UNITED STATES SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM 6-K

REPORT OF FOREIGN PRIVATE ISSUER

PURSUANT TO RULE 13a-16 OR 15d-16 UNDER

THE SECURITIES EXCHANGE ACT OF 1934

Report on Form 6-K dated April 10, 2020

Commission File Number: 001-15092

TURKCELL ILETISIM HIZMETLERI A.S.

(Translation of registrant’s name in English)

Aydınevler Mahallesi İnönü Caddesi No:20

Küçükyalı Ofispark

34854 Maltepe

Istanbul, Turkey

(Address of Principal Executive Offices)

Indicate by check mark whether the registrant files or will file annual reports under cover of Form 20-F or Form 40-F.

Form 20-Fx Form 40-F¨

Indicate by check mark if the registrant is submitting the Form 6-K in paper as permitted by Regulation S-T Rule 101(b)(1):

Yes¨ No x

Indicate by check mark if the registrant is submitting the Form 6-K in paper as permitted by Regulation S-T Rule 101(b)(7):

Yes¨ No x

Indicate by check mark whether the registrant by furnishing the information contained in this form is also thereby furnishing the information to the Commission pursuant to Rule 12g3-2(b) under the Securities Exchange Act of 1934.

Yes¨ No x

If “Yes” is marked, indicate below the file number assigned to the registrant in connection with Rule 12g3-2(b): 82- __________

Enclosure: A press release dated April 10, 2020, regarding the presentation on our initial take on COVID-19.

Istanbul, April 10, 2020

Announcement Regarding the Presentation on Our Initial Take on COVID-19

Please find attached our presentation regarding the initial impacts of COVID-19 pandemic on our Company, precautions taken and our initial take on the issue. The respective presentation is also available on our Company web site through the following link:

https://www.turkcell.com.tr/en/aboutus/investor-relations/presentations.

For more information:

Turkcell Investor Relations

investor.relations@turkcell.com.tr

Tel: + 90 212 313 1888

1 COVID - 19 Initial Take Our Initial Take on COVID - 19 Turkcell Group April 10, 2020

2 COVID - 19 Initial Take CEO Remarks Dear Stakeholders, We are going through an enormous global crisis that has and is expected to impact each and every sector in a variety of ways . As Turkcell, we believe we have acted fairly quickly in taking precautions and actions both for our customers and at the company level against the arising challenges . This presentation aims to summarize our actions, challenges, and anticipated long term opportunities . Due to limited visibility, we are not yet in a position to share exact numerical updates, or a view on our guidance ; however, we will do our best to discuss this more thoroughly in our Q 1 2020 earnings release some weeks from now . Hope you all stay healthy . Warm regards, Murat Erkan

3 COVID - 19 Initial Take Our Initial Take on the Impacts of COVID - 19 KEY POINTS At Turkcell, we are closely monitoring the situation, and act via work groups/squads at each function We prioritize employee health, keeping our services and operations uninterrupted, and management of any potential risks related with balance sheet with an increased emphasis on liquidity management Telecom services ha ve become more critical for work, education & life, and demand has surged We are also aware of potential risks due to limited mobility (roaming etc.) and a prolonged scenario Fast forward digitalization enhances the opportunities in business & entertainment for the long run Our unique portfolio of digital services and solutions positions us favorably in the post - crisis era We have a robust balance sheet with strong liquidity Turkcell has a strong balance sheet with strong liquidity and limited financial risk exposure

4 COVID - 19 Initial Take COVID - 19 in Turkey • The first case reported on March 10, relatively later than in other countries • Schools in recess since March 16; bars, restaurants, social gatherings closed as of March 21 • Curfew for risky group (ages >65 or those with a chronic disease) on March 22 • Curfew for youngsters (ages <20) on April 3 • Suspension of all international and domestic flights ; limitation on intercity coach and car travels • CBRT cut rates by 100bps to 9.75%; and additional liquidity measures for banks announced • Economic Stability Shield package announced, worth TRY 100bn (2.1% of GDP) • provisions for the rescheduling of tax duties, loans, social insurance payments • increase for lowest paid pension ers & incentives for businesses. • Tax filing postponed by 30 days in general, and by 3 months for specific sectors • State banks will provide loans up to 3 year with 7.5% interest (225bps lower than weekly policy rate) • Time extension for loan payments; and NPL provisioning relaxed for banks • Employment support and flexible work support, with government topping up wages up to 75% • 25% dividend pay - out cap announced by Ministry of Treasury and Finance on April 3; this overrides our official dividend policy of distributing minimum 50% of distributable net income New measures announced everyday… Status in Turkey Economic Measures

