SCHEDULE B Audited consolidated balance sheets of Good as at December 31, 2014 and 2013 and the related consolidated statements of operations, consolidated statements of redeemable convertible preferred stock and deficit, and consolidated statements of cash flows for the years ended December 31, 2014 and 2013

B-1 Independent Auditor's Report To the Board of Directors of Good Technology Corporation We have audited the accompanying consolidated financial statements of Good Technology Corporation and its subsidiaries, which comprise the consolidated balance sheets as of December 31, 2014 and December 31, 2013, and the related consolidated statements of operations, redeemable convertible preferred stock and deficit and cash flows for the years then ended. Management's Responsibility for the Consolidated Financial Statements Management is responsible for the preparation and fair presentation of the consolidated financial statements in accordance with accounting principles generally accepted in the United States of America; this includes the design, implementation, and maintenance of internal control relevant to the preparation and fair presentation of consolidated financial statements that are free from material misstatement, whether due to fraud or error. Auditor's Responsibility Our responsibility is to express an opinion on the consolidated financial statements based on our audits. We conducted our audits in accordance with auditing standards generally accepted in the United States of America. Those standards require that we plan and perform the audit to obtain reasonable assurance about whether the consolidated financial statements are free from material misstatement. An audit involves performing procedures to obtain audit evidence about the amounts and disclosures in the consolidated financial statements. The procedures selected depend on our judgment, including the assessment of the risks of material misstatement of the consolidated financial statements, whether due to fraud or error. In making those risk assessments, we consider internal control relevant to the Company's preparation and fair presentation of the consolidated financial statements in order to design audit procedures that are appropriate in the circumstances, but not for the purpose of expressing an opinion on the effectiveness of the Company's internal control. Accordingly, we express no such opinion. An audit also includes evaluating the appropriateness of accounting policies used and the reasonableness of significant accounting estimates made by management, as well as evaluating the overall presentation of the consolidated financial statements. We believe that the audit evidence we have obtained is sufficient and appropriate to provide a basis for our audit opinion. Opinion In our opinion, the consolidated financial statements referred to above present fairly, in all material respects, the financial position of Good Technology Corporation and its subsidiaries as of December 31, 2014 and December 31, 2013, and the results of their operations and their cash flows for the years then ended in accordance with accounting principles generally accepted in the United States of America. Emphasis of Matter As discussed in Note 1 to the consolidated financial statements, if the Company does not consummate an initial public offering with proceeds greater than $75.0 million prior to March 1, 2016, the holders of the Company’s outstanding notes payable totaling $80.0 million have the right to require the Company to immediately repurchase the notes at a repurchase price of 110% of the principal amount of notes plus accrued and unpaid interest, which the Company does not expect to be able to repay without issuing additional debt or equity securities through public or private financings. The risks and uncertainties related to this repurchase obligation could affect amounts reported in the Company’s financial statements in future periods. /s/ PricewaterhouseCoopers LLP San Jose, California March 5, 2015

B-2 GOOD TECHNOLOGY CORPORATION Consolidated balance sheets (In thousands, except per share data) December 31, 2013 December 31, 2014 Pro forma deficit as of December 31, 2014 (unaudited) ASSETS CURRENT ASSETS: Cash and cash equivalents ....................................................................................... $ 42,132 $ 24,496 Accounts receivable, net .......................................................................................... 48,815 51,348 Restricted cash ......................................................................................................... 181 5,957 Deferred commissions, current portion ................................................................... 7,324 9,397 Prepaid expenses and other current assets ............................................................... 9,810 7,406 Total current assets ............................................................................................. 108,262 98,604 NON-CURRENT ASSETS: Property and equipment, net .................................................................................... 17,245 13,129 Deferred commissions, net of current portion ......................................................... 15,901 16,240 Intangible assets, net ................................................................................................ 18,238 66,614 Goodwill ................................................................................................................... 66,156 200,233 Restricted cash, non-current..................................................................................... — 9,411 Other assets .............................................................................................................. 2,315 6,170 Total non-current assets ...................................................................................... 119,855 311,797 TOTAL ASSETS ........................................................................................................... $ 228,117 $ 410,401 LIABILITIES, REDEEMABLE CONVERTIBLE PREFERRED STOCK AND DEFICIT CURRENT LIABILITIES: ........................................................................................... Accounts payable ........................................................................................................... $ 14,325 $ 16,841 Accrued compensation and related benefits .................................................................. 17,875 13,483 Income taxes payable, current portion .......................................................................... 1,372 1,738 Bank debt, current portion ............................................................................................. 5,144 — Deferred revenues, current portion ................................................................................ 126,141 166,195 Accrued and other current liabilities ............................................................................. 11,449 14,624 Total current liabilities .................................................................................................. 176,306 212,881 NON-CURRENT LIABILITIES: ................................................................................. Bank debt, net of current portion .................................................................................. 19,718 — Deferred revenues, net of current portion ..................................................................... 284,378 258,769 Notes payable, non-current ............................................................................................ — 56,146 Warrant liability ............................................................................................................. — 22,801 Income taxes payable, net of current portion ................................................................ 3,355 3,280 Other non-current liabilities .......................................................................................... 3,865 6,446 Total non-current liabilities ........................................................................................... 311,316 347,442 TOTAL LIABILITIES .................................................................................................. 487,622 560,323 Commitments and contingencies (Note 7) .................................................................... Redeemable convertible preferred stock, par value of $0.0001 per share: 131,423 and 151,423 shares authorized, as of, December 31, 2013 and December 31, 2014, respectively; 130,026 and 145,763 shares issued and outstanding as of December 31, 2013 and December 31, 2014, respectively (liquidation preference of $267,384 as of December 31, 2014) actual; no shares issued and outstanding pro forma (unaudited) ............................................. $ 184,798 $ 284,403 $ — DEFICIT: Common stock, par value $0.0001 per share: 271,000 and 311,000 shares authorized as of December 31, 2013 and December 31, 2014, respectively; 52,418 and 73,356 shares issued and outstanding as of December 31, 2013 and December 31, 2014, respectively, actual; 219,119 shares issued and outstanding pro forma (unaudited) .......................................................................... 5 7 22 Additional paid-in capital .............................................................................................. 165,016 269,831 554,219 Accumulated deficit ....................................................................................................... (608,765) (704,163) (704,163) Total Good Technology Corporation stockholders’ deficit .......................................... (443,744) (434,325) (149,922) Noncontrolling interest .................................................................................................. (559) — — Total deficit .................................................................................................................... (444,303) (434,325) $ (149,922) TOTAL LIABILITIES, REDEEMABLE CONVERTIBLE PREFERRED STOCK AND DEFICIT .......................................................................................... $ 228,117 $ 410,401 The accompanying notes are an integral part of these consolidated financial statements.

B-3 GOOD TECHNOLOGY CORPORATION Consolidated statements of operations (In thousands, except per share data) Year ended December 31, 2013 2014 Revenues: Recurring ..................................................................................... $ 46,709 $ 81,444 Perpetual license .......................................................................... 52,210 62,290 Intellectual property ..................................................................... 23,286 20,219 Other ............................................................................................ 38,179 47,901 Total revenues ........................................................................ 160,384 211,854 Cost of revenues ............................................................................... 45,147 53,705 Gross profit ............................................................................. 115,237 158,149 Operating expenses: Research and development .......................................................... 75,875 88,152 Sales and marketing ..................................................................... 112,537 109,007 General and administrative .......................................................... 42,713 44,928 Total operating expenses ........................................................ 231,125 242,087 Loss from operations ........................................................................ (115,888) (83,938) Other expense, net ............................................................................ (417) (3,523) Interest expense, net ......................................................................... (1,176) (5,944) Loss before benefit from (provision for) income taxes .................... (117,481) (93,405) Benefit from (provision for) income taxes ....................................... (954) (1,992) Net loss ............................................................................................. (118,435) (95,397) (Income) loss attributable to noncontrolling interest ........................ 9 (1) Net loss attributable to Good Technology Corporation common stockholders ................................................................................. $ (118,426) $ (95,398) Net loss per share attributable to Good Technology Corporation common stockholders, basic and diluted ...................................... $ (2.41) $ (1.43) Weighted average shares used in computing net loss per share attributable to Good Technology Corporation common stockholders, basic and diluted ..................................................... 49,097 66,649 Pro forma net loss per share attributable to Good Technology Corporation common stockholders, basic and diluted (unaudited) ................................................................................... $ (0.46) Weighted average shares used in computing pro forma net loss per share attributable to Good Technology Corporation common stockholders, basic and diluted (unaudited) .................. 208,385 The accompanying notes are an integral part of these consolidated financial statements.

B-4 GOOD TECHNOLOGY CORPORATION Consolidated statements of redeemable convertible preferred stock and deficit (In thousands) Redeemable convertible preferred stock Common stock Additional paid-in capital Accumulated deficit Total Good Technology Corporation stockholders deficit Noncontrolling interest Total deficit Shares Amount Shares Amount Balances as of December 31, 2012 ..................................... 114,371 121,228 44,772 4 142,946 (490,339) (347,389) (550) (347,939) Stock-based compensation ...... — — — — 15,723 — 15,723 — 15,723 Exercise of stock options ........ — — 7,622 1 5,131 — 5,132 — 5,132 Excess tax benefit from stock option transactions ............... — — — — 92 — 92 — 92 Exercise of common stock warrant ................................ — — 24 — 5 — 5 — 5 Vesting of early exercised stock options........................ — — — — 25 — 25 — 25 Issuance of Series C-1 redeemable convertible preferred stock, net of issuance costs of $696 ......... 15,655 63,570 — — — — — — — Issuance of common stock warrants ............................... — — — — 1,094 — 1,094 — 1,094 Net loss ................................... — — — — — (118,426) (118,426) (9) (118,435) Balances as of December 31, 2013 ..................................... 130,026 184,798 52,418 5 165,016 (608,765) (443,744) (559) (444,303)

B-5 GOOD TECHNOLOGY CORPORATION Consolidated statements of redeemable convertible preferred stock and deficit—(continued) (In thousands) Redeemable convertible preferred stock Common stock Additional paid-in capital Accumulated deficit Total Good Technology Corporation stockholders deficit Noncontrolling interest Total deficit Shares Amount Shares Amount Stock-based compensation ...... — — — — 15,695 — 15,695 — 15,695 Exercise of stock options ........ — — 4,953 — 3,811 — 3,811 — 3,811 Vesting of early exercised stock .................................... — — — — 11 — 11 — 11 Excess tax benefit from stock option transactions ............... — — — — 507 — 507 — 507 Issuance of Series C-1 redeemable convertible preferred stock ..................... 422 1,765 — — — — — — — Issuance of Series C-2 redeemable convertible preferred stock for BoxTone acquisition ........................... 13,123 83,984 — — — — — — — Issuance of Series C-2 redeemable convertible preferred stock for Fixmo acquisition ........................... 2,192 13,856 — — — — — — — Issuance of common stock for BoxTone acquisition ........... — — 11,386 2 56,018 — 56,020 — 56,020 Issuance of common stock options for BoxTone acquisition ........................... — — — — 7,576 — 7,576 — 7,576 Issuance of common stock for Fixmo acquisition ................ — — 2,192 — 8,507 — 8,507 — 8,507 Issuance of common stock for Macheen acquisition ............ — — 1,595 — 6,889 — 6,889 — 6,889 Issuance of fully vested common stock options for Macheen acquisition ............ — — — — 136 — 136 — 136 Issuance of fully vested restricted stock units for Macheen acquisition ............ — — — — 955 — 955 — 955 Issuance of common stock warrants ............................... — — — — 1,524 — 1,524 — 1,524

B-6 Redeemable convertible preferred stock Common stock Additional paid-in capital Accumulated deficit Total Good Technology Corporation stockholders deficit Noncontrolling interest Total deficit Shares Amount Shares Amount Issuance of common stock for professional services ........... — — 65 — 252 — 252 — 252 Issuance of common stock for litigation matters .................. — — 650 — 3,308 — 3,308 — 3,308 Issuance of common stock upon vesting of restricted stock units ........................... — — 115 — — — — — — Repurchase of early exercised stock options........................ — — (18) — — — — — — Earn-out consideration related to the Fixmo acquisition ...... — — — — 300 — 300 — 300 Purchase of noncontrolling interest ................................. — — — — (674) — (674) 558 (116) Net loss ................................... — — — — — (95,398) (95,398) 1 (95,397) Balances as of December 31, 2014 ..................................... 145,763 $ 284,403 73,356 $ 7 $ 269,831 $ (704,163) $ (434,325) $ — $ (434,325) The accompanying notes are an integral part of these consolidated financial statements.

