SCHEDULE C Unaudited interim condensed consolidated statements of financial position of Cylance as at January 31, 2019 and April 30, 2018 and the related condensed consolidated statements of operations and cash flows for the nine months ended January 31, 2019 and 2018.

CYLANCE INC. INDEX TO CONDENSED CONSOLIDATED FINANCIAL STATEMENTS Page Condensed Consolidated Balance Sheets C-2 Condensed Consolidated Statements of Operations C-3 Condensed Consolidated Statements of Comprehensive Loss C-4 Condensed Consolidated Statements of Cash Flows C-5 Notes to Condensed Consolidated Financial Statements C-6 C-1

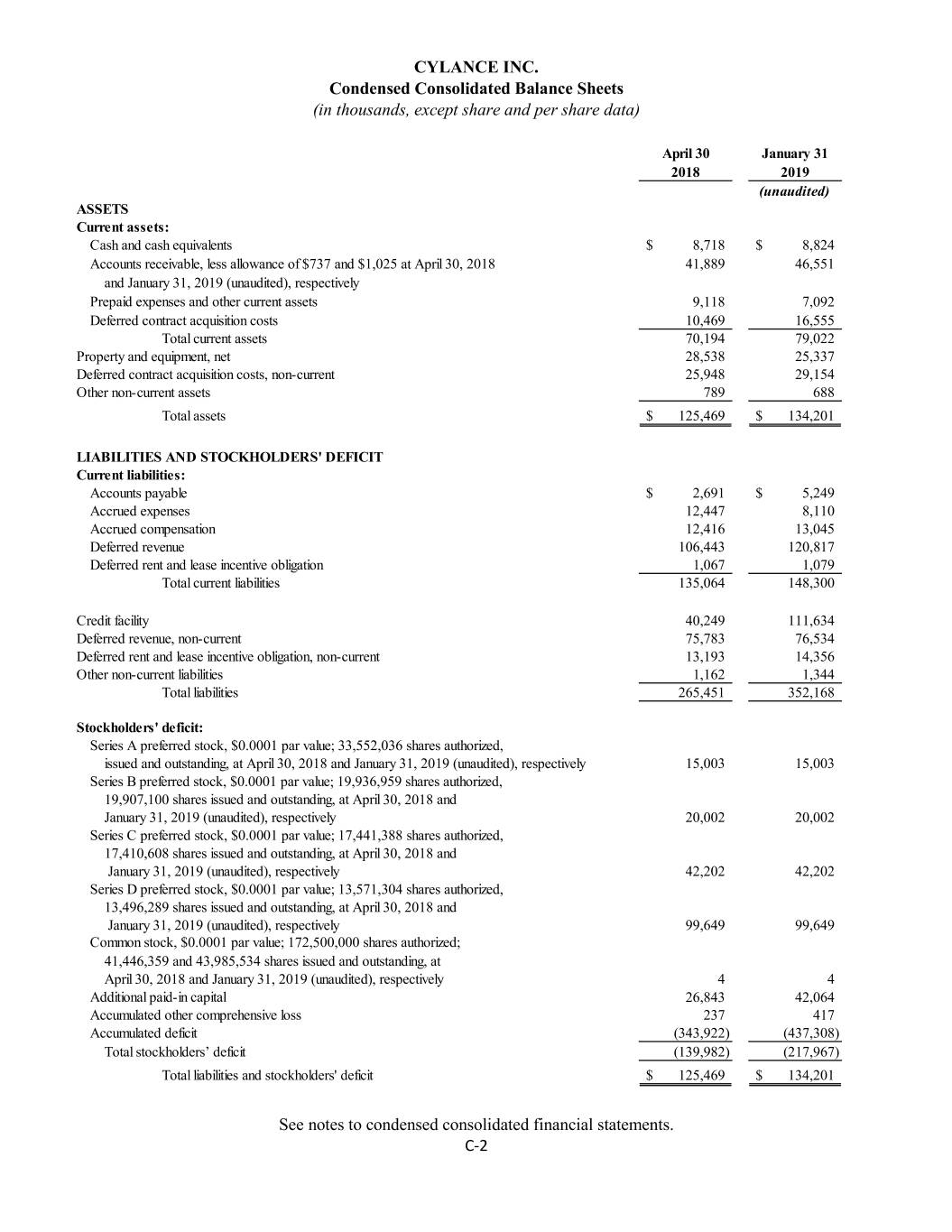

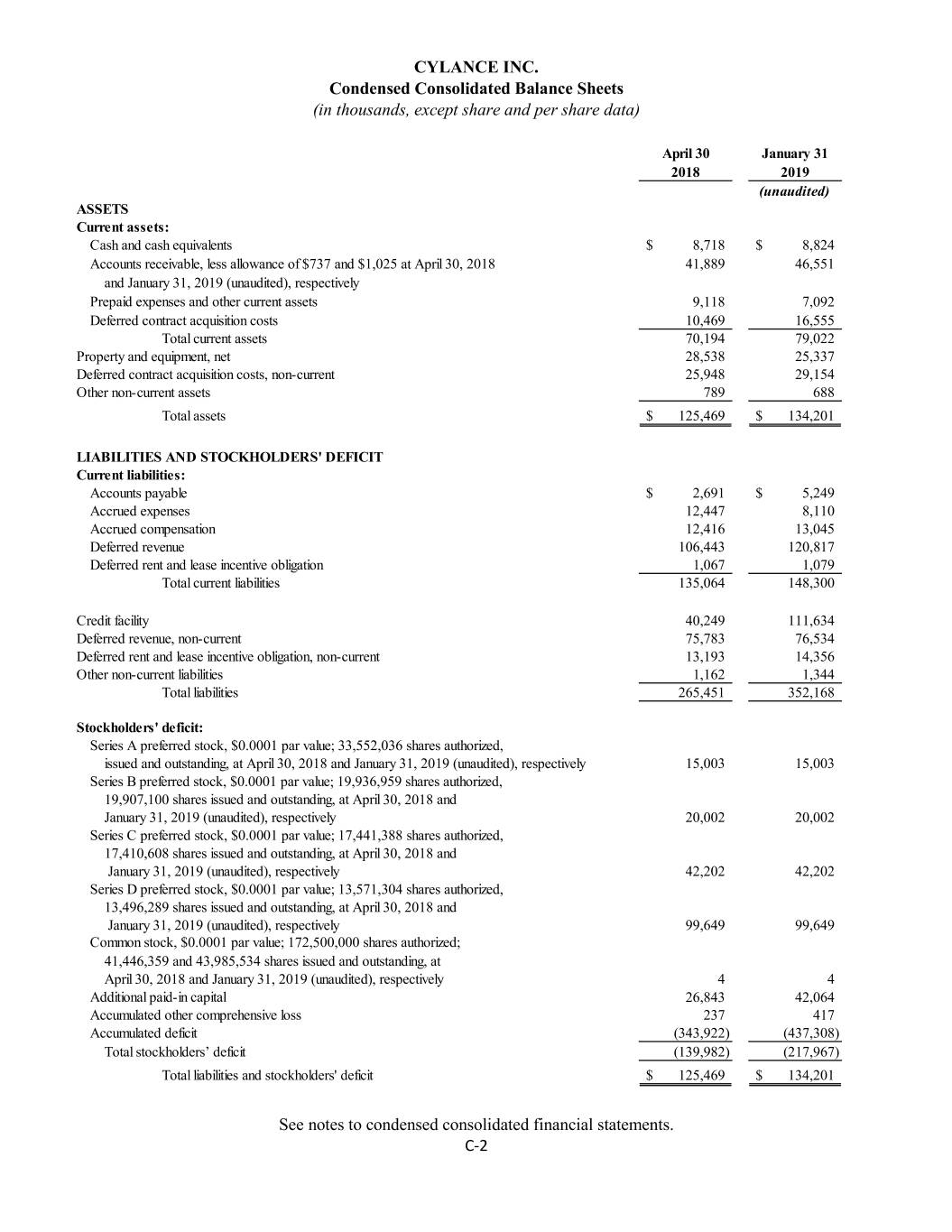

CYLANCE INC. Condensed Consolidated Balance Sheets (in thousands, except share and per share data) April 30 January 31 2018 2019 (unaudited) ASSETS Current assets: Cash and cash equivalents $ 8,718 $ 8,824 Accounts receivable, less allowance of $737 and $1,025 at April 30, 2018 41,889 46,551 and January 31, 2019 (unaudited), respectively Prepaid expenses and other current assets 9,118 7,092 Deferred contract acquisition costs 10,469 16,555 Total current assets 70,194 79,022 Property and equipment, net 28,538 25,337 Deferred contract acquisition costs, non-current 25,948 29,154 Other non-current assets 789 688 Total assets $ 125,469 $ 134,201 LIABILITIES AND STOCKHOLDERS' DEFICIT Current liabilities: Accounts payable $ 2,691 $ 5,249 Accrued expenses 12,447 8,110 Accrued compensation 12,416 13,045 Deferred revenue 106,443 120,817 Deferred rent and lease incentive obligation 1,067 1,079 Total current liabilities 135,064 148,300 Credit facility 40,249 111,634 Deferred revenue, non-current 75,783 76,534 Deferred rent and lease incentive obligation, non-current 13,193 14,356 Other non- current liabilities 1,162 1,344 Total liabilities 265,451 352,168 Stockholders' deficit: Series A preferred stock, $0.0001 par value; 33,552,036 shares authorized, issued and outstanding, at April 30, 2018 and January 31, 2019 (unaudited), respectively 15,003 15,003 Series B preferred stock, $0.0001 par value; 19,936,959 shares authorized, 19,907,100 shares issued and outstanding, at April 30, 2018 and January 31, 2019 (unaudited), respectively 20,002 20,002 Series C preferred stock, $0.0001 par value; 17,441,388 shares authorized, 17,410,608 shares issued and outstanding, at April 30, 2018 and January 31, 2019 (unaudited), respectively 42,202 42,202 Series D preferred stock, $0.0001 par value; 13,571,304 shares authorized, 13,496,289 shares issued and outstanding, at April 30, 2018 and January 31, 2019 (unaudited), respectively 99,649 99,649 Common stock, $0.0001 par value; 172,500,000 shares authorized; 41,446,359 and 43,985,534 shares issued and outstanding, at April 30, 2018 and January 31, 2019 (unaudited), respectively 4 4 Additional paid- in capital 26,843 42,064 Accumulated other comprehensive loss 237 417 Accumulated deficit (343,922) (437,308) Total stockholders’ deficit (139,982) (217,967) Total liabilities and stockholders' deficit $ 125,469 $ 134,201 See notes to condensed consolidated financial statements. C-2

