NOTICE RELATING TO THE REQUEST FOR ADDING ITEMS TO THE AGENDA OF THE GENERAL ASSEMBLY ADDRESSOR: IMTIS Holdings S.a r.l. Address: 9 rue de Bitbourg, L-1273, Luxembourg ADDRESSEE: Turkcell Iletisim Hizmetleri A.S. (Board of Directors) Address: Turkcell Plaza Aydinevler Mah. Inonu Cad. No. 20 Kucukyali Ofispark B Blok, Maltepe, Istanbul For the attention of the Board of Directors ("Turkcell Board") of Turkcell Iletisim Hizmetleri A.S. ("Turkcell"), Re: Request for adding items to the agenda of the Ordinary General Assembly of Turkcell 22/02/2022 Dear Members of the Turkcell Board, We refer to (i) the notice delivered by IMTIS Holdings S.a r.l. ("IMTIS Holdings") to Turkcell through a public notary on 2 February 2022, requesting the convocation of a general assembly of Turkcell (the "Convocation Request"), and (ii) the notice delivered by Turkcell to IMTIS Holdings through a public notary on 11 February 2022, rejecting the Convocation Request (the "Response Letter"). We also refer to (i) Article 411 of the Turkish Commercial Code ("TCC"), entitling shareholders holding at least 5% of the total shares in a publicly held company to request the board of directors to convene a meeting of the general assembly or to add items to the agenda of a meeting of the general assembly to be already convened, to, stating the justifying reasons for such request and the agenda items, and (ii) Article 29/5 of the Capital Markets Law ("CML"), entitling such shareholders to submit draft resolutions to be

discussed at the general assembly meeting in accordance with Article 411 of the TCC. The right attributed to any shareholder holding at least 5% of the shares in a publicly held company to request the addition of items to the agenda of a general assembly meeting that will be convened and to request discussion of the draft resolutions regarding the agenda items has been granted independently of the right to request the convocation of a meeting of the general assembly and to submit proposals during the general assembly meetings. As you know, the general assembly has the inalienable right and authority to resolve upon the matters relating to the election and dismissal of the members of the board of directors as well as amending the articles of association. Such inalienable right and authority has been explicitly recognised under Article 408 of the TCC. Voting on these matters during the general assembly meetings constitutes a fundamental shareholder right that cannot be denied or restricted by the board of directors. The disclosures made by Turkcell in Public Disclosure Platform ("KAP") on 11 February 2022, reflects that the amendments to the articles of association proposed by IMTIS Holdings as part of Convocation Request has been partially taken into account by Turkcell Board. The part of the proposed amendments to the articles of association relating to the disclosure of board member and management executive remuneration which is in line with the Corporate Governance Principle numbered 4.6.5 was not included in the articles of association amendment text disclosed in KAP by Turkcell. Our other requests were also rejected. In the Response Letter, it has been indicated that the necessary transactions regarding the convocation of the Ordinary General Assembly of Turkcell pertaining to the 2021 Fiscal Year (the "Turkcell Ordinary General Assembly") would be undertaken by the Turkcell Board following the publication of the financial results of Turkcell for the 2021 Fiscal Year on 17 February 2022.

Accordingly, IMTIS Holdings hereby requests the following from the Turkcell Board pursuant to Article 411 of the TCC and Article 29/5 of the CML: (a) Please add each of the agenda items set out in Annex 1 hereto (Items Requested to be Added to the Agenda of the Turkcell Ordinary General Assembly, including Articles of Association Amendment Text and IMTIS Holdings' Draft Resolution) (the "Requested Agenda Items") to the agenda of the Turkcell Ordinary General Assembly, so that the Requested Agenda Items and submitted draft resolutions are discussed as separate agenda items or sub-agenda items, as applicable; (b) please take any other action or transaction that is or may be necessary or appropriate to ensure that the Requested Agenda Items are discussed and voted on at the Turkcell Ordinary General Assembly. As of the date of this letter, IMTIS Holdings holds 435,600,000 shares, corresponding to 19.8% of the total issued and outstanding share capital of Turkcell. IMTIS Holdings hereby reserves all rights available to it under the Articles of Association of Turkcell and applicable legislation, including its right to (i) request Turkcell and/or any competent court or authority to convene an ordinary or extraordinary general assembly meeting of Turkcell, (ii) request the addition of further items to the agenda of the Turkcell General Assembly, and (iii) amend or submit further draft resolutions and/or proposals to be discussed and voted on at the Turkcell General Assembly. Yours sincerely,

Enclosure: Annex 1- Items Requested to be Added to the Turkcell Ordinary General Assembly Agenda, including Articles of Association Amendment Text and IMTIS Holdings' Draft Resolution To the attention of the Public Notary; we hereby request that one copy of this notice, consisting of a total of three copies, be served on the addressee thereof by hand by the public notary officer, one copy be kept on records at your office, and one copy incorporating the service annotation be delivered to us. On behalf of IMTIS Holdings S.a r.l. by proxy, Begum DURUKAN OZAYDIN

[ALL IN TURKISH]

Annex 1- Items Requested to be Added to the Turkcell Ordinary General Assembly Agenda, including Articles of Association Amendment Text IMTIS Holdings' Draft Resolution ITEMS THAT ARE REQUESTED TO BE ADDED TO THE AGENDA OF THE ORDINARY GENERAL ASSEMBLY MEETING OF TURKCELL ILETISIM HIZMETLERI A.S. FOR THE 2021 FISCAL YEAR 1. Subject to the approval of the Ministry of Trade of the Republic of Turkey and the Capital Markets Board; Discussion of and decision on the amendments to Articles 9, 17 and 19 of the Articles of Association of the Company in accordance with the amendment text that is proposed by IMTIS Holdings S.a. r.l. and annexed to the agenda; 2. Discussion of and decision on the release of the Board Members, to be voted on individually and not cumulatively, for their actions in connection with the activities and operations of the Company pertaining to the 2021 fiscal year; 2.1. Discussion of and decision on the release of Mr. Bulent Aksu for his actions in connection with the activities and operations of the Company pertaining to the 2021 fiscal year; 2.2. Discussion of and decision on the release of Mr. Huseyin Aydin for his actions in connection with the activities and operations of the Company pertaining to the 2021 fiscal year; 2.3. Discussion of and decision on the release of Mrs. Figen Kilic for her actions in connection with the activities and operations of the Company pertaining to the 2021 fiscal year; 2.4. Discussion of and decision on the release of Mr. Tahsin Yazar for his actions in connection with the activities and operations of the Company pertaining to the 2021 fiscal year; 2.5. Discussion of and decisionon the release of Mr. Senol Kazanci for his actions in connection with with the activities and operations of the Company pertaining to the 2021 fiscal year; 2.6. Discussion of and decision on the release of Mr. Afif Demirkiran for his actions in connection with the activities and

operations of the Company pertaining to the 2021 fiscal year; 2.7. Discussion of and decision on the release of Mr. Nail Olpak for his actions in connection with the activities and operations of the Company pertaining to the 2021 fiscal year; 2.8. Discussion of and decision on the release of Mr. Huseyin Arslan for his actions in connection with the activities and operations of the Company pertaining to the 2021 fiscal year; 2.9. Discussion of and decision on the release of Mr. Julian Michael Sir Julian Horn- Smith for his actions in connection with the activities and operations of the Company pertaining to the 2021 fiscal year; 3. Informing the General Assembly on the amount of donations and contributions made by the Company in the 2021 fiscal year and the beneficiaries of such donations and contributions by explaining each transaction individually; Discussion of and decision on the limit on donations and contributions that can be made by the Company during the period commencing on 1 January 2022 and ending on the date of the Company's general assembly meeting relating to the 2022 fiscal year; 4. Discussion of and decision on the proposed removal of the Board Members, except for those Board Members who have been appointed through the use of the privileges granted to the holders of Group A shares under Article 7 of the Company's Articles of Association, and those Board Members, if any, who have been temporarily appointed by the Board of Directors in accordance with Article 363 of the Turkish Commercial Code and Article 9 of the Company's Articles of Association to fill any board vacancy that may have occurred prior to the date of this General Assembly meeting with respect to the Board Members appointed through the use of the privileges granted to the holders of Group shares, and appointment of new Board Members in their place; 4.1. Discussion of and decision on the removal from the Board of Directors of Mr. Afif Demirkiran or, if applicable, any other Board Member that has been temporarily appointed by the Board of

