QuickLinks -- Click here to rapidly navigate through this documentSCHEDULE 14A

(Rule 14a-101)

INFORMATION REQUIRED IN PROXY STATEMENT

SCHEDULE 14A INFORMATION

Proxy Statement Pursuant to Section 14(a) of the

Securities Exchange Act of 1934

| Filed by the registrantý |

| Filed by party other than the registranto |

Check the appropriate box: |

| o | | Preliminary proxy statement |

| o | | Confidential, for Use of the Commission Only (as permitted by Rule 14a-6(e)(2) |

| ý | | Definitive proxy statement |

| o | | Definitive additional materials |

| o | | Soliciting material pursuant to Rule 14a-12

|

AXONYX INC. |

(Name of Registrant as Specified in its Charter) |

|

(Name of Person(s) Filing Proxy Statement |

| | | | | |

| Payment of filing fee (Check the appropriate box): |

| ý | | No fee required |

| o | | Fee computed on table below per Exchange Act Rules 14a-6(i)(1) and 0-11. |

| | | (1) | | Title of each class of securities to which transaction applies:

|

| | | (2) | | Aggregate number of securities tow which transaction applies:

|

| | | (3) | | Per unit price or other underlying value of transaction computed pursuant to Exchange Act Rule 0-11:

|

| | | (4) | | Proposed maximum aggregate value of transaction:

|

| | | (5) | | Total fee paid:

|

| o | | Fee paid previously with preliminary materials. |

| o | | Check box if any part of the fee is offset as provided by Exchange Act Rule 0-11(a)(2) and identify the filing for which the offsetting fee was paid previously. Identify the previous filing by registration statement number, or the form or schedule and the date of its filing. |

| | | (1) | | Amount previously paid:

|

| | | (2) | | Form, schedule or registration statement no.:

|

| | | (3) | | Filing party:

|

| | | (4) | | Date filed:

|

NOTICE OF 2002 ANNUAL MEETING OF STOCKHOLDERS

TO BE HELD ON JUNE 11, 2002

TO THE HOLDERS OF THE COMMON STOCK:

PLEASE TAKE NOTICE that the 2002 Annual Meeting of Stockholders (the "Annual Meeting") of Axonyx Inc., a Nevada corporation (the "Company"), will be held in the Morrison Room at the Benjamin Hotel, 125 East 50th St., New York, NY 10022 at 9:30 a.m. on June 11, 2002, or at any and all adjournments thereof, for the following purposes, as more fully described in the attached Proxy Statement. At the Annual Meeting, you will be asked to vote on the following matters:

- 1.

- To elect six directors to our Board of Directors to hold office until our 2003 Annual Meeting of Stockholders or until their successors are duly elected and qualified;

- 2.

- To ratify the amendment of the 2000 Stock Option Plan;

- 3.

- To ratify the appointment of Richard A. Eisner & Company, LLP as auditors of our financial statements for the fiscal year ending December 31, 2002; and

- 4.

- To consider and act upon such other matters as may properly come before the Annual Meeting and any adjournment thereof.

Only stockholders of record, as shown on the transfer books of the Company, at the close of business on May 8, 2002 will be entitled to notice of and to vote at the Annual Meeting or at any adjournment thereof. A list of stockholders entitled to vote at the Annual Meeting will be available for examination by any stockholder for a proper purpose during normal business hours at the executive offices of the Company for a period of at least 10 days preceding the Annual Meeting.

Whether or not you expect to be present, please sign, date and return the enclosed proxy sheet in the enclosed pre-addressed envelope as soon as possible. No postage is required if the enclosed envelope is used and mailed in the United States.

| | | By Order of the Board of Directors |

| | | |

| | | |

| | | /s/ MARVIN S. HAUSMAN, M.D.

Marvin S. Hausman, M.D.

President & Chief Executive Officer |

May 20, 2002

PLEASE FILL IN, DATE AND SIGN THE ENCLOSED PROXY AND RETURN IT IN THE ENVELOPE PROVIDED AS PROMPTLY AS POSSIBLE, WHETHER OR NOT YOU PLAN TO ATTEND THE ANNUAL MEETING. IF YOU LATER DESIRE TO REVOKE YOUR PROXY FOR ANY REASON, YOU MAY DO SO IN THE MANNER DESCRIBED IN THE ATTACHED PROXY STATEMENT.

PROXY STATEMENT FOR ANNUAL MEETING

TO BE HELD JUNE 11, 2002

GENERAL INFORMATION

The accompanying proxy is solicited by the board of directors of Axonyx Inc. (the "Board" or "Board of Directors") with its principal executive offices at 825 Third Avenue, 40th Floor, New York, New York 10022 ("Axonyx" or the "Company") to be voted at the 2002 Annual Meeting of Stockholders (the "Annual Meeting") to be held on June 11, 2002, and any adjournment thereof. When a proxy is properly executed and returned to Axonyx in time for the Annual Meeting, the shares it represents will be voted by the proxy holders in accordance with the instructions given in the proxy. If no direction is given in the proxy, the votes represented thereby will be voted in accordance with the recommendation of the Board of Directors with respect to each matter submitted to the Company's stockholders for approval. With respect to any other item of business that may come before the Annual Meeting, the proxy holders will vote in accordance with their best judgment. This Proxy Statement and the accompanying proxy are being sent to stockholders on or about May 20, 2002.

PROXY REVOCATION PROCEDURE

A proxy may be revoked at any time before it has been exercised by written notice of revocation given to the Secretary of the Company, by executing and delivering to the Secretary a proxy dated as of a later date than the enclosed proxy; provided, however, that such action must be taken in sufficient time to permit the necessary examination and tabulation of the subsequent proxy before the vote is taken, or by attending the Annual Meeting and voting in person. Attendance at the Annual Meeting will not in and of itself revoke a proxy.

ABSTENTIONS, BROKER NON-VOTES

Abstentions will be deemed to be present at the Annual Meeting for purposes of determining a quorum. Abstentions will be counted towards the tabulations of votes cast on Proposals Two and Three and will have the same effect as negative votes. Any "broker non-vote" also will be deemed to be present for quorum purposes, but will not be counted as voting with regard to the issue to which it relates.

HOLDERS OF RECORD, QUORUM

Holders of record of our shares of common stock, par value $0.001 per share ("Common Stock"), our only class of voting securities, at the close of business on May 8, 2002 are entitled to vote at the Annual Meeting. There were 17,247,371 shares of Common Stock outstanding as of the record date. The presence, in person or by proxy, of stockholders entitled to cast at least a majority of the votes entitled to be cast by all stockholders will constitute a quorum for the transaction of business at the Annual Meeting. Stockholders are entitled to cast one vote per share on each matter presented for consideration by the stockholders. A list of stockholders entitled to vote at the Annual Meeting will be available for examination by any stockholder for a proper purpose during normal business hours at the executive offices of the Company for a period of at least 10 days preceding the Annual Meeting.

PROXY COMMITTEE

The Board of Directors of the Company has appointed a Proxy Committee consisting of Gosse Bruinsma, M.D. and Michael Espey in whose names the proxies are solicited on behalf of the Company and the Board of Directors.

PROPOSAL 1

ELECTION OF DIRECTORS

The Board of Directors

The Company's business is managed under the direction of its Board of Directors. The Board of Directors has designated as nominees for election the six directors currently serving on the Board. See "Nominees for Director" below for profiles of the nominees. After the election of six directors at the meeting, the Company will have six directors.

All of the nominees have indicated a willingness to serve as directors, but if any of them should decline or be unable to act as a director, the proxy holders will vote for the election of another person or persons as the Board of Directors recommends. The Company has no reason to believe that any nominee will be unavailable.

THE BOARD RECOMMENDS A VOTE FOR AND SOLICITS PROXIES IN FAVOR OF THE NOMINEES LISTED BELOW. The holders of Common Stock of the Company are entitled to one vote per share equal to the number of shares held by such person at the close of business on the record date. As there is no cumulative voting, each stockholder shall cast all of his/her votes for each nominee of his/her choice or withhold votes from any or all nominees. Except to the extent that a stockholder withholds votes from any and all nominees, the persons named in the proxy, in their sole discretion, will vote such proxy for the election of the nominees listed below. The six nominees who receive the most votes shall be elected as directors. Directors are to be elected to hold office until the next annual meeting of stockholders and until their successors are elected and qualified, or until their earlier resignation or removal.