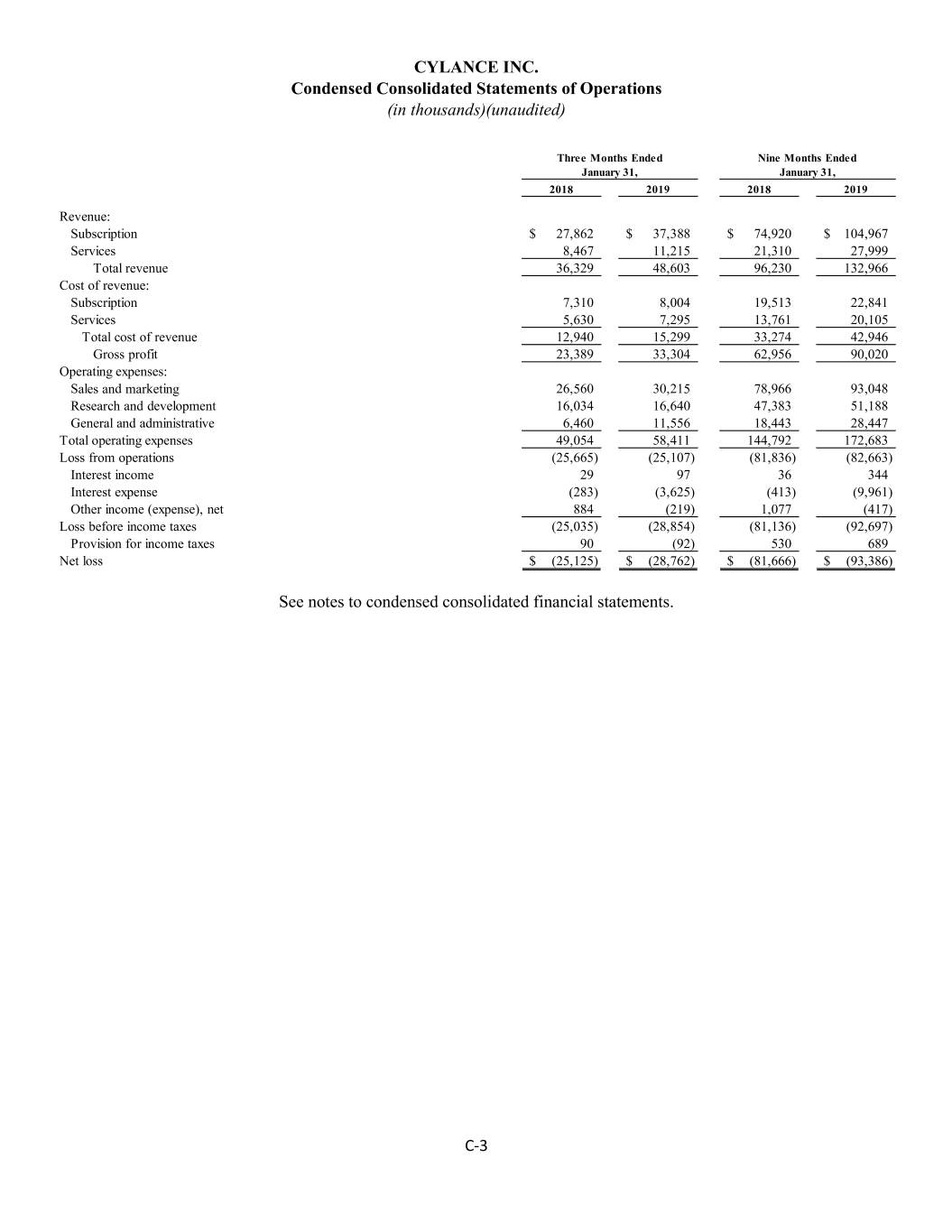

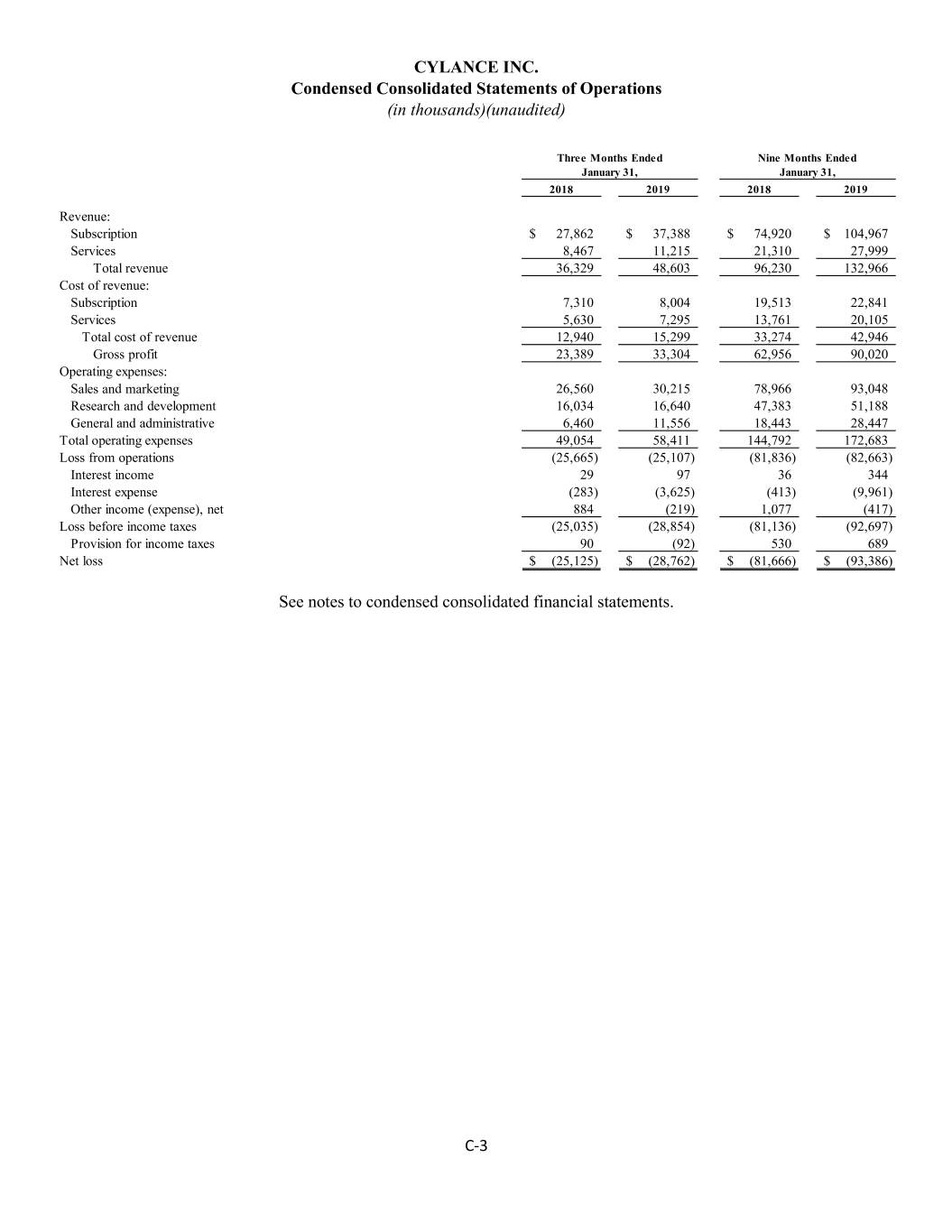

CYLANCE INC. Condensed Consolidated Statements of Operations (in thousands)(unaudited) Three Months Ended Nine Months Ended January 31, January 31, 2018 2019 2018 2019 Revenue: Subscription $ 27,862 $ 37,388 $ 74,920 $ 104,967 Services 8,467 11,215 21,310 27,999 Total revenue 36,329 48,603 96,230 132,966 Cost of revenue: Subscription 7,310 8,004 19,513 22,841 Services 5,630 7,295 13,761 20,105 Total cost of revenue 12,940 15,299 33,274 42,946 Gross profit 23,389 33,304 62,956 90,020 Operating expenses: Sales and marketing 26,560 30,215 78,966 93,048 Research and development 16,034 16,640 47,383 51,188 General and administrative 6,460 11,556 18,443 28,447 Total operating expenses 49,054 58,411 144,792 172,683 Loss from operations (25,665) (25,107) (81,836) (82,663) Interest income 29 97 36 344 Interest expense (283) (3,625) (413) (9,961) Other income (expense), net 884 (219) 1,077 (417) Loss before income taxes (25,035) (28,854) (81,136) (92,697) Provision for income taxes 90 (92) 530 689 Net loss $ (25,125) $ (28,762) $ (81,666) $ (93,386) See notes to condensed consolidated financial statements. C-3