Directors in accordance with Article 363 of the Turkish Commercial Code to fill any board vacancy that may have occurred with respect to Mr. Afif Demirkiran; 4.2. Discussion of and decision on the removal from the Board of Directors of Mr. Nail Olpak or, if applicable, any other Board Member that has been temporarily appointed by the Board of Directors in accordance with Article 363 of the Turkish Commercial Code to fill any board vacancy that may have occurred with respect to Mr. Nail Olpak; 4.3. Discussion of and decision on the removal from the Board of Directors of Mr. Huseyin Arslan or, if applicable, any other Board Member that has been temporarily appointed by the Board of Directors in accordance with Article 363 of the Turkish Commercial Code to fill any board vacancy that may have occurred with respect to Mr. Huseyin Arslan; 4.4. Discussion of and decision on the removal from the Board of Directors of Mr. Julian Michael Sir Julian Horn-Smith or, if applicable, any other Board Member that has been temporarily appointed by the Board of Directors in accordance with Article 363 of the Turkish Commercial Code to fill any board vacancy that may have occurred with respect to Mr. Julian Michael Sir Julian Horn-Smith; 4.5. Discussion of and decision on the appointment of Mr. Serdar Cetin as an independent board member for a term of 1 (one) year to serve until the date of the annual General Assembly meeting approving the consolidated financial statements of the Company for the fiscal year ending 31 December 2022; 4.6. Discussion of and decision on the appointment of Mrs. Mevhibe Canan Ozsoy as an independent board member for a term of 1 (one) year to serve until the date of the annual General Assembly meeting approving the consolidated financial statements of the Company for the fiscal year ending 31 December 2022; 4.7. Discussion of and decision on the appointment of Mr. Gonenc Gurkaynak as an independent board member for a

term of 1 (one year to serve until the date of the annual General Assembly meeting approving the consolidated financial statements of the Company for the fiscal year ending 31 December 2022; 4.8. Discussion of and decision on the appointment of Mr. Alejandro Douglass Plater as a board member for a term of 1 (one) year to serve until the date of the annual General Assembly meeting approving the consolidated financial statements of the Company for the fiscal year ending 31 December 2022; 5. Discussion of and decision on the proposed distribution of dividends and dividend distribution date for the 2021 fiscal year; 5.1. Discussion of and decision on the proposal and draft resolution submitted by IMTIS Holdings S.a r.l., shareholder of the Company, relating to distribution of dividends and the dividend distribution date for the 2021 fiscal year;

Annex to the Agenda - Articles of Association Amendments [See Following Pages]

[PAGES 11-15 are ALL TURKISH]

[PAGES 11-15 are ALL TURKISH]

[PAGES 11-15 are ALL TURKISH]

[PAGES 11-15 are ALL TURKISH]

[PAGES 11-15 are ALL TURKISH]