Nominees for Director

The following persons have been nominated by the Board of Directors for election to the Board of Directors:

Name

| | Age

| | Position

|

|---|

| Albert D. Angel(1),(2),(3) | | 64 | | Chairman of the Board |

| Gosse B. Bruinsma, M.D. | | 47 | | Director, Chief Operating Officer, Treasurer, President of Axonyx Europe, BV |

| Abraham E. Cohen(1),(2) | | 65 | | Director |

| Michael R. Espey | | 40 | | Director, General Counsel, Vice President, Secretary |

| Marvin S. Hausman, M.D.(3) | | 60 | | Director, President & Chief Executive Officer |

| Christopher Wetherhill(1),(2) | | 53 | | Director |

- (1)

- Member of the Compensation Committee

- (2)

- Member of the Audit Committee

- (3)

- Member of the Nominating Committee

Albert D. Angel, Esq. Albert Angel has served as Chairman of the Board of Directors of Axonyx since April 1997. At the 2001 Annual Meeting of Stockholders held on June 14, 2001 Mr. Angel was reelected as a director of Axonyx to serve until the 2002 Annual Meeting of Stockholders. Mr. Angel has more than 30 years of experience in the pharmaceutical and biotechnology fields, primarily at Merck & Co., Inc. Mr. Angel received his law degree from Yale Law School in 1960 and, after army service, was with the firm of Hughes Hubbard Blair & Reed until 1967. Mr. Angel joined Merck in 1967 as Latin American attorney and served successively as European Counsel and International Counsel until 1977 when he relocated to London as Vice-President of Merck Sharp & Dohme

2

(Europe), Inc. During the next 8 years he served first as Regional Director responsible for Merck's Scandinavian businesses and then as Chairman and Managing Director of Merck Sharp & Dohme Limited responsible for business activities in the United Kingdom, Ireland and Anglophone Africa. From 1985 to 1993 Mr. Angel served as Vice-President, Public Affairs for Merck & Co., Inc. Since 1993 Albert Angel has been President of Angel Consulting and since November 1994 Mr. Angel has been a partner in Naimark & Associates, both of which provide management, marketing, planning and public affairs advice to pharmaceutical and biotechnology companies. He is also vice-chair of the National Board of Trustees of the National Jewish Medical and Research Center (Denver, Colorado).

Gosse B. Bruinsma, M.D. Gosse Bruinsma has served as President of Axonyx Europe BV since its formation in October 2000. Dr. Bruinsma has served as the Chief Operating Officer of Axonyx since February 2001 and has been the Treasurer of Axonyx since January 2002. At the 2001 Annual Meeting of Stockholders held on June 14, 2001 Dr. Bruinsma was elected as a director of Axonyx to serve until the 2002 Annual Meeting of Stockholders. At a Board Meeting on June 14, 2001, Dr. Bruinsma was elected as Chief Operating Officer of Axonyx to serve until the Board of Directors meeting to be held as soon as possible after the 2002 Annual Meeting of Stockholders. Dr. Bruinsma has over 15 years experience in the medical, pharmaceutical and biotechnology fields. Dr. Bruinsma received his undergraduate degree from McGill University, Montreal and received his medical degree from the University of Leiden, the Netherlands. He joined the pharmaceutical industry to become European Medical Director for Zambon, Milan. He subsequently joined the international contract research organization, ClinTrials Research, to become their Vice President for Medical and Regulatory Affairs. In September 1995 Dr. Bruinsma joined Forest Laboratories in New York as Medical Director, with responsibility for their anti-hypertensive product launch, HRT program, Cervidil®, and their urological disease projects. From September 1997 to 1999 Dr. Bruinsma was General Manager and Vice-President Development for Chrysalis Clinical Services Europe based in Switzerland. From November 1999 until he joined Axonyx Europe BV, Dr Bruinsma was the Vice President Development for Crucell BV (formerly IntroGene), a biotechnology company based in the Netherlands.

Abraham E. Cohen. Abraham E. Cohen has served as a director of Axonyx since May 2000. At the 2001 Annual Meeting of Stockholders held on June 14, 2001 Mr. Cohen was reelected as a director of Axonyx to serve until the 2002 Annual Meeting of Stockholders. Mr. Cohen is a retired Senior Vice President of Merck & Co. and President of the Merck Sharp & Dohme International Division (MSDI), which manufactures and markets human health products outside the United States. Mr. Cohen joined MSDI in New York in 1957 and moved to India in 1960 during the early development stages of the Merck subsidiary there. Subsequently, he played a key role in the development of Merck's international pharmaceutical business, becoming the first Managing Director for Pakistan in 1962 and Regional Director for South Asia in 1964. He became Regional Director for Northern Europe in 1967 and was elected MSDI's Vice President for Europe in 1969. In 1974, Mr. Cohen was elected Executive Vice President of MSDI at the division's headquarters in Rahway, New Jersey, and became President of the Division in 1977. In 1982, he was named to serve concurrently as a corporate Senior Vice President. In this role, his responsibilities were significantly expanded to include oversight of worldwide strategic issues and the development and acquisition of new businesses outside the United States. Mr. Cohen retired from Merck in January 1992. He continues to be an active international business executive, serving as a director of Akzo Corporation, an international conglomerate, located in the Netherlands, Teva Pharmaceuticals in Israel, Gen-Probe USA, Smith Barney (mutual funds), Pharmaceutical Product Development, Inc., and Chugai Pharmaceutical Co. in Japan. He is a trustee of the Population Council and he also serves as Chairman of Neurobiological Technologies, Inc., Vasomedical, Inc., Kramex Corporation, and Neuromuscular Electrical Stimulation Systems, Ltd in Israel.

Michael R. Espey, Esq. Michael Espey has been a director, Vice President and Secretary of Axonyx since September 1998 and was a director and Vice President of Axonyx since January 1997. He served as Axonyx's Treasurer from January 1997 until September 1998. At the 2001 Annual Meeting of

3

Stockholders held on June 14, 2001 Mr. Espey was reelected as a director of Axonyx to serve until the 2002 Annual Meeting of Stockholders. At a Board Meeting on June 14, 2001, Mr. Espey was reelected as Vice President and Secretary of Axonyx to serve until the Board of Directors meeting to be held as soon as possible after the 2002 Annual Meeting of Stockholders. Michael Espey is an attorney based in Seattle, Washington with extensive experience in securities law and investment banking. From October 1994 to December 1995 Mr. Espey served as General Counsel for the securities firms of Lee, Van Dyk, Zivarts, Pingree & Co. and Financial Services International Corp. in Seattle. From January 1996 to March 1996 Mr. Espey was a self-employed attorney practicing corporate and securities law. From April 1996 to August 1998 Mr. Espey worked at Espey & Associates, Inc. a New York firm where he was involved in structuring several transnational securities placements.

Marvin S. Hausman, M.D. Marvin Hausman has served as a director and President and Chief Executive Officer of Axonyx since January 1997. At the 2001 Annual Meeting of Stockholders held on June 14, 2001 Dr. Hausman was reelected as a director of Axonyx to serve until the 2002 Annual Meeting of Stockholders. At a Board Meeting on June 14, 2001, Dr. Hausman was reelected as President and Chief Executive Officer of Axonyx to serve until the Board of Directors meeting to be held as soon as possible after the 2002 Annual Meeting of Stockholders. Dr. Hausman was a founder of Medco Research Inc., a pharmaceutical biotechnology company specializing in adenosine products. He has thirty years experience in drug development and clinical care. Dr. Hausman received his medical degree from New York University School of Medicine in 1967 and has done residencies in General Surgery at Mt. Sinai Hospital in New York, and in Urological Surgery at U.C.L.A. Medical Center in Los Angeles. He also worked as a Research Associate at the National Institutes of Health, Bethesda, Maryland. He has been a Lecturer, Clinical Instructor and Attending Surgeon at the U.C.L.A. Medical Center Division of Urology and Cedars-Sinai Medical Center, Los Angeles. He has been a Consultant on Clinical/Pharmaceutical Research to various pharmaceutical companies, including Bristol-Meyers International, Mead-Johnson Pharmaceutical Company, Medco Research, Inc., and E.R. Squibb. Since October 1995 Dr. Hausman has been the President of Northwest Medical Research Partners, Inc., a medical technology and transfer company. Dr. Hausman has served on the board of directors of Oxis International, Inc. since March 2002. He was a member of the board of directors of Medco Research, Inc. from May 1996 to July 1998. Dr Hausman was a member of the board of directors of Regent Assisted Living, Inc., a company specializing in building assisted living centers including care of senile dementia residents, from March 1996 to April 2001.

Christopher Wetherhill. Christopher Wetherhill has served as a director of Axonyx since August 1997. At the 2001 Annual Meeting of Stockholders held on June 14, 2001 Mr. Wetherhill was reelected as a director of Axonyx to serve until the 2002 Annual Meeting of Stockholders. From 1971 until 1977 he was the manager of the accounting and management services department at Arthur Young & Co., now Ernst & Young, Bermuda. From 1977 to 1981, he was a director and financial controller of Offshore Contractors (Bermuda) Limited, a Bermuda company involved in offshore oil platform construction and shipping. He is a Fellow of the Institute of Chartered Accountants in England and Wales, a member of the Bermudian and Canadian Institutes of Chartered Accountants, and a Fellow of the Institute of Directors and Freeman of the City of London. Since September 21, 1994, Mr. Wetherhill has been the managing director of Boundary Bay Investments Limited, a major shareholder of Axonyx. Mr. Wetherhill is a chartered accountant and from September 1981 to June 1996, he was the President and Chief Executive Officer of Hemisphere Management Limited of Bermuda, a corporate management company. From June 1996 to December 2000 Mr. Wetherhill was President & CEO of MRM Financial Services Ltd. (the parent company of Hemisphere Management Limited).

There are no family relationships between any of the officers and directors.