5 COVID - 19 Initial Take Initial Management Response EMPLOYEES Remote working since March 13 including more than 10 ,000 call center agents Provided field employees with necessary hygiene equipment CUSTOMERS Free 6 GB/ mo for mobile remote education portal; free 10GB/ mo TV+ users for remote education channels Plans to provide free 6GB/ mo to university students to access online education platform s (under discussion) Free 500 minutes and 5 GB/ mo provided to subscribers in health sector; 10,000 free minutes for family physicians Collection terms eased for subscribers in health sector and subscribers above age 65 Free calls to Consulate Call Center for Turkcell subscribers abroad RETAIL CHANNEL Stores at malls closed (170 out of 1,300 exclusive stores. 4,000+ non - exclusive stores open) Street stores work 6 days of the week between 12pm to 6pm; these stores are provided with hygiene materials NETWORK Network optimization based on AI to manage traffic load actively Network operations teams on alert mode and back - up core capacity is ready for any need Critical equipment orders brought forward and inventory replenished FINANCIAL Increased emphasis on liquidity management and collection risks Daily financial risk management meeting with CFO; weekly status updates with Group CFOs ; monitoring cash flow on a daily basis Dynamic revenue forecasting and cost control measures OTHER Three operators initiated a project with the cooperation of Ministry of Health aimed at identifying high risk groups to virus ba sed on AI, ensuring compliance to lock up rules based on location data and developing a mobile app including updated information on pand emi c

