Investor Presentation March 2019 John S. D’Orazio, CEO Paul W. Nester, CFO

Forward-Looking Statements The statements in this presentation by RGC Resources, Inc. (the "company") that are not historical facts constitute “forward- looking statements” made pursuant to the safe harbor provision of the Private Securities Litigation Reform Act of 1995 that involve risks and uncertainties. These statements include the company's expectations regarding earnings per share, EBITDA, future expansion opportunities, natural gas reserves and potential discoverable natural gas reserves, technological advances in natural gas production, comparison of natural gas consumption and natural gas production, cost of natural gas, including relativity to other fuel sources, demand for natural gas, possibility of system expansion, general potential for customer growth, relationship of company with primary regulator, future capital expenditures, current and future economic growth, estimated completion dates for Mountain Valley Pipeline ("MVP") and MVP Southgate milestones, potential of MVP to provide an additional source of natural gas, additional capacity to meet future demands, increased capital spending and area expansion opportunity and, potential new customers and rate growth in potential expansion area. Management cautions the reader that these forward-looking statements are only predictions and are subject to a number of both known and unknown risks and uncertainties, and actual results may differ materially from those expressed or implied by these forward- looking statements as a result of a number of factors. These factors include, without limitation, financial challenges affecting expected earnings per share and EBITDA, technical, political or regulatory issues with natural gas exploration, production or transportation, impact of increased natural gas demand on natural gas price, relative cost of alternative fuel sources, lower demand for natural gas, regulatory, legal, technical, political or economic issues frustrating system or area expansion, regulatory, legal, technical, political or economic issues that may affect MVP, delay in completion of MVP, increase in cost to complete MVP, including by an increase in cost of raw materials or labor to due economic factors or regulatory issues such as tariffs, economic challenges that may affect the service area generally and customer growth or demand and deterioration of relationship with primary regulator, and those risk factors described in the company’s most recent Annual Report on Form 10-K filed with the Securities and Exchange Commission, which is available at www.sec.gov and on the company’s website at www.rgcresources.com. The statements made in this presentation are based on information available to the company as of the first day of the month set forth on the cover of this presentation and the company undertakes no obligation to update any of the forward-looking statements after the date of this presentation. Non-GAAP Measures: This presentation includes certain metrics that are based on TTM or estimated EBITDA, which are non-GAAP financial measures. 1

Agenda Company Overview Financial Highlights Growth Strategy Outlook 2

Organizational Structure NASDAQ: RGCO Regulated Non-Utility Local Distribution Company Partner in Mountain Valley Pipeline (LDC), located in Roanoke, VA (MVP) Founded in 1883 Partner in proposed MVP Southgate project 3

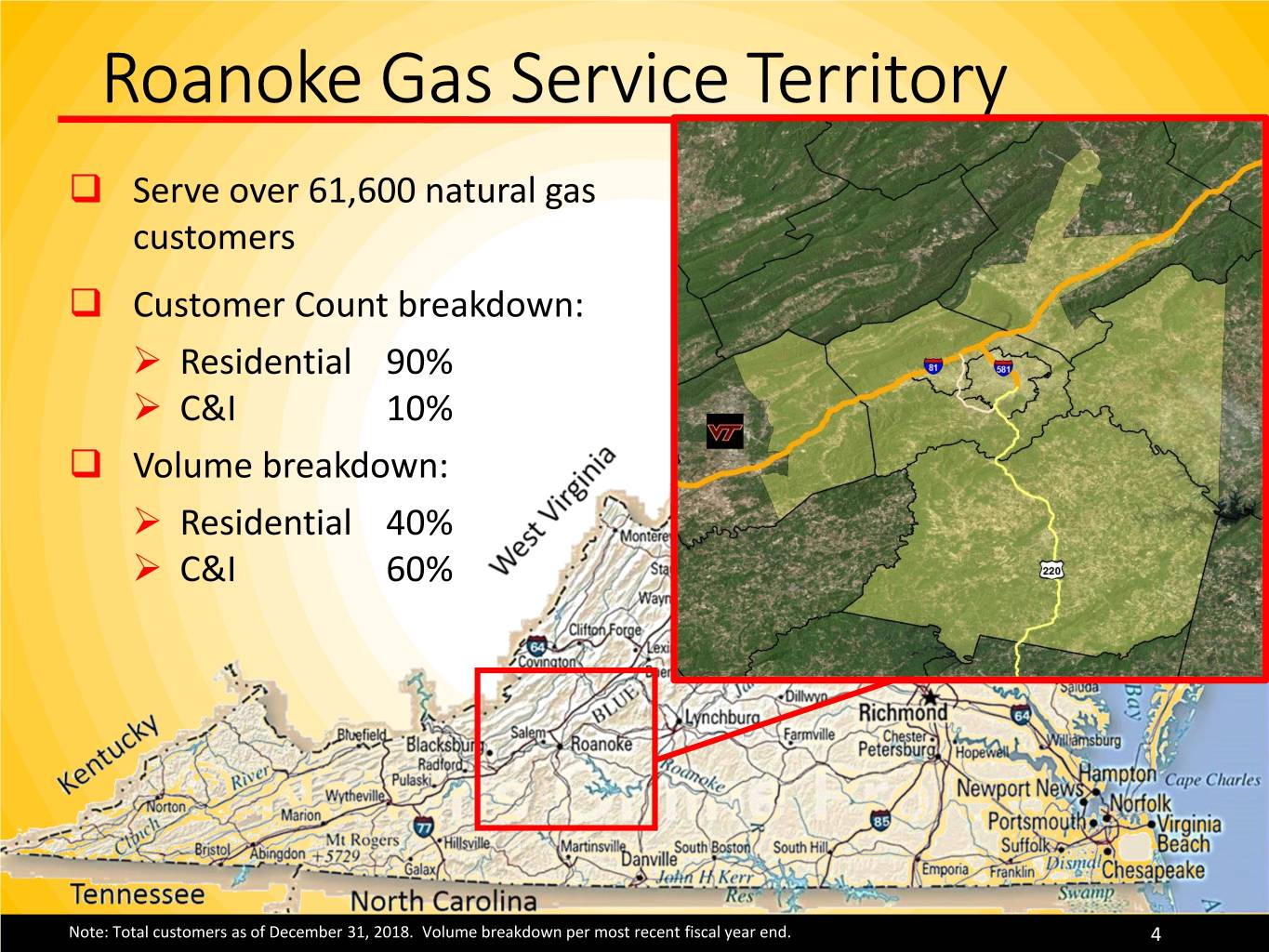

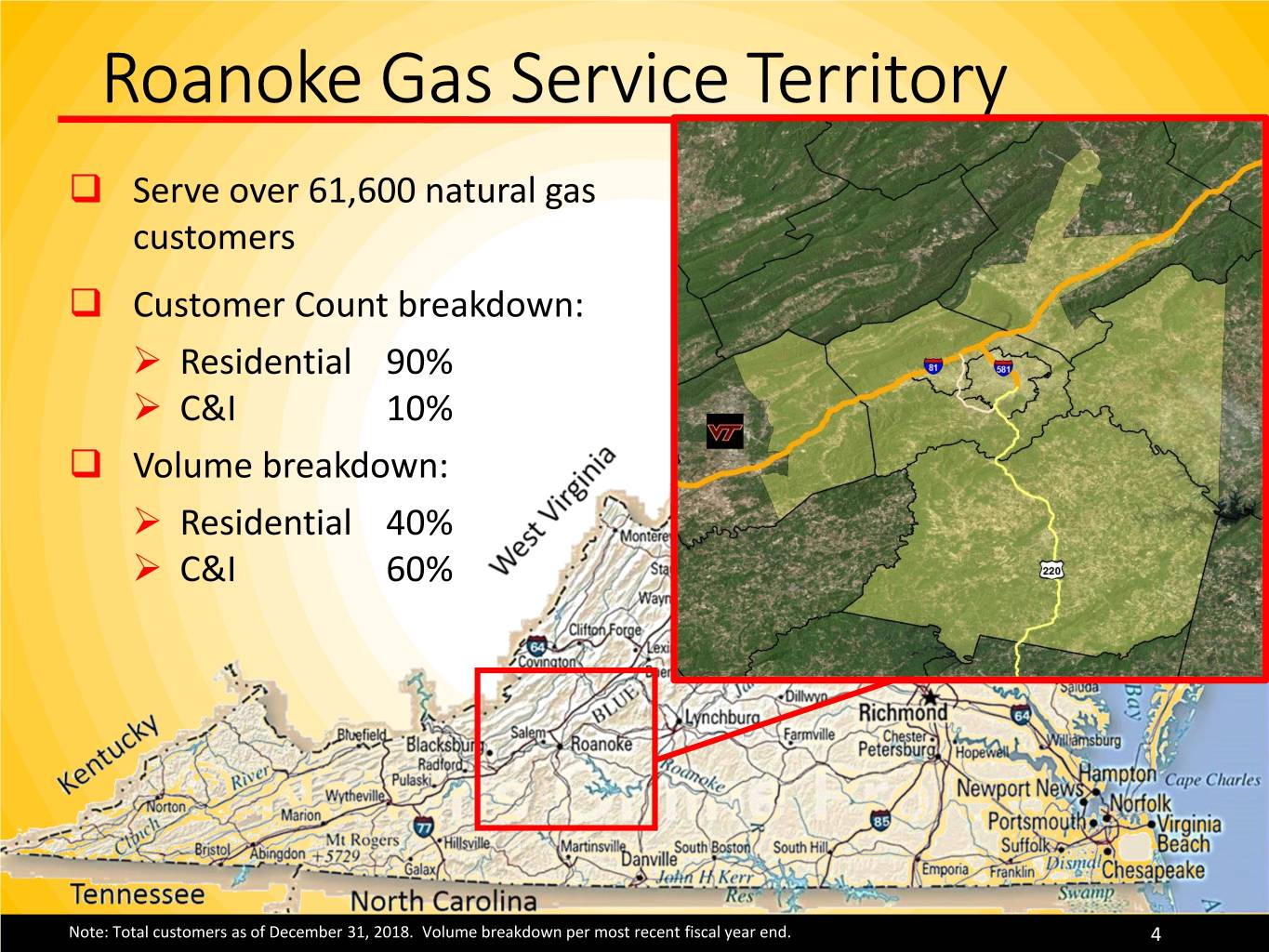

Roanoke Gas Service Territory Serve over 61,600 natural gas customers Customer Count breakdown: Residential 90% C&I 10% Volume breakdown: Residential 40% C&I 60% Note: Total customers as of December 31, 2018. Volume breakdown per most recent fiscal year end. 4

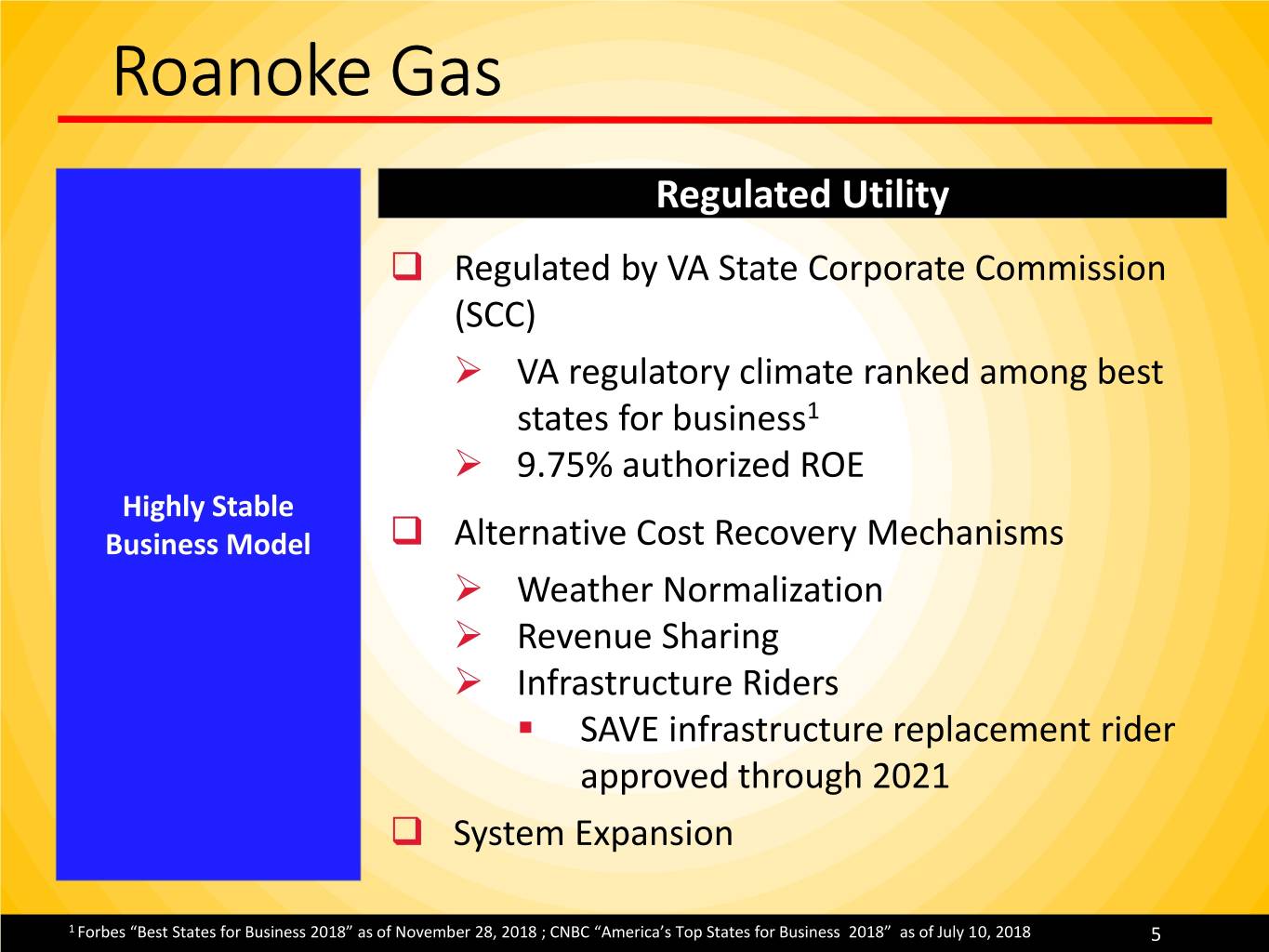

Roanoke Gas Regulated Utility Regulated by VA State Corporate Commission (SCC) VA regulatory climate ranked among best states for business1 9.75% authorized ROE Highly Stable Business Model Alternative Cost Recovery Mechanisms Weather Normalization Revenue Sharing Infrastructure Riders . SAVE infrastructure replacement rider approved through 2021 System Expansion 1 Forbes “Best States for Business 2018” as of November 28, 2018 ; CNBC “America’s Top States for Business 2018” as of July 10, 2018 5

