DEAR SHAREHOLDERS AND FRIENDS:

We are pleased to provide this overview of our results for the first and second quarters of 2011—the first two quarters following our merger with Atlantic BancGroup, Inc. and Oceanside Bank. The merger was consummated on November 16, 2010. We rapidly integrated the operating systems and management teams and in December began operating as one bank. Financial highlights for the quarter and year so far include:

Net income of $1.1 million for the second quarter

Net income of $1.5 million for the six-month period 14% increase in noninterest bearing deposits

Five straight quarters of improving net interest margin Net interest margin of 4.45% for the second quarter

While we remain diligent in the careful monitoring and aggressive management of our loan portfolio in this very difficult banking environment, our primary focus remains serving the needs of our customers. During the first six months of this year, we have made a number of organizational, product and process changes that will assist us in serving our existing customers and reaching out for new relationships. We are well positioned to focus on our core mission of providing extraordinary service to Jacksonville businesses and individuals.

Your Bank, today, is the largest and strongest community bank doing business in the Jacksonville market; our strategy to enhance shareholder value through growth and favorable operating performance is central to our operating philosophy. Every one of us at The Jacksonville Bank looks forward to demonstrating our strong commitment to being the very best bank in town. Thank you for your continued support.

Sincerely,

Price W. Schwenck Donald E. Roller

President & CEO Chairman of the Board

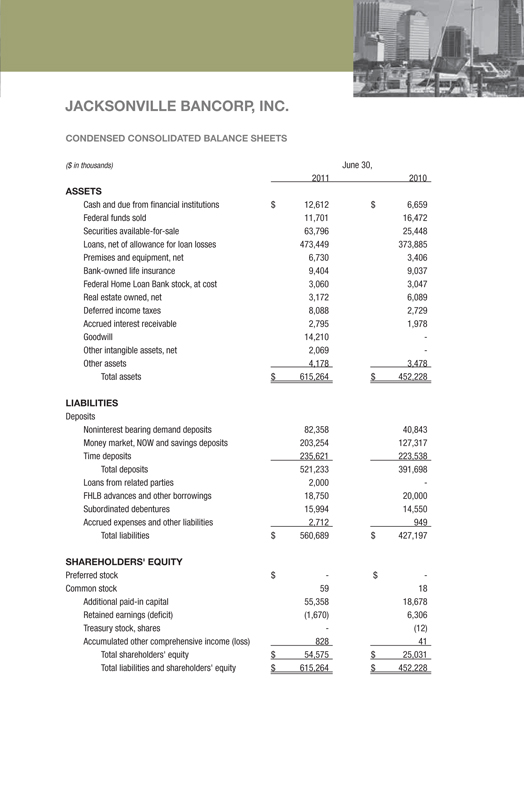

JACKSONVILLE BANCORP, INC .