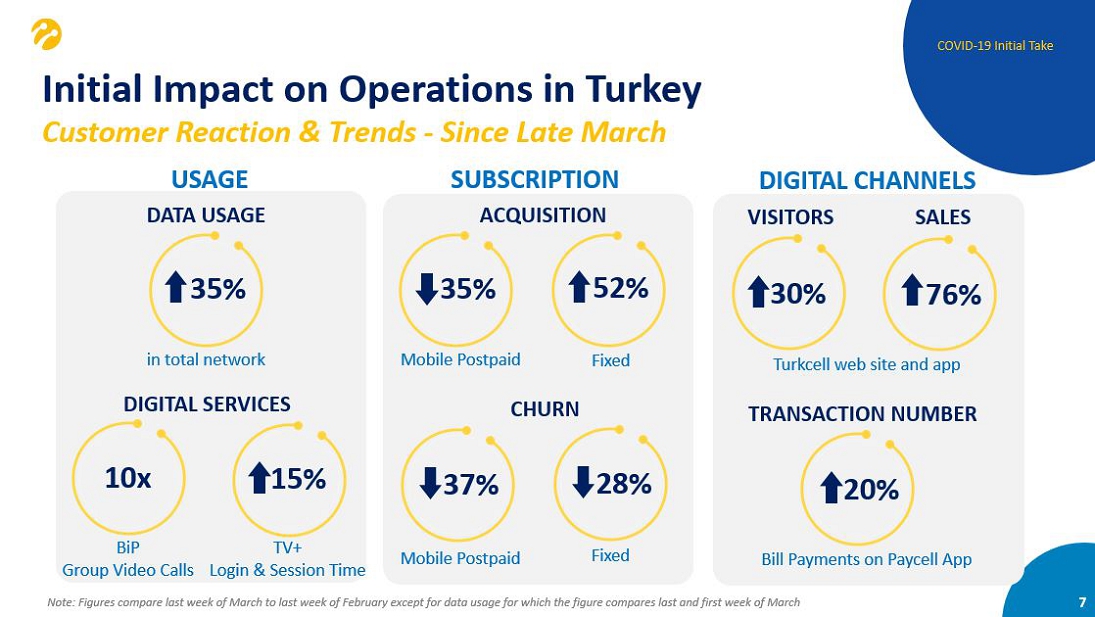

6 COVID - 19 Initial Take Initial Impact on Strategic Focus Areas Digital Services Digital Business Solutions Techfin Services • Our digital services offer entertainment at home; facilitate remote working and education • 2x increase in data usage on TV+ • BiP connecting friends, families and colleagues; 10x rise in group video calls, 2x rise in video call and BiP web usage • 75% increase in number of magazines read on digital publishing platform • Digital Business Solution s ensures 24/7 business continuity for corporate customers regardless of location • Already serving more than 1,600 customers to manage their datacenters remotely • Increased demand from enterprise segment towards remote working & remote education platforms • Accelerating the ongoing city hospital projects • Potential risk on customers in certain sectors that are impacted directly by the pandemic • Paycell aims to enable more users and merchants to have access to mobile payments & contactless payments • Acceleration of payment habits into cashless methods • Paycell online payments at application stores up by 30%; Direct carrier billing usage on e - commerce up by 42% • Potential risk on merchant acquisition targets in physical channels Note: Figures compare last week of March to last week of February

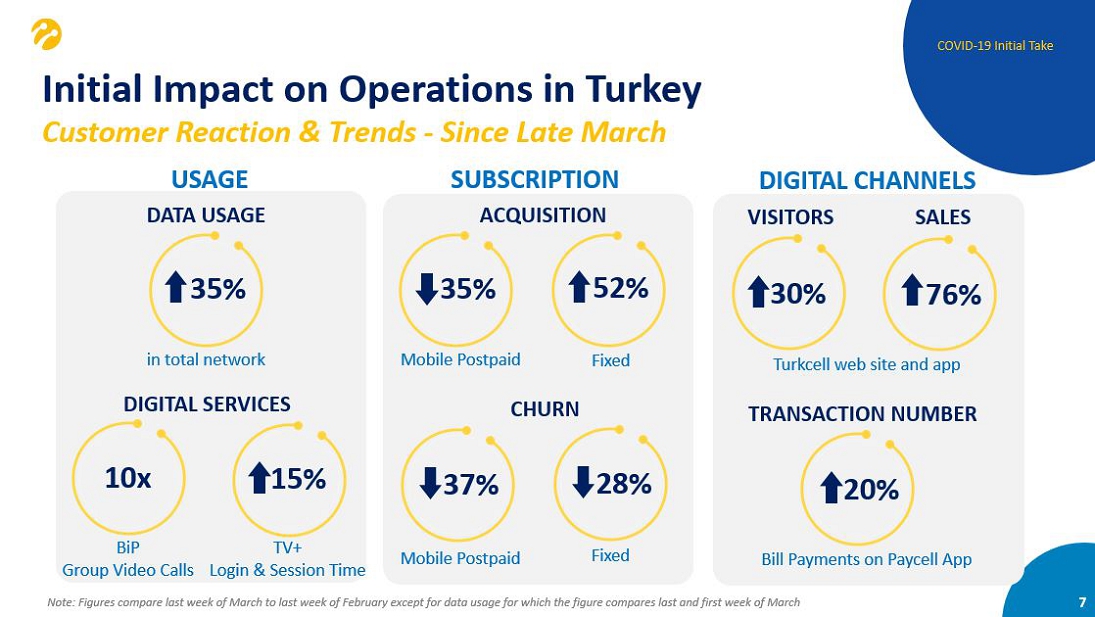

7 COVID - 19 Initial Take USAGE DATA USAGE 35 % in total network ACQUISITION CHURN 35% M obile P ostpaid 37% Mobile Postpaid VISITORS 30% SALES 76% DIGITAL SERVICES 10x BiP Group Video Calls SUBSCRIPTION DIGITAL CHANNELS Note: Figures compare last week of March to last week of February except for data usage for which the figure compares last an d f irst week of March Turkcell web site and app TRANSACTION NUMBER 20% Bill Payments on Paycell App 15% TV+ Login & S ession T ime 52% Fixed 28% Fixed Initial Impact on Operations in Turkey Customer Reaction & Trends - Since Late March