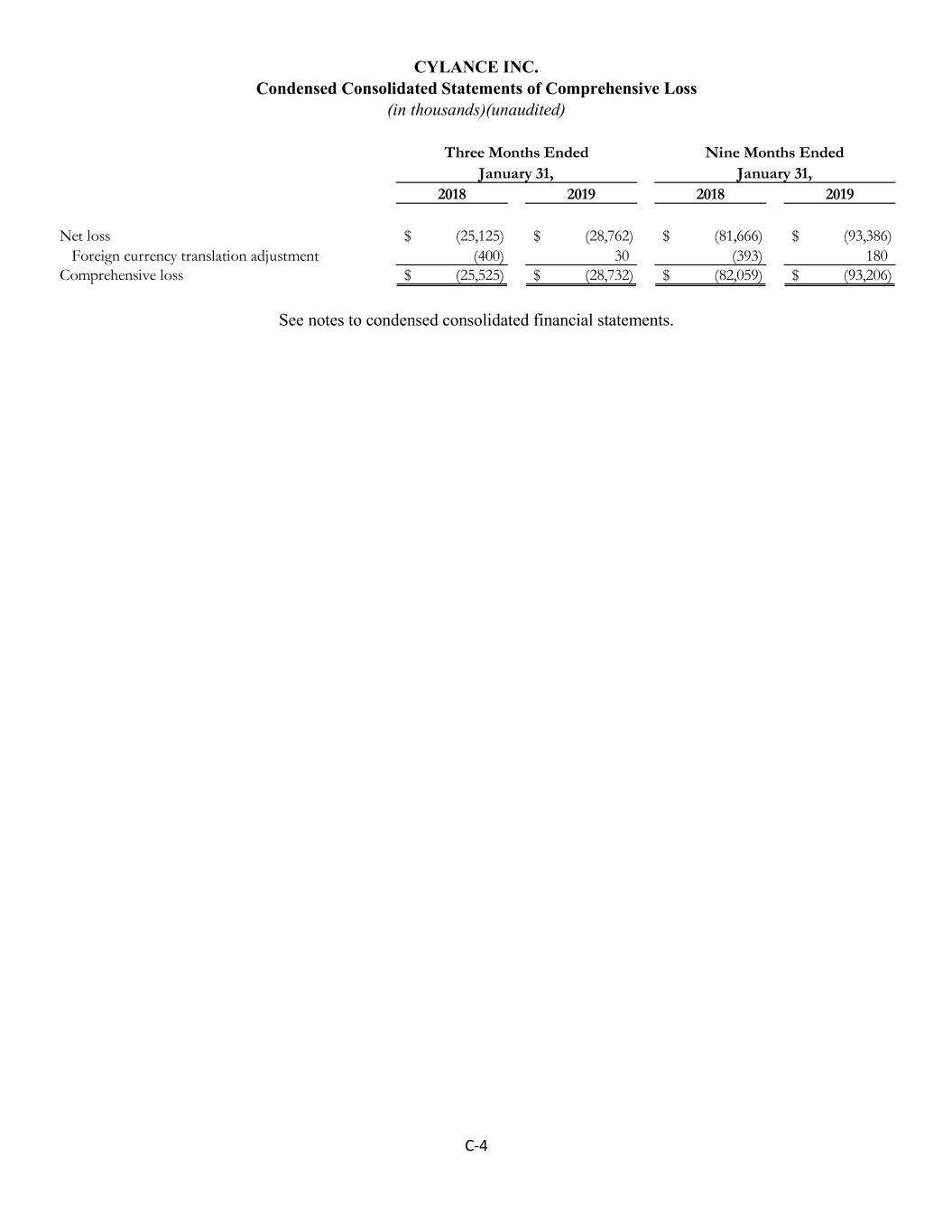

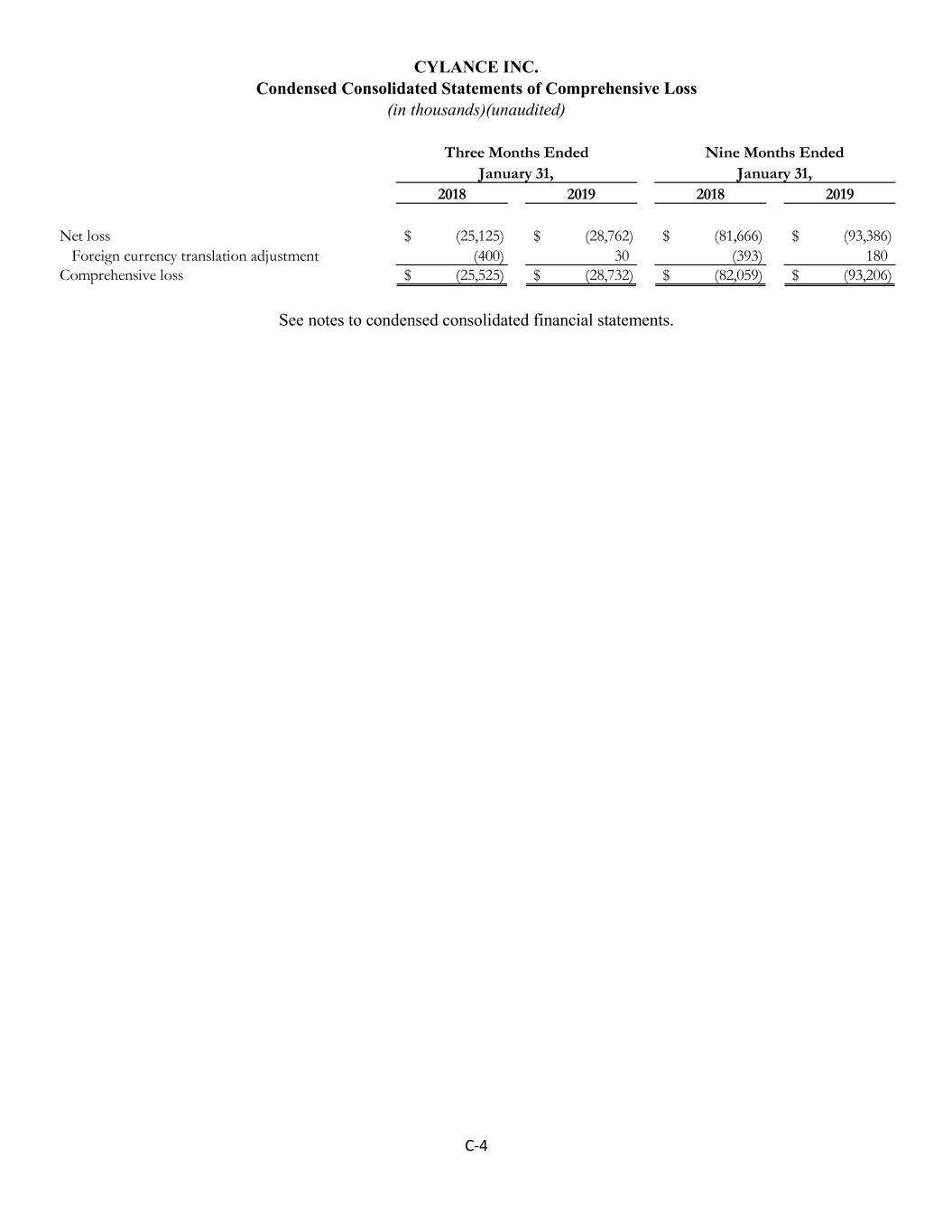

CYLANCE INC. Condensed Consolidated Statements of Comprehensive Loss (in thousands)(unaudited) Three Months Ended Nine Months Ended January 31, January 31, 2018 2019 2018 2019 Net loss $ (25,125) $ (28,762) $ (81,666) $ (93,386) Foreign currency translation adjustment (400) 30 (393) 180 Comprehensive loss $ (25,525) $ (28,732) $ (82,059) $ (93,206) See notes to condensed consolidated financial statements. C-4

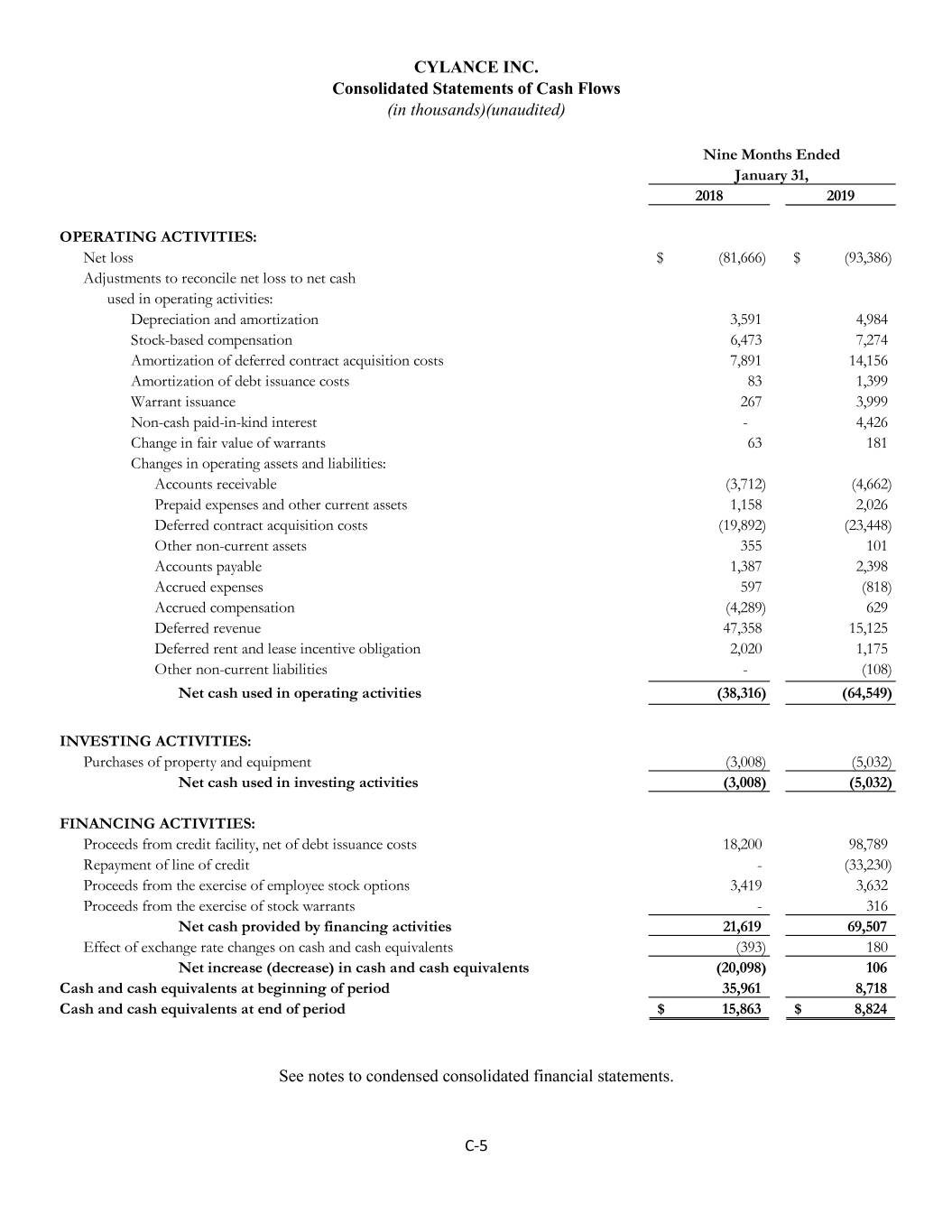

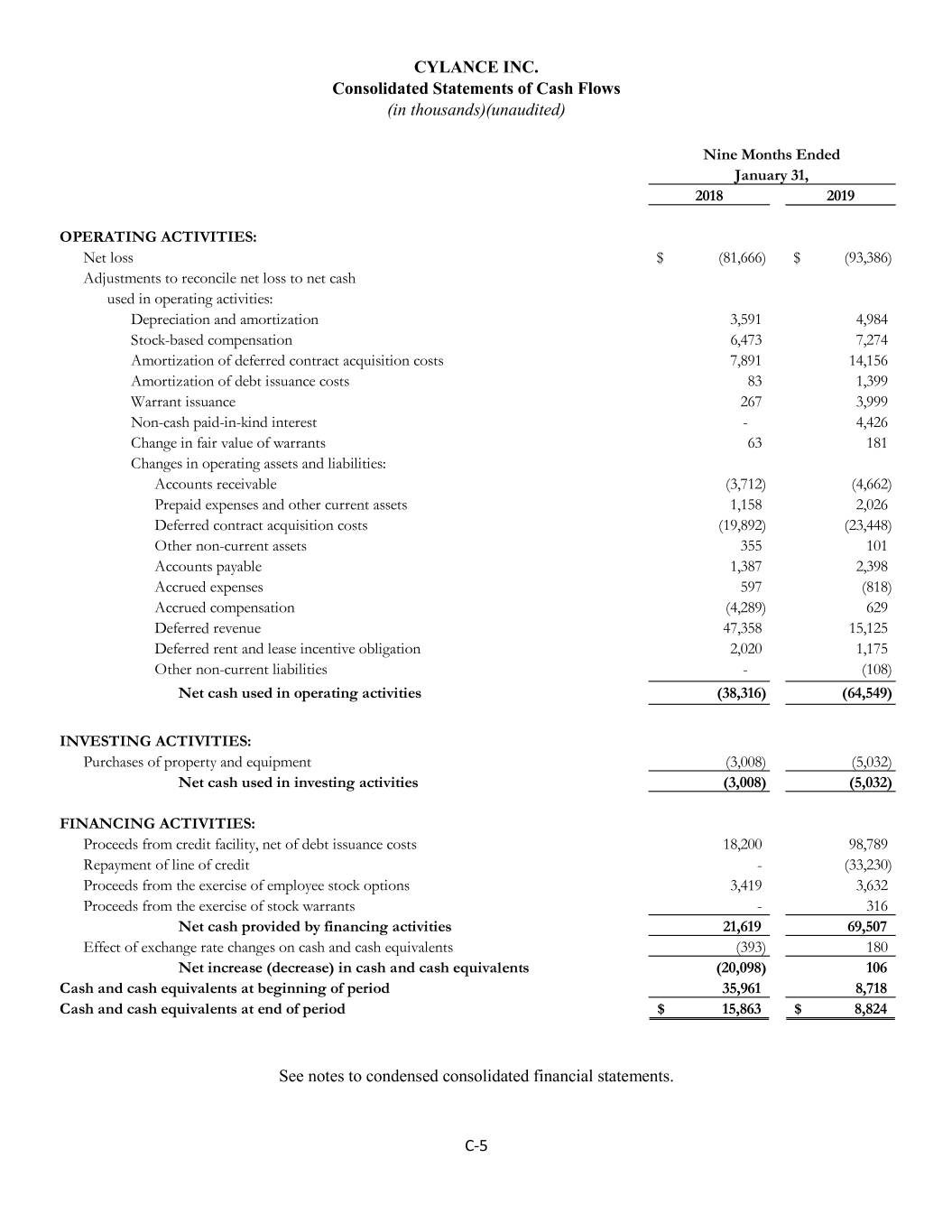

CYLANCE INC. Consolidated Statements of Cash Flows (in thousands)(unaudited) Nine Months Ended January 31, 2018 2019 OPERATING ACTIVITIES: Net loss $ (81,666) $ (93,386) Adjustments to reconcile net loss to net cash used in operating activities: Depreciation and amortization 3,591 4,984 Stock-based compensation 6,473 7,274 Amortization of deferred contract acquisition costs 7,891 14,156 Amortization of debt issuance costs 83 1,399 Warrant issuance 267 3,999 Non-cash paid-in-kind interest - 4,426 Change in fair value of warrants 63 181 Changes in operating assets and liabilities: Accounts receivable (3,712) (4,662) Prepaid expenses and other current assets 1,158 2,026 Deferred contract acquisition costs (19,892) (23,448) Other non-current assets 355 101 Accounts payable 1,387 2,398 Accrued expenses 597 (818) Accrued compensation (4,289) 629 Deferred revenue 47,358 15,125 Deferred rent and lease incentive obligation 2,020 1,175 Other non-current liabilities - (108) Net cash used in operating activities (38,316) (64,549) INVESTING ACTIVITIES: Purchases of property and equipment (3,008) (5,032) Net cash used in investing activities (3,008) (5,032) FINANCING ACTIVITIES: Proceeds from credit facility, net of debt issuance costs 18,200 98,789 Repayment of line of credit - (33,230) Proceeds from the exercise of employee stock options 3,419 3,632 Proceeds from the exercise of stock warrants - 316 Net cash provided by financing activities 21,619 69,507 Effect of exchange rate changes on cash and cash equivalents (393) 180 Net increase (decrease) in cash and cash equivalents (20,098) 106 Cash and cash equivalents at beginning of period 35,961 8,718 Cash and cash equivalents at end of period $ 15,863 $ 8,824 See notes to condensed consolidated financial statements. C-5