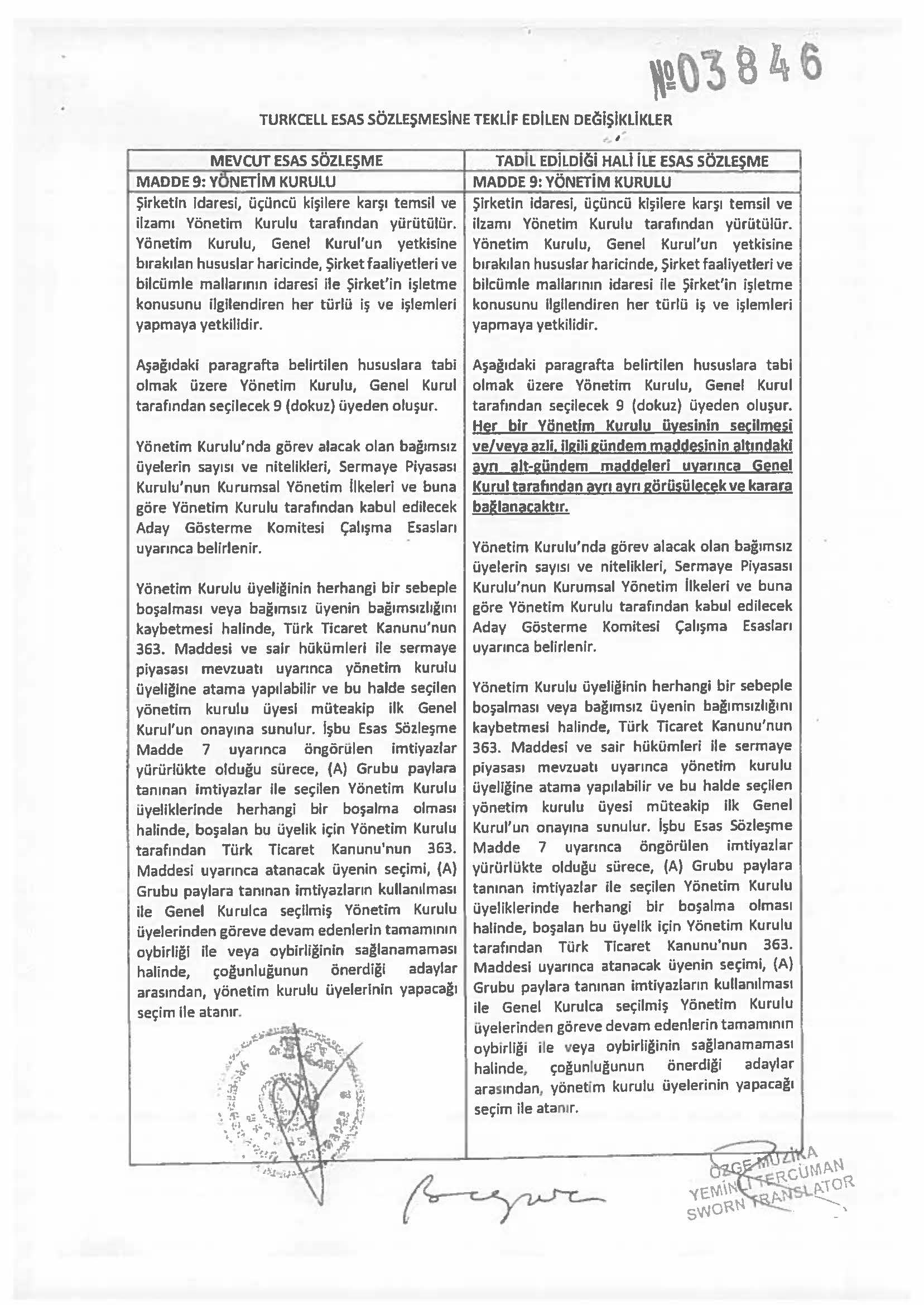

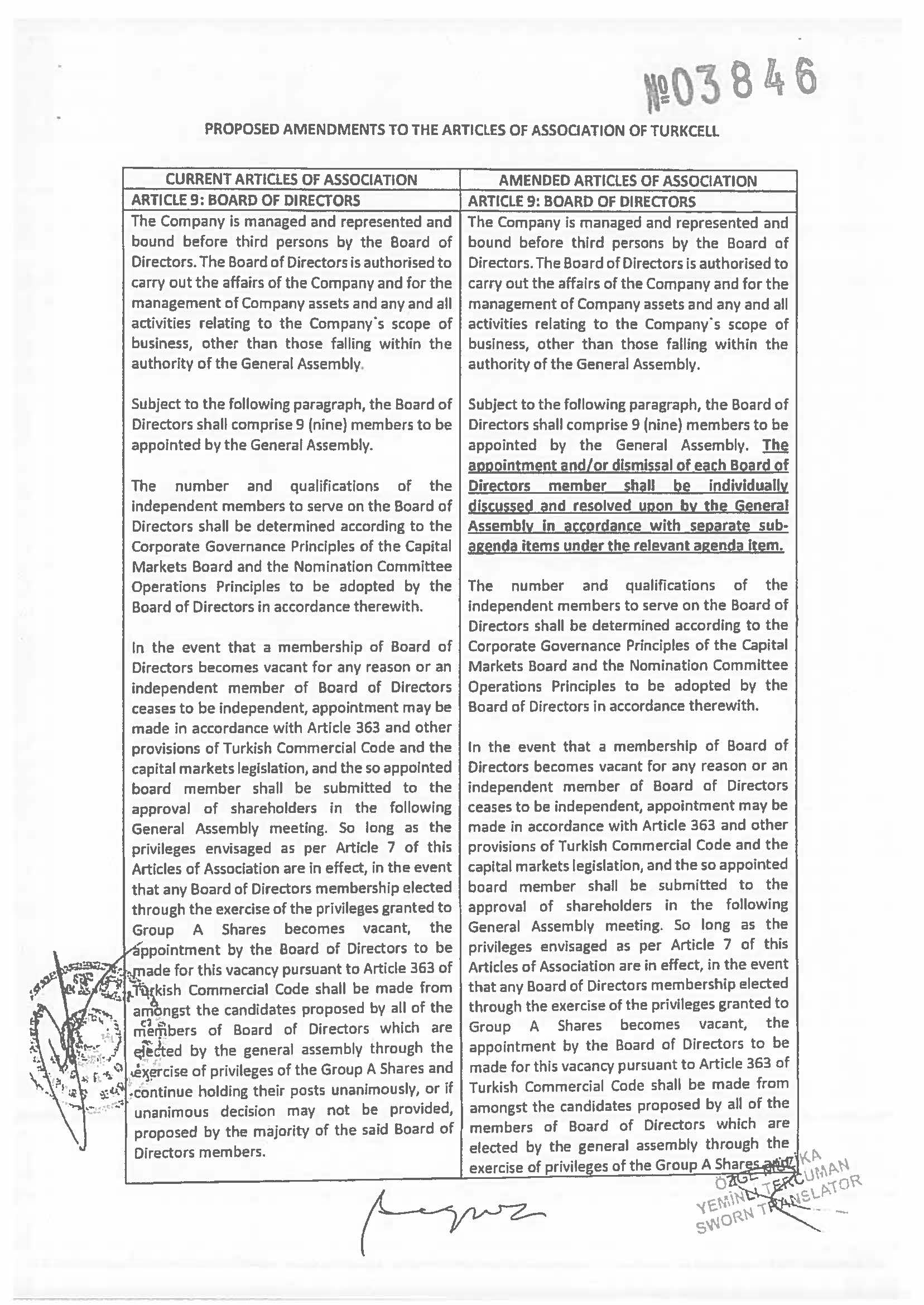

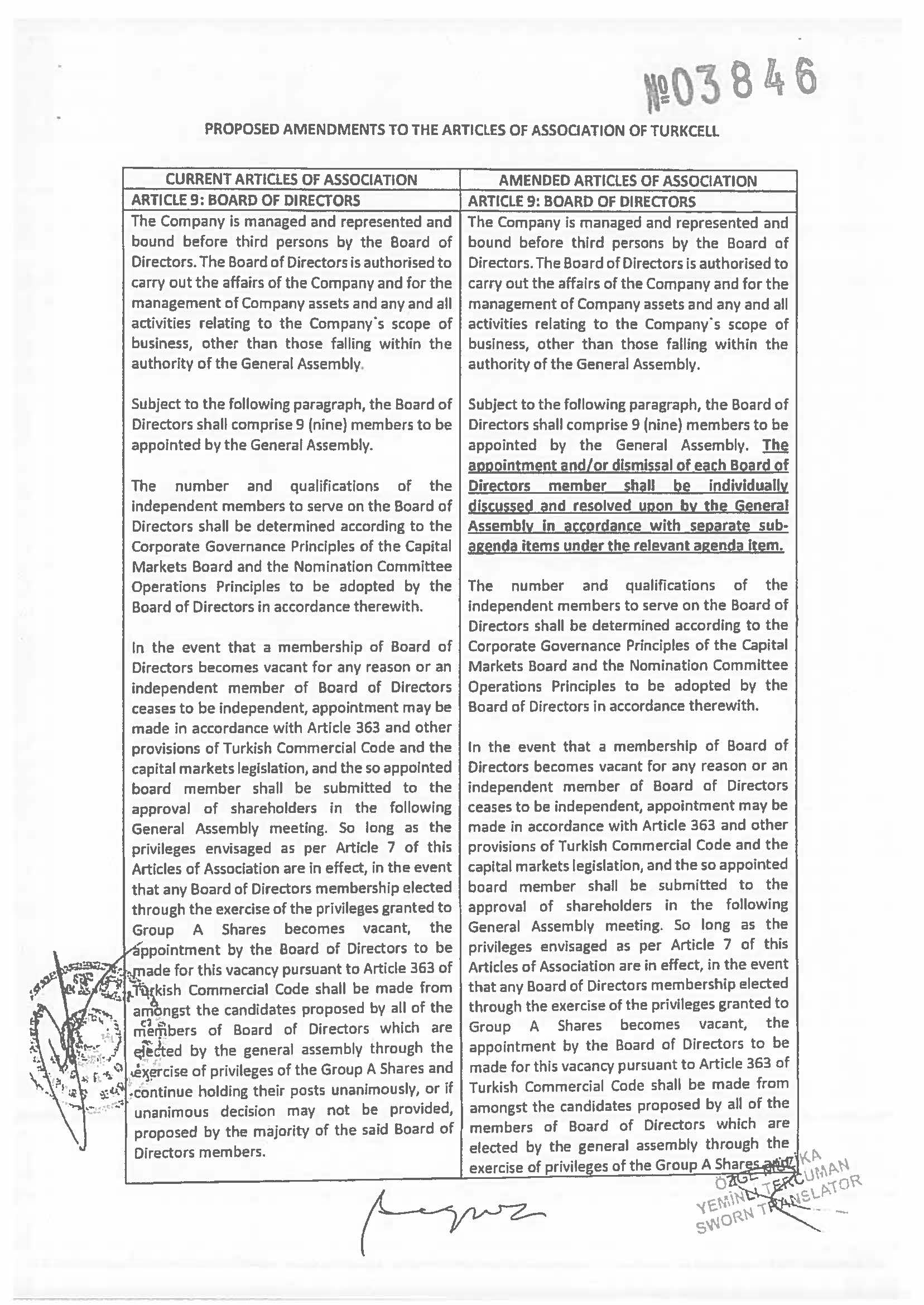

CURRENT ARTICLES OF ASSOCIATION ARTICLE 9: BOARD OF DIRECTORS The Company is managed and represented and bound before third persons by the Board of Directors. The Board of Directors is authorised to carry out the affairs of the Company and for the management of Company assets and any and all activities relating to the Company's scope of business, other than those falling within the authority of the General Assembly Subject to the following paragraph, the Board of Directors shall comprise 9 (nine) members to be appointed by the General Assembly. The number and qualifications of the independent members to serve on the Board of Directors shall be determined according to the Corporate Governance Principles of the Capital Markets Board and the Nomination Committee Operations Principles to be adopted by the Board of Directors in accordance therewith. In the event that a membership of Board of Directors becomes vacant for any reason or an independent member of Board of Directors ceases to be independent, appointment may be made in accordance with Article 363 and other provisions of Turkish Commercial Code and the capital markets legislation, and the so appointed board member shall be submitted to the approval of shareholders in the following General Assembly meeting. So long as the privileges envisaged as per Article 7 of this Articles of Association are in effect, in the event that any Board of Directors membership elected through the exercise of the privileges granted to Group A Shares becomes vacant, the appointment by the Board of Directors to be made for this vacancy pursuant to Article 363 of Turkish Commercial Code shall be made from amongst the candidates proposed by all of the members of Board of Directors which are elected by the general assembly through the exercise of privileges of the Group A Shares and continue holding their posts unanimously, or if unanimous decision may not be provided, proposed by the majority of the said Board of Directors members. AMENDED ARTICLES OF ASSOCIATION ARTICLE 9: BOARD OF DIRECTORS The Company is managed and represented and bound before third persons by the Board of Directors. The Board of Directors is authorised to carry out the affairs of the Company and for the management of Company assets and any and all activities relating to the Company's scope of business, other than those falling within the authority of the General Assembly. Subject to the following paragraph, the Board of Directors shall comprise 9 (nine) members to be appointed by the General Assembly. The appointment and/or dismissal of each Board of Directors member shall be individually discussed and resolved upon by the General Assembly in accordance with separate sub-agenda items under the relevant agenda item. The number and qualifications of the independent members to serve on the Board of Directors shall be determined according to the Corporate Governance Principles of the Capital Markets Board and the Nomination Committee Operations Principles to be adopted by the Board of Directors in accordance therewith. In the event that a membership of the Board of Directors becomes vacant for any reason or an independent member of Board of Directors ceases to be independent, appointment may be made in accordance with Article 363 and other provisions of Turkish Commercial Code and the capital markets legislation, and the so appointed board member shall be submitted to the approval of shareholders in the following General Assembly meeting. So long as the privileges envisaged as per Article 7 of this Articles of Association are in effect, in the event that any Board of Directors membership elected through the exercise of the privileges granted to Group A Shares becomes vacant, the appointment by the Board of Directors to be made for this vacancy pursuant to Article 363 of Turkish Commercial Code shall be made from amongst the candidates proposed by all of the members of Board of Directors which are elected by the general assembly through the exercise of privileges of the Group A Shares and

