QuickLinks -- Click here to rapidly navigate through this documentSCHEDULE 14A INFORMATION

(Rule 14a-101)

INFORMATION REQUIRED IN PROXY STATEMENT

SCHEDULE 14A INFORMATION

Proxy Statement Pursuant to Section 14(a) of

the Securities Exchange Act of 1934

| Filed by the Registrantý |

Filed by a Party other than the Registranto |

Check the appropriate box: |

| o | | Preliminary Proxy Statement |

| o | | Confidential, for Use of the Commission Only (as permitted by Rule 14a-6(e)(2)) |

| ý | | Definitive Proxy Statement |

| o | | Definitive Additional Materials |

| o | | Soliciting Material Pursuant to §240.14a-12

|

Sanders Morris Harris Group Inc. |

(Name of Registrant as Specified In Its Charter) |

not applicable |

(Name of Person(s) Filing Proxy Statement, if other than the Registrant) |

| | | | | |

| Payment of Filing Fee (Check the appropriate box): |

| ý | | No fee required |

| o | | Fee computed on table below per Exchange Act Rules 14a-6(i)(1) and 0-11 |

| | | (1) | | Title of each class of securities to which transaction applies:

not applicable

|

| | | (2) | | Aggregate number of securities to which transaction applies:

not applicable

|

| | | (3) | | Per unit price or other underlying value of transaction computed pursuant to Exchange Act Rule 0-11 (set forth the amount on which the filing fee is calculated and state how it was determined):

not applicable

|

| | | (4) | | Proposed maximum aggregate value of transaction:

not applicable

|

| | | (5) | | Total fee paid:

not applicable

|

| o | | Fee paid previously with preliminary materials. |

| o | | Check box if any part of the fee is offset as provided by Exchange Act Rule 0-11(a)(2) and identify the filing for which the offsetting fee was paid previously. Identify the previous filing by registration statement number, or the Form or Schedule and the date of its filing. |

| | | (1) | | Amount Previously Paid:

not applicable

|

| | | (2) | | Form, Schedule or Registration Statement No.:

not applicable

|

| | | (3) | | Filing Party:

not applicable

|

| | | (4) | | Date Filed:

not applicable

|

April 30, 2003

Dear Fellow Shareholder,

On behalf of our Board of Directors, you are cordially invited to attend Sanders Morris Harris Group's annual meeting of shareholders on Thursday, June 19, 2003. At the meeting among other things, we will review our performance for 2002 and our expectations for the future.

A notice of the meeting and proxy statement follow. Also enclosed is your proxy voting card and the 2002 Annual Report. Your vote is important. Please take a moment now to complete, sign and date the proxy voting card and return it in the postage-paid envelope provided.

I look forward to seeing you on June 19th and addressing your questions and comments.

600 Travis, Suite 3100, Houston, Texas 77002 — 713-993-4610

April 30, 2003

NOTICE OF THE 2003

ANNUAL MEETING OF SHAREHOLDERS

The annual meeting of shareholders of Sanders Morris Harris Group Inc. will be held on Thursday, June 19, 2003, at 10:00 a.m., at the offices of Sanders Morris Harris located in the JPMorgan Chase Tower, 600 Travis, 30th Floor, Houston, Texas 77002, to consider and take action on the following matters:

- 1.

- Election of 10 directors; and

- 2.

- Transaction of any other business properly raised at the meeting.

Your Board of Directors recommends a vote "FOR" each of the nominees for director.

SANDERS MORRIS HARRIS GROUP INC.

600 Travis, Suite 3100

Houston, Texas 77002

PROXY STATEMENT

ANNUAL MEETING INFORMATION

This proxy statement contains information related to the annual meeting of shareholders of Sanders Morris Harris Group Inc. to be held on Thursday, June 19, 2003, beginning at 10 a.m., at the offices of Sanders Morris Harris located in the JPMorgan Chase Tower, 600 Travis, 30th Floor, Houston, Texas 77002 and at any postponements or adjournments of the meeting. The proxy statement was prepared under the direction of our Board of Directors to solicit your proxy for use at the annual meeting. It is being mailed to shareholders on or about May 16, 2003.

Who is entitled to vote?

Shareholders owning our common stock at the close of business on May 5, 2003 are entitled to vote at the annual meeting or at any postponement or adjournment of the meeting. Each shareholder has one vote per share on all matters to be voted on. On April 25, 2003, there were approximately 17,074,373 common shares outstanding.

What am I voting on?

You will be asked to elect nominees to serve on the Board of Directors and to vote on any other matters properly raised at the meeting. The Board of Directors is not aware of any other matters to be presented for action at the meeting. If any other matters requiring a vote of the shareholders arise, your signed proxy card gives authority to Ben T. Morris, our Chief Executive Officer, and George L. Ball, our Chairman, to vote on such matters at their discretion.

How does the Board of Directors recommend I vote?

The Board of Directors recommends a voteFOR each of the nominees for director.

How do I vote?

Sign and date each proxy card you receive and return it in the prepaid envelope.If you sign your proxy card, but do not mark your choices, your proxy holders, Mr. Morris and Mr. Ball, will vote FOR the persons nominated for election as directors. You can revoke your proxy at any time before it is exercised.

To do so, you must either:

- •

- give written notice of revocation to our Corporate Secretary, Sanders Morris Harris Group Inc., 600 Travis, Suite 3100, Houston, Texas 77002;

- •

- submit another properly signed proxy card with a more recent date; or

- •

- vote in person at the meeting.

What is a quorum?

A "quorum" is the presence at the meeting, in person or by proxy, of the holders of a majority of the outstanding shares. There must be a quorum for the meeting to be held. Abstentions are counted in determining the presence or absence of a quorum, but under Texas law are not considered a vote. Shares held by brokers in street name and for which the beneficial owners have withheld from brokers the discretion to vote are called "broker non-votes." They are not counted to determine if a quorum is present and under Texas law are not considered a vote. Broker non-votes will not affect the outcome of a vote on election of directors.

What vote is required to approve each proposal?

The director nominees will be elected by a plurality of the votes cast at the meeting. All other matters to be considered at the meeting require the affirmative vote of a majority of the votes cast.

Who will count the vote?

A representative of Sanders Morris Harris Group Inc. will tabulate the votes cast by proxy or in person at the meeting.