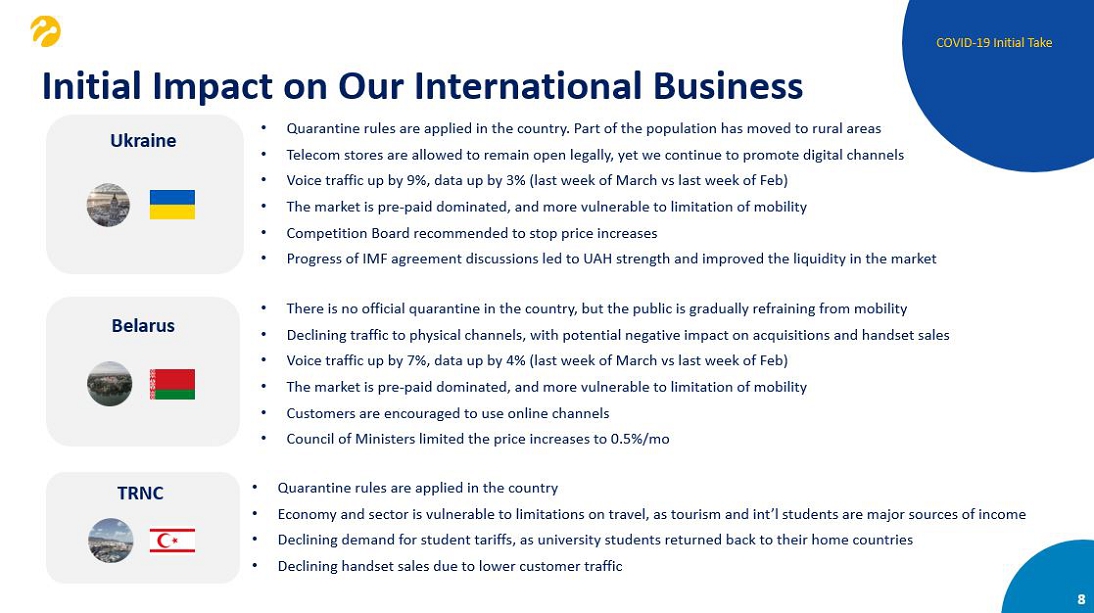

8 COVID - 19 Initial Take I nitial I mpact on Our International Business • Quarantine rules are applied in the country • Economy and sector is vulnerable to limitations on travel, as tourism and int’l students are major sources of income • Declining demand for student tariffs, as university students returned back to their home countries • Declining handset sales due to lower customer traffic • There is no official quarantine in the country, but the public is gradually refraining from mobility • Declining traffic to physical channels, with potential negative impact on acquisitions and handset sales • Voice traffic up by 7%, data up by 4% (last week of March vs last week of Feb) • The market is pre - paid dominated, and more vulnerable to limitation of mobility • Customers are encouraged to use online channels • Council of Ministers limited the price increases to 0.5%/ mo • Quarantine rules are applied in the country. Part of the population has moved to rural areas • Telecom stores are allowed to remain open legally, yet we continue to promote digital channels • Voice traffic up by 9%, data up by 3% (last week of March vs last week of Feb) • The market is pre - paid dominated, and more vulnerable to limitation of mobility • Competition Board recommended to stop price increases • Progress of IMF agreement discussions led to UAH strength and improved the liquidity in the market Ukraine Belarus TRNC