B-7 GOOD TECHNOLOGY CORPORATION Consolidated statements of cash flows (In thousands) Year ended December 31, 2013 2014 CASH FLOWS FROM OPERATING ACTIVITIES: Net loss ............................................................................................ $ (118,435) $ (95,397) Adjustments to reconcile net loss to net cash used in operating activities: Stock-based compensation ............................................................... 15,723 15,695 Issuance of common stock for professional services ........................ — 252 Excess tax benefit from stock option transactions ............................ (92) (507) Depreciation and amortization .......................................................... 13,411 23,926 Amortization of debt discount .......................................................... — 1,765 Amortization of debt issuance costs ................................................. 150 385 Loss on early extinguishment of debt ............................................... — 2,389 Gain on sale of patents ..................................................................... — — Write-off of acquired IPR&D ........................................................... — 4,900 Write-off of property and equipment ................................................ 2,320 — Write-off of initial public offering costs ........................................... 2,260 — Foreign currency (gain) loss ............................................................. 1 593 Deferred income taxes ...................................................................... (431) 273 Provision for (recovery of) bad debts ............................................... 217 (66) (Gain) loss on remeasurement of fair value of warrant and put option liabilities ............................................................................ — (1,354) (Gain) loss on disposal of property and equipment .......................... 649 121 Changes in operating assets and liabilities: Accounts receivable.......................................................................... (1,836) (1,083) Deferred commissions ...................................................................... (3,283) (2,412) Prepaid expenses and other current assets ........................................ (420) (1,733) Other assets....................................................................................... (1,660) (1,654) Income taxes payable ....................................................................... 42 806 Accounts payable and other liabilities .............................................. 3,208 2,664 Deferred revenues ............................................................................. 33,928 9,396 Net cash used in operating activities ................................................ (54,251) (41,041) CASH FLOWS FROM INVESTING ACTIVITIES: Acquisitions, net of cash acquired .................................................... — (10,032) (Increase) decrease in restricted cash ............................................... 429 (15,187) Purchase of property and equipment ................................................ (9,545) (6,866) Proceeds from sale of patents ........................................................... — — Proceeds from sale of property and equipment ................................ — — Net cash used in investing activities ................................................. (9,116) (32,085) CASH FLOWS FROM FINANCING ACTIVITIES: Proceeds from issuance of common stock ........................................ 5,162 3,822 Excess tax benefit from stock option transactions ............................ 92 507 Proceeds from issuance of preferred stock ....................................... 63,570 1,765 Principal payments on capital leases ................................................ (827) (26) Borrowings on term loan, net of issuance costs ................................ 7,311 84,917 Payments on term loan ..................................................................... (7,042) (23,531) Borrowings on revolving line of credit, net of issuance costs .......... 9,927 — Payments on revolving line of credit, including commitment fees ............................................................................................... — —

B-8 Year ended December 31, 2013 2014 Acquisition of noncontrolling interest .............................................. — — Payments of initial public offering costs .......................................... — (2,106) Net cash provided by financing activities ......................................... 5,898 76,087 EFFECT OF EXCHANGE RATE CHANGES ON CASH AND CASH EQUIVALENTS .............................................................. 25 (54) NET INCREASE (DECREASE) IN CASH AND CASH EQUIVALENTS .......................................................................... (11,078) 12,666 CASH AND CASH EQUIVALENTS—Beginning of period .......... 40,544 29,466 CASH AND CASH EQUIVALENTS—End of period ................... $ 29,466 $ 42,132 SUPPLEMENTAL DISCLOSURES OF CASH FLOW INFORMATION: Cash paid for interest ....................................................................... $ 788 $ 748 Cash paid for income taxes .............................................................. $ 1,431 $ 681 NON-CASH INVESTING AND FINANCING ACTIVITIES: Issuance of preferred stock for acquisitions .................................... $ 29,992 $ — Issuance of common stock for acquisitions ..................................... $ 6,827 $ — Issuance of restricted common stock for acquisitions ..................... $ 3,864 $ — Grant of common stock options for acquisitions ............................. $ 2,784 $ — Issuance of redeemable convertible preferred stock warrants ......... $ — $ — Issuance of common stock warrants ................................................ $ — $ 1,094 Transfer of warrant liability to Series B-1 preferred stock upon exercise ........................................................................................ $ 1,629 $ — Period end accounts payable related to property and equipment purchases ..................................................................................... $ 1,338 $ 2,538 Period end accounts payable related to initial public offering costs ............................................................................................. $ — $ 153 Period end accounts payable related to debt financing costs ........... $ — $ — The accompanying notes are an integral part of these consolidated financial statements.

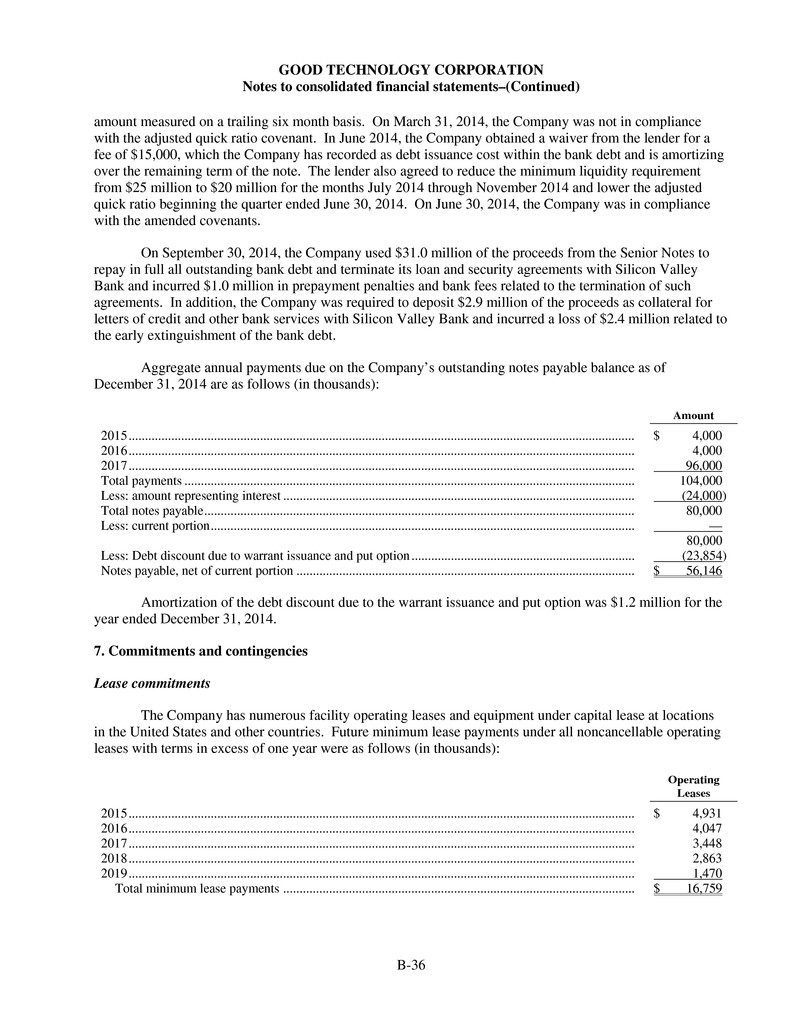

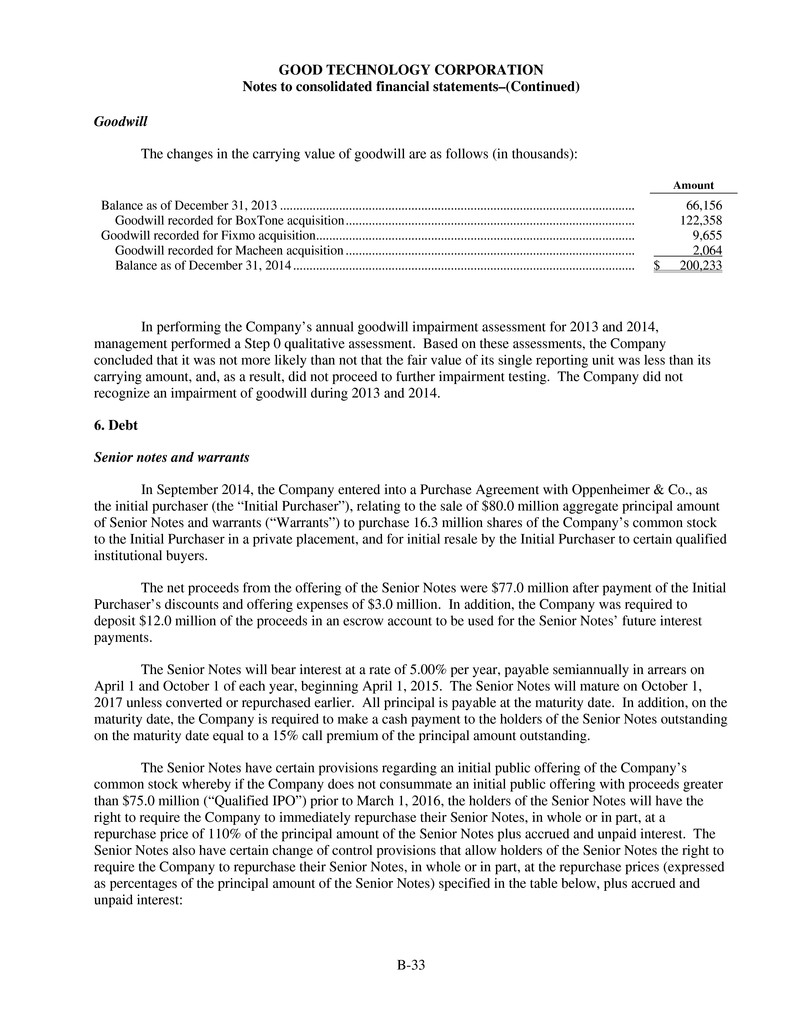

B-9 GOOD TECHNOLOGY CORPORATION Notes to consolidated financial statements 1. Formation and business of the company Visto Corporation (“Visto” or the “Company”) was incorporated in Delaware in July 1996. In February 2009, Visto acquired Good Technology, Inc. from Motorola, Inc. (“Motorola”) and began doing business as Good Technology (“Good”). In September 2012, Visto changed its name to Good Technology Corporation. Good provides a secure mobility solution that enables organizations to increase productivity and transform business processes by delivering a suite of collaboration applications, a secure mobility platform, and a third-party application and partner ecosystem. The Good Collaboration Suite includes Good for Enterprise, which provides secure mobile email, calendar, contacts, attachments, notes and browsing, along with Good Work, the Company’s next generation productivity solution that it makes available in the cloud, on premise, or both, Good Share and Good Connect for file sharing and instant messaging, Good Access, a secure mobile browser, and Good for Salesforce1, the Company’s containerized version of the standard Salesforce1 application. The Company’s secure mobility platform, Good Dynamics, provides both security and application services to enable independent software vendors, systems integrators and internal enterprise development organizations to build applications that include the Company’s security functionality and simplify application development across devices and operating systems. In addition, the Company’s platform provides service management, which is real-time visibility into an organization’s mobile usage and operational status. The Company works with a broad set of third-party independent software vendors and system integrators to incorporate its security architecture and management framework into the run-time environment of many existing, popular applications. These applications can be managed and published in “app stores” to streamline their distribution and policy management. Liquidity The Company has incurred significant losses since its inception and believes that it will continue to incur losses into at least 2015, which will have a negative impact on cash flow from operations. For the years ended December 31, 2013 and 2014, the Company incurred net losses of $118.4 million and $95.4 million, respectively. The Company had an accumulated deficit of $704.2 million and cash and cash equivalents of $24.5 million as of December 31, 2014. As of December 31, 2014, the Company had significant outstanding debt and contractual obligations related to operating leases. In September 2014, the Company entered into a purchase agreement relating to the sale of $80.0 million principal amount of 5% senior secured notes (the “Senior Notes”). The Senior Notes are outstanding as of December 31, 2014 and are due October 1, 2017, together with a 15% premium. See Note 6 and Note 7 for further details regarding the Company’s debt and operating lease commitments, respectively. If the Company does not consummate an initial public offering with aggregate gross proceeds greater than $75.0 million (“Qualified IPO”) prior to March 1, 2016, the holders of the Senior Notes have the right to require the Company to immediately repurchase the Senior Notes, in whole or in part, at a repurchase price of 110% of the principal amount of Senior Notes plus accrued and unpaid interest. Should this occur, the Company does not expect to be able to repay the Senior Notes without issuing additional debt or equity securities through public or private financings. If the Company is unable to issue additional debt or equity securities, the Company may be required to refinance all or part of the existing debt, sell assets or borrow more funds, which the Company may not be able to accomplish on terms acceptable to the Company, or at all.