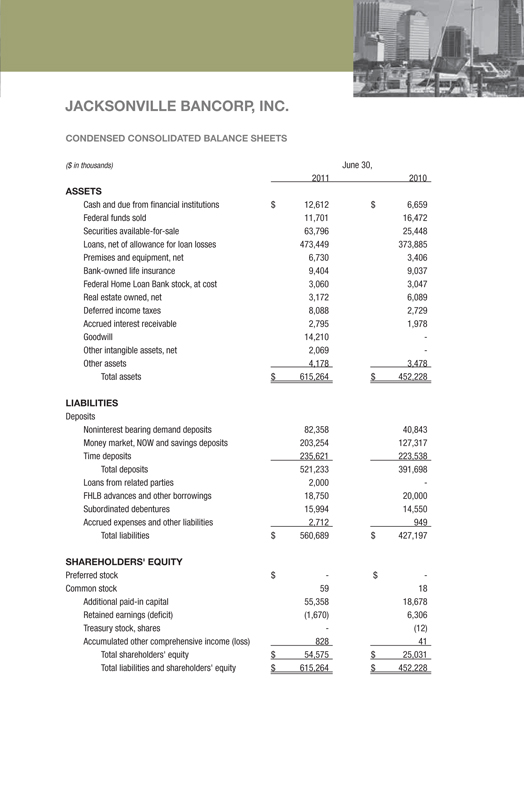

CONDENSED CONSOLIDATED BALANCE SHEETS

($ in thousands) June 3 0,

2011 2010

ASSETS

Cash and due from financial institutions $ 12,612 $ 6,659

Federal funds sold 11,701 16,472

Securities available -for-sale 63,796 25,448

Loans, net of allowance for loan losses 473,449 373,885

Premises and equipment, net 6,730 3,406

Bank-owned life insurance 9,404 9,037

Federal Home Loan Bank stock, at cost 3,060 3,047

Real estate owned, net 3,172 6,089

Deferred income taxes 8,088 2,729

Accrued interest receivable 2,795 1,978

Good will 14,210 -

Other intangible assets, net 2,069 -

Other assets 4,178 3,478

Total assets $ 615,264 $ 452,228

LIABILITIES

Deposits

Noninterest bearing demand deposits 82,358 40,843

Money market, NOW and savings deposits 203,254 127,317

Time deposits 235,621 223,538

Total deposits 521,233 391,698

Loans from related parties 2,000 -

FHLB advances and other borrowings 18,750 20,000

Subordinated debentures 15,994 14,550

Accrued expenses and other liabilities 2,712 949

Total liabilities $ 560,689 $ 427,197

SHAREHOLDERS’ EQUITY

Preferred stock $—$ -

Common stock 59 18

Additional paid -in capital 55,358 18,678

Retained earnings ( deficit) (1,670) 6,306

Treasury stock, shares -(1 2)

