- RGCO Dashboard

- Financials

- Filings

-

Holdings

- Transcripts

- ETFs

- Insider

- Institutional

- Shorts

-

DEF 14A Filing

RGC Resources (RGCO) DEF 14ADefinitive proxy

Filed: 5 Dec 24, 6:45am

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

SCHEDULE 14A INFORMATION

Proxy Statement Pursuant to Section 14(a) of the

Securities Exchange Act of 1934

(Amendment No. )

Filed by the Registrant ☒ Filed by a Party other than the Registrant ☐

Check the appropriate box:

☐ Preliminary Proxy Statement

☐ Confidential, for Use of the Commission Only (as permitted by Rule 14a-6(e)(2))

☒ Definitive Proxy Statement

☐ Definitive Additional Materials

☐ Soliciting Material under Rule 14a-12

RGC RESOURCES, INC.

(Name of registrant as specified in its charter)

Not Applicable

(Name of person(s) filing proxy statement, if other than the registrant)

Payment of Filing Fee (Check all boxes that apply):

☒ | No fee required. |

| |

☐ | Fee paid previously with preliminary materials |

| |

☐ | Fee computed on table in exhibit required by Item 25(b) per Exchange Act Rules 14a-6(i)(1) and 0-11 |

RGC RESOURCES, INC.

519 Kimball Avenue, N.E.

Roanoke, Virginia 24016

NOTICE OF ANNUAL MEETING OF SHAREHOLDERS

TO BE HELD JANUARY 27, 2025

December 6, 2024

NOTICE is hereby given that, pursuant to its Bylaws and call of its Directors, the Annual Meeting of the Shareholders of RGC Resources, Inc. will be held on Monday, January 27, 2025, at 11:30 a.m. The Annual Meeting will be held virtually at www.virtualshareholdermeeting.com/RGCO2025 for the purposes of:

1. | Electing three Class A directors. |

2. | Ratifying the selection of Deloitte & Touche LLP as the independent registered public accounting firm for the year ending September 30, 2025. |

3. | Approving, on an advisory basis, the compensation of our named executive officers. |

4. | Acting on such other business as may properly come before the Annual Meeting. |

Your attention is directed to the Proxy Statement accompanying this Notice for a more complete description regarding matters proposed to be acted upon at the meeting. Only those shareholders of record as of the close of business on November 29, 2024 shall be entitled to vote. If you plan to attend the virtual Annual Meeting, please use the unique identification code provided in your meeting notice materials. This code will allow you to register as a shareholder on our meeting site, access meeting materials, ask questions and vote your shares if you have not previously voted.

YOU MAY VOTE YOUR SHARES AT THE MEETING OR BY THE INTERNET, BY TELEPHONE OR BY PROMPTLY MARKING, DATING, SIGNING AND RETURNING THE ENCLOSED PROXY CARD.

Sincerely, |

|

| John B. Williamson III |

| Chairman |

Important Notice Regarding the Availability of Proxy Materials. This Notice for the Annual Meeting of Shareholders, the attached Proxy Statement and our 2024 Annual Report on Form 10-K are available at www.rgcresources.com/corporate-governance/.

PROXY STATEMENT

ANNUAL MEETING OF SHAREHOLDERS TO BE HELD JANUARY 27, 2025

This Proxy Statement is furnished in connection with the solicitation of proxies to be used at the Annual Meeting of Shareholders of RGC Resources, Inc. ("we", "Resources" or the "Company"). The Annual Meeting will be held virtually on Monday, January 27, 2025, at 11:30 a.m. at the following URL: www.virtualshareholdermeeting.com/RGCO2025 (the “Annual Meeting”).

Record Date and Voting Securities

Notice of the Company's Annual Meeting, this Proxy Statement and the enclosed form of proxy were mailed on or about December 6, 2024 to all shareholders of record. Only shareholders of record at the close of business on November 29, 2024, the record date, are entitled to vote at the Annual Meeting. A list of shareholders entitled to vote at the Annual Meeting will be open to examination by any shareholder, for any purpose relevant to the meeting, during ordinary business hours at the Company’s offices at 519 Kimball Avenue, N.E., Roanoke, Virginia 24016 and online during the Annual Meeting.

As of the record date, 10,263,191 common shares were issued and outstanding. Each common share is entitled to one vote. A majority of the common shares outstanding entitled to vote on the record date, whether present in person or represented by proxy, will constitute a quorum for the transaction of business at the Annual Meeting.

Proxies in the form enclosed herewith are solicited by management at the direction of the Company’s Board of Directors (the "Board").

Voting Procedures

Shareholders of record may vote virtually at the Annual Meeting, online at www.proxyvote.com, by mailing the proxy card or by telephone by calling (800) 690-6903. Votes cast during the Annual Meeting will be verified by an Inspector of Elections, appointed by the Company. All proxy materials are available on the Company's website at www.rgcresources.com or at the virtual meeting site.

If you plan to attend the Annual Meeting, you will be required to register with your unique identification code provided in your meeting notification.

If your shares are held in a brokerage account or by a bank, broker, trustee, or other nominee, you are considered the "beneficial owner" of shares held in "street name". You should have received a voting instruction form with these proxy materials from that organization rather than from the Company. As a beneficial owner, you have the right to direct your broker or other nominee regarding how to vote the shares in your account by following such organization's voting instructions. A “broker non-vote” occurs when a broker or nominee holding shares for a beneficial owner cannot vote shares on a particular proposal because the beneficial owner did not provide voting instructions and the broker or nominee does not have discretionary voting power with respect to that matter (that is, the broker or nominee is not permitted to vote on the matter without shareholder instructions).

Abstentions and broker non-votes are counted as shares present and entitled to vote for the purpose of determining a quorum. Abstentions will be counted towards the vote total for Proposal Nos. 2 and 3 and will have the same effect as AGAINST votes. "Broker non-votes" will not count as votes in favor of or against any of the stated proposals.

If you return a signed and dated proxy card without marking any voting selections or providing different instructions on the proxy card, your shares will be voted at the meeting FOR the election of the three director nominees listed in Proposal No. 1, FOR the ratification of the independent registered public accounting firm in Proposal 2, and FOR the advisory approval of executive compensation in Proposal No. 3. With respect to any other business that may properly come before the Annual Meeting and be submitted to a vote of shareholders, proxies will be voted in accordance with the best judgment of the designated proxy holders. We do not know of any matters to be presented at the Annual Meeting other than those described in this proxy statement.

The director nominees listed in Proposal No. 1 will be elected by a plurality of the votes of the shares present or represented by proxy at the Annual Meeting and entitled to vote on the election of directors. The three nominees receiving the most FOR votes will be elected. The proxy being provided enables a shareholder to vote FOR the election of the nominees proposed by the Board, or to “withhold” authority to vote for one or more of the nominees proposed. Brokers may vote shares on this proposal only if they have received voting instructions from the beneficial owners of the shares. Only shares that are voted in favor of a nominee will be counted towards that nominee’s achievement of a plurality. Accordingly, “withhold” votes and “broker non-votes” will not have any effect on determining the outcome of this proposal.

The appointment of our independent registered public accounting firm listed in Proposal No. 2 will be ratified if a majority of shares present or represented by proxy at the Annual Meeting and entitled to vote thereon vote FOR such proposal. Brokers may vote shares in their discretion on this proposal if they have not received voting instructions from the beneficial owners of the shares. Abstentions will have the same effect generally as a vote AGAINST this proposal.

Proposal No. 3, advisory approval of the compensation of the Company’s named executive officers, will be considered to be approved if it receives FOR votes from the holders of a majority of shares either present or represented by proxy and entitled to vote. Brokers may vote shares on this proposal only if they have received voting instructions from the beneficial owners of the shares. “Broker non-votes” will not have any effect on determining the outcome of this proposal. Abstentions will have the same effect generally as a vote AGAINST this proposal.

Revoking a Proxy

You may revoke your proxy at any time before voting is declared closed at the Annual Meeting by: (i) voting during the Annual Meeting; (ii) executing and delivering a subsequent proxy; (iii) submitting another time and later dated proxy by telephone or the internet or (iv) delivering a written statement to the Corporate Secretary revoking the proxy. Attending the Annual Meeting will not in and of itself revoke a proxy.

Remainder of page intentionally left blank

PROPOSAL 1: ELECTION OF DIRECTORS OF RESOURCES

The Company’s Board of Directors consists of ten members and is divided into three classes (A, B, and C) with staggered three-year terms. The current term of office of the Class A directors expires at the 2025 Annual Meeting. The terms of Class B and C directors expire in 2026 and 2027, respectively. Each of the Company’s current directors and nominees for election are independent directors, as determined under the Company’s independence standards adopted in accordance with the applicable rules of the Securities and Exchange Commission (the “SEC”) and Nasdaq, except Paul W. Nester.

