SCHEDULE 14A

(RULE 14A-101)

INFORMATION REQUIRED IN PROXY STATEMENT

SCHEDULE 14A INFORMATION

PROXY STATEMENT PURSUANT TO SECTION 14(A) OF THE

SECURITIES EXCHANGE ACT OF 1934

(AMENDMENT NO. )

Filed by the Registrantx

Filed by a Party other than the Registrant¨

Check the appropriate box:

¨ | Preliminary Proxy Statement | ¨ | Confidential, for Use of the Commission Only (as permitted by Rule 14a-6(e)(2)) | |||

x | Definitive Proxy Statement | |||||

¨ | Definitive Additional Materials | |||||

¨ | Soliciting Material Pursuant to §240.14a-12 |

Pain Therapeutics, Inc.

(Name of Registrant as Specified in its Charter)

(Name of Person(s) Filing Proxy Statement, if other than the Registrant)

Payment of Filing Fee (Check the appropriate box):

| x | No fee required. |

| ¨ | Fee computed on table below per Exchange Act Rules 14a-6(i)(1) and 0-11. |

| (1) | Title of each class of securities to which transaction applies: |

| (2) | Aggregate number of securities to which transaction applies: |

| (3) | Per unit price or other underlying value of transaction computed pursuant to Exchange Act Rule 0-11 (set forth the amount on which the filing fee is calculated and state how it was determined): |

| (4) | Proposed maximum aggregate value of transaction: |

| (5) | Total fee paid: |

| ¨ | Fee paid previously with preliminary materials. |

| ¨ | Check box if any part of the fee is offset as provided by Exchange Act Rule 0-11(a)(2) and identify the filing for which the offsetting fee was paid previously. Identify the previous filing by registration statement number, or the Form or Schedule and the date of its filing. |

| (1) | Amount Previously Paid: |

| (2) | Form, Schedule or Registration Statement No.: |

| (3) | Filing Party: |

| (4) | Date Filed: |

Pain Therapeutics, Inc.

NOTICE OF ANNUAL MEETING OF STOCKHOLDERS

May 20, 2010

To the Stockholders:

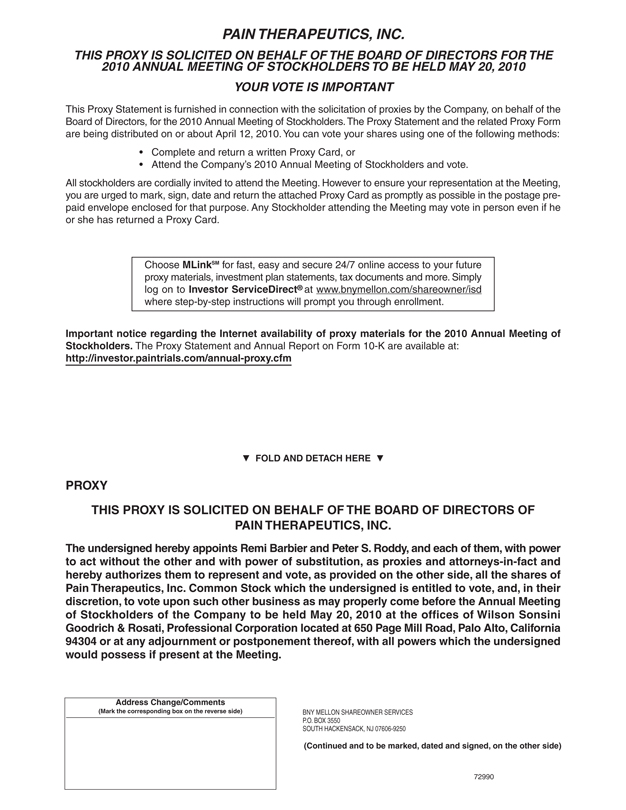

NOTICE IS HEREBY GIVEN that the Annual Meeting of Stockholders of Pain Therapeutics, Inc. (the “Company”), a Delaware corporation, will be held on Thursday, May 20, 2010 at 10:00 a.m., local time, at the offices of Wilson Sonsini Goodrich & Rosati, Professional Corporation, located at 650 Page Mill Road, Palo Alto, California, 94304, for the following purposes:

| 1. | To elect Nadav Friedmann, Ph.D., M.D. and Michael J. O’Donnell as Class I Directors to serve for three-year terms and until their successors are duly elected and qualified (Proposal One); |

| 2. | To approve the amended and restated 2000 Employee Stock Purchase Plan, as amended and restated December 11, 2009 (Proposal Two); |

| 3. | To ratify the selection of Ernst & Young LLP as the independent registered public accounting firm for the Company for the fiscal year ending December 31, 2010 (Proposal Three); and |

| 4. | To transact such other business as may properly be brought before the meeting and any adjournment(s) thereof. |

The foregoing items of business are more fully described in the Proxy Statement accompanying this Notice.

Only stockholders of record at the close of business on April 1, 2010 are entitled to notice of and to vote at the meeting.

| Sincerely, |

/s/ Michael J. O'Donnell |

| Michael J. O’Donnell |

| Secretary |

San Mateo, California

April 1, 2010

YOUR VOTE IS IMPORTANT

THIS PROXY STATEMENT IS FURNISHED IN CONNECTION WITH THE SOLICITATION OF PROXIES BY THE COMPANY, ON BEHALF OF THE BOARD OF DIRECTORS, FOR THE 2010 ANNUAL MEETING OF STOCKHOLDERS. THE PROXY STATEMENT AND THE RELATED PROXY FORM ARE BEING DISTRIBUTED ON OR ABOUT APRIL 12, 2010. YOU CAN VOTE YOUR SHARES USING ONE OF THE FOLLOWING METHODS:

| • | COMPLETE AND RETURN A WRITTEN PROXY CARD |

| • | ATTEND THE COMPANY’S 2010 ANNUAL MEETING OF STOCKHOLDERS AND VOTE |

ALL STOCKHOLDERS ARE CORDIALLY INVITED TO ATTEND THE MEETING. HOWEVER, TO ENSURE YOUR REPRESENTATION AT THE MEETING, YOU ARE URGED TO MARK, SIGN, DATE AND RETURN THE ENCLOSED PROXY CARD AS PROMPTLY AS POSSIBLE IN THE POSTAGE-PREPAID ENVELOPE ENCLOSED FOR THAT PURPOSE. ANY STOCKHOLDER ATTENDING THE MEETING MAY VOTE IN PERSON EVEN IF HE OR SHE HAS RETURNED A PROXY CARD.

IMPORTANT NOTICE REGARDING THE AVAILABILITY OF PROXY

MATERIALS FOR THE STOCKHOLDER MEETING TO BE HELD MAY 20, 2010:

The Company’s Proxy Statement, form of proxy card and Annual Report on Form 10-K are available at: http://investor.paintrials.com/annual-proxy.cfm.

PAIN THERAPEUTICS, INC.

2211 Bridgepointe Parkway, Suite 500

San Mateo, California 94404

PROXY STATEMENT

INFORMATION CONCERNING SOLICITATION AND VOTING

General

The enclosed Proxy is solicited on behalf of the Board of Directors of Pain Therapeutics, Inc. (which we may refer to as the “Company” in this Proxy Statement) for use at the Annual Meeting of Stockholders to be held at the offices of Wilson Sonsini Goodrich & Rosati, Professional Corporation located at 650 Page Mill Road, Palo Alto, California, 94304, on Thursday, May 20, 2010, at 10:00 a.m., local time, and at any adjournment(s) thereof, for the purposes set forth herein and in the accompanying Notice of Annual Meeting of Stockholders. The Company’s principal executive offices are located at the address listed at the top of the page and the telephone number is (650) 624-8200.

The Company’s Annual Report on Form 10-K, containing financial statements for the fiscal year ended December 31, 2009, are being mailed together with these proxy solicitation materials to all stockholders entitled to vote. This Proxy Statement, the accompanying Proxy, the Company’s Annual Report on Form 10-K will first be mailed on or about April 12, 2010 to all stockholders entitled to vote at the meeting.

THE COMPANY SHALL PROVIDE WITHOUT CHARGE TO ANY STOCKHOLDER SOLICITED BY THESE PROXY SOLICITATION MATERIALS A COPY OF THE COMPANY’S ANNUAL REPORT ON FORM 10-K, TOGETHER WITH THE FINANCIAL STATEMENTS REQUIRED TO BE FILED WITH THE ANNUAL REPORT ON FORM 10-K, UPON REQUEST OF A STOCKHOLDER MADE IN WRITING TO PAIN THERAPEUTICS, INC., 2211 BRIDGEPOINTE PARKWAY, SUITE 500, SAN MATEO, CALIFORNIA, 94404, ATTENTION: INVESTOR RELATIONS.