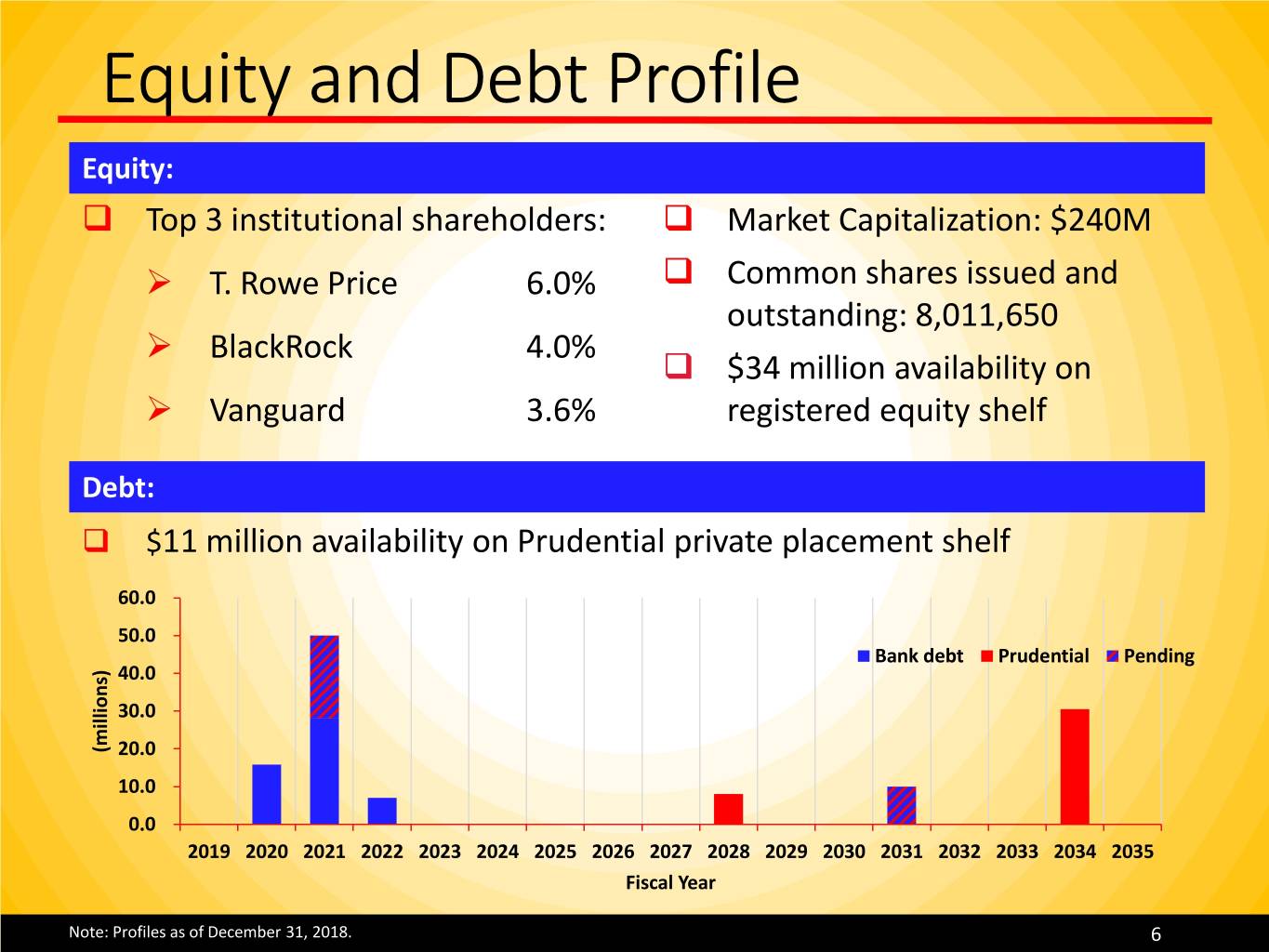

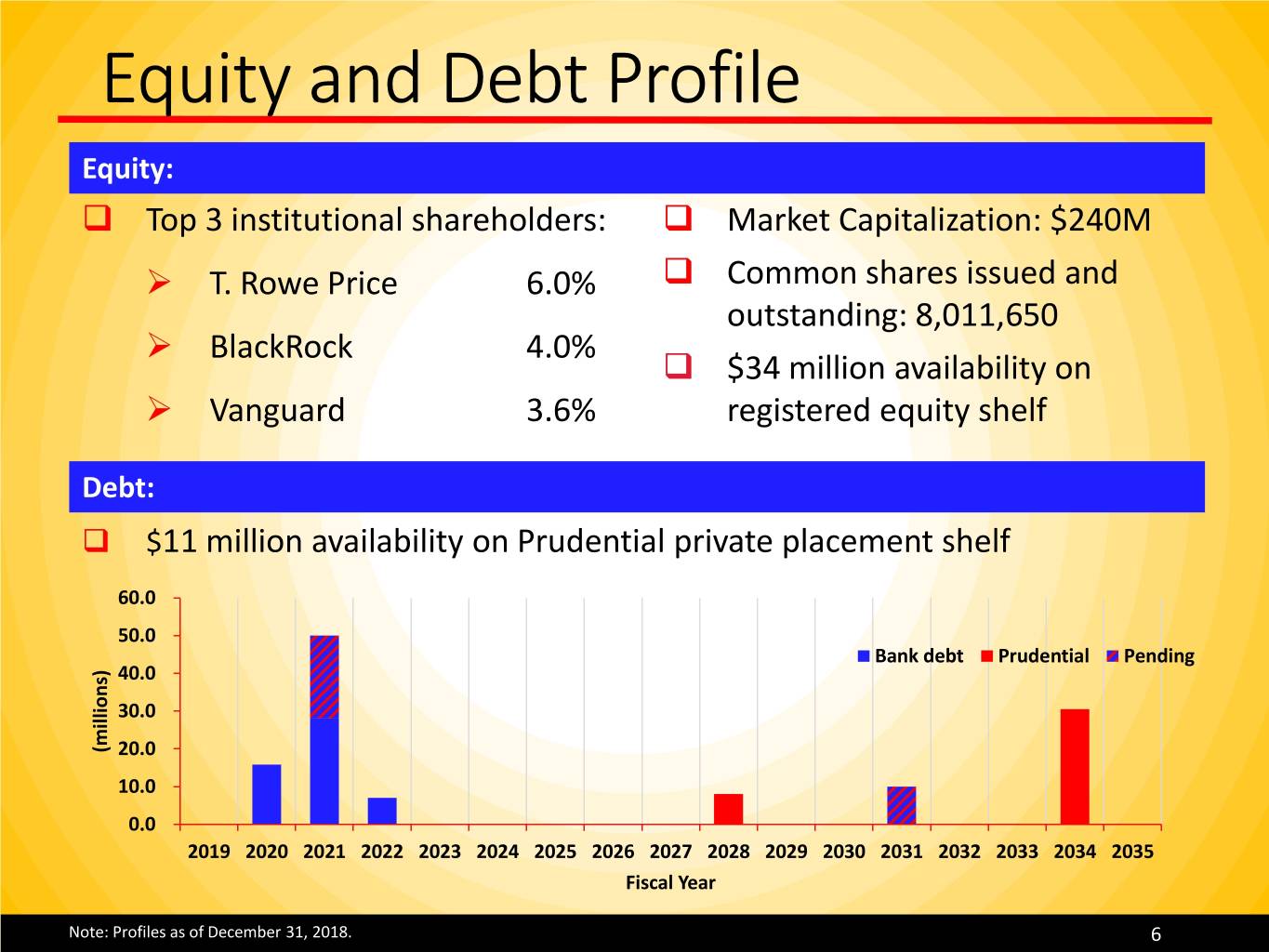

Equity and Debt Profile Equity: Top 3 institutional shareholders: Market Capitalization: $240M T. Rowe Price 6.0% Common shares issued and outstanding: 8,011,650 BlackRock 4.0% $34 million availability on Vanguard 3.6% registered equity shelf Debt: $11 million availability on Prudential private placement shelf 60.0 50.0 Bank debt Prudential Pending 40.0 30.0 (millions) 20.0 10.0 0.0 2019 2020 2021 2022 2023 2024 2025 2026 2027 2028 2029 2030 2031 2032 2033 2034 2035 Fiscal Year Note: Profiles as of December 31, 2018. 6