There are three nominees for Class A directors: Abney S. Boxley III, Elizabeth A. McClanahan and John B. Williamson III. The Governance and Nominating Committee and the Board of Directors have selected and endorsed each of these candidates because each brings unique talents and business experience to the Board.

Abney S. Boxley III is President of Boxley Family, LLC, a construction materials company, since 2021 and has been a director of the Company since 1994. From 2018 to 2021, Mr. Boxley was Executive Vice President, Summit Materials, an SEC-registered manufacturer and distributor of construction materials and aggregate, and formerly President and CEO of Boxley Materials Company, a position in which he served from 1988 to 2018. He also serves on the board of directors of Pinnacle Financial Partners, Inc., an SEC-registered public bank holding company, Insteel Industries, Inc., an SEC-registered manufacturer of steel wire reinforcing products, and Carilion Clinic, a local health-care organization. He holds an MBA degree from the University of Virginia Darden School.

We believe that Mr. Boxley’s public company board experience, deep understanding of mergers, acquisitions, and business development, his knowledge of local construction and economic development opportunities in the Company’s service area, and extensive experience on our Board as well as his leadership as chair of the Audit Committee make him a valuable member of our Board.

Elizabeth A. McClanahan is the CEO of the Virginia Tech Foundation, which manages the university’s endowment and an extensive real estate portfolio, since 2021 and has been a director of the Company since 2022. She also serves as the President of the Virginia Tech Corporate Research Center, which fosters partnerships between the business and research communities to maximize the human and economic impact of scientific research. Ms. McClanahan was President, Dean, and Street Distinguished Professor at Appalachian School of Law from 2019 to 2021. Prior to the Appalachian School of Law, Ms. McClanahan served on the Court of Appeals of Virginia and the Supreme Court of Virginia for a combined 16 years. Ms. McClanahan also served as the Chief Deputy Attorney General for Virginia. Ms. McClanahan began her legal career in the private sector representing energy companies and was a nationally recognized expert in coalbed methane development. Ms. McClanahan was admitted to six state bars and earned a Martindale-Hubbell AV Rating.

Ms. McClanahan serves on the board of Carilion Clinic, the Edward Via College of Osteopathic Medicine, Corvesta Inc., and has served as Chair of the State Council of Higher Education for Virginia. Ms. McClanahan has served as Vice Rector of the College of William and Mary. Ms. McClanahan earned her bachelor’s degree from the College of William and Mary and her law degree from the University of Dayton School of Law.

We believe Ms. McClanahan’s legal and academic experiences, including extensive experience making measured and sound judgments as a justice, as well as her extensive knowledge of the energy industry make her a valuable member of our Board.

John B. Williamson III currently serves as Chairman of the Board, a role he has held since 2003. Mr. Williamson formerly served as the Company’s President and Chief Executive Officer from 1998 to 2014, was involved in the executive management of the Company beginning in 1992, and has served on the Board since 1998. Mr. Williamson holds an MBA from the College of William and Mary. Mr. Williamson is a member of the board of directors of the Bank of Botetourt, a non-registered publicly traded bank and former board member of four SEC-registered companies.

We believe that Mr. Williamson’s utility industry experience, understanding of the changing natural gas business and in-depth knowledge of the operational, financial and regulatory aspects of the Company provide the management team valuable strategic and operating expertise, and along with his public company board experience in corporate governance, strategic planning and compliance, make him a valuable member of our Board.

Your Board of Directors recommends a vote FOR each nominee for Class A Director.

PROPOSAL 2: RATIFICATION OF DELOITTE &TOUCHE LLP, AS THE

INDEPENDENT REGISTERED PUBLIC ACCOUNTING FIRM FOR THE FISCAL YEAR

ENDING SEPTEMBER 30, 2025

The Audit Committee approved Deloitte& Touche LLP (“Deloitte”) as the independent registered public accounting firm to audit the consolidated financial statements of the Company for the year ending September 30, 2024. The Audit Committee has reappointed Deloitte as the independent registered public accounting firm to audit our consolidated financial statements as of and for the fiscal year ending September 30, 2025. A representative of Deloitte is expected to be present at the Annual Meeting, and will have a chance to speak or respond to appropriate questions.

The Company’s Audit Committee is solely responsible for selecting the Company’s independent registered public accounting firm for the fiscal year ending September 30, 2025. Although shareholder ratification of the appointment of Deloitte is not required by the Company's bylaws, the Board of Directors believes that it is desirable to do so. If the shareholders do not ratify the appointment of Deloitte, the Audit Committee will consider whether to engage another independent registered public accounting firm. If the appointment of Deloitte is ratified by shareholders, the Audit Committee may change the appointment at any time if it determines a change would be in the best interest of the Company and its shareholders.

Your Board of Directors recommends a vote FOR the ratification of Deloitte as the Company's independent registered public accounting firm for the fiscal year ending September 30, 2025.

PROPOSAL 3: NON-BINDING SHAREHOLDER ADVISORY VOTE TO

APPROVE EXECUTIVE COMPENSATION

Our shareholders voted to review executive compensation annually. We believe that our executive compensation program is competitive within the industry and strongly aligned with the long-term interests of our shareholders. This program has been designed to promote a performance-based culture and ensure a philosophy of long-term value creation by aligning the interests of the executive officers with those of our shareholders by linking a meaningful portion of their compensation to the Company’s performance. The program is also designed to meet short-term objectives and to attract and retain highly-talented executive officers who are charged with the successful execution of the Company’s strategic business plan.

We also believe that both the Company and shareholders benefit from constructive and consistent dialogue. The proposal set forth above is intended to give you the opportunity to endorse or not endorse the compensation we paid to our named executive officers for fiscal 2024 and the proposed compensation for fiscal 2025.

The Compensation Committee has overseen the development of the executive compensation program, as described more fully in the Compensation Discussion and Analysis section of this Proxy Statement.

Please note that your vote is advisory and will not be binding upon the Company or the Board of Directors. However, the Board of Directors and Compensation Committee value the opinions that our shareholders express in their votes and in any additional dialogue. Consequently, the Compensation Committee intends to take into account the outcome of the vote when considering future executive compensation decisions for our executive officers.

Your Board of Directors recommends a vote FOR approval, on an advisory basis, of the named executive officers compensation as disclosed in this proxy statement.

BOARD OF DIRECTORS AND COMMITTEES OF THE BOARD OF DIRECTORS

The Company’s Board of Directors consists of ten directors and is divided into three classes, with staggered three-year terms. The Board has separate persons serving as its Chair and as the President and CEO of the Company. The Board believes this is the appropriate leadership structure at this time. The Board met nine times during the 2024 fiscal year. All Board members attended at least 75 percent of Board and committee meetings in fiscal year 2024. Consistent with Nasdaq rules, a majority of the Company’s non-management directors met at least once each quarter without management present. All directors serving on the Board attended the 2024 Annual Meeting. The present principal occupation and employment during the past five years, and the office held with the Company, if any, of each director:

Name and Age | Year In Which | Business Experience |

CLASS A DIRECTORS (Serving until the 2025 Annual Meeting) | ||

Abney S. Boxley III Age 66

| 1994 | See disclosure in Proposal No. 1 above.

|

Elizabeth A. McClanahan Age 65

| 2022 | See disclosure in Proposal No. 1 above.

|

John B. Williamson III Age 70

| 1998 | See disclosure in Proposal No. 1 above.

|

| CLASS B DIRECTORS (Serving until the 2026 Annual Meeting) | ||

Nancy Howell Agee Age 72

| 2005 | CEO Emeritus & Director, Carilion Clinic since 2024; CEO & Director, Carilion Clinic 2023-2024; President, CEO & Director, Carilion Clinic 2012-2023; President and COO, Carilion Clinic 2010-2011; COO & Executive Vice President, Carilion Clinic 2007-2010; Director, Healthcare Realty Trust Inc.; Director, Atlantic Union Bankshares; Chair, GO Virginia; Director, Mytonomy; Chair, VFIC; Vice Chair, VBHEC; Past chair, American Hospital Association; Chair, Virginia Business Council. As former CEO of the largest employer in the Company’s service area, her active leadership and participation in the community, her public company board experience, and her leadership as Chair of the Compensation Committee make Mrs. Agee a valuable member of our Board.