Record Date and Share Ownership

Stockholders of record at the close of business on April 1, 2010 (which we will refer to as the “Record Date” throughout this Proxy Statement) are entitled to notice of and to vote at the meeting and at any adjournment(s) thereof. The Company has one series of common shares issued and outstanding, designated as Common Stock, $0.001 par value per share (the “Common Stock”) and one series of undesignated Preferred Stock, $0.001 par value per share (the “Preferred Stock”). As of the Record Date, 120,000,000 shares of Common Stock were authorized and 42,615,576 shares were issued and outstanding and 10,000,000 shares of Preferred Stock were authorized and none were issued or outstanding.

Revocability of Proxies

Any proxy given pursuant to this solicitation may be revoked by the person giving it at any time before its use by

| • | delivering to the Company at its principal offices (Attention: Investor Relations) a written notice of revocation or a duly executed proxy bearing a later date; or |

| • | attending the meeting and voting in person. |

Voting

On all matters, each share has one vote. See Proposal One — Election of Class I Directors — Vote Required and Proposal Two — Approval of the Amended and Restated 2000 Employee Stock Purchase Plan — Vote Required.

Solicitation of Proxies

The Company will bear the entire cost of solicitation of proxies, including preparation, assembly, printing and mailing of this proxy statement, the proxy and any additional information furnished to stockholders. Copies of solicitation materials will be furnished to banks, brokerage houses, fiduciaries and custodians holding in their names shares of the Company’s Common Stock beneficially owned by others to forward to such beneficial owners. The Company may reimburse persons representing beneficial owners of Common Stock for their costs of forwarding solicitation materials to such beneficial owners. Proxies may also be solicited by certain of the Company’s directors, officers and regular employees, without additional compensation, personally or by telephone or facsimile.

Quorum; Abstentions; Broker Non-Votes

Votes cast by proxy or in person at the Annual Meeting (“Votes Cast”) will be tabulated by the Inspector of Elections (the “Inspector”) who will be a representative from BNY Mellon Shareowner Services, the Company’s Transfer Agent and Registrar. The Inspector will also determine whether or not a quorum is present. Except in certain specific circumstances, the affirmative vote of a majority of shares present in person or represented by proxy at a duly held meeting at which a quorum is present is required under Delaware law for approval of proposals presented to stockholders. In general, Delaware law provides that a quorum consists of a majority of shares entitled to vote and present or represented by proxy at the meeting.

The Inspector will treat shares that are voted WITHHELD or ABSTAIN as being present and entitled to vote for purposes of determining the presence of a quorum but will not be treated as votes in favor of approving any matter submitted to the stockholders for a vote. When proxies are properly dated, executed and returned, the shares represented by such proxies will be voted at the Annual Meeting in accordance with the instructions of the stockholder. If no specific instructions are given, the shares will be voted:

| • | for the election of the nominees for director set forth herein; |

| • | for the amended and restated 2000 Employee Stock Purchase Plan, as amended and restated December 11, 2009; |

| • | for the ratification of the selection of Ernst & Young LLP as the independent registered public accounting firm to the Company; and |

| • | upon such other business as may properly come before the Annual Meeting or any adjournment thereof, but will not be voted in the election of directors other than as provided above. |

If a broker indicates on the enclosed proxy or its substitute that such broker does not have discretionary authority as to certain shares to vote on a particular matter (“broker non-votes”), those shares will be considered as present with respect to establishing a quorum for the transaction of business. The Company believes that the tabulation procedures to be followed by the Inspector are consistent with the general statutory requirements in Delaware concerning voting of shares and determination of a quorum.

Broker non-votes with respect to proposals set forth in this Proxy Statement will not be considered “Votes Cast” and, accordingly, will not affect the determination as to whether the requisite majority of Votes Cast has been obtained with respect to a particular matter.

2

Deadline for Receipt of Stockholder Proposals

Stockholders are entitled to present proposals for action at a forthcoming meeting if they comply with the requirements of the Company’s bylaws and the rules established by the Securities and Exchange Commission (the “SEC”), under the Securities Exchange Act of 1934, as amended (the “Exchange Act”). Under these requirements, proposals of stockholders of the Company that are intended to be presented by such stockholders at the Company’s 2011 Annual Meeting of Stockholders must be received by the Company no later than December 11, 2010. A copy of the relevant bylaw provisions related to stockholder proposals is available upon written request to: Pain Therapeutics, Inc., 2211 Bridgepointe Parkway, Suite 500, San Mateo, California, 94404, Attention: Investor Relations.

How to Obtain Directions to Location of Annual Meeting of Stockholders

Our Annual Meeting of Stockholders is being held at the time and place set forth above under the heading “General”. You can obtain directions to attend the Annual Meeting and vote your shares in person by contacting the Company at 650-624-8200.

Internet Availability of Proxy Materials

This Proxy Statement, the form of proxy card and the Annual Report on Form 10-K are available at:http://investor.paintrials.com/annual-proxy.cfm.

3

PROPOSAL ONE

ELECTION OF TWO CLASS I DIRECTORS

Nominees

The Company’s Board of Directors has six authorized directors and currently consists of six members. The Company has a classified Board of Directors, which is divided into three classes of directors whose terms expire at different times. The three classes are currently comprised of the following directors:

| • | Class I consists of Nadav Friedmann, Ph.D., M.D. and Michael J. O’Donnell who will serve until the 2010 Annual Meeting of Stockholders and who stand for re-election as Class I directors at such meeting; |

| • | Class II consists of Robert Z. Gussin, Ph.D., who will serve until the 2011 Annual Meeting of Stockholders; and |

| • | Class III consists of Remi Barbier, Sanford R. Robertson and Patrick J. Scannon, M.D., Ph.D., who will serve until the 2012 Annual Meeting of Stockholders. |

At each annual meeting of stockholders, the successors to directors whose terms will then expire will be elected to serve from the time of election and qualification until the third annual meeting following election and until their successors have been duly elected and qualified.

Unless otherwise instructed, the proxy holders will vote the proxies received by them for the Company’s nominees named below, who are currently directors of the Company. The nominees have consented to be named as such in the proxy statement and to continue to serve as directors if elected. If any nominee becomes unable or declines to serve as a director or if additional persons are nominated at the meeting, the proxy holders intend to vote all proxies received by them in such a manner as will assure the election of the nominees listed below if possible (or, if new nominees have been designated by the Board of Directors, in such a manner as to elect such nominees), and the specific nominees to be voted for will be determined by the proxy holders.

The nominees for the Class I Directors are as follows:

| • | Nadav Friedmann, Ph.D., M.D. and |

| • | Michael J. O’Donnell |

Biographical information for these nominees can be found below in the section entitled “Directors and Executive Officers.”

The Company is not aware of any reason that the nominees will be unable or will decline to serve as directors. The term of office of the individuals elected as directors will continue until the Company’s Annual Meeting of Stockholders held in 2013 or until successors have been elected and qualified. Other than the relationships noted in the section “Employment and Severance Arrangements,” there are no arrangements or understandings between any director or executive officer and any other person pursuant to which he is or was to be selected as a director or officer of the Company.

Vote Required

The directors will be elected by a plurality vote of the shares of the Company’s Common Stock present or represented and entitled to vote on this matter at the meeting. Accordingly, the candidates receiving the highest number of affirmative votes of shares represented and voting on this proposal at the meeting will be elected as directors of the Company. Votes withheld from a nominee and broker non-votes will be counted for purposes of determining the presence or absence of a quorum but, because directors are elected by a plurality vote, will have no impact once a quorum is present. See “Quorum; Abstentions; Broker Non-Votes.”

THE CLASS II AND III DIRECTORS RECOMMEND THAT

STOCKHOLDERS VOTEFOR THE CLASS I NOMINEES LISTED ABOVE.