What are the deadlines for shareholder proposals for next year's annual meeting?

You may submit proposals on matters appropriate for shareholder action at future annual meetings by following the rules of the Securities and Exchange Commission. We must receive proposals intended for inclusion in next year's proxy statement and proxy card no later than January 1, 2004. If we do not receive notice of any matter that a shareholder wishes to raise at the annual meeting in 2004 by April 1, 2004 and a matter is raised at that meeting, the proxy holders for next year's meeting will have discretionary authority to vote on the matter. All proposals and notifications should be addressed to our Corporate Secretary.

How much did this proxy solicitation cost?

We have not engaged anyone to solicit proxies on our behalf. However, we will reimburse banks, brokerage firms and other institutions, nominees, custodians and fiduciaries for their reasonable expenses for sending proxy materials to beneficial owners and obtaining their voting instructions. Certain of our and our subsidiaries' directors, officers and regular employees may solicit proxies personally or by telephone or facsimile without additional compensation.

2

ELECTION OF DIRECTORS

NOMINEES

Ten directors will be elected at the annual meeting. Directors will serve until our next annual meeting or until their earlier resignation or removal. If any nominee is not available for election, proxies will be voted for another person nominated by the Board of Directors or the size of the Board will be reduced.

All of the ten current members of the Board of Directors are standing for election this year.

The Board of Directors recommends a vote FOR all ten nominees to our Board of Directors.

The nominees are as follows:

GEORGE L. BALL

Director since February 2000

Age 64

Mr. Ball was appointed to the Board of Directors on February 1, 2000 as part of the Sanders transaction and has served as our Chairman since May 2002. At the time of the Sanders transaction, he served as Chairman of the Board and a director of Sanders Morris Mundy Inc. Mr. Ball also serves as Chairman of the Board and a director of Sanders Morris Harris Inc. ("SMH") and as a director of Pinnacle Management & Trust Company ("PMT"), SMH Capital, SMH Capital Advisors, Inc. ("SMCA") and Kissinger Financial Services, Inc. ("Kissinger"). He served as a director of Sanders Morris Mundy Inc. since May 1992, and was its non-executive Chairman of the Board from May 1992 to July 1997. From September 1992 to January 1994, Mr. Ball was a Senior Executive Vice President of Smith Barney Shearson Inc. From September 1991 to September 1992, he was a consultant to J. & W. Seligman & Co. Incorporated. In 1982, Mr. Ball was elected President and Chief Executive Officer of Prudential-Bache Securities, Inc., and in 1986 was elected Chairman of the Board, serving in those positions until his resignation in 1991. He also served as a member of the Executive Office of Prudential Insurance Company of America from 1982 to 1991. Before joining Prudential, Mr. Ball served as President of E.F. Hutton group, Inc. Mr. Ball is a former governor of the American Stock Exchange and the Chicago Board Options Exchange, and served on the Executive Committee of the Securities Industries Association.

DONALD R. CAMPBELL

Director since September 1998

Age 62

Mr. Campbell has served as one of our directors since September 1998, and served as our Vice Chairman from January 1999 to January 2000. Mr. Campbell was President and Chief Operating Officer of TEI, Inc., our predecessor issuer, from December 1991 to September 2000, a director of TEI from September 1990 to September 2000, and its Chief Executive Officer from April 1994 to September 2000. He was Executive Vice President of Finance and Chief Financial Officer of TEI from September 1990 to December 1991, and was Treasurer of TEI from October 1990 to December 1991. Mr. Campbell is a director and an audit committee member of Texas Genco, Inc., a New York Stock Exchange listed electrical power generating company.

ROBERT E. GARRISON II

Director since January 1999

Age 61

Mr. Garrison has served as our President and as one of our directors since January 1999, and served as our Chief Executive Officer from January 1999 until May 2002. He also serves as a director of SMH. Mr. Garrison co-founded Harris Webb & Garrison, Inc. ("HWG") and until January 1999

3

served as its Executive Vice President and head of investment banking. Until January 1999, he also served as Chairman and Chief Executive Officer of PMT, which he co-founded in 1994, and still serves as a director. Mr. Garrison also serves as Chairman and a director of SMH Capital and a director of SMCA and Kissinger. From 1990 to 1991, Mr. Garrison served as President and Chief Executive Officer of Medical Center Bank & Trust Company. Before then, he served as managing partner of Lovett Mitchell Webb & Garrison (a division of Kemper Securities Group, Inc.) from 1983 to 1989 and Director of Research for Underwood Neuhaus and Co. from 1971 to 1982. Mr. Garrison serves on the Board of Directors Stock Option Committee of TeraForce Technology Corporation, a public telecommunications equipment company, on the Board of Directors Compensation Committee of FirstCity Financial Corporation, a public financial services company, and as a director of First Capital Bankers, Inc. and Somerset House Publishing. He also serves on the Board of Directors Finance Committee of the Memorial Hermann Hospital Systems and is Chairman of the Board of Directors of BioCyte Therapeutics. He has over 35 years experience in the securities industry and is a Chartered Financial Analyst.

TITUS H. HARRIS, JR.

Director since January 1999

Age 72

Mr. Harris has served as one of our directors since January 1999, and served as our Chairman from January 1999 until May 2002. Mr. Harris co-founded HWG in February 1994 prior to its combination with the Sanders firm in January 2000, and now serves as one of SMH's Executive Vice Presidents and a director, as well as a director of PMT. From September 1991 to February 1994, he served as a Registered Representative at S.G. Cowen & Company, the former correspondent broker of HWG. Before then, Mr. Harris served as Senior Vice President of Lovett Underwood Neuhaus & Webb, (a division of Kemper Securities Group, Inc.) from January 1983 to August 1991, and as Regional Sales Manager for the Houston office of E.F. Hutton and Co., Inc. from January 1978 to December 1982. Mr. Harris has over 40 years experience in the securities industry.