CYLANCE INC. NOTES TO CONDENSED CONSOLIDATED FINANCIAL STATEMENTS (unaudited) Note 1. Organization Organization and Description of Business Cylance Inc. ( “we,” “us,” or “our”) is an artificial intelligence and machine learning company with a current focus on cybersecurity and prevention of advanced malware prior to execution at the endpoint. Our solutions protect both Enterprise and Consumer endpoints, relying on mathematical models to predict whether a file is malicious. We deliver our solutions through a cloud- based platform, providing access to customers through subscriptions, and provide related support and professional services. We were founded and incorporated in 2012 in the State of Delaware. Our headquarters is in Irvine, California, and we conduct business worldwide, with international locations in Ireland, UK, UAE, Japan, and Australia. Note 2. Basis of Presentation and Summary of Significant Accounting Policies Basis of Presentation and Preparation These interim condensed consolidated financial statements have been prepared by management in accordance with United States generally accepted accounting principles (“U.S. GAAP”). They do not include all of the disclosures required by U.S. GAAP for annual financial statements and should be read in conjunction with the audited consolidated financial statements for the year ended April 30, 2018 (the “Annual Financial Statements”), which have been prepared in accordance with U.S. GAAP. In the opinion of management, all normal recurring adjustments considered necessary for fair presentation have been included in these interim condensed consolidated financial statements. Principles of Consolidation The accompanying condensed consolidated financial statements include the accounts of Cylance Inc. and its wholly owned subsidiaries. All intercompany balances and transactions have been eliminated in consolidation. Significant Accounting Policies and Critical Accounting Estimates There have been no material changes to our accounting policies or critical accounting estimates from those described in the Annual Financial Statements. Initial Public Offering (“IPO”) Costs IPO costs were expensed and consisted of fees and expenses incurred in connection with previously anticipated sale of our common stock in an IPO, including the legal, accounting, printing, and other IPO-related costs. For the nine months ended January 31, 2019, we expensed $2.0 million of IPO costs. There were no costs expensed in the nine months ended January 31, 2018. Recently Issued Accounting Pronouncements In February 2016, the FASB issued ASU 2016-02, Leases (Topic 842). The new standard establishes a right-of-use (“ROU”) model that requires a lessee to record a ROU asset and a lease liability on the balance sheet for all leases with terms longer than 12 months. Leases will be classified as either finance or operating, with classification affecting the pattern of expense recognition in the statements of operations. For private business entities, the new standard is effective for fiscal years beginning after December 15, 2019. A modified retrospective transition approach is required for lessees for capital and operating leases existing at, or entered into after, the beginning of the earliest comparative period presented in the financial statements, with certain practical expedients available. We are currently evaluating the effect this new accounting standard may have on our consolidated financial statements. C-6

CYLANCE INC. NOTES TO CONDENSED CONSOLIDATED FINANCIAL STATEMENTS (unaudited) In June 2016, the FASB issued ASU No. 2016-13, Financial Instruments-Credit Losses (Topic 326): Measurement of Credit Losses on Financial Instruments. This standard amends guidance on reporting credit losses for assets held at amortized cost basis and available-for-sale debt securities to require that credit losses on available-for-sale debt securities be presented as an allowance rather than as a write-down. The measurement of credit losses for newly recognized financial assets and subsequent changes in the allowance for credit losses are recorded in the statements of operations. For private business entities, it is effective for fiscal years beginning after December 15, 2020, including interim periods within those fiscal years. Early adoption is permitted. We are currently evaluating the potential impact of this standard on our consolidated financial statements. Note 3. Fair Value Measurements Fair value is defined as the exchange price that would be received from sale of an asset or paid to transfer a liability in the principal or most advantageous market for the asset or liability in an orderly transaction between market participants on the measurement date. We measure our financial assets and liabilities at fair value at each reporting period using a fair value hierarchy which requires us to maximize the use of observable inputs and minimize the use of unobservable inputs when measuring fair value. A financial instrument’s classification within the fair value hierarchy is based upon the lowest level of input that is significant to the fair value measurement. Three levels of inputs may be used to measure fair value: • Level I—Observable inputs are unadjusted quoted prices in active markets for identical assets or liabilities; • Level II—Observable inputs are quoted prices for similar assets and liabilities in active markets or inputs other than quoted prices that are observable for the assets or liabilities, either directly or indirectly through market corroboration, for substantially the full term of the financial instruments; and • Level III—Unobservable inputs that are supported by little or no market activity and that are significant to the fair value of the assets or liabilities. These inputs are based on our own assumptions used to measure assets and liabilities at fair value and require significant management judgment or estimation. We classify cash equivalents, which are comprised of highly liquid money market funds, within Level I of the fair value hierarchy because they are valued based on quoted market prices in active markets. The following table summarizes, for liabilities measured at fair value, the respective fair value and the classification by level of input within the fair value hierarchy (in thousands): As at April 30, 2018 Significant Quoted Prices in Significant Other Unobservable Active Markets Observable Inputs Inputs Total (Level 1) (Level 2) (Level 3) Liability stock warrants $ 210 $ - $ - $ 210 As at January 31, 2019 Significant Quoted Prices in Significant Other Unobservable Active Markets Observable Inputs Inputs Total (Level 1) (Level 2) (Level 3) Liability stock warrants $ 391 $ - $ - $ 391 Level 3 financial liabilities consist of preferred stock warrants for which there is no current market for these securities such that the determination of fair value requires significant judgment or estimation. Changes in fair value measurements categorized within Level 3 of the fair value hierarchy are analyzed each period based on changes in estimates or assumptions and recorded as appropriate. Liability preferred stock warrants are included in other non-current liabilities in the accompanying condensed consolidated balance sheets.

CYLANCE INC. NOTES TO CONDENSED CONSOLIDATED FINANCIAL STATEMENTS (unaudited) We use the Black-Scholes option valuation model to value Level 3 financial liabilities at inception and on subsequent valuation dates. This model incorporates transaction details, such as our stock price, contractual terms, maturity, risk free rates, as well as volatility. The following table sets forth a summary of the changes in the fair value of our Level 3 financial liabilities for the year ended April 30 and the nine months ended January 31, 2019 (in thousands): Fair Value Measurement at Reporting Date Using Significant Unobservable Inputs (Level 3) Balance at April 30, 2017 $ 139 Changes in fair value of preferred stock warrants 71 Balance at April 30, 2018 210 Changes in fair value of preferred stock warrants 181 Balance at January 31, 2019 $ 391 Note 4. Consolidated Balance Sheet Details Accounts receivables There was one customer that comprised more than 10% of accounts receivable as of April 30, 2018 and January 31, 2019. Information about major customers There was one customer that comprised more than 10% of the Company’s revenue for the nine months ended January 31, 2018 and January 31, 2019. Property and Equipment, Net Property and equipment, net consists of the following (in thousands): As of April 30, 2018 January 31, 2019 Furniture, fixtures, and equipment $ 4,446 $ 5,139 Computer hardware and software 11,599 13,645 Leasehold improvements 19,123 18,166 35,168 36,950 Less: accumulated depreciation and amortization (6,630) (11,613) Property and equipment, net $ 28,538 $ 25,337 Depreciation and amortization expense were $3.6 million and $5.0 million for the nine months ended January 31, 2018 and January 31, 2019, respectively. C-8

CYLANCE INC. NOTES TO CONDENSED CONSOLIDATED FINANCIAL STATEMENTS (unaudited) Note 5. Debt Credit Facilities In September 2017, we entered into a $67.5 million facility with Silicon Valley Bank (the “SVB Facility”), for a line of credit and term loan of $37.5 million and $30.0 million, respectively. The SVB Facility has a three-year term. Of the term loan, $7.5 million was funded at the closing date of the facility, with the remaining available for draw subject to certain performance conditions. The line of credit bears interest at a rate of prime plus 0% per annum, payable monthly with prime equaling the rate of interest per annum published from time to time in the Wall Street Journal. The term loan bears interest at a rate of prime plus 5.5% per annum, payable monthly. Both the line of credit and term loan mature in September 2020 and can be repaid without penalty upon a qualified initial public offering (as defined in the SVB Facility). The SVB Facility contains certain covenants, most notably a trailing six-month minimum bookings covenant. In conjunction with the SVB Facility, we issued fully vested warrants to purchase up to 41,088 shares of our common stock associated with the line of credit and warrants to purchase up to 289,262 shares of our common stock associated with the term loan, of which 126,552 were fully vested upon the consummation of the facility. Collectively, these fully vested warrants were valued at $0.3 million and recorded in equity, with an offsetting increase in deferred financing costs. The remaining shares underlying the warrant vested in conjunction with the amendment as discussed further below. We also incurred $0.3 million in fees associated with the SVB Facility, which, along with the $0.3 million in warrants, is recorded as an offset to the gross amount of borrowings on the accompanying consolidated balance sheet, and which is amortized to interest expense ratably over the term of the loan. See Note 8 for further information on warrants. In May 2018, we entered into a loan and security agreement with BTO Cylance Holdings—NQ LP, an affiliate of BTO Cylance Holdings LP (“BTO”), as lead lender, and Mendocino Capital, LLC, an affiliate of ClearSky Power & Technology Fund I LLC (“ClearSky”), as a lender, for a term loan of $65.0 million with a maximum term of three years, bearing cash interest of 4% payable quarterly, and bearing paid-in-kind (PIK) interest of 9% payable at maturity (the “Blackstone Facility”). Each of BTO and ClearSky is a holder of more than 5% of our outstanding capital stock. Under the terms of the Blackstone Facility, we are required to repay all amounts outstanding thereunder upon the occurrence of certain events, including within 10 days following the completion of a Qualified Offering (as defined in the Blackstone Facility). If the Blackstone Facility is repaid prior to maturity, we must pay a penalty equal to either (i) 25% of the principal amount of the loan, less the aggregate amount of cash and PIK interest and other fees paid or accrued through such repayment date, or (ii) if repaid pursuant to a Qualified Offering (as defined in the Blackstone Facility) that is completed prior to January 2019, 18.5% of the principal amount of the loan, less the aggregate amount of cash and PIK interest and other fees paid or accrued through such repayment date. In conjunction with the Blackstone Facility, we issued to the lenders fully vested warrants to purchase up to 495,535 shares of common stock at an exercise price of $0.01 per share valued at $2.5 million. We incurred $1.3 million in offering costs associated with this facility, which, along with the $2.5 million in warrants, is recorded as an offset to the gross amount of borrowings on the accompanying consolidated balance sheet, and which is amortized to interest expense ratably over the term of the loan. The Blackstone Facility contains certain covenants, most notably a trailing six-month minimum bookings covenant. We were in compliance with this and all other covenants under this facility through January 31, 2019. In conjunction with the Blackstone Facility, we amended the SVB Facility to draw an additional $12.5 million under the term loan and reduce the maximum borrowings under that facility to $55.0 million, without the prior approval of BTO Cylance Holdings – NQ LP. In connection with this additional draw, the remaining 162,710 unvested shares issuable under the warrants issued under the SVB Facility became fully vested, with a fair value of $0.5 million. In addition, the bookings covenants under the SVB Facility were adjusted lower. We were in compliance with this and all other covenants under this facility through January 31, 2019. At January 31, 2019, we had $16.0 million outstanding under the SVB line of credit, $30.0 million outstanding under the SVB term loan and $65.0 million outstanding under the Blackstone Facility, all of which are included in the accompanying consolidated balance sheets at January 31, 2019, net of offering costs. Related interest expense was $0.3 million and $8.5 million for the nine month ended January 31, 2018 and January 31, 2019, respectively. C-9

