- CNX Dashboard

- Financials

- Filings

-

Holdings

- Transcripts

- ETFs

- Insider

- Institutional

- Shorts

-

DEF 14A Filing

CNX Resources (CNX) DEF 14ADefinitive proxy

Filed: 23 Mar 23, 4:16pm

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

SCHEDULE 14A

(RULE 14a-101)

INFORMATION REQUIRED IN PROXY STATEMENT

PROXY STATEMENT PURSUANT TO SECTION 14(a)

OF THE SECURITIES EXCHANGE ACT OF 1934

(Amendment No. )

| Filed by the Registrant |  | Filed by a Party other than the Registrant |

| Check the appropriate box: | |

| Preliminary Proxy Statement |

| Confidential, for use of the Commission Only (as permitted by Rule 14a-6(e)(2)) |

| Definitive Proxy Statement |

| Definitive Additional Materials |

| Soliciting Material under §240.14a-12 |

CNX RESOURCES CORPORATION

(Name of Registrant as Specified in Its Charter)

(Name of Person(s) Filing Proxy Statement, if other than the Registrant)

| Payment of Filing Fee (Check all boxes that apply): | |

| No fee required. |

| Fee paid previously with preliminary materials. |

| Fee computed on table in exhibit required by Item 25(b) per Exchange Act Rules 14a-6(i)(1) and 0-11. |

CNX Resources Corporation

CNX Center

1000 Horizon Vue Drive, Suite 400

Canonsburg, Pennsylvania 15317-6506

Telephone (724) 485-4000

March 23, 2023

Three years ago, CNX laid out a differentiated strategy that emphasized long-term value per share creation over short termism and instant gratification. 2022 was another productive year of executing that strategy as we continued to efficiently develop our core assets, position the company for growth opportunities, positively impact our local region and not incidentally, generate significant free cash flow (“FCF”) per share.

CNX enjoys three competitive moats that uniquely position us to execute our sustainable business model and generate substantial free cash flow per share year after year.

First, CNX’s stacked pay acreage position across the Marcellus and Utica shales presents an unparalleled opportunity to lead the development of what the company believes is one of the world’s top two most prolific natural gas basins.

Second, CNX’s integrated upstream and midstream businesses create the lowest all-in operating cost structure in the Appalachian basin, which allows the company to make long-term investments that consistently generate high rates of returns.

Lastly, CNX’s New Technologies business segment, rooted in the company’s extensive legacy asset base and tradition, of innovation, has created unique opportunities in the areas of methane capture and abatement, transportation fuel, market development, and technology deployment. These growth opportunities position CNX well as the world focuses on lower emissions and lower risk energy solutions.

The competitive moats above are drivers of consistent free cash flow generation. When coupled with our capital allocation philosophy of clinically electing projects with the best risk-adjusted rates of return, we are able to deliver substantial intrinsic value creation per share for our owners year after year.

In 2022, the company generated $1.2 billion of net cash provided by operating activities, which resulted in an annual record FCF of $707 million.(1) As of January 17, 2023, our total shares outstanding were 170.1 million shares. If you divide the $707 million(1) by the 170.1 million shares, the resultant free cash flow per share is remarkable. We would do the math for you to highlight the free cash flow per share, but SEC rules(2) forbid us from showing this algebra. The company used approximately 80% of 2022 FCF to repurchase shares and the remaining 20% was dedicated to servicing and paying down debt.

Through the fourth quarter of 2022, the company has delivered 12 consecutive quarters of positive FCF, or approximately $1.6 billion(1) of cumulative FCF since Q1 2020 that has enabled the company to retire shares and reduce debt, generating meaningful shareholder value. We believe that the consistent execution of our operational and capital allocation strategies offers an exceptional opportunity for long-term FCF per share growth.

A reconciliation of FCF to the nearest GAAP measure is set forth in Appendix A to this Proxy Statement. CNX is unable to provide a reconciliation of projected FCF per share in this letter. This is due to our inability to calculate the comparable GAAP projected metrics, given the unknown effect, timing, and potential significance of certain income statement items.

See Answer to Question 102.05, Compliance & Disclosure Interpretations Re: Non-GAAP Financial Measures, SEC, May 17, 2016, available at https://www.sec.gov/corpfin/non-gaap-financial-measures (page listed as last modified on Dec. 13, 2022) (last visited February 16, 2023).

For 2020-2022, the company generated $3.0 billion of net cash provided by operating activities, which resulted in $1.6 billion of free cash flow (FCF),(1) well ahead of our initial expectations set out in 2020. Across that same time period, the company used FCF to return $895 million in capital to shareholders and another $674 million to further strengthen the balance sheet.

In 2022, the company repurchased 33.4 million shares for $565 million at an average price of $16.92 per share. The company has retired nearly 25 percent of its outstanding shares since they peaked following the completion of the CNX Midstream Partners merger in 2020, a level matched by fewer than a handful of companies in the S&P 500 and by only 22 companies in the S&P 1500. Furthermore, since 2017 and through January 17, 2023, CNX has repurchased approximately 102 million shares for $1,479 million at an average price of $14.38 per share. Most importantly, we believe that these shares were repurchased at deeply discounted prices relative to intrinsic value, thereby creating meaningful long-term per share value for our owners.

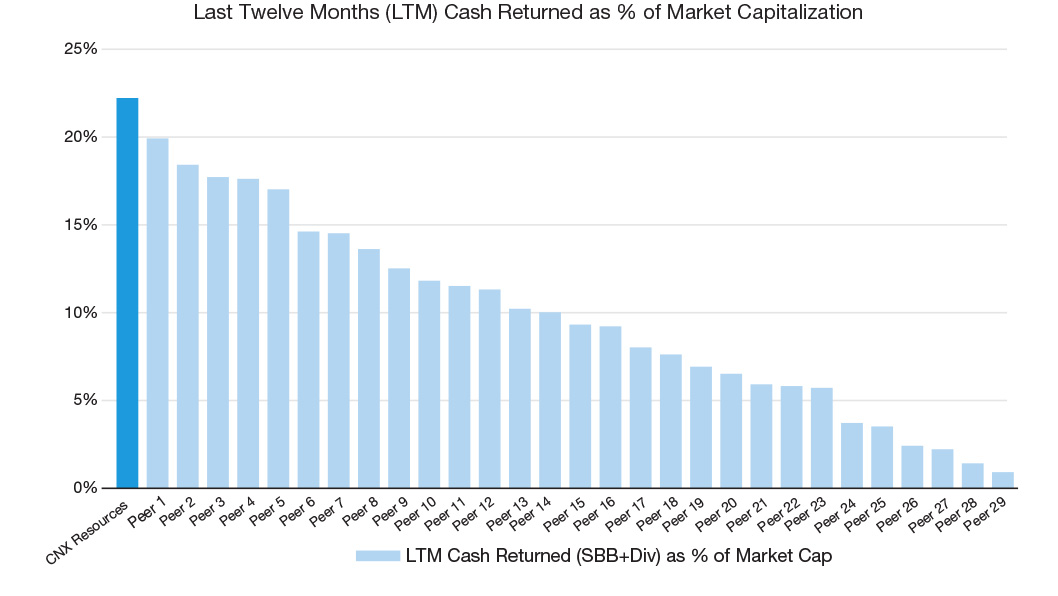

The chart below further highlights how CNX is differentiated from our industry peers. Although many people would place us within the peer group of the top 30 publicly traded U.S. natural gas producers based on production volumes as shown below, we actually see it differently. We look beyond energy companies to those companies that embrace similar capital allocation philosophies and have successfully returned significant amounts of capital to their shareholders over extended time periods. These companies generally fall outside of energy. As the chart below shows, we have returned significant cash to our shareholders as a percentage of our market capitalization. We expect to continue to differentiate ourselves by executing this capital allocation playbook well into the future.

Source: S&P Capital IQ.

Note: LTM data as of 3/10/2023.

The remaining $142 million of FCF(1) generated in 2022 was used to reduce net debt and extend the maturities of our senior notes.

CNX completed a $500 million private offering of 7.375% senior notes due January 2031. In conjunction with the senior notes offering, CNX repurchased $350 million of its outstanding 7.25% senior notes due March 2027. This opportunistic transaction removed future interest rate risk and resulted in a stronger balance sheet with the company’s weighted average debt maturity on the unsecured notes extending to 6.8 years.

Following the transaction, CNX has approximately $500 million in prepayable debt that the company can opportunistically pay down over the next several years. As a result of this transaction, the company is now uniquely positioned to take advantage of any deepening valuation disconnects that might occur in the debt or equity markets.