BEN T. MORRIS

Director since February 2000

Age 57

Mr. Morris was appointed to the Board of Directors on February 1, 2000 as part of the Sanders transaction and has served as our Chief Executive Officer since May 2002. He co-founded Sanders Morris Mundy Inc. in 1987 and served as its President and Chief Executive Officer and as a director at the time of its combination with Harris Webb & Garrison, Inc. Since the Sanders transaction, Mr. Morris has served as President, Chief Executive Officer and a director of SMH. Mr. Morris served as the Chief Operating Officer of Tatham Corporation from 1980 to 1984. Before then, he served in a number of executive positions with Mid-American Oil and Gas, Inc. and predecessor companies from 1973 to 1980, and was its President from 1979 to 1980. He is a director of Capital Title Group, Inc., a public title agency and escrow services company, American Equity Investment Life Holding Company, a public life insurance company, and Tyler Technologies, Inc., a public company that provides information solutions to state and local governments. Mr. Morris is a certified public accountant.

NOLAN RYAN

Director since May 2002

Age 56

Mr. Ryan has served as one of our directors since May 2002. He has been the Chairman of the Board and majority owner of The Express Bank, a Texas bank with branches in Alvin and Danbury, Texas, since June 1990. He has been the principal owner of the Round Rock Express Baseball Club, the Houston Astros' double-A affiliate, since the team was purchased as the Jackson Generals in May 1998 and formed into the Round Rock Express in January 1999. In 1995, Mr. Ryan was appointed by Texas

4

Governor George W. Bush to a six-year term as a Texas Parks and Wildlife Commissioner. Mr. Ryan was a Major League Baseball pitcher from 1968 to 1994 and was inducted into the National Baseball Hall of Fame in July of 1999. Mr. Ryan currently serves on the board or advisory council for several not-for-profit and charitable organizations.

DON A. SANDERS

Director since February 2000

Age 66

Mr. Sanders was appointed to the Board of Directors on February 1, 2000 as part of the Sanders transaction. At the time of the Sanders transaction, he served as Chairman of the Executive Committee and as a director of Sanders Morris Mundy Inc., which he co-founded in 1987. Mr. Sanders serves on the boards of several Houston-based community organizations. Since the Sanders transaction, he has served as our Vice-Chairman and as one of our directors and as a director of SMH. From 1987 to 1996, Mr. Sanders was President of Sanders Morris Mundy. Before joining Sanders Morris Mundy, he was employed by E.F. Hutton & Co., Inc. where he served from 1959 in various capacities, including as an Executive Vice President of E.F. Hutton from 1982 to 1987 and as a member of its board of directors from 1983 to 1987. Mr. Sanders has over 40 years of experience in the securities industry.

JOHN H. STYLES

Director Since June 1999

Age 67

Mr. Styles has served as one of our directors since June 1999. He has been the Chairman, President and Chief Executive Officer of HEALTHPLUS Corporation since 1995. Mr. Styles served in the same capacities for Mid-America Healthcare Group from 1984 until its sale in 1995 and for Outpatient Healthcare, Inc. from 1985 until its sale in 1992. He is also a private venture capitalist, focusing on the healthcare and other growth industries.

W. BLAIR WALTRIP

Director since January 1999

Age 48

Mr. Waltrip has served as one of our directors since January 1999 and as a director of TEI since July 1988. He is also a director of Service Corporation International, a public funeral and cemetery company, and was employed in various capacities by that company from 1977 until January 2000, last serving as an Executive Vice President for more than five years.

DAN S. WILFORD

Director since May 2002

Age 62

Mr. Wilford has served as one of our directors since May 2002. He has been a director of Healthcare Realty Trust Incorporated, a New York Stock Exchange real estate investment trust primarily concentrating on real estate properties and mortgages associated with the delivery of healthcare services, since February 2002. Mr. Wilford served as President and Chief Executive Officer of Memorial Hermann Healthcare System from 1984 to 2002. The Memorial Hermann Healthcare System is the largest not-for-profit healthcare system in the Houston, Texas area consisting of twelve hospitals, including a children's hospital, two long-term nursing facilities and a retirement community.

5

NON-DIRECTOR EXECUTIVE OFFICERS

RICK BERRY

Chief Financial Officer

Age 50

Mr. Berry has served as our Chief Financial Officer since February 2001 and as our Principal Financial Officer since June 2000. Since the Cummer/Moyers transaction in October of 2000, he has served as Vice-President and Secretary of SMCA. Since the Kissinger transaction in April of 2001, Mr. Berry has served as Vice-President and Secretary of Kissinger Financial Services. From March 1999 to April 2000, Mr. Berry served as Executive Vice President, Chief Financial Officer, Secretary and a director of Petrocon Engineering, Inc. From April 1998 to March 1999, Mr. Berry was Executive Vice President and Chief Financial Officer of OEI International, Inc. Mr. Berry was Secretary of TEI, Inc. from January 1997 to April 1998, and the Executive Vice President, Chief Financial Officer and Treasurer of TEI from December 1991 to April 1998. Mr. Berry is a certified public accountant.

6

BOARD COMMITTEES AND MEETING ATTENDANCE

The Board of Directors has four committees, the Executive, Audit, Nominating and Compensation Committees. The committees report their actions to the full Board of Directors at its next regular meeting following a committee meeting. The following table shows the current membership of the four committees. A brief description of the current duties of each committee follows the table below.

Committee Membership and Meetings Held

|

|---|

Name

| | Executive

| | Audit

| | Nominating

| | Compensation

|

|---|

| Mr. Ball | | X | | | | | | |

| Mr. Campbell | | | | X | | X | | |

| Mr. Garrison | | X | | | | | | |

| Mr. Harris | | | | | | | | |

| Mr. Morris | | X | | | | | | |

| Mr. Ryan | | | | | | X | | X |

| Mr. Sanders | | | | | | | | |

| Mr. Styles | | | | | | | | X |

| Mr. Waltrip | | X | | | | | | X |

| Mr. Wilford | | | | X | | | | |

| | |

| |

| |

| |

|

| No. of Meetings in 2002(1) | | 1 | | 4 | | 1 | | 1 |

| | |

| |

| |

| |

|

- X

- Member

- (1)

- Each director attended at least 75% of the aggregate of all meetings of the Board of Directors and committees of the Board to which he belonged.

Executive Committee

- •

- Has full power of the Board between meetings of the Board, with specified limitations relating to major corporate matters.

Audit Committee

- •

- Reviews the financial reports and other financial information provided by Sanders Morris Harris Group to any governmental body or the public.

