China Bio Energy Holdings

(CBEH.OB)

A Leading Integrated Bio-diesel Producer & Distributor

Company Presentation

March 2009

Safe Harbor Statements

Safe Harbor Statement Under the Private Securities Litigation Reform Act of 1995: Any

statements that are not historical facts are forward looking statements that involve risks and

uncertainties that could cause actual results to differ materially from those in the forward-

looking statements, which may include, but not limited to, factors related to the CBEH’ s

anticipated growth strategies, future business development, ability to attract and retain new

clients ability to develop new products, expand to other related industries or markets in

other geographical locations, and other information detailed from time to time in the filings

and future filings with the United States Securities and Exchange Commission. Readers are

advised that this information is intended for the use of investment professionals. Anyone

interested in obtaining information on CBEH should contact CBEH, as set forth above, to

receive the CBEH most recent financial reports. This presentation was developed by CBEH

and is intended solely for informational purposes and is not to be construed as an offer to

sell or the solicitation of an offer to buy the Company’s stock. This profile is based upon

information available to the public, as well as other information from sources which

management believes to be reliable, but is not guaranteed by the Company as being

accurate nor does it purport to be complete. Opinions expressed herein are those of

management as of the date of publication and are subject to change without notice.

3

Agenda

Company Overview

Market Growth

Competitive Advantages

Financial Snapshot

Future Development

Investment Highlights

4

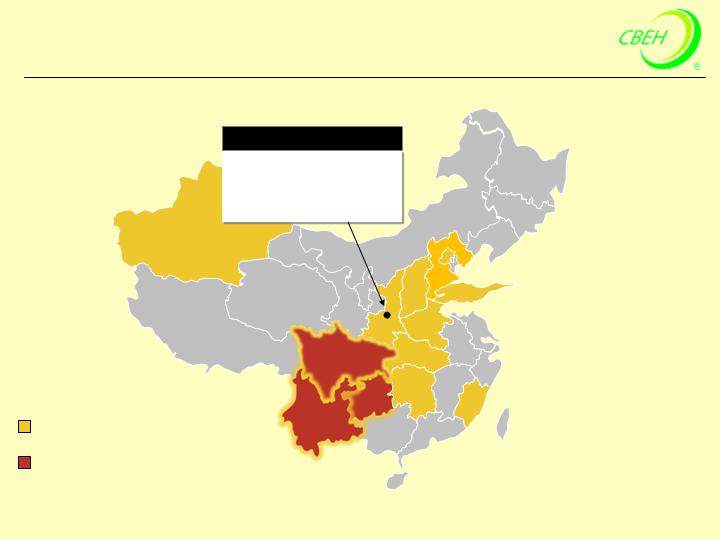

Company Overview

One of the largest bio-diesel manufacturers in

China with 100,000 ton annual capacity

The only integrated bio-diesel producer in China

with distribution license and distribution network

Leverages the same distribution network to sell to

existing customers and to acquire new customers

The only oil distributor in Shaanxi with access

to Sichuan, Yunnan and Guizhou provinces via

military rail

Controls five retail gas stations currently,

planning on further acquisitions

A Leading Integrated Bio-diesel Producer & Distributor

Extensive Distribution Network Covering over 640 Million Population

5

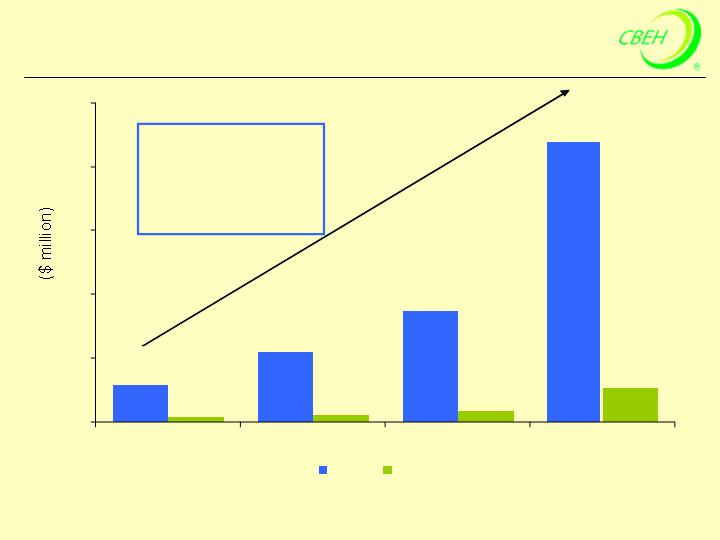

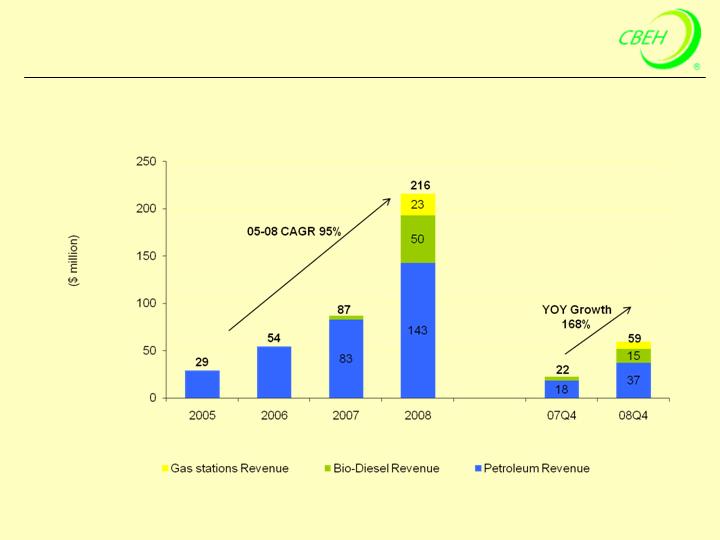

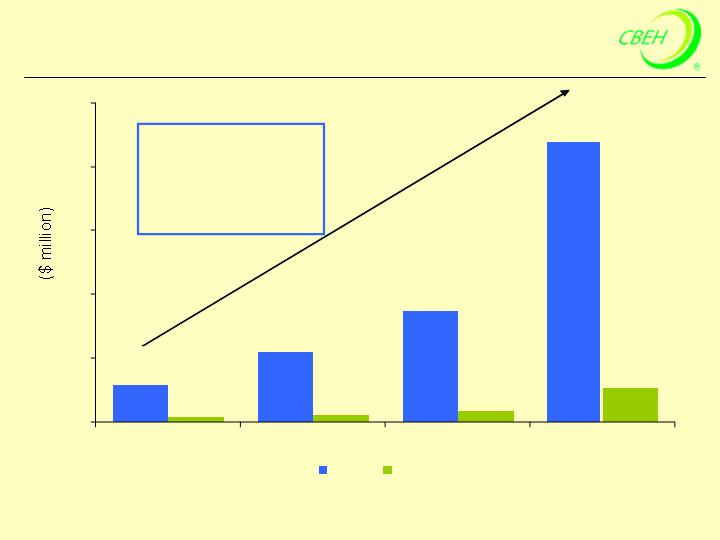

Accelerating Top-line and Bottom-line Growth

29.2

54.4

87.1

216.5

4.1

5.3

8.7

28.6*

0

50

100

150

200

250

2005

2006

2007

2008

Revenue

Net Income

Revenue

2005-2008 CAGR 95%

2007-2008 Growth 149%

Net Income

2005-2008 CAGR 91%

2007-2008 Growth 229%

*Non-GAAP – excluding $9.8 million non-cash, equity compensation expenses related to the release of shares from escrow to the founders for

meeting the 2008 “Make Good” provision.