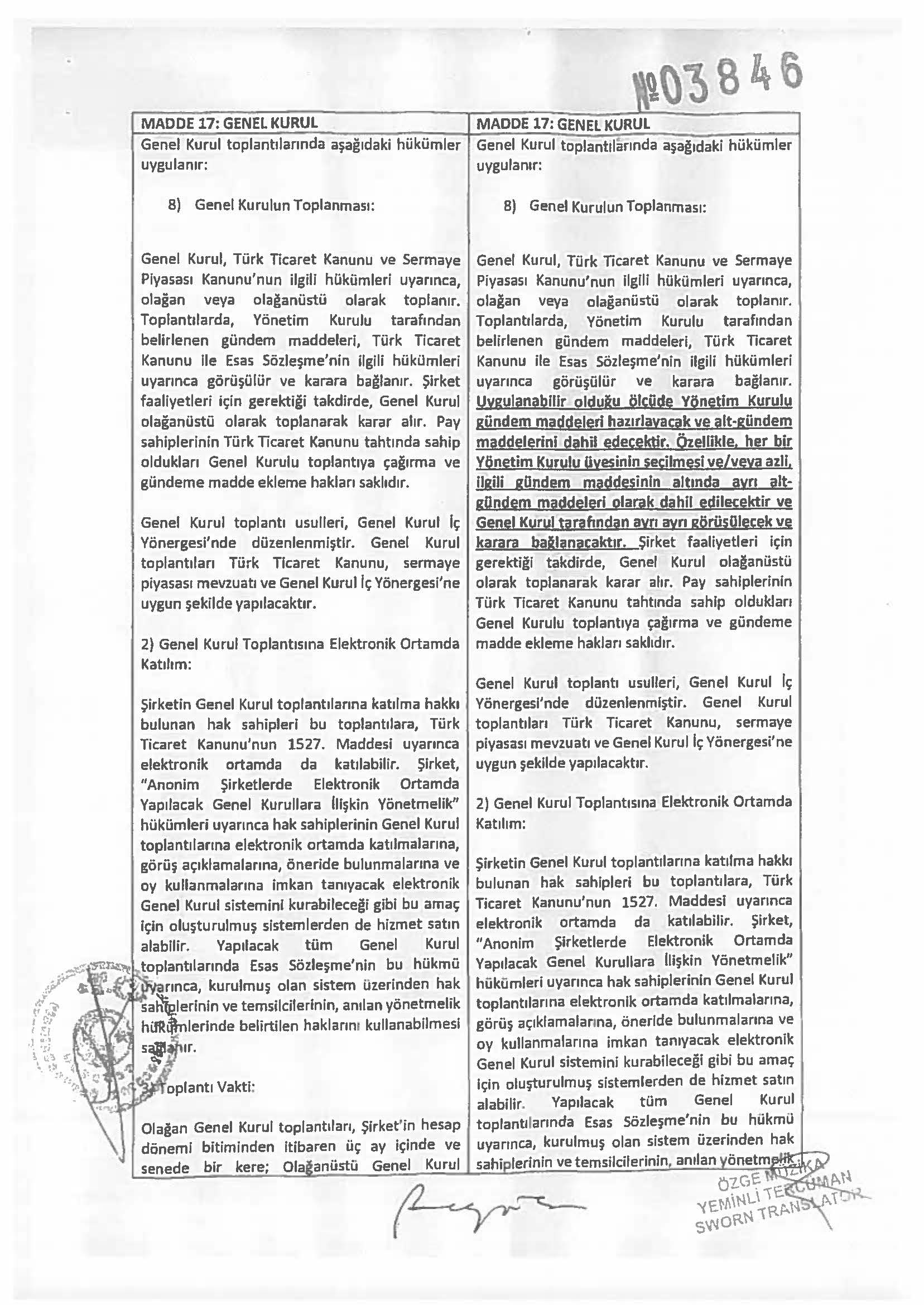

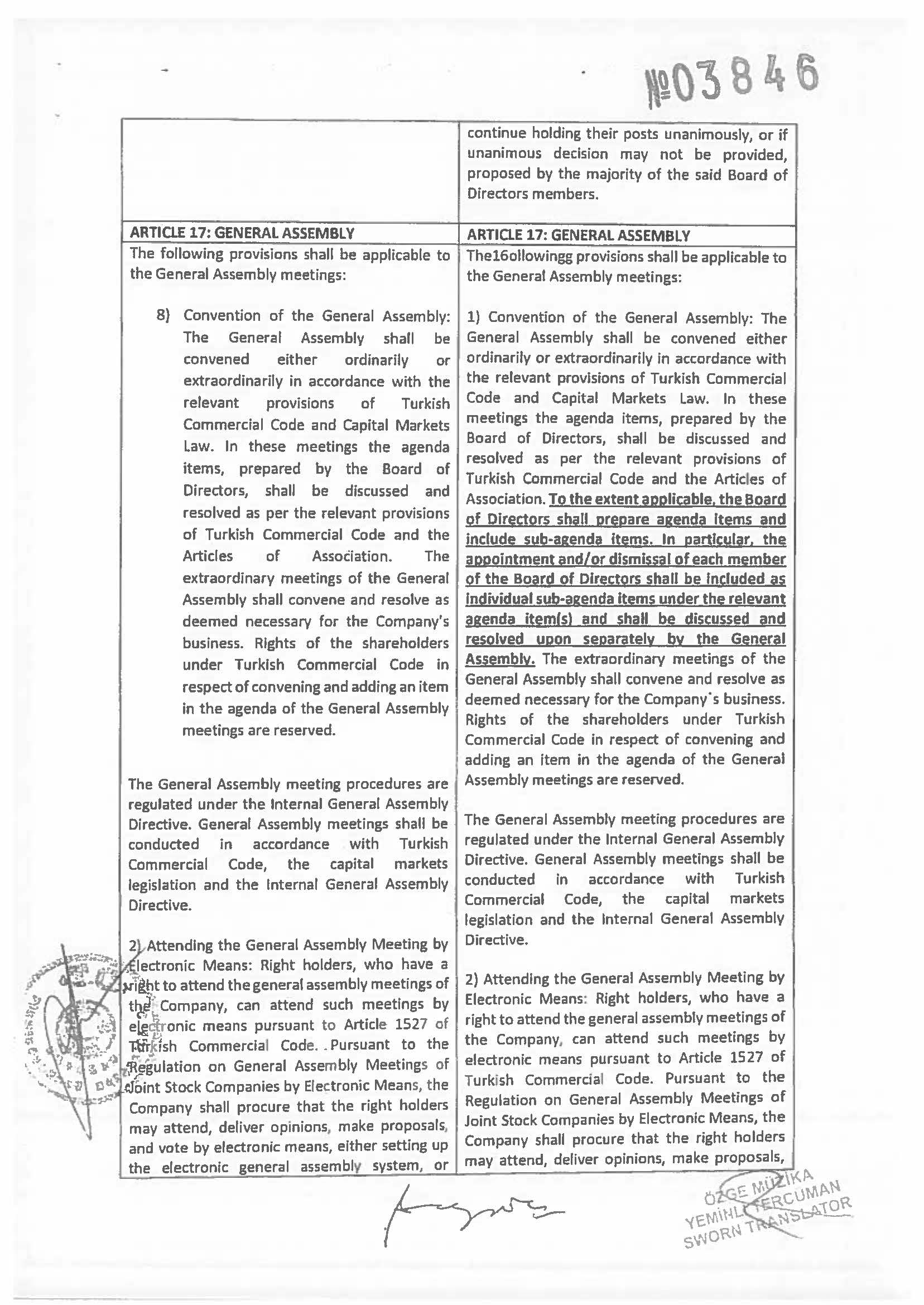

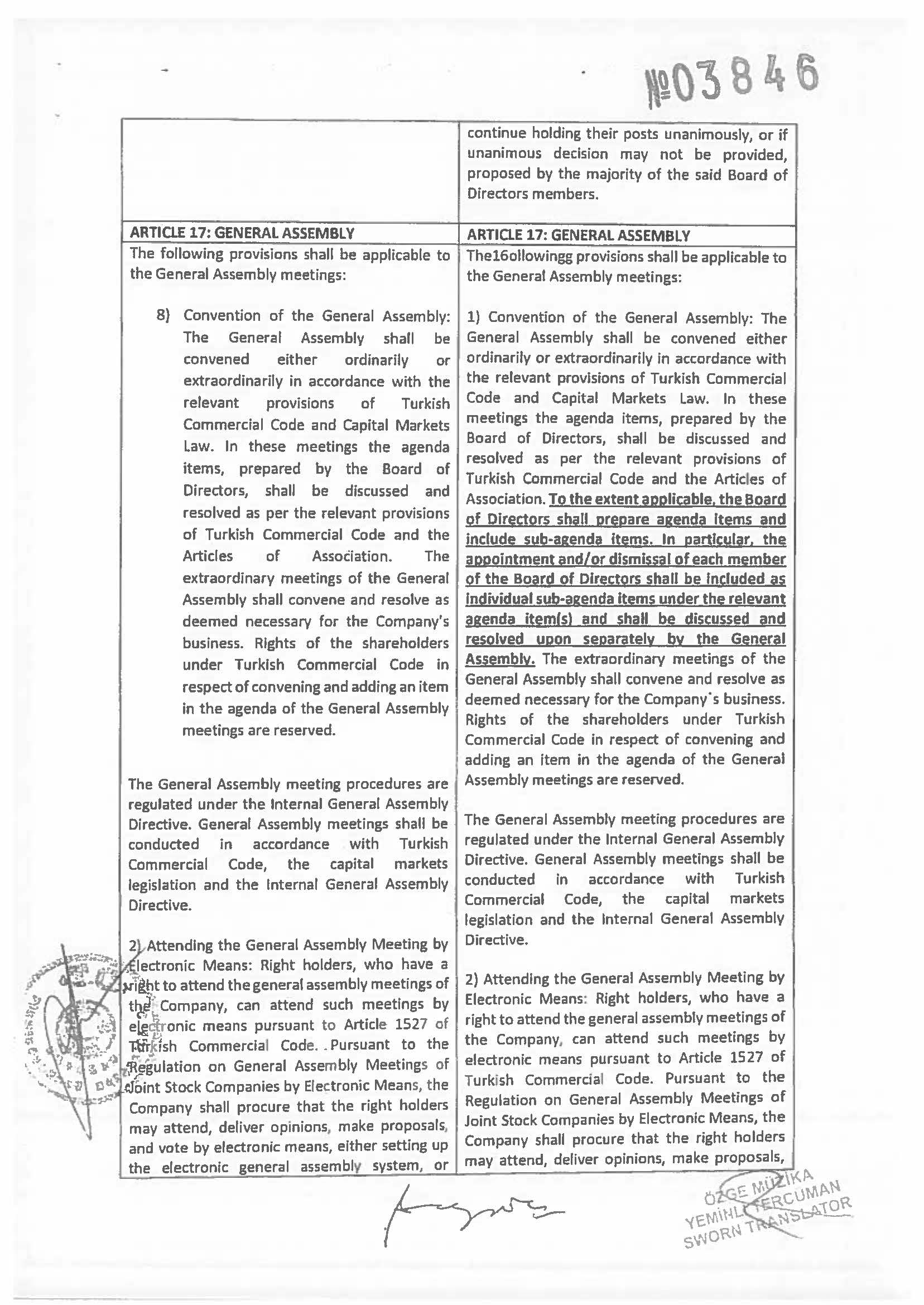

continue holding their posts unanimously, or if unanimous decision may not be provided, proposed by the majority of the said Board of Directors members. ARTICLE 17: GENERAL ASSEMBLY The following provisions shall be applicable to the General Assembly meetings: 8) Convention of the General Assembly: The General Assembly shall be convened either ordinarily or extraordinarily in accordance with the relevant provisions of Turkish Commercial Code and Capital Markets Law. In these meetings the agenda items, prepared by the Board of Directors, shall be discussed and resolved as per the relevant provisions of Turkish Commercial Code and the Articles of Association. The extraordinary meetings of the General Assembly shall convene and resolve as deemed necessary for the Company's business. Rights of the shareholders under Turkish Commercial Code in respect of convening and adding an item in the agenda of the General Assembly meetings are reserved. The General Assembly meeting procedures are regulated under the Internal General Assembly Directive. General Assembly meetings shall be conducted in accordance with Turkish Commercial Code, the capital markets legislation and the Internal General Assembly Directive. 2) Attending the General Assembly Meeting by Electronic Means: Right holders, who have a right to attend the general assembly meetings of the Company, can attend such meetings by electronic means pursuant to Article 1527 of Turkish Commercial Code. Pursuant to the Regulation on General Assembly Meetings of Joint Stock Companies by Electronic Means, the Company shall procure that the right holders may attend, deliver opinions, make proposals, and vote by electronic means, either setting up the electronic general assembly system, or ARTICLE 17: GENERAL ASSEMBLY The following provisions shall be applicable to the General Assembly meetings: 1) Convention of the General Assembly: The General Assembly shall be convened either ordinarily or extraordinarily in accordance with the relevant provisions of Turkish Commercial Code and Capital Markets Law. In these meetings the agenda items, prepared by the Board of Directors, shall be discussed and resolved as per the relevant provisions of Turkish Commercial Code and the Articles of Association. To the extent applicable, the Board of Directors shall prepare agenda items and include sub-agenda items. In particular, the appointment and/or dismissal of each member of the Board of Directors shall be included as individual sub-agenda items under the relevant agenda item(s) and shall be discussed and resolved upon separately by the General Assembly. The extraordinary meetings of the General Assembly shall convene and resolve as deemed necessary for the Company's business. Rights of the shareholders under Turkish Commercial Code in respect of convening and adding an item in the agenda of the General Assembly meetings are reserved. The General Assembly meeting procedures are regulated under the Internal General Assembly Directive. General Assembly meetings shall be conducted in accordance with Turkish Commercial Code, the capital markets legislation and the Internal General Assembly Directive. 2) Attending the General Assembly Meeting by Electronic Means: Right holders, who have a right to attend the general assembly meetings of the Company, can attend such meetings by electronic means pursuant to Article 1527 of Turkish Commercial Code. Pursuant to the Regulation on General Assembly Meetings of Joint Stock Companies by Electronic Means, the Company shall procure that the right holders may attend, deliver opinions, make proposals,