- •

- Reviews the audit efforts of Sanders Morris Harris Group's independent auditors.

- •

- Reviews Sanders Morris Harris Group's system of internal controls regarding finance, accounting, legal compliance and ethics that management and the Board have established; and Sanders Morris Harris Group's auditing, accounting and financial reporting processes generally.

- •

- Provides an open avenue of communication among the independent auditors, financial and senior management, and the Board.

Nominating Committee

- •

- Makes recommendations to the Board of Directors regarding nominees for election as directors, the structure, size and composition of the Board, compensation of Board members and organization and responsibility of board committees.

7

- •

- Reviews general responsibilities and functions of the Board of Directors, the balance of expertise among Board members, and Sanders Morris Harris Group's overall organizational health, particularly plans for management succession and development.

Any shareholder who wishes to recommend a prospective Board nominee should deliver written notice containing the information required by our bylaws to Sandra J. Williams, Corporate Secretary, 600 Travis, Suite 3100, Houston, Texas 77002. To be timely filed, we must receive the notice not less than 60 days nor more that 180 days prior to the first anniversary of our preceding year's annual meeting.

Compensation Committee

- •

- Reviews and recommends the compensation for executive officers and key employees.

- •

- Reviews personnel compensation policies, benefit programs, and any major changes to such policies and programs, and administers them.

- •

- Recommends the granting of stock options and other incentive awards, including the number of shares subject to, and the exercise price of, each stock option and the terms and conditions of other incentive awards granted under our incentive plans.

Compensation of Directors

Currently, our non-employee directors receive an annual retainer of $8,000, $1,500 for each meeting of the Board of Directors attended, $1,000 for each Executive Committee meeting attended, $750 for any other committee meeting attended and an annual grant of 5,000 options. Each non-employee director committee chairman receives an additional annual retainer of $2,000. Our employee directors are not compensated for their service on the Board of Directors.

8

REPORT OF THE COMPENSATION COMMITTEE OF THE BOARD OF DIRECTORS

Role of the Committee

Our Compensation Committee is comprised solely of outside directors whose role is to recommend to the Board of Directors the compensation to be paid to our executive officers and key employees. In addition, the committee is generally responsible for administering executive compensation plans, incentive plans, and other forms of direct or indirect compensation of officers and key employees.

Executive Compensation Program

The Compensation Committee, composed entirely of non-employee directors, establishes our compensation philosophy on behalf of the Board of Directors, determines the compensation of our Chief Executive Officer, and approves the compensation of our executive officers.

The three components of executive officer compensation are base salary, bonuses and long-term incentive compensation.

- •

- Base Salary

The base salary for senior executives (including the Chief Executive Officer) is intended to be competitive with that paid in comparably situated industries, with a reasonable degree of financial security and flexibility afforded to those individuals who are regarded by the Board of Directors as acceptably discharging the levels and types of responsibility implicit in the various senior executive positions. In the course of considering annual executive salary increases, appropriate consideration is given to the credentials, age and experience of the individual senior executives, as viewed in the compensation committee's collective best judgment, which necessarily involves subjective as well as objective elements. Should the committee be persuaded that an executive has not met expectations for a protracted period, a recommendation to the Board of Directors that the executive be terminated would be a more likely eventuality than a reduction in his base compensation.

- •

- Bonuses

For 2002, we awarded bonuses to Robert E. Garrison II, Don A. Sanders, George L. Ball, Ben T. Morris and Rick Berry. Similar to prior years, the bonuses for Messrs. Garrison, Sanders, Ball, Morris and Berry were based on comparisons of executive compensation for peer companies similar to our size.

- •

- Long-Term Incentive Compensation

We made no additional long-term incentive compensation grants during 2002.

Chief Executive Officer Compensation

Ben T. Morris became our Chief Executive Officer in May 2002. For 2002, the Compensation Committee established Mr. Morris' base salary at $225,000, a level which it believes is appropriate based on comparisons with financial services firms of similar size to Sanders Morris Harris Group Inc. Mr. Morris received a bonus of $100,000, and no long-term incentive compensation for 2002. Robert E. Garrison II served as our Chief Executive Officer until May 2002. For 2002, the Compensation Committee established Mr. Garrison's base salary at $225,000, a level which it believes is appropriate based on comparisons with financial services firms of similar size to Sanders Morris Harris Group Inc. Mr. Garrison received a bonus of $100,000, and no long-term incentive compensation for 2002.

9

Deductibility of Executive Compensation

Section 162(m) of the Internal Revenue Code establishes a limit on corporate income tax deductions of $1 million per year paid to any executive officer. In designing compensation plans to meet the executive compensation objectives described above, we reserve the right to establish plans which may result in our inability to deduct compensation under Section 162(m).

Summary

The Compensation Committee believes our executive compensation policies and programs effectively serve the interests of Sanders Morris Harris Group and our shareholders. The various compensation vehicles offered are appropriately balanced to provide increased motivation for executives to contribute to our overall future success, thereby enhancing Sanders Morris Harris Group's value for our shareholders' benefit.

The Compensation Committee will continue to monitor the effectiveness of our total compensation programs to meet Sanders Morris Harris Group's current needs. For 2003, we will reevaluate compensation of executive officers to ensure that it is consistent with a compensation philosophy designed to reward outstanding individual performance and align officers' compensation to the performance of Sanders Morris Harris Group, our individual business units, and our stock price.

Compensation Committee Interlocks and Insider Participation

Messrs. Waltrip, Styles and Ryan, each of whom are outside directors, served on the Compensation Committee in 2002. No director or executive officer of Sanders Morris Harris Group Inc. serves on the compensation committee or the board of directors of any company for which Messrs. Waltrip, Styles or Ryan serve as executive officers or directors.

10

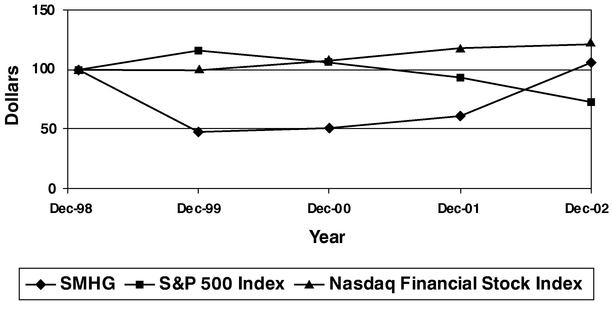

CORPORATE PERFORMANCE

The line graph below shows a one year comparison of the cumulative total shareholder return on TEI's common stock as compared to the cumulative total return of the S&P 500 Index and a selected group of peer companies for fiscal year 1998. TEI was our predecessor issuer and was in the business of industrial wastewater and waste oil treatment and recycling. The performance graph reflects these operations only, which operations were discontinued by us effective December 31, 1998.