6

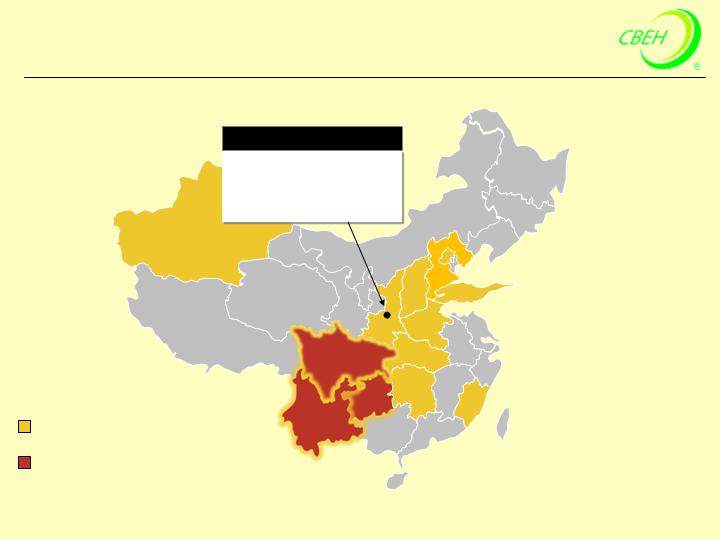

Company Overview

Shandong

Xi’an

Bio-diesel production facility

with annual capacity of

100,000 tons

Headquarter - Xi’an, Shaanxi

Sole access from Shaanxi through CBEH’s

military rail

Distribution areas covering over 640 million

population

Shanxi

Hubei

Henan

Hunan

Sichuan

Yunnan

Guizhou

Beijing

Shanghai

Xinjiang

Fujian

Hebei

7

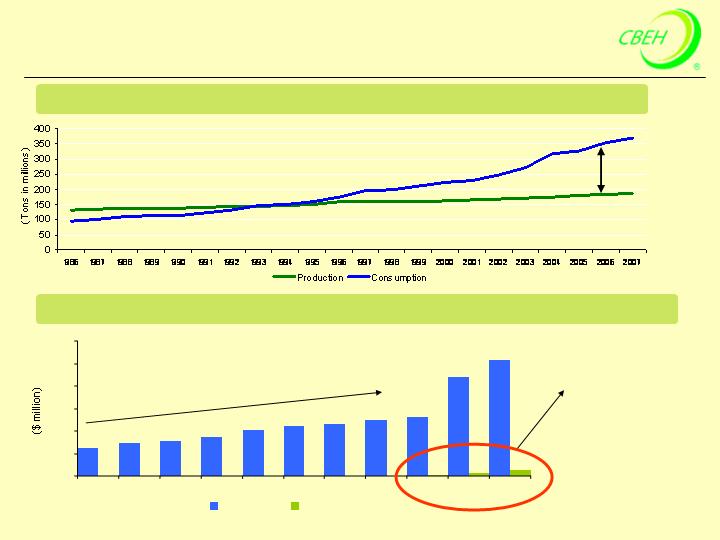

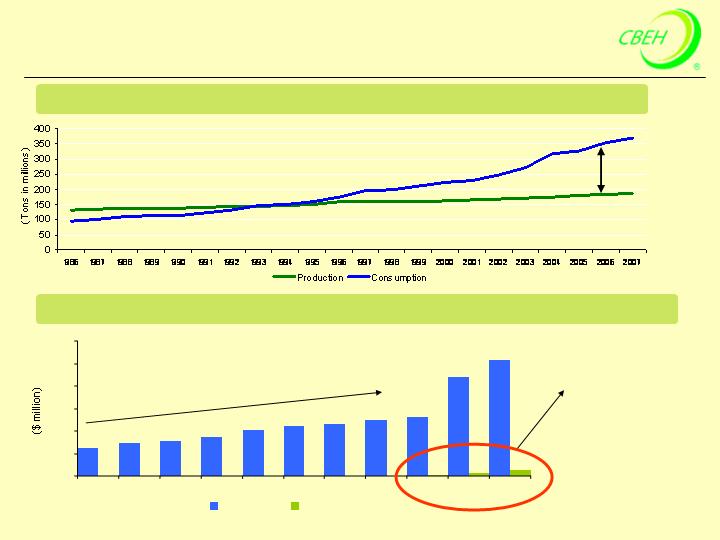

Bio-diesel Growth Fueled by an Emphasis on Renewable Energy

Source: 2008 BP Statistical Review of World Energy; Merrill Lynch research report, CEIC Data Company, Ltd; 2007-2008 Report on China Diesel Industry