GOOD TECHNOLOGY CORPORATION Notes to consolidated financial statements–(Continued) B-10 In addition, the terms of existing or future debt agreements may restrict the Company from pursuing any of these alternatives. If there is a change of control of the Company, the holders of the Senior Notes have the right to require the Company to repurchase their Senior Notes, in whole or in part, at the repurchase prices specified in the Note agreement plus accrued and unpaid interest, further described in Note 6. The consolidated financial statements as of December 31, 2013 and 2014 and for the years ended December 31, 2013 and 2014 were prepared on the basis of a going concern which contemplates that the Company will be able to realize assets and discharge liabilities in the normal course of business. Accordingly, they do not give effect to adjustments that would be necessary should the Company be required to liquidate some of its assets. The Company’s ability to satisfy its total liabilities at December 31, 2014 and to continue as a going concern is dependent upon either the successful completion of its planned IPO or the timely availability of other long-term financing. The financial statements do not include any adjustments that might result from the outcome of these uncertainties. The Company’s current operating plan for 2015 contemplates significant reduction in the Company’s net cash outflows, resulting from sales growth in existing and new products and reduced operating expenses compared to prior periods. In an effort to reduce 2015 operating expenses, the Company implemented a plan in January 2015 and reduced the number of Company employee positions by approximately 15% (see Note 19). The Company believes its available financial resources are sufficient to fund its working capital and other capital requirements through December 31, 2015. The Company’s operations require careful management of cash and working capital balances. The Company’s liquidity is affected by many factors including, among others, fluctuations in revenues, gross profit and operating expenses, as well as changes in operating assets and liabilities. The Company may need additional funds to support working capital requirements and operating expenses, or for other requirements. There can be no assurance that the Company will be successful in executing its business plan, maintaining its existing customer base or achieving profitability. Failure of the Company to generate sufficient revenues, achieve planned gross margins, control operating costs, generate positive cashflows or raise sufficient additional funds may require the Company to modify, delay or abandon some of its planned future expansion or expenditures, which could have a material adverse effect on the Company’s business, operating results, financial condition and ability to achieve its intended business objectives, and therefore, the Company could be forced to curtail its operations, which would have a material adverse effect on the Company’s ability to continue with its business plans. 2. Summary of significant accounting policies Basis of presentation The consolidated financial statements include the Company’s accounts and the accounts of its wholly- and majority-owned subsidiaries. The Company reports noncontrolling interest positions as a separate component of consolidated deficit from Good Technology Corporation stockholders’ deficit. Intercompany transactions and balances have been eliminated. Because the Company does not have any other comprehensive income (loss) components, total comprehensive loss only includes the Company’s net loss.

GOOD TECHNOLOGY CORPORATION Notes to consolidated financial statements–(Continued) B-11 Out-of-period adjustment During Q4 2014, the Company recorded an out-of-period adjustment to correct for a cashflow classification error in Q2 2014 related to the BoxTone acquisition purchase consideration. The impact of the out-of-period adjustment resulted in a $1.6 million decrease in net cash used in operating activities and a corresponding increase of $1.6 million in net cash used in investing activities in Q4 2014. Management does not believe that the error was material to any prior period interim financial statements, and the impact of correcting the error in Q4 2014 is not material to those financial statements. Unaudited pro forma deficit In the event that an initial public offering of the Company’s common stock, or IPO, is completed, all shares of the Company’s outstanding redeemable convertible preferred stock will convert into common stock automatically, as further described in Note 12. The unaudited pro forma deficit as of December 31, 2014 gives effect to the automatic conversion of all outstanding shares of redeemable convertible preferred stock into an aggregate of 145,763,243 shares of common stock. The pro forma deficit does not give effect to any proceeds from the qualifying IPO of the Company’s common stock. Use of estimates The Company’s consolidated financial statements are prepared in accordance with U.S. generally accepted accounting principles (“GAAP”). GAAP requires management to make judgments, estimates and assumptions that may affect the reported amounts of assets and liabilities as of the date of its consolidated financial statements as well as the reported amounts of revenues and expenses during the periods presented. These judgments, estimates and assumptions are used for, but not limited to: revenue recognition including customer useful lives, litigation claims, fair value of assets acquired and liabilities assumed in business combinations, implied fair value of goodwill, potential impairment of property and equipment, potential impairment of intangible assets and goodwill, provision for income taxes, including required valuation allowances and uncertain tax positions, and the fair value of redeemable convertible preferred stock, common stock and stock options issued. The Company bases its estimates on various factors and information which may include, but are not limited to, history and prior experience, current economic conditions and information from third-party professionals that management believes to be reasonable under the circumstances, the results of which form the basis for making judgments about the carrying value of assets and liabilities and recorded amounts of revenues and expenses that are not readily apparent from other sources. Actual results may differ from these estimates, and these differences may be material. Foreign currency The functional currency of the Company and its subsidiaries is the U.S. dollar. Accordingly, the financial statements of the subsidiaries that are maintained in the local currency are remeasured into U.S. dollars at the reporting date. Unrealized gains or losses on transactions in currencies other than the U.S. dollar are recognized in the consolidated statements of operations. Cash and cash equivalents The Company considers highly liquid investments with a maturity of three months or less as of the date of purchase to be cash equivalents. Cash equivalents as of December 31, 2013 and 2014 consisted of a money market mutual fund.

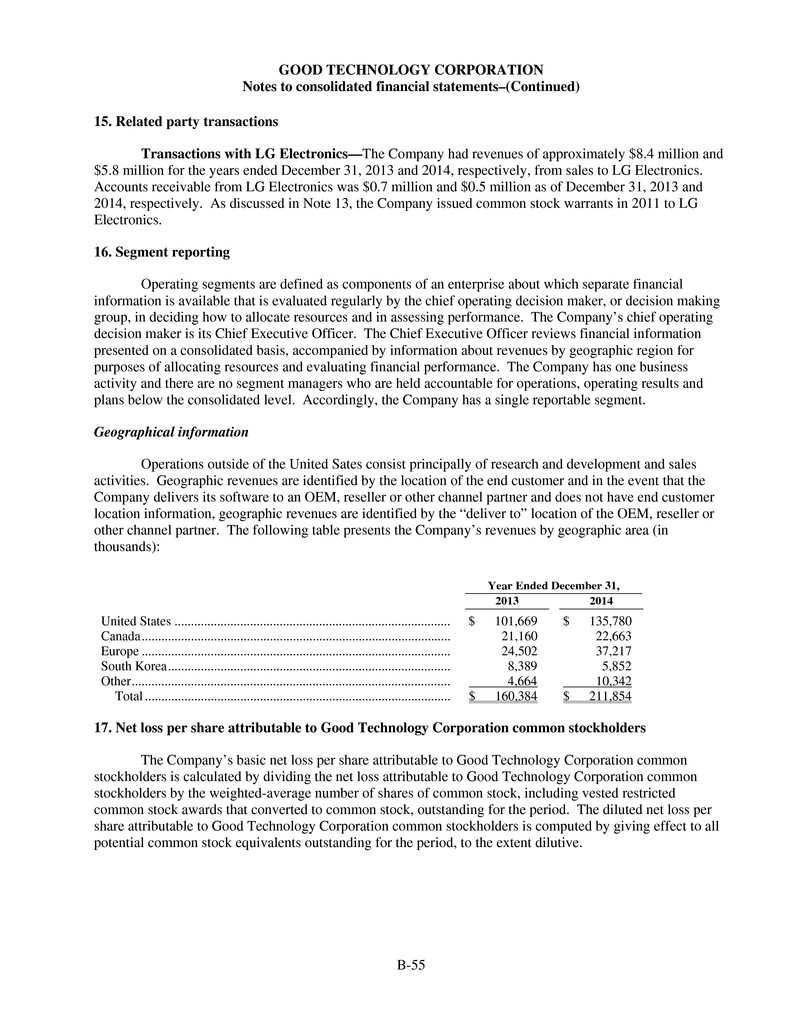

GOOD TECHNOLOGY CORPORATION Notes to consolidated financial statements–(Continued) B-12 Revenue recognition The Company sells software solutions which are composed of secure mobile collaboration applications and mobile application platforms, and essential software-related connectivity services delivered through the Company’s network operating center also referred to as the Company’s Good Secure Cloud. All of the Company’s deliverables are deemed to be in the scope of the software revenue recognition rules. The Company recognizes revenues provided the following criteria of revenue recognition are met: (1) it enters into a legally binding arrangement with a customer; (2) products or services are delivered; (3) fees are fixed or determinable and free of contingencies or significant uncertainties; and (4) collection is probable. Nearly all of the Company’s enterprise software licensing arrangements are multiple element arrangements, which include licenses to use the Company’s software on the customers’ servers and mobile devices, software maintenance and customer support, and secure connectivity services. The Company’s software is sold under term and perpetual licenses and includes an initial software maintenance and support period of one to three years. Software maintenance and customer support are delivered for a single fee and can be renewed upon contract expiration at the customer’s option. Software maintenance includes unspecified software upgrades, updates and bug fixes. Customer support consists of access to live technical support technicians, on-line knowledge resources and on-site support for premium-level customers. For time- based software license sales, the license, maintenance and support fees are bundled into a single selling unit with a defined period of use. Both perpetual and time-based licenses also include access over the entire respective license period to the Good Secure Cloud, which enables a secure connection between the customers’ servers and their mobile devices through the Company’s network operating center. Further, the delivered software elements are essential to the functionality and utility of this secure connectivity service. The Company’s revenues for the years ended December 31, 2013 and 2014 were as follows (in thousands): Year ended December 31, 2013 2014 Recurring Term license revenues ............................................................. $ 9,451 $ 35,389 Maintenance revenues ............................................................. 37,258 46,055 Total recurring revenues ..................................................... $ 46,709 $ 81,444 Perpetual license Perpetual license revenues ...................................................... $ 41,276 $ 54,574 OEM revenues ........................................................................ 10,934 7,716 Total perpetual license revenues ......................................... $ 52,210 $ 62,290 Intellectual property .................................................................... $ 23,286 $ 20,219 Other Carrier revenues ...................................................................... $ 30,757 $ 34,502 Professional service revenues ................................................. 2,178 3,471 Third-party application revenues ............................................ 160 206 Total other revenues ........................................................... $ 33,095 $ 38,179 Total revenues ..................................................................... $ 116,605 $ 160,384 Recurring. Recurring revenues consist of sales of term-based licenses to the Company’s Good for Enterprise and Good Dynamics platform and renewals of maintenance and support related to perpetual licenses, which are recognized ratably over the stated contractual period, which generally range from one to three years.

GOOD TECHNOLOGY CORPORATION Notes to consolidated financial statements–(Continued) B-13 Perpetual license. Perpetual license revenues consist of sales of perpetual licenses to the Company’s Good for Enterprise application and an associated initial maintenance and support contract, all of which are recognized over the estimated customer life, generally five years. When an arrangement includes both time-based and perpetual software licenses, all revenues are recognized ratably over the longer of the service delivery periods applicable to time-based and perpetual software licenses, generally five years. The secure connectivity service element is essential to the functionality of the delivered software and, as such, these services are delivered over the software license period. The number of computing tasks is unspecified and the pattern of delivering the tasks is not discernible. Accordingly, proportional performance is applied by analogy to both the software and service elements included in the arrangement. The Company ratably recognizes the amounts allocated to software fees and the related service fees paid upfront over the specified term or the estimated life of the arrangement. Since the secure connectivity service obligation is perpetual, the Company utilizes an estimated average length of the customer relationship to determine the amortization period for arrangements with a perpetual license that can be transferred to new users, mobile devices or operating systems. The Company estimates the average length of the customer relationship to be five years based on historical trends, technological obsolescence and industry perspectives. In arrangements that do not allow for transferability of the perpetual license, such as the Company’s sales to OEM customers, the Company utilizes the estimated life of the consumer’s mobile device, or 18 months. The Company estimates the average life of the consumer’s mobile device based on industry reports and device refresh eligibility periods by mobile carriers. All elements bundled with the perpetual license are amortized over the same service delivery period. Intellectual property. Intellectual property licensing revenues represent cash settlements with various companies for infringement of the Company’s patents, or direct licenses of the Company’s intellectual property. As part of these settlements, the Company has granted such companies licenses and a release from all prior damages associated with the Company’s patent assets, and in certain circumstances rights to future intellectual property developed by the Company. Revenues from these agreements are recognized, based on the terms of the agreements with licensees, immediately, when the Company has no remaining obligations to the licensee, or amortized over performance periods of up to 13.8 years, when the Company has granted to licensees rights to receive future intellectual property it may develop. Other. Other revenues consist of sales of the Company’s Good for You consumer product, including sales through various revenue sharing arrangements with the Company’s telecommunication carrier partners, professional services and third-party applications. The Company receives a monthly payment from certain telecommunication carriers related to its customers’ use of its legacy Good for You product on its networks. Estimated revenues are recognized when carriers provide reliable sales data within a reasonable time frame following the end of each month to allow for the Company to make reasonable estimates of revenues. Revenues from the remaining carriers are recognized when billed. The Company also provides professional services such as deployment, consulting, and training. These services can be part of software license arrangements, or sold separately. When professional services are sold as part of software license arrangements, amortization of revenues for the entire transaction does not commence until completion and acceptance of these professional services, as delivery is not considered to have occurred. Revenues from professional services sold separately from software licenses are recognized upon completion of the services, and have not been material to date.