TOTAL SHAREHOLDER RETURN

| | Base Period

Dec 97

| | Dec 98

|

|---|

| TEI, Inc. | | 100 | | 105.99 |

S & P 500 Index |

|

100 |

|

126.65 |

Peer Group(1) |

|

100 |

|

62.44 |

- (1)

- The peer group represented for the periods from December 1997 to December 1998 was composed of American Ecology Corp., American Waste Services, Clean Harbors, Inc., Matrix Service Company, Omega Environmental, Inc. and Serv-Tech, Inc. which are or were in businesses similar to TEI's discontinued operations.

11

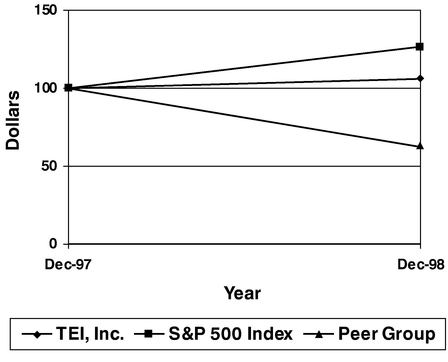

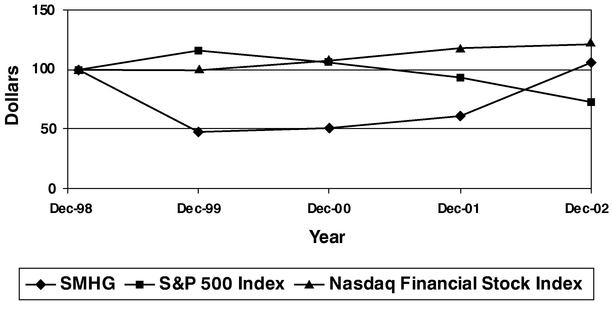

Since discontinuing TEI's liquid waste and recycling business in December 1998 and completing the combination with the three financial services firms in January 1999, we have focused our business on financial services. The line graph below shows a comparison of the cumulative total shareholder return on our common stock as compared to the cumulative total return of the S&P 500 Index and the Nasdaq Financial Stocks Index for the period from January 29, 1999 to the end of last fiscal year.

TOTAL SHAREHOLDER RETURN

| | Base Period

01/29/99

| | Dec 99

| | Dec 00

| | Dec 01

| | Dec 02

|

|---|

| Sanders Morris Harris Group | | 100 | | 47.76 | | 50.75 | | 60.90 | | 106.00 |

S & P 500 Index |

|

100 |

|

116.11 |

|

105.79 |

|

93.31 |

|

72.63 |

Nasdaq Financial Stocks Index(1) |

|

100 |

|

99.45 |

|

107.43 |

|

118.00 |

|

121.43 |

- (1)

- The Nasdaq Financial Stocks Index is composed of all Nasdaq companies with two-digit Standard Industrial Classification codes in the range 60 through 67.

12

COMPENSATION OF EXECUTIVE OFFICERS

Summary of Executive Compensation

The following table shows, for our fiscal years indicated, the annual compensation paid to or earned by our Chief Executive Officer and the other four most highly compensated executive officers (the "Named Officers") in all capacities in which they served.

Summary Compensation Table

|

|---|

| |

| | Annual Compensation

| | Long-Term

Compensation Awards

|

|---|

Name and Principal

Position

| | Year

| | Salary

($)

| | Bonus

($)

| | Other

($)

| | Restricted

Stock

Award(s) ($)

| | Securities

Underlying

Options (#)

|

|---|

Ben T. Morris,

Chief Executive Officer | | 2002

2001

2000 | | 214,583

200,000

183,333 |

(2) | 100,000

75,000

— | | —

—

— | | —

25,500

— |

(5)

| —

—

25,000 |

Robert E. Garrison II,

President(1) | | 2002

2001

2000 | | 225,000

225,000

225,000 | | 100,000

75,000

— | | —

—

— | | —

25,500

— |

(5)

| —

—

— |

Don A. Sanders,

Vice-Chairman | | 2002

2001

2000 | | 337,500

224,740

412,500 |

(2) | 200,000

—

— | | —

—

75,200 |

(4) | 177,746

661,319

— | (6)

(7)

| —

—

30,000 |

George L. Ball,

Chairman | | 2002

2001

2000 | | 214,583

200,000

183,333 |

(2) | 100,000

75,000

— | | —

—

— | | —

25,500

— |

(5)

| —

—

25,000 |

Rick Berry,

Chief Financial Officer | | 2002

2001

2000 | | 178,167

175,000

77,841 |

(3) | 50,000

25,000

2,500 | | —

—

— | | 9,614

—

4,345 | (8)

(9) | —

30,000

— |

- (1)

- Mr. Garrison also served as our Chief Executive Officer until May 2002.

- (2)

- Joined SMHG as part of the Sanders transaction on January 31, 2000. Indicated salary reflects that paid for eleven months of 2000.

- (3)

- Joined SMHG in June 2000. Indicated salary reflects that paid for six months of 2000.

- (4)

- Represents Mr. Sanders' share of profits earned from the exercise and subsequent sale of warrants held as investments by SMH.

- (5)

- Represents 5,000 shares of restricted stock the value of which would have been $25,500 at the end of fiscal year 2001. Any dividends paid on our common stock will also be paid on the restricted stock. The shares of restricted stock vest 50% on February 25, 2003, 25% on February 25, 2004 and 25% on February 25, 2005.

