there is a change in control of the Company, and if at anytime thereafter the employment of Mr. Kuhn is terminated without cause, or if Mr. Kuhn terminates his employment with good reason, we will pay his base salary through the date of termination at the rate in effect at the time, together with a pro-rata bonus. In lieu of any further salary or bonus payments to Mr. Kuhn, we will pay a severance payment in an amount equal to 150% of his base salary as of termination.

Noncompetition and Confidentiality. Mr. Kuhn may not compete with us or solicit our employees for a period of twelve months immediately following the termination of his relationship with us for any reason, whether with or without cause.

Confidentiality and Assignment of Inventions. Mr. Kuhn is also bound by a confidential information and invention assignment agreement that prohibits him from, among other things, disseminating or using confidential information about our business or clients in any way that would be adverse to us. Mr. Kuhn agreed to assign the Company all inventions, which he may develop during his employment.

Mr. Benson:

Compensation. The compensation of Mr. Benson is determined by the Board of Directors provided that, according to his employment agreement, Mr. Benson will receive a salary of not less than $190,000 per year. Effective January 2005 the Board of Directors determined that Mr. Benson would receive an annual salary of $190,000. In addition, Mr. Benson is eligible for cash performance bonuses.

Stock Option Grants. The board of directors may grant stock options to Mr. Benson.

Termination of Agreements. Mr. Benson’s agreement may be terminated with or without cause by either Mr. Benson or us. If we terminate the agreement of Mr. Benson with cause, or if he resigns without good reason, he is only entitled to his base salary through the date of termination. If we terminate the agreement of Mr. Benson without cause or if Mr. Benson resigns for good reason, he is entitled to his base salary through the date of termination, together with his pro-rata bonus. In lieu of any further salary or bonus payments to Mr. Benson, we will pay an amount equal to six months salary, payable in six equal installments after termination of his employment. If there is a change in control of the Company, and if at anytime thereafter the employment of Mr. Benson is terminated without cause, or if Mr. Benson terminates his employment with good reason, we will pay his base salary through the date of termination at the rate in effect at the time, together with a pro-rata bonus. In lieu of any further salary or bonus payments to Mr. Benson, we will pay a severance payment in an amount equal to twelve months of his base salary as of termination.

11

Noncompetition and Confidentiality. Mr. Benson may not compete with us or solicit our employees for a period equal in length to any post-employment installment payment period.

Confidentiality and Assignment of Inventions. Mr. Benson is also bound by a confidential information and invention assignment agreement that prohibits him from, among other things, disseminating or using confidential information about our business or clients in any way that would be adverse to us. Mr. Benson agreed to assign the Company all inventions, which he may develop during his employment.

REPORT OF THE AUDIT COMMITTEE OF

THE BOARD OF DIRECTORS OF THE COMPANY

The Audit Committee reviews the Company’s financial reporting process on behalf of the Board. Management is responsible for the Company’s internal controls and the financial reporting process. The independent auditors are responsible for expressing an opinion on the conformity of the Company’s audited financial statements to generally accepted accounting principles.

In this context, the Audit Committee has reviewed the audited financial statements and held discussions with management and the independent accountants. Management represented to the Audit Committee that the Company’s consolidated financial statements were prepared in accordance with the generally accepted accounting principles. The Audit Committee has discussed with the independent auditors the matters required to be discussed by Statement on Auditing Standards No. 61 (Communication with Audit Committees).

The Audit Committee has received the written disclosures and letter from the independent accountants required by Independence Standards Board Standard No. 1 (Independence Standards Board Standard No. 1, Independence Discussions with Audit Committees) and has discussed and confirmed the independence of the independent accountant.

Following the review and discussions referred to above, the Audit Committee recommended to the Board that the Audited Financial Statements be included in the Company’s Annual Report on Form 10-K for the year ended December 31, 2004, for filing with the Securities and Exchange Commission.

The Audit Committee

John Kernan

William Pade

Robert Holster

The Audit Committee report shall not be deemed incorporated by reference by any general statement incorporating by reference this proxy statement into any filing under the Securities Act of 1933 or the Securities Exchange Act of 1934, and shall not otherwise be deemed filed under these acts.

REPORT OF THE COMPENSATION COMMITTEE OF

THE BOARD OF DIRECTORS OF THE COMPANY ON EXECUTIVE COMPENSATION

Compensation Philosophy

The Compensation Committee reviews the performance and compensation levels for executive officers and sets salary and bonus levels and option grants under the Company’s incentive plans. The objectives of the Compensation Committee are to establish, review and modify as appropriate the compensation plan of the Chief Executive Officer of the Corporation, to review the recommendations of the Chief Executive Officer of the Corporation with respect to the compensation plan of all other executive officers, to grant options and any other rights under the Company’s Second Amended and Restated 1998 Stock Option Plan, and to perform such other duties as may be delegated by the Board.