4

Information Concerning the Board of Directors and Committees Thereof

During the year ended December 31, 2001, the Board of Directors met on eleven occasions, including six unanimous written consent meetings. Each director attended or participated in 75% or more of the meetings held by the Board of Directors and each committee member attended 75% or more of the meetings held by committees on which he served.

The Board of Directors created the Compensation, Audit and Nominating Committees at the Board Meeting on January 13, 1999. Prior to that neither the Company nor its predecessors had any Board Committees.

The Nominating Committee of the Board of Directors, currently consisting of Messrs. Marvin Hausman and Albert Angel, makes proposals to the full Board of Directors concerning the hiring or engagement of directors, officers and certain employee positions. The Nominating Committee met on one occasion in the year 2001. The Nominating Committee will not consider nominations recommended by the stockholders.

The Compensation Committee of the Board of Directors, currently consisting of Messrs. Albert Angel, Barry Cohen and Christopher Wetherhill, administers the Company's 1998 and 2000 Stock Option Plans, and makes proposals to the full Board of Directors for officer compensation programs, including salaries, option grants and other forms of compensation. The Compensation Committee met on three occasions during the year 2001.

The Audit Committee of the Board of Directors, currently consisting of Messrs. Albert Angel, Barry Cohen and Christopher Wetherhill, recommends the firm to be employed as the Company's independent public accountants, and oversees the Company's audit activities and certain financial matters to protect against improper and unsound practices and to furnish adequate protection to all assets and records. The Audit Committee operates under a written charter adopted on March 24, 2000 by the Board of Directors. The three members of the Audit Committee are independent (as defined in Rule 4200(a)(14) of the National Association of Securities Dealers' listing standards). The Audit Committee met on four occasions during the year 2001.

Compensation of Directors

Axonyx paid each of its non-employee directors (Messrs. Angel, Cohen and Wetherhill) an aggregate of $1,000 each for attending Board meetings in 2001. Directors are also reimbursed for their out-of-pocket expenses incurred to attend meetings.

Mr. Angel was also paid $9,875.00 during the year 2001 for office overhead expenses, including compensation for the use of a portion of Mr. Angel's residence.

The non-employee directors of Axonyx were granted stock options in fiscal year 2001 under the Axonyx Inc. 2000 Stock Option Plan, as described below.

On December 11, 2001, Axonyx granted non-statutory stock options to purchase 76,000 shares exercisable at $3.16 per share to Albert D. Angel and non-statutory stock options to purchase 7,600 shares each exercisable at $3.16 per share to each of Abraham Cohen and Christopher Wetherhill. These options were vested as to twenty percent of the shares on the date of grant, and, subject to the individuals continued service as a director, will continue to vest in annual installments of twenty percent on December 1 of each year beginning December 1, 2002 and ending December 1, 2005. The vesting of these options will be accelerated in full upon a change in control of the company.

On December 11, 2001, Axonyx also granted, subject to stockholder approval of Proposal Two, non-statutory stock options, exercisable at $3.16 per share, to purchase 124,000 shares to Albert D. Angel and to purchase 12,400 to each of Abraham Cohen and Christopher Wetherhill. If the stockholders approve Proposal Two, these options will vest as to twenty percent of the shares on the

5

date of the Annual Meeting and subject to the optionee's continued service as a director, will vest in annual installments of twenty percent on December 1 of each year beginning December 1, 2002 and ending December 1, 2005. The vesting of these options will also accelerate in full in the event of a change in control of the company. If the stockholders do not approve Proposal Two, these options will terminate in full on the date of the Annual Meeting.

PROPOSAL 2

ADOPTION OF THE AMENDED AND RESTATED

AXONYX INC. 2000 STOCK OPTION PLAN

The Board of Directors has, subject to stockholder approval, amended the Axonyx Inc. 2000 Stock Option Plan (the "2000 Plan") to increase the aggregate number of shares reserved for issuance thereunder to 2,000,000, to add a provision for an automatic increase in the number of shares reserved for issuance under the 2000 Plan at the start of each calendar year commencing in 2003, to add provisions that permit the grant of performance-based options as described in the Internal Revenue Code Section 162(m), and to amend the 2000 Plan in certain other respects.

The Board of Directors adopted the 2000 Plan on March 24, 2000 and the stockholders of the Company approved the 2000 Plan on June 14, 2000. The Board approved the Amended and Restated 2000 Stock Option Plan on March 20, 2002, subject to stockholder approval as described in this Proposal 2.

The Board believes that increasing the number of shares of Common Stock reserved for issuance under the 2000 Plan is necessary to ensure that a sufficient reserve of Common Stock remains available for issuance to allow the Company to continue to utilize stock options to attract and retain the services of key individuals essential to the Company's long-term growth and financial success. The Company relies on equity incentives in the form of stock option grants in order to attract and retain key employees, consultants and non-employee directors and believes that such equity incentives are necessary for the Company to remain competitive in the marketplace for executive talent and other key individuals. Option grants made to newly-hired and continuing employees, non-employee directors, consultants will be based on competitive market conditions, experience and individual performance. Without the proposed increase to the share reserve under the 2000 Plan, there will be only 65,600 shares remaining available for issuance under the 2000 Plan and 28,900 shares reserved for issuance under the Company's 1998 Stock Option Plan.

A summary of the principal features of the 2000 Plan, as most recently amended is attached hereto as Appendix A, which Appendix is a part of this Proxy Statement.The full text of the proposed Plan, as amended and restated, will be available at the Annual Meeting and a copy is available to interested stockholders upon written or oral request to Victoria Trahan, Officer Manager, 825 Third Avenue, 40th Floor, New York, New York 10022, telephone (212) 688-4770.

6

Awards Under the 2000 Plan

The table below shows, for the Company's Chief Executive Officer ("CEO"), the other most highly compensated executive officers of the Company (with base salary and bonus for the past fiscal year in excess of $100,000) and the other individuals and groups indicated, the number of shares of Common Stock subject to option grants made under the 2000 Plan during fiscal year 2001, other than the Contingent Options described in the table below, together with the weighted average exercise price payable per share.

Name and Position

| | Number of Shares

Underlying Option Grants

| | Weighted Average Exercise

Price Per Share

|

|---|

Marvin S. Hausman, M.D.

Dir., Pres. & CEO | | 95,000 | | $ | 3.16 |

Gosse B. Bruinsma, M.D.

Dir. & COO |

|

126,000 |

|

|

3.69 |

Robert G. Burford, Ph.D.

V.P. |

|

38,000 |

|

|

3.16 |

Michael R. Espey

Dir., V.P., Sec. |

|

15,200 |

|

|

3.16 |

All current executive officers as a group (4 persons) |

|

274,200 |

|

|

3.41 |

Albert D. Angel

Dir. |

|

76,000 |

|

|

3.16 |

Abraham E. Cohen

Dir. |

|

7,600 |

|

|

3.16 |

Christopher Wetherhill

Dir. |

|

7,600 |

|

|

3.16 |

All current non-employee directors as a group (3 persons) |

|

91,200 |

|

|

3.16 |

Michael M. Strage

Former Dir., V.P., Treas. |

|

100,000 |

|

|

3.16 |

Current non-employee consultants who received over 5% of options |

|

230,000 |

|

|

4.15 |

All employees, excluding executive officers, as a group (1 person) |

|

— |

|

|

— |

New Benefit Table

The table below shows, for the Company's CEO and the other individuals and groups indicated, the number of shares of Common Stock subject to option grants that are subject to stockholder approval of the Amended and Restated 2000 Stock Option Plan as described in this Proposal Two, together with the weighted average exercise price payable per share. The dollar value of these options depends upon the fair market value of our Common Stock when exercised and thus cannot presently be determined. The number of shares and the exercise price of the options are to be granted in the future under the 2000 Plan is not presently determinable.

7

Contingent Options

Amended and Restated 2000 Stock Option Plan

Name and Position

| | Number of Shares

Underlying Option Grants

| | Weighted Average Exercise

Price Per Share

|

|---|

Marvin S. Hausman, M.D.

Dir., Pres. & CEO | | 155,000 | | $ | 3.16 |

Gosse B. Bruinsma, M.D.

Dir. & COO |

|

124,000 |

|

|

3.16 |

Robert G. Burford, Ph.D.

V.P. |

|

62,000 |

|

|

3.16 |

Michael R. Espey

Dir., V.P., Sec. |

|

24,800 |

|

|

3.16 |

All current executive officers as a group (4 persons) |

|

365,800 |

|

|

3.16 |

Michael M. Strage Former Dir., V.P., Treas. |

|

— |

|

|

— |

All current non-employee directors as a group (3 persons) |

|

148,800 |

|

|

3.16 |

All employees, excluding executive officers, as a group (1 person) |

|

— |

|

|

— |

- (1)

- These Options were granted on December 11, 2001, subject to stockholder approval of this Proposal Two. The Options have an exercise price of $3.16 per share and are intended to qualify as incentive stock options under Section 422 of the Internal Revenue Code. If Proposal Two is approved by the Stockholders, the options will vest as to twenty percent of the shares on the date of the Annual Meeting, and subject to the optionees continued service with the Company, will vest in annual installments of twenty percent on December 1 of each year beginning December 1, 2002 and ending December 1, 2005. The vesting of these options will accelerate in full in the event of a change in control of the Company. If the stockholders do not approve Proposal Two, these options will terminate full on the date of the Annual Meeting.