Accumulated other comprehensive income( loss) 828 41

Total shareholders ‘ equity $ 54,575 $ 25,031

Total liabilities and share holders’ equity $ 615,264 $ 452,228

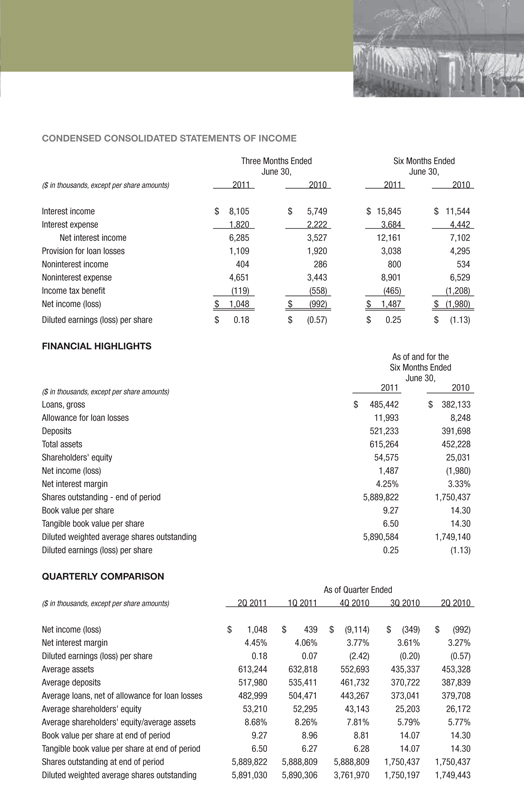

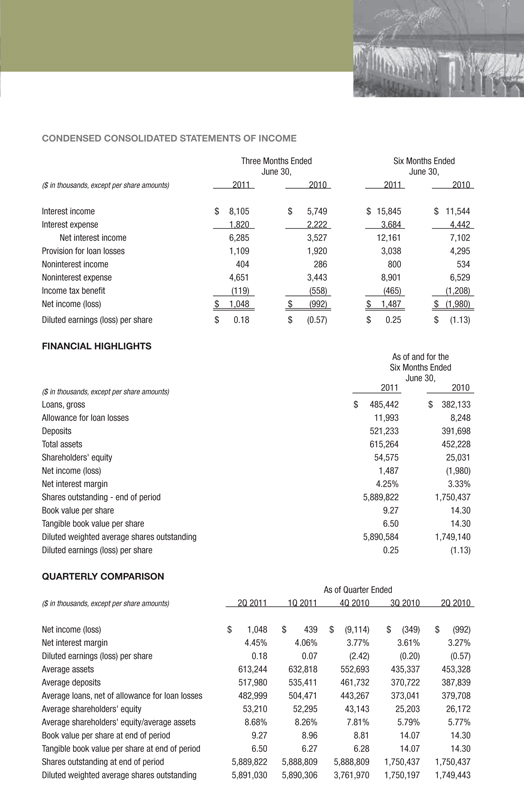

CONDENSED CONSOLIDATED STATEMENTS OF INCOME

Three Months Ended Six Months Ended

June 30, June 3 0,

($ in thousands, except per share amounts ) 2011 201 0 2011 2010

Interest in come $ 8,105 $ 5,7 49 $ 15,845 $ 11,544

Interest expense 1,820 2,2 22 3,684 4,4 42

Net interest in come 6,285 3,5 27 12,161 7,1 02

Provision for loan losses 1,109 1,9 20 3,038 4,2 95

Noninterest income 404 286 800 534

Noninterest expense 4,651 3,4 43 8,901 6,5 29

In come tax benefit (1 19)(5 58)(465)(1 ,208)

Net income( loss) $ 1,048 $(9 92) $ 1,487 $(1 ,980)

Diluted earnings (loss) per share $ 0. 18 $(0.57) $ 0.25 $(1 .13)

FINANCIAL HIGHLIGHTS

As of and for the

Six Months Ended

June 30,

($ in thousands, except per share amounts ) 2011 2010

Loans, gross $ 485 ,4 42 $ 382,133

Allowance for loan losses 11,993 8,248

Deposits 521 ,2 33 391,698

Total assets 615 ,2 64 452,228

Share holders ‘ equity 54,575 25,031

Net income( loss) 1,4 87(1,980)

Net interest margin 4.25% 3.33%

Shares outstanding—end of period 5,889 ,8 22 1,750,437

Book value per share 9.2 7 14 .30

Tangible book value per share 6.5 0 14 .30

Diluted weighted average shares outstanding 5,890 ,5 84 1,749,140

Diluted earnings (loss) per share 0.2 5(1 .1 3)

QUARTERLY COMPARISON

As of Quarter Ended

($ in thousands, except per share amounts ) 2Q 2011 1Q 2011 4Q2 010 3Q 2010 2Q 2010

Net income( loss) $ 1, 048 $ 439 $ (9,114) $ (349) $( 992)

Net interest margin 4.45% 4.0 6% 3.77% 3.61% 3.27%

Diluted earnings (loss) per share 0.18 0.07(2 . 42)(0 .20)(0 .5 7)

Average assets 613,244 632,818 552,693 435,337 453,328

Average deposits 517,980 535,411 461,732 370,722 387,839

Average loans, net of allowance for loan losses 482,999 504,471 443,267 373,041 379,708

Average share holders’ equity 53,210 52,29 5 43 ,1 43 25,203 26,172

Average share holders’ equity/average assets 8.68% 8.2 6% 7.81% 5.79% 5.77%

Book value per share at end of period 9.27 8.96 8.81 14.07 14 .30

Tangible book value per share at end of period 6.50 6.27 6.28 14.07 14 .30

Shares outstanding at end of period 5,889, 822 5,888,809 5,888,809 1,750,437 1,750,437

Diluted weighted average shares outstanding 5,891, 030 5,890,306 3,761,970 1,750,197 1,749,443

COMPANY INFORMATION

Board of Directors Executive Officers Stock Transfer Agent

Inquiries regarding stock

Donald E. Roller Price W. Schwenck transfers, lost certificates

Chairman of the Board President, CEO & Secretary or changes in name and/or

Jacksonville Bancorp, Inc. Jacksonville Bancorp, Inc. and address should be directed

Chairman, CEO & CCO to our stock transfer agent:

Price W. Schwenck The Jacksonville Bank

Chairman of the Board Computershare Investor

The Jacksonville Bank Scott M. Hall Services, LLC

Executive Vice President & CCO 250 Royall Street

Donald F. Glisson, Jr. Jacksonville Bancorp, Inc. and Canton, MA 02021

Chief Executive Officer President & Reg “O” Officer 800.962.4284

Triad Financial Services, Inc. The Jacksonville Bank www.investorcentre.com

James M. Healey Valerie A. Kendall Form 10-K

Owner Executive Vice President & CFO Copies of the Company’s

House & Home Investments, Inc. Jacksonville Bancorp, Inc. and Annual Report on Form 10-K

The Jacksonville Bank are available by visiting our

John C. Kowkabany website at www.jaxbank.com.

Real Estate Investor & Consultant

Committee Chairmen Independent Auditors

R.C. Mills Crowe Horwath LLP

Retired Donald F. Glisson, Jr. 401 East Las Olas Boulevard

Loan Committee Fort Lauderdale, FL 33301

John W. Rose The Jacksonville Bank

Principal Counsel

CapGen Financial LLC R.C. Mills McGuireWoods LLP

Nominating and Corporate 50 North Laura Street

Charles F. Spencer Governance Committee Suite 3300

President, INOC LLC and Jacksonville Bancorp, Inc. Jacksonville, FL 32202

Joshua Development LLC

Donald E. Roller Website

John P. Sullivan Executive Committee www.jaxbank.com

Managing Director Jacksonville Bancorp, Inc.

CapGen Capital Advisors Ticker Symbol

John W. Rose NASDAQ: JAXB

Gary L. Winfield Asset/Liability Management Committee

Medical Director The Jacksonville Bank Online Virtual Banking

Memorial Hospital www.jaxbank.com

John P. Sullivan 877.7MY.JAX

Audit Committee

Jacksonville Bancorp, Inc.

Gary L. Winfield

Organization/Compensation Committee

Jacksonville Bancorp, Inc.

Federal Deposit Insurance Corporation

The Jacksonville Bank is a member of the Federal Deposit Insurance Corporation (“FDIC”). This statement has not been reviewed or confirmed for accuracy or relevance by the FDIC.

BANK LOCATIONS

Beach Boulevard Jacksonville Beach

13799-100 Beach Boulevard 1315 Third Street

Jacksonville, Florida 32224 Jacksonville, Florida 32250

Phone: 904.416.3150 Phone: 904.435.3220

Fax: 904.680.0011 Fax: 904.247.9402

Downtown Mandarin

100 North Laura Street 10325 San Jose Boulevard

Jacksonville, Florida 32202 Jacksonville, Florida 32257

Phone: 904.421.9699 Phone: 904.288.8933

Fax: 904.421.3060 Fax: 904.288.8624

Gate Parkway Neptune Beach

7880 Gate Parkway 560 Atlantic Boulevard

Jacksonville, Florida 32256 Neptune Beach, Florida 32266

Phone: 904.899.0420 Phone: 904.435.0550

Fax: 904.899.0424 Fax: 904.247.9205

Intracoastal West Ortega

12740-200 Atlantic Boulevard 4343 Roosevelt Boulevard

Jacksonville, Florida 32225 Jacksonville, Florida 32210

Phone: 904.220.3001 Phone: 904.899.0400

Fax: 904.220.3376 Fax: 904.899.0410

Corporate Headquarters

904.421.3040

Lobby Hours

Mon – Thurs: 9:00 a.m. – 4:00 p.m. Fri: 9:00 a.m. – 5:00 p.m.

Sat: 9:00 a.m. – 12:00 p.m.

(Jacksonville Beach location only)

Drive-Thru Hours

(except Downtown)

Mon – Thurs: 8:00 a.m. – 5:00 p.m. Fri: 8:00 a.m. – 6:00 p.m.

Sat: 9:00 a.m. – 12:00 p.m.

(Jacksonville Beach location only)

Visit our website at www.jaxbank.com