4

PROPOSAL TWO

APPROVAL OF THE 2000 EMPLOYEE STOCK PURCHASE PLAN,

AS AMENDED AND RESTATED

The stockholders are being asked to approve an amended and restated 2000 Employee Stock Purchase Plan (the “ESPP”). The Board of Directors has adopted the ESPP, subject to approval from the stockholders at the 2010 Annual Meeting. Our current 2000 Employee Stock Purchase Plan (the “Existing ESPP”) will expire in June 2010. If the stockholders approve the ESPP, it would replace the Existing ESPP as of the date determined by the Board of Directors and no further offerings would be granted under the Existing ESPP. The proposed ESPP will be a significant part of our overall equity compensation strategy, especially with respect to our non-executive employees, including employees world wide. The proposed ESPP will be one of the primary programs through which our employees may achieve ownership in the Company and thereby share in its success. Therefore, the Board of Directors has determined that it is still in the best interests of the Company and its stockholders to have an employee stock purchase plan and is asking the Company’s stockholders to approve the ESPP. Approval of the ESPP requires the affirmative vote of the holders of a majority of the shares of our common stock that are present in person or by proxy and entitled to vote at the 2010 Annual Meeting.

The following is a summary of some of the material differences between the ESPP and the Existing ESPP:

| • | A total of 500,000 shares of the Company’s common stock are reserved for issuance under the ESPP and the ESPP does not have a provision (which the Existing ESPP had) allowing for an annual automatic increase in the number of shares reserved for issuance; and |

| • | The ESPP will remain in effect until terminated by the ESPP Administrator in accordance with the terms of the ESPP. |

The comparative summary is qualified in its entirety by reference to the ESPP itself set forth in Appendix A.

The following is a summary of the principal features of the ESPP and its operation. The summary is qualified in its entirety by reference to the ESPP as set forth in Appendix A.

General.

The ESPP was adopted by the Board of Directors in December 2009, subject to approval by our stockholders at the 2010 Annual Meeting. The purpose of the ESPP is to provide a means by which eligible employees of the Company and its designated subsidiaries may be given an opportunity to purchase common stock of the Company through payroll deductions.

The ESPP includes a Code Section 423 Plan Component. The Company’s intention is to have the Code Section 423 Plan Component qualify as an “employee stock purchase plan” under Section 423 of the Internal Revenue Code of 1986, as amended (the “Code”). For purposes of this proposal, a reference to the “ESPP” will mean the Code Section 423 Plan Component.

Shares Available for Issuance.

If our stockholders approve this proposal, a total of 500,000 shares of the Company’s common stock will be reserved for issuance under the ESPP. We expect that the number of shares reserved for issuance under the ESPP will last for approximately eight years.

Administration.

The Board of Directors or a committee appointed by the Board of Directors (referred to herein as the “Administrator”) administers the ESPP. All questions of interpretation or application of the ESPP are determined by the Administrator and its decisions are final and binding upon all participants.

5

Eligibility.

Each of the Company’s, or the Company’s designated subsidiaries, common law employees whose customary employment with the Company or one of such subsidiaries is at least twenty hours per week and more than five months in a calendar year is eligible to participate in the ESPP; except that no employee will be granted an option under the ESPP (i) to the extent that, immediately after the grant, such employee would own 5% or more of the total combined voting power of all classes of the Company’s capital stock or the capital stock of one of the Company’s designated subsidiaries, or (ii) to the extent that his or her rights to purchase stock under all of the Company’s employee stock purchase plans accrues at a rate which exceeds $25,000 worth of stock (determined at the fair market value of the shares at the time such option is granted) for each calendar year. As of April 1, 2010, approximately 16 employees, including all of our executive officers who qualify for participation, would be eligible to participate in the ESPP.

The Administrator, in its sole discretion and prior to an offering date, may determine that an individual will not be eligible to participate if he or she: (i) has not completed at least two years of service since his or her last hire date, (ii) customarily works not more than twenty hours per week (or such lesser period of time as determined by the Administrator in its discretion), (iii) customarily works not more than five months per calendar year (or such lesser period of time as may be determined by the Administrator in its sole discretion), (iv) is an executive, officer or other manager, or (v) is a highly compensated employee, as determined under Section 414(q) of the Code.

Offering Period.

Unless otherwise determined by the Administrator, each offering period under the ESPP will have a duration of approximately twenty-four months, commencing on the first trading day on or after May 1 and November 1 of each year and terminating on the first trading day on or after the May 1 and November 1 offering period commencement date approximately twenty-four months later. Each offering period will generally consist of four purchase periods in which shares may be purchased on a participant’s behalf. Unless the Administrator determines otherwise, a purchase period will be approximately six months and will begin after one exercise date and will end with the next exercise date approximately six months later, except that the first purchase period of an offering period will begin on the first trading day of each offering period and end on the last trading day of the purchase period.

To participate in the ESPP, an eligible employee must authorize payroll deductions pursuant to the ESPP. Such payroll deductions may not exceed 15% of a participant’s compensation during the offering period. For purposes of the ESPP, “compensation” shall mean all base straight time gross earnings but exclusive of payments for commissions, overtime, shift premium, incentive compensation, incentive payments, bonuses and other compensation. Once an employee becomes a participant in the ESPP, the employee automatically will participate in each successive offering period until the employee withdraws from the ESPP or the employee’s employment with the Company or one of the Company’s designated subsidiaries terminates. On the first trading day of each offering period, each participant automatically is granted an option to purchase shares of the Company’s common stock. The option expires at the end of the offering period or upon termination of employment, whichever is earlier, but is exercised at the end of each purchase period to the extent of the payroll deductions accumulated during such purchase period.

Purchase Price.

Unless and until the Administrator determines otherwise, the purchase price will be 85% of the lesser of the fair market value of the common stock on (i) the first trading day of the offering period, or (ii) the last day of the purchase period, subject to compliance with the Code and the terms of the ESPP. To the extent permitted by applicable laws or regulations, if the fair market value of the common stock on any exercise date in an offering period is lower than the fair market value of the common stock on the enrollment date of such offering period,

6

then all participants in the offering period will be automatically withdrawn from the offering period immediately after the exercise of their option and automatically re-enrolled in the immediately following offering period. The fair market value of the Company’s common stock on any relevant date will be the closing price per share as reported on any established stock exchange or a national market system, or the mean between the high bid and low asked prices, if no sales were reported, as quoted on such exchange or reported in The Wall Street Journal. In the absence of an established market for the Company’s common stock, the fair market value will be determined by the Administrator.

Payment of Purchase Price; Payroll Deductions.

The purchase price of the shares is accumulated by payroll deductions throughout each purchase period. The number of whole shares of the Company’s common stock that a participant may purchase in each purchase period will be determined by dividing the total amount of payroll deductions withheld from the participant’s compensation during that purchase period by the purchase price; provided, however, that a participant may not purchase more than 7,500 shares during each purchase period. During an offering period, a participant may discontinue his or her participation in the ESPP, and may increase or decrease the rate of payroll deductions in an offering period within limits set by the Administrator; provided, however, that a participant may only make one payroll deduction change during each month of the offering period. No fractional shares will be purchased under the ESPP and any payroll deductions accumulated in a participant’s account which are not sufficient to purchase a full share will be retained in a participant’s account for the subsequent purchase period or offering period.

All payroll deductions made for a participant are credited to the participant’s account under the ESPP, are withheld in whole percentages only and are included with the Company’s general funds. Funds received by the Company pursuant to exercises under the ESPP are used for general corporate purposes. A participant may not make any additional payments into his or her account.

Withdrawal.

Generally, a participant may withdraw all, but not less than all, of his or her payroll deductions from an offering period at any time by written or electronic notice without affecting his or her eligibility to participate in future offering periods. Once a participant withdraws from a particular offering period, however, that participant may not participate again in the same offering period. To participate in a subsequent offering period, the participant must deliver a new subscription agreement to the Company.

Termination of Employment.

Upon termination of a participant’s employment for any reason, including disability or death, he or she will be deemed to have elected to withdraw from the plan and the payroll deductions credited to the participant’s account (to the extent not used to make a purchase of the Company’s common stock) will be returned to him or her or, in the case of death, to the person or persons entitled thereto as provided in the ESPP, and such participant’s option will automatically be terminated.

Adjustments upon Changes in Capitalization, Dissolution, Liquidation, Merger or Change of Control.

Changes in Capitalization. In the event that any dividend or other distribution (whether in the form of cash, common stock, other securities, or other property), recapitalization, stock split, reverse stock split, reorganization, merger, consolidation, split-up, spin-off, combination, repurchase, or exchange of common stock or other securities of the Company, or other change in the corporate structure of the Company affecting the common stock such that an adjustment is appropriate in order to prevent dilution or enlargement of the benefits or potential benefits intended to be made available under the ESPP, then the Administrator will adjust the number and class of common stock which may be delivered under the ESPP, the purchase price per share and the number of shares of common stock covered by each option under the ESPP which has not yet been exercised, and the maximum number of shares a participant can purchase during a purchase period.