|

| Jacqueline L. Archer Age 62 | 2020 | President, CEO and Director, Blue Ridge Beverage Company, Inc. since 2023; President, COO and Director, Blue Ridge Beverage Company, Inc. 2017–2023; Executive Vice President, CFO, and Director, Blue Ridge Beverage Company, Inc. 2004-2017; Director and Executive Committee Member, Virginia Tech Foundation; Past Chair, Constellation Brands National Distributor Council; Director, Treasurer and Past Chair, Virginia Beer Wholesalers Association. Ms. Archer’s executive experience leading a large, regional business, her previous investment banking experience, and her extensive community involvement make her a valuable member of our Board.

|

Name and Age | Year In Which | Business Experience |

CLASS B DIRECTORS (Serving until the 2026 Annual Meeting) | ||

Robert B. Johnston Age 59

| 2022 | Chief Strategy Officer and Executive Vice President, The InterTech Group, Inc. since 2008; Chair, Supremex, Inc.; Director, Swiss Water Decaffeinated, Inc.; Director, FIH Group PLC; Director, Colabor Group. Mr. Johnston’s experiences as a former CEO of a large corporation, an experienced director of publicly traded companies, including natural gas utilities, as well as his merger and acquisition expertise, make him a valuable member of our Board.

|

J. Allen Layman Age 72

| 1991 | Private Investor. A 30-year career in the telecommunication industry during which he served as President & CEO of R&B Communications and Chairman and President of Ntelos, Inc. Mr. Layman’s experience leading a utility as CEO and his in-depth knowledge of the regulatory environment make him a valuable member of our Board.

|

CLASS C DIRECTORS (Serving until the 2027 Annual Meeting) | ||

T. Joe Crawford Age 69

| 2018 | Retired Vice President and General Manager, Steel Dynamics Roanoke Bar Division 2006-2019; President and Chief Operating Officer, Roanoke Electric Steel Corporation 2004-2006. Mr. Crawford’s professional and community board experience make him a valuable member of our Board.

|

Maryellen F. Goodlatte Age 72

| 2001 | Retired Attorney, Glenn Feldman Darby and Goodlatte 1983-2023. Mrs. Goodlatte’s experience as an attorney in the Company’s service area, in addition to her leadership as chair of the Governance and Nominating Committee, make her a valuable member of our Board. |

Paul W. Nester Age 50

| 2020 | President, CEO and Director, Resources and Roanoke Gas Company since 2020. President, Roanoke Gas Company 2019-2020; Vice-President, Treasurer, and CFO, Resources and Roanoke Gas Company 2012-2019. Mr. Nester provides the Board with in-depth knowledge of the utility industry, the Company’s operations, business strategy, risks and the region’s economic climate.

|

Remainder of page intentionally left blank

The Board has standing Compensation, Audit, and Governance and Nominating committees. The Board has affirmatively determined that the Company’s current directors are considered independent directors in respect to each committee on which he or she serves, as determined under the Company’s independence standards adopted in accordance with the applicable rules of the SEC and Nasdaq. In addition, the Board has determined that Abney S. Boxley III and Jacqueline L. Archer are audit committee financial experts under applicable SEC rules. The following table summarizes each committee.

Committee | Members | Responsibilities | Independence |

Compensation | Nancy Howell Agee, Chair | Assists the Board in fulfilling its responsibility for the oversight of the compensation programs for the Company's directors and executive officers. Reviews with management the Compensation, Discussion and Analysis disclosures and succession plans for executive officers. | Each Member is Independent |

Audit | Abney S. Boxley III, Chair | Assesses the integrity of our financial statements, and reviews the Company’s identified risks, policies for its risk assessment, including cybersecurity, and steps management has taken to control significant risks, except those delegated by the Board to other committees. Includes appointment, compensation (including advance approval of audit fees), retention and oversight of the independent registered public accounting firm, assessment of external audits, as well as overall compliance with legal and regulatory requirements. | Each Member is Independent |

Governance | Maryellen F. Goodlatte, Chair Robert B. Johnston | Responsible for the oversight of a broad range of issues surrounding the composition and operation of the Board, including identifying individuals qualified to become Board members, recommending nominees for Board election and recommending governance principles to the Board. It also provides assistance to the Board in the areas of committee member selection and rotation practices, evaluation of the overall effectiveness of the Board and consideration of developments in corporate governance practices. The Committee also has oversight of ESG initiatives. | Each Member is Independent |

Each charter of the Audit Committee, the Compensation Committee, and the Governance and Nominating Committee is available on the Company’s website at www.rgcresources.com/corporate-governance/.

The Board's Role in Risk Oversight

The Board and management have distinct roles in the identification, assessment and management of risks that could affect the Company. The Board exercises its responsibility for risk directly and through its three standing committees. In Board or committee meetings, management updates members on risk assessment and mitigation strategies. Each committee charged with risk oversight reports to the Board on those matters.

Management provides regular updates to both the Audit Committee and the Board regarding cybersecurity and other related information technology matters. These updates include, but are not limited to, reviews of technology infrastructure changes, incident response plans, network and system testing, employee training programs and pertinent insurance programs.

The Board believes that its current leadership structure facilitates its oversight of risk by combining independent leadership, through independent board committees and majority independent board composition, with an experienced Chairman and a CEO who have intimate knowledge of the business, history, and the complex challenges the Company faces. The Chairman and CEO both have in-depth understanding of these matters and the CEO has direct involvement in the day-to-day management of the Company, uniquely positioning him to promptly identify and raise key business risks to the Board.

Board Diversity

Nasdaq’s Board Diversity Rule, which was approved by the SEC in 2021, is a disclosure standard designed to encourage board diversity for companies and provide stakeholders with a consistent, comparable disclosure concerning a company’s current board composition. Resources’ exceeds the diversity objective by virtue of having four female directors.

Board Diversity Matrix

Total Number of Directors | 10 | |||

Part I: Gender Identity | Female | Male | Non- | Did Not Disclose Gender |

Directors | 4 | 6 | ||

Part II: Demographic Background | ||||

African American or Black | ||||

Alaskan Native or American Indian | ||||

Asian | ||||

Hispanic or Latinx | ||||

Native Hawaiian or Pacific Islander | ||||

White | 4 | 6 | ||

Two or More Races or Ethnicities | ||||

LGBTQ+ | ||||

Did Not Disclose Demographic Background | ||||

Environmental, Social, and Governance

The Governance and Nominating Committee has oversight of the Company’s Environmental, Social, and Governance (“ESG”) matters. Management reports regularly to the Governance and Nominating Committee on these matters.

The Company continues to execute on its commitment to safety, superior customer service, community involvement, environmental stewardship and corporate sustainability. The Company routinely monitors technological advances and customer preferences which inform our operational decision-making and business strategies around our ESG initiatives. The Company is reducing emissions and improving safety and reliability through ongoing investments in the renewal of pipeline and other gas delivery equipment as well as enhanced leak detection technology. The Company’s renewable natural gas facility, constructed in partnership with the Western Virginia Water Authority, was placed into service in March 2023 and has reduced air emissions in the Roanoke area. In addition, as a testament to our commitment to environmental stewardship, the Company has secured Next Generation Gas, which is natural gas that has been securely tracked and independently certified as having low emissions across all segments of the value chain. Further, the Company continues to actively engage with ONE Future. ONE Future is a coalition of natural gas companies working together to voluntarily reduce methane emissions across the natural gas value chain to 1% or less by 2025. Please see our website, in the section titled “ESG”, for more information.

Director Nominations

The Governance and Nominating Committee establishes the process by which candidates are selected for possible inclusion in the recommended slate of director nominees. The Governance and Nominating Committee will take into account the Company’s current needs and the qualities needed for Board service, including experience in business, finance, technology or other areas relevant to the Company’s activities; reputation, ethical character and sound judgment; diversity of viewpoints, backgrounds and experiences; absence of conflicts of interest that might impede the proper performance of director responsibilities; independence under SEC and Nasdaq rules; service on other boards of directors; sufficient time to devote to Board matters and the ability to work effectively with other Board members. In the case of incumbent directors whose terms of office are set to expire, the Governance and Nominating Committee will review such directors’ overall service to the Company during their term, including the number of meetings attended, level of participation and quality of performance. For those potential new director candidates who appear upon first consideration to meet the Board’s selection criteria, the Governance and Nominating Committee will conduct appropriate inquiries into their background and qualifications and, depending on the result of such inquiries, arrange for in-person meetings with the potential candidates.

The Governance and Nominating Committee may use multiple sources for identifying director candidates, including its own contacts and referrals from other directors, members of management, the Company’s advisers and executive search firms. The Committee will consider director candidates recommended by shareholders and will evaluate such director candidates in the same manner in which it evaluates candidates recommended by other sources. Any director candidates to be recommended by shareholders should be described in writing to the Corporate Secretary. This recommendation must be sent no later than 120 days prior to the anniversary of the expected mailing date of this proxy statement, in order to be considered for inclusion in the proxy statement for the 2026 annual meeting of shareholders.