China’s Oil Consumption Outpaces Production and the Imbalance Keeps Growing

Net

Import

China’s Bio-diesel Demand is Expected to Grow Exponentially and is Supported by Government Mandates

2000-2007 Diesel

CAGR 10%

2008-2012

Bio-diesel

CAGR 184%

62

73

77

85

101

110

116

125

130

220

258

2

7

13

0

50

100

150

200

250

300

2000

2001

2002

2003

2004

2005

2006

2007

2008

2010E

2012E

Diesel Sales

Bio-Diesel Sales

8

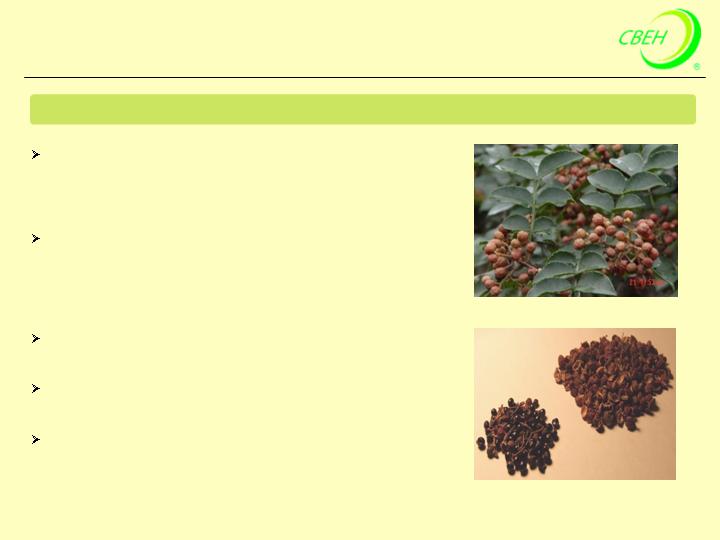

Secured Abundant and Low Cost Raw Materials

Non-edible plants grow abundantly in Shaanxi Province and

have very little alternative uses. Feedstock includes

Chinese prickly ash, castor bean, Chinese pistache,

Chinese pine, and paste oil.

Following the model “Company + Local Government +

Farmers”, CBEH works closely with these key partners to

establish 3.6 million acres of bio-diesel feedstock plant base.

Each acre of feedstock can produce 0.12 ton bio-diesel,

which translates to 430,000 tons of bio-diesel annually

Wildly grown plants in Shaanxi Province can support more

than 100,000 tons of bio-diesel production annually

The local forestry bureau sets a guidance price and

therefore our feedstock costs are relatively stable

CBEH is working with governments to lease feedstock plant

base to further strengthen control

Right of First Refusal to Rich Resources of Non-edible Seeds

9

Secured Abundant and Low Cost Raw Materials (Cont.)

Exclusive Access to Waste Cooking Oil in Xi’an Metro Area

Xi’an Environment Protection Bureau has set up four

Waste Oil Collecting Centers to consolidate supply from

restaurants and other establishments in Xi’an metro area.

We are the only company permitted to buy the collected

waste cooking oil from the bureau.