7

Dissolution or Liquidation.In the event of the Company’s proposed dissolution or liquidation, the Administrator will shorten any offering period then in progress by setting a new exercise date and any offering periods will end on the new exercise date. The new exercise date will be prior to the dissolution or liquidation. If the Administrator shortens any offering periods then in progress, the Administrator will notify each participant in writing, at least ten business days prior to the new exercise date, that the exercise date has been changed to the new exercise date and that the option will be exercised automatically on the new exercise date, unless the participant has already withdrawn from the offering period.

Merger or Change in Control. In the event of a merger or “change in control,” as defined in the ESPP, each option under the ESPP will be assumed or an equivalent option will be substituted by the successor corporation or a parent or subsidiary of such successor corporation. In the event the successor corporation refuses to assume or substitute for the options, the Administrator will shorten the offering period with respect to which such option relates by setting a new exercise date on which such offering period will end. The new exercise date will be prior to the merger or change in control. If the Administrator shortens any offering periods then in progress, the Administrator will notify each participant in writing, prior to the new exercise date, that the exercise date has been changed to the new exercise date and that the option will be exercised automatically on the new exercise date, unless the participant has already withdrawn from the offering period.

Amendment and Termination of the ESPP.

The Administrator may, at any time and for any reason, amend, suspend or terminate the ESPP or any part of the ESPP. If the ESPP is terminated, the Administrator may elect to terminate all outstanding offering periods either immediately or upon completion of the purchase of shares on the next purchase date (which may be sooner than originally scheduled, if determined by the Administrator), or may elect to permit offering periods to expire in accordance with their terms (and subject to any adjustments described above). If an offering period is terminated prior to expiration, all amounts credited to a participant’s account that were not used to purchase shares will be returned to the participant (without interest) as soon as administratively practicable. Without stockholder consent and without limiting the foregoing, the Administrator is entitled to change the offering periods, limit the frequency and/or number of changes in the amount withheld during an offering period, establish the exchange ratio applicable to amounts withheld in a currency other than U.S. dollars, permit payroll withholding in excess of the amount designated by a participant in order to adjust for delays or mistakes in the Company’s processing of properly completed withholding elections, establish reasonable waiting and adjustment periods and/or accounting and crediting procedures to ensure that amounts applied toward the purchase of shares for each participant correspond with amounts withheld from the participant’s compensation, and establish such other limitations or procedures as the Administrator determines in its sole discretion advisable which are consistent with the ESPP. If the Administrator determines that the ongoing operation of the ESPP may result in unfavorable financial accounting consequences, the Administrator may modify, amend or terminate the ESPP to reduce or eliminate such accounting consequence.

Participation in Plan Benefits

Participation in the ESPP is voluntary and is dependent on each eligible employee’s election to participate and his or her determination as to the level of payroll deductions. Accordingly, future purchases under the ESPP are not determinable. Non-employee directors are not eligible to participate in the ESPP. As of April 1, 2010, no purchases have been made under the ESPP since its adoption by the Board of Directors. For illustrative purposes, the following table sets forth (i) the number of shares that were purchased during the last fiscal year under the Existing ESPP, and (ii) the weighted average price per share paid for such shares.

Name of Individual or Group | Number of Shares Purchased | Weighted Average Per Share Purchase Price ($) | |||

All executive officers, as a group | 6,748 | $ | 3.77 | ||

All directors who are not executive officers, as a group | — | — | |||

All employees who are not executive officers, as a group | 46,544 | $ | 3.77 | ||

8

Certain U.S. Federal Income Tax Information

The following brief summary of the effect of U.S. federal income taxation upon the participant and the Company with respect to the shares purchased under the ESPP does not purport to be complete, and does not discuss the tax consequences of a participant’s death or the income tax laws of any state or non-U.S. jurisdiction in which the participant may reside.

The ESPP, and the right of participants to make purchases thereunder, is intended to qualify under the provisions of Sections 421 and 423 of the Code. Under these provisions, no income will be taxable to a participant until the shares purchased under the ESPP are sold or otherwise disposed of. Upon sale or other disposition of the shares, the participant generally will be subject to tax in an amount that depends upon the holding period. If the shares are sold or otherwise disposed of more than two years from the first day of the applicable offering period and one year from the applicable date of purchase, the participant will recognize ordinary income measured as the lesser of (a) the excess of the fair market value of the shares at the time of such sale or disposition over the purchase price, or (b) the excess of the fair market value of a share on the offering date that the right was granted over the purchase price for the right. Any additional gain will be treated as long-term capital gain. If the shares are sold or otherwise disposed of before the expiration of these holding periods, the participant will recognize ordinary income generally measured as the excess of the fair market value of the shares on the date the shares are purchased over the purchase price. Any additional gain or loss on such sale or disposition will be long-term or short-term capital gain or loss, depending on how long the shares have been held from the date of purchase. The Company generally is not entitled to a deduction for amounts taxed as ordinary income or capital gain to a participant except to the extent of ordinary income recognized by participants upon a sale or disposition of shares prior to the expiration of the holding periods described above.

THE FOREGOING IS ONLY A SUMMARY OF THE EFFECT OF U.S. FEDERAL INCOME TAXATION UPON PARTICIPANTS AND THE COMPANY UNDER THE ESPP. IT DOES NOT PURPORT TO BE COMPLETE, AND DOES NOT DISCUSS THE TAX CONSEQUENCES OF A PARTICIPANT’S DEATH OR THE PROVISIONS OF THE INCOME TAX LAWS OF ANY MUNICIPALITY, STATE OR NON-U.S. JURISDICTION IN WHICH THE PARTICIPANT MAY RESIDE.

Vote Required

The approval of the ESPP requires the affirmative vote of a majority of the votes cast on the proposal at the 2010 Annual Meeting.

THE BOARD OF DIRECTORS UNANIMOUSLY RECOMMENDS THAT STOCKHOLDERS VOTEFOR THE APPROVAL OF THE AMENDED AND RESTATED 2000 EMPLOYEE STOCK PURCHASE PLAN AND THE NUMBER OF SHARES RESERVED FOR ISSUANCE THEREUNDER.

9

PROPOSAL THREE

RATIFICATION OF SELECTION OF ERNST & YOUNG LLP AS INDEPENDENT REGISTERED PUBLIC ACCOUNTING FIRM TO THE COMPANY FOR THE FISCAL YEAR ENDING DECEMBER 31, 2010

The Board of Directors and the Audit Committee have selected Ernst & Young LLP, independent registered public accounting firm, to audit the financial statements of the Company for the fiscal year ending December 31, 2010, and recommend that the stockholders vote for ratification of such selection. Although action by stockholders is not required by law, the Board of Directors has determined that it is desirable to request approval of this selection by the stockholders. Notwithstanding the selection or ratification, the Board of Directors and the Audit Committee, in their discretion, may direct the selection of a new independent registered public accounting firm at any time during the year, if the Board of Directors and the Audit Committee determine that such a change would be in the best interest of the Company.

A representative of Ernst & Young LLP is expected to be present at the meeting and will be afforded the opportunity to make a statement if he or she desires to do so, and is also expected to be available to respond to appropriate questions.

THE BOARD OF DIRECTORS UNANIMOUSLY RECOMMENDS THAT STOCKHOLDERS VOTEFOR RATIFICATION OF THE SELECTION OF ERNST & YOUNG LLP AS THE INDEPENDENT REGISTERED PUBLIC ACCOUNTING FIRM TO THE COMPANY FOR THE FISCAL YEAR ENDING DECEMBER 31, 2010.

Principal Accountant Fees and Services

Fees for professional services provided by our independent registered public accounting firm in each of the last two fiscal years, in each of the following categories are:

| Years Ended December 31, | ||||||

| 2009 | 2008 | |||||

Audit Fees | $ | 543,400 | $ | 620,784 | ||

Audit Related Fees | — | — | ||||

Tax Fees | 39,000 | 43,250 | ||||

Other Fees | — | — | ||||

| $ | 582,400 | $ | 664,034 | |||

Ernst & Young LLP served as the Company’s independent registered public accounting firm for the years ended December 31, 2009 and 2008.

Audit fees include fees associated with the Annual Reports on Form 10-K (including fees associated with attestation pursuant to the Sarbanes-Oxley Act of 2002); the Quarterly Reports on Form 10-Q and all services that are normally provided by the independent registered public accounting firm in connection with statutory and regulatory filings. Tax fees in 2009 include tax compliance services. The Company did not incur audit-related or other fees in the year ended December 31, 2009 or 2008.

