McCarthy as Speaker. With the stopgap bill keeping the government funded only through November 17 and the U.S. House effectively closed for business until a new Speaker is elected, investors have jumped from one frying pan into another.

It’s uncomfortable being in the frying pan and nobody knows for sure how this will all play out, certainly not us. That said, we will not be surprised if the tenor of the stock market continues to be negative and volatile as we near the precipice of a shutdown (again). In rocky times like these it’s crucial to remember we own companies with real, profitable businesses, not a bunch of stock ticker symbols. While a company’s stock price can change rapidly from day-to-day, the value of the underlying business is much more stable.

We think you’ll experience a lot less stress and anxiety if you turn off the TV and instead keep these thoughts in mind:

Stay calm. Since 1980 there have been twelve bear markets (declines of 20% or more). They are a scary, but normal part of your investment journey.

Stay in. According to Crandall-Pierce, if you invested $100 in the S&P 500 on January 1, 1973 and left it alone, you would have had $3,252.44 on December 31, 2022 (and 2022 was a terrible year). However, if you had missed only the single best day in each of those 50 years because you got scared, you would have had only $540.23.

Stay the course. The longer your investment time horizon, the less volatility you will experience and the higher your odds for a positive outcome. From January 1950 through December 2022, rolling one-year returns were positive 79% of the time (range -43.3% to 61.2%). Rolling ten-year returns were positive 97% of the time (range shrank to -3.4% to 19.5%).

Periods ending September 30, 2023(2)

(Total Returns-Dividends Reinvested in Index-Annualized)

| | KM Value Fund(1) | S&P 500 Index(3) |

| Six-months | 2.62% | 5.18% |

| One-year | 21.36% | 21.62% |

| Two-years | 1.11% | 1.39% |

| Three-years | 12.99% | 10.15% |

| Five-years | 4.03% | 9.92% |

| Ten-years | 5.35% | 11.91% |

| Since Inception | | |

| (December 31, 1998) | 6.89% | 7.16% |

The Fund’s Gross Expense Ratio and Net Expense Ratio were 1.66% and 1.45%, respectively, according to the Prospectus dated January 27, 2023. Contractual fee waivers are in effect until February 28, 2024.

Performance data quoted represents past performance; past performance is no guarantee of future results. The investment return and principal value of an investment will fluctuate so that an investor’s shares, when redeemed, may be worth more or less than their original cost. Current performance of the fund may be lower or higher than the performance quoted. Performance data current to the most recent month-end may be obtained by calling 1-800-870-8039. The fund imposes a 1.00% redemption fee on shares held less than 30 days. Performance data quoted does not reflect the redemption fee. If reflected, total returns would be reduced.

| (1) | The performance data quoted assumes the reinvestment of capital gains and income distributions. The performance does not reflect the deduction of taxes that a shareholder would pay on Fund distributions or the redemption of Fund shares. |

| (2) | One-year, two-years, three-years, five-years, ten-years and Since Inception returns are Average Annualized Returns. |

| (3) | The S&P 500 Index is an unmanaged, capitalization-weighted index generally representative of the U.S. market for large-capitalization stocks. This Index cannot be invested in directly. |

KIRR, MARBACH PARTNERS

VALUE FUND

Percent Change in Top Ten Holdings from Book Cost (as of 9/30/2023)

| 1. | EMCOR Group, Inc. | +5094.9% | | 6. | Colliers International Group, Inc. | +150.5% |

| 2. | AutoZone, Inc. | +2263.0% | | 7. | Republic Services, Inc. | +74.3% |

| 3. | Broadcom, Inc. | +250.1% | | 8. | Canadian Pacific Railway Ltd. | +2401.2% |

| 4. | Constellation Software Inc. | +114.9% | | 9. | Marathon Petroleum Corp. | +150.7% |

| 5. | Aon Plc. | +229.6% | | 10. | Markel Group Inc. | +372.5% |

Performance quoted represents past performance and is no guarantee of future results.

Fund holdings and sector allocations are subject to change and are not recommendations to buy or sell any security.

Regards,

|  |

| | |

| Mark D. Foster, CFA | Mickey Kim, CFA |

| President | Vice-President, Treasurer and Secretary |

Past performance is not a guarantee of future results.

Mutual fund investing involves risk. Principal loss is possible.

Value Fund invests in foreign securities, which involves greater volatility and political, economic and currency risks and differences in accounting methods. Value Fund may also invest in small- and medium-capitalization companies, which tend to have more limited liquidity and greater price volatility than large-capitalization companies.

Please refer to the Schedule of Investments for complete fund holdings information.

The information provided herein represents the opinion of Value Fund’s investment adviser and is not intended to be a forecast of future events, a guarantee of future results, nor investment advice.

This material must be preceded or accompanied by a current Prospectus.

Quasar Distributors, LLC is the Distributor for Value Fund.

KIRR, MARBACH PARTNERS

VALUE FUND

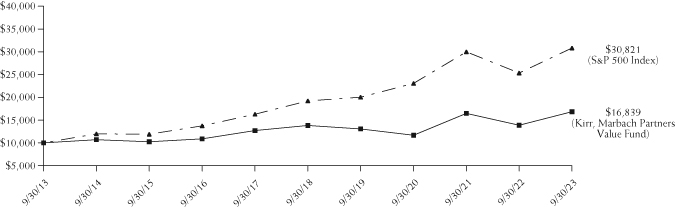

Value of $10,000 Investment (Unaudited)

This chart assumes an initial investment of $10,000. Performance reflects fee waivers in effect. In the absence of fee waivers, total return would be reduced. Past performance is not predictive of future performance. Investment return and principal value will fluctuate, so that your shares, when redeemed maybe worth more or less than their original cost. Performance assumes the reinvestment of capital gains and income distributions. The performance does not reflect the deduction of taxes that a shareholder would pay on Fund distributions or the redemption of Fund shares.

| | Average Annual Rate of Return (%) |

| | | | | |

| | One Year Ended | Five Years Ended | Ten Years Ended | Since Inception* to |

| | September 30, 2023 | September 30, 2023 | September 30, 2023 | September 30, 2023 |

| Kirr Marbach Partners Value Fund | 21.36% | 4.03% | 5.35% | 6.89% |

| S&P 500 Index** | 21.62% | 9.92% | 11.91% | 7.16% |

| * | | December 31, 1998. |

| ** | | The Standard & Poor’s 500 Index (S&P 500) is an unmanaged, capitalization-weighted index generally representative of the U.S. market for large capitalization stocks. This Index cannot be invested in directly. |

KIRR, MARBACH PARTNERS

VALUE FUND

Expense Example

September 30, 2023 (Unaudited)

As a shareholder of the Fund, you incur two types of costs: (1) transaction costs, which may include redemption fees; and exchange fees; and (2) ongoing costs, including management fees; distribution fees; and other Fund expenses. This Example is intended to help you understand your ongoing costs (in dollars) of investing in the Fund and to compare these costs with the ongoing costs of investing in other mutual funds. The Example is based on an investment of $1,000 invested at the beginning of the period and held for the entire period (April 1, 2023 – September 30, 2023).