As of April 30, 2002, 1,449,000 shares of Common Stock were subject to outstanding options under the 2000 Plan, of which 514,600 shares were subject to options granted contingent on stockholder approval of the Amended and Restated 2000 Plan, which is part of this Proposal Two.

Other Stock Option Plan

The Company also maintains the 1998 Stock Option Plan (the "1998 Plan"), under which 2,000,000 shares of Common Stock have been reserved for issuance under stock options granted to employees, non-employee directors and consultants of the Company and any parent or subsidiary of the Company. As of May 3, 2002, no shares have been issued under the 1998 Plan, 1,971,100 shares are subject to outstanding stock options and 28,900 shares remain available for future option grants.

THE BOARD OF DIRECTORS RECOMMENDS THAT THE STOCKHOLDERS VOTE FOR THE AMENDED AND RESTATED 2000 PLAN. The Amended and Restated 2000 Plan will be deemed approved if a majority of the shares of Common Stock present, either in person or by proxy, and voting on the matter, votes in favor of the proposal. Should such stockholder approval not be obtained, the 2000 Plan will continue in effect and option grants may continue to be made under the 2000 Plan until all the shares available for issuance under the 2000 Plan have been issued pursuant to such option

8

grants or until the 2000 Plan's earlier expiration or termination. If stockholder approval is not obtained, the options that were granted contingent upon such approval shall be terminated as of the date of the Annual Meeting.

PROPOSAL 3

RATIFICATION OF APPOINTMENT OF RICHARD A. EISNER & COMPANY, LLP

AS INDEPENDENT AUDITORS OF THE COMPANY

Richard A. Eisner & Company, LLP has served as the Company's independent accountants since 1998. On March 20, 2002, the Board of Directors, subject to stockholder ratification, approved the continued appointment of Richard A. Eisner & Company, LLP, independent auditors, to audit the accounts of the Company for the 2002 fiscal year.

Audit services of Richard A. Eisner & Company, LLP include the examination of the financial statements of the Company and services related to filings with the Securities and Exchange Commission.

The Audit Committee intends to meet with Richard A. Eisner & Company, LLP in 2002 on a quarterly or more frequent basis. At such times, the Audit Committee will review the services performed by Richard A. Eisner & Company, LLP, as well as the fees charged for such services.

Fees Billed to the Company by Richard A. Eisner & Company, LLP during Fiscal 2001.

Audit Fees: An aggregate of $30,000 was billed for professional services rendered for the audit of the Company's annual financial statements for the 2001 fiscal year and for the reviews of financial statements included in the Company's quarterly reports on Form 10-Q for the 2001 fiscal year.

Financial Information Systems Design and Implementation Fees: The Company did not engage Richard A. Eisner & Company, LLC to provide advice to the Company regarding financial information systems design and implementations during the 2001 fiscal year.

All Other Fees: Fees billed to the Company by Richard A. Eisner & Company, LLC during the 2001 fiscal year for all other non-audit services rendered to the Company, including Securities and Exchange Commission registration statements, tax consulting services, statutory audits and other assurance services, totaled $17,015.

The Company's Audit Committee considered whether the provision of non-audit services rendered by Richard A. Eisner & Company, LLC to the Company was compatible with maintaining Richard A. Eisner & Company, LLC's independence.

THE BOARD RECOMMENDS THAT THE STOCKHOLDERS VOTE FOR THE RATIFICATION OF RICHARD A. EISNER & COMPANY, LLP AS INDEPENDENT AUDITORS OF THE COMPANY'S FINANCIAL STATEMENTS FOR THE FISCAL YEAR ENDING DECEMBER 31, 2002. Submission of the appointment to stockholders is not required. However, the Board of Directors will reconsider the appointment if it is not approved by stockholders. The appointment will be deemed ratified if a majority of the shares of Common Stock present, either in person or by proxy, and voting on the matter, votes in favor of the proposal. A representative of Richard A. Eisner & Company, LLP is expected to be present at the Annual Meeting and will have an opportunity to make a statement if he or she desires. The representative is also expected to be available to respond to appropriate questions from stockholders.

9

REPORT OF THE AUDIT COMMITTEE

OF THE BOARD OF DIRECTORS

The following is the report of the Audit Committee of the Board of Directors of Axonyx with respect to Axonyx's audited financial statements for the fiscal year ended December 31, 2001, included in the Company's Annual Report on Form 10-K. The information contained in this report shall not be deemed to be "soliciting material" or to be "filed" with the Securities and Exchange Commission, nor shall such information be incorporated by reference into any future filing under the Securities Act of 1933, as amended, or the Securities Exchange Act of 1934, as amended, except to the extent that the Company specifically incorporates it by reference in such filing.

Review With Management

The members of the Audit Committee reviewed and discussed the audited financial statements with certain members of the management of the Company.

Review and Discussions With Independent Accountants

The Audit Committee of the Board of Directors of Axonyx met on March 20, 2002 to review the financial statements for the fiscal year ending December 31, 2001 audited by Richard A. Eisner & Company, LLP, Axonyx's independent auditors. The Audit Committee discussed with a representative of Richard A. Eisner & Company, LLP the matters required to be discussed by SAS 61. The Audit Committee received the written disclosures and the letter from Richard A. Eisner & Company, LLP required by Independent Standards Board Standard No. 1 and has discussed with Richard A. Eisner & Company, LLP its independence.

Conclusion

Based on the above review and discussions, the Audit Committee recommended to the Board of Directors that the audited financial statements for the fiscal year ending December 31, 2001 be included in the Company's Annual Report on Form 10-K for filing with the Securities and Exchange Commission.

The Audit Committee of the Board of Directors:

| | | Albert D. Angel

Abraham E. Cohen

Christopher Wetherhill |

10

EXECUTIVE COMPENSATION

Executive Officers

The executive officers of the Company are Marvin S. Hausman, M.D., President and Chief Executive Officer, Gosse B. Bruinsma, M.D., Chief Operating Officer and Treasurer, Michael R. Espey, Vice President, General Counsel and Secretary, Robert G. Burford, Ph.D., Vice President, Product Development.

Information Concerning Executive Officers Who Are Not Directors

Robert G. Burford, Ph.D., F.A.C.A. Dr. Burford has been Vice President, Product Development since December 3, 1999 and on June 14, 2001, the Board of Directors reelected him to this position to serve until the Board of Directors meeting to be held as soon as possible after the 2002 Annual Meeting of Stockholders. Dr. Burford has 37 years of experience in pharmaceutical development, including 9 years of preclinical experience with Bio Research Laboratories (Montreal) and 17 years of clinical experience with Searle Pharmaceuticals (Oakville, Ontario and Chicago). He has successfully managed drug development programs for G.D. Searle and Co., Biovail Corporation International, and other major pharmaceutical companies. Most recently he successfully directed the clinical development of Tiazac™, a drug for the treatment of hypertension that now commands 15% of the market. For 10 years prior to joining Axonyx Dr. Burford ran the consulting firm American Clinical Research Consultants Inc., which provided toxicology, and clinical program management services to numerous clients. During this time he acquired extensive experience in interacting with FDA in support of drug and device development programs. Dr. Burford is a 50% owner of Clinfo Systems LLC, a clinical data management company that has rendered services to Axonyx in the past two years. Dr Burford has held various non-academic positions including President of the Society of Toxicology of Canada, Secretary General, International Union of Toxicology, Chairman Scientific Affairs Subcommittee, National Pharmaceutical Council and Chairman, Strategic Grants Committee, Environmental Toxicology Natural Sciences and Engineering Research Council, Government of Canada.

Summary Compensation

The table below sets forth the compensation paid by Axonyx during our last three fiscal years ended December 31, 1999, December 31, 2000 and December 31, 2001 to our Chief Executive Officer and each of the four highest paid executive officers of Axonyx whose annual salary and bonus for fiscal year 2001 exceeded $100,000 (collectively, the "Named Executive Officers"). The Contingent Options described in Proposal Two are excluded from the table below.

11

SUMMARY COMPENSATION TABLE

| |

| |

| |

| | Long Term

Compensation

Awards

| |

|

|---|

| |

| | Annual Compensation(1)

| |

|

|---|

Name and principal position

| |

| | Securities

underlying

Options (#)

| | All other

compensation ($)

|

|---|

| | Year

| | Salary ($)

| | Bonus ($)

|

|---|

Marvin S. Hausman, M.D.

Dir., Pres. & CEO | | 2001

2000

1999 | | $

$

$ | 225,000

190,000

125,000 | |

$

$ |

150,000

150,000 | | 95,000

250,000

200,000 | | | |

Gosse B. Bruinsma, M.D.