All auditing services and non-audit services provided to the Company by our independent registered public accounting firm are required to be pre-approved by the Audit Committee. Any pre-approval of non-audit services by Ernst & Young LLP includes making a determination that the provision of the services is compatible with maintaining the independence of Ernst & Young LLP as an independent registered public accounting firm. In addition, the Audit Committee has delegated pre-approval authority to the Chairperson of the Audit Committee, provided that the Chairperson still reports any decisions to pre-approve such audit and non-audit services to the Audit Committee at its next regularly scheduled meeting. All services for audit and tax fees for the years ended December 31, 2009 and 2008 as set forth in the table above were pre-approved by the Company’s Audit Committee.

10

DIRECTORS AND EXECUTIVE OFFICERS

The following table sets forth for each Class I Director, the Class II Director, each Class III Director and the executive officers of the Company, their ages and present positions with the Company as of the Record Date.

Name | Age | Position | ||

Remi Barbier | 50 | President, Chief Executive Officer, Chairman of the Board of Directors and Class III Director | ||

Nadav Friedmann, Ph.D., M.D. | 67 | Chief Medical and Operating Officer and Class I Director | ||

Peter S. Roddy | 50 | Vice President and Chief Financial Officer | ||

Grant L. Schoenhard, Ph.D. | 65 | Chief Scientific Officer | ||

Robert Z. Gussin, Ph.D.(1)(2)(3) | 72 | Class II Director | ||

Michael J. O’Donnell, Esq.(3) | 51 | Class I Director and Secretary | ||

Sanford R. Robertson(1)(2)(3) | 78 | Class III Director | ||

Patrick J. Scannon, M.D., Ph.D.(1)(3) | 62 | Class III Director |

| (1) | Member of Audit Committee. |

| (2) | Member of Compensation Committee. |

| (3) | Meets the definition of independence under the NASDAQ Stock Market LLC listing standards. |

There is no family relationship between any director or executive officer of the Company.

Remi Barbier,the Company’s founder, has served as President, Chief Executive Officer and Chairman of the Board of Directors since the Company’s inception in 1998. Prior to that time, Mr. Barbier helped in the growth or founding of: Exelixis Inc., a functional genomics company, ArQule, Inc., a chemistry company, and EnzyMed, Inc. (now owned by Albany Molecular Research, Inc.), a chemistry company. Mr. Barbier served as Chief Operating Officer of Exelixis, Inc. from January 1996 to May 1998. Mr. Barbier was Vice President of Corporate Development and Clinical Project Manager of Xoma Corporation, a biotechnology company, from October 1993 to December 1995. Mr. Barbier is a trustee of the Carnegie Institution of Washington and a board member of the Institute for Quantitative Biosciences at the University of California. Mr. Barbier received his B.A. from Oberlin College and his M.B.A. from the University of Chicago.

Nadav Friedmann, Ph.D., M.D. has served as a director since 1998. Dr. Friedmann has served as Chief Operating Officer since October 2001 and Chief Medical and Operating Officer since 2004. Dr. Friedmann is the owner and President of EMET Research Inc., a consulting firm in the pharmaceutical industry. Dr. Friedmann was President and Chief Executive Officer of Daiichi Pharmaceutical Corporation, a pharmaceutical company, from 1997 to April 2000, and was a consultant to the Board of Directors of Daiichi Pharmaceutical Co., Ltd. in Tokyo from 1995 to 1997. From 1992 to 1995, Dr. Friedmann served as Vice President, Clinical Research at Xoma Ltd. (formerly Xoma Corporation). From 1980 to 1991, Dr. Friedmann held various leadership positions with Johnson & Johnson (“J&J”), including the position of Vice President and Head of Research of the J&J Biotechnology Center. Prior to that, Dr. Friedmann was Medical Director of Abbott Laboratories. Dr. Friedmann received his M.D. from the Albert Einstein College of Medicine and his Ph.D. in Biochemistry from the University of California, San Diego.

Peter S. Roddyhas served as Chief Financial Officer since 2002 and as Vice President and Chief Financial Officer since 2004. From 1990 to 2002, Mr. Roddy held a variety of senior management positions at COR Therapeutics, Inc., a biopharmaceutical company (now part of Takeda Pharmaceutical Company Limited), including Senior Vice President, Finance and Chief Financial Officer between 2000 and 2002. Prior to 1990, Mr. Roddy held a variety of positions at Price Waterhouse & Company, Hewlett Packard Company and MCM Laboratories, Inc. Mr. Roddy is a director of Vermillion, Inc., a medical diagnostics company. Mr. Roddy received his B.S. in Business Administration from the University of California, Berkeley.

Grant L. Schoenhard, Ph.D. has served as Chief Scientific Officer since 2001. From 2000 to 2001, Dr. Schoenhard was the Vice President of Preclinical Development. During 2000, Dr. Schoenhard was a

11

consultant and provided pharmacodynamic research and development services to various organizations. From 1998 to 2000, Dr. Schoenhard was Senior Director of Pharmacokinetics, Drug Metabolism and Pharmacology at Genentech, Inc., a biotechnology company. From 1974 to 1998, Dr. Schoenhard held various management positions, including Executive Director of Pharmacokinetics, Drug Metabolism and Radiochemistry at Searle, a pharmaceutical company owned by Monsanto Corporation. Dr. Schoenhard was also Adjunct Professor of Pharmacology, School of Medicine, University of Pennsylvania for a number of years. Dr. Schoenhard received his B.S. from Michigan State University and his M.S. and Ph.D. from Oregon State University.

Robert Z. Gussin, Ph.D.has served as a director since March 2003. Dr. Gussin worked at J&J for 26 years, most recently as Chief Scientific Officer and Corporate Vice President, Science and Technology from 1986 through his retirement in 2000. Prior to assuming this role, Dr. Gussin worked at J&J’s McNeil division for 12 years, most recently as Vice President, Research and Development and Vice President, Scientific Affairs. From 1967 to 1974, Dr. Gussin held various research positions with Lederle Laboratories, a pharmaceutical company. Dr. Gussin sits on the Board of Directors of Duquesne University and the advisory boards of the Duquesne University Pharmacy School and the University of Michigan Medical School Department of Pharmacology. Dr. Gussin received his B.S. and M.S. degrees and D.Sc. with honors from Duquesne University and his Ph.D. in Pharmacology from the University of Michigan, Ann Arbor.

Michael J. O’Donnell, Esq. has served as a director since 1998. Mr. O’Donnell has been a member of the law firm of Wilson Sonsini Goodrich & Rosati, Professional Corporation, the Company’s corporate counsel, since 1993. Mr. O’Donnell serves as corporate counsel to numerous public and private biopharmaceutical and life sciences companies. Mr. O’Donnell received his J.D., cum laude, from Harvard University and his B.A. from Bucknell University, summa cum laude.

Sanford R. Robertsonhas served as a director since 1998. Mr. Robertson has been a partner of Francisco Partners, a technology buyout fund, since 1999. Prior to founding Francisco Partners, Mr. Robertson was the founder and chairman of Robertson, Stephens & Company, a technology investment bank formed in 1978 and sold to BankBoston in 1998. Since the sale, Mr. Robertson has been a technology investor and advisor to several technology companies. Mr. Robertson was also the founder of Robertson, Colman, Siebel & Weisel, later renamed Montgomery Securities, another technology investment bank. Mr. Robertson is a director of Salesforce.com and Dolby Laboratories, Inc. Mr. Robertson received his B.A. and M.B.A. degrees with distinction from the University of Michigan.

Patrick J. Scannon, M.D., Ph.D.has served as a director since 2007. Dr. Scannon is a director of and one of the founders of XOMA, Ltd. Dr. Scannon has been Executive Vice President, Chief Biotechnology Officer of XOMA Ltd. since 2006. From 1993 to 2006, Dr. Scannon served as Chief Scientific and Medical Officer of XOMA, Ltd. Dr. Scannon received his Ph.D. in organic chemistry from the University of California, Berkeley and his M.D. from the Medical College of Georgia.