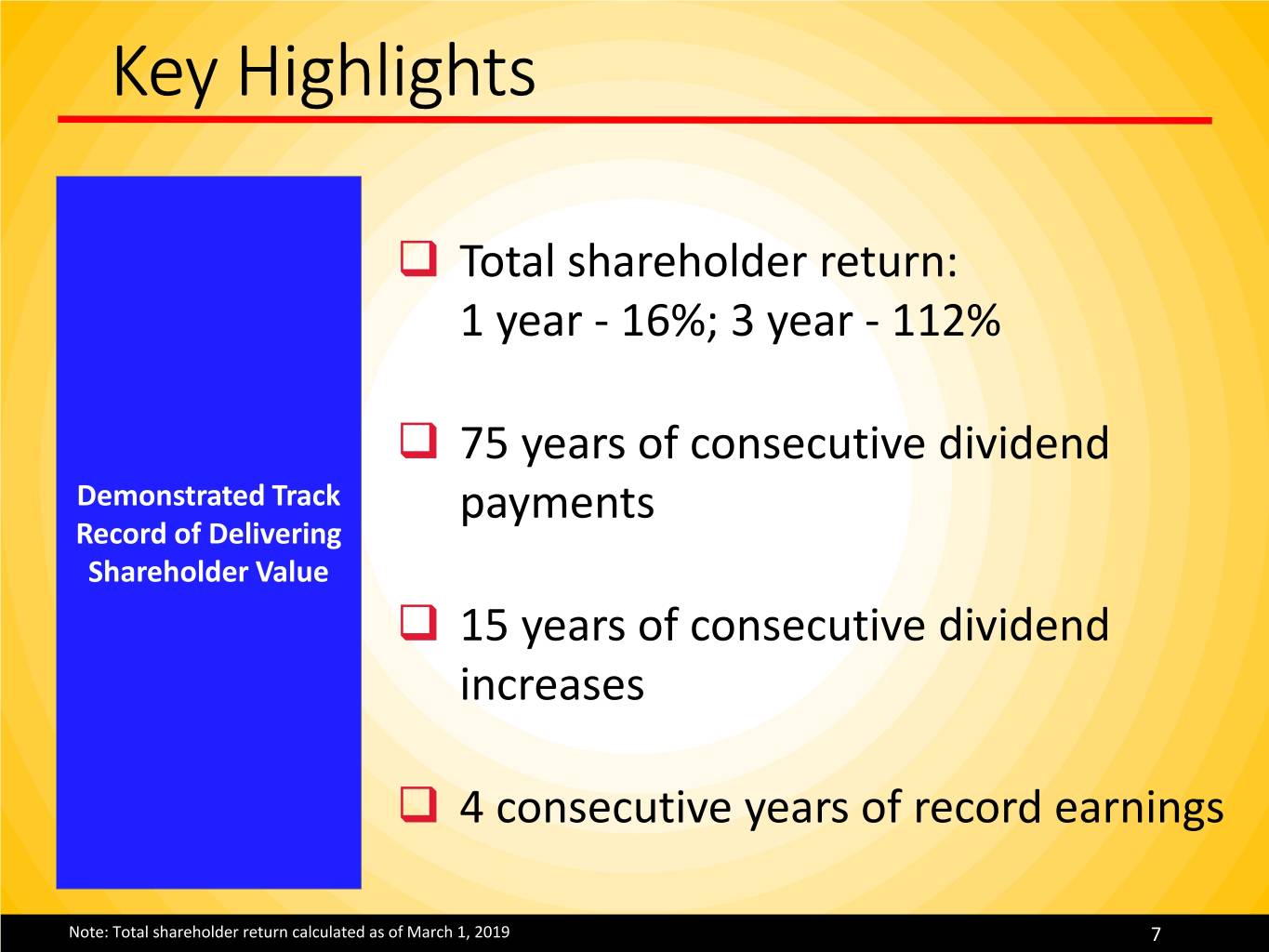

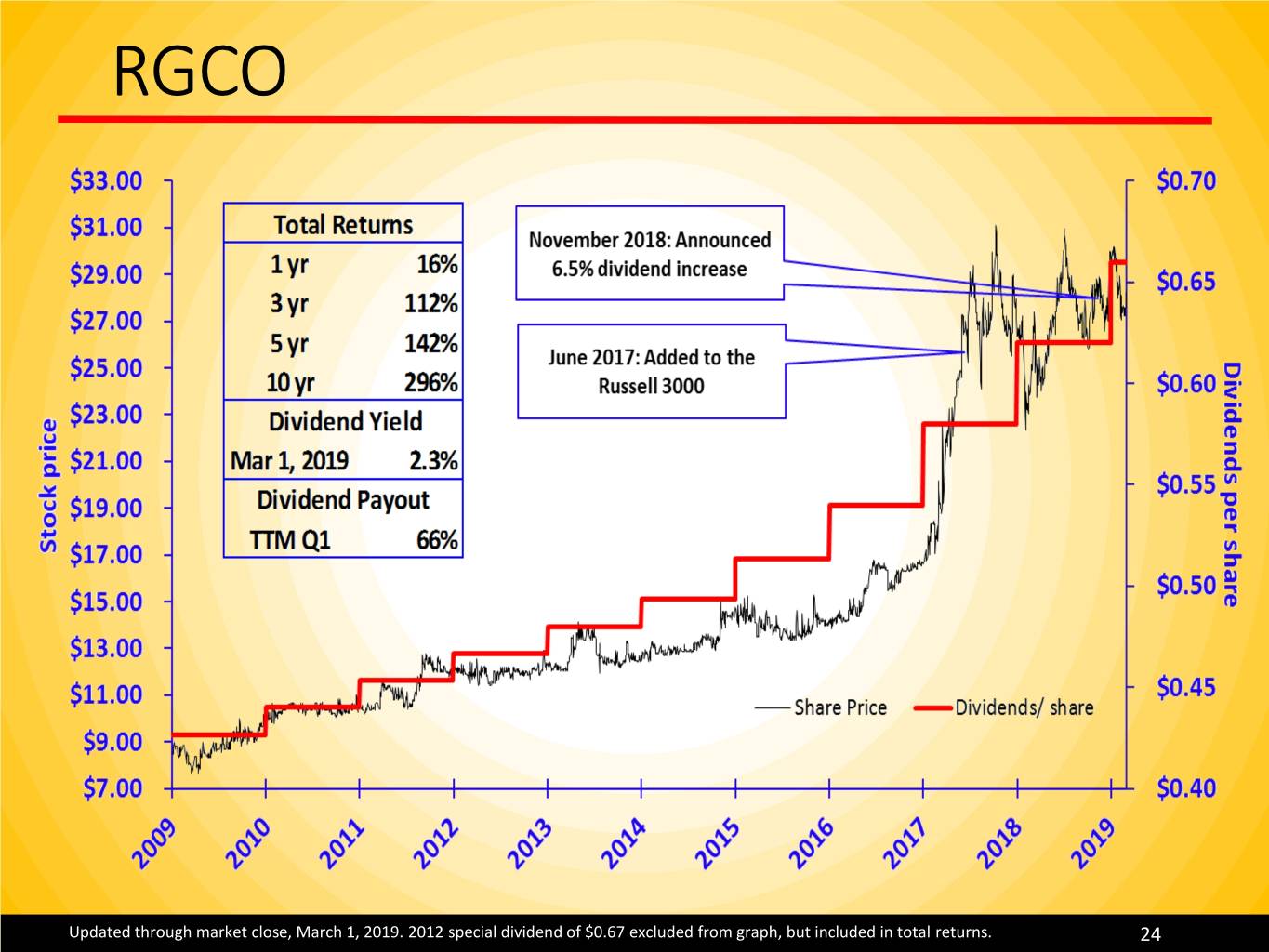

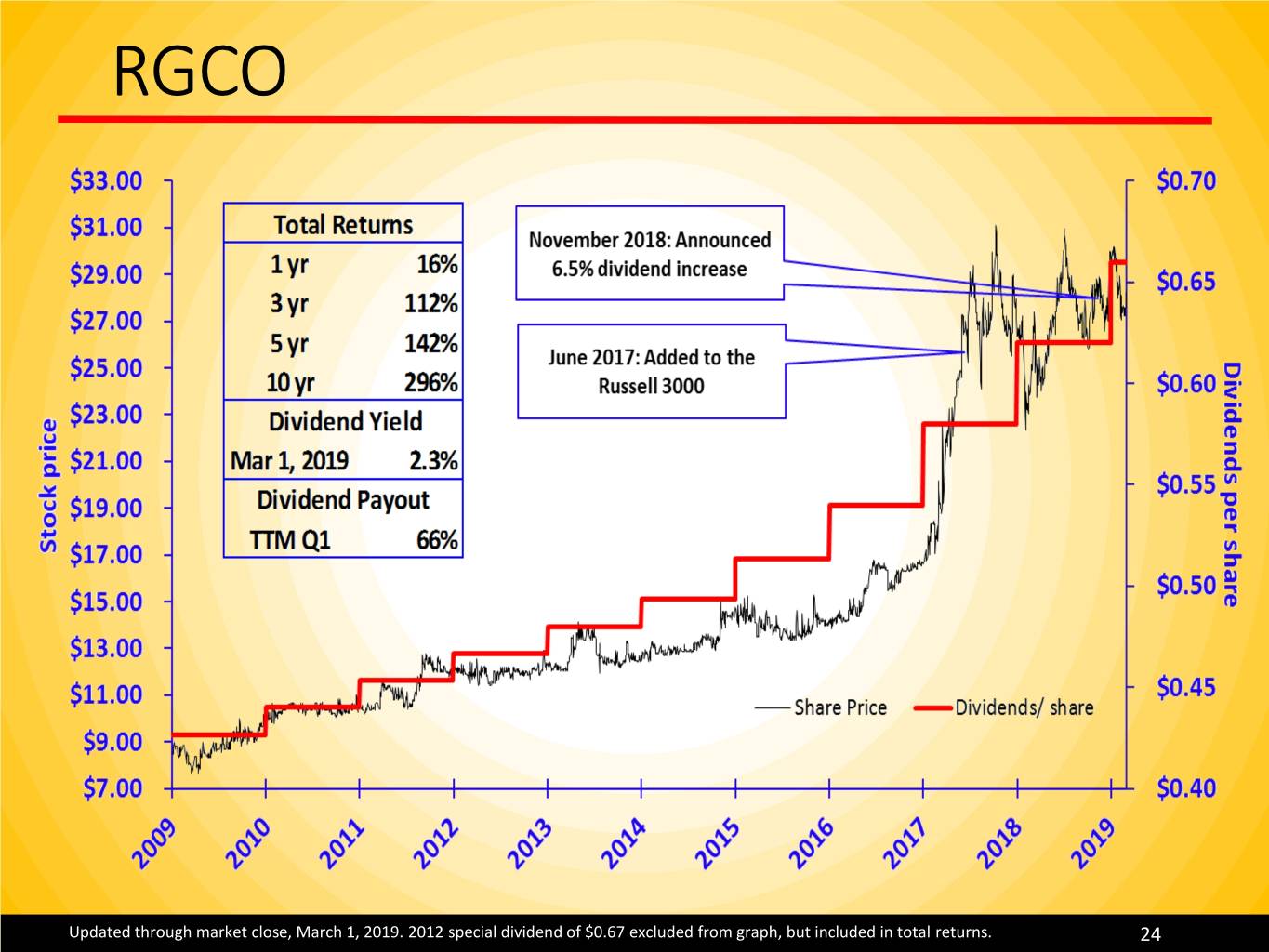

Key Highlights Total shareholder return: 1 year - 16%; 3 year - 112% 75 years of consecutive dividend Demonstrated Track payments Record of Delivering Shareholder Value 15 years of consecutive dividend increases 4 consecutive years of record earnings Note: Total shareholder return calculated as of March 1, 2019 7

Growth Strategy Regulated Utility Investment CapEx Ongoing Regulated Utility Growth Customer Growth Volumes Delivered Non-Utility Investments MVP 8

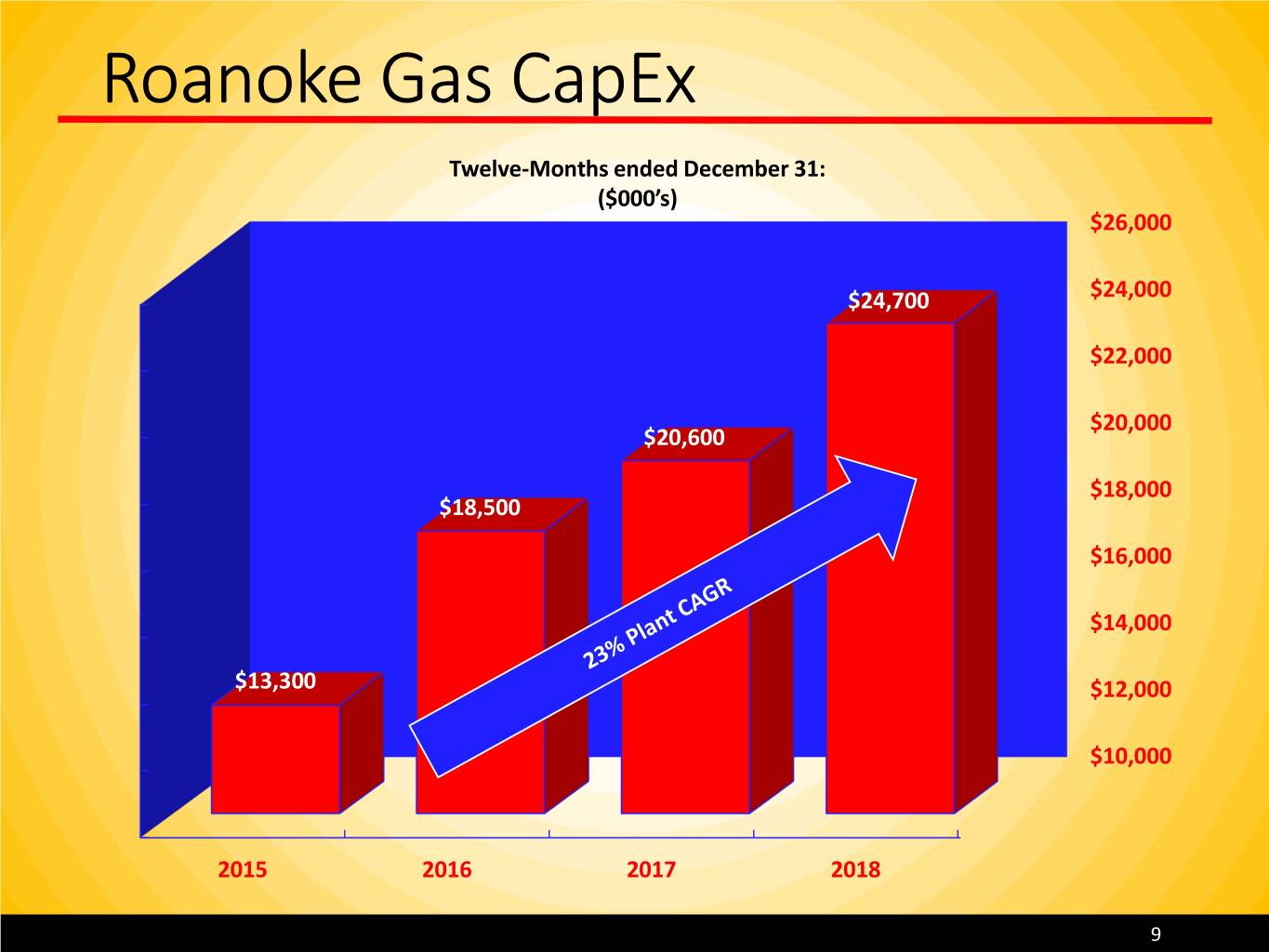

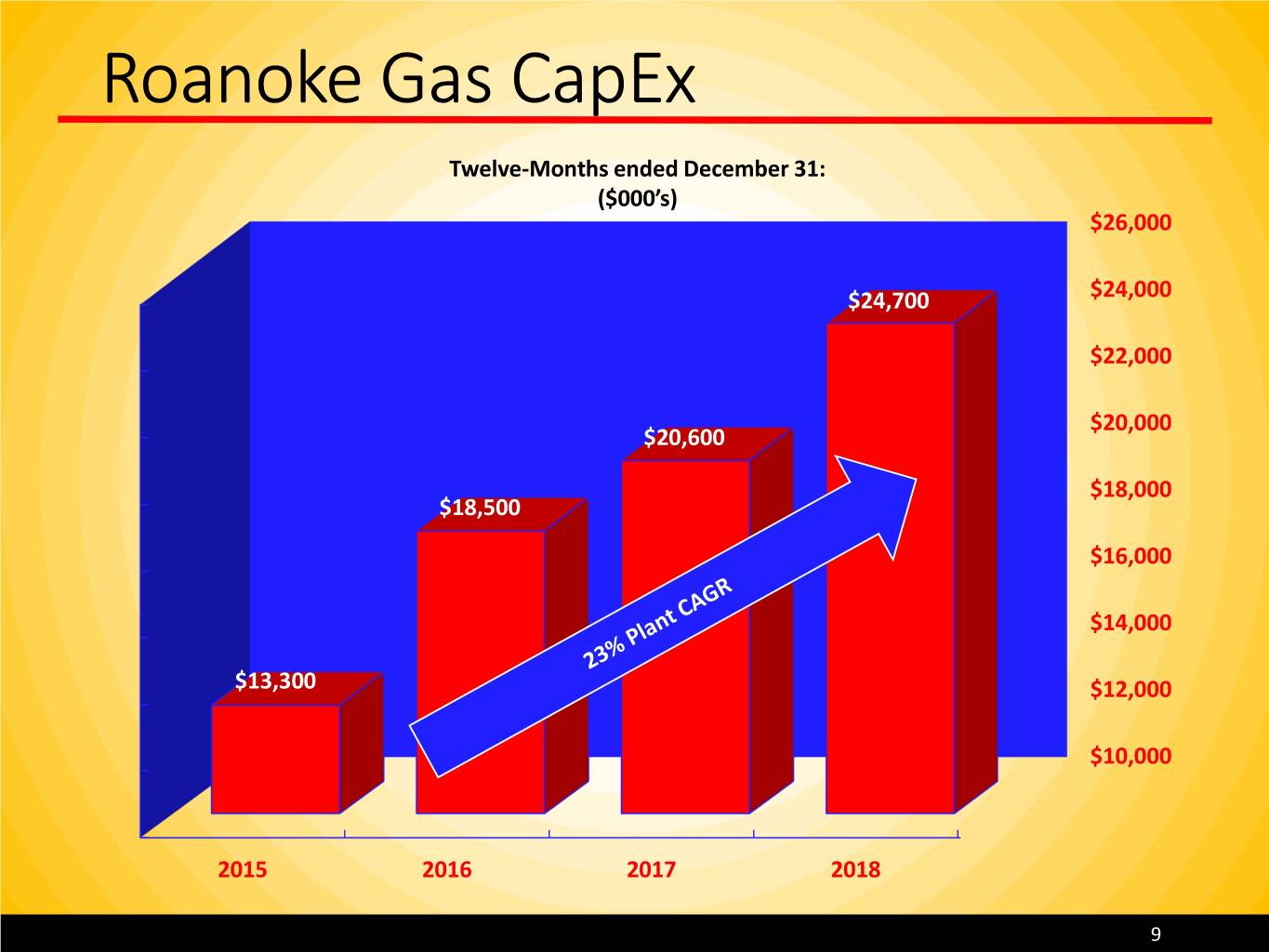

Roanoke Gas CapEx Twelve-Months ended December 31: ($000’s) $26,000 $24,700 $24,000 $22,000 $20,000 $20,600 $18,000 $18,500 $16,000 $14,000 $13,300 $12,000 $10,000 2015 2016 2017 2018 9