Actual Expenses

The first line of the table below provides information about actual account values and actual expenses. Although the Fund charges no sales load or transaction fees, you will be assessed fees for outgoing wire transfers, returned checks and stop payment orders at prevailing rates charged by U.S. Bancorp Fund Services, LLC, doing business as U.S. Bank Global Fund Services, the Fund’s transfer agent. If you request that a redemption be made by wire transfer, currently a $15.00 fee is charged by the Fund’s transfer agent. You will be charged a transaction fee equal to 1.00% of the net amount of the redemption if you redeem your shares within 30 days of purchase. IRA accounts will be charged a $15.00 annual maintenance fee. To the extent the Fund invests in shares of other investment companies as part of its investment strategy, you will indirectly bear your proportionate share of any fees and expenses charged by the underlying funds in which the Fund invests in addition to the expenses of the Fund. Actual expenses of the underlying funds are expected to vary among the various underlying funds. These expenses are not included in the example below. The example below includes, but is not limited to, management fees, shareholder servicing fees, fund accounting, custody and transfer agent fees. However, the example below does not include portfolio trading commissions and related expenses, interest expense and other extraordinary expenses as determined under generally accepted accounting principles. You may use the information in this line, together with the amount you invested, to estimate the expenses that you paid over the period. Simply divide your account value by $1,000 (for example, an $8,600 account value divided by $1,000 = 8.6), then multiply the result by the number in the first line under the heading entitled “Expenses Paid During Period” to estimate the expenses you paid on your account during this period.

Hypothetical Example For Comparison Purposes

The second line of the table below provides information about hypothetical account values and hypothetical expenses based on the Fund’s actual expense ratio and an assumed rate of return of 5% per year before expenses, which is not the Fund’s actual return. The hypothetical account values and expenses may not be used to estimate the actual ending account balance or expenses you paid for the period. You may use this information to compare the ongoing costs of investing in the Fund and other funds. To do so, compare this 5% hypothetical example with the 5% hypothetical examples that appear in the shareholder reports of the other funds.

Please note that the expenses shown in the table are meant to highlight your ongoing costs only and do not reflect any transactional costs, such as redemption fees, or exchange fees. Therefore, the second line of the table is useful in comparing ongoing costs only, and will not help you determine the relative total costs of owning different funds. In addition, if these transactional costs were included, your costs would have been higher.

| | Beginning | Ending | Expense Paid |

| | Account Value | Account Value | During Period |

| | 4/1/23 | 9/30/23 | 4/1/23 – 9/30/23(1) |

| Actual | $1,000.00 | $1,026.20 | $7.37 |

| Hypothetical (5% return before expenses) | 1,000.00 | 1,017.80 | 7.33 |

| (1) | Expenses are equal to the Fund’s annualized expense ratio after reimbursement of 1.45% multiplied by the average account value over the period, multiplied by 183/365 to reflect the one-half year period. The annualized expense ratio prior to reimbursement was 1.55%. |

KIRR, MARBACH PARTNERS

VALUE FUND

Allocation of Portfolio Net Assets (Unaudited)

September 30, 2023

Top Ten Equity Holdings (Unaudited)

as of September 30, 2023

(% of net assets)