A reconciliation of FCF to the nearest GAAP measure is set forth in Appendix A to this Proxy Statement.

Our decisions, resources, and processes remain concentrated on optimizing the long-term intrinsic per share value of the company. Despite the successful execution of the long-term plan over the past three years, we continue to believe that our stock is trading at a significant discount to our intrinsic value, and we will continue to take active advantage of this market disconnect to further reduce shares outstanding.

In 2022, CNX unveiled its Appalachia First strategic vision, which is pro-growth, pro-market, and most importantly, pro-people of this great region. The shale revolution was born from disruptive and innovative technology developed by American entrepreneurship. As part of our vision, CNX and Appalachia are poised to deploy the next wave of technology to further improve the regional economy.

We are focused on leveraging our local natural gas resources to generate broad socio-economic benefits for the residents of the Appalachian region. By doing so, we can liberate downstream economic opportunities, create family sustaining jobs, and empower new vertical markets for the region. The priorities of CNX have historically been and will always be, Appalachia first.

The performance metrics we have developed are ultimately designed to help us achieve our mission:

To empower our team to embrace and drive innovative change that creates long-term per share value for our investors, enhances our communities, and delivers energy solutions for today and tomorrow.

The company’s Board of Directors and Management team continue to focus on guiding CNX according to the following three essential principles:

Optimizing long-term per share returns for our shareholders

Investing capital exclusively in high-return projects which in turn maximizes both capital allocation flexibility and long-term per share value for our shareholders.

We strongly believe that a steadfast, relentless commitment to best-in-class safety, environmental compliance, and diversity also increases efficiencies and margins, both important drivers of long-term intrinsic value per share.

Efficiently and prudently allocating capital

We focus on systematically earmarking capital dollars to the investment opportunities with the highest risk-adjusted returns. Period.

We typically insist on minimum internal rates of return of 20% for all capital investments and our internal projections are based on commodity price assumptions that are at or below the NYMEX strip.

Key components of our long-term capital allocation strategy include the following:

Methodical execution on high IRR exploration & development projects;

Balance sheet strength to drive capital flexibility (centered on a conservative targeted leverage ratio);

Opportunistic share count reduction where we see a significant margin of safety and discount to intrinsic value;

Strategic control of our midstream assets, which provides operational cost advantages and is expected to increase cumulative FCF in 2023 and beyond; and

Risk mitigation with a robust hedge book and tiered service contracts.

Seizing opportunities as the leading Appalachian energy company

Over the next few years, we plan to continue prioritizing the following core initiatives to optimize predictable FCF generation:

Lower Costs. A streamlined corporate office and emphasis on the power of autonomy for business units. We plan to continually reduce costs at headquarters and in our business units, where we seek to maintain a low-cost position relative to our peer group.

Programmatic Hedging. We will continue to follow a robust and programmatic hedging strategy. To optimize predictability, we plan to lock in returns by employing a “total” hedge strategy that hedges both NYMEX and basis and differentiates CNX from its peers.

Incentives. Compensation programs that align management’s interests with those of our shareholders through annual FCF per share targets. Our long-term incentive compensation programs focus on share price outperformance, tangible ESG metrics, and directly aligning management’s interests with those of our shareholders. The goal of both is to place management in the same shoes as our owners.

Growing New Technologies. We seek to leverage our unique asset base and core competencies in the development and commercialization of carbon emission reduction opportunities to drive intrinsic per share value growth. As you will note in this Proxy Statement, we have included a shareholder proposal requesting that the Board annually conduct an evaluation and issue a report on CNX’s lobbying and policy influence activities and how they align with the goal of the Paris Agreement. You will see in our Statement of Opposition to the proposal that CNX is focused on tangible actions developing and deploying a new wave of innovative technologies that are positively impacting the environment and creating shareholder value.

This deep long termism is embedded both in our sustainable business model and in our strategic decision making. At this juncture, all of the necessary ingredients for our long-term growth in intrinsic value are firmly within our control. From our unique core asset base, to our growing New Technology opportunities, to our balance sheet strength and unique approach to programmatic hedging; we have built a deeply sustainable business model with resiliency throughout any commodity price environment.

Our focus in 2023 and beyond will remain on safely and compliantly developing our extensive asset base and on disciplined capital allocation to grow our long-term free cash flow per share. If a disconnect continues to remain between our intrinsic value and our share price, we will act decisively and opportunistically. In other words, we will continue to operate with the mindset of a long-term owner.

“The stock market is designed to transfer money from the active to the patient.” Warren Buffet.

Thank you for your investment in CNX and for your trust and partnership.

|  |

Will Thorndike | Nick DeIuliis |

This letter contains forward-looking statements, estimates and projections within the meaning of the federal securities laws. Statements that are not historical are forward-looking and may include our operational and strategic plans; estimates of gas reserves and resources; projected timing and rates of return of future investments; and projections and estimates of future production, revenues, income, and capital spending. These forward-looking statements involve risks and uncertainties that could cause actual results to differ materially from those statements, estimates and projections. Investors should not place undue reliance on forward-looking statements as a prediction of future actual results. The forward-looking statements in this letter speak only as of the date hereof; we disclaim any obligation to update the statements, and we caution you not to rely on them unduly. Specific factors that could cause future actual results to differ materially from the forward-looking statements are described in detail under the captions “Forward- Looking Statements” and “Risk Factors” in our Annual Report on Form 10-K for the year ended December 31, 2022, filed with the Securities and Exchange Commission (“SEC”) and any subsequent reports filed with the SEC. Those risk factors discuss, among other matters, pricing volatility or pricing decline for natural gas and natural gas liquids; local, regional and national economic conditions and the impact they may have on our customers; events beyond our control, including a global or domestic health crisis; conditions in the oil and gas industry, including a sustained decrease in the level of supply or demand for oil or natural gas or a sustained decrease in the price of oil or natural gas; the financial condition of our customers; any non-performance by customers of their contractual obligations; changes in customer, employee or supplier relationships resulting from the proposed transaction; and changes in safety, health, environmental and other regulations.

CNX’s management uses certain non-GAAP financial measures for planning, forecasting and evaluating business and financial performance, and believes that they are useful for investors in analyzing the Company. Although these are not measures of performance calculated in accordance with generally accepted accounting principles (“GAAP”), management believes that these financial measures are useful to an investor in evaluating CNX because (i) analysts utilize these metrics when evaluating Company performance and have requested this information as of a recent practicable date, (ii) these metrics are widely used to evaluate a company’s operating performance, and (iii) we want to provide updated information to investors. Investors should not view these metrics as a substitute for measures of performance that are calculated in accordance with GAAP. In addition, because all companies do not calculate these measures identically, these measures may not be comparable to similarly titled measures of other companies.

May 4, 2023

10:00 a.m. Eastern Time

To be Held Online at

www.virtualshareholdermeeting.com/CNX2023

NOTICE

of Annual Meeting

of Shareholders

Notice is hereby given that the 2023 Annual Meeting of Shareholders (the “Annual Meeting”) of CNX Resources Corporation (“CNX” or the “Corporation”) will be held on May 4, 2023, at 10:00 a.m. Eastern Time online at www.virtualshareholdermeeting.com/CNX2023, for the following purposes:

Election of Seven Director Nominees;

Ratification of the Anticipated Appointment of Ernst & Young LLP as CNX’s Independent Auditor for the Fiscal Year Ending December 31, 2023;

Advisory Approval of CNX’s 2022 Named Executive Officer Compensation;

Advisory Approval of the Frequency of Future Advisory Votes on CNX’s Named Executive Officer Compensation;

Shareholder Proposal Requesting that the Board Annually Conduct an Evaluation and Issue a Report on CNX’s Lobbying and Policy Influence Activities, if Properly Presented.

Sincerely,

Alexander J. Reyes

Executive Vice President, General Counsel and

Corporate Secretary

By resolution of the Board of Directors, we have fixed the close of business on March 7, 2023 as the record date for determining the shareholders of CNX entitled to notice of, and to vote at, the Annual Meeting and any adjournment or postponement thereof.

Shareholders of record on March 7, 2023 can attend and participate in the Annual Meeting online at www.virtualshareholdermeeting.com/CNX2023. To attend and participate in the Annual Meeting, you will need the 16-digit control number on your (a) Notice of Internet Availability of Proxy Materials (the “Notice”), (b) proxy card or voting instruction card, or (c) instructions that accompanied your proxy materials. We encourage you to access the Annual Meeting before the start time of 10:00 a.m. Eastern Time on May 4, 2023. Please allow ample time for online check-in, which will begin at 9:45 a.m. Eastern Time on May 4, 2023. The online format for the Annual Meeting will permit broader participation in the Annual Meeting by our shareholders and provide you with access to copies of the proxy materials.