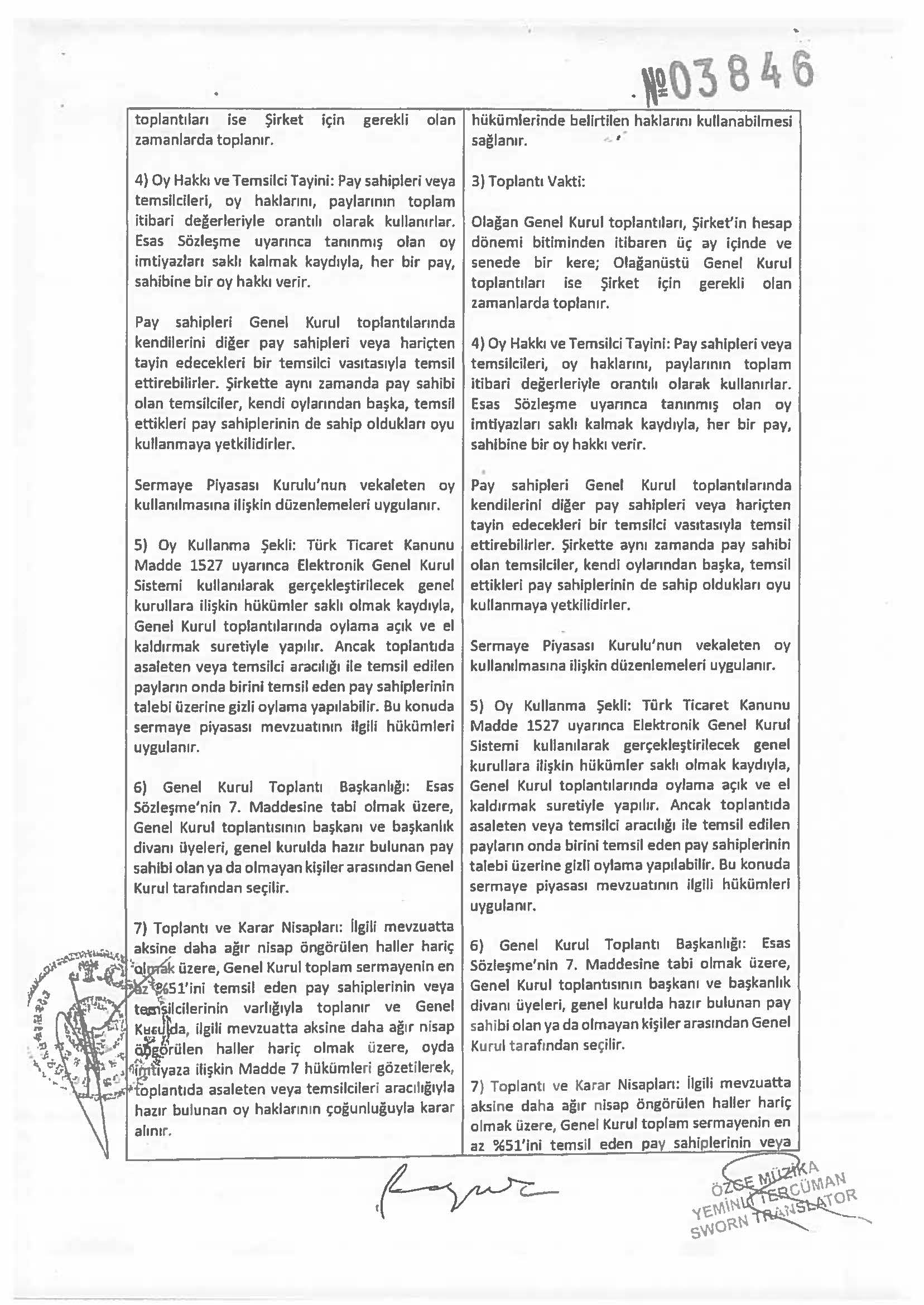

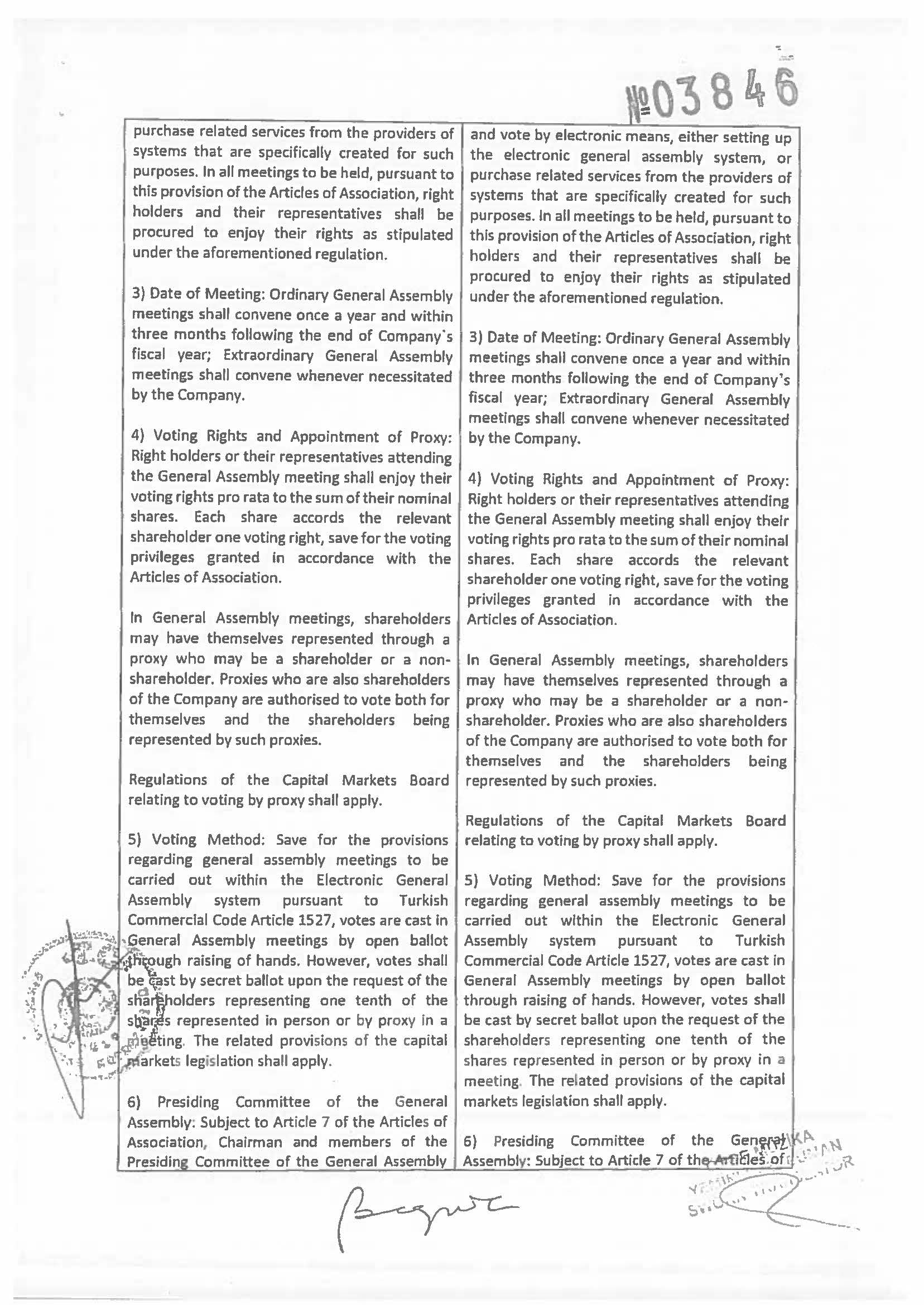

purchase related services from the providers of systems that are specifically created for such purposes. In all meetings to be held, pursuant to this provision of the Articles of Association, right holders and their representatives shall be procured to enjoy their rights as stipulated under the aforementioned regulation. 3) Date of Meeting: Ordinary General Assembly meetings shall convene once a year and within three months following the end of Company's fiscal year; Extraordinary General Assembly meetings shall convene whenever necessitated by the Company. 4) Voting Rights and Appointment of Proxy: Right holders or their representatives attending the General Assembly meeting shall enjoy their voting rights pro rata to the sum of their nominal shares. Each share accords the relevant shareholder one voting right, save for the voting privileges granted in accordance with the Articles of Association. In General Assembly meetings, shareholders may have themselves represented through a proxy who may be a shareholder or a non-shareholder. Proxies who are also shareholders of the Company are authorised to vote both for themselves and the shareholders being represented by such proxies. Regulations of the Capital Markets Board relating to voting by proxy shall apply. 5) Voting Method: Save for the provisions regarding general assembly meetings to be carried out within the Electronic General Assembly system pursuant to Turkish Commercial Code Article 1527, votes are cast in General Assembly meetings by open ballot through raising of hands. However, votes shall be cast by secret ballot upon the request of the shareholders representing one tenth of the shares represented in person or by proxy in a meeting. The related provisions of the capital markets legislation shall apply. 6) Presiding Committee of the General Assembly: Subject to Article 7 of the Articles of Association, Chairman and members of the Presiding Committee of the General Assembly and vote by electronic means, either setting up the electronic general assembly system, or purchase related services from the providers of systems that are specifically created for such purposes. In all meetings to be held, pursuant to the provision of the Articles of Association, right holders and their representatives shall be procured to enjoy their rights as stipulated under the aforementioned regulation. 3) Date of Meeting: Ordinary General Assembly meetings shall convene once a year and within three months following the end of Company's fiscal year; Extraordinary General Assembly meetings shall convene whenever necessitated by the Company. 4) Voting Rights and Appointment of Proxy: Right holders or their representatives attending the General Assembly meeting shall enjoy their voting rights pro rata to the sum of their nominal shares. Each share accords the relevant shareholder one voting right, save for the voting privileges granted in accordance with the Articles of Association. In General Assembly meetings, shareholders may have themselves represented through a proxy who may be a shareholder or a non-shareholder. Proxies who are also shareholders of the Company are authorised to vote both for themselves and the shareholders being represented by such proxies. Regulations of the Capital Markets Board relating to voting by proxy shall apply. 5) Voting Method: Save for the provisions regarding general assembly meetings to be carried out within the Electronic General Assembly system pursuant to Turkish Commercial Code Article 1527, votes are cast in General Assembly meetings by open ballot through raising of hands. However, votes shall be cast by secret ballot upon the request of the shareholders representing one tenth of the shares represented in person or by proxy in a meeting. The related provisions of the capital markets legislation shall apply. 6) Presiding Committee of the General Assembly: Subject to Article 7 of the Articles of