| | EMCOR Group, Inc | | | 6.9 | % |

| | AutoZone, Inc. | | | 6.4 | % |

| | Broadcom, Inc. | | | 5.1 | % |

| | Constellation Software, Inc. | | | 4.4 | % |

| | Aon Plc – Class A | | | 4.4 | % |

| | Colliers International Group, Inc | | | 4.3 | % |

| | Republic Services, Inc. | | | 4.1 | % |

| | Canadian Pacific Railway Ltd. | | | 3.9 | % |

| | Marathon Petroleum Corp. | | | 3.9 | % |

| | Markel Group, Inc. | | | 3.9 | % |

KIRR, MARBACH PARTNERS

VALUE FUND

Schedule of Investments

September 30, 2023

| Number | | | | | |

| of Shares | | | | Value | |

| | | COMMON STOCKS – 95.5% | | | |

| | | | | | |

| | | Basic Materials – 2.5% | | | |

| | 16,507 | | Innospec, Inc. | | $ | 1,687,015 | |

| | | | | | | | |

| | | | Communications – 7.8% | | | | |

| | 19,570 | | Alphabet, Inc. – Class A^ | | | 2,560,930 | |

| | 13,190 | | Anterix, Inc.^ | | | 413,902 | |

| | 20,150 | | eBay, Inc. | | | 888,414 | |

| | 30,880 | | Liberty Media | | | | |

| | | | Corp-Liberty SiriusXM^ | | | 786,205 | |

| | 5,350 | | Liberty Media | | | | |

| | | | Corp-Liberty SiriusXM – Class A^ | | | 136,157 | |

| | 7,170 | | The Walt Disney Co.^ | | | 581,129 | |

| | | | | | | 5,366,737 | |

| | | | | | | | |

| | | | Consumer Cyclical – 14.6% | | | | |

| | 1,733 | | AutoZone, Inc.^ | | | 4,401,803 | |

| | 23,019 | | Dollar Tree, Inc.^ | | | 2,450,372 | |

| | 1,337 | | Liberty Media Corp-Liberty | | | | |

| | | | Live – Class A^ | | | 42,677 | |

| | 7,720 | | Liberty Media Corp-Liberty | | | | |

| | | | Live – Class C^ | | | 247,812 | |

| | 50,380 | | The Shyft Group, Inc. | | | 754,189 | |

| | 15,043 | | Visteon Corp.^ | | | 2,076,987 | |

| | | | | | | 9,973,840 | |

| | | | | | | | |

| | | | Consumer Non Cyclical – 12.6% | | | | |

| | 159,370 | | Alight, Inc. – Class A^ | | | 1,129,933 | |

| | 36,980 | | API Group Corp.^ | | | 958,892 | |

| | 21,471 | | The Brink’s Co. | | | 1,559,653 | |

| | 30,611 | | Colliers International Group, Inc. | | | 2,915,698 | |

| | 4,675 | | ICU Medical, Inc.^ | | | 556,372 | |

| | 18,410 | | Inmode Ltd.^ | | | 560,769 | |

| | 20,590 | | Stride, Inc.^ | | | 927,168 | |

| | | | | | | 8,608,485 | |

| | | | | | | | |

| | | | Energy – 7.9% | | | | |

| | 43,825 | | Coterra Energy, Inc. | | | 1,185,466 | |

| | 17,723 | | Marathon Petroleum Corp. | | | 2,682,199 | |

| | 6,640 | | Pioneer Natural Resources Co. | | | 1,524,212 | |

| | | | | | | 5,391,877 | |

| | | | | | | | |

| | | | Financial – 13.2% | | | | |

| | 9,300 | | Aon Plc – Class A | | | 3,015,246 | |

| | 6,821 | | Brookfield Asset | | | | |

| | | | Management Ltd. – Class A | | | 227,412 | |

| | 41,120 | | Brookfield Corp. | | | 1,285,822 | |

| | 1,816 | | Markel Group, Inc.^ | |

| 2,674,042 | |

| | 27,024 | | Voya Financial, Inc. | | | 1,795,745 | |

| | | | | | | 8,998,267 | |

| | | | | | | | |

| | | | Industrial – 21.5% | | | | |

| | 36,270 | | Canadian Pacific Kansas City Ltd. | | | 2,698,851 | |

| | 22,393 | | EMCOR Group, Inc. | | | 4,711,263 | |

| | 20,654 | | GXO Logistics, Inc.^ | | | 1,211,357 | |

| | 35,164 | | MasTec, Inc.^ | | | 2,530,753 | |

| | 19,485 | | Republic Services, Inc. | | | 2,776,807 | |

| | 39,844 | | RXO, Inc.^ | | | 786,122 | |

| | | | | | | 14,715,153 | |

| | | | | | | | |

| | | | Technology – 12.4% | | | | |

| | 4,208 | | Broadcom, Inc. | | | 3,495,081 | |

| | 1,465 | | Constellation Software, Inc. | | | 3,024,452 | |

| | 4,395 | | Lumine Group, Inc.^ | | | 65,104 | |

| | 33,582 | | SS&C Technologies Holdings, Inc. | | | 1,764,398 | |

| | 2,725 | | Topicus.com, Inc.^ | | | 180,002 | |

| | | | | | | 8,529,037 | |

| | | | | | | | |

| | | | Utilities – 3.0% | | | | |

| | 62,769 | | Vistra Energy Corp. | | | 2,082,675 | |

| | | | TOTAL COMMON STOCKS | | | | |

| | | | (Cost $30,248,404) | | | 65,353,086 | |

| | | | | | | | |

| | | | WARRANT – 0.0% | | | | |

| | | | | | | | |

| | | | Technology – 0.0% | | | | |

| | 1,465 | | Constellation Software, Inc.^* | | | | |

| | | | Exercise Price: $40.00, 03/31/2040 | | | — | |

| | | | TOTAL WARRANT | | | | |

| | | | (Cost $–) | | | — | |

| | | | | | | | |

| | | | MONEY MARKET FUND – 4.6% | | | | |

| | 3,165,071 | | First American Government | | | | |

| | | | Obligations Fund – | | | | |

| | | | Class X, 5.26%** | | | 3,165,071 | |

| | | | (Cost $3,165,071) | | | | |

| | | | Total Investments | | | | |

| | | | (Cost $33,413,475) – 100.1% | | | 68,518,157 | |

| | | | Other Assets and Liabilities, | | | | |

| | | | Net – (0.1)% | | | (94,255 | ) |

| | | | TOTAL NET ASSETS – 100.0% | | $ | 68,423,902 | |

| ^ | | Non-income producing security. |

| * | | Level 3 Security. |

| ** | | Rate in effect as of September 30, 2023. |

See Notes to the Financial Statements

KIRR, MARBACH PARTNERS

VALUE FUND

Statement of Assets and Liabilities

September 30, 2023

| ASSETS: | | | |

| Investments, at current value | | | |

| (cost $33,413,475) | | $ | 68,518,157 | |

| Cash | | | 1,855 | |

| Dividends receivable | | | 17,057 | |

| Prepaid expenses | | | 15,405 | |

| Interest receivable | | | 8,254 | |

| Receivable for Fund shares sold | | | 1,137 | |

| Total Assets | | | 68,561,865 | |

| | | | | |

| LIABILITIES: | | | | |

| Payable to Adviser | | | 52,202 | |

| Payable for legal fees | | | 34,024 | |

| Payable for audit fees | | | 22,200 | |

| Accrued expenses | | | 25,578 | |

| Accrued distribution fees | | | 3,959 | |

| Total liabilities | | | 137,963 | |

| | | | | |

| NET ASSETS | | $ | 68,423,902 | |

| | | | | |

| NET ASSETS CONSIST OF: | | | | |

| Capital Stock | | | 30,393,871 | |

| Total Distributable Earnings | | | 38,030,031 | |

| Total Net Assets | | $ | 68,423,902 | |

| | | | | |

| Shares outstanding (500,000,000 shares | | | | |

| of $0.01 par value authorized) | | | 2,684,970 | |

Net asset value and offering price per share(1) | | $ | 25.48 | |

| (1) | A redemption fee is assessed against shares redeemed within 30 days of purchase. |

Statement of Operations

Year Ended September 30, 2023

| INVESTMENT INCOME: | | | |

| Dividend income | | | |

| (net of withholding of $7,761) | | $ | 679,888 | |

| Interest income | | | 135,313 | |

| Total Investment Income | | | 815,201 | |

| | | | | |

| EXPENSES: | | | | |

| Investment Adviser fees | | | 685,416 | |

| Legal fees | | | 102,842 | |

| Administration fees | | | 57,018 | |

| Distribution fees | | | 56,574 | |

| Transfer agent fees | | | 37,316 | |

| Federal & state registration fees | | | 29,522 | |

| Fund accounting fees | | | 26,721 | |

| Audit fees | | | 22,200 | |

| Custody fees | | | 14,820 | |

| Postage & printing fees | | | 13,154 | |

| Directors fees | | | 11,999 | |

| Other | | | 6,296 | |

| Total expenses before reimbursement | | | 1,063,878 | |

| Less: Reimbursement from Investment Adviser | | | (70,026 | ) |

| Net Expenses | | | 993,852 | |

| | | | | |

| NET INVESTMENT LOSS | | | (178,651 | ) |

| | | | | |

| REALIZED AND UNREALIZED | | | | |

| GAIN ON INVESTMENTS: | | | | |

| Net realized gain on investments | | | 2,764,809 | |

| Net change in unrealized | | | | |

| appreciation on investments | | | 10,036,119 | |

| | | | | |

| Net realized and unrealized | | | | |

| gain on investments | | | 12,800,928 | |

| | | | | |

| NET INCREASE IN NET ASSETS | | | | |

| RESULTING FROM OPERATIONS | | $ | 12,622,277 | |

See Notes to the Financial Statements

KIRR, MARBACH PARTNERS

VALUE FUND

Statements of Changes in Net Assets

| | | Year ended | | | Year ended | |

| | | September 30, 2023 | | | September 30, 2022 | |

| OPERATIONS: | | | | | | |

| Net investment loss | | $ | (178,651 | ) | | $ | (601,414 | ) |

| Net realized gain on investments | | | 2,764,809 | | | | 1,901,816 | |

| Net change in unrealized appreciation (depreciation) on investments | | | 10,036,119 | | | | (12,429,724 | ) |