The proxy materials are first being released to shareholders on March 23, 2023. Regardless of whether you plan to attend the Annual Meeting, you can confirm that your shares are represented at the Annual Meeting by promptly voting and submitting your proxy by telephone or by internet or, if you received a paper copy of a proxy card or voting instruction card, by completing and returning the card by mail which requires no postage if mailed in the United States. Your prompt response and cooperation is appreciated.

March 23, 2023

IMPORTANT NOTICE REGARDING THE AVAILABILITY OF PROXY MATERIALS FOR THE ANNUAL MEETING TO BE HELD ON MAY 4, 2023: | HOW TO VOTE | |||

INTERNET Visit www.proxyvote.com prior to the Annual Meeting. |  BY TELEPHONE Call 1-800-690-6903. |  BY MAIL Complete, date and sign your |  ONLINE Attend the Annual Meeting (instructions above) and vote online. | |

The Proxy Statement, form of proxy, Annual Report on Form 10-K for the fiscal year ended December 31, 2022 and related materials are available free of charge at www.proxyvote.com or may be obtained by contacting the Investor Relations Department at the address and phone number in the Chairman and CEO letter. | ||||

TABLE OF CONTENTS

This Proxy Statement contains forward-looking statements, estimates and projections within the meaning of the federal securities laws. Statements that are not historical are forward-looking and may include our operational and strategic plans; estimates of gas reserves and resources; projected timing and rates of return of future investments; and projections and estimates of future production, revenues, income, and capital spending. These forward-looking statements involve risks and uncertainties that could cause actual results to differ materially from those statements, estimates and projections. Investors should not place undue reliance on forward-looking statements as a prediction of future actual results. The forward-looking statements in this Proxy Statement speak only as of the date hereof; we disclaim any obligation to update the statements, and we caution you not to rely on them unduly. Specific factors that could cause future actual results to differ materially from the forward-looking statements are described in detail under the captions “Forward-Looking Statements” and “Risk Factors” in our Annual Report on Form 10-K for the year ended December 31, 2022, filed with the Securities and Exchange Commission (“SEC”) and any subsequent reports filed with the SEC. Those risk factors discuss, among other matters, pricing volatility or pricing decline for natural gas and natural gas liquids; local, regional and national economic conditions, and the impact those conditions may have on our customers; the impact of events beyond our control, including a global or domestic health crisis; dependence on gathering, processing and transportation facilities and other midstream facilities owned by others; conditions in the oil and gas industry; our current long-term debt obligations, and the terms of the agreements that govern that debt; strategic determinations, including the allocation of capital and other resources to strategic opportunities; cyber incidents targeting our systems, oil and natural gas industry systems and infrastructure, or the systems of our third-party service providers; and changes in safety, health, environmental and other regulations.

|

|

| │4 |

We are providing the enclosed proxy materials to you in connection with the solicitation by the Board of Directors (the “Board”) of CNX Resources Corporation (“CNX” or the “Corporation”) of proxies to be voted at the Annual Meeting of Shareholders to be held on May 4, 2023 (the “Annual Meeting”). We first released these proxy materials to our shareholders on March 23, 2023. Links to the Corporation’s website included in this Proxy Statement are provided for convenience only and the information contained there is not incorporated herein by reference unless otherwise explicitly stated.

This Proxy Statement provides information regarding the matters to be voted on at the Annual Meeting, as well as other information that may be useful to you. In accordance with rules adopted by the Securities and Exchange Commission (“SEC”), instead of mailing a printed copy of our proxy materials to each shareholder of record, we are furnishing proxy materials to our shareholders on the internet.

If you received a Notice of Internet Availability of Proxy Materials (“Notice”) by mail, you will not receive a printed copy of the proxy materials. Instead, the Notice will instruct you as to how you may access and review all the important information contained in the proxy materials. The Notice also instructs you as to how you may submit your proxy over the internet. If you received a Notice by mail and would like to receive a printed copy of the proxy materials, you should follow the instructions for requesting such materials included in the Notice.

This Summary highlights information contained elsewhere in this Proxy Statement. This summary does not contain all the information that you should consider. Please read the entire Proxy Statement carefully before voting.

TIME AND DATE |  PLACE |  RECORD DATE |  VOTING |

10:00 a.m., Eastern Time Thursday, May 4, 2023 | Online at www. virtualshareholdermeeting. com/CNX2023 | March 7, 2023 | Shareholders of CNX as of the record date are entitled to vote. Each share of CNX common stock is entitled to one vote for each director nominee and one vote for each of the other proposals to be voted upon at the Annual Meeting. |

Your vote is very important to us and to our business. Please cast your vote immediately on all the proposals to ensure that your shares are represented.

Item | Proposal | Board Recommendation | Page |

1 | Election of Seven Director Nominees | FOR each Director | |

2 | Ratification of the Anticipated Appointment of Ernst & Young LLP (“EY”) as CNX’s Independent Auditor for the Fiscal Year Ending December 31, 2023 | FOR | |

3 | Advisory Approval of CNX’s 2022 Named Executive Officer Compensation | FOR | |

4 | Advisory Approval of the Frequency of Future Advisory Votes on CNX’s Named Executive Officer Compensation | 1 YEAR | |

5 | Shareholder Proposal Requesting that the Board Annually Conduct an Evaluation and Issue a Report on CNX’s Lobbying and Policy Influence Activities, if Properly Presented | AGAINST |

|

|

| │5 |

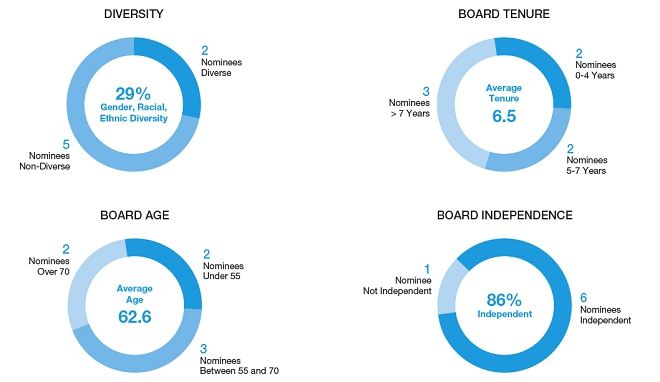

The following table and accompanying graphs provide summary information about our directors as of March 7, 2023. Each director of CNX is elected annually by a majority of votes cast.

Name | Age | Director Since | Occupation | Independent | Current Committee Memberships | |||

AC | CC | ESCR | NCG | |||||

Robert O. Agbede | 67 | 2022 | Chief Executive Officer of Chester Group Inc. and Chairman and Chief Executive Officer of Chester LNG, LLC |  |

| • | • | • |

J. Palmer Clarkson | 66 | 2017 | Chairman of The Lake Doctors, Inc. and Former President and Chief Executive Officer of Bridgestone HosePower, LLC |  |

| • |  | • |

Nicholas J. DeIuliis | 54 | 2014 | President and Chief Executive Officer of CNX |  |

|

| • |

|

Maureen E. Lally-Green | 73 | 2013 | Former Judge—Superior Court of Pennsylvania and Former Dean of Kline School of Law of Duquesne University |  |

| • | • |  |

Bernard Lanigan, Jr. | 75 | 2016 | Chairman and Chief Executive Officer of Southeast Asset Advisors, Inc. |  |  |

| • | • |

Ian McGuire | 44 | 2019 | Founder, Investment Partner of Tempus Partners |  | • |  | • |

|

William N. Thorndike, | 59 | 2014 | Managing Partner of The Cromwell Harbor Partnership |  | • | • | • |

|

Committee Chair AC Audit Committee CC Compensation Committee | ESCR Environmental, Safety and Corporate Responsibility Committee (“ESCR”) NCG Nominating and Corporate Governance Committee (“NCG”) | |||||||

|

|

| │6 |

As outlined below, CNX’s Mission Statement informs our business strategy and drives our decision-making processes every day.

As echoed in our Mission Statement, what we do is important and matters tremendously. We believe the energy CNX develops aids in driving technological advancements that fuel economic growth and helps improve the quality of life in our communities and beyond.