Transactions with Related Persons

The Company has no transactions with related persons to report for fiscal 2024 or fiscal 2023.

There are no material pending legal proceedings to which any director or executive officer of the Company, or any associate thereof, is a party adverse to the Company or any of its subsidiaries or has a material interest adverse to the Company or any of its subsidiaries.

Compensation of Directors

Director fees are set by the Compensation Committee and approved by the Board of Directors after the Committee considers the competitive market for directors and fee levels provided by comparable companies both within the utility industry and in the Company's geographic area. Mr. Nester is not compensated for attendance at Board and committee meetings and does not receive the annual retainer for service as a Board member. The 2024 and 2025 schedule of director fees is as follows:

| 2024 | 2025 | |||||

Annual Director Retainer | $ | 48,000 | $ | 52,800 | ||

Additional Annual Retainer - Board Chair | 20,000 | 20,000 | ||||

Additional Annual Retainer - Audit Committee Chair | 12,000 | 13,200 | ||||

Additional Annual Retainer - Other Committee Chair | 10,000 | 12,000 | ||||

Additional Annual Retainer - Audit Committee | 8,000 | 10,000 | ||||

Additional Annual Retainer - Other Committee | 2,000 | 5,000 | ||||

Restricted Stock Plan for Outside Directors. Under the Company's Amended and Restated Restricted Stock Plan for Outside Directors (the "Director Restricted Plan"), originally adopted January 27, 1997, as amended on March 28, 2016 and effective October 1, 2016, a minimum of 40% of the annual retainer fee paid to each non-employee director of the Company on a monthly basis is paid in shares of Company common stock restricted under the terms of the Director Restricted Plan ("Director Restricted Stock"). If the director owns more than 10,000 shares of Resources stock, the minimum requirement is waived. The number of shares of Director Restricted Stock paid each month is calculated based on the first business day of the month closing price of Resources’ common stock on Nasdaq. A participant can, subject to approval of the Compensation Committee, elect to receive up to 100% of the retainer fee in Director Restricted Stock. Such election cannot be revoked or amended during the fiscal year.

The following table lists directors who elected to receive a higher percentage of fees as Director Restricted Stock in fiscal 2024:

Name | Percent if Greater |

Nancy Howell Agee | 100% |

Jacqueline L. Archer | 100% |

Abney S. Boxley III | 100% |

John B. Williamson III | 100% |

The shares of Director Restricted Stock vest only in the case of a director’s death, disability, retirement (including not standing for re-election to the Board) or in the event of a change in control of Resources. There is no option to take cash in lieu of stock upon vesting of shares under this Plan. The Director Restricted Stock may not be sold, transferred, assigned or pledged by the participant until the shares have vested under the terms of this Plan. The shares of Director Restricted Stock will be forfeited to Resources by a director’s voluntary resignation during his or her term on the Board or removal for cause.

Fiscal Year 2024 Director Fees and Restricted Stock Holdings

| Name | Fees paid in cash | Fees paid in Restricted Stock1 | Total Fees | Shares of Restricted Stock as of 9/30/24 | ||||||||||||

Nancy Howell Agee | $ | — | $ | 62,000 | $ | 62,000 | 41,939 | |||||||||

Jacqueline L. Archer | — | 56,000 | 56,000 | 13,021 | ||||||||||||

Abney S. Boxley III | — | 70,000 | 70,000 | 44,396 | ||||||||||||

T. Joe Crawford | 34,800 | 23,200 | 58,000 | 7,189 | ||||||||||||

Maryellen F. Goodlatte | 68,000 | — | 68,000 | 21,803 | ||||||||||||

Robert B. Johnston | 50,000 | — | 50,000 | — | ||||||||||||

J. Allen Layman | 52,000 | — | 52,000 | 46,027 | ||||||||||||

Elizabeth A. McClanahan | 30,000 | 20,000 | 50,000 | 2,828 | ||||||||||||

John B. Williamson III | — | 68,000 | 68,000 | 20,414 | ||||||||||||

| 1: 40% of the annual retainer fees paid to non-employee directors must be paid in the form of Director Restricted Stock, unless a participant owns at least 10,000 shares of Company stock. This column also includes any additional portion of fees paid to directors in the form of Director Restricted Stock pursuant to the election of the director. |

EXECUTIVE OFFICERS

Name and Age | Period Position Held | Position and Experience |

Paul W. Nester, 50 | February 2020 to present | President & CEO - Resources and Roanoke Gas |

February 2019 to February 2020 | Vice President, Treasurer, Secretary & CFO - Resources and Roanoke Gas; President – Roanoke Gas | |

May 2012 to February 2019 | Vice President, Treasurer, Secretary & CFO - Resources and Roanoke Gas | |

Lawrence T. Oliver, 57 | January 2023 to present | Senior Vice President, Regulatory & External Affairs, Corporate Secretary – Resources and Roanoke Gas |

| January 2022 to January 2023 | Vice President, Regulatory Affairs & Strategy, Corporate Secretary – Resources and Roanoke Gas | |

| June 2021 to January 2022 | Vice President, Interim CFO & Treasurer, Corporate Secretary – Resources and Roanoke Gas | |

| January 2020 to June 2021 | Vice President, Regulatory Affairs & Strategy – Resources and Roanoke Gas | |

| C. James Shockley, Jr., 59 | February 2019 to present | Vice President & COO – Roanoke Gas |

| October 2012 to February 2019 | Vice President, Operations – Roanoke Gas | |

| Timothy J. Mulvaney, 56 | February 2024 to present | Vice President, Treasurer & CFO – Resources and Roanoke Gas |

| C. Brooke Miles, 43 | February 2023 to present | Vice President, Human Resources – Resources and Roanoke Gas |

Remainder of page intentionally left blank

SECURITY OWNERSHIP OF CERTAIN BENEFICIAL OWNERS

AND MANAGEMENT

The following table sets forth, as of November 29, 2024, certain information regarding the beneficial ownership of the common shares of the Company by all directors and nominees, executive officers, any holders of more than 5% of common shares and certain beneficial owners as a group. Unless otherwise noted in the footnotes to the table, the named persons have sole voting and investment power with respect to all outstanding common shares shown as beneficially owned by them. The business address of each of the Company's directors and executive officers is the Company's address.

Name of Beneficial Owner | Common Shares Beneficially Owned as of 11/29/241 | Percent of Class |

Nancy Howell Agee2 | 56,353 | <1% |

Jacqueline L. Archer | 16,599 | <1% |

Abney S. Boxley III3 | 60,819 | <1% |

T. Joe Crawford | 11,946 | <1% |

Maryellen F. Goodlatte | 32,823 | <1% |

Robert B. Johnston | 63,005 | <1% |

J. Allen Layman | 72,076 | <1% |

Elizabeth A. McClanahan | 3,017 | <1% |

C. Brooke Miles4 | 8,885 | <1% |

| Timothy J. Mulvaney | 3,087 | <1% |

Paul W. Nester | 103,887 | 1.0% |

Lawrence T. Oliver4 | 31,958 | <1% |

C. James Shockley, Jr.4 | 41,702 | <1% |

John B. Williamson III | 171,869 | 1.7% |

Anita G. Zucker | 1,381,227 | 13.5% |

c/o The InterTech Group, 4838 Jenkins Ave. North Charleston, SC 29405 | ||

All current directors and officers (as a Group - 14 Persons) | 678,026 | 6.6% |

Name of Investment Advisor | ||

Gabelli Funds, LLC; GAMCO Asset Management; Teton Advisors, LLC | 612,510 | 6.0% |

191 Mason Street | ||

Greenwich, CT 06830 |

1 | Includes Director Restricted Plan shares issued to outside directors and Officer Restricted Stock shares issued to the named officers still subject to vesting. |

2 | Includes 47,912 shares owned in trust and 8,441 shares owned in spousal trust. |

3 | Includes 375 shares owned by child in minor trust. |

4 | Includes stock options shown in the Outstanding Equity Awards at Fiscal Year End section on page 18 for Messrs. Oliver and Shockley. All are exercisable and included as shares beneficially owned. Includes 5,000 stock options for Ms. Miles. |

Delinquent Section 16(a) Reports

Based on the Company's review of the copies of forms related to Section 16(a) of the Securities Exchange Act of 1934 regarding beneficial ownership reporting and representations from certain reporting persons, there are no delinquent Section 16(a) filings to report.

COMPENSATION DISCUSSION AND ANALYSIS

We are committed to creating shareholder value. Our 2024 net income was $11.8 million, or $1.16 per share. Also in fiscal 2024, the Board approved a 1.3% annual cash dividend increase to $0.80 per share. The Board has increased the annual cash dividend every year since 2004.