| Net increase (decrease) in net assets resulting from operations | | | 12,622,277 | | | | (11,129,322 | ) |

| | | | | | | | | |

| CAPITAL SHARE TRANSACTIONS: | | | | | | | | |

| Proceeds from shares sold | | | 1,000,707 | | | | 2,696,741 | |

| Proceeds from reinvestment of distributions | | | 2,174,488 | | | | 2,717,301 | |

| Payments for shares redeemed | | | (4,386,026 | ) | | | (4,107,579 | ) |

| Redemption fees | | | — | | | | 1 | |

| Net decrease (increase) in net assets resulting from capital share transactions | | | (1,210,831 | ) | | | 1,306,464 | |

| | | | | | | | | |

| DISTRIBUTIONS TO SHAREHOLDERS: | | | (2,259,496 | ) | | | (2,823,959 | ) |

| | | | | | | | | |

| TOTAL INCREASE (DECREASE) IN NET ASSETS | | | 9,151,950 | | | | (12,646,817 | ) |

| | | | | | | | | |

| NET ASSETS: | | | | | | | | |

| Beginning of year | | | 59,271,952 | | | | 71,918,769 | |

| End of year | | $ | 68,423,902 | | | $ | 59,271,952 | |

| | | | | | | | | |

| CHANGES IN SHARES OUTSTANDING: | | | | | | | | |

| Shares sold | | | 40,093 | | | | 101,382 | |

| Shares issued to holders in reinvestment of dividends | | | 93,890 | | | | 98,275 | |

| Shares redeemed | | | (174,681 | ) | | | (154,546 | ) |

| Net increase (decrease) in shares outstanding | | | (40,698 | ) | | | 45,111 | |

See Notes to the Financial Statements

KIRR, MARBACH PARTNERS

VALUE FUND

Financial Highlights

For a Fund share outstanding throughout the year.

| | Year Ended September 30, | |

| | | 2023 | | | 2022 | | | 2021 | | | 2020 | | | 2019 | |

| PER SHARE DATA: | | | | | | | | | | | | | | | |

| | | | | | | | | | | | | | | | |

| Net asset value, beginning of year | | $ | 21.75 | | | $ | 26.83 | | | $ | 19.27 | | | $ | 22.01 | | | $ | 25.49 | |

| | | | | | | | | | | | | | | | | | | | | |

| Investment operations: | | | | | | | | | | | | | | | | | | | | |

| Net investment loss | | | (0.07 | ) | | | (0.22 | ) | | | (0.14 | ) | | | (0.08 | ) | | | (0.05 | ) |

| Net realized and unrealized gain (loss) on investments | | | 4.63 | | | | (3.79 | ) | | | 8.01 | | | | (2.18 | ) | | | (1.71 | ) |

| Total from investment operations | | | 4.56 | | | | (4.01 | ) | | | 7.87 | | | | (2.26 | ) | | | (1.76 | ) |

| | | | | | | | | | | | | | | | | | | | | |

| Less distributions: | | | | | | | | | | | | | | | | | | | | |

| Dividends from net investment income | | | — | | | | — | | | | — | | | | — | | | | — | |

| Dividends from net capital gains | | | (0.83 | ) | | | (1.07 | ) | | | (0.31 | ) | | | (0.48 | ) | | | (1.72 | ) |

| Total distributions | | | (0.83 | ) | | | (1.07 | ) | | | (0.31 | ) | | | (0.48 | ) | | | (1.72 | ) |

| | | | | | | | | | | | | | | | | | | | | |

| Paid in capital from redemption fees | | | — | | | | — | (1) | | | — | (1) | | | — | | | | — | (1) |

| | | | | | | | | | | | | | | | | | | | | |

| Net asset value, end of year | | $ | 25.48 | | | $ | 21.75 | | | $ | 26.83 | | | $ | 19.27 | | | $ | 22.01 | |

| | | | | | | | | | | | | | | | | | | | | |

| TOTAL RETURN | | | 21.36 | % | | | -15.80 | % | | | 41.12 | % | | | -10.59 | % | | | -5.53 | % |

| | | | | | | | | | | | | | | | | | | | | |

| SUPPLEMENTAL DATA AND RATIOS: | | | | | | | | | | | | | | | | | | | | |

| Net assets, end of year (in millions) | | $ | 68.4 | | | $ | 59.3 | | | $ | 71.9 | | | $ | 54.1 | | | $ | 68.2 | |

| Ratio of expenses to average net assets: | | | | | | | | | | | | | | | | | | | | |

| Before expense reimbursement/recoupment | | | 1.55 | % | | | 1.66 | % | | | 1.60 | % | | | 1.64 | % | | | 1.54 | % |

| After expense reimbursement/recoupment | | | 1.45 | % | | | 1.45 | % | | | 1.45 | % | | | 1.45 | % | | | 1.45 | % |

| Ratio of net investment income (loss) to average net assets: | | | | | | | | | | | | | | | | | | | | |

| Before expense reimbursement/recoupment | | | (0.36 | )% | | | (1.06 | )% | | | (0.73 | )% | | | (0.65 | )% | | | (0.34 | )% |

| After expense reimbursement/recoupment | | | (0.26 | )% | | | (0.84 | )% | | | (0.58 | )% | | | (0.46 | )% | | | (0.25 | )% |

| Portfolio turnover rate | | | 10 | % | | | 14 | % | | | 9 | % | | | 23 | % | | | 22 | % |

(1) | Less than $0.01 per share. |

See Notes to the Financial Statements

KIRR, MARBACH PARTNERS

VALUE FUND

Notes to the Financial Statements

September 30, 2023

1. ORGANIZATION AND SIGNIFICANT ACCOUNTING POLICIES

Kirr, Marbach Partners Funds, Inc. (the “Corporation”) was organized as a Maryland corporation on September 23, 1998 and is registered under the Investment Company Act of 1940, as amended (the “1940 Act”), as an open-end diversified management investment company issuing its shares in series, each series representing a distinct portfolio with its own investment objective and policies. The Fund is an investment company and accordingly follows the investment company accounting and reporting guidance of the Financial Accounting Standards Board (FASB) Accounting Standards Codification Topic 946 “Financial Services-Investment Companies.” The one series presently authorized is Kirr, Marbach Partners Value Fund (the “Fund”). The investment objective of the Fund is to seek long-term capital growth. The Fund commenced operations on December 31, 1998.