To achieve its Mission, CNX’s strategy is to foster a sustainable business model (“SBM”) that applies the nonreplicable advantages of low cost, low capital intensity, and operational flexibility to generate regular and substantial free cash flow (“FCF”). We then prioritize injecting that FCF back into our business through (1) investments in human capital, (2) optimization of our asset base, (3) investments in our region, (4) debt reduction, and (5) return of capital to our shareholders. We then measure success through the lens of generating and growing FCF per share to create an attractive long-term investment opportunity for our shareholders.

In December 2022, CNX launched its Appalachia First vision to capitalize on the abundant, affordable, and lower emissions natural gas supply of Appalachia to catalyze regional development opportunities. Appalachia First is rooted in three key objectives:

1. Leverage CNX’s and Appalachia’s natural gas opportunity by bolstering all sectors of the economy through lower-cost, lower-carbon, and locally produced natural gas.

2. Develop and deploy a new wave of innovative technologies and enhance local communities by using natural gas product derivatives for vertical market growth.

3. Transform the sectors of aviation, plastics, rail, cargo, mass transit, trucking, and fleet and passenger vehicles by displacing higher carbon fuels with locally produced natural gas.

| │7 |

In 2022, CNX once again demonstrated that disciplined capital allocation and diligent execution of its sustainable business model is a recipe for generating long-term value for shareholders. Highlights from 2022 include:

FCF Three-peat. For the third straight year, CNX achieved record FCF. Indeed, CNX generated $1.3 billion of net cash provided by operating activities and $707 million in FCF for 2022.(1) This builds on the previous CNX records of $927 million of net cash provided by operating activities and $506 million FCF in 2021(1) and $795 million of net cash provided by operating activities and $356 million FCF(1) in 2020. When we published our 7-year plan in early 2020, we forecasted FCF generation of $3.3 billion through the end of 2026.(2) Now, only three years in and approximately $1.6 billion of FCF later, we are nearly 50% of the way to delivering on that plan.(2)

Return of Value to Shareholders. In 2022, CNX repurchased 33.4 million shares for $565 million at an average price of $16.92 per share. Since the completion of the CNX Midstream Partners LP (“CNXM”) take-in transaction in 2020, CNX has retired nearly 25 percent of its outstanding shares, a feat matched or bested by only four companies in the S&P 500 and by only 22 companies in the S&P 1500.(3) With each share repurchased, CNX is reinvesting in its business at what we view as discounted share prices that will drive intrinsic value per share and lead to long-term value for our shareholders.

Balance Sheet Maintenance. While generating record-breaking FCF and steadily repurchasing its outstanding shares, CNX also maintained its focus on maintaining a healthy balance sheet. Indeed, CNX used the remaining balance of its 2022 FCF to reduce net debt and extend bond maturities, which culminated with a $500 million private offering of 7.375% senior notes due January 2031 coupled with a $350 million repayment of outstanding 7.25% senior notes due March 2027. These activities led to CNX closing the year with a stronger balance sheet and an improved weighted average debt maturity on its unsecured notes. Our attention to prudent debt management leaves CNX’s liquidity well positioned to take advantage of future value-creation opportunities in the debt or equity markets.

Efficiently Developing Our Core Assets. In 2022, CNX’s capital program resulted in an increase in its proved developed reserve base of 5%, representing a 1.54x replacement ratio, and bringing total proved developed reserves at year-end 2022 to 6.22 Tcfe. Finding and development costs for this activity in 2022 were $0.36 per Mcfe. This ability to efficiently replace and grow our producing reserves year after year is core to the creation of long term per share value.

CNX New Technologies. CNX’s New Technologies team is working to innovate and implement technological advancements designed to dovetail with derivative products to take full advantage of the energy catalyst situated in our backyard of Appalachia: natural gas. These efforts have the potential to fuel new industrial and manufacturing businesses while at the same time helping to reduce emissions. Examples of the CNX New Technologies team’s successes in 2022 include:

Expanding the CNX partnership with the Allegheny County Airport Authority to develop technology to provide 100% of the airport’s electrical power demand via an on-site microgrid with fuel sourced by on-site natural gas and solar power.

Providing Newlight Technologies with Methane Emissions Rights from captured coal mine methane (“CMM”) for the manufacture of carbon-negative biomaterials used to replace plastic.

Working with Anew Climate, LLC to establish pathways for the recognition of waste gas from a coal mine being captured at CNX’s CMM wells. Creating incentives for the capture of methane that would otherwise be vented to the atmosphere supports broader decarbonization efforts.

Utilizing abated methane emissions from CMM to enable carbon-neutral ground and flight tests for New Frontier Aerospace, Inc.’s next-generation, hypersonic vertical takeoff and landing aircraft.

Strengthening Our Leadership. In late 2022, CNX seized an opportunity to strengthen its operational and leadership acumen when it promoted Navneet Behl to the position of Chief Operating Officer (“COO”). Mr. Behl brings to CNX nearly three decades of upstream operational experience in multiple shale plays across the globe. With Mr. Behl’s track record of success, we are excited to see him elevate CNX’s operational capabilities and help us achieve our vision of making Appalachia the model for transformative energy development.

Reconciliations of 2022 FCF, 2021 and 2020 FCF to the nearest GAAP measures are set forth in Appendix A to this Proxy Statement.

CNX is unable to provide a reconciliation of projected financial results contained in this proxy statement, including the measures referenced above, to their respective comparable financial measure calculated in accordance with GAAP. This is due to our inability to calculate the comparable GAAP projected metrics, including operating income, net cash provided by operating activities and total production costs, given the unknown effect, timing, and potential significance of certain income statement items.

Data sourced from S&P Global Market Intelligence (https://www.capitaliq.com/) on or about January 10, 2023.

|

|

| │8 |

In conjunction with CNX’s commitment to its Appalachia First vision, we focus on ESG initiatives that are Tangible, Impactful and Local. Examples of our approach to ESG in 2022 are as follows:

We view strong corporate governance and promoting a culture of compliance as the foundation of our approach to ESG.

Diverse Additions Bolster Unique Governance Perspective.

In January 2022, CNX appointed Mr. Robert Agbede to its Board. Mr. Agbede’s background as an engineer and energy entrepreneur adds a unique viewpoint to CNX’s Board as it evaluates how to oversee risk and the overall governance strategy for the Corporation.

The diversity of CNX’s executive management team (83% of CEO direct reports self-identify as gender or racially/ethnically diverse) was advanced with the following three recent appointments:

In December 2021, Mr. Ravi Srivastava was elevated to the position of President, New Technologies. Mr. Srivastava leads CNX’s efforts to commercialize emerging technological opportunities focused on methane emissions reduction and alternative fuel development.

In January 2022, Ms. Hayley Scott was appointed to the newly created position of Chief Risk Officer (“CRO”). As CNX’s first CRO, Ms. Scott is responsible for enterprise risk management at CNX.

In November 2022, Mr. Navneet Behl was promoted to the position of COO. In this role, Mr. Behl is responsible for managing CNX’s asset base, and safe, compliant, and effective execution of our operational plan.

Continuous Board Education. In addition to regularly scheduled business meetings, our directors gather periodically to focus specifically on Board education. These meetings enhance our directors’ knowledge about CNX’s business and promote strong corporate governance. Recent sessions spotlighted cybersecurity, CNX’s New Technologies team, and Utica shale development techniques, the latter two of which culminated in a field tour in January 2023. Planned future topics include community relations and hydrogen technology advancements.

Enhanced Governance Focus at All Levels.

CNX named its first CRO in January 2022. The CRO is focused on identifying, evaluating, mitigating and managing CNX’s strategic, operational, compliance and reputational risk profile.

CNX’s Regulatory Reporting Group (“RRG”) facilitates accurate, complete, and timely reporting regarding CNX’s regulatory requirements across its various operations: both upstream and midstream. In 2022, the RRG implemented an enhanced approach to information sharing that provides all CNX employees with centralized access to up-to-date, critical regulatory data.

CNX’s Emission Reduction Task Force (“ERTF”), consisting of members from various operational, environmental, engineering, and data management teams, focused on reducing CNX’s methane emissions throughout 2022. The ERTF meets regularly to prioritize those opportunities with the greatest potential to impact CNX’s overall emissions footprint. Between 2020 and the end of 2022, we reduced our operational methane intensity by 32% in our production segment and 52% in our gathering and boosting segment. Future goals through 2024 are to reduce to below 0.020% the methane intensity level of both our production and gathering and boosting segments, or a reduction since 2020 of approximately 67% and 59% respectively.