Board Structure

The Board of Directors maintains a structure with the Chief Executive Officer of the Company holding the position as Chairman of the Board of Directors, and with an Audit Committee and Compensation Committee for oversight of specific areas of responsibility, discussed further below. The Company believes that this structure is appropriate and allows for efficient and effective oversight, given the Company’s relatively small size (both in terms of number of employees and in scope of operational activities directly conducted by the Company), its corporate strategy (including the use of outsourcing for certain activities) and its focus on drug research and development. The Board of Directors does not have a specific role in risk oversight of the Company. The Chairman, President and Chief Executive Officer, the Committees of the Board and, as needed, other executive officers and employees of the Company provide the Board of Directors with information regarding the Company’s risks. The Board of Directors, or the Committee with special responsibility for oversight of the area implicated by the highlighted risks, then uses this information to perform its oversight role and inform its decision making with respect to such areas of risk.

12

Board Qualifications and Nominations

The Board of Directors requires of itself and selects as candidates to the Board of Directors for appointment or nomination individuals of high personal and professional integrity and ability who can contribute to the Board of Directors’ effectiveness in serving the interests of the Company’s stockholders. In addition, the Board of Directors and director nominees are expected to have appropriate management or scientific experience that would be relevant to our current and expected future direction, a track record of accomplishment and a commitment to ethical business practices. The particular experience, qualification or skills of each member of the Board of Directors that led the Board of Directors to conclude that the individual should serve as a director are:.

Director | Key Qualifications | |

Remi Barbier | Experience as President, Chief Executive Officer, Chairman of the Board of Directors since the inception of the Company. Helped in the growth and founding of several biotechnology companies. | |

Nadav Friedmann, Ph.D., M.D. | Experience as Chief Medical and Operating Officer of the Company. Additional experience as President and CEO and other executive roles at other pharmaceutical and biotechnology companies as an executive officer. | |

Robert Z. Gussin, Ph.D. | Experience in executive roles at J&J and as a director or as advisor to a number of academic institutions. | |

Michael J. O’Donnell, Esq. | Experience as a partner at Wilson, Sonsini, Goodrich & Rosati, Professional Corporation and as counsel and advisor to numerous public and private biopharmaceutical and life sciences companies. | |

Sanford R. Robertson | Experience as founder and director of investment banks and funds and as a director to public companies. | |

Patrick J. Scannon, M.D., Ph.D. | Experience as a founder and executive of a biopharmaceutical company. | |

The Board of Directors evaluates all proposed director nominees and incumbent directors before nomination, including the slate of director nominees proposed by the Board of Directors to our stockholders for election and any director nominees to be elected or appointed by the Board of Directors to fill interim director vacancies on the Board of Directors. The Board of Directors utilizes its own resources to identify qualified candidates to join the Board of Directors and may, in the future, use an executive recruiting firm to assist in the identification and evaluation of such qualified candidates. For these services, an executive recruiting firm would be paid a fee. The Board of Directors determined that a Nominating Committee was not necessary, and that it was in the best interest of the Company to continue to directly oversee the activities and responsibilities that might be delegated by the Board of Directors to a Nominating Committee. All of the Company’s members of the Board of Directors may participate in the consideration of director candidates. The approval of at least a majority of the independent directors on the Board of Directors is required to nominate a director candidate for a position on the Company’s Board of Directors. Such independent directors are identified below in the section entitled: “Certain Relationships and Related Party Transactions — Independence of Directors.”

The Board of Directors has not established a procedure for considering nominees for director nominated by the Company’s stockholders. The Board of Directors believes that our Board of Directors can identify appropriate candidates to our Board of Directors. Stockholders may nominate candidates for director in accordance with the advance notice and other procedures contained in our bylaws.

Board Meetings

The Board of Directors of the Company held a total of five meetings during the fiscal year 2009. No director serving throughout fiscal year 2009 attended fewer than 80% of the aggregate of all meetings of the Board of Directors and the committees of the Board upon which such director served. Mr. O’Donnell, Mr. Robertson, Mr. Barbier and Dr. Gussin attended all meetings of the Board of Directors.

13

We do not have formal policies regarding attendance by members of the Board of Directors at our annual meetings of stockholders, but directors are encouraged to attend annual meetings of the Company’s stockholders. Two directors attended the 2009 annual meeting of stockholders.

Stockholder communications with the Board of Directors

In addition, we do not have a written policy regarding stockholder communication with the Board of Directors. However, stockholders may communicate with the Board of Directors by sending an e-mail to the Company at IR@paintrials.com or by writing to us at Pain Therapeutics, Inc., Attention: Investor Relations, 2211 Bridgepointe Parkway, Suite 500, San Mateo, CA 94404. Stockholders who would like their submissions directed to an individual member of the Board of Directors may so specify, and the communication will be forwarded, as appropriate.

Board Committees

The Board of Directors has a standing Audit Committee that oversees the accounting and financial reporting processes of the Company and audits of the financial statements of the Company, and a standing Compensation Committee. Mr. Barbier is the Company’s Chairman of the Board of Directors, President and Chief Executive Officer. The Board of Directors does not have a lead director or a standing Nominating Committee.

The Audit Committee consists of directors Dr. Gussin, Mr. Robertson and Dr. Scannon, each of whom the Board of Directors of the Company has determined is independent as defined under the NASDAQ Stock Market LLC listing standards as well as the SEC rules. The Board of Directors has also determined that Mr. Robertson is an “audit committee financial expert” as defined in the SEC rules. The Audit Committee operates under a written charter adopted by the Board of Directors. The Company maintains a copy of the Audit Committee charter on its website:www.paintrials.com.The Audit Committee reviews the Company’s internal accounting procedures, consults with and reviews the services provided by the Company’s independent registered public accounting firm and makes recommendations to the Board of Directors regarding the selection of the independent registered public accounting firm. The Audit Committee held six meetings during fiscal 2009.

The Compensation Committee consists of directors Dr. Gussin and Mr. Robertson. The Compensation Committee reviews and recommends to the Board of Directors the salaries, incentive compensation and benefits of the Company’s officers and administers the Company’s stock plans and employee benefit plans. Refer to the Compensation Discussion and Analysis for more information about the Company’s Compensation Committee and its processes and procedures. The Compensation Committee operates under a written charter adopted by the Board of Directors. The Company maintains a copy of the Compensation Committee charter on its website:www.paintrials.com.The Compensation Committee held three meetings during fiscal 2009.

Compensation Committee Interlocks and Insider Participation

No member of the Compensation Committee or executive officer of the Company has served as a member of the board of directors or compensation committee of any entity that has one or more executive officers serving as a member of the Company’s Board of Directors or Compensation Committee. No Compensation Committee member has been an officer or employee of the Company while a member of the Compensation Committee.

14

SECURITY OWNERSHIP OF CERTAIN BENEFICIAL OWNERS AND MANAGEMENT

The following table sets forth as of February 15, 2010, certain information with respect to the beneficial ownership of the Company’s Common Stock by:

| • | any person (including any group as that term is used in Section 13(d)(3) of the Exchange Act), known by the Company to be the beneficial owner of more than 5% of the Company’s voting securities; |

| • | each director and each nominee for director to the Company; |

| • | each of the executive officers named in the Summary Compensation Table appearing herein; and |

| • | all executive officers, directors and nominees for director of the Company as a group. |

The number and percentage of shares beneficially owned are based on the aggregate of 48,189,039 shares of Common Stock outstanding as of February 15, 2010, adjusted as required by the rules promulgated by the SEC. The Company does not know of any arrangements, including any pledge by any person of securities of the Company, the operation of which may at a subsequent date result in a change of control of the Company.