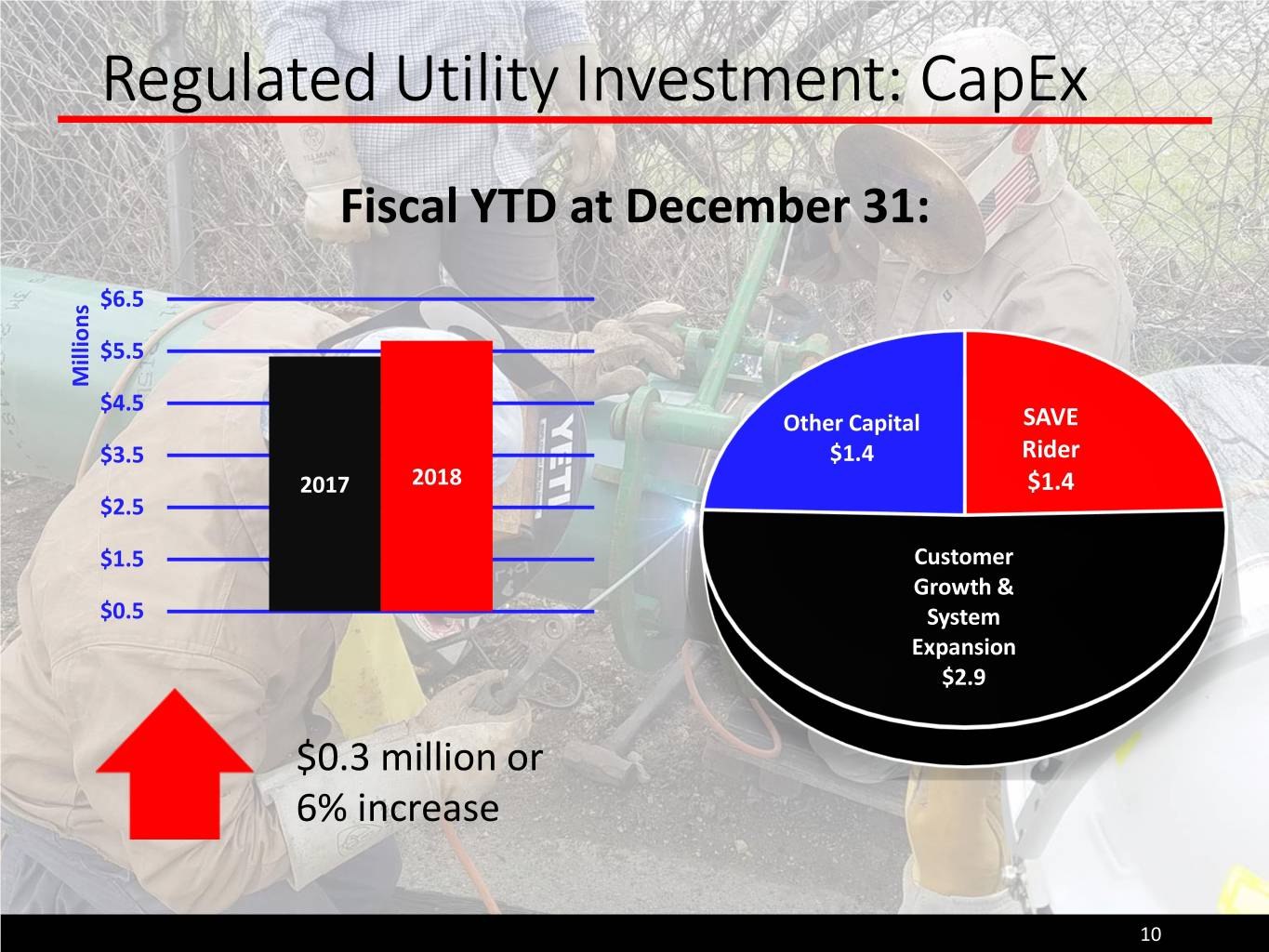

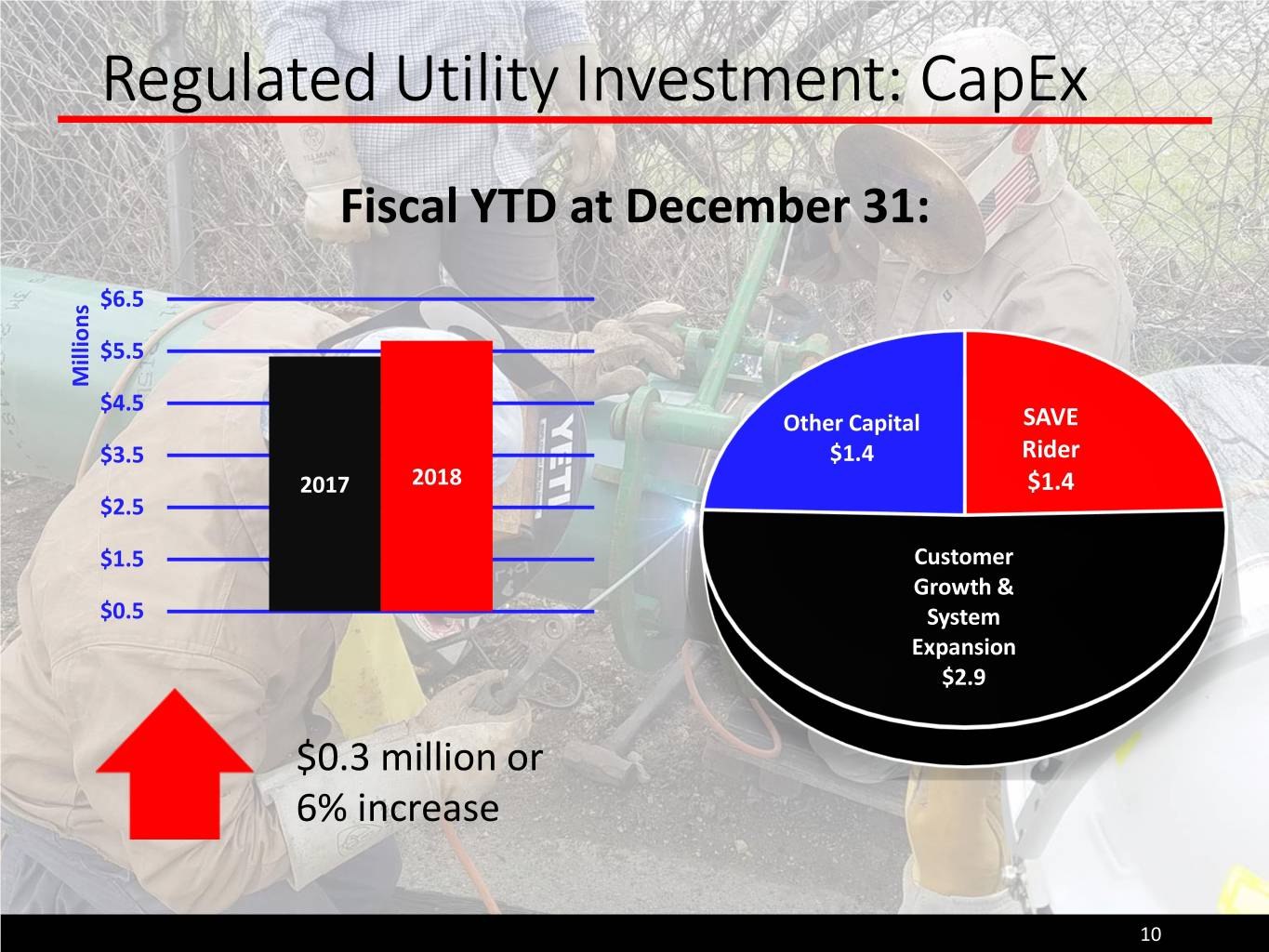

Regulated Utility Investment: CapEx Fiscal YTD at December 31: $6.5 $5.5 Millions $4.5 Other Capital SAVE $3.5 $1.4 Rider 2017 2018 $1.4 $2.5 $1.5 Customer Growth & $0.5 System Expansion $2.9 $0.3 million or 6% increase 10

Regulated Utility Growth: Customers 2.1% growth since 2015 Average Customers (twelve-months ended December 31) 61,000 60,500 60,000 59,500 59,000 58,500 2015 2016 2017 2018 New customer additions: Fiscal 2019 YTD 213 Fiscal 2018 597 Fiscal 2017 631 Fiscal 2016 495 11

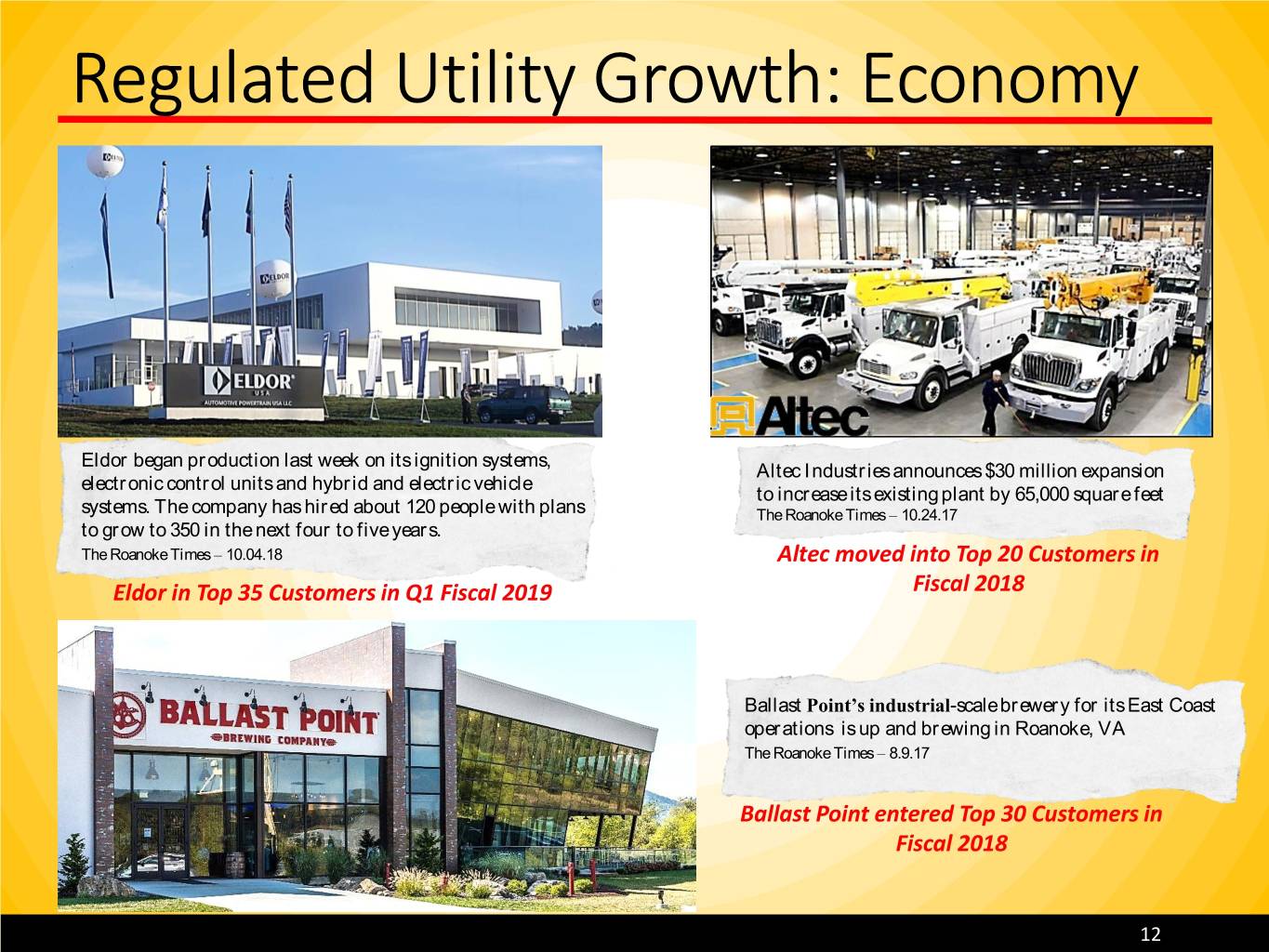

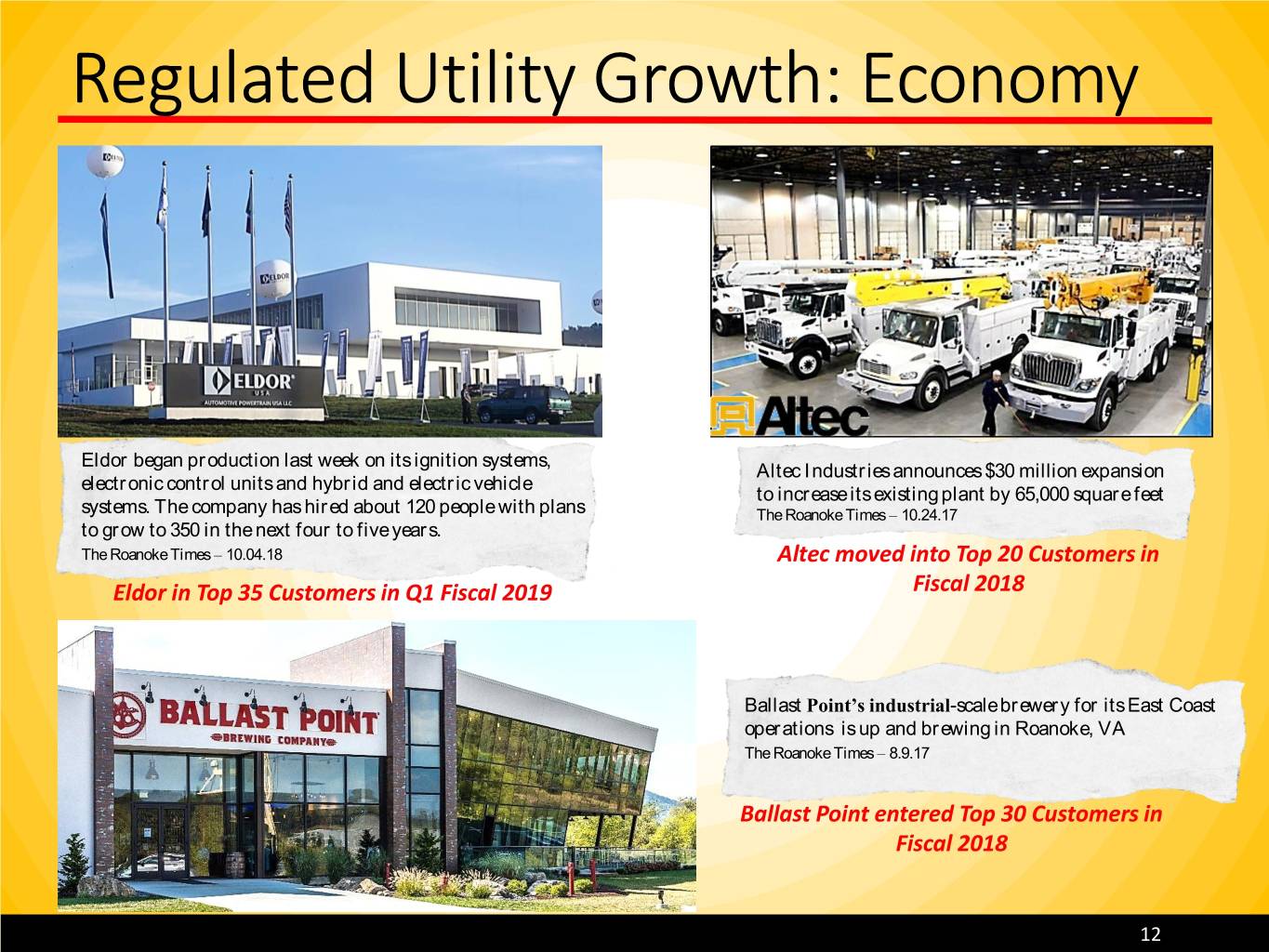

Regulated Utility Growth: Economy Eldor began production last week on its ignition systems, Altec Industries announces $30 million expansion electronic control units and hybrid and electric vehicle to increase its existing plant by 65,000 square feet systems. The company has hired about 120 people with plans The Roanoke Times – 10.24.17 to grow to 350 in the next four to five years. The Roanoke Times – 10.04.18 Altec moved into Top 20 Customers in Eldor in Top 35 Customers in Q1 Fiscal 2019 Fiscal 2018 Ballast Point’s industrial-scale brewery for its East Coast operations is up and brewing in Roanoke, VA The Roanoke Times – 8.9.17 Ballast Point entered Top 30 Customers in Fiscal 2018 12