- (6)

- Represents 28,469 shares of restricted stock the value of which would have been $248,819 at the end of fiscal year 2002. The grants of such restricted stock were in lieu salary in the amount of $112,500. Any dividends paid on our common stock will also be paid on the restricted stock. The shares of restricted stock vest according to the following schedule:

No. of Shares

| | 50% Vest

| | 25% Vest

| | 25% Vest

|

|---|

| 14,276 | | 03/28/03 | | 03/28/04 | | 03/28/05 |

| 14,193 | | 06/28/03 | | 06/28/04 | | 06/28/05 |

- (7)

- Represents 120,957 shares of restricted stock the value of which would have been $616,973 at the end of fiscal year 2001. The grants of such restricted stock were in lieu of bonus and salary in the

13

amount of $415,259. Any dividends paid on our common stock will also be paid on the restricted stock. The shares of restricted stock vest according to the following schedule:

No. of Shares

| | 50% Vest

| | 25% Vest

| | 25% Vest

|

|---|

| 15,573 | | 03/30/02 | | 03/30/03 | | 03/30/04 |

| 13,753 | | 06/29/02 | | 06/29/03 | | 06/29/04 |

| 18,669 | | 09/28/02 | | 09/28/03 | | 09/28/04 |

| 19,737 | | 12/31/02 | | 12/31/03 | | 12/31/04 |

| 43,725 | | 02/25/03 | | 02/25/04 | | 02/25/05 |

| 9,500 | | 02/25/03 | | 02/25/04 | | 02/25/05 |

- (8)

- Represents 1,422 shares of restricted stock the value of which would have been $12,428 at the end of fiscal year 2002. The grants of such restricted stock were in lieu of salary in the amount of $6,000. Any dividends paid on our common stock will also be paid on the restricted stock. The shares of restricted stock vest according to the following schedule:

No. of Shares

| | 50% Vest

| | 25% Vest

| | 25% Vest

|

|---|

| 380 | | 03/28/03 | | 03/28/04 | | 03/28/05 |

| 378 | | 06/28/03 | | 06/28/04 | | 06/28/05 |

| 375 | | 09/30/03 | | 09/30/04 | | 09/30/05 |

| 289 | | 12/31/03 | | 12/31/04 | | 12/31/05 |

- (9)

- Represents 790 shares of restricted stock the value of which would have been $4,029 at the end of fiscal year 2001. The grants of such restricted stock were in lieu of bonus in the amount of $2,500. Any dividends paid on our common stock will also be paid on the restricted stock. The shares of restricted stock vest according to the following schedule:

No. of Shares

| | 50% Vest

| | 25% Vest

| | 25% Vest

|

|---|

| 790 | | 02/16/02 | | 02/16/03 | | 02/16/04 |

Option/SAR Grants in Last Fiscal Year

None of the Named Officers received an option or SAR grant during our last fiscal year.

Aggregated Option Exercises in Last Fiscal Year and Fiscal Year-Ended Option Values

None of the Named Officers exercised any options during the last fiscal year. The following table provides information about unexercised options held by the Named Officers as of the end of our last fiscal year.

| | Number of Securities Underlying

Unexercised Options at

Fiscal Year End (#)

| | Value of Unexercised In-The-Money

Options at Fiscal Year End ($)

|

|---|

Name

| | Exercisable

| | Unexercisable

| | Exercisable

| | Unexercisable

|

|---|

| Ben T. Morris | | 18,750 | | 6,250 | | 80,663 | | 26,887 |

Robert E. Garrison II |

|

89,394 |

|

— |

|

348,213 |

|

— |

Don A. Sanders |

|

22,500 |

|

7,500 |

|

96,795 |

|

32,265 |

George L. Ball |

|

18,750 |

|

6,250 |

|

80,663 |

|

26,887 |

Rick Berry |

|

15,000 |

|

15,000 |

|

59,700 |

|

59,700 |

Executive Employment Contracts

We currently have no employment contracts in effect with any of our directors or executive officers.

14

SECURITIES OWNERSHIP OF MANAGEMENT AND CERTAIN BENEFICIAL OWNERS

The following table shows the number of shares of our common stock beneficially owned by each director, director nominee, executive officer and five percent shareholder, and by all directors and executive officers as a group. The table shows ownership at April 25, 2003.

Directors and executive officers as a group beneficially own approximately 37.9% of our outstanding common stock. For purposes of reporting total beneficial ownership, shares of common stock which may be acquired through stock option exercises that have vested or will vest within 60 days following April 25, 2003 are included.

The information in this section is based on information required to be reported and filed with the Securities and Exchange Commission under Sections 13 and 16 of the Exchange Act.

Name

| | Number of

Common Shares

Beneficially Owned

| | Percent

of Class

|

|---|

| Don A. Sanders(1)(2) | | 2,296,782 | | 13.4 |

Ben T. Morris(1)(3) |

|

1,890,906 |

|

11.1 |

George L. Ball(1)(4) |

|

1,231,438 |

|

7.2 |

Robert E. Garrison II(5) |

|

350,263 |

|

2.0 |

W. Blair Waltrip(6) |

|

320,056 |

|

1.9 |

Titus H. Harris, Jr.(7) |

|

244,015 |

|

1.4 |

John H. Styles(8) |

|

135,059 |

|

* |

Donald R. Campbell(9) |

|

81,665 |

|

* |

Rick Berry(10) |

|

17,351 |

|

* |

Dan S. Wilford(11) |

|

16,000 |

|

* |

Nolan Ryan(11) |

|

15,000 |

|

* |

All directors and executive officers as a group (11 persons) |

|

6,598,535 |

|

37.9 |

- *

- Less than 1% of outstanding shares.

- (1)

- Has a principal business address of 600 Travis, Suite 3100, Houston, Texas 77002.

- (2)

- Includes 30,000 shares issuable on exercise of stock options, 3,000 shares owned by Mr. Sanders' wife, 31,200 shares held by the John Drury Estate, of which he is the executor, 250,000 shares owned by a limited partnership of which Mr. Sanders controls the general partner and 135,233 shares of restricted stock.

- (3)

- Includes 25,000 shares issuable on exercise of stock options, 703,968 shares owned by the Sanders 1998 Children's Trust, of which Mr. Morris is a co-trustee, and as to which Mr. Morris disclaims beneficial ownership, and 2,500 shares of restricted stock.

- (4)

- Includes 25,000 shares issuable on exercise of stock options, 25,000 shares owned by Mr. Ball's wife and 2,500 shares of restricted stock.