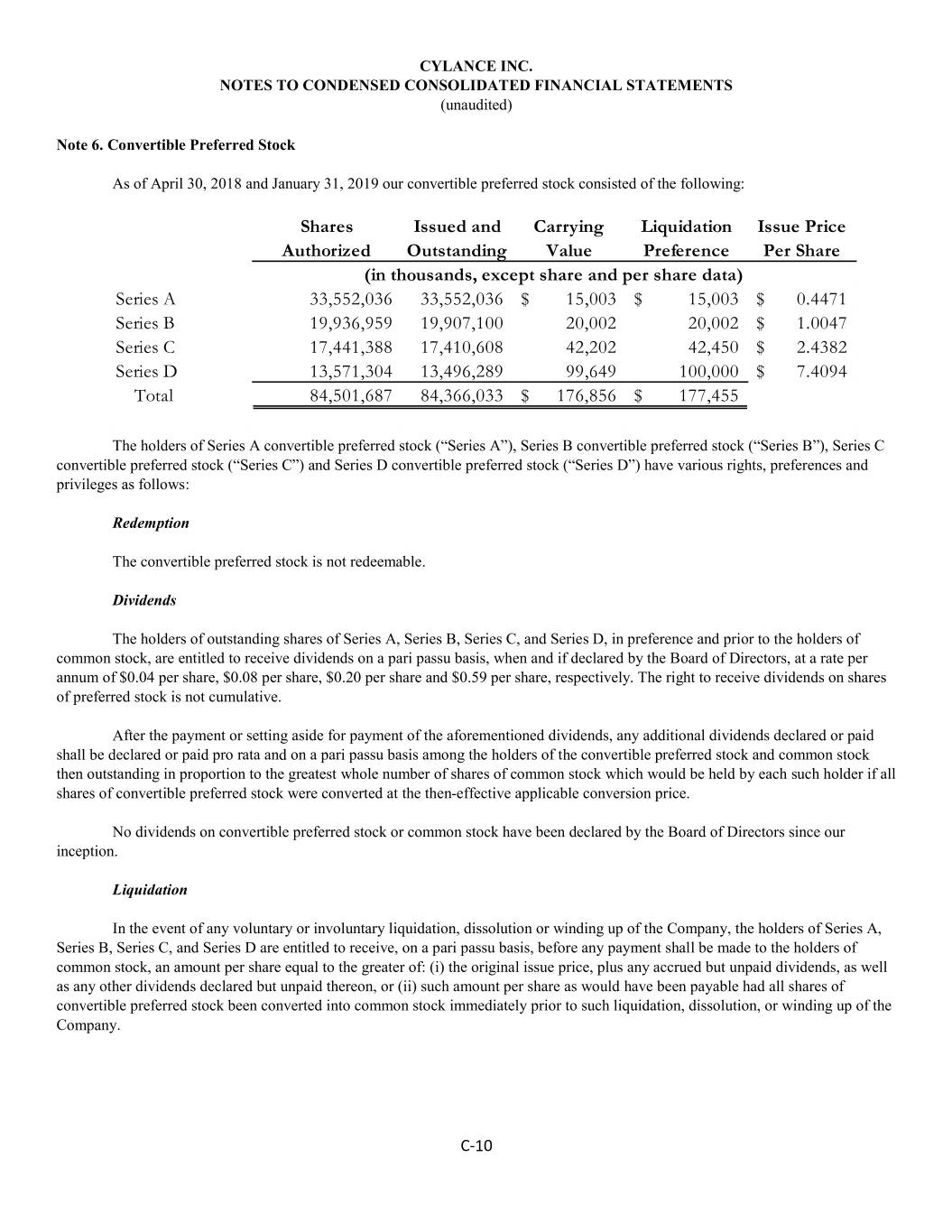

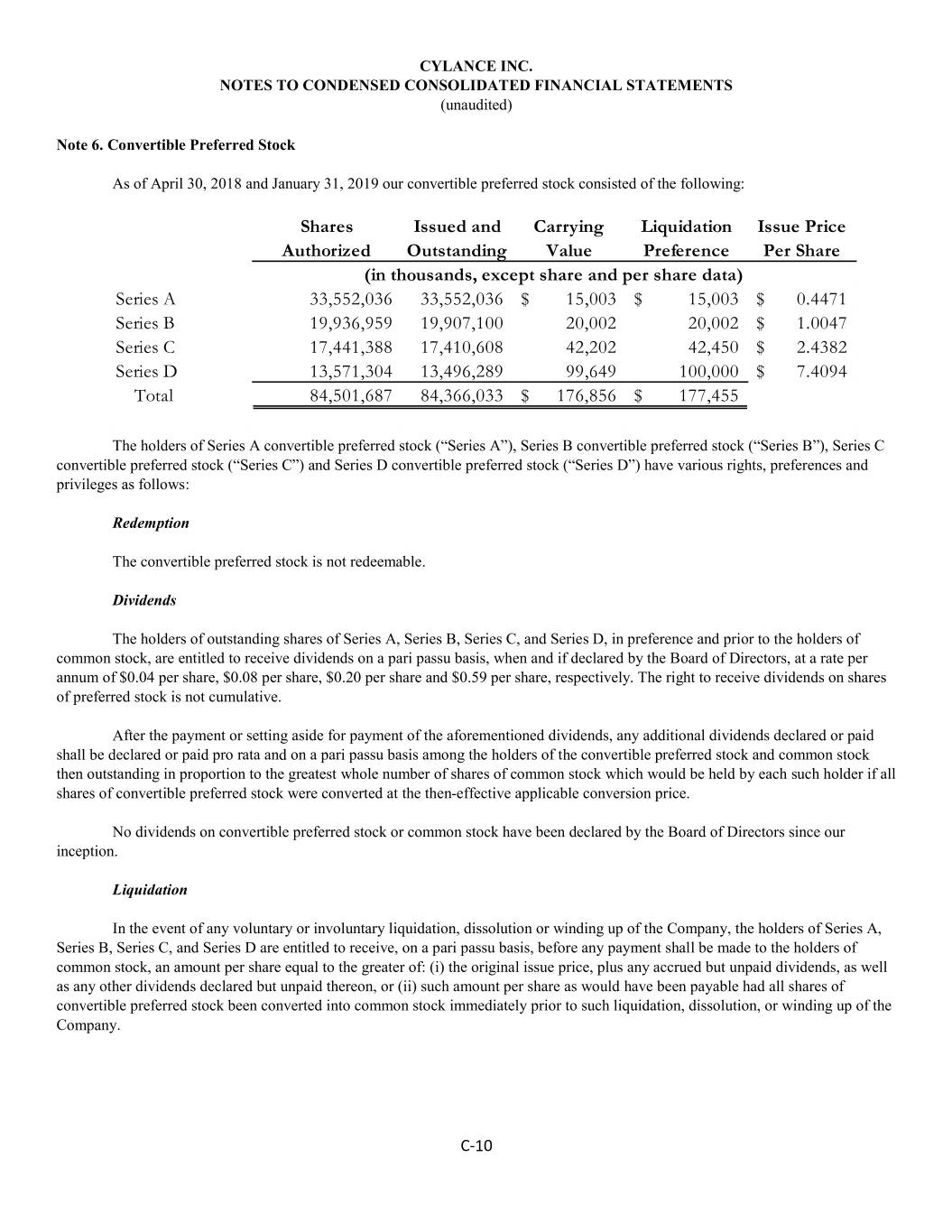

CYLANCE INC. NOTES TO CONDENSED CONSOLIDATED FINANCIAL STATEMENTS (unaudited) Note 6. Convertible Preferred Stock As of April 30, 2018 and January 31, 2019 our convertible preferred stock consisted of the following: Shares Issued and Carrying Liquidation Issue Price Authorized Outstanding Value Preference Per Share (in thousands, except share and per share data) Series A 33,552,036 33,552,036 $ 15,003 $ 15,003 $ 0.4471 Series B 19,936,959 19,907,100 20,002 20,002 $ 1.0047 Series C 17,441,388 17,410,608 42,202 42,450 $ 2.4382 Series D 13,571,304 13,496,289 99,649 100,000 $ 7.4094 Total 84,501,687 84,366,033 $ 176,856 $ 177,455 The holders of Series A convertible preferred stock (“Series A”), Series B convertible preferred stock (“Series B”), Series C convertible preferred stock (“Series C”) and Series D convertible preferred stock (“Series D”) have various rights, preferences and privileges as follows: Redemption The convertible preferred stock is not redeemable. Dividends The holders of outstanding shares of Series A, Series B, Series C, and Series D, in preference and prior to the holders of common stock, are entitled to receive dividends on a pari passu basis, when and if declared by the Board of Directors, at a rate per annum of $0.04 per share, $0.08 per share, $0.20 per share and $0.59 per share, respectively. The right to receive dividends on shares of preferred stock is not cumulative. After the payment or setting aside for payment of the aforementioned dividends, any additional dividends declared or paid shall be declared or paid pro rata and on a pari passu basis among the holders of the convertible preferred stock and common stock then outstanding in proportion to the greatest whole number of shares of common stock which would be held by each such holder if all shares of convertible preferred stock were converted at the then-effective applicable conversion price. No dividends on convertible preferred stock or common stock have been declared by the Board of Directors since our inception. Liquidation In the event of any voluntary or involuntary liquidation, dissolution or winding up of the Company, the holders of Series A, Series B, Series C, and Series D are entitled to receive, on a pari passu basis, before any payment shall be made to the holders of common stock, an amount per share equal to the greater of: (i) the original issue price, plus any accrued but unpaid dividends, as well as any other dividends declared but unpaid thereon, or (ii) such amount per share as would have been payable had all shares of convertible preferred stock been converted into common stock immediately prior to such liquidation, dissolution, or winding up of the Company. C-10