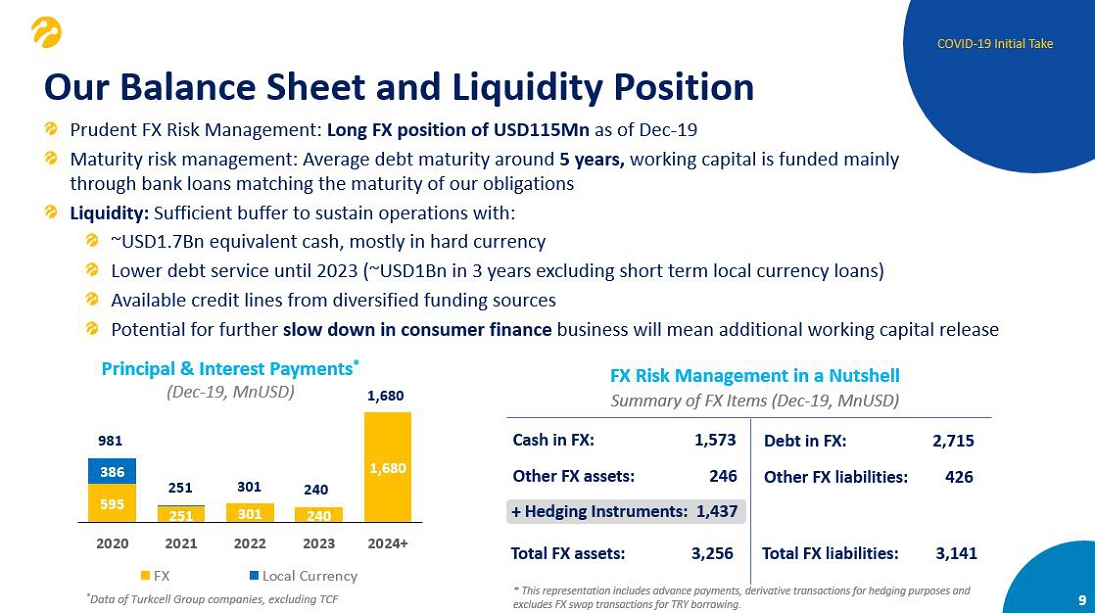

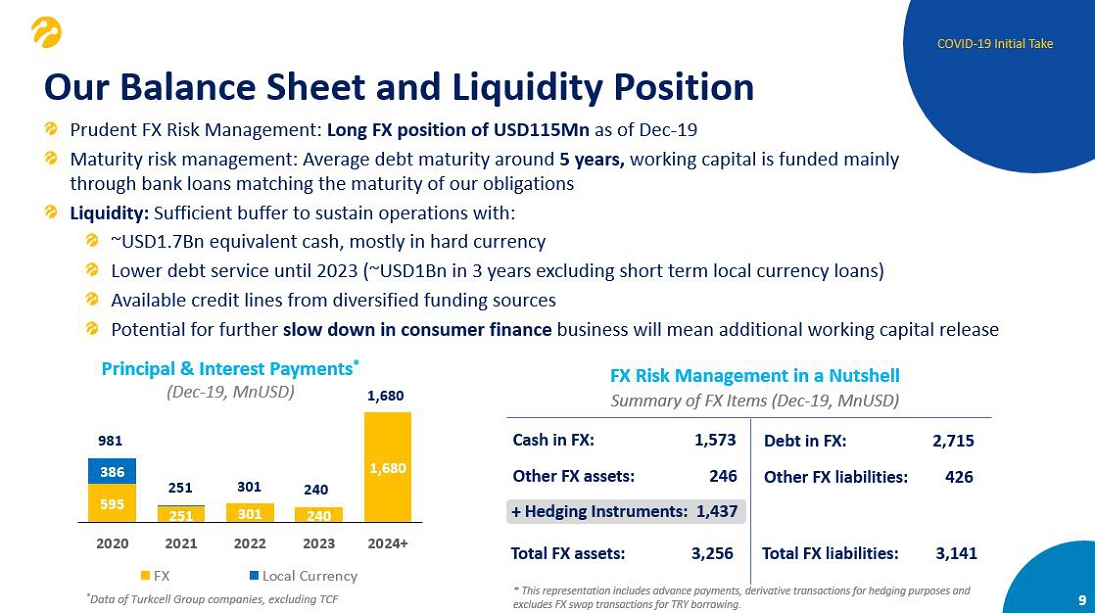

9 COVID - 19 Initial Take Our Balance Sheet and Liquidity Position Prudent FX Risk Management: Long FX position of USD115Mn as of Dec - 19 Maturity risk management: Average debt maturity around 5 years, working capital is funded mainly through bank loans matching the maturity of our obligations Liquidity: Sufficient buffer to sustain operations with: ~ USD 1.7 B n equivalent cash, mostly in hard currency Lower debt service until 2023 (~USD1 B n in 3 years excluding short term local currency loans) Available credit lines from diversified funding sources Potential for further slow down in consumer finance business will mean additional working capital release Principal & Interest Payments * (Dec - 19, MnUSD ) * Data of Turkcell Group companies, excluding TCF 595 251 301 240 1,680 386 2020 2021 2022 2023 2024+ FX Local Currency 981 251 301 240 1,680 FX Risk Management in a Nutshell Summary of FX Items (Dec - 19, MnUSD) Cash in FX : 1,573 Other FX assets: 246 Debt in FX : 2,715 Other FX liabilities: 426 + Hedging Instruments: 1 ,437 Total FX assets: 3,25 6 Total FX liabilities: 3,141 * This representation includes advance payments, derivative transactions for hedging purposes and excludes FX swap transactions for TRY borrowing.

10 COVID - 19 Initial Take Major Challenges and Risks CONSUMER SEGMENT Declining traffic in physical channel impacting customer acquisitions (similar but positive impact on churn levels) Pre - paid line top - ups in physical channels (low pre - paid subs share of 38%, rev. share is <20% in mobile in Turkey) Declining device sales due to limited mobility CORPORATE SEGMENT Certain industries are impacted directly by the pandemic which might lead to requests from clients regarding: Deferral on payments; temporary discount of services SMEs vulnerable to prolonged time and macro risks (rev. share is <10% in Turkey) ROAMING REVENUES Roaming income in consumer and corporate segments at risk with suspension of inbound and outbound travels (rev. share is <3%), but also lower roaming costs CONSUMER FINANCE BUSINESS Potential of further slow down in consumer finance business with the decline in device sales Potential increase in cost of risk on BRSA’s resolution on deferral of loan payments OTHER Stricter lock down conditions might impact fixed broadband service set - ups Any rise in unemployment or decreasing purchasing power may impact our overall business Higher vulnerability to cyber - attacks due to remote working