The following is a summary of significant accounting policies consistently followed by the Fund. These policies are in conformity with generally accepted accounting principles in the United States of America (“GAAP”).

| | a) | Investment Valuation – Securities listed on the Nasdaq National Market are valued at the Nasdaq Official Closing Price (“NOCP”). Other securities traded on a national securities exchange (including options on indices so traded) are valued at the last sales price on the exchange where the security is primarily traded. Exchange-traded securities for which there were no transactions and Nasdaq-traded securities for which there is no NOCP are valued at the mean of the bid and asked prices. If market quotations are not readily available or if a significant event has occurred that indicates the closing price of a security no longer represents the true value of that security, any security or other asset will be valued at its fair value in accordance with rule 2a-5 under the 1940 Act. The Board of Directors has designated the Adviser as the Fund’s valuation designee (the “Valuation Designee”) to make all fair value determinations with respect to the Fund’s portfolio investments, subject to the Board’s oversight. As the Valuation Designee, the Adviser has adopted and implemented policies and procedures to be followed when the Fund must utilize fair value. Foreign securities have been issued by foreign private issuers registered on United States exchanges in accordance with Section 12 of the Securities Exchange Act of 1934. Debt securities, including short-term debt instruments having maturities less than 60 days, are valued at the mean between the bid and asked prices as reported by an approved pricing service. |

| | | |

| | | The Fund has performed an analysis of all existing investments to determine the significance and character of all inputs to their fair value determination. Various inputs are used in determining the value of each of the Fund’s investments. These inputs are summarized in the following three broad categories: |

| | | Level 1 – | Unadjusted quoted prices in active markets for identical assets or liabilities that the company has the ability to access. |

| | | | |

| | | Level 2 – | Observable inputs other than quoted prices included in Level 1 that are observable for the asset or liability either directly or indirectly. These inputs may include quoted prices for the identical instruments on an inactive market, prices for similar instruments, interest rates, prepayment speeds, credit risk, yield curves, default rates, and similar data. |

| | | | |

| | | Level 3 – | Unobservable inputs for the asset or liability to the extent that relevant observable inputs are not available, representing the company’s own assumptions about the assumptions that a market participant would use in valuing the asset or liability, and that would be based on the best information available. |

KIRR, MARBACH PARTNERS

VALUE FUND

Notes to the Financial Statements (Continued)

September 30, 2023

| | | The availability of observable inputs can vary from security to security and is affected by a wide variety of factors, including, for example, the type of security, whether the security is new and not yet established in the marketplace, the liquidity of markets, and other characteristics particular to the security. To the extent that valuation is based on models or inputs that are less observable or unobservable in the market, the determination of fair value requires more judgment. Accordingly, the degree of judgment exercised in determining fair value is greatest for instruments categorized in Level 3. |

| | | |

| | | The inputs used to measure fair value may fall into different levels of the fair value hierarchy. In such cases, for disclosure purposes, the level in the fair value hierarchy within which the fair value measurement falls in its entirety, is determined based on the lowest level input that is significant to the fair value measurement in its entirety. |

| | | |

| | | The inputs or methodology used for valuing securities are not an indication of the risk associated with investing in those securities. The following is a summary of the inputs used to value the Fund’s investments as of September 30, 2023: |

| | | | | Level 1 | | | Level 2 | | | Level 3 | | | Total | |

| | | Common Stocks | | $ | 65,353,086 | | | $ | — | | | $ | — | | | $ | 65,353,086 | |

| | | Short-Term Investment | | | 3,165,071 | | | | — | | | | — | | | | 3,165,071 | |

| | | Warrant | | | — | | | | — | | | | 0 | | | | 0 | |

| | | Total Investments | | $ | 68,518,157 | | | $ | — | | | $ | 0 | | | $ | 68,518,157 | |

| | | Refer to the Schedule of Investments for industry classifications. |

| | | |

| | b) | Federal Income Taxes – A provision, for federal income taxes or excise taxes, has not been made since the Fund has elected to be taxed as a “regulated investment company” and intends to distribute substantially all taxable income to its shareholders and otherwise comply with the provisions of the Internal Revenue Code applicable to regulated investment companies. There is no tax liability resulting from unrecognized tax benefits relating to uncertain income tax positions taken or expected to be taken on the tax return for the fiscal year ended September 30, 2023, or for any other tax years which are open for exam. As of September 30, 2023, open tax years include the tax years ended September 30, 2020 through 2023. The Fund is also not aware of any tax positions for which it is reasonably possible that the total amounts of unrecognized tax benefits will significantly change in the next twelve months. The Fund recognizes interest and penalties, if any, related to unrecognized tax benefits as income tax expense in the Statement of Operations. During the year ended September 30, 2023, the Fund did not incur any interest or penalties. |

| | | |

| | c) | Income and Expenses – The Fund is charged for those expenses that are directly attributable to the Fund, such as advisory, administration and certain shareholder service fees. |

| | | |

| | d) | Distributions to Shareholders – Dividends from net investment income and distributions of net realized capital gains, if any, will be declared and paid at least annually. The character of distributions made during the year from net investment income or net realized gains may differ from the characterization for federal income tax purposes due to differences in the recognition of income, expense and gain items for financial statement and tax purposes. All short term capital gains are included in ordinary income for tax purposes. |

KIRR, MARBACH PARTNERS

VALUE FUND

Notes to the Financial Statements (Continued)

September 30, 2023

| | e) | Use of Estimates – The preparation of financial statements in conformity with GAAP requires management to make estimates and assumptions that affect the reported amounts of assets and liabilities and disclosure of contingent assets and liabilities at the date of the financial statements and the reported amounts of revenues and expenses during the reporting year. Actual results could differ from those estimates. |

| | | |

| | f) | Repurchase Agreements – The Fund may enter into repurchase agreements with certain banks or non-bank dealers. The Adviser will monitor, on an ongoing basis, the value of the underlying securities to ensure that the value always equals or exceeds the repurchase price plus accrued interest. |

| | | |

| | g) | Security Transactions and Investment Income – The Fund follows industry practice and records security transactions on the trade date. Realized gains and losses on sales of securities are calculated on the basis of identified cost. Dividend income is recorded on the ex-dividend date and interest income is recorded on an accrual basis. Withholding taxes on foreign dividends have been provided for in accordance with the Fund’s understanding of the applicable country’s tax rules and regulations. Discounts and premiums on securities purchased are amortized over the expected life of the respective securities. |

| | | |

| | | The Fund distributes all net investment income, if any, and net realized capital gains, if any, annually. Distributions to shareholders are recorded on the ex-dividend date. The treatment for financial reporting purposes of distributions made to shareholders during the year from net investment income or net realized capital gains may differ from their ultimate treatment for federal income tax purposes. These differences are caused primarily by differences in the timing of the recognition of certain components of income, expense or realized capital gain for federal income tax purposes. Where such differences are permanent in nature, GAAP requires that they be reclassified in the components of the net assets based on their ultimate characterization for federal income tax purposes. Any such reclassifications will have no effect on net assets, results of operations or net asset values per share of the Fund. |

| | | |

| | | For the year ended September 30, 2023, the following table shows the reclassifications made: |