Our compensation philosophy is designed to incentivize management to create shareholder value by attracting and retaining talent, rewarding performance and instilling an ownership culture. Our Restricted Stock Plan is intended to advance those goals, by further aligning senior management with our shareholders. As described below, we pay a portion of incentive compensation in the form of restricted stock, based on earnings targets. This section will provide an overview of our executive compensation philosophy and why we believe it is appropriate for the Company and its shareholders.

We also discuss the Compensation Committee’s methodology for determining appropriate and competitive levels of compensation for the named executive officers. Details of compensation paid to the named executive officers can be found in the tables beginning on page 17.

Compensation Philosophy and Objectives

Who are the named executive officers for fiscal year 2024?

The named executive officers of the Company are Paul W. Nester, C. James Shockley, and Lawrence T. Oliver.

What person or group is responsible for determining the compensation levels of named executive officers?

The Compensation Committee has a charter, pursuant to which it reviews and recommends to the Board the compensation, including base salary and annual incentive or discretionary compensation, of the Company’s CEO and the other executive officers.

The CEO is actively involved in the executive compensation process. The CEO reviews the performance of each of the executive officers, other than his own, and, within the defined program parameters, recommends to the Compensation Committee base salary increases and incentive awards for such individuals. He provides the Compensation Committee with financial performance goals for the Company that are used to link pay with performance. The CEO also provides his review to the Compensation Committee with respect to the executive compensation program’s ability to attract, retain and motivate the level of executive talent necessary to achieve the Company’s business goals. The CEO attends the meetings of the Compensation Committee but does not participate in the Committee executive sessions.

What are the Company’s executive compensation principles and objectives?

The Company’s overall executive compensation philosophy is that pay should be competitive with the relevant market for executive talent, be performance based, vary with the attainment of specific objectives and be aligned with the interests of the Company’s shareholders. The core principles of the Company’s executive compensation program include the following:

Pay competitively. The Compensation Committee believes in positioning executive compensation at levels necessary to attract and retain exceptional leadership talent. An individual’s performance and importance to the Company can result in total compensation being higher or lower than the target market position.

Pay-for-performance. The Compensation Committee structures executive compensation programs to balance annual and long-term corporate objectives, including specific measures which focus on operational and financial performance through incentive bonuses and the goal of fostering shareholder value creation through restricted stock grants.

Create an ownership culture. The Compensation Committee believes that using compensation to instill an ownership culture effectively aligns the interests of executive officers and the shareholders. A significant portion of our incentive compensation awarded to executive officers is based on earnings and in the form of restricted common stock. The restrictions are intended to promote stock ownership. In addition, the Committee oversees a modest stock option plan providing another form of equity incentive.

The CEO and the Compensation Committee periodically review the executive compensation philosophy. No recent changes have been made to the compensation philosophy, but programmatic changes have been implemented at various times to enhance the effectiveness of the various compensation elements.

What is the CEO stock ownership requirement?

The CEO is expected to achieve and then maintain a level of stock ownership equivalent to 5 times, or 500%, of annual base salary.

Does the Company have a Clawback Provision?

Yes. In the event the Company determines it must prepare an accounting restatement due to the material noncompliance of the Company with any financial reporting requirement under the securities laws, including any required accounting restatement to correct an error in previously issued financial statements that is material to the previously issued financial statements, or that would result in a material misstatement if the error were corrected in the current period or left uncorrected in the current period, the Company shall reasonably promptly recover any erroneously awarded compensation that was received by a current or former covered officer during the applicable lookback period.

Does the Company have a policy regarding insider trading?

Yes. The Company’s policy applies to all directors and employees and places additional timing restrictions on certain trading of company securities. The policy discusses materiality and non-public information. It makes clear that covered persons may not engage in insider trading at any time. It further indicates that directors, executive officers, and Accounting Department management and supervisory personnel may only trade during designated windows as long as they are NOT in possession of material, non-public information. The Company has included its policy as an exhibit to its Form 10-K.

Does the Company have an anti-hedging and pledging of Company securities policy?

Yes. Directors, executive officers and employees of the Company may not engage in hedging transactions related to the Company's securities. Specifically, pursuant to Company policy, no director, executive officer or employee of the Company (or any of his or her designees) may purchase any financial instruments (including prepaid variable forward contracts, equity swaps, collars, and exchange funds), or otherwise engage in any transactions, that hedge or offset, or are designed to hedge or offset, any decrease in the market value of any “registrant equity securities” (i) granted to such director, executive officer or employee by the Company as part of such person’s compensation or (ii) held, directly or indirectly, by such director, executive officer or employee. Also, directors and executive officers may not pledge the Company's stock as collateral for a loan or hold the Company's stock in a margin account.

How do we determine executive pay?

The Compensation Committee benchmarks base salary, annual and other forms of incentive compensation and the Company's financial performance to a comparison group consisting of publicly traded companies. The Compensation Committee believes this process is the best way to determine whether such compensation is competitive. The comparison group is selected based on six criteria:

1. | Companies that an outsider, with no knowledge of the Company’s internal deliberations on the topic, would agree offer reasonable comparisons for pay and performance purposes; |

2. | Companies that may overlap in the labor market for talent; |

3. | Companies with comparable revenue and market capitalization; |

4. | Companies whose business models, characteristics, growth potential, and human capital are similar but not necessarily identical to those of the Company; |

5. | Public companies based in the United States where compensation and financial data are available in proxy statements and other such public filings; and |

6. | Companies large enough to have similar executive positions to ensure statistical significance. |

Based on these criteria, the comparison group consists of:

| Cadiz, Incorporated | Chesapeake Utilities Corporation |

| Genie Energy LTD | Middlesex Water Company |

| NW Natural, Incorporated | Pure Cycle Corporation |

| Unitil Corporation | York Water Company |

In addition to the comparison group, the Compensation Committee utilizes market compensation data from Salary.com for each of its executive positions. This data provides benchmark information for both base pay and total compensation for energy and utility companies in the $50 million to $200 million size range. While the Compensation Committee has not established a specific target for each executive officer position, the Committee uses the comparison group and salary benchmark data to help ensure compensation is reasonably competitive in the industry and local job market. The Compensation Committee did not utilize an outside consultant in fiscal year 2024.

How do we consider the results of the most recent shareholder advisory vote on executive compensation?

Annually, we ask our shareholders for a non-binding advisory vote on our overall executive compensation. The Compensation Committee and the Board review and consider the voting results. In 2024, 97% of votes cast were in favor of the proposal. The Committee determined that since a substantial majority of our shareholders voted in favor of our executive compensation philosophy and program, the Committee recommended and the Board agreed that changing our overall approach to executive compensation was not necessary at this time.

Compensation Elements

Base Salary. Base salary is fixed compensation and is necessary to attract and retain talent and is the only non-variable element of the Company’s total compensation program. Base salaries are set to reflect each executive officer’s responsibilities, the impact of each executive officer’s position and the contribution each executive officer delivers to the Company. Salaries are determined after analyzing competitive levels in the market, using the Company’s comparison group and the Salary.com compensation data for executives with comparable responsibilities and job scope. Salary increases, if any, are based on individual responsibility and performance, Company performance and market conditions. To gauge market conditions, the Compensation Committee evaluated the comparison group and market data and established recommended salary levels based on the executive’s experience, tenure, performance and potential. Based in part on the executive compensation benchmarking and the target levels for base salary set forth above, the Board, acting on the recommendation of Compensation Committee, set the executive officers’ base salaries for 2025.

Performance Incentive Plan Compensation. The Performance Incentive Plan provides for a bonus based on the achievement of (1) certain qualitative goals for each executive officer, which may be individual in nature or for the Company as a whole, and (2) targets for fiscal year earnings per share. The plan bases 50% of the cash bonus on qualitative goals and 50% on earnings targets. The Compensation Committee evaluates achievement by each executive officer of their qualitative goals and then recommends to the Board an amount of bonus to be awarded in respect of such achievement. The plan sets forth minimum, target and maximum earnings per share that may be achieved. The Company is paying a portion of the 2024 bonuses, based on the earnings target, in the form of restricted stock under the Restricted Stock Plan described below and also plans the same for fiscal 2025.

RGC Resources, Inc. Restricted Stock Plan. The Company has a Restricted Stock Plan, which is intended to incentivize key employees through stock ownership. Each restricted stock award will be evidenced by an agreement with the recipient. The agreement shall set forth the "Vesting Period" and "Restriction Period" for the award and any other conditions or restrictions that the Compensation Committee deems advisable, including requirements established pursuant to the Securities Act, the Exchange Act, the Internal Revenue Code and any securities trading system or stock exchange upon which such restricted shares are listed.