- (5)

- Includes 89,394 shares issuable on exercise of stock options and 2,500 shares of restricted stock.

- (6)

- Includes 10,000 shares issuable on exercise of stock options and 255,806 shares owned by the William Blair Waltrip Trust, of which Mr. Waltrip is the trustee and beneficiary. Includes 26,250 shares owned by the Robert L. Waltrip 1992 Trust #1, of which Robert L. Waltrip, Jr., W. Blair Waltrip, and Holly Waltrip Benson are co-trustees. Includes 28,000 shares owned by the Waltrip 1987 Grandchildren's Trust for the benefit of the grandchildren of R. L. Waltrip, of which W. Blair

15

Waltrip and Robert L. Waltrip are as co-trustees, and as to which W. Blair Waltrip disclaims beneficial ownership.

- (7)

- Includes 31,632 shares issuable on exercise of stock options, 13,251 shares of restricted stock, and 20,787 shares owned by Mr. Harris' wife and as to which Mr. Harris disclaims beneficial ownership.

- (8)

- Includes 21,232 shares issuable on exercise of stock options and 19,198 shares owned by Mr. Style's wife and as to which Mr. Styles disclaims beneficial ownership.

- (9)

- Includes 65,000 shares issuable on exercise of stock options.

- (10)

- Includes 15,000 shares issuable on exercise of stock options and 1,569 shares of restricted stock.

- (11)

- Includes 5,000 shares issuable on exercise of stock options.

Section 16(a)—Beneficial Ownership Reporting Compliance

Based on our records, we believe that during 2002 all our directors, officers and 10% or greater beneficial owners timely filed all required Section 16(a) reports, except for Titus H. Harris, Jr. and Rick Berry who were each late filing a statement of changes in beneficial ownership for transactions occurring on December 31, 2002 and Nolan Ryan who was late filing statements of changes in beneficial ownership for transactions occurring on June 5, 6, 7, 10, 11, 12 and 18 of 2002.

SECURITIES AUTHORIZED FOR ISSUANCE UNDER EQUITY COMPENSATION PLANS

For our equity compensation plans, the following table shows, at the end of fiscal year 2002, (a) the number of securities to be issued upon the exercise of outstanding options, warrants and rights, (b) the weighted-average exercise price of such options, warrants and rights, and (c) the number of securities remaining available for future issuance under the plans, excluding those issuable upon exercise of outstanding options, warrants and rights.

Equity Compensation Plan Information

|

|---|

Plan Category

| | Number of Securities

to be issued

upon exercise of

outstanding options,

warrants and rights

| | Weighted-average

exercise price of

outstanding options,

warrants and rights

| | Number of securities

remaining available for

future issuance under

equity compensation plans

(excluding securities

reflected in column (a))

|

|---|

| | (a)

| | (b)

| | (c)

|

|---|

| Equity compensation plans approved by security holders | | 1,476,224 | | $ | 5.07 | | 1,500,830(1) |

Equity compensation plans not approved by security holders |

|

— |

|

|

— |

|

— |

| | |

| |

| |

|

| |

Total |

|

1,476,224 |

|

$ |

5.07 |

|

1,500,830 |

- (1)

- The number of shares of our common stock available for incentive awards under our 1998 Incentive Plan is the greater of 4,000,000 shares or 25% of the total number of shares of our common stock from time to time outstanding.

CERTAIN RELATIONSHIPS AND RELATED TRANSACTIONS

On occasion SMH's directors, officers, and employees co-invest with our clients. Consequently, it is often the case that certain officers, directors, shareholders, and employees of SMH own securities of SMH's clients for whom SMH has placed or underwritten securities and/or with whom SMH has a financial advisory relationship, which in some cases may, individually or in the aggregate, exceed 1% of the outstanding securities of such clients.

16

Mr. Styles and his family are the principal owners of an entity that is a 50% owner of PTC-Houston Management, L.P. PTC was formed to secure financing for a new proton beam therapy cancer treatment center to be constructed in Houston, Texas. Net operating income recognized by PTC totaled $4.4 million during 2002, 50% of which, or $2.2 million, was attributable to each of SMHG and the Styles-owned entity.

Mr. Garrison serves as Chairman and a director of BioCyte Therapeutics, Inc., one of our indirect subsidiaries, and owns 1,332,670 shares, or approximately 17.5%, of its outstanding common shares. Through SMH Capital, we indirectly own 2,000,000 shares of BioCyte, or approximately 26.3% of its common stock. SMH Capital also holds a warrant for 160,000 BioCyte common shares. Additionally, we had outstanding receivables from BioCyte of $189,000 at December 31, 2002.

On September 1, 2000, we entered into a Severance Agreement with Mr. Campbell providing for semimonthly payments of $2,193 beginning on September 15, 2000 and continuing through and including May 31, 2005. In addition, Mr. Campbell will be reimbursed for all reasonable out-of-pocket expenses incurred by him in connection with the performance of any further duties for us and may participate in our group health and life insurance benefits, subject to certain limitations.

INDEPENDENT AUDITORS

On September 28, 2001, we determined, pursuant to the authority and approval of our Board of Directors, and upon the recommendation of our audit committee, (1) to dismiss PricewaterhouseCoopers LLP ("PwC"), our independent accountants, who were previously engaged as the independent accountant to audit our consolidated financial statements, and (2) to select KPMG LLP as our independent accountants to audit our consolidated financial statements for fiscal 2001. PwC's report on our financial statements for each of the last two fiscal years prior to its dismissal did not contain an adverse opinion or a disclaimer of opinion, nor was it qualified or modified as to uncertainty, audit scope, or accounting principle. During our last two fiscal years and any subsequent interim periods preceding the dismissal of PwC, there were no disagreements with PwC on any matters of accounting principles or practices, financial statement disclosure, or auditing scope or procedure, which disagreement(s), if not resolved to the satisfaction of PwC would have caused them to make a reference to the subject matter of the disagreement(s) in connection with their report. During our last two fiscal years and any subsequent interim periods preceding its dismissal, PwC did not advise us of any reportable events. We authorized PwC to respond fully to any inquiries by KPMG LLP.