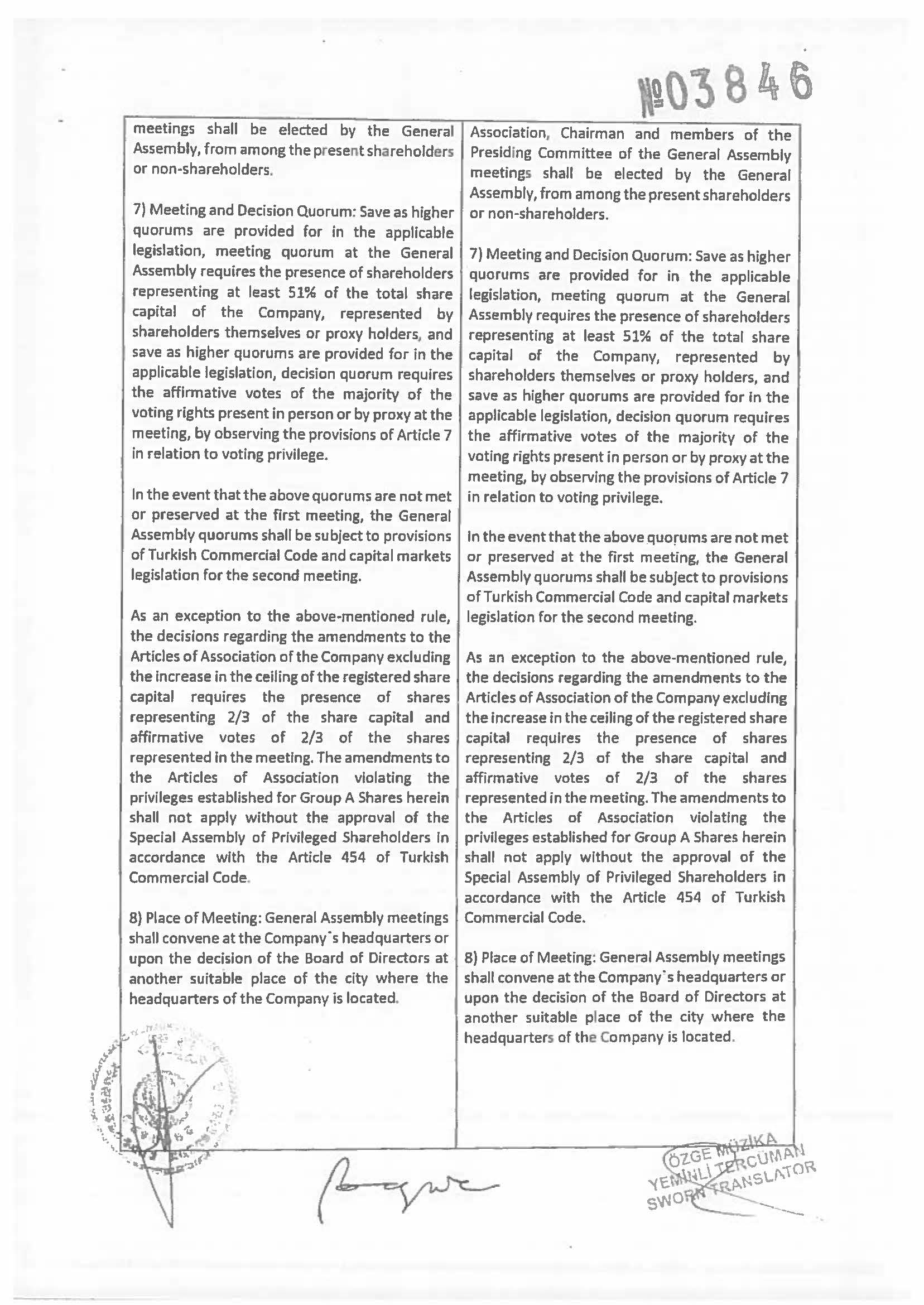

meetings shall be elected by the General Assembly, from among the present shareholders or non-shareholders. 7) Meeting and Decision Quorum: Save as higher quorums are provided for in the applicable legislation, meeting quorum at the General Assembly requires the presence of shareholders representing at least 51% of the total share capital of the Company, represented by shareholders themselves or proxy holders, and save as higher quorums are provided for in the applicable legislation, decision quorum requires the affirmative votes of the majority of the voting rights present in person or by proxy at the meeting, by observing the provisions of Article 7 in relation to voting privilege. In the event that the above quorums are not met or preserved at the first meeting, the General Assembly quorums shall be subject to provisions of Turkish Commercial Code and capital markets legislation for the second meeting. As an exception to the above-mentioned rule, the decisions regarding the amendments to the Articles of Association of the Company excluding the increase in the ceiling of the registered share capital requires the presence of shares representing 2/3 of the share capital and affirmative votes of 2/3 of the shares represented in the meeting. The amendments to the Articles of Association violating the privileges established for Group A Shares herein shall not apply without the approval of the Special Assembly of Privileged Shareholders in accordance with the Article 454 of Turkish Commercial Code. 8) Place of Meeting: General Assembly meetings shall convene at the Company's headquarters or upon the decision of the Board of Directors at another suitable place of the city where the headquarters of the Company is located. Association, Chairman and members of the Presiding Committee of the General Assembly meetings shall be elected by the General Assembly, from among the present shareholders or non-shareholders. 7) Meeting and Decision Quorum: Save as higher quorums are provided for in the applicable legislation, meeting quorum at the General Assembly requires the presence of shareholders representing at least 51% of the total share capital of the Company, represented by shareholders themselves or proxy holders, and save as higher quorums are provided for in the applicable legislation, decision quorum requires the affirmative votes of the majority of the voting rights present in person or by proxy at the meeting, by observing the provisions of Article 7 in relation to voting privilege. In the event that the above quorums are not met or preserved at the first meeting, the General Assembly quorums shall be subject to provisions of Turkish Commercial Code and capital markets legislation for the second meeting. As an exception to the above-mentioned rule, the decisions regarding the amendments to the Articles of Association of the Company excluding the increase in the ceiling of the registered share capital requires the presence of shares representing 2/3 of the share capital and affirmative votes of 2/3 of the shares represented in the meeting. The amendments to the Articles of Association violating the privileges established for Group A Shares herein shall not apply without the approval of the Special Assembly of Privileged Shareholders in accordance with the Article 454 of Turkish Commercial Code. 8) Place of Meeting: General Assembly meetings shall convene at the Company's headquarters or upon the decision of the Board of Directors at another suitable place of the city where the headquarters of the Company is located.