The "Vesting Period" for an award represents substantial risk of forfeiture until certain dates, at which time such shares or a portion of such shares shall begin to "vest" over time and no longer be subject to a substantial risk of forfeiture. The default Vesting Period for an award shall be three years with one-third of the shares vesting on the first, second and third anniversaries of the effective date of the award, respectively, unless the Compensation Committee establishes otherwise. If a recipient resigns or is otherwise terminated from employment with the Company prior to the end of the Vesting Period, he or she will forfeit all interest to his or her unvested shares of restricted stock granted in an award unless the Compensation Committee accelerates vesting for the recipient. Unless otherwise established in an award agreement by the Compensation Committee, in the event of a recipient's death, disability or normal retirement (as considered under our defined benefit pension plan), all of the awarded shares shall vest and no longer be subject to a substantial risk of forfeiture. Likewise, all awarded shares shall vest in the event of a change in control, as defined in the recipient's agreement with the Company that relates to recipient's compensation and benefits upon the occurrence of a change in ownership of the Company or similar event (i.e., the change in control agreement).

The "Restriction Period" for an award represents a period during which the recipient may not transfer, sell, pledge, assign, or otherwise alienate or hypothecate shares of restricted stock and all cash dividends on such shares must be re-invested in our common stock. Unless the Compensation Committee otherwise determines, the Restriction Period shall apply so long as shares of restricted stock are unvested and thereafter apply to 75% of such vested shares unless the recipient satisfies the following minimum ownership levels of our common stock:

President, CEO | 300%, of annual base salary* | |

CFO, COO | 200% of annual base salary | |

Vice President | 150% of annual base salary

|

*This requirement is specific to the vesting requirements of the Restricted Stock Plan. The Compensation Committee has established Mr. Nester’s stock ownership requirement at 500% of annual base salary, as discussed on page 14. |

The Compensation Committee will use its discretion to determine when and how such minimum levels are measured. Once a recipient satisfies the minimum level of ownership or once a recipient is no longer employed by the Company, the Restriction Period will no longer be applicable to vested shares. A change in control will not affect the Restriction Period

Key Employee Stock Option Plan of RGC Resources, Inc. The Company has a Key Employee Stock Option Plan, which is intended to provide the Company’s executive officers and other key employees with long-term incentives and future rewards tied to the price of Resources’ common shares over time. This element of compensation is not routinely awarded. There have been no options awarded within the period of four days prior to or one day following the release of material non-public information. This element of compensation requires each option’s exercise price per share to equal the fair value of the Company’s common shares as of the date of the grant. Under the terms of this Plan, the options become exercisable six months from the grant date and expire ten years subsequent to the grant date. The Key Employee Stock Option Plan has 16,000 options available for issue as of September 30, 2024.

RGC Resources, Inc. Nonqualified Deferred Compensation Plan. At its October 2020 meeting, the Compensation Committee proposed and the Board of Directors approved a Nonqualified Deferred Compensation Plan intended to attract, incentivize and retain certain officers and key employees of the Company. This Plan allows discretionary contributions, based on the achievement toward certain targets, as determined by the Compensation Committee. This Plan also allows a participant to defer up to 80% of their cash compensation earned as base salary or incentive. The Board approved $30,000 in discretionary contributions to the Plan for services rendered during fiscal 2024.

Discussion and Analysis of Summary Compensation

The changes in salary for our named executive officers primarily reflect increases in individual responsibilities, reasonable market adjustments and their significant contributions to the Company’s overall success in fiscal 2024. The Committee also considered economic conditions, competitive market forces and the comparison group in setting the 2025 salary levels.

Summary Compensation

Name | Year | Salary | Bonus1 | Stock | Option | Non-equity | Change in | All Other | Total | ||||||||||||||||||||||||||

Paul W. Nester | 2024 | $ | 443,876 | $ | — | $ | 274,500 | $ | — | $ | 199,688 | $ | 97,503 | $ | 46,416 | $ | 1,061,983 | ||||||||||||||||||

President & CEO | 2023 | 422,576 | — | 321,300 | — | 220,626 | 10,673 | 78,866 | 1,054,041 | ||||||||||||||||||||||||||

2022 | 408,126 | 20,000 | — | — | 49,980 | — | 110,244 | 588,350 | |||||||||||||||||||||||||||

C. James Shockley, Jr. | 2024 | 250,095 | — | 105,787 | — | 92,563 | 582,498 | 39,091 | 746,034 | ||||||||||||||||||||||||||

COO | 2023 | 243,440 | — | 122,269 | — | 106,374 | 2,207 | 51,102 | 525,392 | ||||||||||||||||||||||||||

| 2022 | 237,863 | 10,000 | — | — | 21,558 | — | 36,727 | 306,148 | ||||||||||||||||||||||||||

Lawrence T. Oliver | 2024 | 242,778 | — | 105,000 | 25,750 | 93,750 | 35,926 | 38,490 | 541,694 | ||||||||||||||||||||||||||

Sr. Vice President, | 2023 | 219,111 | — | 100,800 | — | 89,600 | 5,367 | 40,269 | 455,147 | ||||||||||||||||||||||||||

Corp. Secretary | 2022 | 204,569 | 15,000 | — | 10,780 | 25,750 | 6,693 | 35,794 | 298,856 | ||||||||||||||||||||||||||

1 | The Compensation Committee has sole discretion to issue a one-time cash bonus payment to the Company's named executive officers. The Compensation Committee approved a discretionary cash bonus given their level of performance in fiscal 2022. | ||

2 | In October 2024, in respect of fiscal 2024 performance, the Company approved a total of 23,557 shares of restricted stock to be issued to our named executive officers effective January 2, 2025. Mr. Nester received 13,325 shares, which is equal to $274,500 based on the closing price of $20.60 as reported on Nasdaq on October 30, 2024. Mr. Oliver received 5,097 shares, which is equal to $105,000 based on such closing price. Mr. Shockley received 5,135 shares, which is equal to $105,787 based on such closing price. | ||

3 | In October 2023, in respect of fiscal 2023 performance, the Company approved a total of 35,303 shares of restricted stock to be issued to our named executive officers effective January 2, 2024. Mr. Nester received 20,837 shares, which is equal to $321,300 based on the closing price of $15.42 as reported on Nasdaq on October 27, 2023. Mr. Oliver received 6,537 shares, which is equal to $100,800 based on such closing price. Mr. Shockley received 7,929 shares, which is equal to $122,269 based on such closing price. | ||

4 | The Change in Pension Value is an actuarial calculation and was not realized as compensation. Only Mr. Nester and Mr. Shockley have a pension benefit. In 2024, the decrease in discount rate led to the significant increase in the accumulated pension value. | ||

5 | The Change in Nonqualified Deferred Compensation Expense represents plan contributions and unrealized gains and losses. | ||

| 6 | The Change in Pension Value in 2022 for Mr. Nester ($153,456) and Mr. Shockley ($448,425) was negative due to the higher discount rate and has been excluded from the table above in accordance with SEC guidance. |

Other Compensation

Name | Year | 401(k) | Insurance Premiums | Medical | Auto | Stock | Total | ||||||||||||||||||||

Paul W. Nester | 2024 | $ | 17,003 | $ | 2,145 | $ | 2,852 | $ | 4,416 | $ | — | $ | 46,416 | ||||||||||||||

2023 | 16,500 | 2,089 | 21,435 | 4,601 | 34,241 | 78,866 | |||||||||||||||||||||

2022 | 15,250 | 2,045 | 20,598 | 4,416 | 67,935 | 110,244 | |||||||||||||||||||||

C. James Shockley, Jr. | 2024 | 12,693 | 1,281 | 21,343 | 3,774 | — | 39,091 | ||||||||||||||||||||

| 2023 | 12,944 | 1,281 | 21,435 | 4,282 | 11,160 | 51,102 | |||||||||||||||||||||

| 2022 | 12,036 | 1,237 | 20,598 | 2,856 | — | 36,727 | |||||||||||||||||||||

Lawrence T. Oliver | 2024 | 10,951 | 2,145 | 21,178 | 4,216 | — | 38,490 | ||||||||||||||||||||

2023 | 11,298 | 2,089 | 19,818 | 5,554 | 1,520 | 40,269 | |||||||||||||||||||||

2022 | 9,576 | 2,045 | 20,213 | 3,960 | — | 35,794 | |||||||||||||||||||||

Grants of Plan-Based Awards for 2024

The Board awarded the incentive compensation below for fiscal year 2024 performance to be paid in 2025.

.