Xi’an metro area currently has 12 million population and

generates 150,000 tons of waste oil annually, which can

manufacture 135,000 tons of bio-diesel

The Environment Protection Bureau of Xi’an city sets a

guidance price which keeps our costs relatively stable

CBEH is working with other local governments to set up

similar arrangements of waste oil collection

CBEH Has Secured Feedstock Supply to Support 600,000 Tons Bio-diesel Production

10

One of the 10 companies in Shaanxi licensed to distribute

finished oil

One of the 3 companies in Shaanxi licensed to distribute both

finished and heavy oil

The only bio-diesel producer in China with distribution licenses

Distribution licenses are much harder to obtain now due to

increased regulation, particularly related to the environment

and safety

Synergy with Existing Distribution Network

CBEH’s bio-diesel sells through its own wholesale distribution

channel and retail gas stations

CBEH’s extensive distribution network includes a diversified,

established customer base

Other bio-diesel manufacturers have to sacrifice margin to sell

through outside distributors

Bio-diesel Sales Leverage Existing Distribution Network to Achieve Higher Margins

Distribution License Provides a High Barrier to Entry

11

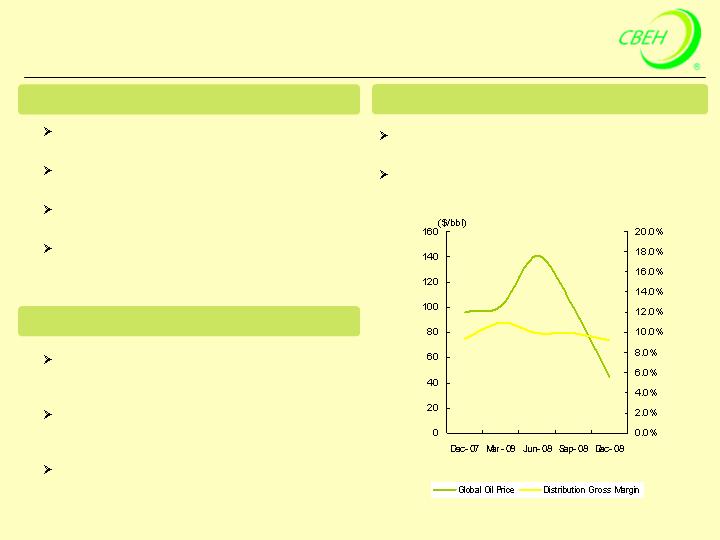

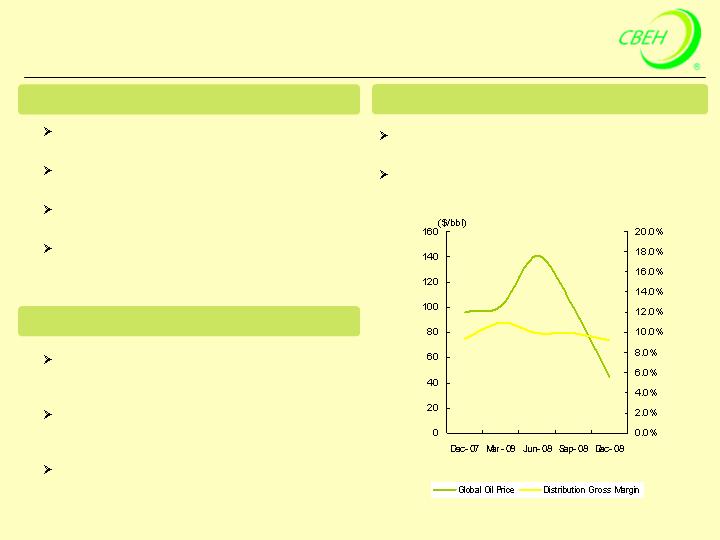

Stable Source of Cash for Growth

Company takes little inventory risk - Stable gross

margins despite oil price volatility

Strong cash flow to support further expansion of

bio-diesel business

Strong Distribution Business Supports Continuous Growth

The Market for Non-State-Owned Oil Distributor

PetroChina, Sinopec and CNOOC have their

own distribution network

Other oil refineries rely on third party

distributors

Large SOE refineries only supply to their own

retail stations

60% of China’s retail gas sales comes from

non state-owned retail gas stations which rely

on third party distributors for supply

Shaanxi Yanchang Oil, the fourth largest oil

producer in China, accounts for 11% of

China’s oil production

Shaanxi production and shipments to the rest

of China are expected to grow 20% annually

in the next 7 years

Established long-term relationship with

Yanchang Oil

Strategic Partnership with Leading Oil Producer

12

Experienced Management Team

Gao, Xincheng

Founder and CEO

Extensive experience in the research and marketing of oil products

Founded predecessor company to Baorun in 1996; founded Baorun in 1999

Prior to founding the Company, Mr. Gao worked in the Oil and Chemical Department of Shaaxi Province

and Zhongtian Oil and Chemical Group, responsible for R&D and marketing

BS degree in mechanical engineering from Xi’an Technology University and MBA from Xi’an