| | Distributable Earnings | Paid In Capital | |

| | $482,325 | $(482,325) | |

| | h) | Market Events Risk – Certain local, regional or global events such as war, acts of terrorism, the spread of infectious illnesses and/or other public health issues, or other events may have a significant impact on a security or instrument. These types of events and other like them are collectively referred to as “Market Disruptions and Geopolitical Risks” and they may have adverse impacts on the worldwide economy, as well as the economies of individual countries, the financial health of individual companies and the market in general in significant and unforeseen ways. Some of the impacts noted in recent times include but are not limited to embargos, political actions, supply chain disruptions, restrictions to investment and/or monetary movement including the forced selling of securities or the inability to participate impacted markets. The duration of these events could adversely affect the Fund’s performance, the performance of the securities in which the Fund invests and may lead to losses on your investment. The ultimate impact of “Market Disruptions and Geopolitical Risks” on the financial performance of the Fund’s investments is not reasonably estimable at this time. Management is actively monitoring these events. |

| | i) | Subsequent Events – Management has evaluated Fund related events and transactions that occurred subsequent to September 30, 2023 through the date of issuance of the Fund’s financial statements. |

KIRR, MARBACH PARTNERS

VALUE FUND

Notes to the Financial Statements (Continued)

September 30, 2023

2. INVESTMENT TRANSACTIONS

The aggregate purchases and sales of securities, excluding short-term investments, by the Fund for the year ended September 30, 2023, were as follows:

| | | Purchases | | | Sales | |

| U.S. Government | | $ | — | | | $ | — | |

| Other | | | 6,417,552 | | | | 9,133,275 | |

At September 30, 2023, the components of distributable earnings on a tax basis were as follows:

| Cost of Investments | | $ | 32,760,609 | |

| Gross unrealized appreciation | | $ | 36,671,497 | |

| Gross unrealized depreciation | | $ | (913,968 | ) |

| Net unrealized appreciation | | $ | 35,757,529 | |

| Undistributed ordinary income | | $ | — | |

| Undistributed long-term capital gain | | $ | 2,407,020 | |

| Total distributable earnings | | $ | 2,407,020 | |

| Other accumulated losses | | $ | (134,518 | ) |

| Total accumulated earnings | | $ | 38,030,031 | |

As of September 30, 2023, the Fund did not have any capital loss carryovers. A regulated investment company may elect for any taxable year to treat any portion of any qualified late year loss as arising on the first day of the next taxable year. Qualified late year losses are certain capital, and ordinary losses which occur during the portion of the Fund’s taxable year subsequent to October 31. For the taxable year ended September 30, 2023, the Fund deferred $134,518 in qualified late year losses.

The tax character of distributions paid during the year ended September 30, 2023, were as follows:

| Ordinary Income* | Long Term Capital Gains** | Total |

| $— | $2,259,496 | $2,259,496 |

The tax character of distributions paid during the year ended September 30, 2022, were as follows:

| Ordinary Income* | Long Term Capital Gains** | Total |

| $1,022,133 | $1,821,826 | $2,823,959 |

| * | For Federal income tax purposes, distributions of short-term capital gains are treated as ordinary income. |

| ** | The Fund also designates as distributions of long-term gains, to the extent necessary to fully distribute such capital gains, earnings and profits distributed to shareholders on the redemption of shares. |

3. AGREEMENTS

The Fund has entered into an Investment Advisory Agreement with Kirr, Marbach & Company, LLC (the “Investment Adviser”). Pursuant to its advisory agreement with the Fund, the Investment Adviser is entitled to receive a fee, calculated daily and payable monthly, at the annual rate of 1.00% as applied to the Fund’s daily net assets.

KIRR, MARBACH PARTNERS

VALUE FUND

Notes to the Financial Statements (Continued)

September 30, 2023

The Investment Adviser has contractually agreed to waive its management fee and/or reimburse the Fund’s other expenses to the extent necessary to ensure that the Fund’s total annual operating expenses (excluding acquired fund fees and expenses, interest, taxes, brokerage commissions and extraordinary expenses) do not exceed 1.45% of its average daily net assets until February 28, 2024. The Investment Adviser may decide to continue the agreement, or revise the total annual operating expense limitations after February 28, 2024. Any waiver or reimbursement is subject to later adjustment to allow the Investment Adviser to recoup amounts waived or reimbursed to the extent actual fees and expenses for a period are less than the expense limitation cap of 1.45%, provided, however, that the Investment Adviser shall only be entitled to recoup such amounts for a period of thirty-six months following the date on which such fee waiver or expense reimbursement was made. Waived/reimbursed fees and expenses subject to potential recovery by month of expiration are as follows:

| Year of expiration | | Amount | |

| October 2023 – September 2024 | | $ | 104,719 | |

| October 2024 – September 2025 | | | 152,632 | |

| October 2025 – September 2026 | | | 70,026 | |

| | | $ | 327,377 | |

As of September 30, 2023, it was possible, but not probable, those amounts would be recovered by the Investment Adviser. At the end of each fiscal year in the future, the Fund will continue to assess the potential recovery of waived/reimbursed fees and expenses for financial reporting purposes.

Quasar Distributors, LLC, (the “Distributor”), a wholly-owned broker-dealer subsidiary of Foreside serves as principal underwriter of the shares of the Fund and is not affiliated with U.S. Bancorp. The Fund’s shares are sold on a no-load basis and, therefore, the Distributor receives no sales commission or sales load for providing services to the Fund. The Corporation has adopted a plan pursuant to Rule 12b-1 under the 1940 Act (the “12b-1 Plan”), which authorizes the Corporation to pay the Distributor and certain financial intermediaries who assist in distributing the Fund shares or who provided shareholder services to Fund shareholders a distribution and shareholder servicing fee of up to 0.25% of the Fund’s average daily net assets (computed on an annual basis). All or a portion of the fee may be used by the Fund or the Distributor to pay its distribution fee and costs of printing reports and prospectuses for potential investors and the costs of other distribution and shareholder servicing expenses. During the year ended September 30, 2023, the Fund incurred expenses of $56,574 pursuant to the 12b-1 Plan.

U.S Bancorp Fund Services, LLC, doing business as U.S. Bank Global Fund Services (the “Administrator”), serves as transfer agent, administrator and accounting services agent for the Fund. U.S. Bank, N.A. serves as custodian for the Fund.

The Fund imposes a 1.00% redemption fee on shares held 30 days or less. For the year ended September 30, 2023 and the year ended September 30, 2022, the Fund collected $0 and $1, respectively, in redemption fees.

KIRR, MARBACH PARTNERS

VALUE FUND

Report of Independent Registered Public Accounting Firm

To the Shareholders and Board of Directors of Kirr, Marbach Partners Value Fund

Opinion on the Financial Statements

We have audited the accompanying statement of assets and liabilities of Kirr, Marbach Partners Value Fund (the “Fund”), including the schedule of investments, as of September 30, 2023, the related statement of operations for the year then ended, the statements of changes in net assets for each of the two years in the period then ended, financial highlights for each of the five years in the period then ended, and the related notes (collectively referred to as the “financial statements”). In our opinion, the financial statements present fairly, in all material respects, the financial position of the Fund as of September 30, 2023, the results of its operations for the year then ended, the changes in its net assets for each of the two years in the period then ended, and the financial highlights for each of the five years in the period then ended, in conformity with accounting principles generally accepted in the United States of America.