Name | Grant | Type | Metric | Threshold | Target | Maximum | Awarded | % of Target | |||||||||||||||

Paul W. Nester | 10/30/2024 | Cash | Performance Achievements | $ | — | $ | 157,500 | $ | 247,500 | $ | 199,688 | 127% | |||||||||||

10/30/2024 | Equity1 | Earnings | — | 180,000 | 337,500 | 274,500 | 153% | ||||||||||||||||

C. James Shockley, Jr. | 10/30/2024 | Cash | Performance Achievements | — | 75,562 | 113,343 | 92,563 | 122% | |||||||||||||||

| 10/30/2024 | Equity1 | Earnings | — | 75,562 | 125,937 | 105,787 | 140% | ||||||||||||||||

Lawrence T. Oliver | 10/30/2024 | Cash | Performance Achievements | — | 75,000 | 112,500 | 93,750 | 125% | |||||||||||||||

| 10/30/2024 | Equity1 | Earnings | — | 75,000 | 125,000 | 105,000 | 140% | ||||||||||||||||

1 These are awards of restricted stock under the Company's Restricted Stock Plan as described above.

Outstanding Equity Awards at Fiscal Year End

The following table shows all outstanding unexercised stock options held by our named executive officers as of September 30, 2024. All stock options are vested and exercisable and have an intrinsic value of $98,210.

Name | Number of Unexercised Options | Option Exercise Price | Option Expiration Date | ||

C. James Shockley, Jr. | 4,500 | $16.37 | Dec. 8, 2026 | ||

| 4,500 | 14.15 | Dec. 3, 2025 | |||

| Lawrence T. Oliver | 5,000 | 16.62 | Oct. 18, 2033 | ||

| 1,000 | 19.90 | Jul. 25, 2032 | ||

| 3,000 | 22.93 | May 26, 2031 | |||

| 5,000 | 27.87 | Apr. 1, 2030 | |||

The following table sets forth the shares of restricted stock that have been awarded, but not vested, as of September 30, 2024:

Name | Grant Date | Restricted Shares Not Vested | Market Value | ||||||

Paul W. Nester | Jan. 2, 2024 | 13,891 | $ | 313,520 | |||||

C. James Shockley, Jr. | Jan. 2, 2024 | 5,286 | 119,305 | ||||||

| Lawrence T. Oliver | Jan. 2, 2024 | 4,358 | 98,360 | ||||||

CEO Pay Ratio

We believe in the spirit of transparency that we should provide the ratio of the annual total compensation of Mr. Nester, President and CEO, to the annual total compensation of the median employee of the Company.

For fiscal 2024, the median total annual compensation of all employees of the Company and its subsidiaries (other than the CEO), was $113,385. Mr. Nester's total annual compensation for fiscal year 2024 was $1,061,983. Based on the information, the ratio of the compensation of the CEO to the median annual total compensation of all employees was estimated to be 9 to 1.

To identify the median employee and to determine the total annual compensation of such employee, we used the following methodology. As defined under SEC regulations, we identified our median employee as of the end of September 30, 2023, using our entire workforce. We defined total annual compensation as base pay, plus annual and long-term incentive compensation, plus benefits as outlined in the Other Compensation Table for the period of October 1, 2023 through September 30, 2024. With respect to the total annual compensation of Mr. Nester, we used the amount reported in the "Total" column of the "Summary Compensation Table".

SEC rules for identifying the median employee and calculating the pay ratio allow companies to apply various methodologies and various assumptions and, as a result, the pay ratio reported by the Company may not be comparable to the pay ratio reported by other companies.

Remainder of page intentionally left blank

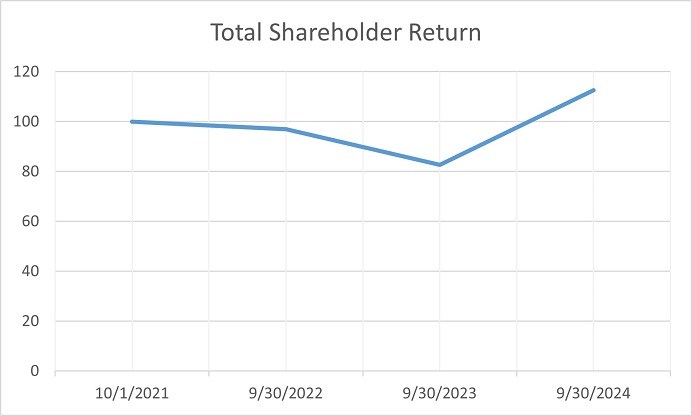

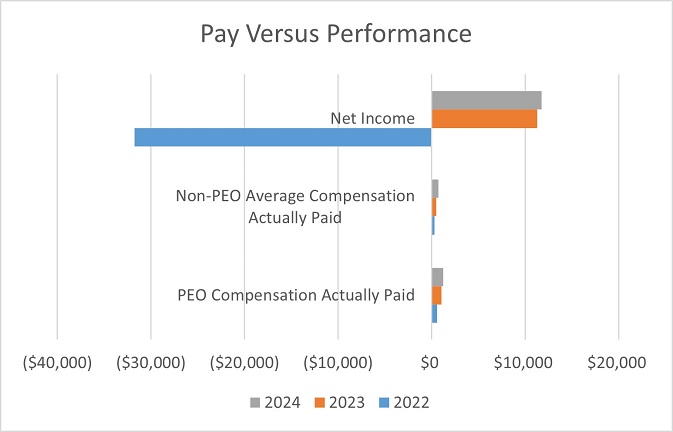

Pay Versus Performance

Year | Summary Compensation Table Total for PEO1 | Compensation Actually Paid to PEO1,2 | Average Summary Compensation Table Total for Non-PEO Named Executive Officers1 | Average Compensation Actually Paid to Non-PEO Named Executive Officers1,2 | Value of Initial $100 Investment Based on Total Shareholder Return3 | Net Income | ||||||||||||||||||

| $ | 1,061,983 | $ | 1,219,062 | $ | 643,864 | $ | 708,681 | $ | 112.54 | $ | 11,760,896 | |||||||||||||

2023 | 1,054,041 | 1,050,564 | 490,270 | 489,644 | 82.75 | 11,299,282 | ||||||||||||||||||

2022 | 588,350 | 598,562 | 302,502 | 300,780 | 97.02 | (31,732,602 | ) | |||||||||||||||||

1 | Paul Nester was Chief Executive Officer for all three years. C. James Shockley, Jr. and Lawrence T. Oliver were the other NEOs for all three years. | ||

| 2 | SEC rules require certain adjustments be made to the Summary Compensation Table (SCT) totals to determine “Compensation Actually Paid” as reported in the Pay Versus Performance Table. Adjustments to the SCT total compensation by year to calculate Compensation Actually Paid for our PEO and the Average Compensation Actually Paid to our Non-PEO NEOs are set forth in the table below. |

| PEO | Average Non-PEO | |||||||||||||

2024 | 2023 | 2022 | 2024 | 2023 | 2022 | |||||||||

SCT Total | $ | 1,061,983 | $ | 1,054,041 | $ | 588,350 | $ | $ 643,864 | $ | 490,270 | $ | 302,502 | ||

Stock Awards per SCT | (274,500) | (321,300) | — | (105,394) | (111,535) | — | ||||||||

Option Awards per SCT | — | — | — | (12,875) | — | (5,390) | ||||||||

Fair value of awards in CY that remain unvested | 274,500 | 321,300 | — | 105,394 | 111,535 | — | ||||||||

Change in fair value of PY awards that are outstanding and unvested | 99,328 | (16,495) | (9,241) | 34,477 | (5,960) | (2,110) | ||||||||

Change in fair value of PY awards that vested during the year | 45,806 | 8,217 | 9,226 | 39,056 | 3,634 | 2,279 | ||||||||

Dividend or other earnings paid during the year prior to vesting | 11,945 | 4,801 | 10,227 | 4,159 | 1,700 | 3,499 | ||||||||

Compensation Actually Paid Total | $ | 1,219,062 | $ | 1,050,564 | $ | 598,562 | $ | 708,681 | $ | 489,644 | $ | 300,780 | ||

3 | Assumes $100 invested on October 1, 2021, the first day of the Company's fiscal 2022 year. |

The Company recorded after-tax impairment charges of its investment in MVP during 2022 totaling $40.9 million, resulting in a $31.7 million net loss. As a result, the PEO and non-PEO's did not earn and were not awarded cash or equity incentives related to earnings for 2022.

2025 Compensation and Performance Incentive Plan

The Compensation Committee is committed to pay-for-performance, paying competitively and creating an ownership culture. It has recommended salary increases that are consistent with individual performance, the Company's overall performance in fiscal 2024 and that reasonably compare with our peers. It has also set the 2025 Performance Incentive Plan metrics to reward the achievement of the Company's objectives and personal performance and thereby drive shareholder return.