Dir., COO(2) |

|

2001

2000

1999 |

|

$

$ |

170,000

43,000 |

|

$

$ |

20,000

20,000 |

|

126,000

150,000 |

|

|

|

Michael M. Strage

Dir., V.P., Treas.(3) |

|

2001

2000

1999 |

|

$

$

$ |

160,000

132,000

100,000 |

|

$

$ |

30,000

45,000 |

|

100,000

140,000

40,000 |

|

$ |

50,000 |

Robert G. Burford, Ph.D.

V.P.(4) |

|

2001

2000

1999 |

|

$

$

$ |

175,000

129,000

17,000 |

|

$ |

50,000 |

|

38,000

100,000

110,000 |

|

|

|

Michael R. Espey

Dir., V.P., Sec. |

|

2001

2000

1999 |

|

$

$

$ |

125,000

125,000

84,000 |

|

$ |

25,000 |

|

15,200

80,000

20,000 |

|

|

|

- (1)

- No Named Executive Officer was paid other annual compensation in an amount exceeding the lesser of either $50,000 or 10% of the total of annual salary and bonus for such Named Executive Officer.

- (2)

- Gosse B. Bruinsma, M.D. became an employee of Axonyx in October 2000.

- (3)

- Michael Strage resigned and was paid $50,000 in severance on December 31, 2001.

- (4)

- Robert G. Burford, Ph.D., through his company American Clinical Research Consultants, Inc., received a consulting fee of $61,000 for services rendered in 1999.

Option Grants in Year Ended December 31, 2001

�� The following table sets forth certain information with respect to option grants to our Named Executive Officers in 2001, exclusive of the Contingent Options described in Proposal Two. All of the grants were made under the 2000 Plan. Axonyx has not granted any stock appreciation rights.

12

Option Grants in Fiscal Year 2001

| | Individual Grants

| |

| |

|

|---|

| | Potential Realizable

Value at Assumed

Annual Rates of Stock

Price Appreciation for

Option Term (4)

|

|---|

| | Number of

securities

underlying

Options

granted

(#)(1)(2)

| | Percent of

total options

granted to

employees

in fiscal

year(3)

| |

| |

|

|---|

Name

| | Exercise or

base price

($/Sh)

| | Expiration

date

|

|---|

| | 5% ($)

| | 10% ($)

|

|---|

| Marvin S. Hausman, M.D. | | 95,000 | | 24.3 | % | $ | 3.16 | | 12/10/11 | | $ | 188,765 | | $ | 478,610 |

| Gosse B. Bruinsma, M.D. | | 50,000

76,000 | (5)

(6) | 32.2 | % | $

$ | 4.52

3.16 | | 5/10/11

12/10/11 | | $

$ | 142,150

151,012 | | $

$ | 178,750

362,888 |

| Michael M. Strage | | 100,000 | | 25.6 | % | $ | 3.16 | | 12/10/11 | | $ | 198,700 | | $ | 503,800 |

| Robert G. Burford, Ph.D. | | 38,000 | (6) | 9.7 | % | $ | 3.16 | | 12/10/11 | | $ | 75,506 | | $ | 191,444 |

| Michael R. Espey | | 15,200 | (6) | 3.9 | % | $ | 3.16 | | 12/10/11 | | $ | 30,202 | | $ | 76,577 |

- (1)

- The vesting of these options will accelerate in full in the event of a change in control of the Company.

- (2)

- Except as otherwise noted, these options were granted on December 11, 2001, options have an exercise price of $3.16 per share and are intended to qualify as incentive stock options under Section 422 of the Internal Revenue Code. Except as otherwise noted, the options were vested as to twenty percent of the shares on the date of grant, and subject to the optionee's continued service with the Company, will vest in annual installments of twenty percent on December 1 of each year beginning December 1, 2002 and ending December 1, 2005.

- (3)

- During 2001, the Company granted employees options to purchase an aggregate of 291,200 shares of Common Stock, exclusive of the Contingent Options.

- (4)

- These amounts represent hypothetical gains that could be achieved for the respective options at the end of the ten year option term. The assumed 5% and 10% rates of compounded stock price appreciation are mandated by rules of the Securities and Exchange Commission and do not represent Axonyx's estimate of the future market price of the Common Stock.

- (5)

- On May 11, 2001, Axonyx granted 50,000 non-statutory stock options exercisable at $4.52 per share to Gosse B. Bruinsma, M.D., with 25,000 options vesting immediately and 25,000 vesting on May 11, 2002.

- (6)

- Intended to qualify as an incentive stock option under Section 422 of the Internal Revenue Code.

Aggregate Option Exercises in Year Ended December 31, 2001 and Year-End Option Values

The following table sets forth the number and value of unexercised options, other than the Contingent Options described in Proposal Two, held by the Named Executive Officers as of December 31, 2001.

13

Aggregated Option Exercises in Fiscal Year 2001 and Year-End Option Values(1)

| | Number of securities

underlying unexercised

options at fiscal

year end (#)

| |

| |

|

|---|

| | Value of unexercised

in-the-money options

at fiscal year end ($)(2)

|

|---|

Name

|

|---|

| | Exercisable

| | Unexercisable

| | Exercisable

| | Unexercisable

|

|---|

| Marvin S. Hausman, M.D., Pres. & CEO | | 369,000 | | 176,000 | | $ | 58,180 | | $ | 16,720 |

| Gosse B. Bruinsma, M.D., COO | | 140,200 | | 135,800 | | $ | 3,344 | | $ | 13,376 |

| Michael M. Strage, V.P. & Treasurer | | 170,000 | | 110,000 | | $ | 20,400 | | $ | 22,000 |

| Robert G. Burford, Ph.D., V.P. | | 117,600 | | 130,400 | | $ | 1,672 | | $ | 6,688 |

| Michael R. Espey, V.P. & Secretary | | 73,040 | | 42,160 | | $ | 669 | | $ | 2,675 |

- (1)

- There were no exercises of options by Named Executive Officers in fiscal year 2001.

- (2)

- Dollar amounts reflect the net values of outstanding stock options computed as the difference between $3.38 (the fair market value at December 31, 2001) and the exercise price of the options.

Employment Contracts with Executive Officers and Termination of Employment and Change-in-Control Arrangements

Axonyx does not have any employment contracts with any of its Named Executive Officers, except as follows:

Gosse B. Bruinsma, M.D., Director, Chief Operating Officer & Treasurer. Effective October 2, 2000, Axonyx entered into an Employment Agreement with Dr. Bruinsma under which Dr. Bruinsma agreed to serve as President of Axonyx Europe BV, a wholly owned subsidiary of Axonyx Inc., and was to be paid 425,000 Dutch florents in annual salary, a $20,000 annual bonus, and granted a stock option to purchase 150,000 shares of Common Stock exercisable at $9.50 per share, with 25,000 options vesting immediately, 50,000 options vesting on October 1, 2001, 25,000 vesting on October 1, 2002, 25,000 options vesting on October 1, 2003 and 25,000 options vesting on October 1, 2004. If the agreement is not renewed, Axonyx will continue Dr. Bruinsma's salary and benefits for an additional six months. In addition, $25,000 per year is available to Dr. Bruinsma for reimbursement of expenses, including for the use of a home office and personal equipment, health insurance, disability insurance, life insurance, pension distribution and auto lease premium. Subsequent to his election as Chief Operating Officer of Axonyx Inc. in February 2001, Dr. Bruinsma's salary has been increased. He was paid $170,000 per year in salary in 2001. Dr. Bruinsma has also received additional option grants. Dr. Bruinsma's agreement is for a term of two years.

Robert G. Burford, Ph.D., Vice President for Product Development. On November 10, 1999, Axonyx signed a letter agreement with Robert Burford under which Dr. Burford agreed to serve as the Vice President for Product Development, and was paid $100,000 per year until July 2000, after which Dr. Burford's salary was increased to $150,000 per year. In addition, Dr. Burford was granted an Incentive Stock Option to purchase 100,000 shares at $8.125 per share, with 12,500 shares vesting immediately, 12,500 options vesting on August 31, 2000, 25,000 options vesting on August 31, 2001, 25,000 options vesting on August 31, 2002, and 25,000 options vesting on August 31, 2003. Dr. Burford's annual salary has been increased since becoming an employee of Axonyx. He was paid a salary of $175,000 per year in 2001, and he has received additional option grants.

Axonyx does not have any arrangements with its executive officers triggered by termination of employment or change in control other than the acceleration of vesting of stock options.

14

Equity Compensation Plan Information

The following table sets forth information about the Common Stock available for issuance under compensatory plans and arrangements as of December 31, 2001.

Plan Category

| �� | (a)

Number of securities to be

issued upon exercise of

outstanding options, warrants

and rights.

| | (b)

Weighted-average exercise

price of outstanding options,

warrants, and rights

| | (c)

Number of securities remaining

available for future issuance

under equity compensation

plans (excluding securities

reflected in column (a))

|

|---|

| Equity compensation plans approved by security holders(1) | | 2,895,500 | | $ | 5.88 | | 104,500 |

| Equity compensation plans not approved by security holders | | 643,600 | (2) | $ | 4.09 | | — |

| Total | | 3,549,100 | | $ | 5.55 | | 104,500 |

- (1)

- Axonyx has granted options to purchase an aggregate of 1,971,100 shares of Common Stock under its 1998 Stock Option Plan and 924,400 shares of Common Stock under its 2000 Stock Option Plan. Without regard to Proposal Two and as previously approved by stockholders, Axonyx may grant options to purchase up to 28,900 shares of Common Stock under its 1998 Stock Option Plan and up to 65,600 shares under its 2000 Stock Option Plan.

