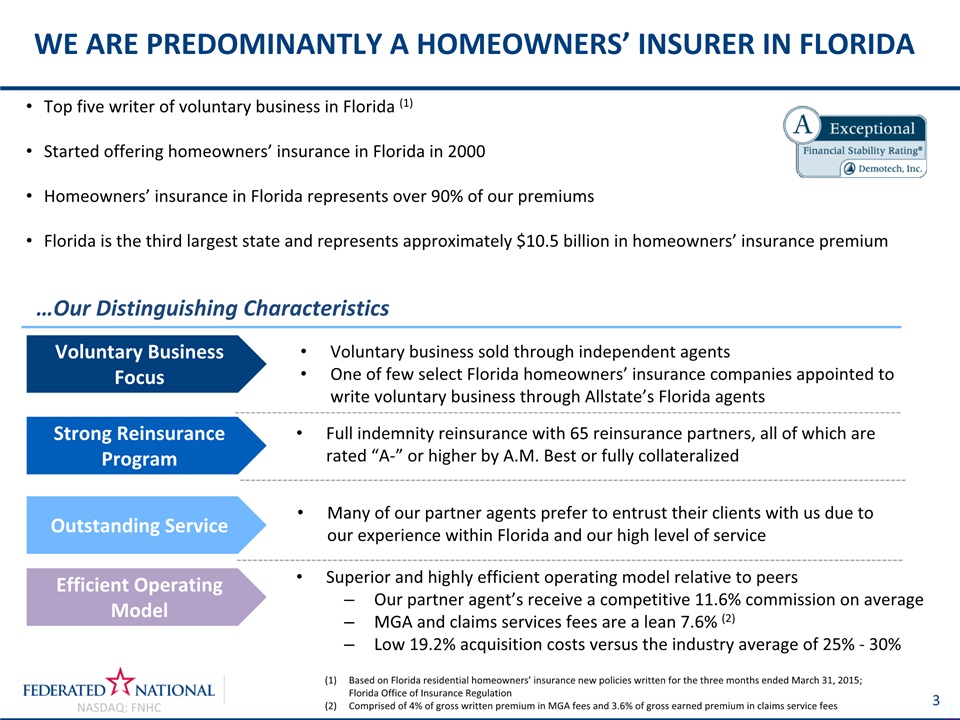

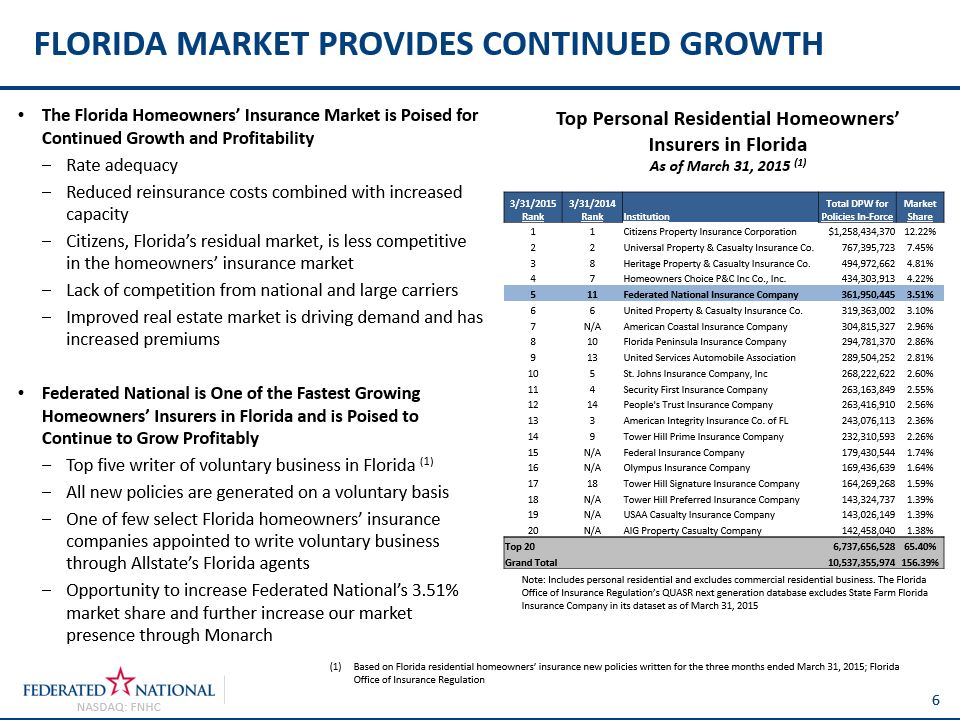

Florida Market provides continued growth 6 Based on Florida residential homeowners’ insurance new policies written for the three months ended March 31, 2015; Florida Office of Insurance Regulation The Florida Homeowners’ Insurance Market is Poised for Continued Growth and Profitability Rate adequacyReduced reinsurance costs combined with increased capacityCitizens, Florida’s residual market, is less competitive in the homeowners’ insurance marketLack of competition from national and large carriersImproved real estate market is driving demand and has increased premiumsFederated National is One of the Fastest Growing Homeowners’ Insurers in Florida and is Poised to Continue to Grow Profitably Top five writer of voluntary business in Florida (1)All new policies are generated on a voluntary basisOne of few select Florida homeowners’ insurance companies appointed to write voluntary business through Allstate’s Florida agentsOpportunity to increase Federated National’s 3.51% market share and further increase our market presence through Monarch Top Personal Residential Homeowners’ Insurers in FloridaAs of March 31, 2015 (1) Note: Includes personal residential and excludes commercial residential business. The Florida Office of Insurance Regulation’s QUASR next generation database excludes State Farm Florida Insurance Company in its dataset as of March 31, 2015 3/31/2015 Rank 3/31/2014 Rank Institution Total DPW for Policies In-Force Market Share 1 1 Citizens Property Insurance Corporation $1,258,434,370 12.22% 2 2 Universal Property & Casualty Insurance Co. 767,395,723 7.45% 3 8 Heritage Property & Casualty Insurance Co. 494,972,662 4.81% 4 7 Homeowners Choice P&C Inc Co., Inc. 434,303,913 4.22% 5 11 Federated National Insurance Company 361,950,445 3.51% 6 6 United Property & Casualty Insurance Co. 319,363,002 3.10% 7 N/A American Coastal Insurance Company 304,815,327 2.96% 8 10 Florida Peninsula Insurance Company 294,781,370 2.86% 9 13 United Services Automobile Association 289,504,252 2.81% 10 5 St. Johns Insurance Company, Inc 268,222,622 2.60% 11 4 Security First Insurance Company 263,163,849 2.55% 12 14 People's Trust Insurance Company 263,416,910 2.56% 13 3 American Integrity Insurance Co. of FL 243,076,113 2.36% 14 9 Tower Hill Prime Insurance Company 232,310,593 2.26% 15 N/A Federal Insurance Company 179,430,544 1.74% 16 N/A Olympus Insurance Company 169,436,639 1.64% 17 18 Tower Hill Signature Insurance Company 164,269,268 1.59% 18 N/A Tower Hill Preferred Insurance Company 143,324,737 1.39% 19 N/A USAA Casualty Insurance Company 143,026,149 1.39% 20 N/A AIG Property Casualty Company 142,458,040 1.38% Top 20 6,737,656,528 65.40% Grand Total 10,537,355,974 156.39%