12

Base Salary

Base salaries of the executive officers are established by evaluating the requirements of the position and the contribution of the executive with respect to Company performance and the executive’s responsibilities. In determining executive officer salaries, the Compensation Committee generally sets base salaries at or below competitive levels, with total potential compensation (including bonuses and stock options) targeted at or above competitive levels. The Compensation Committee relies on, among other things, recommendations from the Chief Executive Officer in making such determinations.

The base salary received by Mr. Kuhn, our Chief Executive Officer, during the fiscal year ending December 31, 2004 was $210,000. The base salary received by Mr. Benson, our Chief Financial Officer, during the fiscal year ending December 31, 2004 was $180,000.

Bonus Compensation

The Company paid an annual cash bonus to one of its executive officers based on several factors that the Compensation Committee considered relevant including performance. During fiscal year 2004, the Company awarded Mr. Benson a cash bonus totaling $21,000 for his ongoing services and performance. The Company may make additional cash bonuses to executive officers from time-to-time based on performance and other factors it considers relevant.

Long-Term Incentives

The Compensation Committee believes that equity ownership provides significant motivation to executive officers to maximize value for the Company’s stockholders and, therefore, periodically grants stock options under the Company’s incentive plans. The Compensation Committee determines the size and frequency of option grants for executive officers after consideration of recommendations of the Chief Executive Officer. Such recommendations are based upon the relative position and responsibilities of each executive officer, previous and expected contributions of each executive officer to the Company and previous option grants to such executive officers. Stock options granted to executive officers are generally incentive stock options with exercise prices that equal the fair market value of the Company’s Common Stock on the date of grant and vest in increments over a four-year period.

Chief Executive Officer Compensation

In the first quarter of fiscal year 2005, the Compensation Committee increased Mr. Kuhn’s base salary by 10.7% to $232,500, based on the Company meeting certain operating and financial metrics in fiscal 2004 and the Company’s return to the NASDAQ National Market in September 2004.

In the first quarter of fiscal year 2004, the Compensation Committee increased Mr. Kuhn’s base salary by 7.7% to $210,000, based on the Company meeting certain operating and financial metrics in fiscal 2004.

Section 162(M)

Section 162(m) of the Internal Revenue Code of 1986, as amended, generally sets a limit of $1 million on the amount of compensation paid to executive employees (other than enumerated categories of compensation, including performance-based compensation) that may be deducted by a publicly-held company. The Committee’s policy is to seek to qualify executive compensation for deductibility to the extent that such policy is consistent with the Company’s overall objectives and executive compensation policy. Compensation attributable to stock options granted under the Company’s stock incentive plans currently is excluded from the $1 million limit as “qualified performance-based compensation” under the rules contained in applicable Treasury regulations. None of the Company’s executive officers received compensation in 2004 in excess of the limits imposed under

13

Section 162(m). The Compensation Committee intends to continue to qualify compensation attributable to stock options as “qualified performance-based compensation” within the meaning of Section 162(m).

COMPENSATION COMMITTEE

Allen Morgan

William Pade

John Kernan

The Compensation Committee report shall not be deemed incorporated by reference by any general statement incorporating by reference this proxy statement into any filing under the Securities Act of 1933 or the Securities Exchange Act of 1934, and shall not otherwise be deemed filed under these acts.

COMPENSATION COMMITTEE INTERLOCKS AND INSIDER

PARTICIPATION AND CERTAIN TRANSACTIONS

No interlocking relationship exists between our board of directors and the board of directors and compensation committee of any other company, nor have such interlocking relationships existed in the past.

Share Repurchase

On November 12, 2004, the Board of Directors of Varsity Group, with the Company’s CEO Eric Kuhn abstaining, approved the repurchase of 83,334 shares of our common stock at an aggregate cost of $0.5 million, from Mr. Kuhn. The purchase price for the shares was $6.00 per share in cash, representing approximately a five percent discount from the 30-day trailing average ending on November 12, 2004. The shares repurchased represented approximately five percent of the beneficial ownership of Mr. Kuhn. This transaction had no effect on our results of operations.