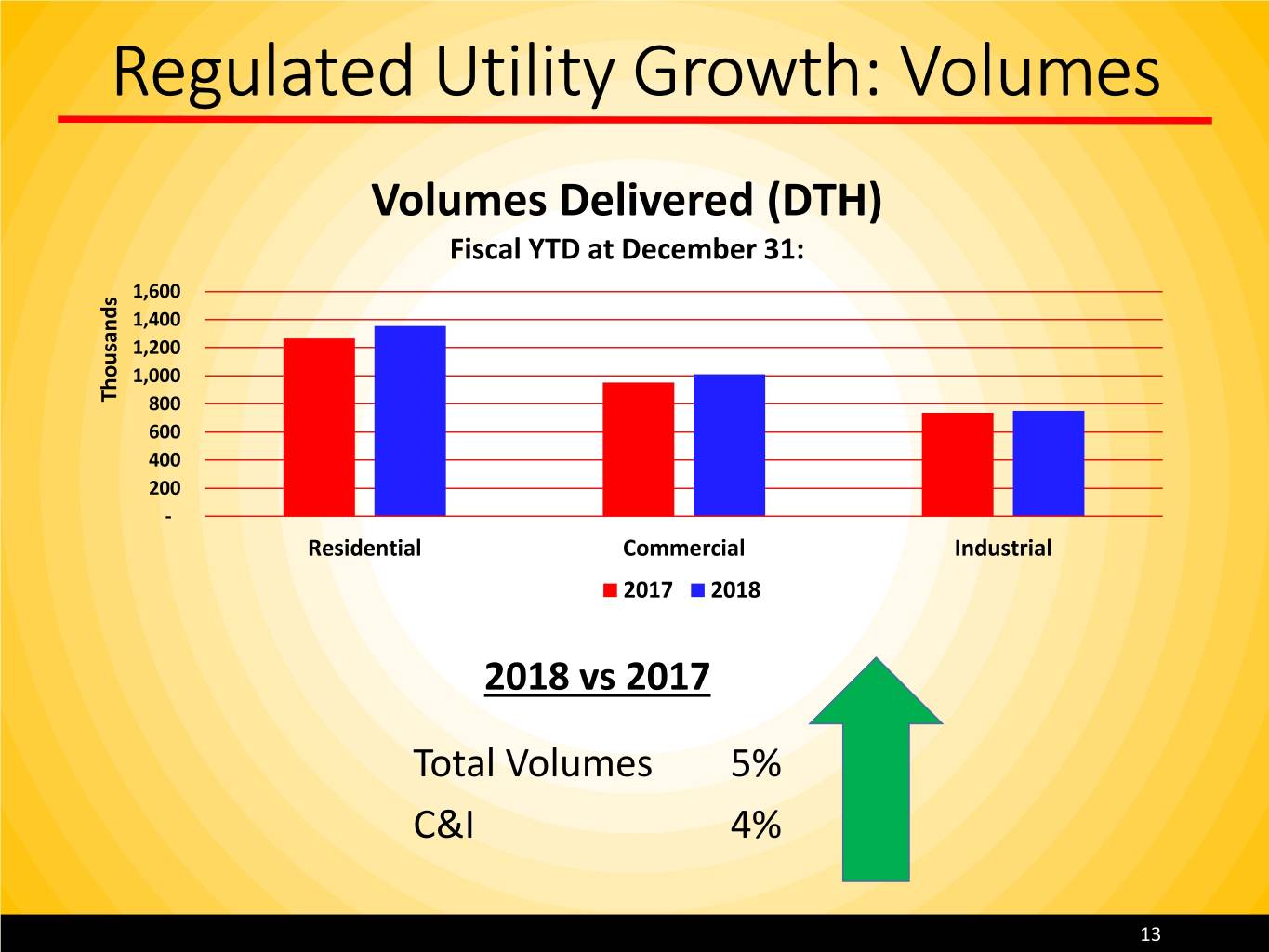

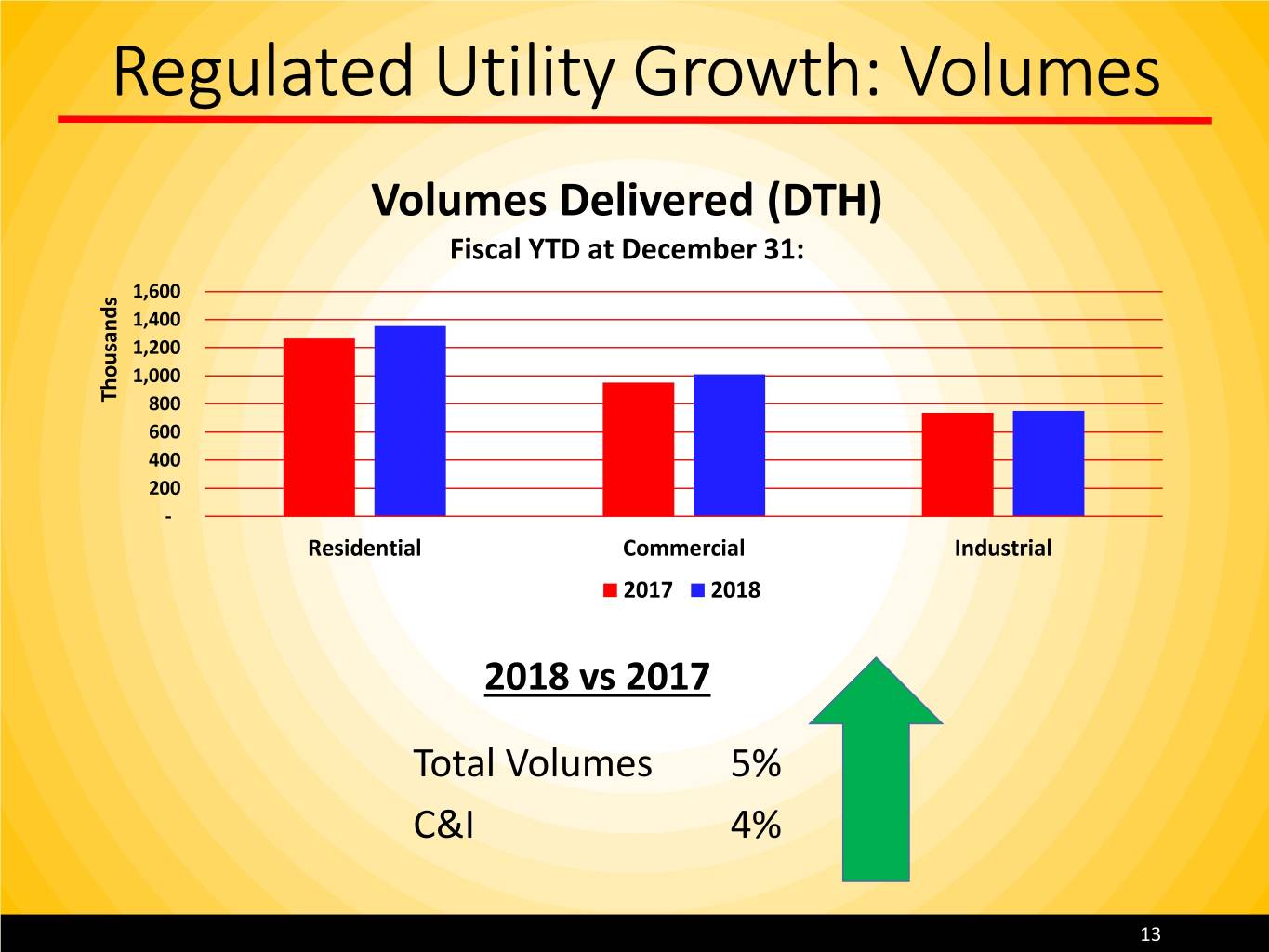

Regulated Utility Growth: Volumes Volumes Delivered (DTH) Fiscal YTD at December 31: 1,600 1,400 1,200 1,000 Thousands 800 600 400 200 - Residential Commercial Industrial 2017 2018 2018 vs 2017 Total Volumes 5% C&I 4% 13

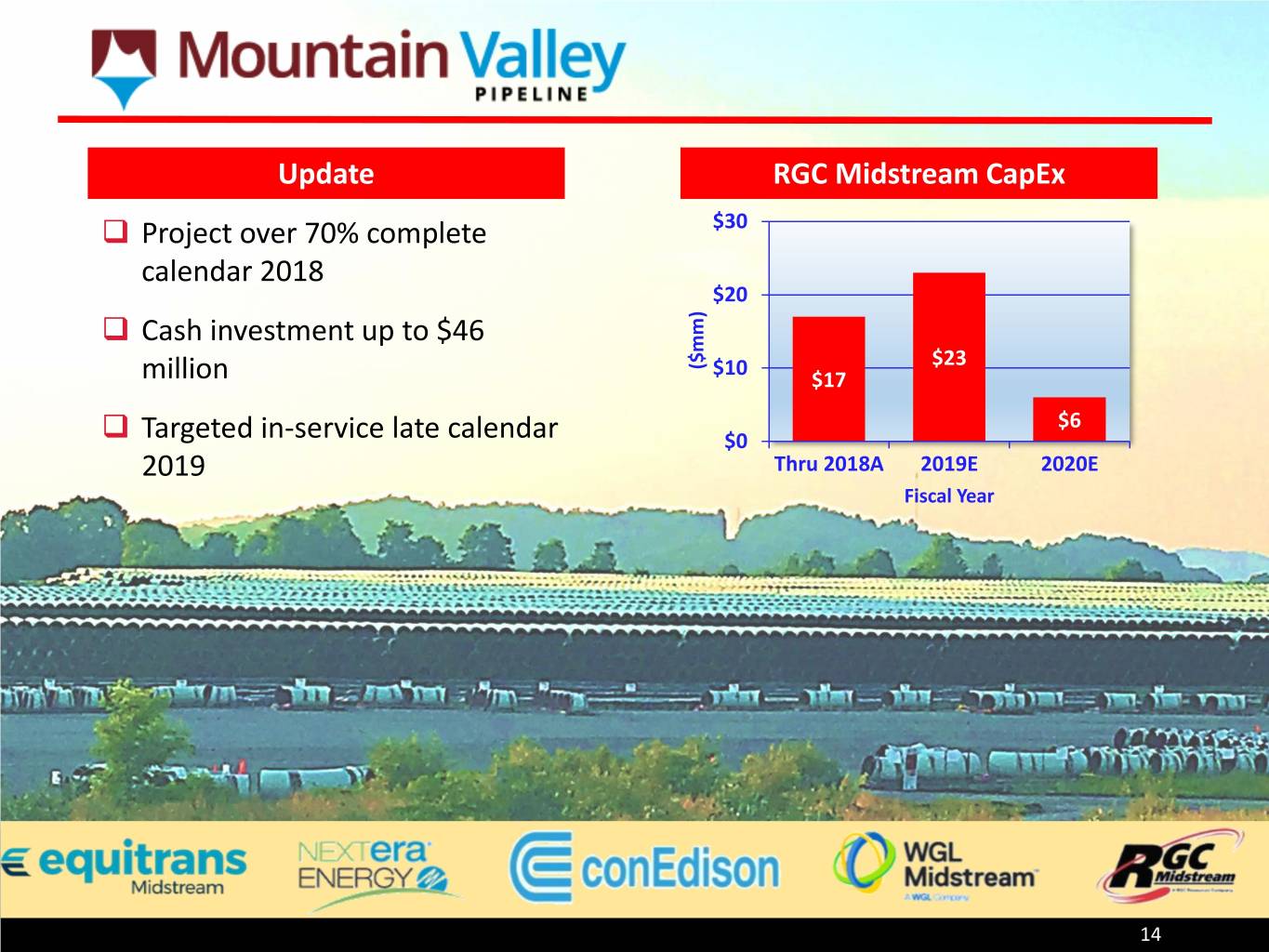

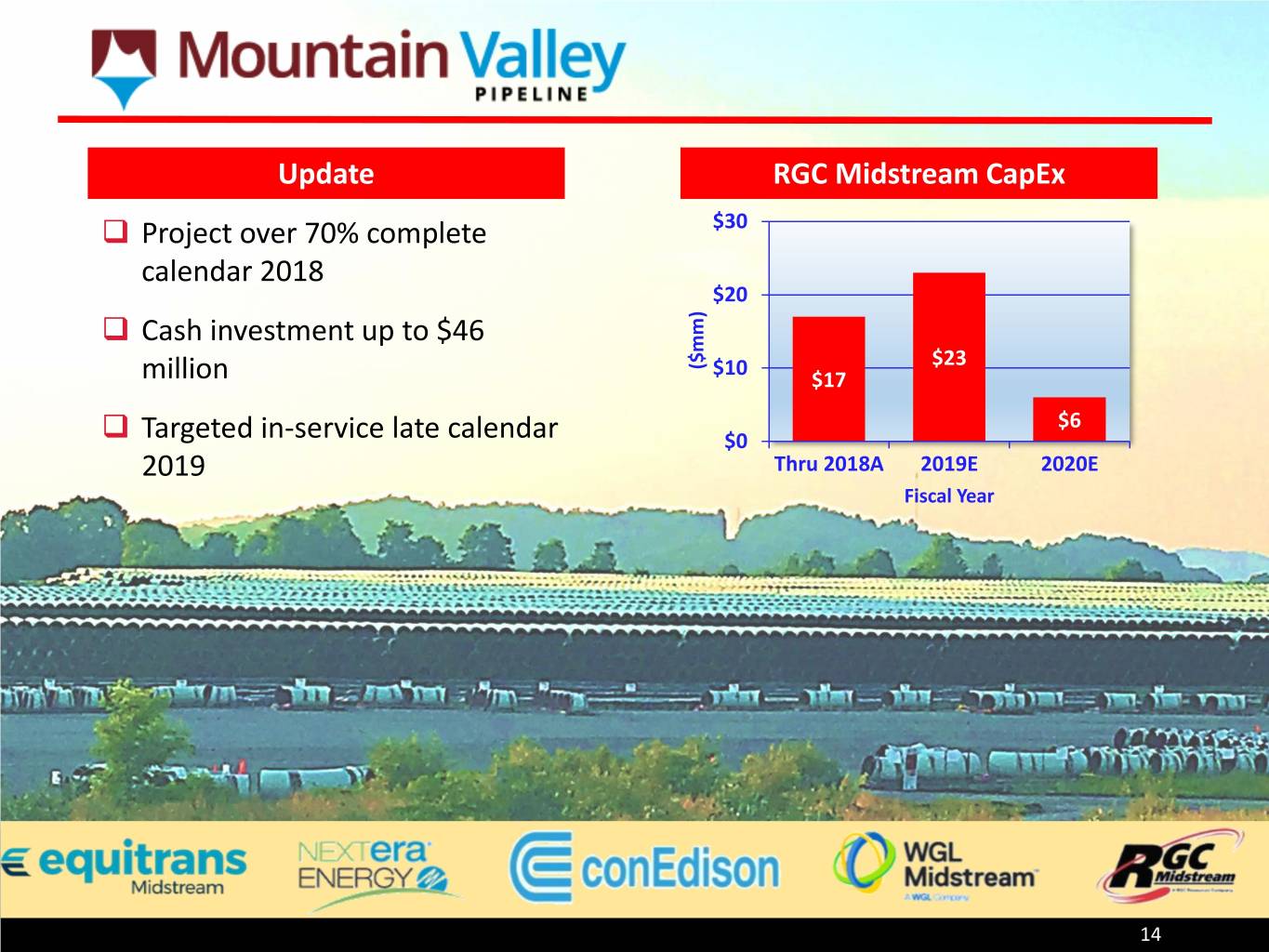

Update RGC Midstream CapEx Project over 70% complete $30 calendar 2018 $20 Cash investment up to $46 ($mm) $10 $23 million $17 $6 Targeted in-service late calendar $0 2019 Thru 2018A 2019E 2020E Fiscal Year 14

Earnings Per Share $1.00 TTM December 31: $0.97 $0.90 Three-months ended $0.85 December 31: $0.80 $0.83 $0.70 $0.72 2018 2017 Basic: $0.30 $0.28 $0.60 $0.63 Diluted: $0.30 $0.28 $0.59 $0.55 $0.50 $0.52 $0.40 2015 2016 2017 2018 Dividends/Share 15