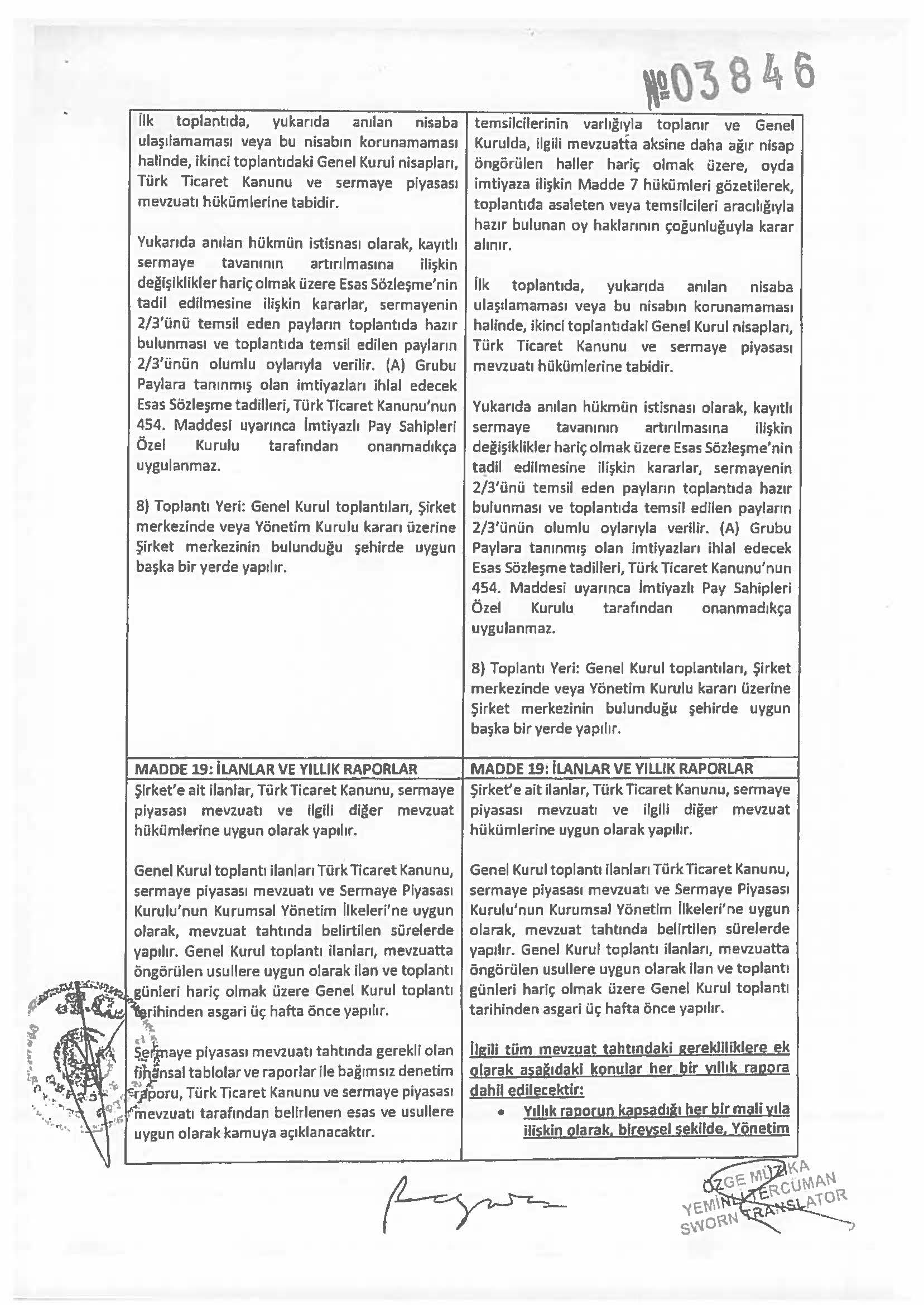

ARTICLE 19: ANNOUNCEMENTS AND ANNUAL REPORTS Announcements with regard to the Company shall be made in accordance with the provisions of Turkish Commercial Code, the capital markets legislation and other relevant legislation. The General Assembly meeting announcements shall be made within the periods specified under the applicable legislation, in accordance with Turkish Commercial Code, the capital markets legislation and the Capital Markets Board's Corporate Governance Principles. The General Assembly meeting announcements shall be made at least three weeks before the date of General Assembly meeting, excluding the dates of announcement and meeting, in accordance with the procedures envisaged under the legislation. Financial tables and reports required by the capital markets legislation and independent audit report, shall be disclosed to the public according to rules and procedures set forth by Turkish Commercial Code and the capital markets legislation. ARTICLE 19: ANNOUNCEMENTS AND ANNUAL REPORTS Announcements with regard to the Company shall be made in accordance with the provisions of Turkish Commercial Code, the capital markets legislation, and other relevant legislation. The General Assembly meeting announcements shall be made within the periods specified under the applicable legislation, in accordance with Turkish Commercial Code, the capital markets legislation and the Capital Markets Board's Corporate Governance Principles. The General Assembly meeting announcements shall be made at least three weeks before the date of General Assembly meeting, excluding the dates of announcement and meeting, in accordance with the procedures envisaged under the legislation. In addition to the requirements under all applicable legislation, the following matter shall be included in each annual report: o Board of Directors member and management executive remuneration and other financial rights, on an individual basis, with respect to each fiscal year covered by the annual report o Information on attendance by members of the Board of Directors to Board of Directors meetings and committee meetings, on an individual basis, with respect to each fiscal year covered by the annual report o Detailed information on Board of Directors' diversity policy, targets, measures and projected timeframes for achievement o Independent auditor fees, with respect to each fiscal year covered by the annual report Financial tables and reports required by the capital markets legislation and independent audit report, shall be disclosed to the public according to rules and procedures set forth by Turkish Commercial Code and the capital markets legislation.

[ALL TURKISH]

DRAFT RESOLUTION REGARDING THE AGENDA ITEM OF THE ORDINARY GENERAL ASSEMBLY MEETING OF TURKCELL ILETISIM HIZMETLERI A.S. ("TURKCELL") FOR THE 2021 FINANCIAL YEAR RELATING TO DIVIDEND DISTRIBUTION For the attention of: The Board of Directors and General Assembly of Turkcell IMTIS Holdings S.a r.l. hereby requests that the following draft resolution, which was submitted with respect to the distribution of a cash dividend for the 2021 financial year, be discussed and voted on at the Ordinary General Assembly of Turkcell to be Convened for the 2021 Financial Year. "Within the scope of the Articles of Association and Dividend Distribution Policy of the Company, for the fiscal year 2021, it has been resolved to distribute a dividend in a gross amount of TRY 3,773,323,500 in total, as gross dividend of TRY 1.7151470 (net TRY 1.5436323) per ordinary share with a nominal value of TRY 1, in cash, to the shareholders, to be paid within the scope of the principles set forth under the legislation on a date/ on dates to be identified for this purpose by the board of directors of the Company and, in any event, by no later than six months after the date of this general assembly meeting." IMTIS Holdings S.a.r.l.

I, David Noel Lloyd FAWCETT, Notary Public of the City of London, England, by Royal Authority duly admitted and sworn, practicing in the said City, DO HEREBY CERTIFY AND ATTEST: THAT the hereunto entered Instrument has been signed on behalf of the Luxembourg company styled "IMTIS HOLDINGS S.a r.l." by Sally PRYCE, born in the Bradford, England on 1st June 1978, holder of British passport number [REDACTED] issued on 8th August 2018, whose personal identity I attest. THAT on this day I caused a search to be made at the Registry of Commerce and Companies of Luxembourg, from which it appears that: the aforementioned "IMTIS HOLDINGS S.a r.l." is a company incorporated and existing in accordance with Luxembourg law, registered at the said Registry under number B244621 with registered office at 9 Rue de Bitbourg, L-1273 Luxembourg, and the said Sally PRYCE is registered as a one of the Gerants of the said company. IN TESTIMONY WHEREOF I have hereunder set my hand and affixed my Seal of Office in the City of London aforesaid, this twelfth day of November in the year Two thousand and twenty-one. David Noel Lloyd FAWCETT Notary Public of London, England APOSTILLE 1 Country: United Kingdom of Great Britain and Northern Ireland This public document 2 Has been signed by David Noel Lloyd Fawcett 3 Acting in the capacity of Notary Public 4 Bearing the seal/stamp of The Said Notary Public Certified 5. at London 6. the 15 November 2021 7. by Her Majesty's Principal Secretary of State for Foreign, Commonwealth and Development Affairs 8. Number APO 9. Seal/stamp 10. Signature