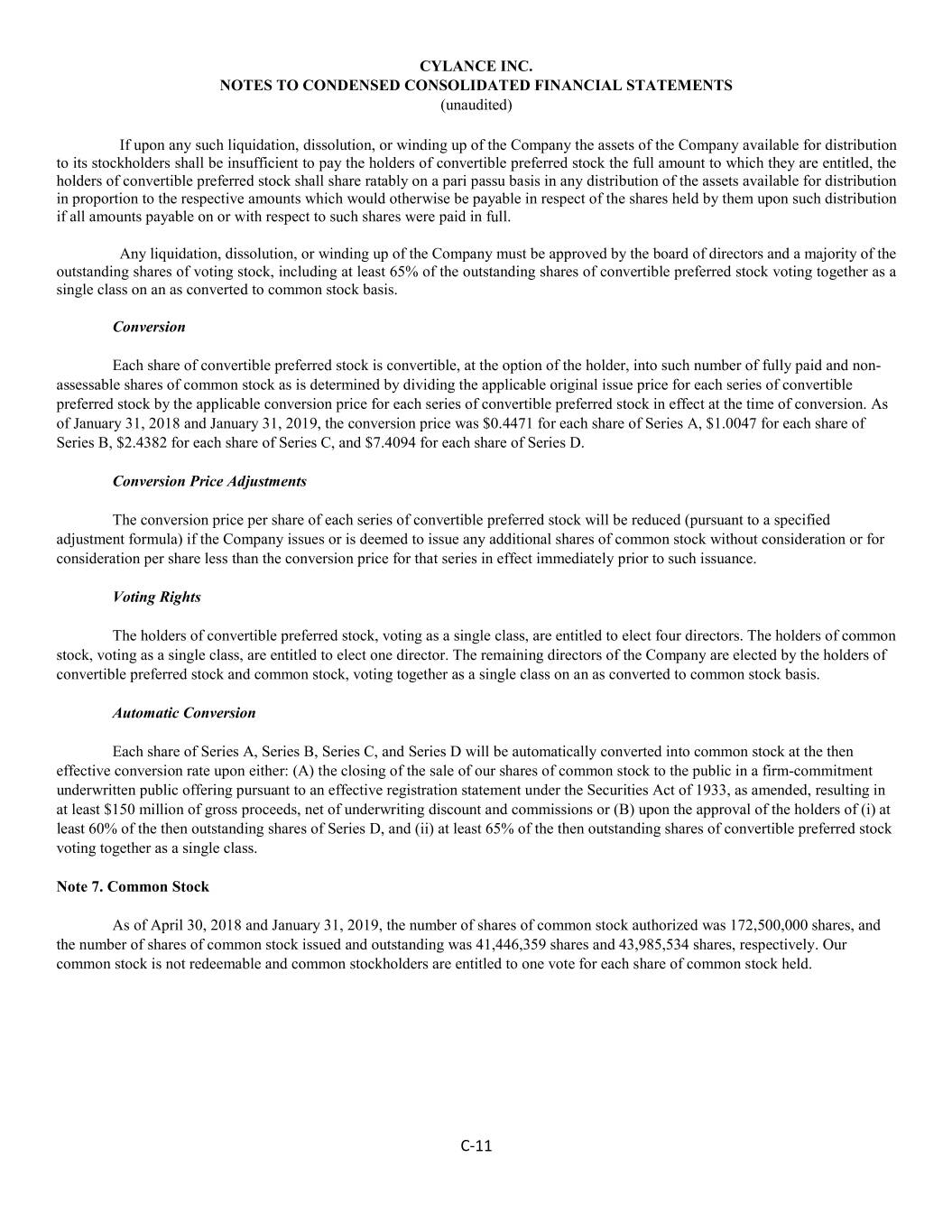

CYLANCE INC. NOTES TO CONDENSED CONSOLIDATED FINANCIAL STATEMENTS (unaudited) If upon any such liquidation, dissolution, or winding up of the Company the assets of the Company available for distribution to its stockholders shall be insufficient to pay the holders of convertible preferred stock the full amount to which they are entitled, the holders of convertible preferred stock shall share ratably on a pari passu basis in any distribution of the assets available for distribution in proportion to the respective amounts which would otherwise be payable in respect of the shares held by them upon such distribution if all amounts payable on or with respect to such shares were paid in full. Any liquidation, dissolution, or winding up of the Company must be approved by the board of directors and a majority of the outstanding shares of voting stock, including at least 65% of the outstanding shares of convertible preferred stock voting together as a single class on an as converted to common stock basis. Conversion Each share of convertible preferred stock is convertible, at the option of the holder, into such number of fully paid and non- assessable shares of common stock as is determined by dividing the applicable original issue price for each series of convertible preferred stock by the applicable conversion price for each series of convertible preferred stock in effect at the time of conversion. As of January 31, 2018 and January 31, 2019, the conversion price was $0.4471 for each share of Series A, $1.0047 for each share of Series B, $2.4382 for each share of Series C, and $7.4094 for each share of Series D. Conversion Price Adjustments The conversion price per share of each series of convertible preferred stock will be reduced (pursuant to a specified adjustment formula) if the Company issues or is deemed to issue any additional shares of common stock without consideration or for consideration per share less than the conversion price for that series in effect immediately prior to such issuance. Voting Rights The holders of convertible preferred stock, voting as a single class, are entitled to elect four directors. The holders of common stock, voting as a single class, are entitled to elect one director. The remaining directors of the Company are elected by the holders of convertible preferred stock and common stock, voting together as a single class on an as converted to common stock basis. Automatic Conversion Each share of Series A, Series B, Series C, and Series D will be automatically converted into common stock at the then effective conversion rate upon either: (A) the closing of the sale of our shares of common stock to the public in a firm-commitment underwritten public offering pursuant to an effective registration statement under the Securities Act of 1933, as amended, resulting in at least $150 million of gross proceeds, net of underwriting discount and commissions or (B) upon the approval of the holders of (i) at least 60% of the then outstanding shares of Series D, and (ii) at least 65% of the then outstanding shares of convertible preferred stock voting together as a single class. Note 7. Common Stock As of April 30, 2018 and January 31, 2019, the number of shares of common stock authorized was 172,500,000 shares, and the number of shares of common stock issued and outstanding was 41,446,359 shares and 43,985,534 shares, respectively. Our common stock is not redeemable and common stockholders are entitled to one vote for each share of common stock held. C-11