Name and Address of Beneficial Owners(1) | Number of Shares | Percent of Common Stock Outstanding | |||

5% Holders | |||||

Visuim Asset Management, LLC(2) | 3,970,746 | 8.2 | % | ||

950 Third Avenue 29th Floor | |||||

BlackRock, Inc.(3) | 2,309,642 | 4.8 | % | ||

40 East 52nd Street | |||||

Burlingame Equity Investors, LP(4) | 2,140,688 | 4.4 | % | ||

One Market Street, Spear Street Tower, Suite 3750 | |||||

Directors and Officers | |||||

Remi Barbier(5) | 8,716,985 | 18.1 | % | ||

Nadav Friedmann, Ph.D., M.D.(6) | 2,051,236 | 4.3 | % | ||

Grant L. Schoenhard, Ph.D.(7) | 666,136 | 1.4 | % | ||

Peter S. Roddy(8) | 590,702 | 1.2 | % | ||

Sanford R. Robertson(9) | 482,455 | 1.0 | % | ||

Michael J. O’Donnell, Esq.(10) | 227,214 | * | |||

Wilson Sonsini Goodrich & Rosati | |||||

Robert Z. Gussin, Ph.D.(11) | 213,436 | * | |||

Patrick J. Scannon, M.D., Ph.D.(12) | 35,624 | * | |||

All directors, executive officers and nominees for director as a group | 12,983,788 | 26.9 | % |

| * | Represents beneficial ownership of less than one percent (1%) of the outstanding shares of the Company’s Common Stock. |

| (1) | This table is based upon information supplied by officers, directors and principal stockholders and Schedules 13G filed with the SEC. Unless otherwise indicated in the footnotes to this table, and subject to community property laws where applicable, each of the stockholders named in this table has sole voting and investment power with respect to the shares indicated as beneficially owned. Unless otherwise indicated, the address for directors, executive officers and nominees for director is the Company’s address. |

| (2) | Based on a Schedule 13G as filed with the SEC and dated February 12, 2010. |

15

| (3) | Based on Schedule 13G as filed with the SEC and dated January 29, 2010. |

| (4) | Based on a Schedule 13G as filed with the SEC and dated February 4, 2010. |

| (5) | Mr. Barbier is also a 5% Holder. Shares held include 48,375 shares held by members of Mr. Barbier’s immediate family, 2,168,166 shares issuable pursuant to options exercisable by Mr. Barbier within 60 days of February 15, 2010 and 150,197 shares issuable pursuant to options exercisable within 60 days of February 15, 2010 by Mr. Barbier’s spouse, who is an employee of the Company. |

| (6) | Includes 500 shares held in trust by Dr. Friedmann for a member of Dr. Friedmann’s family and 1,748,541 shares issuable pursuant to options exercisable by Dr. Friedmann within 60 days of February 15, 2010. |

| (7) | Includes 617,949 shares issuable pursuant to options exercisable within 60 days of February 15, 2010. |

| (8) | Includes 552,289 shares issuable pursuant to options exercisable within 60 days of February 15, 2010. |

| (9) | Includes 238,436 shares issuable pursuant to options exercisable within 60 days of February 15, 2010. |

| (10) | Includes 45,000 shares held by WS Investment Company 98B, 12,162 shares held by WS Investment Company 99B, 1,777 shares held by WS Investment Company 2000A, 5,775 shares held by Michael J. O’Donnell, and 162,500 shares issuable to Mr. O’Donnell pursuant to options exercisable within 60 days of February 15, 2010. Mr. O’Donnell, a director of the Company, is a general partner of WS Investment Company. Mr. O’Donnell disclaims beneficial ownership of the shares held by WS Investment Company, except to the extent of his partnership interest in such shares. Mr. O’Donnell is also a partner in Wilson Sonsini Goodrich & Rosati, Professional Corporation, the Company’s corporate counsel. |

| (11) | Includes 213,435 shares issuable pursuant to options exercisable within 60 days of February 15, 2010. |

| (12) | Includes 35,624 shares issuable pursuant to options exercisable within 60 days of February 15, 2010. |

| (13) | Includes 5,887,138 shares issuable pursuant to options exercisable within 60 days of February 15, 2010. |

16

EXECUTIVE COMPENSATION AND OTHER MATTERS

Compensation Discussion and Analysis

Our compensation programs are designed to provide long-term and currently-paid compensation and cash and non-cash compensation for our executive officers in order to align the compensation of our executive officers with our performance on a short term and long term basis. Our compensation programs reflect the following objectives:

| • | to attract and retain high-performing executive talent; |

| • | to encourage corporate behavior that is consistent with our values and goals; |

| • | to create financial incentives for superior performance; |

| • | to balance the achievement of corporate and individual goals, whereby individual executives are rewarded for the performance of the business functions for which they are responsible in addition to our overall performance; |

| • | to ensure that our executive compensation programs are competitive with those of regional companies in our industry, so that we can continue to attract, retain and motivate executive talent; and |

| • | to encourage the development of a diverse executive talent pool and continuity of leadership. |

These objectives include qualitative factors that strengthen our ability to meet long-term growth, such as demonstrated leadership ability, management development, ensuring compliance with laws, regulations and our policies, and anticipating and responding to changing conditions.

We do not have a set policy for allocating long-term and currently-paid compensation. Each year, our Compensation Committee determines the amount and allocation of long-term and currently-paid compensation and cash and non-cash compensation for executive officers. We believe there is no single source of data that provides the information sought by the Compensation Committee to arrive at these determinations. We rely on data from a number of sources, including a review of internally generated industry surveys; the experience and knowledge of members of the Compensation Committee, Board of Directors and senior management; and additional factors such as recent market trends and general business conditions. Survey data from prior years that we use include compensation information regarding publicly-held companies in our industry that are similar in size, breadth, stage of development or complexity to us.

While none of these sources of data are prescriptive per se, each source helps the Compensation Committee evaluate the appropriateness of total compensation for each executive at a particular point in the Company’s life cycle. For example, a certain position may be highly strategic for a period of time and we believe it may therefore be desirable to pay that position closer to the level of a chief executive officer during that period of time.

To assist the Compensation Committee with its responsibilities, we provide briefing materials prepared or summarized by management. Our Chief Executive Officer participates in the collection and dissemination of survey information and interacts with the Compensation Committee in reviewing some of the elements of yearly performance and compensation of the executive management team. The Compensation Committee believes that an appropriate level of input from our Chief Executive Officer provides a necessary and valuable perspective in helping the Compensation Committee formulate its own independent views on compensation. The Compensation Committee makes all final determinations as to compensation levels for executive officers.

Elements of Executive Compensation

We focus our executive compensation program on three related but distinct elements:

| • | base salary, |

| • | cash bonuses and |

| • | stock related compensation. |

17

We believe that compensation from one component should not offset or reduce compensation from another component.

Base Salary. We offer a base salary to attract and retain qualified executive officers. Base salaries are based on broad salary ranges that take into consideration a number of factors, including:

| • | an executive’s job responsibilities, |

| • | individual performance, |

| • | our corporate performance, |

| • | competitive market data and |

| • | our total compensation expense. |

Changes to base salary vary according to individual contributions to our success and comparisons to similar positions here and at other comparable companies.

In 2009, after reviewing each executive’s job responsibilities, individual performance, our corporate performance, competitive market data and our total compensation expense, the salary of Mr. Barbier was increased by 3% and the salaries for Dr. Friedmann, Mr. Roddy and Dr. Schoenhard were not changed.

Bonuses. Each executive officer is eligible for an annual cash bonus. We provide such bonuses to motivate executive officers to perform on behalf of general corporate goals and to perform in their areas of responsibility. We do not have a policy of prospectively establishing annual target bonuses or bonus criteria. Each individual executive officer’s bonus for the prior year is determined through an evaluation of overall corporate performance with a particular focus on our progress since the prior year’s bonus determination in the areas of research and development, finance and other operations. In its evaluation of performance in 2009, the Compensation Committee considered the U.S. Food and Drug Administration’s, or FDA, complete response letter to our New Drug Application, or NDA, for Remoxy in December 2008, where the FDA indicated that it did not approve Remoxy for marketing and that additional non-clinical data is required to support such approval. The Compensation Committee also noted that the negative impact of the FDA’s response on the Remoxy NDA was offset in part by progress in preclinical development activities in our hemophilia program and clinical development of our metastatic melanoma product candidate. As a result of this evaluation, the Compensation Committee determined that cash bonuses should be substantially lower in 2009 as compared to 2008, resulting in the following:

| • | Mr. Barbier’s bonus in 2009 was reduced to $250,000 from $425,000 in 2008; |

| • | Dr. Friedmann’s bonus in 2009 was reduced to $225,000 from $320,000 in 2008; |

| • | Mr. Roddy’s bonus in 2009 was reduced to $10,000 from $135,000 in 2008; and |

| • | Dr. Schoenhard’s bonus in 2009 was reduced to $40,000 from $105,000 in 2008. |

We did not purchase or generate updated internal survey data in connection with the review of bonus compensation in 2009. We have not paid bonuses to our executive officers in 2010.

Stock Related Compensation. Stock related compensation includes both stock option grants as well as other types of awards and award programs under our 2008 Equity Incentive Plan, such as the Restricted Stock Unit Plan adopted in 2009 and described further below.

Options.