11 COVID - 19 Initial Take Long Term Opportunities DIGITALIZATION OF CUSTOMER Fast forward digitalization enhances the opportunities in business & entertainment Our digital business solutions needed for online education platforms, remote work, e - commerce Rising use of our digital services portfolio leading to established habits DIGITALIZATION OF SERVICE CHANNELS Optimization of our channel costs with faster shift to digital channels Call center agents switched to home agents reducing overhead costs FIXED WIRELESS ACCESS (FWA) Superbox , the brand for FWA in Turkey, stands out as the sole alternative to fiber offering fiber - like speed Faster penetration of Superbox than our plans; 125% increase in acquisitions (last week of March vs last week of Feb) TECHFIN Acceleration of payment habits into cashless methods Surge in demand for digital content: Opportunity for mobile payment growth Increase in QR based and contactless payments

12 COVID - 19 Initial Take Telecom service s ha ve become more critical for work, education & life • Need for Turkcell’s quality service is more important than ever • We see strong demand leading to overage, upsell and behavior change Fast forward digitalization enhances the opportunities in business & entertainment • Our digital business solutions needed for online education platforms, remote work, e - commerce • Rising usage of our digital services portfolio • Optimization of our channel costs with faster shift to digital channels Potential risks lie in certain area and segments • Roaming income at risk if situation extends beyond summer (rev share is <3%) • Top - up of pre - paid cards in physical channels (we have a low pre - paid share of 38%, rev. share is <20% in mobile in Turkey ) • Risk of disruption to the global supply chain depending on the duration of this crisis • Rising vulnerability to cyber - attacks given significant remote working Quality of balance sheet and cash strength is key • Turkcell has a robust balance sheet with strong liquidity: USD1.7Bn cash at hand (Dec - 19) • We carry a long FX position of USD115Mn as of De c - 19 Conclusions