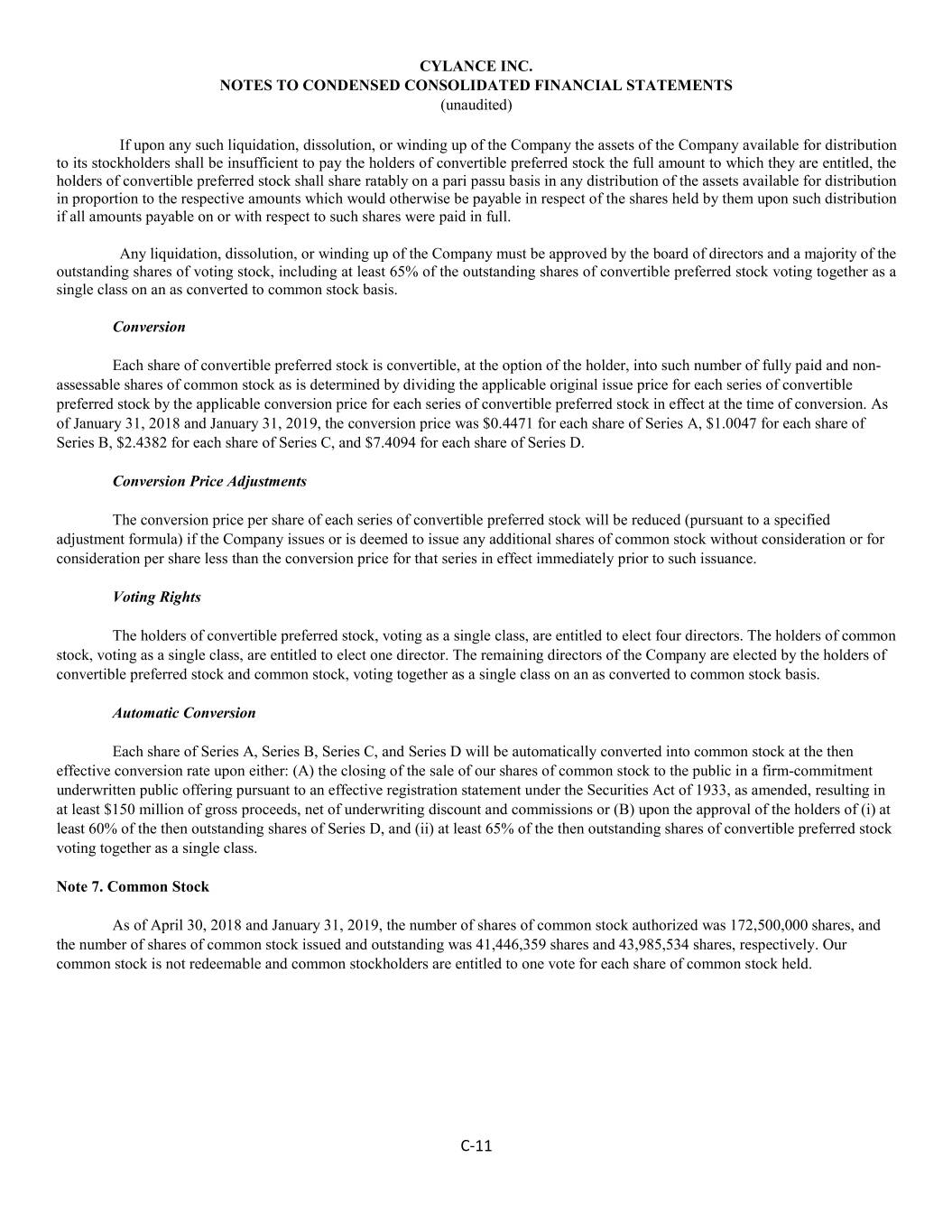

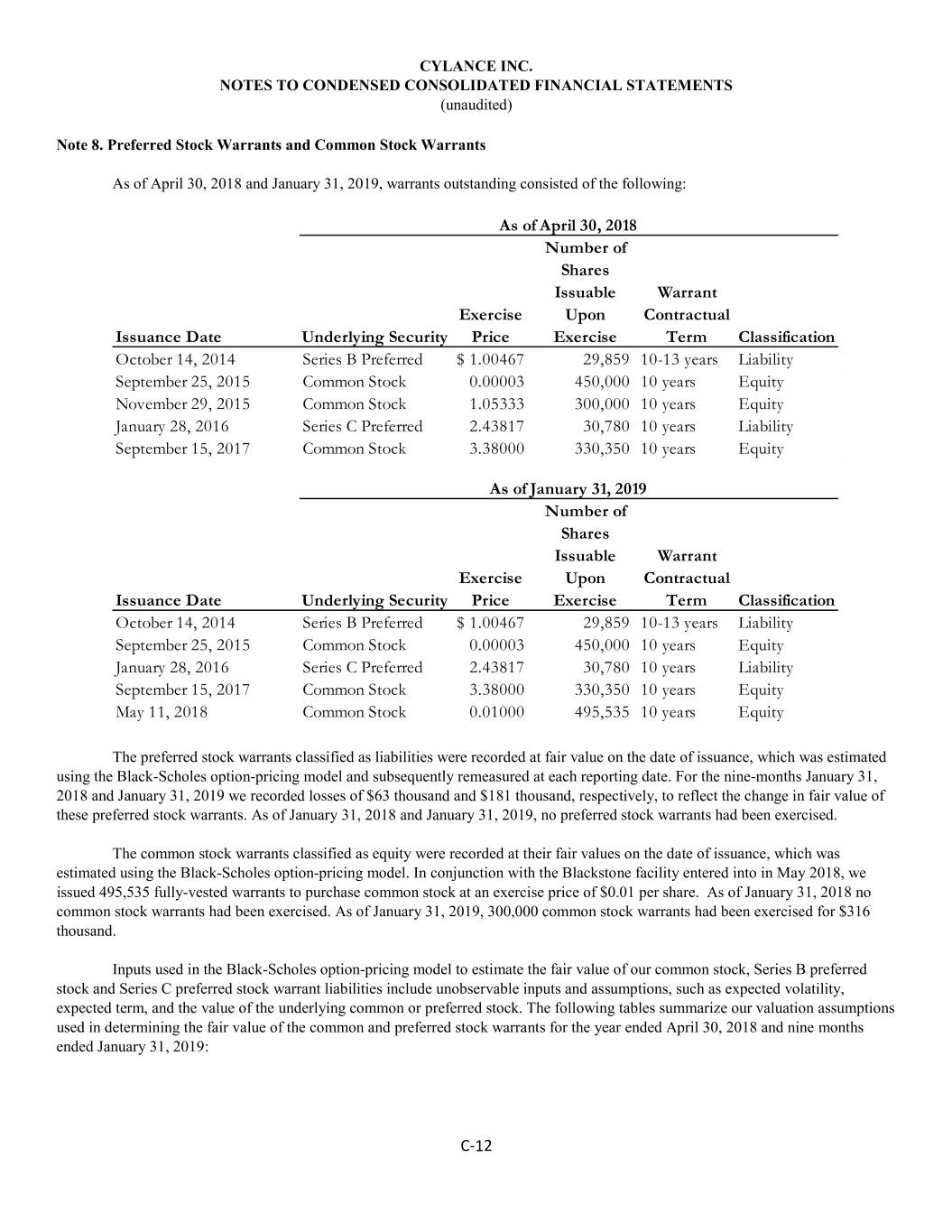

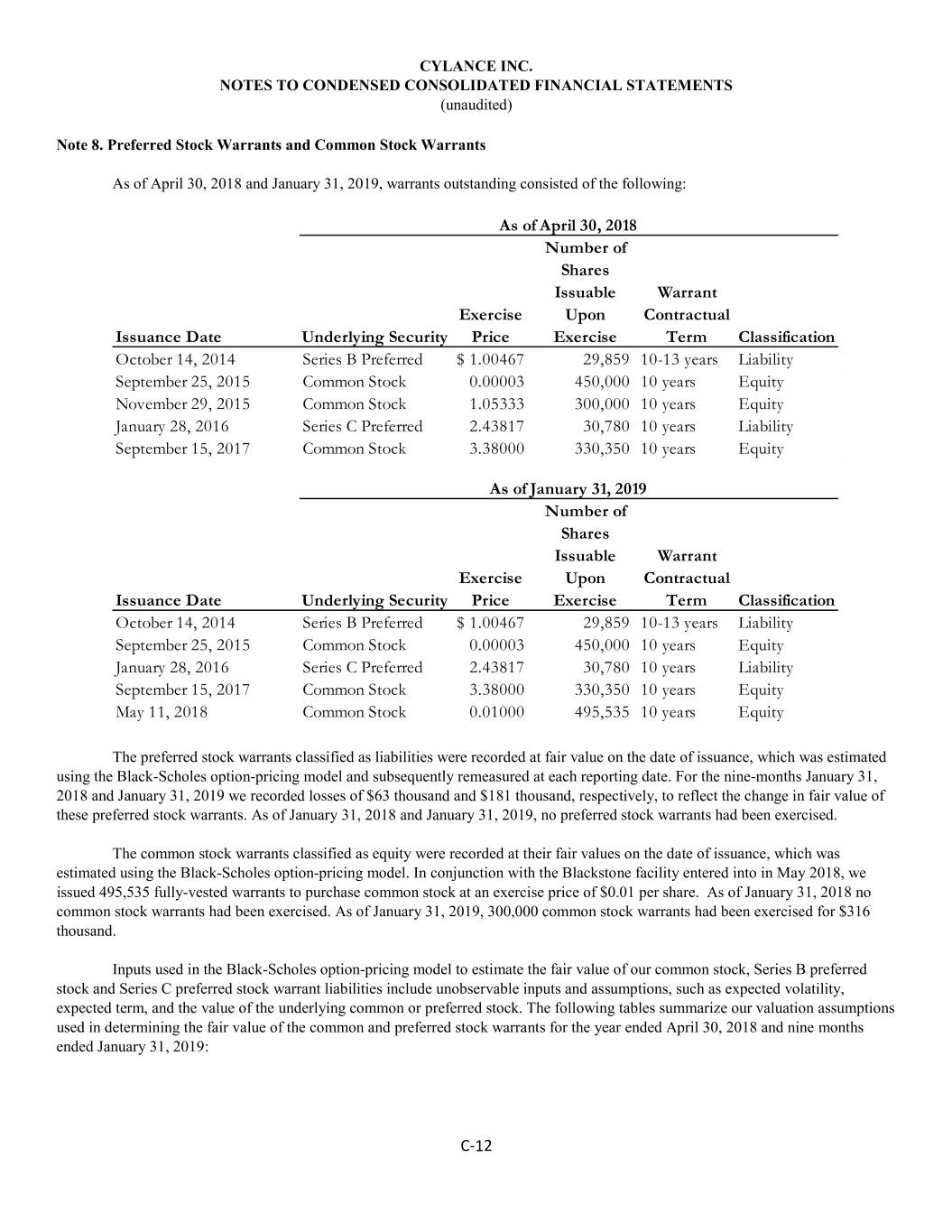

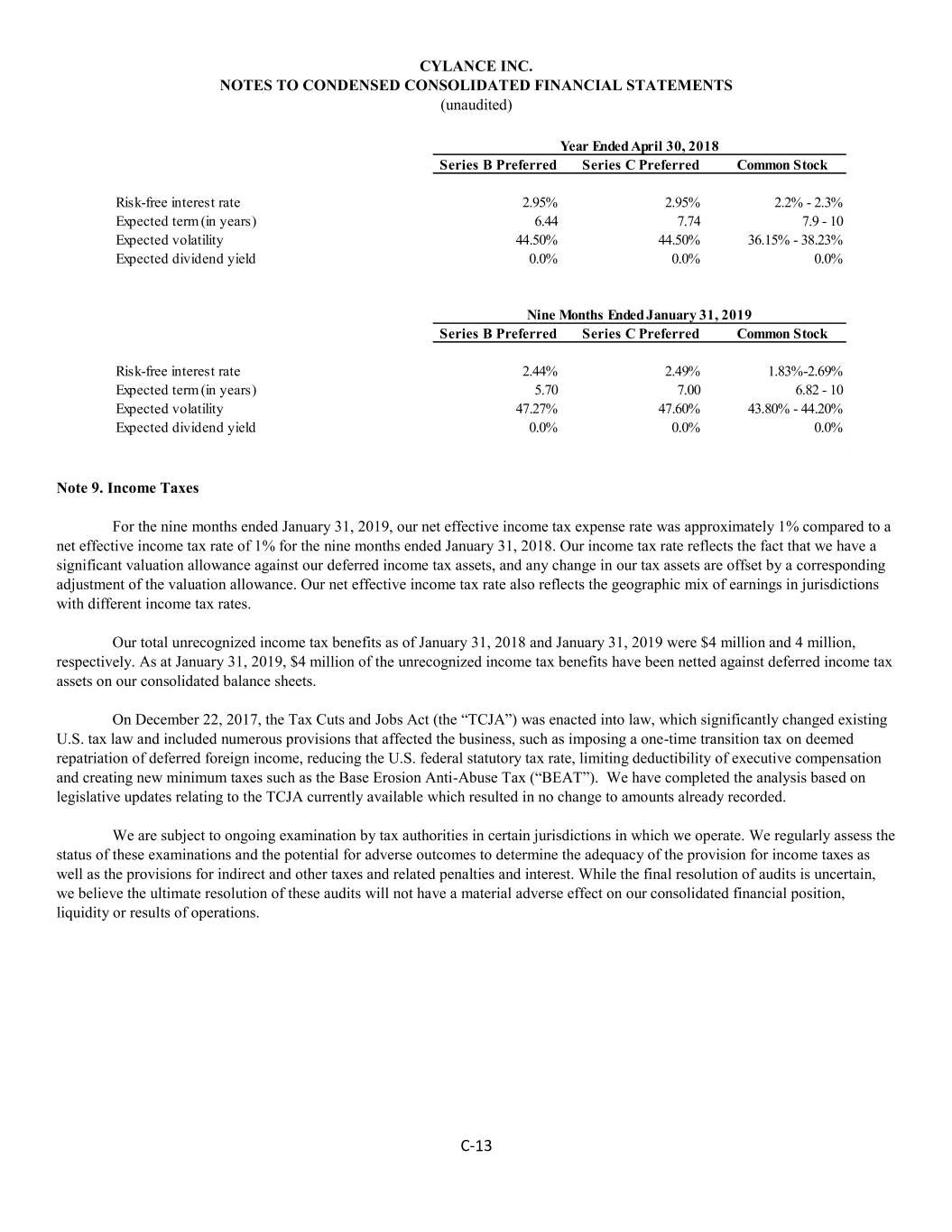

CYLANCE INC. NOTES TO CONDENSED CONSOLIDATED FINANCIAL STATEMENTS (unaudited) Note 8. Preferred Stock Warrants and Common Stock Warrants As of April 30, 2018 and January 31, 2019, warrants outstanding consisted of the following: As of April 30, 2018 Number of Shares Issuable Warrant Exercise Upon Contractual Issuance Date Underlying Security Price Exercise Term Classification October 14, 2014 Series B Preferred $ 1.00467 29,859 10-13 years Liability September 25, 2015 Common Stock 0.00003 450,000 10 years Equity November 29, 2015 Common Stock 1.05333 300,000 10 years Equity January 28, 2016 Series C Preferred 2.43817 30,780 10 years Liability September 15, 2017 Common Stock 3.38000 330,350 10 years Equity As of January 31, 2019 Number of Shares Issuable Warrant Exercise Upon Contractual Issuance Date Underlying Security Price Exercise Term Classification October 14, 2014 Series B Preferred $ 1.00467 29,859 10-13 years Liability September 25, 2015 Common Stock 0.00003 450,000 10 years Equity January 28, 2016 Series C Preferred 2.43817 30,780 10 years Liability September 15, 2017 Common Stock 3.38000 330,350 10 years Equity May 11, 2018 Common Stock 0.01000 495,535 10 years Equity The preferred stock warrants classified as liabilities were recorded at fair value on the date of issuance, which was estimated using the Black-Scholes option-pricing model and subsequently remeasured at each reporting date. For the nine-months January 31, 2018 and January 31, 2019 we recorded losses of $63 thousand and $181 thousand, respectively, to reflect the change in fair value of these preferred stock warrants. As of January 31, 2018 and January 31, 2019, no preferred stock warrants had been exercised. The common stock warrants classified as equity were recorded at their fair values on the date of issuance, which was estimated using the Black-Scholes option-pricing model. In conjunction with the Blackstone facility entered into in May 2018, we issued 495,535 fully-vested warrants to purchase common stock at an exercise price of $0.01 per share. As of January 31, 2018 no common stock warrants had been exercised. As of January 31, 2019, 300,000 common stock warrants had been exercised for $316 thousand. Inputs used in the Black-Scholes option-pricing model to estimate the fair value of our common stock, Series B preferred stock and Series C preferred stock warrant liabilities include unobservable inputs and assumptions, such as expected volatility, expected term, and the value of the underlying common or preferred stock. The following tables summarize our valuation assumptions used in determining the fair value of the common and preferred stock warrants for the year ended April 30, 2018 and nine months ended January 31, 2019: C-12

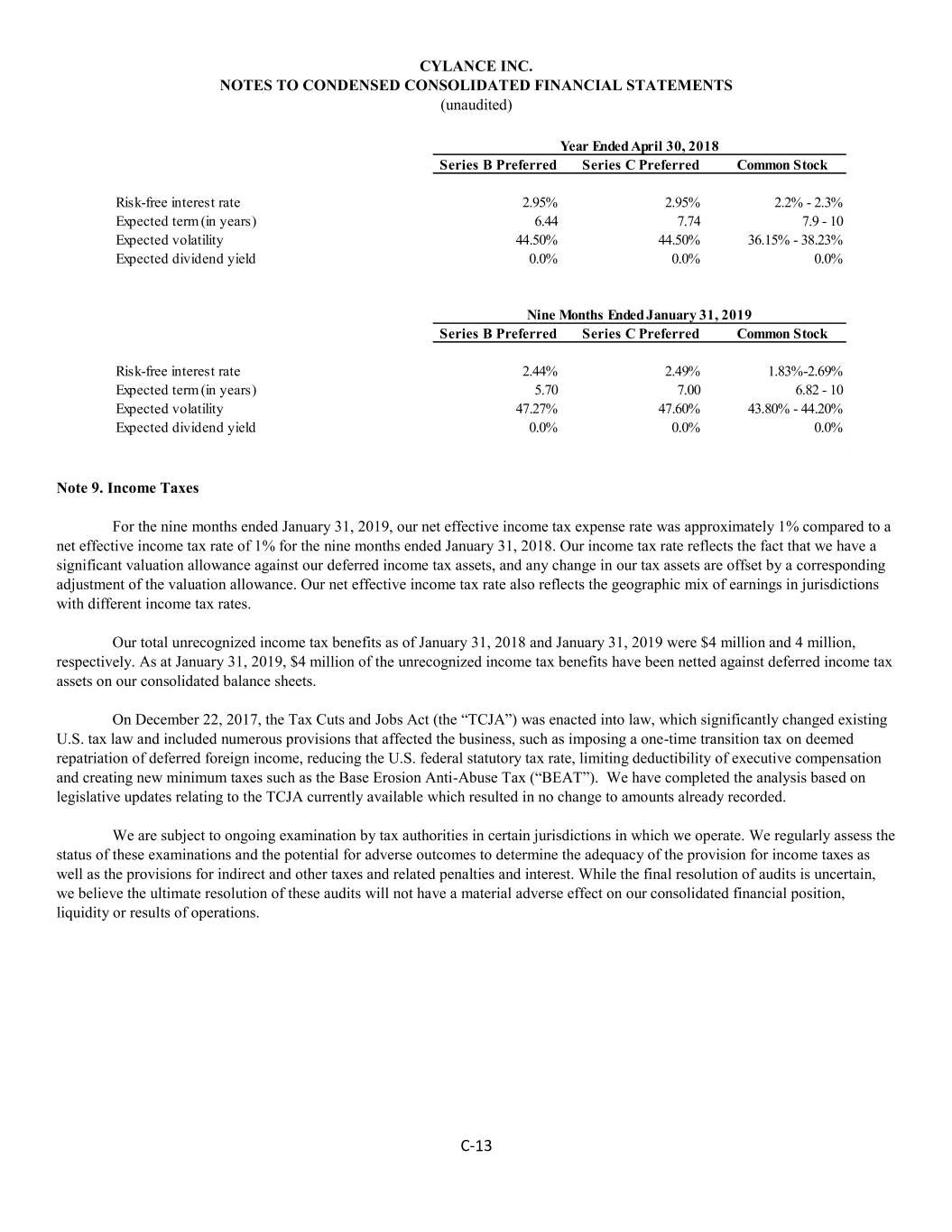

CYLANCE INC. NOTES TO CONDENSED CONSOLIDATED FINANCIAL STATEMENTS (unaudited) Year Ended April 30, 2018 Series B Preferred Series C Preferred Common Stock Risk-free interest rate 2.95% 2.95% 2.2% - 2.3% Expected term (in years) 6.44 7.74 7.9 - 10 Expected volatility 44.50% 44.50% 36.15% - 38.23% Expected dividend yield 0.0% 0.0% 0.0% Nine Months Ended January 31, 2019 Series B Preferred Series C Preferred Common Stock Risk-free interest rate 2.44% 2.49% 1.83%-2.69% Expected term (in years) 5.70 7.00 6.82 - 10 Expected volatility 47.27% 47.60% 43.80% - 44.20% Expected dividend yield 0.0% 0.0% 0.0% Note 9. Income Taxes For the nine months ended January 31, 2019, our net effective income tax expense rate was approximately 1% compared to a net effective income tax rate of 1% for the nine months ended January 31, 2018. Our income tax rate reflects the fact that we have a significant valuation allowance against our deferred income tax assets, and any change in our tax assets are offset by a corresponding adjustment of the valuation allowance. Our net effective income tax rate also reflects the geographic mix of earnings in jurisdictions with different income tax rates. Our total unrecognized income tax benefits as of January 31, 2018 and January 31, 2019 were $4 million and 4 million, respectively. As at January 31, 2019, $4 million of the unrecognized income tax benefits have been netted against deferred income tax assets on our consolidated balance sheets. On December 22, 2017, the Tax Cuts and Jobs Act (the “TCJA”) was enacted into law, which significantly changed existing U.S. tax law and included numerous provisions that affected the business, such as imposing a one-time transition tax on deemed repatriation of deferred foreign income, reducing the U.S. federal statutory tax rate, limiting deductibility of executive compensation and creating new minimum taxes such as the Base Erosion Anti-Abuse Tax (“BEAT”). We have completed the analysis based on legislative updates relating to the TCJA currently available which resulted in no change to amounts already recorded. We are subject to ongoing examination by tax authorities in certain jurisdictions in which we operate. We regularly assess the status of these examinations and the potential for adverse outcomes to determine the adequacy of the provision for income taxes as well as the provisions for indirect and other taxes and related penalties and interest. While the final resolution of audits is uncertain, we believe the ultimate resolution of these audits will not have a material adverse effect on our consolidated financial position, liquidity or results of operations. C-13