- (2)

- Axonyx granted options to purchase an aggregate of 514,600 shares of Common Stock to officers and directors in 2001, which grants are contingent upon stockholder approval of the Amended and Restated 2000 Stock Option Plan. Axonyx may grant options to purchase up to an additional 485,600 shares of Common Stock under its 2000 Stock Option Plan, which grants are also contingent on stockholder approval of the Amended and Restated 2000 Stock Option Plan. Axonyx has granted an aggregate of 129,000 options to consultants and advisors outside of its 1998 and 2000 stock option plans. These consultant and advisor options are not required to be approved by the Company's stockholders.

Compensation Committee Report on Executive Compensation

The Compensation Committee of the Board of Directors, which is composed of directors who have never been employees of the Company, is responsible for setting and administering the policies and programs that govern compensation. The Compensation Committee was originally formed in January 1999. Prior to that time no executive compensation, other than limited consultant fees, was paid. For 2001, the Company's executive compensation consisted of two components: (1) an annual component, i.e., salaries, and the potential for year end bonuses, and (2) a long-term component, i.e., stock options. The Compensation Committee bases its decisions on executive compensation based on individual assessments of the amount of compensation required to attract individuals to fill positions in the Company and motivate those individuals to focus on achieving the objectives of the Company. The Compensation Committee seeks to reward the management team if the Company achieves its corporate objectives, and it also recognizes meaningful differences in individual performance and offers the opportunity for executives to earn rewards when merited by individual performance.

Annual Component. Salaries for executive officers are determined by the Committee with reference to the job description and a general assessment of the executive's performance, experience and potential. Year end bonuses may be granted subject to an assessment of an executive's performance against established objectives. The Committee establishes these salaries annually or semi-annually, depending upon the individual.

15

Long-Term Component. The Compensation Committee awarded stock options to its executive officers in December 2001 based on the Committee's assessment of the accomplishment of corporate and individual objectives. The Compensation Committee also granted stock options to Dr. Bruinsma in May 2001 upon his appointment as Chief Operating Officer. These options provide the opportunity to buy a number of shares of the Company's Common Stock at a price equal to the market price of the stock on the date of Committee approval of the grant. These options are generally subject to four year vesting, so that they become exercisable in annual installments during the participant's period of service with the Company. The Committee believes that, because these options gain value only to the extent that the price of the Company's Common Stock increases above the option exercise price during the term of the optionee's service, management's equity participation offers a significant incentive and helps to create a long-term partnership between management/owners and other stockholders. The Committee believes that the grant of stock options should reflect the Company's success in meeting objectives established by the Board, each individual officer's ability to attain such objectives and such officer's contribution towards the attainment of past objectives.

Chief Executive Officer. Marvin S. Hausman, M.D. does not have an employment agreement with Axonyx. The Compensation Committee has set the annual salary, annual bonus, if any, and the number of stock options to be awarded to Dr. Hausman each year, based on an assessment of Dr. Hausman's performance and the results of operations of the Company during such year, as well as the level of compensation paid to chief executive officers in similarly situated corporations. For 2001, Dr. Hausman was paid a salary of $225,000, and was awarded no bonus. No bonus was awarded to Dr. Hausman for 2001 as no bonus was awarded to any officers for 2001 other than the bonus awarded to Dr. Bruinsma under the terms of his employment agreement. In determining Dr. Hausman's compensation, the Compensation Committee evaluated the Company's progress with respect to research projects, licensing and equity financing, and Dr. Hausman's contribution towards those accomplishments. The Compensation Committee's evaluation of Dr. Hausman's performance resulted in the granting of an option to purchase 95,000 shares of Common Stock at $3.16 per share, the fair market value on the date of grant, as well as the grant of an option to purchase an additional 155,000 shares of Common Stock at the same exercise price, such grant being contingent upon the approval of the stockholders of the Amended and Restated 2000 Plan as described in Proposal Two. The number of options already held by Dr. Hausman and the magnitude of his shareholdings were not considered in determining the option grants for 2001.

COMPLIANCE WITH INTERNAL REVENUE CODE SECTION 162(M)

As a result of Section 162(m) of the Internal Revenue Code of 1986, as amended, the Company will not be allowed a federal income tax deduction for compensation paid to certain executive officers, to the extent that compensation exceeds $1 million per officer in any one calendar year. This limitation will apply to all compensation which is not considered to be performance-based. Compensation which does qualify as performance-based compensation will not have to be taken into account for purposes of this limitation. The Amended and Restated 2000 Stock Option Plan contains certain provisions which permit the Company, on a grant-by-grant basis, to make awards of stock options (with an exercise price equal to or greater than fair market value of the Common Stock on the date of grant) that will qualify as performance-based compensation so that any compensation deemed paid in connection with those options will be excluded from the 162(m) limitation. The Company's 1998 Stock Option Plan does not contain provisions to qualify stock options under that plan as performance-based compensation. The Compensation Committee considers this among all factors taken into account when setting compensation policy and making individual compensation decisions.

The Compensation Committee does not expect that the compensation to be paid to any of the Company's executive officers for 2001 will exceed the $1 million limit per officer; however, it is possible

16

that in the future the deductibility of compensation may be limited by Internal Revenue Code Section 162(m).

The Compensation Committee of the Board of Directors:

| | | Albert D. Angel, Chairman

Abraham E. Cohen

Christopher Wetherhill |

17

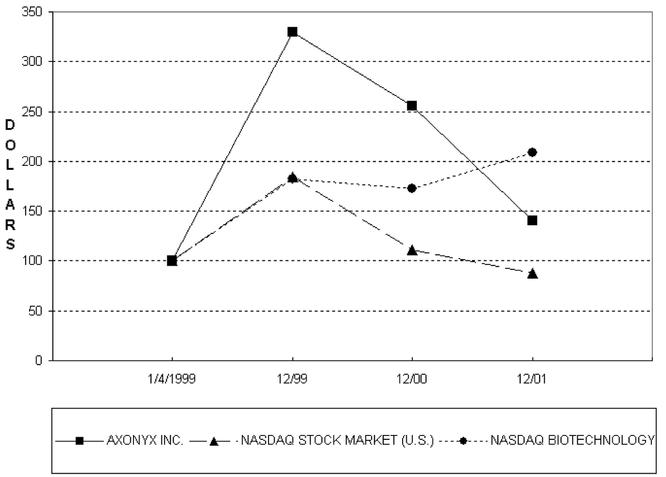

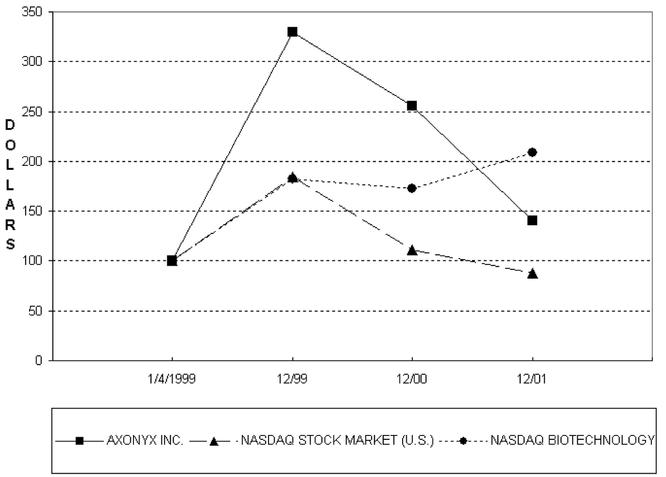

Performance Graph

Set forth below is a graph comparing the cumulative total stockholder return of $100 invested in our Common Stock on January 4, 1999 (the day our shares commenced trading) through December 31, 2001 with the cumulative total return of $100 invested in the Nasdaq Stock Market (U.S.) Index and the Nasdaq Biotechnology Index calculated similarly for the same period.

- (1)

- The graph assumes that $100 was invested at the $2.50 per share offering price on January 4, 1999 in the Company's Common Stock and in each index, and that all dividends were reinvested. No cash dividends have been declared on the Company's Common Stock.

- (2)

- Stockholder returns over the indicated period should not be considered indicative of future stockholder returns.

18

NOTWITHSTANDING ANYTHING TO THE CONTRARY SET FORTH IN ANY OF THE COMPANY'S PREVIOUS FILINGS MADE UNDER THE SECURITIES ACT OF 1933, AS AMENDED, OR THE SECURITIES EXCHANGE ACT OF 1934, AS AMENDED, THAT MIGHT INCORPORATE FUTURE FILINGS MADE BY THE COMPANY UNDER THOSE STATUTES, THE COMPENSATION COMMITTEE REPORT, THE AUDIT COMMITTEE REPORT, AUDIT COMMITTEE CHARTER, REFERENCE TO THE INDEPENDENCE OF THE AUDIT COMMITTEE MEMBERS AND THE STOCK PERFORMANCE GRAPH ARE NOT DEEMED FILED WITH THE SECURITIES AND EXCHANGE COMMISSION AND SHALL NOT BE DEEMED INCORPORATED BY REFERENCE INTO ANY OF THOSE PRIOR FILINGS OR INTO ANY FUTURE FILINGS MADE BY THE COMPANY UNDER THOSE STATUTES.