INDEPENDENT ACCOUNTANTS

Our Audit Committee has selected PricewaterhouseCoopers LLP to continue as its independent accountants for the fiscal year ending December 31, 2005. PricewaterhouseCoopers LLP has informed the Company that it has no material direct or indirect interest in the Company. Our board of directors initially appointed PricewaterhouseCoopers LLP as our independent accountants on October 8, 1999.

A representative of PricewaterhouseCoopers LLP is expected to be present at the Annual Meeting. This representative will have an opportunity to make a statement and will be available to respond to appropriate questions.

Audit Fees

PricewaterhouseCoopers LLP billed the Company an aggregate of $68,200 and $59,400 in fees for professional services rendered in connection with the audit of the Company’s financial statements for the most recent fiscal year and the reviews of the financial statements included in each of the Company’s Quarterly Reports on Form 10-Q during fiscal 2004 and fiscal 2003, respectively. There were no Audit-Related Fees, Tax Fees or Other Fees billed in fiscal 2004 or fiscal 2003. All such fees relate to services, which were pre-approved by our Audit Committee.

14

STOCKHOLDER PROPOSALS FOR 2006 ANNUAL MEETING

Pursuant to rules of the Securities and Exchange Commission, in order for stockholder proposals to be included in the Company’s proxy statement and proxy for the 2006 annual meeting of stockholders, such proposals must be received by the Secretary of the Company at the Company’s principal office in Washington, D.C. no later than January 5, 2006.

Any stockholder proposal not included in the proxy materials disseminated by the management of the Company for the Company’s 2005 annual meeting in accordance with Rule 14a-8 under the Exchange Act will be considered untimely for the purposes of Rules 14a-4 and 14a-5 under the Exchange Act if notice of the proposal is received after March 31, 2005. Management proxies will be authorized to exercise discretionary voting authority with respect to any stockholder proposal not included in such proxy materials for the Company’s annual meeting unless (a) the Company receives notice of such proposal by the date set forth above and (b) the conditions set forth in Rule 14a-4(c)(2)(i)-(iii) under the Exchange Act are met.

By Order of the Board of Directors,

/s/ Jack Benson

Jack Benson

Secretary

Dated: April 29, 2005

STOCKHOLDERS ARE REMINDED TO SIGN AND DATE THE ENCLOSED PROXY AND MAIL IT PROMPTLY IN THE POSTAGE-PAID ENVELOPE PROVIDED.

15

VARSITY GROUP INC.

THIS PROXY IS SOLICITED ON BEHALF OF THE BOARD OF DIRECTORS FOR

THE ANNUAL MEETING OF STOCKHOLDERS TO BE HELD JUNE 24, 2005.

The undersigned hereby appoints Eric Kuhn, attorney and proxy, with power of substitution and revocation, to vote, as designated below, all shares of Common Stock that the undersigned is entitled to vote, with all powers that the undersigned would possess if personally present at the Annual Meeting (including all adjournments thereof) of Stockholders of Varsity Group Inc. to be held at the Mayflower Hotel, 1127 Connecticut Ave., N.W. Washington, D.C. 20036, on June 24, 2005, at 10:00 a.m. EDT time.

Every properly signed proxy will be voted in the manner specified hereon. If no direction is made, this proxy will be voted FOR each nominee for director named on the reverse side and for the other matters described on the reverse side.

PLEASE VOTE, DATE, AND SIGN ON THE OTHER SIDE AND

RETURN PROMPTLY IN THE ENCLOSED ENVELOPE.

(Continued and to be dated and signed on the reverse side.)

The board of directors recommends that you vote FOR the proposals.

x Please mark your votes as in this example

PROPOSAL 1:

To elect one director of the Company for a term expiring at the 2008 annual meeting of stockholders

` FOR

` AGAINST

` ABSTAIN

PROPOSAL 2:

Ratification of the selection of PricewaterhouseCoopers LLP as Independent Auditor

` FOR

` AGAINST

` ABSTAIN

In their discretion, the proxies are authorized to vote upon such other business as may properly come before the meeting.

Change of address and/or comments mark here `

PLEASE MARK, SIGN, DATE AND RETURN THE PROXY CARD PROMPTLY USING THE ENCLOSED ENVELOPE.

VOTES MUST BE INDICATED (X) IN BLACK OR BLUE INK.

SIGNATURE:

SIGNATURE:

DATE:

NOTED: Please sign as name appears hereon. Joint owners EACH must sign. When signing as attorney, trustee, executor, administrator or guardian, please give your FULL title. If a corporation, please provide the full name of the corporation and the signature of the authorized officer signing on its behalf. If a partnership, please sign in partnership name by an authorized person.