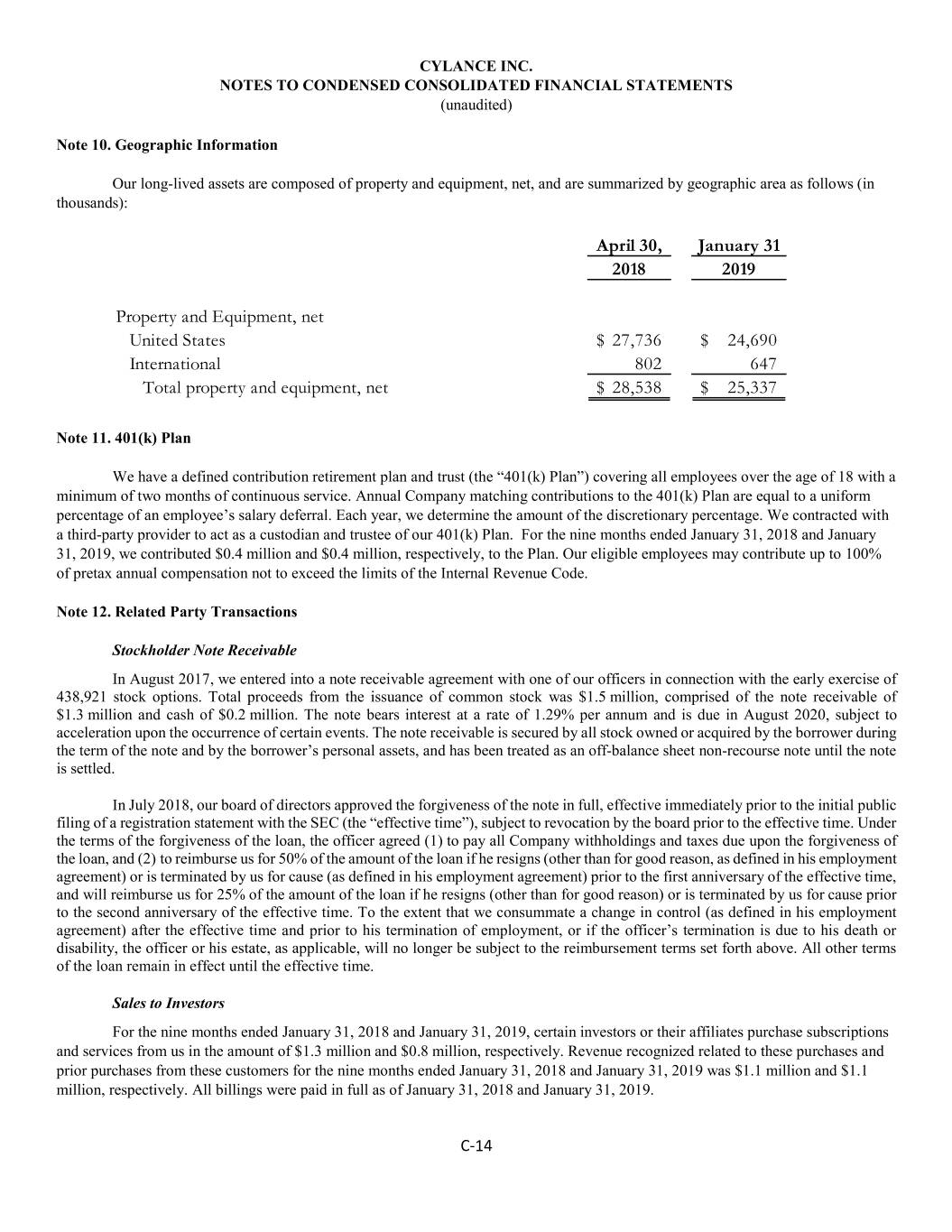

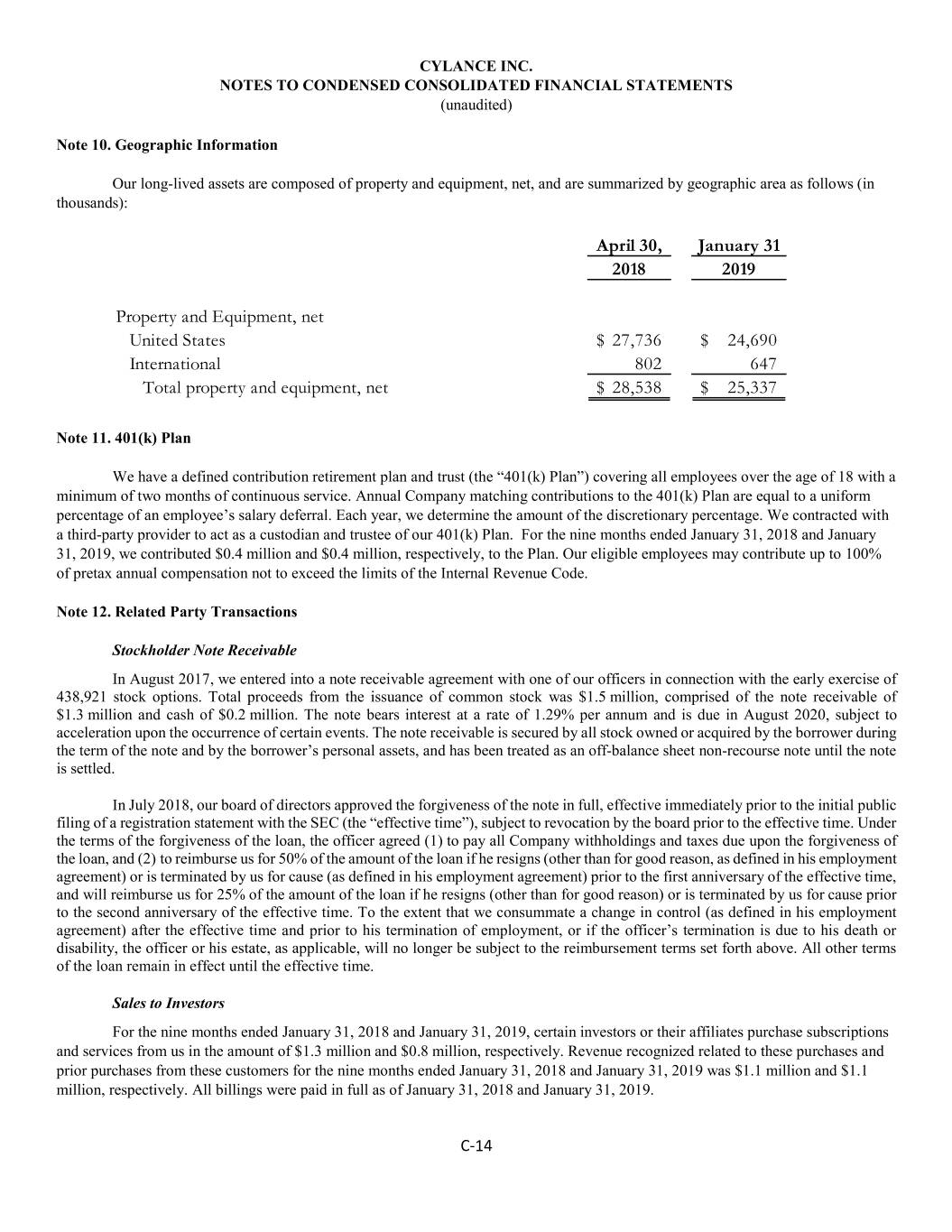

CYLANCE INC. NOTES TO CONDENSED CONSOLIDATED FINANCIAL STATEMENTS (unaudited) Note 10. Geographic Information Our long-lived assets are composed of property and equipment, net, and are summarized by geographic area as follows (in thousands): April 30, January 31 2018 2019 Property and Equipment, net United States $ 27,736 $ 24,690 International 802 647 Total property and equipment, net $ 28,538 $ 25,337 Note 11. 401(k) Plan We have a defined contribution retirement plan and trust (the “401(k) Plan”) covering all employees over the age of 18 with a minimum of two months of continuous service. Annual Company matching contributions to the 401(k) Plan are equal to a uniform percentage of an employee’s salary deferral. Each year, we determine the amount of the discretionary percentage. We contracted with a third-party provider to act as a custodian and trustee of our 401(k) Plan. For the nine months ended January 31, 2018 and January 31, 2019, we contributed $0.4 million and $0.4 million, respectively, to the Plan. Our eligible employees may contribute up to 100% of pretax annual compensation not to exceed the limits of the Internal Revenue Code. Note 12. Related Party Transactions Stockholder Note Receivable In August 2017, we entered into a note receivable agreement with one of our officers in connection with the early exercise of 438,921 stock options. Total proceeds from the issuance of common stock was $1.5 million, comprised of the note receivable of $1.3 million and cash of $0.2 million. The note bears interest at a rate of 1.29% per annum and is due in August 2020, subject to acceleration upon the occurrence of certain events. The note receivable is secured by all stock owned or acquired by the borrower during the term of the note and by the borrower’s personal assets, and has been treated as an off-balance sheet non-recourse note until the note is settled. In July 2018, our board of directors approved the forgiveness of the note in full, effective immediately prior to the initial public filing of a registration statement with the SEC (the “effective time”), subject to revocation by the board prior to the effective time. Under the terms of the forgiveness of the loan, the officer agreed (1) to pay all Company withholdings and taxes due upon the forgiveness of the loan, and (2) to reimburse us for 50% of the amount of the loan if he resigns (other than for good reason, as defined in his employment agreement) or is terminated by us for cause (as defined in his employment agreement) prior to the first anniversary of the effective time, and will reimburse us for 25% of the amount of the loan if he resigns (other than for good reason) or is terminated by us for cause prior to the second anniversary of the effective time. To the extent that we consummate a change in control (as defined in his employment agreement) after the effective time and prior to his termination of employment, or if the officer’s termination is due to his death or disability, the officer or his estate, as applicable, will no longer be subject to the reimbursement terms set forth above. All other terms of the loan remain in effect until the effective time. Sales to Investors For the nine months ended January 31, 2018 and January 31, 2019, certain investors or their affiliates purchase subscriptions and services from us in the amount of $1.3 million and $0.8 million, respectively. Revenue recognized related to these purchases and prior purchases from these customers for the nine months ended January 31, 2018 and January 31, 2019 was $1.1 million and $1.1 million, respectively. All billings were paid in full as of January 31, 2018 and January 31, 2019. C-14

CYLANCE INC. NOTES TO CONDENSED CONSOLIDATED FINANCIAL STATEMENTS (unaudited) Debt Transaction In May 2018, we entered into a loan and security agreement with lenders affiliated with certain of our stockholders. Refer to Note 5 for further discussion. Note 13. Commitments and Contingencies Legal Matters From time to time, and in the ordinary course of business, we may be subject to various claims, charges and litigation. As of January 31, 2019, we did not have any pending claims, charges or litigation that we expect would have a material adverse effect on our consolidated financial position, results of operations or cash flows. Note 14. Subsequent Events Subsequent events have been evaluated through April 18, 2019, the date the financial statements were available to be issued. On February 21, 2019, BlackBerry Limited acquired all of the issued and outstanding shares of the Company for approximately $1.4 billion in cash, and common shares, plus the assumption of unvested employee incentive awards. C-15