Basis for Opinion

These financial statements are the responsibility of the Fund’s management. Our responsibility is to express an opinion on the Fund’s financial statements based on our audits. We are a public accounting firm registered with the Public Company Accounting Oversight Board (United States) (“PCAOB”) and are required to be independent with respect to the Fund in accordance with the U.S. federal securities laws and the applicable rules and regulations of the Securities and Exchange Commission and the PCAOB. We have served as the Fund’s auditor since 2006.

We conducted our audits in accordance with the standards of the PCAOB. Those standards require that we plan and perform the audit to obtain reasonable assurance about whether the financial statements are free of material misstatement, whether due to error or fraud. The Fund is not required to have, nor were we engaged to perform, an audit of its internal control over financial reporting. As part of our audits we are required to obtain an understanding of internal control over financial reporting, but not for the purpose of expressing an opinion on the effectiveness of the Fund’s internal control over financial reporting. Accordingly, we express no such opinion.

Our audits included performing procedures to assess the risks of material misstatement of the financial statements, whether due to error or fraud, and performing procedures that respond to those risks. Such procedures included examining, on a test basis, evidence regarding the amounts and disclosures in the financial statements. Our audits also included evaluating the accounting principles used and significant estimates made by management, as well as evaluating the overall presentation of the financial statements. Our procedures included confirmation of securities owned as of September 30, 2023 by correspondence with the custodian. We believe that our audits provide a reasonable basis for our opinion.

TAIT, WELLER & BAKER LLP

Philadelphia, Pennsylvania

November 22, 2023

KIRR, MARBACH PARTNERS

VALUE FUND

Additional Information

September 30, 2023 (Unaudited)

AVAILABILITY OF FUND PORTFOLIO INFORMATION

The Fund files its complete schedule of portfolio holdings with the SEC for the first and third quarters of each fiscal year on Part F of Form N-PORT, which is available on the SEC’s website at www.sec.gov. The Fund’s Part F of Form N-PORT may be reviewed and copied at the SEC’s Public Reference Room in Washington D.C. For information on the Public Reference Room call 1-800-SEC-0330.

AVAILABILITY OF PROXY VOTING INFORMATION

Both a description of the Fund’s Proxy Voting Policies and Procedures and information about the Fund’s proxy voting record will be available (1) without charge, upon request, by calling 1-800-870-8039, and (2) on the SEC’s website at www.sec.gov.

QUALIFIED DIVIDEND INCOME/DIVIDENDS RECEIVED DEDUCTION

For the fiscal year ended September 30, 2023, certain dividends paid by the Fund may be reported as qualified dividend income (QDI) and may be eligible for taxation at capital gains rates. The percentage of dividends declared from ordinary income designated as QDI was 0.00% for the Fund.

For corporate shareholders, the percent of ordinary income distributions qualifying for the corporate dividends received deduction for the fiscal year ended September 30, 2023, was 0.00% for the Fund.

KIRR, MARBACH PARTNERS

VALUE FUND

Additional Information (Continued)

September 30, 2023 (Unaudited)

| | Position | Term of Office | Principal Occupation | Other | Number of |

| Name, Address | with the | and Length | During Past | Directorships | Funds Overseen |

| and Age | Corporation | of Time Served | Five Years | Held | in Complex |

| INTERESTED DIRECTORS |

| Mark D. Foster* | Director, | Indefinite term | Chief Investment | None | 1 |

| Born 1958 | Chairman | since 1998 | Officer, Kirr, Marbach & | | |

| | and | | Company, LLC | | |

| | President | | | | |

| Mickey Kim* | Director, | Indefinite term | Chief Compliance | Director, | 1 |

| Born 1958 | Vice | since 1998; | Officer and Chief | CrossAmerica | |

| | President, | Chief | Operating Officer, | Partners LP | |

| | Secretary, | Compliance | Kirr, Marbach & | | |

| | Treasurer, | Officer since | Company, LLC | | |

| | and Chief | 2004 | | | |

| | Compliance | | | | |

| | Officer | | | | |

| DIS-INTERESTED DIRECTORS |

| Jeffrey N. Brown* | Director | Indefinite term | President, Travel Indiana, | None | 1 |

| Born 1959 | | since 1998 | LLC (2016 – present); | | |

| | | | President, Home News | | |

| | | | Enterprises (1998 – 2016) | | |

| John A. | Director | Indefinite term | President, Elwood | None | 1 |

| Elwood* | | since 2018 | Staffing Services, | | |

| Born 1970 | | | Inc. (1996 – present) | | |

| Thomas J. | Director | Indefinite term | LLC Member, CEO, | None | 1 |

| Thornburg* | | since 2022 | Sacoma Specialty, | | |

| Born 1967 | | | Products, LLC (2020- | | |

| | | | Present) LLC Manager, | | |

| | | | Brown Hill Landscape, | | |

| | | | LLC (2020-Present) LLC | | |

| | | | Manager, Value Creation | | |

| | | | Advising (2017-Present) | | |

| * | The address for all directors is Kirr, Marbach & Company, LLC, 621 Washington Street, Columbus, Indiana 47201. |

(This Page Intentionally Left Blank.)

Directors

Mark Foster, CFA

Mickey Kim, CFA

Jeffrey N. Brown

John Elwood

Thomas J. Thornburg

Principal Officers

Mark D. Foster, CFA, President

Mickey Kim, CFA, Vice President, Treasurer and Secretary

Investment Adviser

Kirr, Marbach & Company, LLC

621 Washington Street

Columbus, IN 47201

Distributor

Quasar Distributors, LLC

111 East Kilbourn Ave., Suite 2200

Milwaukee, WI 53202

Custodian

U.S. Bank, N.A.

1555 North RiverCenter Drive, Suite 302

Milwaukee, WI 53212

Administrator, Transfer Agent And

Dividend – Disbursing Agent

U.S. Bancorp Fund Services, LLC

615 East Michigan Street

Milwaukee, WI 53202

Independent Registered Public Accounting Firm

Tait, Weller & Baker LLP

Two Liberty Place

50 South 16th Street, Suite 2900

Philadelphia, PA 19102

Legal Counsel

Kirkland & Ellis LLP

300 North LaSalle

This report should be accompanied or preceded by a prospectus.

The Fund’s Statement of Additional Information contains additional information about the

Fund’s directors and is available without charge upon request by calling 1-800-808-9444.