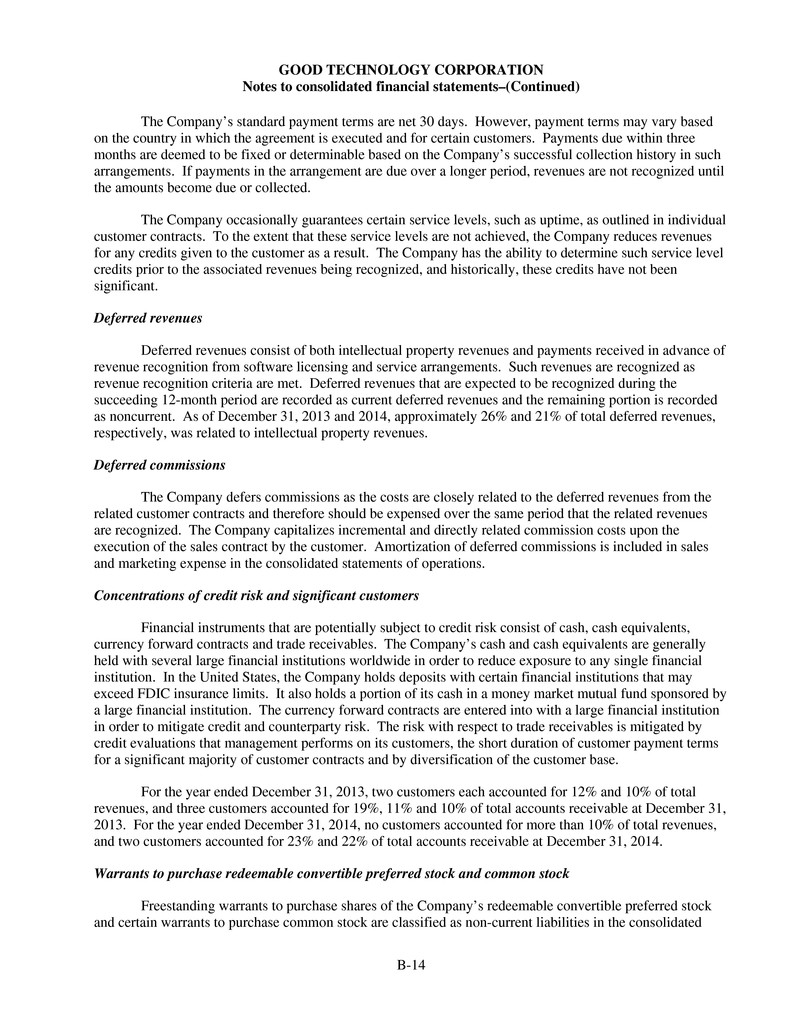

GOOD TECHNOLOGY CORPORATION Notes to consolidated financial statements–(Continued) B-14 The Company’s standard payment terms are net 30 days. However, payment terms may vary based on the country in which the agreement is executed and for certain customers. Payments due within three months are deemed to be fixed or determinable based on the Company’s successful collection history in such arrangements. If payments in the arrangement are due over a longer period, revenues are not recognized until the amounts become due or collected. The Company occasionally guarantees certain service levels, such as uptime, as outlined in individual customer contracts. To the extent that these service levels are not achieved, the Company reduces revenues for any credits given to the customer as a result. The Company has the ability to determine such service level credits prior to the associated revenues being recognized, and historically, these credits have not been significant. Deferred revenues Deferred revenues consist of both intellectual property revenues and payments received in advance of revenue recognition from software licensing and service arrangements. Such revenues are recognized as revenue recognition criteria are met. Deferred revenues that are expected to be recognized during the succeeding 12-month period are recorded as current deferred revenues and the remaining portion is recorded as noncurrent. As of December 31, 2013 and 2014, approximately 26% and 21% of total deferred revenues, respectively, was related to intellectual property revenues. Deferred commissions The Company defers commissions as the costs are closely related to the deferred revenues from the related customer contracts and therefore should be expensed over the same period that the related revenues are recognized. The Company capitalizes incremental and directly related commission costs upon the execution of the sales contract by the customer. Amortization of deferred commissions is included in sales and marketing expense in the consolidated statements of operations. Concentrations of credit risk and significant customers Financial instruments that are potentially subject to credit risk consist of cash, cash equivalents, currency forward contracts and trade receivables. The Company’s cash and cash equivalents are generally held with several large financial institutions worldwide in order to reduce exposure to any single financial institution. In the United States, the Company holds deposits with certain financial institutions that may exceed FDIC insurance limits. It also holds a portion of its cash in a money market mutual fund sponsored by a large financial institution. The currency forward contracts are entered into with a large financial institution in order to mitigate credit and counterparty risk. The risk with respect to trade receivables is mitigated by credit evaluations that management performs on its customers, the short duration of customer payment terms for a significant majority of customer contracts and by diversification of the customer base. For the year ended December 31, 2013, two customers each accounted for 12% and 10% of total revenues, and three customers accounted for 19%, 11% and 10% of total accounts receivable at December 31, 2013. For the year ended December 31, 2014, no customers accounted for more than 10% of total revenues, and two customers accounted for 23% and 22% of total accounts receivable at December 31, 2014. Warrants to purchase redeemable convertible preferred stock and common stock Freestanding warrants to purchase shares of the Company’s redeemable convertible preferred stock and certain warrants to purchase common stock are classified as non-current liabilities in the consolidated

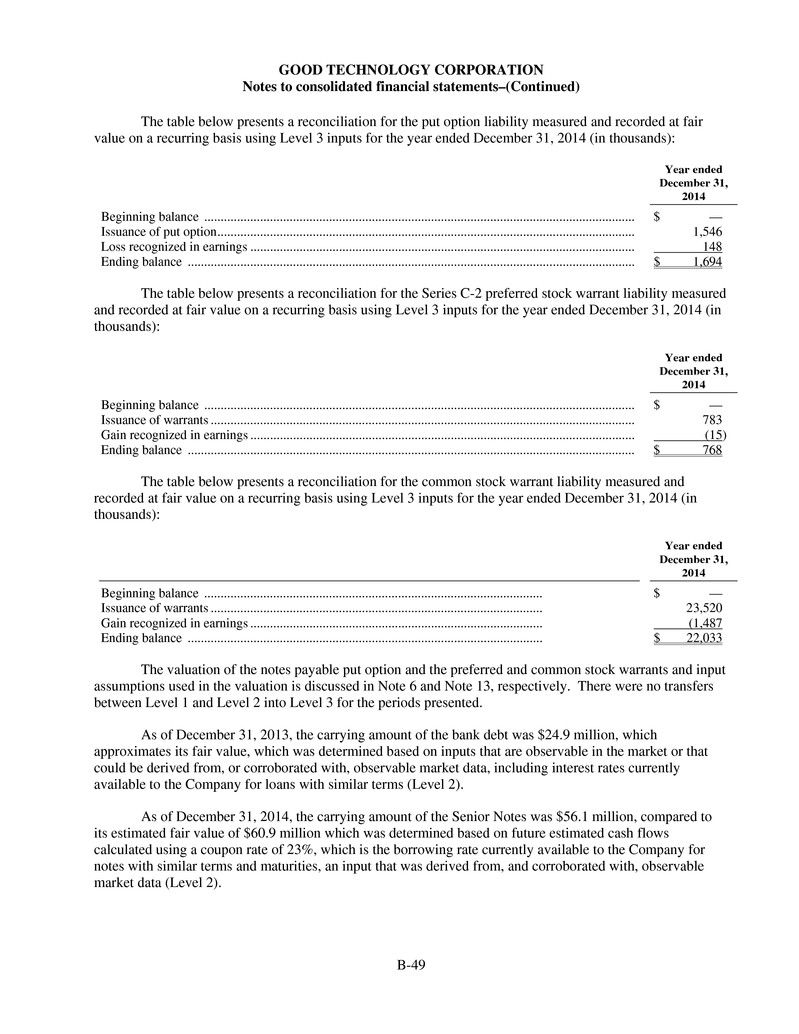

GOOD TECHNOLOGY CORPORATION Notes to consolidated financial statements–(Continued) B-15 balance sheets and are carried at fair value because the warrants may obligate the Company to transfer assets to the holders at a future date under certain circumstances, such as a change in control. The warrants are subject to remeasurement at each balance sheet date and any change in the estimated fair value is recognized as a component of other income (expense), net, in the consolidated statements of operations. The Company estimates the fair value of these warrants at issuance and at each balance sheet date using the Black-Scholes option pricing model. The Company has also issued other common stock warrants, the fair value of which are included in Good Technology Corporation stockholders’ deficit. The fair values of these warrants are estimated at issuance using the Black-Scholes option pricing model and is not subject to subsequent remeasurement. Debt instruments For debt instruments issued with redemption features at the option of the holder, the Company determines if the redemption feature meets the criteria to be treated as an embedded derivative, and if so, will fair value this feature and record it as a derivative liability and also as a discount to the debt proceeds. In addition, for redeemable preferred stock warrants or common stock warrants issued together with debt instruments, these warrants are also fair valued and recorded as a debt discount and classified within equity or liabilities, depending on whether the warrant is freestanding from the debt instrument as well as other economic characteristics. Fair value of financial instruments Carrying amounts of certain of the Company’s financial instruments, including cash equivalents, accounts receivable, and accounts payable approximate fair values due to their short maturities. The carrying amounts of the warrant liability and foreign currency forward contracts represent their fair value. The carrying amount of bank debt approximates its fair value based on borrowing rates currently available to the Company for loans with similar terms. Fair value is defined as the price that would be received from selling an asset or paid to transfer a liability in an orderly transaction between market participants at the measurement date. When determining fair value, the Company considers the principal or most advantageous market in which the Company would transact, and takes into consideration the assumptions that market participants would use when pricing the asset or liability. The Company’s assessment of the significance of a particular input to the fair value measurement of an asset or liability requires management to make judgments and to consider specific characteristics of that asset or liability. The current accounting guidance provides three levels of inputs that may be used to measure fair value, as follows: Level 1–Unadjusted quoted prices in active markets for identical assets or liabilities. Level 2–Observable inputs other than Level 1 prices, such as quoted prices for similar assets or liabilities, quoted prices in markets with insufficient volume or infrequent transactions (less active markets), or model-derived valuations in which all significant inputs are observable or can be derived principally from or corroborated with observable market data for substantially the full term of the assets or liabilities. Level 3–Unobservable inputs to the valuation methodology that are significant to the measurement of the fair value of assets or liabilities.