Compliance with Section 16(a) of the Securities Exchange Act of 1934

Section 16(a) of the Securities Exchange Act of 1934 requires the Company's officers and directors, and persons who own more than ten percent of a registered class of the Company's equity securities, to file reports of ownership and changes in ownership with the Securities and Exchange Commission ("SEC"). In 2001, officers, directors and greater than ten percent stockholders were required by SEC regulation to furnish the Company with copies of all Section 16(a) forms they file. Based on a review of copies of such forms that have been furnished to the Company in 2001, the Company has determined that the following reporting person subject to Section 16(a) failed to file reports on a timely basis. A report on Form 4 filed on behalf of Steven C. Espey, a shareholder of Axonyx, did not include a reportable transaction due to clerical error, and an amended Form 4 was filed.

Security Ownership of Certain Beneficial Owners and Management.

The following table sets forth certain information regarding beneficial ownership of Axonyx's Common Stock as of April 30, 2002 (a) by each person known to Axonyx to own beneficially 5% or more of any class of Axonyx's Common Stock, (b) by each of Axonyx's Named Executive Officers and directors and (c) by all executive officers and directors of Axonyx as a group. As of April 30, 2002 there were 17,247,371 shares of Common Stock of Axonyx issued and outstanding. The numbers of shares beneficially owned include shares of Common Stock which the listed beneficial owners have the right to acquire within 60 days of April 30, 2002 upon the exercise of all options and other rights beneficially owned on that date, excluding the Contingent Options described in Proposal Two assuming

19

stockholder approval thereof. Unless otherwise noted, Axonyx believes that all persons named in the table have sole voting and investment power with respect to all the shares beneficially owned by them.

Name of Beneficial Owner (1)

| | Number of Shares

Beneficially Owned

| | Percent of Class

| |

|---|

| Marvin S. Hausman, M.D. (2) | | 2,249,183 | | 10.67 | % |

| Albert D. Angel (3) | | 1,014,200 | | 5.71 | % |

| Christopher Wetherhill (4) | | 745,770 | | 4.30 | % |

| Michael M. Strage (5) | | 400,000 | | 2.32 | % |

| Michael R. Espey (6) | | 322,665 | | 1.86 | % |

| Robert G. Burford, Ph.D. (7) | | 117,600 | | 0.67 | % |

| Gosse B. Bruinsma, M.D. (8) | | 140,200 | | 0.80 | % |

| Abraham E. Cohen (9) | | 61,520 | | 0.35 | % |

| All directors and executive officers (eight persons) as a group | | 3,538,418 | | 26.13 | % |

| Steven C. Espey (10) | | 1,768,230 | | 10.25 | % |

| Kilkenny Capital Management, LLC (11) | | 1,455,000 | | 8.21 | % |

- (1)

- Unless otherwise indicated, the address of each of the listed beneficial owners identified above is c/o 825 Third Avenue, 40th Floor, New York, NY 10022.

- (2)

- Marvin S. Hausman, M.D. Includes: (i) 1,880,183 shares owned by Dr. Hausman; (ii) 200,000 vested but unexercised options exercisable at $3.11 per share granted on January 13, 1999; (iii) 75,000 vested but unexercised options exercisable at $11.50 per share granted on January 10, 2000; (iv) 75,000 vested but unexercised options exercisable at $7.91 per share granted on December 15, 2000; and (v) 19,000 vested but unexercised options exercisable at $3.16 per share granted on December 11, 2001. Does not include: (i) 3,000 shares gifted to Dr. Hausman's three adult children, with 1,000 to each in October 1999; (ii) 200 shares gifted to Roberta Matta in October 1999; (iii) 5,000 shares gifted to a religious institution in October 2000; (iv) 5,000 shares gifted to six non-affiliate donees in September 2000; (v) 10,550 shares gifted to six non-affiliate donees, including Dr. Hausman's three adult children in July 2001; (vi) 4,300 shares gifted to three non-affiliate donees in October 2001; (vii) 3,000 shares gifted to a non-affiliate donee in October 2001; (viii) 12,300 shares gifted to Dr. Hausman's three adult children and Roberta Matta in December 2001; (ix) 4,717 shares gifted to two non-affiliate donees in December 2001; (x) 25,000 unvested options exercisable at $11.50 per share granted on January 10, 2000; (xi) 75,000 unvested options exercisable at $7.91 per share granted on December 15, 2000; (xii) 76,000 unvested options exercisable at $3.16 per share granted on December 11, 2001; (xiii) 31,000 options that vest upon stockholder approval of Proposal Two, exercisable at $3.16 per share and granted on December 11, 2001; and (xiv) 124,000 unvested options exercisable at $3.16 per share granted on December 11, 2001 that are subject to stockholder approval of Proposal Two.

- (3)

- Albert D. Angel. Includes: (i) 516,000 shares owned by Mr. Angel; (ii) 8,000 Common Stock purchase warrants exercisable at $11.00 per share purchased in a private placement on September 28, 1999; (iii) 300,000 vested but unexercised options exercisable at $2.88 per share granted to Mr. Angel on January 13, 1999; (iv) 75,000 vested but unexercised options exercisable at $11.50 per share granted on January 10, 2000; (v) 100,000 vested but unexercised options exercisable at $7.91 per share granted on December 15, 2000; and (vi) 15,200 vested but unexercised options exercisable at $3.16 per share granted on December 11, 2001. Does not include: (i) 25,000 unvested options exercisable at $11.50 per share granted on January 10, 2000; (ii) 100,000 unvested options exercisable at $7.91 per share granted on December 15, 2000; (iii) 60,800 unvested options exercisable at $3.16 per share granted on December 11, 2001; (iv) 24,800 options that vest upon stockholders approval of Proposal Two, exercisable at $3.16 per

20

share and granted on December 11, 2001; and (v) 99,200 unvested options exercisable at $3.16 per share granted on December 11, 2001 that are subject to stockholder approval of Proposal Two.

- (4)

- Christopher Wetherhill. Includes: (i) 107,500 shares owned by Mr. Wetherhill; (ii) 517,250 shares held by Boundary Bay Investments Ltd. (BBI), a corporation controlled by Mr. Wetherhill; (iii) 37,500 held by Byland Holdings Ltd., a shareholder of BBI controlled by Mr. Wetherhill; (iv) 24,000 Common Stock purchase warrants exercisable at $11.00 per share held by BBI; (v) 8,000 Common Stock purchase warrants exercisable at $11.00 per share held by Byland Holdings; (vi) 40,000 vested but unexercised options exercisable at $2.88 per share granted on January 13, 1999; (vii) 10,000 vested but unexercised options exercisable at $7.91 per share granted on December 15, 2000; and (viii) 1,520 vested but unexercised options exercisable at $3.16 per share granted on December 11, 2001. Mr. Wetherhill holds a controlling position as the Managing Director of BBI and is the sole beneficial owner of Byland Holdings Ltd., a shareholder of BBI. Does not include (i) 10,000 unvested options exercisable at $7.91 per share granted on December 15, 2000; (ii) 6,080 unvested options exercisable at $3.16 per share granted on December 11, 2001; (iii) 2,480 options that vest upon stockholder approval of Proposal Two, exercisable at $3.16 per share and granted on December 11, 2001; and (iv) 9,920 unvested options exercisable at $3.16 per share granted on December 11, 2001 that are subject to stockholder approval of Proposal Two.

- (5)

- Michael M. Strage. Effective January 1, 2002, Michael Strage is no longer an officer or director of Axonyx. Includes: (i) 230,000 shares owned by Mr. Strage; (ii) 40,000 vested but unexercised options exercisable at $2.88 per share granted on January 13, 1999; (iii) 30,000 vested but unexercised options exercisable at $11.50 per share granted on January 10, 2000; (iv) 25,000 vested but unexercised options exercisable at $11.00 per share granted on May 5, 2000; (v) 25,000 unexercised options exercisable at $11.00 per share granted on May 5, 2000 that will vest within 60 days; and (vi) 25,000 vested but unexercised options exercisable at $3.16 per share granted on December 11, 2001 and (vii) 25,000 unexercised options exercisable at $3.16 per share granted on December 11, 2001 that will vest within 60 days. Does not include: (i) 10,000 unvested options exercisable at $11.50 per share granted on January 10, 2000; (ii) 50,000 unvested options exercisable at $11.00 per share granted on May 5, 2000 and (iii) 50,000 unvested options exercisable at $3.16 per share granted on December 11, 2001.