Ownership Stake Promotes Strong Governance. As of the record date, our directors and named executive officers owned over 3.7% of the outstanding shares of CNX. This is an increase from 3.1% a year ago. CNX’s current directors and named executives have not sold shares of CNX stock (excluding tax withholding) since assuming their current roles, which extends back as far as 2011. This visible commitment demonstrates the confidence that our leadership team has in CNX’s sustainable business model, the foundation of which is strong corporate governance.

|

|

| │9 |

CNX is focused on enabling the underserved communities in our region to achieve prosperity. Below are some tangible, local and impactful ways CNX took action in 2022:

CNX Foundation. In 2022, the CNX Foundation contributed $3.38 million to 55 separate organizations aligned with its Tangible, Impactful, Local focus on community support. These efforts are part of CNX’s pledge to invest $30 million through 2026 in local initiatives supporting underserved communities within our operating footprint. Examples for 2022 include:

$1,000,000 to support broadband expansion in Greene County, Pennsylvania;

$250,000 for a waterline project to enhance fire department facilities in Bell Township, Westmoreland County, Pennsylvania;

$100,000 of a 3-year, $500,000 commitment to Blue Prints for coaching programs to provide families with financial stability and affordable housing;

$100,000 for Washington County Food Helpers to support the 471 Kids Challenge assisting food-insecure children;

$73,000 in flood relief to various organizations in southwest Virginia;

$75,000 to Domestic Violence Services of Southwestern Pennsylvania to create abuse prevention programming for local high schools;

$50,000 to Washington City Mission for food supply and workforce development and support for the homeless; and

$50,000 to Canonsburg Meals on Wheels to provide meals to home bound seniors.

CNX Mentorship Academy Growth. In just its second year of existence, the CNX Foundation’s Mentorship Academy grew from 30 to 63 student participants, representing 17 urban and rural high schools across four counties. The volunteer mentor ranks have also grown five-fold over the past year with many mentors coming from other companies within the community. Six graduates from the first year class became full-time employees at CNX with roles in various groups, such as External Relations and Information Systems and Technology. This quick expansion demonstrates the desire for this type of program in our communities and bodes well for the long-term success of the Academy and its graduates.

CNX IMPACT. Building on the work of the CNX Foundation and eager to find more ways to directly support our local communities, CNX launched the Impact initiative in late 2022. Over the course of the final two months of 2022, Impact resulted in the following direct contributions, among others, from CNX employees, which we look forward to growing in 2023:

Over 650 volunteer hours;

Packing of over 36,000 pounds (1,650 boxes) of food with Washington Food Helpers;

Food drives resulting in over 1,131 pounds of food collected with the Corner Cupboard Food Bank and Good Samaritan Food Bank; and

Sponsorship of over 90 children during the Christmas season and donation of over 600 toys through various community organizations.

External Recognition. CNX was recognized as Company of the Year by the Women’s Energy Network of Greater Pittsburgh and was awarded the Charles C. Keller Award for Excellence in Corporate Philanthropy by the Washington County (Pennsylvania) Chamber of Commerce. We appreciate this independent validation of our targeted efforts to support diversity and our local communities.

Words in Action. CNX’s Board approved a $1.5 million reduction in our CEO’s annual compensation for 2023, following a similar $1 million reduction in 2022. These funds were redirected to support the CNX Foundation. And, in 2022, $1 million was pledged to establish the M.O.V.E.S. (Motivation, Opportunity, Value, Experience, Success) program in conjunction with the University of Pittsburgh Medical Center, which will provide entry-level career opportunities in the healthcare sector.

The HQ at CNX. Utilizing space at its headquarters facility in Canonsburg, Pennsylvania, CNX developed the HQ at CNX. The HQ provides workspace to small businesses, including several women-owned businesses; educational institutions; and non-profit organizations emphasizing support for the same local, tangible and impactful causes in which the CNX Foundation invests. Current HQ tenants include:

Autism Caring Center

Big Brothers Big Sisters of Greater Pittsburgh

Community College of Allegheny County

Dress for Success Pittsburgh

K&J Café

The Language and Behavior Center

Leadership Washington County

Nonprofit SideKick

Oakbridge Advisors Group

Transitional Paths to Independent Living

True Fit Marketing

Waynesburg University

Women’s Energy Network, Greater Pittsburgh.

|

|

| │10 |

CNX endeavors to take tangible, measurable actions to reduce its environmental footprint as well as that of others. In 2022, we achieved this in the following ways:

Focus on Innovation in Operations. To advance its environmentally responsible operations, in 2022, as outlined below, we explored several new innovative technologies and continued our strategic collaboration with a long-term vendor dedicated to enhancing its capabilities:

Piloting a project with ICE Thermal Harvesting to capture and convert to electric power engine exhaust heat produced at one of CNX’s compression station sites in West Virginia.

Contracting to manufacture and implement the Appalachian Basin’s first electric powered drilling system fueled entirely by on-site natural gas.

Extending into 2026 CNX’s relationship with Evolution Well Services to utilize its 100% electric, natural gas-fueled, gas turbine-powered fracturing fleet for CNX’s completions activity.

Reducing Methane Emissions. In 2022, CNX further lowered its methane intensity and also directly reduced CO2e emissions by approximately 83,000 tons. This builds on the previous 90% reduction in Scope 1 and 2 CO2e emissions achieved since 2011. CNX’s average annual GHG abatement through methane capture far exceeds its combined Scope 1 and 2 CO2e emissions, and we continue to invest in improvements designed to further reduce emissions. We have allocated $7MM of 2023 capital to methane reduction efforts, which we expect to result in an annualized methane reduction of 70,000 tons CO2e by the end of 2023. These planned future efforts coupled with CNX’s methane intensity reduction of 32% in our production and 52% in our gathering and boosting segment between 2020 and year-end 2022 will help us reach our future goal of methane intensity levels below 0.020% by 2024 for both segments, which would represent a reduction since 2020 of approximately 67% and 59% respectively.

Executive Pay Tied to Methane Emissions Reductions. In 2022, CNX continued the practice of tying 10% of our long-term executive compensation to methane emissions reduction targets based on One Future Coalition standards. This objective performance metric further demonstrates our commitment to tangible methane emissions reduction. For the second straight year, CNX outperformed the established targets.

Others Taking Notice. CNX acts responsibly because it is in the best long-term interests of its stakeholders and the right thing to do. That said, it is always rewarding to receive external recognition for our actions. Following up on our award as a Hart Energy 2021 Energy ESG Top Performer, CNX received the following recognition in 2022:

Enel X named CNX the Market MVP of the PJM Emergency Load Response Program for its efforts to reduce electric power demand during peak periods to help ensure energy grid reliability.

As part of its annual Tech 50 Awards, the Pittsburgh Technology Council presented CNX with the award for Innovator of the Year, Solutions Provider in 2022.

| │11 |

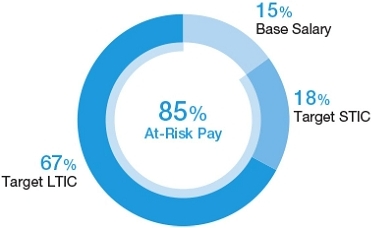

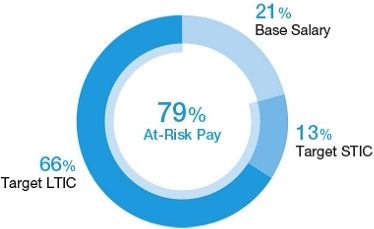

CNX’s compensation philosophy is to provide a total compensation package that will attract and retain employees. This starts with a competitive base salary and traditional benefits package (such as 401(k), health insurance, vacation time, etc.). All full-time employees are also included in our Short-Term Incentive Compensation (“STIC”) program, which awards an annual bonus, contingent on a blend of corporate financial performance (i.e., adjusted FCF per share) and individual contributions. Certain key employees and managers also participate in our Long-Term Incentive Compensation (“LTIC”) program, which awards restricted stock units (“RSUs”) to employees that generally vest over a three-year period. Senior management personnel may also receive performance share units (“PSUs”), including ESG PSUs specifically tied to achieving methane intensity reduction targets, which promote retention and further align overall compensation with CNX’s long-term objective of creating shareholder value.

Highlights from our 2022 compensation program include:

• Continued Focus on Performance-Based Compensation. We again designated as at-risk 10% of our executive’s LTIC award by conditioning vesting of ESG PSU awards on meeting established methane intensity reduction targets. If we fail to meet those targets, our executives will forfeit 10% of their LTIC award for that year. This objective measure demonstrates our commitment to linking compensation to performance and reinforces our specific focus on ESG performance. In addition, we continued the practice of making at-risk an additional 40% of our executive compensation through the use of PSUs subject to Total Shareholder Return and Absolute Stock Price performance metrics, the latter of which for 2023 awards requires the closing price of CNX’s stock to meet or exceed $10.65 per share greater than the Grant-Date Stock Price for 20 consecutive trading days.