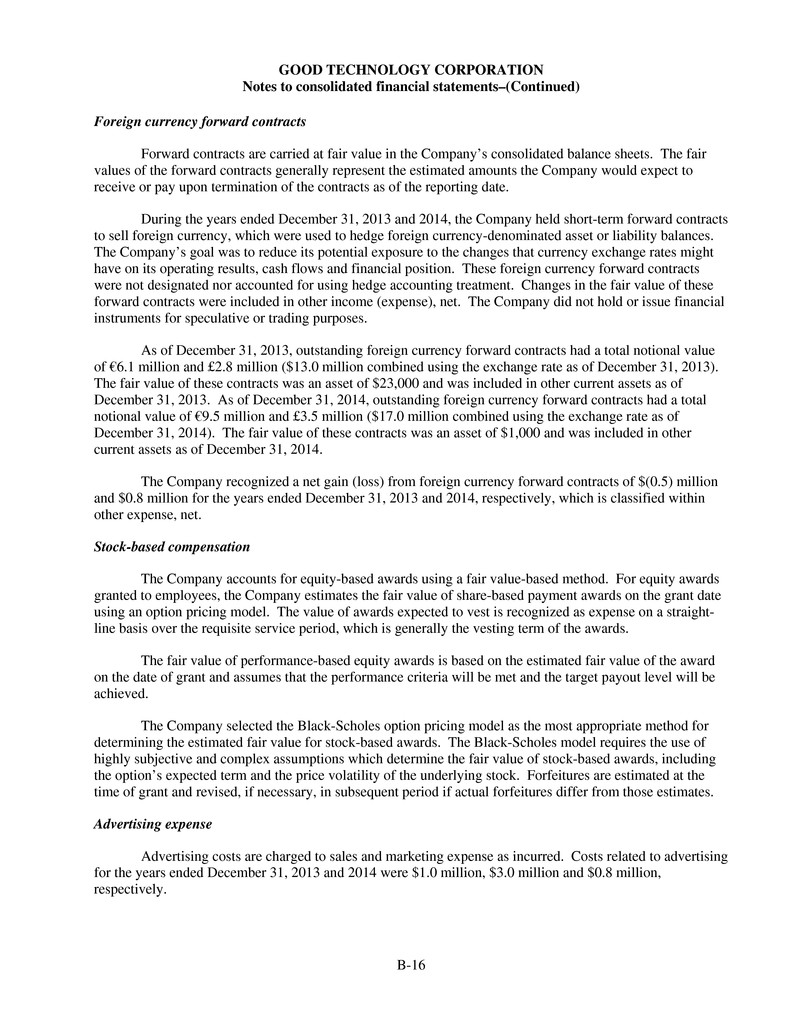

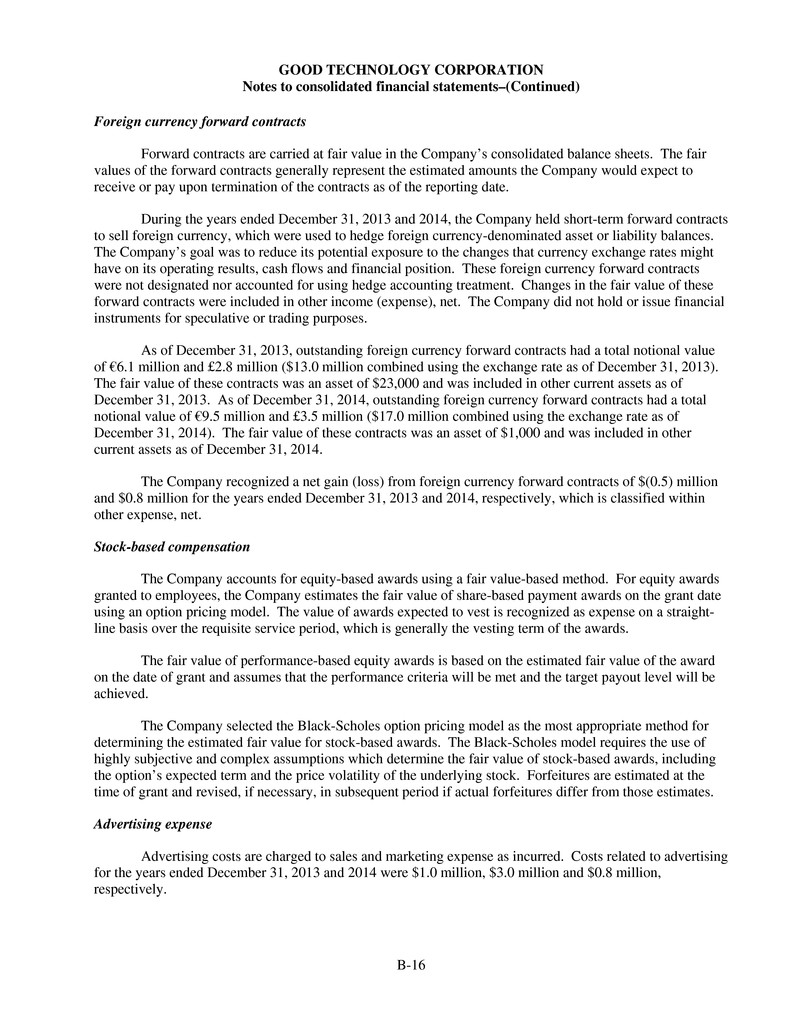

GOOD TECHNOLOGY CORPORATION Notes to consolidated financial statements–(Continued) B-16 Foreign currency forward contracts Forward contracts are carried at fair value in the Company’s consolidated balance sheets. The fair values of the forward contracts generally represent the estimated amounts the Company would expect to receive or pay upon termination of the contracts as of the reporting date. During the years ended December 31, 2013 and 2014, the Company held short-term forward contracts to sell foreign currency, which were used to hedge foreign currency-denominated asset or liability balances. The Company’s goal was to reduce its potential exposure to the changes that currency exchange rates might have on its operating results, cash flows and financial position. These foreign currency forward contracts were not designated nor accounted for using hedge accounting treatment. Changes in the fair value of these forward contracts were included in other income (expense), net. The Company did not hold or issue financial instruments for speculative or trading purposes. As of December 31, 2013, outstanding foreign currency forward contracts had a total notional value of €6.1 million and £2.8 million ($13.0 million combined using the exchange rate as of December 31, 2013). The fair value of these contracts was an asset of $23,000 and was included in other current assets as of December 31, 2013. As of December 31, 2014, outstanding foreign currency forward contracts had a total notional value of €9.5 million and £3.5 million ($17.0 million combined using the exchange rate as of December 31, 2014). The fair value of these contracts was an asset of $1,000 and was included in other current assets as of December 31, 2014. The Company recognized a net gain (loss) from foreign currency forward contracts of $(0.5) million and $0.8 million for the years ended December 31, 2013 and 2014, respectively, which is classified within other expense, net. Stock-based compensation The Company accounts for equity-based awards using a fair value-based method. For equity awards granted to employees, the Company estimates the fair value of share-based payment awards on the grant date using an option pricing model. The value of awards expected to vest is recognized as expense on a straight- line basis over the requisite service period, which is generally the vesting term of the awards. The fair value of performance-based equity awards is based on the estimated fair value of the award on the date of grant and assumes that the performance criteria will be met and the target payout level will be achieved. The Company selected the Black-Scholes option pricing model as the most appropriate method for determining the estimated fair value for stock-based awards. The Black-Scholes model requires the use of highly subjective and complex assumptions which determine the fair value of stock-based awards, including the option’s expected term and the price volatility of the underlying stock. Forfeitures are estimated at the time of grant and revised, if necessary, in subsequent period if actual forfeitures differ from those estimates. Advertising expense Advertising costs are charged to sales and marketing expense as incurred. Costs related to advertising for the years ended December 31, 2013 and 2014 were $1.0 million, $3.0 million and $0.8 million, respectively.

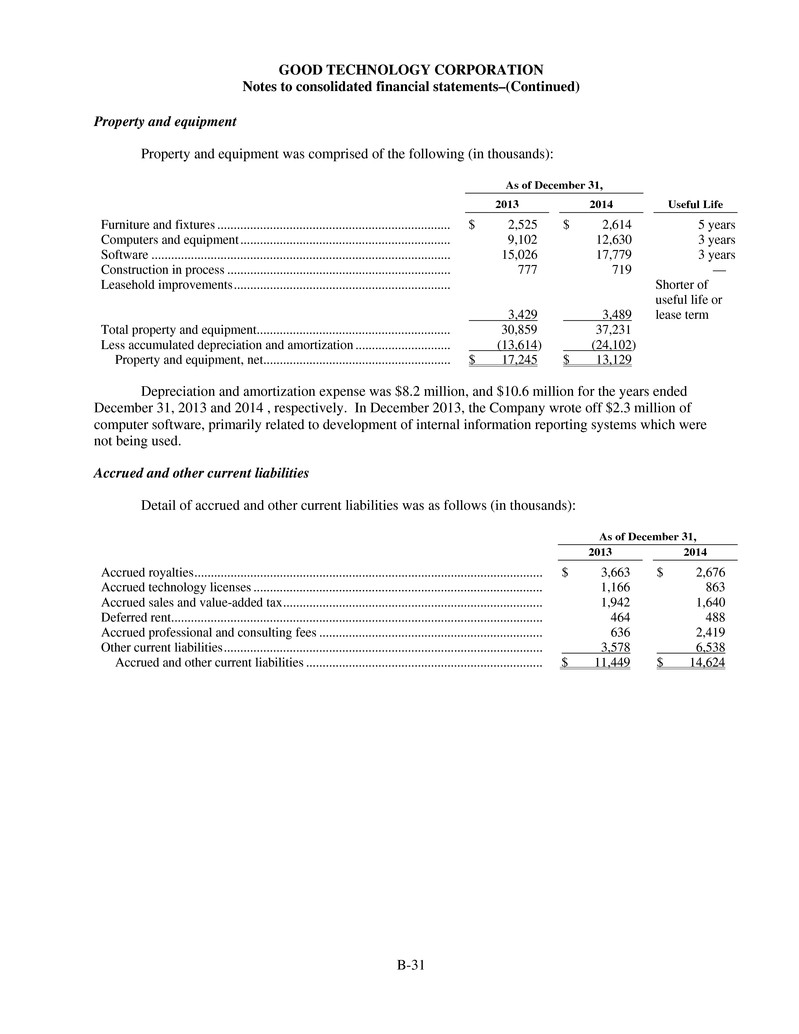

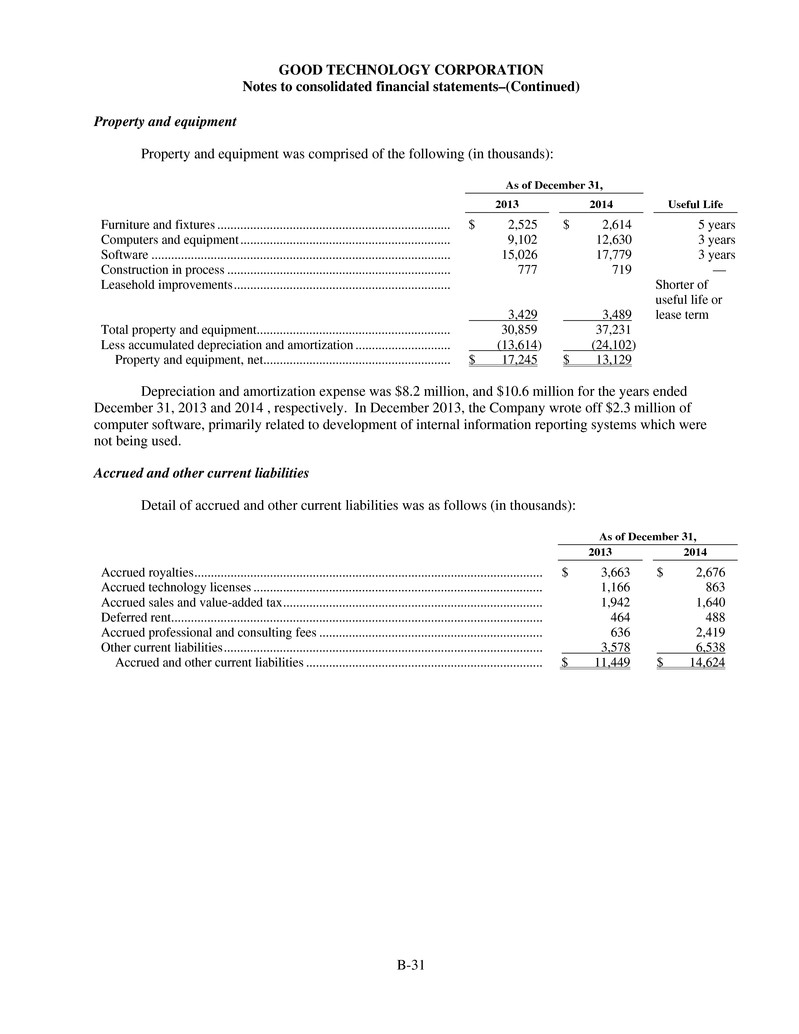

GOOD TECHNOLOGY CORPORATION Notes to consolidated financial statements–(Continued) B-17 Allowance for doubtful accounts The allowance for doubtful accounts reflects management’s best estimate of probable losses inherent in the Company’s accounts receivable balance. The allowance is determined based on known troubled accounts, historical experience and other currently available evidence. The allowance for doubtful accounts was $0.2 million and $0.1 million as of December 31, 2013 and 2014, respectively. Research and development The Company charges costs related to research, design and development of products to research and development expense as incurred. The types of costs included in research and development expenses primarily consist of personnel costs, consulting costs and allocated facilities and information technology costs. Software development costs and purchased software Software development costs incurred in conjunction with product development of software that will be licensed is charged to research and development expense until technological feasibility is established. To date, the period between achieving technological feasibility, which management defines as the establishment of a working model, and general availability of software has been short and associated software development costs during this period have been insignificant. Accordingly, costs eligible for capitalization of software development costs were not material to the Company’s consolidated financial statements for the years ended December 31, 2013 and 2014. The Company also purchases and includes as part of its software offerings third-party software licenses. The Company capitalizes these software purchases and amortizes these costs over the estimated life of these licenses. Property and equipment Property and equipment are recorded at cost less accumulated depreciation. Expenditures for major additions and improvements are capitalized, while minor replacements, maintenance and repairs are charged to expense as incurred. Depreciation expense is recorded over the estimated useful lives of the assets. Leasehold improvements are amortized over the estimated useful lives or lease terms, whichever is shorter. Leased property and equipment meeting certain capital lease criteria is capitalized, and the net present value of the related lease payments is recorded as a liability. Amortization of capital leased assets is recorded using the straight-line method over their estimated useful lives or the lease terms, whichever is shorter, and is included in depreciation and amortization expense in the statements of operations. Internal use software costs Costs related to software acquired, developed or modified solely to meet the Company’s internal requirements, with no substantive plans to market such software at the time of development, are capitalized. These costs include the costs associated with the Company’s data and reporting systems as well as development costs for its Good Secure Cloud. Costs incurred during the preliminary planning and evaluation stage of the project and during post implementation operational stage are expensed as incurred. Costs incurred during the application development stage of the project are capitalized. The Company defines the design, configuration, and coding process as the application development stage. For the years ended December 31, 2013 and 2014, the Company capitalized costs of $6.6 million, $4.4 million and $3.0 million,