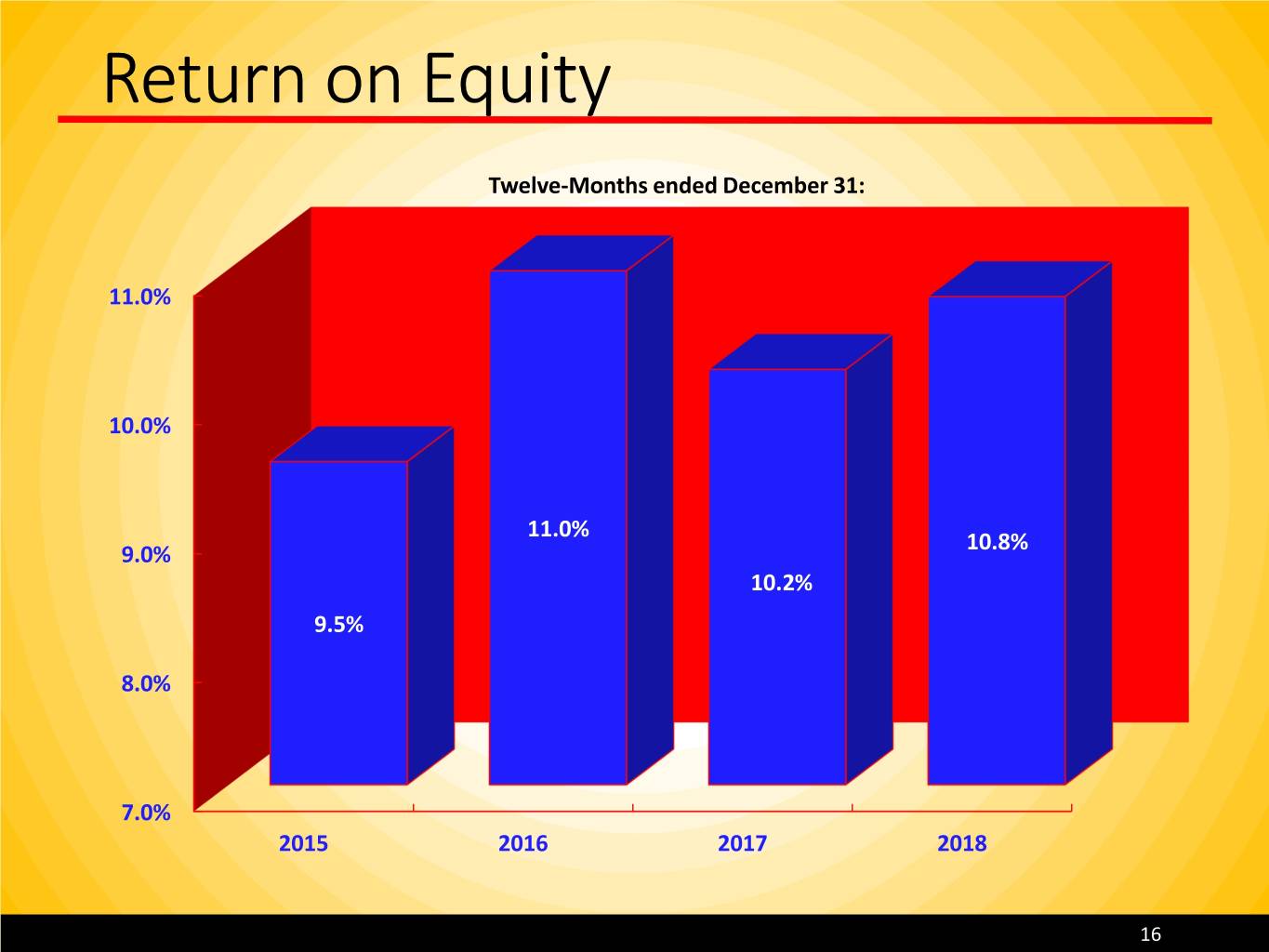

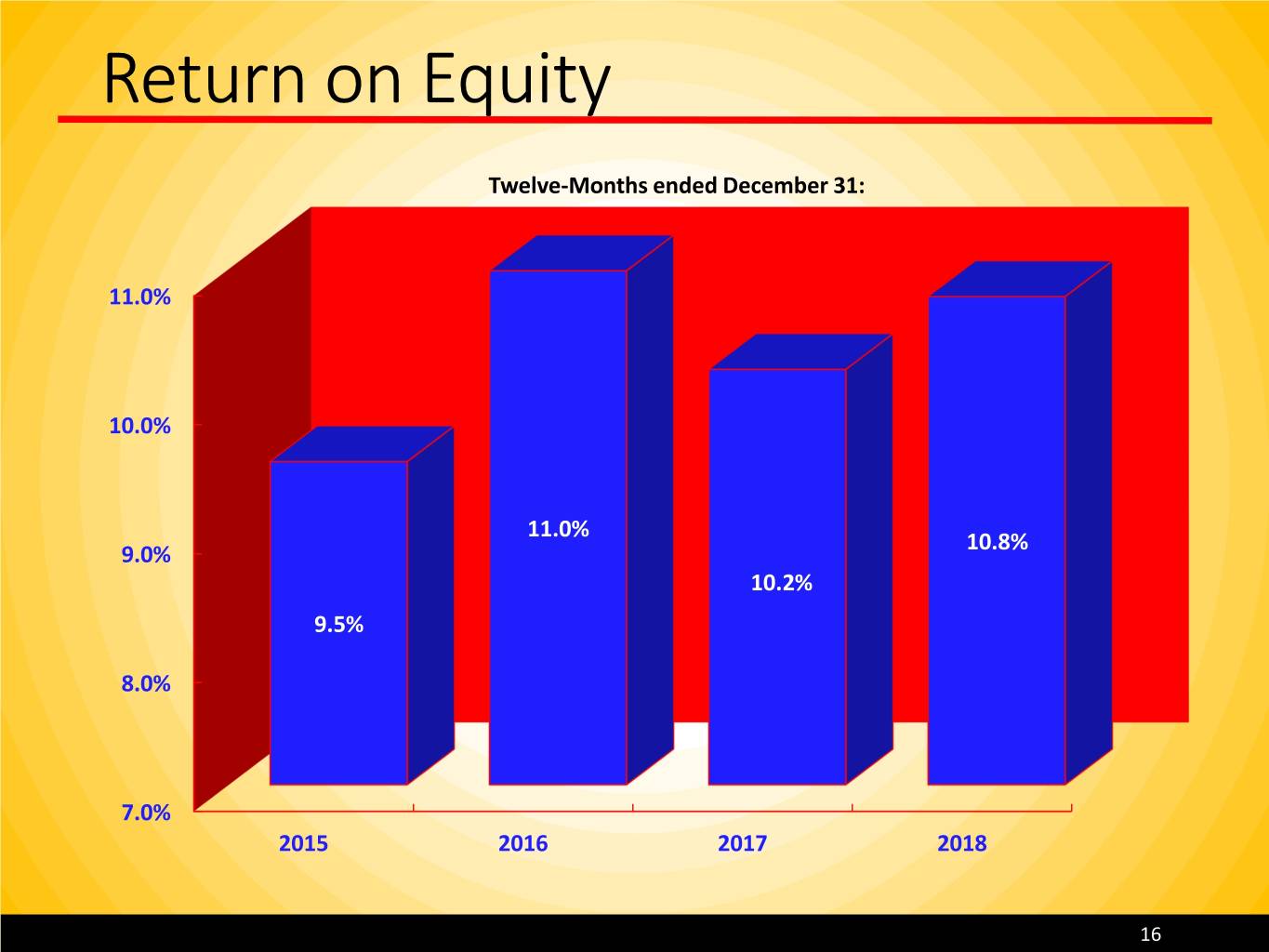

Return on Equity Twelve-Months ended December 31: 11.0% 10.0% 11.0% 10.8% 9.0% 10.2% 9.5% 8.0% 7.0% 2015 2016 2017 2018 16

Outlook Strategic Opportunities CapEx Forecast Rate Case Update Economic Development and System Expansion 17

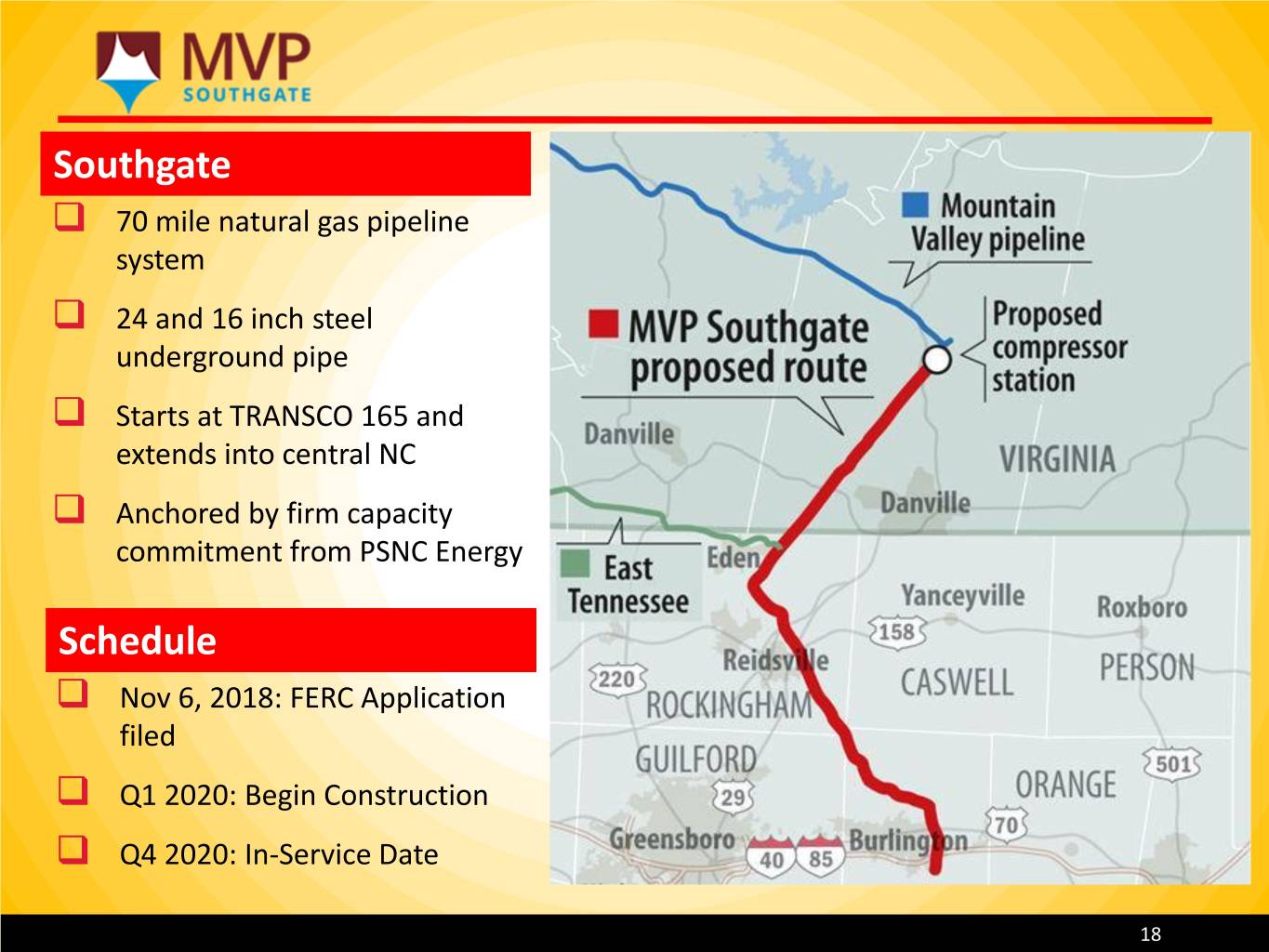

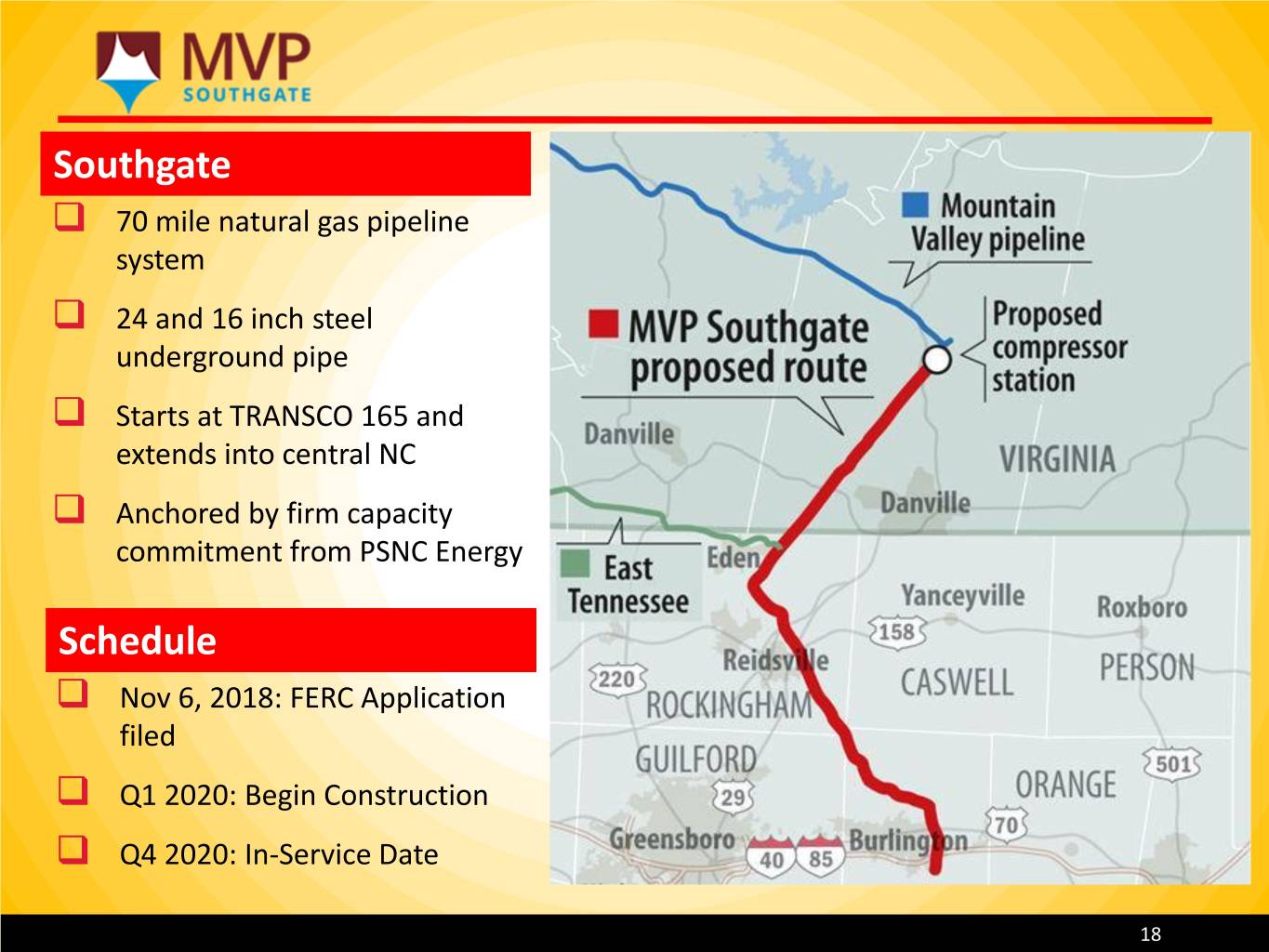

Southgate 70 mile natural gas pipeline system 24 and 16 inch steel underground pipe Starts at TRANSCO 165 and extends into central NC Anchored by firm capacity commitment from PSNC Energy Schedule Nov 6, 2018: FERC Application filed Q1 2020: Begin Construction Q4 2020: In-Service Date 18