• CEO Investment Embodies Tangible, Impactful and Local. In 2022, our Board and CEO agreed to reduce the CEO’s LTIC grant by $1.5 million, which builds on a 2021 reduction of $1 million, and redirected those funds to the CNX Foundation, including the $1 million investment that will establish the UPMC/CNX M.O.V.E.S. program highlighted above. This program will provide career opportunities in the Appalachian region’s growing healthcare sector for CNX Mentorship Academy students, and encapsulates CNX’s tangible, impactful and local approach to investing in the future of our communities. |

| • Strong Shareholder Support. Approximately 94% of the shares voted at our 2022 Annual Meeting of Shareholders approved of our 2021 executive compensation program. We appreciate this support and consider this vote a strong endorsement of our executive compensation program.

• CEO Pay Bucking Trends. In times when CEO pay is increasing, CNX’s CEO pay is trending in the opposite direction. In addition to the Board approving a redirection to the CNX Foundation of an aggregate of $2.5 million of the CEO’s LTIC compensation over the last two years, at the encouragement of our CEO, the Board has not increased his regular annual base salary since 2015. This, coupled with a steady increase in CNX’s median employee compensation (as noted below), led to our CEO Pay Ratio decreasing for the third consecutive year going from 72:1 to 53:1 to 38:1 from 2020 to 2022. This trend is directly attributable to our Board and CEO’s commitment to reinvesting in our business, our employees and our local communities.

• Median Employee Compensation on the Rise. For the third straight year, CNX’s median employee compensation rose. Compared to our 2020 proxy disclosure, our 2022 median employee compensation increased $21,443 to $173,807, or approximately 14%. CNX prides itself on providing compensation packages designed to attract and retain talent and motivate its employees.

|

| │12 |

Our commitment to disciplined capital allocation and generating long-term intrinsic per share value requires close alignment and careful consideration of our business objectives. This is why CNX believes in having a tight-knit Board with each of its members contributing their own unique perspectives to help CNX achieve its mission.

The importance we place on having the right mix of Board members cannot be understated. We consider our right-sized Board a competitive advantage because it promotes a healthy discourse that is not found in larger groups that can become bureaucratic and fragmented. We also believe that diversity of perspective leads to diversity of thought, a concept evident in our Board architecture. Finally, we expect a substantial time commitment that each of our directors invests to engage in an impactful discussion about our business.

Our Board is constantly discussing succession planning and actively considering what skills and perspectives it would benefit from most. And, as opportunities arise to organically supplement the Board’s makeup, CNX is committed to considering the addition of gender and ethnically/racially diverse directors with unique perspectives tailored towards CNX. We will do so over time with the same calculated precision we use in allocating capital for the maximum benefit of our shareholders and in a manner designed to preserve the character of our Board.

The Board seeks to maintain an effective, well-rounded, diverse, and financially literate Board.

BOARD PROCESS FOR IDENTIFICATION AND REVIEW OF DIRECTOR CANDIDATES TO JOIN OUR BOARD

The Corporations’s current Board leadership structure provides for the annual appointment of a non-employee Chair of the Board. The Board believes that an independent Chair creates accountability and enhances the communication of a clear and consistent message to our shareholders and others. Mr. Thorndike has served as our independent, non-employee Chairman of the Board since 2016.

All CNX Board members (except the CEO) are independent. In addition, our Audit Committee, Compensation Committee and NCG Committee are composed entirely of independent directors. We believe that this composition enhances our commitment to independent risk oversight.

| │13 |

Pursuant to its charter, the NCG Committee, in reviewing individuals for Board membership, will include among the attributes it considers an individual’s diversity of background, including specifically diversity of gender and race or ethnicity. This policy is consistent with CNX’s long-standing commitment to have a Board with diverse personal and professional backgrounds, experience, and perspectives, including diversity of race, ethnicity, gender, and age, that, when combined, provide a varied portfolio of experience and knowledge that will well serve CNX’s governance and strategic needs. The NCG Committee assesses the effectiveness of this policy in promoting a diverse Board as part of its regular review of CNX’s Corporate Governance Guidelines and by monitoring changes in the Board’s diversity mix along a variety of dimensions over time.

As set forth in our NCG Committee Charter, the NCG Committee expressly considers an individual’s diversity of background, including specifically diversity of gender and race or ethnicity in connection with its review of potential candidates for Board membership. Below is a matrix demonstrating the current composition of our Board, 29% of which consists of directors self-identifying as diverse in either gender or race/ethnicity. CNX maintains a small, tight-knit Board that fosters nimble decision-making, and we strive to preserve that dynamic while evaluating ways to promote diversity and inclusivity on our Board.

Board Diversity Matrix (As of March 7, 2023)

Total Number of Directors (7) |

| |||

| Female | Male | Non-Binary | Did Not Disclose Gender |

Part I: Gender Identity |

|

|

|

|

Directors | 1 | 6 | — | — |

|

|

|

|

|

Part II: Demographic Background |

|

|

|

|

African American or Black | — | 1 | — | — |

Alaskan Native or Native American | — | — | — | — |

Asian | — | — | — | — |

Hispanic or Latinx | — | — | — | — |

Native Hawaiian or Pacific Islander | — | — | — | — |

White | 1 | 5 | — | — |

Two or More Races or Ethnicities | — | — | — | — |

Did Not Disclose Demographic Background | — | — | — | — |

| │14 |

Our Board strives to include directors with a varied background and skill set. Below is a summary table encapsulating certain key skills our directors possess and a brief description of the importance of each:

| Senior Officer/ Leadership | Finance/ Accounting | Industry/ Technical | Business Strategy | Legal | Risk Management |

Robert O. Agbede | • | • | • |

| • | |

J. Palmer Clarkson | • | • | • | • |

| • |

Nicholas J. DeIuliis | • | • | • | • | • | • |

Maureen E. Lally-Green | • |

|

|

| • | • |

Bernard Lanigan, Jr. | • | • |

| • |

| • |

Ian McGuire | • | • | • | • | ||

William N. Thorndike, Jr. | • | • |

| • |

| • |

*The lack of a mark in a specific category is not indicative of a director lacking that particular skill. Indeed, we rely on the unique knowledge and experience of all our directors in each of these categories (and others). To the contrary, the above table is merely meant to illustrate areas of expertise in which certain directors are particularly prominent and qualified to provide guidance to CNX.

Senior Officer/Leadership Experience: CNX values directors with senior leadership experience that can provide valuable insights about and practical solutions to common issues facing the Corporation and the natural gas industry at large.

Finance/Accounting Expertise: Directors with backgrounds in financial services and accounting bring tremendous value to our Board when advising on strategic capital allocation decisions and in analyzing public company reporting requirements.

Industry/Technical Expertise: We believe that technical expertise, including those directors with a background in engineering, and in particular experience in the natural gas industry, is particularly beneficial to our Board as it considers operational performance and other issues specific to our business.

Business Strategy Expertise: Many of our directors possess decades of experience successfully guiding businesses through strategic decision-making processes. CNX leverages this breadth of experience to assist in developing strategies to help it achieve its long-term goal of creating shareholder value while simultaneously enhancing our communities and delivering energy solutions for today and tomorrow.

Legal Expertise: We value directors with legal skills and a history of promoting compliance with all aspects of internal policies and external regulations and laws applicable to our business.

Risk Management Expertise: Identifying, assessing, and mitigating risk is a core principle of any successful business. This is why CNX seeks out directors with a deep understanding of the existing risks that our business faces and the ability to quickly identify and address new risks that may arise.

| │15 |

Shareholders and other interested persons who wish to communicate with the Board as a whole, any committee of the Board, individual directors, our independent directors as a group, or the Chairman of the Board may do so by writing to the Board at Corporate Secretary, CNX Resources Corporation, CNX Center, 1000 Horizon Vue Drive, Suite 400, Canonsburg, PA 15317, or by sending an e-mail to directors@cnx.com. The Corporate Secretary will relay all such communications to the Board as a whole, to individual directors, or to the Chairman of the Board (as appropriate) at the next regularly scheduled Board meeting (or earlier as necessary) except for spam, junk mail, mass mailings, solicitations, resumes, job inquiries or other matters unrelated to the Corporation. Communications that are intended specifically for the Chairman of the Board or a particular director should be sent to the street address or e-mail address noted above, to the attention of the Chairman of the Board or the particular director, as intended. Information concerning how to communicate with the Board is also included on CNX’s website at www.cnx.com.