The Fund’s Proxy Voting Policies and Procedures are available without charge upon request by calling 1-800-808-9444. A description of the

Fund’s proxy voting policies and procedures is available on the Fund’s website, www.kmpartnersfunds.com, or on the SEC’s website, at

www.sec.gov. Information regarding how the Fund voted proxies relating to portfolio securities during the twelve months ended June 30,

is available without charge upon request by calling 1-800-808-9444 or on the SEC’s website, at www.sec.gov.

Annual Report

Item 2. Code of Ethics.

The registrant has adopted a code of ethics that applies to the registrant’s principal executive officer and principal financial officer. The registrant has not made any substantive amendments to its code of ethics during the period covered by this report. The registrant has not granted any waivers from any provisions of the code of ethics during the period covered by this report.

File: A copy of the registrant’s Code of Ethics is filed herewith..

Item 3. Audit Committee Financial Expert.

The registrant’s board of directors has determined that it does not have an audit committee financial expert serving on its audit committee. At this time, the registrant believes that the experience provided by each member of the audit committee together offers the registrant adequate oversight for the registrant’s level of financial complexity.

Item 4. Principal Accountant Fees and Services.

The registrant has engaged its principal accountant to perform audit services, audit-related services, tax services and other services during the past two fiscal years. “Audit services” refer to performing an audit of the registrant's annual financial statements or services that are normally provided by the accountant in connection with statutory and regulatory filings or engagements for the past fiscal year. “Audit-related services” refer to the assurance and related services by the principal accountant that are reasonably related to the performance of the audit. “Tax services” refer to professional services rendered by the principal accountant for tax compliance, tax advice, and tax planning; including reviewing the Funds’ tax returns and distribution calculations. There were no “other services” provided by the principal accountant. For the fiscal years ended September 30, 2023 and September 30, 2022, the Fund’s principal accountant was Tait Weller. The following table details the aggregate fees billed or expected to be billed for each of the last two fiscal years for audit fees, audit-related fees, tax fees and other fees by the principal accountant.

| | FYE 09/30/2023 | FYE 09/30/2022 |

Audit Fees | $19,000 | $19,000 |

Audit-Related Fees | $0 | $0 |

Tax Fees | $3,200 | $3,200 |

All Other Fees | $0 | $0 |

The audit committee has adopted pre-approval policies and procedures that require the audit committee to pre‑approve all audit and non‑audit services of the registrant, including services provided to any entity affiliated with the registrant.

The percentage of fees billed by Tait, Weller applicable to non-audit services pursuant to waiver of pre-approval requirement were as follows:

| | FYE 09/30/2023 | FYE 09/30/2022 |

Audit-Related Fees | 0% | 0% |

Tax Fees | 0% | 0% |

All Other Fees | 0% | 0% |

All of the principal accountant’s hours spent on auditing the registrant’s financial statements were attributed to work performed by full‑time permanent employees of the principal accountant.

The following table indicates the non-audit fees billed or expected to be billed by the registrant’s accountant for services to the registrant and to the registrant’s investment adviser (and any other controlling entity, etc.—not sub-adviser) for the last fiscal year. The audit committee of the board of trustees has considered whether the provision of non-audit services that were rendered to the registrant's investment adviser is compatible with maintaining the principal accountant's independence and has concluded that the provision of such non-audit services by the accountant has not compromised the accountant’s independence.

Non-Audit Related Fees | FYE 09/30/2023 | FYE 09/30/2022 |

Registrant | $0 | $0 |

Registrant’s Investment Adviser | $0 | $0 |

The registrant has not been identified by the U.S. Securities and Exchange Commission as having filed an annual report issued by a registered public accounting firm branch or office that is located in a foreign jurisdiction where the Public Company Accounting Oversight Board is unable to inspect or completely investigate because of a position taken by an authority in that jurisdiction

The registrant is not a foreign issuer.

Item 5. Audit Committee of Listed Registrants.

Not applicable to registrants who are not listed issuers (as defined in Rule 10A-3 under the Securities Exchange Act of 1934).

(b) Not applicable.

Item 6. Schedule of Investments.

| (a) | Schedule of Investments is included as part of the report to shareholders filed under Item 1 of this Form. |

Item 7. Disclosure of Proxy Voting Policies and Procedures for Closed-End Management Investment Companies.

Not applicable to open-end investment companies.

Item 8. Portfolio Managers of Closed-End Management Investment Companies.

Not applicable to open-end investment companies.

Item 9. Purchases of Equity Securities by Closed‑End Management Investment Company and Affiliated Purchases.

Not applicable to open-end investment companies.

Item 10. Submission of Matters to a Vote of Security Holders.

There have been no material changes to the procedures by which shareholders may recommend nominees to the registrant’s board of trustees.

Item 11. Controls and Procedures.

| (a) | The Registrant’s President and Treasurer have reviewed the Registrant's disclosure controls and procedures (as defined in Rule 30a-3(c) under the Investment Company Act of 1940 (the “Act”)) as of a date within 90 days of the filing of this report, as required by Rule 30a-3(b) under the Act and Rules 13a-15(b) or 15d‑15(b) under the Securities Exchange Act of 1934. Based on their review, such officers have concluded that the disclosure controls and procedures are effective in ensuring that information required to be disclosed in this report is appropriately recorded, processed, summarized and reported and made known to them by others within the Registrant and by the Registrant’s service provider. |

| (b) | There were no significant changes in the Registrant's internal control over financial reporting (as defined in Rule 30a-3(d) under the Act) that occurred during the period covered by this report that has materially affected, or is reasonably likely to materially affect, the Registrant's internal control over financial reporting. |

Item 12. Disclosure of Securities Lending Activities for Closed-End Management Investment Companies

Not applicable to open-end investment companies.

Item 13. Exhibits.

(3) Any written solicitation to purchase securities under Rule 23c‑1 under the Act sent or given during the period covered by the report by or on behalf of the registrant to 10 or more persons. Not applicable to open-end investment companies.

(4) Change in the registrant’s independent public accountant. There was no change in the registrant’s independent public accountant for the period covered by this report.

SIGNATURES

Pursuant to the requirements of the Securities Exchange Act of 1934 and the Investment Company Act of 1940, the registrant has duly caused this report to be signed on its behalf by the undersigned, thereunto duly authorized.

(Registrant) Kirr, Marbach Partners Funds, Inc.

By (Signature and Title)* /s/Mr. Mark Foster

Mr. Mark Foster, President

Date December 8, 2023

Pursuant to the requirements of the Securities Exchange Act of 1934 and the Investment Company Act of 1940, this report has been signed below by the following persons on behalf of the registrant and in the capacities and on the dates indicated.

By (Signature and Title)* /s/Mr. Mark Foster

Mr. Mark Foster, President

Date December 8, 2023

By (Signature and Title)* /s/Mr. Mickey Kim

Mr. Mickey Kim, Treasurer

Date December 8, 2023

* Print the name and title of each signing officer under his or her signature.