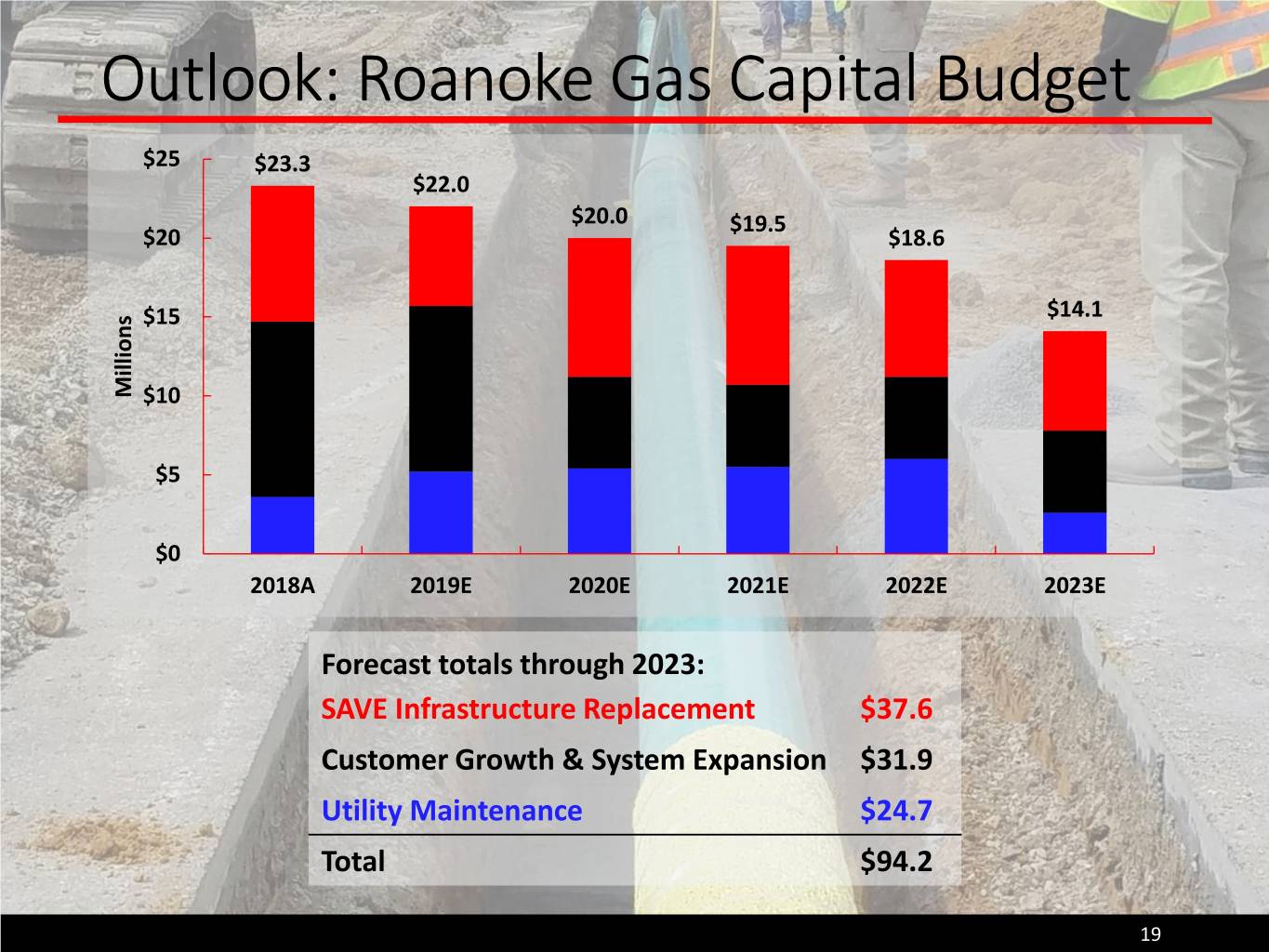

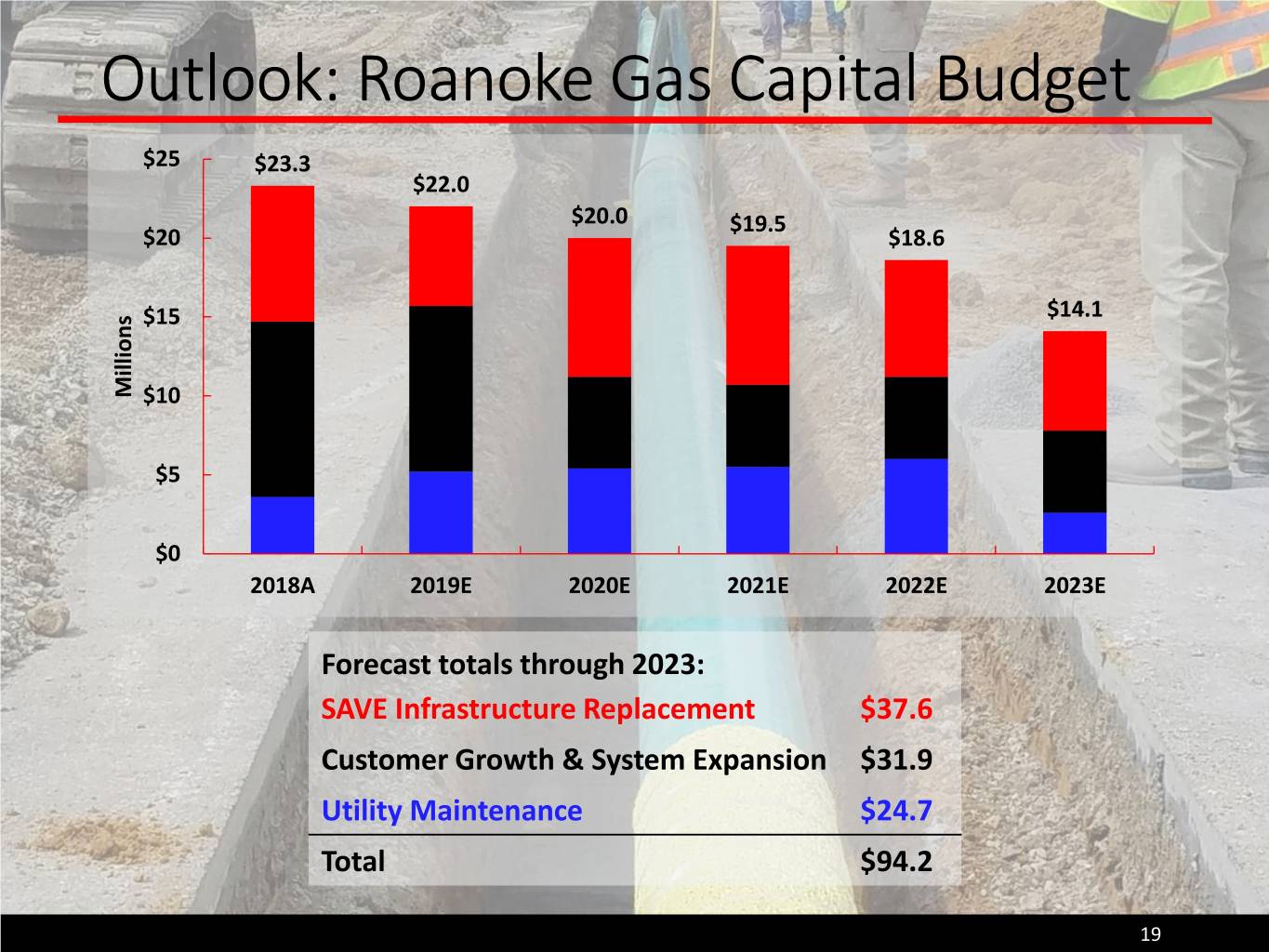

Outlook: Roanoke Gas Capital Budget $25 $23.3 $22.0 $20.0 $19.5 $20 $18.6 $15 $14.1 Millions $10 $5 $0 2018A 2019E 2020E 2021E 2022E 2023E Forecast totals through 2023: SAVE Infrastructure Replacement $37.6 Customer Growth & System Expansion $31.9 Utility Maintenance $24.7 Total $94.2 19

Outlook: Rate Case Filed October 2018 - $10.5 million Prospective rate year calendar 2019 Primary drivers: Incorporate tax reform Recover non-SAVE CapEx investments through 2018 Embed $4.7 million SAVE surcharges into base rates Last rate case 2013 20

Outlook: System Expansion Franklin County Expansion Summit View Business Park 500 acre tract along MVP path RGC interconnect and distribution system under construction Potential to add 1,500 new customers Rate base growth of $10 million MVP Existing Service Territory $1.4 million main extension into City of Roanoke unserved area Approximately 500 Residential and Commercial customers Summit View Business Park Service anticipated in 2020 Rocky Mount Approximately 80% market saturation 21

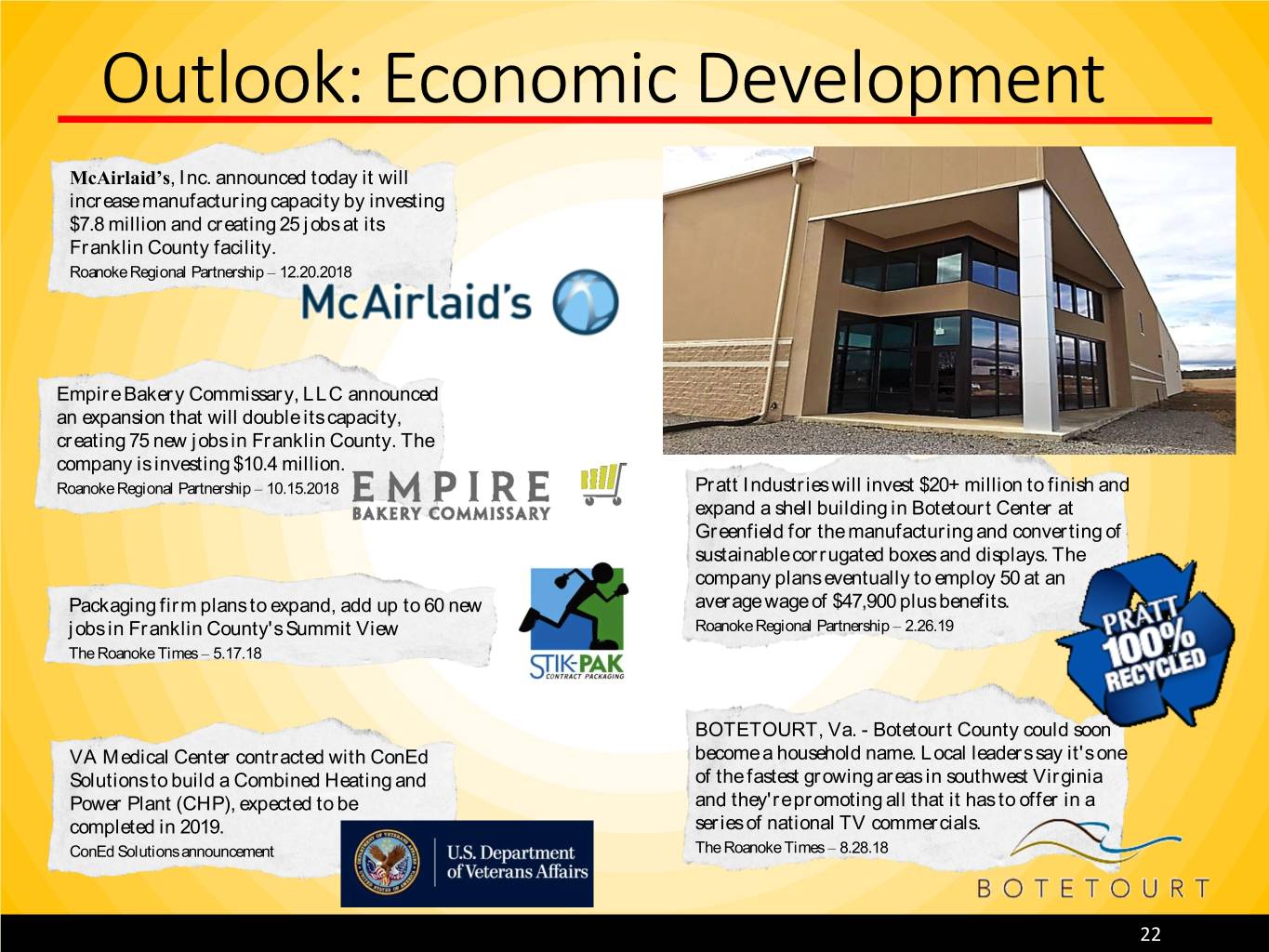

Outlook: Economic Development McAirlaid’s, Inc. announced today it will increase manufacturing capacity by investing $7.8 million and creating 25 jobs at its Franklin County facility. Roanoke Regional Partnership – 12.20.2018 Empire Bakery Commissary, LLC announced an expansion that will double its capacity, creating 75 new jobs in Franklin County. The company is investing $10.4 million. Roanoke Regional Partnership – 10.15.2018 Pratt Industries will invest $20+ million to finish and expand a shell building in Botetourt Center at Greenfield for the manufacturing and converting of sustainable corrugated boxes and displays. The company plans eventually to employ 50 at an Packaging firm plans to expand, add up to 60 new average wage of $47,900 plus benefits. jobs in Franklin County's Summit View Roanoke Regional Partnership – 2.26.19 The Roanoke Times – 5.17.18 BOTETOURT, Va. - Botetourt County could soon VA Medical Center contracted with ConEd become a household name. Local leaders say it's one Solutions to build a Combined Heating and of the fastest growing areas in southwest Virginia Power Plant (CHP), expected to be and they're promoting all that it has to offer in a completed in 2019. series of national TV commercials. ConEd Solutions announcement The Roanoke Times – 8.28.18 22

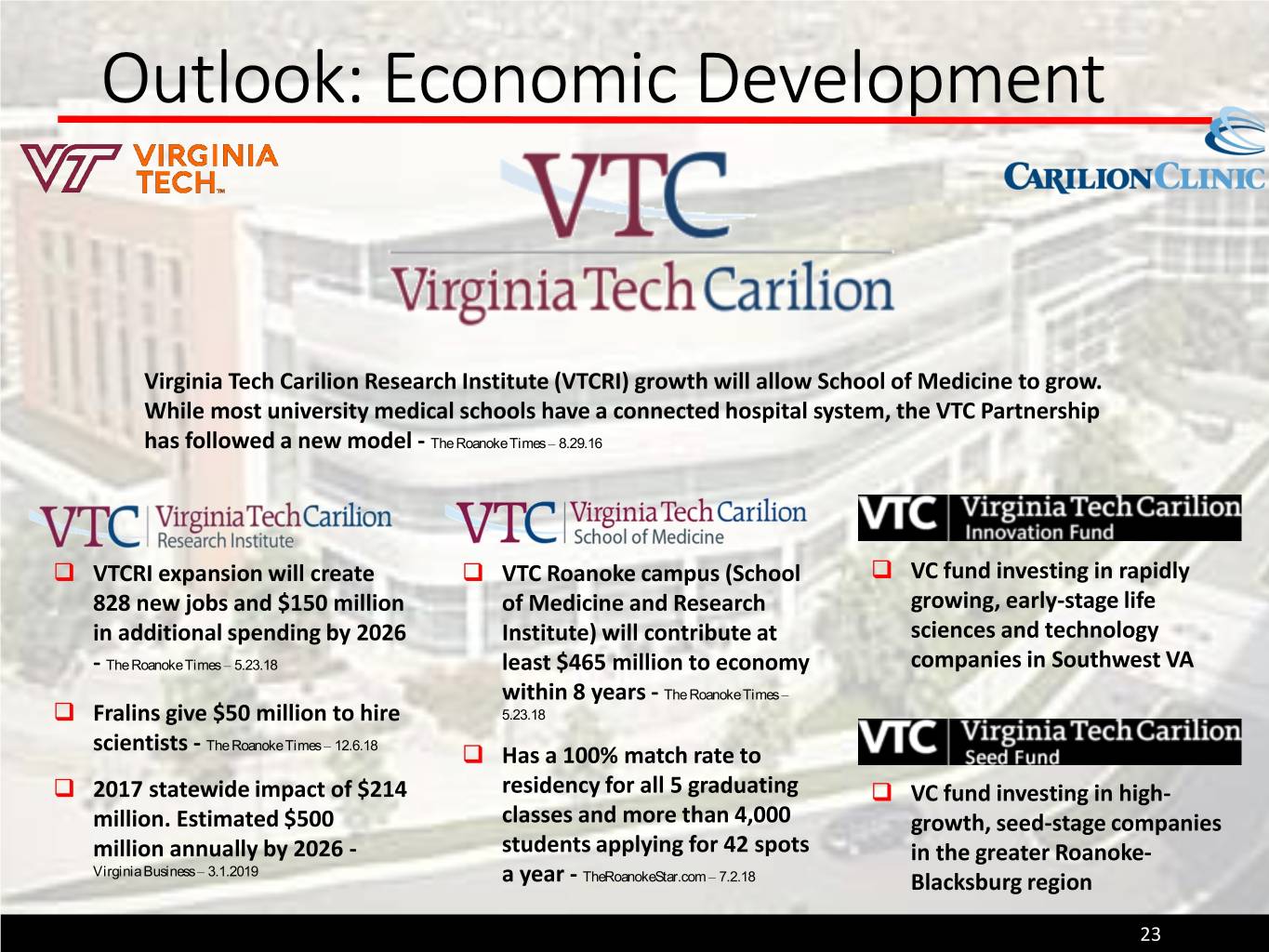

Outlook: Economic Development Virginia Tech Carilion Research Institute (VTCRI) growth will allow School of Medicine to grow. While most university medical schools have a connected hospital system, the VTC Partnership has followed a new model - The Roanoke Times – 8.29.16 VTCRI expansion will create VTC Roanoke campus (School VC fund investing in rapidly 828 new jobs and $150 million of Medicine and Research growing, early-stage life in additional spending by 2026 Institute) will contribute at sciences and technology - The Roanoke Times – 5.23.18 least $465 million to economy companies in Southwest VA within 8 years - The Roanoke Times – Fralins give $50 million to hire 5.23.18 scientists - The Roanoke Times – 12.6.18 Has a 100% match rate to 2017 statewide impact of $214 residency for all 5 graduating VC fund investing in high- million. Estimated $500 classes and more than 4,000 growth, seed-stage companies million annually by 2026 - students applying for 42 spots in the greater Roanoke- Virginia Business – 3.1.2019 a year - TheRoanokeStar.com – 7.2.18 Blacksburg region 23

RGCO Updated through market close, March 1, 2019. 2012 special dividend of $0.67 excluded from graph, but included in total returns. 24 .