KPMG LLP was also our independent auditor for fiscal year 2002. While management expects that our relationship with KPMG LLP will continue to be maintained in 2003, no formal action is proposed to be taken at the annual meeting with respect to the continued employment of KPMG LLP as no such action is legally required. A representative of KPMG LLP is expected to be at the annual meeting. The representative will have the opportunity to make a statement at the meeting if he or she wishes, and will be available to respond to appropriate questions.

The following table sets forth the fees billed for services performed by KPMG LLP for fiscal year 2002 and fiscal year 2001:

| | 2002

| | 2001

|

|---|

| Audit fees | | $ | 332,000 | | $ | 305,250 |

| | |

| |

|

| Audit related fees | | $ | — | | $ | — |

| | |

| |

|

| Tax fees | | $ | 40,000 | | $ | 85,500 |

| | |

| |

|

| All other fees | | $ | — | | $ | — |

| | |

| |

|

17

REPORT OF THE AUDIT COMMITTEE OF THE BOARD OF DIRECTORS

The Audit Committee of the Board of Directors has furnished the following report:

The Board has determined that each member of the committee is "independent," as defined in the Nasdaq listing standards, with the exception of Mr. Campbell. Following our January 1999 combination, Mr. Campbell agreed to continue as an officer and director of Sanders Morris Harris Group and ERRI principally to oversee the sale of ERRI and its operations pending its sale. Mr. Campbell resigned as an officer of Sanders Morris Harris Group and as an officer and director of ERRI after the sale of substantially all of ERRI's assets in July of 2000. The Board has determined, in accordance with the Nasdaq listing standards, that Mr. Campbell's service on the committee is required by the best interests of Sanders Morris Harris Group and our stockholders because, in the Board's opinion, he will exercise independent judgment and his business and financial background and his experience with Sanders Morris Harris Group will materially assist the function of the committee. Mr. Campbell joined the committee in March of 2001.

As noted in the committee's charter, Sanders Morris Harris Group's management is responsible for preparing Sanders Morris Harris Group's financial statements. Sanders Morris Harris Group's independent auditors are responsible for auditing the financial statements. The activities of the committee are in no way designed to supersede or alter those traditional responsibilities. The committee's role does not provide any special assurances with regard to Sanders Morris Harris Group's financial statements, nor does it involve a professional evaluation of the quality of the audits performed by the independent auditors.

The committee has reviewed and discussed the audited financial statements with management. The committee also met with the independent auditors, with and without management present, to discuss the results of their audit and their evaluation of our internal controls. The committee has also discussed with the independent auditors the matters required to be discussed by Statement of Auditing Standards No. 61, Communication With Audit Committees.

The committee has received the written disclosures and the letter from the independent auditors required by Independence Standards Board Standard No. 1, Independence Discussions With Audit Committees, has considered the compatibility of non-audit services with the auditors' independence, and has discussed with the auditors the auditors' independence.

Based on the review and discussions referred to above, the committee recommended to the Board of Directors that the audited financial statements be included in Sanders Morris Harris Group's Annual Report on Form 10-K for 2002 for filing with the Securities and Exchange Commission.

OTHER MATTERS

The Board of Directors is not aware of any other matter to be presented for action at the meeting. If another matter requiring a vote of the shareholders arises, the proxy holders will vote in their best judgment.

18

Sanders Morris Harris Group Inc.

THE BOARD OF DIRECTORS SOLICITS THIS PROXY FOR THE

ANNUAL MEETING OF SHAREHOLDERS

TO BE HELD ON JUNE 19, 2003

Proxy

for

Annual

Meeting

of

Shareholders

June 19, 2003 | | The undersigned shareholder of Sanders Morris Harris Group Inc. (the "Company") hereby appoints Ben T. Morris and George L. Ball, or either of them, the true and lawful attorneys, agents and proxies of the undersigned, each with full power of substitution, to vote on behalf of the undersigned at the Annual Meeting of Shareholders of the Company to be held at the offices of Sanders Morris Harris located in the JPMorgan Chase Tower, 600 Travis, 30th Floor, Houston, Texas 77002, on Thursday, June 19, 2003, at 10:00 a.m., Houston Time, and at any adjournments or postponements of said meeting, all of the shares of the Company's common stock in the name of the undersigned or which the undersigned may be entitled to vote. Any proxy heretofore given by the undersigned with respect to such shares of the Company's common stock is hereby revoked. |

|

|

This Proxy, when properly executed, will be voted in the manner directed herein by the undersigned shareholder.If no direction is made, this Proxy will be voted FOR the election of the nominees for director on the reverse side. |

The Board of Directors recommends a vote FOR the nominees for director. |

PLEASE MARK, SIGN, DATE AND RETURN IN THE ENVELOPE ENCLOSED |

(This Proxy must be dated and signed on the reverse side.) |

(Continued From Other Side)

Proxy for Annual Meeting of Shareholders June 19, 2003

ELECTION OF DIRECTORS

Nominees:

| | | | | For | | Withhold | | | | For | | Withhold |

| | | 1. George L. Ball | | o | | o | | 6. Nolan Ryan | | o | | o |

| | | 2. Donald R. Campbell | | o | | o | | 7. Don A. Sanders | | o | | o |

| | | 3. Robert E. Garrison II | | o | | o | | 8. John H. Styles | | o | | o |

| | | 4. Titus H. Harris, Jr. | | o | | o | | 9. W. Blair Waltrip | | o | | o |

| | | 5. Ben T. Morris | | o | | o | | 10. Dan S. Wilford | | o | | o |

|

|

In their discretion, the proxies are authorized to vote upon such other matters as may properly come before the meeting or any adjournment or postponement thereof. |

|

|

The undersigned hereby acknowledges receipt of the Notice of Annual Meeting of Shareholders, the Proxy Statement furnished with the notice, and the 2002 Annual Report. |

|

|

Dated __________________, 2003 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Shareholder's Signature |

|

|

|

|

|

|

Signature if held jointly |

|

|

|

|

|

|

Signature should agree with name printed hereon. If stock is held in the name of more than one person, EACH joint owner should sign. Executors, administrators, trustees, guardians and attorneys should indicate the capacity in which they sign. Attorneys should submit powers of attorney. |

|

|

PLEASE MARK, SIGN, DATE AND RETURN IN THE ENVELOPE ENCLOSED |

QuickLinks

PROXY STATEMENTELECTION OF DIRECTORS