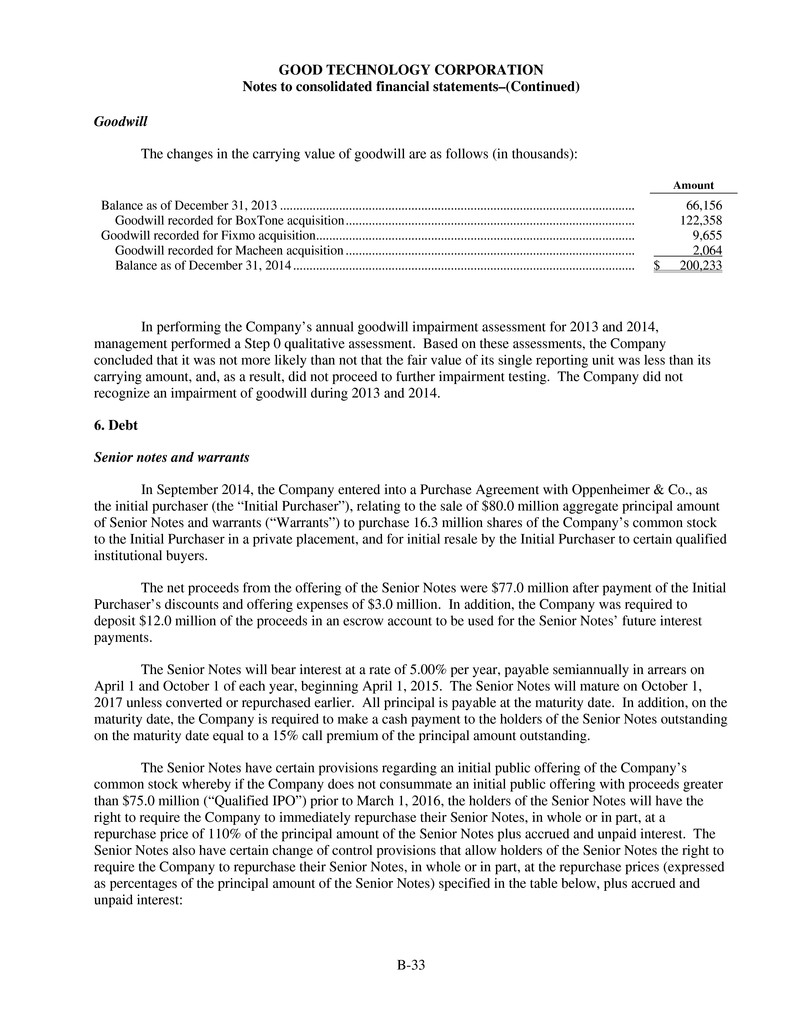

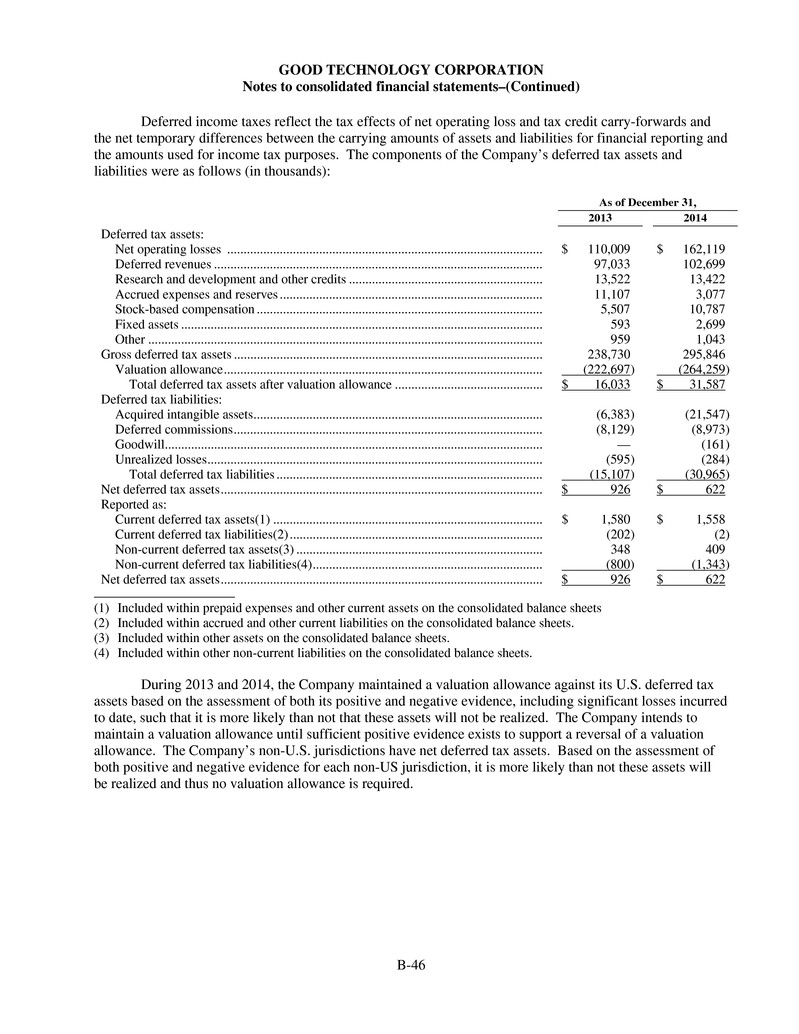

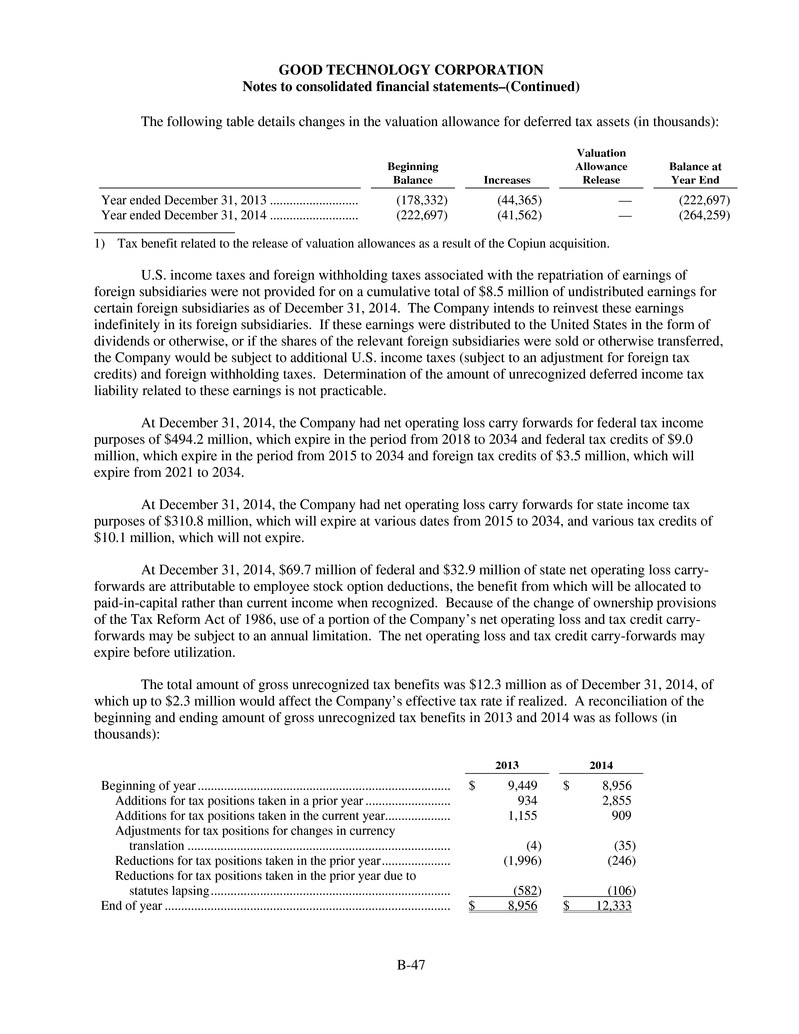

GOOD TECHNOLOGY CORPORATION Notes to consolidated financial statements–(Continued) B-18 respectively, related to computer software developed for internal use, which is included in property and equipment, net on the consolidated balance sheets. Goodwill and impairment analysis Goodwill represents the excess of the purchase price of an acquired business over the fair value of the net tangible and identifiable intangible assets acquired. The carrying amount of goodwill is reviewed at least annually and whenever events or changes in circumstances indicate that the carrying value may not be recoverable. The Company’s test for goodwill impairment starts with a qualitative assessment to determine whether it is necessary to perform the quantitative goodwill impairment analysis. If the Company determines, based on the qualitative factors, that the fair value of the reporting unit is not more likely than not greater than the carrying amount, then quantitative goodwill impairment analysis is required. The quantitative goodwill impairment analysis is comprised of a two-step process. The first step compares the fair value of the Company’s reporting units to the carrying amount of their net assets. The Company operates in one reportable business segment and has one reporting unit, the Company as a whole. If the fair value of the Company’s net assets exceeds the carrying amount of those assets, goodwill is considered not to be impaired and management is not required to perform additional testing. If the carrying amount exceeds the fair value of the Company’s net assets, the Company must perform a second step in order to determine the implied fair value of its goodwill. If the carrying amount exceeds the implied fair value of its goodwill, the Company records an impairment loss equal to the difference. Management performs its annual impairment analysis each year on September 30. The Company did not recognize any goodwill impairment charges for any of the periods presented. Impairment of long-lived assets The Company evaluates long-lived assets, such as property and equipment and amortizable intangible assets, for impairment whenever events or changes in circumstances indicate that the carrying value of an asset may not be recoverable. If indicators of impairment exist and the undiscounted future cash flows that the assets are expected to generate are less than the carrying value of the assets, the Company reduces the carrying amount of the assets to their estimated fair values based on a discounted cash flow approach or, when available and appropriate, to comparable market values. Income taxes The Company utilizes the asset and liability method of accounting for income taxes, under which deferred taxes are determined based on the temporary differences between the financial statement and tax basis of assets and liabilities using tax rates expected to be in effect during the years in which the basis differences reverse and for operating losses and tax credit carry-forwards. The Company is required to evaluate the realizability of its deferred tax assets on an ongoing basis to determine whether there is a need for a valuation allowance with respect to such deferred tax assets. A valuation allowance is recorded when it is more likely than not that some of the deferred tax assets will not be realized. Significant management judgment is required in determining any valuation allowance recorded against deferred tax assets. In evaluating the ability to recover deferred tax assets, the Company considers available positive and negative evidence giving greater weight to its recent cumulative losses and its ability to carryback losses against prior taxable income and lesser weight to its projected financial results. The Company also considers, commensurate with its objective verifiability, the forecast of future taxable income including the reversal of temporary differences and the implementation of feasible and prudent tax planning strategies.