Each executive officer is eligible for stock option grants. Such grants are intended to link executive rewards with shareholder value over time. Only our Board of Directors, acting in its sole discretion, or the Compensation

18

Committee grants options to our executive officers. We view stock options as one of the more important components of our long-term, performance-based compensation philosophy. We provide options through initial grants at or near the date of hire and through subsequent periodic grants. Options for executive officers are granted, vest and become exercisable at such time as determined by our Board of Directors. Generally, stock option grants are exercisable over a four year period and have an exercise price equal to the fair market value of our stock at the time of grant. Initial grants are based on ranges that take into consideration an executive’s job responsibilities and competitive market data. For subsequent periodic grants, the Compensation Committee evaluates performance based on each individual’s contribution to the long-term success and growth of the Company, the Company’s performance based on the factors discussed above and the motivational value of additional incremental stock option grants. No stock options are granted in the absence of satisfactory performance. Stock option grants generally terminate shortly after an executive officer terminates employment. We grant periodic additional stock options:

| • | to reflect the individuals’ ongoing contributions; |

| • | to create an incentive to remain with us; and |

| • | to provide a long-term incentive to achieve or exceed our financial goals. |

In granting stock options in the current year, we may consider the cumulative benefit of stock options granted in prior years. We do not have a program, plan or practice to time stock option grants to our executives in coordination with the release of material nonpublic information. We have not re-priced any of our options and do not intend to re-price or otherwise adjust options in the event that fair market value of our common stock declines below an option grant price. In 2009, after review of each individual’s ongoing contributions to the Company, Mr. Barbier, Dr. Friedmann, Mr. Roddy and Dr. Schoenhard received options to purchase 300,000, 150,000, 70,000 and 70,000 shares of our common stock. We have not granted any options to the named executive officers in 2010.

Other equity awards.

In 2009, the Compensation Committee established specific goals for the senior executives under a Restricted Stock Unit Plan, or RSUP, within the terms of our 2008 Equity Incentive Plan. The purpose of the RSUP is to advance our interests by providing performance based equity compensation to:

| • | encourage senior executives to more closely identify with stockholders’ interests; |

| • | achieve operating and financial results consistent with our long range business plan; and |

| • | provide a vehicle to attract and retain key executives who are responsible for growing the business. |

The performance goals established under the RSUP related to:

| • | maintaining cash balances within budget, or Goal 1, |

| • | achieving a regulatory milestone for the Company’s metastatic melanoma product candidate, or Goal 2; |

| • | achieving a clinical milestone for the Company’s metastatic melanoma product, or Goal 3; |

| • | achieving a product development milestone for the Company’s metastatic melanoma product candidate, or Goal 4; and |

| • | achieving a product development milestone for the Company’s hemophilia program, or Goal 5. |

In order to obtain an award under the RSUP for any given performance goal:

| • | such goal must be met in 2009; |

| • | the plan participant must be an employee in good standing at the time of the award; |

19

| • | the award must be approved by our President and Chief Executive Officer; and |

| • | the Compensation Committee must endorse whether such performance goal has been reached. |

The number of shares of our common stock available to the following executive officers for achieving performance goals under the RSUP are:

| Goal 1 | Goal 2 | Goal 3 | Goal 4 | Goal 5 | ||||||

Remi Barbier | 35,000 | 10,000 | 10,000 | 10,000 | 10,000 | |||||

Nadav Friedmann, Ph.D., M.D. | 5,000 | 15,000 | 20,000 | 30,000 | 20,000 | |||||

Peter S. Roddy | 15,000 | — | — | — | — |

In January 2010, the Compensation Committee endorsed that Goal 1 and Goal 5 had been reached. Restricted stock units totaling 45,000, 25,000 and 15,000 vested for Mr. Barbier, Dr. Friedmann and Mr. Roddy, respectively. The remaining restricted stock units lapsed and 95,000 shares were returned to the pool of available shares in the 2008 Equity Incentive Plan.

Any personal tax obligations resulting from the RSUP are the responsibility of the award recipient. We issued shares to the award recipient net of applicable taxes, which reduced the number of shares issued without reducing the amount of taxable compensation to the award recipient. As a result, 43,699 shares were returned to the pool of available shares in the 2008 Equity Incentive Plan.

Other Compensation

Executive officers are eligible for other benefits in each case on generally the same basis as other employees, subject to applicable law.

Employee Medical and Welfare Benefit Plans: Our employee medical and welfare benefit plans include:

| • | medical; |

| • | dental: |

| • | group life; |

| • | disability and |

| • | accidental death and dismemberment insurance. |

We add to taxable income of each Named Executive an amount representing the premium for term life insurance.

2000 Employee Stock Purchase Plan: Our Named Executives are eligible to participate in our 2000 Employee Stock Purchase Plan, or ESPP. During 2009, Dr. Friedmann purchased 3,374 shares and Mr. Roddy purchased 3,374 shares pursuant to the ESPP. We may terminate the ESPP at any time. In December 2009, the Board of Directors approved an amendment and restatement of the ESPP, described in this Proxy under Proposal Two — Approval of the Amended and Restated 2000 Employee Stock Purchase Plan, or Proposal Two, to extend the date the ESPP terminates and to otherwise update certain terms of the ESPP as described in Proposal Two. The effectiveness of the ESPP is subject to approval by our stockholders at the 2010 Annual Meeting of Stockholders.

401(k) Plan: We maintain a 401(k) Plan that is a defined contribution plan intended to qualify under Section 401(a) of the Code. We have not matched any pre-tax contributions to the 401(k) Plan.

Paid Time Off: Our executive officers do not accrue vacation benefits available to our other employees, but do receive other paid time off benefits on the same basis as other employees.

We do not offer any of our employees a pension plan, retirement plan or other forms of compensation or perquisites paid out upon retirement.

20

Post-Employment Obligations

We have an employment agreement with Mr. Barbier and employment offer letters with Dr. Schoenhard and Mr. Roddy that provide for payments related to termination without cause. The primary basis for selecting termination without cause for triggering payment was that such terms are deemed necessary in attracting and retaining high-performing executive talent.

For additional information on the specific terms and conditions of these employment arrangements, see the discussion in the section entitled “Employment and Severance Arrangements” of this proxy statement.

Accounting and Tax Considerations

Generally, the expense related to an option grant or award is established at the time of awards for purposes of financial reporting and recognized as appropriate over the period of time covered by the option grant or award. Our financial statements include more information regarding this accounting.

The tax deductions related to option grants or awards under the RSUP are generally determined in the future, usually at the time of exercise or sale of the underlying stock from a stock option or at the time of vesting of an award under the RSUP. These tax deductions may be more or less than the amount of the underlying expense recorded for financial reporting purposes. We cannot predict the amount of tax deductions we earn in the future, if any, because the deductions are based on the fair market value of our common stock on the date when the tax deduction is earned.

Under current U.S. tax law, publicly-held companies may be precluded from deducting certain compensation paid to an executive officer in excess of $1.0 million in a year. The regulations exclude from this limit performance-based compensation and stock options provided certain requirements, such as stockholder approval, are satisfied. We plan to take actions, as necessary, to ensure that our stock option plans and executive annual cash bonus plans qualify for exclusion. None of our compensation in 2009 was precluded from deductions. In addition, distributions under severance arrangements with an executive officer can only be made after six months after separation from service. We have endeavored and will continue to endeavor to structure our compensation arrangements to comply with current U.S. tax laws.

Stock Ownership Guidelines

We do not have any stock ownership guidelines, ownership goals or holding requirements. We do have an insider trading policy that establishes certain restrictions on trading windows.

Our Named Executives separately established pre-arranged personal stock trading plans with brokerage firms in accordance with Rule 10b5-1 of the Securities Exchange Act of 1934, as amended, and our insider trading policy. This type of plan enables an executive to sell shares through a broker without direct involvement in the sales such that the sales are not limited by the executive’s access to material non-public information. Consistent with Rule 10b5-1, our insider trading policy permits executives to implement Rule 10b5-1 stock trading plans provided that, among other things, they are not in possession of any material nonpublic information at the time that they adopt such plans. All of the existing 10b5-1 stock trading plans are cancelable immediately.

As we succeed in achieving approval for and commercializing our drug candidates, we expect that we will adapt the elements of our compensation program as appropriate and may include or substitute other elements in our compensation program. Changes in the elements of our compensation program may also reflect changes in the importance of tax or accounting treatments of a particular element of our compensation program.

21

Executive Compensation

The following table sets forth all compensation earned during fiscal year 2009 to our President and Chief Executive Officer and each of our other executive officers.

Name and Principal Position | Year | Salary ($) | Bonus ($) | Stock Awards ($)(1) | Option Grants ($)(1) | All Other Compen- sation ($)(5) | Total ($) | ||||||||

Remi Barbier | 2009 | 588,333 | 250,000 | 198,000 | (2) | 612,360 | 1,260 | 1,649,953 | |||||||