Our Amended and Restated Bylaws (“Bylaws”) provide that if an incumbent director is not elected at a meeting for the election of directors and no successor has been elected at such meeting, the director must tender his or her resignation promptly to the Board. The NCG Committee will make a recommendation to the Board whether to accept or reject the tendered resignation, or whether other action should be taken. The Board will act on the tendered resignation, taking into account the NCG Committee’s recommendation, and publicly disclose its decision and the underlying rationale in a press release, a filing with the SEC or other broadly disseminated means of communication within 90 days from the date of the certification of the election results.

We maintain a corporate governance page on our website at www.cnx.com. The following documents are currently included on our website (under the “Corporate Governance” tabs of the “About Us” and “Responsibility” pages):

Bylaws;

Corporate Governance Guidelines;

Code of Director Business Conduct and Ethics;

Code of Employee Business Conduct and Ethics, which covers all employees of CNX, including executives;

Charters of the Audit, NCG, Compensation, and ESCR Committees;

Compliance Reporting Policy;

Internal Auditing Charter;

Human Rights Statement; and

Related Party Policy and Procedures.

We also will provide a printed copy of these documents, free of charge and upon request, to shareholders who contact the Investor Relations department in writing at CNX Resources Corporation, CNX Center, 1000 Horizon Vue Drive, Suite 400, Canonsburg, Pennsylvania 15317. These documents address important principles and corporate governance processes.

| │16 |

THE BOARD | ||

• Oversees our risk management policies and practices, assesses major risks facing CNX, and reviews options for risk mitigation. • Monitors risks that have been delegated to a particular committee through reports provided by the respective committee chairpersons at each regularly-scheduled Board meeting. • Meets regularly with CNX’s CRO to evaluate risks and develop corresponding mitigation strategies to facilitate a culture of compliance at CNX. | ||

Audit Committee • Assists the Board with policies and guidelines regarding risk assessment/management, including the risk of fraud. • Reviews and assesses the quality and integrity of CNX’s public reporting, compliance with legal and regulatory requirements, the performance and independence of CNX’s independent auditors, the performance of the internal audit department, the effectiveness of CNX’s disclosure controls and procedures, and the adequacy and effectiveness of our risk management programs. • Reviews and assesses CNX’s major financial, legal and similar risk exposures and the steps that management has taken to monitor and control such exposures. |

| ESCR Committee • Reviews with management the quality of CNX’s procedures for identifying, assessing, monitoring and managing the principal risks in the Corporation’s business associated with protection of the environment, safety, corporate responsibility and security matters (including cybersecurity) and report the ESCR Committee’s findings to the Board. • Reviews any significant environmental, safety, corporate responsibility public policy, legislative, political and social issues and trends that may materially affect the business operations, financial performance, or public image of the Corporation or the industry, and management’s response to such matters. • Oversees CNX’s policies to protect the health and safety of employees, contractors, customers, the public, and the environment. • Reviews (i) any material compliance issues with health, safety and environmental laws, (ii) any material pending or threatened administrative, regulatory or judicial proceedings regarding health, safety or environmental matters, and (iii) management’s response to the foregoing matters. |

NCG Committee • Reviews and advises the Board regarding material corporate governance-related risks. • Addresses risks associated with our management structure by reviewing, among other matters, the qualifications, experience, diversity and backgrounds of our directors on an annual basis to ensure that our Board is composed of individuals who are capable of providing appropriate oversight to management. |

| Compensation Committee • Develops compensation plans designed to align with shareholder interests and reflect investor feedback. • Reviews and oversees the risk assessment related to CNX’s compensation programs and reports the results to the Board. • Oversees management development plans and activities, including succession planning. |

MANAGEMENT | ||

• Identifies, communicates and discusses the risks affecting CNX, its subsidiaries, and our business through regular presentations to the Board and appropriate committees (as determined by the subject of the particular risk), including reviewing financial and ESG-related matters. • In 2022, performed a comprehensive risk analysis of the material risks that could affect CNX and communicated those results to the full Board. • CRO has the dual responsibility of evaluating potential risks facing CNX’s business and providing recommended mitigations and promoting an overall culture of compliance. The CRO reports to the CEO and meets regularly with the Board, including in executive session. | ||

| │17 |

Our Board has four standing committees: Audit, Compensation, NCG, and ESCR. Actions taken by our committees are reported to the full Board. Each of our standing committees has a written charter, which is accessible on our website (www.cnx.com) under the “Corporate Governance” tabs of the “About Us” and “Responsibility” pages. In January 2023, the Board determined that all members of each of the Audit, Compensation, and NCG Committees were independent under the current listing standards of the New York Stock Exchange (the “NYSE”) and other applicable regulatory requirements. See “Determination of Director Independence” for additional information regarding the Board’s independence determinations with respect to its members.

RESPONSIBILITIES | THREE INDEPENDENT BOARD MEMBERS |

• assist our Board in its oversight of the integrity of our financial statements, CNX’s compliance with its legal and regulatory requirements, the independent auditor’s qualifications, independence and performance, and the performance of CNX’s internal audit function; • review significant accounting principles and financial statement presentation issues, including significant changes in accounting principles and disclosures; and • prepare the Audit Committee Report. | |

Our Board has determined that all members of the Audit Committee are financially literate within the meaning of SEC rules and under the current listing standards of the NYSE. Our Board has also determined that each of Messrs. Lanigan, McGuire, and Thorndike qualifies as an “audit committee financial expert” under applicable SEC Rules and is independent under the current listing standards of the NYSE, SEC rules, and other applicable regulatory requirements. A copy of the Audit Committee Report for the 2022 fiscal year is included in this Proxy Statement.

RESPONSIBILITIES | FIVE INDEPENDENT BOARD MEMBERS |

• establish and oversee compensation plans and programs for non-employee directors and executive officers; • review the performance of executive officers and award or recommend incentive compensation, as appropriate, based upon performance; • review and monitor our management development and succession plans and activities; • appoint and oversee any outside compensation consultants; and • prepare the Compensation Committee Report. | |

Our Compensation Committee’s charter generally permits it to delegate its authority, duties and responsibilities or functions to one or more members of the Compensation Committee or to the Corporation’s officers when appropriate, consistent with applicable laws, regulations, and listing standards. The terms of our Executive Annual Incentive Plan and CNX Resources Corporation Amended and Restated Equity and Incentive Compensation Plan (“Equity and Incentive Compensation Plan”) also permit our Compensation Committee to delegate its power and authority under such plans to our officers. In accordance with applicable law, the Compensation Committee authorized our CEO to grant during 2022 an aggregate of up to 900,000 shares of our common stock (in the form of equity incentive awards) and annual cash incentive awards to our non-executive employees in compliance with the terms and conditions of such delegation, the plans and applicable laws and regulations.

Our Compensation Committee periodically reviews the compensation paid to our non-employee directors and the principles upon which their compensation is determined. The Compensation Committee also periodically reports to the Board on how our non-employee director compensation practices compare with those of other similarly situated public corporations and, if the Compensation Committee deems it appropriate, recommends changes to our director compensation practices to our Board for approval.

For additional information regarding the Compensation Committee’s processes and procedures for reviewing and determining executive officer compensation, see “Compensation Discussion and Analysis”.

| │18 |

RESPONSIBILITIES | FOUR INDEPENDENT BOARD MEMBERS |

• identify individuals qualified to serve as members of the Board; • provide recommendations to the Board as to (i) its structure and operations and (ii) CNX’s corporate governance principles; • annually review and recommend to the Board the appropriate size, function, and needs of the Board; • recommend to the Board the responsibilities of the Board committees, including each committee’s structure, operations, and delegation authority; • oversee the annual evaluation of the Board and the other Board committees and management, and report to the Board the results of such evaluations; • annually recommend to the Board the slate of director nominees to be elected by shareholders at the annual meeting, taking into consideration nominees submitted by shareholders, and, where applicable, to fill Board vacancies; and • annually review and assess CNX’s Corporate Governance Guidelines and recommend any changes to the Board. | |

The NCG Committee will consider director candidates recommended by shareholders. Shareholders wishing to submit candidates for election as directors should submit the names of such candidates to the Corporate Secretary, CNX Resources Corporation, CNX Center, 1000 Horizon Vue Drive, Suite 400, Canonsburg, PA 15317. See “Additional Matters” for more information on submitting director nominations. Although the NCG Committee does not have specific minimum qualifications that must be met for a prospective director candidate to be nominated, in assessing the Board’s membership needs, the NCG Committee generally seeks to maintain a Board that consists of individuals who are competent in the following areas: general industry knowledge; accounting and finance; ability to make sound business decisions; management; leadership; knowledge of international markets; business strategy; crisis management; corporate governance; and risk management.