POWER OF ATTORNEY This Power of Attorney shall be issued as two separate documents by Sally Pryce and Nathan Scott Fine, members of the board of managers authorized to represent IMTIS Holdings S.a r.l. with their joint signatures, on behalf of IMTIS Holdings S.a r.l. and comprising the authorisations, however, the two separate Power of Attorney mentioned herein, one to be issued by Sally Pryce and the other by Nathan Scott Fine, shall constitute a valid authorisation if and only when they are used and submitted together. IMTIS Holdings S.a r.l. ("IMTIS Holdings"), a company in the form of "societe a responsabilite limitee" incorporated and existing under the laws of Grand Duchy of Luxembourg, under the registration number B244621, having its registered office at 9 Rue de Bitbourg L-1273, Luxembourg, represented in this act by its manager Sally Pryce, hereby names, constitutes, appointed and authorises DURUKAN FADILLIOGLU AVUKATLIK ORTAKLIGI, an attorney partnership incorporated and existing under the laws of the Republic of Turkey, registered under tax number 3200610736 before Besiktas Tax Office, having its registered office at Balmumcu Mah.Bestekar Haci Faik Bey Sk. No: 6/2, 34349, Basiktas/Istanbul, Turkey, and each of Begum DURUKAN OZAYDIN (Turkish Identity No: [REDACTED]), Hikmet FADILLIOGLU (Turkish Identity No:[REDACTED]) (Turkish Identity No: [REDACTED]) and (Turkish Identity No: [REDACTED]), all citizens of the Republic of Turkey and attorneys-at-law, to be its true and lawful attorneys-in-fact, so that any of them may, individually, do and perform any and all acts listed below for and in the name, place and stead of IMTIS Holdings in connection with acts and transactions relating to IMTIS Holdings' investments and shares held in companies within the Republic of Turkey; (i) to file all required public disclosure statements through the Public Disclosure Platform ("PDP") with the Central Registry Agency of Turkey ("CRA"); (ii) to represent IMTIS Holdings and to perform all actions required and to fulfill all procedures necessary related to IMTIS Holdings' shareholding rights and responsibilities in companies within the Republic of Turkey before all public authorities and institutions of the Republic of Turkey, including with limitation PDP, CRA, Capital Markets Board and/or Capital Markets Authority ("CMB"), Central Bank of the Republic of Turkey ("CBAT"), information Technologies and Communication Authority ("TTCA"), trade registries, chambers of commerce, and all companies which IMTIS Holdings is a direct or indirect shareholder of within the Republic of Turkey, including Turkcell (A.S., a publicly listed company incorporated and existing under the laws of the Republic of Turkey, under the registration number 304844, having its office at Istanbul, Turkey ("Turkcell") and its subsidiaries, including Turkcell Elektronik A.S., ("Paycell") (iii) for the purposes set out above, to draft, sign, execute, file, submit, deliver, receive, reply, follow-up, charge, amend or supplement all kinds of information, documents, applications, requests for approvals or, whether oral or written, including with limitation public disclosures, statements, letters, petitions, applications, notifications, correspondences, emails and facsimile messages; and to request and claim before and receive from, and submit to all public authorities and institutions of the Republic of Turket and all companies of which IMTIS Holdings is a direct or indirect shareholder all kinds of information and document in connection with the above; (iv) to do all acts and things necessary to ensure that the actions contemplated above are valid and effective under the laws of the Republic of Turket; Including, without limitation, the total or partial delegation of power and authority created hereby to other attorneys-in-fact, and IMTIS Holdings further GIVES and GRANTS unto each of the said attorneys-in-fact full power and authority to do and perform any and all acts and things reasonably necessary and proper in connection with and for the purposes of the foregoing as fully and to all intents and purposes as IMTIS Holdings or lawfully do and CONFIRMS that the said attorneys shall lawfully do or cause to be done under and by virtue of this Power of Attorney. This Power of Attorney shall be valid and effective until and including 31 December 2023 but the cessation of this authority shall not effect any act theretofore done in exercise hereof. IN WITNESS WHEREOF, IMTIS Holdings has caused this Power of Attorney to be signed in its name and on its behalf in London on 11th day of November 2021. On behalf of IMTIS Holdings S.a r.l. Name Surname: Sally Pryce Title: Manager Date: 11 November 2021 Signature: Sally Pryce

Office of the Secretary of the State of Connecticut APOSTILLE 1. Country: The United States of America THIS PUBLIC DOCUMENT 2. has been signed by ERIN KATHLEEN SPAHN 3. acting in the capacity of NOTARY PUBLIC 4. in the State of Connecticut for the term of December 17, 2020 to December 31, 2025 CERTIFIED 5 at Hartford, Connecticut 6. on November 16, 2021 7. by DENISE W. MERRILL, Secretary of State of Connecticut 8. Number : 2021-18989 9. Seal 10. Signature POWER OF ATTORNEY This Power of Attorney shall be issued as two separate documents by Sally Pryce and Nathan Scott Fine, members of the board of managers authorized to represent IMTIS Holdings S.a r.l. with their joint signatures, on behalf of IMTIS Holdings S.a r.l. and comprising the same authorizations, however, the two separate Power of Attorney mentioned herein, are to be issued by Sally Pryce and the other by Nathan Scott Fine, shall constitute a valid authorization if and only when they are used or submitted together. IMTIS Holdings S.a r.l. ("IMTIS Holdings"), a company in the form of "societe a responsabilite limitee" incorporated and existing under the laws of the Grand Duchy of Luxembourg, under the registration number B244621, having its registered office at 9 Rue de Bitbourg, L-1273, Luxembourg, represented in this act by its manager Sally Pryce, hereby names, constitutes, appoints and authorizes DURUKAN FADILLIOGLU AVUKATLIK ORTAKLIGI, an attorney partnership incorporated and existing under the laws of the Republic of Turkey, registered under tax number 3200610736 before Besiktas Tax Office, having its registered office at Balmumeu Mah. Bestekar Haci Falk Bey Sk. No. 6/2, 34349, Besiktas/Istanbul, Turkey, and each of Begum DURUKAN OZAYDIN (Turkish Identity No: [REDACTED]), Hikmet FADILLIOGLU (Turkish Identity No: [REDACTED]) Muhammed KESIM (Turkish Identity No.: [REDACTED]) and Ilker DEMIRTAS (Turkish Identity No: [REDACTED]), all citizens of the Republic of Turkey and attorneys-at-law, to be its true and lawful attorneys-in-fact, so that any of them may, individually, do and perform any and all acts listed below for and in the name, place and stead of IMTIS Holdings in connection with acts and transactions relating to IMTIS Holdings' investments and shares held in companies within the Republic of Turkey: (i) to file all required public disclosure statements through the Public Disclosure Platform ("PDP") with the Central Registry Agency of Turkey ("CRA"); (ii) to represent IMTIS Holdings and to perform all actions required and to fulfil all procedures necessary relating to IMTIS Holdings' shareholding rights and responsibilities in companies with the Republic of Turkey before all public authorities and institutions of the Republic of Turkey, including without limitation PDP, CRA, Capital Markets Board and/or Capital Markets Authority ("CMB"), Central Bank of the Republic of Turkey ("CBRT"), Information Technologies and Communications Authority ("ITCA"), trade registries, chambers of commerce, and all companies which IMTIS Holdings is a direct or indirect shareholder of within the Republic of Turkey, including Turkcell Iletzim Hizmetleri A.S., a publicly listed company incorporated and existing under the laws of the Republic of Turkey, under the registration number 304844, having its registered office at Aydmevier Mah, Incnu Cad, No. 20 Kucukyali Ofispark Maltepe/Istanbul, Turkey ("Turkcell") and its subsidiaries, including Turkcell Odeme ve Elektronik Para Hitmetleri A.S. ("Paycell"); (iii) for the purposes set out above, to draft, discuss, sign, execute, file, submit, deliver, receive, reply, follow-up, change, amend or supplement all kinds of information, documents, applications, requests for approvals or clearances, whether oral or written, including without limitation declarations, public disclosures, statements, letters, petitions, applications, notifications, correspondences, emails and facsimile messages; and to request and claim before and receive from, and submit to all public authorities and institutions of the Republic of Turkey and all companies of which IMTIS Holdings is a direct or indirect shareholder all kinds of information and documents in connection with the above; (iv) to do all acts and things necessary to ensure that the actions contemplated above are valid and effective under the laws of the Republic of Turkey; including, without limitation, the total or partial delegation of the power and authority created hereby to other attorneys-in-fact, and IMTIS Holdings further GIVES and GRANTS unto each of the said attorneys-in-fact full power and authority to do and perform any and all acts and things reasonably necessary and proper in connection with and for the purposes of the foregoing as fully and to the intents and purposes as IMTIS Holdings might or could itself lawfully do and RATIFIES and CONFIRMS all that the said attorneys shall lawfully do or cause to be done under and by virtue of this Power of Attorney. This Power of Attorney shall be valid and effective until and including 31 December 2023 but the cessation of this authority shall not affect any act theretofore done in exercise hereof. IN WITNESS WHEREOF, IMTIS Holdings has caused this Power of Attorney to be signed in its name and on its behalf in New Fairfield, CT, on this 12th day of November 2021. On behalf of IMTIS Holdings S.a r.l. Name Surname : Nathan Scott Fine Title : Manager Date: Signature