The Board approved the Compensation Committee's recommended annual base salaries beginning January 1, 2025, as shown below:

Name | 2025 Salary | Change | 2024 Salary | Change | 2023 Salary | |||||

Paul W. Nester | $ 472,500 | 5.0% | $ 450,000 | 5.0% | $ 428,400 | |||||

C. James Shockley, Jr. | 259,429 | 3.0% | 251,873 | 3.0% | 244,537 | |||||

Lawrence T. Oliver | 275,000 | 10.0% | 250,000 | 11.6% | 224,000 | |||||

The Board approved the Compensation Committee's Performance Incentive Plan for the fiscal year ending September 30, 2025. The cash incentive compensation for each officer is based 50% on the individual's performance with respect to corporate objectives and 50% on a range of earnings results for fiscal 2025. The equity incentive compensation for each officer is based on a range of earnings results for fiscal 2025. The potential range of incentive compensation for each officer is provided in the table that follows:

Name | Type | Metric | Threshold | Target | Maximum | |||||||||

Paul W. Nester | Cash | Performance Achievements | $ | — | $ | 165,375 | $ | 259,875 | ||||||

Equity | Earnings | — | 189,000 | 354,375 | ||||||||||

C. James Shockley, Jr. | Cash | Performance Achievements | — | 77,829 | 116,743 | |||||||||

Equity | Earnings | — | 77,829 | 129,715 | ||||||||||

Lawrence T. Oliver | Cash | Performance Achievements | — | 82,500 | 123,750 | |||||||||

Equity | Earnings | — | 82,500 | 137,500 | ||||||||||

Severance or Change in Control Agreements

The Company has a change in control agreement with Paul W. Nester, dated May 1, 2023, which contains a three-year term. The agreement entitles him to certain benefits in the event his employment is terminated without cause and within a specific period of time following a change in control of the Company. For purposes of this agreement, a change in control occurs when (i) any person or entity becomes the beneficial owner of at least 50% of the combined voting power of the Company’s voting securities; (ii) any person or entity becomes the beneficial owner of at least 50% of the voting securities of the surviving entity following a merger, recapitalization, reorganization, consolidation or sale of assets by the Company; or (iii) the Company is liquidated or sells substantially all of its assets. If a change in control occurs, the vesting periods of any equity awards or incentives held by Mr. Nester shall be accelerated without limitation. In the event that his employment with the Company is terminated within 90 days prior to or within two years of the date of a change in control, unless the termination is (a) because of his death or disability, (b) for cause (as defined in the agreement) or (c) by him other than for good reason (as defined in the agreement), then he will receive a lump sum severance payment (the “Severance Payment”) equal to 2.0 times his annualized includable compensation for the base period, within the meaning of Section 280G(d) of the Internal Revenue Code of 1986. The Severance Payment will be reduced to the extent necessary to avoid certain federal excise taxes. Also in such event, the Company will continue his life insurance, medical, health and accident and disability plans, programs or arrangements until the earlier of two years after the date of the change in control, his death, or his full-time employment. The agreement does not require him to seek employment to mitigate any payments or benefits provided thereunder. Effective May 1, 2023, the Company also entered into identical change in control agreements with Lawrence T. Oliver and C. James Shockley, Jr.

The Compensation Committee reviews all of the components of each executive’s compensation and awards a level of each component based on what they believe is reasonable when all elements of the compensation are considered. The Company currently does not structure compensation so as to be fully deductible under Section 162(m) of the Internal Revenue Code, but the Committee does not anticipate the Company paying compensation at a level where any amounts would not be fully deductible under such Section 162(m).

Estimated Benefits upon a Change in Control

Name | Cash1 | Equity2 | Benefit | Pension/Tax | Total | |||||

Paul W. Nester | $ | 995,060 | $ | 313,520 | $ | 49,788 | $ | — | $ | 1,358,368 |

C. James Shockley, Jr. | 551,773 | 119,305 | 43,642 | — | 714,720 | |||||

Lawrence T. Oliver | 528,000 | 98,360 | 45,758 | — | 672,118 | |||||

1 The value of the cash benefit under the change in control agreements is based on the prior calendar year compensation. 2 Represents the value of unvested Restricted Stock at the September 30, 2024 Nasdaq closing price of $22.57. 3 Includes amounts for life insurance, medical, health and accident and disability plans. |

COMMITTEE REPORTS

Report of the Compensation Committee

The Compensation Committee has reviewed and discussed with management the section entitled "Compensation Discussion and Analysis" in this Proxy Statement. The Compensation Committee recommended to the Board of Directors that said section be included in this Proxy Statement.

The Compensation Committee met two times during fiscal year 2024 and the meetings were attended by all members. Consistent with the terms of its charter, the Compensation Committee annually reviews and approves corporate goals and objectives related to the CEO and evaluates and determines the CEO compensation level, which is presented to the Board for approval. The Committee also reviews and approves base salary and incentive opportunities for the other executive officers, which is also presented to the Board for approval. Director compensation is reviewed annually and recommendations are made to the Board. The Compensation Committee reviews and approves stock ownership guidelines and reviews and recommends equity incentive grants to officers.

Submitted by the Compensation Committee:

Nancy Howell Agee (Chair), Abney S. Boxley III, T. Joe Crawford and J. Allen Layman

Remainder of page intentionally left blank

Report of the Governance and Nominating Committee

The Governance and Nominating Committee met two times during the fiscal year. Each meeting was attended by all sitting members.

The Governance and Nominating Committee made the recommendation that Abney S. Boxley III, Elizabeth A. McClanahan, and John B. Williamson III be nominated for election to the Board of Directors and to serve a three-year term beginning with the 2025 Annual Meeting and continuing until 2028. The Board approved this recommendation.

The Governance and Nominating Committee annually evaluates and makes recommendations regarding Board committee structures, membership, leadership and accountability, and reviews and recommends committee charters to the Board for approval. The Committee is responsible for the review and evaluation of director independence, ESG oversight, updating the Board on governance issues and making recommendations as needed and monitoring the Board's performance in light of all applicable laws, rules and regulations.

Submitted by the Governance and Nominating Committee:

Maryellen F. Goodlatte (Chair), Nancy Howell Agee, Robert B. Johnston, J. Allen Layman and Elizabeth A. McClanahan

Remainder of page intentionally left blank

Report of the Audit Committee

The Audit Committee met five times in fiscal 2024 with the Company's management and the Company’s independent auditors to review significant financial and accounting matters, internal controls and the auditors’' audit results. Each meeting was attended by all sitting members.

Management is responsible for the Company’s internal controls and the accounting and financial reporting functions. Deloitte is responsible for performing an audit and expressing an opinion in accordance with the standards of the Public Company Accounting Oversight Board ("PCAOB") on the Company’s consolidated financial statements. In this context, the Audit Committee met with management and Deloitte to review and discuss the September 30, 2024 consolidated financial statements including a discussion of the acceptability and quality of the accounting principles, the reasonableness of critical accounting estimates, the clarity of the disclosures in the financial statements and such other matters as are required to be discussed with the Audit Committee under standards established by the SEC and the PCAOB.

The Audit Committee discussed with Deloitte their firm’s independence from the Company and its management and received written representation from Deloitte, in accordance with PCAOB requirements, regarding Deloitte’s independence. The Audit Committee has also reviewed the non-audit services provided by Deloitte and determined that such services did not impact independence.

The Audit Committee considers annually and pre-approves 100% of audit services expenditures, including audit review and attest services, and pre-approves the nature, extent, and cost of all non-audit services provided by Deloitte. The following table sets forth the aggregate fees billed or expected to be billed by Deloitte, and Brown Edwards, the Company’s independent auditor for fiscal 2023, for the years ended September 30, 2024 and 2023, respectively:

2024 | 2023 | |||||||

Audit Fees | $ | 415,000 | $ | 214,161 | ||||

Tax Fees | — | 34,409 | ||||||

All Other Fees | 23,097 | 80,922 | ||||||

Total Fees | $ | 438,097 | $ | 305,846 | ||||

Audit Fees include services performed by Deloitte and Brown Edwards related to the audit of the financial statements and quarterly reviews for the years ended September 30, 2024 and 2023. Tax Fees in 2023 include services rendered by Brown Edwards for federal and state income tax return preparation and other tax strategy consultation. All Other Fees in 2024 includes audit research software licenses and engagement expenses and in 2023 includes services rendered in conjunction with audits of the Company’s employee benefit plans, comfort letters and other general purposes. All services provided by Deloitte and Brown Edwards in 2024 and 2023 were pre-approved by the Audit Committee.