13 COVID - 19 Initial Take Notice This presentation was prepared solely for informational purposes and does not constitute or form part of, and should not be c ons trued as an offer to sell or the solicitation of an offer to buy any security in any jurisdiction and neither the issue of the presentation nor anything contained herein shall form the basis of or be relied upon in connection with, or act as an inducement to enter into, any investment activity. This presentation does not purport to contain all of the information that may be required to evaluate an y i nvestment in the Company or any of its securities and should not be relied upon to form the basis of, or be relied on in connection with any decision, contract, commitment or action whatsoever, with respect t o a ny proposed transaction or otherwise. The merit and suitability of an investment in the Company should be independently evaluated and any person considering such an investment in the Company is advised to o bta in independent advice as to the legal, tax, accounting, financial, credit and other related advice prior to making an investment. This presentation may contain forward - looking statements within the meaning of Section 27A of the Securities Act of 1933, Sectio n 21E of the Securities Exchange Act of 1934 and the Safe Harbor provisions of the US Private Securities Litigation Reform Act of 1995. This includes, in particular, our observations of very short term tr end s that may change significantly due to external factors and expectations regarding our telco business and strategic focus areas; digital services, digital business solutions, techfin services impacted by Covid - 19 virus. More generally, all statements other than statements of historical facts included in this presentation, including, without limitation, certain statements regarding our operations, financial position an d business strategy may constitute forward - looking statements. In addition, forward - looking statements generally can be identified by the written or oral use of forward - looking terminology such as, among others, "will," "expect," "intend," "estimate," "believe", "continue" and “guidance”. Although Turkcell believes that the expectations reflected in such forward - looking statements are reasonable at this time, it ca n give no assurance that such expectations will prove to be correct. All subsequent written and oral forward - looking statements attributable to us are expressly qualified in their entirety by reference to these c autionary statements. For a discussion of certain factors that may affect the outcome of such forward looking statements, see our Annual Report on Form 20 - F for 2019 filed with the U.S. Securities and Excha nge Commission, and in particular the risk factor section therein. You should not place undue reliance on forward - looking statements. We undertake no duty to update, revise or confirm expectations or estima tes or to release any revisions to any forward - looking statements, whether as a result of new information, future events or otherwise. Past performance does not guarantee or predict future performance. Neither the Company nor any of its affiliates, board members, officers, employees or agents make any representation or warran ty, express or implied, in relation to the fairness, accuracy, completeness or correctness of the information or opinions contained in this presentation or any oral information provided in connection here wit h, or any data it generates and accept no responsibility, obligation or liability (whether direct or indirect, in contract, tort or otherwise) in relation to any such information. The Company and its affilia tes , board members, officers, employees and agents expressly disclaim any and all liability which may be based on this presentation and any errors or misstatements therein or omissions therefrom. Neither the Co mpany nor its affiliates, board member, officers, employees or agents, make any representation or warranty, express or implied, as to the achievement or reasonableness of future projections, management ta rgets, estimates, prospects or returns, if any. This presentation contains summary information only and does not purport to be comprehensive and is not intended to be (and should not be used as) the s ole basis of any analysis or other evaluation. The information set out in this presentation will be subject to updating, revision, completion, verification and amendment without notice and such informatio n m ay change materially. Neither the Company nor its respective affiliates, board members, officers, employees, agents or advisors are under an obligation to update or keep current the information contained in this presentation or to provide the recipient with access to any additional information that may arise in connection with it, and any opinions expressed in this presentation are subject to change witho ut notice and none of them will have any liability whatsoever (in negligence or otherwise) for any loss whatsoever arising from any use of this presentation or otherwise arising in connection with this pre sen tation. Please note that all financial data are consolidated whereas non - financial data are unconsolidated unless otherwise specified. I n the charts or tables used in this presentation totals may not foot due to rounding differences. The figures used in this presentation are rounded while percentage changes are calculated based on the figures d isc losed in the press release.

SIGNATURES

Pursuant to the requirements of the Securities Exchange Act of 1934, Turkcell Iletisim Hizmetleri A.S. has duly caused this report to be signed on its behalf by the undersigned, thereunto duly authorized.

| | TURKCELL ILETISIM HIZMETLERI A.S. |

| | | |

| | | |

| Date: April 10, 2020 | By: | /s/ Zeynel Korhan Bilek |

| | Name: | Zeynel Korhan Bilek |

| | Title: | Treasury & Capital Markets Management Director |

| | |

| | |

| | TURKCELL ILETISIM HIZMETLERI A.S. |

| | | |

| | | |

| Date: April 10, 2020 | By: | /s/ Osman Yılmaz |

| | Name: | Osman Yılmaz |

| | Title: | Chief Financial Officer |