EPS Guidance Fiscal Year ended: $1.15 $1.10 $1.11 $1.05 $1.04 $1.00 $0.95 $1.07 $0.90 $1.00 $0.95 $0.85 $0.86 $0.80 2017A 2018A 2019 2020 EPS Range 25

Questions

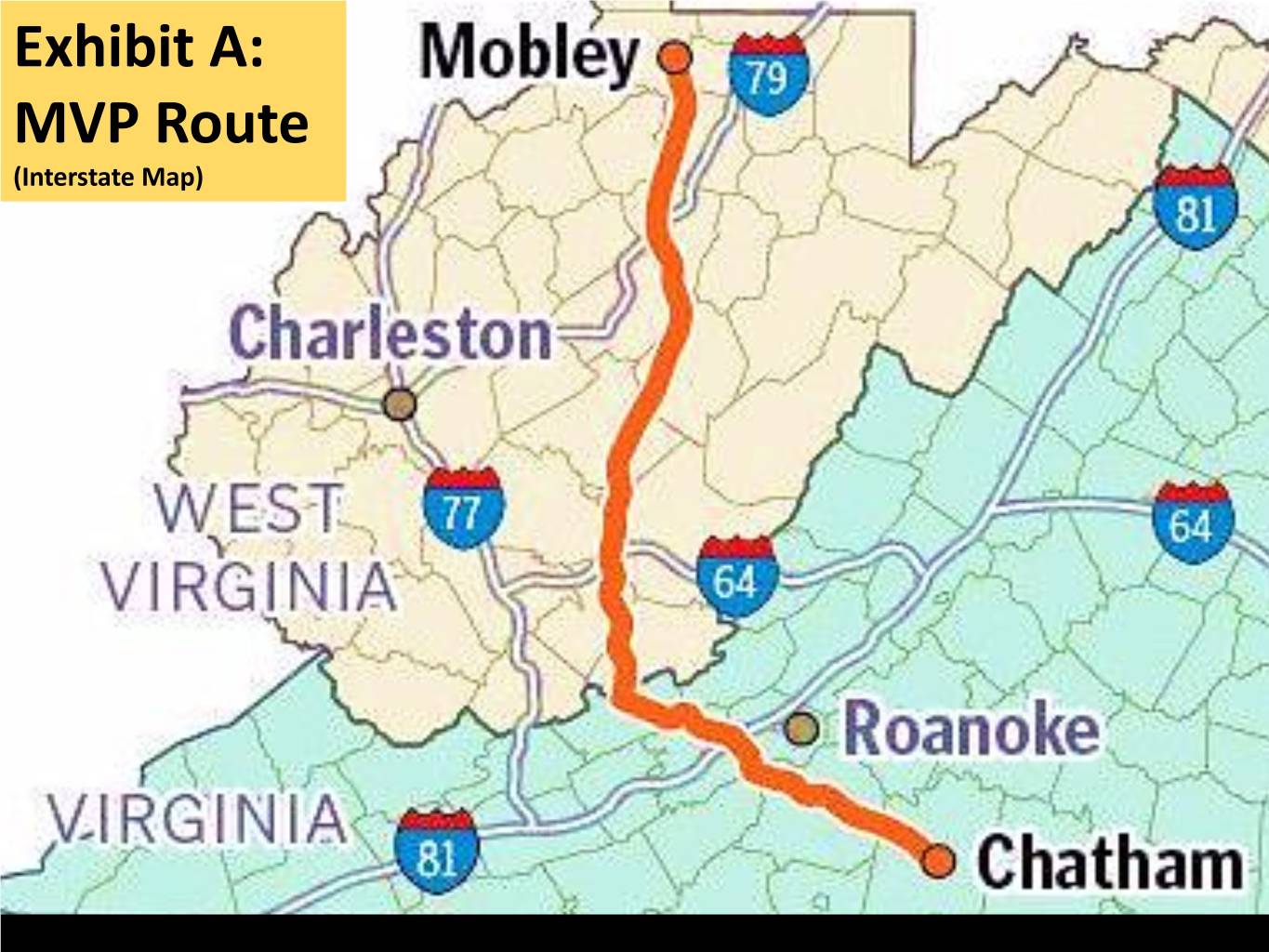

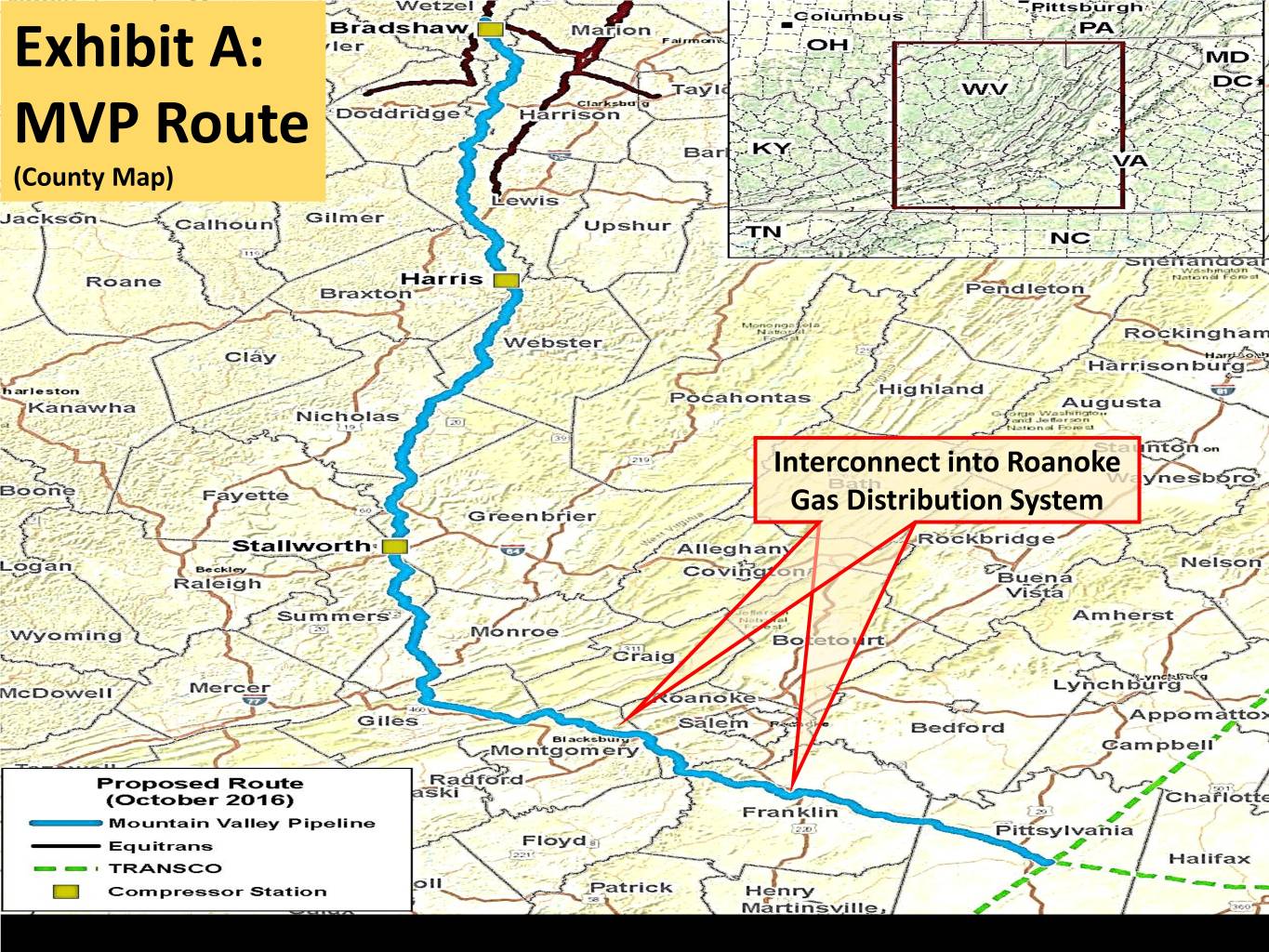

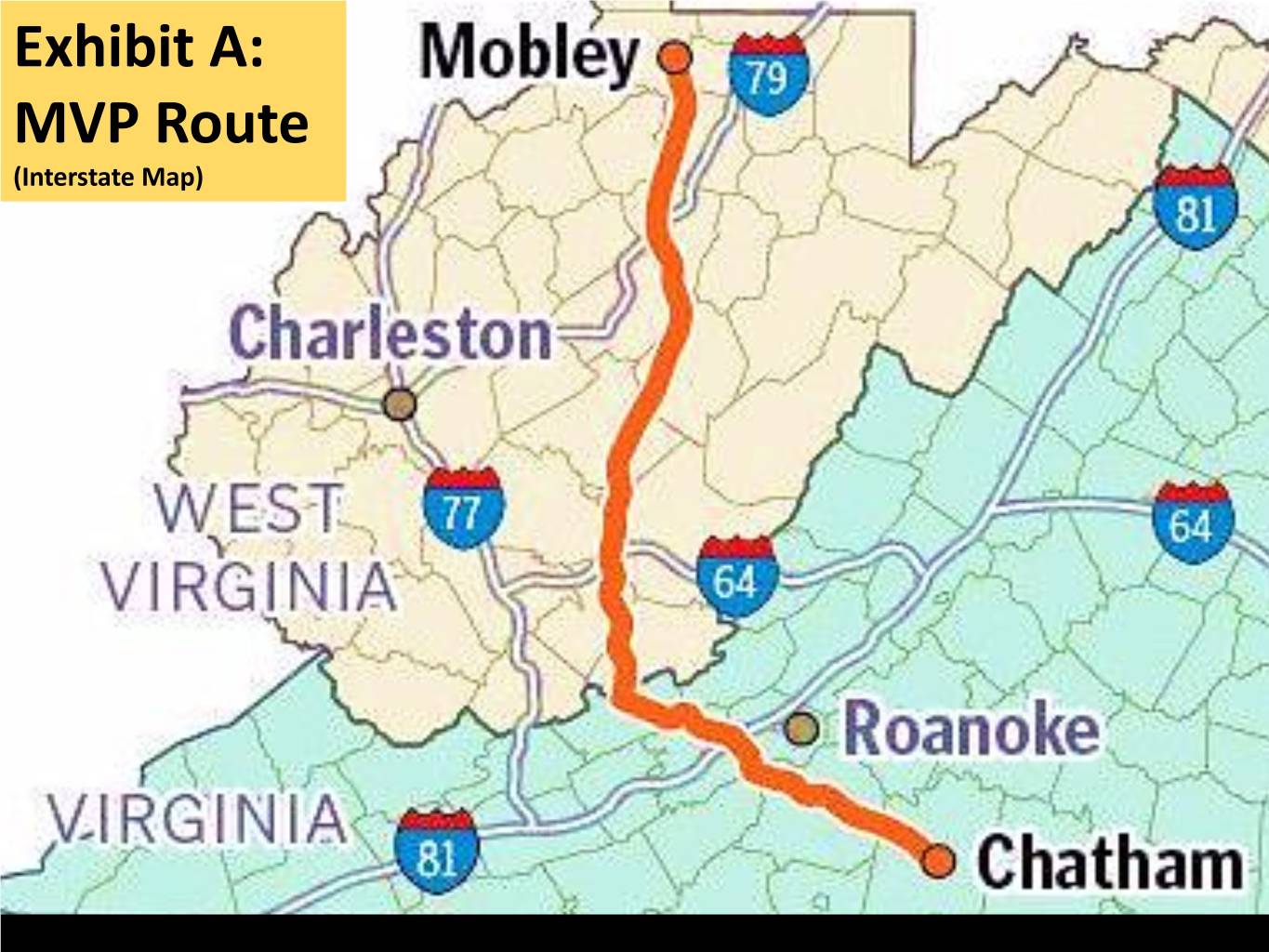

Exhibit A: MVP Route (Interstate Map)

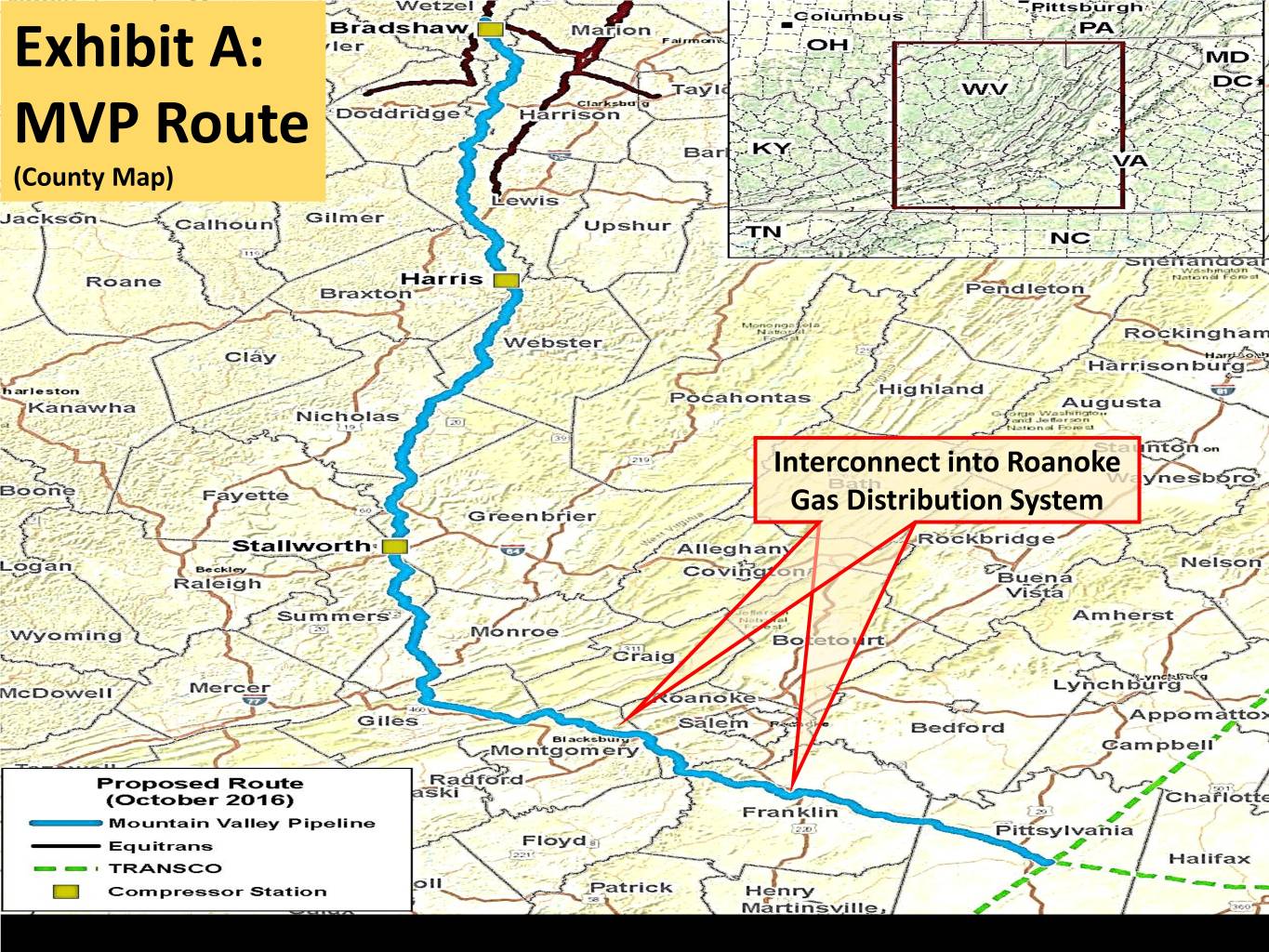

Exhibit A: MVP Route (County Map) Interconnect into Roanoke Gas Distribution System

Exhibit B: Franklin County: Summit Industrial Park