- (6)

- Michael R. Espey. Includes: (i) 249,625 shares owned by Mr. Espey; (ii) 20,000 vested but unexercised options exercisable at $8.50 per share granted on June 7, 1999; (iii) 30,000 vested but unexercised options exercisable at $11.50 per share granted on January 10, 2000; (iv) 20,000 vested but unexercised options exercisable at $7.91 per share granted on December 15, 2000; and (v) 3,040 vested but unexercised options exercisable at $3.16 per share granted on December 11, 2001. Does not include (i) 10,000 unvested options exercisable at $11.50 per share granted on January 10, 2000; (ii) 20,000 unvested options exercisable at $7.91 per share granted on December 15, 2000; (iii) 12,160 unvested options exercisable at $3.16 per share granted on December 11, 2001; (iv) 4,960 options that vest upon stockholder approval of Proposal Two, exercisable at $3.16 per share and granted on December 11, 2001; and (v) 19,840 unvested options exercisable at $3.16 per share granted on December 11, 2001 that are subject to stockholder approval of Proposal Two.

- (7)

- Robert G. Burford, Ph.D. Includes: (i) 2,500 vested but unexercised options exercisable at $4.70 per share granted on March 25, 1999; (ii) 7,500 vested but unexercised options exercisable at $7.20 per share granted on October 1, 1999; (iii) 50,000 vested but unexercised options exercisable at $8.125 per share granted on November 1, 1999; (iv) 50,000 vested but unexercised options exercisable at $7.91 per share granted on December 25, 2000; and (v) 7,600 vested but unexercised options exercisable at $3.16 per share granted on December 11, 2001. Does not

21

include (i) 50,000 unvested options exercisable at $8.125 per share granted on November 1, 1999; (ii) 50,000 unvested options exercisable at $7.91 per share granted on December 25, 2000; (iii) 30,400 unvested options exercisable at $3.16 per share granted on December 11, 2001; (iv) 12,400 options that vest upon stockholder approval of Proposal Two, exercisable at $3.16 per share and granted on December 11, 2001; and (v) 49,600 unvested options exercisable at $3.16 per share granted on December 11, 2001 that are subject to stockholder approval of Proposal Two.

- (8)

- Gosse B. Bruinsma, M.D. Includes: (i) 75,000 vested but unexercised options exercisable at $9.50 per share granted on October 10, 2000; (ii) 25,000 vested but unexercised options exercisable at $4.52 per share granted on May 11, 2001; (iii) 25,000 unexercised options exercisable at $4.52 per share granted on May 11, 2001 that will vest within 60 days; and (iv) 15,200 vested but unexercised options exercisable at $3.16 per share granted on December 11, 2001. Does not include (i) 75,000 unvested options exercisable at $9.50 per share granted on October 10, 2000; (ii) 60,800 unvested options exercisable at $3.16 per share granted on December 11, 2001; (iii) 24,800 options that vest upon stockholder approval of Proposal Two, exercisable at $3.16 per share and granted on December 11, 2001; and (iv) 99,200 unvested options exercisable at $3.16 per share granted on December 11, 2001 that are subject to stockholder approval of Proposal Two.

- (9)

- Abraham E. Cohen. Includes (i) 10,000 shares owned by Mr. Cohen; (ii) 30,000 vested but unexercised options exercisable at $11.00 per share granted on May 5, 2000; (iii) 10,000 unexercised options exercisable at $11.00 per share granted on May 5, 2000 that will vest within 60 days; (iv) 10,000 vested but unexercised options exercisable at $7.91 per share granted on December 15, 2000; and (v) 1,520 vested but unexercised options exercisable at $3.16 per share granted on December 11, 2001. Does not include (i) 10,000 unvested options exercisable at $11.00 per share granted on May 5, 2000; (ii) 10,000 unvested options exercisable at $7.91 per share granted on December 15, 2000; (iii) 6,080 unvested options exercisable at $3.16 per share granted on December 11, 2001; (iv) 2,480 options that vest upon stockholder approval of Proposal Two, exercisable at $3.16 per share and granted on December 11, 2001; and (v) 9,920 unvested options exercisable at $3.16 per share granted on December 11, 2001 that are subject to stockholder approval of Proposal Two.

- (10)

- Steven Espey is Michael Espey's stepfather. Mr. Espey's address is 358 East 69th Street, New York, NY 10021.

- (11)

- Kilkenny Capital Management, LLC. This information is derived from a Schedule 13G dated December 14, 2001 filed with the Securities and Exchange Commission by Kilkenny Capital Management, LLC ("Kilkenny"), Michael P. Walsh ("Walsh"), and KCM Biomedical L.P. ("KCM"). Kilkenny and Walsh hold 1,455,000 shares. Of the 1,455,000 shares held by Kilkenny and Walsh, 1,059,000 shares are held by KCM. Kilkenny is an investment advisor whose clients have the right to receive or the power to direct receipt of dividends from, or the proceeds from the sale of, the shares. Walsh is the manager of Kilkenny. Kilkenny is the general partner of KCM, an investment limited partnership. The address of Kilkenny, Walsh and KCM is One Financial Place, Suite 1021, Chicago, IL 60605.

Certain Relationships and Related Transactions.

On October 2, 2000, Axonyx entered into a Data Management and Reporting Services Agreement with Clinfo Systems, LLC. Robert G. Burford, Vice President, Product Development of Axonyx, is a founding member of Clinfo Systems and owns a fifty percent (50%) membership interest. Pursuant to the agreement, Clinfo Systems provides data management and reporting services in connection with certain clinical trials conducted by Axonyx. Axonyx paid Clinfo Systems $282,000 for services rendered,

22

of which $162,000 was paid during 2001. The agreement expired September 30, 2001, but was extended by mutual agreement through the end of the year. On January 2, 2001, Axonyx entered into a second Data Management and Reporting Services Agreement with Clinfo Systems. Pursuant to the second agreement, Clinfo Systems provides data management and reporting services in connection with certain other clinical trials conducted by Axonyx. Axonyx has paid Clinfo Systems $190,000 for services rendered in 2001. The second agreement expired July 31, 2001, but was extended by mutual agreement to allow for completion of the services. It is expected that an additional payment will be made in the amount of approximately $50,000 in 2002.

OTHER MATTERS

The management of the Company is not aware of any matter to be acted upon at the Annual Meeting other than the matters described above. However, if any other matter properly comes before the Annual Meeting, the proxy holders will vote the proxies thereon in accordance with their best judgment on such matter.

PROXY SOLICITATION

The Company will pay reasonable expenses incurred in forwarding proxy material to the beneficial owners of shares and in obtaining the written instructions of such beneficial owners. This Proxy Statement and the accompanying materials, in addition to being mailed directly to stockholders, will be distributed through brokers, custodians, nominees and other like parties to beneficial owners of shares of Common Stock. The Company will bear the expenses of calling and holding the Annual Meeting and the soliciting of proxies therefor.

The Company may consider the engagement of a proxy solicitation firm. Our directors, officers and employees may also solicit proxies by mail, telephone and personal contact. They will not receive any additional compensation for these activities.

STOCKHOLDER PROPOSALS FOR 2003 ANNUAL MEETING

Proposals which are the proper subject for inclusion in the proxy statement and for consideration at an annual meeting may be presented by stockholders. In order to be eligible to submit a proposal, a stockholder must have continuously held at least $2,000 in market value, or 1% of the Company's securities entitled to be voted on the proposal at the meeting for at least one year by the date the stockholder submits the proposal. In addition, the stockholder must continue to hold those securities through the date of the meeting. Under current SEC rules, to be included in Axonyx's proxy statement and proxy card, any proposal by a stockholder intended to be presented at the 2003 annual meeting of Stockholders must be received by Axonyx, subject to certain exceptions, no later than January 22, 2003. Any such proposal, including any accompanying supporting statement, may not exceed 500 words. Such proposal should be addressed to the Secretary of the Company, Michael R. Espey. In addition, the proxy solicited by the Board of Directors for the 2003 annual meeting of stockholders will confer discretionary authority to vote on any stockholder proposal raised at the 2003 annual meeting of stockholders that is not described in the 2003 proxy statement unless the Company has received notice of such proposal on or before the close of business on April 5, 2003. However, if the Company determines to change the date of the 2003 annual meeting of stockholders more than 30 days from June 11, 2003, the Company will provide stockholders with a reasonable time before the Company begins to print and mail its proxy materials for the 2003 annual meeting of stockholders in order to allow stockholders an opportunity to make proposals in accordance with the rules and regulations of the SEC.

23

ANNUAL REPORTS

Our 2002 Annual Report to Stockholders, which contains selected information from our Annual Report on Form 10-K, as amended, including its financial statements for the year ended December 31, 2001, accompanies this proxy statement.Axonyx's Annual Report on Form 10-K, as amended, for the year ended December 31, 2001 will also be made available (without exhibits), free of charge, to interested stockholders upon written or oral request to Victoria Trahan, Officer Manager, 825 Third Avenue, 40th Floor, New York, New York 10022, telephone (212) 688-4770.

| | | BY ORDER OF THE BOARD OF DIRECTORS |

| | | |

| | | |

| | | /s/ MARVIN S. HAUSMAN, M.D.

Marvin S. Hausman, M.D.

President & Chief Executive Officer |

May 20, 2002

24

APPENDICES

Appendix A: Summary of Axonyx Inc. 2000 Stock Option Plan (as Amended and Restated)