Communication University

Li, Gaihong

Chief Financial Officer

Appointed as CFO in September 2005

Served as CFO of Xi’an Dongfang Oil Group Co., Ltd., a Chinese petroleum producer, from 2000 to 2005

B.S. in Accounting from Xi’an Northwest University in 1997; currently pursuing MBA from Xi’an Jiaotong

University

Chen, Jun

Chief Operating Officer

Joined Baorun in 2005

Served as Manager of Sinopec, Hubei from 2000 to 2005

Established the Company’s sales system and led Baorun’s transition from sale of fuel oil to sale of finished

oil products

He, Nengde

Chief Technology Officer

Joined Baorun in 2005, in charge of research and development of bio-diesel

Specializes in oil extraction, trans-esterification and separation technologies for bio-diesel production

Led key alternative energy projects in multiple chemical companies and has several projects funded by

Chinese National Academy of Science

Ph.D. in chemical engineering from Sichuan University

Pu, Albert

Vice President of Finance

Joined CBEH in February 2009

Global Controller of Amphenol Corporation industrial Operations (NYSE: APH), a U.S. based multinational

manufacturing company, from 2005 to 2009

18 years of accounting/management experience in the US and China

Public accounting/auditing experience with international firm (PwC) and regional firm

New York State Certified Public Accountant (CPA)

B.S. in Accounting from State University of New York Institute of Technology in 1990

13

Summary Income Statement

($ in millions)

Revenue

Gross Profit

Gross Margin

Operating Income

Operating Margin

Net Income

Net Income(Non-GAAP)

Net Margin

Comprehensive Income

FY2005

29.2

4.4

15.0%

4.2

14.2%

4.1

4.1

14.2%

4.3

FY2006

54.4

5.8

10.6%

5.4

9.9%

5.3

5.3

9.8%

5.8

FY2007

87.1

10.4

11.6%

8.4

9.7%

8.7

8.7

9.8%

10.3

FY2008

216.5

33.1

15.3%

29.4

13.6%

18.7

28.6 *

13.2%

31.6

Q4 2008

59.2

10.0

16.9%

7.3

12.3%

-3.3

6.5*

11.0%

6.3

Q4 2007

22.6

3.0

13.3%

2.2

9.7%

2.1

2.1

9.3%

3.3

*Non-GAAP – excluding $9.8 million non-cash, equity compensation expenses related to the release of shares from escrow

to the founders for meeting the 2008 “Make Good” provision.