Nominees and directors must have experience in positions with a high degree of responsibility and leadership experience. Nominees and directors are selected based upon contributions that they can make to CNX. The NCG Committee’s process for identifying and evaluating director nominees is as follows:

determine what types of backgrounds, skills, and attributes are needed to help strengthen and balance the Board, taking into account the competencies described above, as well as diversity of background, including specifically diversity of gender and race or ethnicity;

at appropriate times, actively seek individuals qualified to become new members of the Board, including through the review of candidates submitted by our independent directors, executive officers and shareholders, or identified by a third-party search firm engaged to assist with director recruitment (when a third-party search firm is engaged, the NCG Committee generally provides the firm with guidance as to the qualifications, qualities and skills that the NCG Committee is seeking in potential candidates, and the search firm identifies candidates for the NCG Committee’s consideration);

evaluate potential nominees by considering the competencies described above and conducting interviews (candidates recommended by shareholders are evaluated in the same manner as other nominees); and

recommend to the Board the slate of director nominees to be elected by the shareholders at CNX’s next annual meeting of shareholders.

| │19 |

RESPONSIBILITIES | SEVEN (SIX INDEPENDENT) BOARD MEMBERS |

• oversee policies and management systems for environmental, safety, corporate responsibility and security matters (including cybersecurity); • review CNX’s strategy, including objectives and policies, relative to the protection of the environment, safety of employees, contractors, customers and the public, as well as issues of corporate responsibility and security (including cybersecurity); • review any material compliance issues with health, safety and environmental laws, any material pending or threatened administrative, regulatory, or judicial proceedings regarding health, safety or environmental matters, and management’s response to the foregoing legal matters; and • review any significant environmental, safety, corporate responsibility public policy, legislative, political and social issues and trends that may materially affect the business operations, financial performance or public image of CNX or its industry, and management’s response to such matters. | |

The ESCR Committee is responsible for advising CNX on all issues relating to environmental, safety, corporate responsibility and security (including cybersecurity). It is the only committee of the Board that includes all of CNX’s directors. Additional details about CNX’s ESG efforts are located in the “ESG Highlights” section of this Proxy Statement and on CNX’s website at responsibility.cnx.com.

In 2022, each director named below attended 88% or more of the aggregate of: (i) the total number of meetings held by our Board (during the period for which he or she was a director); and (ii) the total number of meetings held by all Board committees on which he or she served (during the period for which he or she served). Committee membership as of March 7, 2023, and the number of meetings held during 2022 are shown in the following table:

| Board of |

| Audit |

| Compensation |

| NCG |

| ESCR |

Robert O. Agbede | Member |

| — |

| Member |

| Member |

| Member |

J. Palmer Clarkson | Member |

| — |

| Member |

| Member |

| Chair |

Nicholas J. DeIuliis | Member |

| — |

| — |

| — |

| Member |

Maureen E. Lally-Green | Member |

| — |

| Member |

| Chair |

| Member |

Bernard Lanigan, Jr. | Member |

| Chair |

| — |

| Member |

| Member |

Ian McGuire | Member |

| Member |

| Chair |

| — |

| Member |

William N. Thorndike, Jr. | Chairman |

| Member |

| Member |

| — |

| Member |

No. of 2022 Meetings | 9 |

| 8 |

| 4 |

| 4 |

| 4 |

During 2022, the non-management directors held four executive sessions of the Board. The presiding director for the executive sessions was Mr. Thorndike, our Chairman of the Board and an independent director.

The business and affairs of CNX are managed under the direction of our Board. We do not have a policy regarding directors’ attendance at our Annual Meetings of Shareholders; however, all directors are encouraged to attend. All the members of our Board attended the 2022 Annual Meeting.

| │20 |

The following table sets forth the compensation of our directors for the 2022 fiscal year:

Name(1) | Fees Earned or |

| Stock |

| Option | All Other |

| Total | ||||||

Robert O. Agbede | $ | 91,667 |

| $ | 225,000 |

| $ | — |

| $ | — |

| $ | 316,667 |

J. Palmer Clarkson | $ | 120,000 |

| $ | 180,000 |

| $ | — |

| $ | — |

| $ | 300,000 |

Maureen E. Lally-Green | $ | 115,000 |

| $ | 180,000 |

| $ | — |

| $ | — |

| $ | 295,000 |

Bernard Lanigan, Jr. | $ | 125,000 |

| $ | 180,000 |

| $ | — |

| $ | — |

| $ | 305,000 |

Ian McGuire | $ | 120,000 |

| $ | 180,000 |

| $ | — |

| $ | — |

| $ | 300,000 |

William N. Thorndike, Jr. | $ | 115,000 |

| $ | 400,000 |

| $ | — |

| $ | — |

| $ | 515,000 |

(1) Mr. DeIuliis is a member of the Board and President and CEO of CNX. His compensation for the 2022 fiscal year is reported in the Summary Compensation Table — 2022, 2021, and 2020 (“SCT”) and other sections of this Proxy Statement. In 2022, Mr. DeIuliis did not receive any additional compensation for his service on our Board. (2) The non-employee directors may elect to receive deferred stock units (“DSUs”) and options granted under the Equity and Incentive Compensation Plan in lieu of their cash fees. The cash amounts payable for the 2022 fiscal year and received in the form of DSUs and options in lieu of such cash payments included in this column are as follows (rounded to the nearest whole share): (i) Mr. Agbede: no DSUs or options; (ii) Mr. Clarkson: 6,823 DSUs (no options); (iii) Ms. Lally-Green: 3,644 DSUs (no options); (iv) Mr. Lanigan: no DSUs or options; (v) Mr. McGuire: 6,823 DSUs (no options); and (vi) Mr. Thorndike: 2,800 DSUs and 7,233 options. None of the non-employee directors elected to defer into the Directors’ Deferred Fee Plan any portion of their cash fees for the 2022-2023 Board year. Ms. Lally-Green chose to defer into the Directors’ Deferred Fee Plan a portion of her cash fees for the 2021-2022 Board year, $15,333 of which were deferred during 2022. (3) The values set forth in this column are based on the aggregate grant date fair value of awards computed in accordance with Financial Accounting Standards Board (“FASB”) Accounting Standards Codification (“ASC”) Topic 718, “Compensation-Stock Compensation” (“FASB ASC Topic 718”), excluding the effect of estimated forfeitures. The grant date fair value of the RSU awards is computed based upon the closing price per share of CNX’s stock on the date of grant. In addition to his RSU grant for the 2022-2023 Board Year in the dollar amount of $180,000, Mr. Agbede received a one-time, pro-rated grant in the dollar amount of $45,000 upon joining the Board in January 2022 to reflect his partial service during the 2021-2022 Board Year. A discussion of the relevant assumptions made in the valuation of these awards is provided in Note 15 — Stock-Based Compensation in the Notes to the Audited Consolidated Financial Statements in Item 8 of the Corporation’s Annual Report on Form 10-K for the fiscal year ended December 31, 2022 (the “2022 Annual Report”). The values reflect the awards’ fair market values at the date of grant, and do not correspond to the actual values that will be recognized by the directors. As of December 31, 2022, the following directors held RSUs and DSUs relating to CNX common stock in the amounts noted: (i) Mr. Agbede had 4,388 unvested RSUs and 4,389 deferred RSUs; (ii) Mr. Clarkson had 52,167 deferred RSUs and 50,849 DSUs; (iii) Ms. Lally-Green had 4,388 unvested RSUs, 44,118 deferred RSUs and 6,727 DSUs; (iv) Mr. Lanigan had 91,819 deferred RSUs and 16,579 DSUs; (v) Mr. McGuire had 39,945 deferred RSUs and 39,193 DSUs; and (vi) Mr. Thorndike had 205,018 deferred RSUs and 10,501 DSUs. If an RSU was deferred, whether vested or unvested, it is described herein as a deferred RSU. (4) As of December 31, 2022, the number of shares underlying option awards held by our non-employee directors was: (i) 22,129 for Mr. Clarkson; (ii) 35,980 for Ms. Lally-Green; (iii) 69,910 for Mr. Lanigan; and (iv) 123,661 for Mr. Thorndike. | ||||||||||||||