GOOD TECHNOLOGY CORPORATION Notes to consolidated financial statements–(Continued) B-19 The Company accounts for uncertainty in income taxes using a two-step approach to recognizing and measuring uncertain tax positions. The first step is to evaluate the tax position for recognition by determining if the weight of available evidence indicates that it is more likely than not that the position will be sustained on audit, including resolution of related appeals or litigation processes, if any. The second step is to measure the tax benefit as the largest amount that is more than 50% likely of being realized upon settlement. The Company classifies the liability for unrecognized tax benefits as current to the extent that the Company anticipates payment (or receipt) of cash within one year. Interest and penalties related to uncertain tax positions are recognized in the provision for income taxes. Noncontrolling interest In February 2007, the Company acquired 76% of Altexia SA (“Altexia”). The Company follows the applicable accounting guidance for the 24% share of noncontrolling interest of Altexia and classifies this noncontrolling interest as a component of deficit within the consolidated balance sheets and presents net loss (income) attributable to the noncontrolling interest in the consolidated statements of operations. The guidance requires that the noncontrolling interest continue to be attributed its share of losses even if that attribution results in a deficit in the noncontrolling interest balance. In July 2014, the Company acquired the remaining outstanding shares of Altexia from the noncontrolling shareholder for approximately $0.1 million in cash. This acquisition was accounted for as an equity transaction, which reduced the Company’s noncontrolling interests and additional paid-in capital by $0.6 million and $0.7 million, respectively, and therefore, there are no noncontrolling interests in the Company as of December 31, 2014. Net loss per share attributable to Good Technology Corporation common stockholders Basic net loss per share attributable to Good Technology Corporation common stockholders is computed by dividing the net loss attributable to Good Technology Corporation common stockholders by the weighted-average number of shares of common stock outstanding during the period. Diluted net loss per share attributable to Good Technology Corporation common stockholders is computed by giving effect to all potential shares of common stock, including stock options, warrants and redeemable convertible preferred stock, to the extent dilutive. Due to net losses for all the periods presented, basic and diluted loss per share attributable to Good Technology Corporation common stockholders were the same, as the effect of potentially dilutive securities would have been anti-dilutive. Share-based payment awards that have not yet vested meet the definition of a participating security provided the right to receive the dividend is non-forfeitable and non-contingent. These participating securities are therefore included in the computation of basic net income (loss) per share under the two-class method. The Company has concluded that its non-vested restricted stock awards meet the definition of a participating security. However, the unvested restricted shares do not share in residual net assets of the Company and, therefore, do not economically absorb losses until they vest and are excluded in the Company’s computation of basic net loss per share attributable to Good Technology Corporation common stockholders for all periods presented. The Company also concluded that its redeemable convertible preferred stock meet the definition of a participating security. However, as the stockholders of the convertible preferred stock do not have a contractual obligation to share in the Company’s losses, they have not been included in the Company’s computation of basic net loss per share attributable to Good Technology Corporation common stockholders for all periods presented.

GOOD TECHNOLOGY CORPORATION Notes to consolidated financial statements–(Continued) B-20 Recent accounting pronouncements In May 2014, the FASB issued new accounting guidance related to revenue recognition. This new standard will replace all current U.S. GAAP guidance on this topic and eliminate all industry-specific guidance. The new revenue recognition standard provides a unified model to determine when and how revenue is recognized. The core principle is that a company should recognize revenue to depict the transfer of promised goods or services to customers in an amount that reflects the consideration for which the entity expects to be entitled in exchange for those goods or services. This guidance will be effective for the Company beginning January 1, 2017 and can be applied either retrospectively to each period presented or as a cumulative-effect adjustment as of the date of adoption. The Company is evaluating the impact of adopting this new accounting standard on its consolidated financial statements. In June 2014, the FASB issued new guidance related to stock compensation. The new standard requires that a performance target that affects vesting, and that could be achieved after the requisite service period, be treated as a performance condition. As such, the performance target should not be reflected in estimating the grant date fair value of the award. This update further clarifies that compensation cost should be recognized in the period in which it becomes probable that the performance target will be achieved and should represent the compensation cost attributable to the periods for which the requisite service has already been rendered. The new standard is effective for fiscal years, and interim periods within those fiscal years, beginning after December 15, 2015 and can be applied either prospectively or retrospectively to all awards outstanding as of the beginning of the earliest annual period presented as an adjustment to opening retained earnings. Early adoption is permitted. The Company is evaluating the impact, if any, of adopting this new accounting guidance on its consolidated financial statements. In August 2014, the FASB issued ASU 2014-15, “Disclosure of Uncertainties about an Entity’s Ability to Continue as a Going Concern,” which provides guidance around management’s responsibility to evaluate whether there is substantial doubt about an entity’s ability to continue as a going concern and to provide related footnote disclosures. The new standard is effective for fiscal years, and interim periods within those fiscal years, beginning after December 15, 2016. Early adoption is permitted. The Company is evaluating the impact, if any, of adopting this new accounting guidance on its consolidated financial statements. 3. Business combinations The Company completed three business combinations in 2014. There were no business combinations completed during 2013. Acquisition of Macheen, Inc. On October 2, 2014, the Company completed the acquisition of Macheen, Inc. (“Macheen”), a Delaware corporation, by acquiring all of its outstanding shares. The Company acquired Macheen for its mobile application management and application security wrapping technology. The technology allows enterprises to easily distribute, manage, and secure mobile enterprise applications. These solutions will enable enterprises to increase mobile worker productivity while protecting data and applications on current mobile devices. The Company plans to incorporate this technology into its Good Dynamics platform. The purchase consideration comprised 1,594,602 shares of the Company’s common stock, which were issued to Macheen stockholders, fully vested restricted stock units to purchase 221,134 shares of common stock, fully vested options to purchase 86,083 shares of common stock issued to certain of Macheen’s employees and cash of $0.4 million.

GOOD TECHNOLOGY CORPORATION Notes to consolidated financial statements–(Continued) B-21 The fair value of the Company’s common stock per share issued in connection with the acquisition of Macheen was $4.32. In arriving at the overall equity value of the Company’s equity, the Company placed a 50% weighting on the discounted cash flow method of the income approach and a 50% weighting on the guideline public company method of the market approach. The following table summarizes the purchase consideration as of the date of the acquisition: (In thousands, except share data) Shares Amount Common stock valued based upon a weighting of the income and market approaches ................................................................................................................ 1,594,602 $ 6,889 221,134 fully vested restricted stock units .................................................................. 955 86,083 fully vested common stock options, valued using the Black-Scholes option pricing model .......................................................................................................... 136 Cash paid(a) ................................................................................................................. 398 Acquisition date fair value of total purchase consideration ......................................... $ 8,378 (a) Cash paid comprised $0.3 million for Macheen’s transaction closing costs and $0.1 million to cover Macheen’s September 30, 2014 payroll and payroll related expenses. Under the purchase method of accounting, the total purchase price is allocated to the net tangible and identifiable intangible assets acquired and liabilities assumed in connection with the acquisition based on their fair value as of the closing of the acquisition. Total acquisition-related expenses incurred by the Company through December 31, 2014, recorded within general and administrative expenses, were approximately $0.4 million. The Company withheld 15% of the common share purchase consideration in escrow consisting of 239,183 shares of common stock which is included in the table above, for 18 months following the acquisition date in the event of certain breaches of the representations and warranties under the agreement with Macheen. The Company utilized a methodology referred to as the income approach, which discounts expected future cash flows to present value, to estimate the fair value of the acquired intangible assets, which are subject to amortization. The discount rate used in the present value calculations was derived from a weighted-average cost of capital analysis, adjusted to reflect additional risks. Developed technology represents a combination of processes, patents and trade secrets developed through years of experience in design and development of Macheen’s products. Customer relationships represent contractual and non-contractual sales of current and future versions of existing products to existing customers.

