vulnerable to account takeover schemes or cyber-fraud. A breach of our security that results in unauthorized access to our data could expose us to disruption or challenges relating to our daily operations as well as to data loss, litigation, damages, fines, significant increases in compliance costs, and reputational damage. Any of these consequences could have a material adverse effect on our business, results of operations, and financial condition.

A significant portion of our loan portfolio is comprised of commercial loans secured by receivables, inventory, equipment, or other commercial collateral, the deterioration in value of which could expose us to credit losses.

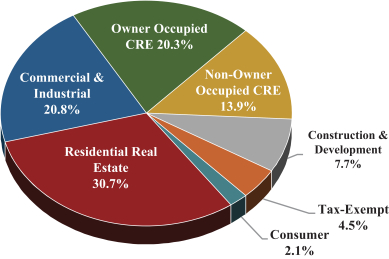

As of December 31, 2018, approximately $275.9 million, or 20.8%, of our total loans were commercial loans collateralized, in general, by general business assets including, among other things, accounts receivable, inventory, and equipment, and most are backed by a personal guaranty of the borrower or principal. These commercial loans are typically larger in amount than loans to individuals and, therefore, have the potential for larger losses on a single-loan basis. Additionally, the repayment of commercial loans is subject to the ongoing business operations of the borrower. The collateral securing such loans generally includes movable property, such as equipment and inventory. These types of collateral may decline in value more rapidly than we anticipate, exposing us to increased credit risk. In addition, a portion of our customer base, including customers in the energy and real estate business, may be exposed to volatile businesses or industries which are sensitive to commodity prices or market fluctuations, such as energy prices. Accordingly, negative changes in commodity prices and real estate values and liquidity could impair the value of the collateral securing these loans. Significant adverse changes in the economy or local market conditions in which our commercial lending customers operate could cause rapid declines in loan collectability and the values associated with general business assets resulting in inadequate collateral coverage. These events, in turn, may expose us to credit losses that could adversely affect our business, financial condition, and results of operations.

We may not be able to adequately measure and limit our credit risk, which could lead to unexpected losses.

Our business depends on our ability to successfully measure and manage credit risk. As a lender, we are exposed to the risk that our borrowers will be unable to repay their loans according to their terms, and that the collateral securing repayment of their loans, if any, may not be sufficient to ensure repayment. In addition, there are risks inherent in making any loan, including risks with respect to the period of time over which the loan may be repaid, risks relating to proper loan underwriting, risks resulting from changes in economic and industry conditions, and risks inherent in dealing with individual borrowers. The creditworthiness of a borrower is affected by many factors including local market conditions and general economic conditions. If the overall economic climate in the U.S., generally, or in Louisiana, specifically, experiences material disruption, our borrowers may experience difficulties in repaying their loans, the collateral we hold may decrease in value or become illiquid, and the level of nonperforming loans, charge-offs, and delinquencies could rise and require significant additional provisions for credit losses.

Our risk management practices, such as monitoring the concentration of our loans within specific industries and our credit approval, review, and administrative practices may not adequately reduce credit risk. Further, our credit administration personnel, policies, and procedures may not adequately adapt to changes in economic or any other conditions affecting customers and the quality of our loan portfolio. A failure to effectively measure and limit our credit risk could result in loan defaults, foreclosures, and additional charge-offs. As a result, we may need to significantly increase our allowance for loan losses, which could adversely affect our net income. All of these consequences could, in turn, have a material adverse effect on our business, financial condition, and results of operations.

Our allowance for loan losses may prove to be insufficient to absorb losses inherent in our loan portfolio.

We establish our allowance for loan losses and maintain it at a level considered adequate by management to absorb probable loan losses based on our analysis of our loan portfolio, our historical loss experience, and conditions within our markets. As of December 31, 2018, our allowance for loan losses totaled

29