14

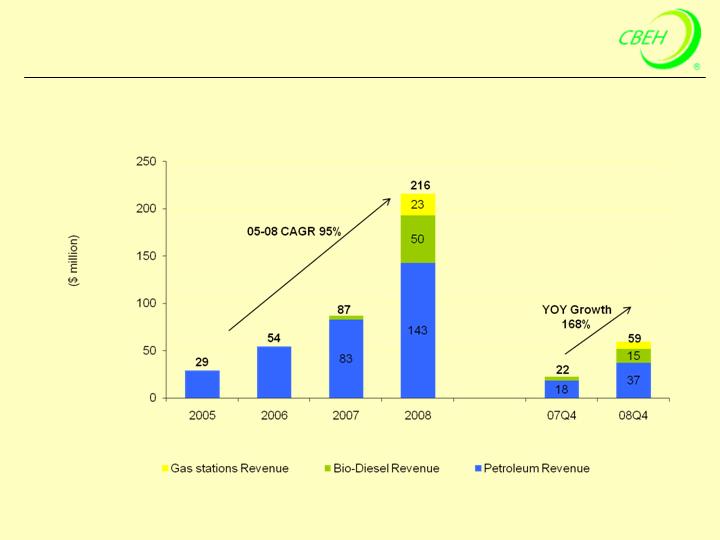

Biodiesel Fuels Accelerating Revenues

15

Improving Profitability

2007 Revenue Breakdown

2008 Revenue Breakdown

2005-2008 Net

Income CAGR

91%

*Non-GAAP – excluding $9.8 million non-cash, equity compensation expenses related to the release of shares from escrow to the

founders for meeting the 2008 “Make Good” provision.

16

Strong Balance Sheet

($ in thousands)

Cash & Equivalents

Accounts Receivable

Inventory

Total Current Assets

Total Assets

Accounts Payable

Total Current Liabilities

Total Liabilities

Total Shareholders’ Equity

Total Liabilities and Shareholders’ Equity

12/31/2008

23,119

8,164

22,269

78,288

94,694

1

10,795

10,795

83,899

94,694

12/31/2007

1,382

289

12,083

35,539

43,706

180

5,476

5,510

38,196

43,706

12/31/2006

631

5,745

7,304

19,096

20,316

2,267

6,014

6,076

14,240

20,316

17

Capital Markets Summary

Ticker Symbol (OTCBB)

Fiscal Year End

Share Price (3/19/2009)

Shares Outstanding

Shares Outstanding (Fully Diluted)

Market Capitalization

Management Ownership (Fully Diluted)

FY08 Revenue

FY08 Net Income

FY08 EPS (Basic)

CBEH

December 31

$4.15

34.2M

38.1M*

$142 M

66%

$216.5 M

$28.6 M**

$1.07**

$ #$$

FY08 EPS (Fully Diluted) $0.84**

*Includes 1.7M warrants @ $3.00 and 2.3M warrants @ $4.40

**Non-GAAP – excluding $9.8 million non-cash, equity compensation expenses related to the release of shares from escrow

to the founders for meeting the 2008 “Make Good” provision.

Current Market Conditions

China’s Oil Pricing Reform Policy

Impact on China Bio Energy

China’s fuel prices have been controlled by the NDRC for the last 9 years

Effective Jan. 1, 2009, China implemented a new pricing regime for refined oil

products aimed to link domestic oil prices more closely to global crude oil prices

In Jan. 2009, Average Sale Price for China Bio Energy’s oil products decreased

22.3% compared to 2008, substantially less than the drop in world crude oil prices

Pressure on revenues, but will maintain stable margins due to lower raw material

costs – waste cooking oil down 50% and non-edible seeds down 20%

Company’s patented technology allows the manufacturing process to utilize different

proportions of waste oil and/or non edible seeds, which enables China Bio Energy to

optimize gross margins based on input prices

Growth Strategy

Expand Bio-diesel Annual Production Capacity to 150,000 tons in 2009

Strengthen Control of Feedstock for Bio-diesel Production

Expand Distribution Network - Acquire Retail Gas Stations

Strengthen Outreach in Certain Key Distribution Areas

Move to NASDAQ or a Higher Exchange by June 30th, 2009

20

20

Investment Highlight

Bio-diesel Growth Driven by Focus on Renewable Energy and Pollution Control

The Only Integrated Bio-diesel Producer and Distributor in China

Solid Cash Management and Working Capital Position

Synergy with Existing Distribution Network that Expands Margins

Secured Abundant and Low-Cost Bio-diesel Feedstock Protects Margins

Low Valuation Relative to Key Financial Metrics and Growth Trajectory

21

Contact Information

Alex Gong

VP of Capital Markets

China Bio Energy Holding Co.

Email: alexgong08@gmail.com

Phone: 011-86-13601279912

Website: www.cbeh.net.cn

Ted Haberfield

Investor Relations

HC International, Inc.

Email: Ted Haberfield

Phone: 760-755-2716

Website: www.hcinternational.net