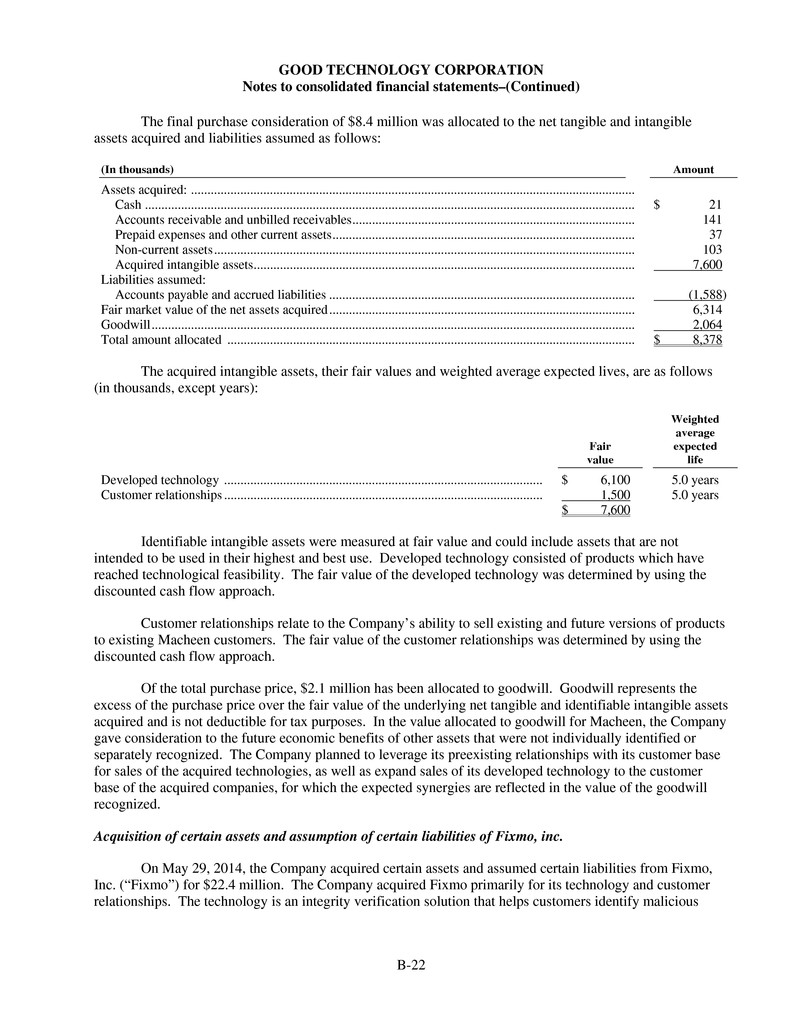

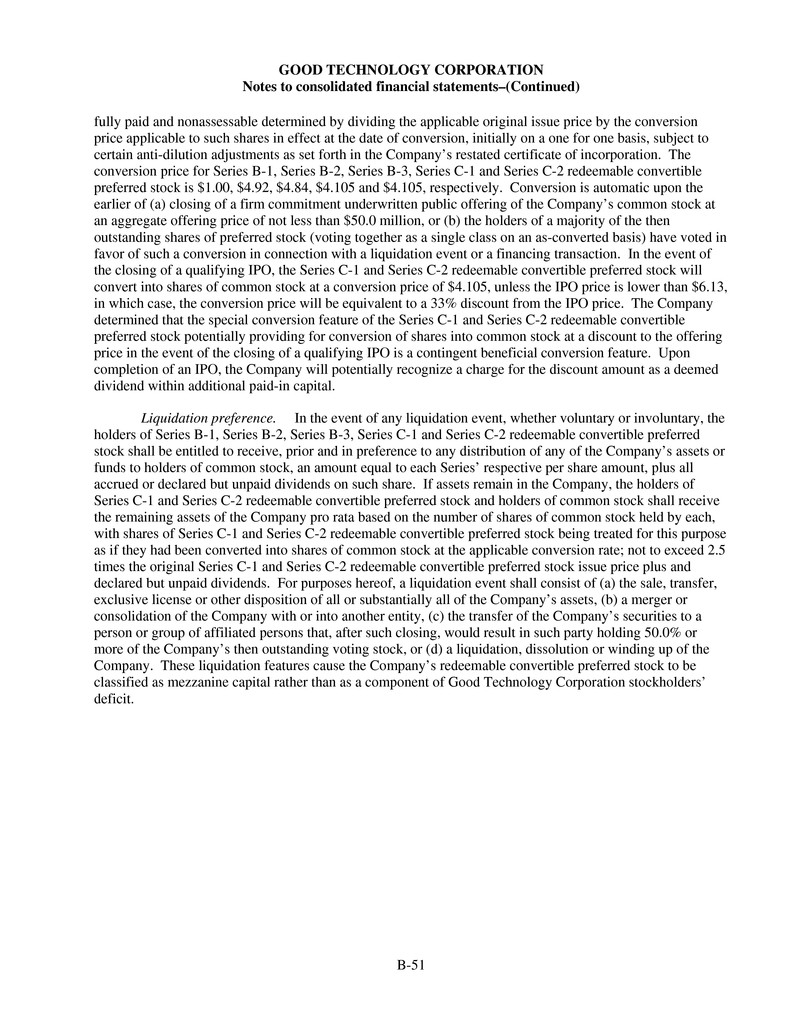

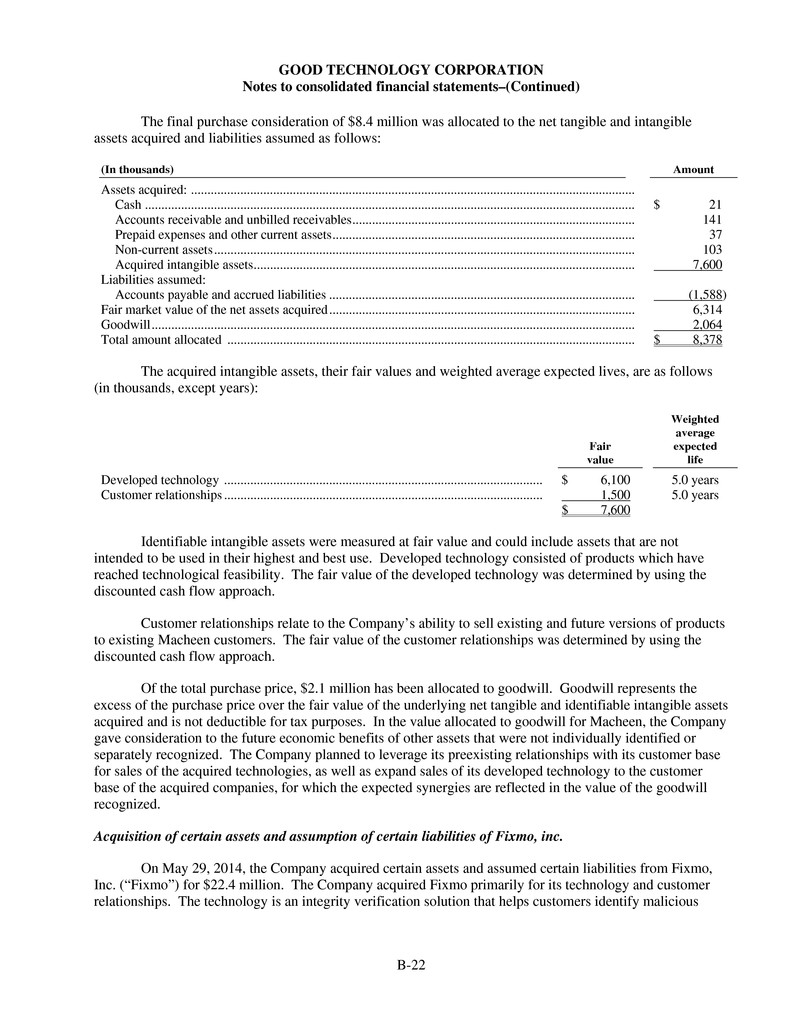

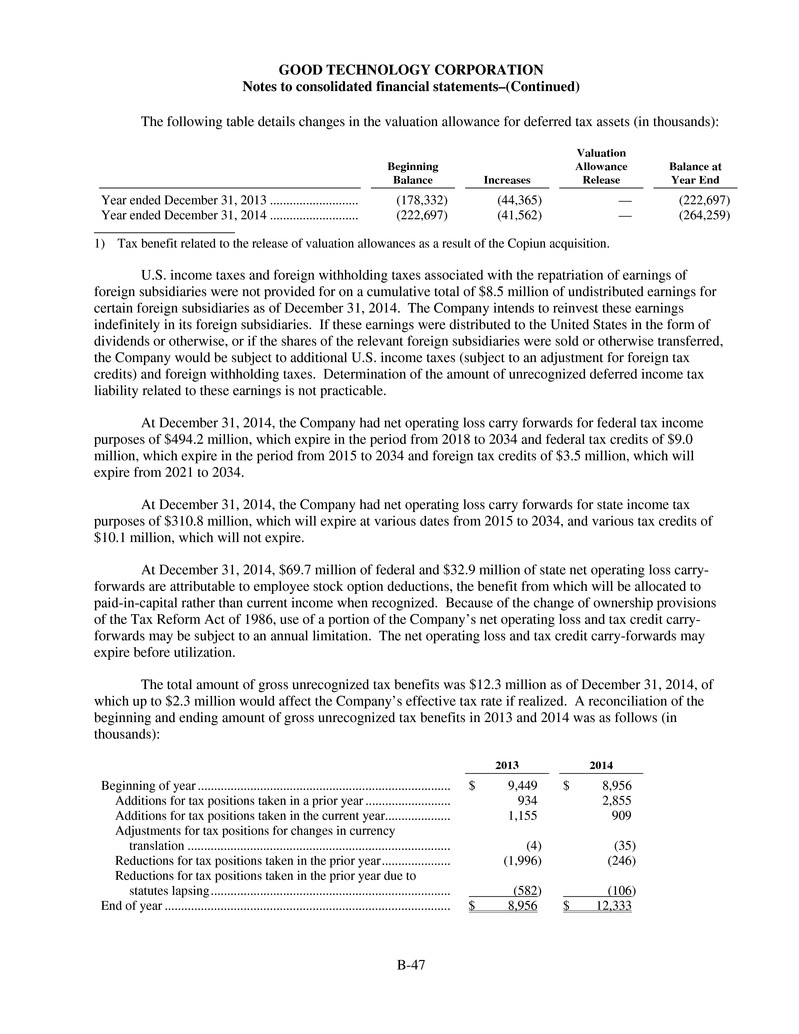

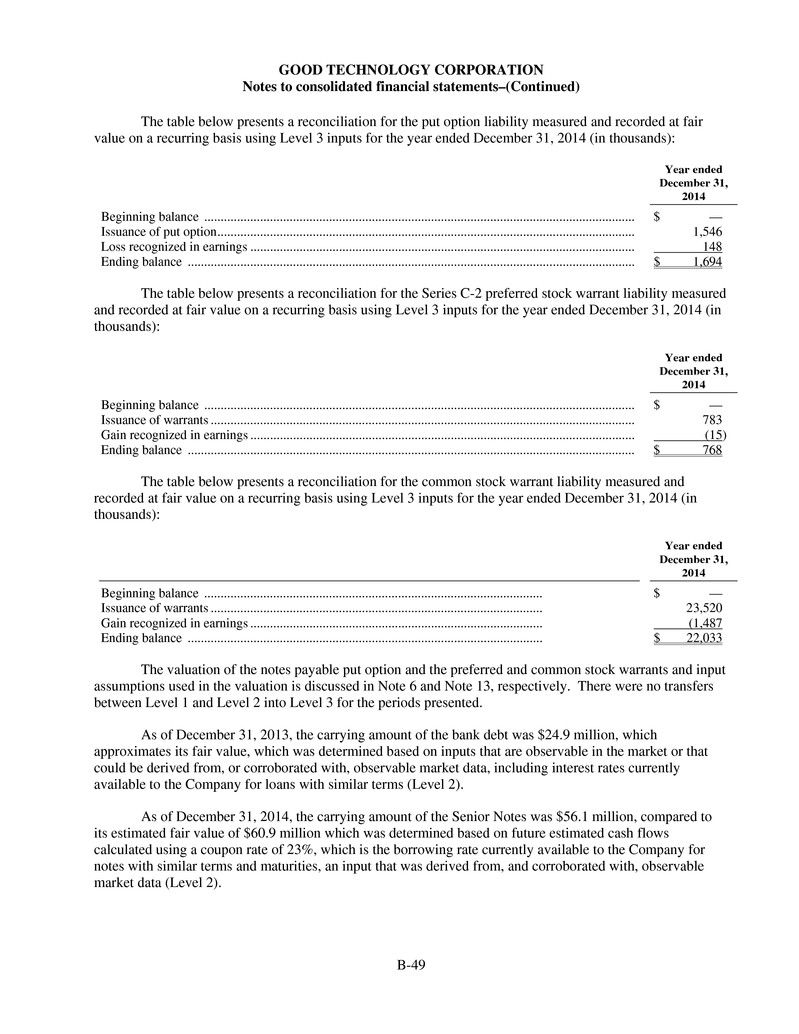

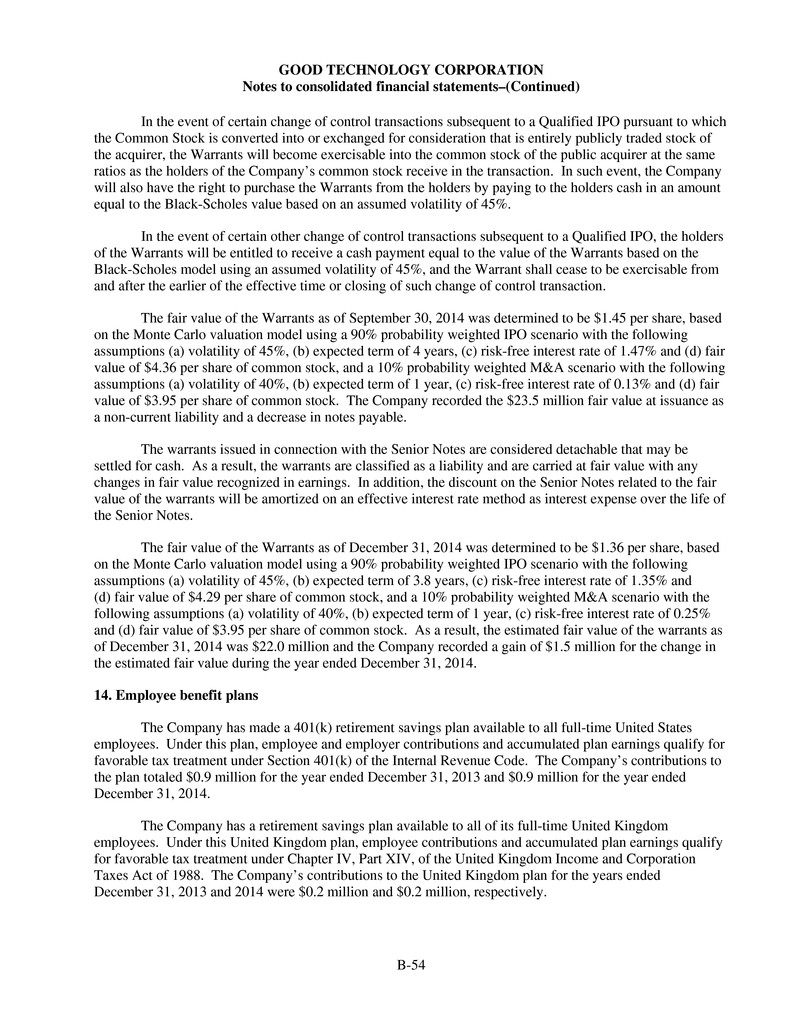

GOOD TECHNOLOGY CORPORATION Notes to consolidated financial statements–(Continued) B-22 The final purchase consideration of $8.4 million was allocated to the net tangible and intangible assets acquired and liabilities assumed as follows: (In thousands) Amount Assets acquired: ....................................................................................................................................... Cash ..................................................................................................................................................... $ 21 Accounts receivable and unbilled receivables ...................................................................................... 141 Prepaid expenses and other current assets ............................................................................................ 37 Non-current assets ................................................................................................................................ 103 Acquired intangible assets .................................................................................................................... 7,600 Liabilities assumed: Accounts payable and accrued liabilities ............................................................................................. (1,588) Fair market value of the net assets acquired ............................................................................................. 6,314 Goodwill ................................................................................................................................................... 2,064 Total amount allocated ............................................................................................................................ $ 8,378 The acquired intangible assets, their fair values and weighted average expected lives, are as follows (in thousands, except years): Fair value Weighted average expected life Developed technology ................................................................................................. $ 6,100 5.0 years Customer relationships ................................................................................................. 1,500 5.0 years $ 7,600 Identifiable intangible assets were measured at fair value and could include assets that are not intended to be used in their highest and best use. Developed technology consisted of products which have reached technological feasibility. The fair value of the developed technology was determined by using the discounted cash flow approach. Customer relationships relate to the Company’s ability to sell existing and future versions of products to existing Macheen customers. The fair value of the customer relationships was determined by using the discounted cash flow approach. Of the total purchase price, $2.1 million has been allocated to goodwill. Goodwill represents the excess of the purchase price over the fair value of the underlying net tangible and identifiable intangible assets acquired and is not deductible for tax purposes. In the value allocated to goodwill for Macheen, the Company gave consideration to the future economic benefits of other assets that were not individually identified or separately recognized. The Company planned to leverage its preexisting relationships with its customer base for sales of the acquired technologies, as well as expand sales of its developed technology to the customer base of the acquired companies, for which the expected synergies are reflected in the value of the goodwill recognized. Acquisition of certain assets and assumption of certain liabilities of Fixmo, inc. On May 29, 2014, the Company acquired certain assets and assumed certain liabilities from Fixmo, Inc. (“Fixmo”) for $22.4 million. The Company acquired Fixmo primarily for its technology and customer relationships. The technology is an integrity verification solution that helps customers identify malicious